Crypto World

Crypto Fund Outflows Drop 89% to $187 Million

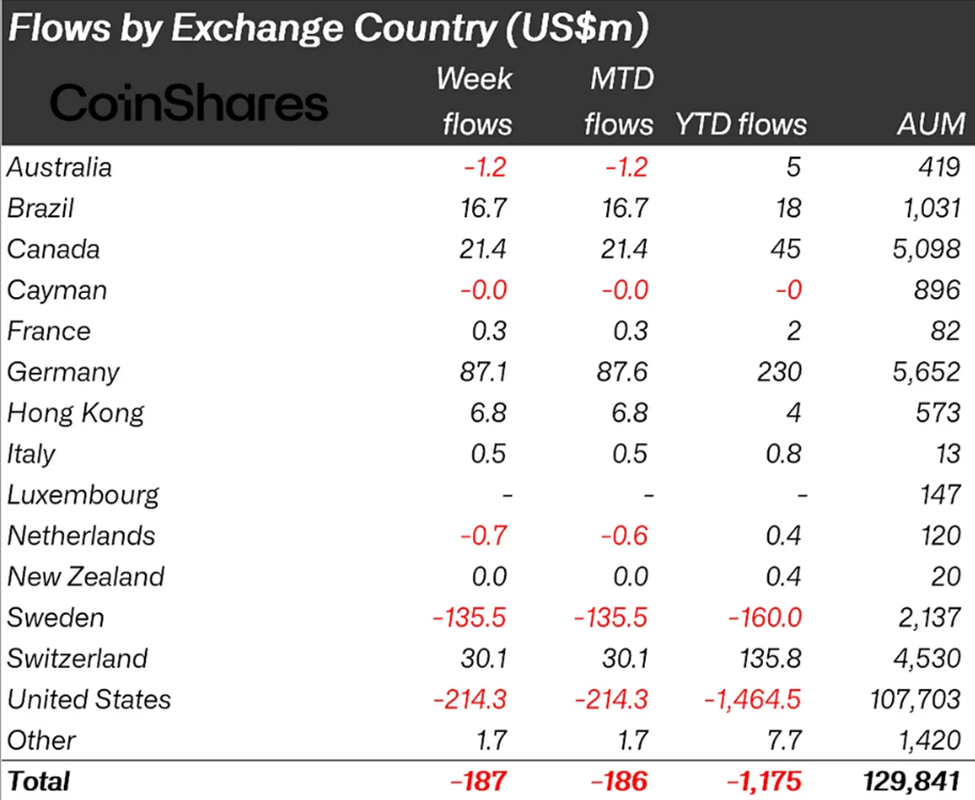

Crypto markets may be showing early signs of stabilization after weeks of intense selling, according to the latest CoinShares report on digital assets.

Investment products saw outflows collapse from over $1.7 billion recorded for two successive weeks to just $187 million last week.

Sponsored

Crypto Outflows Shrink to $187 Million, CoinShares Report Shows

CoinShares’ latest figures show that total assets under management fell to $129.8 billion, the lowest level since March 2025. This reflects the ongoing impact of the recent price slide.

Based on the chart below, regional trends hint at selective confidence, with institutional and region-specific strategies diverging even as global sentiment remains cautious.

Yet while investors were cautious, trading activity remained strong. Crypto exchange-traded products (ETPs) recorded a record $63.1 billion in weekly volume. With this, they surpassed the previous high of $56.4 billion set in October 2025.

Notably, high volumes amid slowing outflows indicate that investors are repositioning rather than abandoning the market, a subtle but important distinction.

Sponsored

Bitcoin experienced $264 million in outflows, highlighting a rotation away from the pioneer crypto toward alternative digital assets.

Among altcoins, XRP, Solana, and Ethereum led inflows, receiving $63.1 million, $8.2 million, and $5.3 million, respectively. XRP, in particular, has emerged as a favorite, attracting $109 million year-to-date.

Crypto Capitulation Shows Signs of Slowing, But Bottom Not Yet Confirmed

Despite continued price pressure, it is worth noting that the sharp drop in outflows is no mean feat, following $1.73 billion in negative flows and $1.7 billion the week before. This sharp contraction in crypto fund flows across successive weeks is being interpreted as a potential inflection point.

Sponsored

According to analysts, such a deceleration often precedes changes in market momentum, suggesting the selling frenzy could be approaching its limit.

“The deceleration in outflows suggests selling pressure is easing, and capital flight may be reaching exhaustion. Historically, this shift often precedes a change in market momentum. Early signs of stabilization are starting to emerge,” stated Andre.

Historically, crypto cycles rarely reverse immediately following peak sell-offs. Instead, the market often experiences a gradual easing of outflows before inflows return, a pattern that seems to be emerging in the current correction.

Therefore, last week’s slowing outflows may be a leading indicator, but should not be misconstrued as a guarantee of recovery.

Sponsored

The broader implication is that the market may be transitioning from panic-driven capitulation to consolidation and selective accumulation.

While Bitcoin continues to see outflows, the inflows into altcoins and regional markets suggest that investors are rotating risk rather than exiting crypto entirely.

Still, caution remains warranted because one week of slower crypto outflows does not signal a confirmed bottom.

Crypto World

Gold Price Climbs Above $5,000 At the Start of the Week

As shown by today’s XAU/USD chart, gold began the week on a bullish note: trading opened with a bullish gap above Friday’s high, lifting the price above the psychological $5,000 level.

The strengthening of gold has been driven by the following factors (according to media reports):

→ The US dollar, which is weakening ahead of key US economic data. The January employment report is due on Wednesday (it is expected to show signs of stabilisation in the labour market), followed by inflation data on Friday.

→ Political developments in Japan. The decisive victory of Prime Minister Sanae Takaichi has reinforced expectations of large-scale fiscal stimulus (“Sanaenomics”), which traditionally puts pressure on the yen and supports gold.

→ Demand from central banks. It has been reported that China’s central bank extended its gold purchases for the fifteenth consecutive month in January.

On 3 February, when analysing gold price fluctuations, we:

→ noted that the market was extremely oversold within the context of a long-term ascending channel;

→ suggested that a rebound from the zone of extreme oversold conditions could encounter a resistance area formed by the median of that channel and the classic Fibonacci levels (50% and 61.8%).

Indeed, on 4 February, after recovering into this area (with the formation of peak C), the market reversed lower and found support near the lower boundary of the aforementioned channel on Friday, 6 February.

Technical Analysis of the XAU/USD Chart

Price action (expanding amplitude) during the formation of low D points to aggressive demand, which may reflect the intentions of large capital.

At the same time, analysis of the market structure based on the A–B–C–D swing points suggests that, following the burst of extreme volatility at the turn of the month (highlighted by the peak in the ATR indicator), the market is searching for a new equilibrium.

It is therefore reasonable to assume that in the near term we may see a contraction in the amplitude of price fluctuations on the XAU/USD chart. It cannot be ruled out that supply and demand will find a temporary balance around the psychological $5k level.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

China’s property slump will be worse than expected

A real estate project under construction along the ancient Huai River in Huai’an City, Jiangsu Province, China on January 29, 2026.

Cfoto | Future Publishing | Getty Images

BEIJING — S&P Global Ratings has lowered its forecast for China property sales this year, barely two months into 2026.

The firm said Sunday that primary real estate sales will likely drop by 10% to 14% this year, worse than the 5% to 8% decline for 2026 sales predicted back in October.

“This is a downturn so entrenched that only the government has capacity to absorb the excess inventory,” the analysts said in a note. They added that the state could buy more unsold property to create affordable housing, but that so far these efforts have been piecemeal.

China’s property market, once accounting for more than a quarter of the economy, has seen its annual sales volume halve in just four years. Beijing’s crackdown on developers’ high reliance on debt for growth sparked the initial slump, while consumer demand for homes has yet to pick up.

Economists have long warned of overbuilding in China’s property market. But developers have only kept up construction despite the sales slump, leading to a sixth-straight year of completed, unsold new housing, according to the ratings agency.

“China’s glut of primary housing is keeping a property market recovery out of reach,” the S&P analysts said, noting the oversupply pressures prices to fall by another 2% to 4% this year, following a similar decline last year.

“Falling prices erode homebuyers’ confidence,” S&P’s report said. “It’s a vicious cycle with no easy escape.”

What’s particularly concerning, S&P said, is that the price decline in China’s biggest cities worsened in the fourth quarter of last year. “We previously viewed these markets as healthy, and as the likely starting place of any national property recovery,” the report said.

The cities of Beijing, Guangzhou and Shenzhen reported home price declines last year of at least 3%, the report said, noting Shanghai was the only major city to report an increase, up 5.7% in 2025 from 2024.

Getting worse

China’s property slump progressively worsened throughout 2025.

In May, S&P predicted a 3% decline in sales of new homes, only to revise that in October to an 8% drop. Sales ended up falling by 12.6% to 8.4 trillion yuan ($1.21 trillion) — less than half the annual sales of 18.2 trillion yuan seen in 2021.

That’s ramping up the pressure on China’s struggling real-estate developers.

If sales end up falling 10 percentage points below S&P’s base case for this year and next, four of the 10 Chinese developers that the company rates could see downward rating pressure, the analysts said.

That excludes China Vanke, once one of the country’s largest developers, which, late last year, asked to delay repayment on some of its debt.

Chinese authorities have yet to release significant new support for real estate, preferring to double down on efforts to develop advanced technologies.

Last month, U.S.-based research firm Rhodium Group said that China’s push into high-tech industries isn’t large enough to offset the country’s property slump, leaving the economy more reliant on exports for growth and more exposed to trade tensions.

Top policymakers are set to release economic goals for the year at a parliamentary meeting next month.

Crypto World

Infini exploiter resurfaces to buy ETH dip for $13M

A wallet linked to the Infini exploit has resurfaced after months of dormancy, spending $13.32 million to buy Ethereum during the recent market dip.

Summary

- A wallet linked to the Infini exploit purchased 6,316 ETH worth $13.3 million during the recent price dip before sending funds to Tornado Cash, on-chain data shows.

- The address had been inactive for more than 200 days, according to alerts from Lookonchain, PeckShield, and CertiK.

- Past transactions suggest the exploiter has repeatedly bought ETH near local lows and sold near cycle highs, highlighting precise market timing.

The funds were later routed through the crypto mixing service Tornado Cash, according to on-chain data and multiple blockchain security firms.

Blockchain analytics firm Lookonchain flagged the activity, showing that the exploiter purchased 6,316 ETH at an average price of $2,109 roughly eight hours before the transfers were detected.

Shortly after the purchase, the wallet consolidated its holdings and sent a total of 15,470 ETH, worth about $32.6 million, to Tornado Cash.

The transactions were also identified by PeckShield and CertiK, both of which confirmed that the address, labeled as the Infini exploiter, deposited the full Ethereum (ETH) balance into the privacy protocol. Thus, marking a resumption of laundering activity after more than 200 days of inactivity.

Pattern of buying lows, selling highs

On-chain records suggest the wallet has repeatedly demonstrated precise market timing. According to Lookonchain, the same entity:

- February 2025: Exploited Infini by stealing $49.5 million in USDC, later converting the funds into 17,696 ETH at $2,798.

- July 2025: Sent 5,000 ETH to Tornado Cash and sold 1,770 ETH for $5.88 million at $3,322.

- August 2025: Sold 1,771 ETH at $4,202, near local cycle highs.

- February 2026: Bought 6,316 ETH at $2,109, before transferring the full balance to Tornado Cash.

“He seems very good at buying low and selling high,” Lookonchain noted, pointing to the consistent timing of the exploiter’s trades across multiple market cycles.

Background on the Infini exploit

Infini suffered the exploit in February 2025 after attackers compromised administrative privileges, resulting in a total loss of approximately $49.5 million. The stolen funds were rapidly swapped across stablecoins and ETH before being dispersed through multiple wallets, complicating recovery efforts.

While Tornado Cash remains operational at the smart-contract level, its use has drawn heightened scrutiny from regulators and blockchain investigators due to its frequent role in laundering illicit funds.

As of press time, there has been no indication that the funds sent to Tornado Cash have been frozen or recovered. Investigators continue to monitor the wallet’s activity for further movement.

Crypto World

Bitcoin (BTC), major tokens drop as traders position for downside protection: Crypto Markets Today

Crypto markets opened the week under pressure, extending losses after a volatile weekend as bitcoin showed tentative signs of stabilizing below $70,000.

Even though the largest cryptocurrency dropped more than 2.8% in the last 24 hours, it remains well off its recent lows of around $60,000. Still, it has struggled to regain momentum after last week’s steep drop that reignited debate over whether the market has entered a deeper bear phase or is nearing a bottom.

Bitcoin bulls pointed to slowing downside moves as a sign of exhaustion, even as critics took victory laps. Nevertheless, attention is being paid to software stocks, some of which started to rebound as concerns of a deeper collapse ease.

The CoinDesk 5 Index (CD5) fell 3.4%, with all five of the largest cryptocurrencies declining. Ether dropped about 5%, underperforming bitcoin as traders cut risk across major tokens, but held above the psychological support at $2,000. The broader CoinDesk 20 (CD20) index is down 3.7%.

Derivatives Positioning

- BTC futures are seeing a clear bearish shift after open interest (OI) slid from $19 billion to $16 billion over the last week, marking a period of sustained deleveraging.

- Funding rates on Bybit (-2.24%) and Binance (-0.5%) have flipped neutral-to-negative, signaling that short sellers are now leading the narrative. With the three-month basis compressing to 3%, institutional demand has cooled, reflecting a broader derivatives landscape dominated by risk-off sentiment.

- Options data confirms this defensive shift, with one-week 25-delta skew for BTC rising to 20% and call dominance dropping to 48%.

- The implied volatility (IV) term structure is now in extreme backwardation, with front-end volatility at 85.03% dwarfing long-term expectations (~50%). That’s a massive premium for immediate protection against near-term price drops.

- Coinglass data shows $397 million in 24-hour liquidations, with a 45-55 split between longs and shorts. BTC ($234 million), ETH ($74 million) and SOL ($14 million) were the leaders in terms of notional liquidations.

- The Binance liquidation heatmap indicates $68,160 as a core liquidation level to monitor in case of a price drop.

Token Talk

- Crypto wallet Rainbow debuted its RNBW token last week, but the launch wasn’t smooth.

- The Ethereum-based project introduced the token on the layer 2 network Base, with the price tumbling to $0.025, a 75% drop from its $0.10 initial coin offering (ICO) just two months earlier. It has since risen to $0.031

- That drop wiped out expectations from speculators betting on a $100 million fully diluted valuation (FDV). On Polymarket, odds of that bet reached a near 80% high earlier in the year. The FDV is now hovering closer to $31 million.

- At the heart of the chaos were delays in token distribution to early buyers and participants in Rainbow’s onchain rewards program. Some users said they had not received their airdropped tokens hours after the launch.

- Rainbow’s cofounder Mike Demarais blamed backend infrastructure buckling under demand. U.S.-based investors won’t be able to fully access their tokens until December 2026, according to vesting terms.

- Rainbow raised $18 million in a 2022 Series A led by Reddit cofounder Alexis Ohanian’s firm, Seven Seven Six. The wallet is known for gamified features and a points system tied to the RNBW token.

Crypto World

FDIC pays $188k, pledges policy shift in Coinbase FOIA crypto case

The FDIC will pay $188,440 and revise its disclosure rules after a Coinbase FOIA lawsuit exposed “pause letters” telling banks to curb or halt crypto services.

Summary

- The FDIC settled Coinbase’s FOIA suit by agreeing to cover $188,440 in legal fees and update how it handles bank supervision documents tied to crypto.

- Courts found the FDIC improperly blanket‑withheld records, leading to the release of dozens of “pause” or cease‑and‑desist‑style letters targeting banks’ crypto activities.

- Coinbase CLO Paul Grewal says the case proves regulators told banks to steer clear of crypto, fueling claims of a quiet “debanking” push against the industry.

The Federal Deposit Insurance Corporation agreed to pay $188,440 in legal fees and revise its public disclosure policy to settle a Freedom of Information Act lawsuit filed by Coinbase, according to court documents.

FDIC and the settlement resolved

The settlement resolves a multi-year legal dispute over the FDIC’s refusal to disclose documents that allegedly directed banks to halt or restrict cryptocurrency services, according to Decrypt.

The case centered on correspondence the FDIC sent to banks, characterized as “cease and seek letters,” which requested financial institutions refrain from offering new cryptocurrency-related services or expanding existing digital asset operations.

Coinbase filed the FOIA request seeking disclosure of these documents after confirming their existence. The FDIC declined to release the materials, prompting the legal action.

The court ruled the FDIC’s response violated the Freedom of Information Act by withholding all documents collectively under a blanket claim that “such documents are not subject to disclosure” without conducting individual document reviews, according to the ruling.

The settlement resulted in the disclosure of dozens of cease and desist letters from the FDIC ordering banks to cease cryptocurrency-related activities, according to legal experts familiar with the case.

Paul Grewal, Chief Legal Officer at Coinbase, stated in a press release following the settlement that the litigation confirmed documents directing banks to avoid cryptocurrency operations existed.

The FDIC is an independent government agency that operates under federal authority to insure bank deposits and supervise financial institutions in the United States.

Crypto World

2026 is the year for money on-chain

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

For over a decade, the idea of money moving on-chain has hovered between promise and pause. The technology was always ahead of behaviour. Infrastructure matured faster than trust. Capital, especially institutional capital, preferred to observe rather than participate.

Summary

- The shift is behavioral, not technical: Infrastructure was ready years ago — 2025 is when institutions started asking “how does this fit?” instead of “how fast can it go?”

- Serious capital has arrived quietly: Family offices and HNWIs are allocating to on-chain assets as long-term infrastructure, not speculative trades — and that kind of money sticks.

- Regulation + tokenization make 2026 inevitable: Clear rules, real-world asset tokenization, and remittances as a killer use case are turning on-chain money from theory into financial plumbing.

That gap has started narrowing. By the end of 2025, the conversation shifted subtly but meaningfully. On-chain activity stopped being framed as a speculative side-show and began appearing in serious discussions around portfolio construction, asset efficiency, and cross-border value movement. As we look at 2026, it is worth asking whether this is the year money meaningfully transitions on-chain; not as a trend, but as an operating layer of global finance.

What changed in 2025 was behaviour, not technology

The biggest shift in 2025 was not technological innovation. It was behavioural maturity. Bitcoin’s (BTC) evolution captures this well. Once viewed almost entirely through the lens of volatility, it is now increasingly discussed as a long-duration asset with specific portfolio characteristics. That change in framing matters far more than price cycles.

Markets mature when participants begin asking better questions. In 2025, the questions shifted from “How fast can this grow?” to “How does this fit?” Custody, governance, auditability, and regulatory alignment became central themes. That is usually the moment when an asset class moves from experimentation to early adoption.

Serious wealth has entered quietly

In light of the turbulent times we’re living in, one of the more understated developments has been the steady participation of high-net-worth individuals and family offices in alternative assets like VDAs. This has not been loud capital. It has been careful, structured, and incremental. Many are allocating a modest percentage of their portfolios to digital assets, not to chase upside but to hedge concentration risk and gain exposure to a parallel financial infrastructure that is largely uncorrelated to traditional assets.

This matters because such capital tends to be sticky. It enters slowly, but it rarely exits impulsively. Once digital assets are treated as an allocation decision rather than a tactical trade, the foundation for long-term participation is laid. In 2026, this segment is likely to deepen its engagement; not necessarily by increasing risk, but by increasing conviction.

Regulation is not the enemy of on-chain money

India’s regulatory tightening has often been interpreted as resistance. In reality, it signals something more important: acknowledgement. Markets are regulated when they become too large to ignore. From a long-term perspective, regulation is not a brake on institutional participation; it is a prerequisite.

Clear rules, even strict ones, allow capital to assess risk with precision. Ambiguity deters serious money far more than compliance does. As India sharpens its regulatory posture and global frameworks such as CARF gain traction, the cost of participating on-chain becomes more predictable. Predictability, not permissiveness, is what institutions look for.

The quiet maturation of assets

Another reason 2026 feels different is asset maturity. Digital assets are no longer limited to cryptocurrencies. The conversation has expanded to tokenised representations of real-world value: real estate, land, funds, and potentially other long-duration assets.

India saw several announcements in 2025 around real estate and land tokenisation. Elsewhere, the New York Stock Exchange has announced a parallel exchange that will trade in tokenized assets with blockchain-based settlements, making T+1, T+2, and market hours history. While large-scale execution across the globe may take time, these developments are significant catalysts. Tokenisation is not about disruption for its own sake. It is about improving liquidity, reducing friction, and increasing transparency in asset classes that have historically been opaque and inefficient.

The real impact will not come from mass adoption overnight, but from selective, compliant use cases where on-chain records offer operational advantages. That is where credibility is built.

Remittances may be the first true test case

If there is one area where on-chain money has a clear functional advantage, it is global remittances. Speed, cost efficiency, and transparency are not theoretical benefits here; they are measurable outcomes.

Traditional systems remain slow, expensive, and fragmented. On-chain rails offer a way to move value across borders with fewer intermediaries and greater traceability. As regulatory clarity improves, remittances could become one of the first mainstream use cases where on-chain money moves from “alternative” to “obvious.”

India’s unresolved stablecoin question

One critical issue that 2026 will force into sharper focus is India’s stance on stablecoins. The RBI has articulated its position clearly, favouring sovereign digital currency models. However, globally, stablecoins continue to play a growing role in on-chain liquidity and settlement. Apparently, India has also proposed linking BRICS’ digital currencies on the back of CBDCs. The real question is whether stablecoin rails will continue to remain global liquidity havens or will the network effects settle on sovereign rails?

India will eventually need to articulate a more detailed position, whether through restriction, regulation, or selective allowance. This decision will shape how seamlessly India integrates into global on-chain financial systems. Avoiding the question may no longer be viable as cross-border capital flows increasingly intersect with digital rails.

So, is 2026 the turning point?

2026 is unlikely to be remembered as the year money fully moved on-chain. But it may be remembered as the year key decisions were made. The year when on-chain money stopped being debated as a possibility and started being evaluated as infrastructure.

The shift will be gradual, uneven, and heavily regulated. That is how financial systems evolve. What feels different now is the convergence of behaviour, regulation, and asset maturity. When those three align, capital tends to follow.

Money rarely moves where excitement is highest. It moves where systems are stable, rules are clear, and long-term value is visible. 2026 may not deliver headlines, but it may quietly mark the beginning of money finding its place on-chain.

Crypto World

Crypto.com founder Kris Marszalek buys ai.com domain name for record $70 million: FT

Kris Marszalek, the founder and CEO of crypto exchange Crypto.com, spent $70 million to buy ai.com, the highest publicly disclosed price paid for a website domain, the FT reported.

The acquisition signals the executive’s move into artificial intelligence, a sector that reached nearly $1.5 trillion in worldwide spending in 2025, according to Gartner. The momentum will intensify this year, with Bloomberg reporting that the four largest U.S. tech giants alone, Alphabet, Amazon, Meta and Microsoft, plan to invest a combined $650 billion in AI infrastructure this year.

The transaction, finalized in April 2025, was conducted entirely in cryptocurrency, the FT said in its report on Friday, citing Larry Fischer of GetYourDomain.com, who brokered the transaction. The price tag more than doubled the previous $30 million record held by Block.one’s 2019 purchase of Voice.com. Block.one is the owner of CoindDesk’s parent, Bullish (BLSH). Marszalek spent $12 million to acquire crypto.com in 2018.

Ai.com announced the debut of a consumer platform featuring autonomous AI agents. Unlike traditional chatbots, these agents are designed to operate on a user’s behalf — executing tasks such as trading stocks, managing calendars and automating workflows. Marszalek said the platform aims to be the “front door to AGI” through a decentralized network.

“We are at a fundamental shift in AI’s evolution as we rapidly move beyond basic chats to AI agents actually getting things done for humans,” said Marszalek. “Our vision is a decentralized network of billions of agents who self-improve and share these improvements with each other.”

The platform announced its debut with a Super Bowl LX commercial on Sunday, generating a surge in traffic that crashed the website for several hours. Writing on X on Monday, Marszalek cited “insane traffic levels” from the 30-second ad, noting that while the team had prepared for scale, the volume of interest was unprecedented.

Crypto World

Bitcoin price outlook: buy signals appear amid deep BTC correction

- Bitcoin (BTC) is showing early buy signals amid an ongoing correction near $69,500.

- The key support levels at $65,800 and $60,100 attract dip buyers.

- A break above $74,500 could trigger renewed bullish momentum.

Bitcoin has been in a volatile state over the past month, with prices hovering near $69,500.

The cryptocurrency has faced a 23.2% drop over the last month, signalling a deeper correction in progress.

Despite the decline, recent market activity suggests early buy signals are starting to emerge.

Bitcoin price trapped in a sideways phase

BTC is currently trading in a sideways range between $62,800 and $78,900 over the past seven days.

This range indicates indecision among traders, with neither bulls nor bears fully controlling the market.

Analyst Doctor Profit warn that this sideways phase could be a trap, potentially leading to a deeper drop toward $44,000–$50,000.

However, this view is balanced by macroeconomic developments that may provide temporary support for Bitcoin.

The recent rebound above $70,000 came after a short squeeze pushed BTC higher, liquidating over $245 million in positions.

This shows that buying pressure still exists, particularly from opportunistic traders looking to enter at perceived lows.

Liquidity remains relatively strong, with 24-hour trading volume exceeding $46 billion, suggesting continued investor participation.

Bitcoin technical outlook: the buy signals

From a technical standpoint, Bitcoin remains capped below key resistance at $69,000–$69,500.

Breaking above this level is essential for bulls to regain control of short-term momentum.

On the flip side, the support levels at $65,800 and $60,100 provide clear thresholds where buyers may step in.

Recent dip buying indicates that some traders are accumulating Bitcoin during the correction.

Notably, the reset of leveraged positions in derivatives markets points to reduced short-term selling pressure.

Meanwhile, macro factors such as strong US economic data and Federal Reserve liquidity injections provide additional tailwinds.

Political events like Japan’s election have also lifted global risk appetite, indirectly supporting BTC and other risk assets.

Historical trends show that Bitcoin often experiences deep corrections after major rallies, making the current slump consistent with past market cycles.

The all-time high of $126,080, reached in October 2025, remains distant, but the current consolidation may offer opportunities for medium-term accumulation.

Analysts emphasise that patience is critical, as further volatility is expected before a sustained uptrend emerges.

Bulls should watch these key technical zones carefully, knowing that a breakout above $74,500 could signal renewed upward momentum.

Conversely, a fall below $65,800 could intensify selling and extend the correction phase.

Overall, the market is balancing between lingering bearish pressure and emerging buying interest, creating a cautious but potentially rewarding environment.

Investors with a longer-term perspective may view current prices as an entry point amid market-wide corrections.

Short-term traders should remain alert to both upside breakouts and downside risks in the coming weeks.

Crypto World

Mining difficulty drops by most since 2021 as miners capitulate

Bitcoin’s mining difficulty dropped by around 11%, its largest decline since China’s 2021 crackdown on the industry, after a sharp decline in hashrate triggered by plunging prices and widespread winter storm-related outages in the U.S.

Mining difficulty, which determines how hard it is to find new Bitcoin blocks, adjusts roughly every two weeks to maintain a 10-minute block interval on the network.

The latest change brought the metric down from over 141.6 trillion to about 125.86 trillion, according to Blockchain.com data, signaling a steep drop in the number of active machines securing the network.

The decline follows a series of blows to miners. Bitcoin prices have fallen significantly from an all-time high of $126,000 in October to around $69,500.

That price drop forced many miners, especially those running outdated equipment and facing high energy costs, to shut down. Some also repurposed their hardware to focus on artificial intelligence (AI), as megacap firms offer stable contracts and often economically irresistible terms.

Bitfarms (BITF) notably saw its share price surge after saying it’s no longer a bitcoin company, and is instead focusing on data center development for high-performance computing and AI workloads.

Bitcoin mining revenue on a per terahash basis, measured via the hashprice, has plunged from nearly $70 at the time the cryptocurrency was trading at an all-time high, to now stand at little over $35.

Severe winter storms, particularly in Texas, compounded the situation. Grid operators issued curtailment requests to conserve electricity for residential users. Public mining firms scaled back production, with some seeing daily bitcoin output fall by more than 60%.

Although a drop in difficulty might appear alarming, it functions as a self-correcting mechanism. For miners who remain online, the reduced competition can increase profitability and help maintain the business model.

Historically, major difficulty drops have also signaled market capitulation, often preceding a stabilization or rebound in price as miners sell the BTC they mine to cover operational expenses.

Crypto World

Why Japan’s Election Is a Short-Term Drag but Long-Term Win for Bitcoin

Japan’s landslide election boosted equities but added near-term pressure to Bitcoin as capital rotated and liquidity tightened.

Japan’s ruling bloc secured a two-thirds majority in the Lower House on February 8, handing Prime Minister Sanae Takaichi a decisive victory that has already reshaped global market positioning.

The result has lifted Japanese equities while adding short-term pressure to Bitcoin (BTC), even as longer-term policy shifts in Tokyo may support institutional crypto adoption.

Takaichi’s Victory Reshapes Capital Flows

Market reaction to the election was swift, with Japanese stocks pushed to fresh record highs in the hours after the result, and the Nikkei extending gains as traders priced in aggressive fiscal stimulus and a more tolerant stance toward yen weakness.

Market watcher Ash Crypto wrote on X that Japan’s stock market had hit a new all-time high following Takaichi’s victory, reflecting optimism around domestic reflation.

Research firms and analysts were more cautious about global spillovers. XWIN Research described the outcome as bearish for Bitcoin in the near term, pointing to tighter global liquidity and shifting capital flows.

Meanwhile, GugaOnChain noted that the so-called “Takaichi Trade” is not a simple exit from U.S. assets but a portfolio rebalance. Japanese Government Bonds, sidelined for years by ultra-low yields, are attracting incremental capital as fiscal expansion raises reflation expectations.

That rotation has coincided with a pullback in U.S. equities. Over the past seven days, the Nasdaq Composite fell about 5.6%, the S&P 500 slipped by about 2.7%, and the Russell 2000 dropped close to 2.6%.

You may also like:

A stronger dollar, driven by yen weakness and persistent rate gaps between the U.S. and Japan, has tightened financial conditions further. In these risk-off phases, Bitcoin has tended to move alongside U.S. equities, allowing equity-led de-risking to spill into crypto markets.

“The Takaichi Trade strengthens Japan but puts pressure on the U.S. and Bitcoin,” wrote GugaOnChain. “The capital flight to JGBs and a robust dollar create an environment of inevitable adjustments, requiring investors to closely monitor the correlation between U.S. indexes and crypto assets.”

Weak Sentiment Now, Policy Tailwinds Later

At the time of writing, BTC was trading just below $71,000, up about 2% on the day but down more than 6% over the past week and nearly 22% in the last month.

Adding to the feeling of fragility in the market, the Bitcoin Fear and Greed Index fell to a 6-year low on February 7 after BTC slid from above $90,000 in late January to near $60,000 before rebounding.

CryptoQuant’s latest report shows Bitcoin trading below its 365-day moving average, with spot and institutional demand weak and liquidity tightening, all common features of a bear phase.

Still, Japan’s political backdrop looks different beyond the immediate risk-off trade. With a two-thirds majority, Takaichi’s administration has room to pursue legislative changes, and officials have previously framed Web3 as an industrial policy focus. As such, analysts expect discussions around crypto tax reform and stablecoin rules to resume.

As XWIN concluded,

“Near-term pressure on U.S. equities and Bitcoin is macro-driven, while Japan’s institutional reforms may support crypto markets longer term.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics18 hours ago

Politics18 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat13 hours ago

NewsBeat13 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business18 hours ago

Business18 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports8 hours ago

Sports8 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics20 hours ago

Politics20 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat3 hours ago

NewsBeat3 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report