Crypto World

BTC’s downside volatility is a feature, not a crisis, says hedge funder

Bitcoin’s sharp decline — nearly 50% from its all-time highs reached just months ago — has reignited debate over the cryptocurrency’s stability, but hedge fund veteran Gary Bode says the selloff is a feature of the asset’s inherent volatility rather than a sign of a broader crisis.

In a post on X, Bode noted that while the recent price drop is “unpleasant and jarring,” it is not unusual in bitcoin’s history. “80% – 90% drawdowns are common,” he said. “Those who have been willing to stomach the always-temporary volatility have been well-rewarded with incredible long-term returns.”

Much of the recent turbulence, he said, can be traced to market reactions to the nomination of Kevin Warsh to succeed Jerome Powell as Federal Reserve chair. Investors interpreted the move as a signal that the Fed might adopt a hawkish stance, raising interest rates and making zero-yield assets such as bitcoin, gold, and silver relatively less attractive. Margin calls on leveraged positions amplified the decline, causing a cascade of forced selling.

Bode, however, disputes the market’s interpretation. He pointed to Warsh’s public statements supporting lower rates and notes from President Trump suggesting Warsh promised a lower fed funds rate. Combined with Congress’ ongoing multi-trillion-dollar deficits, Bode argued, the Fed has limited ability to influence longer-term Treasury yields — a key factor in corporate borrowing and mortgage rates. “I think the market got this one wrong” he said, emphasizing that perception, rather than fundamentals, drove much of the recent selling.

Other commonly cited explanations, he said, also fail to tell the full story. One theory is that “whales” — early bitcoin holders who mined or purchased coins when prices were near zero — are offloading holdings. While Bode acknowledges that large wallets have been active and some big sellers have emerged, he frames these moves as profit-taking rather than an indication of long-term weakness. “The technical skill of the early adopters and miners is something to be applauded,” he said. “That doesn’t mean that their sales (full or partial) tell us much about the future of bitcoin.”

Bode also flagged Strategy ($MSTR) as a potential source of short-term pressure. The company’s stock fell after bitcoin slid below the prices at which Strategy purchased many of its holdings, prompting fears that Saylor might sell. Bode described this risk as real but limited, comparing it to when Warren Buffett buys a large stake in a company: investors like the support but worry about eventual sales. He stressed that bitcoin itself would survive such events, though prices could temporarily dip.

Another factor is the rise of “paper” bitcoin — financial instruments such as exchange-traded funds (ETFs) and derivatives that track the crypto asset’s price without requiring ownership of the underlying coins. While these instruments increase the effective supply available for trading, they do not alter bitcoin’s hard cap of 21 million coins, which Bode said remains a crucial anchor for long-term value. He drew parallels to the silver market, where increased paper trading initially suppresses prices until physical demand pushes them higher.

Some analysts have suggested that rising energy prices could hurt bitcoin mining and reduce the network’s hash rate, potentially lowering long-term prices. Bode calls this theory overblown.

Historical data shows that past bitcoin price drops did not consistently result in hash rate declines, and when declines did occur, they lagged months behind the price drop.

He also pointed to emerging energy technologies — including small modular nuclear reactors and solar-powered AI data centers — that could provide low-cost power for mining in the future.

Bode also addressed critiques that bitcoin is not a “store of value.” While some argue that its volatility disqualifies it from this role, Bode points out that nearly every asset carries risk — including fiat currencies backed by heavily indebted governments. “[…] Gold does require energy to secure unless you’re comfortable leaving it on your front porch,” he said. “Paper Bitcoin can influence the short-term price, but long-term, there are 21MM coins that will be issued and if you want to own Bitcoin, that’s the real asset. Bitcoin is permissionless and requires no trust in a counterparty.”

Ultimately, Bode’s assessment frames the recent decline as a natural consequence of bitcoin’s design. Volatility is part of the game and those willing to endure it may ultimately be rewarded. For investors, the key takeaway is that price swings, no matter how dramatic, are not necessarily a signal of systemic risk.

Crypto World

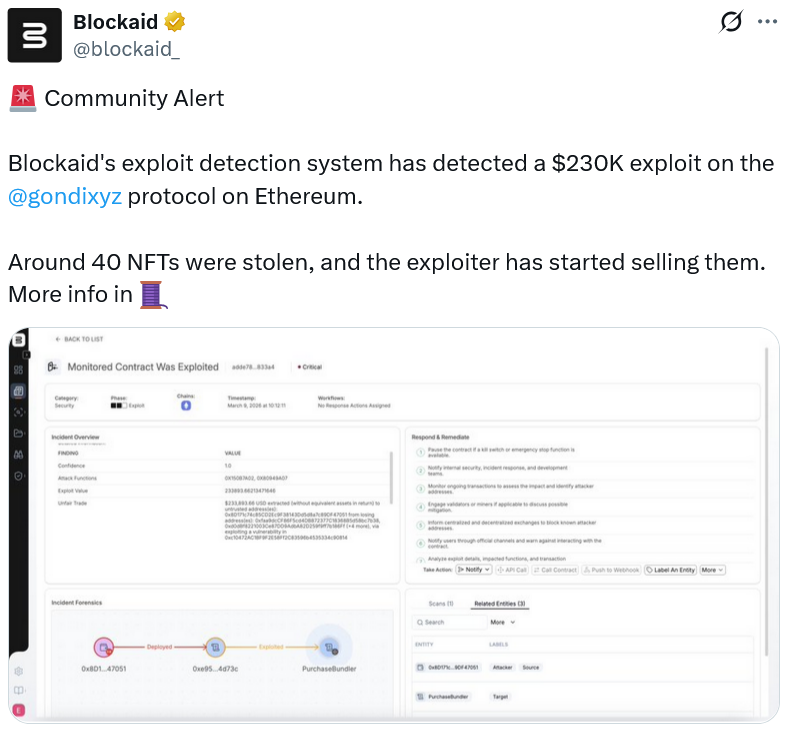

Gondi Disables Smart Contract Bug After $230K Exploit

Nonfungible token platform Gondi said it has disabled the faulty smart contract that allowed a hacker to steal $230,000 worth of NFTs from the protocol, adding it is now in the process of compensating affected customers.

Gondi said in an X post on Monday that the hacker exploited the “Sell & Repay” contract, which lets borrowers sell escrowed NFTs and automatically repay loans on the platform.

Gondi noted that an updated version of that contract was deployed on Feb. 20 but didn’t confirm how the hacker managed to exploit it. Gondi said no other part of the platform was affected by the exploit.

Data from Ethereum block explorer Etherscan shows 78 NFTs were stolen on Monday at about 8:12 am UTC. Blockchain security platform Blockaid estimated the damage to be $230,000.

In an update, Gondi said its “focus has shifted entirely to making affected users whole” and that Blockaid and an independent auditor have since reviewed the platform, concluding it to be safe to use.

That includes repaying, renegotiating, refinancing loans and starting new loans in addition to buying, selling, trading and listing NFTs on the platform.

Gondi said it has not yet deployed a fix to the Sell & Repay contract, which has now been disabled.

Crypto Samaritans help Gondi recover NFTs

While Blockaid said the hacker had started selling some of the stolen NFTs, members of the NFT community managed to recover and return Doodle, Aluminum Gazer, Lil Pudgy and Servant of the Muse NFTs, Gondi noted.

“We are in active conversations on additional items and expect more to follow, including Taxmen.”

Crypto researcher “Tinoch” noted on X that one Gondi user, with wallet address “0x8d1…47051,” lost around $108,000 worth of NFTs, accounting for nearly half of the protocol theft.

Related: Magic Eden winds down EVM, Bitcoin NFT markets to focus on gambling

Gondi said it has already bought “comparable items” from the same NFT collections and transferred them to affected owners, and will continue to do so for any remaining cases.

“While not the exact same piece, we believe this is a fair and meaningful resolution and are coordinating directly with each owner.”

Magazine: What’s a ‘Network State’ and are there real-life examples? Big Questions

Crypto World

Bitcoin jumps past $70,000 as war volatility fades

Bitcoin pushed back above $70,000 Tuesday morning East Asia time, completing a rapid recovery from a weekend selloff that briefly dragged the largest digital asset down to around $65,000.

The move higher came as volatility in energy markets eased after crude oil surged amid fears of disruptions in the Strait of Hormuz. Bitcoin dipped alongside risk assets during the initial shock but quickly stabilized in the mid $60,000 range — given Wall Street’s insulation from the energy crisis — before climbing again as markets digested the geopolitical headlines.

Market maker Enflux said the cryptocurrency showed notable resilience despite the scale of the energy shock.

“Bitcoin dipped below 66k during the initial risk-off wave yet quickly stabilized back in the 66k to 68k range,” the firm said in a note to CoinDesk. “In relative terms, it held up better than equities and even some traditional hedges.”

Institutional demand has also remained supportive.

U.S. spot bitcoin ETFs drew about $568 million in net inflows last week, following $787 million the week prior, according to data from SoSoValue, pushing cumulative net inflows across the products above $55 billion.

Early data from SoSoValue shows that Monday’s U.S. inflows were about $57 million, though not all issuers had reported at the time of publication.

Onchain and derivatives indicators suggest the market is stabilizing after the recent volatility, though conviction has yet to fully return.

“Overall, conditions are stabilizing, with momentum, ETF demand, and profitability metrics improving modestly,” analysts at Glassnode wrote in a recent report. “However, capital flows remain soft, speculative participation is limited, and broader conviction has yet to fully return.”

Prediction markets also flipped more bullish as bitcoin rebounded.

On Polymarket, the odds that BTC will reach $75,000 in March jumped to about 56% on Monday from roughly 34% a day earlier, highlighting how quickly trader expectations shifted as the cryptocurrency reclaimed the $70,000 level.

Crypto World

Zcash Devs Secure $25M From Major VCs Months After ECC Split

The Zcash Open Development Lab (ZODL), formed by the core engineering and product team that previously built the Zodl wallet under Electric Coin Company, has closed a $25 million funding round led by major crypto investors including a16z Crypto and Coinbase Ventures. The group left ECC in January after a dispute with Bootstrap, the nonprofit that oversees Zcash development, over governance and how the privacy protocol should evolve. ZODL said the round included Paradigm, Winklevoss Capital, Cypherpunk Technologies, Maelstrom, and Chapter One, along with notable backers such as Balaji Srinivasan, David Friedberg and Haseeb Qureshi. The developers say the capital will accelerate engineering and product expansion for the Zodl wallet and related privacy-focused infrastructure within the Zcash ecosystem.

Key takeaways

- ZODL raised about $25 million to scale its open-source Zodl wallet and underlying privacy-focused infrastructure.

- Investors described in the round span a16z Crypto, Coinbase Ventures, Paradigm, Winklevoss Capital, Cypherpunk Technologies, Maelstrom and Chapter One, with additional contributions from high-profile tech figures.

- The fundraising comes after the founders departed from Electric Coin Company in January due to governance and strategic disputes with Bootstrap, the nonprofit overseeing Zcash development.

- The Zodl wallet has become a central piece of Zcash’s ecosystem, handling substantial on-chain activity and contributing to a growing shielded pool since its 2024 launch.

- Market reaction to the news saw Zcash (CRYPTO: ZEC) edge higher, reflecting renewed interest in privacy-preserving crypto networks.

Tickers mentioned: $ZEC

Sentiment: Bullish

Price impact: Positive. The funding news coincided with a price uptick for ZEC, signaling investor enthusiasm for privacy-focused infrastructure.

Trading idea (Not Financial Advice): Hold. The development trajectory and capital backing suggest potential for long-term value if the project sustains momentum and adoption within the Zcash ecosystem.

Market context: The move arrives amid a crypto market backdrop marked by selective interest in privacy-preserving protocols and ongoing scrutiny of crypto governance models. As institutions continue to evaluate risk and compliance considerations, capital flowing toward mature privacy infrastructures signals a continued, if cautious, appetite for privacy-first capabilities within decentralized ecosystems.

Why it matters

At the heart of ZODL’s mission is the Zodl wallet, an open-source project that serves as a cornerstone of Zcash’s privacy narrative. Zcash, known for its shielded transactions that hide sender, receiver and amount, relies on a suite of tools and protocols to maintain user privacy while enabling compliance-friendly interfaces where necessary. By mobilizing a significant funding round, ZODL aims to accelerate feature development, expand the engineering team, and deepen the wallet’s integration with the broader Zcash ecosystem. This is not simply a software upgrade; it is a statement that privacy-focused infrastructure remains a viable, scalable area for investment within crypto markets.

The expansion comes after years of internal debates about how Zcash should balance privacy with governance and ecosystem growth. The departure of the ZODL team from ECC in January followed disagreements with Bootstrap, the nonprofit overseeing Zcash development, over priorities for the protocol’s evolution. With seasoned investors backing the effort, ZODL’s leadership argues that a more aggressive development roadmap can help Zcash remain competitive against other privacy-oriented networks while preserving the core principles that make shielded transactions attractive to users seeking confidentiality and censorship-resistance.

Beyond wallet engineering, the round signals confidence in the broader Zcash ecosystem’s potential. The Zodl wallet has already facilitated substantial activity, with the team noting that more than $600 million in ZEC swaps had traversed the wallet since October 2025. At the same time, the protocol’s shielded pool has grown by more than 400% since its 2024 launch, underscoring sustained user interest in privacy-preserving techniques. These metrics are important markers for developers and investors alike because they reflect real usage and value capture within a privacy-first framework, not merely theoretical appeal.

For users and builders, the funding could translate into faster onboarding for privacy-enabled features, smoother user experiences around shielded transactions, and expanded tooling that makes Zcash more accessible to a broader audience. It may also foster cross-project collaboration within the privacy space, as prominent backers with experience across crypto infrastructure bring additional perspectives on scalability, security, and governance that could shape ZEC’s competitive positioning in the market.

What to watch next

- Timeline for增加 engineering hires and product roadmaps as the ZODL team scales operations.

- Updates on Zodl wallet integrations and new privacy features that could affect user adoption and on-chain privacy guarantees.

- Any formal governance milestones or governance-related decisions within the Zcash ecosystem that could influence development direction.

- Market response to ZEC price movements and any related liquidity changes across exchanges and wallets tied to Zcash.

- Broader regulatory signals affecting privacy-preserving technologies and how exchanges and custodians implement privacy solutions.

Sources & verification

- ZODL funding round and investor roster announced via ZODL’s public communications (X post references and press disclosures).

- ZEC price data and market movement available on CoinGecko: https://www.coingecko.com/en/coins/zcash

- ZEC price index and market coverage: https://cointelegraph.com/zec-price-index

- Background on Zcash development and the governance disputes surrounding Bootstrap: https://cointelegraph.com/news/zcash-devs-split-from-electric-coin-company-plan-to-create-new-firm

- Details on Bootstrap’s governance-related discussions impacting Zcash wallet development: https://cointelegraph.com/news/bootstrap-board-split-non-profit-zcash-wallet-investment

What the story means for the market

The ZODL funding round underscores a broader trend in crypto where substantial capital continues to flow into privacy-centric infrastructure, even as mainstream markets wobble. Investors appear to be differentiating between speculative trading activity and the long-term utility of protocol-level privacy tools. For Zcash, the emphasis on a robust, open-source wallet and scalable privacy primitives could help sustain usage in a landscape where users seek both confidentiality and control over their funds.

Rewritten article body: ZODL funding accelerates privacy-focused Zcash wallet expansion

In a move that signals ongoing confidence in privacy-preserving crypto networks, the team behind Zcash’s wallet infrastructure has secured a substantial funding round to accelerate development. The Zodl wallet, central to the Zcash ecosystem since its early iterations, is poised to benefit from a fresh influx of capital that investors describe as a vote of confidence in the long-term viability of decentralized, privacy-first finance.

The genesis of ZODL traces back to the Jan. split from Electric Coin Company, when a group of engineers and product managers who built the Zodl wallet chose to launch a dedicated development lab. Their decision followed what they described as governance concerns with Bootstrap, the nonprofit organization responsible for steering Zcash’s broader trajectory. The new lab positions itself as the custodian of a more autonomous development path for Zcash software, including tools that empower users to transact privately while preserving security and auditability for developers and auditors alike.

Leading the round, notable crypto institutions alongside venture groups contributed to the $25 million funding round. Names like a16z Crypto and Coinbase Ventures joined forces with Paradigm, Winklevoss Capital, Cypherpunk Technologies, Maelstrom, and Chapter One. The round also attracted high-profile individuals in technology and entrepreneurship, such as Balaji Srinivasan, David Friedberg, and Haseeb Qureshi, according to ZODL’s communications. The backing is framed by executives as a clear signal that the market still values privacy tech and that reliable, self-custodied wallets are critical to the ecosystem’s growth. A Monday X post from ZODL highlighted the breadth of the investor list and the strategic intent to scale engineering capacity to meet rising demand.

From a product perspective, ZODL’s mandate centers on expanding the Zodl wallet’s capabilities and ensuring its interoperability with Zcash’s privacy protocols. ZEC, the native token for Zcash, recently found renewed attention among traders and holders as liquidity and interest within privacy-first networks recover from broader market volatility. ZEC’s price movement—tracking the latest price metrics from data aggregators—offers a pragmatic signal of market participants’ willingness to support privacy projects during a period of regulatory scrutiny and macro caution. Analysts noted that ZEC rose on the funding news, a reflection of investor appetite for projects that promise tangible user value through enhanced privacy features and stronger development pipelines.

Beyond the wallet itself, the Zcash shielded pool has demonstrated meaningful growth since its 2024 launch, rising by more than 400%. The shielded pool is central to Zcash’s promise of private transactions, enabling participants to conceal the sender, recipient, and amount in on-chain interactions. The scale of activity the Zodl wallet has enabled—over $600 million in ZEC swaps since October 2025—serves as a practical barometer of the ecosystem’s activity and the wallet’s utility. Taken together, these data points suggest that user demand for private-by-default transactions remains a core driver of Zcash’s relevance in a crowded privacy landscape.

Investors’ confidence in ZODL also reflects a belief that governance and product strategy can be aligned with a sustainable, open-source model. While governance debates within the broader Zcash ecosystem sometimes complicate consensus, the new funding provides the resources needed to hire engineers, maintain code quality, and pursue practical features that simplify private transfers, improve tooling for developers, and expand the wallet’s reach to more users. For users who value control over their financial privacy, ZODL’s trajectory could translate into more accessible privacy-preserving workflows and a more resilient privacy toolkit in the crypto toolkit.

As the crypto market evolves, the emphasis on privacy-centric infrastructure is likely to influence both developer activity and investor sentiment. The Zcash project remains among the most visible proponents of shielded transactions, a technology that can mitigate some of the privacy concerns that come with transparent blockchains. The funding round’s success adds to a growing narrative that privacy technologies are not merely niche experiments but components of a larger, interoperable privacy stack that can adapt to regulatory and technical realities without compromising user confidentiality. The coming months will be telling as the ZODL team implements its roadmap, hires additional engineers, and reports on how the wallet’s features translate into real-world usage and broader ecosystem engagement.

Crypto World

US Banking Group Weighs OCC Lawsuit Over Crypto Trust Charters

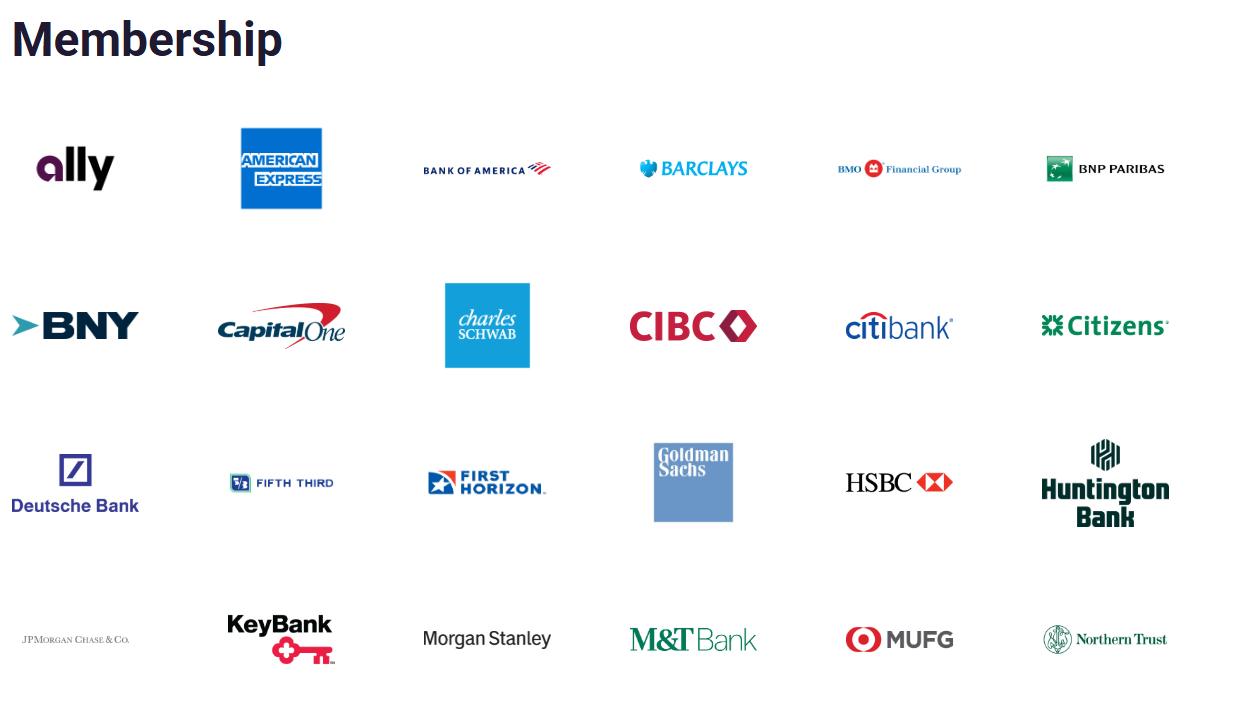

A US trade group made up of some of the country’s biggest banks is reportedly considering suing the Office of the Comptroller of the Currency (OCC), arguing that granting crypto firms bank charters could put Americans and the financial system at risk.

According to a report on Monday by The Guardian, citing a “source familiar with the lobby’s thinking,” the Bank Policy Institute (BPI) is weighing legal options after the OCC failed to heed warnings from banking groups over its reinterpretation of federal licensing rules.

In December, the OCC granted conditional national trust bank charter approvals to several crypto firms, including BitGo, Fidelity Digital Assets, Ripple and Paxos. A growing number of other crypto companies have followed suit since.

Blockchain infrastructure firm Zerohash submitted an application on Feb. 27. The OCC also issued conditional licenses to Crypto.com, Bridge, and Stripe in February.

The Trump-backed World Liberty Financial also applied for a charter in January to expand the use of its USD1 stablecoin, but is still waiting for a decision.

BPI, which counts major US institutions such as Goldman Sachs, American Express, and JPMorgan among its members, is also concerned that crypto firms with national trust bank charters pose risks to the wider financial system.

A national trust bank charter is a federal license from the OCC that permits a company to operate as a trust bank under federal law and engage in fiduciary activities such as trust services, custody and asset safekeeping.

Banking group hasn’t made the final call yet

According to The Guardian, the BPI has not yet made a final decision on whether to pursue legal action against the OCC. Cointelegraph contacted the Bank Policy Institute for comment.

Related: Bankers push OCC to slow crypto trust charters until GENIUS rules clarified

In October, the BPI released a statement urging the OCC to reject national trust company charter applications from a group of crypto firms, including Ripple and Circle. The BPI argued that granting these charters would result in less oversight than is required for full-service national banks.

The BPI was also among a group of banks and business associations that filed a lawsuit against the Federal Reserve in late 2024 over its stress-testing framework for assessing the health and resilience of the banking sector. The Fed has since agreed to reconsider parts of the framework and the case has been paused.

Magazine: China’s ‘50x’ blockchain boost, Alibaba-linked AI mines Bitcoin: Asia Express

Crypto World

Bitcoin ETF inflows fall to $619M as oil shakes markets

TLDR

- Bitcoin ETF products recorded $1.44 billion in inflows during the first three trading days of the week.

- Investors withdrew $829 million dollars before Friday, which reduced the net weekly total to 619 million dollars.

- Bitcoin attracted $521 million in inflows and led all digital asset funds.

- Ethereum and Solana funds posted gains, while XRP recorded outflows during the same period.

- Bitcoin price rose nearly 11 percent early in the week and later declined about 8%.

Bitcoin exchange-traded funds closed the week with $619 million in net inflows after sharp reversals. Early subscriptions reached $1.44 billion before late withdrawals erased momentum. Oil price volatility and geopolitical tension drove the rapid shift in positioning.

Bitcoin ETF Records $619M net Inflow After Volatile Week

Bitcoin ETF products attracted $1.44 billion during the first three trading days. However, investors withdrew $829 million before Friday and reduced the weekly total. CoinShares reported that Bitcoin led inflows with $521 million during the period.

Bitcoin prices moved in line with fund activity and reflected changing risk appetite. The asset rose nearly 11% from $66,356 to $73,648 between March 1 and 5, according to CoinGecko. It later fell about 8% and traded near $67,777 after Thursday.

Ethereum funds captured fresh capital as investors diversified exposure within digital assets. Solana products also recorded inflows during the early part of the week. In contrast, XRP funds posted outflows while other major assets gained subscriptions.

CoinShares stated that US-based investors drove most of the weekly activity. European and Asian investors showed lower participation during the same period. The report linked early inflows to market reaction following the US strike on Iran.

Nima Beni, founder of Bitlease, described the pattern as routine portfolio management. He said, “Portfolio managers often put on positions early in the week, capture the move, and then trim risk.” He added that the behavior reflects standard capital markets practice.

Oil Surge Pressures Crypto Markets and Trims ETF Demand

Oil prices surged to $119 per barrel after the US attack on Iran. Prices later retreated and stabilized near $102 per barrel by week’s end. Crude had traded near $74 only weeks earlier before the spike.

Market participants reacted as energy costs fed inflation expectations and rate concerns. Higher oil prices weighed on risk assets, including cryptocurrencies and related funds. Bitcoin traded in correlation with broader markets during the period.

Jonatan Randin, senior market analyst at PrimeXBT, cited geopolitical escalation as a driver of outflows. He pointed to activity around the Strait of Hormuz as a source of tension. Iranian officials confirmed developments near the key oil transit route.

About 20% of the global oil supply passes through the Strait of Hormuz. Any disruption to shipping can impact energy markets and investor positioning. Oil remained near $102 at the close of the reporting period.

Bitcoin ETF products, therefore, ended the week with $619 million in net inflows. The data reflects combined subscriptions and withdrawals recorded through Friday. CoinShares published the figures in its latest weekly report.

Crypto World

Strategy Buys $1.28B in Bitcoin, Holdings Top 738,000 BTC

TLDR

- Strategy purchased 17,994 Bitcoin for $1.28 billion at an average price of $70,946 per coin.

- The company increased its total holdings to 738,731 BTC at a total cost of $56.04 billion.

- Strategy funded the acquisition through $900 million in common stock sales and $377 million in preferred stock sales.

- The latest purchase marked its largest Bitcoin acquisition since January.

- Strategy’s holdings now represent about 3.7 percent of Bitcoin’s circulating supply.

Michael Saylor’s Strategy expanded its Bitcoin reserves with a $1.28 billion purchase last week. The company acquired 17,994 BTC at an average price of $70,946 per coin. As a result, total holdings reached 738,731 BTC as Bitcoin traded below $68,000.

Strategy Increases Bitcoin Holdings With $1.28 Billion Acquisition

Strategy confirmed the purchase in a filing with the US Securities and Exchange Commission on Monday. The company bought 17,994 Bitcoin for $1.28 billion during the reporting period. It paid an average price of $70,946 per coin, according to the filing.

The purchase pushed total holdings to 738,731 BTC at an aggregate cost of $56.04 billion. Strategy reported an overall average acquisition price of $75,862 per Bitcoin. The latest buy came in below that average cost basis.

Strategy funded most of the acquisition through equity sales during the week. The company raised $900 million from common stock sales to support the purchase. It also secured $377 million from sales of its STRC preferred stock series.

The company stated that the purchase marked its largest Bitcoin acquisition since January. In January, Strategy acquired 22,305 BTC for $2.13 billion at $95,284 per coin. The latest transaction occurred while Bitcoin traded near $67,000 for much of the week.

Bitcoin Supply Dynamics and Market Data

Strategy completed five acquisitions during the current below-cost period since Feb. 9. The company bought 25,229 BTC across those transactions during this timeframe. Its average cost basis declined from $76,052 to $75,862 during that period.

During 2022 and 2023, Strategy executed seven smaller purchases in similar below-cost conditions. The company acquired 28,560 BTC across those earlier transactions. This latest purchase exceeded the pace of its prior buying activity.

Market data shows that miners produce about 450 BTC per day. That output equals roughly 3,150 BTC entering circulation each week. Strategy’s purchase equaled nearly five weeks of newly mined Bitcoin supply.

Strategy’s holdings now represent about 3.7% of Bitcoin’s circulating supply. Circulating supply is expected to reach 20 million coins on Monday. At publication, Bitcoin traded at $67,725, up 2.4% over seven days.

Strategy shares rose 0.2% in pre-market trading following the disclosure. Over the past week, MSTR shares gained 3.6% and closed at $133.5 on Friday. The company disclosed the acquisition details in its Monday filing.

Crypto World

BMNR stock on the verge of a rebound as BitMine Ethereum buying spree continues

The BMNR stock price rose by over 4% on Monday and retested the important resistance level at $20 as Ethereum rebounded and the company continued accumulating.

Summary

- BitMine stock rose on Monday as the company continued buying Ethereum.

- It now holds over 4.5 million ETH tokens worth over $9 billion.

- The stock has formed a falling wedge pattern, pointing to an eventual rebound.

BitMine stock rose to $20, inside a range it has remained in the past few weeks. This price remains much lower than the all-time high of $150.

In a statement, the company said that it continued accumulating Ethereum (ETH) tokens last week, making it the biggest holder in the world. It now holds 4.534 million tokens, which is equivalent to 3.76% of Ethereum’s total supply. Its Ethereum holdings are now worth over $9 billion.

The company hopes to continue accumulating its Ethereum holdings in the coming months. Its goal is to become a 5% owner of Ethereum, a goal it may achieve later this year or in 2026. It has staked 67% of these holdings and generated over $174 million in annualized revenue.

BitMine also owns 195 Bitcoin (BTC), currently worth over $13 million, a $200 million investment in Beast Industries, and $1.2 billion in unencumbered cash.

The company will likely do well, especially when a crypto market rally starts, which is a possibility when the war in Iran ends, which may happen as soon as this month.

BMNR stock price technical analysis

The daily chart shows that the BitMine share price has remained in a narrow range in the past month. It was trading at $20 on Monday, up modestly from the year-to-date low of $16.60.

The stock is along the upper side of the falling wedge pattern, a common bullish reversal sign in technical analysis.

It has formed a bullish divergence pattern as the two lines of the Percentage Price Oscillator have made a bullish crossover and are pointing upwards.

The Relative Strength Index has also moved from the oversold level of 25 in February to the current 43.

Therefore, there is a possibility that the stock will have a strong bullish breakout, potentially to the next key resistance level at 30. The bullish outlook will become invalid if it drops below the year-to-date low of $16.

Crypto World

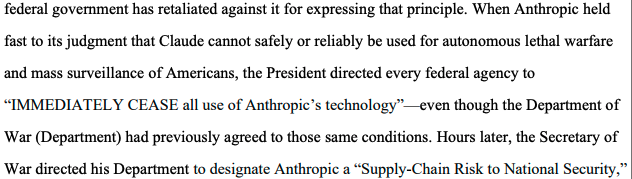

Anthropic Sues Trump Admin to Undo ‘Supply Chain Risk’ Label

Anthropic, the creator of the AI software Claude, has sued the Trump administration for what it says is an “unlawful campaign of retaliation” after the company refused to allow the military unrestricted use of its technology.

Anthropic sued multiple government agencies and officials in a California federal court on Monday, asking the court to reverse the Department of Defense’s decision to label the company a “supply chain risk.”

It also seeks to overturn US President Donald Trump’s directive to federal employees to stop using Claude. Anthropic also filed suit in a Washington, D.C., appeals court to challenge the Defense Department’s decision.

“These actions are unprecedented and unlawful,” Anthropic argued. “The Constitution does not allow the government to wield its enormous power to punish a company for its protected speech.”

Claude “never tested” for uses wanted by Pentagon

Last month, Defense Secretary Pete Hegseth, who is named in the lawsuit, moved to label Anthropic as a supply chain risk, which was finalized on March 3, meaning any person or business doing business with the military can’t also deal with Anthropic.

It is the first time an American company has been designated a supply chain risk, a label usually reserved for companies tied to foreign adversaries.

The US government and the Pentagon have used Anthropic since 2024, and the company’s technology is the first AI to be deployed for use in classified work.

Anthropic said that Hegseth’s decision came after he demanded the company “discard its usage restrictions altogether,” but Anthropic maintained its technology shouldn’t be used for lethal autonomous warfare and mass surveillance of Americans, clauses that were always part of its government contracts.

“Anthropic has never tested Claude for those uses,” the company said in its lawsuit. “Anthropic currently does not have confidence, for example, that Claude would function reliably or safely if used to support lethal autonomous warfare.”

Related: US military used Anthropic in Iran strike despite ban order by Trump: WSJ

Anthropic’s lawsuit also named the US Treasury and its secretary, Scott Bessent, the State Department, and Secretary of State Marco Rubio, along with 17 other government agencies and officials.

A group of more than 30 AI engineers and scientists from OpenAI and Google, including the latter’s chief scientist, Jeff Dean, also filed a legal brief in support of Anthropic on Monday.

“If allowed to proceed, this effort to punish one of the leading U.S. AI companies will undoubtedly have consequences for the United States’ industrial and scientific competitiveness in the field of artificial intelligence and beyond,” the group wrote.

AI Eye: 9 weirdest AI stories from 2025

Crypto World

Collateral Reputation Tokens: Trust-Driven Lending Across Chains

In decentralized finance (DeFi), the concept of collateral has long been tied to raw asset value—how much crypto a borrower locks up to secure a loan. But what if collateral could carry more than just value? What if it could also carry trust? Enter Collateral Reputation Tokens (CRTs), a groundbreaking innovation that introduces a “trust score” into the lending process, reshaping risk assessment in multi-chain finance.

What Are Collateral Reputation Tokens?

Collateral Reputation Tokens are digital assets that embed a reputation score derived from a borrower’s historical behavior across blockchain networks. Unlike traditional collateral, which is purely quantitative, CRTs incorporate qualitative insights about past loan performance, defaults, and repayment consistency. Essentially, each CRT carries a “trust rating” that lenders can use to evaluate a borrower’s reliability beyond simple asset ownership.

How CRTs Work

-

Historical Behavior Tracking: Borrowers’ repayment histories, defaults, and liquidation events are recorded and verified across chains. Advanced oracles and decentralized identity protocols consolidate this data into a unified score.

-

Score Encoding: This behavior is encoded into a CRT, which can then be used as collateral on lending platforms. The higher the score, the more trust the token represents.

-

Cross-Chain Compatibility: CRTs are designed to be interoperable, meaning a borrower’s reputation on one blockchain contributes to their trustworthiness on another. This creates a global credit profile in DeFi.

-

Dynamic Adjustment: Scores update in real time as new behavioral data emerges. Timely repayments increase trust, while defaults lower the CRT’s score, affecting its collateral value.

Advantages of Collateral Reputation Tokens

-

Reduced Over-Collateralization: Traditional DeFi loans often require 150–200% collateral. CRTs allow trusted borrowers to access loans with lower collateral ratios.

-

Incentivized Good Behavior: Borrowers have a tangible reason to maintain consistent repayment records, as their trust score directly affects borrowing power.

-

Enhanced Cross-Chain Lending: Lenders can make informed decisions even with borrowers from unfamiliar ecosystems. CRTs function as a portable credit reputation.

-

Efficient Capital Use: By quantifying trust, platforms can allocate liquidity more effectively, potentially reducing interest rates for high-reputation borrowers.

Challenges to Consider

-

Privacy Concerns: Aggregating behavioral data across chains raises questions about user privacy and the handling of sensitive financial information.

-

Score Manipulation: Ensuring CRTs accurately reflect trustworthiness requires robust, tamper-resistant oracles and decentralized identity verification systems.

-

Market Adoption: Lenders and borrowers must buy into the idea of reputation-weighted collateral, which may take time to gain mainstream traction.

The Future of DeFi Lending

Collateral Reputation Tokens represent a shift from purely asset-backed lending to trust-driven finance. By quantifying reliability and extending it across chains, CRTs could pave the way for more sophisticated credit markets in DeFi, where risk is measured not only in tokens but also in proven behavior.

In the evolving DeFi landscape, trust is becoming as valuable as capital—and CRTs might just be the first currency of credibility.

REQUEST AN ARTICLE

Crypto World

U.S. stocks wobble as Iran tensions, CPI jitters and dollar slide test risk appetite

U.S. stocks and crypto slipped on Monday as Iran–Israel tensions, CPI sticky inflation and a weaker dollar rattled risk appetite and reinforced JPMorgan’s tactically bearish stance.

Summary

U.S. markets are being yanked back into macro reality as rising geopolitical risk, CPI and sticky inflation concerns and a weaker dollar collide with frothy risk assets. JPMorgan’s trading desk warned that an Iran war “could trigger the S&P 500 index to drop by as much as 10% from its peak,” adding that they are now “tactically bearish” on U.S. equities as oil climbs above $100 per barrel.

At the open, all three major U.S. equity benchmarks moved sharply lower, with the Dow Jones down 1%, the S&P 500 off 0.87% and the Nasdaq losing 0.86%, while large‑cap chip names such as Intel and AMD extended recent declines. Andrew Tyler, head of global market intelligence at JPMorgan, said positioning remains “overall neutral, lacking extreme de‑risking actions,” but argued that in a pullback scenario the S&P 500 could slide toward 6,270, roughly 7% below last Friday’s close. Other strategists echo that caution: “We are tactically cautious as we brace for what could be a prolonged period of heightened uncertainty,” JPMorgan’s team said in a recent note on the U.S.–Iran backdrop.

Inflation expectations are adding another layer of tension. Bank of America said in a client report that February’s CPI print is unlikely to change the Federal Reserve’s near‑term stance, projecting a 0.3% month‑on‑month rise in both headline and core CPI and “moderate growth in consumer prices” overall. That keeps rate‑cut optimism on a short leash and leaves equities more sensitive to growth scares and geopolitical shocks.

The U.S. dollar index DXY has briefly dropped more than 10 points in short order, sliding to around 99.25 as traders rotate into other havens and reassess the U.S. macro premium. In digital assets, bitcoin traded near $68,200, down about 4% over the last 24 hours, while ethereum changed hands around $3,040, lower by roughly 4% on the day. Solana was recently quoted near $85.50, shedding about 3.9% over the same period as liquidity thinned out across majors.

-

Politics7 days ago

Politics7 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

News Videos16 hours ago

News Videos16 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World12 hours ago

Crypto World12 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

NewsBeat3 hours ago

NewsBeat3 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech13 hours ago

Tech13 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death