Crypto World

Cango Offloads 4,451 BTC for $305M to Repay Loan and Fund AI

TLDR

- Cango sold 4,451 BTC, reducing Bitcoin reserves by 60% to repay a Bitcoin-collateralized loan.

- The company raised $305M, improving its financial leverage and balance sheet.

- Cango aims to pivot towards AI compute infrastructure, targeting small and medium enterprises.

- Jack Jin, former Zoom Communications leader, appointed CTO of Cango’s AI business line.

- Bitcoin’s price dropped 1.06%, while Cango saw a 3.26% after-hours rebound to $0.9500.

Cango, a Bitcoin mining company, has sold 4,451 BTC for approximately $305 million, reducing its Bitcoin reserves by 60%. The sale aims to repay a Bitcoin-collateralized loan amid recent market volatility.

Bitcoin Sale Reduces Cango’s Reserves and Strengthens Balance Sheet

The sale of 4,451 BTC represents a substantial reduction in Cango’s digital asset holdings. This move is part of a broader strategy to strengthen the company’s balance sheet and reduce financial leverage.

The $305 million raised from the sale was directly applied to partially repay a Bitcoin-backed loan, improving Cango’s financial position. The divestment comes at a time when Bitcoin prices have rebounded from a recent low.

By selling a portion of its reserves, Cango aims to maintain flexibility while funding strategic growth initiatives, including expansion into AI compute infrastructure.

Cango Shifts Focus to AI Compute Infrastructure

In addition to the sale, Cango is pivoting toward AI computing by leveraging its existing infrastructure. The company plans to offer distributed compute capacity for the AI industry, targeting small and medium-sized enterprises.

Cango’s modular approach promises faster deployment timelines compared to traditional data center models. Cango also appointed Jack Jin as CTO of its AI business line.

Jin, a former leader at Zoom Communications, brings expertise in AI/ML infrastructure and large-scale GPU systems. His experience aligns with Cango’s strategy to develop a global distributed inference platform using modular, containerized GPU compute nodes.

Bitcoin Dips 1.06% While Cango Inc. Sees After-Hours Rebound

At the time of press, CoinMarketCap data indicates that Bitcoin’s price is currently $69,983.52, down 1.06% in the last 24 hours. The price fluctuated between $69,730 and $71,000 during the day.

On the other side, Cango Inc. (CANG) closed at $0.9200, down 5.52% on the day. The stock fluctuated between $0.8840 and $0.9887. After hours, the price rose by 3.26%, reaching $0.9500.

The stock had a previous close of $0.9738. Trading volume reached 1,229,780 shares, with an average volume of 985,054. The 52-week range for Cango is between $0.8840 and $2.8750, with a market cap of $318.642 million.

Crypto World

Mantle and Aave cross $1b as DeFi TVL jumps 66% in a week, where do they go from here?

Mantle’s Aave-powered lending market smashed $1b in under three weeks, pushing DeFi TVL to record highs even as MNT trails flows in a classic TVL–price disconnect.

Summary

- Mantle’s Aave lending and borrowing market crossed $1 billion in total market size just 19 days after launch, while Mantle DeFi TVL hit a record above $755 million, up 66% in a week.

- Aave V3 on Mantle rapidly captured around 40% of network TVL, led by USDT and wrapped ETH deposits and backed by a six‑month incentive program funded from Mantle’s $4b+ community treasury.

- Despite surging TVL and volumes, MNT underperformed while AAVE rallied, with analysts flagging a TVL–price disconnect as traders still treat MNT as high‑beta risk in a choppy BTC and ETH market.

Mantle’s (MNT) Aave (AAVE) integration has turned a niche Ethereum (ETH) layer‑2 into one of the fastest‑growing DeFi distribution layers in the market, with numbers big enough that macro desks can no longer ignore them. In just 19 days since launch, the Mantle x Aave lending and borrowing market has surpassed $1 billion in total market size, while Mantle’s broader DeFi TVL has climbed to an all‑time high above $755 million, a 66% jump in a single week.

According to a March 2 press release, the $1 billion threshold was breached “following a record‑breaking launch of $800 million on Friday,” and a weekend that saw “over $200 million in organic inflows,” despite what the team describes as “volatile” broader conditions. That move capped a month‑long ramp‑up. AInvest and other outlets note that Mantle’s DeFi TVL more than doubled from roughly $333 million at the end of 2025 to around $445–543 million by late February, driven primarily by Aave V3’s launch on February 11 and a six‑month incentive program tied to Mantle’s $4‑plus billion community‑owned treasury. Aave’s deployment quickly concentrated liquidity: within days it accounted for around 40% of Mantle’s TVL, with supplied assets led by USDT and wrapped ETH.

Mantle pitches itself as a “premier distribution layer and gateway for institutions and TradFi to connect with on‑chain liquidity and access real‑world assets,” anchored by the MNT token and integrated with partners such as Ethena’s USDe, Ondo’s USDY and other yield‑bearing dollar products. The protocol emphasizes “legacy‑level safety with decentralized efficiency,” leaning heavily on Aave’s status as the largest on‑chain lending network with about 60% market share and more than $50 billion in net deposits, according to the same release. In plain terms, Mantle is trying to industrialize DeFi credit distribution: it deploys treasury capital to seed liquidity, uses Aave as the risk‑managed front end, and then routes both institutional and retail flow into that stack.

For token traders, the picture is more nuanced. As Bankless Times and others have pointed out, Mantle’s TVL and volumes have surged even as MNT’s price has lagged, at one point falling around 4–7% during a week when Aave’s token gained double digits. Analysts frame that as a classic “TVL–price disconnect”: real capital is flowing into the network in search of yield, but secondary‑market buyers are still treating MNT as a high‑beta risk asset in a choppy macro tape. In a market where Bitcoin trades near $70,400 over the last 24 hours, up about 3.5%, and Ethereum around $2,060 with roughly a 2.8% daily rise, Mantle’s story is less about headline price and more about whether this TVL is sticky enough to justify its emerging role as a DeFi credit hub.

Crypto World

Bitcoin Probes $71,500 as Resistance Concerns Plague Bulls

Bitcoin (BTC) found fresh strength at Tuesday’s Wall Street open as bulls eyed a revisit of local highs.

Key points:

-

Bitcoin attempts to push toward the top of its local range, hitting new week-to-date highs.

-

Liquidity conditions spark warnings of a fresh trip lower.

-

The 50-day moving average above $73,500 is a point of concern for BTC/USD going forward.

Bitcoin follows stocks in new relief bounce

Data from TradingView showed 4.5% daily BTC price gains, with BTC/USD passing $71,500 for the first time since the weekly open.

Geopolitical tensions around the Middle East conflict and global oil supply remained, but both Asia and US stocks were confident, with the S&P 500 and Nasdaq Composite Index up by around 0.5%.

“From the looks of it, the market is about to tell us where it wants to go next,” trader Jelle wrote in his latest BTC price analysis on X.

“Reclaim resistance again, and bulls will have a much stronger case in the short-term. Reject here, and the deviation + bear retest locks in, making $60k a likely target next.”

Crypto trader, analyst, and entrepreneur Michaël van de Poppe saw benefits for Bitcoin on the back of a “strong surge” in the Nasdaq.

“Yesterday, deep wick into the lows given the sudden rise on Oil (which was mostly liquidity and derivatives driven). Now, bouncing back and I think we’ll start to run towards new highs as the uncertainty in the Middle-East starts to lower,” he told X followers.

“There are not many arguments left for uncertainty, and in that principle, I do think we’ll see way more upside into Bitcoin & Altcoins during the coming period.”

Crypto liquidations stayed elevated as markets fluctuated, with monitoring resource CoinGlass putting total 24-hour liquidations at over $350 million.

Commenting on the data, CryptoReviewing, the pseudonymous cofounder of trading community Wealth Capital, nonetheless agreed that Bitcoin could drop to take long liquidity at $68,000 next.

“$68,000 is the level to watch. The single largest liquidation cluster sits at $68k, making a sweep of this level possible,” an X post on the day stated.

Bulls tied down by 50-day BTC price trend line

A separate BTC price resistance hurdle on the radar came in the form of the 50-day simple moving average (SMA) at $73,640.

Related: Bitcoin braces for oil shock and death crosses: 5 things to know this week

In his latest YouTube video, independent analyst Filbfilb suggested that Bitcoin’s price would continue to lack the necessary momentum to reclaim the trend line as support.

“I think if we see a close above the 50, taking out the previous high and open interest keep going up, people keep shorting, the likelihood is that we’re going to continue,” he said.

“But I have to say I would expect the bears to come in at the 50-day moving average.”

Trading resource Material Indicators, meanwhile, had a lower ceiling in mind, citing signals from several of its proprietary trading tools.

MTF Mean Reversion, Trend Precognition, and Timescape Levels are all indicating that $BTC is finding a local top around the Q1 2024 Timescape at $71.3k.

El T.A.C.O. could invalidate all of that by de-escalating the so called “excursion” to Iran, or escorting oil tankers out of… pic.twitter.com/hp0LQVf5Un

— Material Indicators (@MI_Algos) March 10, 2026

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

AI Will Boost Jobs With Infrastructure Buildout: Huang

Artificial intelligence won’t be the large-scale job-taker as feared, as the tech needs workers to build and then maintain the trillions of dollars worth of infrastructure for it to run, says Nvidia founder Jensen Huang.

Huang argued in a blog post on Tuesday that AI has become “essential infrastructure, like electricity and the internet,” and the facilities that make the chips, build computers and eventually house AI are “becoming the largest infrastructure buildout in human history.”

“We have only just begun this buildout. We are a few hundred billion dollars into it. Trillions of dollars of infrastructure still need to be built,” he added. “The labor required to support this buildout is enormous.”

Huang said AI data centers require roles such as electricians, plumbers, steelworkers, network technicians and operators, which he added are “skilled, well-paid jobs, and they are in short supply.”

Nvidia (NVDA) is one of the biggest winners of the current AI boom, as it is the most dominant AI hardware supplier, with its chips in high demand. Its share price has risen by over 1,300% since 2023, shortly after OpenAI released the first public version of ChatGPT that kicked off an AI race.

AI needs “five-layer cake”

Huang described AI infrastructure as a “five-layer cake” involving energy, AI chips, infrastructure, AI models and then applications.

He said the infrastructure backing AI “had to be reinvented” from the ground up due to the way it works, as software typically retrieves stored instructions, while AI is “reasoning and generating intelligence on demand.”

AI isn’t a single model. It’s a full stack.

Energy. Chips. Infrastructure. Models. Applications.

That’s the five-layer cake powering the largest industrial buildout in history — and the jobs, factories and AI applications rising with it. pic.twitter.com/rwxO6fdTnE

— NVIDIA Newsroom (@nvidianewsroom) March 10, 2026

“Much of the infrastructure does not yet exist. Much of the workforce has not yet been trained. Much of the opportunity has not yet been realized,” Huang said.

Related: Using AI at work is causing ‘brain fry,’ researchers say

“This is why the buildout is so large. This is why it touches so many industries at once. And this is why it will not be confined to a single country or a single sector,” he added. “Every company will use AI. Every nation will build it.”

Huang’s post comes as multiple companies across a broad range of industries have initiated large-scale layoffs, pointing to efficiencies gained through AI as the reason.

Last month, Block, Inc. cut 40% of its staff, a decision co-founder Jack Dorsey attributed to AI use at the payments company.

Social media platform Pinterest and the chemical company Dow also cited AI as the reason to cut a total of more than 5,000 employees between them earlier this year.

Goldman Sachs analysts said last month that AI-driven job losses have been “visible but moderate,” with the technology helping to raise the US unemployment rate slightly this year, from its current 4.4% to 4.5% by year-end.

AI Eye: IronClaw rivals OpenClaw, Olas launches bots for Polymarket

Crypto World

Bitcoin Sentiment Flipped to FOMO After Rebounding Above $70K

Social media sentiment over Bitcoin has shifted back to optimism as Bitcoin recovered to over $70,000 on Tuesday, driven by US President Donald Trump’s recent comments that the war with Iran could be nearing an end.

In an X post on Tuesday, market intelligence platform Santiment shared data that shows the number of positive social media discussions has been steadily increasing after tanking on Monday.

“Across X, Reddit, Telegram, and other crypto-related discussions, the crowd is encouraged by Trump’s comments that the war may soon end, and oil prices reversing course,” Santiment said.

It added in a separate post that “periods of uncertainty often trigger a search for alternative assets, and crypto markets tend to react quickly because they trade globally around the clock and are not tied to any single government or financial system.”

Tensions in the Middle East escalated last month after the US and Israel launched strikes against Iran. In response, Iran retaliated against several neighboring countries.

US President Donald Trump’s comments on Monday, however, signaled the war could be wrapping up soon, saying: “I think the war is very complete, pretty much,” though he later said in a Truth Social post that if Iran did anything to slow the supply of oil, the US would ramp up its military pressure on the country.

Bitcoin held firm in the face of geopolitical shocks

Ryan McMillin, chief investment officer of Australian crypto investment manager Merkle Tree Capital, told Cointelegraph that several other factors might also be driving a rebound in positive sentiment among traders.

Bitcoin’s strong resilience to geopolitical shocks and institutional momentum from companies such as Strategy, which bought nearly 18,000 Bitcoin last week and made a second purchase this week, could also be contributing, according to McMillin, along with Bitcoin holding above its February lows.

“Bitcoin has shown real strength through tough conditions, with inflation cooling, oil risk aside, adding tailwinds so too a new Fed chair only months away and the Clarity Act inching closer to implementation.”

“Shorts are vulnerable; liquidity on the short side could get squeezed toward $80,000 before a true higher/lower decision point. Bears ruled for months, now they could face their first test of this cycle,” McMillin added.

FOMO could be a good sign overall

Despite social media discussions about Bitcoin trending positively, the Crypto Fear & Greed Index, which measures overall crypto sentiment, remained at 15, indicating it remains in “extreme fear.”

The Crypto Fear & Greed uses several sources for its ratings: Bitcoin volatility, dominance, market momentum, social media and Google Trends data.

Meanwhile, Google Trends data for “Bitcoin” returned a score of around 71 as of Wednesday, down from its peak of 100 on March 5.

“FOMO frequently becomes self-fulfilling in crypto. Sentiment flips from fear to greed attracts fresh buyers, boosts volumes, and drives short-term upside, as we’ve seen in past cycles,” McMillin said.

Related: Bitcoiners celebrate as the network produces its 20 millionth coin

“An oversold technical setup after five months of declines, five straight months down from the $126,000 all-time high in October has left Bitcoin heavily oversold, priming it for a relief rally at very least,” he added.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Bitcoin permabull Arthur Hayes: I wouldn’t bet $1 on BTC now

Bitcoin’s near-term trajectory remains tightly linked to U.S. monetary policy and the evolving geopolitical backdrop, according to Arthur Hayes, the BitMEX co-founder known for his bold price calls. In a recent appearance on the Coin Stories podcast with Natalie Brunell, Hayes said he would not deploy fresh capital into Bitcoin today, preferring to wait and see how the Federal Reserve navigates the post-pandemic economy and whether global tensions escalate further. While he has floated a bold target of 250,000 dollars for Bitcoin in the coming years, his immediate stance is to observe policy signals before committing new funds. At the time of publication, Bitcoin traded around $69,926, well off its October all-time high near $126,000.

Hayes emphasized that the macro environment—rather than purely market dynamics—drives his cautious stance. He warned that if the conflict between the U.S. and Iran persists, there could be broad risk-off pressure that weighs on equities and crypto alike. “The longer this conflict goes on, the higher the likelihood that the Fed has to print money to support the American war machine,” he argued, framing the central bank’s response as a potential catalyst for price moves in favored disinflation hedges like Bitcoin. He drew a sharp distinction between the wartime narrative and the monetization policy, stating plainly that he would start buying Bitcoin only when central banks begin printing money again. “That’s when I’m going to buy Bitcoin when the central banks start printing money,” he said in a direct quote during the discussion.

“That’s when I’m going to buy Bitcoin when the central banks start printing money.”

In his view, money printing—not war itself—has historically provided a supportive backdrop for Bitcoin’s rise. Still, he acknowledged that ongoing geopolitical frictions could drive the price lower in the near term, contrasting with arguments that war itself is a Bitcoin catalyst. While some market observers contend that geopolitical shocks can spark Bitcoin inflows as a non-sovereign store of value, Hayes warned of the possibility of a cascading liquidations scenario if risk assets slide in tandem. The conversation also touched on the notion that volatility could intensify as market participants reassess the pace and scale of monetary stimulus in a world of persistent geopolitical risk.

Bitcoin’s price action has been choppy. The asset briefly tested the $60,000 mark on February 6 before rebounding into a milder uptrend. Hayes noted that the current price level leaves room for further downside, particularly if macro signals deteriorate and liquidation risk rises. He remained steadfast on his longer-term projection, sustaining the idea that Bitcoin could reach a multi-hundred-thousand-dollar level in the next several years, a view that has colored his investment stance and public commentary for some time. The market’s tension between policy direction and geopolitical risk remains a driving force behind price discovery, and Hayes’ stance underscores a broader debate about whether macro catalysts will finally unlock a lasting uptrend for BTC.

As other analysts weigh in on the near-term picture, Michaël van de Poppe recently pointed to a “strong surge” in the Nasdaq as a supporting factor for Bitcoin, arguing that a calmer risk environment could broaden upside for both BTC and altcoins. His assessment aligns with a more optimistic near-term outlook, even as Hayes maintains a more cautious, policy-driven lens. The broader sentiment in the space remains mixed: investors are watching Fed communications, macro data, and geopolitical headlines for signals that could shift liquidity, risk appetite, and correlation dynamics between traditional markets and digital assets.

Hayes has long been known for a contrarian stance on Bitcoin’s price path. The recent discussion did little to dislodge his core thesis that the path to substantial gains hinges on central banks’ willingness to loosen policy rather than on any single development in the crypto space. He has publicly entertained a $250,000 target for Bitcoin, a figure he has echoed in various appearances and interviews, though the timing has varied in public commentary. The juxtaposition of a lofty long-term target with a cautious near-term posture reflects a broader tension in the market: the asset’s allure as a hedge against monetary expansion coexists with vulnerabilities tied to macro shocks and policy shifts.

Why it matters

The episode illustrates how macro policy and geopolitical risk continue to influence crypto narratives at a time when liquidity and risk sentiment are in flux. Hayes’ comments underscore a recurring theme: Bitcoin’s appeal as a non-sovereign instrument may depend more on the stance of central banks than on any single tactical catalyst. If the Fed signals faster-than-expected easing or if geopolitical tensions intensify, BTC could find a renewed bid as investors seek hedges against inflation and policy uncertainty. Conversely, a more aggressive stance on inflation containment or a risk-off shift could amplify downside pressures in the near term, particularly if equities step lower.

For investors, the takeaway is not a call to chase immediate moves but a reminder that macro dynamics—policy normalization, balance-sheet expansion, and global conflicts—can alter the rate and direction of Bitcoin’s price discovery. Hayes’ emphasis on waiting for a policy pivot serves as a caution against chasing a near-term breakout in a market that remains highly sensitive to Federal Reserve cues and to the unfolding geopolitical landscape. In this light, Bitcoin’s current risk-reward profile will hinge on how aggressively policymakers respond to ongoing macro and geopolitical surprises, rather than on crypto-market fundamentals alone.

Ultimately, the narrative around Bitcoin’s price path remains a blend of long-horizon conviction and short-term prudence. The market will likely continue to trade around the interplay of monetary policy expectations, liquidity conditions, and external shocks—factors that have historically driven both volatility and opportunity in the cryptocurrency space. Hayes’ position—to wait for signs of monetary easing before adding exposure—adds another data point to a crowded field of opinions about whether BTC can sustain a trajectory toward higher highs or face renewed headwinds in the months ahead.

What to watch next

- Upcoming Federal Reserve communications or policy adjustments that signal a shift toward easing or continued tightening.

- Geopolitical developments and any escalation in U.S. or regional conflicts that could influence risk sentiment and currency markets.

- Bitcoin price interactions with key technical levels around 60k and 70k, and how liquidity conditions evolve in a risk-on vs. risk-off environment.

- Macro-driven narratives, including Nasdaq performance and broader equity flows, which can affect correlations with BTC.

- Statements from prominent investors or analysts that could recalibrate Bitcoin’s short- to medium-term risk-reward outlook.

Sources & verification

- Hayes’ remarks on the Coin Stories podcast with Natalie Brunell (YouTube): https://www.youtube.com/watch?v=Ny9P1l0WKwo&t=2074s

- Bitcoin price reference page: https://coinmarketcap.com/currencies/bitcoin/

- Bitcoin price context referenced in the piece, including a February 6 dip toward $60,000 and the October all-time high near $126,000

- Reported long-term target of $250,000 for Bitcoin and the assertion that policy shifts (not war alone) drive bullish narratives

This article was originally published as Bitcoin permabull Arthur Hayes: I wouldn’t bet $1 on BTC now on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Crypto World

Polymarket taps Palantir as prediction markets meet Wall Street surveillance

Polymarket hiring Palantir and TWG AI signals prediction markets’ shift from degen toy to regulated financial infrastructure, with industrial‑grade surveillance baked into the order book.

Summary

- Polymarket will use Palantir and TWG AI to screen users against banned‑bettor lists and flag anomalous trading, starting with a new U.S.-regulated venue.

- The move follows CFTC pressure, insider probes and media exposés on Iran and Maduro‑linked trades, as regulators demand exchanges police event‑contract markets.

- For Palantir, the deal is tiny in revenue but powerful signaling that its Vergence‑style surveillance stack is becoming default compliance infrastructure for high‑risk markets.

Polymarket’s move to bring in Palantir and TWG AI is an admission that prediction markets are graduating from crypto toy to regulated financial infrastructure – and that the surveillance stack will match. According to a Bloomberg report, the platform is enlisting Palantir Technologies and TWG AI “to help police its sports contracts,” with the remit to identify, prevent and report suspicious activity as regulators and leagues turn up the heat on insider trading in event markets.

What the partnership actually does

People familiar with the deal told Bloomberg that Palantir and TWG AI will screen Polymarket users “against existing lists of participants already banned from sports betting,” and will build systems to flag anomalous trading patterns for further review. A follow‑up report notes the tools are expected to be deployed first on a U.S.‑regulated venue Polymarket is developing, rather than the current offshore platform that blocks American users, signaling the company’s intent to move closer to the CFTC’s line of sight. Benzinga adds that the system will run on Vergence AI, a surveillance and analytics stack Palantir built with TWG Global, designed to monitor financial transactions in real time and feed potential violations into compliance workflows.

The timing is not accidental. CFTC Chairman Mike Selig recently reminded event‑contract venues that exchanges are his “first line of defense against insider trading,” while rival Kalshi has publicly referred insider trades to the regulator, including a MrBeast editor who racked up “near‑perfect trading success” on low‑probability YouTube markets. At the same time, reporting from WIRED and others has documented alleged insiders making outsized profits on Iran‑linked geopolitical markets, with one Polymarket user reportedly earning roughly half a million dollars in a day on the timing of U.S. strikes. Against that backdrop, Polymarket’s priority is simple: convince regulators, leagues and counterparties that it can police its own order book before they do it for them.

Why it matters for markets

For Palantir, the deal is small in dollars but big in signaling. Its stock trades around $154, at roughly 240 times earnings, on the thesis that it becomes the default infrastructure layer for any organization that needs “rigorous data analysis” in sensitive domains; the fact that a crypto‑native prediction market tapped Palantir as its first serious compliance partner, rather than a legacy sportsbook vendor, supports that narrative. For prediction markets and crypto more broadly, the message is harsher: if you want to play in regulated sports, elections and geopolitics at scale, you don’t just list markets – you embed industrial‑grade surveillance, cross‑reference banned‑bettor lists and treat on‑chain flows as regulated financial data, not anonymous degen PnL.

Crypto World

Inside X Money, Elon Musk’s bid to fuse social media and banking

Elon Musk is quietly wiring X Money into X as a native wallet, testing whether a social network can double as “the place where all money is.”

Summary

- X Money is a custodial wallet inside X for P2P transfers, bill pay and, later, higher‑margin financial services like savings and loans.

- Backed by 40+ U.S. money transmitter licenses, FinCEN registration and a Visa tie‑up, X Money launches more like Venmo-on-X than a startup.

- Musk hints at Bitcoin, Ethereum and Dogecoin support, raising questions over whether an “everything app” will crowd out open crypto payment rails.

Elon Musk is about to bolt a bank onto X in public, not just in pitch decks. X Money, a native wallet and payments layer inside the platform, is already running in closed beta and is slated for a limited external rollout in the next one to two months, with Musk describing it as “the place where all money is” and “the central source of all monetary transactions.”

What X Money actually is

At its core, X Money is a custodial digital wallet tied directly to X accounts, designed to support peer‑to‑peer transfers, bill pay and, over time, higher‑margin financial services. An explainer circulating among X‑aligned commentators describes it as a system where users “will be able to pay your bills directly through the app,” with future features including “high‑yield savings accounts, loans, and investment tools,” while creators can receive tips and subscription income straight into their X Money balance and spend it without ever touching a bank. Musk told employees at an internal xAI town hall that X Money is already live “in closed beta within the company,” and that once external testing is complete “this is intended to be the place where all money is… It’s going to be a game‑changer.”

The regulatory and banking spine is largely in place. X has secured money transmitter licenses in more than 40 U.S. states and Washington, DC, completed registration with FinCEN, and struck a Visa Direct partnership to move funds between bank accounts and in‑app wallets, according to reporting from TradingView, CNBC and other outlets. That effectively positions X Money as a Venmo‑ or Cash App‑style product sitting on top of a social network with roughly 600 million monthly active users, not a greenfield startup fighting for attention.

Crypto, rails and market structure

For now, the launch focus is on fiat. The X‑aligned brief notes that “the initial launch focuses on regular money (fiat),” with explicit plans to “eventually support Bitcoin, Ethereum, and Dogecoin” and more general language from Musk that “if it involves money, it’ll be on our platform.” Industry analyses argue that serious crypto integration – whether direct BTC/ETH/DOGE support, a proprietary stablecoin or both – would turn X into a de facto on‑ramp and payment rail at social‑media scale, with obvious implications for exchanges and stablecoin issuers. In that context, the early X Money beta is less about today’s feature set and more about market structure: a live experiment in whether a single “everything app” can centralize messaging, discovery and payments in the West the way WeChat did in China – and how much room that leaves for the open crypto rails that were supposed to bypass banks and platforms in the first place.

Crypto World

Circle Nanopayments Launches on Testnet to Power Gas-Free USDC Transfers for AI Agents

TLDR:

- Circle Nanopayments enables gas-free USDC transfers as small as $0.000001, built on Circle Gateway infrastructure.

- Batched on-chain settlement bundles thousands of transactions, with Circle covering all gas costs at the settlement layer.

- The x402-compatible system lets agents pay merchants instantly with no account creation or credit card required.

- A robot dog autonomously paid for its own recharging in USDC, marking a real-world agentic commerce milestone.

Circle Nanopayments is now live on testnet, enabling gas-free USDC transfers as small as $0.000001. Built on Circle Gateway, the payments primitive is designed for the emerging agentic economy.

It allows developers to build pay-per-call APIs, real-time compute billing, and machine-to-machine payment flows.

Sub-cent transactions, previously unworkable due to high gas fees, are now economically viable at scale. Circle has introduced batch on-chain settlement to remove per-transaction costs entirely for developers.

How Circle Nanopayments Solves the Sub-Cent Problem

Traditional payment rails, built decades ago, were not designed for high-frequency sub-cent transactions at agent scale. Fixed fees and overhead make ultra-small payments unworkable on legacy systems.

Even modern onchain transactions face barriers when settled individually. On low-cost blockchains, fees for a $0.0001 transfer can reach 1,000% to 5,000% of the payment amount.

Circle Nanopayments resolves this through off-chain aggregation and batched on-chain settlement. Thousands of transactions are bundled into a single onchain batch, reducing each transaction’s gas cost to zero.

Circle covers the on-chain costs at the settlement layer. This lets agents transact nearly instantly, with settlement handled seamlessly in the background.

When an agent initiates a payment, it signs an EIP-3009 authorization message and submits it to the API. The system validates the signature and adjusts the agent’s internal ledger balance accordingly.

The merchant then receives instant confirmation and can release goods or services right away. Actual onchain settlement occurs periodically and does not interrupt the workflow.

Circle announced the launch on X, noting the system follows the x402 standard. The x402 standard lets any agent pay any merchant without creating an account or adding a credit card.

Circle stated: “The financial rail for the agentic economy is here.” This removes sign-up friction for agents operating across multiple autonomous workflows at once.

Real-World Testing and Supported Chains

Circle Nanopayments was recently tested through a collaboration with OpenMind, an open-source robotics software developer. An autonomous robot dog used the system to pay for its own recharging in USDC.

The robot initiated payment, received near-instant confirmation, and continued operating while settlement ran in the background. This shows early-stage agentic commerce functioning effectively in a real environment.

As of February 2026, the payment system operates on the testnets of 12 blockchain networks. These include Arbitrum, Base, Ethereum, Polygon PoS, Avalanche, Optimism, Sei, Sonic, Unichain, HyperEVM, Arc, and World Chain.

It works on any Gateway-supported EVM chain, giving developers broad flexibility. Developers can check the official documentation for the most current list of supported networks.

Use cases for this payment primitive cover pay-per-crawl search, real-time compute billing, and autonomous service marketplaces.

Each model depends on the ability to transfer fractions of a cent instantly and without gas fees. The system allows developers to build products around true sub-cent value exchange. Previously, such business models were not economically practical at this scale.

Developers can access the testnet now to build and test sub-cent payment flows in live conditions. The testnet phase gives builders time to validate applications before any mainnet deployment takes place.

Circle has positioned this as core payments infrastructure for agentic commerce. Each payment carries programmable value with no per-transaction gas cost required from the developer.

Crypto World

Hyperliquid Will Hit $150 by Mid 2026, Predicts BitMEX’s Arthur Hayes

Hyperliquid (HYPE) may hit $150 by August, according to BitMEX co-founder Arthur Hayes.

Key takeaways:

-

CEX volume rotation and demand for macro-linked markets, including oil, are boosting HYPE’s bull case.

-

A cup-and-handle setup is hinting at an initial breakout toward $50.

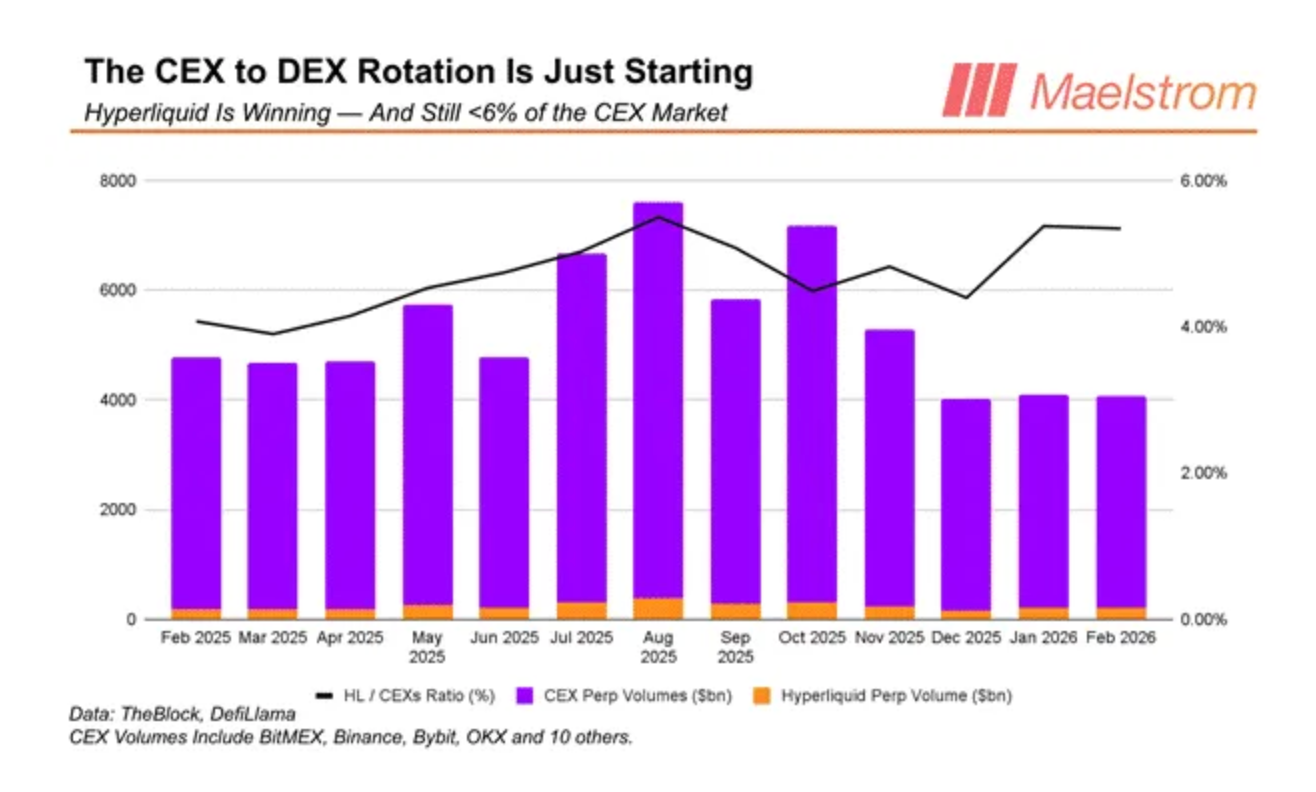

CEX to DEX rotation can grow HYPE prices fivefold

In a post published on Monday, Hayes said that if Hyperliquid keeps pulling derivatives volume away from centralized exchanges (CEX) and expands its product suite, HYPE could climb roughly fivefold from around $30.

To make it happen, Hyperliquid’s 30-day annualized revenue run rate must rise to $1.40 billion by August from $843 million in March.

Such growth is achievable if the platform captures another 3.96% share of derivatives volume from centralized exchanges after already absorbing roughly 6% as of March.

Hyperliquid uses about 97% of its revenue to buy HYPE tokens from the open market. Therefore, most of the money the platform makes is used to buy its own token, which can support the price if trading activity keeps rising.

That structure, Hayes said, boosts HYPE’s odds of rising toward $150.

Tokenized oil boom: Hyperliquid’s bull case

Hayes’s bullish call came as the US–Iran war turned oil into Hyperliquid’s top-traded assets.

On Tuesday, CL-USDC, its crude oil-linked perpetual pair, reached about $1.29 billion in 24-hour volume, overtaking ETH-USDC at roughly $1.24 billion, showing traders are increasingly using the platform to bet on traditional assets, not just crypto.

The trend also supports Hayes’s broader HIP-3 thesis. HIP-3 lets users launch perpetual markets permissionlessly by staking HYPE, and Hayes said newer listings tied to oil, gold, silver and major US indexes are already gaining traction.

Related: Oil retreats from 25% surge as G7 weighs emergency reserve release

He argued that HIP-3 now contributes nearly 10% of Hyperliquid’s revenue and could grow revenue by 160% in the coming months if the DEX keeps offering macro assets like gold and oil.

Last year, Maelstrom, a family office fund tied to Arthur Hayes, predicted declines in HYPE prices due to $11.90 billion in token unlocks. Since then, the Hyperliquid token has fallen by roughly 40%.

Still, Hayes has also made several high-profile calls that did not play out.

That includes Bitcoin targets of $250,000 by the end of 2025 and $200,000 by March 2026, as well as a January 2025 call for TRUMP memecoin to hit a $100 billion market cap by inauguration.

HYPE technicals hint at initial breakout toward $50

From a technical perspective, HYPE may rally toward $50 in March or by April, based on a cup-and-handle pattern.

A cup-and-handle forms after a rounded recovery and a brief consolidation. It confirms when price breaks above the neckline resistance, with upside typically measured by the pattern’s maximum height.

Applying the technical rule to HYPE gives a measured upside target of around $50 if the price breaks decisively above the $35.50 neckline resistance. If the pattern plays out, it will result in gains of more than 40% from current levels.

Conversely, a pullback from $35.50 could push the HYPE price initially toward $30, a level aligning with the 0.236 Fibonacci retracement line and the 50-day exponential moving average (50-day EMA, the red wave).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

UK Government‘s Long-Term Fraud Strategy Labels Crypto as ‘Growing Risk‘

A policy paper from the UK government’s Home Office said that “vulnerabilities remain” in authorities’ attempts to fight fraud in emerging payments, including digital assets.

The UK government has issued a policy paper on how to combat fraud against individuals and businesses from 2026 to 2029, specifically noting that its strategy would consider digital assets.

In a paper published on Monday, the UK’s Home Office identified cryptocurrencies as one medium of exchange “where victims are deceived into willingly transferring money” through scams on social media platforms and messaging. According to authorities, “vulnerabilities remain” in their attempts to fight fraud in emerging payments like crypto, and the technology posed “growing risks” for consumers.

“The [National Crime Agency] launched a nationwide campaign in 2025 to help consumers spot fraud, and the Government is also supporting law enforcement, including the Serious Fraud Office (SFO), to enhance cryptoasset investigation capabilities,” said the UK government.

Measures already taken by the government include the Financial Conduct Authority’s (FCA) crackdown on crypto companies marketing tokens to UK consumers that began in 2023, and HM Treasury introducing a comprehensive regulatory framework for digital assets set to be implemented in October 2027. The paper said that requiring crypto companies “to obtain FCA authorization and comply with its rules” would help fight related fraud.

Related: French couple robbed of $1M in Bitcoin by criminals posing as police

“This is not just about reducing crime; it is about restoring confidence,” said Home Secretary Shabana Mahmood and Minister of State at the Home Office, Lord Hanson of Flint. “Every pound stolen through fraud is a pound not reinvested in our economy. Every victim is a reminder of why we must act. By delivering this Strategy, we will make the UK a safer place to live, work, and do business, and send a clear message to criminals: there is nowhere you can hide.”

Scrutiny over crypto contributions to UK politicians

While the policy paper focused on fraud, it did not explicitly mention an ongoing debate in the UK over whether political parties and candidates should be allowed to accept contributions in digital assets, given potential conflicts of interest. The UK government has reportedly been considering a ban on such contributions as part of an Elections Bill.

At the Bitcoin 2025 conference last year, UK Reform leader Nigel Farage said that the party would begin accepting donations in crypto. Early crypto investor Christopher Harborne sent a combined $16 million to Reform through donations in 2025.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

-

Business5 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

News Videos2 days ago

News Videos2 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

Crypto World2 days ago

Crypto World2 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Politics5 days ago

Politics5 days agoTop Mamdani aide takes progressive project to the UK

-

Business11 hours ago

Business11 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

NewsBeat1 day ago

NewsBeat1 day agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech2 days ago

Tech2 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Business1 day ago

Business1 day agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat6 days ago

NewsBeat6 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show