Crypto World

BitRiver CEO Reportedly Under House Arrest Amid Tax Evasion Charges

The Zamoskvoretsky Court in Moscow has reportedly ordered BitRiver CEO Igor Runets to remain under house arrest amid tax evasion charges. Local outlets RBK and Kommersant reported that Runets was detained on January 30 and faces three counts for allegedly concealing assets to evade taxes. The court documents, cited by the outlets, indicate that Runets was charged on January 31 and placed under house arrest the same day. A narrow window remains for a potential appeal before the measure becomes fully enforceable on February 4. Cointelegraph reached out to Runets for comment as the case unfolds, underscoring the brisk pace of developments in a sector already shaped by sanctions and regulatory scrutiny. The developing story adds another layer to BitRiver’s fraught trajectory in a landscape where crypto mining in Russia intersects with geopolitical risk and energy considerations.

Key takeaways

- Detention and charges: Runets was detained on January 30 and charged on January 31 with three counts related to concealing assets to evade taxes; a house-arrest order was issued on the same day, with enforcement set to begin on February 4 unless an appeal changes the outcome.

- Regulatory backdrop and sanctions: BitRiver has weathered sanctions from the US Treasury in mid-2022, reflecting ongoing geopolitical risk surrounding crypto mining in Russia and the wider energy-intensive sector.

- Client exodus and cost-cutting: By late 2024, BitRiver reportedly initiated cost reductions and scaled back operations, with salary delays affecting staff as the firm faced mounting financial pressures.

- Litigation in the new year: In early 2025, Infrastructure of Siberia filed two lawsuits against BitRiver, alleging non-delivery of equipment after payment under a contract, signaling continued creditor friction as the case progresses.

- Wealth and profile: Bloomberg’s 2024 reporting placed Runets’ net worth at roughly $230 million, illustrating the personal scale of potential risk and the stakes for the founder amid legal scrutiny.

Tickers mentioned: $BTC

Market context: The case sits within a broader framework of regulatory scrutiny of crypto mining in Russia, ongoing sanctions regimes, and the volatility of multinational energy- and infrastructure-intensive mining operations. The outcome could influence financing, partnerships, and operational strategy for Russian miners in the near term.

Why it matters

The Runets case crystallizes the legal and regulatory crosswinds facing Russia’s prominent crypto-mining operators. BitRiver’s prominence—built on large-scale data centers in Siberia that provide crypto mining services to other entities—made it a high-profile target for authorities seeking to enforce asset disclosures and tax compliance. If the court’s decision stands, it could further constrain management decisions in the near term and complicate negotiations with suppliers, lenders, and energy providers who remain sensitive to compliance risk in the sector.

Beyond the consequences for BitRiver itself, the proceedings illuminate how Russia’s crypto ecosystem is navigating a shifting regulatory climate. The mid-2022 sanctions regime linked to BitRiver’s activities and the subsequent 2023 client departure by SBI—reported as halting usage of BitRiver’s infrastructure—underline how sanctions and geopolitical tensions reverberate through day-to-day operations. End-2024 reports of cost cuts and delayed salaries suggest liquidity challenges that could affect payroll, maintenance of mining capacity, and the ability to meet commercial commitments. The early-2025 lawsuits add a creditor-facing dimension to the case, illustrating how disputes over payments and delivered equipment can compound legal risk for a private operator already under scrutiny.

Looking at the broader perspective, the case underscores the persistent tension between rapid growth in private mining capacity and the robust enforcement of financial and asset reporting standards. It also highlights how individual executive-level cases can become proxies for the sector’s governance challenges, including how privately held mining ventures manage assets, liabilities, and cross-border relationships in a climate of sanctions and regulatory ambiguity. The narrative around Runets—once cited as a central figure in Russia’s crypto-mining expansion with a reported net worth around $230 million—emphasizes the high personal stakes involved when market dynamics meet legal accountability.

What to watch next

- February 4 enforcement: Whether Runets’ appeal short-circuits or delays the house-arrest order, and what the court says in any ruling or scheduling update.

- Defense statements: Any formal response or filings from Runets’ legal team that could shape the trajectory of the case or inspire a settlement framework.

- BitRiver operational updates: Any announcements about changes to mining capacity, staffing, or supplier agreements in light of the financial pressures and ongoing investigations.

- Regulatory developments: New or evolving guidance from Russian authorities on tax reporting, asset disclosure, or sanctions-related compliance for mining firms.

- Creditor actions: Developments related to the Infrastructure of Siberia lawsuits and any related settlements or judgments that could affect BitRiver’s balance sheet.

Sources & verification

- Zamoskvoretsky Court documents cited by RBK and Kommersant reporting on Runets’ detention and charges.

- RBK, coverage on Runets’ detention and three-count charge and the timing of the house-arrest order.

- Kommersant, reporting on court filings and the January 31 charge date.

- Bloomberg, 2024 profile referencing Runets’ net worth around $230 million and the broader crypto-mining context.

- US Treasury sanctions on BitRiver in mid-2022, referenced in coverage of the firm’s regulatory exposure.

- Kommersant, late-2024 reporting on BitRiver cost cuts and delayed salaries under pressure.

- Infrastructure of Siberia, early-2025 lawsuits against BitRiver alleging non-delivery of equipment after payment.

Legal pressure mounts on BitRiver founder amid tax-evasion charges

BitRiver, founded in 2017, emerged as one of Russia’s largest Bitcoin (CRYPTO: BTC) mining operators, running expansive data-centers across Siberia that provided mining services to third parties as the sector expanded. The latest legal developments, centered on its chief executive Igor Runets, place a spotlight on asset reporting and tax compliance in a business model built on high-capacity power use and complex vendor relationships. According to court documents cited by local outlets, Runets was detained on January 30 and formally charged on January 31 with three counts of concealing assets to evade taxes. The Zamoskvoretsky Court subsequently ordered him under house arrest on the same day, with the measure slated to take full effect on February 4 unless an appeal is filed or granted. The case thus enters a critical phase, and Runets’ legal team has a narrow window to respond before the period of restriction consolidates.

In the wake of the charges, Runets’ representatives have not issued a public statement, and Cointelegraph confirmed it sought comment from the parties involved. The broader context includes BitRiver’s history of external pressures, notably the US Treasury’s sanctions in mid-2022 in response to the Russia-Ukraine conflict. The March 2023 timeline also saw SBI, a prominent Japanese banking group, pull back from using BitRiver’s infrastructure, a development that underscored the fragility of cross-border partnerships amid geopolitical frictions. By late 2024, industry reporting suggested BitRiver was implementing cost reductions and delaying salaries, signaling liquidity strains that can accompany a company facing legal scrutiny and sanctions exposure.

The financial strain was compounded by a sequence of disputes that surfaced in early 2025 when Infrastructure of Siberia filed two lawsuits alleging that the company paid for equipment that was never delivered. This creditor pressure mirrors the wider challenge for mining operators trying to maintain operation while navigating regulatory risk and the volatility of energy markets, which are essential to the unit economics of crypto mining. The Bloomberg profile in 2024, which pegged Runets’ net worth at around $230 million, adds another layer to the stakes involved—where personal holdings intersect with the fortunes of a fast-growing but increasingly regulated sector. Taken together, the case paints a portrait of a high-stakes industry confronting legal accountability while attempting to preserve capacity and reliability in an environment shaped by sanctions and geopolitical headwinds.

Crypto World

PayPal (PYPL) jumps 7% as Stripe reportedly weighs acquisition. Here is what it means for crypto

Stripe, which processed $1.9 trillion in transactions last year and was recently valued at $159 billion, is considering an acquisition of all or parts of PayPal (PYPL), according to a Bloomberg report.

Deliberations are in early stages, the report continued.

If completed, the deal would bring together two major payment firms that have both moved into stablecoins.

PayPal launched its dollar-backed stablecoin in 2022 through issuer Paxos. The token has since grown to a market value of about $4 billion. It allows users to move dollars across crypto networks at any time of day, often at a lower cost than bank wires.

Stripe has also pushed deeper into crypto. In 2024, it acquired Bridge for $1.1 billion, a company that builds tools for businesses and crypto projects to issue their own U.S. dollar-backed tokens. Stripe is also working with venture firm Paradigm to develop Tempo, a payments-focused blockchain now in testing.

PayPal has struggled mightily in recent years, its stock tumbling about 80% from record highs hit in 2021. Shares were already higher this week on buyout chatter, and they rose another 7% late Tuesday in the wake of the Stripe report.

Read more: Stripe’s Bridge sees stablecoin volume quadruple as utility insulates from ‘crypto winter’

Crypto World

crypto wallets for AI agents are creating a new legal frontier

SAN FRANCISCO, CA – Crypto isn’t just building faster payments rails. It may be building the financial system for non-humans.

As AI agents grow more autonomous, developers are already giving them crypto wallets, allowing software to hold assets, pay for services, trade tokens and even hire other agents. The technical pieces are falling into place. The legal ones are not.

At a recent panel at NEARCON 2026, Electric Capital’s Avichal Garg framed the moment as historically significant.

“What happens if there’s not a human behind it at all?” Garg asked. “It’s some piece of code that owns a wallet, executing code to make more money… How does liability work in that case? I actually don’t know.”

Crypto makes this possible in a way traditional finance cannot. Blockchains allow programmable money, instant settlement and global access. Pair that with AI agents capable of making decisions, and you get something new: software that can both think and transact.

Garg compared the shift to the creation of the limited liability corporation in the 19th century — a legal breakthrough that unlocked pooled capital and industrial-scale growth.

“The cost of participating in the economy has come down so far,” he said. “You’re talking about anybody in the world, with relatively little money, being able to create value.”

But enforcement remains unresolved.

“You can’t punish an AI,” Garg noted. “You can turn them off, but they don’t care.”

If autonomous agents begin trading, lending, hiring and scaling businesses onchain, lawmakers may face a foundational question: Who is liable when software with its own wallet acts independently?

Read more: Kraken’s co-CEO could trust AI with 100% of his crypto — Dragonfly’s Haseeb Qureshi isn’t convinced

Crypto World

Crypto Markets Struggle as BTC Slips Below $64K

BTC failed to hold key support levels, dragging the wider crypto market lower.

Cryptocurrency markets are under pressure again, with traders reacting to broader AI-linked fears, lingering macro uncertainty and signs of waning institutional demand. Today, Feb. 24, total crypto market capitalization slipped 2.5%, currently hovering around $2.27 trillion.

Bitcoin (BTC) slid from about $66,000 on Monday morning, Feb. 23, to near $63,700 at press time, marking a 3% daily decline. BTC’s weekly losses are around 6%.

Ethereum (ETH) tracked BTC’s move, falling 3% to $1,840, and down 5.4% on the week.

Among the rest of the top-10 assets, most are seeing mild to moderate losses today. XRP is down 1.7% to $1.35, BNB lost 3.6% to about $585, and Solana (SOL) declined 3% to $77.

Figure Heloc (FIGR_HELOC) was the only top-10 large-cap in the green this morning, up 1.5%.

Oversold

Alex Thorn, head of firmwide research at Galaxy Digital, noted in an X post today that BTC is approaching all-time oversold territory, with weekly RSI readings lower than any moment outside the deepest bear markets, citing November-December 2018 and mid-2022 as rare comparable periods.

Wintermute analysts highlighted in another X post today that Bitcoin has repeatedly failed to break through the $70,000 mark in the past two weeks, while ETH dipped below the psychologically important $1,900 mark.

“Multiple times over the past decade, growth scares have triggered rotations that ultimately reversed as risk appetite returned and the market found its way back to momentum,” the analysts noted.

They added that thin liquidity with derivatives signals a lack of directional conviction. Some selective interest in altcoins from high-net-worth investors briefly emerged mid-week but quickly faded.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, PIPPIN gained the most, up 6.6% to $0.77 on the day, while Monero (XMR) rose 3.4% to $325.

On the downside, Bitcoin Cash (BCH) led losses at 11% to $475.40, followed by NEXO, down 5.5% to $0.80.

According to CoinGlass data, around 137,000 traders were liquidated over the past 24 hours, with total losses of $412.9 million, where BTC accounted for $156.3 million and ETH for $131.7 million, while other altcoins accounted for $22.1 million.

ETFs and Macro Conditions

Spot Bitcoin ETFs saw $203.8 million in outflows on Monday, bringing cumulative assets to $80.7 billion. Ethereum ETFs recorded $49.4 million in outflows, with total net assets now at $10.4 billion, per SoSoValue data.

Macro conditions still feel shaky. Shares of IBM plunged about 13% on Monday, Feb. 23 — the stock’s steepest drop in more than 25 years. The selloff came after Anthropic said its Claude Code tool can automate COBOL modernization, the old-school language that still rakes in serious revenue for IBM.

Adding to the nervous mood, analysts at Citrini Research warned in a Feb. 22 note that rapid AI adoption could displace large numbers of white‑collar jobs, squeeze consumer spending, and put pressure on both financial and tech sectors.

In comments to investors on Monday, JPMorgan CEO Jamie Dimon drew comparisons between current credit and risk dynamics and those seen in the run‑up to the 2008 financial crisis, fueling more caution among investors.

Crypto World

GCC Leaders Fast-Track GenAI Adoption Across Tax, Finance and Legal Sectors

Editor’s note: The GCC region is moving quickly from experimenting with Generative AI to embedding it across core business functions. Deloitte’s newly released survey of tax, finance and legal leaders shows a clear acceleration in GenAI adoption, driven by a demand for smarter research, decision support and quality assurance. As regional companies navigate data privacy, governance and implementation roadmaps, this editorial note highlights momentum and the remaining gaps that organizations must address to translate ambition into measurable outcomes.

Key points

- GenAI adoption is accelerating across tax, finance and legal functions in the GCC.

- Non-adoption fell from 52% in 2024 to 29% in 2025, with participation rising 47% year over year.

- Priorities have shifted toward research and analysis (41%) and quality improvement (38%).

- Only 18% are piloting GenAI, 9% are scaling, and 10% have enterprise-wide AI strategies and governance in place; 63% remain in pre-implementation.

- Automation remains a major opportunity, with 53% prioritizing automation; emphasis on research and data analysis (41%).

Why this matters

GenAI adoption in the GCC signals a shift from experimentation to strategic capability across tax, finance and legal functions. The findings underscore the importance of governance, robust operating models and workforce readiness to translate momentum into measurable business value and trusted, scalable deployment across enterprises. With rising confidence in AI’s long-term potential, organizations must balance speed with quality, risk controls and responsible governance to sustain momentum.

What to watch next

- Move from pilots to enterprise-wide AI strategies and governance frameworks.

- Strengthen governance, operating models and adoption roadmaps.

- Invest in data quality and capability development for deeper analytics.

- Monitor automation opportunities and balance between speed and quality.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

GCC Leaders Accelerate GenAI Adoption in Tax, Finance and Legal Functions

A new Deloitte survey reveals rapid uptake across the region, alongside growing gaps in governance, strategy and implementation.

Dubai, UAE – 24 February, 2026: A new regional survey by Deloitte’s Tax & Legal business shows that organizations across the GCC are rapidly adopting Generative AI (GenAI) in tax, finance, and legal functions – but many are still struggling to move from experimentation to enterprise-wide impact.

Based on insights from senior tax and finance leaders across Saudi Arabia, the UAE, Qatar, and Kuwait, the survey shows rapid acceleration in GenAI adoption across the GCC. Non-adoption fell sharply from 52% in 2024 to 29% in 2025, while survey participation rose 47% year over year. The survey results indicate that GenAI has become a mainstream strategic priority for regional leadership teams.

While early adoption focused on basic productivity tasks such as email drafting, priorities have moved toward research and analysis (41%) and accuracy and quality improvement (38%). This reflects a transition from efficiency-led experimentation to more strategic value creation. At the same time, 93% of respondents expect AI to have a significant impact on their organizations, highlighting strong regional confidence in the technology’s long-term potential.

Yet despite this momentum, execution remains a key challenge. While 18% of organizations are actively piloting GenAI use cases, only 9% have begun scaling solutions, and just 10% report having enterprise-wide AI strategies and governance frameworks in place. More than 63% remain in pre-implementation stages, underscoring the need for clearer operating models, stronger governance, and structured adoption roadmaps to translate ambition into measurable outcomes.

Automation continues to be a major opportunity area, with 53% of respondents prioritizing automation, particularly in data validation and data reconciliation. However, leaders are increasingly emphasizing quality over speed, with research and data analysis accounting for 41% of current GenAI applications, signalling demand for deeper analytical support rather than simple task automation.

Implementation approaches vary widely across the region. While some organizations are adopting subscription-based or hybrid models, 38% say they are still exploring how to operationalize GenAI, reinforcing the need for advisory support to bridge strategy and execution.

Reflecting on the regional landscape, Muhammad Bahemia, Middle East Tax Leader at Deloitte, said: “The pace of Generative AI adoption across the GCC reflects a region that is both ambitious and pragmatic. Leaders clearly recognize the technology’s potential, but many are now confronting the harder question of how to scale it responsibly. Through our work across tax, finance, and legal functions, Deloitte is helping organizations translate innovation into disciplined execution; strengthening governance, building capabilities, and embedding AI in ways that deliver measurable value and enduring trust.”

Further commenting on the findings, Mohamed Serokh, Partner, at Deloitte Middle East, said: “What we’re seeing across the GCC is a clear shift from curiosity to action. Leaders recognize GenAI’s potential to fundamentally reshape tax, finance, and legal functions, particularly in research, analysis, and quality improvement. However, our survey also shows that many organizations are still navigating how to move from pilots to scalable impact. Success will depend on strong governance, capability development, and a disciplined approach to implementation.”

The survey concludes that while experimentation is widespread, the next phase for GCC organizations must focus on structured execution. Prioritizing high-impact use cases in research and tax analysis, strengthening governance frameworks, and investing in workforce readiness to support responsible, scaled adoption.

Explore the survey insights on this link.

© 2026 Deloitte & Touche (M.E.). All rights reserved.

In this press release references to “Deloitte” are references to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”) a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see deloitte.com/about for a detailed description of the legal structure of DTTL and its member firms. The information contained in this press release is correct at the time of going to press.

About Deloitte & Touche (M.E.) LLP

Deloitte & Touche (M.E.) LLP (“DME”) is the affiliate for the territories of the Middle East and Cyprus of Deloitte NSE LLP (“NSE”), a UK limited liability partnership and member firms of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”).

DME is a leading professional services organization established in the Middle East region with uninterrupted presence since 1926. DME’s presence in the Middle East region is established through its affiliated independent legal entities, which are licensed to operate and to provide services under the applicable laws and regulations of the relevant country. DME’s affiliates and related entities cannot oblige each other and/or DME, and when providing services, each affiliate and related entity engages directly and independently with its own clients and shall only be liable for its own acts or omissions and not those of any other affiliate.

DME provides services throughout 26 offices in 14 countries with more than 7,000 partners, directors and staff.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firms and related entity is liable only for its own acts and omissions, and not those of each other. DTTL, NSE and DME do not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte provides Audit & Assurance, Tax & Legal and Consulting and related services to nearly 90% of the Fortune Global 500® and thousands of private companies. Our professionals deliver measurable and lasting results that help reinforce public trust in capital markets, enable clients to transform and thrive, and lead the way toward a stronger economy, a more equitable society and a sustainable world. Building on its 175-plus year history, Deloitte spans more than 150 countries and territories. Learn how Deloitte’s approximately 457,000 people worldwide make an impact that matters at www.deloitte.com.

Noora Cheikh

Eminence, Media & Digital Marketing Leader

Deloitte & Touche (M.E.)

ncheikh@deloitte.com | www.deloitte.com

Crypto World

Fluid Proposes Establishing a Foundation Funded by $3M Annual Grant From DAO

If approved, the governance proposal by Instadapp’s COO would establish a non-profit foundation to oversee the DeFi protocol’s code, frontend and trademarks.

Fluid DAO is considering a proposal to transfer all of the DeFi platform’s intellectual property into a Cayman Islands foundation, and to approve a $250,000 monthly grant to fund development and operations.

The proposal was submitted on Monday, Feb. 23, by DMH, the COO of Instadapp, the firm behind Fluid. It calls for the creation of the Fluid Foundation governed by DAO votes, a familiar corporate setup for crypto organizations.

Under the plan, “all Fluid Protocol smart contract code,” front-end interfaces, domains, trademarks and related assets would be transferred to the foundation. Once completed, the assets would “belong to the Foundation — not to any individual, company, or labs entity,” DMH wrote.

The foundation would have no owners and would operate through custodians and directors, according to the proposal. Its sole purpose would be to hold and steward the protocol’s intellectual property on behalf of the DAO.

“The Fluid team acts as custodians of the Foundation — not owners,” the proposal states, with FLUID token holders retaining “ultimate authority” through governance.

Control Stays with DAO

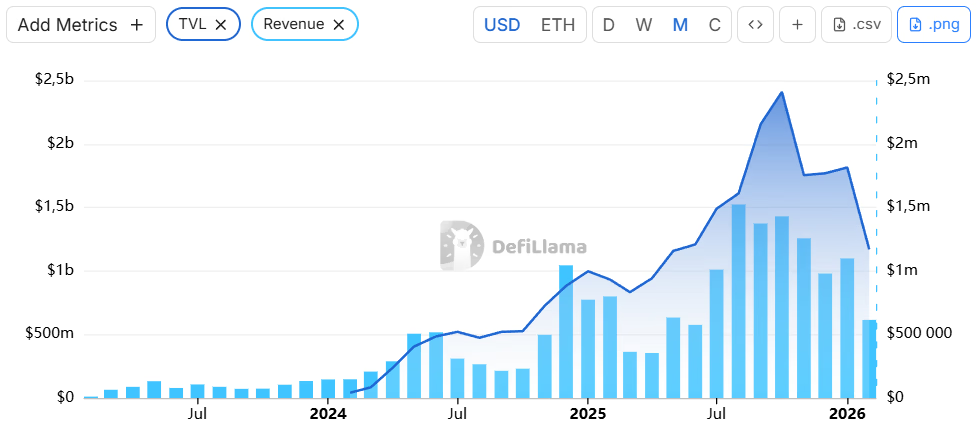

The proposal argues that a legal entity is needed as the protocol, which now has over $1 billion in total value locked (TVL), expands and engages with off-chain counterparties. A foundation structure would allow Fluid to meet “AML, KYC, banking, and regulatory requirements” without altering how token-based governance functions, the proposal argues.

Token holders would also retain the power to change foundation policy or shut it down entirely. The proposal says holders could “in an extreme case, dissolve the Foundation entirely through a governance vote.” DMH further elaborated in a response to a comment on the proposal:

“It is very important to understand that in the legal field, token holders and DAO have no rights; this is why we are creating a legal wrapper that can now have ownership rights over the protocol, and this foundation has no ownership.”

To fund the structure, the DAO is being asked to approve a $250,000 monthly grant, or about $3 million a year from its treasury, which is funded by protocol revenue. The budget would cover engineering, infrastructure, security, business development and general operational costs, according to DMH.

‘Foundation Bears the Legal Costs’

Fluid operates a decentralized lending and borrowing protocol, as well as a swap interface. According to data from DefiLlama, that combination has brought Fluid roughly $1.2 billion in TVL and generated about $1.1 million in revenue in January. In August, the platform saw a record high revenue of $1.52 million. Taking Fluid’s best revenue month yet, the grant would consume around 16% of that monthly revenue.

If approved, legal work to transfer the IP is expected to be completed by mid-2026, with Cayman Islands counsel handling the process. The team also plans to move ownership of all EVM deployments under direct DAO governance.

Some raised concerns about liability if the foundation were sued. In response, DMH said that “if the foundation gets sued, the foundation itself bears the legal costs and any liability.”

Over the past 24 hours, FLUID slid 6% from around $2 to $1.88, but has since recovered to $1.96.

The Defiant reached out to Instadapp for comments on the proposal, but hasn’t heard back by press time.

Late last year, a fee-related dispute between the two main entities behind Aave — Aave Labs and Aave DAO — turned into a broader debate on how crypto organizations should be structured.

Crypto World

Tom Lee’s ETH losses at Bitmine exceed FTX customer losses

Tom Lee, founder of Fundstrat and Chairman of ether (ETH) treasury company Bitmine Immersion Technologies, has lost more on ETH using other people’s money than the $8 billion worth of losses suffered by FTX customers.

With 4,422,659 ETH purchased at an average $3,850 apiece, Lee’s company raised capital to buy the asset at over $2,000 more per coin than today’s price.

As a result, he’s lost $8.8 billion of his company’s assets.

At time of writing, ETH is trading at $1,843, down 60% over the past six months alone. Unfortunately, Bitmine Immersion has been buying tons of ETH over that bearish period — increasing losses for its investors at an alarming rate.

Over the past six months, as ETH was declining 60%, Bitmine Immersion bought an extra 2,708,760 ETH.

Those progressively disastrous additions increased the company’s losses from $4.8 billion to $8.8 billion.

Read more: Even Ethereum treasury companies are selling ETH to pay off debt

Bitmine Immersion lost $8.8 billion by buying ETH

It’s not particularly remarkable for digital asset treasury (DAT) companies to have declined in value.

The Wall Street fad, which peaked in early summer 2025, was to overpay for leverage in the hope that the mania would increase to even more exuberant heights, or that the company could convince bond investors or other capital allocators to offer it even more leverage.

In the distant future, all DATs focused on the ultimately limited supply of bitcoin (BTC) or ETH as another reason to invest in these leveraged acquisition strategies, even though their efforts to corner the market usually fizzled within single digit percentages of the outstanding supply of those assets.

What started as modest premiums of a few percentage points quickly ballooned into stock debuts rallying to 23x the value of their crypto holdings.

That once-23x overvalued stock, like many similar treasury stocks, fell 98% by November from its May peak, and is now down over 99%.

Bitmine Immersion is down 88% from its July 2025 high. It’s lost over $600 million on its ETH holdings in the past week.

Within five months of its June 3, 2025 peak, Lee’s company had shed 80% of its stock value. By February 5 of this year, Lee’s ETH treasury had lost $8 billion for investors, and that loss extended to as much as $9 billion intraday this morning.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

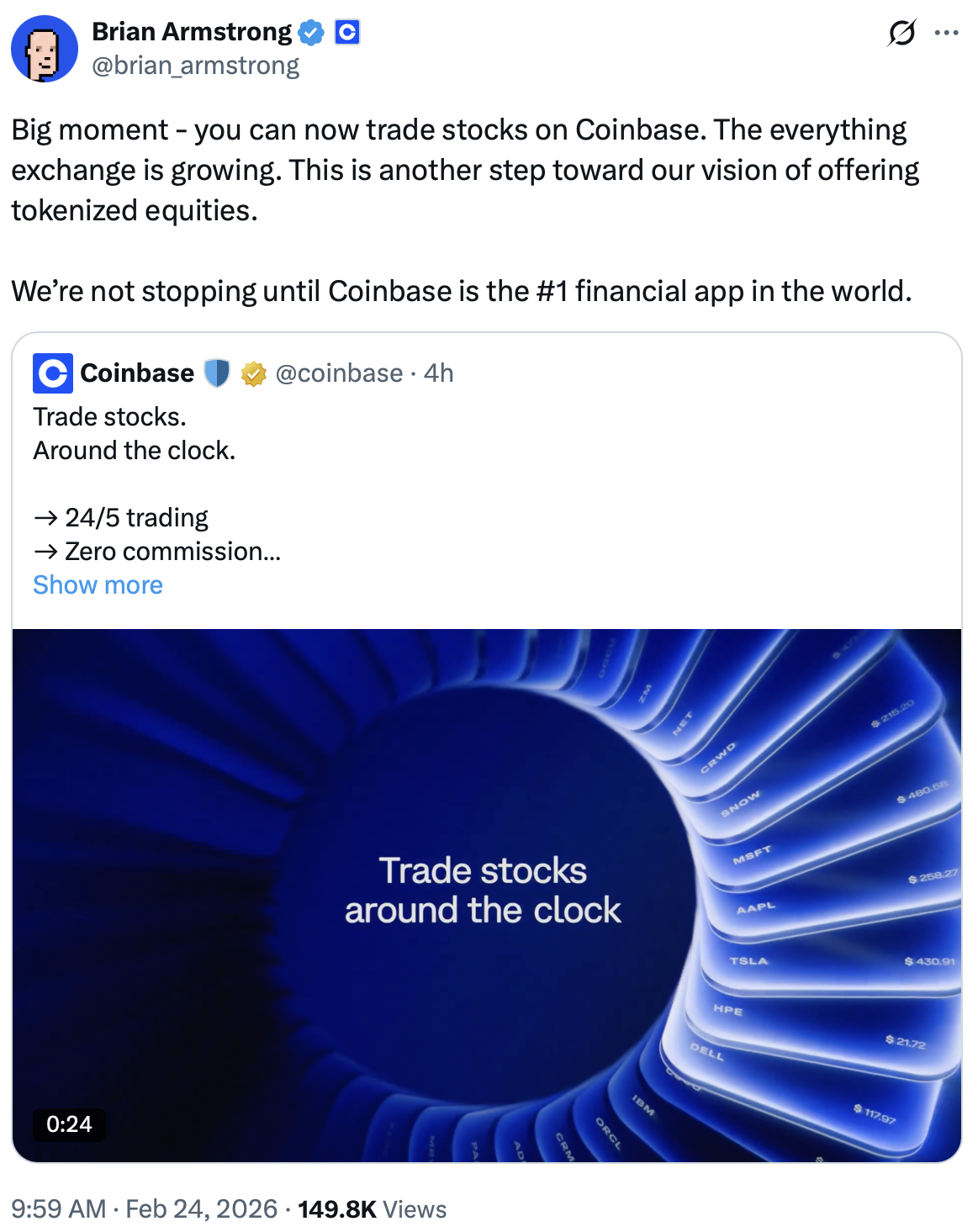

Coinbase Opens Commission-Free Stock and ETF Trading to All US Users

Coinbase has opened stock and exchange-traded fund trading to all US users, allowing customers to buy and sell equities alongside crypto within the same app on a 24/5 basis. The rollout includes commission-free trading, fractional shares, and instant funding with USD or USDC.

According to a company post on Tuesday, thousands of stocks are available to trade 24 hours a day, five days a week, with approximately 6,000 securities currently supported and plans to expand that number in the coming weeks.

Coinbase said it aims to introduce stock perpetual futures for non-US users through Coinbase Bermuda Ltd., subject to regulatory approval, and said it intends to offer tokenized equities in the future.

Today’s announcement comes on the heels of Coinbase expanding its prediction markets offering to all 50 US states last month through a partnership with Kalshi, allowing users to trade contracts tied to real-world events across sports, politics and culture.

Brian Armstrong, CEO of Coinbase, posted the news today on X, writing “The everything exchange is growing.”

Related: WisdomTree gets SEC approval for round-the-clock trading of tokenized MMF

Tokenized equities gain traction from crypto platforms to Wall Street

Tokenized equities, blockchain-based representations of traditional shares, have emerged as a major theme in crypto over the past year.

In June, more than 60 tokenized stocks became available on crypto exchanges Kraken and Bybit, as well as on Solana-based DeFi platforms. The rollout, led by Backed Finance through its xStocks product, gave users blockchain-based exposure to major companies including Apple, Amazon, Tesla, Nvidia, Meta, Coinbase and Robinhood.

In October, fintech Robinhood expanded its own tokenization program on the Arbitrum blockchain, adding 80 new stock tokens and bringing its total to 493 tokenized assets.

While crypto-native and fintech platforms have led recent rollouts, interest in tokenized equities now extends to some of the world’s largest exchanges.

In September, Nasdaq filed with the US Securities and Exchange Commission (SEC) seeking approval to list tokenized equities, and in November, the exchange’s head of digital assets strategy, Matt Savarese, told CNBC that securing SEC approval to list tokenized versions of exchange-listed stocks is a top priority for the company.

In January, the New York Stock Exchange and its parent company, Intercontinental Exchange, announced plans to develop a platform for trading tokenized stocks and ETFs. The proposed system would support 24/7 trading and instant settlement by combining NYSE’s Pillar matching engine with blockchain-based post-trade infrastructure.

Coinbase also today announced a partnership with Yahoo Finance to enable users to move from researching an asset on Yahoo Finance to executing a trade on Coinbase with one click. Yahoo Finance will incorporate real-time information from Coinbase for asset discovery and tracking.

The US-based exchange said Coinbase One members can earn rewards on USDC (USDC) balances used for trading, and Yahoo Finance users will be offered a one-month trial of Coinbase One Basic as part of the partnership.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Binance demands the Wall Street Journal remove ‘damaging’ article

Binance is demanding that the Wall Street Journal (WSJ) remove an article about the crypto exchange firing investigators who discovered $1 billion worth of crypto being sent to Iran-linked wallets.

Binance CEO Richard Teng shared a letter addressed to the WSJ’s Editor-in-Chief, Emma Tucker, and Dow Jones Vice President, Jason Conti, on X today that accuses the WSJ of publishing “defamatory claims” in Monday’s article.

It claims that the article contains “false information” which “should be corrected immediately,” and that any defamatory imputations should be retracted.

Binance says it wants the WSJ to take down the article until the requested corrections are made.

The letter doesn’t explicitly suggest Binance will pursue legal action, but says it must update the piece, “thus potentially avoiding the need for any further action.”

Read more: Is Binance sending cease-and-desist letters?

Binance claims that its client, which remains nameless, “reasonably, cooperatively, and promptly” responded to a series of questions put forward by a WSJ journalist.

However, it claims the piece “fails to reflect” their responses and “falsely asserts to readers that Binance engaged in illegal conduct by breaching Iranian sanctions.”

“While you solicited our client’s position, your failure to reflect our client’s responses is inconsistent with your ethical obligations to ‘remain fair, accurate and impartial’, and suggests an agenda already set, which does not amount to responsible journalism,” Binance claimed.

WSJ says Binance sleuths found sanction-breaking transactions

The WSJ published the article yesterday with the headline “Binance Fired Staff Who Flagged $1 Billion Moving to Sanctioned Iran Entities.”

It claimed that, based on company documents and unnamed sources familiar with Binance, the investigators were fired after uncovering a suspicious account owned by the Hong Kong company Blessed Trust.

The firm converts fiat currency into crypto, and the investigators found it had sent more than $1 billion worth of tether (USDT) to a series of wallets, known as “Entity A.”

US law enforcement claims Entity A is a shadow banking network run by Iran’s Islamic Revolutionary Guard Corps that allows Chinese companies to pay for Iran’s oil.

The account raised numerous internal alerts of suspicious activity throughout 2025. By the time the investigation was raised to Binance’s top execs, the lead investigator and the head of sanctions and counterterrorist financing investigations were suspended, and fired weeks later.

Read more: US hits Iran’s ‘shadow banking’ network in Hong Kong, UAE

A Binance spokesperson told the WSJ that the investigators weren’t fired for raising compliance concerns, but instead left “based on individual circumstances.”

They added that the investigation continued after their departure and that the accounts in question were removed from Binance.

US President Donald Trump pardoned Changpeng Zhao, the former CEO of the company, weeks before the crypto exchange fired the investigators.

All this took place during a period of intense geopolitical tension between the US and Iran. Iran is subject to global sanctions and, as such, is reliant on cryptocurrencies such as USDT to bypass these restrictions.

Iran is now facing a US armada on its doorstep as Trump continues to build his country’s military presence in an attempt to pressure Iran into dropping its nuclear program.

Binance founding member ‘friend’ of Blessed Trust representative

The WSJ also reported that Blessed Trust enjoyed close ties with one of Binance’s founding members, Jukai He, otherwise known as “Rock.”

Screenshots revealed that Rock had some form of friendship with one of Blessed’s representatives. The investigation also found that Binance employees, and a device within Rock’s team, were logging into the Blessed Binance account.

Binance representatives told the WSJ that Rock has no supervisory or operational role within Blessed Trust, and that no Binance employees had logged into the Blessed Trust account.

It said, “Any suggestion that Blessed Trust was operated, directed, or controlled by Binance is false,” and added that the WSJ’s claims are based on “incorrect investigation records.”

Protos has reached out to the WSJ for comment on Binance’s article demands and will update this piece should we hear anything back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Terraform Estate Sues Jane Street Over Trades Tied to 2022 Crypto Collapse

The Terraform Labs bankruptcy estate has sued quantitative trading giant Jane Street, alleging the firm used non-public information to profit as the TerraUSD stablecoin collapsed in May 2022, according to a docket filed yesterday with the New York Southern District Court.

In a report about the lawsuit by the Wall Street Journal, Terraform Labs’ court-appointed administrator, Todd Snyder, stated that Jane Street “abused market relationships” to short the ecosystem during its death spiral, mirroring similar allegations made against Jump Trading late last year.

The estate seeks to recover funds for creditors who lost billions during the $40 billion wipeout of the Terra ecosystem.

Key Takeaways

- The lawsuit alleges Jane Street exploited private liquidity data to profit from the TerraUSD depeg before the public was aware.

- Terraform’s estate claims the trading firm netted millions by front-running a critical $150 million liquidity withdrawal from Curve.

- Jane Street has dismissed the suit as a “desperate” attempt to extract money from legitimate market activities.

Estate Targets “Privileged Access” in Crash Recovery

The lawsuit centers on specific maneuvers executed in May 2022, just as the algorithmic stablecoin UST began to lose its peg to the US dollar.

Terraform Labs’ court-appointed plan administrator, Todd Snyder, alleges that Jane Street capitalized on vulnerabilities in Terra’s mint-and-burn mechanism via manipulative trades.

“Jane Street abused market relationships to rig the market in its favor during one of the most consequential events in crypto history,” Snyder claimed in his statement to WSJ.

The estate argues that these trades were not merely shrewd market moves but were predicated on non-public information regarding Terraform’s internal liquidity management.

The legal action is part of a broader recovery effort following the firm’s Chapter 11 bankruptcy filing, which listed assets and liabilities between $100 million and $500 million, a fraction of the market value destroyed during the collapse.

Discover: The best new crypto to buy

Inside the Curve Pool Incident

The complaint reportedly highlights a pivotal sequence of events involving the Curve3pool, a critical liquidity venue for stablecoins.

According to the filing, Terraform Labs executed an unannounced withdrawal of $150 million from the pool to adjust liquidity. Less than 10 minutes later, a wallet allegedly linked to Jane Street withdrew $85 million.

The estate argues this timing indicates Jane Street possessed “advance insight” into Terraform’s operations, using that data to position itself ahead of the resulting market panic.

This mirrors the scrutiny placed on liquidity shifts in current markets, where traders obsessively monitor order books and Polymarket odds for a Bitcoin price drop to detect institutional positioning before price action hits.

Jane Street firmly denies the allegations.

Implications for DeFi and Stablecoin Regulation

If the court finds merit in the “misappropriation theory” applied to DeFi protocols, it could redefine the legal obligations of market makers in the crypto sector.

The suit suggests that “privileged access” in decentralized finance is a legal liability, not just a competitive edge.

This legal battle arrives as the regulatory environment for stablecoins intensifies. While the 2022 collapse serves as a cautionary tale, modern stablecoins drive $1 trillion in T-bill demand, creating a different set of systemic risks and incentives.

Regulators are currently scrutinizing how private trading firms interact with issuer protocols.

The outcome could also accelerate legislative frameworks. As odds spike for stablecoin talks regarding the Clarity Act, lawmakers may cite these allegations to demand stricter separation between protocol issuers and market makers.

What Comes Next

The case now moves to the discovery phase in Delaware, where Jane Street will be required to produce communications regarding its 2022 trading strategies.

This follows a similar $4 billion lawsuit filed by Terraform Labs against Jump Trading in December, which accused the firm of materially contributing to the Terra ecosystem’s instability.

It looks like Terraform is entering a protracted battle on at least two different fronts that could peel back the curtain on high-frequency trading strategies during crypto market crises.

Discover: The best pre-launch token sales around

The post Terraform Estate Sues Jane Street Over Trades Tied to 2022 Crypto Collapse appeared first on Cryptonews.

Crypto World

Bitwise Expands Staking Capabilities with Chorus One Acquisition

Bitwise Investments has acquired institutional staking provider Chorus One, offering clients access to more than 30 proof-of-stake networks.

Bitwise Investments has announced the acquisition of Chorus One, a leading provider of institutional staking services, marking an expansion in Bitwise’s staking capabilities and onchain offerings.

With more $15 billion in assets under management (AUM), Bitwise is known for its crypto index funds and has been broadening its offerings through its Bitwise Onchain Solutions (BOS) division. The acquisition of Chorus One, renowned for its cross-chain staking infrastructure, significantly boosts BOS’ capabilities in the staking domain. The move enhances Bitwise’s reach across over 30 proof-of-stake networks, according to a press release from Bitwise.

Chorus One’s expertise in providing staking services to institutions complements Bitwise’s existing offerings, allowing for a seamless integration that is set to enhance the overall service quality.

The institutional staking market has been experiencing rapid growth, with more institutions looking to participate in proof-of-stake networks. This trend is driven by the dual benefits of yield generation and contribution to network security, which are increasingly attractive to institutional investors seeking diversified returns.

“For our thousands of clients who hold spot crypto assets, staking is one of the most compelling growth opportunities. I’m thrilled about this acquisition and grateful to the Chorus One team for the trust placed in us. Chorus One is best-in-class across technology and research, with an eight-year track record of doing things the right way.” said Bitwise CEO Hunter Horsely.

This article was generated with the assistance of AI workflows.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World15 hours ago

Crypto World15 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech5 hours ago

Tech5 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

Traders (@_Z3r0wTraders)

Traders (@_Z3r0wTraders)