Crypto World

Crypto ETFs See $1B+ Daily Outflows as Markets Slide

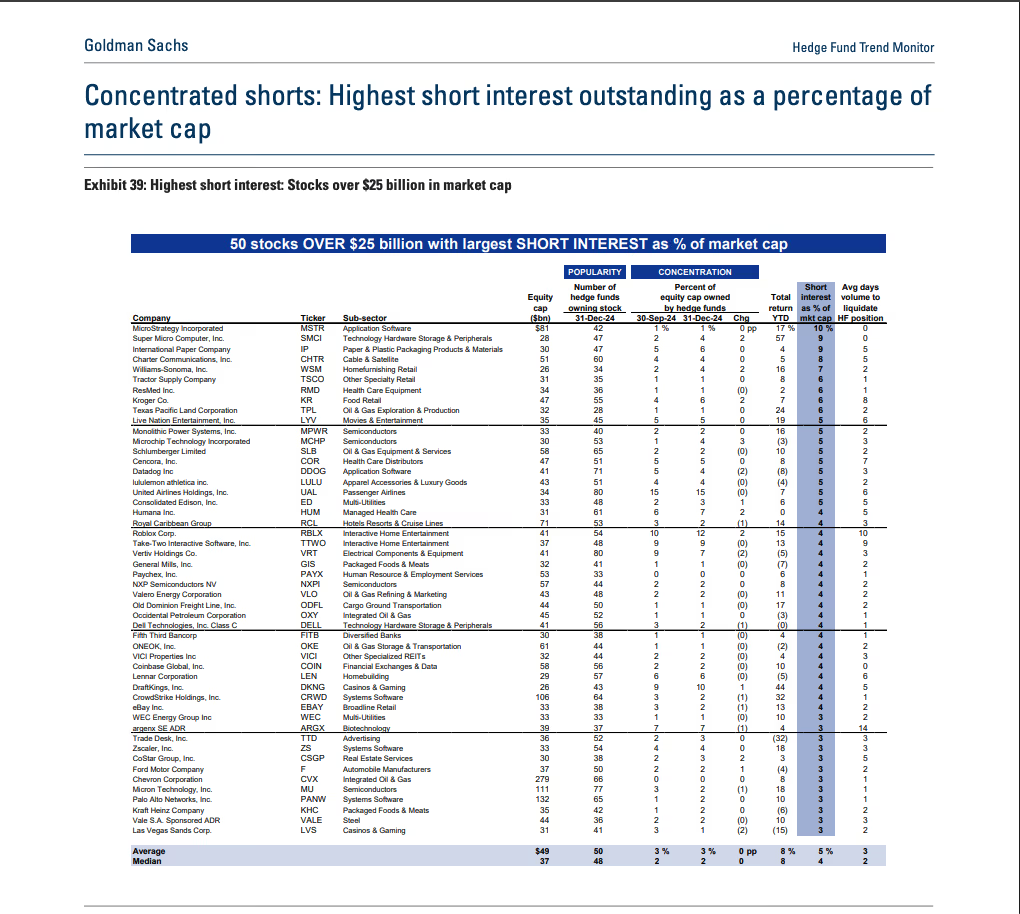

A broad pullback in crypto investment products coincided with a broader market softness, as the total crypto market capitalization slipped roughly 6% on Thursday. Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH) funds together recorded nearly $1 billion in outflows, among the year’s largest single-day moves, according to SoSoValue. Spot Bitcoin exchange-traded funds (ETFs) led the retreat, shedding about $817.9 million and marking the largest daily outflow since November 2025. The dip arrived as risk-off sentiment extended beyond digital assets, with gold retreating about 4% after a recent spike above $5,300 per ounce, based on TradingView data. The day’s market mood also reflected pointers from the traditional technology space, as AI-related stock worries and a sharp slide in Microsoft shares added to the caution in equities.

Key takeaways

- Bitcoin (CRYPTO: BTC) and Ether (CRYPTO: ETH) funds registered nearly $1 billion in net outflows on Thursday, one of the year’s largest moves, underscoring a shift in appetite for top-tier crypto exposures.

- Spot Bitcoin ETFs alone saw $817.9 million leave the market in a single session, the steepest daily withdrawal since late 2025, highlighting the fragility of near-term demand for physically backed BTC products.

- Gold prices fell about 4% as risk sentiment soured and equities, including those tied to AI, faced pressure; Microsoft (EXCHANGE: NASDAQ: MSFT) shares sank about 10%, amplifying the cross-asset pullback.

- Bitcoin ETF flows for January turned negative as weekly outflows persisted, with the week tally nearing $978 million and December-to-January transitions remaining unsettled for many funds.

- Altcoin fund performance remained negative, with spot Ether ETFs pulling out around $155.6 million and XRP (CRYPTO: XRP) funds off about $92.9 million; Solana (CRYPTO: SOL) ETFs also posted modest withdrawals of $2.2 million.

- Overall, crypto ETPs still command significant assets under management, with about $178 billion across crypto exchange-traded products, while spot BTC ETFs account for roughly 6.5% of Bitcoin’s estimated market capitalization of about $1.65 trillion; still a meaningful liquidity channel for institutional players.

Tickers mentioned: $BTC, $ETH, $XRP, $SOL, $MSFT

Sentiment: Bearish

Price impact: Negative. The ongoing outflows and asset-price declines indicate a risk-off environment pressuring both crypto equities and spot assets.

Trading idea (Not Financial Advice): Hold. A wait-and-see stance may be prudent until there is clearer evidence that liquidity improves and macro catalysts stabilize.

Market context: The retreat in crypto ETFs mirrors a wider liquidity pullback in risk assets, with investors reassessing exposure as macro headlines and sector rotations drive correlations higher between digital-asset products and traditional markets.

Why it matters

The weekend and week’s flows paint a portrait of a market still heavily driven by sentiment and macro risk rather than purely on-chain signals. The dual pressure on spot BTC/ETH products and the outflows in altcoin ETFs reveal how sensitive crypto investment products remain to broad risk-off dynamics. With ETF inflows/funding often used by institutional participants to gain or unwind exposure, a sustained pattern of redemptions can translate into thinner daily price moves for the underlying assets. The data suggest that even well-established products — including spot BTC ETFs, which continue to represent a sizable slice of the asset’s investable demand — are susceptible to shifts in investor risk tolerance that accompany geopolitical and macro headwinds.

From a market structure perspective, the outflows widen the disconnect between headline price action and long-run narrative of crypto as a macro-hedge or risk-on asset. While Bitcoin and Ether still command tens of billions in AUM across ETPs, and despite their relative dominance in investor allocations, fund flows point to a cautious crowd prioritizing liquidity protection and redemptions over new capital allocation. The Bitcoin ETF segment alone has accumulated roughly $107.65 billion in assets under management, representing approximately 6.5% of Bitcoin’s current market capitalization, underscoring the brokerage and fund-structure role in the pricing and liquidity framework of the space.

The broader risk environment is also shaping how crypto markets interact with traditional tech equities. The indiscriminate sell-off in AI-related shares, as illustrated by Microsoft’s rapid drawdown, feeds into a larger narrative of selective risk appetite rather than a targeted crypto downturn. This broader cross-asset mood can complicate trading strategies that rely on near-term catalysts in crypto markets, making the coming weeks a test of whether the weakness is transitory or a signal of a more persistent capital reallocation away from crypto-priced instruments.

Industry observers have pointed to elevated leverage in certain derivatives venues as another contributor to the slide. In a note cited by CryptoQuant, high leverage positions at a decentralized derivatives exchange were found to have suffered material losses in a short period, illustrating how leverage can amplify market moves across a downturn. The biography of risk surrounding crypto ETPs is not purely driven by on-chain metrics; it also reflects how investors deploy (and unwind) leverage via derivatives and related products when sentiment shifts.

Beyond the price action, underlying structural elements such as asset stewardship and regulatory signals continue to shape the landscape. The UK market has already shown a willingness to adopt crypto ETPs through new launches, as Valour and other providers received regulatory clarity in the wake of lifting certain restrictions; these evolutions could reintroduce fresh demand channels for BTC and ETH exposures once the macro fog clears.

What to watch next

- Next batch of crypto ETP flow data and updated weekly aggregates to assess whether outflows persist or begin to reverse.

- Regulatory developments in the UK and elsewhere that enable new ETPs and potential shifts in product structure for BTC and ETH exposures.

- Liquidity and leverage metrics in key derivatives venues, particularly around Hyperliquid and other decentralized platforms mentioned by market analytics firms.

- Price action for BTC and ETH in the near term, with attention to macro catalysts and potential support levels that could trigger a capex-based repricing of risk assets.

Sources & verification

- SoSoValue data on outflows for BTC and ETH and the scale of spot BTC ETF withdrawals

- TradingView data on gold price movements and context around XAUUSD

- CoinShares and related AUM updates for crypto ETPs and overall crypto ETP market share

- CryptoQuant commentary on leverage exposure and Hyperliquid’s long positions wiped out during the session

- UK regulatory moves and related ETP launches such as Valour’s BTC/ETH products post-FCA developments

Crypto World

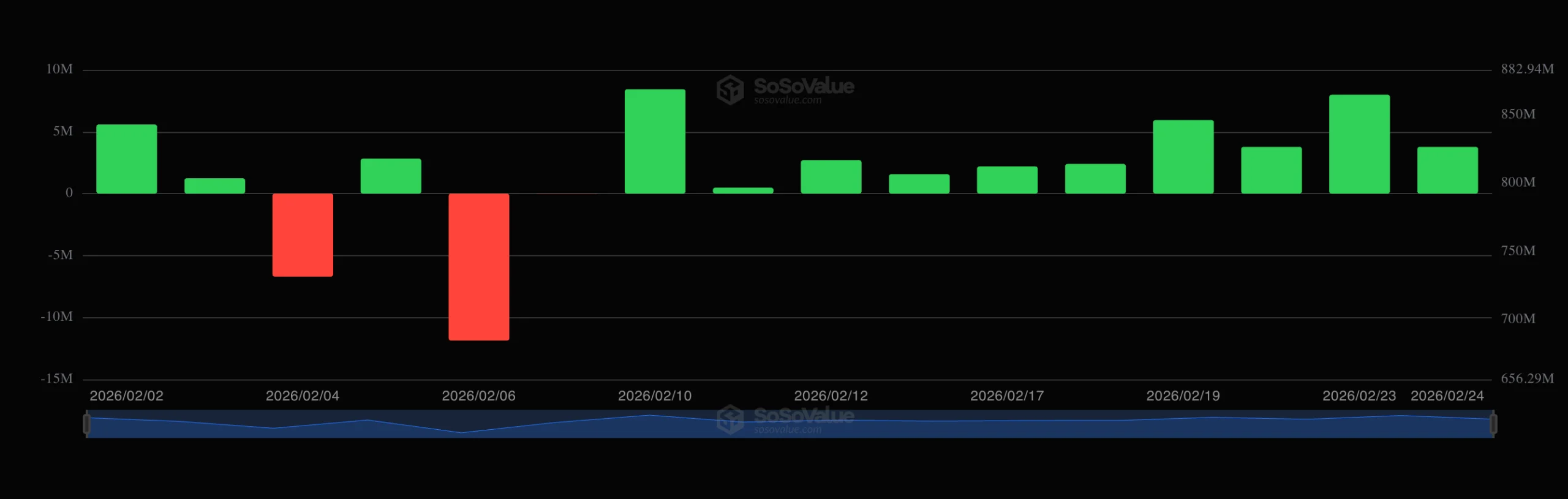

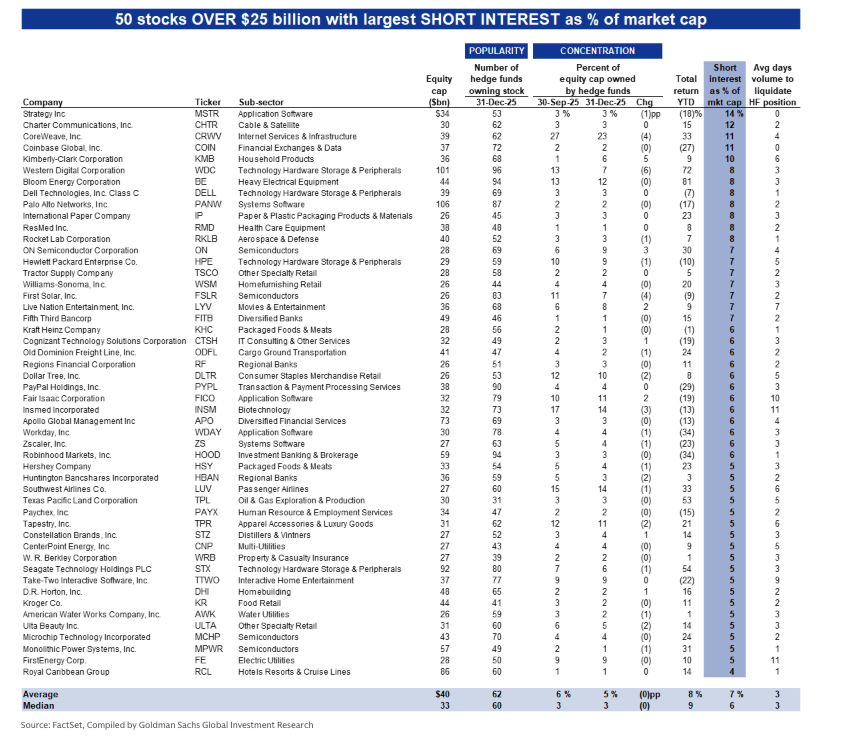

MSTR tops list of most heavily shorted stocks, but don’t assume pure bearishness

The market for Bitcoin-holder Strategy (MSTR) shares is among the most “heavily shorted,” a market slang term for dominance of bearish plays, according to FactSet and Goldman Sachs data. Yet the positioning may not reflect investor bias toward a continued price crash, per some observers.

According to the report released last week, bearish short bets on Strategy (MSTR) equaled 14% of its market capitalization of $34 billion at the time, making it the most shorted stock by that measure. Cryptocurrency exchange Coinbase (COIN) ranked fourth at 11% of its market cap. The report tracked positioning in stocks with market capitalization of over $25 billion.

This comes as Strategy is sitting on roughly a $7 billion unrealized loss on its bitcoin holdings. That figure, however, has no impact on the stock in the near term. Strategy began adding BTC to its balance sheet in 2020 and has since gobbled up 717,722 BTC, worth $47 billion. As of writing, its market cap stood closer at $42 billion, despite the stock falling 20% year-to-date.

One explanation for the elevated short interest offered by analysts is the basis trade – a strategy that seeks to profit from the price difference between two related markets. In this context, traders may bought bitcoin spot ETFs, like BlackRock’s IBIT, while simultaneously shorting the MSTR stock. to profit from a narrowing of MSTR’s premium to its BTC holdings narrows, plus any funding from paired futures if layered on, while staying market neutral.

“I suspect a lot of this short interest is still MSTR / BTC basis trade. Jane Street, in particular, has recently acquired a conspicuously large IBIT position,” Brian Brookshire, specialist in bitcoin treasury companies, said.

According to recent 13F filings, Jane Street purchased more than 7 million shares of BlackRock’s iShares Bitcoin Trust. It also held a large position in MSTR.

If Brookshire’s instincts hold, Jane Street’s purchases of IBIT could be a part of the carry/basis trade, paired with short positions in MSTR.

So far this year, that trade would have not worked. The MSTR-to-IBIT ratio is up about 12%, meaning MSTR has outperformed IBIT on the downside. MSTR is down 20% year to date, while IBIT has fallen 27%.

Crypto World

Institutional ETF Flows Tilt Toward This Altcoin in February

Solana exchange-traded funds (ETFs) are diverging from broader crypto ETF trends this month. While demand for Bitcoin and Ethereum products has shown signs of cooling, Solana-linked funds have maintained steady inflows.

The shift comes amid heightened volatility in digital asset markets. With macro uncertainty weighing on investor sentiment, ETF flows may be offering a signal of where institutional capital is positioning in the short term.

Solana ETF Streak Stands Out in Volatile Crypto Market

According to data from SoSoValue, Solana ETFs have recorded consecutive inflows since February 10. As of February 24, the products have logged only three red days this month. Overall, the ETFs have pulled in $30.33 million.

The streak stands out against the more uneven performance seen in larger crypto ETFs during the same period.

Bitcoin ETFs have posted mixed results in February. Inflows were recorded on seven trading days this month. Ethereum ETFs have followed a similar pattern, reflecting inconsistent demand rather than sustained accumulation.

Despite those positive sessions, cumulative flows remain deeply negative. So far this month, Bitcoin ETFs’ net outflows stand at $939.94 million. In addition, Ethereum ETFs recorded outflows of $490.58 million.

When compared to other altcoin products, Solana’s performance also appears relatively stronger. XRP-linked ETFs have experienced outflows on three trading sessions this month while recording zero flows on four days.

Although the number of positive sessions is comparable, the consistency of Solana’s streak since mid-February remains notable.

Nonetheless, it is important to contextualize the data. In absolute dollar terms, inflows into Solana ETFs remain smaller than those seen in Bitcoin products.

Bitcoin and Ethereum ETFs continue to command the majority of institutional crypto exposure and overall capital allocation. However, consistency in flows can indicate relative resilience in demand during periods of broader uncertainty.

The steady inflows into Solana products suggest that some investors are maintaining or selectively increasing exposure to higher-beta assets, even as flagship crypto ETFs experience uneven demand. Still, the divergence may reflect short-term capital rotation rather than a structural shift in institutional positioning.

SOL Price Remains Under Pressure

Despite the ETF inflows, Solana’s price performance has continued to reflect broader market weakness. Like most major digital assets, SOL has trended downward over the past month, declining 32.8%.

The altcoin saw a modest recovery today, rising more than 7% as total crypto market capitalization expanded by approximately $32 billion. At press time, SOL was trading at $82.15.

However, technical analysts remain cautious on the asset’s near-term outlook. Market commentator Alejandro suggested that Solana’s next downside target could be $45.

Whale Factor described the token as entering a high-probability “make or break” zone on the 4-hour chart. According to the analysis, SOL’s wedge formation is “reaching maximum exhaustion,” signaling a potential volatility squeeze at a critical inflection point.

The analyst outlined two possible scenarios:

“Bull Case: Clean break and retest of $82 targets the $97-100 macro resistance. Bear Case: Failure to hold the $78 support level opens the door for a retest of $68.”

Whether Solana will extend its recovery or face renewed downside pressure remains to be seen.

Crypto World

Bitcoin Rebounds as Traders Debate Jane Street “10am Price Slam”

Bitcoin (BTC) sought to reclaim $65,000 as support into Wednesday’s Wall Street open as rumors swirled around US institutional pressure.

Key points:

-

Bitcoin bounces 2.5% as talk turns to alleged selling pressure from Wall Street trading company Jane Street.

-

Jane Street rebuts claims of crypto market manipulation during the 2022 bear market.

-

“Razor thin” order books boost BTC price volatility.

Bitcoiners debate Jane Street “10am price slam”

Data from TradingView tracked a BTC price rebound, taking BTC/USD to $66,300 on Bitstamp before the pair consolidated.

Daily price gains remained at more than 2% at the time of writing, while crypto market participants became increasingly interested in potential deliberate BTC price suppression.

A theory circulating on social media revolved around secretive quantitative investment firm Jane Street, now subject to legal action by defunct crypto company Terraform Labs.

Coordinated algorithmic selling of Bitcoin at 10am Eastern time daily, it alleged, provided the main impetus for months of BTC price downside beginning in October 2025.

What Happened Today:

>Jane Street was exposed for massive manipulation of the crypto market and for being behind the TerraLuna collapse.

>An insider leaked that they were forced to shut down their trading algos.

> no 10am price slam for the first time.

>8pm, Bitcoin…

— AMCrypto (@AMCryptoAlex) February 25, 2026

Amid the ongoing legal proceedings, Jane Street may have been forced to suspend its trading strategy, leaving the market to adjust higher.

The Terraform Labs complaint makes specific reference to “market manipulation” that impacted crypto throughout 2022, the year in which Bitcoin put in its last bear market bottom of $15,600 in Q4.

Jane Street told Cointelegraph that the accusations were “baseless, opportunistic claims.”

The 10am argument, meanwhile, failed to convince many. Crypto YouTuber Wise Advice was among them, suggesting that the theory was too simplistic to be valid.

🚨 Everyone on CT right now:

“Jane Street got sued.”

“10AM manipulation stopped.”

“ $BTC finally free.”Do you really think they’re that stupid?

You’re talking about Jane Street.

A top quant firm.

And they supposedly:• Ran a visible daily pattern

• Let everyone track it…— Wise Advice (@wiseadvicesumit) February 25, 2026

BTC price versus “razor thin” liquidity

Commenting on the latest BTC price move, traders remained cautious.

Related: Bitcoin ETF sell-off is ‘purification’ of bull case, investor says

“$BTC is facing major resistance at $66k – from both the local range lows and the 4h trend,” trader Jelle wrote in his latest analysis on X.

“Flipping that could spark short-term relief, but until that happens, the trend is clear. Don’t fight it.”

Keith Alan, cofounder of trading resource Material Indicators, said that a “razor thin order book” on exchanges had contributed to the price rebound.

Overhead sell liquidity, he told X followers, had been pulled in advance of US President Donald Trump’s State of the Union address.

Looks like we got a roof pull just before Trump’s State of the Union Address, and $BTC price ripped through a razor thin order book. pic.twitter.com/bgBtwg6aaZ

— Keith Alan (@KAProductions) February 25, 2026

The 24-hour crypto liquidations totaled $333 million at the time of writing, per data from CoinGlass, with shorts accounting for $213 million of that figure.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin Stays Below $65,000, but Big Money Is Moving Quietly

Bitcoin (BTC) continued its downward trajectory in February, trading at $64,492, nearly 50% below its early October all-time high (ATH) price.

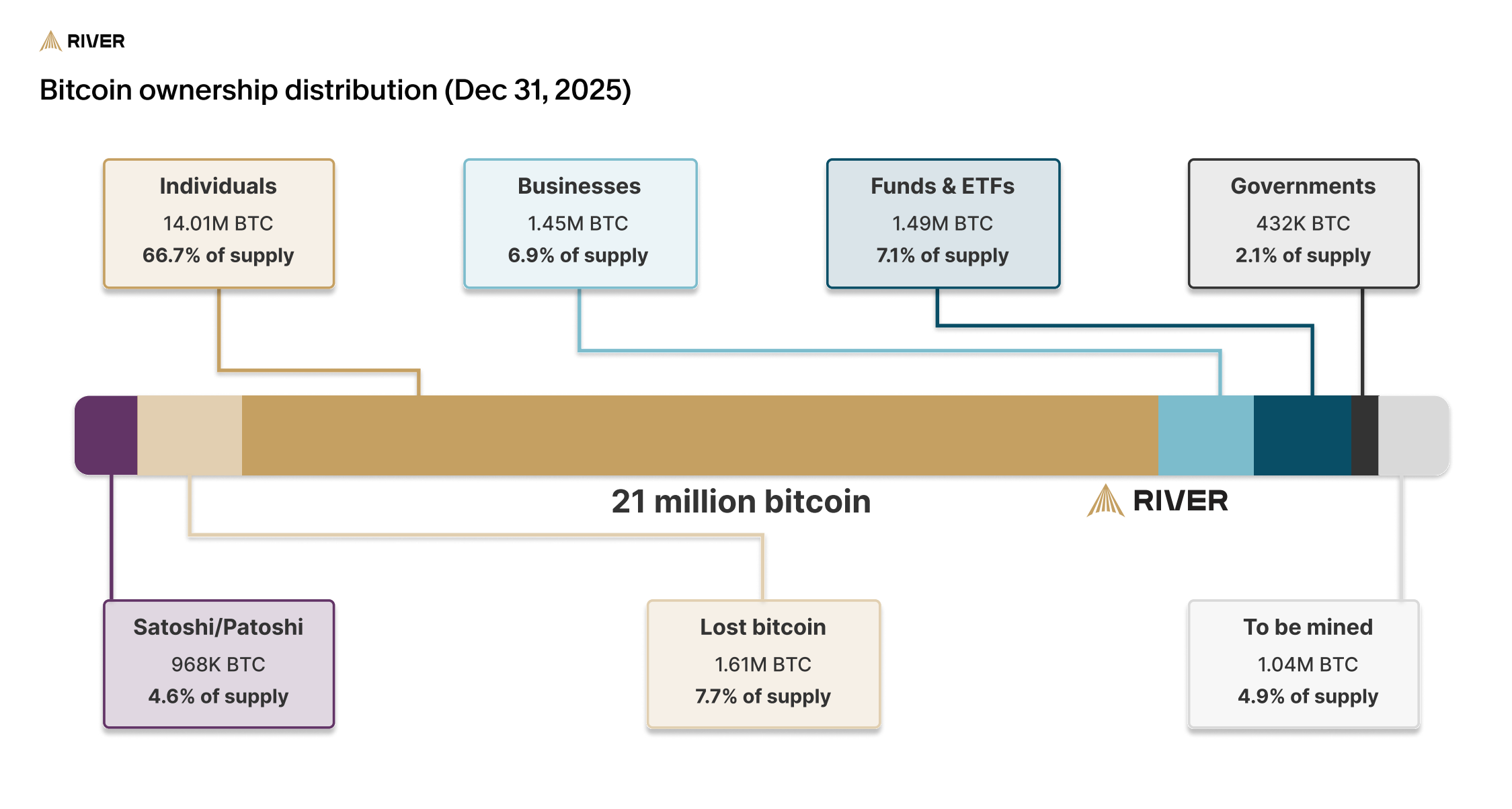

Yet, price action tells only part of the story. According to River, Bitcoin adoption accelerated last year, with institutions, banks, merchants, public companies, and even nation-states increasing their exposure.

Is Bitcoin’s 50% Decline Masking a Structural Bullish Trend?

BeInCrypto recently reported that the crypto market has slipped into extreme fear, with retail investors growing increasingly pessimistic about Bitcoin’s price. This sentiment is reflected in a surge of “Bitcoin going to zero” searches, which recently reached an all-time high.

The price drawdown has also weighed on institutional participants. Crypto hedge funds have pulled back from the market.

“With Bitcoin and ETH continuing to slide, crypto hedge funds have retreated to cash. Their average cash levels are currently 15.32%, the highest in almost a year,” Nic Puckrin, co-founder of Coin Bureau, told BeInCrypto.

Moreover, recent disclosures show that in Q4 2025, institutional investors also trimmed their Bitcoin exchange-traded fund (ETF) exposure.

However, when viewed from a broader perspective, the long-term adoption trajectory remains constructive. In a recent market report, River highlighted that the largest cryptocurrency’s adoption surged in 2025.

“There is no bear market in bitcoin adoption. Bitcoin is down 50% from all-time highs, but adoption is compounding in ways that aren’t affecting the price, yet,” the post read.

According to River, institutions collectively added approximately 829,000 BTC in 2025. This figure includes purchases from businesses, governments, funds, and ETFs.

Registered investment advisors allocated close to $1.5 billion per quarter into Bitcoin ETFs over the past two years. Notably, none of those quarters recorded net outflows.

Although exposure among RIAs is widespread, with 29 of the 30 largest US firms holding positions, portfolio allocations remain minimal, averaging 0.008%.

Businesses emerged as the largest buyers in 2025. They added $54 billion worth of Bitcoin to their balance sheets during the year.

Bitcoin treasury companies account for the majority of corporate holdings, collectively controlling 866,000 BTC. At the same time, the number of publicly listed firms with Bitcoin holdings rose to 194.

At the sovereign level, five nations became new Bitcoin holders in 2025, including purchases linked to two sovereign wealth funds, Luxembourg and Saudi Arabia, as well as the Czech Republic’s central bank. In total, 23 nation-states now hold Bitcoin.

“Trust in bitcoin has grown faster than that of any asset in history. What began as an experiment is now a globally recognized store-of-value, with adoption patterns that rival the internet,” River wrote.

US Businesses Embrace Bitcoin Payments

Beyond direct accumulation, payment adoption expanded materially. The number of US merchants accepting Bitcoin payments tripled during the year. Furthermore, global usage increased by 74%.

Meanwhile, development activity within traditional finance continues. Approximately 60% of the 25 largest US banks are building Bitcoin products, indicating ongoing institutional integration.

River stated that the current wave of adoption is unlikely to trigger an immediate 10-fold price surge for Bitcoin. However, the firm argued that this type of steady integration may carry greater significance.

Looking ahead, River said it expects adoption to accelerate meaningfully over the coming years as broader participation deepens.

Crypto World

Meta to plug Stripe stablecoins into Facebook, Instagram, WhatsApp in 2026

Meta targets H2 2026 for stablecoin creator payouts, enabled by Stripe’s Bridge under new U.S. rules.

Summary

- Meta plans to integrate third-party stablecoins for creator payouts across Facebook, Instagram and WhatsApp, focusing on ~$100 cross-border transfers.

- Stripe’s Bridge, acquired for ~$1.1b in 2024, just secured conditional OCC trust bank approval, enabling regulated stablecoin issuance and custody.

- The GENIUS Act, signed in 2025, created a federal framework for fully reserved payment stablecoins, giving Meta and Bridge clearer compliance rails.

Meta Platforms Inc. is preparing to integrate stablecoin payments across its social media platforms in the second half of 2026 through a third-party provider, CoinDesk reported, citing three people familiar with the plans.

The company has issued requests for proposals to external infrastructure firms, with Stripe emerging as the likely partner, according to the report. Stripe CEO Patrick Collison joined Meta’s board in April 2025.

The initiative marks a shift from Meta’s previous stablecoin effort. The company’s 2019 Libra project, later rebranded as Diem, faced intense regulatory opposition and was ultimately abandoned. Libra was designed as a global currency backed by a basket of assets, which regulators viewed as an attempt by a private company to build sovereign-scale monetary infrastructure.

According to Fortune reporting from May 2025, Meta CEO Mark Zuckerberg told Stripe’s John Collison that the Diem project was dead.

The current approach differs significantly from the earlier effort. Meta will not mint its own stablecoin but will instead integrate existing stablecoin infrastructure, positioning itself as a distribution channel rather than an issuer, according to a source who told CoinDesk the company wants to pursue the initiative “at arm’s length.”

The likely integration partner is Stripe’s Bridge platform, which received conditional approval from the Office of the Comptroller of the Currency for a national trust bank charter in February 2026.

The timeline of developments includes Stripe’s acquisition of Bridge for approximately $1.1 billion in October 2024, Collison’s appointment to Meta’s board in April 2025, and Bridge’s OCC conditional approval in February 2026, the same month Meta sent out requests for proposals.

In its 2025 annual letter, Stripe reported that Bridge’s transaction volume quadrupled as stablecoin adoption expanded beyond cryptocurrency market cycles. “Stablecoin payments are advancing quietly and inexorably as real-world uptake continues apace,” the company stated.

Meta’s focus centers on reducing costs for international creator payouts, particularly small transfers around $100 that currently face high wire transfer and foreign exchange fees. The company’s platforms, including Facebook, Instagram, and WhatsApp, serve approximately 3 billion users globally.

Stablecoin integration could reduce costs for cross-border settlements and accelerate payout speeds compared to traditional banking systems, according to the CoinDesk report. The move would also position Meta competitively against X and Telegram in developing super app functionality.

The regulatory environment has shifted since Meta’s earlier stablecoin attempt. The GENIUS Act, signed by President Donald Trump in July 2025, established the first federal legal framework for U.S. stablecoin issuers, contrasting with the regulatory opposition that existed between 2019 and 2022.

Bridge’s pursuit of an OCC charter reflects the new regulatory approach, operating within a federal framework rather than outside it.

Several implementation details remain unclear, including which specific stablecoins Meta will support, whether transactions will be on-chain or abstracted from blockchain infrastructure, how the company will handle wallet custody and compliance requirements, and whether non-U.S. markets will serve as initial testing grounds.

Meta declined to comment on the reported plans. Stripe did not immediately respond to requests for comment.

Crypto World

The Dollar Index (DXY) May Close February Higher

The second half of February has seen the dollar index strengthen, driven by a combination of bullish factors:

→ A hawkish Fed stance. Minutes from the latest FOMC meeting revealed differing views on rate cuts. With inflation remaining resilient, some members even left the door open to further tightening.

→ Rising tensions between the US and Iran, along with uncertainty surrounding trade tariffs, have boosted demand for the dollar as a safe-haven asset.

→ Recent data pointing to solid industrial output and labour market resilience have reinforced confidence in the strength of the US economy.

As a result, an upward trend line (shown in blue) has formed on the DXY chart, increasing the likelihood that the index will finish February in positive territory after three consecutive months of decline.

Technical Analysis of the DXY Chart

On 16 February, when analysing the dollar index (DXY), we:

→ Updated the descending channel (marked in red), originating in November 2025.

→ Highlighted strong demand, reflected in the confident upward trajectory (shown by the arrow) following the brief break below the multi-month low of 96.50 in late January.

Lower highs at points A and B suggest that the upper boundary of the channel continues to act as resistance, while the hesitant price action after breaking the 5 February high indicates waning bullish momentum. This raises the possibility that the blue uptrend line could soon come under pressure from renewed bearish attempts.

On the other hand, there are clear signs of active demand near the key 96.50 level. Therefore, in the longer term, bulls may regain strength and attempt to overturn the broader downtrend.

Trade global index CFDs with zero commission and tight spreads (additional fees may apply). Open your FXOpen account now or learn more about trading index CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

AERO Price Jumps 12% Today

Aerodrome Finance price climbed 12% over the past 24 hours, drawing renewed attention from traders. Despite the sharp uptick, AERO remains locked in a broader sideways structure.

This consolidation phase reflects cautious optimism rather than confirmed breakout strength. While short-term momentum improved, sustained upside requires stronger follow-through.

AERO Holders Exhibit Optimism

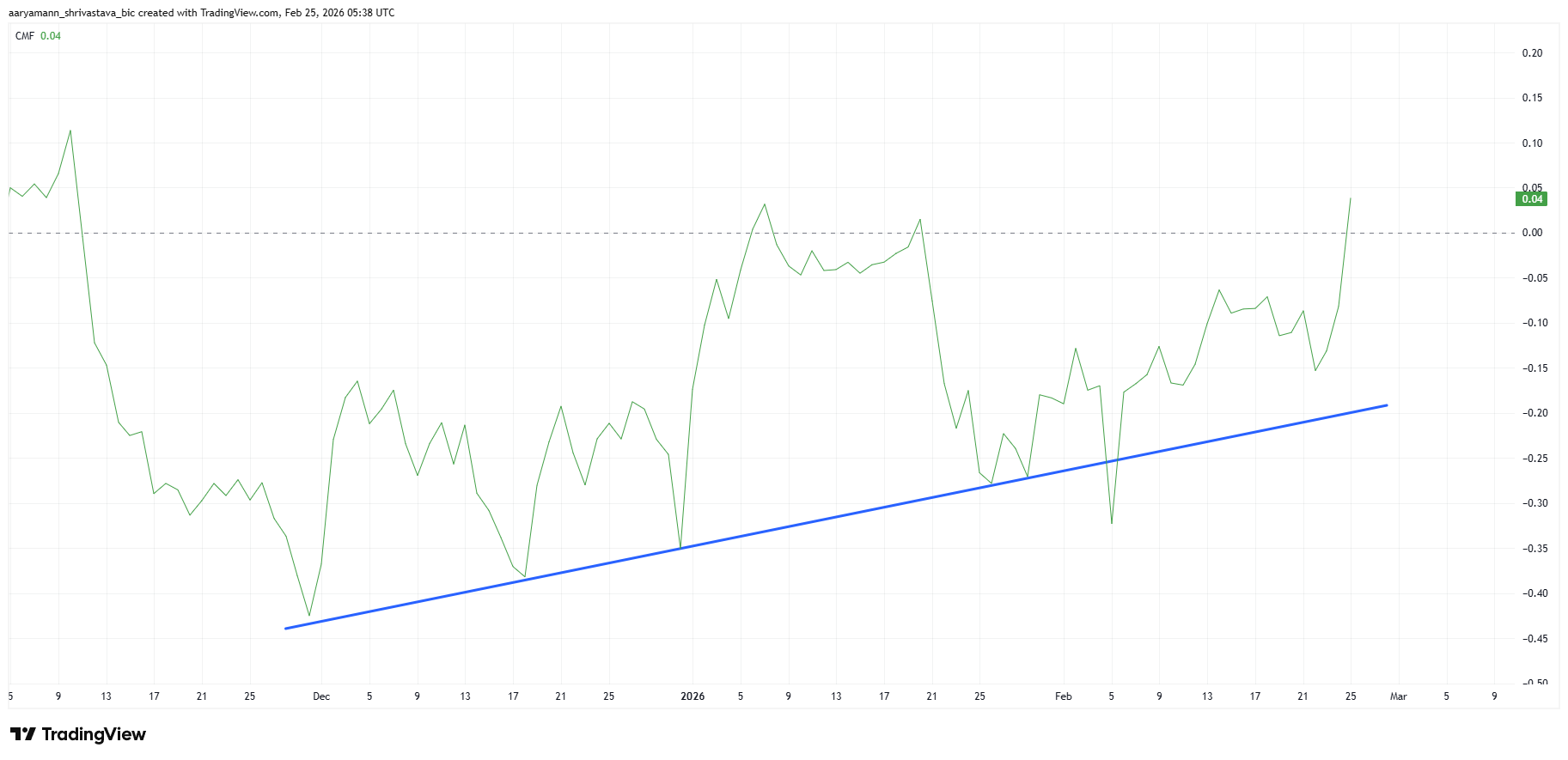

The Chaikin Money Flow indicator signals improving macro sentiment for Aerodrome Finance. Outflows that peaked around early December 2025 have steadily declined. Inflows now dominate, suggesting capital is returning to AERO. This shift indicates investors are gradually rebuilding exposure.

CMF currently sits at a three-and-a-half-month high. Elevated readings often reflect sustained buying pressure rather than short-lived speculation. Strengthening inflows point to growing confidence among participants. This macro bullishness may provide structural support for further price appreciation.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Futures market data reinforces the constructive outlook. AERO contracts are currently skewed toward long positions. Traders are positioning for potential upside continuation. Long exposure stands at approximately $2.35 million, reflecting notable bullish interest.

The $0.351 resistance level remains a critical barrier. A move above this threshold would trigger a significant short liquidation cluster worth roughly $623,560. Forced short covering can accelerate upward momentum. Such dynamics often amplify breakouts in volatile crypto markets.

AERO Price Is Awaiting a Breakout

AERO is trading at $0.327 at the time of writing after posting a 12% daily gain. Despite the surge, the token remains within its consolidation range. Current technical and derivatives signals present a cautiously bullish outlook. However, confirmation depends on overcoming immediate resistance.

Breaching the $0.352 barrier is essential for a sustained breakout. Clearing this level would likely trigger short liquidations and strengthen bullish momentum. The Squeeze Momentum indicator shows compression building, while the histogram reflects underlying strength. A squeeze release could propel AERO toward $0.400.

Downside risks persist if buyers fail to maintain control. Continued consolidation between $0.352 and $0.292 would signal hesitation. A breakdown below $0.292 would weaken the bullish structure. Further losses could push AERO toward $0.273 or even $0.243, invalidating the current recovery thesis.

Crypto World

Glassnode flags extended sell-side pressure ahead

BTC is down ~28% this month; Glassnode’s sub‑1 realized P/L ratio signals 5–6 more months of downside pressure.

Summary

- BTC trades near ~$63k after a sharp February selloff, about 47% below its ~$126k ATH from October 2025.

- Glassnode’s 90D realized profit/loss ratio has fallen below 1, historically preceding at least 5–6 months where realized losses dominate realized profits.

- In prior cycles, BTC dropped ~25% over six months in 2022 and >50% over five months in 2018 after this metric flipped sub‑1, implying risk of further drawdown if patterns repeat.

Bitcoin has approached previous highs following a sharp decline in February, though blockchain analytics firm Glassnode has indicated further downward pressure may persist for several months, according to the company’s recent analysis.

Glassnode reported that Bitcoin’s realized profit/loss ratio, measured as a 90-day moving average, has fallen below 1. The firm stated this metric suggests the decline could continue for an additional five to six months.

In a post on social media platform X, Glassnode cited historical data showing that drops in the Realized Profit/Loss Ratio below 1 have preceded decline periods lasting at least six months. The firm noted that a return above 1 generally indicates a decrease in selling pressure.

The analytics company referenced the 2022 and 2018 bear markets as comparative examples. During the 2022 bear market, Bitcoin declined 25% in value six months after its profit/loss ratio fell below 1, according to Glassnode. Under similar conditions in 2018, Bitcoin experienced a drop exceeding 50% over five months.

Glassnode stated that if historical patterns repeat, the cryptocurrency’s price could continue its downward trend for five months or longer.

The Realized Profit/Loss Ratio measures the ratio of profits to losses realized on the Bitcoin network, providing insight into market sentiment and selling pressure among holders.

Crypto World

5 red months, 74% LTH profit rapidly eroding

BTC is down ~50% from ATH, with 74% LTH profit shrinking as supply in loss hits 50% amid multi‑month selling.

Summary

- Long-term BTC holders still sit on ~74% average profit, but that margin is compressing as price grinds toward the LTH cost basis near ~$39k.

- BTC has printed almost five straight red monthly candles after a volatility spike above 150%, while weekly RSI hits one of its most oversold levels ever around the $60k-$65k zone.

- BTC supply in loss has hit ~10m coins, roughly 50% of the 20m circulating, a capital destruction level that has historically coincided with bear market bottoms.

Bitcoin long-term holders currently hold an average profit of approximately 74%, though that margin continues to decline as the cryptocurrency’s price moves closer to their cost basis, according to CryptoQuant analyst Darkfost.

The analyst noted that historical bear market cycles have been characterized by prices breaking below the long-term holder cost basis, triggering capitulation phases marked by realized losses of around 20%. Long-term holders are defined as investors known to be less sensitive to short-term price fluctuations, Darkfost stated.

Market recovery and bull phase entry have historically occurred only after such capitulation events, according to the analysis.

Glassnode reported that the 90-day moving average of the Realized Profit/Loss Ratio has fallen below 1, confirming a transition into an excess loss-realization regime. The blockchain analytics firm stated that these bearish conditions have historically persisted for at least six months before liquidity returns to markets.

Analyst James Check reported that Bitcoin has recorded nearly five consecutive red monthly candles following the largest volatility spike of the current cycle. Check observed that one-week realized volatility spiked above 150%, a level typically associated with capitulation events, and that weekly RSI has reached one of the most oversold readings in Bitcoin’s history. A significant amount of Bitcoin has migrated to new holders in a high price range this year, according to Check’s analysis.

Bitcoin supply in loss reached 10 million coins, the fourth-highest reading on record, analyst James Van Straten reported. Van Straten noted that circulating supply will reach 20 million Bitcoin next week, with 50% held at a loss. Historical patterns suggest such capital destruction levels are sufficient for a bear market bottom, according to Van Straten.

Bitcoin experienced a minor price rebound during early Asian trading hours, though bearish sentiment remains dominant in the market. The price movement formed another lower high while a key support level continues to hold, according to technical analysis.

Crypto World

Anchorage Digital Buys Strategy STRC as Stock Becomes Most-Shorted

Crypto bank Anchorage Digital said it now holds Strategy’s perpetual preferred security STRC on its balance sheet, adding an institutional backer to Michael Saylor’s Bitcoin treasury company at a time when Wall Street traders are increasingly betting against it.

In a Wednesday post on X, Anchorage co-founder and CEO Nathan McCauley said the purchase shows alignment between two companies built around Bitcoin (BTC) infrastructure and corporate treasury adoption. “Conviction compounds. Institutions don’t just talk about Bitcoin, they structure around it,” McCauley wrote.

“When the company that operationalizes Bitcoin infrastructure puts capital alongside the company that operationalized the Bitcoin treasury strategy…that’s a signal,” he added. Anchorage did not reveal the size or timing of the position.

According to Strategy’s website, STRC is a Nasdaq-listed perpetual preferred security marketed as a short-duration, high-yield instrument. The shares pay an 11.25% annual dividend distributed monthly in cash. Capital raised through the instrument has historically financed the firm’s continued Bitcoin accumulation.

Related: Michael Saylor says quantum threat to Bitcoin is more than 10 years away

Strategy becomes Wall Street’s most-shorted stock

Anchorage’s purchase comes as Strategy has climbed to the top of Goldman Sachs’ list of most-shorted large-cap US equities by short interest as a percentage of market capitalization. A year ago, it did not rank among the top 50. The company began rising on the list in late 2025 as its share price weakened even before Bitcoin peaked in October.

Short selling involves borrowing shares and selling them with the expectation of repurchasing later at a lower price. Losses can grow if the stock rises.

Strategy functions as a leveraged public-equity proxy for Bitcoin. It issues securities and deploys the proceeds into BTC. Gains can amplify during rallies, while downturns magnify pressure on the share price.

The company currently holds 717,722 Bitcoin worth about $46.68 billion at current market prices. On Monday, it announced another purchase, acquiring 592 BTC for $39.8 million. The coins were acquired at an average cost of roughly $76,020, leaving the company sitting on an estimated $7 billion unrealized loss with Bitcoin trading near $66,000.

Related: Michael Saylor hints at Strategy’s 100th Bitcoin buy

Strategy plans debt-to-equity shift

Last week, Strategy founder Michael Saylor said the company intends to convert roughly $6 billion in convertible bond debt into equity, replacing repayment obligations with newly issued shares. The change would lower leverage on the balance sheet by turning bondholders into shareholders, though it could dilute existing investors.

The firm added that its Bitcoin treasury would still cover its liabilities even in an extreme downturn. According to the company, Bitcoin would need to fall close to $8,000, an estimated 88% drop, before its holdings and debt reached parity.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Entertainment7 days ago

Entertainment7 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Sports2 days ago

Sports2 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics2 days ago

Politics2 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business3 days ago

Business3 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World1 day ago

Crypto World1 day agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business3 days ago

Business3 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment7 days ago

Entertainment7 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Tech3 days ago

Tech3 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat2 days ago

NewsBeat2 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat3 days ago

NewsBeat3 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics3 days ago

Politics3 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World7 days ago

Crypto World7 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech16 hours ago

Tech16 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat12 hours ago

NewsBeat12 hours agoPolice latest as search for missing woman enters day nine

-

Crypto World6 days ago

Crypto World6 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

Sports2 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week