Crypto World

Epstein eyed Coinbase, XRP, XLM, Circle in pre-mainstream crypto era

Epstein’s 2010s emails show Gensler talks, XRP/XLM bets, CBDC and stablecoin funding links.

Summary

- 2018 emails show Epstein sought crypto talks with Gensler and briefed Summers on early digital currency discussions.

- Records cite about $3m into Coinbase plus speculative exposure to XRP, XLM, Circle and early stablecoin structures tied to Brock Pierce.

- Reports mention funding for MIT-linked CBDC pilots and private crypto ventures as crypto policy circles were still nascent.

Newly released documents from the Jeffrey Epstein case contain references to communications involving cryptocurrency policy discussions and Gary Gensler, according to reports published this week.

The documents include emails dated 2018 that reportedly mention conversations between Epstein and individuals connected to policy and academic circles in the cryptocurrency sector. Gensler, who later served as Chair of the Securities and Exchange Commission, appears among the names referenced in the materials.

According to the reports, the files contain correspondence suggesting Epstein discussed arranging a meeting with Gensler regarding cryptocurrency topics. Emails from 2018 indicate Epstein told former U.S. Treasury Secretary Lawrence Summers that Gensler had arrived early for crypto-related discussions, according to the documents. Summers reportedly responded that he knew Gensler and considered him intelligent.

No documents released to date have established a direct connection between Epstein and any specific cryptocurrency decision or project, according to available reports. However, records suggest Epstein invested millions in early cryptocurrency ventures, including approximately $3 million in Coinbase in 2014, reports stated.

Some emails reportedly referenced XRP and Stellar, leading to speculation about possible investments in those projects, though the documents do not provide clear confirmation, according to observers.

Additional claims in the reports suggest Epstein provided funding for U.S. central bank digital currency pilot programs through MIT and certain Federal Reserve Banks. Gensler taught at MIT during that period and worked in academic policy circles before entering government service and participating in the development of U.S. cryptocurrency regulation.

Reports also indicate Epstein explored early stablecoin-related investments, including Circle, through connections associated with Brock Pierce. Pierce reportedly requested Epstein’s assistance in connecting with Lawrence Summers, according to accounts of the correspondence.

The documents suggest Epstein maintained investments in private cryptocurrency ventures while maintaining relationships with academic and policy circles involved in digital currency regulation, according to analysts reviewing the materials. The timing of these connections has drawn attention as they occurred before cryptocurrency markets achieved mainstream adoption.

Crypto World

Bitcoin ETFs Retain $53B in Net Inflows After Sell-Off

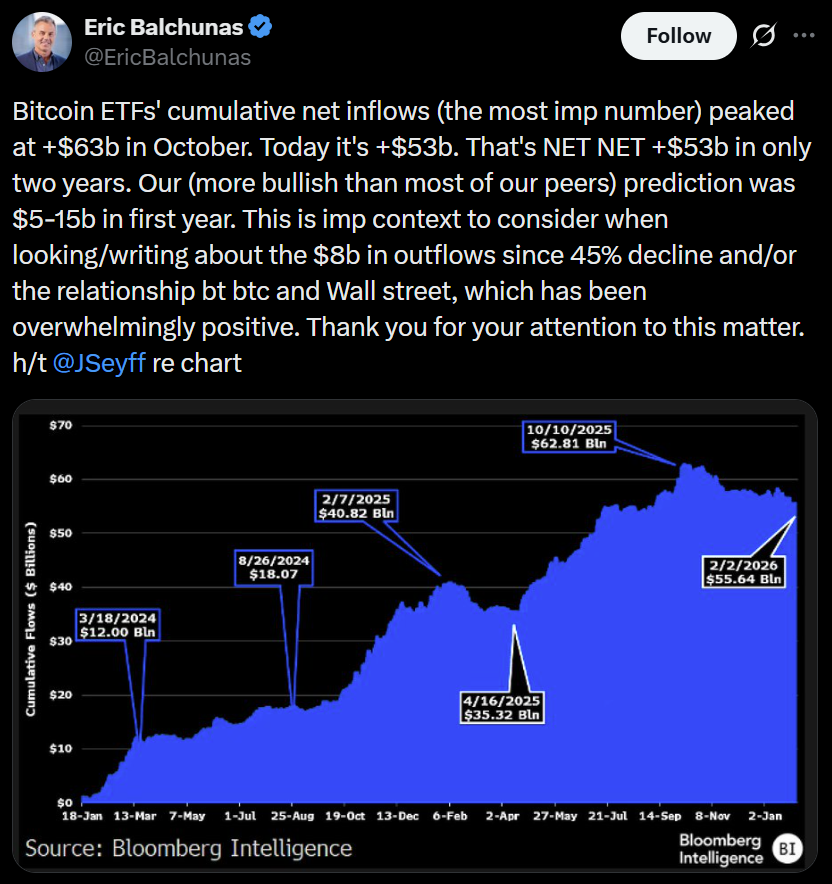

US spot Bitcoin exchange-traded funds (ETFs) may be seeing heavy outflows lately, but the broader picture tells a different story.

According to Bloomberg ETF analyst Eric Balchunas, cumulative net inflows into Bitcoin (BTC) ETFs peaked at $63 billion in October and now stand at about $53 billion, even after months of redemptions.

“That’s NET NET +$53b in only two years,” Balchunas wrote on X, sharing data compiled by fellow analyst James Seyffart.

The figure far exceeds Bloomberg’s early projections, which had called for inflows of $5 billion to $15 billion over that time frame.

In other words, recent withdrawals haven’t erased the bigger success story. Despite Bitcoin’s roughly 50% pullback from its highs, institutional money hasn’t fled at the same pace, suggesting many investors are holding for the long term rather than panic selling.

The US spot Bitcoin ETFs were approved in early 2024 and quickly became a dominant force in the market. Bitcoin went on to hit new all-time highs ahead of its April 2024 halving event, breaking historical trends, with ETF accumulation accelerating through 2025 and peaking in October as prices surged past $126,000.

The launches are widely considered among the most successful in US ETF history. BlackRock’s iShares Bitcoin Trust, in particular, became the fastest ETF ever to surpass $70 billion in assets, reaching the milestone in under a year.

Related: BlackRock sees record quarter for iShares ETFs as Bitcoin, Ether demand surges

Bitcoin faces an uncertain 2026 as cycle debate intensifies

To be sure, 2026 is shaping up to be a challenging year for Bitcoin and the broader digital asset market, following a renewed sell-off in late January and early February that sent the biggest cryptocurrency to about $60,000.

Investor sentiment remains fragile, prompting some analysts to argue that the latest bull market, consistent with Bitcoin’s historical four-year cycle, may have run its course.

Others contend the cycle is simply evolving. They argue that a longer business cycle and changing macro conditions could be stretching Bitcoin’s traditional rhythm rather than ending it.

Bitwise analysts Matt Hougan and Ryan Rasmussen go further, suggesting Bitcoin may be breaking from its long-standing four-year pattern altogether due to the growing influence of institutional capital.

“The wave of institutional capital that began entering the space in 2024 is likely to accelerate in 2026,” the analysts said, pointing to expanded access on major wealth platforms such as Morgan Stanley and Merrill Lynch.

Despite rapid institutional adoption through spot ETFs, Bitcoin appeared to lose retail attention in 2025 as investors gravitated toward other high-growth themes, according to data from crypto market maker Wintermute.

Related: Bitcoin mining’s 2026 reckoning: AI pivots, margin pressure and a fight to survive

Crypto World

ProShares launches money market ETF for stablecoin issuers

ProShares has launched a new money market exchange-traded fund designed to help stablecoin issuers manage regulatory-compliant reserves backed by short-term U.S. Treasuries.

Summary

- ProShares has introduced the IQMM ETF to meet reserve rules for stablecoin issuers under the GENIUS Act framework.

- The fund invests only in short-term U.S. government securities and offers intraday trading and same-day settlement.

- The product reflects growing ties between traditional asset managers and the digital asset sector.

The company said in a Feb. 19 statement that the ProShares GENIUS Money Market ETF, trading under the ticker IQMM, is built to meet reserve rules under the GENIUS Act. The fund invests only in short-term U.S. Treasury securities and is designed to serve as a low-risk cash management option.

ProShares described IQMM as a conservative product for institutions, financial advisers, and individual investors. A key target group is companies that issue dollar-backed stablecoins and need compliant ways to manage large reserve balances.

Focus on stablecoin reserve management

IQMM holds only short-term government-backed securities, including Treasury bills and related instruments. This structure allows the fund to qualify as eligible backing for payment stablecoins.

Under current U.S. rules, stablecoin issuers must maintain one-to-one reserves in safe and liquid assets. These requirements have increased demand for products that combine regulatory compliance with operational flexibility.

The ETF allows investors to trade throughout the day and settle transactions on the same day. Weekly income distributions are planned, giving holders a steady return on idle funds.

IQMM also uses a floating net asset value and dual NAV options. These features are intended to help institutions move large cash positions without disrupting daily operations.

ProShares said the fund carries a net expense ratio of 0.15%. While retail investors can access the product, the main focus remains on firms managing large reserve pools. Industry estimates suggest stablecoin issuers held more than $150 billion in U.S. Treasuries by late 2025.

“We believe that IQMM will be an attractive cash management alternative for institutional investors, including stablecoin treasuries,” said ProShares chief executive Michael L. Sapir.

Traditional finance deepens its crypto ties

The launch reflects closer links between traditional asset managers and the digital asset industry, as regulators demand higher standards for stablecoin backing.

With IQMM, ProShares is offering a ready-made option for companies that prefer not to manage Treasury portfolios on their own. The ETF structure allows issuers to meet reserve rules while relying on familiar market infrastructure.

Analysts say such products could make compliance easier for crypto firms entering more regulated environments. Instead of building internal treasury operations, issuers can place reserves in approved funds with clear reporting and oversight.

Some market observers, however, note that heavy redemptions during periods of stress could put pressure on money market ETFs tied to stablecoin activity. Managing liquidity during volatile conditions will remain an important test.

ProShares manages more than $95 billion across its ETF and mutual fund platforms. In recent years, the firm has expanded into crypto-linked, income-focused, and tactical investment strategies.

Crypto World

ProShares Launches Treasury ETF for GENIUS Stablecoin Reserves

US-based exchange-traded funds issuer ProShares has launched a money market ETF designed to qualify as an eligible reserve asset under the GENIUS Act, positioning it for potential use by stablecoin issuers.

The ProShares GENIUS Money Market ETF, trading under the ticker IQMM, invests exclusively in short-term US Treasurys. Unlike conventional government money market funds, it uses a floating net asset value (NAV) based on market pricing and trades intraday on an exchange.

According to an announcement on Wednesday, the structure includes same-day settlement and dual NAV features designed for institutional reserve management.

The prospectus adds that because the portfolio is limited to reserve-eligible assets under the GENIUS Act, the fund’s yield may be lower than that of money market funds with broader mandates. It also says that shares are expected to be held primarily by one or more stablecoin issuers backing outstanding tokens.

The prospectus further warns that future rulemaking under the GENIUS Act or other US legislation could affect how the ETF may be used as a reserve vehicle.

The US GENIUS Act, passed in July 2025, establishes federal standards for payment stablecoin reserves, including requirements that backing assets be held in high-quality, short-duration instruments such as US Treasurys.

Bethesda, Maryland-based ProShares was founded in 2006, and manages more than $95 billion in assets across its ETF and mutual funds, according to the company.

Related: Ether bulls target $2.5K as staking ETF launch, RWA growth fuel optimism

New SUI staking ETFs launch as Bitcoin funds post weekly outflows

Several asset managers rolled out new crypto ETFs this week, including staking-focused SUI (SUI) products.

On Wednesday, Canary Capital Group launched the Canary Staked SUI ETF on Nasdaq under the ticker SUIS, offering exposure to the spot price of SUI while participating in the Sui Network’s proof-of-stake validation process to generate additional token rewards reflected in the fund’s net asset value.

According to data from Nasdaq.com, the ETF was trading between $23.42 and $23.71 on Thursday, with 3,633 shares changing hands at the time of writing. The ETF closed its first day of trading on Wednesday at $24.17 after opening at $25.00 a share.

The same day, Grayscale Investments said its Sui Staking ETF began trading on NYSE Arca under the ticker GSUI, offering exposure to SUI and reflecting staking rewards generated through participation in the Sui network.

SUI is the native token of the Sui Network, a layer-1 blockchain built by former Meta Libra engineers to support high-throughput, low-cost applications across decentralized finance, digital marketplaces and gaming.

The new alt-coin ETFs launched as spot Bitcoin ETFs remained under pressure this week, extending their run of net outflows.

US-listed products recorded $133.3 million in net redemptions on Wednesday, bringing weekly withdrawals at that point to $238 million, according to SoSoValue data. BlackRock’s iShares Bitcoin Trust led the declines, with $84.2 million exiting the fund.

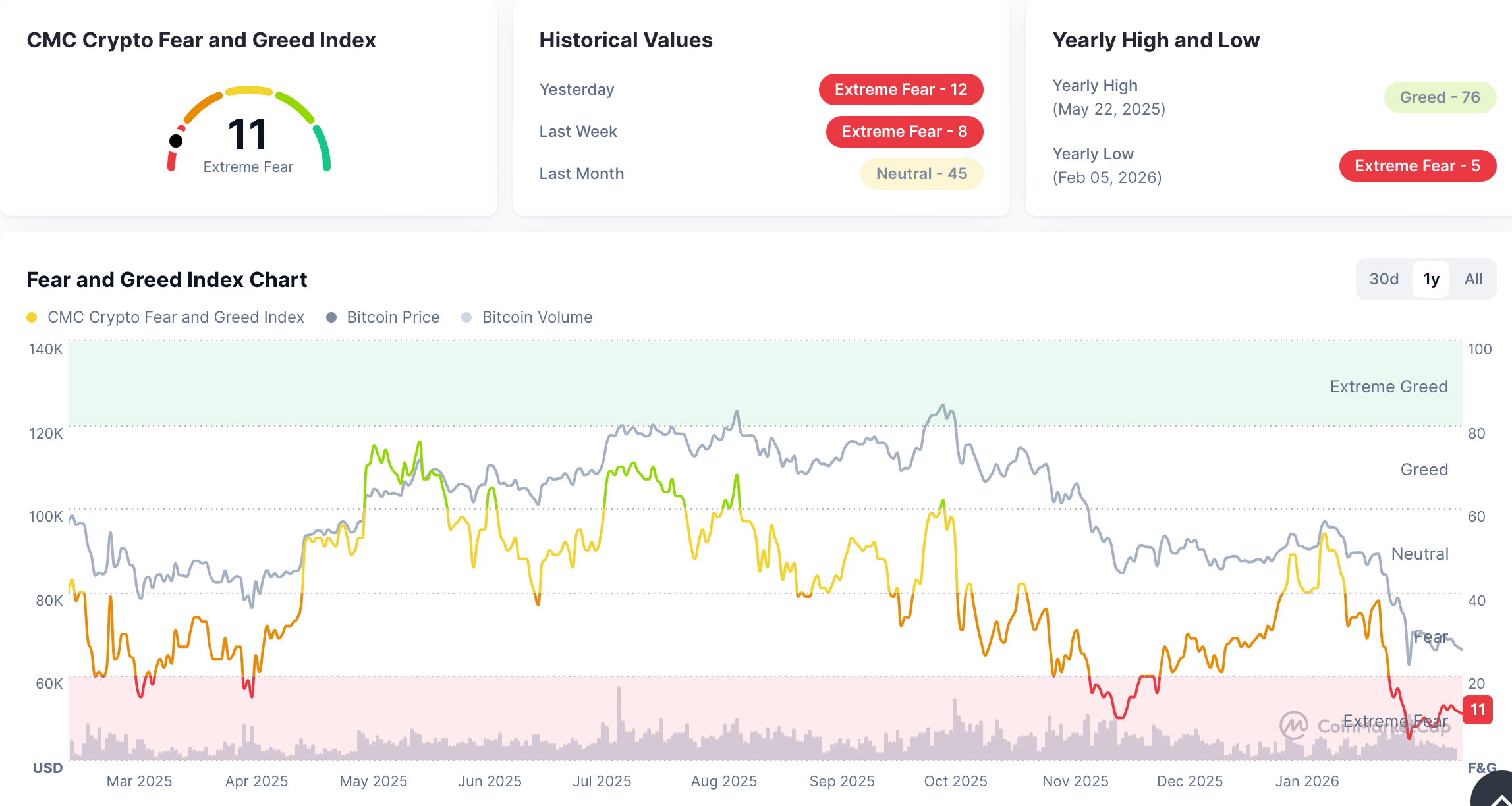

CoinMarketCap’s Crypto Fear and Greed Index remains in extreme fear at 11 out of 100, underscoring persistently weak sentiment across digital asset markets.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Hyperliquid launches Washington policy center to press for regulatory clarity

Decentralized perpetual futures exchange Hyperliquid has launched a new advocacy group in Washington to push for clearer rules around decentralized finance in Congress.

Summary

- Hyperliquid launched the Hyperliquid Policy Center in Washington to advocate for clearer regulations governing decentralized finance.

- HPC will focus on perpetual derivatives and blockchain-based financial infrastructure.

The Hyperliquid Policy Center will be “dedicated to advancing a clear, regulated path for decentralized finance to thrive in the United States,” according to a Feb. 18 announcement.

It will do this by producing “rigorous technical research” and “practical regulatory frameworks” for defi with a special focus on the derivatives market and blockchain-based financial infrastructure.

HPC has selected crypto policy veteran Jake Chervinsky to lead the organization. Chervinsky has a long track record in digital asset regulation and securities litigation, and has previously served as Chief Legal Officer at Variant and Chief Policy Officer at the Blockchain Association, as well as General Counsel at Compound Labs.

“U.S. financial regulations weren’t written for decentralized tech like Hyperliquid,” Chervinsky said in an X post, adding that “HPC will add expertise in perpetual derivatives, decentralized markets, and other technical topics to the conversation in Washington.”

The Hyper Foundation, an independent body supporting the growth of the Hyperliquid ecosystem, has pledged 1 million Hyperliquid tokens to fund the launch of the Hyperliquid Policy Centre.

As the industry matures, the traditional one-size-fits-all approach to blockchain advocacy is being replaced by surgical, sector-specific lobbying.

Last year, top Ethereum protocols, including Aave, Uniswap, and Lido, among others, came together to form the Ethereum Protocol Advocacy Alliance, a joint advocacy effort to advance global policy change.

More recently, the Digital Chamber launched the Prediction Markets Working Group in a bid to protect and formalize the legal status of event-based contracts in the United States by reinforcing the Commodity Futures Trading Commission as the exclusive regulator for prediction markets.

Crypto World

Illicit Stablecoin Activity Hit a Five-Year High in 2025

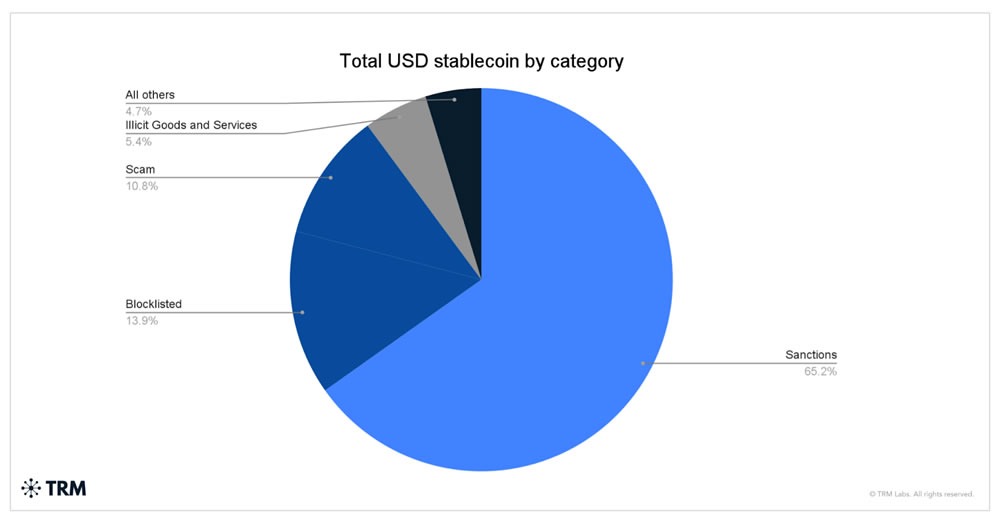

Illicit entities received around $141 billion via stablecoins in 2025, the highest level observed in the last five years, says blockchain analytics firm TRM Labs.

TRM said in a report released on Tuesday that the increase doesn’t reflect a broader growth in crypto-enabled crime, but does show a “deeper reliance on stablecoins within specific activity types where they offer clear operational advantages.”

Stablecoins have been particularly used in sanctions-linked networks and large-scale money movement services, it said.

Sanctions-related activity accounted for 86% of all illicit crypto flows in 2025. Of the $141 billion in stablecoin flows, around half, or $72 billion, was linked specifically to the Russian ruble-pegged token A7A5, “whose activity is almost entirely concentrated within sanctions-linked ecosystems,” TRM said.

Russian-linked networks, such as one called A7, intersect with other state-linked ecosystems, including entities tied to China, Iran, North Korea, and Venezuela, “underscoring how stablecoins have become a connective infrastructure for sanctioned actors seeking to move value outside traditional financial controls,” TRM stated.

Guarantee marketplaces exclusively on stablecoins

Comparatively, scams, ransomware, and hacking activity make more selective use of stablecoins, often favoring Bitcoin (BTC) or other crypto assets before using stablecoins later in the laundering process.

The report also noted that categories such as illicit goods and services and human trafficking showed “near-total stablecoin usage,” suggesting these markets “prioritize payment certainty and liquidity over price appreciation.”

Volume on guarantee marketplaces like Huione surged to over $17 billion by late 2025, predominantly in stablecoins.

“The fact that roughly 99% of this volume is denominated in stablecoins reinforces the role these services play as laundering infrastructure, not speculative venues,” they stated.

Related: Crypto launderers are turning away from centralized exchanges: Chainalysis

Chainalysis reported earlier in February that crypto flows to suspected human trafficking networks increased 85% year over year in 2025. International escort services and prostitution networks operated almost exclusively using stablecoins, they noted.

TRM Labs reported that total stablecoin transaction volume exceeded $1 trillion on multiple occasions in 2025.

Approximating this over a year yields around $12 trillion, meaning illicit use accounts for about 1% of the total.

Compared with the United Nations estimate, the amount of illicit money laundered globally in one year is 2% to 5% of global GDP, or around $800 billion to $2 trillion.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express

Crypto World

Bitdeer Stock Drops 17% on $300M Convertible Note Sale

Shares in Bitdeer Technologies Group took a hit on Thursday after the Bitcoin mining and artificial intelligence infrastructure firm announced a $300 million convertible senior note offering.

Bitdeer said that it intends to offer a “principal amount” of $300 million in convertible senior notes with an option for purchasers to buy an additional $45 million in a private placement.

It is the second convertible note offering from the firm, following a $150 million offering in April 2024, which also caused an 18% stock slump.

Convertible senior notes are a loan that investors can convert into shares of the issuing company’s common stock, and holders of these notes have priority over other debt holders in the event of the company’s bankruptcy.

The new notes, due to settle in 2032, are senior unsecured obligations with interest paid semiannually, and can be converted to cash, shares, or a combination of both.

Bitdeer intends to use the proceeds for datacenter expansion, AI cloud growth, crypto mining rig development, and for general corporate purposes.

The company is headquartered in Singapore with datacenters in the US, Norway, and Bhutan.

Bitdeer stock tanks 17% on latest offering

Shares in Bitdeer (BTDR) ended trading on Thursday down 17.38% to $7.94 and saw a slight fall in after-hours trading to $7.89.

Company stock is currently down 29% since the beginning of the year and almost 70% since its January 2025 all-time high of around $26.

Related: Strategy to equitize convertible debt over 3-6 years: Saylor

Convertible debt often puts pressure on shares as investors factor in the risk of future dilution, as in the event the stock rises, noteholders may convert their debt into equity, increasing the share count.

Capped call transactions to offset dilution

Bitdeer is also running a concurrent registered direct share offering tied to a plan to repurchase a portion of its existing convertible notes due in 2029.

Bitdeer plans to use “capped call transactions,” which are derivatives used when issuing convertible notes designed to offset some dilution, but that did not prevent its stock from sliding.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express

Crypto World

Fed’s Neel Kashkari Says Crypto ‘Utterly Useless’

Neel Kashkari, the president of the US Federal Reserve Bank of Minneapolis, says that crypto is “utterly useless” in comparison to artificial intelligence and took a swipe at stablecoins, saying they don’t have many uses.

Speaking at the 2026 Midwest Economic Outlook summit on Thursday, Kashkari drew comparisons between AI and crypto, saying the latter “has been around for more than a decade, and it’s utterly useless.”

“AI has not been around very long, and people are using it every day,” he added. “This is demonstrating to me that this thing is real and it has real long-term potential for the US economy as opposed to crypto.”

Kashkari said that the way the crypto industry has framed how stablecoins can be used is “a buzzword salad.”

“I always ask people: What can I do with the stablecoin that I can’t do with Venmo today?” he said. “I could send any one of you $5 with Venmo, or PayPal, or Zelle, so what is it that this magical stablecoin can do? Then I get a buzzword salad answer, blah blah blah, tokenized deposits.”

Kashkari took specific aim at the notion of stablecoins being used for remittances, as he highlighted that this mainly serves people outside the US, and argued that its not as cheap as people think.

Related: SEC leaders seek to clarify how tokenized securities interact with existing regulation

He used the example of his father-in-law, based in the Philippines, arguing that while he could receive stablecoins quickly, he still needs to pay fees to convert them into the local currency to actually transact with them.

“If everybody in the world uses the same currency or the same payment platform. All these frictions go away. But all these other countries are not going to abandon their own monetary policy [for stablecoins],” he said.

“When it comes to anything about crypto or stablecoins, ask the most basic questions and don’t settle for word salad nonsense answers,” he said.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Why is the crypto market down today? (Feb. 19)

The crypto market remained in a downtrend on Thursday, dropping nearly 3% to $2.35 trillion due to a confluence of macroeconomic uncertainty and geopolitical tensions that spooked investors.

Summary

- The latest FOMC minutes report has cast uncertainty regarding rate cuts hurting risk-on sentiment.

- Fears of a full-blown US-Iran war have pushed investors to the sidelines.

- Crypto ETFs recorded billions in outflows over the past weeks.

Bitcoin (BTC), the world’s largest crypto asset, fell 3.5% to around $65,900 before experiencing a partial recovery back above $66,700 at press time. Ethereum (ETH) was down 1.6% after losing the $2,000 key support level, while other major cryptos such as XRP (XRP), BNB (BNB), Solana (SOL), and Dogecoin (DOGE) were also in the red, posting losses between 1% and 4%.

Some of the top laggards of the day were Provenance Blockchain (HASH), Zcash (ZEC), and Memecore (M).

The latest slide triggered a liquidation wave, with the open interest of the total market falling by 0.71%. Data from SoSoValue show that in the past 24 hours, over $224 million worth of positions were liquidated from the futures market, with roughly $164 million coming from long positions.

At the same time, the crypto fear and greed index, a metric investors use to gauge the general sentiment of the market, remained in the extreme fear thresholds.

The crypto market tanked on Thursday after the FOMC minutes report on Feb. 19, which revealed uncertainty over more rate cuts moving into the coming months. This shifting stance could set the Federal Reserve on a direct collision course with President Donald Trump, who has consistently pressured for aggressive rate cuts. It also complicates the path for Trump’s nominee for Fed chair, Kevin Warsh.

According to market predictions platform Polymarket, the odds of no changes in rate cuts for the next FOMC meeting in March have increased to 93% at the time of writing. Cryptocurrency prices have historically fallen back or remained suppressed when the Fed sets a hawkish tone surrounding interest rate policies.

U.S.-Iran war tensions

Investors also remain wary of a potential full-scale war between the United States and Iran. According to recent reports, the United States and Israel are planning a potential joint campaign to target Iran’s nuclear and missile facilities, which could escalate into a weeks-long conflict. Meanwhile, Iran has vowed to retaliate against any strikes on its territory.

When markets enter a period of geopolitical stress, such as an armed conflict, investors often rotate capital to cash and traditional safe-haven assets and, in turn, dump volatile crypto assets. Bitcoin has so far failed to establish a credible safe-haven narrative as it continues to trade as a high-beta risk asset rather than digital gold.

During this latest escalation, the premier cryptocurrency has mirrored the declines seen in tech stocks, struggling to absorb the stress bid that has instead bolstered physical gold and crude oil prices.

Bitcoin ETFs outflows hit 5-week streak

Another layer eroding retail confidence in the crypto market is the lackluster interest shown by institutional investors towards crypto ETFs, specifically majors like Bitcoin and Ethereum ETFs.

Data from SoSoValue shows that the 12 spot Bitcoin ETFs have recorded 5 straight weeks of outflows so far, with the total tally of these net withdrawals standing at over $3.6 billion within the period. Meanwhile, their Ethereum counterparts have posted outflows of over $1.2 billion.

As investor demand in these investment vehicles continues to be sluggish, it removes a key safety net of consistent institutional buying pressure that has historically stabilized prices during periods of high volatility. Without this reliable influx of capital, the market remains more vulnerable to sudden selloffs and the prevailing negative sentiment.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Bitcoin price outlook as CLARITY Act approval odds hit 90%

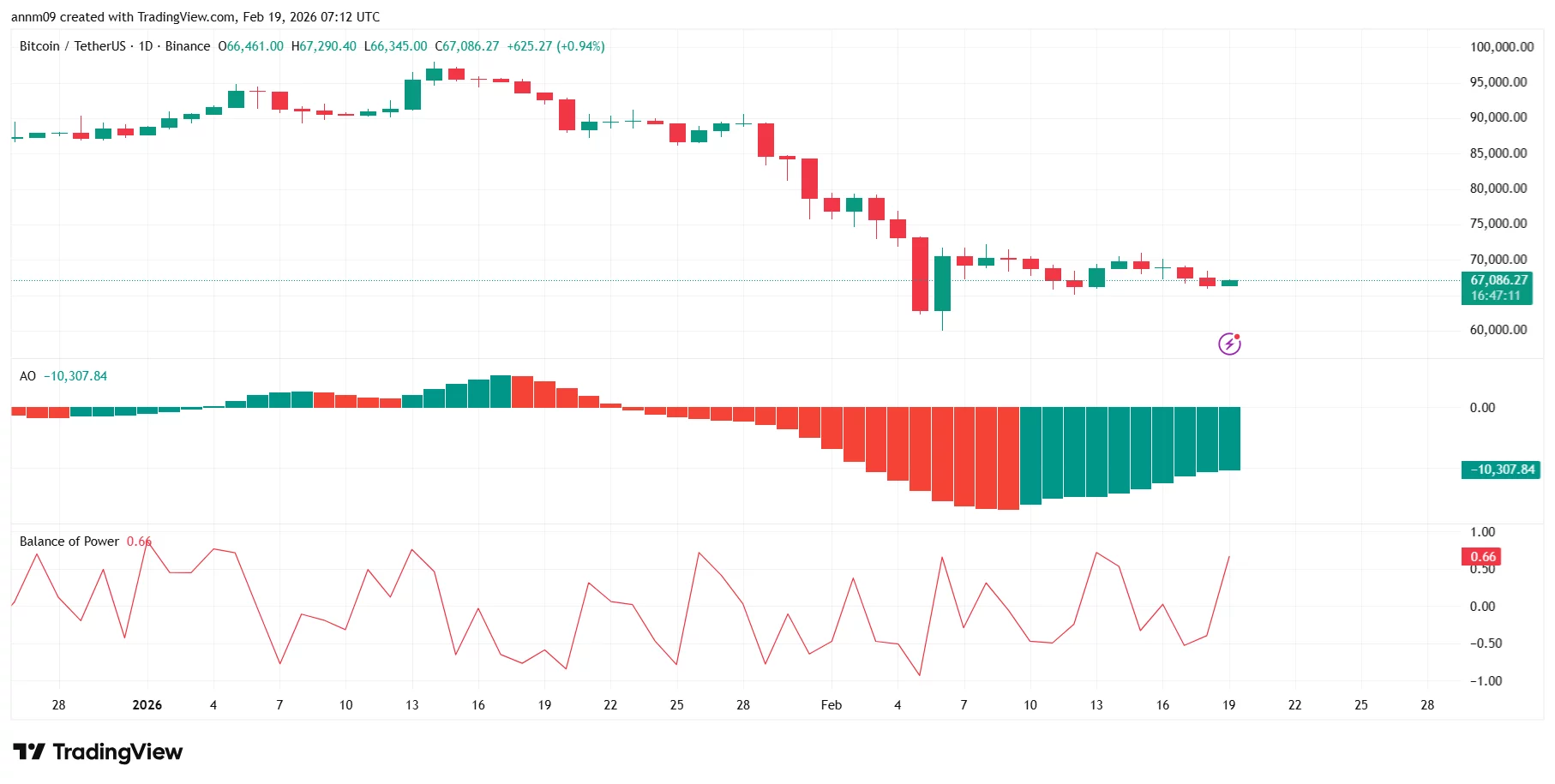

Bitcoin traded near $67,000 on Thursday, steadying after a session that coincided with sharp swings in prediction market odds for the CLARITY Act.

Summary

- Bitcoin traded near $67,000 as Polymarket odds for the CLARITY Act swung from 90% to 55%, highlighting regulatory uncertainty.

- The CLARITY Act aims to define oversight between the SEC and CFTC, potentially reducing ambiguity and boosting institutional confidence in crypto markets.

- Technically, BTC is consolidating between $65,000 and $70,000, with weakening bearish momentum but key resistance overhead at $70,000–$75,000.

On Polymarket, approval odds for the CLARITY Act briefly surged to 90% earlier in the day before sharply retracing to around 55% at press time, reflecting uncertainty around the bill’s path forward.

The CLARITY Act is a proposed U.S. crypto market structure bill designed to define regulatory oversight between the SEC and CFTC. The legislation aims to provide clearer rules for digital assets, token classification, and exchange compliance.

If passed, it could reduce regulatory ambiguity, encourage institutional participation, and improve long-term capital inflows into the crypto sector.

Bitcoin price outlook: Momentum stabilizing after sharp drop

On the daily chart, Bitcoin remains in a broader short-term downtrend following its sharp selloff from the mid-$90,000 region earlier this year. Price action shows a series of lower highs and lower lows before stabilizing around the mid-$60,000 range.

The recent large red candle near $72,000 marked a capitulation-style move, with price briefly dipping toward the low-$60,000s before rebounding. Since then, BTC has been consolidating between roughly $65,000 and $70,000.

The Awesome Oscillator (AO) remains in negative territory but is printing rising green bars, suggesting bearish momentum is weakening. Meanwhile, the Balance of Power (0.66) has turned positive, indicating buyers are attempting to regain short-term control.

Immediate resistance sits near $70,000, followed by a stronger ceiling around $75,000, where prior breakdown occurred. On the downside, key support lies at $65,000, with a deeper level near $60,000 if selling resumes.

For now, Bitcoin appears to be consolidating. A decisive break above $70,000 could open the door for recovery, while failure to hold $65,000 may invite renewed downside pressure.

Crypto World

Sui price eyes $1.20 breakout zone as staking ETFs launch

Sui price is holding the $0.93 support zone as two new U.S. spot staking exchange-traded funds begin trading.

Summary

- SUI trades near support after a prolonged downtrend.

- Two U.S. spot staking ETFs now offer direct exposure with on-chain yield.

- $1.20 remains the key breakout level to confirm a trend shift.

Sui was trading at $0.9364 at press time, down 3.3% in the last 24 hours. Over the past week, the price moved between $0.8991 and $1.04. Buyers have stepped in several times near the $0.90 area.

The wider trend is still weak. Sui (SUI) is down 40% in the last 30 days and about 70% over the past year. Each recovery attempt has stalled below prior highs.

Derivatives show mixed positioning. According to CoinGlass data, futures volume rose 5% to $616.58 million, while open interest fell 2.93% to $493 million. When volume increases but open interest drops, it often points to short-term trades being opened and closed rather than strong conviction in one direction.

First U.S. spot SUI ETFs begin trading

Two spot ETFs tied directly to SUI began trading on Feb. 18.

The Canary Staked SUI ETF (SUIS) from Canary Capital Group began trading on Nasdaq. The fund holds spot SUI and stakes part or all of its holdings on the network. Staking rewards are reflected directly in the ETF’s net asset value.

On the same day, Grayscale Investments launched the Grayscale Sui Staking ETF (GSUI) on NYSE Arca. The fund carries a 0.35% annual sponsor fee, waived for the first three months or until assets reach $1 billion. At launch, 100% of holdings were staked.

Both products are structured as spot ETFs, not futures-based funds. They hold actual SUI tokens and pass staking rewards through to investors via net asset value. With Sui’s staking yield near 7%, the structure offers exposure to both price movement and on-chain yield.

ETF launches for Bitcoin in 2024 and Ethereum in 2025 attracted significant inflows. It is unclear if SUI will experience a comparable level of demand. Further token purchases by the funds could support the price. If participation disappoints, the impact may be limited.

Sui price technical analysis

On the daily chart, $0.93–$0.90 has acted as key support. The price has repeatedly tested this area, with buyers intervening to stabilize price. Short-term downward pressure might lessen if $0.90 holds.

The tightening of the Bollinger Bands indicates compression of volatility. Larger moves are often preceded by such squeezes. Whether or not resistance is recovered will determine the course.

The relative strength index is currently in the mid-30s after recovering from oversold levels close to 25. A mild bullish divergence has formed, with RSI making a higher low while price retested support. Momentum is improving, though it has not yet turned bullish.

SUI still trades below the 20-day moving average. Lower highs remain intact since the rejection near $2.00. The first sign of structural improvement would be a break above $1.05–$1.10.

The major breakout level sits at $1.15–$1.20. This zone aligns with the prior breakdown structure and horizontal supply. A daily close above $1.20 would break the lower-high pattern and could open room toward $1.45–$1.60.

If $0.93 fails, the next supports lie near $0.85 and $0.75. For now, SUI is compressing near support while ETF catalysts enter the market. Volume expansion on a move above $1.05–$1.20 will likely decide the next trend.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Video3 hours ago

Video3 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World7 hours ago

Crypto World7 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market