CryptoCurrency

Business Guide to Cryptocurrency Development Types (2026)

Crypto adoption is accelerating, but so are failed implementations. Enterprises, fintech firms, and growing platforms are actively integrating cryptocurrency into payments, platforms, and financial operations. Yet many projects struggle, not because crypto does not work, but because the wrong development model was chosen at the start.

In 2026, cryptocurrency development is no longer about launching fast. It is about building systems that survive regulation, scale with demand, and deliver real business value. This guide walks you through the different types of cryptocurrency development and helps you understand which model aligns with your business goals.

Why Understanding Cryptocurrency Development Types Matters More in 2026

Cryptocurrency development has shifted from experimentation to essential business infrastructure. In 2026, the type of cryptocurrency a business chooses directly impacts compliance, scalability, and long-term value creation.

What the data clearly shows:

- Crypto activity surged in 2025, with the United States recording nearly 50% growth, while South Asia, led by India, saw an 80% increase, signaling strong enterprise and SMB adoption.

- 83% of institutional investors planned to increase crypto exposure, and 76% committed to investing in tokenized assets by 2026.

- Transaction volumes exceeded $4 trillion by mid-2025, growing over 80% year over year, with total volumes reaching $20.2 trillion. Stablecoins now account for 30 percent of all on-chain crypto transactions.

- 34% of SMBs use cryptocurrency, while 18% actively use stablecoins, more than doubling year over year.

- Real operational impact is measurable. Businesses using stablecoins report $2,000 to $5,000 in monthly payroll savings, near-zero payment failures, and up to 98% reduction in cross-border transaction costs.

- Regulatory clarity has improved. Frameworks such as the GENIUS Act in the US and MiCA in Europe now define reserve backing, audits, and compliance standards, making early alignment in cryptocurrency development critical.

The takeaway is simple. Crypto development in 2026 is not one-size-fits-all. Payment-focused cryptocurrencies, stablecoins, utility tokens, and asset-backed models each serve different business objectives. Choosing the wrong development path creates compliance debt, limits scalability, and increases long-term costs.

Businesses that understand cryptocurrency development types early build resilient, compliant systems. Those that do not often face expensive rebuilds and delayed growth.

Planning crypto in 2026? Get your development path right before you build.

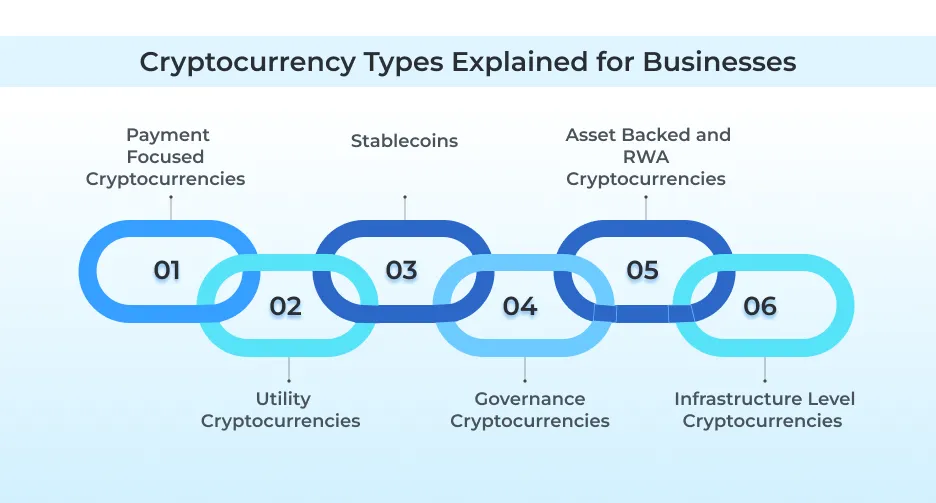

Different Types of Crypto Development Every Business Should Know in 2026

1. Payment Focused Cryptocurrencies

- Purpose: Fast, compliant digital payments

What they do

Enable quick, low-cost value transfer across borders without multiple intermediaries.

Where businesses use them

- Merchant payments

- Cross-border remittances

- Payroll and vendor payouts

- B2B settlements

2026 development focus

Scalability, predictable fees, and regulatory compatibility.

Why execution matters

Most companies depend on expert crypto development services to integrate these currencies with wallets, payment gateways, and compliance systems.

2. Utility Cryptocurrencies

- Purpose: Power platform activity

What they do

Support access, rewards, usage rights, and internal transactions within a product.

Where businesses use them

- Marketplaces

- Gaming and metaverse platforms

- Content and creator ecosystems

- Web3 applications

2026 development focus

Clean token economics, controlled supply, smooth user experience.

Business impact

Higher engagement, stronger retention, healthier ecosystems.

3. Stablecoins

- Purpose: Operational currency for businesses

What they do

Deliver price stability while keeping blockchain speed and transparency.

Where businesses use them

- Treasury management

- Payroll and settlements

- Cross-border B2B payments

2026 development focus

Reserve design, transparency, compliance readiness.

Who needs them most

Fintech firms, payment providers, and globally operating enterprises are using cryptocurrency development services.

4. Governance Cryptocurrencies

- Purpose: Structured decentralized decision making

What they do

Allow token holders to vote on platform or protocol decisions.

Where businesses use them

- DAOs

- Community-driven platforms

- Decentralized applications

2026 development focus

Balanced voting power, security against manipulation, and clear governance rules.

Best fit for

Platforms that want participation without losing control.

5. Asset Backed and RWA Cryptocurrencies

- Purpose: Tokenize real-world value

What they do

Represent ownership or claims over assets like real estate, commodities, or financial instruments.

Where businesses use them

- Asset tokenization platforms

- Enterprise finance systems

- Investment and ownership models

2026 development focus

Legal alignment, data integrity, secure on-chain representation.

Why expertise matters

High complexity often requires specialized cryptocurrency development teams.

6. Infrastructure Level Cryptocurrencies

- Purpose: Secure and sustain blockchain networks

What they do

Incentivize validators, secure transactions, and support network operations.

Where businesses use them

- Layer 1 and Layer 2 networks

- Enterprise blockchain platforms

2026 development focus

Network security, long-term sustainability, and performance optimization.

Key takeaway

This form of cryptocurrency development is highly technical and designed for long-term scalability.

One wrong decision can stall your crypto product. Get clarity first.

How Businesses Should Choose the Right Cryptocurrency Development Path

Choosing the right cryptocurrency development path is a strategic business decision, not a technical shortcut. In 2026, the companies that succeed are those that align blockchain capabilities with real operational, compliance, and growth objectives.

- Start by defining the exact business problem you want to solve. Cryptocurrency development should support payments, platform utility, governance, asset tokenization, or infrastructure, not exist for visibility alone.

- Evaluate regulatory exposure early in the planning stage. Payment models and stablecoins demand higher compliance readiness, which is why experienced development services providers play a critical role.

- Focus on utility and long-term value creation. Sustainable development prioritizes real usage, efficiency, and system benefits over short-term speculation.

- Assess scalability requirements from day one. Transaction volumes, user growth, and cross-border activity must shape architectural decisions in any serious crypto development initiative.

- Align token economics with revenue and growth goals. Supply design, incentives, and distribution should reinforce business sustainability through structured development.

- Plan for seamless integration with existing systems. Wallets, APIs, payment gateways, and internal platforms must work together for crypto development to deliver measurable business impact.

- Prioritize security, audits, and risk management. Enterprise-grade development services embed security across smart contracts, wallets, and blockchain layers.

- Ongoing maintenance, governance updates, and compliance evolution are essential parts of long-term cryptocurrency development.

When businesses approach cryptocurrency development with clarity, compliance awareness, and a long-term vision, they build scalable digital infrastructure rather than short-lived experiments.

Final Thoughts

Crypto development in 2026 is no longer about experimentation. It is about precision, compliance, and long-term execution. Businesses that understand the different types of cryptocurrency development make smarter architectural choices, build resilient products, and earn stronger trust from users, partners, and investors. Clear alignment between use case and development model reduces risk and accelerates growth.

Whether your focus is on payments, stablecoins, platform utility, infrastructure, or digital ownership, selecting the right cryptocurrency development services early determines how smoothly your product scales and how well it performs under real market conditions. This blog is not the finish line. It is the starting point for making informed, high-impact development decisions that are built to last in 2026 and beyond. If you are ready to move from strategy to execution, businesses across industries turn to Antier, a renowned crypto token development company, for structured, compliant, and scalable development built for real-world adoption.

Frequently Asked Questions

01. Why is understanding cryptocurrency development types important in 2026?

In 2026, the type of cryptocurrency a business chooses directly impacts compliance, scalability, and long-term value creation, making it essential for building resilient and compliant systems.

02. What are the benefits of using stablecoins for businesses?

Businesses using stablecoins report significant savings in monthly payroll, near-zero payment failures, and up to a 98% reduction in cross-border transaction costs.

03. What challenges do enterprises face when integrating cryptocurrency?

Many projects struggle due to choosing the wrong development model at the start, which can lead to compliance debt, limited scalability, and increased long-term costs.