Crypto World

Enterprise dApp Development Cost Guide

Enterprises considering dApp development are not looking for hype. They are looking for clear answers. They want to know whether a decentralized platform can integrate with existing systems, meet security and compliance standards, and scale without constant redesign. They want to understand what drives cost, where projects usually fail, and how risks can be controlled before development begins.

Most decision-makers are trying to avoid three things: unpredictable budgets, delayed launches, and dependency on external vendors. They want a delivery model that supports internal governance, protects data, and remains manageable after deployment. They are also looking for practical guidance on architecture, audits, integrations, and operational ownership. Not generic estimates, but structured frameworks that explain how technical choices affect stability, timelines, and resource planning. This guide addresses those concerns directly. It explains how enterprise dApp development projects are planned, executed, and maintained, and how disciplined teams achieve predictable outcomes without compromising security or control.

Why Enterprise dApp Development Costs Are Often Misjudged

Most enterprises approach dApp initiatives using traditional software assumptions. That is where the disconnect begins, especially when organizations rely on generic services without fully accounting for the structural differences between decentralized and centralized systems. dApp introduces new cost variables that do not exist in Web2 environments:

- Smart contract immutability

- External security audits

- Blockchain infrastructure dependencies

- Regulatory exposure

- Governance and upgrade mechanisms

When these factors are underestimated or addressed too late, costs rise sharply, not because vendors are inefficient, but because the system was never designed for enterprise scale and accountability. As projects progress, gaps in planning, security alignment, and integration strategy begin to affect execution quality. These challenges become more visible during advanced dApp development phases, where architectural limitations and compliance constraints restrict flexibility.

The true cost of enterprise dApp development is not a single figure. It is the cumulative outcome of architectural discipline, risk management practices, and operational maturity, reinforced through professional development services that emphasize transparency and sustainability.

Request a Custom Enterprise DApp Budget Analysis

The Six Core Factors That Determine Enterprise dApp Cost

Instead of asking for price quotes, enterprise leaders should evaluate the structural and operational cost drivers that shape every decentralized application initiative.

- Architecture Complexity

Architecture is the single largest determinant of cost predictability in enterprise blockchain initiatives. Key contributors include:

- Number of smart contracts

- Upgradeability requirements

- On-chain and off-chain logic distribution

- Cross-chain or multi-network support

Poor architectural decisions often lead to expensive rewrites, repeated audit failures, and performance bottlenecks. In contrast, well-designed systems built through structured dApp development practices reduce long-term cost by minimizing rework, simplifying governance, and enabling controlled scalability.

- Integration Depth

Enterprise dApps rarely operate in isolation within modern digital ecosystems. They must integrate with:

- Identity and access management systems

- Payment rails

- ERP, CRM, or legacy databases

- Compliance and reporting tools

Each integration layer increases testing requirements, security validation, and operational oversight. Organizations that fail to evaluate integration complexity during early planning stages often experience budget overruns during production rollout, especially when enterprise-grade dApp development services are not aligned with existing infrastructure.

- Security and Risk Management

Security is not an optional line item in enterprise dApp initiatives. It is foundational to long-term viability. Enterprise dApp security includes:

- Secure contract design

- Internal code reviews

- External audits

- Ongoing monitoring

- Incident response planning

The cost impact rarely comes from audits themselves. It comes from the rework required when vulnerabilities are discovered late. Mature teams embed security into their development lifecycle from day one, which significantly reduces financial exposure and reputational risk.

- Compliance and Governance Requirements

Regulatory expectations vary by geography and industry, but enterprises must account for:

- Data privacy considerations

- Transaction traceability

- Governance controls

- Upgrade and kill switch mechanisms

Compliance work does not simply add effort. It shapes system design and operational workflows. When governance frameworks are ignored early, enterprises are forced into costly architectural changes later, which remains one of the most common causes of project escalation.

- Performance, Scalability, and Reliability Targets

Enterprise dApps are expected to meet production-grade performance standards from the outset. These include:

- High availability

- Predictable latency

- Fault tolerance

- Disaster recovery capabilities

These requirements directly influence infrastructure design, node management strategies, and monitoring systems. Teams that postpone scalability planning often face rising operational costs and service disruptions once adoption increases.

- Post-Launch Operations and Ownership

Many enterprises allocate budgets for development but underestimate the financial impact of sustained ownership. Ongoing cost drivers include:

- Monitoring and analytics

- Upgrades and governance changes

- Support SLAs

- Security patching

Without a structured post-launch strategy, operational expenses gradually increase over time. Enterprises that fail to plan for maintenance and lifecycle management experience cost creep long after initial deployment, which undermines projected ROI.

Understand Your Enterprise DApp Investment Before Making Final Decisions

The Hidden Cost Traps Enterprises Fall Into

Across enterprise blockchain initiatives, the same financial and operational mistakes appear repeatedly, especially when organizations choose a dApp development company based only on speed or pricing rather than architectural and governance maturity.

Trap 1: Skipping Structured Discovery

Rushing into development without proper discovery creates unclear scope and unrealistic expectations.

Trap 2: Treating MVPs Like Prototypes

Enterprise MVPs must follow production standards. Disposable MVPs increase technical debt and force costly rebuilds.

Trap 3: Delaying Security Decisions

Late audits expose design flaws that require major rework. Early security planning within professional dApp development services helps control risk and budget.

Trap 4: Vendor Lock In

Poor documentation and limited knowledge transfer create dependency, increasing operational cost and reducing flexibility.

How Leading Enterprises Reduce dApp Development Cost

Enterprises that control costs do not rely on shortcuts. They apply repeatable operating principles and work with a capable dApp development company that aligns technology decisions with business accountability.

| Strategic Focus Area | What Leading Enterprises Do | Why It Reduces Cost |

|---|---|---|

| Architecture Planning | Define system boundaries, modular contracts, and upgrade paths before development begins | Prevents redesign cycles and architectural rework |

| Execution Model | Break initiatives into gated phases with clear validation points | Limit overinvestment before assumptions are proven |

| Security Strategy | Integrate reviews and testing during design and early builds | Reduces late-stage remediation and audit friction |

| Engineering Efficiency | Use proven frameworks, middleware, and standardized integrations | Lowers the custom development effort during dApp development |

| Ownership Readiness | Maintain documentation, access controls, and governance workflows | Reduces dependency and support overhead through professional dApp development services |

Why does this approach work?

This model shifts cost control upstream. Instead of reacting to overruns, enterprises design predictability into execution. Each decision reduces uncertainty, improves accountability, and supports stable delivery as systems move toward production.

Final Thoughts: Cost Control Is a Leadership Decision

For enterprises, dApp development is a strategic infrastructure decision, not an experiment. Success depends on architectural clarity, disciplined execution, and experienced guidance. Organizations that partner with a trusted dApp development company avoid uncertainty by focusing on governance, security, and operational readiness across the development lifecycle. This approach delivers predictability and confidence as systems move into production.

Antier brings proven expertise in building secure, scalable decentralized platforms for enterprise use cases. Our dApp development services are designed to help organizations reduce risk, maintain control, and move forward with clarity. Book an Enterprise dApp Assessment!

Frequently Asked Questions

01. What are the main concerns enterprises have when considering dApp development?

Enterprises are primarily concerned about integration with existing systems, meeting security and compliance standards, managing costs, avoiding project delays, and minimizing dependency on external vendors.

02. Why are costs often misjudged in enterprise dApp development?

Costs are often misjudged because enterprises apply traditional software assumptions to dApp initiatives, overlooking unique factors like smart contract immutability, external security audits, and blockchain infrastructure dependencies.

03. What factors contribute to the true cost of enterprise dApp development?

The true cost is influenced by architectural discipline, risk management practices, operational maturity, and the need for professional development services that ensure transparency and sustainability throughout the project.

Crypto World

Tether invests in LayerZero Labs as it doubles down on cross-chain tech, agentic finance

Tether Investments, the investment arm of the leading stablecoin issuer, has made a strategic investment in LayerZero Labs, which develops an interoperability protocol called LayerZero.

The move is essentially a bet on the technology underpinning USDt0, a blockchain-agnostic version of Tether’s dollar-pegged token that has moved over $70 billion across blockchains in less than a year, according to a press release the company shared.

LayerZero’s infrastructure enables cryptocurrencies to flow across different blockchains without fragmentation or illiquidity. That allows developers building financial tools to rely on stablecoins without getting their funds locked in a single network.

That same architecture also supports more experimental use cases, like AI agents managing their own wallets and sending payments autonomously, in what Tether called “agentic finance.”

Tether’s investment comes on the heels of USDt0’s deployment by Everdawn Labs and is built using LayerZero’s Omnichain Fungible Token (OFT) standard. Alongside their tokenized Tether gold token, XAUt0, the projects are seen as real-world tests of LayerZero’s interoperability framework.

The financial terms of the deal were not disclosed, and Tether did not reply to a request for comment.

The stablecoin giant has been using the billions it generates from backing USDT tokens in circulation to make a wide range of investments. These include a majority stake in Latin American agricultural firm Adecoagro (AGRO), a privacy-focused health app, and a stake in video-sharing platform Rumble (RUM).

The company has been aggressively accumulating gold, and earlier this month, itbought a $150 million stake in Gold.com to boost the distribution of tokenized gold.

LayerZero’s ZRO token gained as much as 10% on the news, but quickly reversed, now lower by 3% over the past 24 hours.

Crypto World

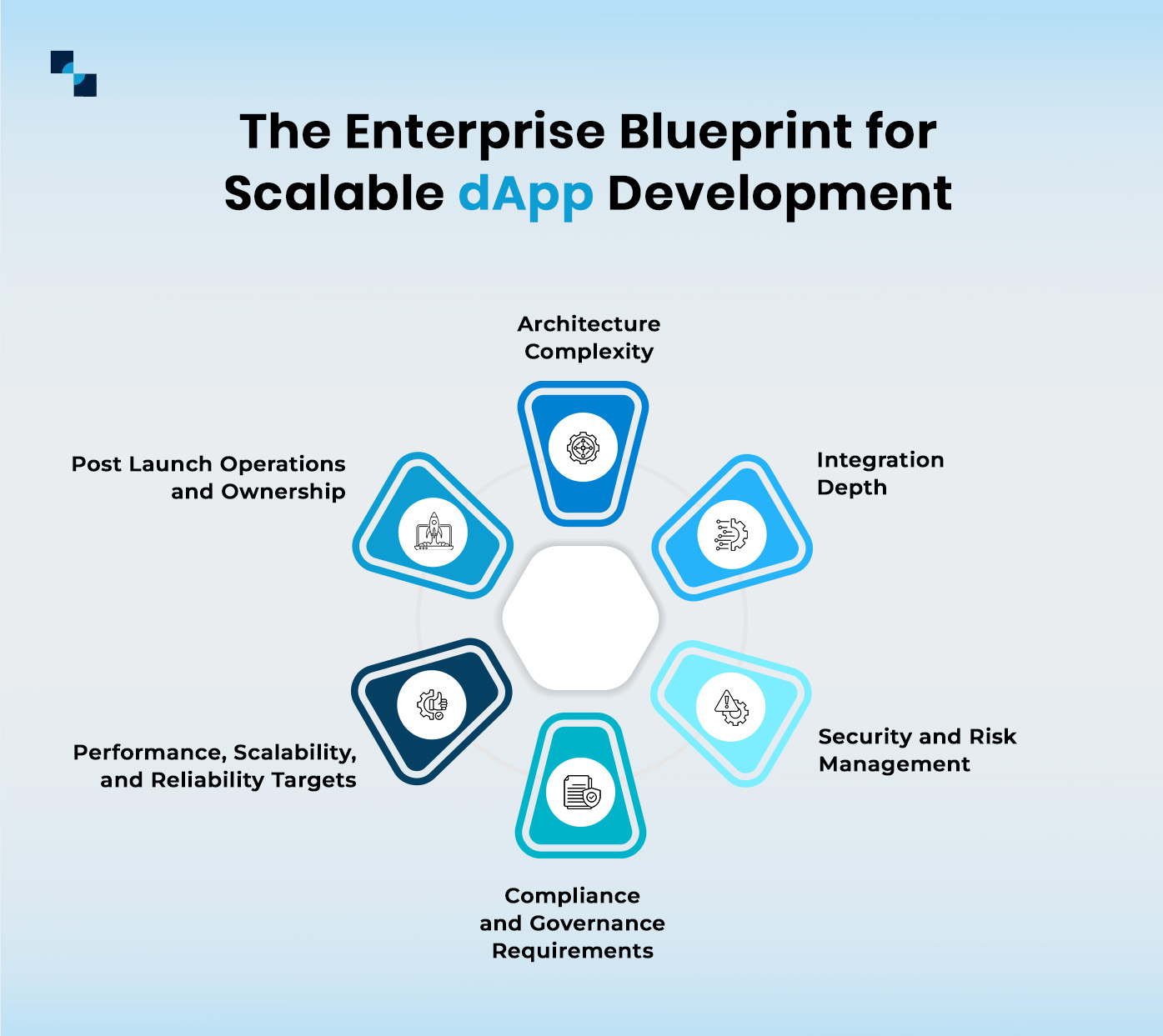

Bad Bunny’s Super Bowl Zara Moment Signals Luxury Shift

Editor’s note: This press release examines the market implications of Zara’s recent cultural visibility during the Super Bowl, framing it as more than a one-off branding moment. Through commentary from an eToro market analyst, the announcement explores how global consumer brands are redefining value by prioritizing cultural relevance, accessibility, and identity over traditional luxury signals like exclusivity and price. While rooted in fashion and consumer culture, the analysis connects directly to long-term brand positioning, investor perception, and how intangible assets such as narrative and cultural alignment can shape competitive advantage over time.

Key points

- Zara’s Super Bowl moment is positioned as a strategic signal, not a traditional advertising play.

- The brand is increasingly framed as “accessible luxury” rather than fast fashion.

- Cultural embedding is highlighted as a form of earned media that reduces marketing dependence.

- Employee inclusion is cited as a source of internal cohesion and intangible capital.

- The growing influence of Hispanic culture is identified as a structural demand driver.

Why this matters

For investors and market observers, the analysis highlights how cultural relevance can reshape long-term brand valuation even when near-term financials remain unchanged. As attention costs rise and consumer identity becomes central to purchasing behavior, companies that successfully shift their perceived category may unlock durable advantages that are not immediately priced in by markets. This dynamic is especially relevant for consumer-facing companies competing across global, demographically diverse markets.

What to watch next

- How Zara’s brand positioning continues to evolve in future cultural moments.

- Whether market perceptions begin to reflect a reclassification beyond fast fashion.

- Signals of sustained alignment with emerging demographic and cultural trends.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Abu Dhabi, United Arab Emirates – 10 February, 2026: Zara’s appearance on the Super Bowl stage has sparked renewed debate around the evolving definition of luxury, highlighting a broader shift in how global brands compete for cultural relevance, consumer identity, and long-term value.

Commenting on the development, Javier Molina, Market Analyst at eToro, said the moment carries strategic significance beyond its cultural visibility.

What may initially appear as a high-profile cultural moment reflects a deeper change in perceived value hierarchies, where cultural resonance and accessibility increasingly rival traditional notions of exclusivity.

The episode underscores Zara’s ability to generate global relevance without relying on direct advertising expenditure. As the cost of consumer attention continues to rise, embedding the brand within culture has become a powerful source of earned media — supporting brand strength while limiting the need for incremental marketing investment.

More importantly, the moment signals a potential repositioning. Zara is increasingly being viewed beyond the confines of fast fashion, occupying a middle ground best described as accessible or functional luxury. Rather than competing on price or scarcity, the brand is engaging consumers through narrative, identity, and cultural alignment — factors that resonate strongly with younger generations and are structurally difficult for traditional luxury brands to replicate.

There are also internal implications. By placing employees at the centre of the story as recipients of symbolic value rather than passive observers, the brand strengthens cohesion and execution within a business model built on speed, scale, and operational efficiency. This intangible capital can translate into improved performance over time.

Finally, the moment reinforces a broader structural trend shaping Western consumption: the growing influence of Hispanic culture as a driver of both demand and cultural leadership. For Zara, this represents not just visibility, but strategic alignment with the demographic and cultural momentum of its core markets.

From an investment perspective, Molina noted that such cultural shifts may not immediately impact quarterly results, but they play a meaningful role in redefining long-term brand positioning. When a company begins to change the category in which it operates, markets are often slow to fully reflect that transformation — creating potential value over time.

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Disclaimers:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is a group of companies that are authorised and regulated in their respective jurisdictions. The regulatory authorities overseeing eToro include:

- The Financial Conduct Authority (FCA) in the UK

- The Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Financial Services Authority (FSA) in the Seychelles

- The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) in the UAE

- The Monetary Authority of Singapore (MAS) in Singapore

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Crypto World

This Trending Meme Coin Explodes by 100% Weekly: What Comes Next?

Is this the new crypto sensation or just another scam?

The cryptocurrency market experienced a severe pullback in the past few weeks, culminating in a sharp crash on February 6.

The meme coin sector was significantly affected by the red wave, and most leading tokens in that niche have posted substantial losses. However, the lesser-known pippin (PIPPIN) defied the carnage and its valuation soared by over 100% in the past week.

Swimming Against the Tide

PIPPIN is a Solana-based meme coin that began trading in late 2024. It is themed around an AI-generated unicorn character named “Pippin,” which has become the logo of the token.

The meme coin had its glory days toward the end of 2025, when its price reached an all-time high of almost $0.60, and its market capitalization surpassed $500 million. While January was also positive, the beginning of February offered a deep correction.

In the past week, though, the asset entered another major uptrend, which contrasts with the overall bearish environment in the crypto market. As of press time, PIPPIN is worth roughly $0.38, or a 114% increase on a weekly basis.

Analysts are curious if the bull run is sustainable since there isn’t an evident catalyst driving the move north. X user ALTS GEMS Alert claimed the price has initiated a “strong bounce” from the demand zone at around $0.26, predicting that if buyers remain active, PIPPIN could soar to $0.40 and even $0.60.

Satori chipped in, too. The analyst told their over 700,000 followers on X that they have added the coin to their watchlist, arguing it has potential for much more impressive gains ahead.

You may also like:

A Ticking Time Bomb?

At the same time, some industry participants warned investors to stay away from PIPPIN, claiming its valuation is driven by pure speculation, and its utility is questionable.

X user Dippy.eth described the asset as “the largest scam of the past year,” arguing it has reached the first “take profit” zone. “0 technologies, 0 real metrics, 0 real users, 0 attention from real CT degens,” they added.

Crypto_Jobs is also pessimistic, envisioning a possible plunge to as low as $0.21. Some indicators, such as PIPPIN’s Relative Strength Index (RSI), support the bearish scenario. The technical analysis tool measures the speed and magnitude of recent price changes to help traders identify potential reversal points.

It ranges from 0 to 100, and readings above 70 suggest the valuation has risen too much in a brief period and could be due for imminent correction. Currently, the RSI stands at around 85.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

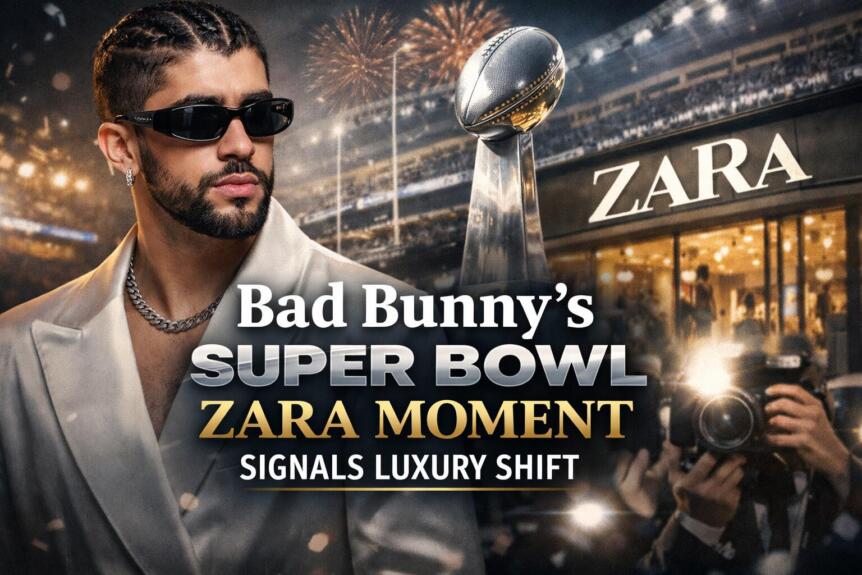

index falls 3.4% as all constituents trade lower

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1968.37, down 3.4% (-69.59) since 4 p.m. ET on Monday.

None of the 20 assets are trading higher.

Leaders: CRO (-1.1%) and BCH (-2.1%).

Laggards: APT (-5.5%) and ETH (-5.4%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Crypto exchange Kraken fires CFO Stephanie Lemmerman as long-awaited IPO draws closer

Kraken sacked its chief financial officer, Stephanie Lemmerman, just as the crypto exchange prepares to publicly list in the U.S. in the early part of this year, according to two people familiar with the matter.

Lemmerman joined Kraken from Dapper Labs in November 2024 and was the exchange’s CFO for one year and four months. She now has a strategic advisory role at Kraken, one of the people said.

Robert Moore, formerly VP of business expansion, has basically taken over her job, the person said. An updated leadership page on the website of Kraken’s parent company, Payward Inc., lists Moore as deputy CFO. Lemmerman does not appear.

Clearly it matters that Kraken has removed its CFO after lodging a confidential filing with U.S. regulators in November. That came just days after Kraken raised $800 million at a $20 billion valuation, including $200 million from Citadel Securities.

Other people who have been promoted to senior roles include Curtis Ting, who was made chief operating officer in December, and Kamo Asatryan was made chief data officer in January.

A second person familiar with the changes said finance at Kraken is changing to become more of a product than a back-office function.

Kraken declined to comment.

Crypto World

Michael Saylor downplays Strategy credit risk as bitcoin tumbles: ‘We’ll refinance the debt’

Strategy CEO Michael Saylor brushed off concerns about the company’s credit risk if bitcoin continues to tumble.

In fact, Saylor said he plans to keep accumulating the cryptocurrency for the company every quarter.

“If bitcoin falls 90% for the next four years, we’ll refinance the debt,” the executive said Tuesday on CNBC’s “Squawk Box.” “We’ll just roll it forward.”

Asked whether he believed banks would continue to lend to the digital asset treasury firm if bitcoin collapses, Saylor said, “Yeah, because the volatility of bitcoin is such that it’s always going to be a value.”

Bitcoin was last trading at $68,970.45, down 9% over the past five days. It has retreated as investors broadly reassess its utility, with the token tumbling 15% to $60,062.00 on Thursday — its lowest level in roughly 16 months. At its trough, the crypto was down more than 50% from its record.

Strategy has more than $8 billion in total debt on its balance sheet, in part due to its issuance of convertible notes used to buy bitcoin.

The executive also dismissed suggestions that Strategy would sell any of its digital asset holdings: “I expect we’ll be buying bitcoin every quarter forever,” Saylor said.

Strategy, 1 year

Strategy holds 714,644 bitcoins worth about $49 billion as of writing time, per its website. That makes it the largest corporate owner of the digital asset.

Saylor noted his firm has two-and-a-half years worth of cash on its balance sheet to cover dividends.

Strategy shed about 2% on Tuesday as bitcoin broke below $70,000 again. The stock has tumbled more than 40% over the past three months.

Crypto World

Vitalik Buterin outlines how the blockchain could play a key role in the future of AI

Ethereum co-founder Vitalik Buterin called for a rethink of how crypto and AI should come together, warning that a growing focus on developing artificial general intelligence (AGI) risks missing the bigger picture.

In a post on X that revisits ideas he first outlined two years ago, Buterin argues that the accelerated push toward artificial general intelligence often resembles the kind of unchecked speed and scale that Ethereum itself was created to challenge.

Rather than racing to build more powerful AI systems, he says the goal should be to guide AI development in a way that protects human freedom, spreads power more evenly and avoids both extreme AI risks and everyday security failures.

Buterin outlines a near-term vision where Ethereum plays an important — though not exclusive — role as infrastructure for AI. That includes tools to allow people to interact with AI models more privately, reducing the need to trust centralized providers. For example, running models locally, making anonymous payments for AI services and using cryptography to verify how AI systems behave.

He also describes Ethereum as a way for AI systems to coordinate economically, allowing bots to pay other bots, post security deposits, build reputations and resolve disputes without relying on a single company. Paired with AI tools that help people evaluate decisions and outcomes, Buterin argues these systems could make long-discussed ideas like decentralized governance work at real-world scale.

“To me, Ethereum, and my own view of how our civilization should do AGI, are precisely about choosing a positive direction rather than embracing undifferentiated acceleration of the arrow,” Buterin wrote on X.

Crypto World

MSTR stock eyes rebound, Strategy’s Michael Saylor: Bitcoin’s not for sale

The MSTR stock price remains in a deep bear market amid the ongoing crypto winter.

Summary

- The MSTR stock price could be on the verge of a strong bullish breakout.

- Michael Saylor insisted that Strategy will not sell Bitcoin.

- Instead, he believes that the company will keep buying Bitcoin forever.

Strategy was trading at $138 on February 10, down sharply from the all-time high of $542. Its market capitalization has slumped from a record high of over $133 billion to the current $39 billion.

Technical analysis: MSTR stock poised for rebound

The weekly timeframe chart shows that the MSTR share price has remained in a bear market in the past few months as Bitcoin (BTC) has plunged from its all-time high of $126,300 to the current $69,000.

There are signs that the stock is about to bottom. The most important sign is that the Relative Strength Index has plunged to 27, its lowest level since June 2022.

Strategy, previously known as MicroStrategy, jumped by over 2,700% the last time the RSI moved to this level. It jumped from ~$20 to a record high of $542.

The spread of the two lines of the Percentage Price Oscillator has narrowed, a sign that a bullish crossover is possible.

At the same time, the stock has settled at the 78.6% Fibonacci Retracement level, a sign that a rebound may happen soon.

If this happens, the next key target to watch will be the 61.8% Fibonacci Retracement level at $216 followed by $232, its lowest level in March and April last year.

Saylor confirms Strategy will not sell Bitcoin

Meanwhile, Saylor, the company’s founder and chairman, maintains his bullish outlook on Bitcoin, arguing that claims over whether the company would sell were unfounded and that he will continue buying.

Strategy bought 1,142 coins last week, bringing the total holdings to 714,644, which are now valued at over $49 billion. The company remains in the red, with an average cost per Bitcoin of $76,052.

Strategy’s balance sheet also has over $2.4 billion in cash, which is enough to cover dividends and debt maturities. He said:

We have two-and-a-half years’ worth of dividends in cash, our net leverage ratio is investment grade. We will not be selling. Instead, I believe we will be buying Bitcoin every quarter forever.

Saylor believes that Bitcoin will eventually bounce back as it has done in the last crypto bear markets. He also expects the coin to outperform traditional assets such as gold and the stock market.

Crypto World

Solana Historic Pattern Suggest a Recovery Rally is Incoming

Solana has spent recent sessions under heavy pressure, sliding to levels not seen in nearly two years. The sharp decline followed broader market weakness, dragging SOL well below prior support zones.

Despite the drawdown, early signs of stabilization are emerging. Historical patterns suggest Solana may be preparing for a recovery that could eventually carry the price back toward, and potentially beyond, the $100 mark.

Sponsored

Sponsored

Solana Has Seen Similar Conditions Before

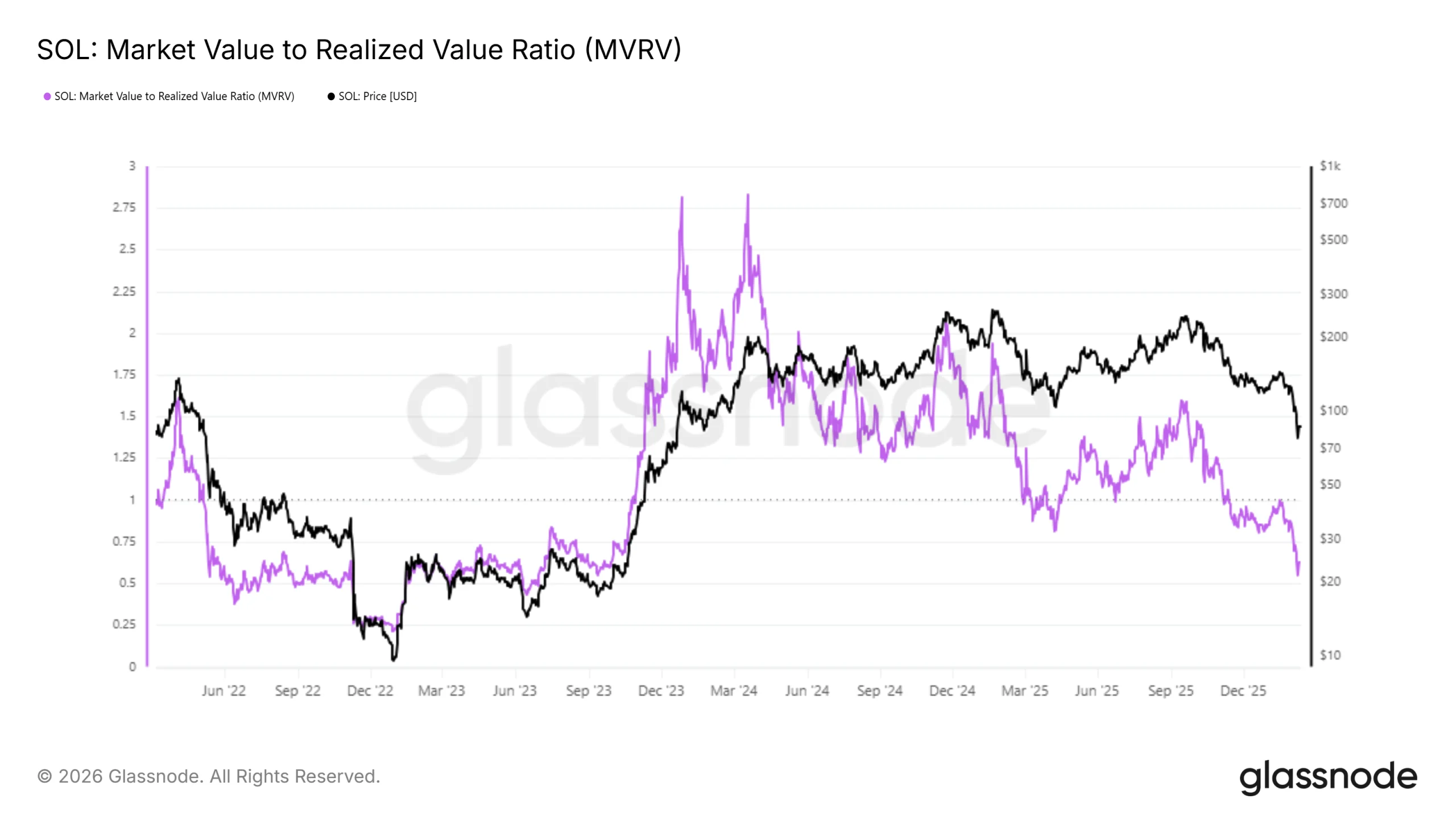

On-chain valuation metrics indicate Solana is deeply undervalued. The Market Value to Realized Value ratio has fallen to a near two-and-a-half-year low. This reading shows the market value of SOL is significantly below the aggregate cost basis of circulating tokens, reflecting widespread unrealized losses among holders.

Such conditions have historically marked late-stage corrections rather than early sell-offs. When realized value exceeds market value by this margin, selling pressure often diminishes. Investors become less inclined to exit at a loss, setting the stage for stabilization. This valuation imbalance supports the view that SOL is trading below fair value..

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Profitability data reinforces this outlook. Only 21.9% of Solana addresses are currently in profit, meaning roughly 78.1% of holders are underwater. This level of distress has historically aligned with market bottoms, as lower prices tend to attract demand from value-oriented participants.

Sponsored

Sponsored

In previous cycles, profitability dropping near or below 20% preceded notable recoveries. Reduced profit-taking limits supply, while depressed prices encourage accumulation. If history repeats, Solana could benefit from renewed interest as investors position for a rebound from deeply discounted levels.

SOL Price Bounce Back Requires Breaching This Level

Solana is trading near $86 at the time of writing, holding above the 23.6% Fibonacci retracement. This level is often described as bear market support. As long as SOL remains above it, downside risk appears contained, increasing the probability of a technical bounce.

Current stabilization suggests SOL may be forming a bottom. Any recovery will likely depend on improving capital flows. The Chaikin Money Flow indicator shows an uptick while still in negative territory. This shift suggests outflows are slowing, an early signal that selling pressure is easing.

A decisive move above $90 would place Solana on a recovery path toward $100. Confirmation would come if price flips the 61.8% Fibonacci level near $105 into support. Failure of inflows to materialize, however, could reverse progress. A drop below $81 would expose SOL to further declines toward $75 or even $70.

Crypto World

RIVER coin price bounces back 27%: analysts fear it could be a dead bounce

- RIVER coin price has surged 27% on bridge launch and new exchange listing.

- The cryptocurrency’s volume has spiked 126%, confirming strong buyer interest.

- Key support lies at $15.40, and a break below risks causing a $14.09 pullback.

RIVER coin has surged 27.4% in the past 24 hours, reaching an intraday high of $17.94.

The sudden spike comes after a period of relative stagnation, sharply outperforming a broader flat crypto market.

Traders are cautiously optimistic, but some analysts warn this could be a short-lived recovery.

The catalysts behind the rally

The primary driver of the rally was the launch of RIVER’s official cross-chain bridge.

This bridge allows seamless asset transfers between Ethereum, Base, and BNB Chain.

By enabling smoother liquidity flows, it addresses a core challenge faced by many DeFi projects.

At the same time, RIVER went live on LBank, a major centralised exchange, sparking fresh market activity.

$RIVER spot trading is live on @LBank_Exchange pic.twitter.com/U7HCPJR2dG

— River (@RiverdotInc) February 9, 2026

The exchange listing was accompanied by a $50,000 trading competition, which boosted short-term trading volume.

Combined, these events enhanced the token’s utility and made it easier for investors to access RIVER.

Volume data confirms the strength of the move, with a 126% surge in 24-hour trading volume to $83 million.

This shows that the rally was driven by genuine buying interest rather than thin order books.

The token also benefited from positive sentiment in the broader DeFi sector, which continues to attract investor attention.

RIVER coin price outlook

Analysts are watching key price levels closely to gauge the sustainability of the bounce.

If RIVER can hold above $15.40, it could attempt to reach a near-term target of $20.65.

This would represent a continuation of the current bullish momentum and strengthen confidence in the token’s recovery.

However, a break below $14.09 could signal that the rally has lost steam.

In that case, the coin may experience a pullback toward $12.50, testing lower support levels.

Traders are advised to monitor volume and bridge adoption as indicators of whether the move has lasting strength.

The rally also coincides with broader infrastructure upgrades, which could attract long-term users.

The cross-chain bridge is designed to simplify liquidity access and reduce fragmentation across networks.

Sustained adoption of this feature will be critical for supporting higher prices in the coming months.

Despite these positive factors, some analysts caution that the rebound could be a “dead mouse bounce.”

They argue that while short-term catalysts are present, the coin is still trading far below its all-time high of $87.73 that it hit at the beginning of the year 2026.

Price action remains fragile, and a failure to maintain support levels could result in another rapid decline.

Investors are therefore advised to weigh the recent gains against the risk of a correction.

The combination of technical indicators, exchange activity, and sector momentum will likely determine the next phase.

For now, the market is watching closely to see whether RIVER can convert its recent spike into a sustainable uptrend.

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat20 hours ago

NewsBeat20 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World8 hours ago

Crypto World8 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports19 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World8 hours ago

Crypto World8 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoDriving instructor urges all learners to do 1 check before entering roundabout