Crypto World

BitMine Faces $8 Billion Loss as Ethereum Drops Below $2,000

TLDR

- BitMine holds 4.29 million ETH, now worth $8 billion less than its initial investment.

- Ethereum’s price drop to below $2,000 has caused significant unrealized losses for the company.

- BitMine’s stock has fallen 88% from its peak in July, reflecting investor concerns over Ethereum exposure.

- The company continues to accumulate Ethereum and generates income through staking despite the downturn.

- BitMine is not under pressure to liquidate its assets as it used equity issuance to fund its ETH purchases.

BitMine Immersion Technologies, led by Wall Street strategist Thomas Lee, has faced substantial losses as Ethereum (ETH) dropped below $2,000. The company’s position is now worth nearly $8 billion less than its initial investment of approximately $16.4 billion. The downturn has caused BitMine’s stock to fall sharply, reflecting a significant loss on its Ethereum holdings.

BitMine’s Ethereum Bet and Unrealized Losses

BitMine holds around 3.55% of Ethereum’s total circulating supply, with 4.29 million ETH accumulated through equity issuance. The company’s massive ETH stake was once worth $16.4 billion but is now valued at just $8.4 billion, marking a $8 billion unrealized loss. Despite the decrease in Ethereum’s value, BitMine has maintained a strategy of holding and staking its Ether, generating income despite the ongoing market volatility.

The company’s approach of using equity issuance instead of debt financing has shielded it from immediate liquidation pressure. With $538 million in cash and nearly $200 million in annual staking revenue from its ETH holdings, BitMine is positioned to ride out the current market challenges. “There is no pressure to sell any ETH at these levels,” Thomas Lee stated, defending the firm’s strategy of holding through market downturns.

Stock Price Declines Alongside Ethereum’s Drop

The recent downturn in Ethereum has coincided with a sharp decline in BitMine’s stock price. Shares of BMNR have fallen by 88% from their peak in July, reflecting growing concerns over the company’s heavy exposure to Ethereum. The stock hit new multi-month lows, paralleling Ethereum’s 30% drop over the past month, and investors are scrutinizing BitMine’s ability to weather the market downturn.

Bitmine Immersion Technologies, Inc., BMNR

Despite the loss in stock value, BitMine’s strategy of staking 2.9 million ETH has provided some cushion. The firm has also continued accumulating Ether, adding more to its holdings even during this difficult market period. Investors are keenly watching how BitMine manages its exposure to Ethereum amid the current price fluctuation.

No Immediate Need for Liquidation

Lee’s defense of BitMine’s strategy highlights that the company has no immediate need to sell its Ethereum holdings. Unlike other firms with significant debt, BitMine has no obligations forcing it to liquidate at a loss. Instead, the firm focuses on earning consistent revenue through staking, which has allowed it to manage liquidity even as Ethereum’s price continues to decline.

BitMine’s strategy centers on long-term growth, with the firm continuing to bet on the future of Ethereum. While the value of its holdings has dropped, the company remains optimistic about the long-term potential of its Ethereum position.

Crypto World

Ethereum Derivatives Market Contracts Sharply as Macro Pressures and Geopolitical Risks Drain Risk Appetite

TLDR:

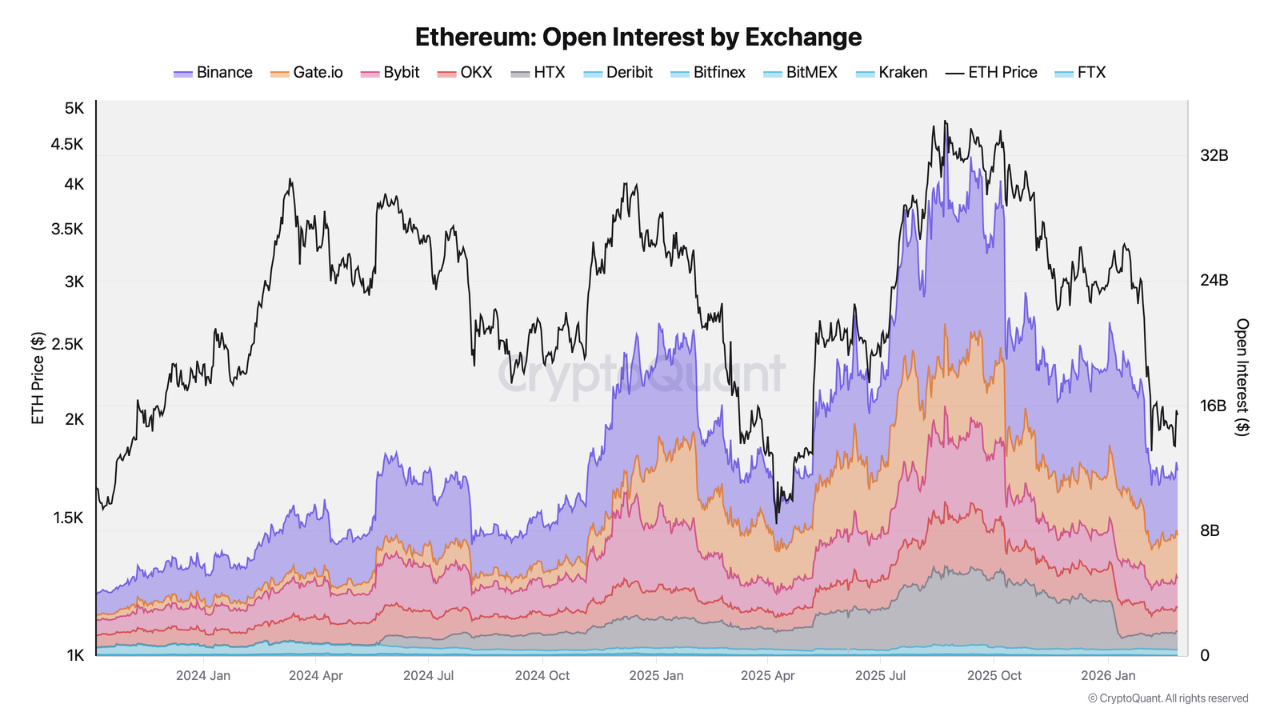

- Ethereum open interest in ETH terms fell from 7.79M to 5.8M across all major derivatives exchanges.

- Binance notional open interest dropped from $12.6B to $4.1B, yet still holds nearly 35% of total market share.

- Core PPI rose 0.8% month-over-month, reducing Federal Reserve rate cut expectations and pressuring risk assets.

- Bybit and Gate.io both recorded steep open interest declines, confirming a broad market-wide deleveraging phase.

The Ethereum derivatives market is experiencing a sharp contraction as macroeconomic pressures weigh on crypto assets.

Core PPI data rose 0.8% month-over-month, confirming that inflation remains persistent. This reading has reduced expectations for a near-term Federal Reserve rate cut.

Meanwhile, rising U.S.-Iran tensions over the weekend added further uncertainty. Together, these factors pushed traders toward risk aversion, triggering a broad deleveraging across Ethereum’s futures and derivatives segment.

Open Interest Drops Sharply Across Major Exchanges

The Ethereum derivatives market saw open interest in ETH terms fall from 7.79 million to 5.8 million across all exchanges. That represents a reduction of nearly 2 million contracts across the board.

Binance alone concentrated roughly 2 million of the affected positions. The contraction reflects a clear pullback from leveraged exposure across the market.

Binance remains the dominant player despite the notable decline, holding close to 35% of total open interest. Its notional open interest, however, dropped sharply from $12.6 billion to $4.1 billion.

This decline factors in both reduced contract volumes and falling ETH prices. Even after the drop, Binance’s share remains well ahead of all competitors.

Bybit, which holds roughly 15% of total open interest, saw its figures fall to $1.9 billion. That marks approximately a threefold reduction from its prior recorded levels.

Gate.io also declined, dropping from $5.2 billion to $2.75 billion. Gate.io now accounts for approximately 23% of the overall Ethereum derivatives market.

Analyst Darkfost noted the wide scope of this deleveraging phase across platforms. The data reflects active leverage unwinding rather than a routine price correction.

Traders across exchanges are steadily reducing exposure amid unfavorable macro conditions. The speed of this contraction points to deliberate risk management decisions by market participants.

Macro Pressures Drive Risk Aversion Across Crypto Markets

The Federal Reserve’s rate cut prospects have dimmed following the latest inflation data. Core PPI rising 0.8% month-over-month confirmed that price pressures have not eased.

Markets are now pricing in a prolonged period of restrictive monetary policy. This environment tends to reduce appetite for risk assets, including cryptocurrencies.

Altcoins have been among the first to absorb the pressure as risk sentiment shifted. Ethereum led the decline among major digital assets during this period.

The derivatives market responded accordingly, with leveraged positions being quickly reduced. Reduced leverage typically reflects a move by traders toward greater caution.

Geopolitical developments added further pressure on already fragile market conditions. Growing tensions between the United States and Iran surfaced over the weekend.

These events increased uncertainty at a time when investors already lacked clear direction. Risk assets, including crypto, tend to react quickly to such external geopolitical shocks.

The Ethereum derivatives market is now in a clear contraction phase across all major platforms. Traders have broadly pulled back from leveraged positions as conditions tightened.

The combination of macro headwinds and geopolitical risks has created a structurally unfavorable environment. Until conditions stabilize, the derivatives market may continue facing continued downward pressure.

Crypto World

Crypto hacks drop to $37.7M, lowest since March 2025

Crypto hacks and exploits resulted in approximately $37.7 million in losses during February 2026 and were the lowest monthly figure since March 2025 according to Certik data.

Summary

- Crypto hacks totaled $37.7M in February, lowest since March 2025.

- Wallet compromises led losses at $16.6M, ahead of phishing and exploits.

- About 30% of stolen funds were frozen or recovered during February.

Phishing attacks accounted for $8.6 million of the total, while wallet compromise led incident categories with $16.6 million in losses.

YieldBlox topped individual exploits with $10.6 million stolen, followed by IoTeX at $8.9 million and Foom at $2.3 million.

DeFi protocols suffered the largest losses by type at $14.4 million, while AI-related projects recorded $8.9 million in thefts.

Funds returned or frozen reached $11.3 million, representing approximately 30% of total losses.

Wallet compromise and price manipulation drive February losses

Wallet compromise incidents totaled $16.6 million across February and were the largest crypto hacks loss category.

Price manipulation attacks followed with $11.4 million in stolen funds, while phishing schemes drained $8.6 million from victims.

Code vulnerability exploits accounted for $5.1 million, with exit scams adding $2.1 million.

Instadapp posted the largest single incident at $10.5 million, followed by EFX at $8.9 million. Kasm recorded $2.2 million in losses, while Initia saw $2.1 million stolen.

CryptoFarm experienced two separate incidents totaling $2.7 million combined.

Smaller incidents included UCC and Hedgehog at $400,000 each, with Lending and SEI Token both posting $200,000 in losses.

DeFi protocols continued to see the highest exploit activity with $14.4 million in losses across multiple incidents.

AI-related projects emerged as the second-largest target with $8.9 million stolen. Gambling platforms lost $2.3 million, while address poisoning and wallet drainer schemes combined for $2.7 million.

February shows 60% crypto hack drop from January

The $37.7 million February total is a sharp drop from typical monthly figures seen throughout 2025.

Certik data shows January and February 2026 both posted lower losses than most 2025 months.

Total incidents remained relatively stable month-over-month based on the chart. The reduction in total losses comes from fewer high-value exploits rather than decreased attack frequency.

Phishing incidents showed similar patterns across both months, with February’s $8.6 million matching January levels.

Exploit total loss also dropped from January’s elevated levels to February’s $37.7 million.

Crypto World

Cardano Price Tests Bear Market Support

Cardano’s price has entered a tight consolidation phase over the past several days. ADA is trading within a narrowing range as momentum weakens. Repeated attempts to break higher have stalled, reflecting broader caution in the crypto market.

Bearish signals dominate the short-term outlook. However, one key cohort of holders is providing support.

Cardano Is Under Pressure

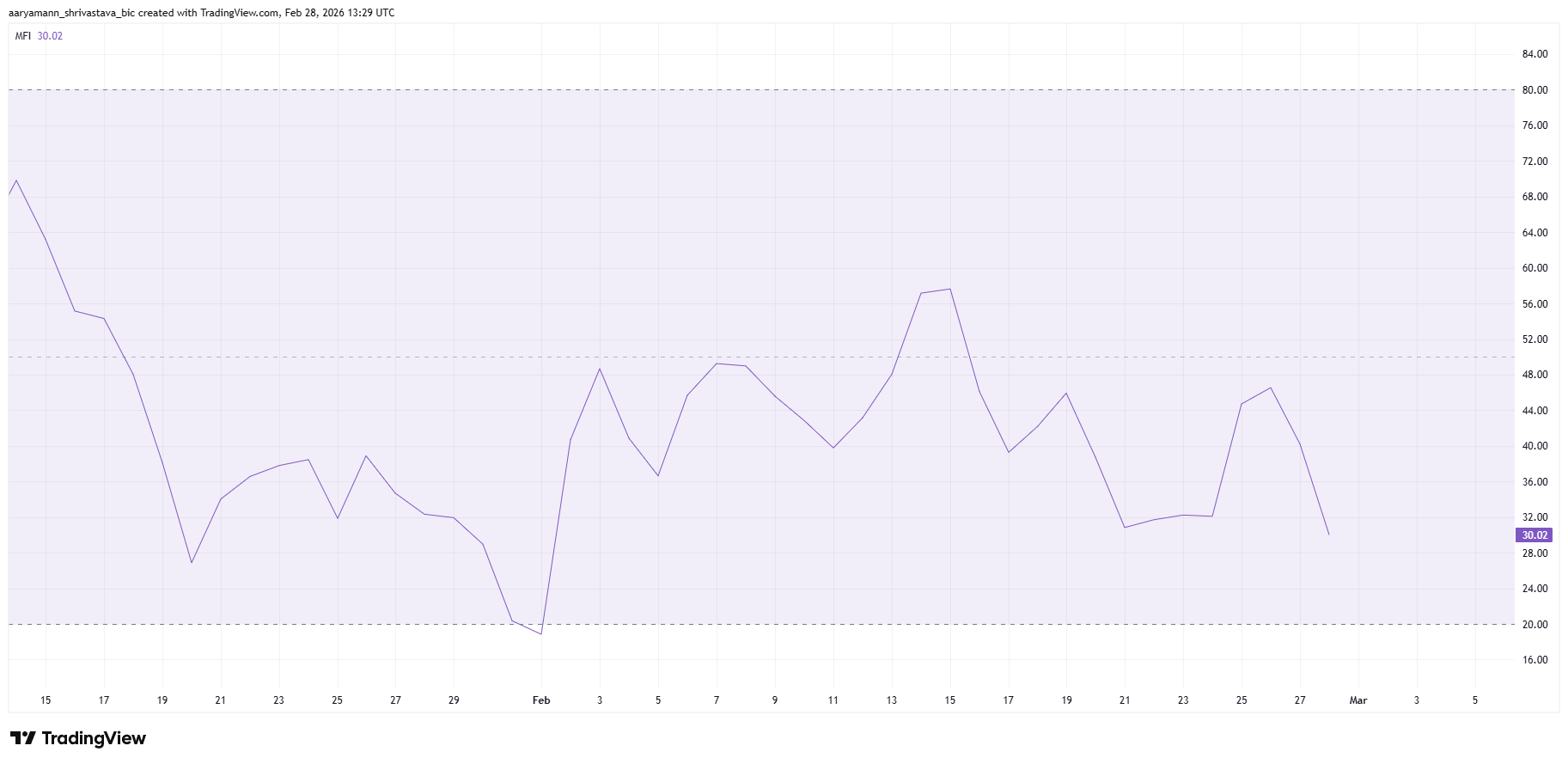

The Money Flow Index shows persistent selling pressure on ADA. The indicator remains below the neutral 50 level, signaling sustained capital outflows. Weak inflows suggest that buyers are hesitant to step in at current prices.

A shift in momentum requires reclaiming the 50 mark or entering oversold territory. At present, ADA is far from both conditions. Without a strong reversal signal, selling pressure may continue to weigh on Cardano price action.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Derivatives data reinforces the bearish narrative. The liquidation map indicates that Cardano futures contracts are skewed toward short positions. Exposure on short contracts stands near $23 million compared with $14 million in potential long liquidations.

This imbalance highlights trader expectations for further downside. Elevated short interest can increase volatility if the price moves sharply. However, current positioning suggests that many traders anticipate continued weakness rather than a breakout.

Sustained bearish positioning may amplify price swings. If ADA attempts a recovery, short liquidations could accelerate upside. Conversely, additional selling could reinforce negative momentum. For now, macro sentiment in futures markets remains defensive.

ADA LTHs Provide Relief

Long-term holders are currently offsetting part of the sell pressure. The Mean Coin Age metric is rising, indicating that older coins are remaining inactive. This trend suggests that LTHs are choosing to hold rather than distribute.

Resilience among long-term investors is crucial. Persistent holding behavior reduces circulating supply pressure. While it does not guarantee recovery, it helps ADA defend critical support levels during periods of uncertainty.

ADA Price Needs To Hold Above This Support

Cardano is trading at $0.264 at the time of writing, rangebound between $0.295 resistance and $0.256 support. The lower boundary aligns with the 13.6% Fibonacci retracement, often referred to as the bear market support floor. ADA has maintained this level for nearly three weeks.

Given current indicators, consolidation appears likely to continue. A successful defense of $0.256 could enable a rebound toward $0.278. Sustained buying may push ADA back to $0.295, testing upper range resistance once again.

However, increased selling pressure would shift the outlook. A decisive breakdown below $0.256 would weaken structural support. In that scenario, Cardano price could decline toward $0.239, invalidating the short-term bullish thesis and reinforcing bearish control.

Crypto World

Anthropic CEO Slams Pentagon Decision As ‘Unprecedented’

The CEO of AI company Anthropic, Dario Amodei, has responded to the United States Department of Defense and the White House, ordering military defense contractors that do business with the Department of Defense to stop using Anthropic’s products.

Anthropic objected to the use of its AI models for mass domestic surveillance and fully autonomous weapons that can fire without any human input, Amodei told CBS on Saturday.

He added that Anthropic was fine with all of the US government’s proposed use cases for its AI models, except for surveillance and fully autonomous weapons platforms. He said:

“These are things that are fundamental to Americans: the right, not to be spied on by the government, the right for our military officers to make decisions about war, themselves, and not turn it over completely to a machine.”

The decision by the Defense Department to label Anthropic as a “supply chain risk,” meaning that military contractors cannot use Anthropic’s products on defense contracting work, is “unprecedented” and “punitive,” he added.

Amodei later clarified that he is not against the development of fully automated weapons if foreign militaries begin using them in the future, but that AI is not yet reliable enough to function autonomously in a military setting.

The law has not caught up to the rapidly developing AI sector, Amodei said, calling on the United States Congress to pass “guardrails” to prevent the use of AI in domestic mass surveillance programs.

Related: Anthropic says it’s been targeted in massive distillation attacks

OpenAI wins a defense contract after US officials label Anthropic a supply chain risk

On Friday, US “Secretary of War” Pete Hegseth announced that Anthropic is a “Supply-Chain Risk to National Security.”

“Effective immediately, no contractor, supplier, or partner that does business with the United States military may conduct any commercial activity with Anthropic,” he said.

Hours later, rival AI company OpenAI accepted a contract with the US Defense Department to deploy its AI models across military networks.

The announcement of the deal from OpenAI CEO Sam Altman drew online backlash from critics, who cited AI being used for mass domestic surveillance and undermining individual privacy as a red line.

Magazine: ‘Slaughterbot’ drones in Ukraine, MechaHitler becomes sexy waifu: AI Eye

Crypto World

Ethereum Holder Retention Rebounds From a 4-Year Low

Ethereum price continues to trade in a sideways structure that reflects a gradual decline rather than stability. ETH has struggled to generate sustained upside momentum. The exit of new participants has weighed on sentiment, even as some long-term metrics show early signs of improvement.

This divergence creates a mixed outlook for Ethereum. While network growth has weakened, improving holder retention offers a counterbalance.

Ethereum New Holders Dip

Ethereum has seen a sharp decline in new addresses over the past several days. Daily new addresses fell nearly 36% within 48 hours, dropping from 298,000 to 191,000. This contraction pushed Ethereum’s Network Growth metric to a two-month low.

The slowdown has persisted since the beginning of the month. Fewer new participants reduce organic demand. Weak onboarding also signals hesitation among retail investors. This trend has added pressure to ETH price performance and contributed to cautious market sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Ethereum Holder Retention Rate provides deeper context that even though new holders are declining, the ones that are staying are staying for good. This metric tracks the percentage of addresses maintaining a balance across consecutive 30-day periods. It measures whether holders continue to retain ETH rather than exit positions.

The retention rate recently fell to 92.4%, marking a 4.5-year low and the weakest reading since September 2021. This decline confirmed wavering conviction among newer holders.

However, the metric has begun to improve modestly, suggesting renewed stability among participants. Rising retention can strengthen structural support if sustained.

ETH Price Shows Potential To Bounce Back

Ethereum is trading at $1,904 at the time of writing, holding above the $1,816 support level. While price action appears flat, a descending resistance line indicates a slow downtrend. Without stronger demand, ETH remains vulnerable to continued weakness.

The Chaikin Money Flow indicator offers cautious optimism. CMF has shifted into positive territory after a gradual uptrend. This movement signals improving capital inflows. Transitioning from outflows to inflows is essential for any sustained Ethereum price recovery.

If inflows continue and support holds, Ethereum could rebound from $1,816 and attempt a move toward $2,165. A breakout above this resistance would invalidate the current downtrend line. Such a shift would likely restore investor confidence and reinforce bullish momentum.

However, failure to maintain positive capital flow would undermine this outlook. A breakdown below $1,816 would invalidate the recovery thesis. In that scenario, Ethereum price could slide toward $1,600, increasing downside risk and reinforcing bearish control across the broader crypto market.

The post Ethereum Holder Retention Rebounds From a 4-Year Low appeared first on BeInCrypto.

Crypto World

Why TradFi Keeps Betting On An ETH Surge

Key takeaways:

-

Institutional adoption of the Ethereum network accelerates despite Ether disappointing price action. Ethereum and its layer-2s hold 65% of TVL market share.

-

Vitalik Buterin is shifting focus toward base layer scalability and ZK-EVM to ensure long-term onchain efficiency and security.

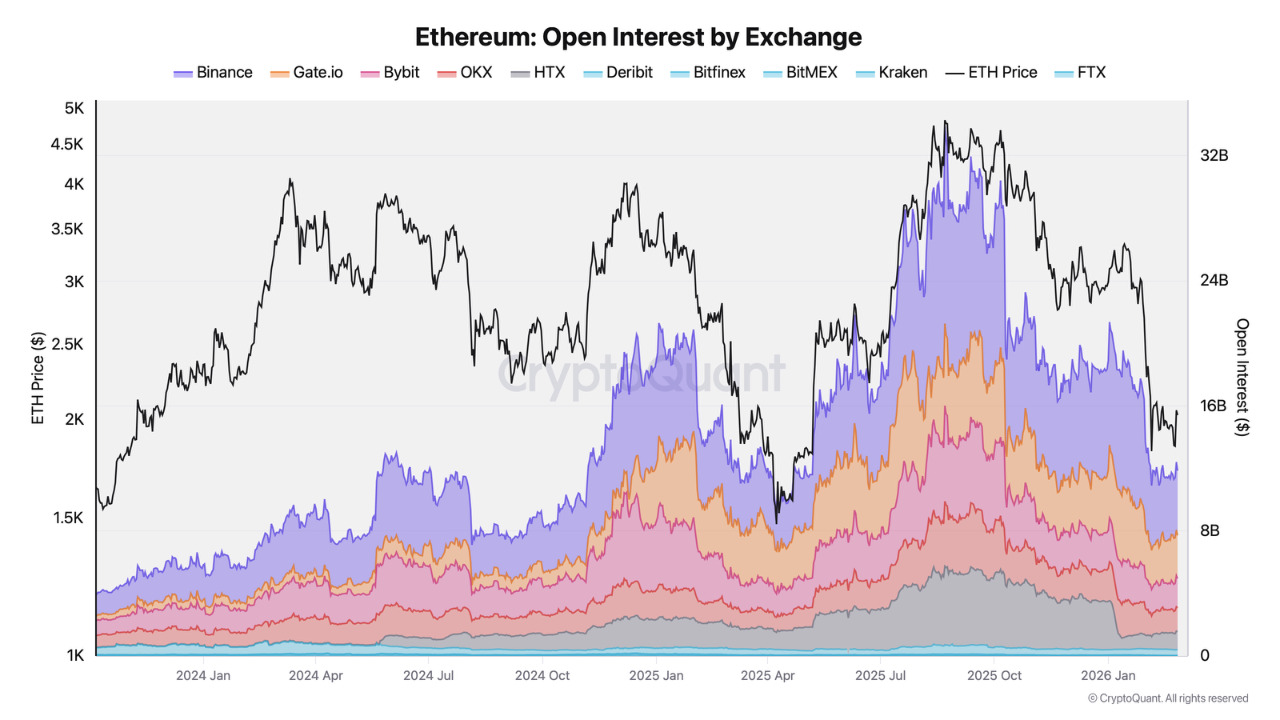

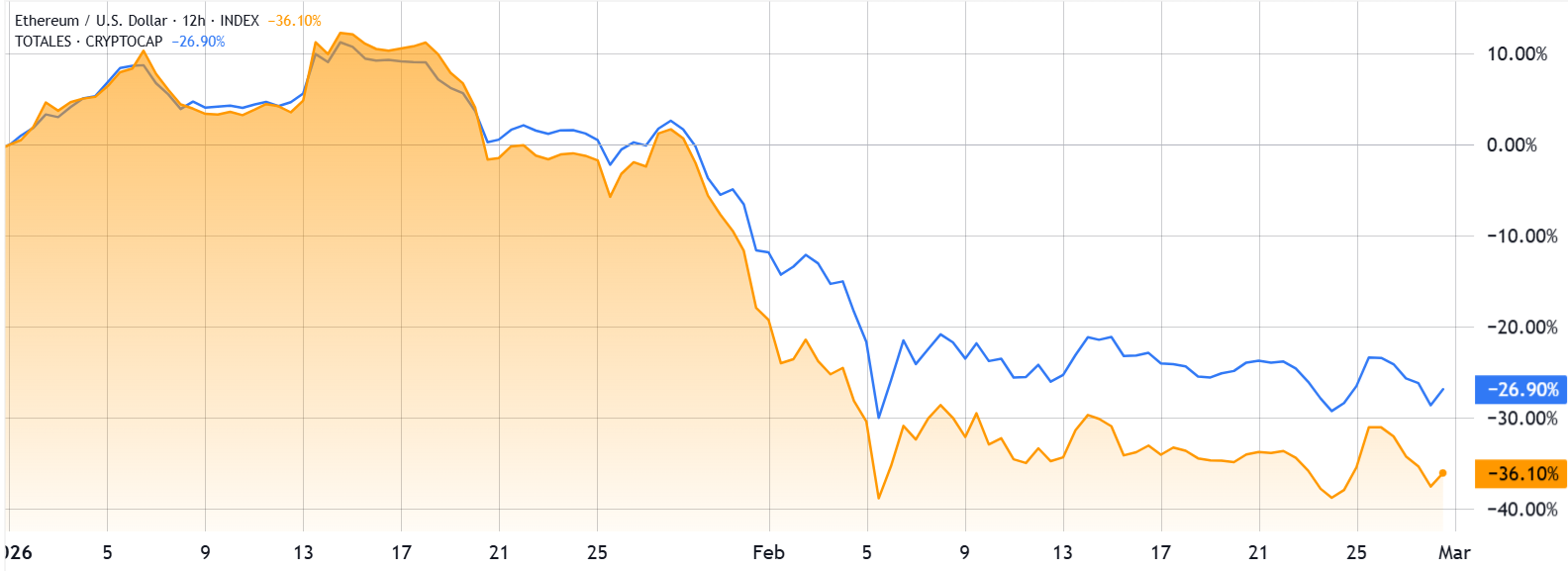

Ether (ETH) has declined 36% in 2026, sparking frustration as the $3,000 level feels increasingly out of reach. Despite a retreat toward $1,900, Ethereum fundamentals appear resilient. Development continues at a rapid pace, specifically targeting base layer scalability, privacy, and quantum resistance.

Critics claiming Ether is poorly positioned may be surprised if the market sentiment shifts back toward cryptocurrencies.

Ether has underperformed the broader crypto market by 9% during the first two months of 2026, challenging the theory that external factors are the sole drivers of this correction. Decentralized exchange (DEX) volumes on the Ethereum network fell 55% over the past six months, while competitor Solana saw a more modest 21% decline during that same timeframe.

Ethereum DEX volumes dropped to $56.5 billion in February 2026, down significantly from a peak of $128.5 billion in August 2025. During the same period, monthly Solana volumes reached $95.5 billion, down from $120.6 billion in August. This contraction in activity has weighed on network fees and decentralized application (DApp) revenue, effectively reducing the immediate incentives for holding Ether.

Institutions choose Ethereum over other blockchains

The narrow focus on volume ignores the fact that Ethereum maintains a 57% market share in total value locked (TVL), totaling $52.4 billion. When including layer-2 solutions such as Base, Arbitrum, Polygon, and Optimism, Ethereum’s dominance rises to 65%. For comparison, Solana’s TVL sits at $6.4 billion, while BNB Chain holds an aggregate $5.5 billion locked in smart contracts.

Major institutions, including JP Morgan Asset Management, Citi, Deutsche Bank, and BlackRock, have recently launched onchain projects using Ethereum. From tokenized funds to dedicated layer-2 rollups and bank-issued stablecoins, Ethereum remains the primary venue for decentralized finance (DeFi) innovation, commanding a 68% market share in Real World Assets (RWA).

Ethereum’s strategic decision to prioritize layer-2 scalability via rollups has been partially labeled a failure, as competing chains like Tron and Solana currently lead in network fees. Regardless of how critics judge the decision to subsidize rollup costs, no “Ethereum killer” has managed to match its monetary value. Even the highly successful Hyperliquid maintains a relatively modest $1.5 billion in TVL.

Vitalik Buterin, Ethereum’s co-founder and lead architect, recently expressed intentions to reduce dependence on rollups by targeting base layer scalability. According to Buterin, the proposed changes include parallel block verification, aligning gas costs with actual execution time, and the implementation of a zero-knowledge Ethereum Virtual Machine (ZK-EVM).

These updates will be implemented gradually. Buterin recommends that a minority of the network participate initially before moving toward mandatory block confirmation systems that rely on ZK-EVM. Additionally, Ethereum maintains a clear roadmap to navigate the quantum computing era, which includes consensus-layer signatures based on privacy-focused proof systems.

Related: Why institutions still prefer Ethereum despite faster blockchains

Buterin has admitted that quantum-resistant signatures are significantly larger and more difficult to verify, noting that lattice-based solutions are currently inefficient. Consequently, the proposed solution involves fixing protocol-layer recursive signature and proof aggregation while developing vectorized math precompiles to reduce gas costs. While the Ethereum network is not yet perfect, a viable path for scalability exists.

Before dismissing ETH as a failure, it is necessary to analyze what has made the network successful relative to competing DApp-focused blockchains. Decentralization and trust require years, if not decades, to establish. ETH maintains a significant first-mover advantage and appears well-positioned to capture a future surge in demand for institutional-grade onchain activity.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin rebounds after Iran strikes wipe $128B from market

Bitcoin fell to $63,062 before recovering to $66,201 following reports of large explosions in Tehran as the United States and Israel launched strikes across Iran.

Summary

- Bitcoin dropped to $63K on Iran strike news before rebounding above $66K.

- Crypto market lost $128B in panic selling as missiles hit Middle East.

- UAE intercepted missiles safely as BTC and ETH recovered from lows.

Ethereum (ETH) dropped to $1,837 before rebounding to $1,940. As per the data at the time of the attack, the crypto market erased approximately $128 billion in value in the immediate aftermath.

Iran launched retaliatory missiles at multiple locations including Israel, Qatar, the United Arab Emirates, and Bahrain.

They also threatened further strikes against U.S.-linked bases in Iraq.

The UAE Ministry of Defence successfully intercepted Iranian missiles without damage or injuries, though fragments fell across Abu Dhabi.

Bitcoin and Ethereum recover from intraday lows

Bitcoin (BTC) traded in a 24-hour range of $63,062 to $66,108 before settling at $66,201. The asset gained 1.12% over one hour and 1.28% over 24 hours. The intraday low of $63,062 is a 4.6% drop from the 24-hour high.

Ethereum’s 24-hour range spanned $1,837 to $1,946, with the current price at $1,940. The asset posted gains of 1.42% over one hour.

Both assets demonstrated quick recovery from initial panic selling as markets assessed the scope of the military action.

Bitcoin reclaimed the $66,000 level while Ethereum held above $1,900 after testing support below $1,850.

Regional missile exchanges cause risk-off sentiment

The strikes began Saturday with explosions reported in Tehran. U.S. President Donald Trump urged Iranians to overthrow the government once the military campaign concludes.

Hours after the initial strikes, Iran launched missiles targeting Israel, Qatar, UAE, and Bahrain.

The UAE Ministry of Defence intercepted the new wave of Iranian missiles launched toward the country.

Fragments of intercepted missiles fell across several parts of Abu Dhabi including Saadiyat Island, Khalifa City, Bani Yas, Mohammed bin Zayed City, and Al Falah. No injuries were reported.

The ministry affirmed readiness to deal with any threats and stated it is taking all necessary measures to counter anything aiming to undermine the country’s security and stability.

Crypto World

Iran War Rocks Global Markets: What It Means for Stocks, Bitcoin, Gold and the Economy

TLDR:

- Bitcoin dropped to $63K within minutes of the Iran War breaking out, triggering over $515M in crypto liquidations.

- Gold surged past $5,200 as the Iran War intensified, with Bank of America forecasting a $6,000 per ounce target.

- The Strait of Hormuz carries 20% of global oil daily, and tankers are already halting movement amid the Iran War.

- Recession probability jumped from 25–30% to 40–50% as the Iran War threatens sustained disruption to global oil supply.

The Iran War has triggered an immediate financial shockwave across every major asset class. Open military conflict between the U.S., Israel, and Iran erupted on February 28, following explosions across Tehran, southern Lebanon, and near U.S. military bases.

President Trump declared “major combat operations” under Operation Epic Fury. Iran responded with missile strikes on Israeli and U.S. Gulf bases.

Investors across every market are now reassessing their positions as the situation continues to evolve hour by hour.

Stock Markets Face a Historic Test as War Escalates

The Iran War arrived at an already fragile moment for equities. The S&P 500 had turned negative for 2026 before the first strike even landed.

Bank of America held the most bearish S&P 500 outlook heading into the conflict, with a year-end target of just 7,100.

Historical data, however, offers a counterpoint worth noting. CFA Institute data shows U.S. large-cap stocks returned 11.9% annualized during wartime versus 10.0% during peacetime periods.

Across six major conflicts, the pattern has remained consistent — markets sell off before the war begins, then recover shortly after it starts.

The critical difference this time is oil. None of those previous wars directly threatened a supply corridor handling 20% of global crude.

If the Strait of Hormuz faces prolonged disruption, the historical “buy the war” playbook may not hold. Recession probability has already shifted from roughly 25–30% to an estimated 40–50%.

Bitcoin and Gold Split as Investors Seek Safety

Bitcoin dropped to approximately $63,000 within minutes of the Iran War breaking out, falling 3.8% almost immediately.

Over $515 million in crypto liquidations followed, erasing roughly $128 billion from total market capitalization. Ethereum fell 5.5%, with $149 million in ETH futures liquidations recorded by CoinGlass.

Gold, by contrast, surged past $5,200 and settled near $5,296 in the same window. Silver climbed 7.85% alongside it.

Gold had already gained 13.31% in January alone, reflecting a months-long trend driven by central bank buying and growing de-dollarization momentum.

The divergence between the two assets tells a clear short-term story. Bitcoin is trading like a risk-on asset, absorbing panic selling during weekend hours when no other liquid market is open.

Gold is functioning as the traditional safe haven. Bank of America expects gold to reach $6,000 per ounce over the next 12 months, and every current macro condition supports that trajectory.

Oil Prices and Economic Fallout Determine What Comes Next

The Iran War’s economic consequences hinge almost entirely on what happens at the Strait of Hormuz. Roughly 20 million barrels of oil pass through it daily, covering Qatar’s LNG, UAE crude, and most of Kuwait and Iraq’s exports.

Tanker traffic has already slowed, with Japanese shipping firm Nippon Yusen directing its full fleet away from the strait.

Brent crude closed the prior Friday at $72.48, while WTI jumped to $75.33, up 12% in a single session. Lombard Odier estimates a temporary spike to $100 per barrel is plausible under current conditions.

A sustained 20–30% oil price increase could depress global growth by 0.5–1.0% and push headline inflation higher by a similar margin.

The chain reaction from there runs through the entire economy. Higher oil raises costs across transportation, manufacturing, and consumer goods. Spending contracts, confidence falls, and growth slows.

The Federal Reserve, already stuck with rates at 3.5%–3.75% and inflation near 3%, has little room to respond. If Brent remains below $90, markets may stabilize. Above $100 sustained, the road through 2026 becomes considerably rougher.

Crypto World

Here’s how bitcoin’s price rise could be fueled by job-stealing AI software

Bitcoin’s future in an artificial intelligence-driven world may depend less on code and more on central banks.

In a new note, Greg Cipolaro, global head of research at financial services and infrastructure firm NYDIG, argued that artificial intelligence will affect bitcoin mainly through macroeconomic channels and its impact on the labor market.

The key variables are growth, employment, real interest rates and liquidity. Bitcoin, he writes, sits downstream of those forces.

If automation cuts jobs and wages, consumer demand could weaken and, in a severe case, falling incomes would strain debt payments and pressure asset prices.

Those fears appear to be well-grounded. Just this week, Jack Dorsey’s fintech firm Block unveiled its shrinking back toward its pre-pandemic size, cutting staff by about 40%. Dorsey cited AI-enabled efficiency for the job cuts, something that was theorized in Citrini’s research on the AI-doom that spooked the market this week.

In such a scenario, policymakers might respond with lower rates or fiscal spending to stabilize the economy. That wave of liquidity could support bitcoin, which has often tracked shifts in global money supply.

A different outcome would look less friendly for the cryptocurrency. If AI boosts productivity and economic growth without major job losses, real yields could rise, and central banks might keep policy tight.

Higher real rates have historically weighed on bitcoin by raising the opportunity cost of holding it and making risk assets less attractive.

Shift in demand

Anxiety around AI echoes past moments of upheaval in Human society.

The steam engine displaced manual labor in factories and on farms. Electrification then rewired entire industries. Later, computers and the internet automated clerical work and reshaped retail, media and finance.

Each wave triggered fears of permanent job loss. In the early 1900s, factory mechanization sparked labor unrest as machines replaced skilled craftsmen. In the 1980s and 1990s, personal computers cut typist pools and back-office staff. More recently, e-commerce helped hollow out brick-and-mortar retail roles.

Yet aggregate demand did not collapse. Productivity rose. New industries absorbed displaced workers, even if the transition proved uneven and painful. Nowadays, we have industries that were unthinkable before the dawn of the internet. Think cloud computing.

Cipolaro argued AI may follow a similar pattern. As a general-purpose technology, it requires firms to redesign workflows and invest in complementary tools. Over time, that process tends to expand productive capacity rather than shrink it.

“The implication is not that disruption will be painless, but that the equilibrium response to new technology has historically been integration, not obsolescence,” Cipolaro wrote. “Society’s response to AI will likely follow the same pattern.”

For bitcoin, that distinction matters. If AI ultimately lifts long-term growth, the structural backdrop could differ from the short-term shocks that often drive liquidity injections.

Meanwhile, adoption may also rise thanks to agentic payments, which would essentially see software pay other pieces of software without human involvement. One of Bitcoin’s earliest visions centered on machine-to-machine payments, and AI may be the necessary tool to make them a reality.

Still, incentives aren’t currently there for a widespread rollout. Credit cards bundle rewards and short-term credit, features that stablecoins do not yet match, Cipolaro noted.

Ultimately, while the rise of AI brings new challenges, what matters is the human response to the disruption it brings. If AI triggers a deflationary shock and forces the money printer to turn back on, or if it fuels a productivity boom that raises real yields, bitcoin will reflect that.

Crypto World

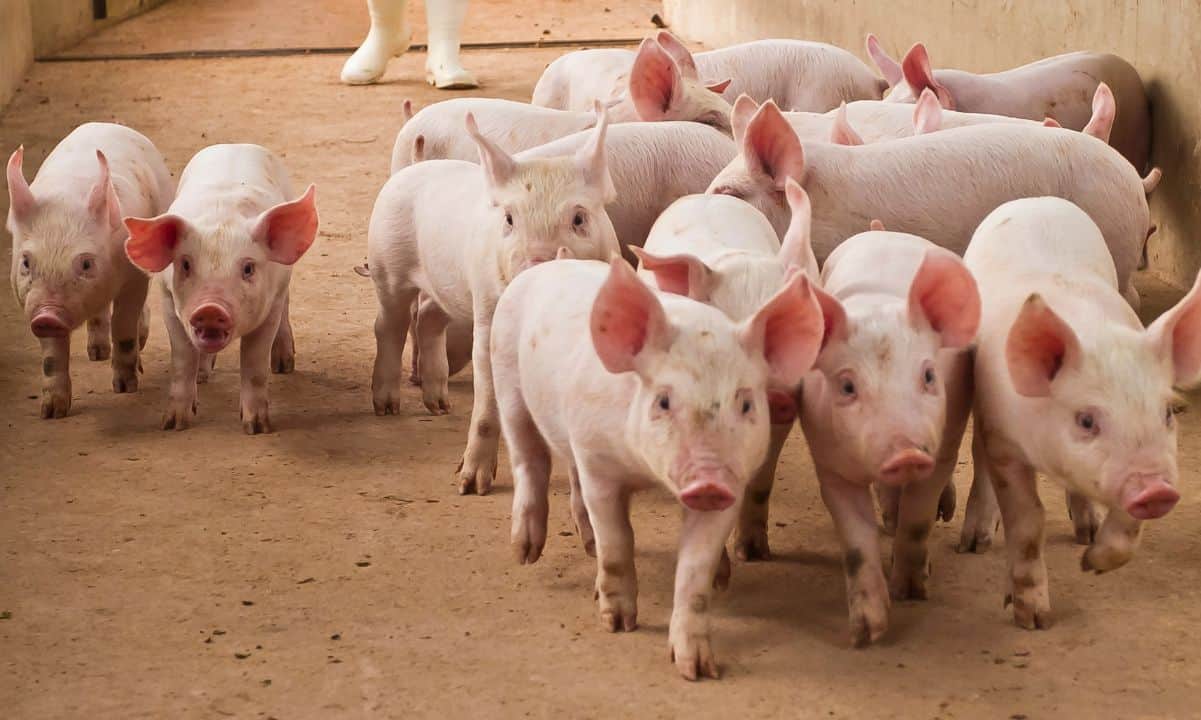

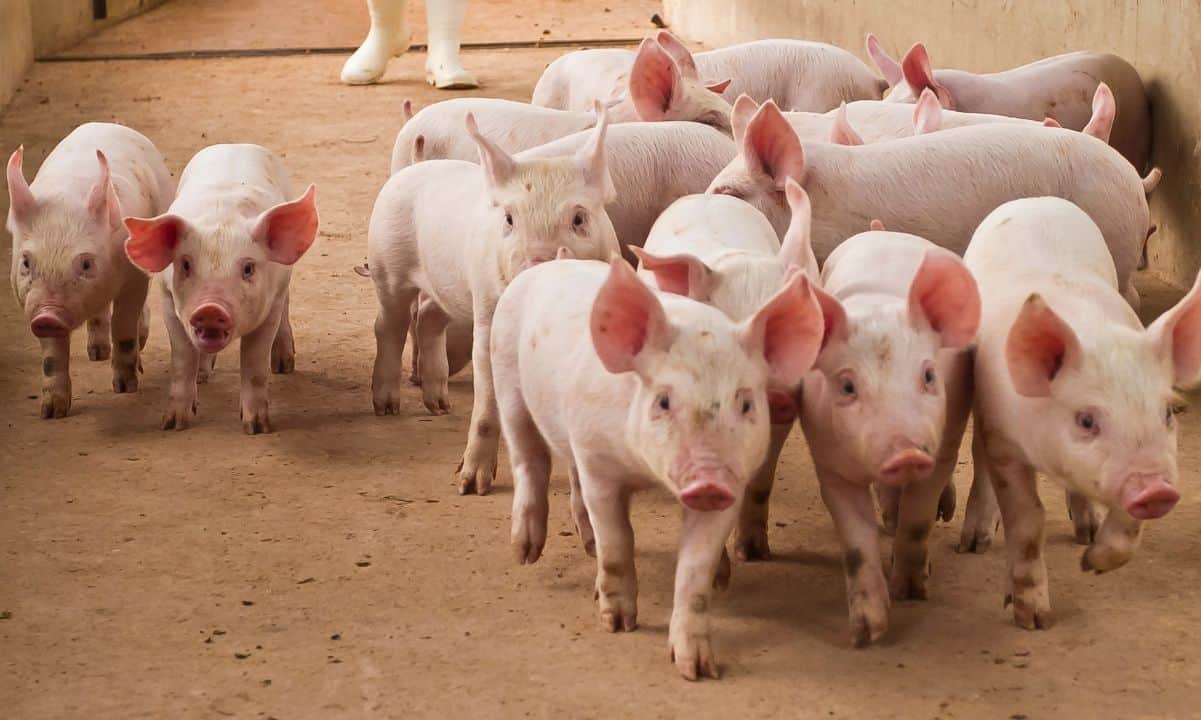

Feds Seize $61 Million in Tether Linked to ‘Pig Butchering’ Crypto Scams

A tip to Homeland Security unraveled a multi-wallet laundering scheme, which ultimately resulted in a $61 million Tether confiscation.

US federal agents have seized more than $61 million worth of USDT. Investigators traced the seized funds to cryptocurrency addresses allegedly linked to the laundering of criminal proceeds obtained through “pig butchering” schemes.

According to the official press release, the funds were connected to scams in which victims were recruited and manipulated into transferring money under false pretenses.

Romance, Fake Profits, and $61M in USDT

Court filings state that criminal actors targeted victims by establishing trust and often posed as romantic partners. After gaining victims’ confidence, the scammers claimed to have specialized knowledge or techniques that could generate massive profits through cryptocurrency trading.

Victims were directed to fraudulent cryptocurrency trading platforms that closely resembled legitimate platforms in name and appearance. These fake platforms displayed fabricated investment portfolios and showed unusually high returns in order to encourage victims to invest increasing amounts of money.

When victims attempted to withdraw their funds, they were unable to do so and were frequently told they needed to pay additional “taxes” or “fees” to release their assets. According to authorities, these tactics were used to extract more money from victims.

Once funds were transferred to cryptocurrency wallets controlled by the scammers, the money was rapidly moved through multiple wallets to conceal its source, ownership, and control. In this case, Homeland Security Investigations (HSI) agents and analysts in Raleigh received a complaint through the HSI Tip Line and traced the victim’s funds through several cryptocurrency wallets involved in the alleged fraud and money laundering scheme.

Authorities also revealed that some of those wallets still held significant amounts of victims’ funds, making them subject to seizure and forfeiture.

You may also like:

Crackdowns

Tether has been involved in several financial crime investigations in coordination with international law enforcement agencies. The stablecoin issuer has assisted efforts to track, freeze, and support the seizure of illicit funds. On July 22, 2025, the US Department of Justice announced a civil forfeiture action against Buy Cash Money and Money Transfer Company that involved freezing and reissuing $1.6 million in USDT allegedly tied to Gaza-based terror financing.

In June 2025, Brazilian authorities recognized Tether’s assistance in blocking approximately $6.2 million, connected to a cross-border money-laundering scheme conducted through Klever Wallet. Also in June 2025, the Department of Justice and OKX enabled a civil forfeiture complaint seeking to seize roughly $225 million in USDT allegedly linked to pig butchering investment scams. In March 2025, the United States Secret Service froze $23 million in funds associated with transactions on the Russian-sanctioned exchange Garantex.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Politics7 days ago

Politics7 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion1 day ago

Fashion1 day agoWeekend Open Thread: Iris Top

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World5 days ago

Crypto World5 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports17 hours ago

The Vikings Need a Duck

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 hours ago

NewsBeat5 hours agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat10 hours ago

NewsBeat10 hours agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat4 days ago

NewsBeat4 days agoPolice latest as search for missing woman enters day nine