Crypto World

BlackRock Bitcoin ETF Options Surge, Overtake Gold in Market Volume

BlackRock’s Bitcoin ETF (IBIT) options have surged to new heights, surpassing gold ETFs in both open interest and trading volume. As of February 10, IBIT options reached a total of 7.33 million active contracts, positioning it as the ninth-largest options market in the U.S. This marks a significant shift, as Bitcoin gains momentum over traditional assets like gold.

The surge in IBIT options highlights a growing interest in cryptocurrency. This uptick has coincided with Bitcoin’s strong performance, outpacing gold in recent trading sessions. As Bitcoin continues to rise, the surge in IBIT options reflects broader market trends, with investors responding to changing global risk sentiment.

BlackRock Bitcoin ETF’s Growing Dominance in the Options Market

The rise of IBIT options points to a shifting preference towards Bitcoin-based assets. With 7.33 million IBIT contracts now open, Bitcoin has solidified its position in the options market, surpassing even gold ETFs like SPDR Gold Shares (GLD). By contrast, GLD options currently sit at 6.44 million, showing a distinct advantage for Bitcoin in this space.

IBIT options have recorded impressive trading volumes, with over 284 million shares traded, resulting in more than $10 billion in notional value. This represents a notable increase from the previous record set in November. The growing volume and interest reflect a clear trend of Bitcoin gaining ground in the financial market.

The put/call ratio for IBIT options is currently 0.64, indicating a more balanced market outlook compared to gold’s ratio of 0.50. As Bitcoin continues to rise, its options market is becoming increasingly influential, while interest in gold begins to wane. This shift signals a broader change in market sentiment, with Bitcoin gaining prominence over gold.

Bitcoin Options Outpace Gold Amid Global Market Shifts

Bitcoin options have experienced significant growth, while the price of gold has weakened. A resurgence in global risk appetite has caused gold prices to ease, as equity indices show positive performance. This shift in sentiment has been attributed to anticipation surrounding upcoming U.S. economic data, including jobs reports and CPI inflation figures.

Despite expectations that gold could hit new highs in the coming years, Bitcoin continues to outperform it in terms of market sentiment. BNP Paribas has projected that gold could reach $6,000 by 2026, but Bitcoin has maintained a stronger position in the current market. This shift in favor of Bitcoin reflects a reassessment of traditional safe-haven assets.

As market conditions change, the growing focus on Bitcoin-based assets like IBIT may continue to challenge traditional investments such as gold. With Bitcoin rising in prominence, it could represent an increasing share of investor portfolios, reshaping the landscape for safe-haven investments.

Bitcoin’s Performance in the Face of Increased Volatility

Despite a 30% crash in the market recently, Bitcoin has shown remarkable resilience. This volatility has sparked ongoing debates regarding Bitcoin’s future, especially in comparison to gold. However, some analysts believe that Bitcoin’s volatility could attract more investors if market conditions continue to favor riskier assets.

JPMorgan’s Nikolaos Panigirtzoglou noted that Bitcoin’s volatility relative to gold has decreased to a record low of 1.5. This reduced volatility ratio makes Bitcoin more attractive to investors looking for higher returns. As Bitcoin’s volatility continues to drop, it may attract a new wave of interest from risk-seeking investors.

With this shift in market dynamics, Bitcoin’s recognition as a significant asset is growing. Many experts suggest that Bitcoin’s price may rally toward $266,000 once the current negative sentiment dissipates. This potential for growth signals that Bitcoin could become even more appealing to investors in the near future.

Spot Bitcoin ETF Sees Record Inflows Despite BlackRock ETF Redemptions

BlackRock’s Bitcoin ETF (IBIT) has seen a surge in options activity, but its overall performance has been mixed. On February 6, spot Bitcoin ETFs recorded $144.9 million in net inflows, signaling renewed interest in cryptocurrency. This marks a positive reversal after a period of outflows, demonstrating a shift in sentiment towards Bitcoin.

However, BlackRock’s Bitcoin ETF faced redemptions of $20.9 million, signaling a less favorable outlook for the ETF itself. Despite this, the IBIT ETF remains an influential player in the market. The growing activity in Bitcoin options, along with fluctuating ETF inflows and outflows, suggests that Bitcoin’s role in traditional financial markets is evolving.

This discrepancy between inflows and redemptions highlights the complexity of investor behavior in the cryptocurrency space. While Bitcoin options gain in popularity, the ETF market remains volatile. Nonetheless, the rise in Bitcoin options is a strong signal that Bitcoin is establishing itself as a dominant asset in global financial markets.

Crypto World

February Inflation Data Stable, But Iran Conflict Threatens New Price Surge

TLDR

- February’s Consumer Price Index increased 2.4% year-over-year, aligned with analyst predictions

- Core inflation (stripping out food and energy costs) registered at 2.5% annually, meeting forecasts

- Report captures timeframe prior to U.S.-Israel coordinated strikes against Iran

- Crude oil has jumped approximately 18% since late February, while pump prices climbed 20%

- Federal Reserve anticipated to maintain current interest rate range of 3.5%–3.75% at upcoming meeting

While February’s inflation report appeared reassuring at first glance, the underlying narrative reveals a more complex situation unfolding.

The Consumer Price Index advanced 0.3% month-over-month in February and climbed 2.4% on an annual basis. These metrics aligned precisely with economist projections. Meanwhile, core CPI—which excludes volatile food and energy categories—increased 0.2% monthly and 2.5% yearly, similarly matching consensus estimates.

The Bureau of Labor Statistics published these figures on Wednesday, March 11.

Both energy and food categories showed increases during February, though these changes were relatively contained compared to subsequent developments following the data collection period.

Crucially, this report reflects conditions that existed before coordinated U.S. and Israeli military operations against Iran commenced in late February. Those hostilities have subsequently created significant disruptions throughout global energy markets.

Iran Crisis Delivers Major Shock to Energy Sector

The Strait of Hormuz—a critical chokepoint handling approximately 20% of worldwide oil shipments—has experienced a dramatic reduction in tanker movement. Intelligence reports suggest Iran has deployed naval mines throughout the waterway, prompting President Trump to warn of potential additional military responses.

Brent crude futures stood near $92 per barrel at press time, following an earlier spike to almost $120 this week. Motorists across America have seen gasoline costs surge 20% as a direct consequence.

Bank of America’s economist Stephen Juneau noted that petroleum prices have climbed roughly 18% since February concluded. He indicated that sustained conflict would probably generate upward pressure on both headline and underlying inflation measures in coming months.

The International Energy Agency has put forward its most substantial strategic reserve release proposal to date aimed at market stabilization, the Wall Street Journal reported. IEA member countries were scheduled to vote on this initiative Wednesday. The prior record stood at 182 million barrels, authorized following Russia’s 2022 Ukraine invasion.

Implications for Federal Reserve Policy

The Fed’s favored inflation metric—the Personal Consumption Expenditures index—registered 2.9% annually in December. This remains substantially above the central bank’s 2% objective. January’s PCE figures are scheduled for Friday release, with forecasters anticipating a 3.1% annual rate.

Market indicators suggest the Federal Reserve will almost certainly maintain its current rate posture during next week’s policy meeting, preserving the 3.5%–3.75% band, per CME FedWatch tracking data.

Employment trends add another dimension of complexity to the Fed’s calculus. The U.S. economy surprisingly shed 92,000 positions last month, elevating the unemployment rate to 4.4%.

President Trump indicated earlier this week the military operations might conclude “very soon,” though U.S. and Israeli forces have maintained strikes across multiple Iranian targets throughout the Middle East region.

Crypto World

Ghana opens crypto trading sandbox with 11 firms under new VASP law

Ghana’s Securities and Exchange Commission (SEC) said 11 companies have been granted access to a regulatory sandbox to test cryptocurrency and digital asset services under the country’s Virtual Asset Service Providers Act, 2025.

The program allows companies to run their products in a controlled environment while regulators monitor risks and compliance.

The sandbox will run for 12 months and sits at the center of Ghana’s early efforts to bring oversight to the crypto sector, according to a press release.

Companies in the first cohort include asset tokenization firms like Africoin, Blu Penguin, Vaulta, XChain and Goldbod as well as cryptocurrency exchanges like Hyro Exchange, HanyPay and WhiteBit.

The commission said firms whose products are market-ready and meet regulatory requirements could transition to a full license after six months. Others may remain in the sandbox for the remaining period to refine their services.

The SEC said the exercise will also help it shape detailed licensing guidelines for different types of crypto businesses. Data gathered during the pilot will inform rules covering areas such as investor protection, market integrity and anti-money laundering controls.

Once the sandbox closes, the regulator plans to publish the final guidelines and open the licensing process to a broader set of virtual asset service providers.

Crypto World

Scaling Next-Gen AI Is Increasing Risks, Not Benefits

Artificial intelligence has long been defined by scale—larger models, faster processing, and sprawling data centers. Yet a growing cohort of researchers, investors, and practitioners is suggesting the traditional growth path is hitting a ceiling. AI is increasingly capital-intensive and tethered to physical limits, with diminishing returns appearing sooner than many anticipated. The latest data underscore the shift: electricity demand from global data centers is projected to more than double by 2030, a surge comparable to expanding entire industrial sectors; in the United States, data-center power usage is forecast to rise well over 100% by the end of the decade. As the economics of AI tighten, trillions of dollars in new investment and substantial grid upgrades loom, coinciding with the way the technology embeds itself into finance, law, and crypto workflows.

Key takeaways

- Energy demand tied to AI is accelerating, with the IEA projecting data-center electricity use will more than double by 2030, highlighting a fundamental constraint in the current scaling paradigm.

- The United States could see data-center power consumption surge by more than 100% before the 2030s, signaling a major resource and infrastructure challenge for AI-enabled sectors.

- Frontier AI training costs are skyrocketing, with estimates suggesting single training runs could exceed $1 billion, making inference and ongoing operation the dominant long-term expense.

- The verification burden grows with scale: as AI outputs proliferate, human oversight becomes increasingly critical to prevent errors from propagating, such as false positives in automated AML flagging.

- Architectural shifts toward cognitive or neurosymbolic systems—emphasizing reasoning, verifiability, and localized deployment—offer a path to reduce energy use and improve reliability versus brute-force scaling.

- Blockchain-enabled, decentralized AI concepts may distribute data, models, and computing resources more broadly, potentially lowering concentration risk and aligning deployment with local needs.

Sentiment: Neutral

Market context: The convergence of AI with crypto analytics and DeFi tooling sits amid broader questions about energy consumption, regulation, and the governance of automated decision-making. As AI tools increasingly monitor on-chain activity, assess sentiment, and assist in smart-contract development, the industry faces a tighter coupling between performance, verification, and accountability.

Why it matters

The debate over AI scaling is not a theoretical one—it touches the core of how and where AI is deployed in high-stakes sectors. Large language models (LLMs) have grown fluent by pattern-matching across vast text corpora, enabling impressive capabilities but not necessarily robust, reliable reasoning. As these systems become embedded in legal workflows, financial risk management, and crypto operations, the consequences of incorrect outputs become less tolerable and more costly.

Training frontier AI models remains a mission-critical and expensive endeavor. Independent analyses suggest that the cumulative cost of training can be immense, with credible voices estimating that a single training run could cross the $1 billion threshold in the near future. Yet even more consequential is the ongoing cost of inference—running models at scale with low latency, high uptime, and rigorous verification requirements. Each query consumes energy, and each deployment necessitates infrastructure. As usage expands, energy use compounds, pressuring both operators and grids alike. In crypto contexts, AI systems increasingly monitor on-chain activity, analyze sentiment, generate code for smart contracts, flag suspicious transactions, and automate decision-making; missteps here can move capital and undermine trust across markets.

The industry is beginning to recognize that fluency alone is insufficient. When AI can produce convincing but incorrect conclusions, verification burdens intensify. False positives in AML flagging, for instance, have been documented as a practical drag on resources, diverting investigators from genuine activity. This dynamic underscores why a shift toward architectures that integrate cause-and-effect reasoning, explicit rules, and self-checking mechanisms is gaining traction. Cognitive AI and neurosymbolic approaches—where knowledge is structured into interrelated concepts and reasoning can be revisited and audited—promise higher reliability with lower energy demands than brute-force scaling.

Beyond the architecture, there is a broader trend toward decentralization of AI development itself. Some platforms explore blockchain-enabled models for contributing data, models, and computing resources, reducing concentration risk and aligning deployment with local needs. In a field where room for error is small and the stakes are high, the ability to inspect, audit, and shape AI systems matters just as much as the outputs they produce. The turning point is clear: scaling for the sake of scale may no longer be sufficient. The industry must invest in architectures that make intelligence more reliable, verifiable, and controlled by communities rather than distant, centralized infrastructure.

As AI considerations bleed into crypto workflows, the stakes grow sharper. On-chain monitoring, sentiment analysis for market signals, automated code generation for smart contracts, and risk-management automation are all increasingly dependent on AI, yet they demand a higher standard of trust. The tension between speed and accuracy—between fast, automated decisions and verifiable reasoning—will shape the next wave of crypto tooling and governance. The upshot is not simply bigger models; it is better systems that can reason about their own steps, explain conclusions, and operate within clear constraints.

Ultimately, the industry faces an inflection point. If architecture and reasoning take precedence over sheer scale, AI could become more affordable to operate, while remaining safer and more controllable. The era of growth-at-any-cost may yield to a more deliberate phase where wealth creation in AI and crypto hinges on transparent verification, resilient design, and decentralized collaboration. The author argues that the path forward lies in rethinking how intelligence is built and deployed—prioritizing robust reasoning and governance over incremental increases in parameter counts.

What to watch next

- Regulatory and policy developments around AI safety, auditing, and accountability in finance and crypto.

- Advances in cognitive AI and neurosymbolic architectures, including practical deployments on edge devices and local servers.

- Decentralized AI initiatives that use blockchain-inspired models to distribute data, models, and computing resources.

- Shifts in data-center capacity, energy pricing, and grid infrastructure tied to AI-enabled demand.

- New benchmarks or case studies illustrating the trade-offs between scale, reasoning, and verification in real-world crypto applications.

Sources & verification

- Energy demand from AI: IEA, Energy and AI — energy demand from AI.

- U.S. data-center power demand projections: Pew Research Center / energy use at US data centers amid the AI boom.

- UK legal AI cautionary note: Guardian article on the High Court warning against AI-generated fabricated case law in legal filings (June 2025).

- AML false positives and AI risk: IBM Think topics on AI fraud detection in banking and related AML flagging issues.

- Costs to train frontier AI models and ongoing inference costs: Epoch AI blog and Digital Experience Live analyses.

- On-chain and crypto AI applications: efforts around Ethereum and on-chain tooling that leverage AI signals (as referenced in industry coverage).

Rethinking AI scaling: energy, reasoning, and the crypto interface

Artificial intelligence has long scaled on a simple premise—more data, bigger models, faster hardware would continually unlock better performance and lower costs. The latest economic and technical signals, however, suggest a pivot. Energy and capital intensity are rising faster than anticipated, with global data-center electricity demand projected to more than double by 2030. In the United States alone, data-center power consumption is expected to rise by more than 100% before the decade ends, a trajectory that will require massive investments in grid capacity and infrastructure as AI becomes embedded in critical sectors, including markets, compliance, and on-chain activity monitoring.

Training frontier AI models remains extraordinarily expensive, with credible estimates pointing to costs that could top $1 billion per training run. Yet even more consequential is the ongoing cost of inference—sustained, low-latency operation that must deliver results with high reliability. In markets and crypto, AI systems are increasingly used to monitor on-chain activity, analyze sentiment, generate smart-contract code, flag suspicious transactions, and automate governance decisions. The result is a double exposure: the potential for rapid, data-driven signals coupled with the risk of false signals that can misallocate capital or mischaracterize risk. Notably, false positives in automated AML flagging illustrate how unreliable outputs can waste human resources and erode trust when deployed widely.

To address these pressures, the narrative is shifting away from sheer scale toward architectures that emphasize reasoning and verifiability. Cognitive AI and neurosymbolic approaches seek to braid pattern recognition with structured knowledge, rules, and self-checks. These systems aim to deliver usable reasoning traces and transparent decision processes, reducing the need for brute-force computation and enabling more predictable energy use. Early demonstrations suggest that local or edge deployments, supported by knowledge representations, could keep control with users and organizations rather than entrusting cognition to centralized, opaque infrastructure.

Decentralized AI models—where data, models, and computation can be contributed by diverse participants—offer another path to resilience. By distributing the workload and oversight, communities can mitigate concentration risk and tailor AI deployments to local needs. In this ecosystem, the role of governance becomes more pronounced: platforms must enable auditing, adjustment, and interoperability without compromising security or performance. The shift toward more sophisticated reasoning, coupled with a commitment to verifiable outcomes, marks a meaningful departure from scaling solely for scale’s sake. If the industry can operationalize cognitive architectures at scale, the economics of AI may improve—reducing both energy consumption per decision and the verification burden on human operators.

In the crypto arena, this evolution matters. The reliability of AI-assisted on-chain analytics, fraud detection, and smart-contract tooling will influence investor confidence and market integrity. The path forward requires not only bigger systems but smarter ones—systems whose inner workings can be inspected, challenged, and improved by a broad community. The debate is no longer about whether AI should grow, but how to grow it in a way that is auditable, trustworthy, and aligned with the needs of decentralized finance and broader digital markets.

Crypto World

BTC remains modestly lower at $69,500 following in line inflation data

U.S. inflation data met expectations on Wednesday, reinforcing anticipation that the Federal Reserve will keep interest rates steady not just at its March 18 meeting, but likely at the bank’s April meeting as well.

The Consumer Price Index (CPI) rose 0.3% in February, according to a report from the Bureau of Labor Statistics. Economist forecasts had been for a rise of 0.3% and January’s increase was 0.2%.

On a year-over-year basis, CPI was higher by 2.4% against expectations of 2.4% and January’s 2.4%.

Core CPI, which excludes food and energy costs, rose 0.2% in February versus forecasts of 0.2% and January’s 0.3%. Year-over-year core CPI was higher by 2.5% versus forecasts of 2.5% and January’s 2.5%.

Under modest pressure for the morning, bitcoin was trading at $69,500 in the minutes following the report, lower by 1.2% over the past 24 hours.

U.S. stock index futures were slightly lower across the board and the 10-year Treasury yield ticked up to 4.18%. The main actor in markets this week, WTI crude oil was higher by 4.2% to $87 per barrel.

Ahead of the data, markets were pricing in a 99% probability that the Federal Reserve would leave interest rates unchanged at its March meeting next week, according to the CME FedWatch tool. For the April meeting, rate cut odds were at just 11% versus 21% one month ago.

February’s inflation numbers, of course, are somewhat old news given the events that have transpired since, namely the war in Iran and spiking oil prices. How much this plays into the Fed’s thinking on interest rates should become more evident following next week’s policy meeting.

Crypto World

Mining giant Foundry to introduce institutional zcash mining pool

Foundry Digital, one of largest Bitcoin mining pools by hashrate, said it plans to introduce a zcash (ZEC) mining pool by next month, expanding beyond BTC and bringing a large institutional operator into the privacy-focused network.

With the new pool, Foundry aims to offer zcash miners a U.S.-based platform designed around compliance checks, reporting standards and operational controls often required by public companies and large firms.

The move addresses what Foundry describes as a gap in Zcash infrastructure. While the cryptocurrency has existed for nearly a decade, much of its mining ecosystem still consists of smaller global pools that often operate outside formal compliance frameworks.

“Zcash has matured into an institutional-grade asset, but the mining infrastructure supporting it hasn’t kept pace,” Foundry CEO Mike Colyer said in a statement shared with CoinDesk.

Betting on privacy

The expansion comes as privacy-focused cryptocurrencies regain attention across the market as new crypto tax reporting rules, with threat of asset seizure, kicked in across the European Union at the turn of the year and as onchain analysis keeps developing, leading to growing demand for financial anonymity.

Zcash, along with other privacy coins including monero (XMR) and dash (DASH) has seen renewed interest that has helped their prices surge. ZEC has seen significant outperformance, up more than 670% in the last 12 month period, compared XMR’s 72% rise in the same period, while DASH is up 51%.

ZEC’s outperformance can likely be attributed to its hybrid privacy model, which makes shielded – completely anonymous – transactions optional with selective disclosure. This means that transactions can be transparent for custody and exchanges, and attracted accumulation from a Winklevoss-backed treasury firm as well as into the Grayscale Zcash Trust.

Foundry’s shift toward zcash also likely reflects broader changes in mining economics. Bitcoin mining profitability has tightened following the 2024 halving, which cut block rewards in half while mining difficulty surged.

Speaking to CoinDesk, Coyler pushed back on the idea the move is primarily a response to lowering bitcoin margins.

“We evaluate opportunities based on where institutional infrastructure is needed, not on bitcoin margins at any given moment,” he said. “Foundry’s bitcoin mining business is strong and remains our core foundation.”

The expansion, Coyler said, was over an identified gap in compliant Zcash infrastructure. “Institutional and public miners who want exposure to zcash have had no US-based, compliant, purpose-built infrastructure to do it through,” he added.

As for whether the move shows a broader multi-chain strategy, Coyler said the company’s focus is “squarely on bitcoin and zcash” for now, though he added that Foundry is “always evaluating opportunities” that align with its mission and the demands of institutional miners.

While the price of bitcoin saw a major rise to near $125,000 late last year, its price has since corrected to now stand at $69,500. That has seen hashprice, a measure of expected value of 1TH/s of hashing power a day, drop from over $60 to $30 per petahash.

As margins shrink, many large mining firms have begun exploring other proof-of-work networks to diversify revenue.

Zcash mining infrastructure

Zcash launched in 2016 as a privacy-focused cryptocurrency built on zero-knowledge proof technology. The network allows users to send transactions on a public blockchain while keeping key details private. Using a cryptographic method known as zk-SNARKs, Zcash can verify that a transaction is valid without revealing the sender, receiver or amount involved.

Like Bitcoin, the Zcash network relies on proof-of-work mining to secure its blockchain and miners use specialized hardware to solve complex mathematical puzzles to help secure the network. When a miner or mining pool solves one of these puzzles, it adds a new block of transactions to the chain and earns a reward in newly issued ZEC tokens along with transaction fees.

Zcash blocks are produced about every 75 seconds, faster than bitcoin’s blocks which are produced every 10 minutes. Still, both shared a supply cap of 21 million coins. The mining process uses an algorithm called Equihash, which differs from Bitcoin’s SHA-256 and was designed to require large amounts of memory during computation.

Network difficulty, which helps the time between block production remain consistent, means the probability of solving a block alone is low. As a result miners bundle together in what are known as mining pools, in which participants combine computing power and share rewards based on how much work they contribute. Large pools can influence the stability and decentralization of a network because they control significant portions of its total hashrate.

Foundry’s zcash pool

Foundry said its zcash pool will include identity verification checks for participants through rigorous know-your-customer and anti-money laundering compliance, transparent payout calculations and reporting tools aimed at institutional users. It’ll feature a dedicated support team and its operations will be based in the United States.

The company plans to apply the same operational framework used by its bitcoin pool, which has undergone SOC 1 Type 2 and SOC 2 Type 2 compliance audits, it said.

Mining rewards will be distributed through transparent Zcash addresses, not shielded ones, the company said. The pool will be paying miners on a Pay Per Last N Shares (PPLNS) model, which Coyler said is “fully auditable” and provides detailed data supporting daily payment reconciliation.

Foundry didn’t disclose the fee for miners, saying only it will offer “competitive pool fee rates.” There will be no minimum hashrate threshold to join the pool, Coyler said, noting that the Zcash mining ecosystem is still emerging.

The company expects demand from miners that already operate in regulated environments such as North America. Many of those firms rely on formal reporting systems and compliance programs to meet corporate governance requirements.

If the zcash pool launches on schedule in 2026, it would mark one of the largest institutional entries into the Zcash mining ecosystem to date. Other major mining pools operating within it include F2Pool, 2Miners, and ViaBTC.

Crypto World

Market Analysis: EUR/USD Reclaims Ground While USD/JPY Momentum Fades

EUR/USD is recovering losses from 1.1500. USD/JPY is correcting gains from 159.00 and might decline further if it stays below 158.30.

Important Takeaways for EUR/USD and USD/JPY Analysis Today

- The Euro struggled to stay in a positive zone and declined below 1.1700 before finding support.

- There was a break above a connecting bearish trend line with resistance at 1.1580 on the hourly chart of EUR/USD at FXOpen.

- USD/JPY started a decent increase above 157.00 before the bears appeared near 158.90.

- There is a key contracting triangle forming with resistance near 158.30 on the hourly chart at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh decline from 1.1825. The pair broke below 1.1665 and the 50-hour simple moving average. Finally, it tested the 1.1500 zone. A low was formed at 1.1507, and the pair is now recovering losses.

There was a move above 1.1550 and a connecting bearish trend line at 1.1580. The pair surpassed the 38.2% Fib retracement level of the downward move from the 1.1826 swing high to the 1.1507 low. On the upside, the pair is now facing resistance near the 50% Fib retracement at 1.1665.

The first major hurdle for the bulls could be 1.1705. A break above 1.1705 could set the pace for another increase. In the stated case, the pair might rise toward 1.1775.

If not, the pair might drop again. Immediate support is near the 50-hour simple moving average and 1.1620. The next key area of interest might be 1.1565. If there is a downside break below 1.1565, the pair could drop towards 1.1505. The main target for the bears on the EUR/USD chart could be 1.1440, below which the pair could start a major decline.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair gained pace for a move above 158.00. The US dollar even traded close to 159.00 against the Japanese yen before the bears emerged.

A high was formed at 158.90 before a downside correction. The pair dipped below 158.00 and the 50% Fib retracement level of the upward move from the 156.45 swing low to the 158.90 high. However, the bulls were active above 157.00 and protected the 61.8% Fib retracement.

The pair is back above the 50-hour simple moving average and 158.00. Immediate resistance on the USD/JPY chart is near 158.30. There is also a key contracting triangle at 158.30.

If there is a close above the triangle and the hourly RSI moves above 65, the pair could rise towards 158.90. The next major barrier for the bulls could be 159.25, above which the pair could test 160.00 in the near term.

On the downside, the first major support is near 158.00. The next key region for the bears might be 157.40. If there is a close below 157.40, the pair could decline steadily. In the stated case, the pair might drop towards 156.45. Any more losses might send the pair toward 155.85.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Scaling AI Makes It Riskier

Opinion by: Mohammed Marikar, co-founder at Neem Capital

Artificial intelligence has consistently been defined by scale, so far — bigger models, faster processing, expanding data centers. The assumption, based on traditional technology cycles, was that scale would keep improving performance and, over time, costs would fall and access would expand.

That assumption is now breaking down. AI is not scaling like other software. Instead, it is capital-intensive, constrained by physical limits, and hitting diminishing returns far earlier than expected.

The numbers make this clear. Electricity demand from global data centers will more than double by 2030 — levels once associated with entire industrial sectors. In the US alone, data center power demand is projected to rise well over 100 percent before the decade ends. This expansion is demanding trillions of dollars in new investment alongside major expansions in grid capacity.

Meanwhile, these systems are being embedded into law, finance, compliance, trading and risk management, where errors propagate quickly but credibility is non-negotiable. In June 2025, the UK High Court warned lawyers to immediately stop submitting filings that cited fabricated case law generated by AI tools.

The scaling AI debate

When an AI system can invent a precedent that never existed, and a professional relies on it, debates about scaling start becoming serious questions of public trust. Scaling is amplifying AI’s weaknesses rather than solving them.

Part of the problem lies in what scale actually improves. Large language models (LLMs) are evolving to become increasingly fluent because language is pattern-based. The more examples an LLM sees of how real people write, summarize and translate, the faster it improves.

Deeper intelligence — reasoning — does not scale the same way. The next generation of AI must understand cause and effect and know when an answer is uncertain or incomplete. It will need to explain why a conclusion follows, not simply produce a confident response. This does not reliably improve with more parameters or more compute.

The consequence is a growing verification burden. Humans must spend more time checking machine output rather than acting on it, and that burden builds as systems are deployed more widely.

The cost of training AI models

Training frontier AI models has already become extraordinarily expensive, with credible tracking suggesting costs have been multiplying year over year, and projections that single training runs could soon exceed $1 billion. Training is only the entry cost.

The larger expense is inference: running these models continuously, at scale, with real latency, uptime and verification requirements. Every query consumes energy. Every deployment requires infrastructure. As usage grows, energy use and costs compound.

In terms of markets and crypto, AI systems are increasingly used to monitor onchain activity, analyze sentiment, generate codes for smart contracts, flag suspicious transactions and automate decisions.

In such a fast-moving, competitive environment, fluent but unreliable AI propagates errors quickly; false signals move capital, and fabricated explanations and hallucinations undermine trust. One example of this is false positives being generated in automated Anti-Money Laundering (AML) flagging, a common issue that wastes time and resources on investigating innocent trading activity.

Time to improve reasoning

Scaling AI systems without improving their reasoning amplifies risk, especially in use cases where automation and credibility are vital and tightly coupled.

Ensuring AI is economically viable and socially valuable means we cannot rely on scaling. The dominant approach today prioritizes increasing compute and data while leaving the underlying reasoning machinery largely unchanged, a strategy that is becoming more expensive without becoming proportionally safer.

Related: Crypto dev launches website for agentic AI to ‘rent a human’

The alternative is architectural. Systems need to do more than predict the next word. They need to represent relationships, apply rules, check their own steps and make it possible to see how conclusions were reached.

This is where cognitive or neurosymbolic systems come into play. By organizing knowledge into interrelated concepts, rather than relying solely on brute-force pattern matching, these systems can deliver high reasoning capability with far lower energy and infrastructure demands.

Emerging “cognitive AI” platforms are demonstrating how structured reasoning systems can operate on local servers or edge devices, allowing users to keep control over their own knowledge rather than outsourcing cognition to distant infrastructure.

Cognitive AI systems are harder to design and can underperform on open-ended tasks, but when reasoning is reusable in this way rather than rederived from scratch through massive compute, costs fall and verification becomes tractable.

Control over how AI is built matters as much as how it reasons. Communities need systems they can shape, audit and deploy without waiting for permission from centralized platform owners.

Some platforms are exploring this frontier by using blockchain to enable both individuals and corporations to contribute data, models and computing resources. By decentralizing AI development itself, these approaches reduce concentration risk and align deployment with local needs rather than global demands.

AI faces an inflection point. When reasoning can be reused rather than rediscovered through massive pattern matching, systems require less compute per decision and impose a smaller verification burden on humans. That shifts the economics. Experimentation becomes cheaper, inference becomes more predictable. Scaling no longer depends on exponential increases in infrastructure.

Scaling has already done what it could. What it has exposed, just as clearly, is the limit relying on size alone. The question now is whether the industry keeps pushing scale or starts investing in architectures that make intelligence reliable before making it bigger.

Opinion by: Mohammed Marikar, co-founder at Neem Capital.

This opinion article presents the author’s expert view, and it may not reflect the views of Cointelegraph.com. This content has undergone editorial review to ensure clarity and relevance. Cointelegraph remains committed to transparent reporting and upholding the highest standards of journalism. Readers are encouraged to conduct their own research before taking any actions related to the company.

Crypto World

UniFirst (UNF) Stock Soars as Cintas Announces $5.5 Billion Acquisition

Key Highlights

-

Cintas announces acquisition of UniFirst at $310 per share in $5.5B transaction.

-

Deal projects $375M in operating cost synergies over four-year period.

-

United organization will provide services to 1.5M commercial clients throughout North America.

-

Workforce to receive enhanced professional development and technological resources.

-

Deal expected to finalize in second half of 2026, subject to regulatory and shareholder approval.

UniFirst Corporation (UNF) stock finished regular trading at $257.91, declining 1.80%, before surging to $281.00 in pre-market activity, representing an 8.86% gain. Cintas Corporation (CTAS) revealed a binding agreement to purchase UniFirst through a combination of cash and stock valued at $310 per share. The approximately $5.5 billion deal is designed to create a dominant North American service provider.

This merger unites two family-established enterprises known for exceptional service quality and operational performance. The consolidated company will support approximately 1.5 million commercial accounts while combining complementary distribution systems, manufacturing facilities, and technological platforms. The integration is expected to broaden service portfolios while enhancing operational effectiveness and financial performance.

Cintas projects approximately $375 million in operational cost savings to be realized over a four-year timeline. These efficiencies will come from optimizing materials procurement, manufacturing processes, service delivery, and corporate overhead. The transaction structure prioritizes value creation while preserving service excellence and employee welfare.

Operational Advantages and Strategic Value of the Acquisition

The unified organization will offer an enhanced portfolio spanning uniform programs, facility services, and workplace safety solutions. Increased scale and capabilities will strengthen competitive positioning against major industry players and emerging alternatives. Commercial customers will access more comprehensive, streamlined, and economical solutions through the combined operation.

The acquisition enables consolidation of overlapping assets, distribution systems, and digital infrastructure. Cintas intends to utilize both organizations’ capital investments to enhance operational performance and service consistency. This approach will drive expansion initiatives while upholding quality benchmarks and client loyalty.

UniFirst team members are projected to gain from increased professional prospects within the enlarged organization. Professional growth programs, educational initiatives, and digital tools will facilitate employee progression. The integration strategy prioritizes talent retention while strengthening service delivery for customers throughout North America.

Deal Structure and Financial Considerations

UniFirst investors will obtain $155 cash and 0.7720 Cintas shares for each UniFirst share held. The aggregate $310 per share consideration equals 8.0x UniFirst’s trailing twelve-month EBITDA. Cintas will finance the cash component through available capital, committed financing facilities, and arranged bridge funding.

Both companies’ boards have unanimously endorsed the agreement, which remains subject to standard regulatory clearances and stockholder approval. The Croatti family, controlling two-thirds of voting rights, has committed to vote in favor of the combination. Completion is anticipated during the latter half of 2026, with execution focused on realizing cost efficiencies and driving operational expansion.

Cintas disclosed preliminary third quarter fiscal 2026 revenues of $2.84 billion, reflecting 8.9% year-over-year growth. Organic revenue expansion, excluding acquisitions and foreign exchange impacts, measured 8.2%. UniFirst is scheduled to announce second quarter fiscal 2026 earnings on April 1, 2026, and will not provide quarterly outlook updates given the pending acquisition.

Crypto World

How bombing Iran shifted oil and bitcoin prices

Since the world learned of massive US military deployments toward Iran on February 18, crude oil has rallied 36%, far surpassing bitcoin’s (BTC) 2.8%.

War-related headlines have definitely affected BTC which, with its 24-hour spot trading venues, has served as a trillion-dollar proxy for risk-on assets.

By charting the price of oil relative to BTC from the de facto start of the war, some of the conflict’s most critical moments become clear.

As a reference price for their pre-wartime starting points, at 12:15am New York time on February 18, BTC traded at $67,833. Oil, specifically contracts for difference (CFDs) on WTI crude, were trading at $62.39 per barrel.

At that time, open-source intelligence accounts began documenting “the largest US Air Force combat buildup in Europe and the Middle East since the Gulf War,” listing dozens of tankers, F-22s, and F-16s repositioning toward the Persian Gulf and Iran.

Chart 1: Price reaction to historic US naval movements toward Iran

The onset of war became obvious, and oil prices responded to the likelihood of supply restrictions. CFDs for the world’s most-traded and arguably most important commodity rallied without interruption for hours, and by two days later, oil had jumped 7% to $66.76 per barrel.

BTC, meanwhile, barely budged to $67,376, a near-flat 48-hour performance from its $67,833 start.

The divergence in those first 48 hours set the template for what followed.

Oil immediately priced in an imminent kinetic war. BTC did not.

The sophistication of oil traders relative to BTC traders was obvious during those first two days.

Slowly, as anyone should expect from the class of risk-on investments as threats become too obvious to ignore, BTC slid deeper into the red after the initial military buildup reports, hitting a low of $62,525 a week later on February 24, a 7.8% decline from its 12:15am start on February 18.

Oil, in contrast, had already begun a steady climb as more confirmation of military intent trickled into the mainstream news cycle. War was inevitable, and oil traders knew it.

Chart 2: Price reaction to official announcement of war

Finally, at 1:15am New York time on February 28, US and Israeli airstrikes on Iran formally commenced under the banner of “Operation Epic Fury.” Donald Trump announced the operation via Truth Social.

At this time, BTC was trading at $65,492. However, because the announcement fell on a weekend, oil CFDs weren’t open for trading, so there’s no way to know exactly how high oil would have traded.

Unfortunately, the most recent simultaneous price for both assets was February 27 at 5pm New York time: BTC at $65,524 and oil at $67.28 per barrel.

BTC panicked on the initial, formal announcement from Trump. Within 30 minutes, it dropped 3.8% to $63,037. It then recovered.

By Sunday, March 1 at 6pm New York time, when oil CFDs resumed trading, crude had gapped up 11.5% to $75 per barrel.

BTC, at $65,245, remained essentially flat since Trump’s formal announcement.

Oil was already repricing supply disruptions through the Strait of Hormuz, where Iran’s Islamic Revolutionary Guard Corps was threatening to block tanker traffic. BTC wasn’t. It had already sold off slightly from its pre-war, $67,833 start.

Oil surges 91% to $119 per barrel, while BTC recovers its mild loss

The war escalated quickly, sending the price of oil skyrocketing, but risk-on assets soon recovered entirely.

Iran tried to close the Strait of Hormuz, briefly disrupting roughly 20% of global oil supply. Tanker traffic through the chokepoint dropped 81%. Airports and US bases throughout the Middle East took on drone and missile damage.

Oil producers declared force majeure on contracts. Drone strikes hit Saudi Arabia’s largest refinery and Qatari export facilities. Gulf oil production collectively fell by 6.7 million barrels per day by March 10.

Incredibly, oil prices wicked up to $119.48 per barrel at 10:32pm New York time on March 8, a 91.5% surge from its February 18 baseline. BTC peaked much earlier, at $74,075 on March 4 at 2:15pm New York time, for a comparatively modest 9.2% gain.

By 10:40pm New York time on March 10, oil had pulled back 29% from its peak to $84.86 per barrel, partly on comments from Trump suggesting the conflict would resolve “very soon.”

BTC sat at $69,725.

Read more: Bitcoin up, Dubai real estate down since Iran war began

Chart 3: From start to finish, two wildly different returns

In the roughly three weeks since the start of the war, oil has gained approximately 35% while BTC as a risk-on asset has gained approximately 3%. The above chart illustrates that time period.

Oil’s entire trading range over that time period was $62.39 to $119.48 per barrel. BTC’s range, despite its far smaller size, was a far more conservative $62,525 to $74,075.

One asset reacted to a worldwide a supply shock. The other absorbed headline volatility and largely shrugged it off.

As usual, there are many ways to trade headlines. At least across the opening weeks of this war, oil scarcity has been the bullish trade. BTC was the hold.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

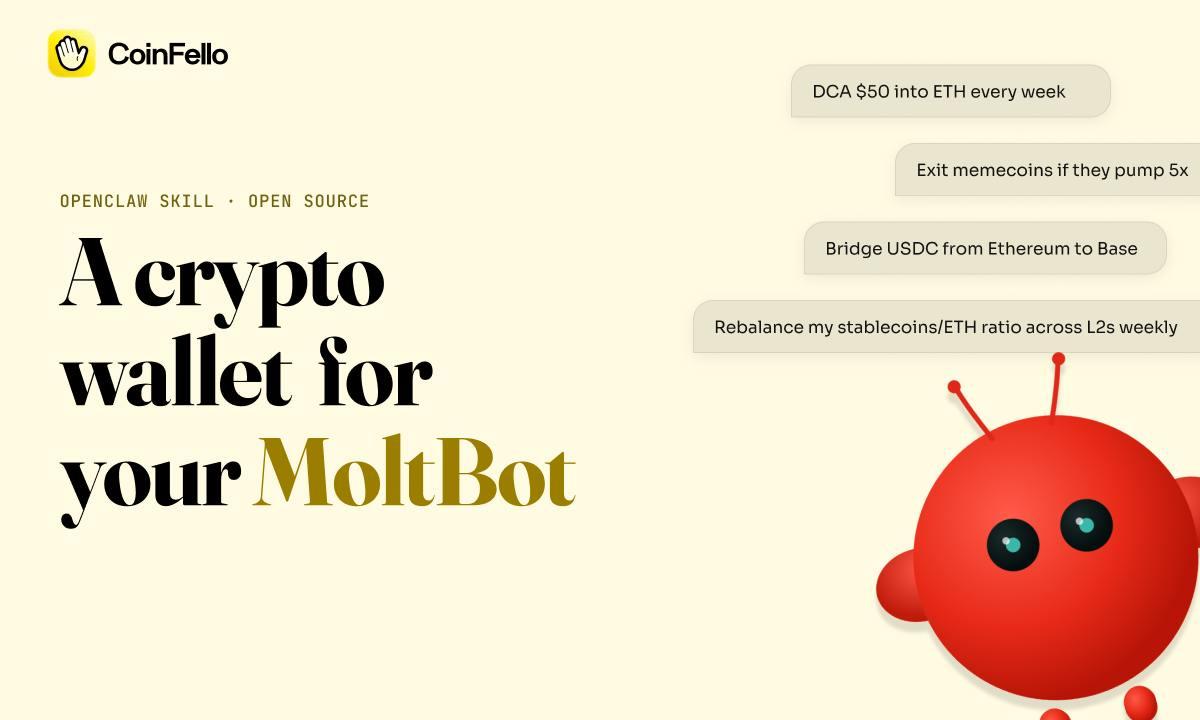

CoinFello Launches OpenClaw Skill for AI Agent Transactions

[PRESS RELEASE – Fort Worth, Texas, March 11th, 2026]

CoinFello, an AI agent optimized for interacting directly with any EVM smart contract, today announced the release of its open source OpenClaw skill in partnership with MetaMask. The new integration enables Moltbots, personal AI agents running on OpenClaw, to securely execute on-chain transactions using delegated smart wallet permissions.

The launch introduces a new framework for connecting AI agents with crypto wallets while maintaining user custody of private keys. By leveraging ERC-4337 smart accounts and ERC-7710 delegations through the MetaMask Smart Accounts Kit, the CoinFello OpenClaw skill allows Moltbots to grant other agents, such as CoinFello, narrowly defined delegations to act on their behalf. This represents a significant advancement in agentic wallet security compared to the current status quo, where agents typically store private keys or API credentials in plain text.

The system follows the principle of least privilege. A user’s Moltbot can grant CoinFello, and eventually other compatible agents, only the permissions required to complete a specific task, ensuring no agent receives broader wallet access than necessary. When a user submits a natural-language request, CoinFello converts the instruction into a delegated transaction and validates it in an evaluation layer before execution.

“If we want agents to participate meaningfully in the on-chain economy, we need a security model that is better than handing an autonomous system a private key,” said Brett Cleary, CTO at CoinFello. “The CoinFello Skill introduces hardware-isolated keys and fine-grained delegations, giving AI agents a secure way to execute transactions while helping bootstrap on-chain capabilities for the broader agent ecosystem.”

The release comes amid the rapid growth of the OpenClaw ecosystem. Over the past two months, the OpenClaw GitHub repository has surpassed 150,000 stars and 22,000 forks, while npm downloads exceeded 416,000 in the previous 30 days.

Until now, many AI agent wallets have given the agent direct access to a private key or API credential, exposing sensitive secrets within the agent’s runtime and creating a large attack surface.

Some newer designs attempt to mitigate this risk by using server-side trusted execution environments (TEEs), but they still rely on centralized infrastructure.

The CoinFello skill takes a different approach. The signing key stays on the user’s device, while tasks are carried out through fine-grained ERC-7710 delegations. Agents can execute actions without ever accessing the private key.

Using the CoinFello skill, Moltbots can perform a wide range of blockchain actions via natural-language prompts. Supported capabilities include swapping between ERC-20 assets, bridging across EVM networks, interacting with NFTs such as ERC-721 or ERC-1155 tokens, staking, lending, automatic rebalancing of token portfolios, and executing multi-step trading strategies.

The CoinFello OpenClaw skill is built on the Agent Skills specification and is compatible with OpenClaw environments and Claude Code. The implementation is released under the MIT license, allowing developers to freely deploy, modify, and contribute to the skill in their own AI agent environments.

CoinFello notes that the system is designed to remain open and configurable. While CoinFello acts as the default Web3 agent, Moltbots can delegate permissions to any compatible on-chain agent. The company says future development will focus on expanding permissions frameworks and deeper integrations with the MetaMask Smart Accounts Kit to support broader portfolio management features.

Interest in the intersection of AI agents and crypto infrastructure has accelerated in recent months as developers experiment with autonomous software agents capable of interacting with decentralized networks. The CoinFello OpenClaw skill aims to provide a secure foundation for this emerging category by bridging natural language interfaces with on-chain execution.

About CoinFello

CoinFello is an AI agent designed to explain, execute, and automate interactions with smart contracts. Built for self-custody, the platform is currently available in private alpha for end users, with developer versions expected soon. CoinFello supports EVM-compatible networks, leverages EigenAI to enable a self-custodied AI environment, and integrates the MetaMask Smart Accounts Kit to give users control over their assets.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Business5 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

News Videos2 days ago

News Videos2 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Ann Taylor

-

Crypto World2 days ago

Crypto World2 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech6 hours ago

Tech6 hours agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Sports6 days ago

Sports6 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics5 days ago

Politics5 days agoTop Mamdani aide takes progressive project to the UK

-

Sports4 days ago

Sports4 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business21 hours ago

Business21 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

NewsBeat6 days ago

NewsBeat6 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business3 days ago

Business3 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business6 hours ago

Business6 hours agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat2 days ago

NewsBeat2 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech2 days ago

Tech2 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Entertainment7 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Crypto World7 days ago

Crypto World7 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

![Bitcoin Has One Hurdle To Beat Before Going Higher! [Data]](https://wordupnews.com/wp-content/uploads/2026/03/1773233177_maxresdefault-80x80.jpg)