Crypto World

DAO Development for Regulated Stablecoin Ecosystems

Over the past five years, DAOs promised borderless governance, permissionless finance, and community-driven growth. Today, a new reality is reshaping this vision. Regulation is no longer operating in the background. It is now directly influencing how DAOs design their governance, manage treasuries, and build trust with investors and institutions. At the same time, stablecoins have become the primary settlement layer for Web3 economies. For founders, investors, and governance leaders, this shift raises critical questions. How do you remain decentralized while meeting compliance expectations? How do you protect treasury assets from regulatory risk? How do you design governance systems that institutions can trust? This blog answers those questions.

Inside, you will learn how regulation is transforming DAO architecture, why traditional governance models are losing credibility, and how modern DAO development is evolving into a scalable, institution-ready framework. If you are building, investing in, or advising a DAO, this guide will help you make informed decisions for long-term growth in regulated stablecoin ecosystems.

How Stablecoin Regulation Is Reshaping DAO Architecture

Governments worldwide are implementing formal rules for stablecoin issuance, custody, and settlement, fundamentally reshaping how DAOs operate in regulated financial environments and accelerating the demand for advanced DAO development frameworks. In the United States, authorities are enforcing reserve audits and issuer licensing, while the European Union is advancing MiCA compliance frameworks. Across Asia, regulators are strengthening payment-token supervision models, and Middle Eastern jurisdictions are establishing dedicated digital asset oversight authorities.

As regulated stablecoins become the dominant settlement layer, DAOs integrating them are now expected to meet higher operational standards, including full treasury transparency, automated KYC and AML compliance layers, real-time transaction monitoring systems, and clearly defined governance accountability norms. As a result, traditional anonymous treasury and token-based voting models are becoming structurally weak and increasingly incompatible with institutional and regulatory expectations.

What Changes Inside a DAO?

Modern DAO architecture is shifting toward:

- Segmented treasury wallets

- Role-based governance permissions

- Regulated payment rails

- Smart-contract compliance logic

- Hybrid on-chain/off-chain reporting

This transformation is being led by specialized DAO development company providers that understand both blockchain engineering and regulatory frameworks.

Prepare your DAO for regulation-driven stablecoin ecosystems today

Why Traditional DAO Governance Models Are Breaking

As regulatory expectations reshape DAO infrastructure and treasury operations, governance frameworks are now being examined more closely, pushing projects to rely on advanced DAO development services for compliance-ready design. Structures that once worked in loosely regulated environments are increasingly proving inadequate in a modern, compliance-driven ecosystem.

1. Token Voting Limits

Token-based governance is facing growing structural limitations as DAOs scale and attract regulatory attention. Three major challenges now define voting systems: capital concentration, low participation rates, and regulatory scrutiny.

In many DAOs, less than five percent of token holders control more than eighty percent of voting power. Regulators increasingly view this imbalance as centralized influence presented as decentralization, weakening institutional trust.

2. Treasury Risk Levels

As DAOs accumulate large reserves in regulated stablecoins, treasury operations are becoming more vulnerable to compliance and jurisdictional risks.

Key exposure points include account freezes, regulatory investigations, jurisdictional conflicts, and dependency on traditional banking relationships. These risks remain fragmented and largely unmanaged without professional DAO platform development.

3. Governance Standards

Modern governance systems are expected to function with the same transparency and accountability as financial institutions.

Future-ready DAOs must demonstrate clear decision traceability, financial accountability, conflict resolution mechanisms, and legal clarity across jurisdictions. Governance is no longer defined by voting alone. It is now measured by institutional credibility and operational discipline.

The New Compliance-Ready Stablecoin-Based DAO Operating Model

The Rise of “Regulated-Native” Stablecoin DAOs

As regulated stablecoins become the foundation of on-chain payments and treasury management, next-generation DAOs are being designed from day one to operate within compliant financial ecosystems.

These modern governance frameworks are built to support:

- Stablecoin licensing alignment

- Multisig compliance approval flows

- Automated reporting dashboards

- Smart-contract risk monitoring

- Legal wrapper integration

Implementing these systems at scale requires professional DAO development services rather than fragmented, do-it-yourself governance frameworks.

Core Layers of a Future-Ready DAO

| Layer | Function |

|---|---|

| Governance | Role-based voting and accountability |

| Treasury | Segmented regulated wallets |

| Compliance | Automated AML and KYC systems |

| Reporting | Real-time audit dashboards |

| Operations | Smart workflow management |

This modular architecture allows stablecoin-powered DAOs to scale across jurisdictions while minimizing regulatory friction and operational risk.

Why Investors Are Repositioning Around Regulated DAOs

As governance models mature and compliance becomes a defining success factor, the way capital evaluates decentralized organizations is undergoing a fundamental shift. What once attracted speculative funding now demands structural credibility, financial transparency, and regulatory preparedness.

Capital Is Moving Toward Compliance-Ready Projects

Institutional and venture capital are no longer chasing hype-driven DAO experiments. Instead, serious investors are reallocating funds toward projects that demonstrate regulatory awareness, financial discipline, and long-term governance stability, often backed by professional DAO development services that ensure regulatory and technical alignment from day one.

Today, capital is increasingly flowing into DAOs that operate within structured ecosystems, including:

- RWA-backed governance networks

- Stablecoin-powered payment infrastructures

- Regulation-aligned DeFi protocols

- Institutional-grade treasury platforms

These projects signal operational maturity, a key factor in modern investment decisions.

How Investors Evaluate DAOs in 2026?

Investor due diligence has evolved beyond token metrics and community size. Leading funds now assess DAOs using governance, compliance, and sustainability indicators such as:

- Legal survivability across jurisdictions

- Governance resilience under regulatory pressure

- Exposure to stablecoin issuer risk

- Ability to adapt to changing compliance frameworks

These factors determine whether a DAO can scale responsibly in global markets.

The New Institutional Due Diligence Checklist

Before allocating capital, most professional investors now require evidence of:

- Verified treasury compliance

- Assessed stablecoin counterparty risk

- Documented governance audit trails

- Mapped jurisdictional exposure

- Automated financial reporting systems

DAOs that fail to meet these benchmarks are increasingly excluded from institutional portfolios, regardless of their technical innovation.

Build compliant DAO platforms without sacrificing decentralization.

How Founders Should Rebuild DAO Strategy in 2026

Step 1: Redesign Governance Architecture

Founders must move beyond token-only voting toward:

- Weighted governance systems

- Committee-based approvals

- Regulatory oversight nodes

- Emergency intervention layers

Step 2: Professionalize Treasury Operations

Treasury must function like a fintech institution:

- Regulated custody

- Multi-jurisdiction banking

- Stablecoin diversification

- Risk hedging

Step 3: Implement Compliance Automation

Manual compliance does not scale.

Modern DAOs use:

- On-chain identity modules

- Smart AML triggers

- Reporting oracles

- Audit automation

Step 4: Choose the Right DAO Development Partner

Not every blockchain agency understands regulatory engineering.

Working with experienced providers in DAO infrastructure ensures:

- Long-term scalability

- Legal adaptability

- Institutional readiness

Conclusion: The Next Decade Belongs to Compliance-Native DAOs

The future of DAOs belongs to projects that combine decentralization with regulatory readiness. As stablecoins become the backbone of Web3 finance, governance models, treasury systems, and reporting structures must evolve to meet institutional and legal expectations. For founders, investors, and compliance leaders, this is no longer a theoretical shift. It is a strategic decision point.

Working with professional DAO development company ensures your DAO is built for scalability, transparency, and long-term resilience in regulated ecosystems. This is where Antier plays a critical role. With deep expertise in governance engineering and compliance-focused infrastructure, we help DAOs transition from experimental frameworks to enterprise-ready platforms.

Frequently Asked Questions

01. How is regulation impacting the governance of DAOs?

Regulation is directly influencing how DAOs design their governance, manage treasuries, and build trust with investors and institutions, leading to higher operational standards and transparency requirements.

02. What are the key changes in modern DAO architecture?

Modern DAO architecture is evolving to include segmented treasury wallets, role-based governance permissions, regulated payment rails, and smart-contract compliance to meet regulatory expectations.

03. Why are traditional governance models losing credibility in the context of DAOs?

Traditional anonymous treasury and token-based voting models are becoming structurally weak and increasingly incompatible with institutional and regulatory expectations, prompting a shift toward more transparent and accountable governance systems.

Crypto World

ARK Invest Snaps Up $33M in Robinhood Shares Amid Bitcoin Dip

ARK Invest, the investment firm led by Bitcoin bull Cathie Wood, snapped up a significant batch of crypto-linked stocks on Wednesday as BTC briefly dipped below $66,000.

ARK purchased 433,806 shares of Robinhood (HOOD) for approximately $33.8 million, according to a trade notification reviewed by Cointelegraph.

The asset manager also boosted its exposure to crypto exchange Bullish (BLSH) and USDC (USDC) issuer Circle (CRCL), acquiring 364,134 shares valued at $11.6 million and 75,559 shares worth $4.4 million, respectively.

The purchases came as all three stocks traded lower on the day, with Robinhood shares sliding nearly 9%, according to TradingView data.

ARK withheld from buying more Coinbase (COIN) shares after dumping $17 million of the stock last week.

Robinhood becomes top crypto holding in ARK’s flagship fund

ARK’s latest Robinhood acquisition coincided with the company’s official testnet launch of the Robinhood Chain, a permissionless layer 2 (L2) blockchain built for financial services and tokenized real-world assets (RWAs).

Earlier this week, Robinhood reported record net revenue of nearly $1.28 billion for the fourth quarter of 2025. While revenue surged 27% year over year, it fell short of Wall Street expectations of $1.34 billion, sending the stock down about 8%.

As of Feb. 11, Robinhood stands as the largest crypto-linked position in ARK’s flagship ARK Innovation ETF (ARKK), accounting for roughly 4.1% of the portfolio, or about $248 million, according to the fund’s data.

Spot Bitcoin ETFs mirror BTC weakness as inflows stall

Broader market weakness has spilled over into US spot Bitcoin (BTC) exchange-traded funds (ETFs), which failed to sustain momentum after a three-day inflow streak.

According to SoSoValue data, Bitcoin ETFs recorded $276.3 million in net outflows on Wednesday, nearly wiping out weekly gains, which now stand at just $35.3 million. Total assets under management declined to $85.7 billion, the lowest level since early November 2024.

Ether (ETH) ETFs also posted losses, with daily outflows totaling $129.2 million. XRP (XRP) funds saw no inflows, while Solana (SOL) ETFs recorded modest inflows of roughly $0.5 million.

Related: Strategy CEO eyes more preferred stock to fund Bitcoin buys

At the time of publication, Bitcoin was trading at $67,227, up 0.4% over the past 24 hours, according to CoinGecko.

The latest pullback comes after analysts had pointed to a potential inflection point in crypto investment products following three consecutive weeks of outflows totaling more than $3 billion.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

BNB Chain real-world assets soar 555% on institutional demand

BNB Chain’s real-world assets surged 555% in Q4 2024 as institutions tokenized funds and stocks, even as BNB’s market cap and DeFi TVL faced volatility.

Summary

- Real-world asset value on BNB Chain climbed 555% year over year in Q4 2024, making it the second-largest RWA network behind Ethereum.

- Institutional players tokenized money market funds, U.S. stocks, and ETFs via partners like CMB International, Ondo Global Markets, and Securitize.

- Despite a Q4 BNB market-cap drop and softer DeFi TVL, network activity, stablecoin supply, and infrastructure upgrades continued to strengthen.

Real-world assets on BNB Chain (BNB) expanded 555% year over year in the fourth quarter of 2024, driven by institutional capital inflows and stablecoin growth, according to a report by research firm Messari.

The blockchain network ranked second among all blockchains by real-world asset value at quarter-end, surpassing Solana and trailing only Ethereum, the report stated. The growth occurred despite a decline in the network’s native token price during the period.

BNB Chain’s native token market capitalization fell quarter over quarter following an industry-wide liquidation event on Oct. 11 that pressured cryptocurrency markets, according to Messari. The token had reached a record high in mid-October before declining through year-end. The token remained the third-largest cryptocurrency by market capitalization at quarter-end, behind Bitcoin and Ethereum.

Network activity strengthened during the quarter, with average daily transactions rising substantially from third-quarter levels, the report said. Daily active addresses also increased, with early October volatility causing a brief spike in activity. Excluding that surge, usage remained above third-quarter levels, indicating steady user growth, according to Messari.

Total real-world asset value on BNB Chain rose sharply from the third quarter and increased 555% from the prior year, the research firm reported.

Institutional partnerships drove the expansion. In October, BNB Chain partnered with CMB International to launch a tokenized money market fund. Ondo Global Markets subsequently added more than 100 tokenized U.S. stocks and exchange-traded funds to BNB Chain, expanding offerings beyond money market funds into equities. In November, a major institutional fund issued through Securitize expanded to BNB Chain, according to the report.

Real-world asset value remained concentrated in a small number of products. A single product accounted for the majority of total value, followed by another representing approximately one quarter, Messari stated. Other assets, including Matrixdock Gold and VanEck’s Treasury Fund, held smaller amounts. Tokenized shares of major companies represented a small portion of overall value.

BNB pivoting towards real-world assets

Decentralized finance activity slowed during the fourth quarter, with total value locked declining from third-quarter levels, the report said. Total value locked remained above year-earlier levels, and BNB Chain ranked as the third-largest network by that metric.

PancakeSwap remained the largest decentralized finance platform on the network, holding a significant portion of total value locked and controlling approximately one-third of the market, according to Messari. Its total value locked declined by a small amount, indicating user and fund retention. Other protocols experienced declines following liquidity withdrawals and reduced borrowing demand, with smaller projects affected most significantly as traders reduced risk exposure.

Stablecoin supply on BNB Chain increased during the quarter, with total stablecoin value rising, the report stated. One major stablecoin remained the largest after posting gains. Another prominent stablecoin grew substantially, aided by payment use cases and gas-fee discounts.

New partnerships expanded payment applications on BNB Chain. A payments network added support for multiple stablecoins to settle cross-border transfers on-chain and later enabled cloud-service customers to pay for services using BNB through the system, according to Messari. A new stablecoin launched in December allowing users to mint tokens using major stablecoins as collateral.

BNB Chain deployed several upgrades in 2024, including Pascal, Lorentz, Maxwell, and the ongoing Fermi hardfork, the report said. Block times decreased and transaction finality improved. Network capacity more than doubled, and gas fees fell sharply.

The protocol’s 2025 plans target approximately 20,000 transactions per second with sub-second finality, according to the report. The development team plans to integrate off-chain computing with on-chain verification to process additional transactions without performance degradation. Long-term development includes a trading-focused chain designed for near-instant confirmation, Messari stated.

Crypto World

Bitcoin price prediction as BTC ETFs break three-day inflow streak

Bitcoin prices traded cautiously after US-listed spot Bitcoin ETFs snapped a three-day inflow streak, adding pressure to an already fragile market structure.

Summary

- Bitcoin traded cautiously near $67,000 after US-listed spot Bitcoin ETFs ended a three-day inflow streak, flipping back to net outflows.

- ETF flow data points to waning institutional demand, reinforcing fragile market structure amid ongoing price consolidation.

- Technically, BTC remains well below its 50-day moving average, with RSI in the low-30s, keeping near-term momentum tilted to the downside.

Bitcoin price struggles as ETF momentum stalls

Bitcoin (BTC) was trading around $67,000 at press time, struggling to attract strong upside follow-through after recent attempts to stabilize.

ETF flow data shows Bitcoin spot ETFs recorded steady inflows over the previous three sessions, signaling a brief return of institutional demand as BTC attempted to stabilize near $67,000.

However, that trend reversed in the latest session, with net outflows replacing inflows, suggesting renewed caution among investors amid ongoing price consolidation.

The halt in ETF inflows comes as broader risk sentiment remains mixed, with traders closely watching whether institutional demand can reassert itself after weeks of volatility.

Bitcoin price action weak below key moving average

The daily chart shows Bitcoin remains well below its 50-day simple moving average, which is currently hovering near $85,000. This large gap highlights the depth of the recent correction and signals that the broader trend remains under bearish control.

Meanwhile, the Relative Strength Index (RSI) is holding below the neutral 50 level. It sits in the low-30s, suggesting bearish momentum is still dominant, even as selling pressure has eased compared with January’s sharp breakdown.

On the downside, immediate support sits near $66,500–$66,000, a level that has repeatedly attracted buyers in recent sessions. A decisive break below this zone could expose Bitcoin to deeper losses toward $64,000, followed by a broader psychological support area near $60,000.

On the upside, initial resistance is located around $70,000, where prior rebound attempts have stalled. Beyond that, stronger resistance emerges near $74,000–$75,000, a former support zone that now acts as a selling area.

A sustained move above these levels would be required to signal a shift in near-term momentum.

Overall, Bitcoin remains in a consolidation phase following a sharp correction, with ETF flow data and broader market sentiment likely to determine whether BTC breaks higher or resumes its downward trend in the days ahead.

Crypto World

Thailand recognizes cryptocurrencies under the Derivatives Trading Act

Thailand has officially recognized cryptocurrencies as an underlying asset under the Derivatives Trading Act.

Summary

- Thailand has formally recognized cryptocurrencies like Bitcoin as underlying assets under the Derivatives Trading Act.

- The SEC will draft rules to support crypto-linked derivatives and review licenses for exchanges and brokers.

According to a Bangkok Post report, the Thai government approved the Finance Ministry’s proposal to allow cryptocurrencies to be used as the foundation for regulated futures and options contracts within the country’s derivatives on Feb. 10.

Under the new guidelines, cryptocurrencies like Bitcoin will be classified as “permissible goods and variables,” according to SEC secretary-general Pornanong Budsaratragoon, whose department put forward the proposal in early 2026.

The SEC will now draft the specific regulatory requirements for market participants, which include amending derivatives business licenses to allow existing digital asset operators to offer these new contracts and establishing strict contract specifications to mitigate the unique volatility risks associated with crypto assets.

Budsaratragoon said the amendments will help promote market inclusiveness and allow investors to diversify their portfolios, while also improving risk management.

Further, the SEC will collaborate with the Thailand Futures Exchange to make way for the launch of its first suite of crypto-linked derivatives, including Bitcoin futures. It is currently reviewing the existing licensing framework to ensure that broker and clearing houses are aligned to offer these new products, the report said.

As part of the amendment, carbon credits are also being classified as variables instead of goods, which means Thai investors will soon be able to access physically delivered carbon credit futures.

The SEC’s 2026 roadmap also includes plans to roll out crypto exchange-traded funds as it looks to position itself as a regional crypto trading powerhouse.

Last month, the SEC’s deputy secretary-general, Jomkwan Kongsakul, said that the commission plans to launch crypto ETFs in Thailand “early this year.”

Thailand is also eyeing crypto use in the tourism sector. Thailand’s Deputy Prime Minister Pichai Chunhavajira introduced the TouristDigiPay initiative last year to bolster the country’s tourism sector by allowing travelers to convert their digital assets into the local fiat currency.

Crypto World

OKX Ventures backs STBL in partnership with Hamilton Lane and Securitize

OKX Ventures, the venture capital arm of the global cryptocurrency exchange, has made a strategic investment in STBL, a next-generation stablecoin and yield infrastructure provider.

STBL, co-founded by Reeve Collins, who also co-founded Tether, and tokenization pioneer Avtar Sehra, also announced a partnership with Hamilton Lane (HLNE), an alternative-investment management firm, and Securitize, a regulated digital securities issuance firm whose clients include BlackRock (BLK).

The plan is to develop a stablecoin backed by real-world assets (RWA) on OKX’s Ethereum-compatible layer-2 blockchain X Layer, the companies said on Thursday.

The endeavor features a feeder fund to Hamilton Lane’s Senior Credit Opportunities Fund (SCOPE), issued and tokenized via Securitize, according to a press release.

“RWA markets are entering a new phase, where tokenization must deliver real utility, not just representation,” said Sehra, who is also CEO of the company. “STBL provides a purpose-built architecture for RWA-backed stablecoins combined with compliant yield management.”

The collaboration shows how tokenization brings utility to assets when it’s paired with regulated issuance and programmable settlement, said Securitize CEO Carlos Domingo.

“By embedding institutional private credit directly into onchain money flows, we’re turning tokenized assets into functional building blocks: assets that can be settled, composed and used across financial applications, not just held,” Domingo said.

Crypto World

Berachain (BERA) is up 75%: here’s why the altcoin is rising

- Berachain’s strategic shift toward revenue-driven apps boosted long-term confidence.

- The successful mainnet launch and smooth token unlock have helped ease BERA’s selling pressure.

- Berachain’s token price needs to stay above $0.8318 for the bullish momentum to hold.

Berachain’s native token, BERA, posted a sharp 75% rally in 24 hours, drawing renewed attention from traders and long-term crypto investors alike.

The move comes after a prolonged period of weakness that pushed the token close to its all-time lows earlier this year, coinciding with the broader crypto market’s plunge.

This sudden reversal has not been driven solely by hype, but by a combination of structural, strategic, and market-specific developments that have shifted sentiment around the project.

Below is a breakdown of the key reasons behind BERA’s strong rebound and what it could mean going forward.

Strategic shift toward revenue-generating applications

One of the most important catalysts behind BERA’s rally is Berachain’s strategic pivot toward supporting applications that generate real, sustainable revenue.

In its end-of-year report, Berachain stated that it has moved away from heavy reliance on token incentives and emissions that often attract short-term liquidity but create long-term sell pressure.

Instead, the focus is now on encouraging builders to create businesses that generate fees, activity, and organic demand for the token.

This shift has resonated with the market because it addresses one of the biggest criticisms of many layer-1 projects, which is the lack of durable economic value.

By prioritising sustainable use cases, Berachain has improved investor confidence in the long-term utility of BERA.

This narrative change has helped reframe BERA from a speculative asset into a token with a clearer economic role within its ecosystem.

Token unlock passed without heavy selling pressure

BERA also benefited from a token unlock event that did not result in the aggressive selling many had anticipated.

According to data from Tokenomist, Berachain, on February 6, unlocked tokens worth around $24 million.

Token unlocks often lead to sharp declines as early holders rush to realise profits.

In this case, the market absorbed the additional supply relatively smoothly.

The lack of panic selling surprised traders and reinforced the idea that weaker hands had already exited during the long downtrend.

This dynamic contributed to a relief rally, as short sellers were forced to reconsider their positions.

As selling pressure failed to materialise, upward momentum accelerated.

Berachain mainnet launch

Berachain’s mainnet launch on February 6 marked a critical milestone for the project and laid the foundation for long-term ecosystem growth.

The launch was accompanied by a large airdrop that distributed a meaningful portion of the token supply to early users and contributors.

This helped decentralise token ownership and encouraged active participation across the network.

By rewarding testnet users and liquidity providers, Berachain strengthened its community and increased on-chain engagement.

The mainnet launch also made it easier for users to interact with the network through familiar wallet infrastructure.

Together, these developments increased visibility and usage, supporting the recent recovery in price.

BERA price forecast

From a technical perspective, the most important support level sits at $0.8318, which needs to hold to maintain the current bullish structure.

As long as BERA remains above this zone, buyers are likely to stay in control.

On the upside, the first major resistance level is located at $1.51, where profit-taking pressure could emerge.

A clean break and sustained move above $1.51 would open the door for a rally toward the next resistance at $1.86.

If bullish momentum continues and market conditions remain favourable, analysts say that the third resistance level to watch is around $2.19.

Failure to hold above the key support, however, could invalidate the bullish outlook and return BERA to consolidation.

But for now, the combination of improved fundamentals and constructive technical levels suggests that traders will remain closely focused on how price behaves around these zones.

Crypto World

Bitmine’s Tom Lee says bottom may be near

BitMine executive Tom Lee discussed Ethereum’s price outlook at Consensus, saying past downturns have always ended in sharp, “V-shaped” recoveries.

Summary

- BitMine executive Tom Lee says Ethereum is likely nearing a bottom, noting that ETH has recovered from every major 50%+ drawdown since 2018.

- Lee points to a potential “undercut” near $1,890 as a technical signal that the current sell-off could be close to exhaustion.

- Ethereum is trading near $1,900 support, with momentum indicators suggesting selling pressure is easing, though key resistance remains overhead.

Ethereum has always rebounded after major drops, says Tom Lee

Lee pointed out that Ethereum (ETH) has fallen more than 50% eight times since 2018, and in every case ETH recovered quickly after hitting a low. He suggested that the current decline is behaving similarly to prior drops and that the market may be close to a bottom.

The Bitmine exec referenced analysis from market timer Tom DeMarc, who believes a revisit to about $1,890, an “undercut” level, would signal a perfected bottom.

“If you’ve already seen the decline, you should be thinking about opportunities here instead of selling,” Lee said, showing his confidence that ETH will rebound again.

Lee emphasized that nothing fundamental has changed about Ethereum’s long-term trajectory despite the recent drop. He believes the current decline should also find a floor soon and transition into an uptrend.

While Lee did not provide exact timing, his comments reflect a bullish long-term view rooted in historical price behavior and technical undercut levels, offering some optimism to investors navigating near-term volatility.

Ethereum price action hovers near $1,900 support

Ethereum’s price has been trading near the $1,900–$2,000 range recently amid broader crypto volatility. At press time, ETH was trading around $1,965, fluctuating in a tight range over the past 24 hours and reflecting cautious sentiment among traders.

The daily chart shows ETH well below its 50-day simple moving average, which is currently positioned near $2,800 and acting as firm overhead resistance. This gap highlights how extended the recent sell-off has been.

The Relative Strength Index (RSI) has rebounded from deeply oversold territory. While RSI remains below the 50 mark, the recovery indicates selling momentum is slowing rather than accelerating.

Price action over recent sessions points to short-term base formation around the $1,850–$1,900 range. This zone has acted as support, with buyers stepping in to defend repeated dips. A decisive break below $1,850 would weaken the near-term structure and open the door toward the next support near $1,750.

On the upside, initial resistance sits near $2,000, a psychological level that has capped recent rebound attempts. Beyond that, stronger resistance emerges around $2,100–$2,150.

Crypto World

OKX Ventures backs STBL in partnership with Hamilton Lane and Securitize

OKX Ventures, the venture capital arm of the global cryptocurrency exchange, has made a strategic investment in STBL, a next-generation stablecoin and yield infrastructure provider.

STBL, co-founded by Reeve Collins, who also co-founded Tether, and tokenization pioneer Avtar Sehra, also announced a partnership with Hamilton Lane (HLNE), an alternative-investment management firm, and Securitize, a regulated digital securities issuance firm whose clients include BlackRock (BLK).

The plan is to develop a stablecoin backed by real-world assets (RWA) on OKX’s Ethereum-compatible layer-2 blockchain X Layer, the companies said on Wednesday.

The endeavor features a feeder fund to Hamilton Lane’s Senior Credit Opportunities Fund (SCOPE), issued and tokenized via Securitize, according to a press release.

“RWA markets are entering a new phase, where tokenization must deliver real utility, not just representation,” said Sehra, who is also CEO of the company. “STBL provides a purpose-built architecture for RWA-backed stablecoins combined with compliant yield management.”

The collaboration shows how tokenization brings utility to assets when it’s paired with regulated issuance and programmable settlement, said Securitize CEO Carlos Domingo.

“By embedding institutional private credit directly into onchain money flows, we’re turning tokenized assets into functional building blocks: assets that can be settled, composed and used across financial applications, not just held,” Domingo said.

Crypto World

Ripple CEO Garlinghouse Reassures XRP Community Amid Market Struggles

Ripple’s CEO, Brad Garlinghouse, recently addressed the ongoing turbulence in the cryptocurrency market, emphasizing XRP’s importance to the company’s future. During his appearance on X Spaces, Garlinghouse reassured the community that XRP remains central to Ripple’s operations. Despite the market’s struggles, Ripple is focused on long-term goals that center around the utility and liquidity of XRP and the XRP Ledger.

XRP is the “North Star” for Ripple ✨

@BradGarlinghouse highlights how Ripple Payments, Ripple Prime, & Ripple Treasury all drive utility & liquidity around $XRP. pic.twitter.com/g9xlCPpToy

— 𝗕𝗮𝗻𝗸XRP (@BankXRP) February 11, 2026

Garlinghouse explained that XRP continues to be the company’s guiding principle, described as its “North Star.” He pointed out that Ripple’s various products, including Ripple Payments, Ripple Prime, and Ripple Treasury, all aim to increase XRP’s utility. The goal, he noted, is to build trust around XRP, which remains the “heartbeat” of Ripple’s financial infrastructure.

Ripple’s focus on XRP is evident in the company’s aggressive strategies. These efforts include expanding its services in traditional finance while working to build cross-sector solutions for both crypto and traditional financial systems. This strategy aligns with Garlinghouse’s belief that XRP plays a crucial role in shaping the future of financial systems globally.

Ripple Takes an Offensive Approach Amid Market Drawdown

Garlinghouse acknowledged the recent market downturn, which he described as a “bloodbath.” Despite the setback, he suggested that the current conditions could offer an opportunity for investors to enter the market. His view echoes the sentiment that periods of fear can present valuable buying chances for those willing to take risks.

He noted that, while the crypto market is facing significant challenges, XRP has remained resilient. Since November 2024, XRP has been one of the top performers in the market, contrasting with Bitcoin’s relatively flat performance. This positive outlook highlights the coin’s strength and Ripple’s commitment to its long-term vision despite market fluctuations.

Ripple’s Focus on Expansion and Strategic Acquisitions

After years of navigating regulatory challenges, Ripple is now focusing on aggressive acquisitions to accelerate its growth. Garlinghouse described this shift as a crucial move to position Ripple for future success. The company is working hard to recover time lost due to past delays and to maintain its momentum in 2026.

Ripple’s acquisition strategy aims to expand its reach beyond the cryptocurrency community and into traditional finance. By blending both sectors, the company aims to bridge gaps and create solutions that benefit both crypto and conventional financial institutions. This dual focus positions Ripple for broader success as the company prepares to make an even stronger impact in 2026.

Ripple’s approach, according to Garlinghouse, will allow the company to forge new paths in the crypto space while securing XRP’s dominance in the global financial ecosystem. With its aggressive acquisition strategy and renewed focus, Ripple is set to continue pushing forward into 2026, determined to shape the future of finance.

Crypto World

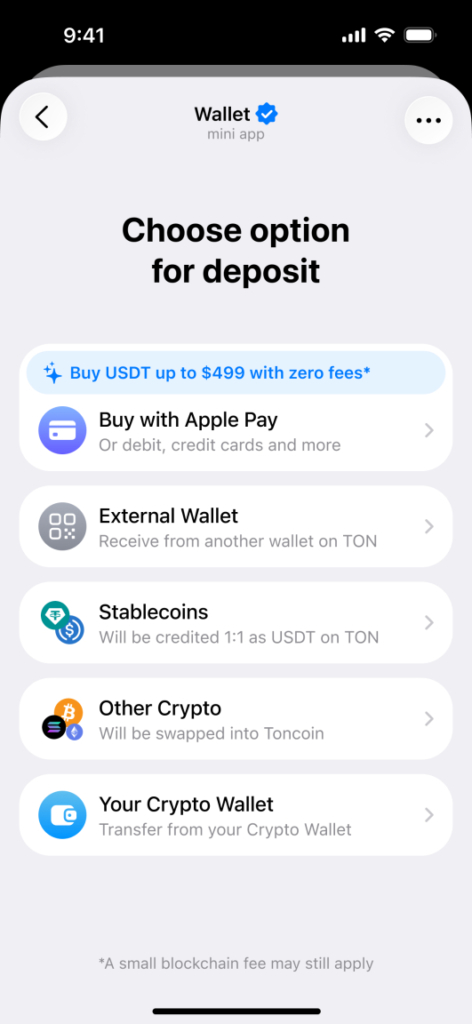

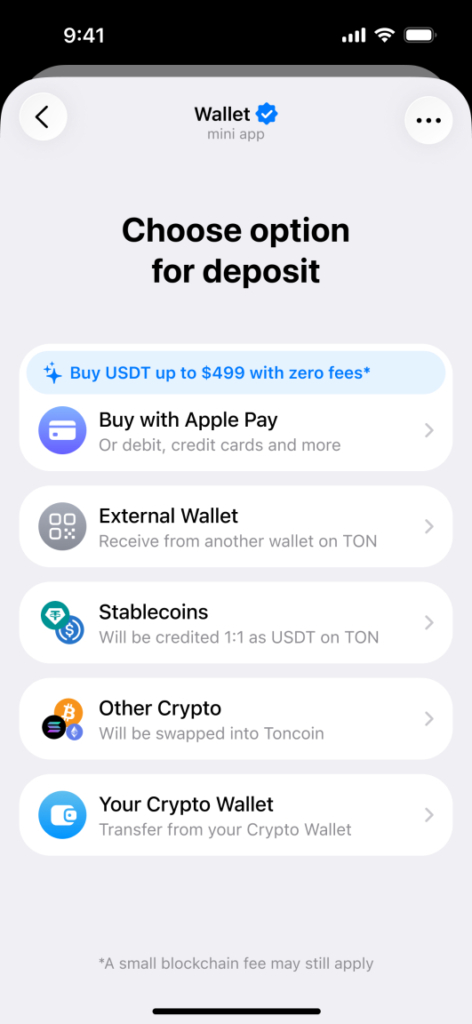

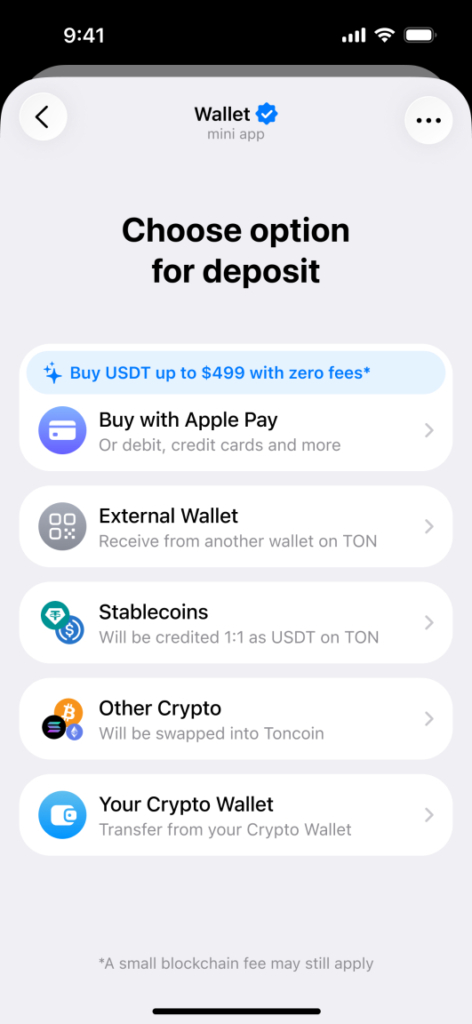

Wallet in Telegram Launches Cross Chain Deposits in Self Custodial TON Wallet

[PRESS RELEASE – Ile Du Port, Seychelles, February 11th, 2026]

Over 100 million users can now fund their TON Wallet using crypto from the most popular blockchains – no additional bridges, swaps or manual conversions required.

Wallet in Telegram today announced the launch of cross-chain deposits in its self-custodial TON Wallet, enabling users to fund their wallets with crypto from the most popular blockchains. Powered by MoonPay, the integration manages cross-chain transfers behind the scenes, ensuring a smooth deposit experience in TON Wallet.

With this launch, more than 100 million users can transfer their stablecoins from other chains to TON without friction or losing value. TON Wallet users can now deposit USDC or USDT from Ethereum, Solana, TRON, BSC, Polygon, Arbitrum, and Base – converted at a 1:1 rate to USDT (TON) – directly in Wallet in Telegram. This removes the need to already hold TON-native assets, opening the ecosystem to users across the broader crypto landscape. As part of the integration, users will soon be able to withdraw USDT on TON to USDT or USDC on popular blockchains with a fee and deposit BTC, ETH, and SOL, which are automatically converted into Toncoin.

This Launch Introduces the Following Functionality

- Stablecoin deposits from leading blockchains, allowing users to deposit USDC or USDT with automatic 1:1 conversion into USDT (TON)

- Stablecoin withdrawals from USDT (TON) to USDT or USDC on other major blockchains, processed at a 1:1 rate, subject to applicable network and service fees. Will be available soon.

- Crypto deposits from BTC, ETH, and SOL, which are automatically converted into Toncoin upon arrival in TON Wallet

Removing Barriers to Web3 Adoption on Telegram

Funding a self-custodial wallet has traditionally been a complex, multi-step process. Through its collaboration with MoonPay, Wallet in Telegram removes this friction by introducing a single, seamless deposit flow that works across blockchains and assets. As a result, cross-chain transfers are now as simple as custodial ones, significantly streamlining onboarding into TON Ecosystem – while preserving value by minimizing unnecessary conversion losses and fees.

“One of the biggest challenges in crypto adoption is the first step – getting users funded and ready to participate. Until now, using TON Wallet meant already having assets on TON, which created unnecessary friction and limited access to the broader ecosystem. Now, we’re removing that barrier entirely. Users can bring their funds directly into TON Wallet from other networks, without unnecessary conversions, exchanges or lock-ins,” said Andrew Rogozov, Founder and CEO of The Open Platform and Wallet in Telegram. “Our goal is simple: make entering, and exiting, TON ecosystem as seamless as using a custodial wallet, while preserving the freedom and control of self-custody.”

Powered by MoonPay Deposits and built on MoonPay’s infrastructure, the solution supports the end-to-end flow, from deposit detection to final asset delivery, and is integrated natively into partner environments

“Users shouldn’t have to buy new assets or navigate complex steps just to fund an account,” said Ivan Soto-Wright, CEO of MoonPay. “We simplify the process by letting people use the crypto they already have while we handle the technicalities behind the scenes, making it easier to move value across the ecosystem and access a broader range of applications.”

Funding a TON Wallet now takes just a few steps

- The Deposit section includes two options: Stablecoins (for 1:1 stablecoin deposits) and Other Crypto (for converting BTC, ETH, or SOL to TON).

- After selecting the token and the originating network, a deposit address is generated automatically.

- The deposit address can be copied or accessed via QR code.

- This address is entered on the withdrawal page of the external wallet or exchange.

- The transfer amount must meet the minimum deposit requirement.

- Once the details are verified, the transfer is confirmed on the sending platform.

Funds arrive in the user’s selected asset, fully compatible with TON ecosystem and Telegram’s growing network of decentralized applications.

Built for Scale, Native to Telegram

The new deposit experience is available exclusively in the self-custodial TON Wallet, part of Wallet in Telegram’s dual-wallet setup, and is fully integrated into the Telegram interface. By abstracting away cross-chain complexity, Wallet in Telegram makes it easier for users to participate in DeFi, gaming, payments, and on-chain apps – without needing deep crypto expertise.

This launch marks a major step toward making Telegram the most accessible Web3 gateway in the world, combining mass-market distribution with self-custody and open blockchain infrastructure.

About Wallet in Telegram

Wallet in Telegram is a digital asset solution natively embedded into Telegram’s interface. Backed by The Open Platform, Wallet in Telegram has gained 150M+ registered users to date and continues to grow. The company offers a dual-wallet experience with Crypto Wallet (a multi-chain wallet for trading and sending crypto to contacts) and TON Wallet (a self-custodial wallet with access to TON ecosystem of apps and TON-based digital assets).

About MoonPay

Founded in 2019, MoonPay is a global financial technology company that helps businesses and consumers move value across fiat and digital assets. MoonPay has more than 30 million customers across 180 countries and supports more than 500 enterprise customers spanning crypto and fintech.

Through a single integration, MoonPay powers on- and off-ramps, trading, crypto payments, and stablecoin infrastructure, connecting traditional payment rails with blockchains. MoonPay maintains a broad regulatory footprint, including a New York BitLicense, a New York Limited Purpose Trust Charter, and money transmitter licenses across the United States, as well as MiCA authorization in the EU.

MoonPay is how the world moves value.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports8 hours ago

Sports8 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World9 hours ago

Crypto World9 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 hours ago

Video5 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month