Crypto World

Cardano price gets oversold, crashes to key suppport level

The Cardano price continued its strong downward trend, reaching its lowest level since October 2023, making it one of the crypto industry’s top laggards.

Summary

- Cardano price dropped to a crucial support level this week.

- The developers are working on Pentad, which aims to grow the ecosystem.

- The coin has become highly oversold, with the RSI moving to 28.

Cardano (ADA), a top layer-1 network, slipped to $0.2640, down over 80% from its December 2024 peak and 91% below its all-time high of $3 in 2021.

ADA extended its sharp decline despite several major catalysts, including this week’s CME futures launch and the upcoming Midnight mainnet debut. The futuress product made it available to American retail and institutional investors.

Midnight, its upcoming zero-knowledge sidechain, is expected to launch either later this month or in March. Data shows that its testnet continues to perform well, having handled over 185,000 blocks and 295 million slots. NIGHT, its native token, has achieved a market capitalization of over $800 million.

Cardano’s developers are working to fix the network and attract more creators. They are working on the Leios upgrade, which will make it a faster network than many popular chains.

At the same time, they are implementing the Pentad program, which aims to attract more oracle network, tier-1 stablecoins like USDT and USDC, and analytics tools. It has already attracted Pyth Network, a top oracle network, and Dune, a popular analytics tool.

Therefore, Cardano price is falling because of the ongoing crypto market crash, which has affected Bitcoin and most altcoins.

Cardano price prediction: technical analysis

The weekly timeframe chart shows that ADA token has continued falling in the past few months. It has slumped from a high of $1.3230 in December 2024 to the current $0.2638.

The coin has dropped below the 50-week Exponential Moving Average, a sign that bears remain in control. Also, Cardano token has settled at the key support at $0.2212, the neckline of the head-and-shoulders pattern.

ADA has become oversold, with the Relative Strength Index at 28, the oversold level. The Stochastic Oscillator has also moved below the oversold line.

Therefore, the coin may rebound in the coming days, potentially to the psychological level of $0.50. However, a drop below the current support level at $0.2212 will confirm more downside, potentially to $0.15.

Crypto World

AI agents choosing denationalized money

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Sylvia To on AI agents choosing denationalized money

- Top headlines institutions should pay attention to by Francisco Rodrigues

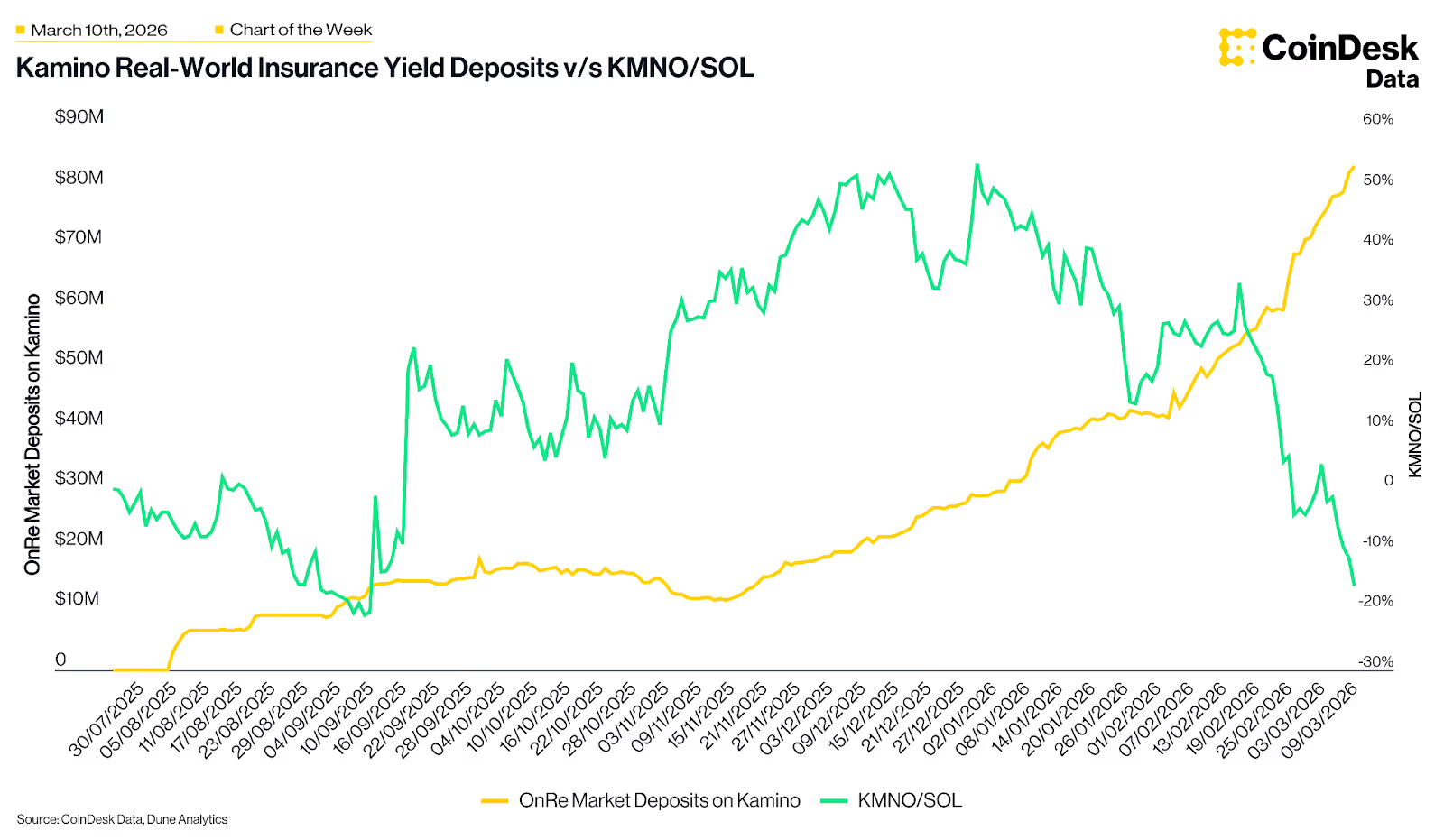

- Kamino hits $90M in OnRe liquidity while $KMNO drops 16% in Chart of the Week

Thanks for joining us!

Expert Insights

Hayek predicted it, Satoshi built it, agents will use it: the stealth denationalization of money

– By Sylvia To, vice president, Bullish Capital Management

While F.A Hayek, Satoshi and AI may seem like three unrelated topics, the next few minutes will reveal exactly how critical this triad is to our financial sovereignty and it will fundamentally change your view on money as we know it.

Crypto’s cypherpunk ethos

Amid flashy distractions of memecoins, speculation and NFTs, Satoshi would want us to remember the true ethos of crypto, that is: privacy, decentralization and censorship resistance. These ideologies did not come from central banks or policy makers. They came from the cypherpunk’s definition that freedom is best defended not by persuasion but by architecture.

As Vitalik Buterin recently articulated in his March 2026 thread on X, this means building “sanctuary technologies” that create “shared digital space with no owner,” enabling “interdependence that cannot be weaponized” and advancing “de-totalization” to prevent total control by any power.

Money should be a product, not a decree

In 1976, Hayek argued that money should not be “legal tender” forced on people by the state. It should be discovered, adopted and discarded through market choice like any other product. His book Denationalisation of Money outlined these characteristics of “good money”:

• Non-state issuance: not decreed, not voted, not bail-out-able.

• Rule-based monetary policy: predictable supply schedule, not discretionary.

• Global choice: adoption is voluntary; anyone can opt in or out.

• Resistance to capture: no central issuer to pressure, no board to replace.

• Settlement without permission: value transfer doesn’t require institutional approval.

Sound familiar? Yes, Bitcoin.

Bitcoin sits in a special category inside that experiment. Not because it’s perfect today, but because it is plausibly the first monetary network to meet Hayek’s central requirement. That is money introduced by some pathway that cannot easily be stopped. As Bitcoin undergoes price discovery, its volatility is the cost of birth and the market deciding what an ungoverned, credibly scarce asset is worth in a world trained for fiat. But even in that turbulent phase, Bitcoin checks a surprising number of Hayek’s boxes.

The trojan horse: stablecoins and the trap inside it

If we’re honest, stablecoins are currently one of crypto’s most successful use cases. They are fast, programmable and easy to price. They move across borders with far less friction than bank wires.

But here’s the uncomfortable truth: stablecoins don’t denationalize money. They digitize the existing national money and extend its reach. Most stablecoins do not compete with the dollar. They import the dollar.

The dollar is a tool of state policy. Pegging to it ties you to its inflation, its surveillance, its sanction regime, its banking chokepoints and its regulatory priorities. Stablecoins may feel like freedom because they move on open networks, but their reference asset is still the same old sovereign instrument.

So while stablecoins can be useful, they also risk becoming the perfect bridge into tighter control. In that sense, stablecoins are not neutral. They are a competitor to decentralized currencies. If bitcoin is denationalization, stablecoins are nationalization with better UI.

The real end user

Here’s where the story gets more interesting and more Hayekian.

Humans are emotional, irrational, politically driven and short-term oriented. Our monetary systems reflect that. We routinely trade long-term stability for short-term relief, then act surprised when crises compound.

But what happens when most of the participants in the economy aren’t humans?

With the meteoric rise of agentic software, and apps increasingly being designed for agents using frameworks like Model Context Protocol (MCP), there is a credible near-term future where autonomous agents purchase services, data, compute, API calls, storage, inference and specialized tools through continuous micropayments.

Agents will care less about branding and narratives and more about properties like:

• machine-readable transaction metadata

• instant, programmable finality

• composability with other systems

• low transaction overhead

• censorship resistance (because uptime is a feature)

• predictable monetary rules (because models optimize against them)

In other words: agents will gravitate toward money that behaves like good infrastructure. A stablecoin is stable because an issuer maintains a peg. An agent might ask: What is the failure mode of the issuer? What is the policy risk? What is the censorship risk? What is the settlement risk under stress? Bitcoin’s value may fluctuate, but its rule set is unusually legible. Its issuance is not negotiated. Its core properties do not depend on a board decision, a regulator’s discretion or the solvency of a nation.

Maybe humans won’t choose the best money because we’re too entangled in politics, habit and fear.

Maybe Hayek’s “new money” was never meant for humans — at least not first.

Maybe the pathway that governments “can’t stop” isn’t a mass political movement.

Maybe it’s AI agents who operate at machine speed, indifferent to national identity, optimizing for reliability, who can be the deciders of the new monetary rails.

When that tipping point arrives, denationalization of money won’t feel like a philosophical triumph. It will be an inevitable engineering outcome, propelled not by ideology, but by raw machine necessity.

When that tipping point arrives, denationalization of money won’t feel like a philosophical triumph. It will be an inevitable engineering outcome, propelled not by ideology, but by raw machine necessity.

Headlines of the Week

– By Francisco Rodrigues

Traditional finance giants, including the owner of the NYSE, ICE, and Morgan Stanley, have kept on making strategic moves in the crypto space, while regulatory milestones like Kraken securing Fed access signal the industry’s path toward mainstream integration.

- NYSE owner invests in crypto exchange OKX at $25 billion valuation: Intercontinental Exchange, the parent company of the New York Stock Exchange, acquired a minority stake in crypto exchange OKX, valuing the firm at $25 billion. ICE will license OKX’s spot crypto prices to launch crypto futures, while OKX will offer ICE futures and tokenized equities to its customers.

- Morgan Stanley names Coinbase and BNY as custodians in proposed bitcoin ETF filing: The Wall Street giant updated its S-1 filing for a proposed spot bitcoin ETF, designating BNY as administrator and cash custodian and Coinbase Custody as the crypto custodian.

- Kraken becomes first crypto company to secure Fed master account access: The approval lets Kraken speed up deposits and withdrawals for large traders and institutional clients, but is limited, with Kraken not earning interest on reserves or accessing the Fed’s emergency lending.

- Kazakhstan central bank to invest $350 million worth of gold, forex reserves into digital assets: The strategy will focus on shares of high-tech and cryptocurrency infrastructure companies, as well as crypto-linked index funds.

- Billions in crypto are moving in Iran. Analysts can’t agree if it’s war-time panic or business as usual: When airstrikes hit Iran on Feb. 28, crypto outflows from Nobitex spiked 873%, suggesting a “digital bank run” was ongoing. The reality may be more complex.

Chart of the Week

Kamino hits $90M in OnRe liquidity while $KMNO drops 16%

Kamino’s OnRe market has increased 80% to nearly $90M in 30 days, cementing its position as the primary liquidity layer for OnRe’s on-chain reinsurance protocol. This growth allows users to bet on a $480B+ real-world vertical by using $ONyc- a tokenized insurance asset – as collateral.

However, this fundamental RWA scaling sharply diverges from the native $KMNO token; the KMNO/SOL pair has dropped 16% over six months, pressured by a broader market downturn and 13M monthly token unlocks (0.13% of total supply).

Listen. Read. Watch. Engage.

Looking for more? Receive the latest crypto news from coindesk.com and explore our robust Data & Indices offerings by visiting coindesk.com/institutions.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc., CoinDesk Indices or its owners and affiliates.

Crypto World

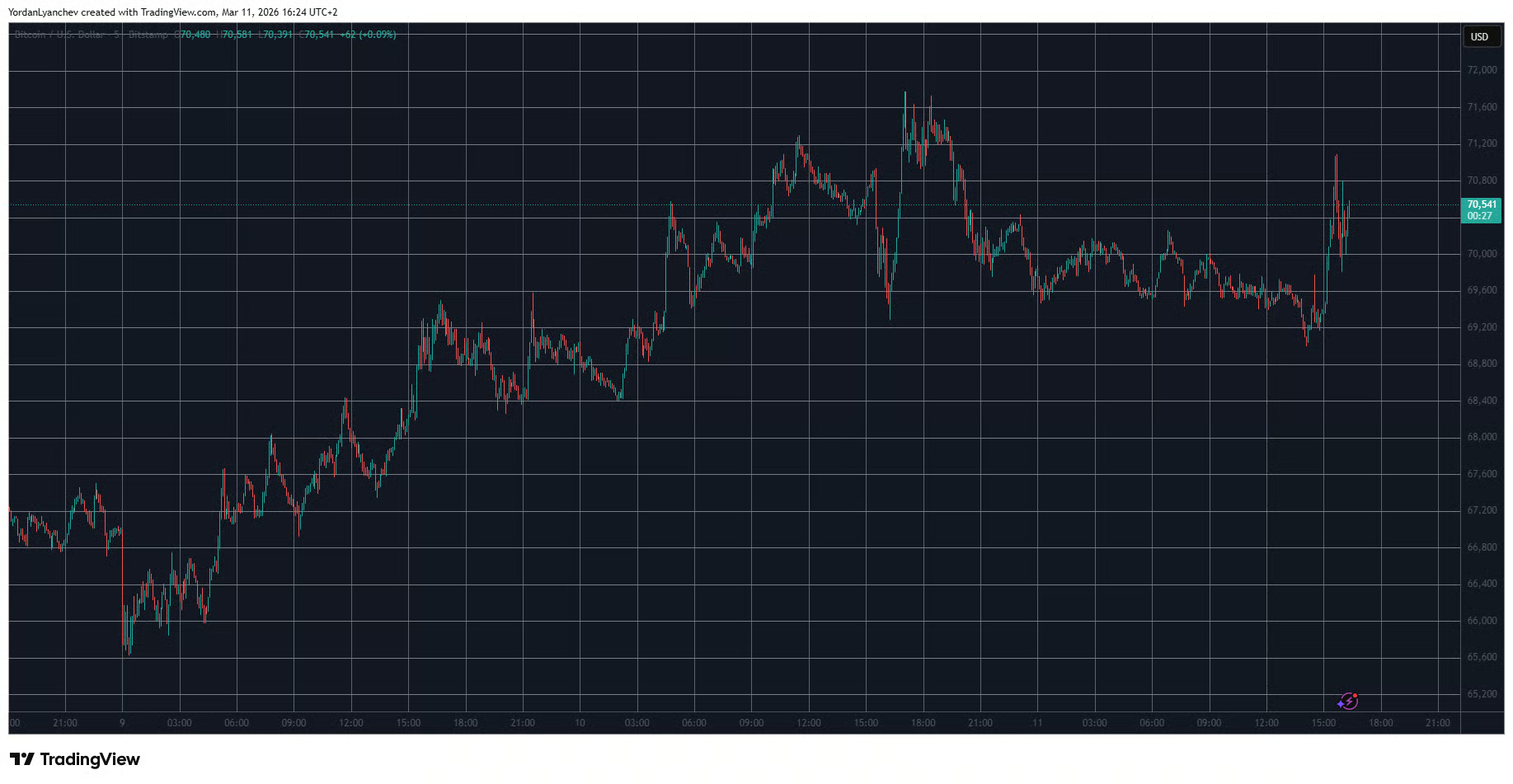

Bitcoin Whipsaws Around $70K as Trump Says There’s ‘Nothing Left’ to Hit in Iran

The other reason behind BTC’s latest volatile session could be linked to the recently released CPI numbers for February.

US President Donald Trump continues to comment on the quickly escalating tension in the Middle East, suggesting once again that the war could be over soon.

Bitcoin’s price experienced immediate volatility after his remarks became viral on social media.

TRUMP SAYS ‘NOTHING LEFT TO TARGET’ IN IRAN WAR

Donald Trump told Axios the conflict with Iran will end “soon” because there is “practically nothing left to target.” He added, “Any time I want it to end, it will end.”

U.S. and Israeli officials, however, plan at least two more…

— *Walter Bloomberg (@DeItaone) March 11, 2026

This is Trump’s second similar claim in the past few days, after he noted on Monday that the war “is very complete, pretty much.” However, his statements are not supported by some country officials as well as its partner in this case, Israel.

Walter Bloomberg’s report indicated that the two countries plan “at least two more weeks of strikes.” Additionally, the situation lastly escalated after the US started reporting that Iran had put mines in the Strait of Hormuz.

The US military has destroyed at least 16 mine-laying boats in the region, but officials have asserted that “it’s unclear how many mines Iran has deployed.”

Bitcoin traded at $69,200 before Trump’s statement went live, but skyrocketed by almost two grand instantly. Although it was stopped at $71,100, it still trades above $70,000 as of press time.

You may also like:

There’s another possible reason behind BTC’s volatility. As reported a few hours ago, the US CPI data for February was released, and it matched expectations. However, bitcoin remained relatively calm in the first 90 minutes after the news went live, so Trump’s remarks on the war seem to have a more profound impact.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Wells Fargo files WFUSD trademark for crypto services

TLDR

- Wells Fargo filed a U.S. trademark application for the wordmark WFUSD on March 9.

- The USPTO lists the application as live and pending review.

- The filing covers software for digital asset trading, payments, and wallet services.

- It also includes cryptocurrency exchange services and financial data processing.

- The application references tokenization and blockchain-based trading infrastructure.

Wells Fargo & Company has filed a U.S. trademark application for the wordmark “WFUSD.” The filing covers software, trading, payments, and tokenization services tied to digital assets. The United States Patent and Trademark Office lists the application as live and pending.

Wells Fargo Moves to Secure ‘WFUSD’ Trademark

Wells Fargo & Company submitted the trademark application on March 9, according to USPTO records. The filing appeared publicly on the USPTO site early Wednesday. The agency confirmed the application met minimum filing requirements. However, it has not yet assigned an examining attorney.

The application spans three international classes that cover digital asset services. Class 009 includes downloadable software for digital asset trading, payments, and wallet functions. Class 036 covers cryptocurrency trading and exchange services and financial information processing. Class 042 includes software-as-a-service for tokenizing assets and operating blockchain trading infrastructure.

The filing also references software used to process stablecoin transactions. The name “WFUSD” resembles ticker symbols for U.S. dollar-pegged stablecoins. However, Wells Fargo has not issued any public statement about the application.

Filing Aligns with Wells Fargo’s Prior Crypto Activity

Wells Fargo has backed digital asset infrastructure firms in recent years. In February 2020, Wells Fargo Strategic Capital invested $5 million in Elliptic. The blockchain analytics firm counts SBI Holdings and Santander InnoVentures among its investors.

In May 2022, the bank joined a $105 million Series B round for Talos. Citigroup, BNY, and DRW also participated in that funding round. The investment valued Talos at $1.25 billion.

The trademark filing follows commentary from the Wells Fargo Investment Institute. In March 2025, the institute stated that digital assets have “evolved into a viable investment asset.” The report classified digital assets as “part of real assets within an asset-allocation framework.”

The institute also described digital assets as “potential portfolio diversifiers.” The report cited low five- and ten-year correlations with traditional asset classes. It framed digital assets within a broader allocation strategy.

Wells Fargo reported net income of $5.36 billion for the fourth quarter of 2025. The bank posted $1.62 per diluted share during that period. In the same quarter a year earlier, it reported $5.08 billion, or $1.43 per share.

Wells Fargo manages approximately $2.1 trillion in assets. The USPTO currently lists the “WFUSD” application as live and pending. The agency has not yet assigned the filing to an examining attorney.

Crypto World

Hollywood Star-Turned-Skeptic Releases Trailer for Anti-Crypto Doc

Ben McKenzie’s film, “Everyone Is Lying to You for Money” touts interviews with former FTX CEO Sam Bankman-Fried on his political donations.

Ben McKenzie, a Hollywood actor known for his roles on television shows including Gotham and The OC, has released the trailer for a documentary about cryptocurrency featuring interviews with actors and former executives at once-prominent trading platforms.

Released by international sales agency and distributor The Forge on Tuesday, the trailer for the documentary, titled “Everyone Is Lying to You for Money,” showed McKenzie saying cryptocurrency was “pretty stupid” and the actor’s journey to advocating against the industry. The film features footage from 2022 of former FTX CEO Sam “SBF” Bankman-Fried and former Celsius CEO Alex Mashinsky before their respective companies collapsed, as well as interviews with celebrities including Morena Baccarin and Gerard Butler.

The trailer shows McKenzie directly asking SBF how much he had donated to politicians; it lists among its cast El Salvador’s President Nayib Bukele, who advocated for the country to adopt Bitcoin (BTC) as legal tender in 2021. Notably, Butler said in an interview with McKenzie that he had “made a ton of money” investing in crypto but didn’t “actually know anything about it.”

McKenzie shifted from working in Hollywood to speaking out against issues in the crypto industry after learning about the technology in 2020. After the collapse of FTX in 2022, he testified at a US Senate hearing investigating the downfall of the exchange, calling the industry “the largest Ponzi scheme in history.”

Related: Ex-SafeMoon chief sentenced to more than 8 years over $9M investor fraud

Cointelegraph reached out to the filmmakers for comment on the content of the interviews with SBF and Bukele but had not received a response at the time of publication.

Bankman-Fried still exploring a potential presidential pardon or appeal

The former FTX CEO is serving a 25-year sentence in US federal prison following his 2023 conviction on seven felony counts related to the misuse of customer funds at the exchange. However, Bankman-Fried has two potential paths to early release.

Shortly after his 2024 sentencing, SBF’s lawyers filed an appeal to overturn the conviction and sentence. The Second Circuit Court of Appeals had not released any decision as of Wednesday.

In addition, Bankman-Fried has been lobbying US President Donald Trump through social media posts praising his actions, often on matters unrelated to crypto. However, Trump said in a January interview that he was not considering a pardon for the former CEO.

Magazine: All 21 million Bitcoin is at risk from quantum computers

Crypto World

Crypto News Today: Bhutan Shifts $11.8M BTC to New Wallet While DeepSnitch AI, Zcash, and Dash Flash the Best Setups in Today’s Market

As per the crypto news today, Blockchain analytics platform Arkham flagged Bhutan shifting 175 BTC worth $11.85 million from its main national holding address to a fresh wallet that was created only a month ago and had already received 184 BTC from the government before today’s move.

That kind of structural buying at the macro level does not stay isolated at the Bitcoin layer for long. It filters down into the highest conviction plays sitting below it, and the presales like DeepSnitch AI with working utility and exchange listings still ahead are historically the first place that rotating capital lands when the market is in absorption mode like this.

Bhutan’s $11.8M BTC move can be a bull run loading signal?

Today, Bhutan sits at around 5,600 BTC, ranked the 5th largest among nation-state holders globally. Arkham pointed out on X that the last time Bhutan executed a similar transfer in February, it sold $7 million worth of Bitcoin directly with QCP Capital, and historical patterns show the kingdom sells in consistent clips of $5 to $10 million with its heaviest activity running through mid-to-late September 2025.

This does not look like panic selling. Bhutan appears to be running a structured government-level selling strategy, offloading Bitcoin at prices far above its mining costs while the market steadily absorbs the supply.

For traders watching the tape, that is actually a bullish signal. It shows that real demand is strong enough to absorb nation-state selling, and the traders already positioned in the right coins are usually the ones who benefit when the next rotation across the market begins.

Top three coins to watch in today’s market

1. DeepSnitch AI (DSNT)

The craziest crypto news in the presale market right now is that DeepSnitch AI is closing its presale on March 31, with the current entry sitting at $0.04399 per $DSNT while demand continues to push the price higher.

You can already open the platform and use five AI tools built to give you a real trading edge in a market where speed and information decide who wins. Just buy $DSNT and run SnitchGPT for market analysis, scan contracts with AuditSnitch, and track whale wallets with SnitchFeed before the crowd catches on. Every tool is live, in a unified dashboard, and designed to help you make smarter trades right now.

The latest crypto news today for presale hunters is that Uniswap is the first listing milestone, and rumored tier-1 and tier-2 CEX listings follow in Q2, meaning the traders who are in at $0.04399 right now are positioned ahead of every demand wave that exchange listings are going to bring.

It is currently running a 150% bonus exclusively for entries of $10,000 or more on top of the already low presale price of $0.04399.

Run the math on a $10,000 entry at $0.04399 with the 150% bonus applied, and you are looking at roughly 568,000 $DSNT tokens. Now think about what happens if $DSNT reaches $30 post-launch. It sounds crazy at first, but remember how RENDER ran from under $1 to about $13.60 in one cycle on the decentralized GPU narrative. Or how TAO jumped from under $50 to over $700 simply on the decentralized AI infrastructure story.

DeepSnitch AI is not asking you to trust a narrative without a product behind it because five live AI tools are already generating real daily users, the smart contract has been independently verified by both Coinsult and SolidProof, and tier-1 exchange listings may be coming in Q2.

At $30 per DSNT, a 568,000 token bag becomes about $17 million.

2. Zcash (ZEC)

The breaking crypto news on Zcash this week is that the Zcash Open Development Lab just raised $25 million from Paradigm, a16z crypto, and Coinbase Ventures in one of the most significant privacy coin funding rounds of the cycle, sending ZEC spiking 10.9% on the announcement alone.

ZEC is trading around $223 as of March 10, still miles below its $2,034 all time high from 2016, which is why a lot of traders see a solid recovery play here. If the privacy coin narrative comes back strong, the upside math from these levels starts looking pretty interesting.

Some analysts are putting ZEC’s 2026 range between $480 and $850 if institutional interest in privacy infrastructure keeps building after the latest funding news. ZEC is a strong cycle hold with real money backing it, but at a $3.7 billion market cap, it is not the ground-floor entry that the $DSNT presale still offers at $0.04399.

3. Dash (DASH)

The cryptocurrency news update on Dash is moving fast in March 2026, and traders who have been sleeping on this one are going to feel it if the momentum holds.

On March 4 this week, Dash went live on NEAR Intents via a dedicated contract that now enables swaps across more than 35 blockchains, which is a meaningful DeFi expansion for a coin whose narrative has historically been limited to payments.

DASH is currently trading around $33 on March 10. Analysts are placing the 2026 range between $400 and $1,200 if the privacy coin rotation that already lifted XMR extends to the rest of the sector.

Final thoughts

ZEC and DASH are both worth holding this cycle. Neither of them offers the ground-floor entry math that $DSNT still has available right now.

DeepSnitch AI is sitting at $0.04399 in presale with five working AI tools, over $2M raised, and a March 31 deadline that does not come back once it passes. The latest crypto news today for traders who want the highest conviction play before the market fully reprices is still the $DSNT presale entry that turns $10,000 into a whopping $17 million when the exchange listing hits.

Visit the official presale website and load your bags before the tier-1 exchange listing send this to the moon. Join X and Telegram for the latest updates before the presale closes.

FAQs

What does today’s breaking crypto news about Bhutan selling BTC actually mean for traders trying to time the market right now?

When a nation-state is selling Bitcoin in $5 to $10M clips, and the market holds above $70K, that is breaking crypto news, confirming demand is absorbing supply with ease. Rotate into the best crypto presale setups like DeepSnitch AI before the recovery fully prints.

Is Zcash the best privacy coin to hold based on the latest crypto news today, after the $25M Paradigm and a16z funding round?

ZEC picking up $25M from Paradigm, a16z, and Coinbase Ventures is some of the most bullish latest crypto news today for the privacy sector. It’s a solid cycle hold, but DeepSnitch AI at $0.04399 still beats it on entry price and upside math.

What is the most important cryptocurrency news update traders should act on before the end of March?

The most urgent cryptocurrency news update on any serious trader’s radar right now is the DeepSnitch AI presale closing March 31 at $0.04399. It has five live AI tools, $2M raised, and 500x potential.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Binance Sues Wall Street Journal Over Iran Report

TLDR

- Binance filed a defamation lawsuit against Dow Jones in a federal court in New York.

- The lawsuit targets a February 23 report published by The Wall Street Journal.

- The report alleged that Iranian entities may have used Binance to evade U.S. sanctions.

- Binance denied the allegations and called the claims false and defamatory.

- The exchange stated that it provided factual corrections before the article was published.

Binance has filed a defamation lawsuit against The Wall Street Journal in federal court in New York. The exchange sued Dow Jones after a report linked its platform to Iranian sanctions evasion. The filing comes days after a U.S. judge dismissed a separate case tied to alleged terror financing claims.

The complaint targets an article published on February 23 that cited a Justice Department probe. Binance claims the report contains false statements about its compliance controls. The exchange seeks compensatory damages, legal fees, and a jury trial.

Binance Challenges Report Over Iran Sanctions Claims

Binance filed the lawsuit in the United States District Court for the Southern District of New York. The company named Dow Jones, the publisher of The Wall Street Journal, is the defendant. The action followed a report that questioned whether Iranian entities used Binance to bypass sanctions.

The article stated that the U.S. Justice Department had begun examining Iran’s use of the exchange. It cited concerns from investigators and lawmakers about possible sanctions violations. Binance rejected the claims and said the publication misrepresented its compliance framework.

An American reporter, Eleanor Terrett, disclosed details of the filing on March 11. She reported that Binance acted after the outlet published the February story. The lawsuit marks a direct legal response to the allegations.

Binance Seeks Jury Trial and Damages

In the complaint, Binance argued that the article included “false and defamatory” statements. The company stated that those claims harmed its reputation and business interests. It also asserted that it had provided factual corrections before publication.

Binance claimed that The Wall Street Journal ignored those corrections and proceeded with the story. The exchange stated that it maintains strict anti-money laundering and sanctions compliance procedures. It denied facilitating transactions for sanctioned Iranian entities.

The lawsuit requests compensatory damages, though Binance has not disclosed the dollar amount. It also seeks recovery of legal fees and related costs. The company demanded a jury trial to resolve the dispute.

The filing follows a recent legal development involving Binance in another federal case. A U.S. judge dismissed allegations tied to an alleged terror financing matter. That dismissal cleared the exchange of those specific claims.

Binance now faces a new legal battle centered on defamation. The case will proceed in federal court in New York. Court records show that the complaint was filed on Wednesday, March 11.

Crypto World

Stablecoins won’t get any kind of deposit insurance under GENIUS rules, says FDIC chief

Stablecoin users won’t benefit from any government guarantee of their money when the new U.S. law is implemented to govern these tokens, said Federal Deposit Insurance Corp. (FDIC) Chairman Travis Hill.

He also specified that the ban will include protections known as “pass-through insurance” in which financial firms obtain the government protections on behalf of customers.

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act that’s being implemented now by U.S. markets and banking regulators included a ban on FDIC insurance for holdings of stablecoins, the tokens such as Circle’s USDC and Tether’s USDT that are designed to maintain the value of a U.S. dollar. That’s meant to distinguish them from bank deposits, which are guaranteed up to $250,000 by the U.S. backstop.

“The FDIC is planning to propose that payment stablecoins subject to the GENIUS Act are not eligible for pass-through insurance,” Hill told an audience Wednesday at an American Bankers Association summit in Washington. Though he said the GENIUS Act didn’t explicitly block those relationship, Hill said such a prohibition seems to follow the intent of the law.

“It is difficult to estimate the extent to which stablecoin arrangements would qualify for pass-through insurance if they were eligible,” he said. “For example, current pass-through insurance rules require that the identities and interests of end-customers must be ascertainable in the regular course, which is not a common feature of large stablecoin arrangements today.”

While stablecoins won’t get the FDIC insurance that’s buttressed American’s bank accounts for generations, the law mandates that they be fully reserved, so they’ll be protected by the issuers’ own safety net.

Protecting banks

Treating stablecoin holdings distinctly from bank deposits is a highly relevant arena of regulatory discussion, because the banking industry had halted progress on the crypto industry’s Digital Asset Market Clarity Act over whether stablecoins could be associated with yield.

Bankers have argued that such an arrangement could poison their relationship with depositors, which is at the core of that industry’s business model in which deposited funds fuel lending. Jefferies analysts even said this week that the boom in stablecoin could translate into 3% to 5% core deposit runoff over the next five years from banks, eating into their profits.

But White House crypto adviser Patrick Witt has maintained a drumbeat in posts on the social media platform X that the Clarity Act objections are unfounded attempts to derail an important bill.

“The CLARITY Act must remain a pro-innovation piece of legislation,” he said in his most recent post on Tuesday night. “Attempts to hijack the legislative process and turn it into an anti-competition bill are shameful.”

Hill addressed the argument that customers may move their money out of banks and into stablecoins to chase higher rewards, contending that “a customer moving funds from a bank account into a stablecoin generally does not remove the funds from the aggregate banking system, but this would have impacts on the nature and distribution of deposits across the system.”

The FDIC chief also said his agency is weighing another position that the GENIUS Act didn’t address: tokenized deposits. Those are bank deposits represented as a programmable token on a blockchain. He suggested that such deposits probably need to be considered as deposits under the law, “regardless of the technology or recordkeeping utilized, and thus tokenized deposits should be eligible for the same regulatory and deposit insurance treatment as non-tokenized deposits.”

Read More: U.S. FDIC proposes first U.S. stablecoin rule to emerge from GENIUS Act

Crypto World

Binance Sues WSJ for Defamation as DOJ Opens Iran Sanctions Probe

The exchange’s lawsuit was filed the same morning the Journal reported a new federal investigation into whether Iran used Binance to evade U.S. sanctions.

Binance, the world’s largest crypto exchange, has filed a lawsuit against Dow Jones, publisher of The Wall Street Journal, over a February 23 article that the company calls “false and defamatory.”

The filing comes as the Journal further reported today that the U.S. Department of Justice is investigating whether Iranian networks used the exchange to move funds in violation of American sanctions.

“We view this lawsuit as a necessary step to defend ourselves against misinformation, hold The Wall Street Journal accountable for prioritizing clicks over journalistic integrity, and address the significant reputational harm and business consequences that have resulted,” said Dugan Bliss, Binance’s Global Head of Litigation, in a company blog post.

The February article alleged that Binance dismantled an internal compliance investigation after its own investigators flagged $1.7 billion in crypto flows linked to entities connected to Iran-backed militant groups. The report also claimed that investigators who raised concerns were later suspended or fired.

Meanwhile, Fortune and The New York Times also cited anonymous sources and internal documents in reports claiming that Binance ignored internal warnings that sanctioned entities were using the platform to launder nearly $2 billion.

The reports triggered political fallout. U.S. Senator Richard Blumenthal opened an inquiry into Binance’s sanctions compliance, writing that “Binance appears to have ignored clear warning signs, knowingly allowed illicit accounts to operate, and even provided hands-on support to entities engaged in money laundering.”

Binance flatly denies the allegations and says it did not fire employees for raising compliance concerns. Binance also claims the $1.7 billion in flagged funds “did not originate at Binance and did not end at Binance,” passing through multiple independent intermediaries.

In 2023, Binance pleaded guilty to violating U.S. anti-money laundering and sanctions laws and agreed to pay $4.3 billion in penalties. Founder Changpeng “CZ” Zhao also pleaded guilty and served four months in prison before receiving a presidential pardon in October 2025.

Binance previously sued Forbes over similar allegations in 2020 but dropped that case several months later.

Crypto World

Here’s Why Ripple (XRP) Could be on the Verge of a Huge Move

XRP looks primed for significant volatility, yet it remains unclear whether that will translate into a rally or a steep pullback.

Ripple’s native cryptocurrency has been trading in a relatively tight range over the past few days, but one indicator suggests that a major price move could be on the way.

Opinions vary among analysts: some project substantial upside in the short term, whereas others see a renewed correction as the more probable outcome.

Fasten Your Belts

After a period of heavy turbulence earlier this year, XRP’s price movement appears to have calmed down a bit lately. Over the last week, the asset has been hovering between $1.33 and $1.47, currently trading at around $1.40.

Ali Martinez noted the reduced volatility, claiming that a huge move could be on the horizon given the squeezed Bollinger Bands. The technical indicator, developed by John Bollinger in the 1980, helps traders spot oversold or overbought conditions.

It is made up of a moving average with upper and lower bands that widen or narrow as market conditions change. When the bands tighten, it signals a period of low volatility that sometimes precedes a strong rally or a sharp decline.

The analysts on X have been quite divided in XRP’s potential future performance. Some, like Trading Shot, think the valuation could plummet below $1, whereas WealthManager alerted that a “huge drop could be imminent.”

Others, including EGRAG CRYPTO, emphasized that XRP’s RSI has fallen on a weekly scale, entering its most oversold level in history. Such a trend is typically followed by a price pump, whereas overbought territory is seen as a warning for an incoming correction.

You may also like:

Crossing This Zone is Crucial for the Bulls

Another industry participant who touched upon XRP’s performance is X user CRYPTOWZRD. They argued that the asset needs to reclaim $1.4230 to enter bullish territory, whereas a rejection could offer a further decline and short opportunities.

The fading interest in spot XRP ETFs is another development that won’t sit well with the bulls. Data shows that outflows have surpassed inflows over the past four days, suggesting that major institutional players, such as pension funds, hedge funds, and asset managers, have been scaling back their positions.

The first company to launch a spot XRP ETF in the US, which has 100% exposure to the token, is Canary Capital. This happened in November 2025, and shortly after, Bitwise, Grayscale, Franklin Templeton, and 21Shares followed suit. According to data from SoSoValue, these financial vehicles have generated a cumulative net inflow of $1.21 billion to date.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Revolut, crypto-friendly fintech, becomes fully licensed UK bank

Revolut, the London-based crypto-friendly fintech, said it received a full U.K. banking license, allowing it to offer a wider range of services and providing deposit protection for eligible funds almost two years after receiving a restricted registration.

The company, valued at about $75 billion in a funding round in November, set up a new entity called Revolut Bank UK Ltd. and will migrate customer accounts in coming months, according to a statement on its website.

The development completes a regulatory process that began years earlier. In 2024, Revolut secured a restricted U.K. license and entered a mobilization stage designed for new banks. Approval comes shortly after Revolut filed for a U.S. banking license.

The bank is supervised by the Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA), the same regulatory framework that governs traditional U.K. banks. The change means eligible customer deposits will qualify for protection under the Financial Services Compensation Scheme (FCSC), which covers up to £120,000 ($160,000) per person if a bank fails.

Converting accounts to the new bank will take place in stages, and users will receive notice through email or in-app messages when their accounts are ready to move.

Most day-to-day features will remain the same. Account numbers, sort codes and IBAN details will not change, the company said, and the Revolut app will continue to show past transactions and statements.

Some services will remain outside the new banking entity. Savings balances will still be held with partner banks, each with its own FSCS coverage limits. Crypto trading, commodities and stock services will continue to operate through separate Revolut entities.

-

Business5 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

News Videos2 days ago

News Videos2 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Ann Taylor

-

Crypto World2 days ago

Crypto World2 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech11 hours ago

Tech11 hours agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Sports6 days ago

Sports6 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics5 days ago

Politics5 days agoTop Mamdani aide takes progressive project to the UK

-

Sports4 days ago

Sports4 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports4 days ago

Sports4 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business1 day ago

Business1 day agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Entertainment5 days ago

Entertainment5 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

NewsBeat6 days ago

NewsBeat6 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business3 days ago

Business3 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business11 hours ago

Business11 hours agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat2 days ago

NewsBeat2 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech2 days ago

Tech2 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Entertainment7 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Crypto World7 days ago

Crypto World7 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech6 days ago

Tech6 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview