Crypto World

: Crypto Week Ahead

The brief, partial U.S. government shutdown put paid to the Employment Situation report that was due Friday; it’s coming this week instead. Look for the bellwether nonfarm payrolls report on Wednesday. The world’s largest economy is forecast to have created 70,000 jobs last month, more than in December, while the unemployment rate is expected to hold steady at 4.4%.

The week also includes earnings from some of the biggest, highest-profile crypto companies, including crypto exchange Coinbase (COIN). Robinhood (HOOD), a trading platform that covers equities as well as crypto, is also on the roster.

Outside the U.S., there will be plenty of focus on Asia, where CoinDesk’s second annual Consensus Hong Kong conference takes place. There’s a high chance participating companies will use the event as a venue for corporate announcements.

What to Watch

(All times ET)

- Crypto

- Macro

- Feb. 9, 11 a.m.: U.S. consumer inflation expectations for January (Prev. 3.4%)

- Feb. 10, 7 a.m.: Brazil inflation rate YoY (Prev. 4.26%), MoM (Prev. 0.33%)

- Feb. 10, 8:30 a.m.: U.S. retail sales MoM for December Est. 0.5% (Prev. 0.6%)

- Feb. 10 8:30 a.m.: U.S. employment cost index QoQ (Prev. 0.8%)

- Feb. 10, 2 p.m.: Argentina inflation rate YoY (PRev. 31.5%), MoM (Prev. 2.8%)

- Feb. 10, 8:30 p.m.: China inflation rate YoY for January (Prev. 0.8%); MoM (Prev. 0.2%)

- Feb. 11, 8:30 a.m.: U.S. nonfarm payrolls for January Est. 70K (Prev. 50K)

- Feb. 11, 8:30 a.m.: U.S. unemployment rate for January Est. 4.4% (Prev. 4.4%)

- Feb. 11, 8:30 a.m.: U.S. average hourly earnings for January YoY Est. 3.8% (Prev. 3.6%)

- Feb. 12, 2:00 a.m.: U.K. GDP MoM for December. (Prev. 0.3%)

- Feb. 12, 5:30 a.m.: India inflation rate YoY for January (Prev. 1.33%); MoM (Prev. 0.05%)

- Feb. 12, 8:30 a.m.: U.S. initial jobless claims week ending Feb. 7 (Prev. 231K)

- Feb 12, 10 a.m.: U.S. existing home sales for January Est. 4.25M (Prev. 4.35M)

- Feb. 13, 8:30 a.m.: U.S. core inflation rate YoY for January (Prev. 2.6%); MoM Est. 0.3% (Prev. 0.2%)

- Feb. 13, 8:30 a.m.: U.S. inflation rate YoY for January (Prev. 2.7%); MoM Est. 0.3% (Prev. 0.3%)

- Feb. 14: Japan GDP growth rate QoQ for Q4 (Prel) est. 0.4% (Prev. -0.6%); Annualized est. 1.6% (Prev. -2.3%)

- Earnings (Estimates based on FactSet data)

- Feb. 10: Canaan (CAN), pre-market, -$0.03

- Feb. 10: Robinhood Markets (HOOD), post-market, $0.63

- Feb. 10: Upexi (UPXI), post-market, -$0.07

- Feb. 10: Lite Strategy (LITS), post-market

- Feb. 12: Coinbase (COIN), post-market, $1.04

- Feb. 12: Coincheck Group (CNCK), post-market, $0.01

- Feb. 12: Bitdeer Technologies Group (BTDR), pre-market, -$0.06

- Feb. 13: Trump Media & Tech Group (DJT), post-market

- Feb. 13: HIVE Digital Technologies (HIVE), post-market, -$0.07

Token Events

- Governance votes & calls

- Feb. 11: Ripple to host XRP Community Day on X Spaces discussing XRP adotion, regulated finance and innovation.

- Unlocks

- Token Launches

Conferences

Crypto World

Senators try to unlock stalled crypto Clarity Act with compromise on stablecoin yield

The U.S. banking industry had effectively lobbied to halt the crypto industry’s market structure bill, the Digital Asset Market Clarity Act, over a dispute about the proper role for stablecoin rewards. But lawmakers continue to negotiate a compromise to move that legislation forward.

One of the lawmakers at the center of those talks, Senator Angela Alsobrooks, told an audience at an American Bankers Association summit in Washington on Tuesday, that both sides of the negotiation — bankers trying to limit most stablecoin rewards as a threat to traditional deposits and the crypto industry that argues they’re an important consumer incentive — are going to be “just a little bit unhappy.” The Maryland Democrat has been working with Senator Thom Tillis, a North Carolina Republican, to hash out a way to get a long-delayed Senate Banking Committee hearing on the legislation.

“The compromise that myself and Senator Tillis have been working on is one that we believe will allow us to have the guardrails in place that will help us to prevent — in all the ways we can — the deposit flight that we do not want to see happen, and to allow the innovation to grow at the same time,” Alsobrooks said, referencing the banks’ insistence that rewards on stablecoin holdings are so similar to bank deposits that people will take their money out of the banks.

“We absolutely have to have these protections to prevent the deposit flight, but we’re going to probably have to make some compromises,” the senator said.

So far, the compromise seems to focus on the possibility that some narrower area of stablecoin activity be eligible for customer rewards paid by crypto platforms.

Last year’s stablecoin law, the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, “barred payment stablecoin issuers from paying interest to attract customers,” noted ABA President Rob Nichols. He argued that “unless crypto exchanges and other affiliated companies are bound by the same common-sense restrictions, the result is a clear effort to evade congressional intent.”

Senator Mike Rounds, a South Dakota Republican who — like Alsobrooks and Tillis — is a member of the Senate Banking Committee, told the banks on Tuesday that he’s “not sure” how to properly approach stablecoin rewards, yet. He said that handing out rewards to customers can’t be about how much money is held in an account, but it might be tied to how active the account is.

“We’re trying to reflect that in the discussions,” he said.

The bankers, who were preparing Tuesday to disperse to meetings across Capitol Hill to make their points with lawmakers and staffs, have pushed for a very narrow allowance for rewards. But JPMorgan Chase & Co. CEO Jamie Dimon, the leader of the biggest U.S. institution, suggested in a recent interview that his industry could accept transaction-based rewards — a position that’s been offered by the crypto industry in meetings at the White House.

The U.S. Office of the Comptroller of the Currency recently proposed a rule to adopt much of the GENIUS Act, though its position on stablecoin rewards was seen as murky by the crypto industry. The agency had said that it wouldn’t allow evasions of the yield ban for stablecoin issuers. But industry insiders have expressed comfort that they’ll be able to set up rewards programs that won’t run afoul of the OCC’s proposal, which the digital assets advocates say allows considerable room for rewards programs designed as customer incentives.

Despite the bankers further underlining the dangers of the yield loophole on their business model this week, the legislation could still advance if Alsobrooks, Tillis and others on the Senate Banking Committee are satisfied with new compromise language. The next step would be a markup hearing, like the one delayed earlier this year. If the bill passes that, it would be combined with a version that already cleared the Senate Agriculture Committee.

A final version would then be put before the entire Senate for a vote, which would require a considerable number of Democrats to pass.

That may remain a concern because other debates beyond stablecoin yield have gone unresolved. Senate Democrats have raised concerns about the decentralized finance (DeFi) sector posing vulnerabilities to bad actors, and they’ve also argued that Democrats be appointed to vacant roles at the CFTC and SEC. But possibly the most contentious of their requests is to ban senior government officials from profiting on personal crypto business ties — most pointedly, President Donald Trump.

There are procedural headwinds, too. Senate floor time is always at a premium, and other matters could still get in the way, such as the war in Iran and Trump’s threats that he won’t sign any approved bills until Congress sends him a voter-ID package he can sign into law before the midterm congressional elections.

Crypto World

Nigel Farage aide George Cottrell bets US war will last four more months

Nigel Farage aide George Cottrell is betting $41,000 that the US war with Iran will last for another four months, despite Reform UK calling for an end to the conflict.

When Israel and the US attacked Iran in February, Farage criticised UK Prime Minister Keir Starmer for not allowing the US access to its military bases.

Reform maintained its position that the US-led war should be backed by the UK before the party u-turned this week.

Indeed, Reform politician Robert Jenrick called for the war to end “as soon as possible” because of its potential negative impact on the UK economy.

Farage added today that the UK should stay out of the war, but only because of perceived shortcomings in the country’s defensive capabilities following a drone attack in Cyprus.

However, despite this change in direction from the party, Cottrell was betting between March 7 and 9 that a ceasefire between the US and Iran wouldn’t happen before June 30, 2026.

Read more: Reform UK insider George Cottrell tied to Trump Polymarket bets worth millions

The Polymarket bet stands to win $123,000 if the US keeps up its war against Iran for another four months. The bet’s market, however, doesn’t seem to agree, and his wager faces a current unrealised loss of -$6,240.

Nigel Farage says Cottrell ‘is like a son to me’

Cottrell, who has reportedly been Farage’s “right-hand man” for years, was convicted of wire fraud in March 2017 after he was caught agreeing to launder drug trafficking proceeds.

The financier lived in Montenegro, where he was accused of illegal political financing and was investigated over a crypto ATM’s usage. An avid gambler, he reportedly lost €20 million ($23 million) in a single poker game while in the country.

However, Cottrell’s recent Polymarket bets, including on Starmer’s departure, US strikes against Iran, and the vote share of New York’s newly elected mayor, Zohran Mamdani, have lost over $800,000.

Read more: Nigel Farage milkshake’d while touring with shady crypto ally

Despite this, his losses pale in comparison to his previous $13.2 million win on Donald Trump’s election in 2024.

Crypto billionaire funded Farage’s Trump lobbying efforts

Cottrell is just one strand in Farage’s web of crypto connections, which now includes the UK’s former chancellor Kwasi Kwarteng and his bitcoin holdings firm, in which Farage just invested £215,000 ($289,000).

One of Reform’s biggest backers is Tether shareholder Christopher Harborne. Last week, he took his donations to Farage’s Reform UK to over £22 million ($29.6 million).

The Guardian has also linked Harborne to a private jet that was used to fly Farage to the Chagos Islands in late February.

Read more: Tether shareholder was Boris Johnson’s advisor in Ukraine, report

The trip was meant to reinforce Reform’s position against the UK government’s deal to transfer sovereignty of the island to Mauritius while cotinuing to lease a military base there for another 99 years.

Farage was flown to the Maldives but failed to reach the Chagos Islands after the UK military turned him away. He then attempted to talk with Trump about the deal at his Mar-a-Lago mansion last week.

However, the two never actually met.

Beyond Harborne’s investments in Tether, he’s also the largest shareholder of military firm QinetQ.

QinetQ’s US arm has secured multiple US Army contracts over the last year. It was awarded part of a $4 billion contract for military surveillance systems, given $41 million to develop counter-drone technology, and contracted to develop new target acquisition systems.

The firm also secured million-pound contracts from the UK under Boris Johnson’s government.

Despite the contracts, earlier this year, Reuters reported that the firm is restructuring its US division due to “operational and profitability challenges stemming from geopolitical uncertainty and shifting procurement cycles.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Investment firm Multicoin bets ‘Internet Labor Markets’ will drive crypto’s next wave of adoption

For much of crypto’s history, the primary use case has been simple: buying tokens and trading them.

Now, some investors and builders believe the industry may be moving toward a different model altogether: earning crypto instead of buying it.

One version of that idea is what venture firm Multicoin Capital calls Internet Labor Markets (ILM) — networks in which users receive tokens by contributing work, resources or expertise.

“The reason people get their first crypto in the future won’t be because they bought it,” Sengupta said in an interview with CoinDesk. “It’ll be because they earned it.”

The concept has begun gaining attention, particularly in ecosystems like Solana, where a growing number of projects are experimenting with networks that reward users for performing verifiable tasks.

That shift — from speculation to earning — is at the heart of Internet Labor Markets, where users contribute work, resources or judgment to decentralized networks and receive tokens in return. If the model takes hold, Sengupta believes crypto could evolve into something closer to a global labor marketplace.

For most of crypto’s existence, participation meant converting traditional money into digital assets such as bitcoin, ether or solana before interacting with the ecosystem. ILMs flip that dynamic: instead of buying tokens first, users complete tasks and receive crypto as payment.

“The idea is simple,” Sengupta said. “There are two ways people enter crypto — they either buy in or they earn in.”

Over the past decade, most users followed the first route. But Sengupta believes the next wave will come from the second.

“If you have a system where you can issue new assets and move them around at super low cost,” he said, “you can coordinate labor globally.”

In practice, that labor can take many forms — contributing bandwidth, labeling data, reducing energy consumption or performing physical tasks tied to decentralized infrastructure.

“Someone starts a company to source something the market needs, and 50,000 people around the world can get paid for producing that labor,” Sengupta said.

The concept builds on earlier crypto experiments, such as decentralized physical infrastructure networks (DePIN) — a category of projects that has largely emerged from the Solana ecosystem — which reward participants for contributing resources, such as wireless coverage or mapping data.

But Sengupta believes the next phase goes beyond hardware.

“The system moves from just plugging in hardware to people doing more active work — contributing judgment, effort and time,” he said.

Instead of passive contributions, many ILM systems focus on discrete tasks that can be verified and paid for instantly. A network might reward users for labeling data, reporting local information, identifying bugs in code or completing real-world assignments.

The blockchain advantage

Blockchain infrastructure makes those systems possible because work can be verified and settled automatically.

In traditional employment systems, payments often require invoices, approvals and delays. ILMs replace that process with deterministic verification — confirming work was completed and paying contributors instantly through crypto rails.

Much of that work may ultimately intersect with artificial intelligence.

One example Sengupta points to is Grass, a network that allows users to share unused internet bandwidth through software installed on their devices. The bandwidth can then be used for data-scraping tasks to help train AI models.

Multicoin Capital is a crypto investment firm that manages a multi-billion-dollar token hedge fund. In January 2022, the firm said it raised $422 million for a venture fund backing early-stage blockchain startups.

“People around the world download the software, contribute spare bandwidth, and earn tokens for participating in the network,” he said.

But the model could evolve further.

“The next phase is not just scraping data, but humans applying discretion — labeling data, judging quality — in ways that only humans can,” he said.

In other words, the internet’s next generation of labor markets may involve humans collaborating with AI systems rather than competing against them.

Sengupta argues that AI could actually increase demand for distributed human contributors. As companies become smaller and more automated, they still depend on people for tasks that require judgment, verification or real-world execution.

AI may shrink core teams, he said, but it also increases the need for on-demand contributors — creating demand for systems that can source, verify, and pay those contributions globally.

If this vision materializes, crypto’s next users may not arrive through speculation at all — but through work.

Crypto World

Crypto Theft Drops in February as Phishing and Wallet Approval Scams Rise

Crypto-related hacks declined sharply in February, but attackers are increasingly targeting users through phishing campaigns and malicious wallet approvals — a shift suggesting they are focusing more on exploiting human behavior than on vulnerabilities in smart contracts.

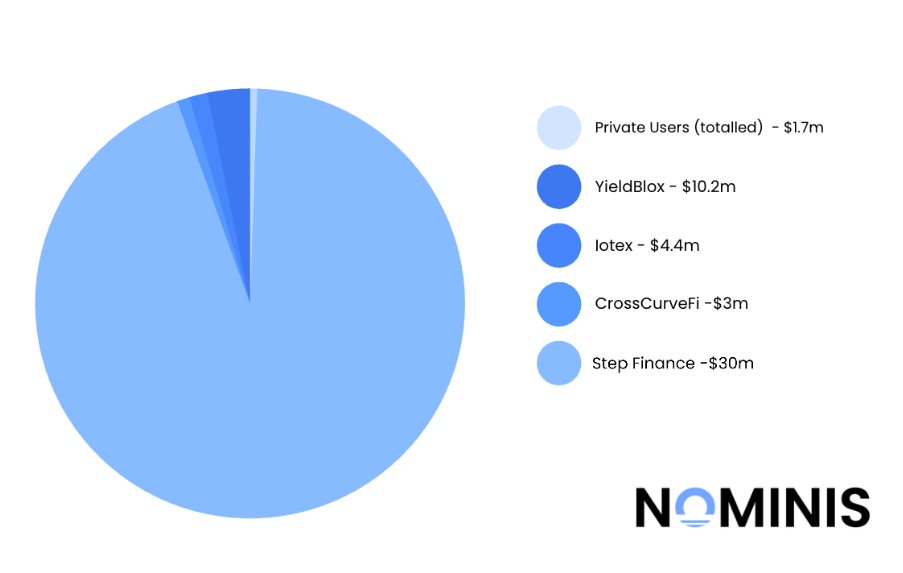

According to Nominis’ monthly report, roughly $49 million was lost to crypto-related exploits in February.

A single breach involving Step Finance, a portfolio dashboard and analytics platform built on the Solana blockchain, accounted for the bulk of the losses, with attackers draining approximately $30 million.

The February figure marks a steep decline from the $385 million stolen in January. While one month of data does not necessarily indicate a sustained trend, the drop suggests that large-scale protocol exploits were less prevalent during the period.

Social engineering attacks caused more cumulative damage than traditional smart contract exploits, Nominis said, with phishing campaigns increasing sharply during the month. These attacks typically trick users into interacting with malicious links or signing fraudulent transactions.

Private individuals were the most common victims, rather than centralized exchanges or decentralized finance protocols.

The most prevalent attack method was authorization abuse, in which victims unknowingly granted wallet permissions that allowed attackers to move funds from their accounts.

The figures broadly align with separate reporting from blockchain security company PeckShield, which estimated that February crypto exploits totaled $26.5 million, the lowest monthly losses since March 2025. PeckShield attributed the decline partly to stronger risk controls and improved security practices across the industry.

Related: South Korea sells $21.5M in recovered Bitcoin after custody breach

Crypto security improving, but major exploits persist

Hacks and scams have been a persistent feature of the cryptocurrency industry since its early days, though exchanges and security firms say defenses are gradually improving.

Crypto exchange Bybit recently reported that its fraud-prevention system blocked more than $300 million in unauthorized withdrawals during the final quarter of last year. The company said it flagged roughly 350 high-risk fraud addresses and prevented around 8,000 users from falling victim to potential scams.

Despite improvements in detection systems, large-scale attacks remain a major risk for the industry. According to Chainalysis, crypto hacks resulted in $3.4 billion in cumulative losses last year, underscoring the scale of the threat.

Related: Google uncovers iOS exploit kit used in crypto phishing attacks

Crypto World

Is the $71K Pump a Bull Trap? Why Analysts Are Calling for a $50K Bitcoin Crash

Can BTC collapse to $45,000 in the next 10 days?

The primary cryptocurrency is back in green territory, rising well above $71,000 following Donald Trump’s latest remarks that the war in Iran might be coming to an end.

Nonetheless, this could represent a classic “dead-cat bounce” since numerous analysts believe the bear market is far from being over.

‘The Flush is Approaching’

Despite climbing 7% over the past week and reclaiming the $70,000 level, BTC is down 45% from its all-time high of approximately $126,000 recorded in October 2025, a clear indication that the asset remains in a broader bear market.

Many industry participants think the bottom is yet to be formed. X user bee, for instance, described the latest resurgence as “just a liquidity grab before the next dump,” envisioning a drop to $50,000 in the second quarter of the year.

Leshka.eth and Mr. Crypto Whale also made bearish predictions. The former reminded that every single bear market in history has seen at least a 78% drawdown from the top, claiming “the flush is approaching.”

Mr. Crypto Whale argued that BTC might be entering its final accumulation stage. Based on their chart projection, the price could nosedive to $45,000 in the next 10 days before reversing course.

“If that scenario plays out, volatility will spike, and weak hands will get shaken out. Make sure you’re prepared for both directions. The biggest opportunities often appear when the market creates maximum fear,” they added.

The renowned analyst Ali Martinez gave his two cents, too. He compared BTC’s downtrend to that in 2022, speculating that the valuation could crash below $32,000 during this cycle.

You may also like:

BTC Will ‘Shock Everyone?’

Of course, there are those suggesting that the asset could be gearing up for a price explosion rather than a renewed pullback. X user Crypto Fergani thinks that BTC will “shock everyone” this cycle, envisioning a rise to a new all-time high. According to the analyst, some factors that could fuel the pump include the “dying” fiat, “unpayable” debt, mass money printing, and the involvement of major institutions such as BlackRock.

“It’s only a matter of time before crypto does what it always does next. Crypto doesn’t need your belief to take over,” they claimed.

Merlijn The Trader and Michael van de Poppe also chipped in. The former argued that quantitative tightening had just ended, noting that the last time the Fed made such a pivot, BTC rallied by over 2,000%. It is worth saying that the official QT ending was widely determined to be the start of December, 2025.

Michael van de Poppe believes the recent surge could be followed by a further jump to $75,000, then a potential spike to $80,000 sometime this month.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Vitalik Buterin pushes ‘DVT-Lite’ to make validator setup easier

The Ethereum Foundation is testing a method for running validators that could make it significantly easier for institutions holding large amounts of ether to set up staking infrastructure, widening the pool of participants and creating a more decentralized network.

In a post on X, blockchain co-founder Vitalik Buterin said the foundation is using a simplified version of distributed validator technology, or “DVT-lite,” to stake 72,000 ETH. The experiment aims to make running validators across multiple machines less complicated.

Buterin said the goal is to reduce the process to something close to a one-click setup, where operators choose which computers will run validator nodes, launch the software and enter the same key on each machine. The system would then automatically connect the nodes and begin staking.

“My hope for this project is that we can make it maximally easy and one-click to do distributed staking for institutions,” Buterin wrote.

Running Ethereum validators today typically means operating a single node that holds the key used to sign blocks and participate in the network. If that machine fails or goes offline, the validator can stop working and may be penalized.

Distributed validator technology (DVT) changes that by allowing multiple independent machines to collectively act as a single validator. Instead of relying on one key and one computer, several nodes work together and only a handful of them sign for the validator to function. That means the validator can keep operating even if some machines go down.

But existing DVT systems can be complicated to deploy because operators must coordinate networking, keys and communication between nodes. Buterin has previously argued that complexity is one reason large staking providers have come to dominate the ecosystem.

The “DVT-lite” setup aims to automate much of that process, making it easier for institutions to run distributed validators with minimal infrastructure expertise.

Buterin said he plans to use the system himself and hopes large ETH holders will adopt similar setups, helping spread control of Ethereum’s staking infrastructure across more operators rather than concentrating it among a handful of professional providers.

“The idea that ‘running infrastructure’ is this scary, complicated thing where each person participating must be a ‘professional’ is awful and anti-decentralization, and we must attack it directly,” he wrote.

Read more: Vitalik Buterin proposes simpler ‘distributed validator’ staking for Ethereum

Crypto World

Record-high Bitcoin Orderbook Asks Warn Of Price Correction

Bitcoin (BTC) appears to have reclaimed $70,000 as support, although the market remains cautious as technical charts indicate a setup resembling the bull trap that occurred in January 2026.

Bitcoin’s sell-side liquidity has expanded sharply during the latest range retest. According to crypto trader Ardi, Bitcoin ask orders reached a two-month high. The trader said,

“Asks on Bitcoin just hit a 2-month high. $1.57B in sell-side liquidity stacked above price vs $1.125B in bids below.”

Within a 5% band around the spot price, the sell orders exceed demand by roughly 40%, creating a heavier supply layer above the market price. At the same time, the bids form a thinner support cushion below BTC price.

Ardi noted the last comparable setup occurred in January after Bitcoin briefly broke above $98,000. A similar sequence followed Bitcoin’s recent move above $72,000 before the price slipped back toward the middle of its range. Elevated ask liquidity during a retest often signals that traders are using rebounds to take profit.

Another positioning metric also turned in the same direction. The 30-day moving average of Bitcoin’s net taker volume remained positive at $83 million in March, indicating increased buying activity through market orders.

Related: Bitcoin price analysis warns of potential dip after $72K liquidity sweep

Will BTC’s underwater supply cap its rebound?

Bitcoin short-term holders’ (STHs) cost-basis data shows the average holder entered the market at significantly higher prices. The STH realized price, which tracks the average acquisition price of coins held for under six months, sits near $88,900.

According to Bitcoin researcher Axel Adler Jr., the largest supply cluster lies between $86,000 and $99,000, where many coins were accumulated between November 2025 and February 2026. This range forms the main breakeven area for a large share of the short-term market, making it a key market inflection zone.

On the positive side, realized profit and loss data shows selling pressure has begun to reduce. Crypto analyst Darkfost noted about $611 million in realized losses against $346 million in profit last week, bringing net weekly profit-and-loss to -$264 million.

That figure is far lower than the $2 billion weekly loss recorded during the February drop below $60,000.

Compared with January’s retest, Bitcoin price currently sits much further below the main short-term cost-basis cluster. That distance limits the amount of breakeven selling that typically appears during smaller rallies.

As a result, many short-term holders may prefer to wait for higher prices, potentially closer to $86,000, rather than selling at a loss after holding through a month-long consolidation.

A move back above the $70,000 to $72,000 range eases part of the near-term selling pressure, but a more meaningful shift may require Bitcoin to reclaim the $86,000 to $89,000 range, where most of the short-term holders reach breakeven.

Related: Strategy records biggest STRC issuance day with estimated 1,420 BTC buy

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Circle (CRCL) may rally another 60% driven by stablecoin adoption, AI agentic finance: Bernstein

Shares of Circle (CRCL), the crypto firm behind the USDC (USDC) stablecoin, could add to their recent remarkable surge, according to analysts at brokerage Bernstein.

The team, led by Gautam Chhugani, rate the stock at outperform with a $190 price target, suggesting about 60% upside from current $120 level. And that’s after the stock rallied more than 100% in the past few weeks following an earnings beat, which likely triggered a short squeeze.

Bernstein’s thesis centers on stablecoin adoption increasingly diverging from the broader crypto market.

Circle’s USDC supply briefly fell after the October liquidity shock in crypto markets but has since rebounded to just shy of its record $78 billion, even as bitcoin and the broader crypto markets remain well below its highs. The total market for U.S. dollar-backed stablecoins also remained steady at around $270 billion despite the crypto bear market, the report noted.

Transaction activity is accelerating as well, the report noted. Adjusted stablecoin volumes grew more than 90% year-over-year, while transaction velocity — a measure of how frequently tokens change hands — has increased, suggesting stablecoins are increasingly used beyond crypto trading.

Payments adoption is a key driver behind that, Bernstein said, as stablecoins are increasingly getting embedded with traditional card networks, enabling everyday transactions. Visa (V), for example, now supports more than 130 such stablecoin-linked cards across 50 countries, processing roughly $4.6 billion in annualized settlement volume, the report noted.

Circle is also expanding its Circle Payments Network, which allows institutions to send USDC cross-border and convert it into local currencies through banking partners. The network now includes about 55 institutions, with annualized volumes reaching $5.7 billion earlier this year, the report said.

Looking ahead, Bernstein also highlighted a potential new growth theme: AI-driven “agentic finance.” As autonomous software agents increasingly transact online, stablecoins could become a natural payment rail for micropayments between machines, such as for API calls or automated services.

To support that vision, Circle is building a high-throughput, payments-focused blockchain called Arc, designed for fast, low-cost transactions.

Read more: Why Circle and Stripe (And Many Others) Are Launching Their Own Blockchains

Crypto World

Polymarket and Palantir team up to protect the integrity of sports betting as prediction platforms face a make-or-break moment

Prediction market platform Polymarket has teamed up with Palantir and TWG AI to build a monitoring system designed to detect suspicious trading and manipulation in sports prediction markets, a move that reflects growing pressure on the fast-growing sector to establish credibility.

The new system will use Palantir’s data infrastructure and TWG AI’s analytics to monitor trading activity across Polymarket markets. The companies say the platform will detect unusual trading patterns, screen participants and generate compliance reports that could be shared with regulators or sports leagues.

Polymarket founder and CEO Shayne Coplan said the goal is to bring “world-class analytics and monitoring to sports markets” while helping leagues and teams maintain confidence in the integrity of games.

The effort reflects a broader challenge facing prediction markets as they move from niche crypto experiments to platforms that increasingly influence public discussion about elections, economics and sports.

Prediction markets allow users to trade contracts tied to the outcome of real-world events. Because participants put money behind their views, proponents argue the markets can aggregate information efficiently and produce accurate forecasts.

But that same structure creates risks.

Prediction markets have faced criticism in recent years over the possibility that traders with inside knowledge could profit from events before the public becomes aware of them. Markets have emerged around sensitive topics such as policy decisions, military actions, labor strikes and political pardons, raising questions about whether participants might be trading on privileged information.

Carlos Pereira, a general partner at BITKRAFT Ventures, which manages more than $1 billion across investments in gaming, AI and digital assets, said those concerns could become a serious obstacle for the industry if they are not addressed.

“There has been what seems to be insider trading,” he said. “When you have a market that is new and by consequence a little bit fragile, making the news in negative ways can be dangerous.”

The monitoring system Polymarket is building resembles the kind of surveillance infrastructure used by traditional financial exchanges. According to the company, it will track trading before and after orders are placed, flag coordinated activity and identify traders who may be prohibited from participating.

For prediction market operators, the stakes are partly regulatory. Formal insider trading rules for these markets remain unclear in many jurisdictions, particularly in the U.S., where regulators are still debating how to classify them.

Efforts to strengthen monitoring could help the industry demonstrate that it can police itself.

Absent those safeguards, Pereira said regulators may feel pressure to intervene more aggressively.

“If markets don’t show they are trying to manage insider trading,” he said, “the odds of regulation becoming harsher and tapering growth would be much higher.”

Crypto World

CFTC Chair Michael Selig Outlines DeFi, Prediction Market Rulemaking Plans

Calling the U.S. the “crypto capital of the world,” Commodity Futures Trading Commission (CFTC) Chairman Mike Selig updated his agency’s ongoing plans to provide long-awaited regulatory clarity for decentralized finance (DeFi) developers, crypto derivatives and prediction markets.

Speaking this week at the FIA Global Cleared Markets Conference in Boca Raton, Florida, Selig said the U.S. is reclaiming leadership in digital assets through closer coordination between regulators. He said he and the Securities and Exchange Commission (SEC) Chairman Paul Atkins have put an “end to the days of CFTC-SEC infighting by partnering on the Project Crypto initiative.”

During his speech, Selig reiterated the CFTC will issue guidance to clarify how prediction markets, known as event contracts in regulation, can list and trade products under U.S. law and will launch a rulemaking process seeking public input on how the fast-growing sector should be overseen. Prediction markets are no longer a niche and have become a fast-growing ecosystem of trading platforms that allow users to trade contracts tied to elections, economic outcomes and real-world events.

Selig said that because “market participants deserve clarity” the agency intends to assert a more active role in regulating these markets and defending its authority over them amid ongoing legal challenges from several U.S. states. He repeated his sentiment from last month that the CFTC must be seen as the regulator for these markets, and he “will continue to assess litigation strategies to make sure the agency’s voice is heard.”

DeFi developers and crypto derivatives

The CFTC, he said, also plans to address one of the crypto industry’s most contentious regulatory questions: “For too long, there has been an open question as to whether software providers trigger the CFTC’s registration requirements,” Selig said. “We intend to address this question head-on.”

The agency is also analyzing how U.S. law should treat several crypto trading structures that have historically operated in regulatory gray areas, including leveraged crypto spot trading and standards for margined spot trading on exchanges. Previous Acting Chairman Caroline Pham got started last year on erasing old guidance on “actual delivery” standards from President Donald Trump’s first term so the regulator could write something friendlier to the industry spot-market practices.

The agency has also been addressing the classification of crypto perpetual derivatives, a dominant product in global crypto markets.

Read More: CFTC chief Selig to clear path for U.S. perpetual futures in coming weeks

The CFTC chairman also pointed to the rise of artificial intelligence (AI) and automated trading systems across digital markets and the need for regulatory frameworks that support innovation in these technologies.

Selig’s comments echo recent statements by NEAR co-founder Illia Polosukhin, who said AI agents will soon be the primary blockchain users, and Coinbase CEO Brian Armstrong, who wrote on X that “very soon there are going to be more AI agents than humans making transactions.”

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos1 day ago

News Videos1 day ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World1 day ago

Crypto World1 day agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech6 days ago

Tech6 days agoBitwarden adds support for passkey login on Windows 11

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports3 days ago

Sports3 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business7 days ago

Business7 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

Business4 hours ago

Business4 hours agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment4 days ago

Entertainment4 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

NewsBeat19 hours ago

NewsBeat19 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech1 day ago

Tech1 day agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World6 days ago

Crypto World6 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment6 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business24 hours ago

Business24 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs