Crypto World

Crypto Industry Proposes Sharing Stablecoin Reserves with Community Banks: Report

Crypto firms offered concessions on stablecoins, including reserve-sharing with banks, to ease tensions blocking a major digital asset bill.

The crypto industry has reportedly proposed sharing stablecoin reserves with community lenders as it steps up efforts to win over skeptical banks.

The move aims to preserve the stalled crypto market structure bill that could significantly alter the financial system.

Deposit Fears and the Search For Compromise

A Bloomberg report revealed that crypto firms have spent weeks trying to win over doubtful banks by offering new concessions focused on stablecoins, which have become the central point of disagreement.

According to sources cited in the report, the latest ideas include giving community banks a larger role in the stablecoin ecosystem. One proposal would require issuers to hold a portion of their reserves at these financial institutions. Another recommendation would make it easier for these firms to issue their own dollar-pegged digital assets.

However, the two sides have not agreed on any resolution, and it remains unclear whether the proposals would go far enough to address fears of customers moving deposits out of the banking system.

A separate report from analyst Geoff Kendrick had warned that stablecoins could lead to the exit of as much as $500 billion in bank deposits across industrialized nations by the end of 2028. This comes as the overall digitalized dollar market continues to experience notable growth, with the total supply in circulation having risen by roughly 40% over the past year.

Digital Asset Firms Remain Divided

On the other hand, not all crypto companies are aligned with the suggestions. One of the biggest points of contention is whether platforms like Coinbase should be allowed to pay users rewards for holding stablecoins. Traditional financial institutions also argue that these payouts could pull customers away from checking and savings accounts, which threatens a major source of deposits for them.

You may also like:

In an attempt to resolve this, the Trump administration convened a meeting at the White House on Monday between crypto and banking trade groups, but the talks ended without agreement on how to resolve these core issues.

Despite the friction, the development is still being viewed as a positive sign that the market-structure bill will keep moving in Congress. This is after the legislation was passed by the House of Representatives last year, but has since slowed in the Senate due to unresolved disagreements between the two sectors.

Meanwhile, in a recent interview with Fox News, Tim Scott, the chairman of the Senate Banking Committee, expressed his optimism about finding a compromise.

“We can protect consumers and community banks while still allowing innovation and competition to lower prices and expand access,” the senator said. “Both sides are working toward a compromise that keeps innovation here in America.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

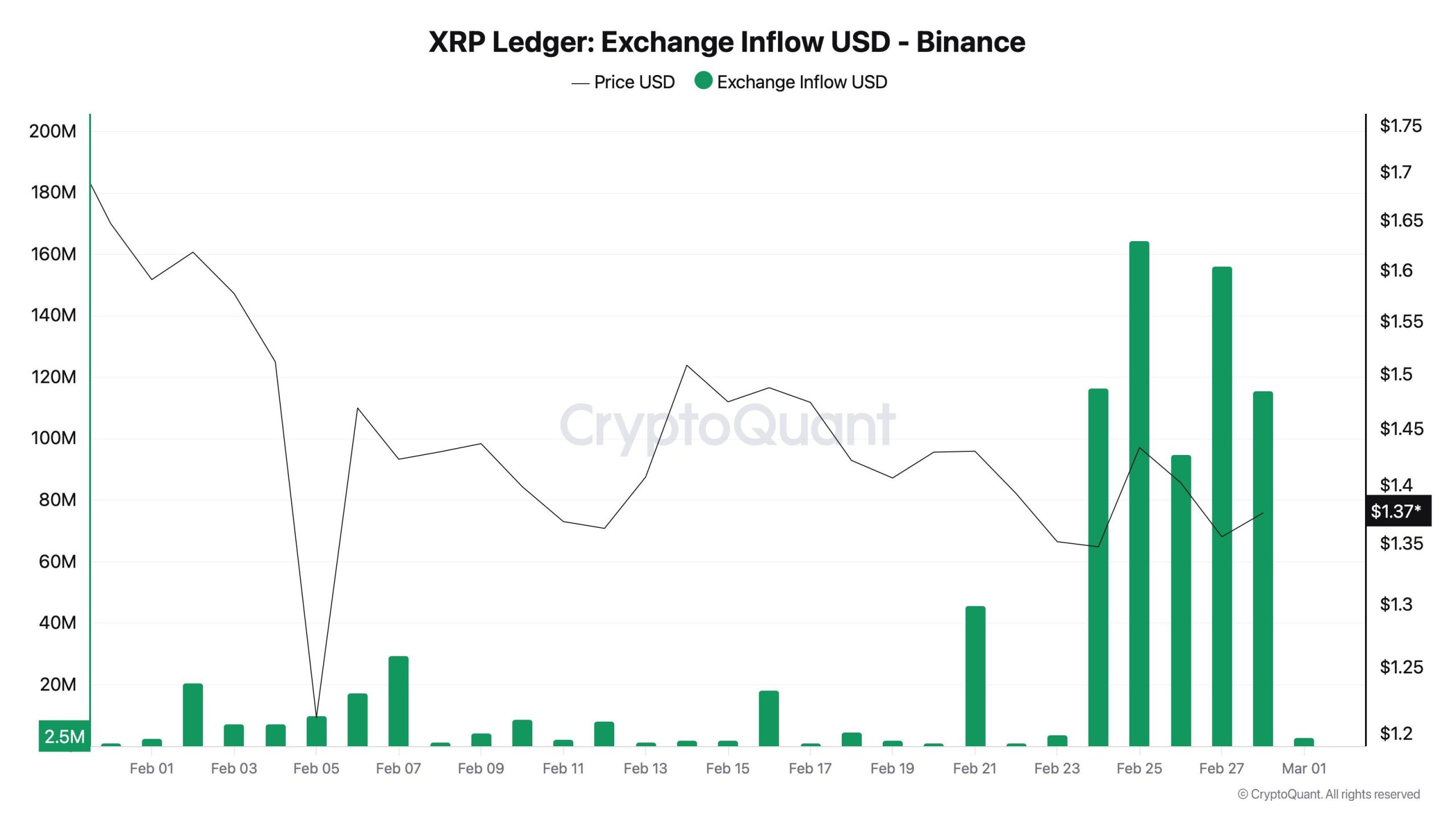

$652M XRP Hits Binance as Iran Tensions Spark Risk-Off Wave

XRP (XRP) holders appear to be adopting a defensive stance amid intensifying geopolitical tensions between the United States, Israel, and Iran.

On-chain data shows more than $650 million worth of XRP flowing into Binance over the past week. The sharp rise in exchange inflows suggests investors may be positioning for increased volatility, raising the risk of short-term downside if market uncertainty persists.

Rising Middle East Tensions Trigger XRP Positioning Shift

BeInCrypto reported that a joint strike by Israel and the United States on Iran on Saturday triggered a sharp sell-off across crypto markets.

“The first strikes were launched shortly after the close of traditional financial markets. This timing amplified uncertainty across risk assets, with crypto reacting almost immediately to the geopolitical shock,” analyst Darkfost stated.

Tensions escalated further over the weekend following reports that Iran’s Supreme Leader, Ayatollah Ali Khamenei, had been killed. Iran has intensified retaliatory attacks targeting Israel and several Gulf Arab countries, deepening fears of broader regional instability. The rising geopolitical risk has weighed heavily on investor sentiment.

Crypto markets have declined alongside other risk assets. Meanwhile, gold surged as capital rotated toward traditional safe havens. XRP has not been immune.

On-chain analyst Darkfost noted that more than 472 million XRP, worth approximately $650 million, were transferred to Binance over the past week. According to the analyst, this was the “largest inflow period of the month of February.”

Follow us on X to get the latest news as it happens

Large exchange inflows are often interpreted as a sign of potential selling pressure, as tokens typically need to be moved onto trading platforms before they can be sold. However, inflows do not automatically translate into immediate sell-offs.

Such transfers may also reflect liquidity repositioning, arbitrage strategies, collateral management, or precautionary moves during periods of heightened volatility. Still, it raises concerns.

“Such inflows typically reflect a more defensive posture from investors holding XRP. When large amounts of tokens move onto exchanges, it often signals a potential willingness to sell or at least to position liquidity closer to the market. When amount of flows like this are recorded, they can create the conditions for a sudden wave of selling pressure capable of impacting price action in the short term,” Darkfost said.

The main question is whether the large inflow signals a lasting distribution phase or just a temporary response to crises. Notably, the transfer has caused Binance’s XRP reserves to tick up.

CryptoQuant data showed that exchange reserves had been broadly declining since October 2025. The recent inflow marks a modest reversal of that trend for now.

Meanwhile, XRP extended its losses in line with the broader crypto market downturn. According to BeInCrypto Markets data, the altcoin has dropped more than 4% in the past 24 hours. At the time of writing, XRP was trading at $1.37.

The next few days will reveal whether this $652 million move was a one-off or signals the start of further adjustments among XRP holders. As geopolitical risk and crypto market structure collide, both near-term volatility and long-term adoption narratives remain at the forefront.

Subscribe to our YouTube channel to watch leaders and journalists provide expert insights

Crypto World

5 US Economic Reports That Could Move Bitcoin This Week

Bitcoin price enters one of the most consequential macro weeks of the first quarter, trading in the $66,000 range, down modestly amid fragile sentiment, thin liquidity, and geopolitical overhang.

After weeks of several lower highs, and with the pioneer crypto recording its weakest start to a year on record, traders are now turning to a heavy slate of US economic data that could redefine Federal Reserve (Fed) rate-cut expectations and, by extension, crypto market direction.

US Economic Data Points to Influence Bitcoin Price This Week

Below are the five key reports expected to sway Bitcoin sentiment this week.

Manufacturing PMI

The week begins with February’s S&P Global Manufacturing PMI and the closely watched ISM Manufacturing PMI.

Consensus expects readings around 51.2 for S&P and 52.0–52.3 for ISM, following January’s surprise surge to 52.6, the strongest expansion since 2022.

The implications could extend to Bitcoin, where a reading above 52.5, particularly if new orders and production strengthen, would reinforce the “resilient economy” narrative.

That scenario typically delays Fed rate cuts, lifts Treasury yields and the U.S. dollar, and puts pressure on non-yielding assets like BTC.

Conversely, a drop toward 50, the contraction threshold, would shift expectations toward earlier easing. Historically, contraction combined with weak BTC positioning has delivered strong upside reversals.

“ISM above 50 is bullish for markets,” commented analyst Bull Theory.

Notably, manufacturing is not the dominant engine of the U.S. economy. However, as the week’s first catalyst, it could set the volatility tone for March.

ADP Employment Signals Labor Tightness

Meanwhile, Wednesday’s ADP Employment Change report acts as the market’s first real labor pulse for February. Economists expect roughly 50,000 new private-sector jobs, up from January’s modest 22,000 gain.

Because ADP often serves as a preview for Friday’s Non-Farm Payrolls (NFP), traders react aggressively to deviations. A strong print above 60,000–75,000 would suggest labor resilience, reinforcing the Fed’s “higher for longer” posture. That would likely push yields and the dollar higher, weighing on Bitcoin.

On the other hand, a soft reading, especially below 40,000, would revive the liquidity narrative. Signs of cooling labor conditions strengthen expectations for rate cuts later this year, which historically benefit risk assets and crypto.

With markets already pricing roughly two to three cuts in 2026, even modest surprises could recalibrate positioning.

Services PMI

Later Wednesday, attention shifts to the services sector with the S&P Services PMI and ISM Services PMI.

Expectations sit in the 52.3–53.5 range, consistent with steady expansion. January’s ISM Services reading came in at 53.8.

Because services account for the majority of U.S. economic activity, this report carries more influence than manufacturing.

Strong services print alongside solid employment data would reinforce economic resilience, dampening hopes for near-term easing and pressuring BTC.

However, signs of slowing demand or weaker employment could quickly change the narrative. Markets remain hyper-sensitive to any indication that growth momentum is cooling.

A combined miss across ADP and services would amplify dovish bets, potentially sparking a relief rally in Bitcoin toward the $70,000 psychological level.

Jobless Claims

Thursday’s Initial Jobless Claims, expected around 215,000, versus the previous 212,000, provide a high-frequency gauge of labor-market stress.

While often overlooked compared to NFP, claims can meaningfully shape expectations ahead of Friday’s headline report.

Last week’s lower-than-expected claims reinforced tight labor conditions and coincided with BTC slipping below $68,000.

If claims remain subdued, it strengthens the hawkish case: a tight labor market limits urgency for rate cuts.

Conversely, an unexpected spike would support the cooling narrative, softening yield pressure and providing near-term support for crypto.

Given its proximity to NFP, Thursday’s release could either validate earlier signals or introduce fresh uncertainty.

Non-Farm Payrolls

Friday’s U.S. Employment Report is the week’s defining event and the highest beta catalyst. Consensus calls for approximately 54,000 new jobs in February, down sharply from January’s strong 130,000 gain.

The unemployment rate is expected at 4.3%, with hourly wages rising 0.3% month-over-month.For Bitcoin, notwithstanding, the NFP is the highest-beta macro catalyst.

A hot print, say above 80,000 jobs with firm wage growth, would reinforce the narrative that the economy remains too strong for imminent cuts.

Yields would likely spike, the dollar would strengthen, and BTC could test lower support zones near $62,000–$59,000.

A soft report, particularly below 40,000 jobs or rising unemployment, would accelerate rate-cut pricing and potentially ignite a liquidity-driven rally.

With sentiment fragile and Bitcoin trading below key resistance in the $72,000–$75,000 range, this week’s data could define March’s trajectory.

Crypto World

Kalshi CEO defends ‘no death’ rule after Khamenei market backlash

Kalshi’s CEO has defended the company’s handling of its market on whether Iran’s Supreme Leader, Ali Khamenei, would be “out” of power, after backlash from users who accused the platform of unfair settlement practices.

Summary

- Kalshi says it does not allow markets that directly settle on death and structured the Khamenei contract with a “death carve-out.”

- The market was settled at the last traded price before the time of death, with fee refunds and reimbursements issued.

- Users accused the platform of unclear rules, unfair payouts and inconsistent standards, threatening to switch to competitors.

In a detailed post on X, the CEO said Kalshi does not list markets that settle directly on someone’s death.

When outcomes may involve death, he explained, the company structures rules to prevent users from profiting from it. That approach was applied to the Khamenei contract, which allowed trading on whether he would be out as Supreme Leader, a development the company argued carries major geopolitical, economic and national security implications, including potential effects on oil and commodity prices.

Under Kalshi’s rules, the market was settled at the last traded price before the time of death. All positions, regardless of when they were opened, were paid out based on that final pre-death price. In addition, the company said it reimbursed the difference for users who bought shares after the time of death at higher prices and refunded all trading fees tied to the market.

The CEO acknowledged that some users disagreed with the “death carve-out,” arguing that simpler rules without exceptions would be preferable. He said the company would work on improving how such caveats are displayed in the user interface.

However, several users pushed back sharply, accusing Kalshi of unclear rules, deleting responses, and failing to honor what they believed was a straightforward bet. Some claimed financial losses and said they would move to rival prediction markets.

Others pointed to previous contracts involving elderly public figures, arguing the company had previously allowed markets where death was a foreseeable outcome.

The dispute highlights growing tensions over how regulated U.S. prediction markets handle sensitive, mortality-linked events.

Crypto World

AI Could Be Turbulent but Also Boost Bitcoin, NYDIG

Bitcoin will see a boost if artificial intelligence disrupts the labor market or causes volatility that would prompt central banks to ease their monetary policy, says Greg Cipolaro, the research lead at crypto services company NYDIG.

Cipolaro said in a research note on Friday that AI could likely be seen as a “general-purpose technology” such as electricity, and the macroeconomic effects it would have on employment, economic growth and risk appetite will affect Bitcoin (BTC).

“If AI-driven growth occurs alongside expanding liquidity and contained real rates, that backdrop can be supportive for Bitcoin,” Cipolaro said. “But if stronger growth lifts real yields, tightens policy, and reduces the need for monetary accommodation, Bitcoin may face headwinds.”

“Conversely, if AI generates labor disruption or volatility that prompts fiscal expansion and easier monetary policy, the resulting liquidity impulse would likely favor Bitcoin,” he added.

The economy is already seeing the impact of the technology, as companies are undertaking mass layoffs fuelled by AI, as billions of dollars in investments pour into companies creating AI models.

Jack Dorsey said on Friday that his payments company Block would cut roughly 40% of its staff due to AI, and predicted that many more companies would soon follow suit.

AI transition may be volatile and uneven

Goldman Sachs’ research arm claimed in a report in August that widespread AI adoption could displace up to 7% of the US workforce, but would also likely create new job opportunities.

Related: Crypto VC Paradigm expands into AI, robotics with $1.5B fund: WSJ

Cipolaro acknowledged the transition will “pose challenges,” requiring workflow redesign, new skills, and additional investment. Still, he predicts AI will follow the same “historical pattern” as previous technological advancements.

“The implication is not that disruption will be painless, but that the equilibrium response to new technology has historically been integration, not obsolescence. Society’s response to AI will likely follow the same pattern,” he said.

“Firms that integrate it effectively will widen margins and productivity gaps. Workers who adapt will enhance their relevance. Those who resist may fall behind,” Cipolaro added.

AI adoption is also expanding within the crypto. In October, crypto exchange Coinbase announced a new tool, Payments MCP, that grants AI agents access to the same on-chain financial tools used by people, with AI and blockchain executives noting that it can be safe but also introduces new risks.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation — Santiment founder

Crypto World

What to Expect From Early March’s $572 Million Token Unlocks

Crypto tokens worth more than $572 million will enter the market over the next seven days. Notably, three major ecosystems, Hyperliquid (HYPE), Ethena (ENA), and RedStone (RED) will release new token supply into circulation in early March 2026.

The token unlocks will inject fresh liquidity into the market and can also trigger price swings and volatility. So, here is a breakdown of what to watch for in each project.

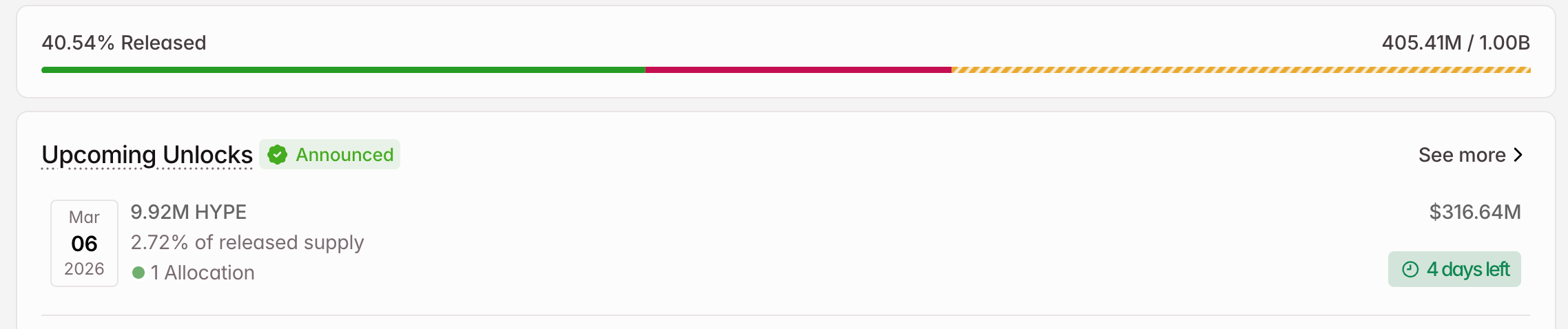

1. Hyperliquid (HYPE)

- Unlock Date: March 6

- Number of Tokens to be Unlocked: 9.92 million HYPE

- Released Supply: 405.41 million HYPE

- Total Supply: 1 billion HYPE

Hyperliquid is a leading decentralized perpetual futures exchange built on its own Layer-1 blockchain. It offers high-performance trading with low latency, on-chain order books, and sub-second transaction finality.

On March 6, the team will unlock 9.92 million HYPE worth $316.64 million. The tokens account for 2.72% of the released supply.

Hyperliquid will direct all unlocked altcoins to core contributors.

2. RedStone (RED)

- Unlock Date: March 6

- Number of Tokens to be Unlocked: 40.85 million RED

- Released Supply: 253.25 million RED

- Total Supply: 1 billion RED

RedStone is a modular blockchain oracle protocol that feeds trusted, real-time external data into smart contracts and decentralized finance (DeFi) applications across multiple blockchains.

The team will release 40.85 million tokens on March 6. The tokens are worth $6.04 million. Furthermore, they account for 16.13% of the released supply.

The team will split the unlocked supply four ways. Early backers will get 26.42 million tokens. Core contributors will receive 5.56 million RED.

In addition, the team will allocate 5.54 million altcoins to the ecosystem and data providers. Lastly, it will direct 3.33 million tokens towards protocol development.

3. Ethena (ENA)

- Unlock Date: March 2

- Number of Tokens to be Unlocked: 40.63 million ENA

- Released Supply: 7.62 billion ENA

- Total Supply: 15 billion ENA

Ethena is a synthetic dollar protocol built on Ethereum (ETH). The protocol’s flagship product is USDe, a synthetic dollar stablecoin. Furthermore, ENA is the protocol’s governance token.

The team will release 40.63 million ENA tokens on March 2 via its cliff vesting schedule. The tokens, worth $4.21 million, account for 0.53% of the released supply.

Ethena will award the entire unlocked supply to the Foundation. In addition to these three, Staika (STIK), Spectral (SPEC), and IOTA (IOTA) will also experience new supply entering the market in the first week of March.

Crypto World

Fed Will Print Money for Iran War, Boosting Crypto

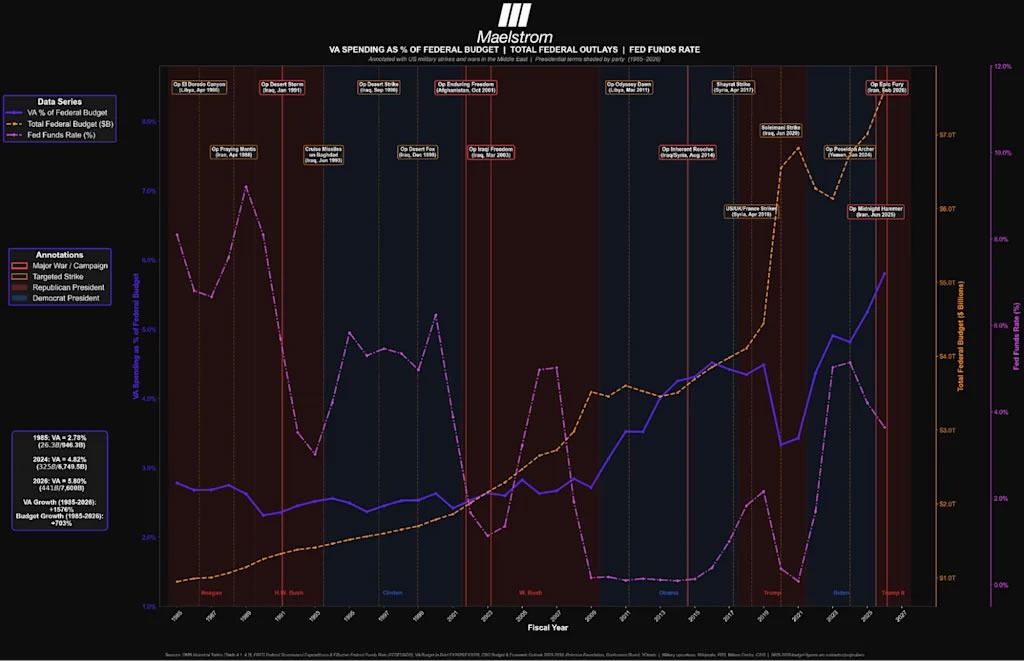

The US Federal Reserve could ease its hawkish monetary policy to help finance the country’s conflict with Iran, which would boost crypto markets, says BitMEX co-founder Arthur Hayes.

Hayes said in a blog post on Monday that every US president since 1985 has launched military action in the Middle East, and each time, the Federal Reserve has responded by cutting rates and expanding the money supply to finance the conflict.

“The longer Trump engages in the extremely costly activity of Iranian nation-building, the higher the likelihood that the Fed lowers the price and increases the quantity of money to support Pax Americana’s latest bout of Middle Eastern adventurism,” he added.

Hayes said that the Gulf War in 1990, the global war on terrorism after the Sept. 11 attacks in 2001, and the so-called “surge” in Afghanistan in 2009 had all resulted in Fed rate cuts or monetary easing.

Over the weekend, Israel and the US initiated a series of airstrikes on Iran that killed the country’s supreme leader, Ali Khamenei, which President Donald Trump has pledged to continue.

Hayes advises a wait-and-see approach

“We do not know how long Trump will remain interested in spending billions, if not trillions, of dollars reshaping Iran’s politics to his liking, nor how much geopolitical and financial market pain he can politically tolerate before he cuts and runs,” said Hayes. “The prudent action is to wait and see.”

“The time to back up the truck and buy Bitcoin and high-quality shitcoins […] is immediately after the Fed cuts rates and or prints money to support the government’s goals in Iran,” he added.

Hayes has recently shared other theories on how the Fed may approach monetary policy, and in the past three months has said the Fed would start quantitative easing due to a new liquidity tool called Reserve Management Purchases, or to alleviate the Japanese bond crisis, or because artificial intelligence will take jobs, leading to a credit crisis.

Related: Bitcoin traders eye Iran reactions as oil sparks US 5% inflation forecast

Futures show only a marginal drop

After the Israel-US strikes on Iran, crypto social media saw a spike in mentions of “World War 3” over the weekend, according to Santiment.

However, the mentions remain much lower than in June 2025 when Israel launched strikes on Iran’s nuclear and military sites, which escalated into a 12-day conflict.

Macro newsletter The Kobeissi Letter said, “This is not a futures open that is anywhere near WW3,” a reference to US stock futures, which opened down marginally in early trading on Monday.

Oil prices have already erased nearly half of their opening gap higher, and the S&P 500 is down less than 1%, it added.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Fed Could Print Money to Back US-Iran Conflict, Hayes Says

Analysts say that shifting US monetary policy could hinge on geopolitical developments in the Middle East, with crypto markets watching for signals from the Federal Reserve. BitMEX co-founder Arthur Hayes argues in a Monday blog post that American presidents have repeatedly engaged in Middle East action, and the Fed has historically responded by cutting rates or expanding the money supply to finance those campaigns. He writes that the longer an administration pursues Iran-focused objectives, the greater the likelihood the Fed will “lower the price and increase the quantity of money” to support those efforts, a pattern he sees echoed in past conflicts. Hayes cites the Gulf War of 1990, the post-9/11 wars, and the 2009 Afghan surge as episodes where monetary easing followed military action. Over the weekend, Israel and the US conducted airstrikes on Iran that killed Ali Khamenei, a development President Donald Trump has pledged to continue.

Key takeaways

- The analytically argued link between wartime financing and Fed easing suggests policy pivots could accompany geopolitical shocks, with crypto markets potentially benefiting from increased liquidity.

- Historical precursors—Gulf War (1990), the post-9/11 era, and the 2009 Afghan surge—are cited as episodes where rate cuts or aggressive money printing supported wartime aims, according to Hayes.

- The weekend strikes on Iran introduced fresh geopolitical risk, intensifying scrutiny of how policy makers balance inflation, growth, and security concerns while markets price in potential easing.

- Crypto-market chatter around “World War III” spiked on social media after the latest flare-up, though observers noted that current dynamics are not comparable to peak speculative periods in 2025.

- Hayes has floated liquidity tools such as Reserve Management Purchases and other easing measures, signaling how policymakers might adapt if macro risks escalate, a thread that dovetails with ongoing debates about liquidity in crypto markets.

Tickers mentioned: $BTC

Price impact: Positive. The piece frames geopolitical risk and potential Fed easing as supportive for crypto markets, implying upside for BTC if policy shifts materialize.

Market context: The narrative sits at the intersection of macro policy, geopolitics, and crypto liquidity. As risk sentiment shifts with geopolitical headlines, traders monitor whether Fed actions—or lack thereof—will unlock liquidity channels that typically buoy risk assets including digital currencies.

Why it matters

The episode highlights how macro policy and geopolitical trajectories can influence the behavior of crypto markets. If the Federal Reserve were to pivot toward rate cuts or quantitative easing in response to ongoing conflict dynamics, liquidity could expand and risk appetite could rise, creating a more favorable environment for digital assets like Bitcoin. The discussion also underscores the fragility of markets that are sensitive to policy signals; investors may pivot quickly in anticipation of liquidity injections or policy tightening, reinforcing the need for disciplined risk management.

For market participants, the perspective from Hayes — that policy responses to geopolitical frictions can be both reflexive and pro-cyclical for crypto — adds a layer of nuance to how traders interpret price movements. It also draws attention to liquidity tools and central-bank balance-sheet dynamics as structural drivers that could shape the next phase of the crypto cycle. While none of this guarantees a specific price path, it emphasizes that policy and geopolitics remain key variables in the crypto trading playbook.

What to watch next

- Federal Reserve communications and any signals about rate cuts or new liquidity programs, including Reserve Management Purchases.

- Developments in the Iran-Israel conflict and leadership dynamics in the region, alongside any shifts in geopolitical risk assessments.

- Bitcoin price action in response to macro news and policy signals, with attention to test levels around major milestones.

- Regulatory and institutional flows that could affect BTC-related products and overall market liquidity.

Sources & verification

- BitMEX blog: Arthur Hayes on iOS warfare and monetary policy implications — https://www.bitmex.com/blog/ios-warfare

- Cointelegraph coverage: Israel-US airstrikes on Iran and the described leadership developments — https://cointelegraph.com/news/bitcoin-recovers-to-68k-following-reported-death-of-iranian-supreme-leader

- Kobeissi Letter remark on futures and WW3 framing — https://x.com/KobeissiLetter/status/2028251687572688942

- Santiment data on World War III mentions in crypto discourse — https://x.com/santimentfeed/status/2028285118553493784

- Jane Street discussion on Bitcoin price narratives — https://magazine.cointelegraph.com/bitcoin-price-manipulation-jane-street-bitcoiners-debate-cointelegraph/

Market reaction and key details

The central thread running through this discourse is the tension between geopolitics and macro policy and how that tension spills into crypto markets. Hayes’ framing rests on a historical pattern: wartime actions tend to be financed through monetary easing, which, in turn, broadens liquidity and tends to support assets that thrive on risk-taking. In the current moment, observers watch for any official signal from the Fed that policy might shift toward easing, a move that could catalyze a broader crypto rally if liquidity taps are opened.

Beyond the macro angle, the conversation threads in public commentary include market data points such as marginal moves in stock futures and shifts in energy prices, which can influence risk appetite across asset classes. As noted in related analyses, Bitcoin and other crypto narratives have at times mirrored shifts in traditional markets, but the relationship remains imperfect and highly context-dependent. The social-media chatter around WW3 underscores how fast sentiment can pivot on headlines, even if the underlying price action is more nuanced than headline narratives suggest.

Notably, the discourse extends to liquidity tools and policy mechanisms that could shape the trajectory of crypto markets. Hayes has previously floated ideas like Reserve Management Purchases as a potential tool to soothe markets, and he has linked these constructs to broader money-printing dynamics that could accelerate crypto adoption during periods of policy stress. In parallel, market observers have debated whether large participants and market makers have the capacity to influence price through strategic liquidity provisioning, a theme that has featured in discussions around Jane Street and other firms in analyses like the one titled “Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets.”

As with any geopolitical and macro narrative, investors should command a cautious, context-aware approach. The next few weeks could deliver clarity on the Fed’s stance, the evolution of the conflict in the Middle East, and the way crypto markets weigh fresh liquidity signals against ongoing macro uncertainties. While Hayes’ framework provides a lens to interpret potential policy responses, it is one of many factors driving price discovery in Bitcoin and other digital assets.

Crypto World

Over $9 billion flees BTC and ETH ETFs in four months

The U.S.-listed spot bitcoin and ether exchange-traded funds (ETFs) have seen record outflows over the past four months, confirming that a full-blown crypto market is underway.

Investors have pulled $6.39 billion from bitcoin ETFs over four straight months of outflows, the longest monthly losing streak since the funds launched in January 2024, according to data source SoSoValue data.

Ether ETFs have also fallen out of favor, bleeding $2.76 billion over the past 4 months.

These huge outflows indicate that institutional appetite for digital assets has collapsed, which explains the price losses in the two tokens. Bitcoin, the leading cryptocurrency by market value, peaked at over $126,000 in early October and has since almost halved to $67,000. Ether has had a much steeper fall, down over 60% from highs above $4,950 in August last year.

Alternative investment vehicles such as spot ETFs emerged as the clearest and most observable source of sustained institutional activity after their debut in early 2024. Investors poured billions in 2024 and in months following pro-crypto Donald Trump’s victory in the U.S. elections, greasing the bull run in both tokens at the time.

The demand, however, evaporated after the early October crash, which was supposedly led by pricing inefficiencies on offshore exchange Binance. Recent days have seen sporadic inflows, but analysts say a sustained trend is needed for any meaningful market bounce.

Crypto World

MicroStrategy Raises STRC Dividend as MSTR Share Dips 14.77%

Strategy, formerly MicroStrategy, raised its STRC preferred stock dividend by 25 basis points for March 2026, as Bitcoin (BTC) drawdown continues to push MSTR shares down.

Strategy is the largest corporate holder of Bitcoin (BTC). The STRC dividend rate is set monthly to keep shares trading near their $100 par value, limiting price volatility.

Why it matters:

- Bitcoin’s drawdown has impacted both MicroStrategy’s Class A shares, MSTR, and its balance sheet.

- MSTR has declined 14.77% year-to-date (YTD) amid BTC’s drawdown. The largest cryptocurrency itself has dropped nearly 24% in the same time frame.

- STRC’s stability near $100 par contrasts with MSTR’s volatility.

The details:

- Executive Chairman Michael Saylor announced the 11.50% STRC dividend rate on X (formerly Twitter), up from 11.25% in February.

- The March increase marks the seventh STRC dividend hike since the shares began trading in July 2025.

- Strategy prices STRC dividends monthly to anchor shares near $100 par value.

- CEO Phong Le stated in February that the company plans to shift toward preferred share issuance over common stock for BTC purchases.

The big picture:

- Strategy holds the largest corporate BTC reserve globally and continues to purchase BTC despite $6.6 billion in paper losses.

- The pivot to preferred shares offers a lower-volatility capital raise vehicle compared to MSTR equity dilution.

- BTC’s current drawdown tests whether the Strategy’s accumulation model holds under prolonged price pressure.

Crypto World

Bitcoin under pressure as oil spikes 6%. What’s next?

A brief Sunday rally didn’t survive contact with Monday.

Bitcoin slid to $66,702 in early Monday trading, down 1.1% over the past 24 hours, as traditional markets reopened and began pricing the U.S.-Iran conflict that crypto had been trading in isolation since Saturday.

Sunday’s bounce to $68,000 on the Khamenei confirmation has now been mostly unwound, with the market settling back into the mid-$66,000 range that preceded the strikes.

The broader crypto picture was mixed. Ether fell 2.5% to $1,967, solana dropped 4.1% to $84, and XRP lost 3.6% to $1.36. The weekly numbers paint the real damage, with solana down 8.1% over seven days to lead losses among majors.

Traditional markets told the story crypto was anticipating. Brent crude surged as much as 13% at the open before settling around $77.50, still up 6.4%, the biggest jump since Russia’s invasion of Ukraine in 2022.

The Strait of Hormuz, through which roughly a fifth of the world’s oil flows, is effectively closed, per Bloomberg. Asian equities dropped 1.4% and U.S. equity futures fell 0.7%. Gold climbed to $5,350 an ounce.

The oil move is what matters most for crypto’s near-term direction. Higher energy prices feed directly into inflation expectations, which push back the timeline for Fed rate cuts, which tighten the liquidity conditions that drive risk asset prices.

But the situation remains fluid. Conflicting reports emerged Monday about whether Iran is seeking to resume nuclear talks with the U.S. The Wall Street Journal reported a fresh push to negotiate, while Iran’s national security chief Ali Larijani said the country won’t negotiate.

Earlier Sunday, Trump said the bombing campaign will continue until objectives are achieved, though The Atlantic reported he agreed to talk with Iran’s new leadership.

Meanwhile, some crypto traders say further downside risks for the market could be limited.

“Given that Iran has been isolated from global financial markets for quite some time, we believe that downside risk is limited,” said Jeff Mei, chief operating officer at BTSE.

“Some have been concerned about oil prices and their potential impact on inflation, but the world has been weaned off Iranian oil and increased supply from OPEC and the U.S. should be enough to stabilize prices.”

Whether that proves right depends on whether the Strait of Hormuz reopens and how long Trump’s “objectives” take to achieve. Until both of those questions have answers, crypto trades as a risk asset in a world that just got riskier.

-

Sports6 days ago

Sports6 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Iris Top

-

Politics7 days ago

Politics7 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Business5 days ago

Business5 days agoTrue Citrus debuts functional drink mix collection

-

Politics3 days ago

Politics3 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech1 day ago

Tech1 day agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports2 days ago

The Vikings Need a Duck

-

Crypto World6 days ago

Crypto World6 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat16 hours ago

NewsBeat16 hours ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat7 days ago

NewsBeat7 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat1 day ago

NewsBeat1 day agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoPolice latest as search for missing woman enters day nine

-

Business4 days ago

Business4 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Sports7 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week

-

Business3 days ago

Business3 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality