Crypto World

China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

When prompted with carefully engineered sentences, China’s Alibaba AI (aka KIMI) model reveals detailed and ambitious price scenarios for XRP, Solana, and Bitcoin by the end of the year.

Based on KIMI’s assessment, a prolonged crypto bull cycle alongside clearer and more constructive regulation in the United States could lift major digital assets to new all-time highs (ATHs) over the coming eleven months.

Below, we break down KIMI’s projections for the three leading cryptocurrencies.

XRP ($XRP): Alibaba AI Charts a Clear Path Toward $10 by 2027

Ripple’s XRP ($XRP) is the largest cryptocurrency for institutional-grade cross-border payments.

Just last week, Ripple, in a blog post, teased its blockchain’s growing utility for institutional-grade payments and tokenization. To XRP HODLers, the message was clear: XRP has a central role in Ripple’s protocol.

Currently trading around $1.45, KIMI estimates that under sustained bullish conditions, XRP could surge to as high as $10 by the end of 2026. That scenario would translate into gains of roughly 600%, or close to 7x increase from current prices.

From a technical perspective, XRP’s Relative Strength Index (RSI) is hovering near 30, placing the asset on the boundary of oversold territory. This often signals that selling pressure is close to peaking, with buyers likely to step in at current levels to capitalize on discounted prices.

At the same time, January’s support and resistance zones formed bullish flag patterns across late 2025 and early 2026, a technical structure that frequently precedes upside breakouts.

Institutional inflows from newly approved U.S.-based XRP exchange-traded funds, along with Ripple’s growing network of partners and the possibility of the US CLARITY bill getting finalised this year, could act as the explosive catalysts needed to hit Alibaba’s target.

Solana (SOL): Alibaba AI Sees SOL at $400

The Solana ($SOL) network now hosts approximately $6.4 billion in total value locked (TVL) and commands a market cap close to $50 billion, supported by steady gains in network usage, developer engagement, and daily users.

Investor interest in SOL has intensified following the launch of Solana-linked ETFs from major asset managers, including Bitwise and Grayscale.

After undergoing a sharp correction in late 2025, SOL spent recent months consolidating around a crucial support range and currently trades near $85.

Like most altcoins, Solana’s price action remains closely correlated with Bitcoin. If BTC reclaims the $100,000 level, a milestone it could reach before midyear, this could quickly set the stage for a strong SOL rebound.

Under KIMI’s most optimistic outlook, Solana could climb to $400 by 2027. That would represent nearly 5x returns for current HODLers while decisively pipping its previous ATH of $293, set last January.

Institutional adoption continues to reinforce Solana’s long-term thesis. The network is increasingly being used for real-world asset tokenization, with firms such as Franklin Templeton and BlackRock leveraging Solana for the tech so far.

Bitcoin (BTC): Alibaba AI Predicts 1BTC will Soon be Half a Million Dollars

Bitcoin ($BTC), the first and largest cryptocurrency by market value, reached a fresh ATH of $126,080 on October 6 and has been pulling back ever since.

Despite the troubles, KIMI’s analysis suggests that Bitcoin’s broader year-over-year uptrend can still continue, with 2026 price targets stretching to between $150,000 and by $500,000.

Often described as digital gold, Bitcoin continues to attract both institutional and retail investors seeking protection against inflation and broader macroeconomic uncertainty.

Bitcoin currently accounts for roughly $1.4 trillion of the $2.4 trillion total cryptocurrency market. Since setting its latest all-time high, BTC has declined by about 45% and now trades below $70,000, following two sharp selloffs exacerbated by geopolitical tensions surrounding potential U.S. military action involving Iran and Greenland.

Looking past near-term risks, KIMI’s outlook points to accelerating institutional participation and post-halving supply constraints as major drivers that could push Bitcoin to multiple new highs this year.

Moreover, if U.S. lawmakers advance proposals to establish a Strategic Bitcoin Reserve, Bitcoin’s long-term upside could exceed even KIMI’s already bullish projections.

New Maxi Doge Presale Could Be the Next Dogecoin

Finally, outside of Alibaba’s AI-driven forecasts, Maxi Doge ($MAXI) is one of the most talked-about meme coin presales of 2026, raising $4.6 million ahead of its public launch.

The project’s mascot is a high-octane parody (and envious distant cousin) of Dogecoin, combining gym-bro bravado with unapologetic degen humor.

Loud, pumped, and intentionally over the top, Maxi Doge fully embraces the irreverent spirit that originally propelled Dogecoin and Shiba Inu into the spotlight.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, giving it a notably smaller environmental footprint compared to Dogecoin’s proof-of-work design.

During the presale, participants can stake MAXI tokens to earn yields of up to 68% APY, with returns gradually declining as the staking pool expands.

The token is currently priced at $0.0002803 in the latest presale phase, with automatic price increases applied at each funding milestone. Purchases are supported via MetaMask and Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new alpha in Dogesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026 appeared first on Cryptonews.

Crypto World

BTC takes aim at $70,000 after Trump says U.S. ahead of schedule in Iran attack

A wild 24 hours continued in all markets after President Trump said the war against Iran could be over soon.

The action against Iran is “very far ahead” of what was expected to be a four-to-five-week time frame, said Trump in late-afternoon comments. He is expected to give updates on the situation at 5:30 pm ET.

Already in the midst of a sharp reversal higher after plunging Sunday evening as oil soared as much as 30%, crypto and equity markets added to gains following the comments.

Just ahead of the close, the Nasdaq was ahead 1.25% and S&P 500 0.8%. Bitcoin at just above $69,000 was up 2.4% over the past 24 hours.

Oil, meanwhile, tumbled even further. After rising as much as 30% to $120 per barrel on Sunday evening, WTI crude plunged all the way back to $85, now lower by 6% for the day.

Crypto-related stocks added to Monday’s gains, with Circle (CRCL) up 10% while Strategy (MSTR) and Coinbase (COIN) were 5% and 2% higher, respectively.

Crypto World

Bitcoin Eyes $70K, Oil Prices Dump as Trump Claims the War Is Almost Over

The S&P 500 and gold are also surging.

After a day of more fluctuations prompted by the quickly developing situation in the Middle East, bitcoin’s price aimed at $70,000 minutes ago as Trump addressed the war and the Strait of Hormuz.

His words sent shockwaves through other financial fields as well, especially with oil, as the CFDs on WTI Crude Oil plunged to under $90 per barrel after skyrocketing to $120 earlier today.

BREAKING: President Trump says “I think the war is very complete, pretty much.”

Oil prices officially turn negative on the day, erasing a gain of +30%, in one of the largest daily reversals ever recorded. pic.twitter.com/c01Ni9RZIS

— The Kobeissi Letter (@KobeissiLetter) March 9, 2026

The POTUS’s indication that the war is pretty much completed comes in a rather intriguing time, as Iran just chose a new Supreme Leader – Mojtaba Khamenei, who is the son of the former. Trump repeatedly outlined that he is not happy with the choice, calling it a big mistake.

At the same time, reports continue to emerge that several countries in the region, including the UAE and Turkey, keep intercepting more drones and missiles from Iran.

While also addressing the situation in the Middle East, President Trump reportedly added that the US is mulling taking over the Strait of Hormuz, which has been essentially closed for days, thus reducing the amount of transported goods, mostly oil.

As mentioned above, oil prices dumped again following Trump’s latest remarks after reaching a multi-year peak this morning. Gold and the S&P 500 went on a run, with the former tapping $5,140/oz, while the latter climbed above 6,800.

You may also like:

Bitcoin quickly jumped from $68,000 to $69,600 (on Bitstamp) but was stopped there and now trades around $69,000 again. Ethereum has jumped past $2,000, while SOL is above $85.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Pudgy Penguins’ Pudgy World launch lifts pengu token

Pudgy Penguins’ Pudgy World launch is turning PENGU into a high‑beta bet on NFT gaming as traders test whether the brand’s cultural hype can translate into lasting on-chain activity.

Summary

- Pudgy Penguins’ Pudgy World launch is boosting attention and liquidity around the ecosystem’s PENGU token, turning it into a high-beta bet on NFT gaming.

- PENGU’s trading volume has surged into the nine-figure daily range on some venues, signaling aggressive speculation rather than just passive community holding.

- The launch ties Pudgy’s Web3 IP, gaming, and token together, positioning PENGU as a leveraged play on whether the brand can convert cultural hype into sustainable on-chain activity.

Global crypto markets are being steered less by conviction and more by where the next forced seller sits. At the margin, market structure, macro, and meme‑driven liquidity are colliding in real time – with Pudgy Penguins’ latest gaming push emerging as a surprisingly clear case study.

Pudgy Penguins (PENGU), one of NFT land’s stickier brands, has launched its third title, Pudgy World, extending the project’s reach from profile pictures into casual gaming. CoinGecko highlighted the move in a post stating: “Pudgy Penguins launches its third game, Pudgy World. $PENGU is now trending #2 on CoinGecko, up 7.4% today.” The framing is not accidental. Trending status and intraday performance now function as both marketing and market structure, broadcasting where liquidity and attention are rotating in a session dominated by macro‑sensitive flows.

Underneath the social buzz, the numbers are modest but telling. CoinGecko data show Pudgy Penguins (PENGU) trading around $0.0069, with roughly $105.8 million changing hands over the last 24 hours. It is a classic reflexive micro‑cap: price action feeds narrative, which in turn drives more flow into a tightly held token tied to recognizable IP. As one community‑aligned commentator observed in response to the launch, the $PENGU ecosystem is “actively expanding and attracting new users,” with Pudgy World seen as evidence the brand is “making waves” rather than fading into NFT winter.

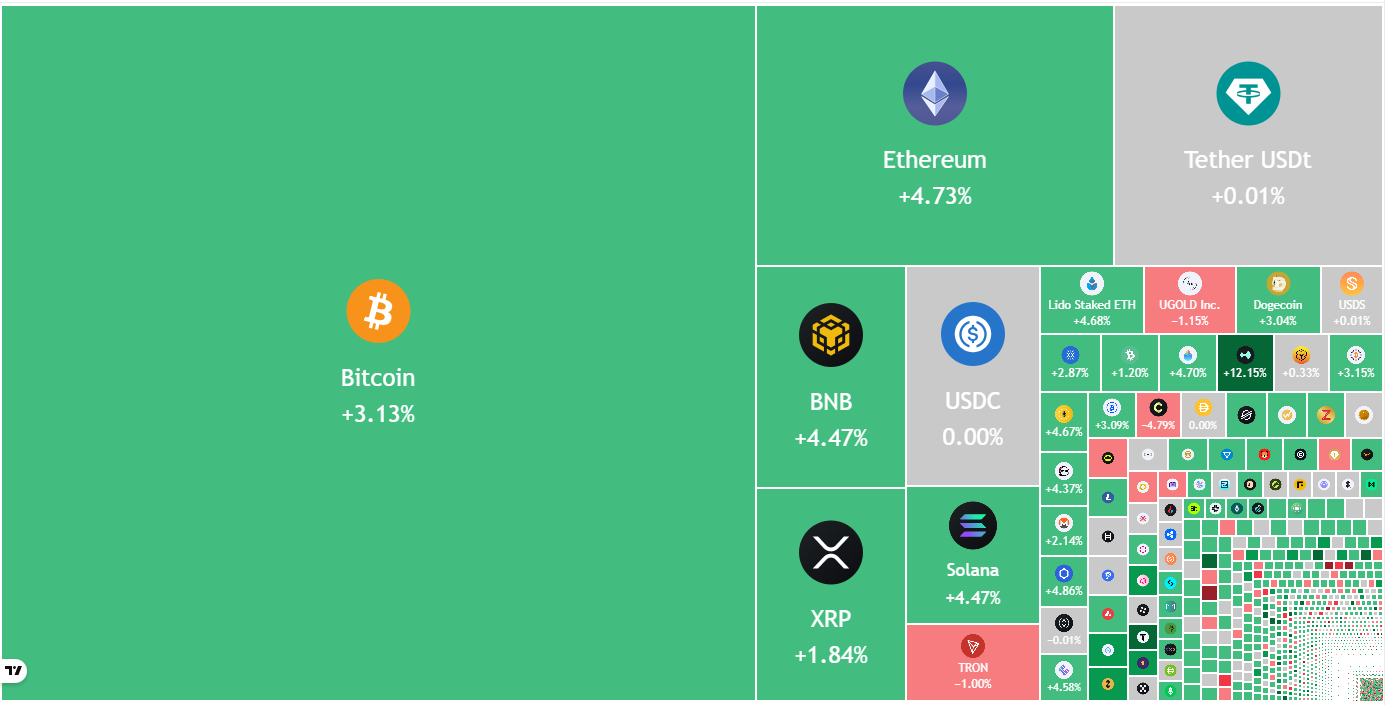

Against that sits a far heavier macro backdrop. Bitcoin trades near $68,615, up about 2.5% over the past day, on 24‑hour volumes above $50.7 billion according to CoinMarketCap, reaffirming its role as the market’s beta instrument when global risk sentiment shifts. Ethereum hovers around $2,011, down roughly 3.7% in the same period, with a market cap near $260.2 billion as traders debate how much further the current drawdown can run before structural buyers re‑engage.

In practice, this leaves PENGU and similar tokens trading like long‑dated venture risk embedded inside a macro‑sensitive, dollar‑denominated system. The launch of Pudgy World may be a bright spot for NFT loyalists, but it is also a reminder: even the most playful corners of crypto now sit squarely inside a trading environment defined by liquidity, leverage, and the timing of the next forced seller.Provide 3 titles for this article. The titles should be no more than 90 characters, only capitalize essential words, names and terms not every word. Next, summarize the entire article in 160 characters or less. Then provide 3 summary bullet points. write an original short decription for socials max length 200 characters, use emojis.

Crypto World

DeFi lending platform Compound Finance hijacked again

DeFi users reported suspicious functionality on the website of lending platform Compound Finance on Sunday.

The incident is the latest in a string of website hijackings that have affected Maple Finance, OpenEden and Curvance.

It’s the second time attackers have compromised Compound’s front end in less than two years.

Read more: Compound Finance and Celer Network websites compromised in ‘front-end’ attacks

Compound’s security provider later published an update on the project’s governance forum, reassuring users that the incident had been rectified and “all other credentials on the affected infrastructure account have been rotated.”

The post explains that the project’s website redirected users to “a phishing site hosted on a lookalike domain (‘compOOnd’),” but “no user loss of funds [was] identified.”

Compounding errors

Previously, the Compound front end was hacked in July 2024, along with other Squarespace-based DeFi domains.

There are worries that such attacks may become more common as AI tools lower the bar for would-be phishing scammers.

Read more: AI just bypassed the Cloudflare protection that DeFi needs

Luckily, any users of Compound were better protected yesterday.

According to the forum post, the app.compound.finance subdomain, on which users connect wallets and make transactions, “is served via IPFS, allowing [security providers] to independently verify its integrity.”

Sunday’s incident is the latest in a string of blunders for what was once one of DeFi’s top protocols.

Last year, the Compound DAO came under scrutiny over conflict-of-interest concerns related to service provider Gauntlet.

In 2022, an operational error bricked the cETH market (worth over $800 million at the time) for a week while a fix was implemented. The previous year, almost $150 million of excess rewards were distributed, also by mistake.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Mastercard and Google Team Up to Build Trust for AI-Powered Shopping

Verifiable Intent creates a tamper-resistant, cryptographic record of what a user authorized when an AI agent acts on their behalf.

Mastercard has unveiled Verifiable Intent, a new open, standards-based trust framework co-developed with Google, designed specifically for “agentic commerce” — a world where artificial intelligence (AI) systems don’t just assist shoppers, but actively plan, decide, and complete purchases autonomously.

The core problem Verifiable Intent aims to solve is visibility: when a consumer delegates a purchase to an AI agent, the clear “click buy” or “tap to pay” moment that traditionally signals intent disappears. Mastercard’s Chief Digital Officer Pablo Fourez argues that this creates a new challenge for every party involved — consumers need assurance their instructions were followed, merchants need confirmation an agent is authorized to buy, and issuers need to distinguish legitimate activity from fraud.

To address this, Verifiable Intent creates a tamper-resistant, cryptographic record of what a user authorized when an AI agent acts on their behalf — linking identity, intent, and action into a single, privacy-preserving audit trail.

The framework uses Selective Disclosure, a privacy control technique, to ensure that only the minimum necessary information is shared between parties and only when needed, allowing merchants and issuers to verify transactions without access to sensitive consumer data.

It leverages widely adopted standards from the FIDO Alliance, EMVCo, the Internet Engineering Task Force, and the World Wide Web Consortium, and is designed to work across agentic protocols, devices, wallets, and platforms. Mastercard says Verifiable Intent will be integrated into its Agent Pay APIs in the coming months.

Crypto Rails Join the Fray

Not everyone sees traditional payment networks as the right foundation for AI-driven commerce, however, highlighting a growing debate about whether AI agents will ultimately transact through incumbent networks like Mastercard or bypass them entirely in favor of crypto-native infrastructure.

“Very soon there are going to be more AI agents than humans making transactions. They can’t open a bank account, but they can own a crypto wallet. Think about it,” Coinbase CEO Brian Armstrong posted on X today.

In September, EigenCloud, Ethereum’s largest restaking protocol with nearly $9 billion in total value locked, announced a partnership with Google Cloud to serve as the verifiable backbone for AI agent payments.

Meanwhile, the Ethereum Foundation launched a dedicated AI initiative called the dAI Team, with a stated mission to make Ethereum the preferred settlement and coordination layer for the emerging “machine economy.”

The following month, attention turned to x402 protocols, which enable AI agent payment systems and increase the practicality of agentic AI-led finance.

Taken together, these developments paint a picture of an industry racing to solve the same core problem from two very different directions. Mastercard and traditional finance are building trust layers on top of existing payment rails, while crypto proponents are betting that blockchain infrastructure is better suited to a world where AI agents are first-class economic actors.

Crypto World

140,000 BTC Exit Short-Term Holders as Capitulation Pressure Builds in Bitcoin

Short-term holders are currently facing about 24% unrealized losses.

Bitcoin’s short-term holders have continued to realize losses, as on-chain data found sustained selling pressure across most of the past week.

According to the latest analysis by Axel Adler Jr., the Short-Term Holder Spent Output Profit Ratio (STH SOPR), a metric that measures whether coins held for less than 155 days are being sold at a profit or loss, remained below the neutral level of 1.0 for seven of the last eight days between March 2 and March 9.

A reading below 1.0 indicates that the cohort is selling at prices lower than their acquisition cost.

Bitcoin’s Weak Hands Are Selling

As of March 9, the intraday average STH SOPR stood at 0.987, and only six out of 35 observed blocks, or about 17%, closed above the 1.0 threshold. The 7-day moving average for the metric remained near 0.992, which further supports the view that loss realization among short-term holders has persisted for several consecutive days rather than appearing as a single isolated event.

During the same period, the metric crossed above 1.0 only once, on March 4, when the price of Bitcoin briefly reached $74,000 before returning to loss-selling territory. The lowest weekly reading occurred on March 6 at 0.979, while March 8 registered 0.991. Both of these instances confirm that most transactions from this cohort were executed below cost basis.

Adler explained that the first clear signal of a change in market conditions would be STH SOPR closing above 1.0 for several consecutive days alongside rising prices.

Capitulation

In addition to the profitability metric, Adler examined changes in terms of the overall supply held by short-term investors. Over the past two weeks, the total volume of coins within the short-term holder cohort declined from approximately 6.06 million BTC to about 5.92 million BTC. This essentially indicated that roughly 140,000 BTC left the cohort.

You may also like:

Such a reduction reflects either capitulation through realized losses or the natural aging of coins into long-term holder status after surpassing the 155-day holding threshold. At the same time, the cohort’s realized price remained around $89,028, while the market price traded near $67,000 during the period analyzed.

The difference represents an unrealized loss of roughly 24% for the average short-term holder. Adler observed that this gap between the realized price and the current market value creates a structural supply overhang in the market. As prices recover, some short-term investors who purchased at higher levels may use rallies as opportunities to exit positions without losses, and would potentially add supply and reduce the strength of upward moves.

The combination of the two indicators points to an ongoing “cohort cleansing,” in which the more price-sensitive segment of the market is gradually exiting through selling pressure rather than through a recovery in profitability.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Bitcoin, Ethereum, and Solana ETFs flash red as prices stay resilient

U.S. Bitcoin, Ethereum, and Solana ETFs saw rare same‑day outflows on March 9, but positive weekly flows and steady spot prices point to rotation, not capitulation.

Summary

- Bitcoin, Ethereum, and Solana ETFs all booked one‑day net outflows, signaling a sharp but concentrated de‑risking across major U.S. spot products.

- Weekly flows remain positive for BTC, ETH, and SOL, suggesting ETF desks are rotating risk within crypto rather than exiting the asset class.

- Despite red ETF prints, Bitcoin trades in the high‑$60K band, Ethereum near $2,000, and Solana just under $90, underscoring a resilient spot tape.

U.S. crypto ETFs flashed a rare warning signal on March 9 as spot products for Bitcoin, Ethereum, and Solana all recorded simultaneous net outflows, even as underlying prices held firm near recent ranges.

ETF flows: risk-on, but defensive

On-chain analytics firm Lookonchain reported that U.S. Bitcoin ETFs saw a one-day net outflow of 5,409 BTC, while Ethereum ETFs shed 36,599 ETH and Solana products lost 68,933 SOL, underscoring a sharp but concentrated bout of de-risking across majors. A separate summary of the same dataset framed the move as a short-term shock inside a still-positive weekly trend, noting that “Bitcoin ETFs experienced a one-day net outflow of 5,409 BTC… however, the seven-day net inflow stood at a positive 8,154 BTC,” with Ethereum and Solana showing similar one-day outflows but net inflows over seven days.

In that analysis, Solana stood out as the most volatile leg of the trade: “Solana ETFs displayed the most dramatic shifts… with a one-day net outflow of 68,933 SOL… Contrarily, the seven-day net inflow reached +266,247 SOL,” a pattern more consistent with fast money rotation than structural capitulation.

Macro structure: liquidity, not faith

The flows come against a macro backdrop where crypto still trades as a high‑beta expression of global liquidity rather than a simple tech proxy.

As one ETF strategist put it in the Lookonchain-linked commentary, recent moves “could influence trading strategies, as traders monitor whether these outflows represent profit-taking or a shift in investor confidence amid broader market volatility,” highlighting that desks are treating ETF flows as a real‑time barometer of positioning, not a referendum on the asset class itself.

Price action: resilient tape

Despite the ETF outflows, majors held up. Bitcoin recently traded around the high‑$60K band, with multiple spot dashboards placing it near $68K–$69K and up roughly 1–3% over the last 24 hours at press time.

Ethereum changed hands near $2,000–$2,050, gaining about 3–4% on the day, while Solana hovered around $85.20, up 3.69% in 24 hours as it continued to “grind sideways just under $90.”

For traders, the message is blunt: ETF red prints are back, but as long as weekly flows stay positive and spot refuses to break, the underlying market structure still looks like rotation within a risk bucket rather than an exit from it.

Crypto World

Crypto Traders Ignore High Oil Prices As BTC, Altcoins Rally

Key points:

-

Rising oil prices have not hurt crypto sentiment as buyers attempt to push Bitcoin above $69,000

-

Buyers are attempting to propel several major altcoins above their overhead resistance levels, indicating demand at lower levels.

A sharp rally in oil prices failed to deter cryptocurrency buyers who pushed Bitcoin (BTC) above $69,000 on Monday. Although the spot BTC exchange-traded funds witnessed outflows on Thursday and Friday, the week saw net inflows of $568.45 million per SoSoValue data. That was the second successive week of net inflows, a first in five months.

While some analysts believe that BTC may have bottomed out, on-chain analyst Willy Woo said in a post on X that BTC was solidly in the middle of a bear market from a long-range liquidity perspective and was forming a bull trap.

Usually, when negative news fails to sink the price to a new low in a bearish trend, it suggests that the selling may be drying up. That doesn’t guarantee a sharp rally in the near term, as markets tend to consolidate in a range for a while before starting the next leg higher.

Could buyers push BTC and major altcoins above their resistance levels? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index price prediction

The S&P 500 Index (SPX) closed below the 6,775 level on Friday, indicating that the bears are attempting to take charge.

The moving averages have completed a bearish crossover, and the relative strength index (RSI) has dipped into the negative territory, indicating the path of least resistance is to the downside. The next crucial support to watch out for on the downside is 6,550. If the level cracks, the correction may deepen to 6,147.

Buyers will have to drive the price above the moving averages to signal strength. That improves the prospects of a rally to the 7,290 level.

US Dollar Index price prediction

The US Dollar Index (DXY) is facing resistance near the 99.50 level, but the bulls have kept up the pressure.

The upsloping 20-day exponential moving average (98.17) and the RSI above the 63 level suggest that the bulls are in command. If the price closes above the 99.50 level, the index may retest the critical overhead resistance at the 100.54 level. A close above the 100.54 resistance suggests the start of a new up move.

Sellers will have to tug the price below the moving averages to retain the index inside the 95.50 to 100.54 range.

Bitcoin price prediction

BTC fell below the 20-day EMA ($68,553) on Friday, but the bears could not sink the price below the support line. That suggests demand at lower levels.

If the price maintains above the 20-day EMA, the likelihood of a break above the $74,508 resistance increases. Such a move suggests that the BTC/USDT pair may have bottomed out in the short term. The Bitcoin price may then soar to $84,000, where the bears are expected to mount a strong defense.

This positive view will be invalidated in the near term if the price turns down and breaks below the support line. The pair may then drop to the vital support at $60,000.

Ether price prediction

Ether (ETH) broke below the 20-day EMA ($2,018) on Friday, but the bears could not sink the price to the $1,750 level.

That suggests selling dries up at lower levels. The bulls are attempting to push the price back above the 20-day EMA. If they manage to do that, the ETH/USDT pair may climb to the 50-day SMA ($2,249). Sellers will attempt to halt the relief rally at the 50-day SMA, but if the bulls prevail, the pair may jump to $2,600.

Contrary to this assumption, if the Ether price turns down from the $2,111 level and breaks below $1,916, it signals that the pair may remain inside the range for a while longer.

BNB price prediction

BNB (BNB) fell below the 20-day EMA ($633) on Friday, but the bears could not pull the price to the $570 level.

That attracted buyers who are trying to push the price back above the 20-day EMA. If they succeed, the BNB/USDT pair may retest the overhead resistance at $670. Sellers are expected to fiercely defend the $670 level, as a close above it opens the doors for a rally to $730 and then $790.

Instead, if the BNB price turns down from the current level or the $670 resistance, it suggests that the range-bound action may continue for a few more days. Sellers will have to yank the pair below the $570 level to start the next leg of the downtrend toward $500.

XRP price prediction

XRP (XRP) has been trading just below the 20-day EMA ($1.39) for several days, indicating that the bulls continue to exert pressure.

A close above the 20-day EMA will be the first sign of strength. The XRP/USDT pair may then rally to the $1.61 level and subsequently to the downtrend line of the descending channel pattern. Buyers will have to break and sustain the XRP price above the downtrend line to signal a short-term trend change.

Conversely, if the price turns down from the 20-day EMA and breaks below $1.27, it suggests that the bulls have given up. That may sink the pair to the support line, which is likely to attract buyers.

Solana price prediction

Solana (SOL) has been consolidating between $76 and $95 for several days, indicating a balance between supply and demand.

The flattish 20-day EMA ($85) and the RSI just below the midpoint do not give a clear advantage either to the bulls or the bears.

The next trending move is expected to begin on a close above $95 or below $76. If buyers drive the Solana price above $95, the rally may reach $117. Alternatively, a break and close below $76 suggests that the bears have overpowered the bulls. The SOL/USDT pair may then slump to the Feb. 6 low of $67.

Related: Bitcoin at $67K despite oil shock is ‘strongest indicator’ bottom may be in

Dogecoin price prediction

Dogecoin (DOGE) fell below the $0.09 support on Sunday, but the bears could not sustain the lower levels. The bulls bought the dip and are attempting to reclaim the level.

If the relief rally turns down from the 20-day EMA ($0.09), it suggests that the bears remain in control. That heightens the risk of a drop to Feb. 6 low of $0.08.

Buyers are likely to have other plans. They will attempt to push the Dogecoin price above the moving averages. If they can pull it off, the DOGE/USDT pair may surge to the breakdown level of $0.12. Buyers will have to achieve a close above the $0.12 resistance to suggest that the pair may have bottomed out at $0.08.

Cardano price prediction

Cardano (ADA) slipped below the $0.25 support on Sunday, but the bears are struggling to sustain the lower levels.

The bulls will attempt a recovery, which is expected to face selling at the 20-day EMA ($0.27). If the price turns down sharply from the 20-day EMA, the bears will strive to sink the ADA/USDT pair to the support line of the descending channel pattern. If the Cardano price rebounds off the support line with strength, it suggests that the pair may remain inside the channel for some more time.

The bulls will have to drive and maintain the price above the downtrend line to signal a potential short-term trend change.

Bitcoin Cash price prediction

Bitcoin Cash (BCH) has been witnessing a tough battle between the bulls and the bears at the $443 level.

The bulls are attempting a relief rally, but the bears are likely to halt any recovery attempt at the 20-day EMA ($478). If the Bitcoin Cash price turns down sharply from the 20-day EMA, it increases the likelihood of a break below the $443 level.

If that happens, the BCH/USDT pair will complete a bearish head-and-shoulder pattern. That may start a downward move to $375.

Contrarily, a close above the 20-day EMA suggests that the selling pressure is reducing. The pair may then rally to the 50-day SMA ($525).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Zcash price forecast as ZEC extends gains above $200

- Zcash gained 9% to above $215 but faces resistance and could dump hard.

- The altcoin rose amid Bitcoin’s rebound to above $69,000 on Monday.

- Privacy coin narrative and venture funding have helped ignite ZEC’s uptick.

Zcash (ZEC) rose nearly 9% after bouncing from recent lows, placing the token among the top gainers among the 100 largest cryptocurrencies by market capitalisation.

The privacy-focused coin retested resistance above $215 as altcoins broadly posted modest gains over the past 24 hours.

Sentiment improved after Bitcoin climbed above $69,000, helping lift the wider market.

ZEC advanced alongside other privacy-oriented tokens, including Tornado Cash, Oasis Network, and Dash.

Monero (XMR) also recorded gains, with the token rising nearly 3% over the past 24 hours.

What could help Zcash price higher?

While the broader market rebound has supported Zcash (ZEC), other factors may also be contributing to the token’s recent bounce.

ZEC appears to be drawing momentum from a new report by the United States Department of the Treasury, which acknowledged that crypto privacy tools such as token mixers can serve legitimate purposes.

The report states that such tools may be used for “legitimate financial privacy purposes,” marking a shift in tone from previous official positions regarding mixers and other privacy-focused technologies.

“Lawful users of digital assets may leverage mixers to enable financial privacy when transacting through public blockchains,” the Treasury said in its report to Congress.

The token has also benefited from ecosystem developments.

The team behind a new Zcash-powered mobile wallet recently secured $25 million in a funding round backed by several venture capital firms active in the digital asset sector.

Zcash Open Development Lab (ZODL) has secured over $25 million in funding from a16z, Paradigm, Winklevoss Capital, Coinbase Ventures, Cypherpunk Technologies, Maelstrom (family office of Arthur Hayes), Chapter One, David Friedberg, Haseeb Qureshi, Mert, Balaji and others.

If you… https://t.co/yeTadbUCR5 pic.twitter.com/PyisPQLWVJ

— Josh Swihart 🛡 (@jswihart) March 9, 2026

According to ZODL, the backing “signals strong investor confidence” in shielded ZEC transactions.

Players that participated in the funding include Paradigm, a16z crypto, Winklevoss Capital, and Coinbase Ventures.

Others were Cypherpunk Technologies and Arthur Hayes’ family office, Maelstrom.

Josh Swihart, the former CEO of Zcash developer Electric Coin Company (ECC), founded Zodl (formerly Zashi) in 2024.

Zcash price: breakout or dump below $175?

Zcash (ZEC) was among the standout performers in the privacy-focused segment of the crypto market in 2025.

The token rallied from lows near $50 in September to a peak of about $700 by mid-November.

However, the gains proved difficult to sustain as the broader market turned lower.

As Bitcoin declined and the wider crypto market followed, ZEC retraced sharply, slipping to below $220.

The token fell further to around $184 on February 5, 2026, during a broader market sell-off that coincided with the departure of core developers from Electric Coin Company (ECC).

Following the sharp downturn, ZEC is currently down about 58% on a year-to-date basis.

Zcash price chart by TradingView

The daily chart indicates that Zcash (ZEC) has rebounded from a key support level near $200.

If upward momentum strengthens, the token could test initial resistance in the $290–$300 range, with a potential move toward $400 if buying pressure persists.

The relative strength index (RSI) has turned higher around the 50 level, suggesting the possibility of continued bullish momentum.

However, the moving average convergence divergence (MACD) points to weakening upside strength, which could give sellers an opportunity to push the price back toward recent lows.

On the downside, ZEC could decline to levels last seen in October 2025 if bearish pressure intensifies.

A decisive close below $175 may open the door to further losses, with the next key support level around $120.

Crypto World

Wyoming Senator Revives Crypto Tax Exemption Debate

Cynthia Lummis, one of Wyoming’s two US senators, who announced plans to leave the chamber in 2027, has revived a push for a de minimis tax exclusion on small cryptocurrencies transactions as the Senate debates a digital asset market structure bill.

In a CNBC interview on Wednesday, Lummis said that the House Ways and Means Committee and Senate Finance Committee were considering a $300 exemption to allow crypto users to better use Bitcoin (BTC) for transactions without paying capital gains taxes.

The Wyoming senator’s statement followed her introduction of a standalone bill in July 2025 proposing a de minimis tax exemption for crypto transactions under $300, with a $5,000 limit annually.

“We’re trying to figure out how to weigh, the appropriate way, to decide when a sale — for example of Bitcoin — should be subject to capital gains and when it should be allowed to be used as a simple means of exchange the same way we use the US dollar,” said Lummis.

Lummis, who sits on the Senate Banking Committee, said that her Democrat colleagues were still not voting “yes” on the crypto market structure bill, which passed the House of Representatives as the CLARITY Act in July 2025.

The committee had been scheduled for a markup on the bill in January, but the chair, South Carolina Senator Tim Scott, postponed the meeting indefinitely after Coinbase CEO Brian Armstrong said that the exchange could not support the legislation “as written,” citing concerns with tokenized equities.

Related: Crypto turnaround at Fed as Kraken scores account and Trump nominee goes to Senate

The Wyoming senator has been one of the most outspoken proponents for the market structure bill in Congress. However, Lummis announced in December that she would not seek reelection to the Senate, making her last day in January 2027.

Donald Trump gets deeper into crypto-banking clash on stablecoins

Concerns over the market structure bill, ranging from tokenized equities, responsibilities for US financial regulators, ethics over potential conflicts of interest, and stablecoin yield have effectively stalled progress of the legislation in the Senate.

However, last week US President Donald Trump took to social media to urge banking groups to “make a good deal” with the crypto industry, adding that banks could not hold the CLARITY Act “hostage.” As of Monday, the Senate Banking Committee had not rescheduled its markup of the bill.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

News Videos8 hours ago

News Videos8 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Crypto World5 hours ago

Crypto World5 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Tech6 hours ago

Tech6 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business34 minutes ago

Business34 minutes agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs