Crypto World

Damex Secures MiCA CASP Licence

Damex has announced that its Malta entity has been granted authorisation as a Crypto Asset Services Provider under the European Union’s Markets in Crypto-Assets Regulation (MiCA) by the Malta Financial Services Authority, marking a significant milestone in the company’s regulatory and institutional development.

With this authorisation, Damex joins just 148 firms across Europe approved as a CASP under the MiCA framework. Of these, only 46 are authorised to provide custody and exchange services, and only one also holds a Gibraltar licence within its group to deliver similar regulated digital asset services currently offered by Damex.

This positions Damex among Europe’s Tier-1 Digital Asset institutions.

MiCA introduces a harmonised regulatory framework designed to raise standards across the digital asset sector, establishing clear requirements around governance, operational resilience, transparency, and consumer protection.

For businesses and financial institutions, the implications are significant. Engaging with crypto providers that are not MiCA-licensed introduces regulatory exposure and operational risks without protections.

The MiCA licence places Damex within the same regulatory recognition as major institutions such as Revolut, BBVA, and Coinbase, reinforcing its role as a trusted crypto and distributed ledger technology (DLT) partner to banks and large financial institutions across Europe.

Damex has operated at the highest levels of digital asset regulation since 2017, holding a Gibraltar DLT licence and delivering regulated infrastructure for institutional clients long before MiCA’s implementation.

While the licence has now been granted, Damex is entering its final pre-operational phase under MiCA, focusing on system readiness, governance alignment, and operational controls ahead of full launch.

The company is now welcoming early engagement from institutions and businesses seeking to operate within Europe’s regulated digital asset environment.

About Damex

Damex is a regulated digital asset and payments infrastructure group of companies serving businesses and financial institutions across Europe and globally. Operating since 2017, Damex delivers compliance focused solutions for digital asset custody, exchange, payments, and treasury operations, bridging traditional finance and the digital asset economy.

Damex Digital Ltd is a limited liability company registered in Malta with registration number C110325 with registered address at MK Business Centre 115A Floor 2, Triq Il-Wied, Birkirkara, BKR 9022, Malta. Damex Digital Ltd is authorised by the Malta Financial Services Authority as a Crypto Asset Services Provider pursuant to Regulation (EU) 2023/1114 (MICAR) to provide for its clients (i) the Custody and administration of crypto assets; (ii) exchange of crypto assets for funds and other crypto assets; (iii) execution of orders for crypto assets; and (iv) providing transfer services for crypto assets.

Please visit www.damex.io/eea for further information.

Crypto World

Bitcoin price low-volume bounce raises bull trap concerns

Bitcoin’s price has bounced from key support near $60,000, but declining volume and rising overhead resistance are raising concerns that the move may be a bull trap rather than a sustainable recovery.

Summary

- $60,000 support sparked the bounce, but demand remains weak

- Low volume and VWAP/Fibonacci rejection, signal fragile upside

- Acceptance below the point of control, favors rotation back toward support

Bitcoin (BTC) price action has staged a short-term rebound after successfully retesting a major high-timeframe support level near $60,000. While the bounce initially appeared constructive, deeper analysis reveals that the move higher has lacked strong participation.

Declining volume during the rally suggests that bullish momentum remains fragile, increasing the probability that the recent upside is corrective rather than trend-defining.

Bitcoin price key technical points

- $60,000 support has held, triggering a short-term bounce

- Rising price on declining volume, signaling weak bullish conviction

- Rejection at VWAP and 0.618 Fibonacci, reinforcing local resistance

From a volume profile perspective, Bitcoin’s recent advance has occurred on noticeably declining volume. In healthy bullish reversals, price expansion is typically accompanied by increasing participation, reflecting strong demand and conviction from buyers. In contrast, the current rally lacks this confirmation, suggesting the move may be driven by short-covering or opportunistic buying rather than sustained accumulation.

This type of low-volume bounce often appears during corrective phases within broader bearish or range-bound environments. Without renewed volume expansion, the probability of follow-through remains limited, leaving price vulnerable to renewed selling pressure.

Rejection from key resistance levels

Technically, Bitcoin is now facing a strong confluence of resistance. The current rejection is occurring near the 0.618 Fibonacci retracement of the recent decline, an area that often acts as a decision point in corrective rallies. This level is reinforced by VWAP resistance, drawn from the recent swing high prior to the series of sharp sell-offs.

The combination of Fibonacci resistance and VWAP creates a high-probability supply zone. Price rejection from this area, particularly on weak volume, strengthens the case that sellers remain active and willing to defend higher levels.

Acceptance below the point of control

Another important development is Bitcoin’s inability to hold above the local point of control (POC). The POC represents the price level at which the highest trading volume has occurred and often serves as a market balance point.

Finding acceptance below this level suggests that sellers are regaining control and that the market is transitioning back into imbalance. Historically, acceptance below the POC following a low-volume rally increases the likelihood of a rotational move lower, especially when broader structure remains bearish or neutral.

Range rotation likely to continue

From a market structure perspective, Bitcoin appears to be trading within a developing high-timeframe range. The lower boundary of this range is defined by the $60,000 support, while the upper boundary sits near $76,200. Until price can break above resistance with strong volume confirmation, rotations within this range remain the higher-probability outcome.

Given the current rejection and lack of bullish participation, the probability favors a move back toward the lower end of the range. A rotation toward $60,000 would be consistent with range behavior and would test whether buyers can continue to defend this critical support.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Bitcoin’s recent bounce shows signs of weakness. The combination of declining volume, rejection from key resistance, and acceptance below the point of control raises the risk that the move higher is a bull trap.

If selling pressure increases, Bitcoin is likely to rotate back toward the $60,000 region to retest high-timeframe support. A strong reaction from this level would keep the broader range intact, while failure to hold could expose deeper downside risk.

Crypto World

BMNR stock slowly preps rebound as key Ethereum metrics soar

The BMNR stock price hovered at the crucial support level of $20 as BitMine continued to accumulate Ethereum, and its fundamentals improved.

Summary

- BitMine’s stock price has formed a falling wedge pattern, pointing to a rebound.

- Data shows that Ethereum’s transactions and network fees have soared recently.

- The supply of ETH tokens in exchanges has continued falling this month.

BitMine stock has retreated by over 85%from its highest level in July last year. It is also slowly forming the highly bullish falling wedge pattern, pointing to a strong rebound.

In a statement, Tom Lee’s BitMine said that it continued to buy Ethereum (ETH) tokens last week, bringing its total holdings to over 4.326 million. It also holds 193 Bitcoin (BTC) and nearly $600 million in cash. Its other assets include $200 million in Beast Industries and $19 million in Eightco Holdings, a company that has invested in Worldcoin.

BitMine stock may ultimately benefit from Ethereum’s fundamentals, which have continued improving in the past few months, with third-party data showing relentless growth. Ethereum transactions, fees, and active addresses have continued to soar over the past few months, a trend that has accelerated after the Fusaka upgrade.

More data show that the amount of staked Ethereum continues to rise. The staking queue has jumped to over 4 million coins, with entry rising to over 70 days. Rising staking inflow is a sign that demand continues rising.

At the same time, data show that the supply of ETH tokens on exchanges has continued to fall and is now at its lowest level since 2016.

BMNR stock price prediction: Technical analysis

The daily timeframe chart shows that the BitMine stock price has been in a strong downward trend in the past few months. It plunged from a record high of $160 to the current $20.

On the positive side, the coin has formed a falling wedge pattern, which consists of two descending and converging trendlines.

This wedge is nearing its confluence, which could lead to a rebound soon. Also, the Relative Strength Index has moved from the oversold level of 30 to the current 32.

Therefore, the stock will likely have a strong bullish breakout in the coming days, potentially to the key resistance level at $35, its highest level in January this year.

On the other hand, a move below the lower side of the wedge will point to more downside in the near term.

Crypto World

South Korea’s FSS Launches AI-Powered Crackdown on Crypto Market Manipulation

TLDR:

- FSS targets whale trading, cage methods, and racehorse schemes in planned 2026 market investigations

- AI-powered systems will analyze abnormal price surges within seconds to identify manipulation patterns

- Digital Asset Basic Act preparatory team established to support phase-2 virtual asset legislation

- New licensing manuals developed for digital asset service providers and stablecoin issuers nationwide

South Korea’s Financial Supervisory Service announced comprehensive plans to investigate virtual asset market manipulation on February 9.

The regulatory body outlined targeted enforcement actions against high-risk trading schemes that disrupt market order.

The FSS will deploy artificial intelligence tools to detect abnormal price movements and suspicious trading patterns.

A preparatory team for the Digital Asset Basic Act was also established to support upcoming phase-2 legislation implementation.

Planned Investigations Target High-Risk Market Manipulation Schemes

The FSS identified several manipulation methods as priority investigation targets for 2026. Whale trading operations that deploy substantial capital for coordinated buy-and-sell activities will face increased scrutiny.

The cage method, which artificially controls prices of assets with suspended deposits on specific exchanges, represents another enforcement focus.

Racehorse schemes that rapidly inflate prices through concentrated buying at predetermined times also made the list.

Market manipulation through application programming interface orders presents additional concerns for regulators. The automated nature of API-based trading allows manipulators to execute complex strategies at scale.

Social media platforms have become tools for spreading false information about virtual assets. These coordinated misinformation campaigns can trigger artificial price movements and harm retail investors.

The FSS plans to develop sophisticated detection capabilities using artificial intelligence technology. The new system will analyze virtual assets experiencing abnormal price surges within seconds or minutes.

Automated extraction functions will identify suspect trading periods and participant groups. Text analysis powered by AI will examine communications and social media posts for manipulation indicators.

Fraudulent transactions remain a persistent threat to market integrity and investor protection. The combination of human oversight and technological tools aims to create a more robust enforcement framework.

Regular monitoring of high-risk trading patterns will enable faster regulatory responses. The FSS expects these measures to deter potential manipulators and restore confidence in virtual asset markets.

Digital Asset Framework Prepares for Phase-2 Legislative Implementation

The Financial Supervisory Service recently formed a preparatory group for the Digital Asset Basic Act. This team will support the effective rollout of phase-2 virtual asset legislation currently under development.

The preparatory group’s mandate includes creating comprehensive regulatory frameworks for market participants.

Coordination with lawmakers and industry stakeholders will ensure practical implementation of new legal requirements.

Disclosure systems for virtual asset issuance and transaction support are under active development. The preparatory team will establish standardized reporting requirements for token launches and trading platforms.

Transparency measures aim to provide investors with essential information for informed decision-making. Clear disclosure standards will also help distinguish legitimate projects from potentially fraudulent schemes.

Licensing review procedures for digital asset operators and stablecoin issuers require detailed operational manuals. The FSS will create guidelines covering application processes, compliance requirements, and ongoing obligations.

Stablecoin issuers face particular scrutiny given their role in maintaining price stability mechanisms. Digital asset service providers must demonstrate adequate technical capabilities and financial stability for licensure.

The regulatory body plans to enhance virtual asset exchange fee management and disclosure practices. Current fee structures lack standardization across different trading platforms and service types.

Refined disclosure requirements will enable users to compare costs across exchanges more effectively. The FSS believes transparent fee structures will promote healthy competition and rational consumer choices.

Better fee management should reduce barriers to entry for new market participants while protecting existing users.

Crypto World

Only 130M BDAG Left in BlockDAG’s $0.00025 Entry As DOGE & XRP Chase Gains

2026’s crypto market continues to navigate a period of uncertainty, with volatility, macro pressure, and shifting liquidity shaping short-term price action across major assets. As sentiment stabilizes, traders are closely watching key support zones.

Within this environment, Dogecoin price today is showing signs of stabilization after defending a long-term support range, while the XRP price prediction remains cautious amid ongoing downside pressure and weakening technical momentum. Both assets reflect the broader market’s search for direction.

At the same time, attention is turning toward early-stage opportunities like BlockDAG (BDAG). As it approaches its February 16 exchange launch, its final private sale phase, fixed pricing, and early access structure are drawing interest from traders looking beyond short-term volatility and serious gains..

Target Recovery for Dogecoin Price Today at 0.15

Analysts believe Dogecoin price today is entering a stabilization phase after hitting a long-term support base between 0.105 and 0.110. This specific zone has historically acted as a springboard for multi-month growth during past market cycles. Technical indicators suggest the current Dogecoin price today represents a generational accumulation zone with a very favorable risk-to-reward ratio.

While resistance levels at 0.135 and 0.150 currently cap the upside, the lack of aggressive selling suggests buyers are absorbing the available supply. If the support holds, Dogecoin price today could be positioned for a steady recovery toward its 0.15 target as speculative excess leaves the market.

While resistance levels at 0.135 and 0.150 currently cap the upside, the lack of aggressive selling suggests buyers are absorbing the available supply. If the support holds, Dogecoin price today could be positioned for a steady recovery toward its 0.15 target as speculative excess leaves the market.

Bearish Targets for XRP Price Prediction at 1.00

The current XRP price prediction remains cautious as the asset faces significant downward pressure after crashing 35% from its yearly peak. Despite Ripple securing new licenses in Europe and the UK, and real-world assets on the ledger growing by 270% to 1.47 billion, technical momentum is fading. Technical indicators like the RSI falling to 30 suggest the token is oversold but still vulnerable to further selling.

Looking ahead, the XRP price prediction centers on critical support levels at 1.37 and 1.15 to determine if a rebound is possible. If the current bearish momentum persists and the price breaks below 1.37, analysts warn of a potential crash toward the 1.00 psychological milestone. While institutional interest remains high with 1.3 billion in total inflows, the short-term outlook depends on market stabilization.

Final Countdown: Secure Your 100% Unlocked BDAG Before Feb 16

BlockDAG is entering its final private sale stage at $0.00025 per token, just ahead of its confirmed exchange debut on February 16 at $0.05. This steep pricing gap highlights a shrinking opportunity for early positioning before public trading fully determines valuation.

The project has already secured over $452 million in funding, underscoring strong demand and long-term backing. With only 130 million tokens remaining in this last allocation, the private sale is approaching its definitive end as availability tightens rapidly.

What sets this phase apart is its simplicity and transparency. There are no vesting periods, unlock schedules, or delayed withdrawals. Buyers receive 100% of their tokens directly into their wallets on launch day, ensuring immediate access, full liquidity, and complete control from the outset.

Participants in the private round also gain a meaningful timing advantage, with up to nine hours of early trading access before public markets open. This window allows holders to observe initial liquidity, assess price behavior, and position calmly before wider participation accelerates volatility and demand.

As the February 16 launch draws closer, BlockDAG completes its shift from development to a live market asset. Once the final allocation is filled, private access closes permanently. For investors researching the next big crypto, the combination of early access, instant delivery, and a potential 200× pricing gap defines a closing window that will not reopen.

Key Takeaways

Dogecoin and XRP reflect two very different phases of the current market. Dogecoin price today shows early signs of stabilization after defending a critical long-term support zone, suggesting recovery potential if buying pressure continues to build. In contrast, the XRP price prediction remains cautious, with downside risks still present.

But only one project stands out with a time-sensitive opportunity. What analysts are now calling the next big crypto, BlockDAG, offers a final private sale at $0.00025 before a confirmed $0.05 exchange launch, only 130M tokens left, zero vesting, and up to nine hours of early trading access. With a potential 200× pricing gap and permanent closure once filled, the urgency is real.

Private Sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Morgan Stanley backs Cipher (CIFR) and TeraWulf (WULF), but is cool on Marathon (MARA)

Morgan Stanley initiated coverage of three publicly traded bitcoin mining companies on Monday, backing two names tied to data center leasing while taking a more cautious stance on a miner focused on bitcoin exposure.

Analyst Stephen Byrd and his team started coverage of Cipher Mining (CIFR) and TeraWulf (WULF) with Overweight ratings and set price targets of $38 and $37, respectively. Shares of CIFR are higher by 12.4% Monday to $16.51, while WULF is ahead 12.8% to $16.12.

He also initiated coverage of Marathon Digital (MARA) with an Underweight rating and an $8 target. Shares of MARA are marginally higher on Monday at $8.28.

Byrd’s core argument rests on viewing certain bitcoin mining sites less as crypto bets and more as infrastructure assets. Once a mining company has built a data center and signed a long-term lease with a strong counterparty, he wrote, the asset is better suited to investors who value steady cash flow than to traders focused on bitcoin price swings.

“At a macro level, once a bitcoin company has a built-in data center and entered into a long-term lease with a creditworthy counterparty, that DC’s natural investor habitat is not among bitcoin investors but among infrastructure investors,” Byrd wrote, adding that such assets should be valued for “long-term, stable cash flow.”

To make the point concrete, Byrd compared these facilities to data center real estate investment trusts such as Equinix (EQIX) and Digital Realty (DLR), which he described as “the closest comparable companies to consider when valuing DC assets developed by bitcoin companies.” Their shares trade at more than 20 times forward EBITDA, meaning investors are willing to pay over $20 for every $1 of expected annual operating cash flow because those firms offer scale, diversification and steady growth.

Byrd does not expect data centers developed by bitcoin companies to trade at similar levels, “primarily because these data center REITs have growth potential that a single DC asset does not provide.” Still, he sees room for higher valuations than the market currently assigns.

Cipher sits at the center of that view. Byrd described the company’s data centers as suitable for what he called a “REIT endgame.” “We use the phrase ‘REIT endgame’ to describe our valuation approach because, ultimately, these contracted DCs should be owned by REIT-like investors that appropriately value long-term, low-risk contracted cash flows,” he wrote.

In a simple scenario, a Cipher site that shifts from self-mining bitcoin to leasing space to a large cloud or computing customer could resemble a toll road. Cash flows become predictable. The role of bitcoin fades.

TeraWulf earned a similar framework. Byrd pointed to the company’s history of signing data center agreements and to management’s background in power infrastructure. “TeraWulf has a strong track record of signing agreements with data center customers, and the management team has extensive experience in building a wide range of power infrastructure assets,” he wrote.

He expects the firm to convert sites without bitcoin-to-data-center contracts at a present value of about $8 per watt. His base case assumes the company succeeds in roughly half of its planned annual data center growth of 250 megawatts per year over 2028-2032. In a more optimistic scenario, he assumes that the success rate rises to 75%.

The tone shifted with Marathon Digital. Byrd argued that the company offers “lower potential upside driven by bitcoin-to-DC conversions.” He cited Marathon’s hybrid strategy, which combines mining with data center ambitions rather than fully repurposing sites, along with its focus on maximizing exposure to bitcoin’s price, including issuing convertible notes and using the proceeds to buy bitcoin.

Marathon’s limited history of hosting data centers also weighed on the view. “For MARA, bitcoin mining economics are the dominant driver of the stock’s value,” Byrd wrote.

That focus carries risk. “Fundamentally, we see significant risks to profitability of bitcoin mining, both in the near and long terms,” Byrd added, noting that “the historical ROIC of the bitcoin mining business has been unattractive.”

The coverage lands as investors debate whether bitcoin miners should evolve into power and computing landlords. Morgan Stanley’s answer is selective. Where long-term leases and infrastructure discipline take hold, Byrd sees value. Where mining remains the core business, he sees fewer reasons to expect outsized gains.

Crypto World

BYD Sues U.S. Government Over Tariffs on Chinese Imports

TLDR

- BYD has filed a lawsuit against the U.S. government, challenging tariffs imposed by President Trump using IEEPA.

- The company seeks a refund for tariffs paid since April 2018, claiming they harm its U.S. operations.

- BYD’s lawsuit is the first by a Chinese automaker to challenge U.S. tariffs on imports.

- Despite tariffs, BYD overtook Tesla in 2025 global EV sales, delivering 2.26 million vehicles.

- BYD plans expansion with 13 models, including the U9 Xtreme hypercar, and 3,000 fast-charging stations.

Chinese automaker BYD has filed a lawsuit against the U.S. government over tariffs imposed by President Donald Trump. The lawsuit challenges Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs. BYD also seeks a refund for all levies paid since April 2018 as part of its ongoing dispute.

BYD’s Legal Challenge Against U.S. Tariffs

BYD’s lawsuit is the first by a Chinese carmaker challenging U.S. tariffs on imported goods. The company filed the complaint on January 26 at the U.S. Court of International Trade. In its suit, BYD’s U.S. subsidiaries argue that the IEEPA does not authorize the imposition of tariffs.

The complaint asserts that the word “tariff” is not used within the text of the law, invalidating the basis for the levies. BYD’s suit seeks a refund for the tariffs it has already paid since April 2018.

The company claims the tariffs unfairly impacted its operations in the U.S., which includes sales of buses, commercial vehicles, batteries, and solar panels. The lawsuit also argues that the levies violate international trade principles by imposing excessive costs on foreign businesses operating in the U.S.

Legal Implications and Ongoing Supreme Court Case

In addition to BYD’s lawsuit, the U.S. Supreme Court is reviewing a separate case on the legality of the tariffs. Trade Representative Jamieson Greer confirmed that the Supreme Court is carefully considering the case, given its broad implications.

The decision could affect future tariffs and trade policies, especially regarding their impact on foreign companies and their rights to challenge such measures. Despite the legal actions, the tariffs remain in place for the time being, with BYD pushing forward to protect its interests.

The company’s lawsuit represents a broader push by global businesses to challenge the U.S. government’s use of tariffs under the IEEPA. These legal proceedings are likely to shape future trade policies and enforcement.

BYD Overtakes Tesla in Global EV Sales

Despite pressure from tariffs, BYD surpassed U.S.-owned Tesla in global EV sales, delivering 2.26 million battery-electric vehicles in 2025. The company, originally a battery manufacturer, has expanded into a major EV maker, employing over 120,000 R&D engineers.

BYD’s manufacturing expertise plays a key role in its success, producing components for about a third of the world’s smartphones. The company now offers 13 car models across Europe and the Gulf region, including the high-speed U9 Xtreme hypercar and the Euro NCAP five-star-rated Dolphin. BYD is addressing charging infrastructure with innovative 1-megawatt charging technology and plans for 3,000 fast-charging stations.

Crypto World

Pony AI Begins Mass Production of Robotaxis with Toyota Partnership

TLDR

- Pony AI has started mass production of its autonomous robotaxis in partnership with Toyota, planning 1,000 units this year.

- By 2026, Pony AI aims to operate a fleet of 3,000 autonomous vehicles across mainland China, Europe, and the GCC.

- The robotaxis will feature level 4 (L4) autonomous capabilities, capable of operating without human intervention.

- Pony AI plans to offer affordable robotaxi services, with fares up to 10% lower than regular taxi rides.

- The company’s strategy includes expanding infrastructure, such as ultra-fast charging stations, to support robotaxi growth.

Pony AI has initiated mass production of its autonomous robotaxis in collaboration with Toyota. The company plans to roll out 1,000 driverless cabs this year, with deployment in key cities across mainland China. This move signals a major milestone in the commercialization of autonomous vehicles and the company’s ambitious expansion.

Mass Production of Robotaxis Begins

Pony AI, the Chinese self-driving technology firm, has started the production of its robotaxis in collaboration with Toyota. By the end of 2026, the company expects to operate a fleet of more than 3,000 autonomous vehicles globally. The Guangzhou-based company emphasized the milestone as a new phase in scaling production and commercial deployment.

The development also highlights the deep integration between the partners in autonomous driving technology and vehicle manufacturing. According to the company, the partnership leverages Toyota’s vehicle manufacturing capabilities combined with Pony AI’s advanced self-driving technology.

The vehicles will feature level 4 (L4) autonomous capabilities, meaning they can operate without human intervention under most conditions. As the first step in its global strategy, Pony AI aims to provide autonomous services in mainland Chinese cities and potentially expand to other international markets by 2026.

Pony AI’s Vision for the Future of Autonomous Vehicles

Pony AI has outlined its plans to expand its robotaxi fleet to more than 3,000 units by the end of 2026. The company intends to operate autonomous vehicles not just in China, but also in regions such as Europe and the Gulf Cooperation Council (GCC). The cars will provide affordable mobility options, with fares up to 10% lower than regular taxi services.

Pony AI’s rapid scaling strategy includes establishing the necessary infrastructure for autonomous driving, such as ultra-fast charging stations and battery storage solutions. Pony AI’s collaboration with Toyota aims to create a model for the global autonomous taxi market.

According to financial consultant Ding Haifeng, the combination of self-driving technology and robust vehicle assembly creates a powerful growth engine for the robotaxi industry. With 1,000 driverless cabs set to hit the streets this year, the company is making strides toward widespread adoption and furthering its mission to revolutionize urban transportation.

Crypto World

ETH Movements Hit Peak Levels Since Last August

On-chain data shows ETH transfers climbing to 2.75M as holders rush to stablecoins and exchanges during sharp drawdown.

Ethereum (ETH) has seen a notable rise in on-chain token transfers this week as its price slid from around $3,000 to near $2,000, with activity reaching levels last seen in August 2025, according to data shared by analyst CryptoOnchain.

The surge in token movement points to heavy sell-side pressure and forced repositioning, even as other indicators suggest a tightening supply on exchanges.

Token Transfers Spike as ETH’s Price Drops

CryptoOnchain’s assessment showed Ethereum’s 14-day simple moving average of total tokens transferred climbing from about 1.6 million on January 29 to approximately 2.75 million by February 7. That is the highest reading since August 2025 and came as ETH corrected sharply from the $3,000 area to the low $2,000s.

The divergence between falling prices and rising network activity is often associated with panic-driven behavior, where holders rush to move assets during fast drawdowns.

CryptoOnchain linked the spike to investors rotating into stablecoins, moving funds onto exchanges for sale, and a wave of liquidations across decentralized finance protocols as collateral values fell.

“This significant spike in ERC-20 token transfers during a price crash suggests investors are rushing to exit positions, likely converting volatile assets into stablecoins or moving funds to exchanges for liquidation,” the market observer wrote.

The timing also lines up with a broader market sell-off that saw Bitcoin fall from above $80,000 to near $60,000 before rebounding toward $72,000, while Ethereum struggled to hold key support near $2,000.

Selling pressure has not been limited to smaller holders, with the likes of Ethereum co-founder Vitalik Buterin selling more than 6,100 ETH over several days last week. Other large holders also reduced exposure to repay loans, adding to short-term pressure during the drop.

You may also like:

Exchange Balances Fall Even as Volatility Stays High

Despite the recent rush of token movement, several indicators have also pointed to declining ETH availability on exchanges. According to on-chain detective CoinNiel, Ethereum held on exchanges has fallen to levels last seen in mid-2016. Experts from the Arab Chain platform also added that Binance’s ETH reserves have dropped to about 3.7 million ETH, the lowest since 2024.

The situation has created a mixed picture. On one hand, ETH’s price action remains weak, with the asset currently trading around $2,040, down about 3% over the past 24 hours and nearly 11% in the last seven days. The token briefly dipped below $1,900 on February 5, per data from CoinGecko, before recovering to its current level.

On the other hand, falling exchange balances suggest fewer coins are readily available for spot selling, and some of the recent transfers may reflect stress-driven repositioning rather than long-term distribution. According to CryptoOnchain, similar spikes in transfer activity during past drawdowns have sometimes occurred near local lows, once forced selling eased.

For now, Ethereum sits between ongoing volatility and shrinking exchange supply, with on-chain data showing fear-driven movement even as longer-term holders continue pulling coins off trading platforms.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

EU Launches NanoIC, Europe’s Largest Chips Act Pilot Line

TLDR

- The EU has launched NanoIC, its largest Chips Act pilot line, with €700 million in funding to advance semiconductor capabilities.

- NanoIC will use extreme ultraviolet lithography to produce semiconductors beyond two nanometres, crucial for AI and 6G tech.

- The facility at IMEC Leuven allows open access for start-ups, researchers, and large organizations to collaborate on chip designs.

- The EU aims to increase semiconductor production to 20% of global output by 2030, with NanoIC playing a key role.

- NanoIC’s €2.5 billion investment includes funding from the EU, national governments, and industry partners like ASML.

The European Union has launched NanoIC, the largest pilot line under its Chips Act initiative. The €2.5 billion project aims to enhance Europe’s semiconductor capabilities. The EU has committed €700 million, with additional funding from national governments and industry partners.

NanoIC to Boost Europe’s Semiconductor Manufacturing Capabilities

The NanoIC facility at IMEC Leuven will be Europe’s first to deploy the latest extreme ultraviolet lithography machine. This technology will allow for the manufacturing of semiconductors beyond two nanometres.

The project aims to improve the development of next-generation semiconductor technologies, crucial for AI, autonomous vehicles, healthcare, and 6G mobile technologies.

The NanoIC facility will help Europe compete with global semiconductor leaders, allowing institutions and companies to test chip designs at a near-industrial scale.

The facility provides open access, enabling start-ups, researchers, and large organizations to collaborate on new chip designs. The partnership between the EU, IMEC, and several other organizations ensures that the facility can rapidly scale and contribute to the European semiconductor ecosystem.

European Union Investment and Strategic Collaborations

The €700 million in EU funding is part of a €2.5 billion total investment in the NanoIC project. This collaboration includes national and regional government contributions, along with investments from industry partners such as ASML.

The Chips for Europe initiative, supported by NanoIC, aims to strengthen Europe’s position in the global semiconductor market and attract talent to the region. The opening of NanoIC marks a step in Europe’s plan to develop a self-sustaining semiconductor industry.

The facility’s open-access approach allows multiple stakeholders to benefit from advancements in semiconductor manufacturing. By 2030, the European Union aims to produce at least 20% of the world’s semiconductors, with this facility playing a key role in meeting that target.

Crypto World

Trading Techniques of the Inside Bar Pattern

Candlestick patterns are an important part of a comprehensive trading strategy. However, it may be difficult to choose the pattern you can rely on. In this case, traders focus on the most popular setups that have proven to work across various markets and timeframes. One of such patterns is the inside bar pattern.

In price action trading, the inside bar is often analysed as a pause in market structure, reflecting short-term volatility compression that may lead to either trend continuation or trend reversal.

In this article, we will break down the basics of the inside bar pattern, examine examples of this formation on real-market price charts, and discuss how to interpret its signals for trading purposes.

What Is an Inside Bar Candle Pattern?

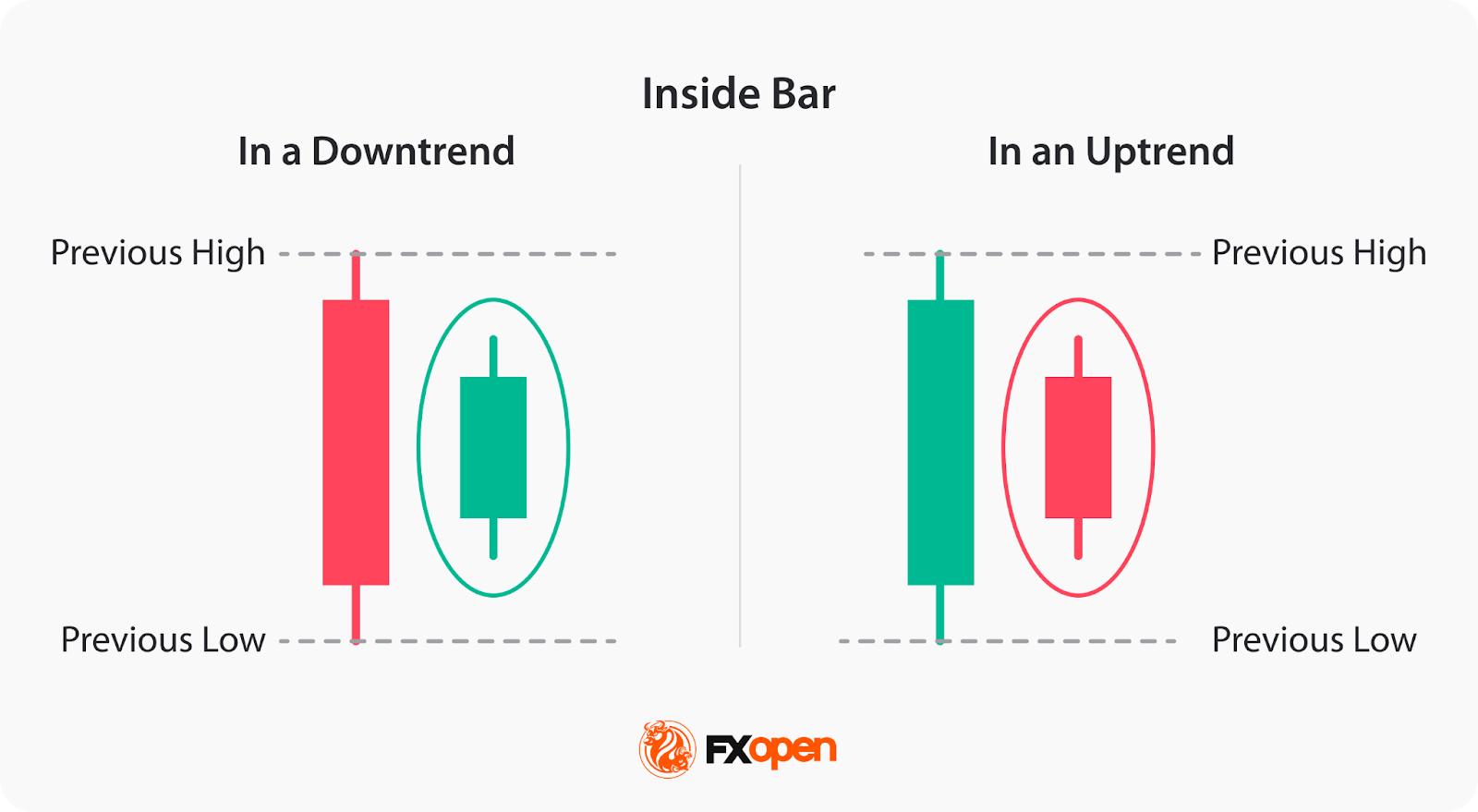

An inside bar is a two-candlestick formation that appears on a price chart when a candlestick’s high and low range is contained within the high and low range of the preceding candle. In other words, the entire price action of one candle is confined within the previous candlestick’s price range.

The preceding candle is commonly referred to as the mother bar, while the following candle is the inside bar itself. This formation highlights range contraction and a brief consolidation phase, where buying and selling pressure temporarily reach equilibrium.

Still, the pattern doesn’t signal a trend reversal or a trend continuation. The price may continue moving in the prevailing trend or turn around. Also, the pattern may appear in both an uptrend and a downtrend.

The inside bar can be observed across different financial instruments such as stocks, cryptocurrencies*, ETFs, indices, and forex currency pairs and can be traded using contracts for difference (CFDs) provided by FXOpen. In the forex market, traders most often apply the inside bar pattern to liquid currency pairs, where higher trading volume may support trade execution.

Identifying the Inside Bar on Trading Charts

To identify this formation on trading charts, traders follow these steps:

- Look for two candlesticks: Traders start by identifying two candlesticks that look like the inside bar.

- Compare the high and low range: After that, they check if the high and low range of the subsequent candle, inside bar, is entirely contained within the high and low range of the preceding candlestick, mother bar.

- Confirm the pattern: Once they identify that the subsequent candle meets the criteria, traders confirm it as an inside bar.

The reliability of the pattern’s signals may vary by timeframe, with many traders favouring the H1, H4, or daily charts, as higher timeframes tend to filter out market noise and reduce the risk of false breakouts.

In the forex market, inside bars tend to form more frequently during lower-liquidity periods, such as the Asian session, while breakouts are more commonly observed during high-liquidity phases like the London and New York session overlap.

Many traders incorporate multi-timeframe analysis when evaluating inside bar setups. A formation that appears on a lower timeframe but aligns with a higher-timeframe trend or key level may carry more significance than a pattern that develops in isolation. For example, an inside bar forming on an hourly chart within a daily uptrend may be interpreted as a continuation signal rather than a reversal attempt, particularly when supported by broader market structure.

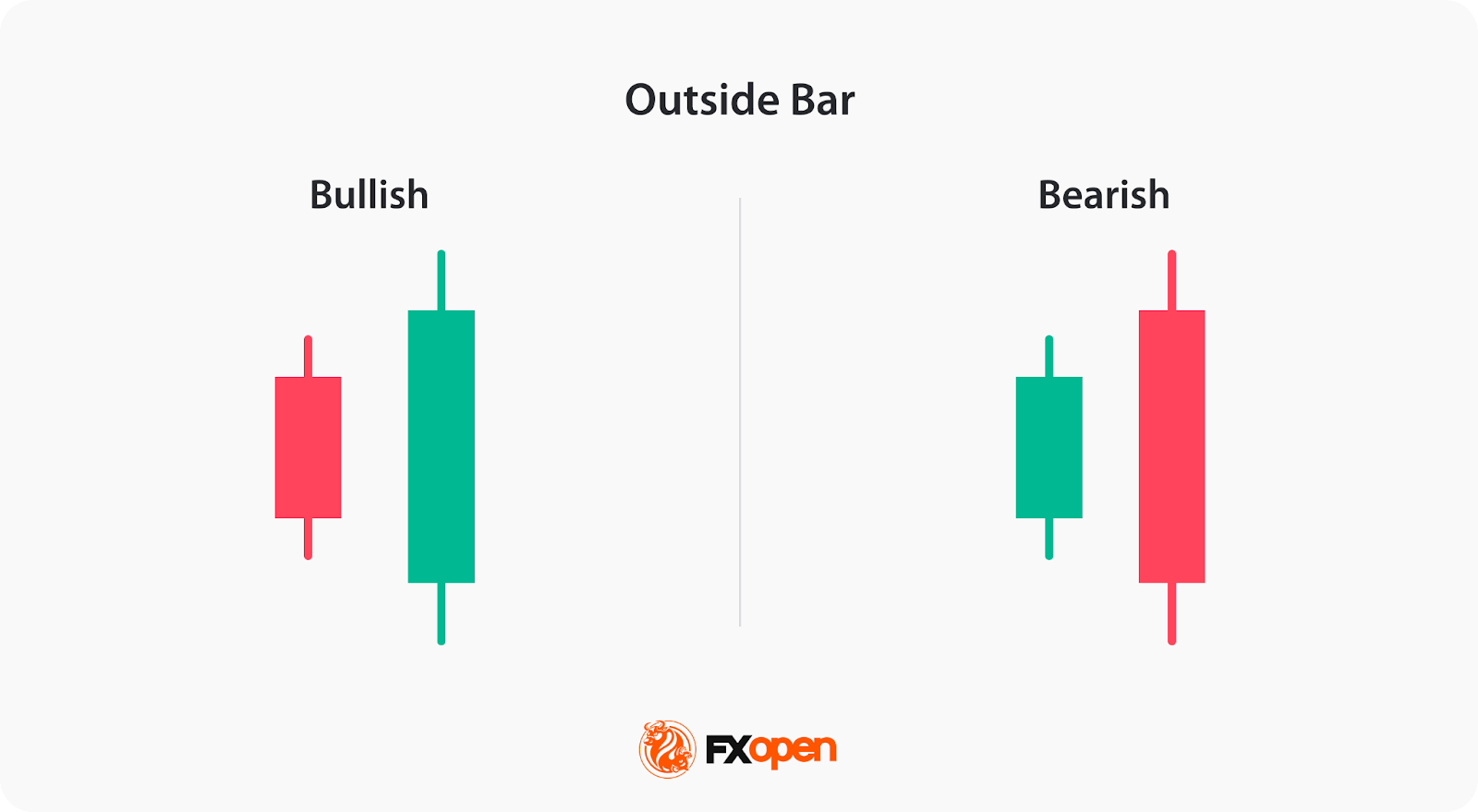

Inside Bar vs Outside Bar

The inside candle pattern occurs when the high and low of a candle are contained within the range of the preceding candlestick, indicating consolidation or indecision in the market. It suggests a potential reversal or continuation of the current trend.

On the other hand, an outside bar—often considered a form of engulfing pattern—appears when a candlestick completely exceeds the previous candle’s high–low range. As Al Brooks defines it in his Trading Price Action Trends, an outside bar occurs when “the high of the current bar is above the high of the previous bar and the low is below the low of the previous bar,” reflecting increased participation from both buyers and sellers. A bearish outside setup typically forms near the top of an uptrend and may signal a downward reversal, while a bullish outside setup forms near the bottom of a downtrend and may suggest an upward reversal.

While the inside bar reflects volatility compression and consolidation, the outside bar typically signals volatility expansion and a stronger momentum shift in price action. Both are widely used by traders for technical analysis and identifying potential trades.

Traders can analyse outside and inside bars on forex, stocks, and other markets using the FXOpen TickTrader platform.

Trading the Inside Bar Pattern

Trading with the inside bar candlestick pattern involves using it as a signal for potential breakouts or continuation of the prevailing trend. Here are the steps traders usually follow when trading with the pattern:

Determine the Direction of the Preceding Trend

Traders may use trendlines or moving averages (EMA or SMA) to define overall market bias and confirm trend direction.

When the formation develops within a strong, established trend and aligns with that trend’s direction, it is typically interpreted as a continuation setup. However, when the same structure appears after an extended directional move and forms at significant technical levels such as higher-timeframe support, resistance, or supply and demand zones, it may instead reflect trend exhaustion and potential reversal conditions. For this reason, traders evaluate both trend context and location before assigning directional bias to the pattern.

In some cases, several inside bars may form consecutively, creating a coiling pattern that reflects extended price compression and can precede a stronger volatility expansion.

Wait for a Breakout

The formation indicates consolidation and potential price compression. Traders often wait for a breakout from the setup’s range to initiate a trade. A breakout above the high of the formation suggests a bullish signal, while a breakout below the low indicates a bearish signal.

However, failed or false breakouts—sometimes referred to as fakey setups—can occur when price briefly breaks the mother bar range before reversing, often due to low liquidity or weak momentum.

Breakouts that occur near key support and resistance levels confirmed by additional tools are often considered stronger. John Murphy’s Technical Analysis of the Financial Markets highlights the value of indicators such as RSI and MACD in confirming breakout strength. Low-volume moves carry a higher risk of false breakouts.

Some traders monitor these false breaks as potential reversal signals, particularly when they occur against an extended trend.

Consider Additional Confirmation

Many traders wait for 2-3 candlesticks to form in a breakout direction. Also, to avoid false breakouts, traders may look for additional confirmation indicators to support their trading decisions. An increasing volume at the breakout or a signal from a trend indicator may provide additional confluence. Common confirmation tools include Average True Range (ATR) and volume indicators, which may help assess volume and volatility conditions.

Set Their Entry Points

Traders typically apply several entry models when trading an inside bar setup. The most common approach is a breakout entry using stop orders placed beyond the high or low of the mother bar.

In trend-continuation conditions, traders may also use a break-and-retest model, entering after price closes beyond the formation and then retests the breakout level as support or resistance.

Set Stop-Loss and Take-Profit Orders

Although there are no strict rules, traders typically set stop-loss orders above the bearish and below the bullish pattern, considering the timeframe and the entry point, so they aren’t too wide. Some traders trail stops below swing highs or lows during strong trends. Monitoring volatility through tools such as ATR may also help traders determine whether to widen or tighten stops as the market transitions from consolidation to expansion.

For take-profit targets, traders might consider significant swing points or key support/resistance levels. As part of risk management, traders often apply predefined risk-to-reward ratios (such as 1:2 or 1:3) and adjust position sizing.

Live Market Example

Below, we provide an example of an inside bar breakout strategy with a bullish inside bar stock pattern on a Tesla chart. This setup represents a typical bullish continuation pattern, where the breakout is confirmed by candles closing above the mother bar’s high and holding above a nearby resistance level.

Following the inside bar breakout trading strategy, the trader waits for the breakout above the high of the mother bar marked by a horizontal line. The stop loss is set below the candle’s low, and the take profit is at the next resistance level.

Final Thoughts

While the inside bar pattern can be a useful tool for identifying trend reversals and continuations, it’s important not to rely solely on this pattern for your trading decisions. In practice, traders often combine the inside bar with technical indicators, broader market context, and structured risk management tools to form a complete trading strategy.

If you want to develop your own trading strategy, you can use FXOpen’s TickTrader trading platform. If you have a strategy and you would like to trade it across over 700 instruments with tight spreads and low commissions (additional fees may apply), you can consider opening an FXOpen account.

FAQ

Is an Inside Bar Bullish or Bearish?

The inside bar setup does not inherently indicate a bullish or bearish bias. It simply represents a period of consolidation or market indecision. Thus, a formation in an uptrend can be bullish and signal a continuation of the trend, or bearish and signal a trend reversal. The same concept applies to a downtrend, where the indicator may be bearish and the trend will continue, or bullish and the trend will reverse.

What Does a Bullish Inside Bar Mean?

The meaning of an inside bar candle pattern that is bullish refers to the pattern, after which the price moves upwards. When this pattern forms during an uptrend, it suggests a temporary pause or consolidation before the uptrend potentially resumes. When it is formed in a downtrend, it signals a trend reversal.

What Is the Inside Bar Strategy?

In the inside bar strategy, traders wait for the pattern to form and look for a breakout above the high of the formation to enter a long position or below the low to enter a short trade. A stop-loss order might be placed below the low of the pattern in a long trade and above the high of the pattern in a short trade. Profit targets can be determined based on the trader’s trading plan, technical indicators, or key support and resistance levels.

How May You Confirm an Inside Bar Signal?

As the inside bar provides both continuation and reversal signals, it is critical to confirm them. First, traders wait for the pattern to form and the following candles to close above or below it. Second, traders use volume or momentum indicators to identify the strength of the price movements. Another option is to use chart patterns that also provide continuation or reversal signals. Confirmation may also come from alignment with support and resistance or volatility conditions measured by ATR.

Are Inside Bars More Popular in Downtrends?

No, the inside bar pattern can be used in both uptrends and downtrends. No statistics can confirm that the pattern is more preferable in a downtrend. Traders can use it in their trading strategies regardless of the trend they trade in.

Which Timeframe Is Most Popular for Inside Bar Trading?

The inside bar pattern can form on any timeframe, but many traders consider it more reliable on higher timeframes, such as the H1, H4, and daily charts. Higher timeframes tend to reduce market noise and filter out minor price fluctuations, which may lower the risk of false breakouts. Lower timeframes, such as 5-minute or 15-minute charts, can also be used, but they often require stricter confirmation and more active risk management.

Is the Inside Bar a Breakout or Continuation Pattern?

The inside bar is described as a neutral consolidation pattern rather than a strictly breakout or continuation setup. It reflects a pause in price action caused by range contraction and reduced volatility. Depending on market context, an inside bar may lead to a breakout, signal a trend continuation, or occasionally precede a trend reversal. Traders usually rely on the prevailing trend, support and resistance levels, and confirmation tools, such as momentum readings from RSI or MACD, increased volume, or volatility conditions measured by ATR, to determine how to trade the setup. However, in the Encyclopedia of Chart Patterns, Bulkowski presents that the pattern provides continuation signals in 62% of cases.

How Reliable Is the Inside Bar in Forex Trading?

The reliability of the inside bar in forex trading depends largely on market conditions and confirmation. The common required conditions for any trade are liquid currency pairs and active trading sessions, such as the London or New York sessions. When combined with tools like support and resistance, momentum indicators, and clear risk management rules, the inside bar can be a useful component of a broader trading strategy. On its own, however, it should not be treated as a guaranteed signal.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat19 hours ago

NewsBeat19 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business24 hours ago

Business24 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports14 hours ago

Sports14 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat9 hours ago

NewsBeat9 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know