Crypto World

Crypto VC firm Dragonfly raises $650 million despite ‘gloom of a bear market’

Crypto venture firm Dragonfly Capital completed a $650 million fourth fund, marking one of the largest raises in the sector at a time when many blockchain-focused VCs are struggling, Managing Partner Haseeb Qureshi said.

“It’s a weird time to celebrate,” Qureshi wrote on a social media post on Tuesday, describing low spirits and “the gloom of a bear market” for crypto. However, he noted that Dragonfly has historically raised capital during downturns, including the 2018 ICO crash and just before the 2022 Terra collapse, ‘vintages,’ he said, ultimately became the firm’s best performers.

In September, the firm said it was aiming to raise $500 million for its fourth fund, which would target early-stage projects. It has not yet identified any of them. In May 2023, Dragonfly Capital raised $650 million for its third crypto fund for later-stage companies.

‘Biggest bet yet’

The new vehicle comes as token prices slumped this year and fundraising across crypto ventures has slowed sharply. Bitcoin has lost roughly 46% of its value since its all-time high of more than $126,000 in October of last year, and the crypto downtrend has wiped out more than $1.4 trillion in market cap.

While market sentiment remains bearish, Qureshi is bullish on crypto’s financial use cases, saying the sector “is exploding,” while other non-financial use cases are failing. In fact, Dragonfly has increasingly leaned into crypto-financial infrastructure, from stablecoins to tokenization and on-chain payments, reflecting a broader shift away from speculative Web3 applications and toward blockchain-based financial services.

“Stablecoins are eating the world. DeFi has grown so big it’s rivaling CeFi. Financial institutions around the world are racing to build out their crypto strategies. And prediction markets are becoming the most trusted source of truth on the internet,” he wrote.

Qureshi also noted the growth in Dragonfly’s recent investments, including Polymarket, Ethena, Rain, and Mesh, as examples of his thesis that crypto’s financial use cases are having a moment.

His comments come after VC firms at Consensus Hong Kong 2026 struck a cautious tone about the state of the crypto market amid prevailing bearish sentiment. The crypto VCs that included Qureshi, Maximum Frequency Ventures’ Mo Shaikh and Pantera Capital’s Paul Veradittakit all echoed the same sentiment: invest in what’s working, like stablecoins and tokenizations, while selectively betting on sectors such as AI and prediction markets.

Qureshi seems to be doubling down on the idea that the crypto industry isn’t dead, despite the gloom, but just realigning and noted that the new fund is his firm’s “biggest bet yet that the crypto revolution is still early in its exponential.”

Fortune was first to report Dragonfly’s recent raise.

Crypto World

MYX Oversold for the First Time

MYX Finance has entered a critical phase after weeks of intense selling pressure. The token has suffered a steep decline amid broader bearish crypto market conditions.

Heavy profit-taking and forced exits accelerated the fall. MYX has now become a focal point of concern among traders

Sponsored

Sponsored

MYX Finance Token Forms History

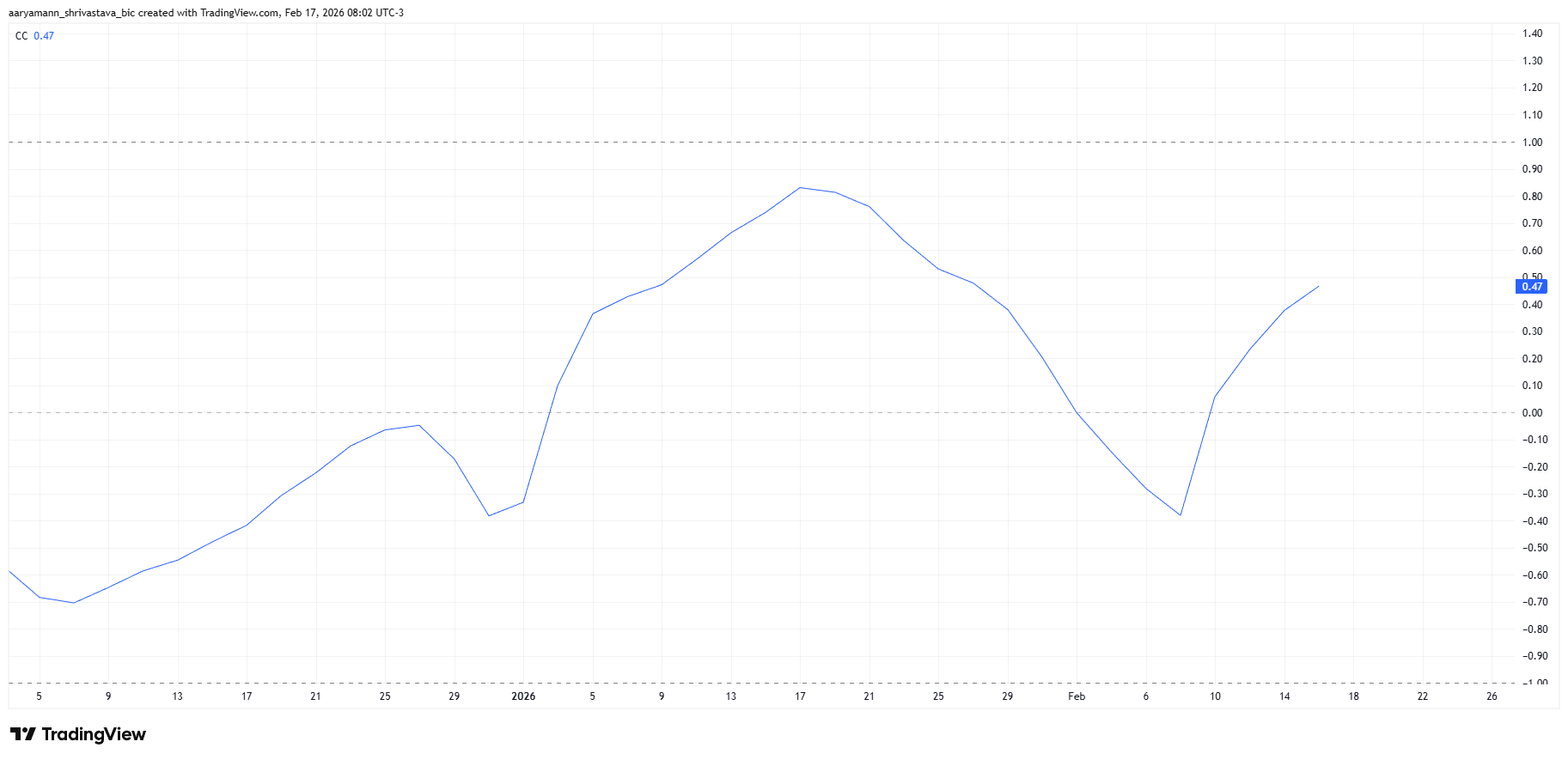

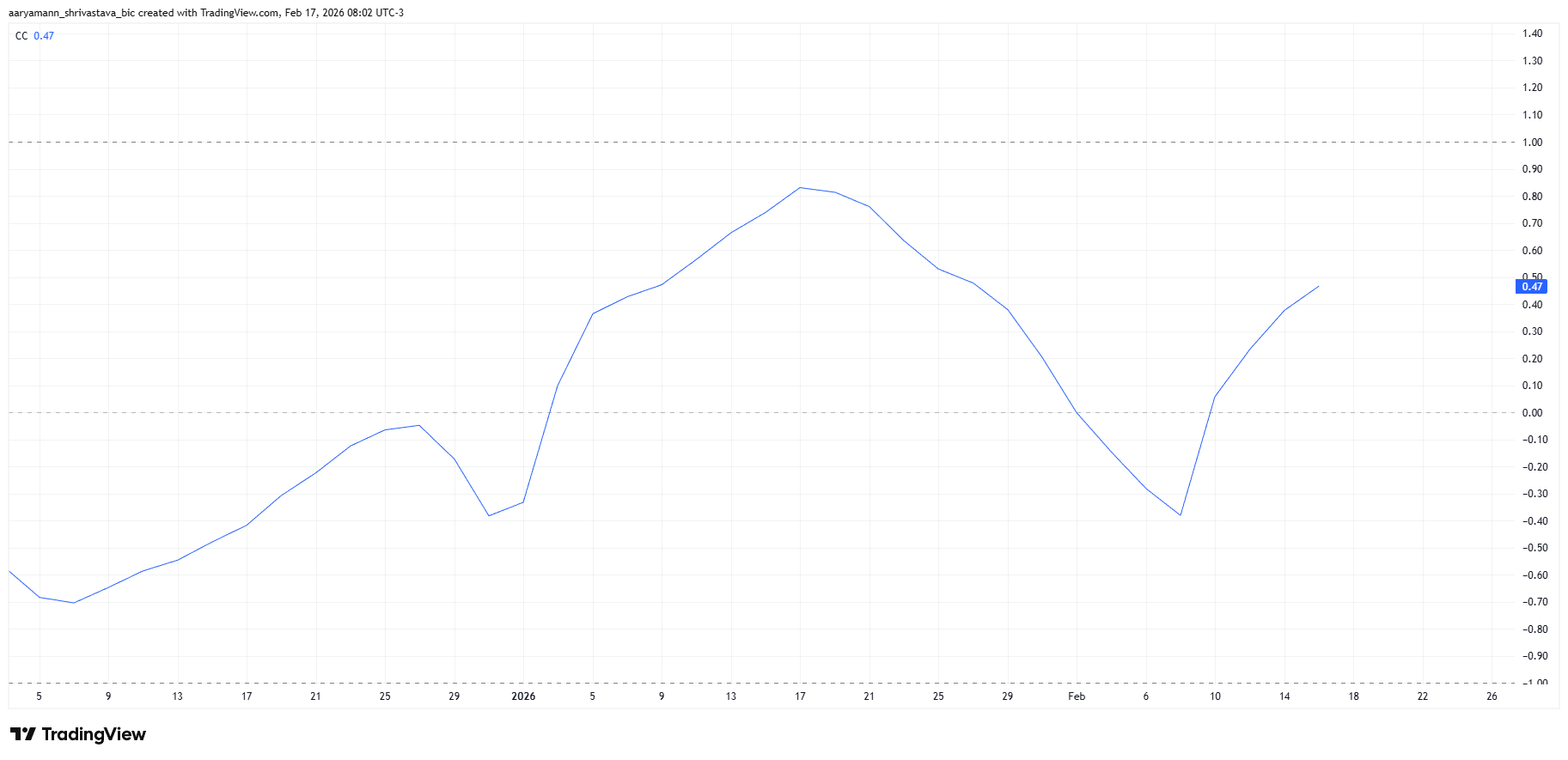

MYX’s correlation with Bitcoin has shifted sharply since February 8. The coefficient improved from negative 0.42 to positive 0.47. This change indicates that MYX is increasingly tracking Bitcoin’s price movements.

However, this alignment presents risk. Since February 8, Bitcoin has remained in consolidation without meaningful recovery. A stronger positive correlation suggests MYX may continue mirroring Bitcoin’s weakness. Without a BTC breakout, bearish conditions could persist for MYX.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

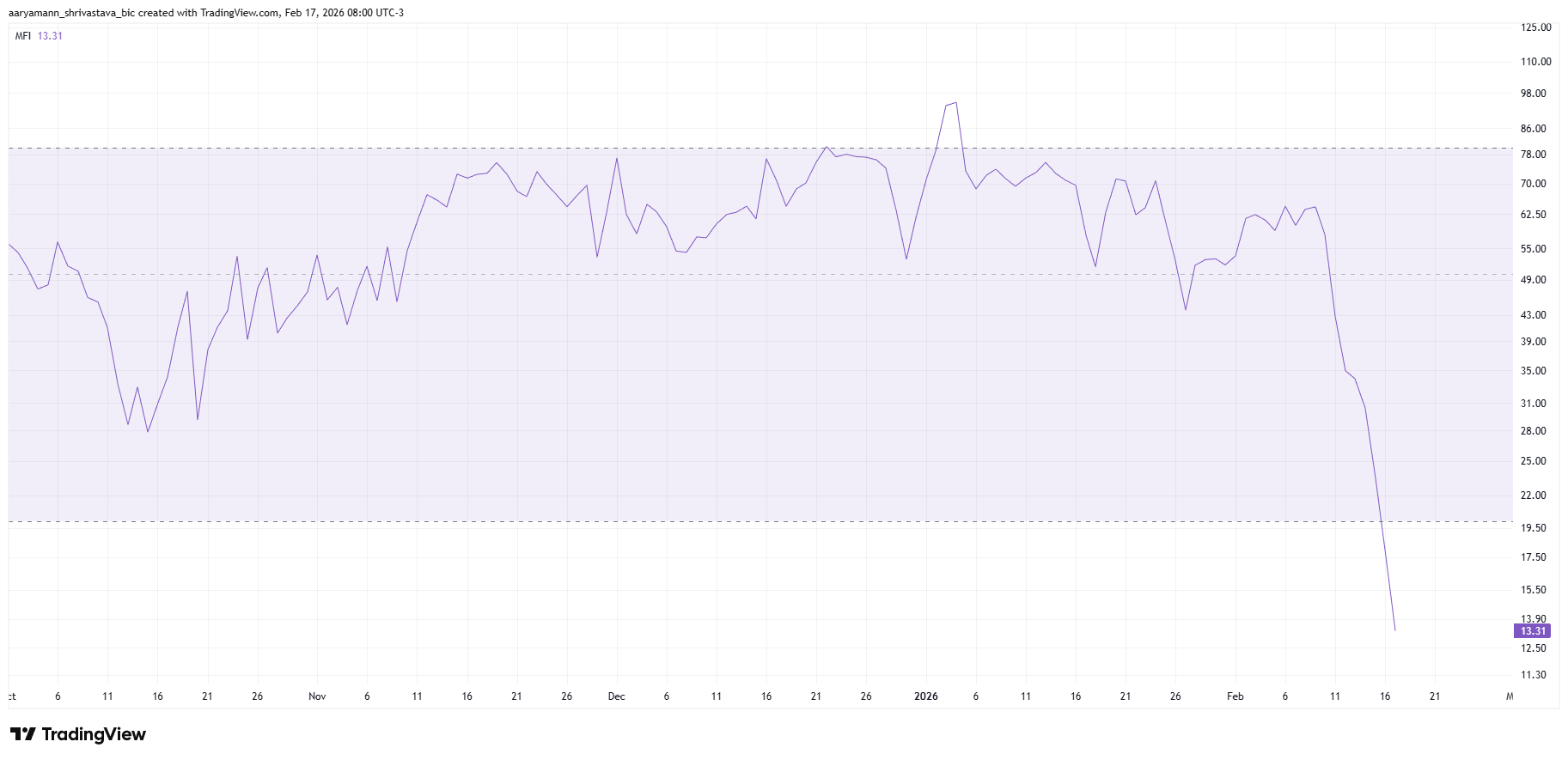

The Money Flow Index highlights the intensity of recent selling. The indicator shows severe capital outflows as investors rushed to exit positions. Panic selling, combined with leveraged liquidations, intensified downward pressure.

Sponsored

Sponsored

This wave of capitulation has pushed MYX into oversold territory for the first time in its trading history. Typically, oversold conditions suggest selling may slow as value-focused buyers step in. In many cases, such readings precede short-term relief rallies.

However, context matters. Oversold signals alone do not guarantee immediate recovery. Broader market weakness and fragile sentiment could delay accumulation. If Bitcoin fails to stabilize, MYX may struggle to attract fresh capital despite extreme technical readings.

MYX Price Bounce Back Unlikely

MYX price is down nearly 30% in the past 24 hours. The token trades at $1.50 at the time of writing. This sharp drop compounds a 70% decline recorded since February 8, reinforcing the scale of the correction.

Current technical and macro signals suggest further downside risk. Continued correlation with Bitcoin and persistent outflows could pressure MYX lower. A retest of the $1.22 level appears plausible before oversold conditions trigger meaningful stabilization.

Conversely, investor behavior could shift sooner than expected. If holders halt selling and begin accumulating at discounted levels, momentum may change. Reclaiming the $1.68 support level would mark an early recovery signal. A confirmed bounce could open MYX price’s path toward $2.01 and potentially higher, invalidating the prevailing bearish outlook.

Crypto World

Stripe-Owned Bridge Gets OCC Conditional Approval for Bank Charter

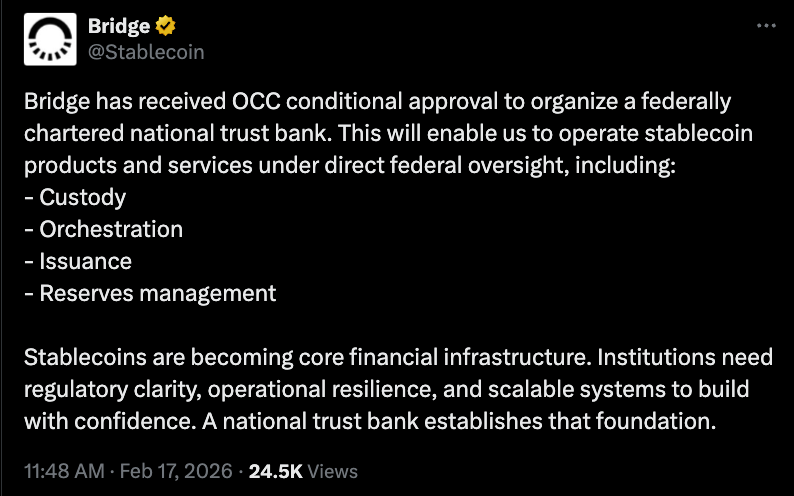

Stablecoin platform Bridge, owned by the payments processor Stripe, said it had received conditional approval to operate as a federally chartered national trust bank under the US Office of the Comptroller of the Currency (OCC).

In a Tuesday notice, Bridge said it had received conditional approval from the banking regulator, allowing the company to “operate stablecoin products and services under direct federal oversight” once fully approved. Bridge said the charter would allow it to offer custody of digital assets, issue stablecoins and manage stablecoin reserves.

“Our compliance framework already positions Bridge to be GENIUS ready,” said the company, referring to the stablecoin bill signed into law in July 2025. “Now achieving a national trust bank charter will provide our customers the regulatory backbone they need to build with stablecoins confidently and at scale.”

Bridge is one of several crypto-aligned companies seeking a national trust bank charter from the OCC following the passage of the GENIUS Act. In December, the agency conditionally approved applications from BitGo, Fidelity Digital Assets and Paxos to convert their respective state-level trust companies, and conditionally approved Circle and Ripple for national trust bank charters.

Related: Bankers push OCC to slow crypto trust charters until GENIUS rules clarified

According to OCC records, Bridge applied for a bank charter in October and was given approval on Feb. 12. Stripe acquired the platform in 2025 as part of a $1.1 billion deal for the company to support stablecoin payments.

In a Wednesday letter, the American Bankers Association (ABA) urged the OCC to slow its approval of crypto companies for national bank trust charters, saying rules under the GENIUS Act were still unclear. According to the banking group, companies could use national trust charters to essentially bypass oversight by US financial regulators.

“[…] ABA strongly encourages OCC to be patient, not measure its application decisioning progress against traditional timelines, and allow each charter applicant’s regulatory responsibilities to come fully into view before moving a charter application forward,” said the letter.

US policymakers still considering how to handle stablecoin rewards

As US lawmakers in the Senate advance bills to establish a comprehensive digital asset market structure framework, White House officials continue to meet with representatives from the crypto and banking industries to address stablecoin yield. Addressing stablecoins within the market structure bill, as well as issues related to tokenized equities and conflicts of interest, could be a sticking point for many lawmakers ahead of a potential vote in the Senate.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Pred Raises $2.5M to Build the Fastest Trading Experience in Sports Prediction

[PRESS RELEASE – Panama City, Panama, February 17th, 2026]

Pred, a peer-to-peer sports prediction exchange, announced a $2.5 million funding round led by Accel, with participation from BEF by Coinbase Ventures and Reverie. The capital will support team expansion, liquidity development, and global user onboarding as Pred builds exchange-grade infrastructure for sports prediction markets. The platform is live in private beta, with traders being onboarded through an invite-only program ahead of broader public access.

Pred is building the fastest sports prediction exchange on Base, Coinbase’s layer-2 blockchain network. The platform lets traders buy and sell positions on sports outcomes with 200-millisecond execution and spreads under 2 percent. It is designed for traders who approach sports markets with the same analytical discipline used in financial markets, emphasising transparent order books, market-driven pricing, and on-chain settlement.

“Prediction markets have proven their value for episodic events, but sports represent an entirely different scale of opportunity, continuous, global, and deeply liquid. Pred is building purpose-built infrastructure for this market rather than retrofitting general-purpose tools. That’s the kind of focused execution we back.” – Prayank Swaroop, Partner at Accel.

While prediction markets have historically demonstrated strong forecasting accuracy, most applications have been limited to episodic events such as elections or macroeconomic outcomes. Sports present a fundamentally different environment, with continuous global demand, frequent events, and a natural fit for high-speed trading strategies. Despite the scale of the global sports betting economy, the majority of volume remains concentrated within house-controlled sportsbooks that set prices and manage risk internally.

Pred takes a different approach by applying an exchange model to sports predictions, allowing participants to trade directly with one another. Prices emerge through real supply and demand, reflecting collective market sentiment rather than fixed odds. By removing the house from the equation, Pred aims to create a more efficient, transparent, and trader-driven marketplace for sports outcomes.

“Sports prediction is a $500B global industry still running on infrastructure that punishes winners. We built Pred to change that, a decentralised exchange where speed, transparency, and skill are rewarded, not penalised.” – Amit Mahensaria, CEO and Co-Founder.

Pred will use the funding to build out its team with talent from financial and sports sectors, deepen market liquidity through institutional partnerships, and drive the trader growth needed to sustain a high-velocity exchange. The goal: become the premier global destination for sports prediction trading.

About Pred

Pred is building a sports prediction exchange that lets traders buy and sell positions on sports outcomes with 200ms execution and spreads under 2%. Unlike traditional sportsbooks that limit or ban winning users, Pred operates as a peer-to-peer exchange where skilled traders are welcome.

*Disclaimer: Pred does not operate in India, Singapore, the US, or OFAC-sanctioned countries.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Vitalik Buterin Draws a Clear Line

Users need not share his politics, product opinions, or cultural tastes to freely use the decentralized network, says Vitalik Buterin.

Ethereum co-founder Vitalik Buterin said that users do not need to agree with his views on applications, trust assumptions, politics, decentralized finance, decentralized social platforms, privacy-preserving payments, artificial intelligence, or even cultural preferences in order to use Ethereum.

He believes that disagreement with him on any one issue does not require agreement or disagreement on any other.

“Corposlop” Isn’t Censorship

In a lengthy post on X, Buterin stated that he does not claim to represent the entire Ethereum ecosystem. He described Ethereum as a decentralized protocol built around permissionlessness and censorship resistance, which allows anyone to use the network in whatever way they choose without regard for his opinions, the views of the Ethereum Foundation, or those of Ethereum client developers.

He said that labeling applications he dislikes as “corposlop” is not censorship. According to Buterin, free speech means individuals cannot prevent others from operating, but remain free to criticize, just as they may be criticized in return.

Buterin said such criticism is necessary and rejected the concept of “pretend neutrality,” in which individuals present themselves as equally open to all perspectives while avoiding clearly stated positions. He wrote that neutrality should apply to protocols, such as HTTP, Bitcoin, and Ethereum, and within limited scope to certain institutions, but not to individuals, who should instead clearly state their principles, including by identifying and criticizing things they believe are incompatible with those principles, and working with others who share aligned goals to build a metaverse where those principles are treated as a baseline.

He asserted that principles cannot be confined solely to protocol design, while arguing that any principle naturally leads to conclusions not only about how a protocol should be built but also about what should be built on top of it, and that such principles inevitably extend beyond technology into broader social questions, which he said should not be avoided.

Hollow Uses of “Freedom” in Tech

Buterin added that valuing concepts such as freedom while treating them as relevant only to technical choices and disconnected from other aspects of life is not pragmatic but is hollow. He further stated that a decentralized protocol must not be viewed as belonging to only one metaverse and that the boundaries of a metaverse are inherently fuzzy, which makes it common for people to align on some axes while disagreeing on others.

You may also like:

The latest comments from the Ethereum co-founder came a month after he backed the view held by Bitcoin maximalists that concerns around digital sovereignty were well-founded. Buterin had then argued that today’s internet has pivoted toward corporate-controlled systems that erode user power and described sovereignty as protecting privacy, attention, and autonomy from profit-driven platforms, not just resisting governments.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Shiba Inu price stabilizes at monthly support as oversold conditions ease

Shiba Inu price has reclaimed a key monthly support level after an impulsive sell-off, signaling that oversold conditions may be giving way to a relief rally as buyers begin to step back in.

Summary

- Monthly support reclaim signals seller exhaustion and short-term stabilization

- Oversold conditions are easing, supporting upside rotation

- Holding above value area low favors a move toward range highs

Shiba Inu (SHIB) price action has entered a critical phase after a sharp bearish expansion pushed the token into deeply oversold territory. Following this impulsive decline, SHIB briefly traded below a major high-timeframe support level before quickly reclaiming it, a technical development that often signals seller exhaustion rather than sustained breakdown.

This reclaim has shifted the short-term narrative from risk of continuation to potential stabilization. While broader market conditions remain mixed, SHIB’s ability to recover lost support and hold above it suggests that demand is beginning to absorb supply at lower levels.

The coming sessions will be key in determining whether this move develops into a larger recovery or remains a short-lived reaction.

Shiba Inu price key technical points

- Monthly support has been reclaimed, invalidating the recent breakdown

- Oversold conditions are easing, supporting a relief bounce scenario

- Holding above value area low increases upside probability, toward range highs

The recent sell-off in Shiba Inu was aggressive, producing a sequence of lower lows and strong bearish momentum. However, this downside move ultimately pushed the price below a key monthly support level, a zone that has historically attracted demand.

Rather than accepting below this level, the price quickly rebounded and reclaimed support, forming a bullish retest. This type of behavior is often associated with capitulation-style moves, where sellers exhaust themselves and buyers step in aggressively once liquidity is taken.

From a market structure perspective, reclaiming lost support after a brief breakdown weakens the bearish case and increases the likelihood that the move lower was corrective rather than trend-defining.

Consolidation at value area low

Following the reclaim, SHIB has entered a consolidation phase around the value-area low of the prior trading range. This region represents the lower boundary of fair value and is often where markets pause to rebalance after impulsive moves.

Holding above the value area low is critical. Acceptance above this level would indicate that buyers are defending price and absorbing remaining supply. Conversely, a failure to hold this region would reopen downside risk and call into question the recent reclaim.

At present, price action suggests balance rather than renewed selling pressure, reinforcing the stabilization narrative.

Oversold conditions support a relief rally

Momentum indicators had reached extreme oversold levels during the recent decline, reflecting panic-driven selling rather than orderly distribution. As price stabilizes, these oversold conditions are beginning to ease, a common prerequisite for relief rallies.

When oversold momentum coincides with a reclaim of high-timeframe support, the probability of a rotational move higher increases. This does not necessarily imply a full trend reversal, but it does open the door for a corrective rally toward higher resistance levels.

Volume behavior will be key in confirming this thesis. Sustained bullish volume during consolidation and early expansion phases would strengthen the case for continued upside.

Upside targets come into focus

If SHIB can hold above the value area low on a closing basis, the next logical upside objective is near the value area high of the previous range. This level represents the upper boundary of fair value and often acts as the first major resistance during recovery phases.

A move toward this area would complete a clean rotational structure, shifting sentiment from defensive to constructive in the short term. However, failure to reclaim and hold above value would keep the market vulnerable to renewed volatility.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Shiba Inu is showing early signs of stabilization after an oversold sell-off. The reclaim of monthly support and consolidation above the value area low suggest that downside momentum is weakening.

In the near term, traders should watch for continued acceptance above current support levels and an increase in bullish volume. If these conditions persist, a rotational move toward higher resistance becomes increasingly likely.

That said, SHIB remains within a broader corrective environment, and patience is required. As long as price holds above reclaimed support, the path of least resistance favors further upside exploration rather than immediate continuation lower.

Crypto World

Crypto custodian BitGo a potential acquisition target for Wall Street, analysts say

Wall Street analysts are betting that BitGo’s push into full-service institutional crypto finance will not only fuel long-term growth but also position the company as a prime acquisition target for traditional finance firms.

Compass Point analyst Ed Engel, who has a buy rating on the stock, wrote that the firm’s services could be attractive to traditional firms looking to offer crypto products to their clients.

“We … view BTGO as an ideal M&A target for Wall Street companies expanding into crypto. BitGo offers a full suite of services that could be integrated into traditional prime brokers and new entrants could acquire BitGo to provide these solutions to clients,” the analyst wrote.

BitGo was one of the first digital asset firms to go public this year, providing custody and security services for digital assets, primarily catering to institutional clients. The IPO marked one of the first times public equity investors could gain direct exposure to crypto infrastructure, making BitGo the bridge between traditional finance and digital assets as more financial firms push deeper into the digital asset space.

The infrastructure play is one of the points Engel said could offer more upside, noting that investors are overly focused on its core custody business rather than BitGo’s “opportunity to cross-sell prime services.” The analyst went as far as comparing it to Galaxy (GLXY) and Coinbase’s (COIN) prime brokerage services and noting that Galaxy’s average revenue per trading counterparty is “~6x BitGo’s, implying significant upside,” for BitGo, if the firm is able to ramp up its services.

‘Attractive’ take over target

The company’s competitive advantage and acquisition potential were echoed by at least one other Wall Street investment bank’s analyst.

“We believe BitGo’s competitive moat is solid, but more importantly we believe the company could make an attractive time-to-market asset for major Tradfi players looking to enter this market in an expedited manner,” said Canaccord Genuity in a note. The analyst has a $15 price target and a buy rating on the stock.

BitGo’s acquisition potential isn’t without precedent.

In May 2021, Galaxy Digital said it agreed to buy the firm for $1.2 billion, but later abandoned the deal after Galaxy said BitGo had failed to provide financial statements by a deadline at the end of July. With the stock being public, those concerns may no longer be an issue.

BitGo’s stock has dropped more than 40% since the company set its January IPO at $18 per share, now trading near $10.26. Meanwhile, bitcoin has declined about 24% year-to-date, Galaxy fell about 9% and Coinbase tumbled nearly 30% amid a broader crypto market selloff.

The IPO valued the firm at $2 billion, but after the recent selloff, the stock’s market cap is currently about $1.24 billion, bringing it closer to the valuation near the failed Galaxy deal.

However, Canaccord sees BitGo’s underperformance as an overreaction by the market. “BTGO shares… have reacted much more severely than any shorter term P&L trajectory weakness might warrant,” the investment bank’s analyst said, defending the stock.

BitGo currently has 10 analysts covering the stock, with nine buy ratings and one hold rating, according to FactSet data. Analyst price targets range from $12 to $18 per share, implying the stock could still rise by 17% to 75% from current prices.

Read more: Crypto M&A Heats Up as Big Banks and Fintechs Race to Scale

Crypto World

BitMine stock rebound? Tom Lee expects ETH V-shaped recovery

BitMine stock price could be on the verge of a strong bullish breakout in the coming weeks or months if Tom Lee’s Ethereum prediction works out.

Summary

- BitMine stock price formed a falling wedge pattern on the daily chart.

- Tom Lee predicts that the Ethereum price will have a V-shaped recovery.

- Ethereum has some of the best fundamentals in the crypto industry.

BMNR stock was trading at the crucial support level at $20, inside a range it has been stuck at in the past few days. It remains well below the all-time high of $160.

Tom Lee, the company’s Chairman, believes that the stock will rebound once the ongoing Ethereum (ETH) price bearish market ends. In a statement, Lee argued that Ethereum has had eight major drawdowns since 2018. All these drawdowns ended with a V-shaped recovery, and this one will do the same.

At the same time, Lee noted that ETH has some potential demand drivers, including its status as the largest smart contract blockchain, with top companies such as JPMorgan leveraging its technology.

More data show that Ethereum’s demand remains strong as exchange supply continues to fall. It has dropped to the lowest level in years, while the staking queue has reached a record high. Ethereum is also the biggest network for stablecoin processing, handling trillions in transactions a quarter.

These factors explain why BitMine has continued to accumulate Ethereum this year. The company now holds over 4.3 million tokens worth over $8.4 billion. It has bought over 157k coins in the last 30 days and is generating yield by staking the coins. It is also generating yield by investing its cash balances.

The company is also aiming to invest in more startups, a move that may generate substantial returns in the future. For example, it invested $200 million in Beast Industries, a company owned by Mr. Beast.

BitMine stock price technical analysis

The daily timeframe chart shows that the BMNR stock price has formed a giant falling wedge pattern. This pattern consists of two descending, converging trendlines, with a bullish breakout occurring when the two lines near their convergence.

The Relative Strength Index has moved from the oversold level of 25 to 37 and is pointing upward.

Therefore, the most likely scenario is that the BitMine stock price rebounds to the key resistance level at $34, its highest level in January, about 72% above the current level.

Crypto World

Pepe price reclaims structure as bullish engulfing candles signal reversal

Pepe price has reclaimed key high-timeframe support after a deviation lower, with a strong bullish engulfing candle breaking bearish structure and signaling a potential bottoming process.

Summary

- Deviation below support was invalidated, suggesting a liquidity sweep

- Bullish engulfing candle broke the lower-high structure, shifting momentum

- Reclaiming the value area low opens upside rotation toward the resistance

Pepe (PEPE) price action is showing early signs of structural recovery after a sharp deviation below a major high-timeframe support level. What initially appeared to be a breakdown has now been invalidated, as price quickly reclaimed the lost level with a decisive bullish engulfing candle.

This type of price behavior often signals exhaustion in selling pressure rather than the start of a sustained bearish continuation. Deviation-and-reclaim patterns are important inflection points in technical analysis, particularly when they occur at high-timeframe support.

In Pepe’s case, the reclaim has also disrupted the prevailing bearish market structure, raising the probability that a local or even macro bottom could be forming.

Pepe price key technical points

- Deviation below high-timeframe support has been reclaimed, invalidating the breakdown

- Bullish engulfing candle broke the sequence of lower highs, signaling a structure shift

- Value area low reclaim is required, to open upside continuation toward resistance

PEPE’s recent move below high-timeframe support can be classified as a deviation, where price briefly trades below a key level to trigger stop-losses and capture liquidity before reversing sharply higher. This behavior is commonly seen near market bottoms, as weak hands are flushed out before stronger participants step in.

Rather than finding acceptance below support, PEPE quickly reclaimed the level, indicating that sellers were unable to sustain control. The speed of the reclaim is significant, as prolonged trading below support would have suggested genuine bearish continuation.

From a market structure perspective, deviations followed by strong reclaims tend to weaken the bearish thesis and increase the probability of a rotational move higher.

Bullish engulfing breaks bearish structure

The reclaim of support was confirmed by a strong bullish engulfing candle, which engulfed multiple prior bearish candles. This type of candlestick formation often reflects aggressive buying interest and marks a shift in short-term momentum.

More importantly, this bullish engulfing candle broke the sequence of lower highs, which had defined PEPE’s bearish structure. Once lower highs are invalidated, the market transitions from a bearish trend into either balance or early bullish structure.

This structural shift does not guarantee immediate upside continuation, but it does suggest that the dominant bearish control has weakened substantially.

Holding above the high-timeframe support is critical

While the initial reclaim is constructive, confirmation will depend on PEPE’s ability to remain above high-timeframe support in the sessions ahead. Sustained acceptance above this level would indicate that demand is strong enough to absorb the remaining supply.

If price slips back below this support and fails to reclaim it, the deviation would lose its significance and downside risk would re-emerge. For now, however, the ability to hold above support keeps the bullish scenario intact.

Value area low reclaim opens upside path

The next key technical milestone for PEPE is the value area low (VAL). This level represents the lower boundary of fair value within the broader trading range. A reclaim and hold above the VAL on a closing basis would confirm acceptance back into value and increase the probability of continuation higher.

Once value is reclaimed, price often rotates toward the point of control (POC), which acts as the next major resistance and balance point within the range. This would represent a natural upside target if bullish momentum continues to build.

Range rotation scenario builds

With bearish structure broken and support reclaimed, PEPE is transitioning from a trend phase into a potential range-rotation environment. This means price may move higher in stages, rather than trending impulsively.

Such rotations are common after deviations and often lead to sustained recovery moves if volume and follow-through remain supportive.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, PEPE is showing early signs of a bullish shift. The deviation below support, followed by a strong bullish engulfing candle, significantly reduces near-term downside continuation risk.

In the coming sessions, traders should monitor whether the price can reclaim and hold above the value area low. Acceptance above this level would open the door for a rotational move toward the point of control and higher resistance within the range.

While volatility may remain elevated, the evidence currently favors stabilization and further upside exploration, rather than renewed breakdown, as long as PEPE holds above reclaimed support.

Crypto World

Stripe’s stablecoin firm Bridge wins initial approval to form national bank trust charter

Bridge, a stablecoin infrastructure firm owned by Stripe, said Tuesday it has received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to form a national trust bank.

The charter would let Bridge National Trust Bank issue stablecoins, custody digital assets and manage reserves under direct federal oversight. It’s the latest step in Stripe’s broader push into blockchain-based payments since it acquired Bridge for $1.1 billion in 2024.

“This approval positions Bridge to help enterprises, fintechs, crypto businesses and financial institutions build with digital dollars inside a clear federal framework,” the company said in the press release.

Bridge says its systems already meet the compliance standards outlined in the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, the law passed last year that’s aimed at regulating stablecoin issuers. Federal banking regulators, including the OCC, Federal Reserve and Federal Deposit Insurance Corp., haven’t yet instituted the specific regulations mandated by the GENIUS Act, but they’re moving through that process now.

Bridge is part of a growing group of firms seeking to build stablecoin products inside a federal framework. In December, Circle, Ripple, Paxos, Fidelity Digital Assets and BitGo all received similar conditional approvals from the OCC, and Erebor Bank was granted a conditional national bank charter in October. Bridge applied for its charter in October, and the OCC’s records show it signed off last week.

The company currently powers stablecoin issuance for products like Phantom’s CASH and MetaMask’s mUSD via Stripe’s Open Issuance platform.

The OCC has not announced a timeline for final approval.

Crypto World

Tether’s tokenized gold (XAUT) to be sued for dividend payments

Elemental Royalty Corporation (ELE) is now offering shareholders something no other public gold company has before: the option to receive dividends in blockchain-based tokens backed by gold.

In a move announced Tuesday, the Canada-based royalty company said it will distribute shareholder returns using stablecoin issuer Tether’s tokenized gold, Tether Gold (XAUT).

Shareholders choosing this route will receive their dividends in XAUT rather than fiat money, providing exposure directly tied to the price of gold with the added flexibility of digital settlement.

This marks the first time a publicly listed gold company has made such an offer, according to the press release. The move comes after Tether bought one-third of Elemental last year.

Gold-backed tokens has emerged as a fast-growing asset class. The total market for tokenized gold has surpassed $5 billion, with XAUT currently leading the sector in both volume and supply. Much of this growth has been driven by retail investors seeking exposure to gold without relying on traditional custodians or intermediaries.

Read more: Tether’s gold stash tops $23 billion as buying outpaces nation states, Jefferies says

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech18 hours ago

Tech18 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video13 hours ago

Video13 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World12 hours ago

Crypto World12 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports19 hours ago

Sports19 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery