Crypto World

Crypto ETF Outflows Surge To Nearly $1B as Volatility Spikes

Join Our Telegram channel to stay up to date on breaking news coverage

U.S.-listed spot Bitcoin and Ethereum ETFs recorded one of their worst combined outflow days of 2026 as falling prices and rising volatility pushed institutional investors to cut exposure. Nearly $1 billion exited crypto ETFs in a single session, signaling a sharp shift in institutional sentiment toward digital assets.

According to data from SoSoValue, Bitcoin ETFs alone saw $817.9 million in outflows on January 29, marking their largest single-day withdrawal since November 20. Ethereum ETFs followed with $155.6 million in outflows. The heavy selling coincided with a broader crypto market downturn, where Bitcoin dropped below $85,000, briefly fell to $81,000, and later recovered to around $83,000. Ethereum also declined by about 6% within 24 hours.

Other spot crypto ETFs were not spared. XRP ETFs experienced notable outflows totaling $92.92 million, while Solana ETFs saw relatively minor withdrawals of $2.22 million, suggesting selective risk reduction rather than rotation into alternative crypto assets. This pattern indicates that institutions are broadly pulling back from crypto exposure rather than reallocating within the sector.

Dollar Liquidity Tightens, Pressuring Bitcoin Prices

Among individual funds, BlackRock’s IBIT suffered the largest loss with $317.8 million in outflows, followed by Fidelity’s FBTC at $168 million. On the Ethereum side, BlackRock’s ETHA lost $54.9 million, while Fidelity’s FETH recorded $59.2 million in outflows. This contrasts sharply with early January, when crypto ETFs consistently attracted fresh capital.

Roughly $300bn fall in $ liq over past few weeks driven mostly by $200bn rise in TGA, gov could be raising cash balances to fund spending in case of shutdown. $BTC falling not a surprise given the fall in $ liquidity. pic.twitter.com/ctPjWd8188

— Arthur Hayes (@CryptoHayes) January 30, 2026

BitMEX founder Arthur Hayes linked Bitcoin’s price decline to a tightening of U.S. dollar liquidity. He noted that roughly $300 billion has been drained from markets in recent weeks, largely due to a $200 billion increase in the U.S. Treasury General Account (TGA). Hayes suggested the U.S. government may be building cash reserves in preparation for a potential government shutdown.

While Hayes previously predicted a Bitcoin rally driven by Federal Reserve intervention in Japan’s weakening yen, current market conditions have continued to deteriorate, weighing heavily on both crypto prices and ETF flows.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

MoonPay unveils AI onramp for brave new agent economy

Cryptocurrency payments firm MoonPay has introduced a non-custodial financial layer that gives AI agents access to wallets, funds, and the ability to transact autonomously, the company said on Tuesday.

MoonPay Agents, as the new service is called, requires a user to verify and fund their agent’s wallet through MoonPay, and thereafter the agent can take over, trading, swapping, and moving money on its own.

While AI agents are primed and ready to trade, allocate capital and execute strategies, they are constrained inasmuch as they can’t participate in the economy without access to money, Moonpay said in an emailed press release. The idea of MoonPay Agents is to unlock that financial layer, from funding to execution to off-ramping back to fiat.

The AI service generates a MoonPay link to fund a wallet, and the user completes a one-time KYC and connects a payment method through MoonPay’s checkout, and the agent can then transact autonomously.

“AI agents can reason, but they cannot act economically without capital infrastructure,” said Ivan Soto-Wright, CEO and Founder of MoonPay. “MoonPay is the bridge between AI and money. The fastest way to move money is crypto, and we’ve built the infrastructure to let agents do exactly that: non-custodial, permissionless, and ready to use in minutes.”

Crypto World

Bitcoin Realized Losses Have Hit Bear Market Levels

Data from Glassnode shows loss-taking now outweighs profits, a shift rarely seen outside deep bear phases.

Bitcoin’s on-chain data has flashed a signal that has historically come before prolonged bear market conditions, with the Realized Profit/Loss Ratio confirming a regime shift toward loss-dominant selling.

The move suggests that liquidity is evaporating from the market, forcing investors to realize losses rather than book profits, a dynamic last seen during the deepest crypto winter periods of 2018 and 2022.

Key Metric Flips Below 1 Signaling Capitulation Risk

According to data from on-chain analytics firm Glassnode, the 90-day simple moving average of the Realized Profit/Loss Ratio has officially fallen below 1. The metric, which compares the total value of BTC sold at a profit versus those sold at a loss, indicates that loss-taking now outweighs profit-taking across the network.

“This confirms a full transition into an excess loss-realization regime,” Glassnode analysts noted in a February 24 update on X.

The firm highlighted that historically, breaks below this threshold have persisted for six months or more before reclaiming the 1 level, a recovery that typically signals a “constructive return of liquidity to the market.”

The reading represents the culmination of a trend that began in early February, when the ratio was hovering near 1.5, and late January, when it stood around 1.32.

Furthermore, the current on-chain structure shows confluence with previous bear market bottoms. CryptoQuant contributor _OnChain observed that indicators tied to whale activity, particularly Unspent Profitability Ratios (UPR) for various holder cohorts, have reached levels similar to May-June 2022, a period that preceded significant downside before the ultimate bottom formed later that year.

Market Context and Historical Parallels

The current sell-side pressure follows a dramatic cooldown in profit-taking that occurred in December 2025. Glassnode’s earlier data showed that 7-day average realized profits crashed from over $1 billion in Q4 2025 to just $183.8 million by December, which temporarily allowed Bitcoin to stabilize and rally above $96,000 in early January.

You may also like:

However, that stabilization proved short-lived as macroeconomic headwinds intensified, with Bitcoin trading at approximately $63,200 at the time of writing, down 3.6% in 24 hours and almost 29% over the past month. The asset is also nearly 50% below its all-time high reached in October 2025.

Analysts have attributed the continued weakness to a combination of macro factors rather than a structural breakdown in Bitcoin’s fundamentals. U.S. President Donald Trump’s recent tariff announcements, including a proposed increase on taxes on global imports, have rattled risk assets across traditional and crypto markets.

Despite the bearish signals, some analysts maintain that Bitcoin’s long-term cycle remains intact. Bitwise CIO Matt Hougan recently framed current volatility as a necessary “teenage state” of monetary evolution, arguing that maturing assets must pass through speculative gradients before achieving institutional stability.

However, chartist Ali Martinez warned that a three-day “death cross” could be confirmed in late February, which foreshadowed final downside moves in 2014, 2018, and 2022, historically leading to additional declines of 30% to 50%.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

This Has Never Happened in Bitcoin’s History: Will BTC Finally Rebound?

The primary cryptocurrency experienced another substantial decline over the past 24 hours, potentially due to geopolitical tensions among other factors.

However, one important indicator signals that bulls might soon regain control.

First Time in History

As of this writing, Bitcoin trades around $63,000, down 5% on a daily basis, while its market capitalization has fallen below $1.3 trillion. Despite the grim reality, X user il Capo Of Crypto spotted an interesting development.

The analyst, who has almost 1 million followers, said the asset’s Relative Strength Index (RSI) has reached an oversold zone on a 10-day scale. Moreover, they argued that this has occurred for the first time in the history of BTC.

The technical analysis tool measures the speed and magnitude of recent price changes and is used by traders to identify potential trend reversals. It ranges from 0 to 100, and ratios below 30 indicate the asset is oversold and could be headed for a resurgence, whereas anything above 70 signals overbought territory.

One person commenting on the post claimed that “all sorts of indicators are going to be acting unusually going forward.” il Capo Of Crypto agreed with the thesis, saying the RSI is not going to be used as “a sole signal, but it’s great for confluence.”

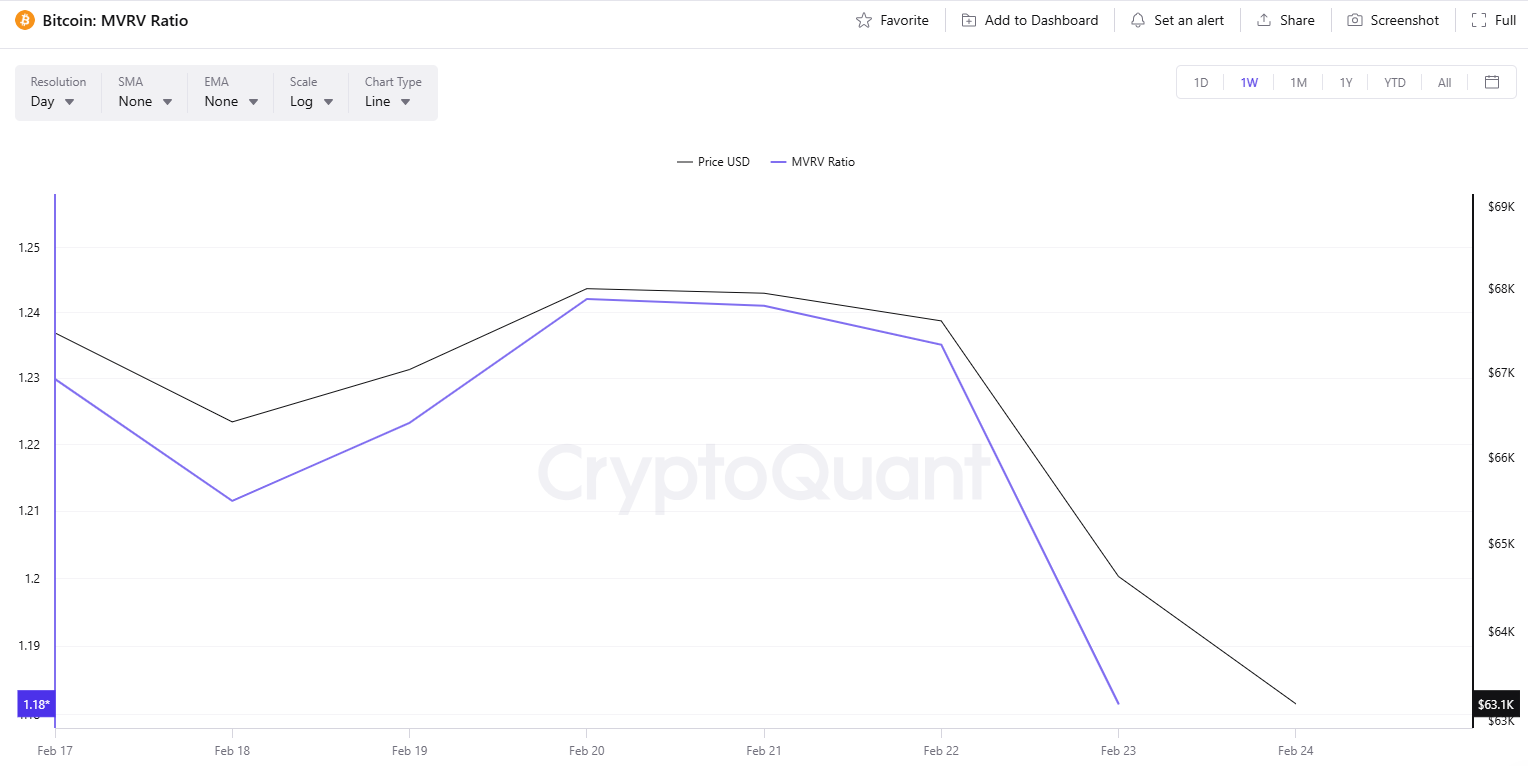

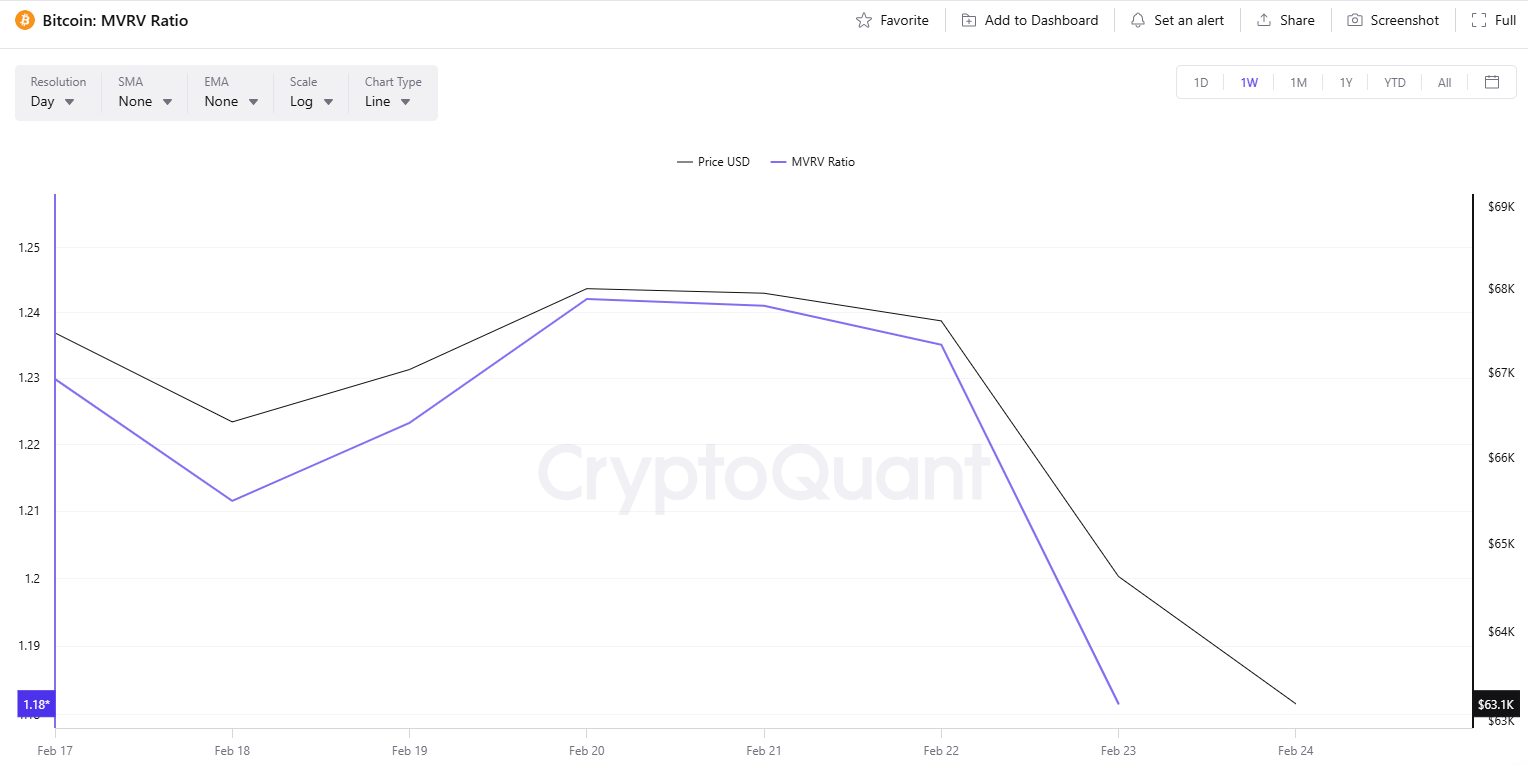

BTC’s Market Value to Realized Value (MVRV) also suggests that a rebound might be knocking on the door. It compares the current value of all coins to the price at which people originally paid to acquire their holdings. According to CryptoQuant, readings below 1 indicate a bottom, whereas anything above 3.7 signals the top is in. Over the past seven days, the MVRV has been declining, currently pointing at 1.18.

The Bears Might be Resistant

Despite the aforementioned bullish factors, many other indicators suggest the bear market is far from over. Over the past several weeks, crypto funds have been bleeding heavily, with outflows significantly outpacing inflows.

According to SoSoValue, investors have withdrawn billions of dollars from spot BTC ETFs, a trend that may signal further downside risk for the price.

Meanwhile, the amount of BTC stored on crypto exchanges has risen over the last few days. This doesn’t guarantee a further correction but is often interpreted as a pre-sale step, thereby potentially setting the stage for additional weakness in the market.

The post This Has Never Happened in Bitcoin’s History: Will BTC Finally Rebound? appeared first on CryptoPotato.

Crypto World

Is ETH Building a Base at $1.8K or Preparing for $1.5K?

Ethereum remains under sustained downside pressure after the February liquidation cascade, with the price now stabilizing around the mid-$1,800s.

The broader structure still reflects a cyclical correction rather than a completed bottom, but short-term momentum has cooled, and the market is attempting to build a base above a major higher-timeframe demand region.

Ethereum Price Analysis: The Daily Chart

On the daily chart, ETH trades within a well-defined descending channel, with the price currently hugging the lower half of the structure near $1,800–$1,850. The breakdown from the $2,300–$2,400 support block and the rejection well below the declining 100-day and 200-day moving averages confirm a bearish medium-term trend, while the daily RSI remains depressed near oversold territory, consistent with a strongly extended move.

The immediate technical focus is the horizontal demand band around $1,750–$1,800, and sustained consolidation above this area could allow a mean-reversion bounce toward the $2,000–$2,200 zone, whereas a decisive loss of it would open the door toward deeper supports closer to $1,500–$1,600 and the lower boundary of the channel.

ETH/USDT 4-Hour Chart

On the 4-hour chart, the prior ascending support line originating from the early-February low has been broken, and the asset is now consolidating just below that trendline inside the same $1,750–$1,850 demand zone. Short-term momentum is weak but no longer accelerating lower, with the RSI flattening after an oversold print, which often precedes either a sideways consolidation or a corrective rebound.

As long as the market holds above the recent intraday lows around the $1,750 mark, the structure allows for a retracement back toward $1,900–$1,950, where the former range floor and short-term moving averages converge. Failure to defend the $1,780 area would likely trigger another round of selling toward the next liquidity pocket below $1,700.

On-Chain Analysis

Perpetual futures positioning reflects a markedly defensive stance: funding rates across major exchanges have flipped sharply negative and remain below zero after the recent decline, indicating that short positions are paying longs and that the derivatives market is skewed toward bearish exposure.

This shift follows a prolonged period of mostly positive funding during the prior uptrend, suggesting that a large portion of the current move has been driven by aggressive shorting and long liquidations rather than organic spot selling alone.

While persistent negative funding can reinforce downside pressure if spot demand stays weak, in combination with an oversold technical backdrop, it also creates the preconditions for a short squeeze should price stabilize and buyers step in around the present support cluster.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

‘Tariffs’ chatter surges after Trump’s announcement on global exports

BTC swung violently around tariff headlines as ‘tariffs’ mentions spiked across crypto social media.

Summary

- Santiment data shows three major tariff announcements in the past year each triggered sharp jumps in “tariffs” mentions on X, Reddit and Telegram, aligning with key BTC inflection points.

- April 2025’s country-specific tariffs (60% on China, 25%-40% on Mexico, EU, Japan, India) saw retail discourse surge near a local market bottom, while a later 100% China tariff coincided with a BTC peak and 4‑month drawdown.

- Trump’s latest 15% global tariff, imposed despite a Supreme Court ruling against such measures, again sparked “tariffs” social dominance and fresh BTC selloffs, underscoring elevated macro and legal uncertainty.

Mentions of “tariffs” have spiked across cryptocurrency social media platforms following President Donald Trump’s announcement of a 15% global tariff on imports, according to data from market intelligence firm Santiment.

The surge in social media discussion mirrors previous episodes that coincided with significant price movements in Bitcoin markets, Santiment reported. Over the past year, three separate tariff announcements generated large increases in discourse across platforms including X, Reddit, and Telegram, each occurring near notable market shifts.

In April 2025, Trump introduced country-specific tariffs, including a 60% tariff on China and tariffs ranging from 25% to 40% targeting Mexico, the European Union, Japan, and India. Social media engagement around tariffs increased sharply as retail traders reacted to the policy announcement, according to Santiment. The spike in retail-driven discourse coincided with heightened volatility across cryptocurrency markets, the firm stated. That period aligned with a market bottoming process, with prices later stabilizing and recovering.

Five days after Bitcoin reached an all-time high, Trump announced a 100% tariff on Chinese imports. Social media volume spiked again, though the tariff was rescinded two days later. That period marked a peak before Bitcoin entered a four-month decline, according to market data.

The most recent announcement of a 15% global tariff follows a Supreme Court ruling declaring tariffs illegal, adding uncertainty to markets. Social media discussion surrounding tariffs has surged again, coinciding with renewed Bitcoin selloffs, Santiment data showed.

The geopolitical backdrop includes a legal dispute between federal authority and presidential power, extending uncertainty beyond economic policy into questions of institutional stability, analysts noted.

Santiment’s data indicates that large retail discourse spikes often coincide with emotionally charged phases in market cycles. The pattern observed over the past year shows extreme retail activity has aligned with local market bottoms, while aggressive policy announcements near price peaks have preceded extended corrections.

Bitcoin’s response to the current tariff situation will depend on broader liquidity conditions and macroeconomic stability, market observers stated. Until clarity emerges around policy enforcement and legal resolution, volatility is expected to remain elevated, according to market analysts.

Crypto World

Cipher Digital (CIFR) sinks premarket after revenue miss, bets big on hyperscale future

Cipher Digital (CIFR) shares fell about 5% in premarket trading after the company reported fourth-quarter results that missed Wall Street expectations and highlighted its shift away from bitcoin mining and toward high-performance computing (HPC) data centers.

The company, formerly known as Cipher Mining, reported fourth-quarter revenue of $60 million, below analyst estimates of $84.4 million. Adjusted earnings per share came in at a loss of $0.14, wider than the forecast loss of $0.06. Cipher posted an adjusted net loss of $55 million for the quarter.

Management pointed to 2025 as a transformative year as it pivots away from bitcoin mining and toward long-term HPC infrastructure. During the quarter, Cipher secured 600 megawatts of contracted capacity, including a 15-year, 300 megawatt (MW) lease with Amazon Web Services and a 10-year, 300 MW lease with Fluidstack and Google.

The company also raised $3.73 billion through three senior secured bond offerings to finance construction at its Barber Lake and Black Pearl data center projects, both of which remain on schedule.

Cipher divested its 49% stakes in three mining joint ventures for about $40 million in stock, further simplifying its structure as it transitions to a data center-focused business model.

Crypto World

Does Vitalik Buterin Even Like His Chain? Sells 10,000+ ETH as Ethereum Price Tests $1,800

Vitalik Buterin has been selling as Ethereum price tumble. And some might think that he doesn’t like his chain or even crypto at all.

On chain data shows the Ethereum co founder liquidated 10,723 ETH, worth about $21.7M, since early February. The sales come at a sensitive moment, with Ether struggling to defend the $1,825 support zone.

The timing has raised eyebrows, but Buterin has said past sales are meant to fund open source work; steady founder selling during a weak market naturally feeds bearish sentiment.

Key Takeaways

- $21.7 Million Liquidated: Buterin has sold a total of 10,723 ETH since February 2, averaging a sale price of approximately $2,027 per token.

- Recent Acceleration: Data shows 3,765 ETH ($7.08 million) was sold in just the three days leading up to Feb. 24.

- Bearish Market Structure: The sales coincide with a 38% drop in ETH value over the last 30 days, currently testing support near $1,825.

The Ethereum Offloading Triggering Alarm?

A founder selling almost always spooks the market, no matter the reason, and Buterin said the funds are going toward open source and security-focused projects. Still, more than 10,000 ETH hitting the market creates real sell pressure.

Traders are not just reacting to the $21.7M already sold. They are watching what could come next. The original allocation was 16,384 ETH, meaning roughly 6,000 ETH may still be unloaded.

The sales began on February 2 and continued through the month. The most aggressive selling occurred recently, with 3,765 ETH sold for $7.08 million between Feb. 21 and Feb. 24.

The average execution price across these three weeks sits at $2,027. With Ethereum currently trading around $1,825, Buterin effectively front-ran the latest 10% leg down.

Ethereum Price Could Dip To $1,500 Is Very Likely Now

Ethereum’s structure has clearly weakened after losing the $2,000 psychological level.

The daily chart shows a confirmed bear flag breakdown. RSI is hovering near oversold, but MACD has not flashed a bullish crossover, so momentum still favors sellers.

Immediate support sits around $1,800. A daily close below that opens the door to the $1,500 zone, where liquidity previously built up. The 50-day EMA has also crossed below the 200-day EMA, forming a classic death cross that reinforces the downtrend.

To invalidate the bearish setup, bulls would need to reclaim $2,150 with strong volume. Until that happens, rallies are likely to face selling pressure, especially with continued founder distribution adding supply.

Watch the $1,780 to $1,820 range closely. A bounce could shape a double bottom. A clean break lower, and $1,475 becomes the next logical target.

Discover: Here are the crypto likely to explode!

The post Does Vitalik Buterin Even Like His Chain? Sells 10,000+ ETH as Ethereum Price Tests $1,800 appeared first on Cryptonews.

Crypto World

Amazon (AMZN) Stock: $12 Billion Louisiana Data Center Plan Explained

TLDR

- Amazon is investing $12 billion in data centers across northwest Louisiana, in Caddo and Bossier Parishes

- The project will create 540 full-time jobs and is being developed with STACK Infrastructure

- Amazon will fund 100% of construction costs plus up to $400 million in local water infrastructure

- 2026 capital spending is forecast at $200 billion, up from $131 billion in 2025

- AMZN is down 11% year-to-date; Wall Street has a Strong Buy consensus with a $282.21 average price target

Amazon is spending $12 billion to build data centers in Louisiana, marking one of its largest single-state infrastructure commitments to date.

The facilities will be built across Caddo and Bossier Parishes in the northwest of the state, in partnership with STACK Infrastructure. Amazon says it will cover 100% of the construction costs and is working with local utility Southwestern Electric Power Company on power infrastructure needs.

The project is expected to create 540 full-time jobs, with additional roles needed for ongoing support — electricians, HVAC technicians and similar trades.

Addressing Local Concerns

Data center projects have faced resistance in some communities due to strain on power grids and high water usage. Amazon is moving to address both.

The company plans to invest up to $400 million in public water infrastructure near the sites and says water use will be limited to cooling and operational purposes. It has also pointed to prior solar investments in Louisiana that added up to 200 MW of carbon-free energy to the state’s grid.

Part of a Much Bigger Spending Plan

The Louisiana announcement fits into Amazon’s broader capital expenditure strategy. During Q4 earnings earlier this month, Amazon said it expects to spend $200 billion in 2026 — up sharply from $131 billion in 2025.

That number hit AMZN stock hard. The stock dropped after the earnings release and is now down about 11% year-to-date, closing Monday at $205.27 after a 2.3% single-day drop.

Asked whether the $12 billion Louisiana figure sits inside that $200 billion plan, Amazon gave a non-committal answer — saying it “regularly makes investment announcements at the federal, state, and local level” that “often occur over many years.”

Tech companies as a group have committed at least $630 billion in capital spending this year, driven by AI infrastructure demand. Louisiana is becoming a notable destination — Meta Platforms has also chosen the state for its Hyperion data center, part of a $27 billion joint venture with Blue Owl Capital.

What Wall Street Thinks

Despite the stock’s slide, analyst sentiment on AMZN remains firmly positive. Out of 43 analysts covering the stock, 40 rate it a Buy and three say Hold. The average price target is $282.21 — implying around 37.5% upside from current levels.

AMZN stock is down 11% year-to-date as of the latest close.

Crypto World

CryptoQuant Says Bitcoin Is In A ‘Not Digital Gold’ Period

Shrinking crypto market liquidity is a concerning sign for crypto asset valuations, as investors gravitate towards safe-haven assets like precious metals amid growing global trade uncertainty.

The stagnating stablecoin supply is presenting a “notable headwind” for Bitcoin (BTC) and the broader crypto ecosystem, according to Matrixport. “Stablecoins serve as the primary liquidity rail within digital assets and stagnation in supply often signals that capital is being off-ramped back into fiat rather than redeployed within crypto markets,” said the digital asset platform in a Tuesday X post.

The stablecoin supply has fallen by $5.6 billion year-to-date, from $159 billion on Jan. 1, to $153.4 billon on Tuesday, according to analytics platform CryptoQuant. Stablecoin reserves on the leading crypto exchange, Binance, also shrank by 19% since November 2025, Cointelegraph reported earlier on Tuesday.

Bitcoin no longer trading like “digital gold,” says CryptoQuant CEO

Bitcoin also appears to be decoupling from gold in the short term. BTC’s 90-day Pearson correlation with gold has turned negative, falling near -0.75, according to analytics platform CryptoQuant.

The Pearson correlation measures how closely the returns of Bitcoin and gold move together at a given period, with a -1 marking a perfect negative correlation.

“Bitcoin is in a ‘not digital gold’ period,” said Ki Young Yu, the founder and CEO of CryptoQuant, in a Tuesday X post.

Tariff uncertainty, precious metal rotation are thinning crypto liquidity: analyst

The backdrop has been complicated by renewed tariff uncertainty. On Saturday, US President Donald Trump announced a global tariff plan that has fueled uncertainty, with a 10% rate taking effect while an increase to 15% has been discussed.

Related: Tether USDT supply set for biggest monthly decline since 2022 FTX collapse

The renewed geopolitical concerns are accelerating the crypto capital exodus towards precious metals, according to crypto exchange Bitget’s chief analyst, Ryan Lee.

The tariff fears are limiting the upside of digital assets, which are now competing with other defensive and growth assets, the analyst told Cointelegraph, adding:

“The ongoing slide in Bitcoin and Ethereum reflects a broader risk-off macro backdrop, where tariff uncertainty, geopolitical tensions, and capital rotation into precious metals and AI-linked equities have thinned crypto liquidity and weakened narratives.”

Crypto market upside will remain limited until “recovery catalysts” such as clearer US policy or more “constructive” Federal Reserve signals emerge on interest rate cuts, added Lee.

Related: Bitcoin treasuries log rare selling streak as BTC trades near $66K

The precious metal rotation is also visible in the charts, as gold and silver rose 19% and 21% year-to-date, respectively, while Bitcoin’s price fell by 27%, according to TradingView.

Tokenized real-world-assets (RWAs) are also showing signs of a rotation towards safe-haven assets, as Tehter Gold’s (XAUT) value rose 20% to $2.7 billion during the past 30 days, while holders increased by 33%, data from RWA.xyz shows.

The tokenized commodities market surpassed $6 billion on Feb. 11, logging an 53% increase in less than six weeks, as more gold investment moved on the blockchain.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation — Santiment founder

Crypto World

Telegram CEO facing Russia probe over terrorism-facilitation claims

Russian authorities have opened a criminal case against Pavel Durov, the co‑founder and chief executive of Telegram, in what state media describe as an investigation into the alleged facilitation of terrorist activities. Rossiyskaya Gazeta, the official government newspaper, reported on February 24, 2026 that the Federal Security Service (FSB) is pursuing the case, with Kremlin spokesperson Dmitry Peskov confirming that the matter rests on materials produced by the FSB as part of its operational duties. The development marks a significant escalation in Russia’s ongoing scrutiny of Telegram, coming as state regulators previously tightened restrictions on the platform in early February. Telegram has not publicly responded to the reports by the time of publication, and attempts by media and Reuters could not secure an immediate comment from the company.

Key takeaways

- The case centers on allegations that Telegram facilitated terrorist activities, with the FSB providing the core evidentiary basis for investigators.

- Roskomnadzor, Russia’s communications watchdog, expanded and intensified restrictions on Telegram in early February, signaling a broader push to curb perceived extremist content on the platform.

- Telegram has reportedly refused to remove material flagged as extremist content, and authorities are considering whether the platform itself could be designated extremist, which would carry additional legal risks for users and the service.

- Analysts warn that a formal label of extremism could complicate or criminalize certain financial transactions on the platform, including payments for premium services and advertising, if such activity is deemed to facilitate prohibited activity.

- Pavel Durov argues the pressure is a broader political maneuver aimed at steering users toward a state-backed messenger, MAX, and he has pointed to similar attempts in other countries, including Iran, where authorities have sought to restrict usage while many citizens continue to favor Telegram for privacy and free expression.

Market context: The case in Russia emerges amid a broader global tightening of regulation around encrypted messaging services and online content moderation. Regulators in multiple jurisdictions are weighing how to balance security concerns with privacy and freedom of expression, a dynamic that increasingly intersects with fintech and digital payments as platforms expand into financial services and commerce.

Why it matters

The investigation underscores the vulnerability of large messaging platforms to state demands for content control in environments where authorities maintain broad powers to regulate information flows. For Telegram users in Russia and abroad, the case raises questions about access, censorship, and the potential criminalization of routine platform use in the event of extremism labeling. While Telegram has built a reputation for privacy protections and opposition to state surveillance, governments exploring how to police content on messaging apps could reconfigure the operating risks for the service and its users. The tension also highlights how geopolitical friction can spill over into digital platforms that cross borders, complicating compliance for a service with a global user base.

Beyond the immediate regulatory landscape, the incident feeds into a longer-running debate about how tech platforms should be regulated when they serve as conduits for information, finance, and social organization. Durov’s public comments and the high-profile nature of the investigation may influence both user sentiment and the strategic choices Telegram makes as it navigates competing demands from regulators, advertisers, and users who prize a degree of privacy and uncensored communication. The ongoing scrutiny also has implications for developers, investors, and policymakers who watch how platforms respond to perceived security risks while balancing civil liberties on an increasingly complex digital stage.

From a geopolitical perspective, the Russian case sits at the intersection of domestic policy and international diplomacy. Durov has framed the pressure as part of a broader effort to promote a state-controlled alternative messenger, a theme that has resonances in other jurisdictions where authorities seek to shape the digital communications landscape. While Russia emphasizes extremism and national security, observers note that the outcomes could influence global norms around the governance of encrypted messaging apps, particularly for platforms that operate across a mosaic of regulatory regimes and market priorities.

What to watch next

- Any formal public statements from the FSB or Roskomnadzor outlining the charges, evidence, or procedural steps in the case against Durov.

- Developments in Russia’s regulatory stance toward Telegram, including whether the platform faces further restrictions or a potential extremism designation.

- Responses from Telegram regarding the investigation, including any new compliance measures or policy changes in Russia or elsewhere.

- Related legal actions or investigations in other countries, such as France, where Durov has faced inquiries, and any outcomes that could affect cross-border service provisions.

- Any changes in the global regulatory environment for encrypted messaging services and how those shifts could impact user access and platform opportunities in the crypto and digital payments space.

Sources & verification

- Rossiyskaya Gazeta report detailing the FSB-led criminal probe and referencing the Kremlin spokesperson’s confirmation.

- Statement attributed to Dmitry Peskov confirming the investigation and referencing FSB materials.

- Roskomnadzor’s reported tightening of Telegram restrictions in early February as covered by major Russian tech outlets.

- Public reporting on Telegram’s response or lack thereof, and coverage of Durov’s broader legal exposure, including investigations abroad.

Russian case against Durov sheds light on Telegram’s regulatory pressure

Russia’s latest move against Telegram places Pavel Durov at the center of a high-stakes intersection between digital freedom, security, and the state’s capacity to police online content. The FSB’s involvement signals a level of scrutiny that goes beyond routine regulatory complaints, elevating the Telegram platform into the realm of criminal investigations when linked to alleged facilitation of extremist activity. Rossiyskaya Gazeta’s reporting on February 24, 2026, describes a case that is being handled with the involvement of the country’s premier security institution, a development that could have lasting implications for both the platform’s operations in Russia and its reputation globally.

The Kremlin’s confirmation, via Dmitry Peskov, that the investigation rests on FSB materials, reinforces the perception that Moscow regards Telegram as a strategic communications channel with potential cross-border impact. While the exact charges remain undisclosed in public materials, the use of criminal procedures in this context signals a hardening stance toward platforms that resist state-directed content moderation. The case aligns with a broader push by Roskomnadzor to tighten the screws on messaging apps, particularly those with robust privacy features and the capacity to host large volumes of user-generated content outside centralized control.

Telegram’s stance has been consistently positioned as a defense of user privacy and a refusal to remove content that authorities deem extremist or harmful. This friction is illustrated by the ongoing tension surrounding content moderation, with Russian regulators insisting on compliance and the platform resisting what it views as overreach. The numbers cited by state-connected outlets—namely, that roughly 155,000 channels, chats, and bots have not been removed in response to local requests—underscore the scale of Telegram’s footprint in Russia and the challenge regulators face in enforcing content rules across a platform that migrates between jurisdictions and languages. The broader implication is that a potential extremism designation could alter Telegram’s business model, affect user access, and complicate any monetization strategy anchored to the platform’s freedom of use.

Industry observers have flagged that the extremism label could carry far-reaching consequences beyond speech restrictions. German Klimenko, a former adviser to the Russian president on internet policy, warned that such a designation could criminalize payments related to Telegram Premium subscriptions and advertising on the platform. This kind of impact would affect not just end users but also service providers and advertisers who rely on Telegram as a channel for outreach and revenue. The possibility of criminal penalties or significant legal exposure for seemingly routine activities signals a broader risk landscape for digital platforms operating in regulated environments where state interests are closely aligned with national security imperatives.

Durov has publicly framed the investigation as part of a broader strategy to push users toward a state-backed messenger known as MAX, a claim that dovetails with his long-standing emphasis on privacy and freedom of expression. He has drawn parallels with other jurisdictions, including Iran, where authorities have attempted to restrict access to messaging apps while users continue to rely on them. In a February post on his Telegram channel, Durov argued that restricting citizens’ freedom is not a legitimate response and reiterated Telegram’s mission to defend privacy and speech rights in the face of pressure. This framing places Telegram’s predicament within a broader debate about how states balance security concerns with civil liberties in the digital era.

The legal and political dynamics surrounding Durov’s case extend beyond Russia’s borders. Durov’s international exposure—captured in ongoing inquiries abroad and previously including an arrest in France in 2024 and a travel ban that was lifted in 2025—illustrates how actions in one jurisdiction can resonate across multiple regulatory environments. The French developments, though not resolved in the public sphere at the time, emphasize that Telegram’s legal and regulatory challenges are not confined to a single country. As regulators and lawmakers reassess the balance between security, privacy, and platform openness, Telegram’s approach to compliance and user protection will likely shape the trajectory of encrypted messaging apps in the coming years. In the Russian context, the FSB-backed investigation remains a focal point for observers seeking to gauge how far the state will go in policing online communications and what this means for services that operate globally but must navigate local laws.

-

Video4 days ago

Video4 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics2 days ago

Politics2 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports19 hours ago

Sports19 hours agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics20 hours ago

Politics20 hours agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 days ago

Sports5 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World6 hours ago

Crypto World6 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market