Crypto World

Cardano faces deeper plunge as Bitcoin breaches $70K amid bear-cycle fears

- Cardano price dropped to near $0.26 as cryptocurrencies continued to struggle.

- ADA bulls face further pain if the price breaks below $0.25.

- Bitcoin’s crash to under $70,000 amid bear cycle fears is a major trigger.

Cardano price fell more than 9% to extend its downturn, with this coming as Bitcoin tumbled to below the $70,000 support level.

With BTC dragging the broader crypto market into turmoil, Cardano (ADA) dropped to lows of $0.26, signaling prolonged downside risks in this bear cycle.

Other altcoins had it even rougher, with XRP plummeting 14% to under $1.40 and Solana breaching support at $90.

Altcoins slide as BTC tanks amid market panic

Bitcoin sank further on Thursday, with bears breaking below $70,000 to plunge the whole sector into fresh turmoil.

The 8% drop from a retest of $73,000 came as Strategy, the world’s largest corporate holder of Bitcoin, sank into unrealized losses worth billions of dollars.

Treasury Secretary Scott Bessent had also noted on Wednesday that the government would not “bail out” Bitcoin.

However, despite confirmation that the US will not sell its BTC holdings, Cardano, alongside all the top altcoins, nosedived as BTC touched lows of $69,500.

Analysts at Glassnode pointed out that forced selling is escalating.

The $BTC capitulation metric has printed its second-largest spike in two years, highlighting a sharp escalation in forced selling.

These stress events typically coincide with accelerated de-risking and elevated volatility as market participants reset positioning.… pic.twitter.com/mcvVqXJcYq— glassnode (@glassnode) February 5, 2026

Cardano ADA price dives to $0.26

Cardano traded at $0.27 at the time of writing on February 5, 2026, down nearly 9% on the day.

Recent declines mean Cardano price has dived 21% in the past week and 36% in the past month.

The plunge from the $0.8 peak in October 2025 has only accelerated in the past month, with bulls failing to hold onto notable bounces above the $0.30 level.

ADA’s move aligns with bear cycle indicators, including a Fear & Greed Index in extreme fear territory and negative funding rates across exchanges.

Retail and institutional outflows have also amplified the slide, with macroeconomic conditions fueling further pain in a brutal start to the year for buyers.

Given Bitcoin’s outlook, analysts see the current support level of $0.26 as a fragile one for Cardano.

Bearish technicals signal further ADA downtrend

ADA’s daily chart gives a largely bearish outlook after the token’s dip below $0.30 and $0.28.

The dump across risk assets saw buyers fail to hold the 50-day moving average mark, while daily RSI hovers near oversold but lacks bullish divergence.

Data from Coinglass also shows a sharp decline in open interest, and negative funding rates reinforce the outlook.

If the altcoin carnage accelerates amid a broader bear cycle crash, ADA could revisit $0.20 or lower.

On the upside, a shift in macro conditions and regulatory tailwinds could spark bullish bets.

Catalysts like network upgrades or ETF approvals also favour bulls, with short-term targets at $0.50 and $1.

Crypto World

New Crypto Mutuum Finance Crosses $150M TVL in Testnet Liquidity

Mutuum Finance, a decentralized lending and borrowing cryptocurrency protocol currently operating on the Sepolia testnet, has reported surpassing $150 million in testnet total value locked (TVL). The team also announced ongoing development activity, including a new feature scheduled for release next week.

Mutuum Finance (MUTM)

The MUTM token is currently priced at $0.04. Out of a capped total supply of 4 billion tokens, approximately 1.82 billion were allocated to the sale phase. According to project disclosures, around 850 million tokens have been sold to more than 19,000 holders, with total funds raised exceeding $20.6 million to date.

The team recently implemented a new feature, announcing on X the launch of Safe-Mode Borrow Presets. Borrowing within the testnet V1 protocol is now structured as a one-click process with predefined risk presets that target specific Stability Factor levels: Safe, Balanced and Aggressive. With the addition of these presets, users can select a predefined risk profile when opening a borrowing position in the test environment.

For example, if a user deposits $1,000 worth of ETH as collateral, and the maximum loan-to-value (LTV) ratio is 75%, the user could borrow up to $750 in stablecoins. Under the Safe preset, the system maintains a higher collateral buffer by targeting a stronger Stability Factor, meaning the user borrows below the maximum LTV. This reduces liquidation risk in the event of price volatility. The Balanced and Aggressive presets allow borrowing closer to the maximum LTV, increasing capital efficiency while proportionally increasing exposure to market risk.

Lending and Borrowing Benefits Within the Protocol

Many investors could ask why they should put more collateral to borrow crypto assets. The reason is that instead of selling their current holdings, for example Ethereum, a user can deposit it as collateral without selling it and borrow USDT for other expenses while still maintaining exposure to Ethereum and potentially benefiting from its price increase. In other words, while using the borrowed funds, the Ethereum position remains intact and continues to participate in market movements.

Another factor that will benefit users is lending within the protocol. When users supply assets to Mutuum Finance, those assets are deposited into a liquidity pool and made available to borrowers. In return, the protocol issues mtTokens on a 1:1 basis as proof of deposit. These mtTokens represent the user’s share of the pool and accrue yield over time based on borrowing demand and pool utilization.

For example, if a user supplies $10,000 worth of USDT to the protocol and the average annual percentage yield (APY) is around 5–6%, the position could generate approximately $500 to $600 in yield over a one-year period, depending on utilization levels. The yield is reflected in the increasing value of the mtTokens, allowing users to earn passive income while their assets remain in the liquidity pool.

mtTokens can also be staked within the protocol, allowing users to receive dividends in MUTM tokens. According to the project’s model, a portion of the fees generated by protocol activity is used to purchase MUTM tokens from the open market and distribute them to eligible stakers, linking platform usage to token-based incentives over time.

Mutuum Finance’s recent testnet milestone and feature updates reflect ongoing development ahead of mainnet deployment. The project reports more than $20.6 million raised and over $150 million in testnet total value locked (TVL), alongside continued codebase improvements.

Crypto World

Stablecoin Salary Payout Platform Development: UK & EU Guide

Stablecoin-based payroll infrastructure is entering a regulated growth phase across the United Kingdom and the European Union. The UK and EU represent one of the largest fintech and cross-border employment markets globally. As regulatory clarity around digital assets improves under the Financial Conduct Authority (FCA) and the Markets in Crypto-Assets (MiCA) regulation, enterprises are accelerating efforts to modernize payroll infrastructure using stablecoins.

For fintech startups, payroll SaaS providers, cross-border payment companies, and embedded finance platforms, this presents a strategic opportunity. Launching a compliant and scalable stablecoin payment platform built specifically for regulated workforce payouts is a major competitive advantage. This guide explains the requirements to design, build, and deploy a stablecoin salary payout infrastructure that meets UK and EU regulatory expectations while remaining commercially viable and technically scalable.

Why Stablecoin Salary Payouts Are Growing in the UK and EU

A stablecoin salary payout platform allows employers to distribute wages using regulated digital currencies such as USD Coin (USDC) or Tether (USDT). These digital assets maintain price stability relative to fiat currencies while enabling programmable and near real-time settlement.

Unlike simple crypto transfers, enterprise payroll systems must include:

- Employer onboarding and identity verification

- Employee wallet provisioning

- Automated recurring payment execution

- Fiat conversion capabilities in GBP and EUR

- Audit logs and compliance reporting

- Risk monitoring and transaction analytics

From the Trenches Insight: Industry experience shows that reconciling fast stablecoin settlement with strict GDPR data privacy standards is often the primary hurdle for modern payout gateways. When structured properly, the system functions as a fully compliant payment gateway seamlessly integrated with traditional HR software and financial institutions.

Core Architecture of a Stablecoin Salary Payout Platform

Building a stablecoin payroll system requires a multi-layered infrastructure designed for resilience and scale.

- Blockchain Settlement Layer: Select a blockchain network that balances scalability, cost efficiency, and ecosystem maturity. Smart contracts must support scheduled payments, multi-recipient distribution, and programmable treasury logic.

- Wallet and Custody Layer: Institutional clients often prefer custodial or hybrid custody models with hardware-backed key management and multi-signature controls.

- Fiat On and Off Ramp Layer: Integration with regulated banks or Electronic Money Institutions (EMIs) ensures smooth conversion between stablecoins and GBP or EUR.

- Compliance and Risk Engine: Embed identity verification APIs, AML monitoring tools, transaction analytics, and automated reporting modules.

- Integration Layer: API-first architecture ensures seamless connectivity with HRMS, ERP systems, and payroll software providers.

Talk to a specialist at Antier today to scope the technical requirements.

Once deployed, the infrastructure can evolve into a comprehensive stablecoin remittance platform supporting vendor payouts, contractor settlements, and treasury transfers beyond salary use cases.

Regulatory Considerations in the UK and EU

Compliance is the foundation of any stablecoin payroll solution in these regions. Regulatory readiness is often the deciding factor for enterprise adoption. Failure to design compliance into the architecture from day one can delay licensing approvals and restrict institutional partnerships.

UK vs. EU Regulatory Landscape for Stablecoins:

| Feature | UK (FCA) | EU (MiCA) |

|---|---|---|

| Regulatory Body | Financial Conduct Authority (FCA) | European Securities and Markets Authority (ESMA) |

| Primary Framework | E-Money Regulations & Cryptoasset Registration | Markets in Crypto-Assets (MiCA) |

| Stablecoin Rules | Strict focus on fiat-backed stablecoins | Authorization required for E-Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs) |

| AML & KYC | Money Laundering Regulations (MLRs) | AMLD6 and strict Travel Rule compliance |

Businesses must align with anti-money laundering standards, Know Your Customer (KYC) requirements, Travel Rule data-sharing obligations, and GDPR data privacy regulations. A compliant gateway should include automated onboarding workflows, sanctions screening, risk classification systems, and real-time monitoring dashboards.

Essential Features for Enterprise Adoption

Enterprise clients expect more than just basic blockchain settlement. To compete effectively, a solution should include:

- Multi-stablecoin compatibility: Support for major fiat-pegged assets like USDC, EURC, and USDT.

- Automated payroll scheduling: Smart contract triggers for bi-weekly or monthly disbursements.

- Bulk payout execution: Batch processing to minimize gas fees and streamline employer operations.

- Treasury management dashboard: Real-time visibility into asset reserves and liquidity.

- FX visibility tools: Transparent conversion rates between crypto and fiat.

- Compliance export modules: One-click report generation for internal audits and tax authorities.

- Role-based administrative controls: Multi-tier access for HR, finance, and executive teams.

- Scalable API endpoints: Easy integration for white-label partners.

Providing full-stack stablecoin remittance platform development enables fintech startups and payroll companies to deploy branded solutions without building the infrastructure internally.

Access the 2026 MiCA & FCA Enterprise Checklist

Monetization Model for Stablecoin Payroll Platforms

A profitable stablecoin payroll solution in the UK and EU should combine recurring revenue with transaction-based income and enterprise services.

- Transaction Fees: Charge per salary payout, bulk disbursement, or contractor transfer. A well-structured system automates fee calculation and provides transparent reporting.

- Subscription Plans: Offer tiered SaaS pricing based on active employees, transaction volume, API access, and compliance features.

- White Label Licensing: Allow payroll SaaS providers and fintech firms to deploy under their own brand. Licensing and setup fees create long-term recurring contracts.

- FX and Conversion Margins: Earn revenue from GBP and EUR conversions. Efficient settlement through secure payment rails ensures competitive spreads.

- API and Compliance Modules: Premium features such as advanced AML tools and reporting dashboards can expand the platform into a scalable cross-border remittance tool, even revenue and recurring platform income in a rapidly growing digital payroll market.

Frequently Asked Questions

- Is paying salaries in stablecoins legal in the UK and EU?

Yes, paying salaries in stablecoins is legal in both regions, provided the employer and the payment platform comply with local tax laws, employment contracts, and financial regulations (such as FCA guidelines in the UK and MiCA in the EU). Both parties must mutually agree to the payment method in writing.

- What are the tax implications of a stablecoin salary?

In the UK and EU, stablecoin salaries are subject to standard income tax and social security contributions. The fiat value of the stablecoin at the exact time of the payout is used to calculate the tax liability. Employees may also be subject to capital gains tax if the stablecoin fluctuates in value before it is sold or converted to fiat.

- How do stablecoin payroll platforms handle fiat off-ramping?

Enterprise payroll platforms partner with regulated Electronic Money Institutions (EMIs) or crypto-friendly banks. This integration allows employees to receive stablecoins into a designated wallet and immediately convert them into GBP or EUR, which is then routed directly to a traditional bank account via SEPA or Faster Payments.

Moving Forward

If evaluating blockchain salary infrastructure as a fintech founder, payroll technology provider, or enterprise, this is a strategic inflection point. The UK and EU are moving toward regulated digital asset integration. Companies that establish compliant and scalable payroll infrastructure today will lead tomorrow’s cross-border workforce economy.

Antier helps businesses design and deploy enterprise-ready solutions tailored for these markets. Whether launching a stablecoin payment platform, integrating a compliant payment system, or optimizing settlement through secure stablecoin payment rails, the development delivered is strictly aligned with regulatory and enterprise standards. Ready to build a regulation-ready stablecoin payroll platform? Connect with Antier’s experts today and start the deployment journey.

Crypto World

Why Do Analysts Expect an Altcoin Season in March?

Although the market recovery in February remains fragile, it has revealed several notable signals. These signs have led analysts to expect that an altcoin season could emerge in March.

However, investor sentiment remains cautious, with capital still favoring Bitcoin over altcoins, which could hinder a broader recovery.

Hope Returns to the Altcoin Market in March

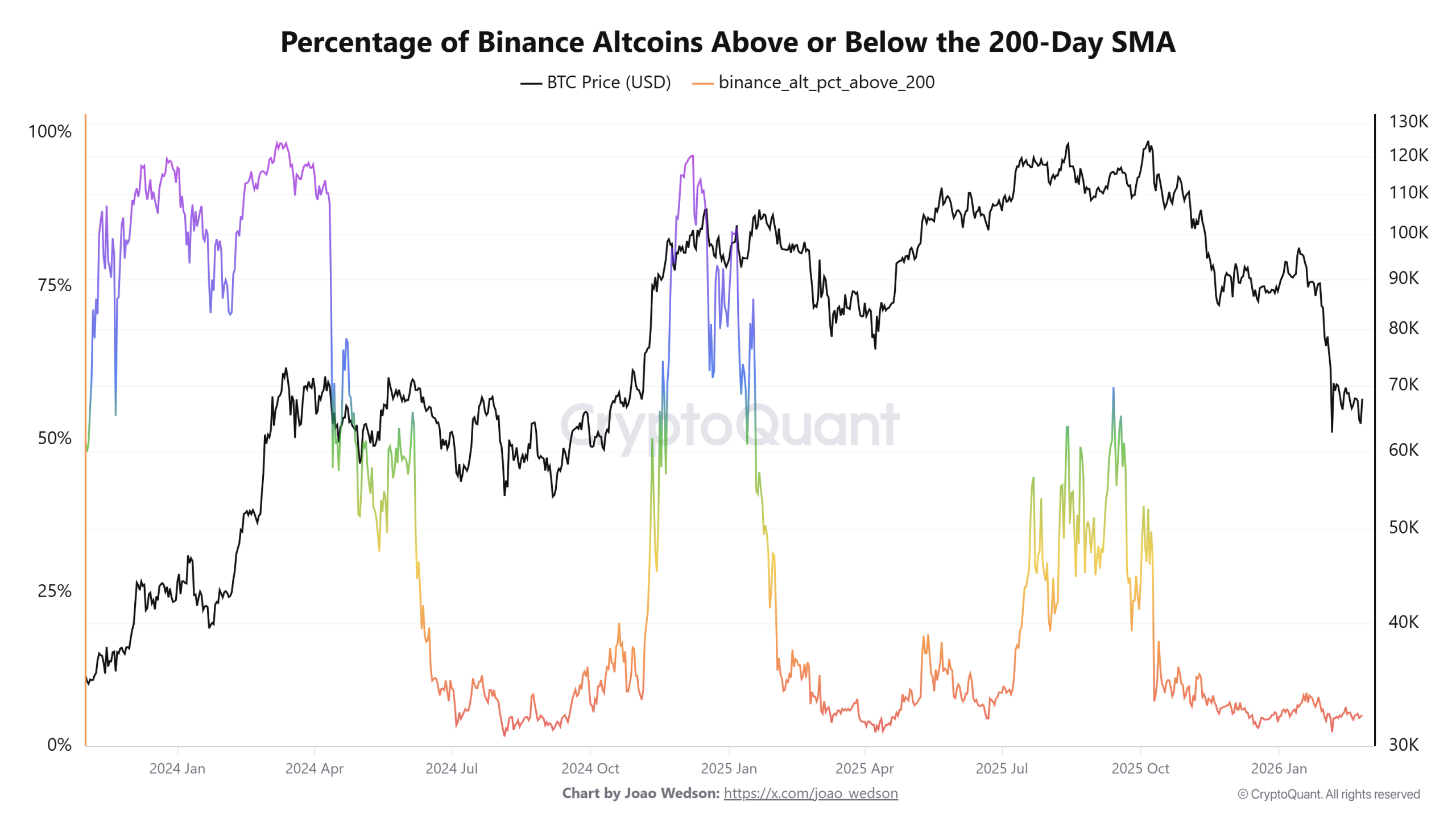

Data from CryptoQuant shows that only about 5% of altcoins listed on Binance are trading above their 200-day simple moving average (200-day SMA). This means that 95% remain below this level, reflecting the current weak performance of altcoins.

However, historical patterns offer a glimmer of hope. Over the past two years, this ratio typically stayed below 15% for a maximum of five months before rebounding. This pattern appeared during the June–October 2024 period and again from February to June 2025.

The ratio began declining in October last year and has now reached the end of its fifth month. This development raises expectations of a potential demand boost, as investors may view most altcoins as having fallen to attractive price levels.

Meanwhile, several analysts have identified early positive signals on the OTHERS/BTC chart in February, which tracks total altcoin market capitalization excluding Bitcoin against BTC.

Analyst Blade noted that the chart shows potential reversal signs on the monthly timeframe. The MACD indicator has crossed above the signal line and formed its first green histogram bar since early 2024. Similar signals appeared before major altcoin rallies in 2017 and 2020.

“Momentum shift plus structure compression usually precede expansion. The biggest altseason is coming,” Blade predicted.

These factors have strengthened expectations that altcoins could post a recovery in March.

Altcoin Investors Remain Cautious

For a more balanced perspective, data from CryptoQuant indicates that the ratio of altcoin trading volume to Bitcoin trading volume on centralized exchanges (CEXs) has fallen to its lowest level in the past year.

In 2025, the ratio peaked at around 3.5. It then gradually declined, falling below 2.5 by late last year and continuing to hover near 2.2 in early 2026.

This trend shows that investor expectations for an altcoin season remain weak. Capital continues to concentrate mainly on Bitcoin, leaving altcoins relatively neglected on centralized exchanges. A true altcoin season may require sustained capital rotation and fresh inflows into the market.

At the time of writing, the Altcoin Season Index stands at 43, still far from the 75-point threshold needed to confirm an altcoin season.

A recent report by BeInCrypto stated that the altcoin market has faced 13 consecutive months of net selling. Even if an altcoin season materializes, it is likely to be selective and driven by strong fundamentals.

Crypto World

The worst may lie ahead. BTC price chart revisits historic pattern: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

Uh-oh, the bitcoin price pattern that presaged the final and deepest phases of previous bear markets has appeared again.

In mid-November 2018, CoinDesk discussed a bearish flip in long-term averages on a chart that bundles three days of price action into each candle. It warned that a similar occurrence in 2014 deepened the bear market and, within a week, bitcoin crashed to under $4,500 from $6,000, extending the decline from the peak of roughly $20,000.

Cut to April 2022. The same pattern occurred, with the same result. BTC’s bear market deepened and prices cratered to $17,500 from $32,000, having already dropped from the late 2021 record of nearly $70,000.

Now, the pattern’s back again (check the Technical Analysis section). While past performance is not a guarantee of future results, history calls for caution. Some savvy traders are preparing for a deeper crash below $60,000.

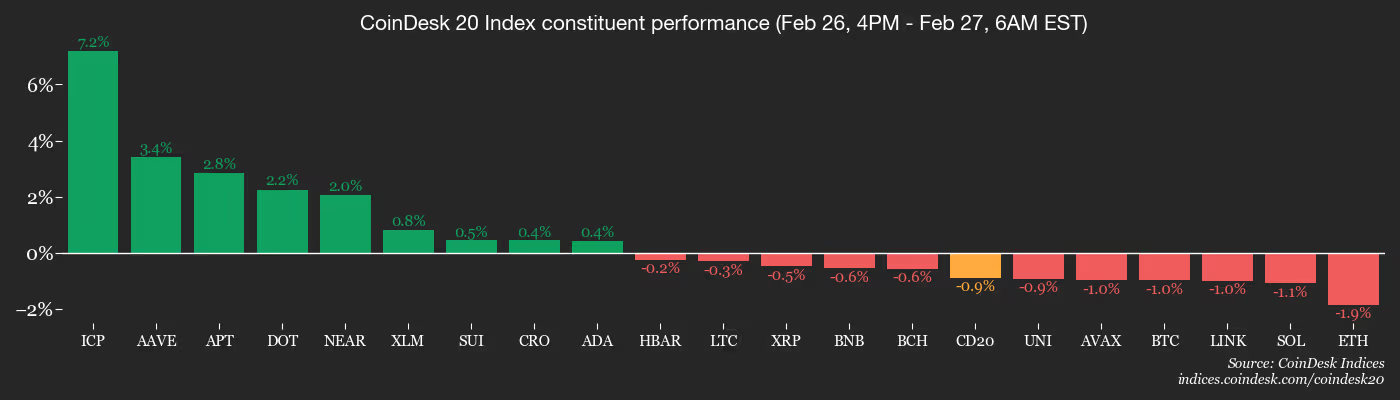

Bitcoin recently traded near $66,100, down 3% in 24 hours. Other major tokens and the CoinDesk 20 Index lost even more. Still, U.S.-listed spot bitcoin ETFs have pulled in over $1 billion in three days.

“That breadth of demand signals absorption rather than speculation,” Iliya Kalchev, an analyst at Nexo Dispatch, said in an email. “On-chain data reinforces the shift: wallets holding more than 10,000 Bitcoin have accumulated through the recent pullback from the $70,000 region, suggesting long-term holders are stepping in as supply thins.”

Even so, ETF flows need to persist to lift BTC sustainably higher, Kalchev said.

In traditional markets, oil prices remain supported by U.S.-Iran uncertainty and the potential for an escalation over the weekend. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Macro

- Feb. 27, 8:30 a.m.: U.S. PPI MoM for January est. 0.3% (Prev. 0.5%); Core PPI MoM est. 0.3% (Prev. 0.7%)

- Feb. 27, 8:30 a.m.: U.S. PPI YoY for January est. 2.9% (Prev. 3%)

- Feb. 27, 8:30 a.m.: Canada GDP growth rate annualized for Q4 (Prev. 2.6%); QoQ (Prev. 0.6%)

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- 1inch DAO is voting to allocate 2,000,000 USDC from its treasury to the Aave V3 market on Ethereum to generate yield. Voting ends March 1.

- Unlocks

- Token Launches

- Feb. 27: Fabric Protocol (ROBO) to be listed on Binance, Bybit, Bitget, KuCoin, and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is unchanged from 4 p.m. ET Thursday at $67,423.09 (24hrs: -0.95%)

- ETH is down 0.89%at $2,012.51 (24hrs: -2%)

- CoinDesk 20 is unchanged at 1,968.26 (24hrs: -2.49%)

- Ether CESR Composite Staking Rate is up 4 bps at 2.89%

- BTC funding rate is at -0.006% (-6.5799% annualized) on Binance

- DXY is unchanged at 97.74

- Gold futures are unchanged at $5,191.50

- Silver futures are up 2.82% at $90.05

- Nikkei 225 closed up 0.16% at 58,850.27

- Hang Seng closed up 0.95% at 26,630.54

- FTSE is up 0.39% at 10,888.78

- Euro Stoxx 50 is unchanged at 6,161.33

- DJIA closed on Thursday up 0.03% at 49,499.20

- S&P 500 closed down 0.54% at 6,908.86

- Nasdaq Composite closed down 1.18% at 22,878.38

- S&P/TSX Composite closed up 1.1% at 34,501.96

- S&P 40 Latin America closed down 1.4% at 3,772.90

- U.S. 10-Year Treasury rate is down 3 bps at 3.987%

- E-mini S&P 500 futures are down 0.28% at 6,900.75

- E-mini Nasdaq-100 futures are down 0.19% at 25,033.75

- E-mini Dow Jones Industrial Average Index futures are down 0.48% at 49,294.00

Bitcoin Stats

- BTC Dominance: 58.49% (-0.11%)

- Ether-bitcoin ratio: 0.02973 (-1.06%)

- Hashrate (seven-day moving average): 1,055 EH/s

- Hashprice (spot): $29.31

- Total fees: 3.43 BTC / $232,808

- CME Futures Open Interest: 107,780 BTC

- BTC priced in gold: 12.8 oz.

- BTC vs gold market cap: 4.46%

Technical Analysis

- The chart shows BTC’s price swings on a three-day time frame in candlestick format from 2024-2025 and 2018-2022. Each candle bundles the price action seen over three days, or 72 hours.

- On this chart, moving averages of 50- and 200-candles have crossed bearish.

- Similar patterns led to deeper slides in 2014, 2018 and 2022.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $181.06 (-1.57%), unchanged in pre-market

- Circle Internet (CRCL): closed at $87.21 (+4.90%), unchanged in pre-market

- Galaxy Digital (GLXY): closed at $21.94 (-3.90%)

- Bullish (BLSH): closed at $32.73 (-0.49%), unchanged in pre-market

- MARA Holdings (MARA): closed at $8.45 (-1.40%), +15.98% at $9.80

- Riot Platforms (RIOT): closed at $17.09 (+0.06%), +0.12% at $17.11

- Core Scientific (CORZ): closed at $17.98 (-0.55%), -1.50% at $17.71

- CleanSpark (CLSK): closed at $10.44 (-0.10%), -0.77% at $10.36

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $42.17 (-0.40%)

- Exodus Movement (EXOD): closed at $10.45 (-1.69%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $133.40 (-1.66%), +0.62% at $134.23

- Strive (ASST): closed at $8.19 (-4.10%), +0.24% at $8.21

- SharpLink Gaming (SBET): closed at $7.21 (-3.09%), +0.55% at $7.25

- Upexi (UPXI): closed at $0.76 (-7.87%), +0.22% at $0.76

- Lite Strategy (LITS): closed at $1.14 (-3.39%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $254.4 million

- Cumulative net flows: $54.81 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: $6.6 million

- Cumulative net flows: $11.68 billion

- Total ETH holdings ~5.72 million

Source: Farside Investors

While You Were Sleeping

Crypto World

WTI Oil Pulls Back from Its 2026 High

As the XTI/USD chart shows, the price of a barrel:

→ set fresh 2026 highs above $67 earlier this week;

→ but yesterday posted a sharp reversal lower (as indicated by the blue arrow).

The spike in volatility was driven by conflicting reports from Geneva, where talks between the United States and Iran were taking place:

→ some sources suggested negotiations had reached an impasse, as Washington insists on a complete halt to uranium enrichment;

→ meanwhile, according to Omani mediators, progress has been made and another round of talks is scheduled for next week.

Technical Analysis of the XTI/USD Chart

When analysing the oil price chart on the morning of 19 February, we suggested that:

→ the market could soon set a new high for the year (which materialised, with a series of highs formed between 19 and 23 February);

→ the 65.20 level would act as support (confirmed on 23 February).

Today’s chart indicates growing bearish pressure, reflected in the following:

→ WTI struggled to hold above its yearly highs, forming signs of potential bull traps;

→ yesterday’s candle (marked with a red arrow) shows a pronounced upper wick.

At the same time, bulls clearly defended the former resistance level at $63.73. The lower boundary of the ascending trajectory that has defined WTI price movements in 2026 also supports the bullish case.

It is worth noting that an OPEC+ meeting is scheduled for the weekend. According to media reports, analysts expect an increase in output from April, which could heighten concerns about oversupply — particularly after US crude inventories rose on Wednesday. As a result, Monday’s trading may open with elevated volatility.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Tether USDT Price Outlook 2026-2030

Tether (USDT) Price Prediction

Tether’s USDT peg persists amid competition from yield-bearing stablecoins and evolving regulations. Reserve accumulation and cross-chain volume growth reinforce its market position. Analysts monitor depeg potential through quarterly attestations, futures open interest, and macroeconomic developments. Price scenarios for 2026 to 2030 appear next, covering base, stress, and premium cases informed by reserve structures, transaction flows, and external variables.

2026-2030 Price Scenarios

Base case projects a $0.99-$1.01 range through 2030. Annual supply growth of 8–10% tracks reserve expansion, keeping coverage modestly above 100% to maintain peg stability. Tokenization demand and emerging market absorption prevent sustained premium formation.

Stress scenarios anticipate temporary declines to $0.96-$0.98 during 2026-2027. Coverage falling below 1.01x prompts $5-10 billion in redemptions, mirroring 2022 patterns. Burns and arbitrage restore equilibrium within 30-60 days.

Premium scenarios target $1.02-$1.05 by 2030 during scarcity phases. Yield-bearing alternatives claim less than 10% market share as real-world asset tokenization accelerates. Regulatory simplification drives institutional inflows.

| Year | Base Range | Stress Range | Premium Range | Base Probability |

|---|---|---|---|---|

| 2026 | $0.99-1.00 | $0.96-0.98 | $1.01-1.02 | 85% |

| 2027 | $0.99-1.00 | $0.95-0.97 | $1.01-1.03 | 82% |

| 2028 | $1.00-1.01 | $0.96-0.98 | $1.02-1.04 | 84% |

| 2029 | $1.00-1.01 | $0.97-0.99 | $1.02-1.04 | 87% |

| 2030 | $0.99-1.01 | $0.97-0.99 | $1.02-1.05 | 88% |

Reserves and Peg Stability

Latest attestations show reserves modestly exceeding liabilities, with coverage approaching parity historically triggering several billion dollars in redemptions. U.S. Treasuries and cash equivalents represent the dominant allocation, typically accounting for roughly 70–80% of total reserves, while the remainder includes secured loans, precious metals, and a limited Bitcoin position. Excess reserves fluctuate quarterly and function as a liquidity buffer rather than a fixed structural surplus.

Composition favors short-duration Treasuries, which yield compression from Fed policy affects minimally. Quarterly burns offset mints, limiting supply growth to 8% annualized. USDC trails at $75 billion circulation with similar transparency standards.

| Component | Allocation ($B) | Share |

|---|---|---|

| U.S. Treasuries | 112.4 | 80% |

| Reverse Repos | 21.0 | 15% |

| Cash Equivalents | 6.4 | 5% |

| Excess Coverage | 6.8 | 4% |

Redemption queues process within 48 hours under normal conditions. During May 2022 volatility, USDT briefly traded well below $1 on secondary markets, with intraday prints near $0.95 on some venues before arbitrage restored parity. Emerging market holdings concentrate 40% of issuance, amplifying velocity over domestic flows.

Chain Trends Driving Volume

Tron and Ethereum dominate USDT transfers. Tron leads in low-cost, high-velocity transfers, while Ethereum anchors DeFi liquidity. Solana handles a smaller share (~8%) through high throughput. Emerging markets account for ~40% of TRC20 activity, prioritizing transaction speed over smart contract depth.

Market participants use USDT TRC20 swap tools to capture fee arbitrage during Ethereum congestion, preserving liquidity across protocols without premium costs.

| Chain | Volume Share | Average Fee | Primary Application |

|---|---|---|---|

| TRC20 | 45% | $0.001 | High-velocity transfers |

| ERC20 | 50% | $0.50 | DeFi liquidity pools |

| Solana | 8% | $0.0005 | Rapid settlement trades |

Tron issuance exceeds 80 billion tokens, reflecting sustained adoption in dollar-scarce regions. ERC20 maintains pricing anchor despite fee disadvantage. Volume distribution signals preference for cost efficiency over ecosystem lock-in.

Platform Execution for Traders

USDT pairs account for 60% of exchange volume, with futures open interest steady at $26 billion across major platforms. Binance remains the primary venue for USDT liquidity, while Coinbase lists USDT but structurally prioritizes USDC in U.S. markets. Execution differences emerge in liquidity depth and order book resilience during volatility spikes.

Traders compare Coinbase vs Binance metrics when selecting USDT pair venues, weighing spread tightness against regulatory exposure for range-bound positioning.

| Platform | USDT Volume Share | Open Interest ($B) | Spread (bps) |

|---|---|---|---|

| Binance | 45% | 15 | 1.2 |

| Coinbase | 22% | 6 | 2.1 |

| Others | 33% | 5 | 1.8 |

Funding rates average 0.01% daily, signalling low leverage risk. Platform choice influences slippage on $1-2 billion daily rotations, particularly during attestation windows. Concentration on two venues exposes systemic liquidity risks if outflows coincide.

Technical Indicators Now

USDT trades in a narrow $0.998-$1.002 range under recent market conditions, indicating low volatility. Technical indicators, such as Bollinger Bands and RSI, suggest range-bound positioning, consistent with peg stability.

Futures open interest remains at $26 billion with funding rates near 0.01%. MACD lines converge without histogram divergence, pointing to consolidation ahead of quarterly reports. Volume profiles flatten week-over-week, consistent with range-bound positioning.

- Support levels sit near $0.997 (50-day EMA) and around $0.99 for historical stress periods.

- Resistance caps at $1.002 (upper band) and $1.005 (recent high).

Breakouts below $0.997 signal deeper tests of psychological support. Upper breaches require sustained mints exceeding $2 billion daily. Current setup favors mean reversion over directional bets.

Catalysts and Headwinds

Real-world asset tokenization eyes $400 billion by 2028, channeling demand to USDT pairs. Emerging markets generate 35-40% circulation growth via TRC20 in Latin America and Southeast Asia. U.S. regulatory easing curbs NYAG scrutiny, supporting $20 billion annual institutional inflows.

Yield-bearing stablecoins take 6-8 DeFi TVL points:

- USDe yields 4.8-5.5% APY on $12 billion.

- PYUSD hits $1.8 billion through merchants.

Fed rate paths squeeze Treasury yields on 80% reserves. Coverage margins tighten. The EU’s Markets in Crypto-Assets framework imposes stricter reserve transparency and liquidity standards for compliant issuers, increasing scrutiny on stablecoin structures operating within the bloc.

A visible decline in reserve coverage toward parity would likely accelerate institutional redemptions, with magnitude driven by liquidity conditions rather than a fixed numerical trigger. RWA gains offset this, locking in 62-65% dominance through 2027.

Trader Tactics and Storage

Position USDT within 20-30% portfolio limits to manage concentration risk. Review reserve attestations each quarter for coverage trajectory. Store amounts over $100,000 in multi-signature or hardware wallets, keeping recovery phrases offline.

Chain preferences vary by use case:

- TRC20 suits transfers below $50,000 where fees stay under $0.001.

- ERC20 fits DeFi positions despite $0.50 average costs.

- Solana handles sub-second needs for high-frequency execution.

Primary redemptions typically settle within 1–2 business days under normal conditions. Cross-chain swaps capture fee savings during Ethereum spikes. Avoid leverage entirely. Shift 10-15% to yield options only in stable conditions. Track funding rates exceeding 0.02% daily as outflow warnings. Coverage drops below 1.02x demand immediate position cuts.

USDT Peg Outlook

Reserve buffers slightly above parity support the $0.99–$1.01 range under normal market conditions, bolstered by TRC20 efficiencies and RWA flows. Technical ranges and volume shifts confirm resilience. Yield rivals plus MiCA test margins, but redemptions cap stress at $0.96-$0.98 with rapid recovery.

Platform tactics and storage limit slippage risks. USDT continues to hold a majority share of the global stablecoin market, with dominance dependent on liquidity depth, regulatory positioning, and cross-chain accessibility. Prioritize quarterly attestations, 20-30% caps, and chain rotations before Fed yield squeezes. Premiums over $1.02 require rival erosion below 10%, unlikely by 2030.

FAQ

Will USDT maintain its $1 peg through 2030?

Base scenarios project 85-88% probability within $0.99-$1.01. Stress cases limit breaches to $0.96-$0.98 with burn-driven recovery.

What drives TRC20’s volume dominance?

TRC20 leads in low-cost, high-velocity transfers (~45% of USDT activity), while ERC20 supports DeFi liquidity despite higher fees (~50%). Emerging markets prioritize transaction speed in dollar-scarce regions, contributing to TRC20’s practical advantage.

How do yield rivals impact USDT?

USDe and PYUSD erode 6-8 DeFi TVL points at 4.8-5.5% APY. Liquidity depth restricts share loss below 10%.

What triggers a 2026 stress depeg?

Coverage approaching parity can trigger several billion dollars in redemptions, historically absorbed by arbitrage and reserve buffers. Fed yield compression or MiCA collateral caps may accelerate outflows.

Should portfolios hold USDT long-term?

Cap exposure at 20-30% for peg reliability. Allocate 10-15% to yields during stable periods.

Can USDT trade above $1.02 sustainably?

Premium scenarios need rival erosion below 10% share. RWA scarcity supports this at 5-10% odds by 2030.

How reliable are these projections?

Ranges derive from attestation trends and historical patterns, with coverage consistently above parity. Black swans alter probabilities.

Why prefer TRC20 over ERC20?

TRC20 suits transfers under $50,000. ERC20 anchors DeFi despite fee disadvantage.

What storage secures larger USDT positions?

Multi-signature or hardware wallets for over $100,000. Keep phrases offline; enable direct Treasury redemption.

When do Fed rates affect reserves?

Treasury yield drops on 80% allocation narrow coverage. Monitor before rate cuts for rotation signals.

Disclaimer

This article offers informational analysis only. It does not constitute investment, financial, or trading advice. Cryptocurrency markets exhibit high volatility, and historical patterns do not predict future outcomes. Readers must conduct independent research and consult qualified professionals before making decisions. The publisher assumes no liability for any losses incurred.

Crypto World

Judge Blocks Binance Bid to Force US Crypto Claims into Arbitration

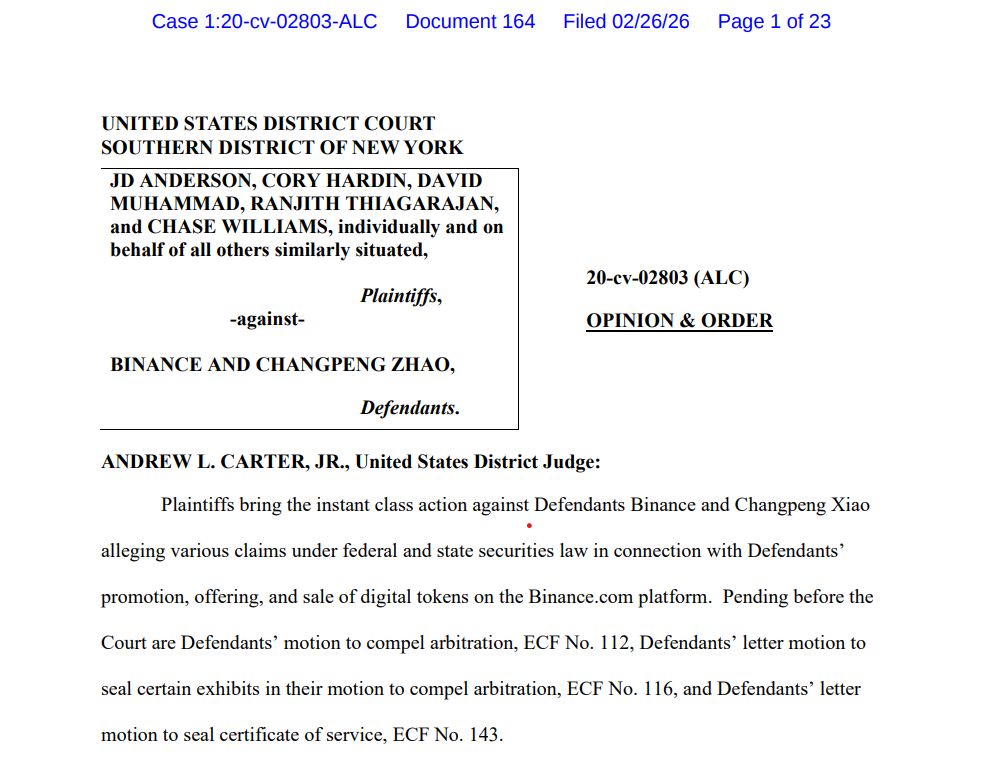

A United States federal judge ruled that Binance cannot force a group of US customers to arbitrate claims over losses on crypto tokens they bought on its global platform before Feb. 20, 2019, keeping a major class action in open court.

The decision on Thursday by District Judge Andrew Carter Jr. in the Southern District of New York held that those claims were not bound by Binance.com’s 2019 arbitration clause because users lacked sufficient notice when the company unilaterally shifted its terms of use away from the 2017 version, which contained no arbitration or class action waiver provisions.

According to the judge, Binance relied on a general change‑of‑terms clause and the posting of updated 2019 terms on its website, and there was no evidence that the exchange provided any individual notice or formally “announced” the new arbitration provision to users.

Carter found that Binance’s “new world” rhetoric about operating in a decentralized manner did not change the basic contract law analysis for internet‑based agreements.

He concluded that the 2019 arbitration clause could not be applied retroactively to claims that arose before its Feb. 20 effective date, because the contract never clearly said it would cover earlier conduct.

Related: US senator launches probe into Binance over Iran, Russia sanctions claims

Carter also held that a purported US class action waiver embedded in a section heading of the 2019 terms was unenforceable in federal court because the contract never actually sets out the terms of any such waiver and had to be interpreted narrowly against Binance as the drafter.

Binance says post‑2019 claims already dismissed

The case, Williams v. Binance, is a proposed class action brought by five US investors from California, Nevada and Texas who claim that Binance and founder Changpeng Zhao (CZ) illegally sold unregistered securities on Binance.com and failed to register as a broker‑dealer.

The case was previously dismissed in 2022 before the Second Circuit revived the investors’ claims in 2024, sending the dispute back to Carter’s court.

In a statement to Cointelegraph, a Binance spokesperson said that “in response to our motion on this issue plaintiffs voluntarily and correctly dismissed all claims that accrued on or after Feb. 20, 2019.” They added that Binance would “vigorously defend the limited claims that remain in this meritless case.”

The remaining claims will now proceed in a federal US court rather than private arbitration in Singapore, as judges, rather than arbitrators, assess whether crypto platforms can rely on unilaterally updated online terms to limit investor lawsuits.

Magazine: Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

BTC price falls with ETH, SOLwhile decred, AI-linked tokens advance: Crypto Markets Today

Decred (DCR), a token built for autonomy and decentralized governance, extended gains even as the broader market led by bitcoin struggled.

The token has risen 16% in the past 24 hours and now trades at $34.58, the highest since November, CoinDesk data show. It’s the best-performing top-100 token over the past four weeks, having gained more than 80% after a Feb. 8 change to its treasury rules.

Bitcoin, for its part, is facing renewed selling pressure, trading just around $67,000, a weak follow-through after bouncing to $70,000 on Wednesday. The cryptocurrency is down 2% on a 24-hour basis, with ether (ETH), XRP (XRP), solana (SOL), and the CoinDesk 20 Index (CD20) registering similar losses.

Market participants remain cautious and are continuing to seek put options, or downside protection, in bitcoin. Deribit said that ETF holders and corporate treasuries are buying put options at the $60,000 strike expiring in six to 12 months.

Analysts said institutional flows are improving but not yet decisive, and traders should avoid taking big risks.

“Long-term investors may consider staggered accumulation (SIP-style allocation) near support zones rather than deploying lump sums at resistance,” Vikram Subburaj, CEO of crypto exchange Giottus.com, said in an email to CoinDesk.

Derivatives positioning

- Cumulative crypto futures open interest (OI) has fallen back to recent multimonth lows of around $93.5 billion. The drop shows how quickly the optimism sparked by Wednesday’s bitcoin price bounce has fizzled out.

- Major tokens, including bitcoin and ether, have seen capital outflows from futures as notional OI declined more than their spot prices.

- The market-wide long-short ratio continues to show a dominance of shorts, or bearish bets.

- OI in tether gold (XAUT) dropped another 11% extending the decline from early this week. Gold-linked assets seem to have fallen out of favor lately.

- Most large-cap tokens, including BTC and ETH, are again seeing negative perpetual funding rates. That means bearish plays are dominating the market once more.

- Participation in CME bitcoin futures is falling, as shown by open interest hitting the lowest levels this year.

- On Deribit, one-month bitcoin puts still trade at a 7% premium to calls in a sign of lingering concerns of further spot price declines. The same is true for ether.

- Bitcoin put spreads, a bearish strategy, accounted for 75% of the total block flow over 24 hours. In ETH’s case, traders chased put spreads and straddles (volatility strategies).

Token Talk

The DFINITY Foundation proposed burning 20% of cloud engine revenue, introducing a deflationary element tied directly to network usage for Internet Computer (ICP).

The remaining 80% of revenue would be routed to node operators, replacing fixed emissions with performance-based incentives. The idea is to make ICP’s token supply more responsive to real demand.

ICP’s price moved up roughly 6% in the last 24-hour period, from around $2.41 to $2.56. It’s down from a high of $2.7 seen during the period. The price appears to be influenced not just by the foundation’s proposal, but also by Nvidia’s blowout earnings.

Those earnings boosted sentiment surrounding artificial intelligence-linked assets, with Nvidia CEO Jensen Huang saying AI is only getting better.

ICP, often marketed as a decentralized alternative to traditional cloud AI infrastructure, was among several AI-linked tokens, including render (RENDER) and bittensor (TAO), to benefit from renewed investor interest in the sector.

Crypto World

Be The Boss Surpasses $2M in Real Payouts as Playnance Ecosystem Generates $5.3M Ahead of G-Token Launch

Tel Aviv, Israel, 26th February 2026, Chainwire

[PRESS RELEASE – Tel Aviv, Israel, February 26th, 2026]

Playnance today announced that its “Be The Boss” program has surpassed $2 million in real cash payouts (fiat), while expanding to 2,809 active Bosses across its ecosystem. Overall, the platform has generated more than $5.3 million in total revenue to date. The momentum comes as the company prepares for the upcoming launch of its G-Token, the core utility token designed to power and unify activity across Playnance’s live, on-chain consumer platforms.

The Be The Boss program was designed as a structural layer within the Playnance ecosystem, allowing participants to take an active role in platform-level economics tied directly to real user activity. Unlike speculative participation models that rely on projected growth, the program is integrated into Playnance’s live infrastructure, which currently processes approximately 1.5 million on-chain transactions per day and serves more than 10,000 daily active users. All user activity across Playnance’s platforms is executed and recorded on-chain through a non-custodial system, while maintaining familiar Web2 onboarding flows that remove blockchain complexity for mainstream users.

As users engage with platforms such as PlayW3, Up vs Down, and other ecosystem products, transaction activity flows through a shared wallet and infrastructure layer. The Be The Boss structure is designed to align with this activity, creating a framework that reflects ecosystem performance rather than external incentives. The growth to 2,809 Bosses, more than doubling participation, signals increasing engagement ahead of the G-Token launch and demonstrates sustained interest in the underlying system.

The upcoming G-Token already serves as the core utility layer across the Playnance ecosystem, functioning as the connective asset between products, infrastructure, and user participation. Built directly into platform mechanics, the token is designed to power interactions, support settlement flows across applications, and unify multiple consumer platforms under a shared on-chain economic model. Rather than operating as a standalone digital asset, G-Token forms the foundation of the ecosystem’s architecture, linking user behavior, transaction activity, and platform-level incentives within a single framework.

The Be The Boss program operates within this token-driven structure, reinforcing Playnance’s approach of building live systems at scale before publicizing them. By grounding its token model in measurable activity, including 1.5 million daily on-chain transactions, Playnance positions G-Token as an extension of an already functioning ecosystem rather than a speculative launch.

“Our focus has always been on building real systems that operate at scale before talking about them,” said Pini Peter, CEO of Playnance. “The growth of the Be The Boss program and the upcoming launch of G-Token reflect years of infrastructure development, live user activity, and continuous refinement. We designed the token to serve a working ecosystem, not the other way around, and this milestone shows that the foundation is already in place.”

Playnance plans to continue expanding its ecosystem in alignment with observed user behavior and platform performance, further strengthening the integration between consumer applications, shared infrastructure, and the G-Token economy.

About Playnance

Founded in 2020, Playnance is a Web3 infrastructure company developing live, non-custodial, on-chain products designed to onboard mainstream Web2 users into blockchain environments. The company develops consumer-facing platforms built on shared wallet systems and high-volume on-chain execution, currently processing approximately 1.5 million transactions per day. Playnance focuses on reducing friction between user experience and blockchain infrastructure by abstracting complexity while maintaining full on-chain transparency and non-custodial architecture.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin’s 5-Month Slump Could Drag in March as $70K Cap Holds Price

Bitcoin is contending with a rare confluence of resistance on the weekly chart, a setup that could determine whether the bear phase eases into March or drags on for longer. The price action comes as BTC hovers in a tight zone just below three major barriers: the 200-week exponential moving average (EMA) at about $68,330, the long-standing 2021 all-time high near $69,000, and the round-number psyche of $70,000. The most recent moves show a struggle to reclaim those levels after a mid-week peak that touched $70,040 but failed to hold. This backdrop has traders weighing the probability of a sustained rebound versus another leg lower, with the market watching for a decisive bullish signal.

Key takeaways

- Bitcoin is testing a triple-resistance cluster on the weekly chart, with the 200-week EMA at roughly $68,330, the 2021 peak around $69,000, and $70,000 acting as a psychological barrier.

- BTC has dropped about 14% in February, marking a fifth consecutive red month, highlighting persistent downside pressure even as buyers consider a potential shift in momentum.

- The price hovered near $67,720 after failing to reclaim the $70,000 level, underscoring the need for a weekly close above the 200-week EMA to sustain any upside.

- Analysts have flirted with the idea that March could turn bullish if a weekly close clears the EMA hurdle, suggesting a possible retest toward higher targets if momentum builds.

- Historical precedent factors into the discussion: a similar streak in late 2018 preceded a multi-month rally, raising expectations that a reversal could materialize in the spring once selling pressure loosens.

- Longer-term signals remain mixed, with traders eyeing the potential break above a major cost-basis level around $74,500 as a potential marker for a sustained bull phase.

Tickers mentioned: $BTC

Market context: The price action arrives as liquidity and risk appetite swing with broader market dynamics, including a stock-market rebound and earnings data that have previously boosted risk-on assets. Traders are balancing technical resistance with macro cues, keeping a close watch on trend-following signals and key levels on the chart.

Why it matters

From a technical standpoint, the trio of resistance points converges at a zone that has historically defined BTC’s near-term fate. A weekly close above the 200-week EMA at $68,330 would be a rare indication that sellers are losing steam and that bulls are regaining control. Such a move could rekindle momentum toward the next psychological and technical targets, potentially delivering a more substantive bounce than a cursory intraday spike.

The broader context matters because these levels are not arbitrary driftlines; they reflect long-standing anchors in Bitcoin’s price history. Confronting the old high at $69,000 provides a test of whether demand can overwhelm supply that has persisted through a prolonged drawdown. The $70,000 level, in turn, functions as more than a price barrier—it signals a market memory of previous turning points when risk appetite reacted to macro news and liquidity conditions. A sustained move through these gates could alter sentiment in a market that has endured a multi-month downtrend.

Beyond the immediate price optics, the discussion is inseparable from the mechanism of a potential bear-market exit. Some market observers point to a pivotal threshold around $74,500—the cost basis for the 18-24 month age band—as a possible inflection line for the bear narrative. A break above that zone has historically carried implications for the durability of any upward move, even if the current price action remains within a volatile corridor. In this sense, the path forward is not simply about punching higher; it is about confirming a durable change in the supply-demand dynamics that have characterized BTC for months.

The market’s current mood is further informed by a blend of on-chain and sentiment signals that emphasize demand resilience and the risk of renewed selling pressure if macro catalysts deteriorate. Market watchers have noted that previous episodes of similar consolidation tended to be followed by more pronounced moves once the EMA and key resistance levels gave way. This pattern, while not a guarantee, has shaped a cautious outlook for March as participants await the weekly cadence of candles to reveal whether bulls can sustain a breakout or whether fresh selling emerges to prolong the consolidation.

In parallel, commentary from prominent traders underscores the fragility of any rally, noting that a lack of a convincing weekly close could delay a meaningful rebound. For instance, a trader known as Captain Faibik argued that clearing the 200-week EMA on a weekly basis could pave the way for a resurgence toward higher targets, cautioning that March could shape up as a turning point if momentum is captured. His assessment reflects a common view that the longer horizon—beyond a single daily move—matters for how the market assigns value to risk assets in the near term.

As a reminder of the historical context, a Cointelegraph piece noted that the bear market could end if BTC reclaimsthe cost basis around the 18-24-month band, a threshold that has historically signaled a shift in trend. The question remains whether this time will mimic the late-2018 to early-2019 period when a months-long drawdown was followed by a dramatic multi-bagger rally. If selling pressure abates and demand returns, April could mark the onset of a more constructive phase for the asset, even as the journey toward that inflection point remains uncertain.

“I think March is going to be a bullish month.”

Data from CoinGlass reinforces the immediacy of the trend, showing a five-month streak of negative performance for Bitcoin with February posting about a 14% decline. The cadence of losses has raised concerns about macro-driven risk-off sentiment, yet it also sets the table for a potential reversal should macro news align with technical breakouts. The market’s memory of past cycles—where similar declines have given way to decisive rallies—keeps the discussion open for a spring resurgence, provided the price clears the critical thresholds and maintains momentum.

In this environment, traders are urged to monitor the confluence of signals rather than relying on a single data point. A sustained push through the key hurdle at $68,330 on a weekly close would be a more meaningful signal than a fleeting intraday peak. If momentum bets align with a broader market backdrop that supports risk-on assets, the path toward higher levels could materialize, offering traders a clearer roadmap for the weeks ahead.

What to watch next

- Watch for a weekly close above the 200-week EMA near $68,330 to confirm momentum and potentially open a path toward $70,000 and beyond.

- Monitor price action around $69,000 and $74,500 as potential inflection points that could alter the bear narrative and attract new buyers or trigger renewed selling.

- Observe the interplay between macro catalysts and risk appetite, including market reactions to earnings data and macro releases, which have previously influenced BTC’s correlation with broader assets.

- Track on-chain indicators and investor behavior for signs of exhaustion in selling pressure and the emergence of accumulation patterns that precede sustained rallies.

Sources & verification

- BTC price context and resistance levels as discussed in a Cointelegraph piece focusing on the confluence of barriers at $68k–$70k

- BTCUSD TradingView data illustrating price hovering around $67,720 after rejection from $70,000

- CoinTelegraph report on bear-market dynamics tied to reclaiming $74,500 as a key end-state

- CoinGlass data documenting February’s 14% decline and the five-month red streak

- Public posts by traders on X, including insights from CryptoFaibik and Alek Carter, discussing near-term momentum and historic precedents

-

Politics5 days ago

Politics5 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports4 days ago

Sports4 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics4 days ago

Politics4 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business3 days ago

Business3 days agoTrue Citrus debuts functional drink mix collection

-

Politics13 hours ago

Politics13 hours agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World3 days ago

Crypto World3 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business5 days ago

Business5 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Business5 days ago

Business5 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Tech3 days ago

Tech3 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat4 days ago

NewsBeat4 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech5 days ago

Tech5 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat5 days ago

NewsBeat5 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics5 days ago

Politics5 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

NewsBeat3 days ago

NewsBeat3 days agoPolice latest as search for missing woman enters day nine

-

Business1 day ago

Business1 day agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Sports4 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Crypto World3 days ago

Crypto World3 days agoEntering new markets without increasing payment costs