CryptoCurrency

BlackRock’s BUIDL Reaches $100M Cumulative Dividend Payouts

Join Our Telegram channel to stay up to date on breaking news coverage

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL), the asset manager’s first tokenized money market fund, has paid out $100 million in cumulative dividends since its launch.

That milestone was announced on Monday by Securitize, the tokenized fund’s issuer and tokenization partner that oversees the onchain issuance and investor onboarding.

BUIDL Has Seen Strong Adoption

BUIDL was launched in March last year, and was initially issued on the Ethereum blockchain, which has been a popular choice for traditional finance firms who are looking to come onchain.

The fund invests in short-term, US-dollar denominated assets. This includes US Treasury bills, repurchase agreements and cash equivalents. Through BUIDL, investors are able to earn yield via a blockchain-based vehicle while still maintaining liquidity.

To get access to those yields, investors purchase BUIDL tokens, which are pegged to the US dollar. Holders then receive their dividend distributions directly on the blockchain, which reflect income that the fund generates from its underlying assets.

Since debuting on the Ethereum network, BUIDL has expanded to seven additional blockchains, namely Aptos, Avalanche, Optimism, Solana, BNB Chain, Arbitrum, and Polygon.

The $100 million milestone comes as interest around blockchain tokenization continues to grow. BUIDL, in particular, has seen strong adoption since its launch. Earlier this year, the tokenized fund surpassed $2 billion in total asset value.

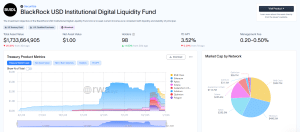

BUIDL overview (Source: RWA.xyz)

Data from RWA shows that BUIDL’s total asset value has since dropped to around $1.733 billion, representing a more than 25% decline from 30 days ago. However, there has been a 1% rise in the number of holders of the fund in the last month, pushing the total to 98.

BUIDL’s Highest Market Cap Is On BNB Chain

When looking at BUIDL’s market cap by blockchain network, the BNB Chain accounts for the majority of the tokenized fund’s capitalization at $502.7 million, the RWA data shows.

Ethereum comes in at second with $490.5 million, while APTOS accounts for the third-highest amount of $295.5 million.

The Solana blockchain ranks at number 4, and accounts for $255.3 million of BUIDL’s capitalization.

BNB Chain making up the highest portion of BUIDL’s market cap comes after Binance, the blockchain’s owner and the largest crypto exchange by 24-hour trade volumes, announced in the middle of November that traders can start using BUIDL tokens as off-chain collateral on its platform.

BlackRock’s BUIDL, the world’s largest tokenized RWA, is now accepted as off-exchange collateral for trading on #Binance

This milestone reflects our dedication to enabling institutions to access digital assets with control, yield, security, and capital efficiency.

— Binance (@binance) November 14, 2025

The move was driven by demand from institutional clients for yield-bearing assets that can be used as collateral in active trading strategies. Binance’s decision also followed similar moves made by Crypto.com and Deribit earlier this year.

Crypto.com, a competing crypto exchange, started accepting collateral for margin trading and advanced trading purposes in June, allowing institutional users and advanced traders to post BUIDL to secure positions across multiple products on its platform.

With regards to Deribit, traders are able to put BUIDL as collateral for futures and options trading.

More recently, the M0 stablecoin platform followed those companies’ lead and announced earlier this month that it will also start accepting BUIDL as collateral backing for stablecoin issuers on its platform as well.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage