Crypto World

Cardano price forecast: will ADA breakout or decline further from here?

- Cardano (ADA) may rebound if it breaks resistance near $0.31–$0.35.

- Leios upgrade aims to boost Cardano’s speed, security, and decentralisation.

- CME futures launch adds regulated institutional exposure to ADA.

Cardano (ADA) has struggled to regain momentum over the past year.

Currently, ADA is trading at $0.2635, with a slight 0.7% increase in the last 24 hours.

The 24-hour range spans from $0.2611 to $0.2723, reflecting modest intraday volatility.

Over the last seven days, ADA has lost about 11%, and its one-year performance remains down 62.4%.

Despite the persistent bear market, Cardano’s trading volumes over 24 hours remain significantly high at $407.8 million, indicating that the token continues to see active trading.

Market catalysts and institutional support

Cardano’s broader market outlook is influenced by the upcoming layer-1 upgrade dubbed Ouroboros Leios.

The Ouroboros Leios upgrade, confirmed at a Tokyo community event on the Midnight Japan Tour by Input Output’s Michael Smolenski and Cardano founder Charles Hoskinson, is expected to improve scalability, security, and decentralisation.

Leios will introduce parallel block processing to increase transaction throughput dramatically.

If successful, this upgrade could address the blockchain trilemma and attract more developers and users to the network.

On the institutional front, the CME Group recently launched ADA futures, including standard and micro contracts.

Cardano, Chainlink and Stellar futures are now available to trade.

Expand your trading strategy with the capital efficiency and flexibility of these new contracts, available in both larger and micro sizes.

Start trading today. ➡️https://t.co/CMksnUfZpo pic.twitter.com/19thOQHGZk

— CME Group (@CMEGroup) February 9, 2026

These futures provide regulated exposure to Cardano for professional traders and investors.

The addition of micro contracts lowers the entry barrier and may boost liquidity in the short to medium term.

Historical price data also provides context.

ADA’s all-time high was $3.09 in September 2021, while its all-time low of $0.01925 in March 2020 demonstrates the token’s extreme volatility.

Despite its current decline, ADA has grown by over 1,200% from its lowest point, showing long-term resilience.

Cardano technical outlook

From a technical standpoint, ADA faces key resistance around $0.28 to $0.31, which could define the short-term trajectory.

The Relative Strength Index (RSI) is near 33, suggesting the token is approaching oversold conditions.

The Moving Average Convergence Divergence (MACD) indicator also shows bearish momentum, although the potential for reversal exists if buyers step in.

Bollinger Bands indicate that the price is near the lower range, hinting at some room for a bounce.

On the upside, a recovery above $0.31 could open the path toward $0.35, while a failure to hold support near $0.25–$0.26 may push ADA lower.

Analysts note that an inverse head-and-shoulders pattern may be forming, signalling a potential trend reversal.

They highlight that a breakout above $0.275–$0.28 could target $0.346, representing roughly a 30% upside from current levels if the selling pressure continues to ease and trading volume confirms the move.

Ultimately, ADA’s next move will depend on whether buyers gain confidence and push the token above resistance.

Crypto World

S&P Global Finds Bitcoin’s Evolving Role in Markets

Editor’s note: S&P Global today releases Bitcoin volatility and market dynamics findings, highlighting Bitcoin’s shift from a niche asset to a market-connected instrument. The full report, Bitcoin Volatility Trends: A Deep Dive into Market Dynamics and Risk, examines price patterns, volatility, and the interplay with traditional markets, while noting that tokenized assets and new products introduce additional risks beyond the asset itself. As Cristina Polizu, Managing Director of S&P Global Ratings, emphasizes, volatility has trended down in the long term, yet remains linked to broader market conditions and carries custodial, smart contract, and operational risks.

Key points

- Volatility Trends: Bitcoin’s price swings are on a long-term downward trend as institutional adoption grows, with increased liquidity from futures and ETFs.

- Bitcoin Hedge Insights: Bitcoin functions more effectively as a hedge against long-term currency debasement than as a hedge against short-term inflation.

- Structural Market Risks: Bitcoin’s trading structure, featuring leveraged perpetual futures markets and automated liquidations, amplifies price volatility compared to other financial assets.

- New Product Risks: Innovations like tokenized bitcoin, ETFs, and Digital Asset Treasury companies introduce extra risks beyond the asset, including counterparty, custodial, smart contract, and operational risks.

Why this matters

This research suggests Bitcoin’s volatility is trending lower over time while its market connections deepen, linking its performance to broader financial conditions. The addition of new products and tokenized offerings can add complexity and risk, influencing how investors assess exposure to digital assets and their role in diversified portfolios.

What to watch next

- Monitor institutional adoption and liquidity trends as futures and ETFs expand.

- Watch developments in tokenized bitcoin and other new-product offerings for risk implications.

- Observe Bitcoin’s price behavior and its relationship to traditional markets as the asset evolves.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

S&P Global Finds Bitcoin’s Evolving Role in Markets

— Bitcoin now accounts for more than half of cryptocurrency markets’ nearly $2.33 trillion capitalization*

— Bitcoin’s price has dropped by nearly half since October 2025

— Price volatility for bitcoin is on a long-term downward trend – though it remains higher than that of traditional assets

NEW YORK (March 5, 2026) – S&P Global today published new research (see report link) examining how bitcoin has evolved from a niche asset to one with meaningful linkages to traditional financial markets.

‘Bitcoin Volatility Trends: A Deep Dive into Market Dynamics and Risk,’ provides a detailed analysis of bitcoin’s market behavior, price patterns, and market trends.

Key findings from the research reveal:

-

- Volatility Trends: Bitcoin’s price swings are on a long-term downward trend as institutional adoption grows, though they remain larger than those of traditional assets. A growing market for bitcoin futures and exchange-traded funds (ETFs) increased bitcoin adoption, which in turn increased liquidity.

- Bitcoin Hedge Insights: The analysis indicates bitcoin functions more effectively as a hedge against long-term currency debasement than as a hedge against short-term inflation.

- Structural Market Risks: Bitcoin’s trading structure, featuring leveraged perpetual futures markets and automated liquidations, amplifies price volatility compared to other financial assets.

- New Product Risks: Innovations like tokenized bitcoin, ETFs, and Digital Asset Treasury companies introduce extra risks beyond the asset, including counterparty, custodial, smart contract, and operational risks.

Cristina Polizu, Managing Director, S&P Global Ratings, said: “Our research indicates that bitcoin’s volatility has trended down over the long term, and that its behavior is increasingly linked to broader market conditions. At the same time, the added complexity of new bitcoin-related products can introduce risks beyond the asset itself, including custodial, smart contract, and operational risks.”

Bitcoin Volatility Trends: A Deep Dive into Market Dynamics and Risk,’ is part of the Look Forward research series, special reports that offer a deep dive into the most important themes, trends, and topics that are transforming the global economy.

S&P Global: Building on Growth in Digital Assets

S&P Global has continued driving growth in Digital Assets markets, underpinned by its leading analyst-driven research and opinions:

Media Contacts

Isabel Allanwood

S&P Global

Russell Gerry

S&P Global Ratings

About S&P Global

S&P Global (NYSE: SPGI) enables businesses, governments, and individuals with trusted data, expertise and technology to make decisions with conviction. We are Advancing Essential Intelligence through world-leading benchmarks, data, and insights that customers need in order to plan confidently, act decisively, and thrive economically in a rapidly changing global landscape.

From helping our customers assess new investments across the capital and commodities markets to guiding them through the energy expansion, acceleration of artificial intelligence, and evolution of public and private markets, we enable the world’s leading organizations to unlock opportunities, solve challenges, and plan for tomorrow – today. Learn more at www.spglobal.com.

Crypto World

Circle Shares Surge as Bernstein Sees Stablecoin Adoption Upside

Circle (CRCL) shares just delivered one of Wall Street’s sharpest equity runs of 2026. The stock closed Tuesday at $118.09, up 5.6% on the session, pushing the company’s market cap to roughly $27.81 billion.

Shares in Circle gained 42% year to date and more than doubled since bottoming near $50 in early February, outrunning an S&P 500 that’s down 1.12% and a Nasdaq 100 that’s down approximately 1% over the same stretch.

Bernstein analysts are staying bullish. The firm reiterated its “Outperform” rating on CRCL and maintained a $190 price target, implying 60% upside from current levels.

The thesis centers on accelerating stablecoin adoption and the regulatory clarity that’s making institutional deployment of digital dollars increasingly viable.

The numbers behind the call are hard to ignore. USDC’s market cap grew 73% to $75.12 billion in 2025, gaining ground on Tether as the dominant dollar-pegged token. Circle reported full-year 2025 revenue of $2.7 billion, up 64% year over year, with Q4 swinging to profitability on BlackRock-managed reserve yields.

The company beat Q4 earnings per share (EPS) estimates of $0.35 by delivering $0.43, triggering a 35% single-day surge on February 25 that marked the start of the current run.

Bernstein’s bullish thesis leans heavily on the GENIUS Act, passed in 2025, which established a federal regulatory framework for stablecoins, setting standards for reserve backing, disclosures, and oversight.

That kind of clarity is what converts institutional interest into institutional allocation. Wall Street’s appetite for regulated crypto exposure has been building steadily, and Circle’s equity is increasingly functioning as a proxy for that demand.

The Levels That Change Everything for Circle (CRCL) Shares

Right now, $120 is the level everyone is watching. CRCL closed just below that mark Tuesday, and clearing it with volume would push the stock into territory last seen during its post-IPO decline from the 2025 highs above $260.

Generally, on the downside, $100 is the floor that matters. It’s a round-number psychological level and sits just below the 100-day moving average zone. If selling pressure returns and CRCL loses $100, the structure weakens quickly, and the February lows near $50 become a real reference point again.

The stock’s RSI had been near oversold territory in early February before the earnings-driven reversal, so a sustained move below $100 would reset sentiment sharply.

The Circle Payment Network is facilitating $3.4 billion in annual transactions, and the company has secured conditional OCC approval for a regulated banking charter.

Those initiatives reduce the revenue concentration risk that spooked investors during 2025’s rate-squeeze period.

Additionally, institutional flows into regulated crypto products have been accelerating broadly, and Circle’s banking ambitions position it to capture more of that pipeline.

What Traders Are Watching Next for CRCL

The immediate catalyst is whether Circle can post back-to-back profitable quarters. One profitable quarter stopped the bleeding; two consecutive quarters would confirm the business model is structurally sound, not just a one-time reserve yield pop.

If USDC continues gaining market share against Tether and interest rates stay supportive of reserve income, Bernstein’s $190 target starts looking less like a stretch and more like a base case.

But if rates compress reserve yields again or USDC growth stalls, the premium priced into CRCL at current levels evaporates fast.

The definitive signal bulls are waiting for is a sustained close above $130 on above-average volume. Until then, the stock is in a confirmed uptrend, but one that still needs to prove it can hold new highs.

Discover: The best crypto to diversify your portfolio with

The post Circle Shares Surge as Bernstein Sees Stablecoin Adoption Upside appeared first on Cryptonews.

Crypto World

Gold Price Analysis: How Iran Conflict and Surging Oil Keep Precious Metal Above $5,000

Key Highlights

- Precious metal slipped 0.1% to approximately $5,187 per ounce Wednesday, maintaining levels well above $5,000

- Escalating oil costs, fueled by Middle East conflict involving the U.S. and Israel, are stoking inflation concerns

- Critical Strait of Hormuz passage has been essentially closed, putting approximately 20% of worldwide oil and gas shipments at risk

- February’s U.S. Consumer Price Index registered 2.4% annually, meeting expectations but covering pre-conflict period

- Financial markets anticipate Federal Reserve will maintain current rates at upcoming March 18 policy meeting

The precious metal market remained relatively stable Wednesday as competing pressures balanced each other out. Spot gold declined a modest 0.1% to approximately $5,187 per ounce, while futures contracts for April delivery fell 0.9% to roughly $5,194.

The yellow metal has experienced significant swings since reaching a near-peak of approximately $5,600 per ounce in the final weeks of January. Despite the subsequent retreat, prices have consistently remained above the $5,000 threshold.

The military confrontation involving the United States, Israel, and Iran reached its twelfth consecutive day Wednesday, with aerial bombardments persisting among all parties involved. President Trump indicated Monday evening that hostilities were nearing conclusion, though actual combat operations demonstrated little evidence of de-escalation.

The ongoing military engagement has virtually closed the Strait of Hormuz, a critical maritime corridor responsible for transporting approximately one-fifth of global petroleum and liquefied natural gas supplies.

Oil prices gained ground Wednesday as traders expressed skepticism about whether the International Energy Agency’s unprecedented reserve release initiative could adequately compensate for potential Middle Eastern supply shortfalls.

Escalating energy costs are elevating inflation projections. This development weighs on gold because it diminishes the probability of Federal Reserve interest rate reductions. Since the precious metal generates no yield, it becomes less appealing when borrowing costs remain elevated or increase.

An appreciating U.S. dollar combined with climbing Treasury yields are applying additional downward force on gold values. A robust dollar increases the cost of gold for international purchasers.

Consumer Price Data Meets Projections

The Labor Department disclosed Wednesday that American consumer prices advanced 2.4% during the twelve-month period ending February, aligning with both the previous month’s figure and expert predictions.

On a monthly basis, prices climbed 0.3%, accelerating from January’s 0.2% gain. Both energy and food expenses registered increases. The core Consumer Price Index, which excludes volatile food and energy components, posted a 2.5% year-over-year reading, matching January’s level.

Nevertheless, the February data predominantly reflects conditions before the Iran confrontation commenced in late February. Market observers anticipate March statistics will reveal a more pronounced inflationary uptick.

Upcoming Fed Meeting and PCE Release

Market participants are currently focused on two crucial forthcoming data releases. The Personal Consumption Expenditures index for January arrives Friday, with forecasters projecting a 3.1% annual rate.

The PCE serves as the Federal Reserve’s primary inflation gauge and has registered higher readings than CPI throughout recent months.

The Federal Reserve’s two-day policy gathering wraps up March 18. Market consensus strongly anticipates officials will keep interest rates unchanged.

Swissquote analyst Carlo Alberto De Casa observed that market participants seem to be expanding their positions in gold as a protective asset amid the continuing Middle East crisis.

Spot gold was quoted at $5,187 per ounce during Wednesday’s European trading session.

Crypto World

ECB Launches Appia Project to Shape Tokenized Markets

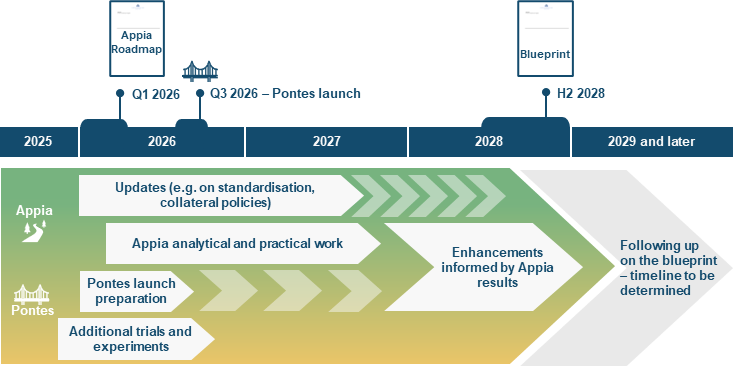

The European Central Bank (ECB) on Wednesday published its Appia roadmap, setting out a long-term plan for building tokenized wholesale financial markets in Europe anchored in central bank money.

The roadmap is built around two linked initiatives. Pontes is the Eurosystem’s distributed ledger technology settlement solution, while Appia is the broader strategic framework for developing a future tokenized financial ecosystem. The ECB said Pontes is scheduled to launch in the third quarter of 2026.

“With Appia, we are building a road from today’s financial system to tomorrow’s tokenized markets, firmly grounded in central bank money,” ECB executive board member Piero Cipollone said.

Pontes is the Eurosystem’s DLT solution, while Appia is a strategic roadmap

Pontes, a key component of the Appia roadmap, introduces the Eurosystem’s distributed ledger technology (DLT) solution, designed to enable central bank money settlement for market transactions through interoperable networks.

The Eurosystem is the monetary authority of the euro area, comprising the ECB and the national central banks of the EU member states that have adopted the euro.

By the end of the third quarter of 2026, Pontes aims to bridge market DLT infrastructures with the Eurosystem’s “TARGET” Services, which stands for Trans-European Automated Real-time Gross settlement Express Transfer system.

TARGET Services are a set of Eurosystem-operated payment and settlement systems that support euro-denominated transactions across Europe. They include three main types: TARGET2 for large-value payments, T2S for securities settlement and TIPS for instant payments.

ECB invites public and private sector stakeholder feedback

Alongside the launch, the ECB opened a public consultation and invited both public- and private-sector participants to comment on the roadmap and express interest in contributing to its implementation.

The consultation is divided into two parts: Part one collects feedback on specific chapters of the roadmap, which may be published with the respondent’s name, while part two allows stakeholders to submit proposals to actively contribute to Appia’s building blocks, with responses treated confidentially.

Related: Tokenized stocks surpass $1B as Ondo, xStocks dominate sector

Responses will help shape the long-term blueprint for Europe’s tokenized financial ecosystem. All feedback must be submitted via the online survey by April 22.

The Appia rollout also comes as the ECB continues work on the digital euro. Earlier this month, the central bank said it planned to begin selecting payment service providers in 2026 ahead of a 12-month pilot scheduled to start in the second half of 2027.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

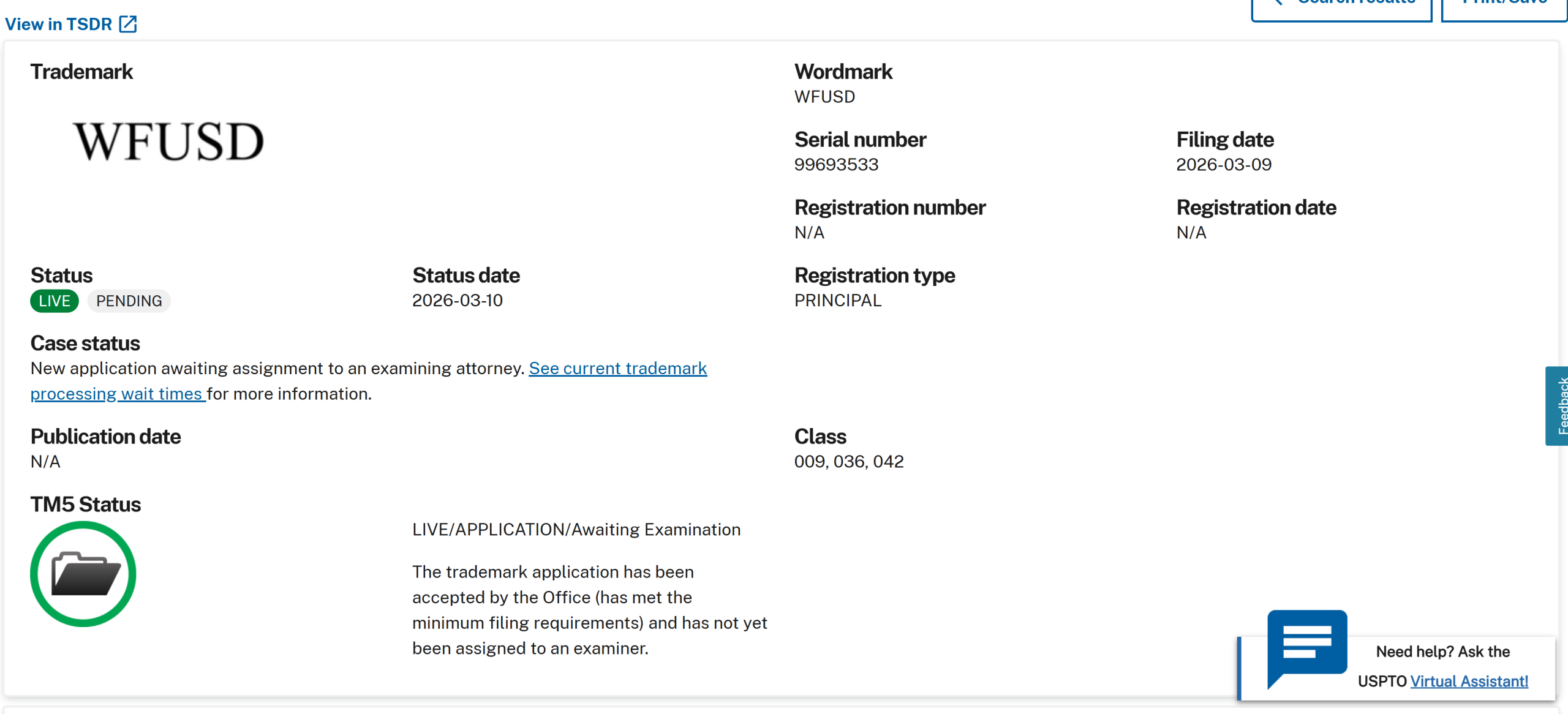

Wells Fargo Files Trademark for ‘WFUSD’ Crypto Services Platform

US banking giant Wells Fargo has filed a trademark application covering a wide range of cryptocurrency trading, payments and blockchain software services.

A filing submitted to the US Patent and Trademark Office (USPTO) on Tuesday seeks protection for the name “WFUSD.” The application is currently awaiting assignment to an examining attorney, according to official trademark records.

The filing outlines a broad list of potential products and services linked to digital assets, including “cryptocurrency trading services; cryptocurrency exchange services; cryptocurrency payment processing; financial brokerage services for cryptocurrency trading; electronic transfer of virtual currencies.”

The trademark also covers software tools designed for blockchain ecosystems. The application lists downloadable software for staking digital assets, accessing non-fungible tokens (NFTs), managing crypto wallets and executing digital asset trades.

Related: Western Union’s ‘WUUSD’ trademark hints at crypto offerings

Wells Fargo filing includes staking and tokenization

Other services mentioned in the filing include cryptocurrency payment processing, electronic transfers of virtual currencies and financial data feeds providing price information to blockchain-based smart contracts.

In addition to trading infrastructure, Wells Fargo’s trademark application references software-as-a-service platforms for tokenizing assets, verifying blockchain transactions and enabling cryptocurrency staking operations. The filing also includes authentication services and blockchain-based data transmission tools used in decentralized applications.

While trademark filings do not guarantee a product launch, companies often use them to secure branding for potential future offerings.

Wells Fargo is a prominent American multinational financial services company and one of the “Big Four” US banks.

Related: South Korean bank stocks surge on stablecoin trademark filings

Banks ramp up stablecoin push

The new trademark filing comes after several major US banks, including JPMorgan, Bank of America, Citigroup and Wells Fargo itself, reportedly discussed a joint stablecoin project in 2025.

Earlier this year, Fidelity Digital Assets also launched the Fidelity Digital Dollar (FIDD), a 1:1 US dollar-pegged, fully collateralized stablecoin on the Ethereum blockchain.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

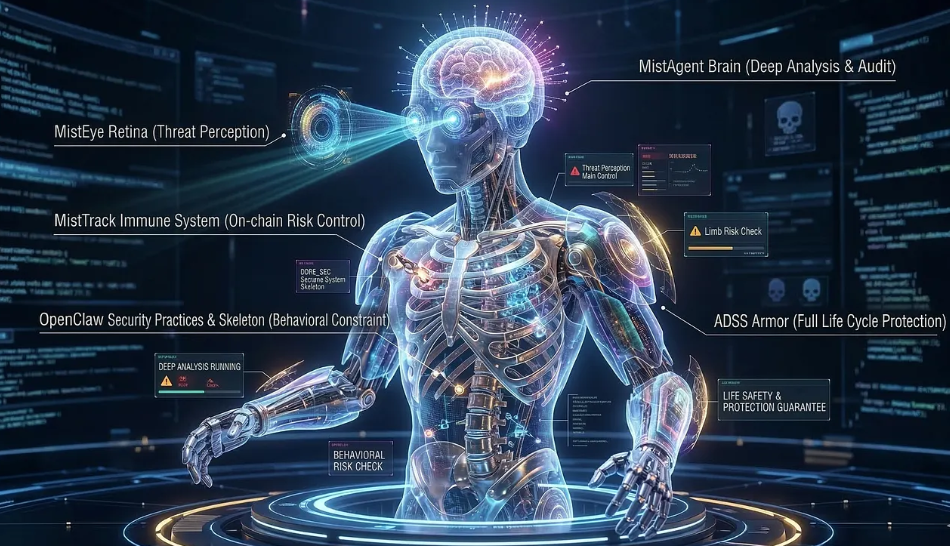

SlowMist Introduces Security Framework for Autonomous AI Agents in Crypto

Cybersecurity company SlowMist has introduced a five-layer security framework for AI and Web3 agents, pitching it as a way to reduce the growing risks that come with autonomous systems handling onchain actions and digital assets.

In a Wednesday blog post, the company said the framework centers on a user’s AI agents and combines governance controls through its AI Development Security Solution, or ADSS, with execution-layer tools including OpenClaw, MistEye Skill, MistTrack Skill and MistAgent. The company said the system is designed to create a closed-loop process of checks before execution, constraints during execution and review afterward.

SlowMist’s so-called “digital fortress” aims to defend against risks including prompt injection, supply chain poisoning attacks, data leaks and asset loss due to unauthorized operations or AI agent behavior exploits. It also seeks to reduce risks without sacrificing AI efficiency.

Autonomos AI agents introduce new attack surface in business operations

The push comes as more crypto firms experiment with autonomous tools for trading and execution, introducing “new attack surfaces,” such as supply chain poisoning, which has become a new entry point for hackers embedding secret backdoors into devices, according to SlowMist.

The framework’s governance layer, ADSS, aims to establish auditable security standards for organizations to prevent these risks. It includes AI agent permission constraints, real-time threat checks for external interactions and strengthened onchain risk detection.

ADDS’ core value lies in improving “scattered security actions” into a systematic operation that is “executable, auditable, and sustainable,” SlowMist said.

Related: OpenAI eyes trillion-dollar IPO amid global AI arms race: Report

Autonomous crypto trading bots on the rise

Crypto companies are launching more autonomous crypto trading bots. On Jan. 21, crypto intelligence platform Nansen launched autonomous crypto trading tools that enabled users to execute trades through AI agents and natural language prompts, with cross-chain execution on the Base and Solana blockchains.

Other companies that launched no-code AI trading agents include Coinbase, Bitget, Walbi and Gate.io. These solutions seek to lower barriers to entry for retail investors through automated strategies and conversational interfaces.

Magazine: Everybody hates GPT-5, AI shows social media can’t be fixed

Crypto World

DOJ investigates Iran’s alleged use of Binance as exchange sues Wall Street Journal

Binance filed a defamation lawsuit against Dow Jones, the publisher of The Wall Street Journal, on the same day the newspaper published a report claiming the U.S. Justice Department is investigating whether Iran used the world’s largest crypto exchange to move funds in violation of American sanctions.

In the complaint filed in the U.S. District Court for the Southern District of New York, the company said the newspaper published “false and defamatory statements” about its compliance practices and handling of Iran-linked transactions in an article published on Feb. 23.

In that article, the Journal said Binance fired staff who flagged funds moving through the exchange to sanctioned entities, allegations Binance rejected. The lawsuit says Binance did not fire employees for raising compliance concerns. Staff departures stemmed from alleged breaches of internal data protection policies rather than retaliation, it said.

“Binance categorically did not dismantle any compliance investigation,” a spokesperson for the exchange told CoinDesk. “The WSJ continues to report the same falsities. As a result, we have filed a lawsuit against the Wall Street Journal for defamation.”

In Wednesday’s story, the Journal said DOJ officials contacted individuals with knowledge of the transactions as they gathered evidence tied to cryptocurrencies that moved through the platform. It cited people familiar with the situation. It is unclear whether the department is examining potential wrongdoing by Binance itself or focusing only on customers who used the exchange, it said.

Binance fires back

In a blog post published Wednesday, the exchange addressed the Journal’s February report point by point. It said the $1.7 billion in flagged funds “did not originate at Binance and did not end at Binance,” passing instead through multiple independent intermediaries, with “the vast majority of funds” having “no confirmed Iranian nexus.”

The newspaper had said internal investigators had flagged crypto transfers from Chinese clients into wallets linked to Iranian financing networks. A large share of the funds, more than $1 billion, allegedly flowed through Blessed Trust, a Hong Kong-based payments company that worked with the exchange.

Binance said its investigators were “granted immediate access” to the Blessed Trust account, which “was repeatedly renewed, as confirmed by system logs.”

It says it identified the suspicious activity through information from law enforcement and its own internal investigation, then reported the activity and removed the accounts involved.

Earlier this month, it told a U.S. Senate investigation it found no evidence that accounts on its platform transacted directly with Iranian entities.

“The truth is that Binance’s investigation continued and uncovered a sophisticated, multi-jurisdictional pattern of financial activity spanning Asia, the Middle East, and beyond,” the spokesperson said. “Binance mapped this complex activity, offboarded the relevant user accounts, and reported to law enforcement.”

The company says it “cooperates fully with law enforcement” and employs more than 1,500 staff in compliance and risk roles, equivalent to around 25% of its global headcount.

Legal spotlight

The suit and probe return Binance to the legal spotlight.

In 2020, it sued Forbes for making false allegations against the company. That suit was dropped several months later.

In 2023, the company pleaded guilty to violating U.S. anti-money laundering and sanctions laws and agreed to pay $4.3 billion in penalties. Founder Changpeng “CZ” Zhao also pleaded guilty to a related charge and served four months in prison before receiving a presidential pardon in October 2025.

As part of the settlement, Binance operates under a U.S.-appointed compliance monitor. That monitor has also requested records related to the Iranian-linked transfers.

UPDATE (March 11, 13:00 UTC): Adds Binance statement, court case details and details from Journal report starting in third paragraph.

Crypto World

Strive (ASST) buys 179 BTC, raises SATA dividend, and purchases $50 million of MSTR’s Stretch

Roughed-up bitcoin treasury company Strive (ASST) announced a number of balance sheet moves on Wednesday.

The company purchased an additional 179 bitcoin, bringing total holdings to 13,311 BTC, worth about $930 million at current prices.

Strive also lifted the dividend on its perpetual preferred security SATA by 25 basis points to 12.75%. SATA was ahead 1.4%, but still trading well below par at $96.22.

The company also announced the purchase $50 million of Strategy’s (MSTR) perpetual preferred stock, STRC, which currently yields 11.5%.

Among a large group of companies quickly formed in 2025 to try and mimic the success of Michael Saylor’s Strategy, Strive has struggled, losing more than 90% of its value since its summer 2025 peak and recently having to undertake a 1:20 reverse stock split to keep its share price above $1.

ASST was higher by 2.2% early Wednesday as bitcoin re-took the $70,000 level.

Crypto World

BTC manages quick gain as oil drops $3 per barrel

After retreating back to the $69,000 area during early U.S. morning hours Wednesday, bitcoin has quickly spiked to nearly $71,000.

Other crypto assets, including ether (ETH), solana (SOL) and XRP, saw the same sharp moves higher.

The gains appeared to come as crude oil quickly reversed most of its session’s large gains, dropping $3 per barrel in a matter of minutes. At press time, WTI crude futures for April were at $85, up 2% for the day.

Crude’s drop also benefited stocks, with the Nasdaq moving from a small decline to a gain of 0.5% in early U.S. trade.

Crypto-related shares were mixed, with Strategy (MSTR), Galaxy Digital (GLXY) and Bullish (BLSH) posting modest advances, while Coinbase (COIN) and eToro (ETOR) were slightly lower.

With the ongoing war against Iran, risk markets this week have been mostly ruled by oil’s price action. Stocks and crypto plunged on Sunday evening as oil surged to $120, but then gained as oil quickly retreated.

Fresh inflation data

Wednesday’s February CPI report was in line with economist forecasts, up 0.3% on a month-to-month basis, putting the 12-month inflation rate at 2.4%. Next month, however, could show a much different picture due to the outbreak of the U.S.-Iran war, posing the question of whether the Federal Reserve will respond to the temporary shock or take a more hawkish stance after being caught off guard during the last inflation cycle.

Stephen Coltman, head of macro at 21shares says the Fed’s choice will be critical, noting that investors will be watching next week’s Fed meeting closely for signs on how officials plan to react.

As for bitcoin, the rise in next month’s data is likely “already baked in the cake,” he said.

Crypto World

Arthur Hayes Deploys Net Liquidity Strategy: Not Buying BTC Now Even If He Has Only $1

Arthur Hayes has officially stopped buying Bitcoin ($BTC). The BitMEX co-founder says he will not deploy fresh capital until the Federal Reserve explicitly expands the money supply.

With Bitcoin struggling to break resistance, Hayes is tracking a specific “Net Liquidity” metric that suggests the current rally lacks fundamental fuel.

He is waiting for the centralized banking cartel to restart the money printer before chasing the market any higher.

Discover: The best pre-launch crypto sales

Why Arthur Hayes Is Slamming the Brakes on Bitcoin

Hayes’s hesitation stems from his Net Liquidity framework, a formula that subtracts the Treasury General Account (TGA) and Reverse Repo (RRP) balances from the Fed’s total balance sheet.

While nominal prices are high, real dollar liquidity has not expanded enough to support a sustained breakout above $90,000. Hayes views the current market as a trap for traders expecting a straight line up.

“If I had $1 to invest right now, would I be putting it into Bitcoin? No. I would wait,” Hayes said on a podcast. He argues that while geopolitical tensions usually drive safe-haven assets, the only thing that truly matters for Macro Crypto cycles is fiat debasement.

This thesis is reinforced by market data showing Bitcoin decoupling from traditional bond yields, a divergence that historically signals impending volatility.

Hayes warns that without an immediate pivot back to Quantitative Easing, the “American war machine” alone cannot sustain asset prices. He believes the market is pricing in liquidity that hasn’t arrived yet. If the Fed refuses to loosen its monetary policy, Hayes predicts the current chop could move downwards.

He is positioning for a scenario where the TGA drains slowly, leaving risk assets starved for capital in the short term. Only when the printing press whirs to life will the Net Liquidity conditions turn green for aggressive accumulation.

The Levels to Watch for Bitcoin

Bitcoin Price Analysis currently shows a market caught between institutional accumulation and macro exhaustion. Bitcoin is trading under the $90,000 psychological ceiling, a level that has rejected bulls multiple times. Hayes suggests that a failure here could trigger a slide toward $60,000, flushing out late longs.

$60,000 is the level that matters most. If price action breaks below this support, Hayes anticipates a “massive sell-off” driven by cascading liquidations. Concurrently, Wall Street is buying Bitcoin strategically but is not yet invested enough to chase breakouts unconditionally.

Conversely, the bull case requires a definitive reclaim of $90,000 on high volume. If spot buyers can push through this resistance, the path to $100,000 opens up quickly, invalidating the bearish liquidity thesis.

Traders looking for confirmation might look at simple math that nailed the last BTC bottom to identify safe entry points if Hayes’ predicted dip materializes.

If Net Liquidity remains flat, Bitcoin likely ranges sideways or bleeds slowly. But if the Fed is forced to cut rates due to external shocks, the $90,000 cap will likely shatter overnight.

Discover: The best new cryptocurrencies

The post Arthur Hayes Deploys Net Liquidity Strategy: Not Buying BTC Now Even If He Has Only $1 appeared first on Cryptonews.

-

Business5 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

News Videos2 days ago

News Videos2 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Ann Taylor

-

Crypto World2 days ago

Crypto World2 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech8 hours ago

Tech8 hours agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Sports6 days ago

Sports6 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics5 days ago

Politics5 days agoTop Mamdani aide takes progressive project to the UK

-

Sports4 days ago

Sports4 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business23 hours ago

Business23 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Entertainment5 days ago

Entertainment5 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

NewsBeat6 days ago

NewsBeat6 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business3 days ago

Business3 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business8 hours ago

Business8 hours agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat2 days ago

NewsBeat2 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech2 days ago

Tech2 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Entertainment7 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Crypto World7 days ago

Crypto World7 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview