Crypto World

Crypto Twitter Erupts With Binance Scam Allegations: What’s True?

Crypto Twitter is angry again. This time, the target is familiar: Binance, the world’s largest crypto exchange, and its co-founder Changpeng Zhao (CZ).

Over the past few days, major allegations have taken over Twitter (or X) timelines, with some users calling him “a scammer” and demanding he be “sent back to prison.” So what is actually behind the latest accusations, and how much of it is supported by verifiable evidence?

The October Market Crash: What Happened?

One of the most serious allegations facing Binance dates back to October, during what later became known as “Crypto Black Friday.”

On October 10, US President Donald Trump announced 100% tariffs and export controls targeting China. The announcement immediately rattled global markets, sending risk assets sharply lower.

Crypto was no exception. BeInCrypto reported that Bitcoin fell around 10%. Major altcoins followed suit: Ethereum (ETH), XRP (XRP), and BNB (BNB) each declined by more than 15%.

Within 24 hours, more than $19 billion in leveraged positions were liquidated, marking the largest liquidation event tracked by crypto data analytics firm CoinGlass.

Initially, the crash was widely viewed as a market-wide panic triggered by macroeconomic news. However, market participants soon began to question whether the collapse was purely organic.

Sponsored

Sponsored

On social media, traders speculated that the scale and speed of the liquidations suggested something more coordinated than a standard sell-off. Attention soon turned to Binance.

Why Binance Became the Focus

During the sharpest phase of the crash, Binance users reported frozen accounts and failed stop-loss orders, and difficulties accessing the platform. Some traders also pointed to brief flash crashes that pushed assets, such as Enjin (ENJ) and Cosmos (ATOM), to near zero.

BeInCrypto reported that three Binance-listed assets, including USDe, wBETH, and BNSOL, temporarily lost their pegs amid the turmoil.

Binance publicly acknowledged disruptions during the event. The exchange cited “heavy market activity” as the cause of system delays and display issues, while reiterating that user funds remained SAFU.

Still, the explanation failed to calm all critics. Some users accused Binance of benefiting from the trading freeze, alleging that the disruption allowed the exchange to profit during peak volatility.

Did Binance’s Compensation Strategy Work?

On October 12, Binance released a statement following an internal review of the incident. According to the exchange, core spot and futures matching engines, as well as API trading, remained operational.

“According to data, the forced liquidation volume processed by Binance platform accounted for a relatively low proportion to the total trading volume, indicating that this volatility was mainly driven by overall market conditions,” the exchange noted.

However, Binance acknowledged that certain platform modules experienced brief technical glitches after 21:18 UTC on October 10, and that some assets suffered de-pegging due to extreme market fluctuations.

Binance stated that it completed compensation for affected users within 24 hours, distributing approximately $283 million across two batches.

Two days later, on October 14, Binance launched a $400 million support initiative. The package included $300 million in reimbursement vouchers for eligible impacted traders, with the remaining funds allocated to low-interest institutional loans.

While Binance was at the center of community backlash, it was not the only platform affected amid the crash. Other major exchanges, including Coinbase and Robinhood, also reported service disruptions.

Coinbase’s Bitcoin trading activity also drew scrutiny, though no conclusive evidence has linked it to market manipulation or to triggering the crash.

It’s worth noting that scrutiny continued in the weeks following the crash; some earlier claims were later reassessed. One trader who had publicly accused Binance later retracted those claims.

After reviewing technical data provided by the exchange, the trader said Binance’s logs showed no system errors. He subsequently deleted the original post, stating he did not want to contribute to the spread of unverified information.

“My main argument was that ‘API orders failed, and reduce-only orders returned a 503 error.’ But Binance’s technical team provided complete logs during our meeting, which showed that the reduce-only orders never encountered a 503 error. An investment firm connected to my friend also joined the investigation. The main account management team and their responsible staff reviewed the global logs and confirmed that there was no 503 error for reduce-only orders,” the post read.

Why the Binance Backlash Resurfaced in January 2026

For a while, the dust seemed to settle. Then 2026 arrived, and the allegations came roaring back. This had a lot to do with how the crypto markets performed in the months following October.

Sponsored

Sponsored

After the massive deleveraging event, the market stayed under pressure. Bitcoin and Ethereum gave up all of their 2025 gains, closing the year in the red. Market experts increasingly pointed to the October crash as a key factor behind the sector’s muted performance.

“There was a massive deleveraging…some exchanges and market makers…so the industry is sort of limping along, but the fundamentals have improved a lot,” BitMine Chairman Tom Lee stated.

The discussion intensified further after Ark Invest CEO Cathie Wood’s recent comments. In a recent interview with Fox Business, she said:

“What we have undergone in the last 2-3 months are the reverberations after 10/10…October 10….is the flash crash associated with a software glitch on Binance that deleveraged the system, and to the tune of $28 billion, there were a lot of people hurt.”

Soon, other industry figures began to weigh in. Star Xu, founder of OKX, commented that people have “underestimated the impact of 10/10,” arguing that the crash caused “real and lasting damage” to the crypto industry.

An industry-leading company, he said, should prioritize core infrastructure, trust with users and regulators, and the long-term health of the ecosystem. Without mentioning specific firms, Xu contrasted that ideal with what he described as a growing focus on short-term gains.

“Instead, some chose to pursue short-term gains—repeatedly launching Ponzi-like schemes, amplifying a handful of “get-rich-quick” narratives, and directly or indirectly manipulating the prices of low-quality tokens, drawing millions of users into assets closely tied to them. This has become their shortcut for attracting traffic and user attention. Legitimate criticism is then drowned out—not through facts or accountability, but via aggressive narrative control and coordinated influencer campaigns,” the executive added.

Binance Faces Trader Accusations

Market watchers began circulating what they described as alleged evidence of Binance’s wrongdoing.

In a post on X (formerly Twitter), Star Platinum pointed to Binance’s October 6 announcement that it would update the pricing source for BNSOL and wBETH, with the update scheduled for October 14.

StarPlatinum further claims that more than $10 billion moved in the 24 to 48 hours before the event, including large USDT and USDC inflows into exchange hot wallets.

The analyst also highlighted USDe flows tied to wallets they label as Binance-linked. The analyst contrasted Binance’s situation with Coinbase’s, stating:

“Coinbase didn’t list the weak links (USDe / wBETH / BNSOL) but did two things: Moved 1,066 BTC from cold to hot minutes before the cascade ($130M at pre crash prices). During the drop, large flow that couldn’t fill on Coinbase appears to have been routed out via market makers (Prime-style diversion). Coinbase’s cbETH peg held; Binance’s wBETH collapsed.”

StarPlatinum also noted that major market-making firms such as Wintermute and Jump appeared to have limited activity in USDe, wBETH, and BNSOL during the period of extreme volatility.

Sponsored

Sponsored

“Pull bids in those books while Binance marks collateral off those books, and the liquidation engine eats itself,” the analyst remarked.

They also allege a new account built up to around $1.1 billion in notional BTC and ETH shorts in the final two hours before the crash, with one ETH position increasing roughly a minute before a key post, generating an estimated $160 million to $200 million in profit.

Another user accused Binance of manipulating liquidation timestamps. According to the user, Binance announced after the crash that it would compensate eligible liquidations occurring after 05:18 (UTC+8).

However, the trader says his liquidation was recorded on the platform at 05:17:06, placing it just outside the eligibility window.

The trader argues that this timestamp conflicts with an automated system email showing a liquidation trigger time of 05:20:08 (UTC+8), a difference of approximately three minutes.

“This auto-generated, tamper-proof email is the most ironclad evidence. This is the core of crypto: Code Is Law,” the post stated.

Meanwhile, Binance’s own statement cited a different timeframe:

“All Futures, Margin, and Loan users who held USDE, BNSOL, and WBETH as collateral and were impacted by the depeg between 2025-10-10 21:36 and 22:16 (UTC) will be compensated, together with any liquidation fees incurred,” the exchange mentioned.

Crypto Twitter Erupts With “Scammer” Claims Against CZ

As these claims circulated, it did not take long for the tone on social media to escalate. Users began sharing lengthy posts labeling CZ a “scammer” and accusing him and Binance of systematically abusing their market dominance to the detriment of competitors and retail traders.

Multiple posts gained traction, with several going viral as community members amplified the claims and expressed support. As engagement surged, the allegations became a recurring fixture on Crypto Twitter timelines.

In an interview with BeInCrypto, Ray Youssef, CEO of NoOnes, described Binance as a US-aligned instrument for what he called a “controlled demolition” of the crypto market.

Youssef suggested that Zhao has aligned himself with the US establishment, which he characterized as the real power now influencing Binance’s direction.

For Youssef, Binance’s growing ties to the United States are a cause for concern. He claimed the exchange has become a controlled asset that could ultimately be used to trigger or accelerate a broader market collapse.

“Binance is becoming is the next FTX or what FTX should have been…When CZ burst the bubble on FTX, the damage was really basically 1% of what the state planned it to be. Now they’re going to use Binance as that they’re going to make that corpse explode right in our face,” Youssef told BeInCrypto.

Sponsored

Sponsored

Criticism has also extended to Zhao’s recent comments on the buy-and-hold strategy.

“I’ve seen many different trading strategies over the years, very few can beat the simple ‘buy and hold’, which is what I do. Not financial advice,” CZ wrote.

The remarks drew swift backlash. Critics pointed to the performance of tokens listed on Binance, arguing that many have lost significant value and questioning whether a buy-and-hold approach is realistic for retail users.

“The biggest scam exchange to ever exit, all project should apply for a delisting from binance,” an analyst asserted.

However, BeInCrypto reporting shows that the weakness was not exchange-specific. Crypto tokens listed across major platforms in 2025 broadly struggled to sustain positive price performance.

The trend held regardless of the exchange, reflecting a market-wide downturn rather than issues tied to any single trading venue.

That’s not all. Users also accused Binance of selling Bitcoin today amid the market crash.

Binance and CZ Issue Response Amid Backlash on Crypto Twitter

Nonetheless, as the backlash grew louder, Binance moved to project strength. The exchange announced plans to convert the entire $1 billion reserve of its Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin over the next 30 days.

In an open letter to the community, Binance stressed that it “holds itself to elevated standards” and “continually improves based on feedback” from users and the broader public.

The exchange revealed that in 2025, it continued investing in risk controls, compliance, and ecosystem development, citing a series of highlights:

- Binance said it assisted in recovering $48 million across 38,648 incorrect user deposits.

- It added that it helped 5.4 million users and prevented an estimated $6.69 billion in potential scam-related losses.

- It said cooperation with law enforcement contributed to the confiscation of $131 million in illicit funds.

- It noted that 2025 spot listings spanned 21 blockchains, led by Ethereum, BNB Smart Chain, and Solana.

- It reported Proof of Reserves totaling $162.8 billion across 45 crypto assets.

A personal response also came. CZ weighed in publicly, brushing off the latest allegations as a familiar cycle.

“Not the first time, won’t be the last time. Been receiving FUD attacks since day 1. Will address it in the AMA tonight, look below the surface on why and how,” he shared.

The renewed scrutiny of Binance reflects more than a single event or set of claims. It highlights how fragile trust remains in crypto after years of volatility, leverage-driven crashes, and high-profile failures.

In a market still struggling to recover, unresolved questions tend to resurface.

Crypto World

Binance demands the Wall Street Journal remove ‘damaging’ article

Binance is demanding that the Wall Street Journal (WSJ) remove an article about the crypto exchange firing investigators who discovered $1 billion worth of crypto being sent to Iran-linked wallets.

Binance CEO Richard Teng shared a letter addressed to the WSJ’s Editor-in-Chief, Emma Tucker, and Dow Jones Vice President, Jason Conti, on X today that accuses the WSJ of publishing “defamatory claims” in Monday’s article.

It claims that the article contains “false information” which “should be corrected immediately,” and that any defamatory imputations should be retracted.

Binance says it wants the WSJ to take down the article until the requested corrections are made.

The letter doesn’t explicitly suggest Binance will pursue legal action, but says it must update the piece, “thus potentially avoiding the need for any further action.”

Read more: Is Binance sending cease-and-desist letters?

Binance claims that its client, which remains nameless, “reasonably, cooperatively, and promptly” responded to a series of questions put forward by a WSJ journalist.

However, it claims the piece “fails to reflect” their responses and “falsely asserts to readers that Binance engaged in illegal conduct by breaching Iranian sanctions.”

“While you solicited our client’s position, your failure to reflect our client’s responses is inconsistent with your ethical obligations to ‘remain fair, accurate and impartial’, and suggests an agenda already set, which does not amount to responsible journalism,” Binance claimed.

WSJ says Binance sleuths found sanction-breaking transactions

The WSJ published the article yesterday with the headline “Binance Fired Staff Who Flagged $1 Billion Moving to Sanctioned Iran Entities.”

It claimed that, based on company documents and unnamed sources familiar with Binance, the investigators were fired after uncovering a suspicious account owned by the Hong Kong company Blessed Trust.

The firm converts fiat currency into crypto, and the investigators found it had sent more than $1 billion worth of tether (USDT) to a series of wallets, known as “Entity A.”

US law enforcement claims Entity A is a shadow banking network run by Iran’s Islamic Revolutionary Guard Corps that allows Chinese companies to pay for Iran’s oil.

The account raised numerous internal alerts of suspicious activity throughout 2025. By the time the investigation was raised to Binance’s top execs, the lead investigator and the head of sanctions and counterterrorist financing investigations were suspended, and fired weeks later.

Read more: US hits Iran’s ‘shadow banking’ network in Hong Kong, UAE

A Binance spokesperson told the WSJ that the investigators weren’t fired for raising compliance concerns, but instead left “based on individual circumstances.”

They added that the investigation continued after their departure and that the accounts in question were removed from Binance.

US President Donald Trump pardoned Changpeng Zhao, the former CEO of the company, weeks before the crypto exchange fired the investigators.

All this took place during a period of intense geopolitical tension between the US and Iran. Iran is subject to global sanctions and, as such, is reliant on cryptocurrencies such as USDT to bypass these restrictions.

Iran is now facing a US armada on its doorstep as Trump continues to build his country’s military presence in an attempt to pressure Iran into dropping its nuclear program.

Binance founding member ‘friend’ of Blessed Trust representative

The WSJ also reported that Blessed Trust enjoyed close ties with one of Binance’s founding members, Jukai He, otherwise known as “Rock.”

Screenshots revealed that Rock had some form of friendship with one of Blessed’s representatives. The investigation also found that Binance employees, and a device within Rock’s team, were logging into the Blessed Binance account.

Binance representatives told the WSJ that Rock has no supervisory or operational role within Blessed Trust, and that no Binance employees had logged into the Blessed Trust account.

It said, “Any suggestion that Blessed Trust was operated, directed, or controlled by Binance is false,” and added that the WSJ’s claims are based on “incorrect investigation records.”

Protos has reached out to the WSJ for comment on Binance’s article demands and will update this piece should we hear anything back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

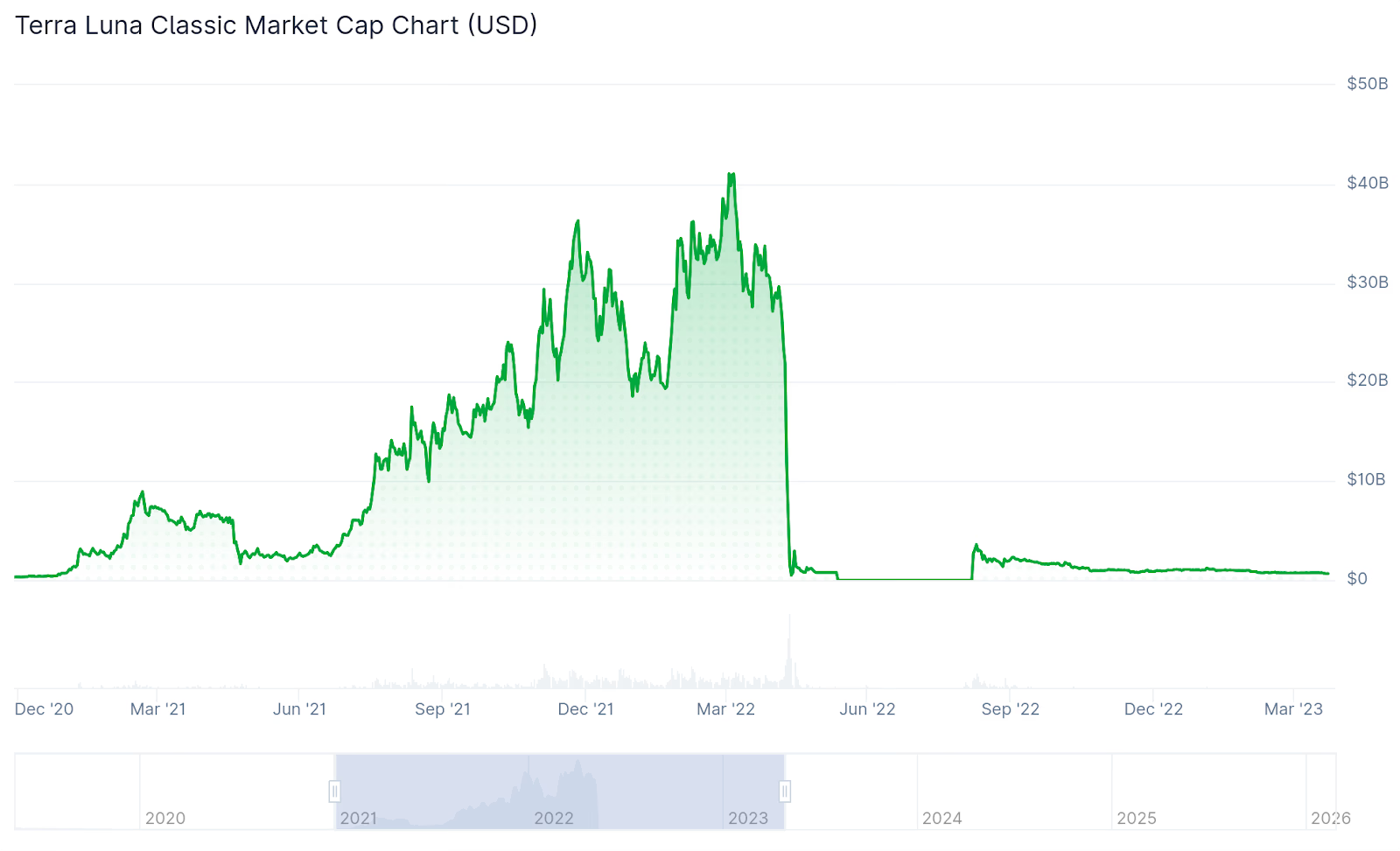

Terraform Estate Sues Jane Street Over Trades Tied to 2022 Crypto Collapse

The Terraform Labs bankruptcy estate has sued quantitative trading giant Jane Street, alleging the firm used non-public information to profit as the TerraUSD stablecoin collapsed in May 2022, according to a docket filed yesterday with the New York Southern District Court.

In a report about the lawsuit by the Wall Street Journal, Terraform Labs’ court-appointed administrator, Todd Snyder, stated that Jane Street “abused market relationships” to short the ecosystem during its death spiral, mirroring similar allegations made against Jump Trading late last year.

The estate seeks to recover funds for creditors who lost billions during the $40 billion wipeout of the Terra ecosystem.

Key Takeaways

- The lawsuit alleges Jane Street exploited private liquidity data to profit from the TerraUSD depeg before the public was aware.

- Terraform’s estate claims the trading firm netted millions by front-running a critical $150 million liquidity withdrawal from Curve.

- Jane Street has dismissed the suit as a “desperate” attempt to extract money from legitimate market activities.

Estate Targets “Privileged Access” in Crash Recovery

The lawsuit centers on specific maneuvers executed in May 2022, just as the algorithmic stablecoin UST began to lose its peg to the US dollar.

Terraform Labs’ court-appointed plan administrator, Todd Snyder, alleges that Jane Street capitalized on vulnerabilities in Terra’s mint-and-burn mechanism via manipulative trades.

“Jane Street abused market relationships to rig the market in its favor during one of the most consequential events in crypto history,” Snyder claimed in his statement to WSJ.

The estate argues that these trades were not merely shrewd market moves but were predicated on non-public information regarding Terraform’s internal liquidity management.

The legal action is part of a broader recovery effort following the firm’s Chapter 11 bankruptcy filing, which listed assets and liabilities between $100 million and $500 million, a fraction of the market value destroyed during the collapse.

Discover: The best new crypto to buy

Inside the Curve Pool Incident

The complaint reportedly highlights a pivotal sequence of events involving the Curve3pool, a critical liquidity venue for stablecoins.

According to the filing, Terraform Labs executed an unannounced withdrawal of $150 million from the pool to adjust liquidity. Less than 10 minutes later, a wallet allegedly linked to Jane Street withdrew $85 million.

The estate argues this timing indicates Jane Street possessed “advance insight” into Terraform’s operations, using that data to position itself ahead of the resulting market panic.

This mirrors the scrutiny placed on liquidity shifts in current markets, where traders obsessively monitor order books and Polymarket odds for a Bitcoin price drop to detect institutional positioning before price action hits.

Jane Street firmly denies the allegations.

Implications for DeFi and Stablecoin Regulation

If the court finds merit in the “misappropriation theory” applied to DeFi protocols, it could redefine the legal obligations of market makers in the crypto sector.

The suit suggests that “privileged access” in decentralized finance is a legal liability, not just a competitive edge.

This legal battle arrives as the regulatory environment for stablecoins intensifies. While the 2022 collapse serves as a cautionary tale, modern stablecoins drive $1 trillion in T-bill demand, creating a different set of systemic risks and incentives.

Regulators are currently scrutinizing how private trading firms interact with issuer protocols.

The outcome could also accelerate legislative frameworks. As odds spike for stablecoin talks regarding the Clarity Act, lawmakers may cite these allegations to demand stricter separation between protocol issuers and market makers.

What Comes Next

The case now moves to the discovery phase in Delaware, where Jane Street will be required to produce communications regarding its 2022 trading strategies.

This follows a similar $4 billion lawsuit filed by Terraform Labs against Jump Trading in December, which accused the firm of materially contributing to the Terra ecosystem’s instability.

It looks like Terraform is entering a protracted battle on at least two different fronts that could peel back the curtain on high-frequency trading strategies during crypto market crises.

Discover: The best pre-launch token sales around

The post Terraform Estate Sues Jane Street Over Trades Tied to 2022 Crypto Collapse appeared first on Cryptonews.

Crypto World

Bitwise Expands Staking Capabilities with Chorus One Acquisition

Bitwise Investments has acquired institutional staking provider Chorus One, offering clients access to more than 30 proof-of-stake networks.

Bitwise Investments has announced the acquisition of Chorus One, a leading provider of institutional staking services, marking an expansion in Bitwise’s staking capabilities and onchain offerings.

With more $15 billion in assets under management (AUM), Bitwise is known for its crypto index funds and has been broadening its offerings through its Bitwise Onchain Solutions (BOS) division. The acquisition of Chorus One, renowned for its cross-chain staking infrastructure, significantly boosts BOS’ capabilities in the staking domain. The move enhances Bitwise’s reach across over 30 proof-of-stake networks, according to a press release from Bitwise.

Chorus One’s expertise in providing staking services to institutions complements Bitwise’s existing offerings, allowing for a seamless integration that is set to enhance the overall service quality.

The institutional staking market has been experiencing rapid growth, with more institutions looking to participate in proof-of-stake networks. This trend is driven by the dual benefits of yield generation and contribution to network security, which are increasingly attractive to institutional investors seeking diversified returns.

“For our thousands of clients who hold spot crypto assets, staking is one of the most compelling growth opportunities. I’m thrilled about this acquisition and grateful to the Chorus One team for the trust placed in us. Chorus One is best-in-class across technology and research, with an eight-year track record of doing things the right way.” said Bitwise CEO Hunter Horsely.

This article was generated with the assistance of AI workflows.

Crypto World

Credit Card Stocks Fall After Citrini AI Report

Shares dropped after Citrini Research published a thought experiment, but the Kobeissi Letter argues the outlook may be too pessimistic.

Shares of major credit card companies fell on Monday, Feb. 23, after a thought experiment report from Citrini Research raised concerns about how artificial intelligence (AI) could change the payments industry – however, a separate note from The Kobeissi Letter pushed back, saying the disruption risks are overstated.

According to market data shared by Bearly AI in a post on X, Visa dropped about 4.4%, Mastercard fell 6.3%, American Express slid 7.9%, and Capital One declined roughly 8% on Feb. 23 after Citrini’s note was published on Feb. 22.

Notably, by Tuesday afternoon, shares were mostly steady or slightly higher. Visa was around $306, flat on the day, while Mastercard traded near $497, up about 0.5%. American Express was also little changed at $321, and Capital One rose about 4% to around $197.

The situation underscores how quickly viral narratives can move markets and how sensitive both stocks and crypto are to FUD (fear, uncertainty, and doubt). It also shows investors are still unsure how much AI will disrupt the industry.

AI Agent Payments

Citrini Research described a scenario in which AI programs make purchases on their own and seek the cheapest way to send money. In that case, stablecoins could replace credit cards for some transactions.

“What follows is a scenario, not a prediction,” the note emphasized. “This isn’t bear porn or AI doomer fan-fiction. The sole intent of this piece is modeling a scenario that’s been relatively underexplored.”

Meanwhile, in a separate note published last night, The Kobeissi Letter said the negative view assumes demand will not change. It argued that when technology makes things cheaper, people usually spend more. Lower-cost AI services could give consumers more buying power and help new businesses start.

“The doomsday scenario went viral because it captured something visceral,” The Kobeissi Letter note reads. “It framed AI not as a productivity tool, but as a macroeconomic destabilizer capable of triggering a negative feedback loop: layoffs lead to weaker consumption, weaker consumption leads to more automation, and automation accelerates layoffs.”

The memo said AI could also have a positive impact. While some companies may face pressure, lower costs could improve productivity and support economic growth over time. “AI amplifies outcomes. It can amplify fragility if institutions fail to adapt, and it can also amplify prosperity if productivity outpaces disruption,” the note reads.

The back-and-forth comes amid declines in some software and tech stocks following major AI announcements. For instance, shares of IBM plummeted about 13% on Monday, the stock’s steepest drop in more than 25 years.

Crypto World

Smarter Web Gains $30M Bitcoin Credit Line From Coinbase to Boost Buying

TLDR

- Smarter Web secured a $30 million Bitcoin-backed credit facility from Coinbase Credit.

- The company stated that the facility will help it execute Bitcoin purchases faster after equity raises.

- Smarter Web confirmed that it will not use the credit line as long-term debt for Bitcoin accumulation.

- The firm reported holding 2,689 BTC, which is valued at about $170 million at current market prices.

- Tracker data shows that Smarter Web continued to increase its Bitcoin holdings after its 2025 disclosure.

Smarter Web opened a new phase in its treasury plan as it secured a $30 million Bitcoin-backed credit line, and the firm said the move will speed purchase timing after fundraises, and the structure will support rapid deployment during volatile sessions.

Credit Facility Details and Early 2026 Treasury Activity

The Smarter Web Company confirmed the new facility with Coinbase Credit and stated that the credit line is secured against Bitcoin held in custody with Coinbase. The firm said the facility helps it act quickly after equity raises and cuts timing risk during fast markets. The company stressed that it does not plan to use the structure as ongoing debt and intends to repay it once the funds clear.

Smarter Web trades on the London Stock Exchange Main Market and also trades on the OTCQB Venture Market in the United States. The firm describes Bitcoin as core to its treasury plan and continues to expand digital asset holdings. Data shows digital asset treasuries recorded billions in inflows from late 2025 through early 2026 before slowing in February.

DefiLlama data shows treasuries reached $4 billion in inflows during December and $3.7 billion in January. The figure reached $363 million through February 24 and stayed positive but below earlier peaks. The company cited these flows when noting its need for faster execution during market shifts.

Smarter Web Treasury Position and Sector Activity

Smarter Web reported holdings of 2,689 BTC with an average cost of $112,865 per coin. At current prices near $64,472, the position is valued at about $170 million. The firm said the book reflects an unrealized loss based on its reported cost basis and continues to track long-term plans.

The company reported 2,470 BTC on September 12, 2025, and called itself the largest corporate holder in the United Kingdom. It also mentioned interest in acquiring competitors and referenced future index ambitions. Tracker data indicates the company continued steady accumulation after that point.

The new credit line allows the firm to borrow against existing Bitcoin and act quickly after equity raises. The structure then allows repayment once fundraising proceeds settle.

The company said this approach helps reduce timing gaps during active sessions.

Strategy added 592 BTC on Monday and raised its total to 717,722 BTC. The company marked its 100th purchase since 2020 and maintained its accumulation pattern. Meanwhile, Bitdeer reported selling its entire treasury and shifted to a convertible debt raise while removing all corporate Bitcoin.

Crypto World

JPM CEO Jamie Dimon says AI is reshaping workforce, bank plans ‘huge redeployment’

Jamie Dimon, chairman and CEO of JPMorgan Chase, attends the ribbon-cutting ceremony opening the firm’s new headquarters at 270 Park Ave., in New York, Oct. 21, 2025.

Eduardo Munoz | Reuters

JPMorgan Chase CEO Jamie Dimon said the bank is taking steps to address the impact of artificial intelligence on its workers, part of what he said should be a broader societal response to the potentially disruptive nature of AI.

Dimon described at an investor meeting late Monday his bank’s internal plans to shift employees into new roles as automation accelerates.

“We already have huge redeployment plans for [our] own people,” Dimon said. “In fact, we spoke about it today, and we have to up that a little bit so we can take people who are displaced — and we have displaced people from AI — and we offer them other jobs.”

JPMorgan, the world’s biggest bank by market cap, has the industry’s largest annual tech budget at nearly $20 billion. Its executives have outlined an ambitious agenda to become “fundamentally rewired” for the AI era.

Even at this early stage, the bank’s workforce provides a snapshot of what happens when corporations employ AI technology, including models from OpenAI and Anthropic, which are both used by JPMorgan’s AI portal.

The bank’s headcount was roughly unchanged at 318,512 over the past year, but there were changes below the surface: Operations and support staff fell by 4% and 2%, respectively, as the firm added 4% to roles that involve catering to clients and generating revenue.

It did that by using technology to boost the number of accounts that each operations employee can handle (up 6%), reducing the per-unit cost to deal with fraud (down 11%) and making their software engineers 10% more efficient, according to the bank’s presentation.

JPMorgan has doubled the use cases for generative AI this year, focusing on customer service and the firm’s technology workers, Chief Financial Officer Jeremy Barnum said at the investor meeting.

A JPMorgan spokeswoman declined to elaborate on Dimon’s comments about plans for redeployment.

Disruption risk

When an analyst on Monday asked if Dimon was concerned about the risk of widespread unemployment because of AI — one of several fears circulating as every AI model update seems to wallop the shares of public companies in recent weeks — Dimon had this response: “We are going to deploy AI as best we can to do a better job for our customers,” he said.

The CEO has previously likened the potential impact of AI to that of electricity or the printing press.

Beyond the “huge redeployment plans” for his bank, Dimon expressed concern that the rapid adoption of AI could put entire professions out of work.

As a thought experiment, what if autonomous trucks were introduced overnight, he asked.

“Would you do it if you put 2 million people on the street?” Dimon asked. “That next job is $25,000 a year, stocking shelves.”

Businesses and governments need to begin planning for this risk now, with ideas including assistance and training for displaced workers, he said.

“Society’s got to think through what it wants to do if this becomes that kind of problem,” Dimon said. “Now is the time to start thinking about it.”

Crypto World

Key Bitcoin On-Chain Signal Could Ignite BTC’s Next Demand Revival

Bitcoin’s on-chain signals have cooled after a run of elevated profitability and aggressive selling, suggesting a potential valuation reset rather than a definitive bottom. In the latest data reads, investor profitability has drifted back toward the long-run mean, while spot order flow shows signs of calmer unloading even as trading activity remains subdued. The interplay between valuation metrics and liquidity conditions is shaping expectations for when genuine spot demand could re-emerge and whether that would accompany a sustained trend reversal. Across the metrics, there is a defensively postured market rather than a clear pivot higher, at least for now.

Key takeaways

- Bitcoin’s market value to realized value (MVRV) has normalized after previously trading at extremes, signaling a shift back toward historical baselines rather than an overt undervaluation.

- Realized capitalization declined to about $1.09 trillion from a peak near $1.12 trillion in November 2025, reflecting roughly $33 billion in on-chain value leaving the network.

- Coins aged three to six months now represent 25.9% of the supply, the largest cohort in the dataset, indicating a substantial portion of holders purchased higher and are underwater on many positions.

- Spot cumulative volume delta (CVD) improved to -$161.5 million from -$177.1 million, while spot trading volume slipped to $6 billion from $7.6 billion, pointing to thinner participation and a more cautious posture among traders.

- Bitcoin has remained range-bound around $62,000–$64,000, suggesting supply absorption could pick up pace only if spot participation and risk appetite recover from current levels.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Neutral. On-chain signals suggest a balanced view rather than a clear, imminent move higher or lower.

Trading idea (Not Financial Advice): Hold. The combination of a mean-reverting valuation backdrop and thinner spot activity argues for patience until clearer demand signals emerge.

Market context: The data aligns with a broader phase of cautious liquidity in crypto markets, where on-chain metrics and macro- and risk-off sentiment influence how quickly fresh spot demand can materialize. While some coins’ outflows have stabilized, the absence of a decisive upshift in participation keeps near-term catalysts subdued.

Why it matters

The evolving on-chain picture matters because it reframes the risk-reward calculus for Bitcoin holders and potential entrants. A move back toward the long-run mean in MVRV implies that the market is not yet deeply undervalued, even as some segments of investors have capitulated in the sense of exiting positions near peak prices. The retrace in realized capitalization reinforces the notion that capital has been reallocated away from high-cost entrants, a behavior consistent with risk-off dynamics rather than aggressive accumulation.

From a supply-demand perspective, the aging cohort — coins held for three to six months — being the largest on record signals that much of the newly minted supply may be sitting underwater. That concentration creates a potential for a more pronounced impact if macro conditions or on-chain signals improve, but it also poses a risk: a wave of unprofitable sellers could re-emerge if price pressure intensifies. The literature around realized cap and MVRV suggests caution, as movements toward positive momentum have historically required renewed, broad-based demand rather than a few strong rallies.

On the liquidity side, the improvement in spot CVD alongside a drop in trading volume paints a portrait of restrained selling pressure rather than a sudden flood of buy orders. In prior cycles, periods where CVD tightened and price action stabilized often foreshadow a bottom, but only when participation recovers meaningfully. In this cycle, BTC has held within a relatively narrow corridor, which implies the market is digesting recent action rather than signaling an imminent breakout.

Analysts have pointed to a neutral-to-defensive posture in the current regime. The data does not indicate a forced capitulation, but it also stops short of confirming the onset of a sustainable upturn. The resulting stance mirrors a broader crypto market landscape where liquidity remains episodic, and traders await clearer macro cues and on-chain signals before reestablishing aggressive exposure.

In related analyses, researchers have flagged similar themes in other data points. For instance, discussions around excessive loss realization have highlighted potential pressure points that could push BTC below certain thresholds, while other research has underscored the possibility of a fair-value gap guiding price targets in different market environments. Taken together, these threads reinforce a cautious approach to near-term positioning until volatility and participation trends tilt decisively in favor of bulls.

What to watch next

- BTC price stability within the $62k–$64k range and any sustained breakout above or below these levels.

- Momentum in realized capitalization — whether the roughly $33 billion drawdown since November 2025 begins to reverse as new capital re-enters the market.

- The share of the supply held by the 3–6 month cohort and any shifts toward older or younger age bands, which could signal changing holder behavior.

- On-chain liquidity signals, particularly if spot volume begins to rebound from current lows and CVD moves toward positive territory.

- Any regulatory or institutional developments that could influence risk sentiment and bid/offer dynamics in spot markets.

Sources & verification

- On-chain profitability and MVRV normalization observations attributed to expert commentary on X, including excerpts from Chris Beamish.

- Realized capitalization levels and monthly change data tracked by on-chain analytics datasets (noting the $1.09 trillion level and the $33 billion decline from the November 2025 peak).

- Spot CVD and trading volume figures, including the move from -$177.1 million to -$161.5 million and the drop in spot volume from $7.6 billion to $6.0 billion.

- Analyses describing the distribution of coins by age, with the 3–6 month cohort comprising 25.9% of supply.

- Related studies and articles cited in the original material for context on potential price implications and fair-value considerations.

Bitcoin valuation indicators in focus

Bitcoin (CRYPTO: BTC) has been navigating a delicate balance between on-chain fundamentals and the psychology of risk markets. The normalization of MVRV away from extreme deviations suggests that investors are no longer chasing outsized upside with the same intensity as earlier in the cycle, while realized cap has cooled after peaking in late 2025. The 30-day realized cap is down about 2.26%, signaling that capital outflows have persisted, even as some long-term holders remain reluctant to surrender positions wholesale.

The market’s price behavior in the $62,000 to $64,000 zone has become a focal point. In many periods when CVD trends toward stability and the bid-ask dynamics thin out, price action tends to consolidate before the next leg — if there is one — depends on the injection of fresh demand. The current mix of data implies a neutral stance on near-term direction, with the potential for a more decisive move only if spot participation and new inflows pick up meaningfully.

These dynamics illuminate how market participants are weighing risk, returns, and capital preservation in an environment where on-chain signals can diverge from short-term price action. While the trajectory remains uncertain, the analytical framework suggests that bulls will need a sustained improvement in on-chain demand and liquidity to push BTC beyond a fresh milestone, beyond the immediate range that has defined recent trading sessions.

Crypto World

Jane Street Accused of Intentionally Attacking Terra

Terraform Labs is suing quantitative trading firm Jane Street for its role in the collapse of the Terra ecosystem.

Terraform Labs’ estate has filed a lawsuit against quantitative trading firm Jane Street, alleging that the firm abused insider knowledge to profit from Terra and that it inadvertently contributed to the downfall of the ecosystem.

“In this case, however, Jane Street Capital and its traders exploited the public’s participation in crypto markets and contributed to the collapse of Terraform’s cryptocurrency ecosystem. They did so by misappropriating confidential information and manipulating market prices,” the suit reads.

The filing is heavily redacted, but focuses on a move related to the UST Curve 3pool. Per Snyder, Terraform withdrew $150 million of UST from the pool, a move that “was not publicly announced,” to deploy it to 4pool in the coming week.

Nine minutes later, Jane Street allegedly made its “first and only sale of UST in that pool,” selling $85 million of UST in a single transaction.

Snyder says that the swap directly led to a steep selloff in UST that resulted in Terra’s subsequent death spiral, and accuses Jane Street of using its connections with Terraform Labs to “maximize its own profits and avoid losses suffered by other investors who did not have this confidential information.”

Following the UST depeg, LUNA, now LUNC, plummeted from a $29 billion market capitalization to nearly zero in a matter of days, after reaching as high as $41 billion in April 2022.

In December, Terra founder Do Kwon was sentenced to 15 years in prison, a sentence that exceeded the Department of Justice’s 12-year target, after Kwon pleaded guilty to fraud charges in August 2025.

Jane Street is one of the largest quantitative firms in traditional finance and crypto, with more than $650 billion in assets under management (AUM).

Crypto World

LINK price rebounds as SEC taps former LINK lawyer to head crypto task force

- SEC hires ex-Chainlink lawyer Taylor Lindman to head Crypto Task Force counsel.

- LINK rebounds near $8 but is still down about 51% over the past year.

- Chainlink (LINK) price analysis shows support at $6.80 and resistance near $8.19.

Chainlink (LINK) has rebounded slightly, though it is still in the red as the US SEC taps Chainlink’s veteran Taylor Lindman to head the Crypto Task Force counsel.

At press time, LINK was currently trading at around $8.18, recovering slightly from a low of $8.13. This rebound comes amid broader market volatility that has seen LINK fall roughly 51% over the past year.

SEC taps Chainlink veteran for crypto regulation

The US Securities and Exchange Commission (SEC) has appointed Taylor Lindman, formerly a senior legal officer at Chainlink Labs, as chief counsel for its Crypto Task Force.

Lindman brings over five years of experience in blockchain and regulatory compliance.

He played a key role in advising Chainlink on legal matters and navigating complex digital asset regulations before his departure in February 2023.

Lindman’s move to the SEC signals that regulators are increasingly interested in professionals with hands-on experience in decentralised finance (DeFi) and smart contract ecosystems.

SEC Commissioner Hester Peirce, who leads the Crypto Task Force, welcomed Lindman’s appointment.

Analysts suggest that Lindman’s expertise could influence future guidance and enforcement actions around digital assets.

LINK price performance

The market appeared to respond positively with institutional investors, including firms like Grayscale, steadily accumulating LINK tokens.

The continued institutional interest, combined with Lindman’s transition to the SEC, has reignited confidence in Chainlink’s long-term positioning.

Short-term technical indicators show that LINK recently found support at around $6.80, while the resistance at $8.19 has limited upward movement in the past.

The rebound above $8 could open the door for higher price action, while a fall below $6.80 might signal further downside risk.

Short-term LINK price prediction

With regulatory developments and institutional interest converging, LINK is drawing attention from both traders and long-term investors.

Its price movement over the next few weeks will likely reflect a mix of market sentiment, technical pressure, and evolving regulatory signals.

For short-term traders, analysts have highligted $6.80 as the immediate key short-term support level to watch. Holding above this level would suggest that the market is stabilising after recent volatility.

If LINK can break through the $8.19 resistance, the next target would be $9.51.

A sustained move above $10.80 could indicate stronger bullish momentum, attracting further buying interest.

On the downside, if the $6.80 support fails, traders should monitor the $5.38 zone as a potential safety net.

Price action around these levels will be critical in defining LINK’s short-term trend.

Crypto World

Bitcoin price defends $62,000, low volume signals weakness

Bitcoin price is holding above $62,000 support, but weak volume participation raises concerns that the current bounce lacks strength and downside risk remains.

Summary

- Bitcoin defending $62K support within broader range structure

- Low volume signals weak bullish conviction

- $60,000 range low remains key downside target if weakness continues

Bitcoin (BTC) price action has entered a consolidative phase after weeks of corrective movement, with the market recently testing daily support near the $62,900 region. This level has so far held firm, preventing an immediate breakdown and allowing price to stabilize within the broader trading range. While the defense of support may appear constructive on the surface, underlying market signals suggest caution remains warranted.

The recent bounce from support lacks convincing momentum, particularly when analyzing volume behavior. In healthy reversals or sustained rallies, price expansion is typically accompanied by strong bullish participation. However, current market conditions reveal subdued trading activity, raising questions about whether the move represents genuine accumulation or merely a temporary oversold reaction.

As long as volume remains weak, Bitcoin may struggle to transition into a sustained bullish trend, leaving the market vulnerable to further downside rotation.

Bitcoin price key technical points

- $62,900 daily support defended: Buyers preventing immediate breakdown

- Low volume weakens recovery: Lack of strong bullish participation

- $60,000 range low remains magnet: Continued rotation within broader range likely

Bitcoin’s recent reaction at the $62,900 support level demonstrates that buyers are still active within this region. The market has shown resilience by holding above support, preventing a rapid continuation lower. From a structural standpoint, this defense keeps Bitcoin trading within its established high-timeframe range rather than confirming a trend collapse.

However, price stability alone does not confirm strength. The bounce from support has occurred with noticeably low volume participation across the volume profile. Strong reversals typically require an influx of directional buying pressure capable of shifting market sentiment.

Without this participation, rebounds often fail to sustain momentum, even as broader institutional and regulatory developments, such as Arizona lawmakers advancing a digital assets reserve fund bill, continue to highlight growing adoption narratives.

This dynamic suggests that the current move may represent an oversold reaction rather than the beginning of a broader bullish recovery.

Volume profile reveals lack of conviction

Volume remains one of the most critical indicators in assessing market intent. In Bitcoin’s current structure, volume profile nodes reveal limited bullish conviction during the recovery phase. Despite holding support, buyers have not entered the market aggressively enough to drive expansion toward higher resistance levels.

When price rises on declining or weak volume, it often indicates short covering or temporary relief rather than genuine demand. These conditions frequently lead to renewed selling pressure once the initial bounce loses momentum.

The absence of strong bullish influx increases the probability that Bitcoin continues rotating within its broader range rather than initiating a breakout. Until volume expands meaningfully, the market remains susceptible to further corrective movement.

Range structure keeps $60,000 in focus

Bitcoin continues to trade within a clearly defined high-timeframe range between resistance near $72,000 and range-low support around $60,000. Markets operating within ranges often rotate between extremes when neither buyers nor sellers establish dominance.

Given the weak nature of the current bounce, the $60,000 range low becomes an increasingly likely destination. This level represents a significant liquidity zone and has historically attracted strong market reactions.

A move toward $60,000 would not necessarily invalidate the broader market structure but instead reinforce the ongoing consolidation phase. Range environments commonly feature multiple tests of support and resistance before a decisive directional move emerges.

This type of price behavior has recently been amplified by macro-driven volatility, with Bitcoin swinging sharply as tariff-related headlines triggered heightened discussion across crypto social media.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Bitcoin’s defense of $62,000 support remains constructive but fragile. Without a clear expansion in bullish volume, the current bounce risks fading into continued downside rotation.

If low participation persists, price is likely to revisit the $60,000 range-low support while continuing to trade within the broader $72,000 to $60,000 high-timeframe range.

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech7 days ago

Tech7 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World14 hours ago

Crypto World14 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Tech4 hours ago

Tech4 hours agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

Traders (@_Z3r0wTraders)

Traders (@_Z3r0wTraders)