Crypto World

Cardano’s Next Support Levels as ADA Tumbles by Double Digits in a Week

“It will get worse, it will get redder,” Charles Hoskinson warned.

Cardano’s ADA plunged by double digits in the past seven days, in line with the bloodbath that covered the entire crypto market.

The question now is whether the price is headed for a further slump or a much-needed recovery.

What’s Next?

On Friday morning, ADA nosedived to around $0.22 (per CoinGecko’s data), the lowest level since June 2023. The renowned analyst Ali Martinez outlined three important support levels where the asset could find buyers if the sell-off continues. The first line is $0.249, the second is $0.115, and the third is the extreme case at $0.053.

As shown in the chart below, there was a brief breakdown below the $0.249 support level, but bulls regained some lost ground, and ADA currently trades at approximately $0.26.

Some industry participants expect further recovery and even a major rally in the future. X user CryptoPatel claimed that ADA is at the exact level that triggered a huge pump years ago, wondering if history is about to repeat. They set a short-term target at $0.40, followed by a “full cycle extension” to above $3. However, the analyst warned that a weekly close below $0.10 would invalidate the setup.

X user Sssebi chipped in, too, noting that ADA has never been this oversold on the weekly timeframe in its entire history. According to CryptoWaves, the Relative Strength Index (RSI) has fallen to around 28 on that scale, matching the lowest mark witnessed in 2019.

You may also like:

The technical analysis tool measures the speed and magnitude of recent price changes and can indeed help traders determine whether the asset is oversold or overbought. Ratios below 30 signal that the valuation has plunged too rapidly over a short period, suggesting it could be on the verge of a resurgence, while anything above 70 is considered a bearish zone.

ADA’s exchange netflow also hints that stabilization may be on the horizon. Data from CoinGlass shows that outflows have dominated inflows over the past several weeks and months, indicating that investors continue to move their holdings from centralized platforms to self-custody. This usually results in reduced selling pressure.

Hoskinson’s Crucial Losses

Cardano’s founder, Charles Hoskinson, reported losing over $3 billion due to the market decline. He predicted that the prices may continue plunging, but at the same time gave investors some inspirational guidance that may help them pass through the turbulent times:

“Don’t let the markets get you down. It will get worse, it will get redder, it is what it is. But at the end of the day, are you having fun? Find a way to. And know that each and every one of you in the cryptocurrency space, you are doing something that matters, you are doing something that has the potential to change the world.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Stablecoin Depegs and the DeFi Chain Reaction

Stablecoins are often described as the foundation of decentralized finance (DeFi). They provide price stability in a volatile crypto market and act as the primary medium for trading, lending, liquidity provisioning, and yield farming. From decentralized exchanges to lending platforms, stablecoins power a large portion of on-chain financial activity.

However, this deep integration also introduces systemic risk. When a stablecoin loses its peg, the impact rarely remains isolated. Instead, the instability can ripple through the entire DeFi ecosystem, causing liquidation cascades, liquidity imbalances, and cross-protocol failures.

This phenomenon is known as stablecoin contagion—a chain reaction where instability in one stablecoin spreads across interconnected DeFi systems.

What Is Stablecoin Contagion?

Stablecoin contagion refers to the spread of financial instability triggered by a stablecoin losing its price peg. Because stablecoins are deeply embedded in DeFi infrastructure, their failure can impact multiple protocols simultaneously.

When a depeg occurs, several events can unfold:

-

Lending positions become undercollateralized

-

Automated liquidations trigger across multiple protocols

-

Liquidity pools become imbalanced

-

Arbitrage traders drain stable assets from pools

-

Cross-chain markets transmit instability to other ecosystems

The result is a network-wide stress event that can rapidly escalate if not contained.

Why Stablecoins Are Systemically Important in DeFi

Stablecoins serve several essential roles in decentralized finance:

Trading pairs

Most decentralized exchanges use stablecoins as the base trading asset.

Collateral assets

Lending protocols allow users to borrow funds against stablecoin deposits.

Liquidity provision

Stablecoins form the backbone of many automated market maker (AMM) pools.

Yield farming incentives

Many protocols distribute rewards based on stablecoin liquidity participation.

Because these roles overlap across multiple platforms, a single stablecoin can become deeply embedded across dozens of DeFi protocols simultaneously.

The Four Core Contagion Mechanisms

1. Liquidation Cascades

One of the fastest ways contagion spreads is through collateral liquidations.

Many lending platforms require overcollateralized positions. When a stablecoin depegs below $1:

-

Collateral value suddenly drops

-

Borrowers fall below the required collateral ratios

-

Smart contracts trigger automatic liquidations

-

Liquidated assets flood the market

These forced sales can push asset prices down further, triggering additional liquidations across other protocols.

Callout:

⚠️ Liquidation cascades can propagate across multiple DeFi platforms within minutes.

2. Liquidity Pool Imbalances

Decentralized exchanges rely heavily on stablecoin liquidity pools.

When a stablecoin loses its peg:

-

Traders rush to swap the unstable asset

-

Arbitrageurs drain stable assets from the pool

-

Liquidity providers are left holding mostly the depegged asset

This imbalance causes massive impermanent loss for liquidity providers and weakens overall market liquidity.

Callout:

💡 AMM pools amplify contagion because they automatically rebalance toward the failing asset.

3. DeFi Composability Risk

DeFi is built on composability, often called “money legos.” Assets from one protocol are frequently reused in others.

For example:

-

Deposit Stablecoin A into a lending protocol

-

Borrow Stablecoin B

-

Use B to provide liquidity on a DEX

-

Stake LP tokens in a yield farm

If Stablecoin A depegs, the user’s entire stack becomes unstable. This layered exposure allows contagion to spread across multiple platforms simultaneously.

Callout:

🔗 Composability multiplies risk because a single asset can support multiple financial layers.

4. Cross-Chain Transmission

Stablecoins often exist across multiple blockchains via bridges.

When instability begins on one chain:

-

Arbitrage spreads price imbalances across chains

-

Bridged liquidity pools become unstable

-

Protocols using wrapped versions of the stablecoin inherit the risk

This allows contagion to spread beyond a single blockchain ecosystem.

Callout:

🌐 Cross-chain liquidity turns local stablecoin failures into global DeFi risks.

Stablecoin Types and Their Contagion Risk

Not all stablecoins carry the same systemic risk.

Fiat-Backed Stablecoins

These stablecoins are backed by real-world reserves such as cash or treasury bonds.

Advantages

Risks

Crypto-Collateralized Stablecoins

These stablecoins are backed by crypto assets locked in smart contracts.

Advantages

Risks

Algorithmic Stablecoins

Algorithmic stablecoins rely on supply adjustments rather than collateral reserves.

Advantages

-

Capital efficient

-

Fully on-chain

Risks

Historically, this model has produced the largest contagion events in DeFi history.

Case Study: The Terra Collapse

One of the most dramatic examples of stablecoin contagion occurred during the collapse of the Terra ecosystem.

The algorithmic stablecoin UST lost its peg, triggering a massive chain reaction:

-

Billions withdrawn from Anchor Protocol

-

Large-scale liquidations across DeFi markets

-

Liquidity pools drained across multiple blockchains

-

Over $40 billion in value was wiped out

This event highlighted how one stablecoin failure can destabilize an entire ecosystem.

How Researchers Model Stablecoin Contagion

As DeFi grows more complex, researchers are developing frameworks to measure systemic risk.

Network Dependency Models

These models map relationships between stablecoins, protocols, and liquidity pools to identify systemic exposure.

Spillover Volatility Models

Statistical models estimate how volatility from one stablecoin spreads to others during extreme market conditions.

Systemic Risk Metrics

Composite indicators track:

These tools help analysts detect potential contagion risks before they escalate into full market crises.

Strategies to Reduce Stablecoin Contagion

DeFi protocols are beginning to implement safeguards to limit systemic risk.

Diversified Collateral

Using multiple asset types instead of relying on a single stablecoin.

Emergency Shutdown Mechanisms

Protocols can temporarily halt liquidations or trading during extreme volatility.

Liquidity Backstops

Reserve funds or insurance pools can stabilize markets during stress events.

Cross-Protocol Risk Monitoring

Shared analytics systems help track exposure across the broader DeFi ecosystem.

The Future of Stablecoin Risk Management

Stablecoins are essential to the growth of decentralized finance, but their interconnected nature means instability can spread quickly. As the ecosystem evolves, stronger risk models and protocol safeguards will be critical for preventing systemic failures.

Understanding stablecoin contagion models helps developers, investors, and researchers anticipate vulnerabilities and build more resilient financial systems.

In a highly composable financial network like DeFi, the stability of one asset can influence the stability of the entire ecosystem.

REQUEST AN ARTICLE

Crypto World

Global insurance broker Aon tests stablecoin payments on Ethereum, Solana with Coinbase, Paxos

Aon (AON), which advises on $5 trillion in assets as one of the world’s largest insurance brokers, said it carried out a proof-of-concept using stablecoins to settle insurance premium payments, an early sign that dollar-pegged tokens may start moving deeper into corporate finance.

The London-based company worked with crypto exchange Coinbase (COIN) and blockchain infrastructure firm Paxos to complete the transactions using Circle Internet’s (CRCL) USDC token on Ethereum and on Solana, according to a press release Monday.

Aon said the initiative marked the first known example of a major global insurance broker accepting stablecoins for premium settlement, even if only in a controlled demonstration.

While limited in scope, the exercise shows how stablecoins could simplify how large financial payments move through the insurance industry. Premiums today often pass through banks, whose clearing systems can take days to settle, especially across borders. Blockchain-based payments, proponents say, can move funds in minutes and leave a transparent record of the transaction.

The timing also underscores how the $300 billion stablecoin asset class is becoming increasingly embedded into traditional finance as the regulatory backdrop improves. The U.S. Genius Act, passed in 2025, established a federal framework for stablecoin issuers and set rules around reserves and oversight. That clarity has encouraged banks, fintech firms and large companies to test how tokenized dollars might fit into existing financial plumbing.

“While broader adoption of stablecoins across corporate payments is still emerging, the long-term potential is significant,” John King, head of corporate portfolio strategy and treasurer for Aon, said in the statement.

“This work allows us to understand how these mechanisms operate within established systems and frameworks, so we are prepared to evaluate efficiency and cost-savings opportunities over time as the technology matures.”

Read more: Circle moves $68 million in just 30 minutes by using its own stablecoin for internal payments

Crypto World

Bitcoin Slumps to $66K as Oil Breakout Adds Macro Pressure

Today’s Bitcoin (BTC) sell-off coincides with a massive breakout in crude oil prices, which surged past $110 per barrel on escalating Middle East tensions.

The original cryptocurrency briefly dropped down to $66,010 on Monday, marking a 10% slide from its March 5 peak of $73,670.

That energy shock is rattling risk assets globally. As oil costs climb 30% on the day, traders fear renewed inflation will force the Federal Reserve to keep interest rates elevated, draining liquidity from speculative markets.

Discover: The best pre-launch token sales

Bitcoin and Stocks: Oil Prices are Recoupling Them

The correlation between Bitcoin and equities has tightened significantly, leaving the asset vulnerable to broader market panic.

The oil spike triggered immediate losses in Asia, where Japan’s Nikkei plunged 7% and South Korea’s KOSPI dropped 6% Monday. This risk-off shift has already impacted institutional flows. Bitcoin ETFs saw $576.6 million in net outflows late last week, adding sell-side pressure to the spot price.

That heavy selling aligns with broader cross-asset weakness. As Bitcoin price and stocks stabilize, the bond market continues to signal ongoing macro risk, suggesting the path of least resistance remains lower for now.

If risk assets continue to sell off, Bitcoin’s high correlation suggests it will struggle to find a floor independent of the stock market.

Technical Price Analysis: The Levels That Change Everything

The technical picture shows Bitcoin testing critical support levels after losing the $70,000 handle. The price is currently hovering near $66,000.

The slide has brought Bitcoin back to levels seen before the recent surge.

If sellers push the price below $62,300, the chart structure risks a breakdown toward Fibonacci support levels at $56,800 or even $52,300.

Bearish momentum is supported by the 50-day SMA at $77,200, which is currently acting as overhead resistance.

However, on-chain data offers a counter-narrative. Bitcoin is vanishing from exchanges, suggesting a potential supply shock could cushion the downside if long-term holders refuse to sell at these levels.

To invalidate the bearish structure, buyers need to reclaim the $72,600 level. Anything below that keeps the bears in control.

Bitcoin Fears: Rising Oil Prices Drive a Hawkish Fed

The surge in oil is the primary headwind. Crude prices rose 72% in the past month, sparking fears that input costs will drive inflation higher across industries.

Former President Donald Trump commented that the spike is a “very small price to pay,” but for markets, the cost is liquidity. If energy prices bleed into CPI data, the Fed may be forced to hold rates higher for longer.

That policy risk puts a cap on upside volatility. Traders monitoring options expiry and max pain levels should expect continued chop as the market prices in a more hawkish Fed.

Key Levels Summary

Resistance stands at $72,600. Bulls need to reclaim this level and the 50-day SMA to restart momentum.

The macro trigger remains crude oil at $110. Continued upside here exerts heavy pressure on risk assets and inflation expectations.

Support sits at $60,000 to $62,300. A loss of this zone opens the door to $52,000 as the next major demand area.

The post Bitcoin Slumps to $66K as Oil Breakout Adds Macro Pressure appeared first on Cryptonews.

Crypto World

Can v20.2 Protocol Update Push PI to $0.30?

Check out what suggests that a major sell-off could be on the horizon.

The past several days have been quite successful for Pi Network’s PI, whose price spiked to a three-month high.

While some market observers believe the asset could post additional gains in the short term, certain indicators suggest it might be time for a sharp pullback.

Back to Red Territory?

PI is the best-performing cryptocurrency (at least in the top 100) over the past week, with its valuation rising 30% during the period. A few days ago, it surpassed $0.23 for the first time since December last year, while it currently trades at around $0.21 (per CoinGecko’s data).

Its rally follows the latest updates announced by the Core Team. Recently, the protocol v19.9 migration was successfully completed, while the next version, v20.2, is scheduled for release around March 12 (just two days before Pi Day 2026). Another catalyst might have been the newly revealed case study showing that Pi Nodes could be used for distributed AI computing and model training.

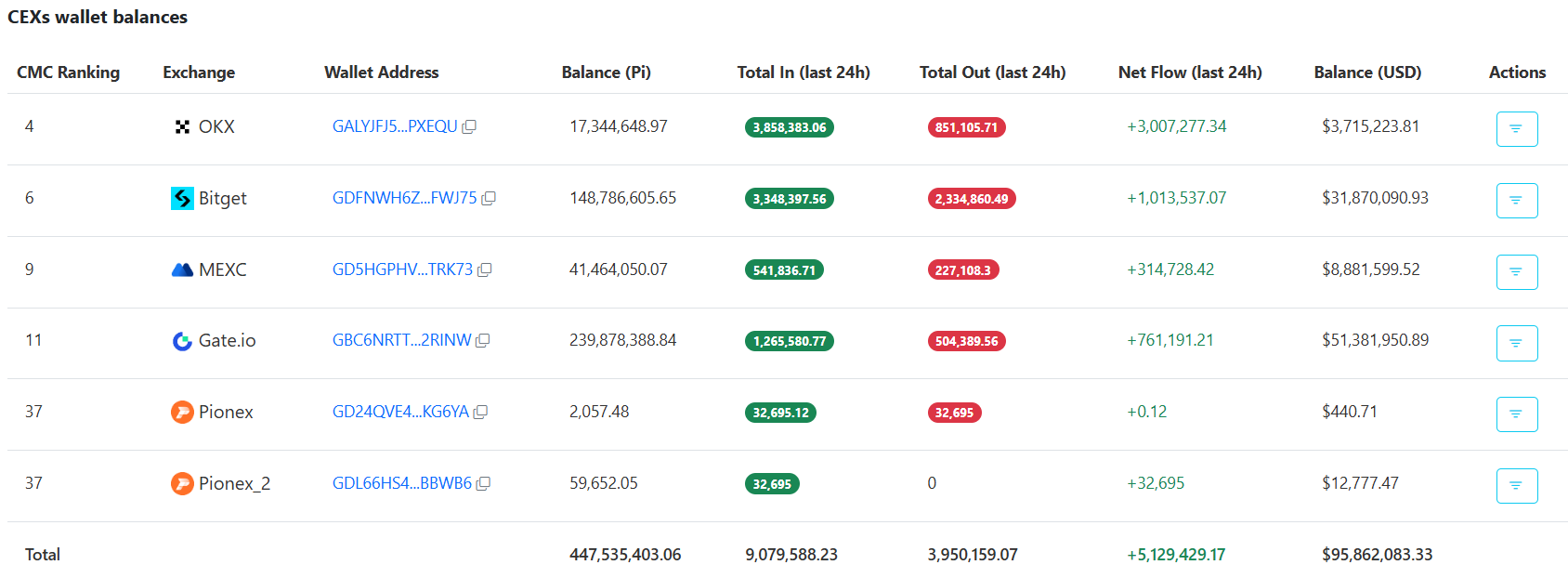

However, two important factors suggest that the ascent may soon be replaced by a correction. Data shows that more than 6.2 million PI have been transferred to exchanges in the past 24 hours alone, thus bringing the total figure to almost 450 million. The majority of the coins (53%) are stored on Gate.io, whereas Bitget ranks second with approximately 148.8 million. This development doesn’t guarantee a short-term price decline but is often considered a pre-sale step.

Next on the list is PI’s Relative Strength Index (RSI). It measures the speed and magnitude of recent price changes to help traders gauge whether the asset is on the verge of a turning point. The tool ranges from 0 to 100, with ratios above 70 indicating that PI has entered overbought territory and could be due for a pullback. Currently, the index stands at around 71.

More Gains Ahead?

Contrary to the worrying factors mentioned above, some X users remain optimistic that PI could be gearing up for an additional rally in the near future. The analyst, who goes by the moniker Vuori Trading, predicted a potential increase to $0.64, while ALTS GEMS Alert forecasted an ascent to as high as $0.30.

You may also like:

The upcoming protocol update scheduled for later this week may give PI another boost, though there’s always the risk of a classic “sell-the-news” reaction, which investors should keep in mind.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

The 20 Millionth BTC Has Been Mined

Bitcoin’s network achieved one of the most significant milestones today.

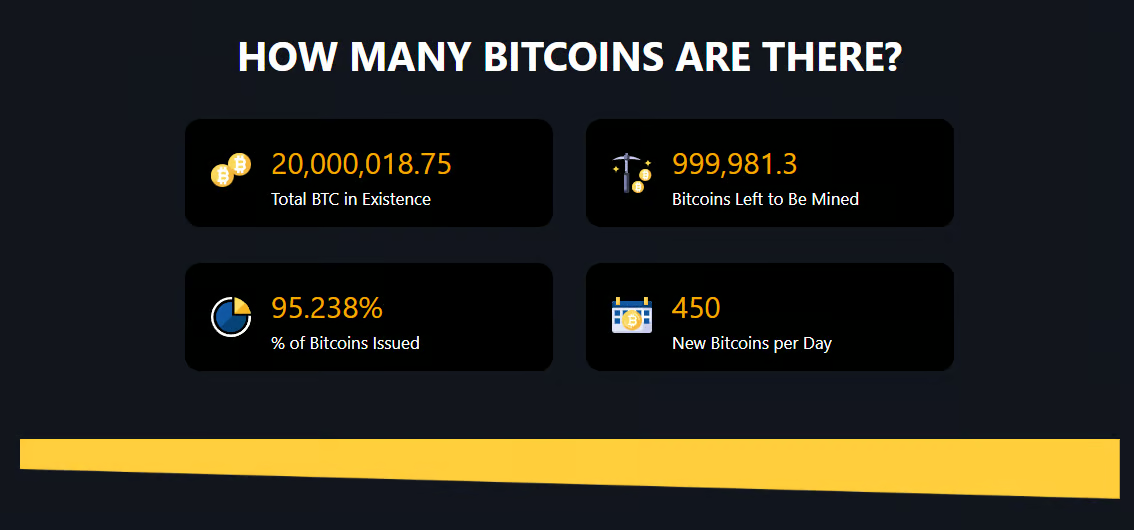

The Bitcoin network has reached a massive milestone: the 20 millionth BTC has been officially mined. With its total supply permanently capped at 21 million, this moment marks a monumental step toward its permanent scarcity.

Moreover, the event highlights one of the network’s defining features: its transparency and predictability. Unlike traditional fiat currencies, which can be pretty much printed at will and indefinitely, BTC follows a very strict issuance schedule, hardcoded into its protocol. With Bitcoin, code is law, and this code cannot be changed (at least not without massive market turbulence and seismic shifts in the entire industry), and can be publicly verified by anyone interested.

Digital Scarcity, but at a New Level

Data from BiTBO shows that 95.2% of Bitcoin’s total supply, representing exactly 20,000,018.75 BTC, has been mined at the time of this writing.

The remaining one million coins will be increasingly difficult to mine because of how the network is structured to function. Halvings take place roughly every four years, which slashes the rewards miners receive for adding new blocks to the network by 50%. In essence, this reduces the fresh supply by half, hence the name. In other words, the more time passes, the harder it will become to mine BTC. In fact, some estimates predict that the last BTC will be mined in 2140.

All of this highlights one of Bitcoin’s core concepts – digital scarcity. That’s why many investors have been comparing it to gold – because of its limited and ever-decreasing supply.

But one thing that many tend to forget is that millions of BTC are believed to be permanently lost due to forgotten phrases, lost wallets, and more. this makes the situation even more constrained, putting the effective circulating supply significantly lower than 21,000,000.

What the Final Million Means

The last Bitcoin halving occurred in 2024, reducing the block reward from 6.25 to 3.125 BTC. The next one should take place in two years, effectively making BTC even scarcer.

You may also like:

To put matters in perspective, only about 450 BTC (roughly) is mined daily, meaning that by 2030, only a tiny fraction of the remaining BTC will be in circulation.

This also means that miners, who secure the network and validate blocks, will be relying increasingly on the fees as the block reward continues to decline.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

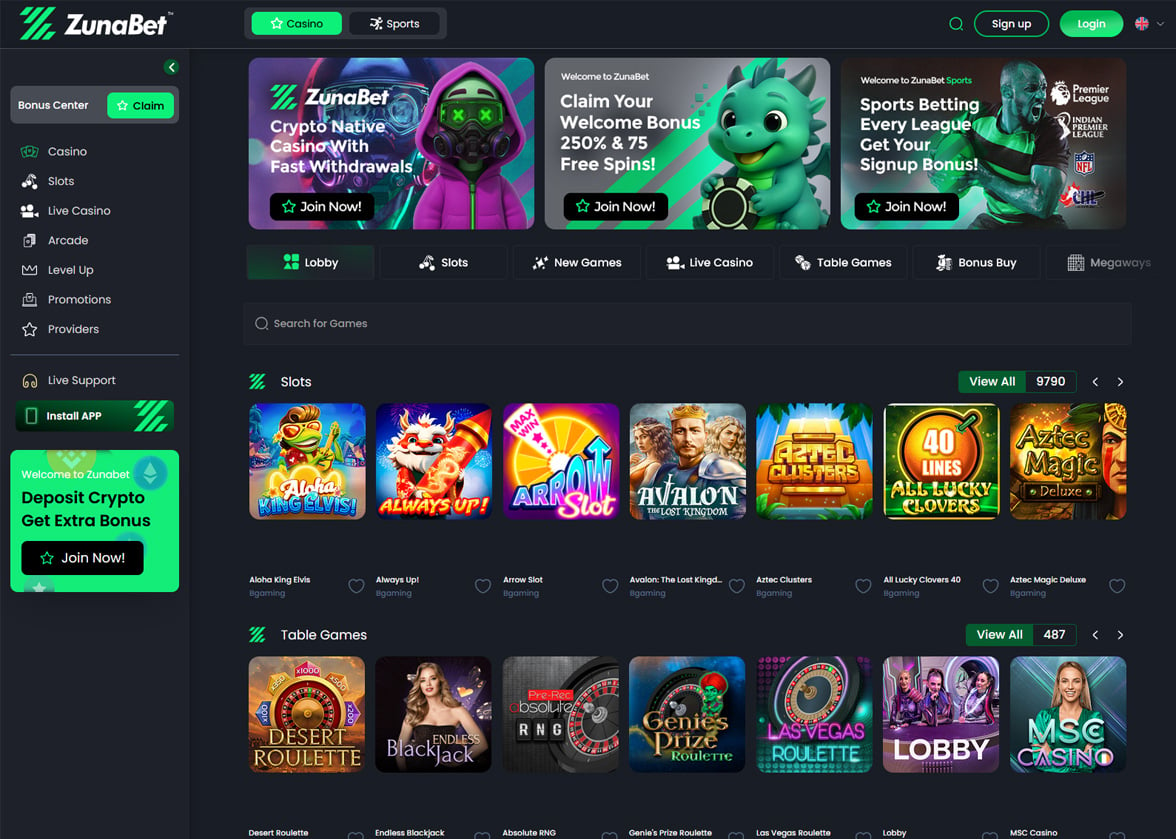

How LeoVegas and ZunaBet Compare on Your Phone in 2026

The casino in your pocket matters more than the one on your desktop. That shift happened years ago, and every serious operator knows it. Mobile is where most sessions start, most bets are placed, and most withdrawals are requested. LeoVegas recognised this earlier than most and built a brand around it. ZunaBet arrived in 2026 with native apps and a platform that was designed for mobile from the first sketch. Both platforms take mobile seriously, but what they deliver through those mobile experiences differs in ways that matter to anyone who primarily gambles from their phone. Here is how they stack up.

LeoVegas: The Brand That Made Mobile Its Identity

LeoVegas launched in 2012 with mobile gambling as its defining mission. Founded in Sweden, the company secured licenses from the UK Gambling Commission, Malta Gaming Authority, and other regulatory bodies as it expanded across European markets. MGM Resorts International acquired the company in 2022, placing it within one of the largest gambling groups on the planet.

The mobile product has always been the headline. LeoVegas invested in native app development and mobile-optimised interfaces from the outset, building a reputation for smooth performance, clean design, and intuitive navigation on phones and tablets. For years, it was the benchmark other mobile casinos were measured against.

The game library brings together slots, table games, live dealer experiences, and some exclusive titles secured through provider partnerships. NetEnt, Microgaming, Play’n GO, Evolution, and other reputable studios supply content that typically numbers in the low thousands depending on market. It is a well-curated collection that prioritises quality over sheer volume.

A sportsbook covers major sports including football, tennis, basketball, ice hockey, and horse racing. It integrates with the casino account and provides a serviceable betting option, though it has always served as a supporting product to the casino.

Payments process through traditional infrastructure. Visa, Mastercard, Trustly, Skrill, Neteller, bank transfers, and other standard methods handle deposits and withdrawals. E-wallets provide the fastest cashout route while bank methods extend across business days. The system is dependable but bound by the speed constraints that all traditional payment networks impose.

Loyalty at LeoVegas has taken different forms across markets and over time, particularly since the MGM acquisition. Promotional campaigns, VIP tiers, free spin offers, and seasonal deals form the bulk of the reward experience. The approach provides value in waves that fluctuate with the promotional schedule and vary based on where the player is located.

ZunaBet: Mobile-Native With Crypto at the Core

ZunaBet launched in 2026 under Strathvale Group Ltd, holding an Anjouan gaming license and built by a team with over 20 years of combined gambling experience. The platform was designed on crypto-native infrastructure from the ground up, and mobile was embedded into the architecture from day one rather than treated as a secondary adaptation. Native apps for iOS, Android, Windows, and MacOS deliver an experience that was purpose-built for each platform rather than stretched across them.

The interface runs a dark theme with responsive design and fast loading across all screen sizes. Performance on a phone matches what the platform delivers on a desktop monitor. In 2026, that kind of parity should be standard, but many platforms still deliver a compromised experience on smaller screens. ZunaBet does not.

What sits behind that interface is where the real separation begins. ZunaBet carries 11,294 games from 63 providers. Pragmatic Play, Evolution, Hacksaw Gaming, Yggdrasil, and BGaming lead the provider list, supported by more than fifty additional studios contributing to a catalog that spans slots, live dealer tables, and RNG games with exceptional breadth. Every title is accessible through the mobile apps, meaning a player’s phone connects them to one of the largest game libraries in the crypto casino space.

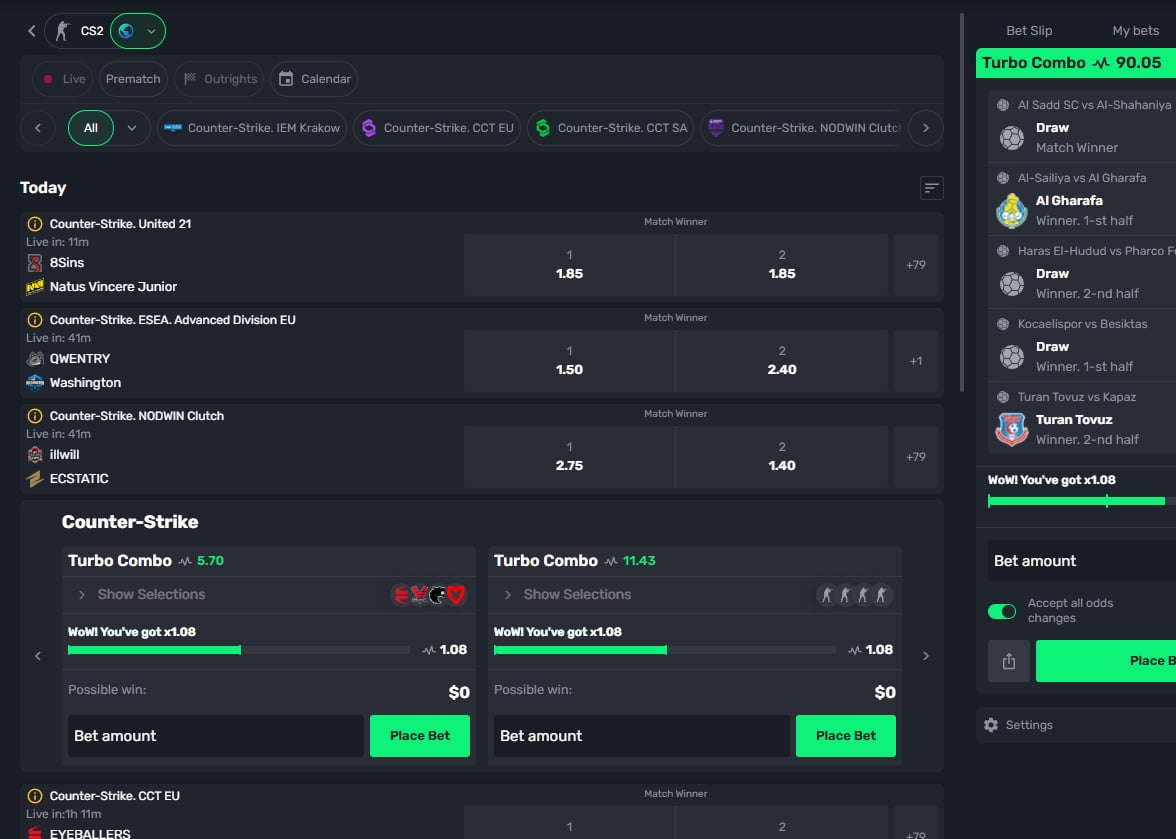

Sports betting runs as a standalone product within the same app. Football, basketball, tennis, hockey, and mainstream international sports receive full coverage. Esports are integrated as a primary category with betting markets on CS2, Dota 2, League of Legends, and Valorant. Virtual sports and combat sports push the breadth further. Switching between casino and sportsbook on mobile is seamless, which matters for players who move between the two throughout the day.

Payments operate entirely on crypto. Over 20 coins are supported including BTC, ETH, USDT across multiple chains, SOL, DOGE, ADA, XRP, and many more. Zero platform fees. Blockchain-based withdrawals process without bank involvement, without business hour limitations, and without geographic speed differences. On mobile, this translates to deposits and withdrawals that process as quickly and simply as any other transaction a player performs on their phone throughout the day.

The welcome package reaches up to $5,000 plus 75 free spins over three deposits. First deposit matches at 100% up to $2,000 with 25 spins. Second at 50% up to $1,500 with 25 spins. Third at 100% up to $1,500 with 25 spins. The entire bonus process works smoothly through the mobile apps.

Live chat support runs around the clock and is accessible from within the app at all times.

What Mobile Actually Gives You Access To

LeoVegas proved that a mobile casino could deliver a premium experience. In 2012, that was a genuine innovation. The app was fast, the games loaded well on the devices of the era, and the interface felt designed for thumbs rather than mouse clicks. That head start built a brand identity that has persisted for over a decade.

But the mobile landscape in 2026 is fundamentally different from 2012. Smooth app performance is a minimum expectation, not a differentiator. Every major operator offers it. The question that matters now is what a player can do through that smooth interface, and this is where ZunaBet opens up a significant lead.

Over 11,000 games accessible on mobile versus a couple of thousand through LeoVegas. A fully integrated sportsbook with native esports coverage versus a companion betting feature. Real-time crypto payments from a phone screen versus traditional banking timelines that no amount of mobile optimisation can accelerate. The mobile experience at ZunaBet is not just polished — it connects to fundamentally more content, faster payments, and a broader betting product than what LeoVegas currently offers.

Earning Rewards From Your Phone

Mobile players tend to play in shorter, more frequent sessions spread throughout the day. That pattern makes the loyalty model particularly important because the return needs to accumulate meaningfully across many smaller interactions rather than a few large ones.

LeoVegas distributes rewards through promotional offers and VIP treatment that varies by market. Free spins drops, deposit matches, and seasonal campaigns rotate in and out. VIP players get personalised attention. The value is real when it appears but depends on timing and location. A mobile player who opens the app on a day when no relevant promotion is running gets nothing extra for their session.

ZunaBet guarantees a return on every session through its dragon evolution loyalty program. Six tiers from Squire at 1% rakeback to Ultimate at 20% assign every player a permanent return rate. A dragon mascot called Zuno evolves visually through each tier. Higher levels unlock up to 1,000 free spins, VIP club access, and double wheel spins.

For the typical mobile player who logs in frequently throughout the week, rakeback at a known rate means every single session generates a measurable return. There are no promotional gaps, no market-specific availability issues, and no need to check whether an offer is live before playing. The accumulation is automatic and continuous. Over the course of a month of regular mobile play, the difference between structured rakeback and intermittent promotions translates directly into more money returned to the player.

Mobile Payments: Convenience Redefined

The promise of mobile gambling is convenience — play anywhere, anytime. But that promise breaks down at the cashier if withdrawals take days to process regardless of how quickly the rest of the app performs.

LeoVegas handles mobile payments through traditional channels. Deposits are generally quick. Withdrawals follow the usual pace — e-wallets in hours, banks and cards in days. The mobile interface for initiating these transactions is well-designed, but good design cannot override the processing timelines imposed by the financial institutions behind the scenes.

ZunaBet makes mobile payments match the speed of everything else on the platform. A deposit from a crypto wallet to the app takes moments. A withdrawal from the app to a wallet processes on-chain without waiting for institutional approval. No fees. No delays tied to business hours or geography. The entire financial cycle — deposit, play, withdraw — can happen within a single mobile session. That level of financial fluidity on a phone is something traditional payment infrastructure is not equipped to deliver.

For players who want their mobile casino to be as fast and frictionless as every other app on their phone, ZunaBet delivers that experience while traditional platforms remain limited by the banking systems behind their interfaces.

Which Mobile Experience Wins in 2026

LeoVegas earned its place in mobile gambling history by being first to take it seriously. The app remains polished, the brand carries MGM backing, and players who prefer traditional banking and established European regulation still have a quality mobile product. That foundation matters.

But being first to take mobile seriously is not the same as offering the best mobile experience today. ZunaBet’s native apps connect players to over 11,000 games, a complete sportsbook with esports, instant crypto payments, and transparent rakeback up to 20%. Every feature works natively on mobile without compromise. The content is deeper, the payments are faster, the rewards are more consistent, and the total package is simply larger than what LeoVegas currently puts in a player’s hand.

LeoVegas showed the industry what mobile gambling could be. ZunaBet is showing what it should be in 2026. For mobile players choosing where to play right now, the platform that delivers the most complete experience on their phone is the one that deserves their attention — and by every measurable standard, that platform is ZunaBet.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Bitcoin (BTC) could be the big winner if the U.S.-Iran conflict drags on for several months

Bitcoin may gain if a potential U.S.-Iran conflict stretches on for months as higher government spending, rising debt and lower interest rates create conditions that have historically supported the cryptocurrency, according to macrostrategist Mark Connors.

Wars are expensive, and financing them typically requires governments to issue more debt, said Connors, formerly the head of research at 3iQ and global head of portfolio and risk advisory at Credit Suisse. That increases the supply of dollars in the financial system, lowering — or debasing — the value of the existing circulation, and tending to benefit non-dollar assets like bitcoin.

“Liquidity drives bitcoin,” said Connors, who now has his own bitcoin advisory firm called Risk Dimensions, in an interview with CoinDesk. If the conflict extends into the next several months, he expects deficit spending to accelerate as the U.S. finances military operations. “If the war runs longer, that means more spending and more deficit spending. That’s constructive for bitcoin.”

The U.S. debt load has already been growing rapidly. Connors said federal debt has been rising at roughly a 14% annualized pace since mid-2025. If the trend continues, the debt could increase about 15% year-over-year.

“That’s debasement,” he said.

Bitcoin appeared to reflect some of that dynamic on Monday. The cryptocurrency rallied overnight and into the U.S. morning as investors pulled money out of equities and repositioned portfolios for the possibility of a prolonged conflict. Since the first U.S. strike on Iran, bitcoin has gained 3.6%.

A war-driven surge in oil prices could complicate the outlook by pushing inflation higher, Connors said. But he argued that even a stagflationary environment — where growth slows while prices rise — could support bitcoin.

In that scenario, policymakers would likely prioritize financial stability and government financing over fighting inflation alone.

Connors said the Federal Reserve effectively operates under an additional mandate beyond its traditional goals of stable prices and maximum employment: maintaining the smooth functioning of financial markets, particularly the Treasury market.

Authorities cannot allow disruptions like the 2019 repo market crisis or the regional bank failures seen in 2023 after aggressive rate hikes, he said.

“The Fed has to make sure the Treasury market functions,” Connors said.

That constraint may push policymakers toward lower interest rates over time, especially as the government shifts toward issuing more short-term Treasury bills rather than long-term bonds. Lower rates are also more likely if Kevin Walsh — picked by President Trump partly for his dovish stance — becomes chair of the Fed in May, pending confirmation by the Senate.

With a larger share of debt rolling over quickly, lowering short-term rates would directly reduce the government’s interest costs.

If rates fall while deficits continue to expand, liquidity conditions would likely improve — a combination Connors believes would favor bitcoin.

“When rates go lower and debt keeps rising, that’s the backdrop where bitcoin tends to perform well,” he said.

Crypto World

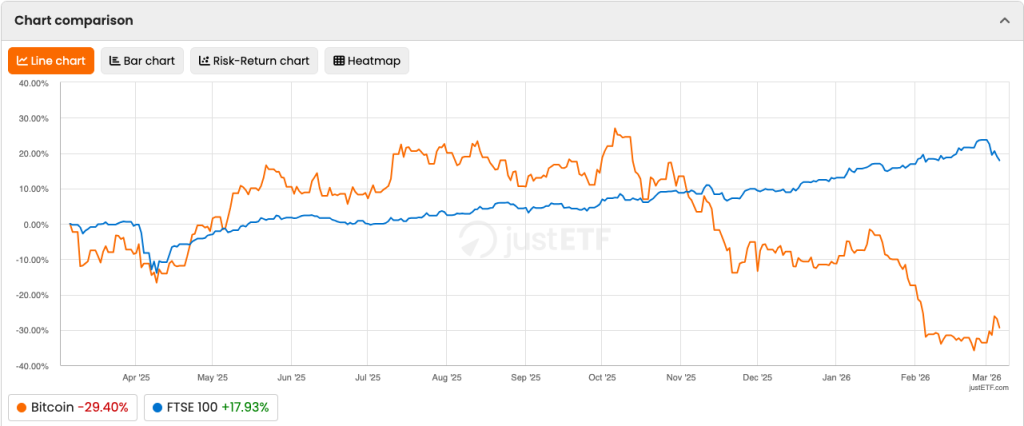

Bitcoin Decouples from Sinking FTSE 100 as Gilt Yields Surge

Bitcoin (BTC) is defying a broader risk-off mood in European equities this morning, hovering around $69,000 while the FTSE 100 slides under the weight of surging bond yields.

American markets are opening one hour earlier due to daylight saving time (15:30 UTC), which is causing more overlap with European sessions. This extended overlap could bring higher liquidity and bigger moves to Bitcoin.

Crypto traders are watching to see if this divergence holds as Wall Street liquidity hits the books.

Bond Yields Flash Warning: Is the FTSE 100 Dragging Down Sentiment?

London markets are signaling stress today as the FTSE 100 drops 1.04%, pressured heavily by a sharp rise in UK 10-year Gilt yields.

Typically, rising yields tighten financial conditions and pull liquidity from risk assets, a pattern that usually sends both stocks and crypto prices lower.

Bitcoin price movements often stabilize only once bond market risk subsides, given the asset’s historical sensitivity to cost-of-capital spikes.

However, while energetic and industrial stocks in the UK slump, the crypto market is showing unexpected resilience. Normally, a Gilt yield surge of this magnitude would trigger a lockstep sell-off in digital assets. But this time, the correlation is breaking.

Bitcoin Decouples from FTSE 100: What is Driving the Divergence?

The FTSE 100 correlation with Bitcoin is currently neutral, indicating that crypto is currently moving on internal mechanics rather than global macro fears.

Propelling this move is sustained Institutional Inflow into spot ETFs, which creates a demand floor that ignores traditional equity weakness.

Data from CoinGlass shows a short squeeze on March 5 that already cleared leverage above $71,000, forcing bears to cover and fueling the current run.

With Bitcoin vanishing from exchanges due to institutional accumulation, the supply side is too thin to allow a steep drop merely because London stocks are red.

Analysts note that as long as ETF buyers, led by giants like BlackRock, continue to absorb daily issuance, the decoupling could widen.

The key resistance sits at $74,000. If bulls clear this, the bond yield narrative becomes irrelevant for the short term.

Discover: The next crypto to explode

The Levels That Change Everything: What Traders Are Watching

A drop below $71,000, the launchpad of the recent squeeze, would invalidate the decoupling thesis and realign Bitcoin with risk-off equity flows.

Market participants are also monitoring the US 10-year Treasury yield at the open; if it spikes in tandem with UK Gilts, the $71,000 support will face a severe test.

The definitive level to watch to maintain the bullish structure is $74,000, where a breakout would signal a complete separation from traditional market drag.

If this level holds through the US session, it confirms that the market has absorbed the yield shock and is targeting new highs.

As the US bell rings at 15:30 UTC, volume will determine if this morning’s resilience is a trap or a trend.

If ETF inflows remain robust despite the Bond yield noise, Bitcoin could close the day having completely ignored the bond market tantrum.

Discover: The best new crypto tokens

The post Bitcoin Decouples from Sinking FTSE 100 as Gilt Yields Surge appeared first on Cryptonews.

Crypto World

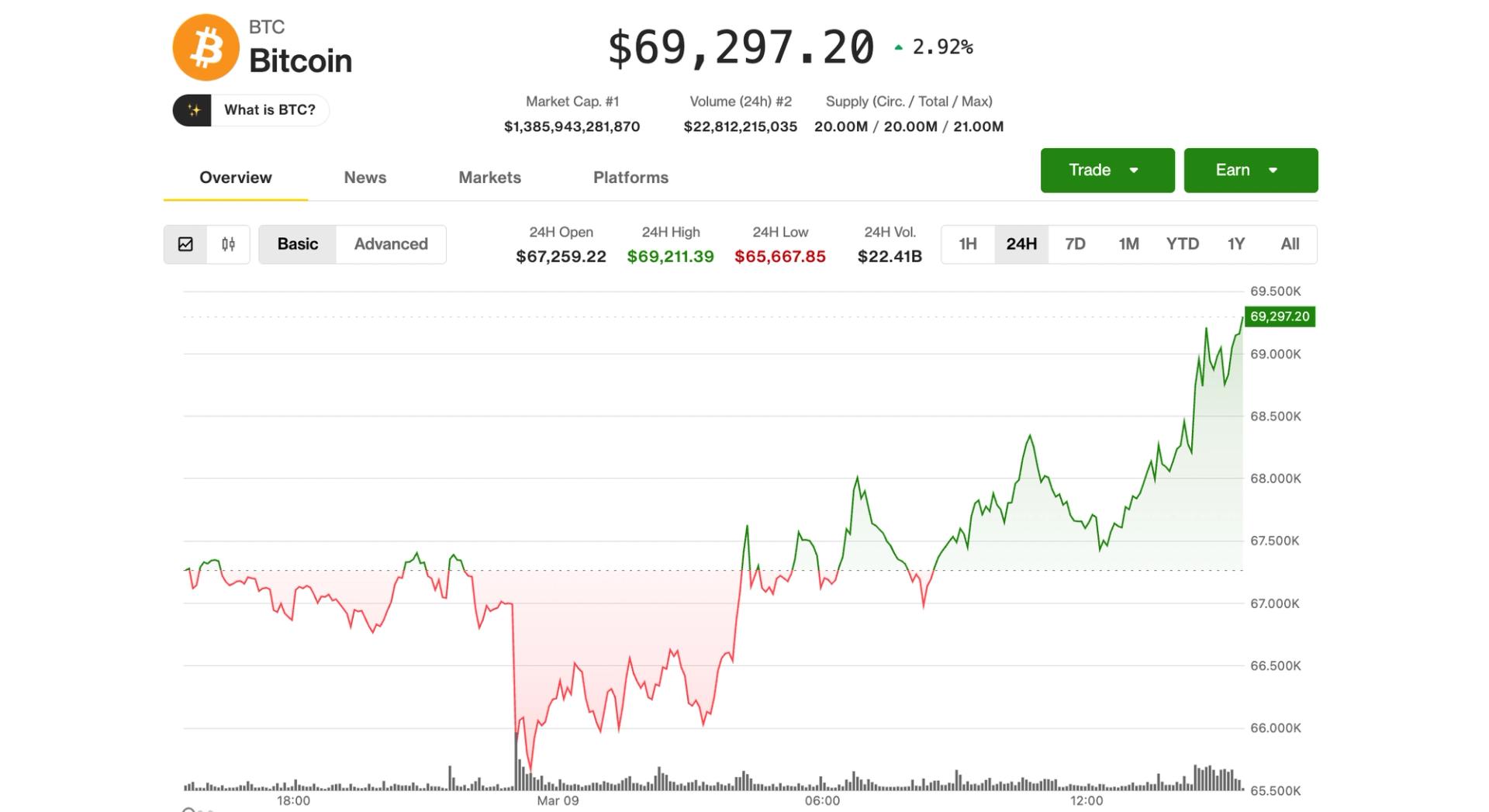

BTC rises 5% from worst overnight levels, re-taking $69,000

Crypto assets traded higher during the U.S. session on Monday, rebounding from sharp overnight losses that had brought bitcoin down to nearly $65,000.

Bitcoin was trading just shy of $69,000 at midday up 2.5% over the past 24 hours, while ether (ETH) reclaimed the $2,000 level, ahead 4% over the same time period.

Among crypto-related stocks, stablecoin issuer Circle (CRCL) saw the biggest price jump, up 8% as global insurance giant Aon said it paid an insurance premium for the first time in stablecoins, including in Circle’s USDC. Other crypto stocks traded in the green as well, with Strategy (MSTR) higher by 3% after announcing a large $1.28 billion acquisition of bitcoin last week. Crypto exchange Coinbase (COIN) was modestly lower for the day.

The gains for crypto came alongside a big bounce in stocks after crude oil reversed much of its spectacular overnight gain, the Nasdaq swinging from a 2% loss to flat. Up 30% to $120 per barrel at one point overnight, WTI crude pulled back to $95, ahead just 5% on the session.

The initial large gain in oil prices came after a weekend that showed no sign of an immediate end to the war in Iran.

“Bitcoin has displayed surprising resilience despite the extreme volatility exhibited across traditional assets,” said David Morrison, senior market analyst at Trade Nation. “The bulls will be encouraged if it can quickly push back above $70,000 and then hold this level on any subsequent pullback.”

“With traditional financial markets under pressure and supply chains threatened by disruptions in the Middle East, digital assets appear to be attracting defensive capital from investors seeking alternatives to oil-sensitive assets,” he said.

Speaking of stocks, Ram Ahluwalia, CEO of wealth management platform Lumida Wealth, said that he expects “we will see a local bottom sometime today and a rally during the week.”

However, that could be a tactical short-term bounce, he added, as weakness persists and the S&P 500 will struggle to reclaim the record highs “anytime soon.”

Crypto World

Sonic Labs launches USSD stablecoin backed by US Treasuries

Sonic Labs has launched USSD, a USD-pegged stablecoin supported by tokenized U.S. Treasury assets, adding a new source of stable liquidity to the Sonic blockchain ecosystem.

Summary

- Sonic Labs launched USSD, a USD stablecoin integrated directly into its network.

- The token is backed 1:1 by short-duration U.S. Treasury assets.

- Reserve assets include products from BlackRock, Superstate, and WisdomTree.

The new stablecoin, announced on March 9, will serve as a dependable on-chain dollar across the network. It can be used for trading, lending, payments, and settlement in decentralized finance applications running on Sonic.

Sonic Labs said the launch gives developers and users a stable asset that can move easily across DeFi platforms within the network.

Institutional Treasury backing

USSD maintains a 1:1 backing with high-quality U.S. dollar assets held with regulated custodians. The reserves include tokenized Treasury products linked to major financial institutions such as BlackRock, Superstate, and WisdomTree.

These tokenized Treasury funds bring traditional financial instruments into blockchain markets while maintaining transparency and stability on-chain. Sonic Labs says the reserve structure follows the same framework used by Frax (FRAX), which focuses on clear redemption mechanics and dependable backing.

Users can mint USSD through non-custodial smart contracts on the Sonic network. Supported dollar-based assets may be deposited at a one-to-one ratio, and the minting process carries no fees.

The structure makes it easier for liquidity providers and DeFi participants to enter the ecosystem without additional costs.

Cross-chain liquidity and Sonic’s DeFi strategy

USSD launches with cross-chain minting support from more than ten blockchain networks. A user can deposit assets on another chain and receive USSD directly on Sonic, allowing liquidity to move between ecosystems with fewer barriers.

Through Frax’s cross-chain infrastructure, the stablecoin can also be exchanged for supported dollar assets. This setup enables users to settle transactions, transfer money between networks, and manage liquidity without depending on fragmented markets.

Stablecoins often serve as the main currency for DeFi, supporting trading pairs, collateral for lending, and settlement in derivatives markets.

A native stablecoin will help keep liquidity within the Sonic ecosystem and gives applications a consistent dollar reference. Revenue generated from the Treasury assets backing USSD may later support ecosystem incentives and network development as activity on Sonic continues to grow.

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

News Videos5 hours ago

News Videos5 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business23 hours ago

Business23 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech3 hours ago

Tech3 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

NewsBeat4 days ago

NewsBeat4 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show

EUROPEAN STOCKS SINK AS OIL SURGES

EUROPEAN STOCKS SINK AS OIL SURGES