CryptoCurrency

Chinese Investors Pour $188M Into Digital Yuan Firms After PBOC Allows Wallet Interest

Chinese investors have injected over $188 million into digital yuan-related stocks following the People’s Bank of China’s (PBOC) decision to allow central bank digital currency wallets to earn interest.

According to Securities Times, the top ten shareholders in digital yuan firms now hold a combined market value of 1.89 billion yuan ($265 million).

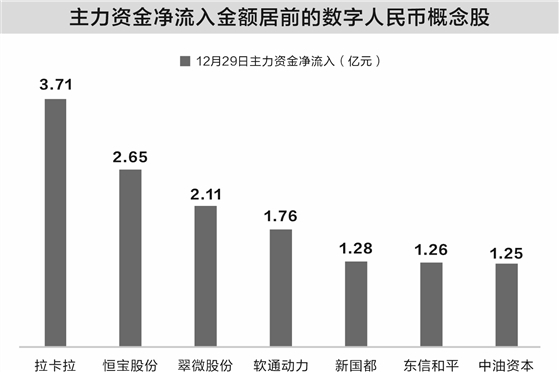

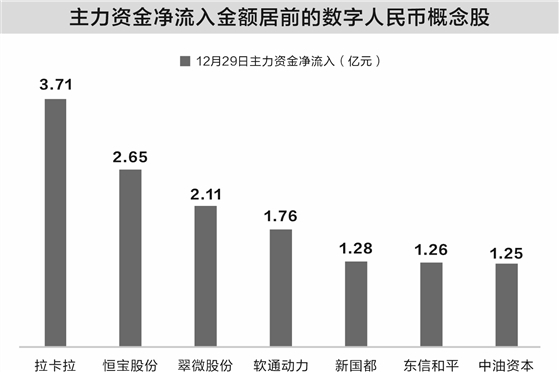

Seven CBDC-related stocks attracted net inflows exceeding 100 million yuan from major investors on December 29 alone, with Lakala leading at 371 million yuan ($52 million), followed by Hengbao Co., Ltd. at 265 million yuan ($37 million), Cuiwei Co., Ltd. at 211 million yuan ($29.5 million), and iSoftStone Co., Ltd. at 176 million yuan ($24.6 million).

Digital Yuan Wallet Interest Drives Investors’ Optimism

The PBOC’s decision to permit interest earnings on digital yuan wallets represents a fundamental shift in the CBDC’s value proposition.

An unnamed financial expert told Shanghai Securities News the policy creates a “win-win situation for all parties,” explaining that “enterprises and individuals will receive interest income and enjoy a wider variety of financial products and services. And commercial banks will receive incentives for conducting digital yuan business.”

Starting January 1, 2026, banks can independently manage assets and liabilities within digital yuan wallet balances under the central bank’s action plan covering 2026 to 2030.

The wallets already deployed in pilot zones function offline in areas without internet access and automatically update balances when contacting internet-connected point-of-sale devices or transit barriers.

Beyond interest capabilities, Shandong Province launched a digital yuan loan program for entrepreneurs through its capital city, Jinan.

The “Ji Dan – Entrepreneurial Loan” online system offers startup funding capped at 200,000 yuan (approximately $28,000), marking the first such initiative to benefit small businesses in the province.

The PBOC Digital Currency Research Institute issued warnings about fraudsters exploiting the new interest features to steal personal and financial data.

Scammers promising cashback returns up to 5% have created fake chat rooms and hosted in-person events to convince people to “convert” digital yuan through unofficial channels.

These schemes involve phishing links, counterfeit apps, and fabricated investment platforms falsely presented as part of the official digital yuan rollout.

The warning comes at a key moment as China works to build public trust in its CBDC ahead of the launch of the enhanced framework.

China Pushes Digital Yuan Expansion Amid Global CBDC Competition

China’s renewed push for a digital yuan contrasts sharply with the United States, where President Donald Trump signed an executive order nearly a year ago banning federal agencies from issuing or endorsing CBDCs.

The PBOC is now aggressively promoting both domestic and cross-border applications for its CBDC, first unveiled in 2020.

Earlier this month, a state-owned bank issued $600 million in commercial bonds to buyers who paid in digital yuan via a private blockchain network.

PBOC Deputy Governor Lu Lei outlined the modern digital yuan’s attributes, including its functions as “a measure of monetary value, store of value, and cross-border payment,” with technical support and supervision provided directly by the central bank.

As of November 2025, the digital yuan processed 3.48 billion transactions totaling 16.7 trillion yuan ($2.34 trillion).

The system supports 230 million personal wallets and 18.84 million corporate wallets through its dedicated app.

The multilateral central bank digital currency bridge processed 4,047 cross-border transactions worth 387.2 billion yuan ($54.2 billion), with the digital yuan accounting for approximately 95.3% of total transaction value across all currencies

Similarly, in September, the PBOC established a digital yuan operations center in Shanghai to advance the yuan’s internationalization as part of Governor Pan Gongsheng’s vision for a multi-polar monetary system supporting the global economy.

The post Chinese Investors Pour $188M Into Digital Yuan Firms After PBOC Allows Wallet Interest appeared first on Cryptonews.

China's CBDC hits ¥7.3T in transactions and 180M wallets by mid-2024. The digital yuan offers offline payment capabilities and is being integrated into public services, from transportation to utilities.

China's CBDC hits ¥7.3T in transactions and 180M wallets by mid-2024. The digital yuan offers offline payment capabilities and is being integrated into public services, from transportation to utilities.