CryptoCurrency

Can RLUSD’s Binance Listing Help XRP Escape Downtrend?

XRP continues to trade under pressure as broader crypto market weakness weighs on sentiment. The token remains in a short-term downtrend, driven partly by macro bearishness and partly by lingering investor skepticism.

Despite this, Ripple’s operational progress continues, offering potential long-term support for XRP price stability and recovery.

Sponsored

RLUSD Listed On Binance

Ripple recently confirmed that its U.S. dollar-backed stablecoin, RLUSD, has been listed on Binance. The listing expands RLUSD’s visibility and accessibility, which is critical as stablecoin adoption accelerates across global markets. Increased usage typically strengthens the issuing ecosystem’s relevance within digital payments and settlement infrastructure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Although RLUSD currently operates on the Ethereum network, future expansion to the XRP Ledger could be significant. Integration with XRPL would increase on-chain utility, transaction demand, and network activity. This development positions Ripple to benefit from tokenization and cross-border settlement growth, indirectly supporting XRP’s fundamental outlook.

Sponsored

XRP Holders Are Selling

Despite these advances, XRP holders remain cautious. On-chain data shows net realized profit and loss turning negative in recent sessions. Investors are selling XRP below their acquisition price, a behavior often linked to fear of further downside rather than confidence in near-term recovery.

This loss realization reflects hesitation among retail participants. Persistent selling into weakness can slow momentum shifts, even when fundamentals improve. Until investor confidence stabilizes, XRP may struggle to translate Ripple’s ecosystem progress into immediate price appreciation.

Sponsored

Large Wallets Are Still Bullish On XRP

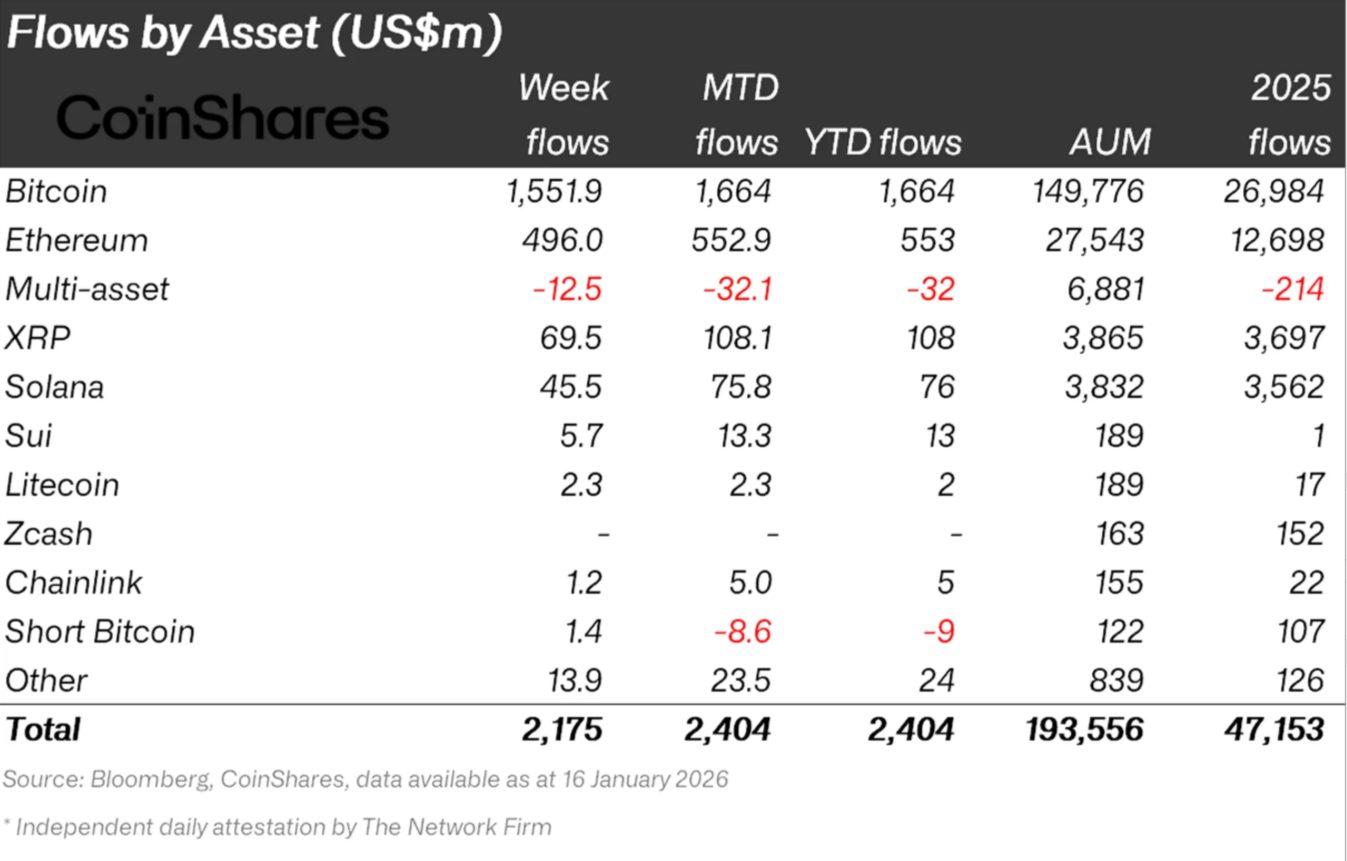

Institutional behavior offers a contrasting signal. For the week ending January 16, XRP recorded $69.5 million in institutional inflows. Month-to-date inflows reached $108.1 million, despite XRP remaining in a downtrend. Such consistency suggests larger investors maintain long-term conviction.

Institutional flows often precede trend reversals, as these participants tend to accumulate during periods of pessimism. Continued inflows provide liquidity support and reduce downside risk. This divergence between retail caution and institutional confidence may help XRP establish a recovery base.

Sponsored

XRP Price Needs To Escape Downtrend

XRP trades near $1.96 at the time of writing, remaining below a downtrend line active for more than two weeks. Technical pressure persists, yet improving fundamentals and institutional demand increase the probability of a breakout. Escaping the downtrend would mark a key shift in short-term momentum.

A confirmed move above the downtrend line would likely push XRP past the $2.00 psychological level. Clearing $2.03 could open the path toward $2.10. If momentum builds, the recovery target near $2.35 becomes achievable in the near term.

The bullish scenario weakens if XRP fails to reclaim $2.00. Rejection at this level could renew selling pressure. Under that outcome, XRP price may slide toward $1.86 or lower, invalidating the bullish thesis and extending the existing downtrend.