CryptoCurrency

Digital Commodity Trading Platform Development Guide 2026

Commodity trading is no longer just about warehouses and brokers. They’re going digital with data-driven ecosystems and high-speed trading engines.

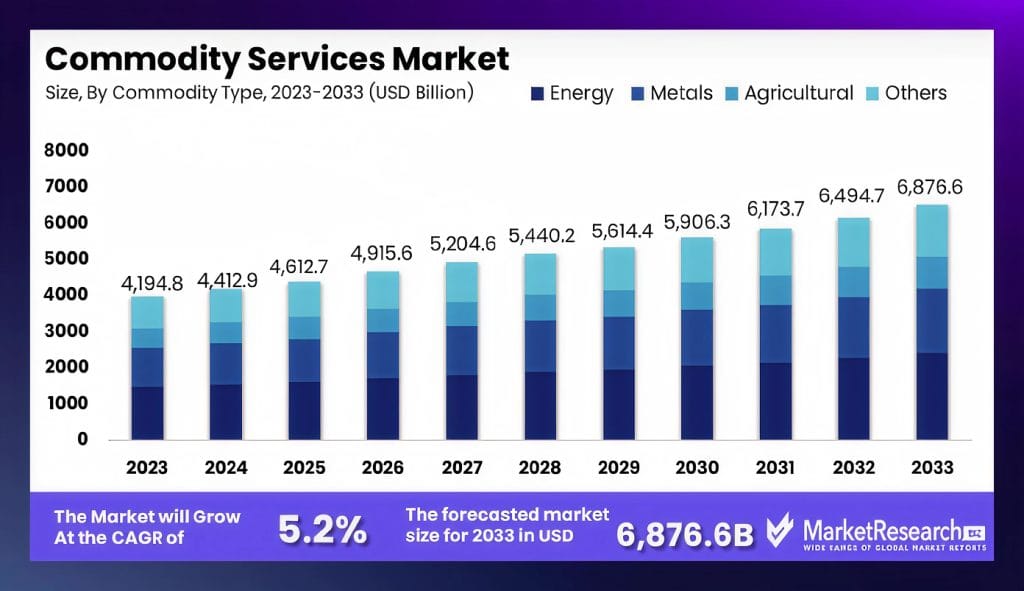

The global commodity trading services market, estimated at $4.19 trillion in 2023, is expected to hit $6.88 trillion by 2033 at a 5.2% CAGR during 2024-2033. Alongside the rise in demand for metals, energy, and agricultural commodities, the technological innovations in data analytics and blockchain are stimulating the expansion.

Enterprises still relying on manual workflows or outdated systems risk being left behind in a market shifting swiftly toward automation, tokenization, and on-chain settlement.

“Given the data and our industry’s continued move toward digitization and greater transparency, we believe it is now time to consider the long-term future of pricing at the LME—with the intention of providing certainty, which will allow all customers to make their future business decisions with confidence.”

— Matthew Chamberlain, CEO, London Metal Exchange (LME)

This blog unveils what digital commodity exchange software is, its features, and development costs, while shedding light on why enterprises must build them in 2026.

What is a Commodity Exchange Software?

A commodities trading platform is a trading infrastructure that facilitates trading for standardized contracts for physical or derivative commodities like energy, metal, or agricultural goods. Digital multi-commodity exchanges leverage blockchain and AI/ML to turn the manual processes into automated, borderless, and transparent trading environments.

Why are Enterprises Digitizing Commodity Trading?

- Traditional trading is slow, opaque, and jurisdiction-bound.

- Digital platforms offer 24/7 market access, real-time market data, instant and transparent trade settlement, and data-backed decision-making.

- AI and smart contracts bring precision and scalability that manual systems can’t match. Moreover, AI enhances risk management and helps optimize pricing, hedging, and delivery decisions in real time.

No wonder digital adoption is skyrocketing in commodity trading. The $1.5 billion digital commodity trading platform market in 2025 is going to be worth $9.63 trillion by 2033 with 18.5% CAGR.

Paula Freire, CIO at Amerpora, which launched a “state-of-the-art commodity trading platform,” recently mentioned that they’re integrating AI and enhanced data management technologies to streamline processes, improve efficiency, and drive innovation. They even mentioned that Agentic AI will further autonomously manage and execute commodity trades.

Build Your Blockchain-Based Commodity Exchange With Antier

What Are the Key Features of A Modern Commodity Trading Platform?

Essential Features of A Commodity Exchange Software

Your commodity exchange software must be more than a glorified marketplace for RWAs. It needs enterprise-grade architecture, top-notch security, AI-intelligence, compliance, and automation baked in to be a digital infrastructure that actually solves problems. Let’s discuss the key components of a modern commodity exchange software platform

1. Advanced Order-Matching Engine

This component manages order matching logic, price feeds, and order books that facilitate smooth multi-commodity or single-commodity trading over blockchain-based infrastructures. It ensures microsecond trade execution, market depth visibility, and cross-commodity liquidity management.

Key capabilities include:

- Configurable trading pairs for spot, futures, and options contracts.

- Aggregation of live market data APIs and external liquidity feeds.

- Support for multi-commodity order types, with precision matching logic built for blockchain-based or hybrid infrastructures.

- Integration with AI models for real-time volatility detection and price prediction.

2. Real-Time Market Data, Analytics, and Forecasting Layer

Modern commodities trading platforms are data-driven. This layer of commodity trading infrastructure powers continuous market analysis, predictive modeling, and visual reporting for traders and administrators alike.

Core features:

- Dynamic price feeds, indices, and charting dashboards.

- AI/ML models for trend forecasting, anomaly detection, and risk scoring.

- Sentiment analytics to anticipate price swings and hedge volatility.

- Integration with compliance logic for proactive fraud alerts and position management.

3. Smart Contract & Settlement Layer

This commodities trading exchange component manages all aspects of digital and physical settlement with zero manual intervention.

Functions include:

- Instant reconciliation for blockchain-based trades or off-chain settlements.

- Integration with ERP and warehousing systems to automate delivery confirmations.

- Configurable payment and collateral management workflows.

- Compatibility with tokenized commodities for programmable settlements and fractional ownership.

Additional Module: Enterprises can future-proof their commodity exchange software by integrating a tokenization module at this stage. Monty C.M. Metzger, CEO & Founder at LCX.com and TOTO Total Tokenization, says.

“By 2035, tokenization will become a primary issuance and settlement rail for a broad range of assets — from equities and bonds to commodities and real-world assets. It will unlock programmability, fractional ownership, instant settlement, and global liquidity in ways traditional markets can’t match.”

4. Compliance & Risk Management

Built to align with regional and international regulations, this layer protects the commodities trading platform and its users from operational, legal, and credit risks.

Core elements:

- Embedded KYC/AML and jurisdiction-based compliance toggles.

- Automated margin tracking, audit logs, and delivery verification.

- AI-based anomaly detection for suspicious behavior or outlier trades.

- Configurable reporting templates for regulatory filings and risk dashboards.

5. APIs and Integration Capabilities

This component of commodities trading platforms is a crucial bridge between the digital trading layer and the physical supply chain.

Capabilities:

- Open APIs connecting brokers, banks, logistic partners, and financial institutions.

- REST and WebSocket endpoints for real-time trade data sharing.

- Extensions for DeFi and tokenized asset protocols, ensuring future compatibility.

- Partner integration kits for institutional onboarding and liquidity management.

6. Scalable Multi-Tier Architecture

A scalable architecture, built for high throughput, low latency, and regional deployment, forms a foundation for long-term sustainability and optimal performance. This allows modular scaling across commodities, geographies, and asset classes.

Highlights:

- Cloud-native or hybrid deployment for localized regulatory needs.

- Horizontally scalable microservices to support new trading pairs or derivatives.

- Advanced caching, queuing, and load-balancing layers for uninterrupted uptime.

- Built-in monitoring tools for performance analytics and failover automation.

How Much Does it Cost to Build a Blockchain-Based Commodity Trading Platform?

Building the best commodity trading platform that is enterprise-ready costs anywhere between $250k $500k, depending on the core requirements and complexity. It takes plenty of time to custom-build a feature-rich, highly scalable infrastructure. The commodity exchange software cost estimate involves putting together all the essential components of commodity trading platforms, along with cloud infrastructure and scaling costs, and ongoing maintenance.

But the benefits and ROI justify the time and money deployed in blockchain-based commodities trading platform development. Enterprises adopting automation and AI report 2-3X ROI within three years, largely through reduced manual overheads and faster settlements

Get the 2026 Jurisdiction Readiness Report

What are the Benefits of Commodity Exchange Software Development?

- Profit Margins and Optimization: Iron ore traders using digital logistics tools have captured up to $5 per metric ton in added value.

- Operational Efficiency: Multicommodity exchange and management firms are automating trade reconciliations, compliance checks, and other repetitive tasks, slashing processing times by 30%.

- Global Market Access: With digital infrastructures, commodity trading businesses can connect with buyers and sellers 24/7 from multiple jurisdictions in real time.

- Transparency and Trust: Blockchain integration ensures auditability and immutable records, enhancing stakeholders’ confidence in commodity exchange software.

- Risk Mitigation and Profitability: AI-powered analytics flag volatility and delivery risks early. Multiple AI enhancements in commodity exchange software can drastically reduce risks. AI-powered digital commodities trading platforms also yield 2X more profits for traders.

- Resilience and Future Readiness: Tokenized commodities, DeFi integrations, and programmable settlement rails are becoming the new norm. Even Cryptocurrency exchange software is integrating RWA trading capabilities and fiat RWA ramps to enable effortless trading of commodities.

What are the Challenges Associated with Commodity Exchange Software Development?

- Ignoring Regulatory Nuance: Regulations for oil, gold, and agri-commodities vary globally. You need adaptive compliance and geofencing capabilities to launch globally without a hitch.

- Underestimating Liquidity Needs: No exchange can survive without liquidity. If you’re building a multi-commodity exchange, you need early market-makers and institutional partners to make commodities tradable on your platform.

- Overcomplicating UX: Complex dashboards deter new traders. Traders want clarity, so your exchange software development company must design for execution and not decoration.

- Data Integrity Risks: Without reliable sources, your exchange loses trust. So, commodities trading platforms must integrate APIs from highly credible sources to stay relevant and accurate.

- Weak Infrastructure: Over 60% of failed exchange projects cite inadequate cybersecurity. Downtime also destroys credibility, so foolproof security is essential for building your commodity trading infrastructure.

Is Now the Time to Build?

Absolutely. Digital disruption is already here. Gross margins in commodity trading fell over 20% in 2024, but digital-first multicommodity exchange firms are doubling profitability through algorithmic trading and AI logistics. Those still operating manually are bleeding efficiency and market share. Adeniyi Adebayo, the Co-Founder of Mysten Lab, also said:

“In the future, most trades are going to happen on-chain — public, transparent, and permissionless.”

So, now is your time to lead the commodity trading space.

Build Your Digital Commodity Exchange with Antier

Antier, a leading exchange software development company, empowers enterprises to launch fully compliant, scalable, and AI-ready commodity exchanges that bridge traditional and tokenized markets.

What we bring to the table:

- Exchange DNA: Proven experience with crypto, derivatives, and hybrid exchange infrastructure.

- Custom Architecture: Modular, white label, or fully bespoke solutions built for compliance and scalability.

- Tokenization Expertise: Ready for the era of fractionalized, programmable commodity assets.

- AI-Infused Systems: Predictive risk models, automated reconciliation, and analytics dashboards.

- Multi-Jurisdictional Legal Strategy: Comprehensive legal expertise for green and orange zones.

Let’s build the best commodity trading platform together. Connect today!

Frequently Asked Questions

01. What is commodity trading software?

Commodity trading software is a digital platform that facilitates trading standardized contracts for physical or derivative commodities, utilizing technologies like blockchain and AI/ML to automate and enhance trading processes.

02. Why are enterprises moving towards digital commodity trading?

Enterprises are digitizing commodity trading to benefit from 24/7 market access, real-time data, instant trade settlement, and improved risk management, which traditional manual systems cannot provide.

03. What is the projected growth of the digital commodity trading platform market?

The digital commodity trading platform market is expected to grow from $1.5 billion in 2025 to $9.63 trillion by 2033, with a compound annual growth rate (CAGR) of 18.5%.