Crypto World

CME Goes 24/7: Here’s When Crypto Futures and Options Trading Starts

TLDR:

- CME will offer 24/7 crypto futures and options starting May 29, pending approval.

- Year-to-date 2026 ADV hits 407,200 contracts, up 46% from last year.

- Futures ADV rises 47% YoY, signaling strong institutional interest in crypto derivatives.

- CME implements brief weekly maintenance; all holiday trades settle the next business day.

CME Group will begin round-the-clock trading for cryptocurrency futures and options starting May 29. The move awaits regulatory approval. Trading will run continuously on CME Globex, with a brief weekly maintenance window.

The update comes amid record demand for digital asset risk management, according to Walter Bloomberg. In 2025, CME reported $3 trillion in crypto notional volume. Year-to-date 2026 volumes are up 46%, highlighting growing institutional participation.

The announcement was confirmed via a press release from CME Group. It emphasizes access to regulated, transparent crypto products at all times for market participants.

Continuous Trading and Market Access

Starting Friday, May 29 at 4:00 p.m. CT, CME cryptocurrency products will trade 24/7. A

two-hour weekly maintenance period will occur over weekends. Trade dates for holiday or weekend activity will follow the next business day. Clearing, settlement, and regulatory reporting will also be processed on the next business day.

Tim McCourt, Global Head of Equities, FX, and Alternative Products at CME Group, said client demand for digital asset risk management is at an all-time high. Providing 24/7 access aims to let clients manage exposure anytime. Consequently, traders can react to market changes without delay.

This continuous trading structure includes both futures and options. CME Globex will host all transactions. As a result, the exchange meets rising institutional interest in high-frequency crypto risk management.

Record Volumes and Market Impact

Crypto trading at CME continues to reach record levels in 2026. Average daily volume stands at 407,200 contracts, up 46% year-over-year. Futures ADV alone is 403,900 contracts, marking a 47% increase. Open interest has risen 7% to 335,400 contracts.

CME operates across multiple asset classes, including interest rates, equity indexes, and commodities. Its derivatives platform allows clients to manage risk efficiently and capture opportunities.

By offering 24/7 crypto trading, CME provides a regulated alternative to unregulated markets.

The update also aligns with CME’s goal to enhance market transparency. Clients can trade with confidence, knowing all activity occurs under regulated oversight. This development strengthens the exchange’s position as a leading crypto derivatives marketplace.

Crypto World

Bitcoin Miners Plan 30GW AI Capacity Amid Margin Pressure

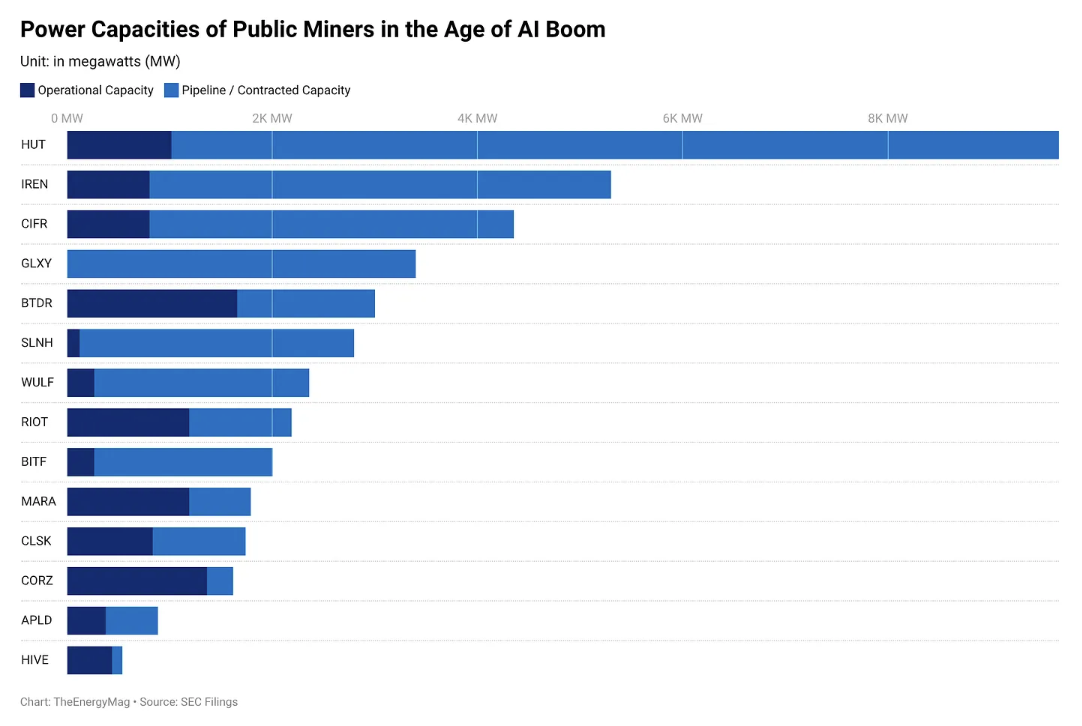

Public Bitcoin miners are planning about 30 gigawatts of new power capacity aimed at artificial intelligence workloads, nearly three times the 11 GW they currently have online, as they race to offset shrinking mining margins and reposition for the next growth cycle.

The buildout, compiled by TheEnergyMag across 14 publicly traded Bitcoin (BTC) miners, underscores how aggressively the industry is pivoting away from traditional hashpower amid persistently weak hashprice conditions.

On paper, the planned expansion amounts to what TheEnergyMag described as “a small country’s worth of power infrastructure.” In reality, much of the 30 GW sits in development pipelines, interconnection queues or early-stage plans, rather than operational facilities.

The widening gap suggests competition is shifting from ASIC efficiency to securing power, financing and delivering data centers on time.

“This is the megawatt arms race of the AI boom,” TheEnergyMag said, adding that monetization ultimately depends on whether AI demand remains strong enough to justify the scale of investment.

Related: The real ‘supercycle’ isn’t crypto, it’s AI infrastructure: Analyst

AI pivot delivers early revenue gains for some miners

The shift toward artificial intelligence infrastructure reflects an increasingly hybrid strategy among established Bitcoin miners, with some companies already reporting meaningful revenue contributions from AI and high-performance computing (HPC) workloads.

One example is HIVE Digital, which recently posted record quarterly revenue driven in part by its AI and HPC business lines. The company reported fourth-quarter sales of $93.1 million, up 219% year on year, even as Bitcoin prices declined during the period.

Investors, too, are attuned to the shift. Earlier this week, Starboard Value went public with its suggestion to Riot Platforms management that they accelerate the miner’s expansion into HPC and AI data centers.

The push to diversify comes as mining profits have taken a hit since the 2024 Bitcoin halving, which cut block rewards and squeezed margins across the industry.

Conditions have gotten even tougher since the fourth quarter, when heavy selling pressure sent Bitcoin tumbling from its record high above $126,000. Prices eventually stabilized in February, after briefly falling to below $60,000.

Despite these headwinds, US-based miners showed resilience at the start of the year, with output rebounding after a severe winter storm temporarily disrupted operations.

Related: Paradigm reframes Bitcoin mining as grid asset, not energy drain

Crypto World

Strong US Jobless Claims & Surging Trade Deficit Stir Markets

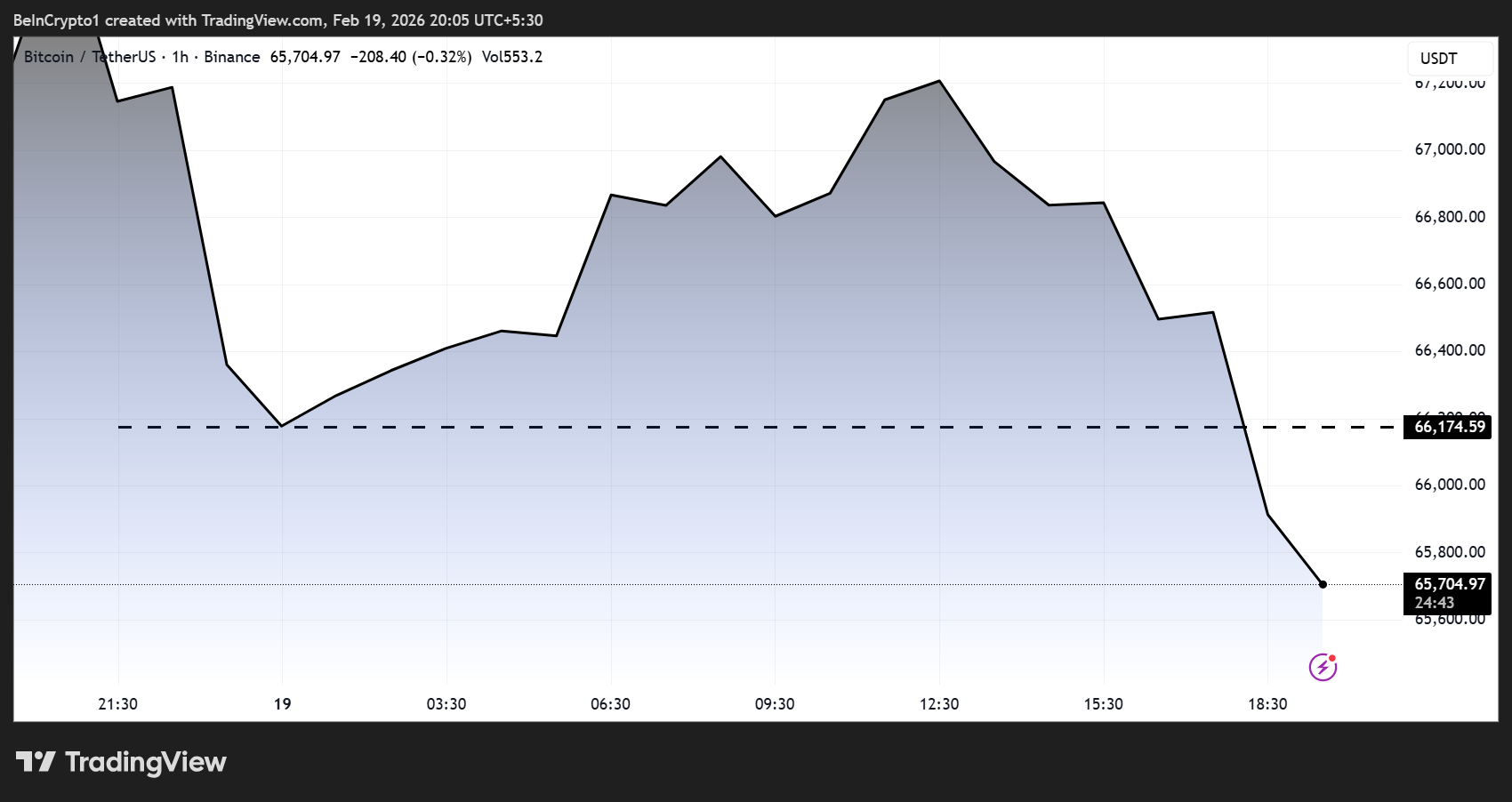

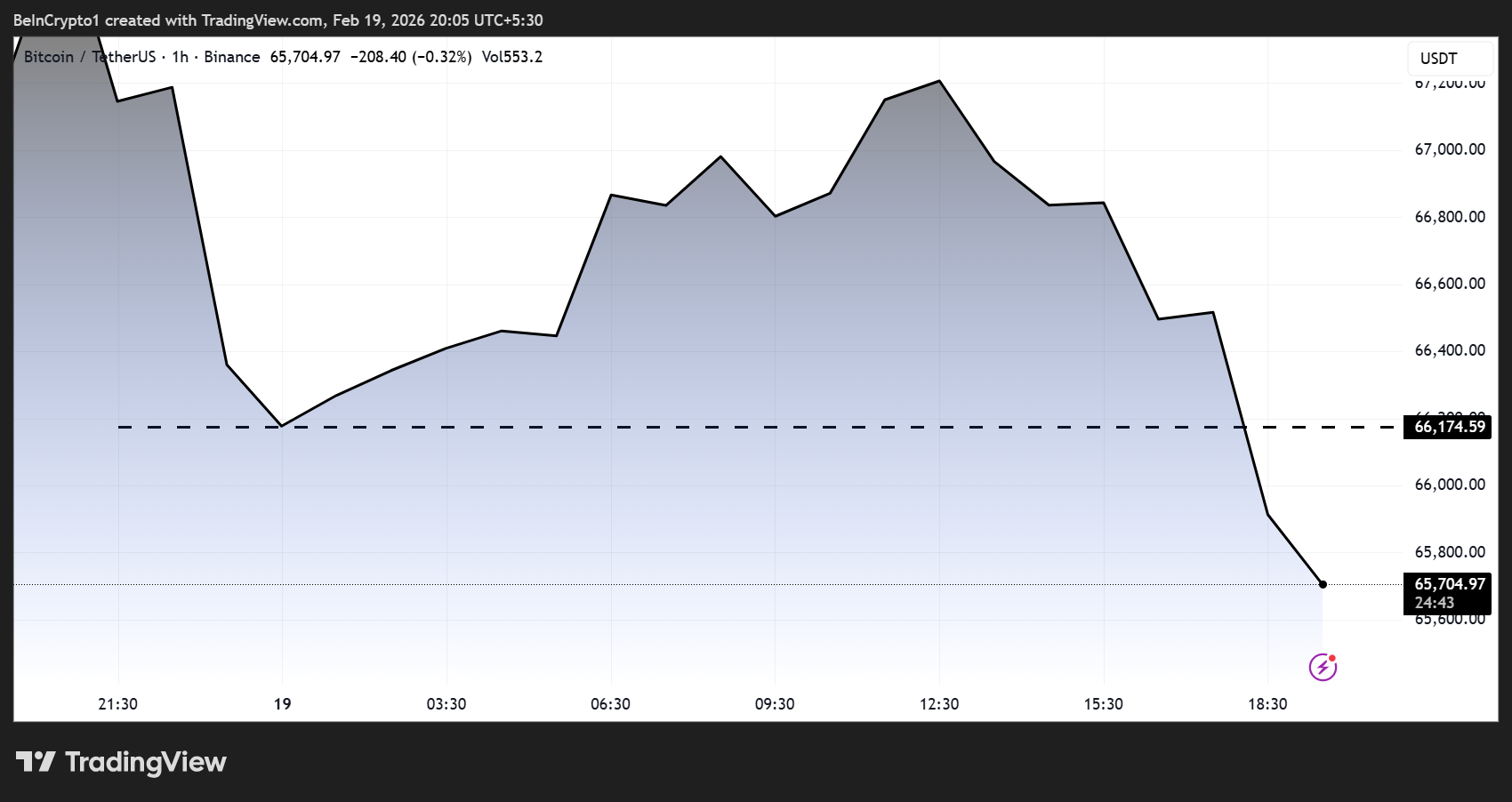

Bitcoin fell below $66,000 on Thursday following mixed US economic data. Initial jobless claims beat expectations, while the trade deficit widened sharply, fueling renewed risk-off sentiment in crypto markets.

Crypto markets in general were watching today’s data release, which featured among the economic data expected to influence Bitcoin sentiment this week.

Bitcoin Retreats Below $66,000 Amid Mixed US Economic Signals

The Labor Department reported 206,000 initial jobless claims, down from a revised 229,000 the prior week and well below market expectations of 225,000.

The four-week moving average also edged lower to 219,000, signaling a labor market that remains resilient despite ongoing economic headwinds.

At the same time, continuing claims, which track ongoing unemployment, rose by 17,000 to 1.869 million, slightly above forecasts of 1.860 million.

This reflects a stable but softening labor market, with limited new hiring but no dramatic layoffs.

“[These advanced numbers] support the thesis of a softer, yet stable, labor market with limited hiring but no dramatic job losses,” Truflation noted.

While the labor data might have suggested stability, markets were rattled by the unexpected jump in the US trade deficit.

The Treasury Department reported that the trade gap surged to $70.3 billion in January, well above the $55.5 billion expected and the prior $53.0 billion print.

The widening deficit reflects growing external imbalances amid persistent domestic demand. This adds a layer of uncertainty for investors already witnessing complex macro conditions.

Despite signs of cooling inflation, Truflation data shows prices remaining below 1% since early February. Crypto markets reacted negatively. Bitcoin’s retreat below $66,000 coincided with broader crypto sell momentum, as traders digested the juxtaposition of strong employment, weak trade balances, and low inflation.

This highlights how technical market sentiment can amplify reactions to economic surprises. The latest macro environment has triggered cautious positioning, with investors reducing exposure amid heightened uncertainty.

The divergence between labor market resilience and a blowout trade deficit illustrates the current macroeconomic tension.

While the labor market data may temper fears of a sudden economic slowdown, the sharp increase in trade deficits could weigh on risk assets if it signals broader demand imbalances.

The interplay of strong employment figures, sub-1% inflation, and a widening trade gap is creating a delicate backdrop for both traditional and digital markets.

Traders will likely watch upcoming economic releases, particularly December PCE and core PCE, and the final Q4 GDP revision reports to gauge whether risk sentiment stabilizes or volatility intensifies further.

Crypto World

Fed’s Kashkari says crypto is ‘utterly useless’

Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, offered a blunt take on digital assets, arguing that cryptocurrencies, including bitcoin and stablecoins, have yet to prove real utility.

Speaking at the 2026 Midwest Economic Outlook Summit in Fargo, North Dakota on Thursday, he contrasted the everyday utility of artificial intelligence (AI) tools with cryptocurrencies.

“Crypto has been around for more than a decade, and it’s utterly useless,” he said, while AI “has real long term potential for the U.S. economy.”

After asking the audience who had used AI tools like ChatGPT or Gemini in the past week, Kashkari posed a second question: “raise your hand if you’ve bought or sold something with bitcoin.”

When the discussion turned to payments and stablecoins, Kashkari said he’s unconvinced the technology improves on existing financial rails. “I hear these words and I like, it’s just, it’s like a buzzword salad,” he said. “What can I do with the stablecoin that I can’t do with Venmo today?”

Pressed on stablecoins being used for cheaper and faster cross-border payments, Kashkari argued that proponents quickly concede that those benefits aren’t aimed at U.S. consumers. While he admitted that adoption in emerging countries is rising, the said the tech still faces technical problems.

While stablecoin advocates promise instant transfers, he said, recipients still need to convert into local currency for everyday payments like buying groceries, which can be expensive.

Kashkari’s skepticism stands in stark contrast to the Trump administration, which has increasingly championed bitcoin and U.S. dollar-backed stablecoins as key strategic tools.

Treasury Secretary Scott Bessent argued that regulated stablecoins can extend the greenback’s dominance in global payments and reinforce its status as the world’s reserve currency, strengthening U.S. financial influence. President Trump also signed an executive order in March to create a strategic bitcoin reserve, which Bessent was an advocate for.

Crypto World

Compare Bitcoin mining features, fees, and performance

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Cloud mining is gaining traction ahead of 2026 as investors seek low-cost, hassle-free access to Bitcoin mining, with platforms like Hashbitcoin leading a growing field of global providers.

Summary

- Hashbitcoin tops the 2026 rankings with daily payouts, transparent operations, and a beginner-friendly setup, plus a $15 trial bonus.

- Major platforms, including BitFuFu, Binance, ECOS, and NiceHash, offer flexible contracts, industrial infrastructure, and stable returns.

- Other notable options, such as Genesis Mining, KuCoin, HashShiny, Bitdeer, and Kryptex, broaden access with low entry costs, automation, and global availability.

As 2026 approaches, cloud mining has rapidly become the preferred choice for investors. Amid the current challenging economic climate, more and more people are seeking secure, low-barrier ways to participate in Bitcoin mining without purchasing expensive ASIC miners or dealing with complex technical setups. Cloud mining perfectly meets this demand, allowing users to easily start earning Bitcoin daily.

With Bitcoin prices continuing to rise and mining difficulty increasing year by year, choosing a reliable cloud mining platform has never been more important. Here’s a compiled list of the top 10 trusted cloud mining platforms for 2026.

1. Hashbitcoin

Hashbitcoin is a leading cloud mining platform designed to provide users with a secure, efficient, and user-friendly mining experience. Developed by MRK Financial Management Limited, Hashbitcoin aims to make cryptocurrency mining accessible to everyone, no hardware, no maintenance, and no prior experience required.

Why Choose Hashbitcoin?

Investors choose Hashbitcoin for three key reasons:

Transparent mining structure

Hashbitcoin provides real hash power supported by robust and eco-friendly mining farms. All mining operations, profit calculations, and payments follow a clear, DAO-governed structure, ensuring transparency with no hidden fees.

Fast daily bitcoin payments

Users can track their earnings in real-time, with profits automatically paid out every 24 hours, helping miners build a stable daily passive income stream.

Beginner-friendly experience

Hashbitcoin offers a simple, guided process that makes it easy for even complete beginners to get started. Anyone can create an account, activate a plan, and start earning immediately. Additionally, all new users receive a $15 free trial bonus to begin mining at no cost.

Key features of Hashbitcoin (2026 Update)

- Total hash power: 16 EH/s

- Active users: Over 10 million worldwide

- Global coverage: Available in more than 220 countries and regions

- Supported cryptocurrencies: Bitcoin (BTC), Litecoin (LTC), Dogecoin (DOGE)

- System type: Fully managed cloud mining system

- Uptime guarantee: High uptime ensures stable mining performance

- Customer support: 24/7 dedicated support team

- New user bonus: $15 free registration bonus for all new users

As one of the few platforms combining massive mining capacity, global reach, and reliable daily payouts, Hashbitcoin has become a top choice for investors worldwide.

How to start earning Bitcoin with Hashbitcoin

Hashbitcoin simplifies the mining process into three easy steps:

Step 1: Register for a free account

New users can visit the Hashbitcoin website and register using their email and password. Once registered, they’ll automatically receive a $15 free mining bonus to start mining right away.

Step 2: Choose a mining plan

Then, they can select a plan that fits their budget and daily earning goals. Once activated, mining begins automatically, requiring no further action.

Step 3: Collect daily Bitcoin earnings

Users’ earnings are settled every 24 hours and credited directly to their accounts. Once they meet the minimum withdrawal limit, they can withdraw their Bitcoin or reinvest it into new mining plans.

Key advantages of Hashbitcoin Mining contracts:

- No hidden fees; all costs are transparent.

- Daily profits are automatically distributed.

- Paid plans refund the initial principal upon contract completion.

- Real-time mining data, including hash rate and earnings, is displayed on the dashboard.

- 24/7 risk control systems ensure secure and stable operations.

Hashbitcoin’s transparency and commitment to prioritizing miners’ interests make it one of the most popular cloud mining platforms on the market.

Hashbitcoin referral and affiliate program

Hashbitcoin offers one of the most lucrative affiliate programs in the mining industry, including:

- Unlimited referrals: Users can refer as many users as they like to join Hashbitcoin.

- Daily passive income: Users can earn up to 3% commission from the profits of their referred paying users.

- Automatic tracking and payments: All referral earnings are calculated automatically and credited to user accounts.

Importantly, referral commissions do not reduce the earnings of the referred users. This allows investors, influencers, and content creators to build an additional source of cryptocurrency income at no extra cost.

2. BitFuFu

BitFuFu is a globally recognized cloud mining brand that operates a wide network of industrial-grade mining facilities. Its partnerships with major hardware manufacturers ensure a reliable and transparent platform.

Key advantages:

- Industrial-grade mining farms

- Flexible contract durations

- Stable daily Bitcoin payouts

3. Binance Cloud Mining

As the world’s largest cryptocurrency exchange, Binance offers official cloud mining services where users can easily purchase hash power and earn daily Bitcoin profits.

Key advantages:

- Strong global reputation

- Transparent fee structure

- Simple onboarding process, ideal for beginners

4. ECOS Mining

ECOS is a regulated cloud mining company based in the free economic zone of Armenia, offering legitimate Bitcoin mining services.

Key features:

- Fully compliant and regulated operations

- Stable daily earnings

- Mobile app for mining management

5. NiceHash

NiceHash is one of the largest hash power marketplaces in the world, connecting buyers and sellers of mining power and offering flexible mining options.

Key advantages:

- Flexible mining contracts

- Fast daily payouts

- Established reputation since 2014

6. Genesis Mining

As one of the earliest cloud mining platforms, Genesis Mining has built a strong reputation with thousands of users worldwide.

Key features:

- Long history of operation

- Support for Bitcoin and multiple altcoins

- Easy-to-manage contract

7. KuCoin Cloud Mining

KuCoin integrates cloud mining into its trading platform, allowing users to rent hash power and earn daily rewards without owning hardware.

Key advantages:

- Beginner-friendly platform

- Secure and transparent mining environment

- Daily Bitcoin payouts

8. HashShiny

HashShiny is a popular platform offering low-cost cloud mining plans with daily Bitcoin rewards, ideal for new users.

Key features:

- Low entry cost

- Automatic mining switching

- Easy registration and operation

9. Bitdeer

Bitdeer provides high-quality cloud mining services supported by top-tier mining farms across multiple continents, catering to both short-term and long-term investors.

Key features:

- Transparent daily earnings

- Flexible contract durations

- Verified industrial-grade mining farms

10. Kryptex Mining

Kryptex combines cloud mining with mining software, offering users flexible earning options.

Key features:

- Fast earnings updates

- User-friendly interface

- Low withdrawal thresholds

Conclusion

After evaluating multiple platforms, Hashbitcoin stands out as the best choice for 2026 due to its:

- Transparent mining structure: High hash power capacity governed by decentralized systems ensures transparency.

- Daily payouts: Earnings are credited every 24 hours, allowing users to withdraw funds anytime.

- Beginner-friendly system: Zero barriers to entry, with a $15 free trial bonus for new users.

- Global trust: Serving over 10 million users in 220+ countries.

Users can sign up on Hashbitcoin to claim their $15 free bonus and start their cloud mining journey today.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Robinhood (HOOD) L2 testnet logs 4 million transactions in first week

Robinhood’s (HOOD) testnet has logged four million transactions in its first week that its testnet chain is live, CEO of the investment platform Vlad Tenev said on X on Thursday.

The Robinhood Chain, which focuses on tokenization and trading, comes at a time where centralized exchanges are looking to building their own blockchain infrastructure even as the broader Ethereum ecosystem debates its future.

“Developers are already building on our L2, designed for tokenized real world assets and onchain financial services,” Tenev wrote.

Testnets are risk-free environments for developers to test code and experimental features ahead of its mainnet going live. The two stages of a network’s development could be compared to a flight simulator and a commercial flight.

The Robinhood Chain’s testnet has arrived against the backdrop of a larger reckoning in the Ethereum world.

Earlier this month, Ethereum co-founder Vitalik Buterin declared that the protocol’s long-held layer-2 (L2) rollup-centric roadmap “no longer makes sense,” arguing that many rollups have fallen short of full decentralization and that Ethereum’s base layer is scaling faster than expected.

That philosophical shift has fueled chatter in the Ethereum community about what scaling and meaningful decentralization may look like in 2026. But while some in the developer community push for new frameworks, Tenev and other centralized players appear to be doubling down on proprietary chains and tokenized markets as a way to capture users and liquidity.

The contrast underscores a growing divide in crypto’s direction. While Ethereum’s core architects reassess how scaling should evolve on the base layer, major trading platforms are looking to control more of the stack themselves. For exchanges, owning the infrastructure could mean tighter user capture, new revenue streams and greater influence over how tokenized markets take shape.

Read more: Robinhood starts testing its own blockchain as crypto and tokenization push deepens

Crypto World

Ethereum Price Eyes Recovery as 4-Week ETF Streak Ends

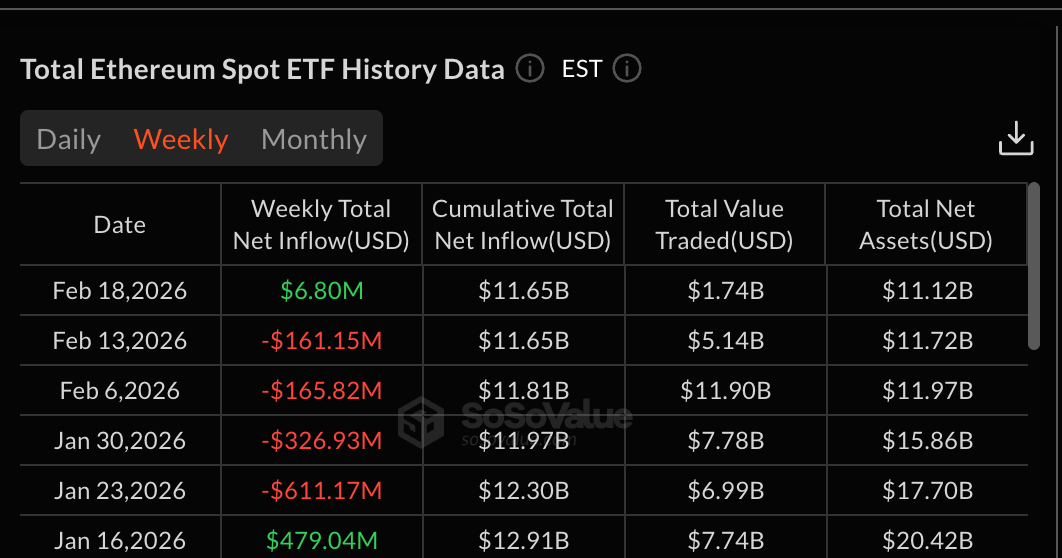

Ethereum has finally broken a four-week streak of continuous ETF outflows. The week ending February 18 recorded inflows, marking the first sign of returning institutional demand. At the same time, whale wallets have started accumulating again. Yet long-term holders continue selling into every Ethereum price bounce.

This creates a direct conflict that could decide whether Ethereum’s price recovery continues or stalls.

Sponsored

Sponsored

ETF Outflow Streak Ends as Whale Accumulation Begins

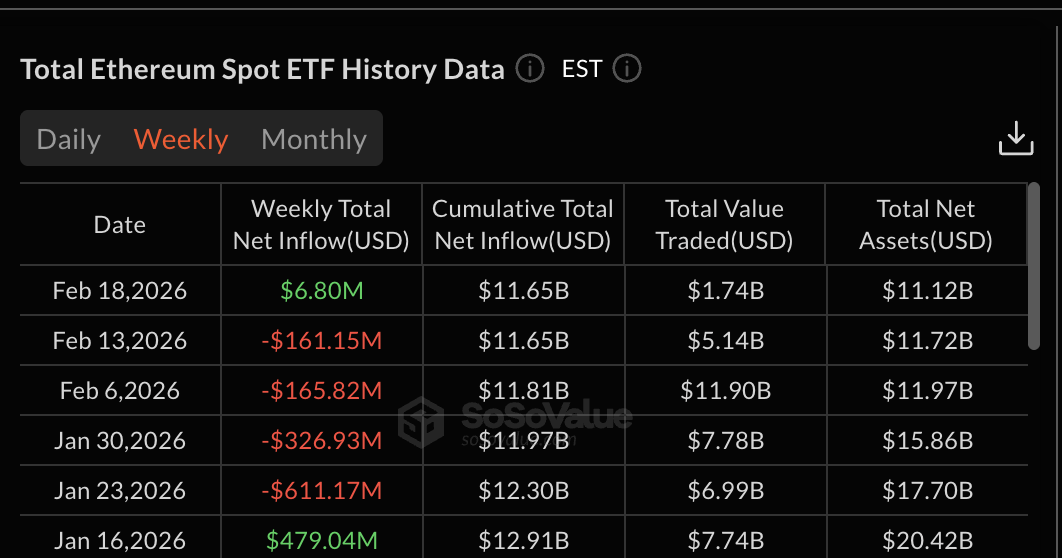

Ethereum spent four straight weeks under consistent institutional selling pressure. Spot Ethereum ETFs recorded net outflows in the weeks ending January 23, January 30, February 6, and February 13. This sustained selling reflected weak institutional confidence and coincided with Ethereum’s broader price decline.

That trend has now changed. The week ending February 18 saw a net inflow of $6.80 million. This shift suggests institutional selling pressure has paused, at least temporarily. When ETF flows turn positive after extended outflows, it often signals early stages of stabilization. However, the inflow figures are still weak and not at par with the outflow strength, yet.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, whale accumulation has returned. Data shows wallets holding large amounts of Ethereum increased their holdings from 113.50 million ETH on February 15 to 113.63 million ETH currently. This represents an increase of 130,000 ETH. At the current price, this equals roughly $253 million worth of Ethereum accumulated in just a few days.

Whale accumulation during weakness is important because large investors often position early before broader recoveries begin. However, this growing optimism faces resistance from another group of investors.

Sponsored

Sponsored

Ethereum Price Flashes Bullish Divergence, But Long-Term Holders Continue Selling

Ethereum’s 8-hour chart shows a key momentum signal that has historically preceded price bounces.

Between February 2 and February 18, Ethereum’s price formed a lower low. This means the price dropped below its previous support level. But during the same period, the Relative Strength Index (RSI) formed a higher low. The RSI measures buying and selling strength and this pattern is called bullish divergence.

This signal has already proven effective twice earlier this month. The first bullish divergence formed between February 2 and February 11. Ethereum’s price then rallied 11%. The second divergence appeared between February 2 and February 15. This led to another 6% recovery.

Both these ETH bounces happened while ETF outflows were still ongoing, showing that buyers were already attempting to regain control. Now, ETF inflows have returned, and whales are accumulating. This increases the probability that another bounce attempt could happen.

Sponsored

Sponsored

However, long-term holders are moving in the opposite direction. The Hodler Net Position Change measures whether long-term holders are accumulating or selling. A negative value means long-term holders are distributing their holdings.

On February 17, long-term holders sold 34,841 ETH over the rolling 30-day period. By February 18, that number increased to 38,877 ETH. This represents a sharp increase in selling pressure in just one day, even as bullish divergence signals appeared.

This shows long-term holders are using price strength to exit positions. The same behavior was visible during earlier February rallies. Both previous bounces failed to sustain upward momentum because long-term holder selling capped the recovery.

This creates a clear conflict. Whale accumulation and ETF inflows support recovery, while long-term holder selling limits upside potential, hinting at a clear risk. This conflict is now reflected directly in Ethereum’s price structure.

Sponsored

Sponsored

Triangle Pattern Reveals Critical Levels

Ethereum is currently trading inside a symmetrical triangle pattern on the 8-hour chart. This pattern forms when the price moves between converging support and resistance lines.

A symmetrical triangle represents balance between buyers and sellers. In Ethereum’s case, buyers include whales and institutional investors returning through ETF inflows. Sellers include long-term holders distributing their positions.

This balance explains why Ethereum remains stuck in consolidation.

The first key resistance level sits near $2,030. This level stopped the previous recovery attempt. A successful move above this level would signal strengthening momentum and also confirm the triangle breakout. The next major resistance stands at $2,100, another bounce blocker. Breaking this level would confirm a stronger recovery and could open the path higher.

However, downside risks remain. Immediate reclaim level sits at $1,960. Failure to hold this level could push Ethereum down to $1,890. A deeper decline could extend toward $1,740 if selling pressure accelerates.

Crypto World

Canary and Grayscale Launch Sui ETFs With Staking Rewards in the US

Sui crypto just stepped into the big boys area.

the first SUI ETFs are now live in the US, Canary Capital and Grayscale both launched products today. And they come with staking yield baked in.

Key Takeaways

- Canary Capital’s SUIS is actively trading on the Nasdaq, while Grayscale’s GSUI launched on the NYSE after converting from a trust.

- Both funds offer staking rewards, a first-of-its-kind feature for US spot crypto ETFs that allows investors to capture network yield.

- The listings arrive as SUI trades near $0.95, down roughly 40% over the last 30 days amidst broader altcoin market capitulation.

Why Sui Crypto ETFs With Staking Matter

While spot Bitcoin and Ethereum ETFs have attracted over $140 billion in inflows, they notably lack staking mechanisms due to initial regulatory hurdles.

The new SUI ETFs from Canary and Grayscale actually can stake the tokens. They tap into Sui delegated proof of stake system and earn rewards. That yield can help offset the usual management fees.

For institutions, that is a big deal. They do not just want price exposure. They want income too.

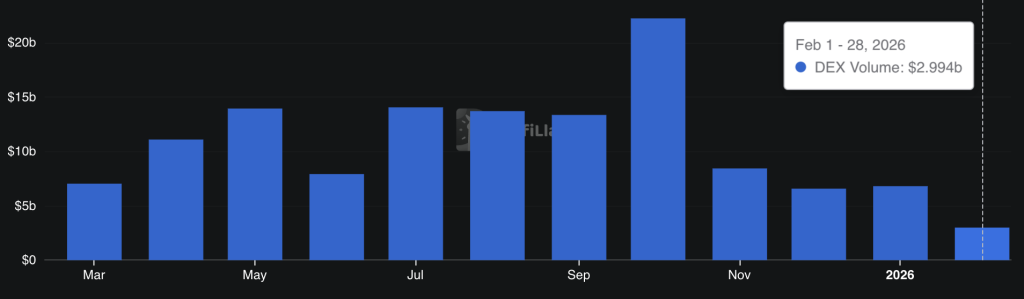

Demand for smarter products is rising rapidly. However, the SUI chain itself has been in decline over the past couple of months. We’re now in mid-January, and DEX volume is at $3B. It may outperform this January, but it is still lower than last year’s numbers.

Breaking Down the ETF Structure

Canary Capital’s ETF is live on Nasdaq under SUIS. It sits under the 1940 Act, which means tighter oversight.

That usually attracts the more cautious money. CEO Steven McClurg made it clear. Investors get direct access to net staking rewards.

At the same time, Grayscale flipped its old Sui trust into an ETF called GSUI on the NYSE. The fee is 0.35%, waived for the first three months or until assets hit $1B.

And here is the kicker. 100% of the tokens were staked at launch. Classic Grayscale move. Turn legacy trusts into spot ETFs and scale fast.

Discover: Here are the crypto likely to explode!

The post Canary and Grayscale Launch Sui ETFs With Staking Rewards in the US appeared first on Cryptonews.

Crypto World

Dash Integrates Zcash Privacy Pool As the Privacy Narrative Heats Up

Dash, a layer-1 blockchain protocol with privacy-preserving features, announced on Thursday the integration of Zcash’s “Orchard” shielded pool into the Dash Evolution chain, a secondary layer on the L1 network that supports smart contract functionality.

The integration will go live following the completion of cybersecurity audits and is expected to launch in March, according to an announcement shared with Cointelegraph.

Initially, the integration will support basic transfers of Zcash (ZEC) from one party to another on the Evolution chain, with subsequent upgrades adding Orchard’s privacy features for tokenized real-world assets (RWAs), the announcement said.

The price of the DASH (DASH), the native token of the network, surged by over 125% in January. Dash briefly reached a local high of about $96 on the Binance crypto exchange before retracing to current levels.

Onchain privacy protocols and privacy blockchain tokens gained significant momentum in 2025 and early 2026, with proponents of the technology framing it as a response to increased financial surveillance from governments and corporations.

Related: Starknet taps EY Nightfall to bring institutional privacy to Ethereum rails

Lack of privacy is holding back crypto payments, while the tech comes under fire

“Lack of Privacy may be the missing link for crypto payments adoption,” according to Changpeng Zhao (CZ), the co-founder of the Binance cryptocurrency exchange.

Businesses will not adopt blockchain technology unless privacy-preserving tools can shield payments, which contain sensitive information about employee compensation, CZ said.

Transaction data could also reveal information about key partnerships and other trade secrets to competitors, Avidan Abitbol, a former business development specialist for the Kaspa cryptocurrency project, told Cointelegraph.

Agata Ferreira, assistant professor at the Warsaw University of Technology, argues that true financial privacy is achieved through a combination of regulation, culture and code, rather than simply protecting onchain metadata.

User anonymity can still be breached, and ownership of privacy tokens can be determined through forensic analysis and law enforcement investigation, according to critics of the technology, like author and Bitcoin (BTC) advocate Saifedean Ammous.

In January 2026, Dubai’s Financial Services Authority (DFSA), a financial regulator for the emirate, banned privacy tokens, including ZEC and XMR (XMR), the native token of the Monero privacy protocol.

The ban does not prevent citizens from holding the tokens, but does prohibit regulated crypto exchanges from selling the tokens to new users, highlighting the tension between state regulators and privacy technology.

Magazine: 2026 is the year of pragmatic privacy in crypto: Canton, Zcash and more

Crypto World

Hims & Hers (HIMS) Stock: Company Acquires Eucalyptus for Up to $1.15 Billion

TLDR

- Hims & Hers Health (HIMS) will acquire Australian digital health company Eucalyptus for up to $1.15 billion.

- The deal includes ~$240 million cash at closing, deferred payments over 18 months, and performance-based earnouts through early 2029.

- Eucalyptus runs a ~$450 million annual revenue business with brands like Juniper and Pilot, serving 775,000+ customers.

- The acquisition expands HIMS into Australia and Japan, and deepens its presence in the UK, Germany, and Canada.

- Eucalyptus CEO Tim Doyle will head international operations at Hims & Hers post-closing.

Hims & Hers Health announced Thursday it will acquire Australian digital health company Eucalyptus in a deal valued at up to $1.15 billion.

Hims & Hers Health, Inc., HIMS

The transaction will be structured with roughly $240 million payable in cash at closing, followed by deferred payments over 18 months and additional performance-based earnouts running through early 2029.

Hims & Hers said it plans to fund most of the deal using existing cash and U.S. operating cash flows. The company also retains the option to settle a majority of deferred and earnout obligations in either cash or stock.

The deal is expected to close around mid-2026, subject to regulatory approvals and customary closing conditions.

Eucalyptus brings a fast-growing business to the table. The Australian company is running at nearly $450 million in annual revenue and has served more than 775,000 customers across its portfolio of consumer health brands.

Those brands include Juniper, a weight-loss program, and Pilot, a men’s telehealth service. Both operate across multiple international markets.

A Foothold in New Markets

For Hims & Hers, the strategic appeal is clear. The deal would give it direct operations in Australia and Japan, two markets where it currently has no presence.

It also strengthens existing partnerships in the UK, Germany, and Canada — markets where Hims & Hers has been building out its telehealth footprint.

Post-closing, Eucalyptus CEO Tim Doyle is set to lead all international operations at Hims & Hers. The Eucalyptus brands will be folded into the Hims & Hers platform over time.

Management said the combined business is expected to support category leadership in Australia and reinforce HIMS as a major telehealth provider in Europe.

The Wegovy Shadow

The deal comes at a complicated time for Hims & Hers domestically. The company is currently facing a lawsuit from Novo Nordisk after the FDA crackdown forced it to pull its $49 compounded copy of Wegovy from the market.

That regulatory setback hit a key growth driver for HIMS, making the international diversification story behind this acquisition particularly timely.

The most recent analyst rating on HIMS stock is a Buy with a $30.00 price target.

HIMS shares were up 2.65% in after-hours trading following the announcement, though the stock was down 2.64% during the regular session on Thursday.

Crypto World

How AI-Powered Decision Intelligence Transforms Business Outcomes

Running a business? Still making million-dollar decisions based on the reports of the last quarter? Is your organization simply following the market trends instead of anticipating the changes? If so, you’re already falling behind.

In the current dynamic business environment, the key differentiators are speed and accuracy in decision-making. Companies that are still relying on conventional business intelligence tools, static dashboards, lagging indicators, and intuitive forecasting are being left behind by those who have already adopted Enterprise Predictive Analytics Services and Artificial Intelligence-Powered Decision Intelligence. The gap between reactive and predictive companies is no longer operational; it’s existential.

As McKinsey suggests, companies that leverage data and analytics at scale are 23 times more likely to acquire customers, 6 times more likely to retain them, and 19 times more likely to turn a profit.

However, the truth is that the majority of companies are struggling to move past the basics of reporting. The data exists. The technology exists. What’s missing, for most organizations, is a clear strategy to harness it.

Let’s unpack how predictive analytics and decision intelligence are rewriting the rules of business performance and what industry leaders already know that most businesses are still figuring out.

What Industry Leaders Know About Predictive Analytics That Most Businesses Don’t

The myth is that predictive analytics is a technology for business giants and Fortune 500 companies, that the cost of entry is too high, the infrastructure too complex, and the ROI too uncertain. This myth has long been debunked by industry leaders.

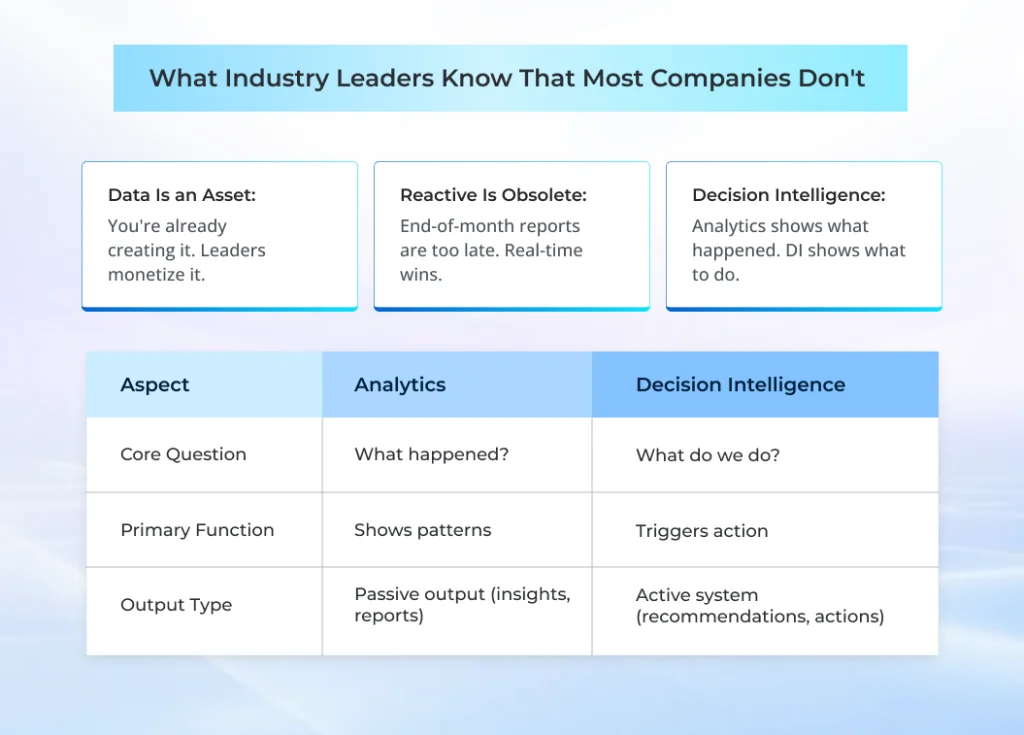

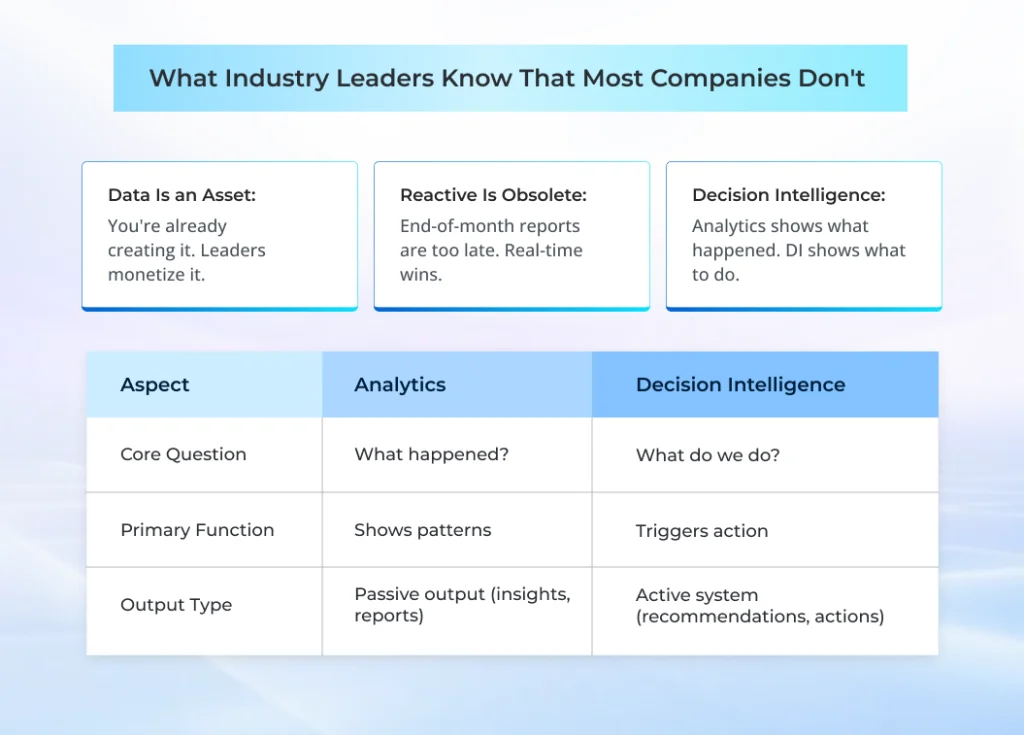

| Aspect | Analytics | Decision Intelligence |

|---|---|---|

| Core Question | What happened? | What do we do? |

| Primary Function | Shows patterns | Triggers action |

| Output Type | Passive output (insights, reports) | Active system (recommendations, actions) |

This is what they know that most mid-sized and growing companies don’t:

1. Data Is an Asset, Not a Byproduct

Most companies create massive amounts of data that are associated with transactions, operations, customer interactions, and supply chains. They view it as a byproduct, not as a strategic asset. Industry leaders, on the other hand, invest in Enterprise Predictive Analytics Services because they know that structured data in real-time is the raw material of competitive advantage.

Amazon, for instance, uses predictive analytics to predict demand and pre-position inventory before customers even click the “buy” button. It’s not just about operational efficiency; it’s a completely different philosophy about what data is for.

2. Reactive Intelligence Is Already Obsolete

The days of waiting for the end-of-month report to gain insight into business performance are now behind us. AI-Powered Decision Intelligence enables leaders to know what will happen and why, before it happens. This includes churn prediction, demand forecasting, fraud detection, and risk analysis, all in real-time.

A global logistics company that implemented an AI-Powered Decision Intelligence solution was able to reduce freight delays by 34% in one year, not by hiring more people or more trucks, but through predictive route optimization and demand analysis.

“The goal is to turn data into information, and information into insight.” — Carly Fiorina, Former CEO of Hewlett-Packard

3. Consulting Expertise Is the Bridge Between Data and Decisions

Outcomes cannot be achieved through technology alone. The leaders who have been able to unlock real value from predictive analytics always emphasize the importance of Predictive Analytics Consulting Services in their success stories. These consultants not only focus on the implementation of technology but also ensure that predictive analytics are linked with the business key performance indicators, and the outputs from algorithms are converted into decisions that are at the executive level.

Most analytics projects get stuck at the “proof of concept” stage.

4. Decision Intelligence Is a Layer Above Analytics

Here’s the key difference that most companies get wrong: Analytics shows you what has happened and what could happen. Decision Intelligence shows you what to do about it. A Decision Intelligence Platform for Business combines predictive analytics with business rules, business processes, and human expertise – building a closed-loop system that automatically acts on insights.

A financial services company with a Decision Intelligence Platform for Business can automatically identify high-risk loan applications, send them to the correct underwriters, and change credit policies in real-time.

5. The ROI Is Real But It Requires the Right Foundation

According to Gartner research, for large companies with annual revenues of $1 billion or more, the average return on investment for emerging technologies in 2023 was 20x (or 2000%) in 2023, primarily due to AI and analytics, as reported in 2024.

However, such ROI is not achieved instantly or by chance. The leadership is well aware that the underlying structure, such as clean data, strong infrastructure, scalable models, and sound interpretation of results, is of prime importance.

Those companies that perceive analytics as a one-time function, rather than an operational capability, are likely to be less successful than companies that perceive it as an operational function.

Make faster strategic decisions with AI-powered decision intelligence services from Antier

The Science Behind Better Business Outcomes: Predictive Analytics & Decision Intelligence

Understanding the mechanics that drive the predictive analytics and decision intelligence processes will help to clarify these technologies for leaders who are skeptical or overwhelmed by them.

How Enterprise Predictive Analytics Services Actually Work

The architecture is not as mysterious as the vendors claim. Enterprise Predictive Analytics Services begin with data, structured input from your CRM, ERP, and supply chain systems, as well as external data such as market data, economic data, and sometimes unstructured data such as customer feedback or web behavior. This data is cleaned and integrated into statistical and machine learning models that are trained to find patterns that would never be detected by human analysts.

What comes out the other side looks like:

- A probability score telling you which customers are most likely to churn in the next 30 days and why.

- A demand forecast accurate enough to adjust inventory by SKU and region three months out.

- A risk flag surfacing a supplier that’s showing early signs of financial distress before your procurement team has noticed.

- A scenario model showing what a 7% price increase would do to volume across your top five customer segments.

None of this is theoretical. These are outputs that enterprise teams are using to make real decisions today.

What Makes a Decision Intelligence Platform for Business Different

A lot of companies have analytics. Fewer have decision intelligence. The difference is what happens after the prediction is made.

A Decision Intelligence Platform for Business doesn’t just point to an insight, it links that insight to a particular decision, sends it to the right person or system, and tracks what happens when it’s implemented (or not). Over time, the platform learns which suggestions are being accepted, which are being overridden, and what the outcomes were. That’s the feedback loop that makes AI-Powered Decision Intelligence truly different from a dashboard with better charts.

How does it work?

A dashboard tells your supply chain manager that inventory is low. A Decision Intelligence Platform for Business tells them what to buy, from whom, at what price, based on current lead times and demand forecasts, and alerts it for approval or automatically implements it, depending on the dollar amount.

Advanced Analytics Services for Enterprises: Where It Works Across Industries

Advanced Analytics Services for Enterprises have a set of diverse capabilities applied differently, depending on the business. Here’s what that looks like in practice across a few verticals:

1. Financial Services

Banks using AI-Powered Decision Intelligence for credit underwriting have moved beyond static FICO scores to real-time models that factor in hundreds of behavioral and contextual signals. As a result, default rates went down 20–30% in documented cases, and credit was extended more accurately to customers who would have been declined by legacy models. Fraud detection teams are catching anomalies in milliseconds rather than reviewing flagged transactions the next morning.

2. Retail and eCommerce

Retailers applying Advanced Analytics Services for Enterprises to markdown optimization have reduced inventory carrying costs by 15–25% while improving margin recovery on aged stock. Customer lifetime value models are helping merchants stop spending acquisition budgets on customers who won’t return, and start investing in the ones who will often get back, by enabling personalized offers for each segment’s actual price sensitivity.

3. Manufacturing and Supply Chain

Predictive maintenance is probably the most well-documented manufacturing use case, with unplanned downtime reductions of up to 50% when implemented well. However, supply chain disruption modeling, which became a survival skill during the pandemic, is now a standard application of Enterprise Predictive Analytics Services in industrial environments. Knowing three weeks early that a key supplier is at risk gives procurement teams options. Finding out when the shipment doesn’t arrive gives them nothing.

4. Healthcare and Life Sciences

Healthcare systems employing predictive models to identify patients eligible for high-risk readmission have been able to focus post-discharge follow-through efforts on those who can significantly lower 30-day readmission rates. For the pharmaceutical industry, predictive models for clinical trial site selection are reducing the time and expense of getting products to market by identifying the most likely sites for on-time and successful recruitment.

What Predictive Analytics Consulting Services Actually Deliver

When companies engage Predictive Analytics Consulting Services, the deliverable isn’t a model. It’s a working capability that is part of the business. That usually means that there are a few different stages that you have to go through: understanding the current state of the data environment and where the actual gaps are, finding use cases that have the best ROI-to-effort ratio, developing and testing models that can withstand exposure to the actual production data, integrating those models into the systems that your teams are actually using, and then implementing governance to make sure that the models are correct as the world changes.

The change management component is the part that most technical vendors tend to underestimate. A model that frontline managers don’t trust or don’t know how to use . It is just an expensive science project. Getting adoption means explaining the output in plain language, giving people a way to flag when something feels off, and demonstrating over time that the model’s track record justifies the trust being asked of them.

Turn enterprise data into actionable insights with AI-powered decision intelligence today

Building a Scalable Advanced Analytics Services for Enterprises Foundation

Enterprises that get sustained value from Advanced Analytics Services for Enterprises don’t build one model and call it done. They build a platform, a unified data layer that all models draw from, a registry that tracks what’s deployed and when it was last validated, an environment where new use cases can be tested before they go live, and deployment infrastructure that makes updating a model straightforward rather than a months-long IT project.

The Decision Intelligence Platform for Business layer that sits on top of all this needs to do one thing exceptionally well, and that is to make it easy for the business to understand why a recommendation was made. In regulated industries, especially banking, insurance, and healthcare, explainability isn’t a nice-to-have. Regulators expect it. Compliance teams require it. Frankly, business leaders shouldn’t be comfortable acting on recommendations they can’t interrogate.

The ROI Conversation: What CFOs Actually Want to Hear

The global decision intelligence market is expected to climb from USD 17.7 billion in 2025 to approximately USD 72.3 billion by 2034, at a 16.9% CAGR.

The most effective AI-Powered Decision Intelligence solutions are built with measurement in mind from day one, with baseline metrics set up before deployment, decision influence tracked, and outcome data collected automatically so that the ROI discussion is always based on actual numbers, not forecasts.

Wrapping Up

The businesses that are pulling away from their competition right now aren’t necessarily smarter or better funded. Many of them simply made the decision earlier to stop operating in the dark. They invested in Enterprise Predictive Analytics Services when it felt premature. They built their Decision Intelligence Platform for Business before they fully understood how they’d use it. Now, they’re operating with a visibility and speed advantage that is genuinely difficult for later movers to close.

You don’t need to have solved your data challenges before starting this journey. You don’t need a perfect data warehouse or a team of in-house data scientists already on payroll.

That’s what Antier does. Our Advanced Analytics Services for Enterprises are built around your specific business context, not a generic platform deployed out of the box. We’ve worked across financial services, retail, healthcare, and manufacturing to help enterprise teams move from fragmented data to decisions they can trust.

If there’s a decision your business is making today that you’re not fully confident in pricing,

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports13 hours ago

Sports13 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment19 hours ago

Entertainment19 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World22 hours ago

Crypto World22 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show