Crypto World

Ethereum address poisoning strikes again

An Ethereum user lost $600,000 on Tuesday morning to a common crypto scam known as ‘address poisoning.’

Highlighting the loss, SpecterAnalyst, a self-described “onchain investigator,” warned users to “always verify the entire wallet address.”

The costly mishap comes just one week after another user lost over $350,000 to the same scam, despite first sending a test transaction to the attacker’s address.

Read more: Crypto trader loses $50M USDT to address poisoning scam

Address poisoning is an attack vector in which scammers send spam transactions to genuine users, after they make a transfer.

The incoming transactions come from similar-looking addresses in the hopes that the user will confuse them for the intended address in future transfers. Fake versions of common token tickers may be transferred in these spam transactions, or small amounts of genuine assets.

The strategy requires generating a new, look-alike address with identical beginning and end characters, which the user accidentally copies and pastes into future transfers.

Popular block explorers often abbreviate the middle portion of addresses to save space.

Read more: Refund of $70M ‘address poisoning’ scam ongoing, over 50% returned

Barabazs.eth, of the Ethereum Foundation and Ump.eth, proposes a partial solution to this issue. The tool allows for visually truncated addresses, while the full text remains searchable for users to double-check before transfers.

However, using an address book is far safer than copying addresses from a block explorer.

After Ethereum’s Fusaka upgrade lowered transaction costs, address poisoning has surged. The volume of freshly created addresses has risen sharply following the protocol upgrade in December last year, according to research from Andrey Sergeenkov.

Test failed successfully

In the wake of today’s loss, SpecterAnalyst also drew attention to a significant loss from last week.

This time, the user even sent a test transaction to the scammer’s spoofed address, but “the test fund was not properly confirmed before sending the main amount.”

The simple error led to a loss of over $350,000.

SpecterAnalyst suggests that, for this user, testing became “a routine step rather than serving its actual purpose of confirming the correct destination address.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Mubadala Investment Company and Al Warda boosted IBIT stakes in Q4

Two of Abu Dhabi’s major investment firms increased their exposure to bitcoin in the fourth quarter of 2025, buying into BlackRock’s spot bitcoin ETF as the market fell, according to recent regulatory filings.

Mubadala Investment Company, a sovereign wealth fund backed by the Abu Dhabi government, added nearly four million shares of BlackRock’s iShares Bitcoin Trust (IBIT) between October and December, bringing its total holdings to 12.7 million shares. The move came as bitcoin fell roughly 23% during the quarter.

Mubadala made its first purchases in IBIT in late 2024 and has been adding since.

Al Warda Investments, another Abu Dhabi-based investment management firm that oversees diversified global assets on behalf of government-related entities, held 8.2 million shares at the end of the fourth quarter, up slightly from 7.96 million shares three months earlier.

Together, the two funds held more than $1 billion worth of bitcoin via IBIT at the end of 2025. However, with bitcoin down another 23% year-to-date in 2026, the current value of their combined holdings has dropped to just over $800 million as of Tuesday (assuming they haven’t continued adding in 2026).

The disclosure, made through 13F filings with the U.S. Securities and Exchange Commission, reflects growing institutional interest in spot bitcoin ETFs, even during periods of market stress. BlackRock’s IBIT, which launched in early 2024, has quickly become the dominant vehicle for regulated exposure to bitcoin in the U.S.

While the crypto market has faced ongoing headwinds in early 2026 — including low volatility, reduced retail participation, and macroeconomic uncertainty — some long-term investors appear to be using the downturn to build positions in regulated, liquid products tied to digital assets.

BlackRock head of digital assets, Robert Mitchnick, said on a recent panel that there is a mistaken belief that hedge funds using ETFs are driving volatility and heavy selling, but that does not match what the firm is observing. Instead, he said, IBIT holders are in it for the long term.

Crypto World

ETH Mass Adoption Across TradFi Backs $2.5K Price Target

Key takeaways:

-

Institutional sentiment is shifting toward ETH as elite funds reallocate capital from Bitcoin to Ether ETFs.

-

BlackRock’s ETH ETF pairs secure staking with a low 0.25% fee, creating a major win for mainstream crypto access.

-

Dominance in the $20 billion real-world asset sector proves that big money prioritizes network security over low gas fees.

Ether (ETH) has failed to reclaim the $2,500 level since Jan. 31, leading traders to question what might spark sustainable bullish momentum. Investors are waiting for definitive signs of a favorable sentiment shift; meanwhile, three distinct events could signal the end of the bear cycle that bottomed at $1,744 on Feb. 6.

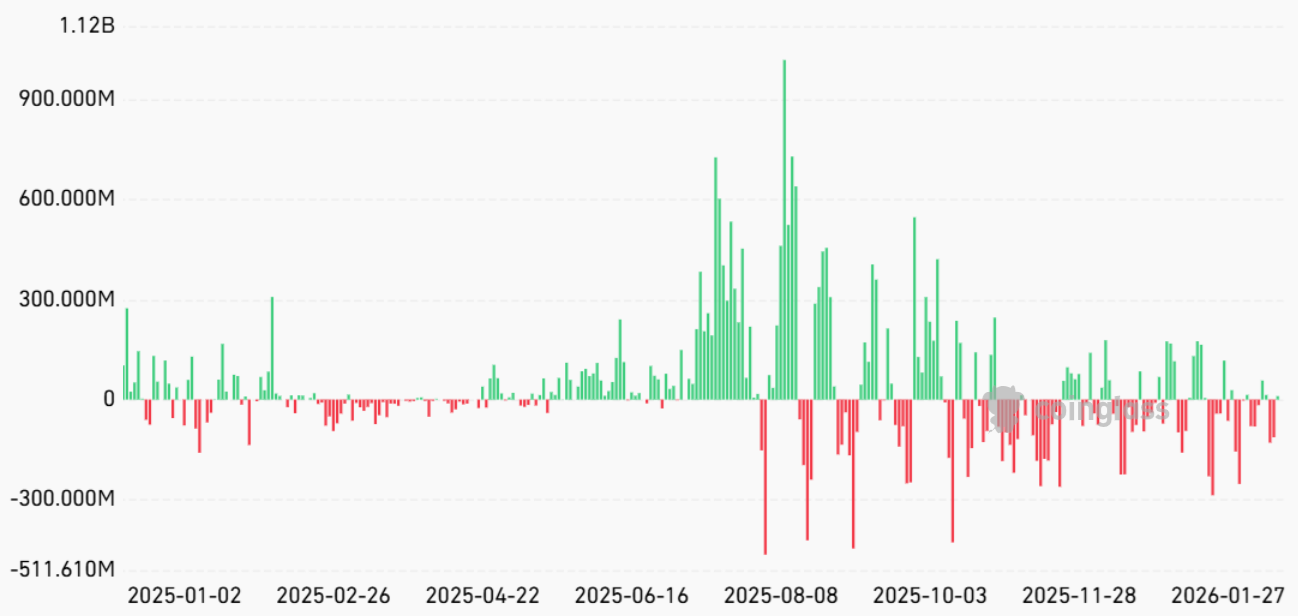

At first glance, the $327 million in net outflows from spot Ether exchange-traded funds (ETFs) in February is mildly concerning. The apparent lack of institutional appetite while ETH sits 60% below its all-time high could be seen as a lack of confidence in the $1,800 support level. However, these outflows represent less than 3% of the total assets under management for Ether ETFs.

Recent Ether ETF milestones may boost ETH’s price

While investors currently focus almost exclusively on short-term flows, the magnitude of recent Ether ETF developments will eventually reflect positively on ETH price. In bearish markets, positive news is often ignored or downplayed, but strategic moves from the world’s largest asset managers can quickly flip investor risk perception.

The latest US Securities and Exchange Commission filings showed on Monday that the Harvard endowment fund added an $87 million position in BlackRock’s iShares Ethereum Trust during the final quarter of 2025. Interestingly, this vote of confidence arrived as Harvard reduced its iShares Bitcoin Trust holdings to $266 million, down from $443 million in September 2025.

In parallel, BlackRock amended its Staked Ethereum ETF proposal on Tuesday to include an 18% retention of total staking rewards as service fees. While some market participants criticized the hefty fee, the ETF sponsor must compensate intermediaries like Coinbase for staking services. Moreover, the relatively low 0.25% expense ratio remains a net positive for the industry.

The final piece of evidence pointing to growing institutional adoption lies in real world asset (RWA) tokenization, a segment that has surpassed $20 billion in assets. Ethereum stands as the absolute leader, hosting offerings from BlackRock, JPMorgan Chase, Fidelity and Franklin Templeton. This intersection of blockchain applications and traditional finance may trigger sustainable demand for ETH.

Nearly half of the $13 billion in RWA deposits on Ethereum represent tokenized gold, though investments in US Treasurys, bonds and money market funds grew to an impressive $5.2 billion. By comparison, the combined RWA listings on BNB Chain and Solana amount to $4.2 billion, a strong indicator that institutional money is less concerned with fees and more focused on security.

Related: Tokenized RWAs climb 13.5% despite $1T crypto market drawdown

Even if RWA issuers currently focus on closed-end systems using exclusive decentralized finance pools or their own layer-2 networks, intermediaries will eventually find ways to connect with the broader Ethereum ecosystem. Crypto venture capital firm Dragonfly Capital’s latest $650 million funding round signals a strong appetite for tokenized stocks and private credit offerings.

Rather than backing layer-1 blockchains and consumer-focused applications, investors are directing capital toward RWA infrastructure, institutional custody and trading platforms, a clear sign of market maturation. Although it is difficult to predict how long these shifts will take to impact Ether’s price, these events clearly indicate that a bounce back to $2,500 in the near term is feasible.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

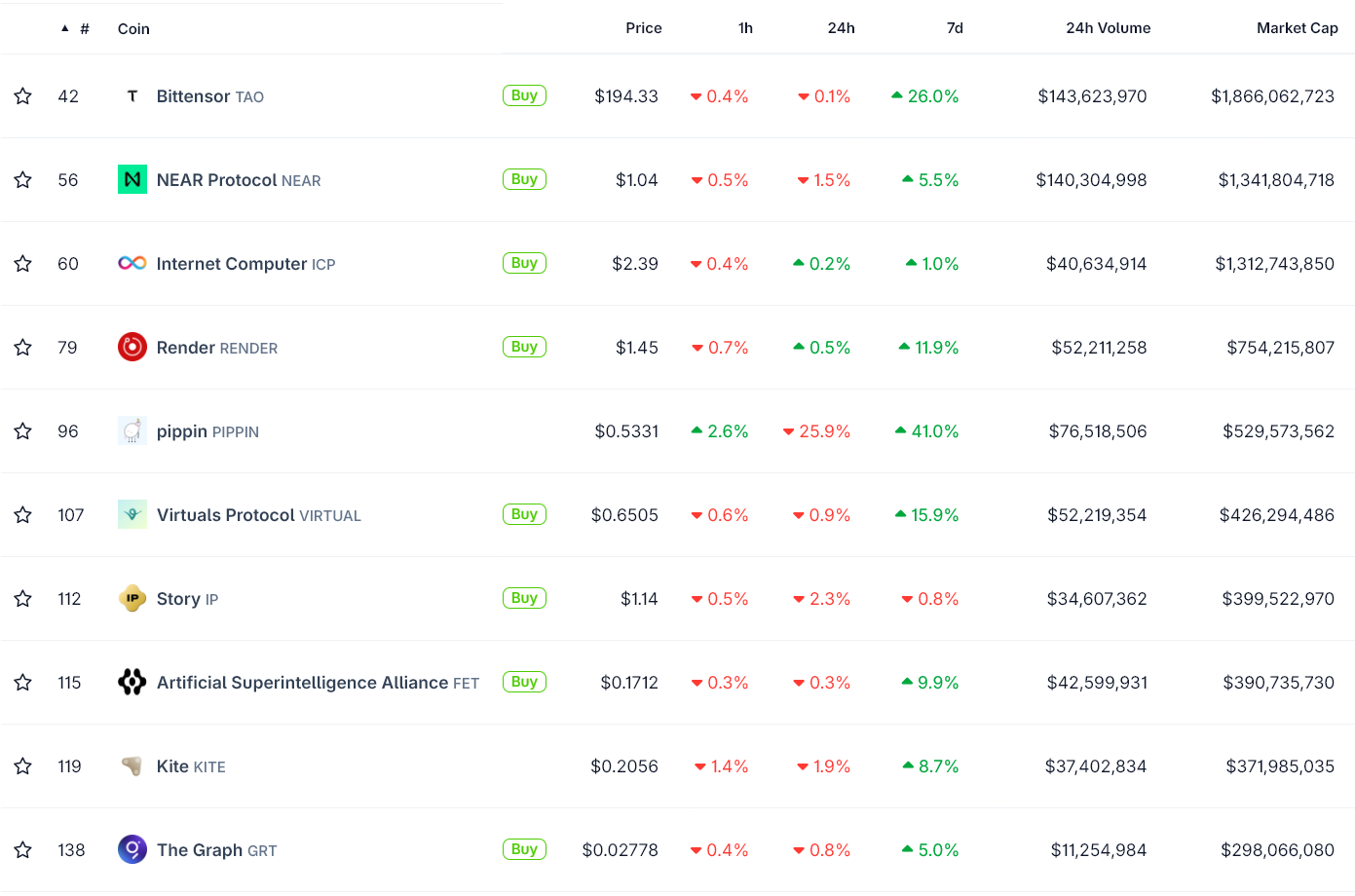

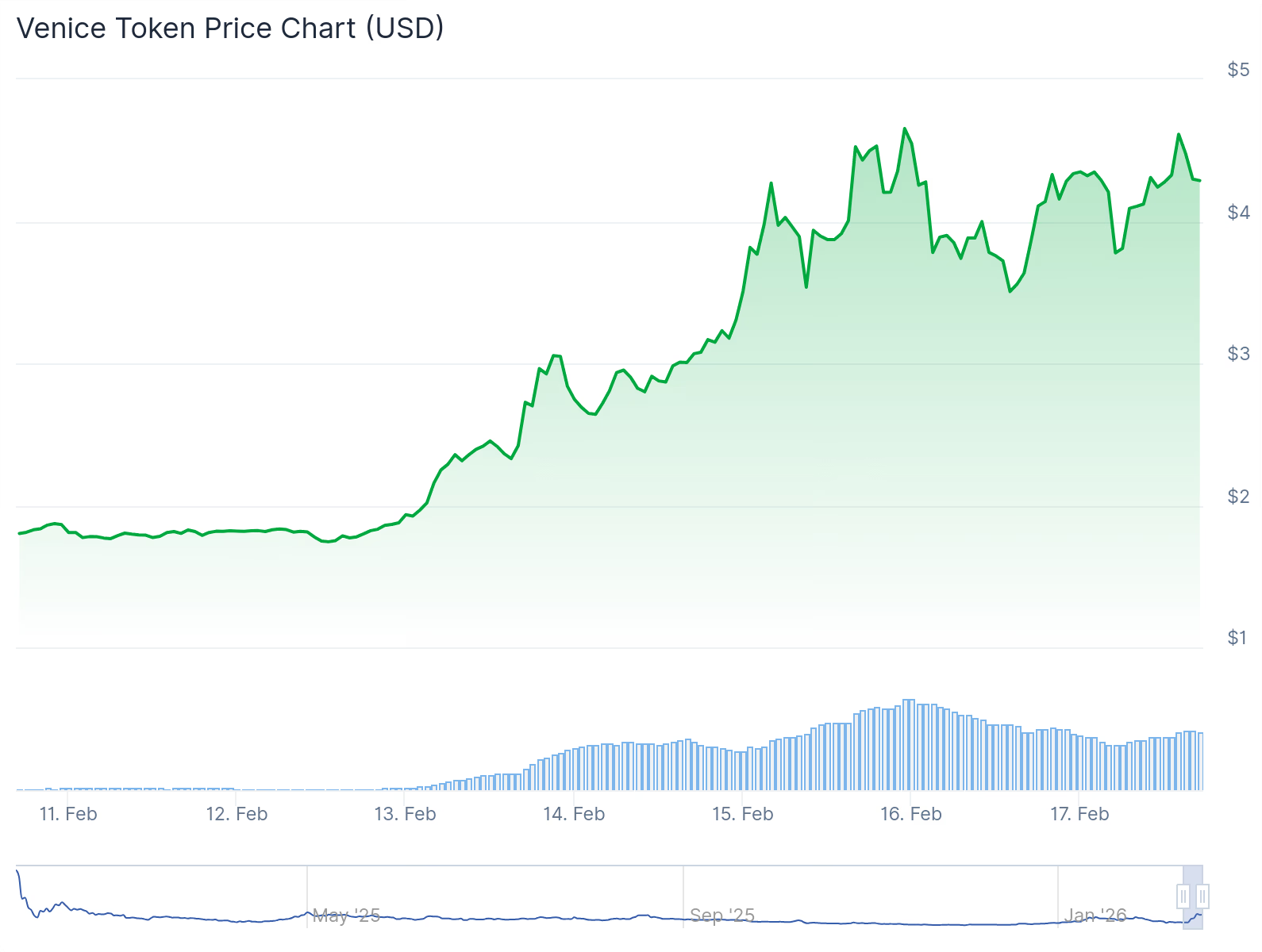

Erik Voorhees’ Venice AI Leads Altcoin Market

The decentralized artificial intelligence protocol is up 350% from its November low.

Venice AI, an agentic artificial intelligence (AI) protocol created by Erik Voorhees, the founder and CEO of ShapeShift, has led the altcoin market over the past week.

Venice AI’s VVV token is up 135% over the last week, and 14% today to $4.28, or a $336 million fully diluted valuation (FDV), a 375% jump off its November low of $0.9.

Venice utilizes a dual-token system following the DIEM token launch in September, which provides DIEM stakers with free access to Venice AI models. DIEM reached an all-time high of $672 over the weekend, and currently changes hands at $586, a 200% increase from its launch price.

The token was launched during the peak of AI agent mania in January 2025, and traded as high as $9 within a week. However, VVV fell alongside the rest of the low-cap altcoin and AI agent market following the LIBRA token scam in February.

A year later, VVV is trading at its highest level since August 2025, with the protocol’s metrics hitting all-time highs. Voorhees posted on X that Venice is processing more than 45 billion large language model (LLM) tokens per day – double what he reported on Feb 4.

Crypto World

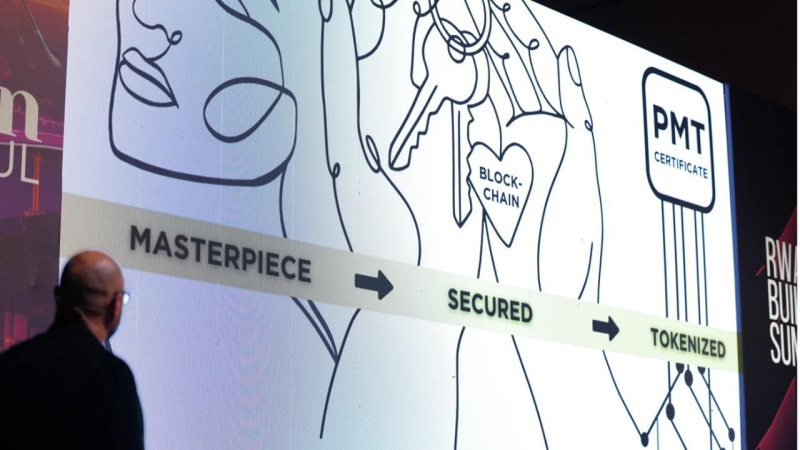

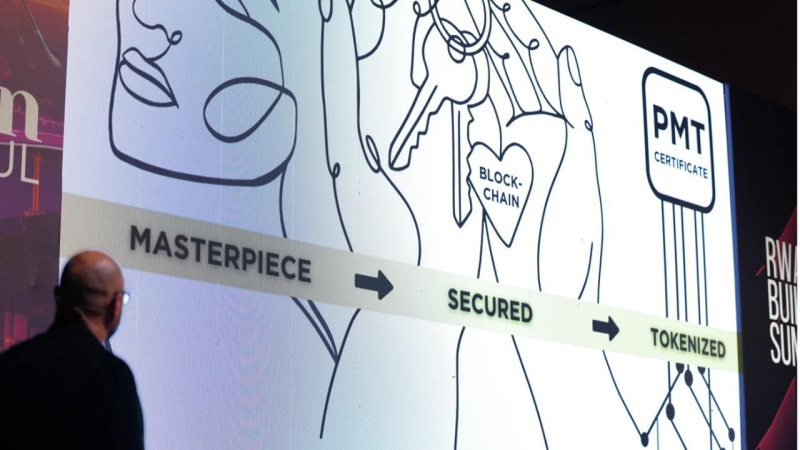

Public Masterpiece Announces PMT Chain, A Layer 1 Built for the Real-World Asset Economy

[PRESS RELEASE – Karavas, Cyprus, February 17th, 2026]

At a time when much of the blockchain industry is still recovering from one of its harshest downturns, a small number of companies are quietly moving in the opposite direction: expanding, building, and positioning themselves for the next era of adoption.

Public Masterpiece, a Cyprus-based real-world asset tokenization company, has announced PMT Chain, its own purpose-built Layer 1 blockchain. Alongside the announcement, the company confirmed a strategic repositioning: PMT, once short for Public Masterpiece Token, will now stand for Public Masterpiece Technology.

The timing is notable. Crypto did not simply experience a correction, but a $1.1 trillion stress test that dismantled inflated narratives and exposed weak token models. Many projects will not return.

Public Masterpiece is positioning itself as one of the exceptions. Even before revealing its Layer 1 ambitions, the company built traction through its Layer 2 presence on BNB Chain. Over the past 12 months, PMT has reportedly increased in price by 75%, outperforming 86% of the top 100 crypto assets, including Bitcoin and Ethereum, while trading above its 200-day moving average and remaining near its all-time high.

CoinMarketCap Screenshot of the Public Masterpiece Token Chart as of 13.02.2026

PMT Chain is designed specifically for real-world asset tokenization, with the company positioning the network as infrastructure for internationally renowned museums, galleries, private collectors, and global brands seeking secure and transparent certification solutions.

At the center of the ecosystem will be a Certification Hub in the UAE, staffed by evaluators, art experts, and historians. The goal is to establish an international framework for authenticating and evaluating physical artworks on-chain, addressing long-standing issues such as forgery, provenance manipulation, and the illegal trafficking of art, artifacts, collectibles, and historical goods.

CEO Kamran Arki described the mission with clarity:

“The last market cycle proved one thing: narratives collapse when foundations are weak. PMT Chain was built for real-world value and long-term trust. Museums, collectors, and brands need transparency, security, and permanence. That is exactly what we engineered.”

Public Masterpiece revealed that PMT Chain has been built over seven years, with five years dedicated solely to research and development, a timeline that stands in sharp contrast to the rapid-launch culture of the blockchain sector.

COO Garen Mehrabian emphasized the broader responsibility behind the project:

“Web3 will not reach mass adoption if it feels like a casino. Builders have the responsibility to create systems people can trust and understand. We didn’t build PMT Chain to ride a wave. We built it to create an ecosystem that survives every wave.”

Public Masterpiece Keynote Presentation at the main Stage of the RWA BUILDERS SUMMIT 2025

Public Masterpiece Keynote Presentation at the main Stage of the RWA BUILDERS SUMMIT 2025

While art remains the cultural foundation, Public Masterpiece confirmed that PMT Chain is designed to scale beyond it, including real estate tokenization and broader RWA deployment. The network will also offer white-label tokenization and certification solutions, enabling institutions and companies to integrate blockchain infrastructure without building their own systems from scratch.

Perhaps most notably, Public Masterpiece confirmed that several governments are already in discussions regarding PMT Chain implementation. No names have been revealed, and the company has not announced a launch date. While the blockchain is reportedly ready, the founders have stated it will go live only when the timing is strategically optimal.

In a market where speculation has been punished and confidence is scarce, Public Masterpiece is betting that the next era of blockchain adoption will be defined by infrastructure, not hype.

About Public Masterpiece

Public Masterpiece is a real-world asset tokenization company building blockchain infrastructure designed to support tokenization, certification, and provenance for physical value across art and broader real-world asset markets.

Useful Links:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

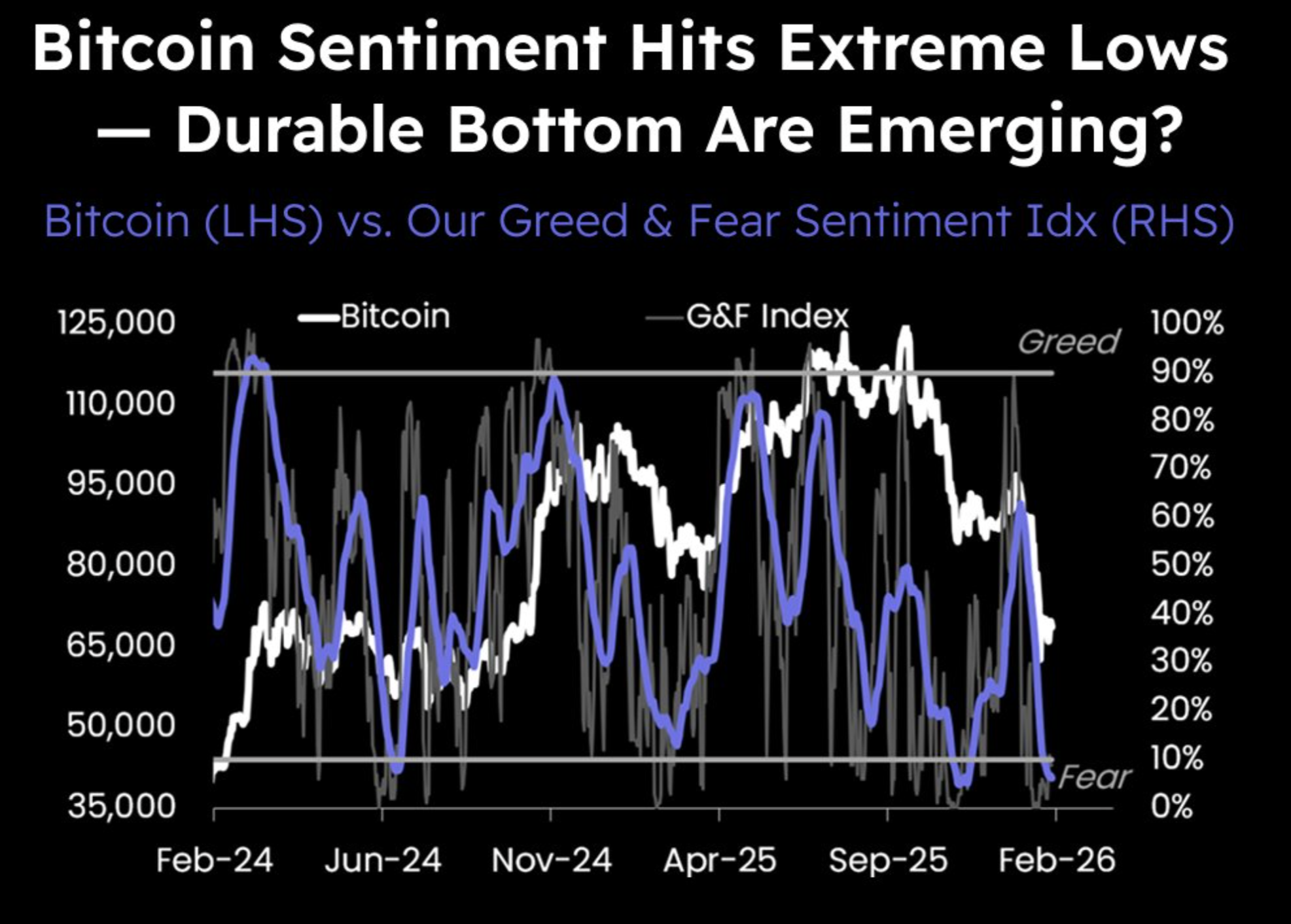

Bitcoin Risks 40% Drop Despite Sentiment Lows

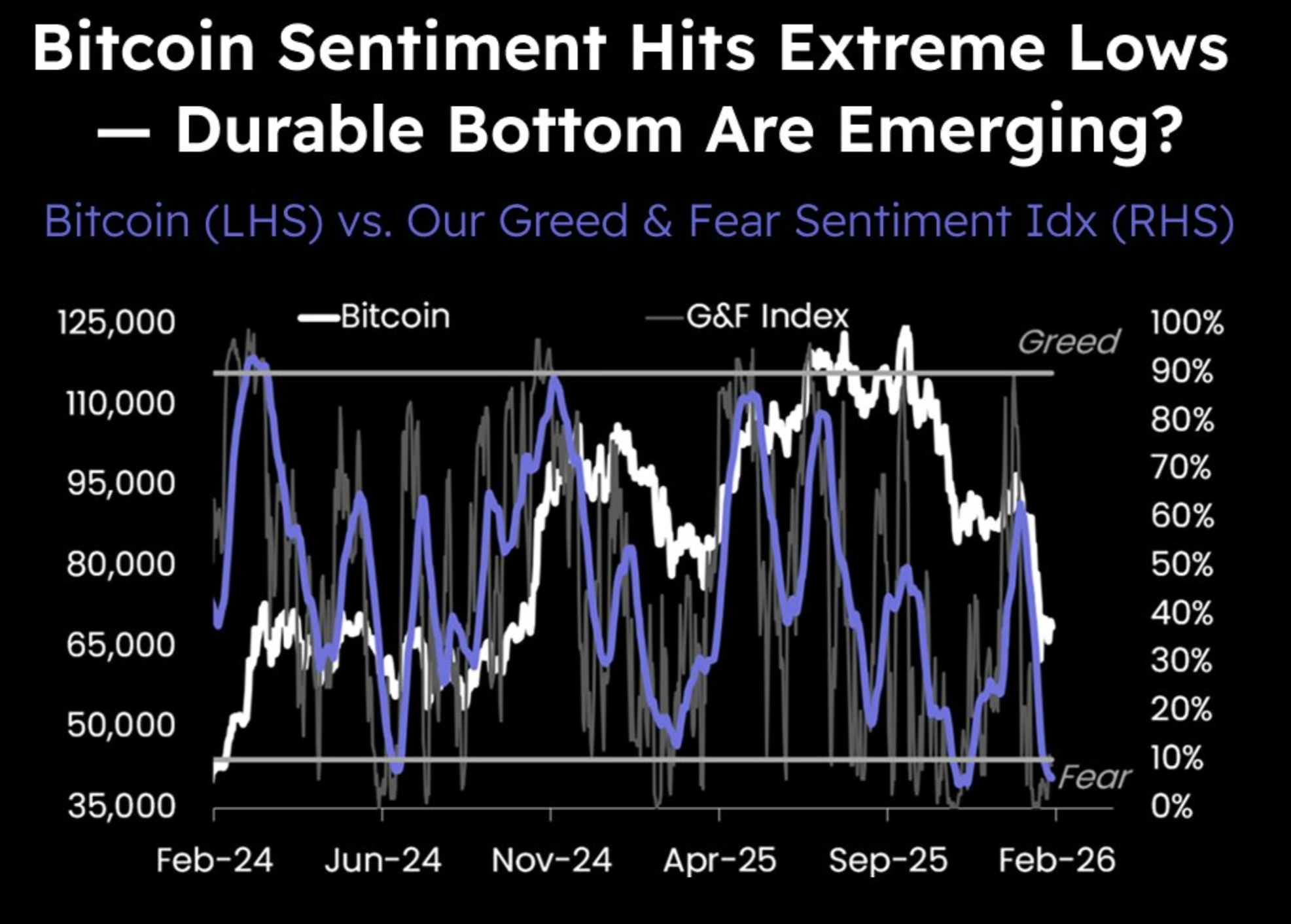

Crypto market sentiment has deteriorated sharply, with Matrixport’s Greed & Fear index falling to extremely depressed levels, suggesting the market may be approaching another inflection point.

Even so, Matrixport suggested that Bitcoin may still see downside ahead.

Sponsored

Sentiment Signals Possible Inflection Point For Bitcoin

In a recent market update, Matrixport said overall sentiment has dropped to extreme lows, reflecting broad-based pessimism across the digital asset space.

The firm highlighted its proprietary Bitcoin fear and greed gauge, explaining that “durable bottoms” have typically emerged when the 21-day moving average dips below zero and subsequently begins to turn upward. The setup appears to be in place, according to the chart.

“This transition signals that selling pressure is becoming exhausted and that market conditions are beginning to stabilize,” the post read.

The report added that, given the cyclical relationship between sentiment and Bitcoin price action, the latest extreme reading may indicate that the market is nearing another potential turning point.

At the same time, Matrixport warned that prices may continue to decline in the near term.

Sponsored

“While caution remains warranted, the current environment is increasingly forcing us to sharpen our focus and prepare for the conditions that typically precede a meaningful rebound,” the firm said.

On-Chain Indicators Signal Bear Market Stress

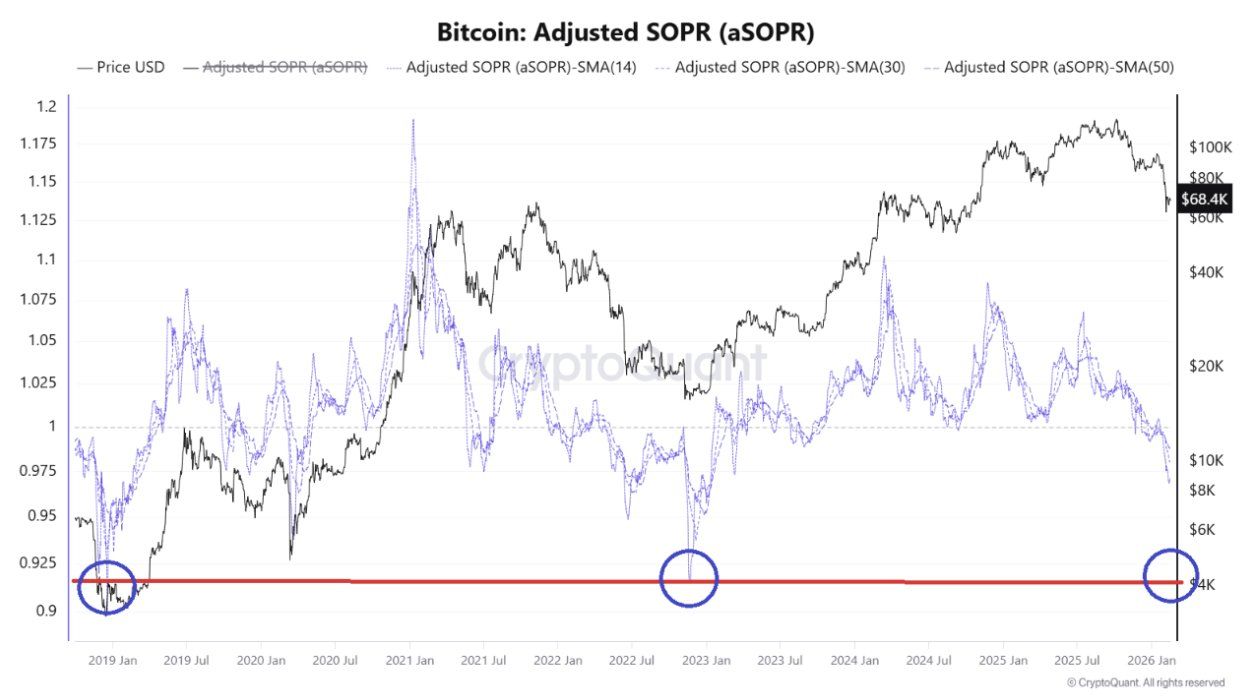

Meanwhile, technical indicators strengthen the picture of a stressed Bitcoin market. An analyst, Woominkyu, noted that the adjusted Spent Output Profit Ratio (aSOPR) has fallen back into the 0.92-0.94 range, a zone that previously coincided with major bear-market stress periods.

“In 2019 and 2023, similar readings occurred during deep corrective phases where coins were being spent at a loss. Each time, this zone represented capitulation pressure and structural reset,” the post read.

Sponsored

Historically, multiple cycle lows formed around the 0.92 to 0.93 region. The current structure, Woominkyu noted, resembles prior transitions into bear market phases rather than routine mid-cycle pullbacks.

If the metric fails to recover above 1.0 in the near term, it could increase the probability that Bitcoin is entering a broader bearish phase rather than undergoing a simple correction.

True market bottoms, the analyst argued, tend to form only after deeper compression in aSOPR, peak loss realization, and full exhaustion of selling pressure. While the market appears to be entering a stress zone, it may not yet reflect full capitulation.

“aSOPR is signaling structural deterioration. This looks less like a dip and more like a regime shift. The real bottom may still require deeper compression before a durable reversal forms,” the analyst added.

Sponsored

This view aligns with broader bearish projections suggesting Bitcoin could revisit levels below $40,000 before forming a durable bottom.

BeInCrypto Markets data shows Bitcoin is currently trading around $68,000. A drop below $40,000 would imply a decline of more than 40% from current levels, highlighting the scale of downside risk some analysts believe remains on the table.

For now, sentiment indicators hint at a potential turning point, but on-chain data suggests structural weakness may still need to run its course before a recovery can begin.

Crypto World

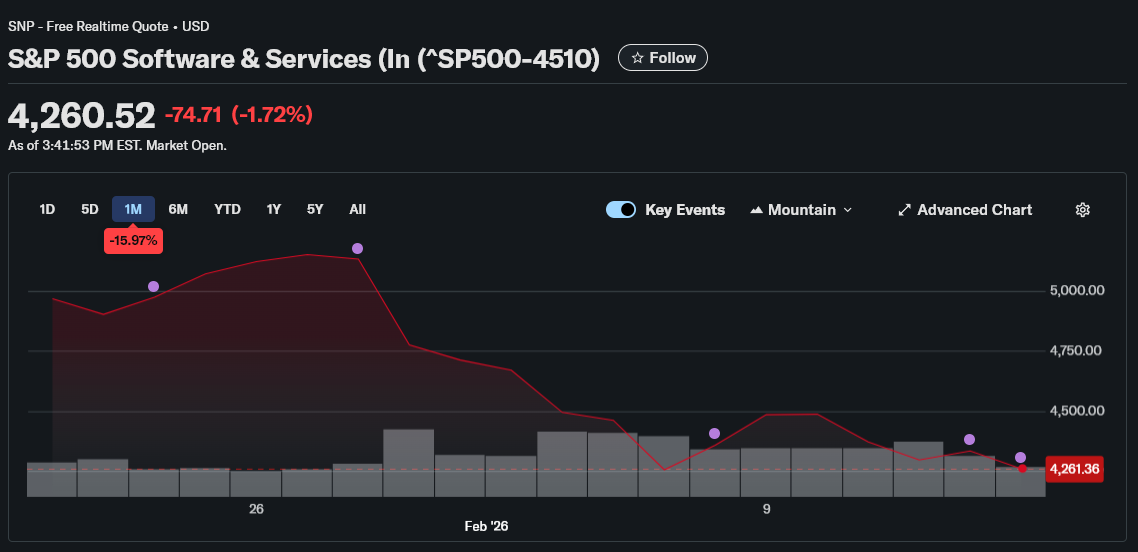

Should Crypto Markets Worry About the SaaSpocalypse?

The term “SaaSpocalypse” is trending across financial markets, tech media, and investor circles. It refers to a sudden loss of confidence in software-as-a-service (SaaS) companies after the launch of advanced AI agents capable of automating tasks traditionally handled by enterprise software.

The term became popular after Anthropic released its Claude Cowork AI platform in late January. Following its launch, nearly $300 billion in global software market value was erased. Stocks of major SaaS firms—including Salesforce, Workday, Atlassian, and ServiceNow—fell sharply as investors questioned whether AI agents could replace large parts of their business.

Sponsored

Sponsored

AI Agents Trigger Market Panic

The core fear driving the SaaSpocalypse is simple: AI agents can now perform entire workflows autonomously.

Tools like Claude Cowork can review contracts, analyze sales data, generate reports, and execute multi-step tasks across multiple applications.

Instead of employees using five separate SaaS tools, a single AI agent can complete the same work.

This directly threatens the SaaS pricing model, which typically charges companies per user or “seat.” If AI reduces the need for human users, companies may need fewer licenses. Investors reacted quickly to this risk.

The S&P 500 Software and Services Index fell nearly 19% in early February, marking its worst losing streak in years.

Sponsored

Sponsored

At the same time, capital rotated toward AI infrastructure providers such as Nvidia, Microsoft, and Amazon, which supply the compute power behind AI agents.

Why the SaaSpocalypse Matters Beyond Software

The SaaSpocalypse reflects a deeper shift in how software creates value. Instead of selling tools that humans operate, companies are beginning to sell outcomes delivered by AI.

Analysts now describe this as a transition from software-as-a-service to “AI-as-a-service.” This shift challenges decades-old business models and forces software companies to rethink pricing, licensing, and product strategy.

Sponsored

Sponsored

However, this is not necessarily the end of SaaS. Many enterprises will still rely on established platforms for security, compliance, and data management.

Instead, the disruption will likely reshape the industry, forcing software companies to integrate AI deeply into their products.

How the SaaSpocalypse Could Impact Crypto Markets

The SaaSpocalypse is already affecting crypto markets indirectly. Both crypto and SaaS are considered high-growth, risk-sensitive sectors.

Sponsored

Sponsored

When investors sell software stocks, they often reduce exposure to crypto as well. In early February 2026, Bitcoin fell sharply as software stocks also posted heavy losses.

More importantly, capital is shifting toward AI. Venture capital invested over $200 billion into AI startups in 2025—far more than crypto received.

This means fewer resources may flow into new crypto projects, slowing innovation in some areas.

At the same time, crypto could benefit in specific niches such as decentralized computing and AI infrastructure.

But overall, the SaaSpocalypse signals a major capital rotation. AI is becoming the dominant investment theme, and crypto markets will need to compete for investor attention in this new environment.

Crypto World

Strategy Doubles Down as Portfolio Hits Unrealized Loss

Nevertheless, the company continues to be in the red on its BTC position.

The world’s largest corporate holder of bitcoin has used the current market slump as an opportunity to increase its BTC portfolio at prices of under $70,000.

In its latest purchase, announced minutes ago, Strategy’s co-founder, Michael Saylor, said the firm accumulated 2,486 BTC for almost $170 million at an average price of $67,710 per unit. This puts the NASDAQ-listed company’s total bitcoin fortune at 717,131 BTC, bought at an average price of $76,027.

Strategy has acquired 2,486 BTC for ~$168.4 million at ~$67,710 per bitcoin. As of 2/16/2026, we hodl 717,131 $BTC acquired for ~$54.52 billion at ~$76,027 per bitcoin. $MSTR $STRC https://t.co/wvxRYZlQ3Y

— Michael Saylor (@saylor) February 17, 2026

The cryptocurrency market’s decline in the past several weeks has turned Strategy’s holdings into a losing position, even though the firm has repeatedly reassured that it has no plans to dispose of any of its BTC.

At a bitcoin price of $68,000 as of press time, Strategy’s holdings are now worth less than $49 billion. In other words, the firm stands in an unrealized loss of over $5 billion for the first time since the 2023 bear-market closure.

The company’s stock price experienced heightened broader market volatility over the past few weeks, falling from $140 to $120 last week before stabilizing at around $134.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Stripe-owned Bridge Bank Gains OCC Conditional National Charter Approval

Bridge, the stablecoin platform owned by payments giant Stripe, has won conditional approval from the US Office of the Comptroller of the Currency to organize as a federally chartered national trust bank. The OCC decision, announced on February 12, would enable Bridge to operate stablecoin products under direct federal oversight once final clearance is granted and custody digital assets, issue stablecoins, and manage reserves within a nationwide banking framework. Bridge described the milestone as a step toward scaling stablecoins with robust governance, noting that the GENIUS Act—signed into law in July 2025—creates a regulatory backdrop in which banks can participate more confidently. The move coincides with Stripe’s 2025 acquisition of Bridge for about $1.1 billion to bolster stablecoin payments.

Key takeaways

- Bridge has earned conditional approval to organize as a federally chartered national trust bank, placing its stablecoin and custody activities under federal oversight once final clearance is granted.

- The charter would empower Bridge to custody digital assets, issue stablecoins, and manage stablecoin reserves within a regulated banking framework.

- Bridge’s move is part of a broader OCC push to license crypto firms as national trust banks, with BitGo, Fidelity Digital Assets, Paxos, Circle, and Ripple cited in related actions.

- The GENIUS Act’s implications are now central to the conversation, with Bridge describing its compliance framework as “GENIUS ready” as regulators clarify stablecoins, yield, and oversight.

- The American Bankers Association has urged caution, arguing that GENIUS rules remain unclear and that national charters could be used to bypass existing regulatory oversight, prompting a careful pace in approvals.

- Policy discussions in the White House and in Congress continue to weigh stablecoin yield and the broader digital-asset market structure, potentially shaping how chartered institutions interact with tokenized assets and investor protections.

Market context: The OCC’s latest action comes as the broader push for regulated stablecoin rails gains momentum and lawmakers pursue a comprehensive digital asset framework in the Senate. With the GENIUS Act guiding how federal charters apply to crypto services, the market is watching closely for clarity on yield, custody, and interoperability across regulated banks and crypto platforms. The development signals a potential shift toward more formalized on-ramps for institutions seeking stablecoin-based payments and settlements.

Why it matters

For users and developers, a federally chartered national trust bank could offer stronger consumer protections, clearer governance, and the potential for more scalable, regulated stablecoin services. A formal federal framework may reduce counterparty risk and improve liquidity for on-chain payments that depend on stablecoins for settlement and cross-border remittances, creating a more predictable environment for builders and merchants integrating digital assets into payments rails.

For issuers and platforms, obtaining a national charter could streamline governance, custody, and treasury operations, enabling broader product offerings at scale. Yet regulatory clarity remains a work in progress, particularly as GENIUS Act rules are implemented and interpreted, leaving room for ongoing debate over how stablecoins fit within the broader financial system and how yield incentives align with investor protections.

From a market perspective, regulated rails could attract traditional finance participants into the crypto ecosystem, potentially boosting liquidity and interoperability while concentrating influence among a handful of chartered institutions. The balance between robust oversight and fostering innovation will shape how quickly these rails expand and how risk is managed across custody providers, issuers, and banks working on crypto-native products.

What to watch next

- Final OCC approval for Bridge’s national trust bank charter and any accompanying compliance conditions.

- Regulatory clarifications around the GENIUS Act, including timelines for implementing rules affecting stablecoins and tokenized assets.

- Updates on other charter applications (Circle, Ripple, BitGo, Fidelity, Paxos) and their progress through the OCC process.

- Any Congressional or White House developments on the digital asset market structure framework and stablecoin yield policy.

- Stripe’s follow-on steps to integrate Bridge’s charter with its broader payments ecosystem and stablecoin issuance plans.

Sources & verification

- Bridge announces conditional OCC approval to organize a federally chartered national trust bank (Bridge blog post).

- OCC CAAS filing details Bridge’s application and approval on February 12 for a national bank charter.

- Stripe’s 2025 acquisition of Bridge for approximately $1.1 billion to support stablecoin payments.

- American Bankers Association letter urging OCC to slow crypto trust charter approvals and seek GENIUS Act clarity.

- White House discussions with crypto and banking industry representatives on stablecoin yield and the market-structure framework.

Bridge advances toward a federally chartered stablecoin backbone under GENIUS Act

Bridge’s path to a federally chartered national trust bank represents a notable milestone in the evolving architecture of crypto rails in the United States. The OCC’s conditional blessing—arrived at a moment when several crypto firms are pursuing national trust bank charters—signals a shift from state-level trust status to a federally supervised framework. Bridge’s core business—custody of digital assets, stablecoin issuance, and reserve management—appears poised to move under the OCC’s direct oversight, subject to final approval conditions that would iron out governance, risk controls, and capital requirements. Bridge did not merely seek a license; it framed the move as an alignment with a broader regulatory philosophy spawned by GENIUS Act provisions, which aim to give regulated banks and crypto platforms clearer boundaries and predictable accountability in a rapidly changing landscape.

In a public post outlining the significance of the milestone, Bridge highlighted its commitment to a “GENIUS-ready” posture. The firm argued that a national trust bank charter would provide customers with a robust regulatory backbone, enabling them to build and scale stablecoin-enabled services with greater confidence. Bridge’s stance gains resonance in an ecosystem where stablecoins have become a fundamental component of daily settlement, cross-border payments, and DeFi liquidity flows. The company’s assertion that federal oversight can coexist with innovation reflects a broader assumption in the sector: when properly structured, regulated rails reduce systemic risk and lay the groundwork for responsible growth.

Context matters: Bridge’s bid comes amid a wave of OCC activity aimed at formalizing crypto banking services. Earlier in the year, regulators conditionally approved BitGo, Fidelity Digital Assets, and Paxos to convert state-level trust charters into national ones, while Circle and Ripple were also cited as pursuing national bank charters. The development underscores a shared regulatory objective—provide credible, centralized supervision for digital-asset activities that involve custody, settlement, and stablecoin issuance—without stifling technological progress. The OCC’s caution around GENIUS rule clarity, voiced by the American Bankers Association, reflects a healthy insistence on transparent standards before broad approvals, ensuring that national charters do not create loopholes that circumvent existing oversight or risk controls.

Bridge’s news sits within a larger policy milieu shaped by ongoing Senate deliberations on a comprehensive digital asset market structure framework. In parallel, White House officials have continued to meet with representatives from the crypto and banking sectors to discuss stablecoin yields and related conflicts of interest, highlighting the administration’s interest in aligning economic incentives with consumer protections. As policymakers weigh the balance between innovation and risk management, the question remains: will GENIUS Act guidance crystallize quickly enough to catalyze a new class of federally regulated crypto rails, or will regulatory ambiguity slow the pace of charter grants? The answer will influence how institutions, investors, and developers navigate the next wave of stablecoin adoption and institutional custody solutions.

Bridge’s forthcoming steps—whether that entails final OCC certification, the refinement of risk-management policies, or integration with Stripe’s wider payments infrastructure—will be closely watched by market participants seeking predictable regulatory footing for stablecoins and on-chain settlement. For many in the industry, the news signals a disciplined shift toward formalized governance and oversight that could unlock new levels of scale and reliability in digital-asset services. Yet the path remains contingent on regulatory clarifications, the pace of approvals for other charter applicants, and the evolution of how stablecoins are treated within the broader financial system. As the year unfolds, the OCC’s decisions and legislative updates will likely shape the contours of crypto banking for the foreseeable future.

Crypto World

HBAR price risks a downward spiral as Hedera’s ecosystem woes persist

HBAR price has rebounded in the past few days, moving from the year-to-date low of $0.0725 to the psychological level at $0.100.

Summary

- The HBAR price has crashed by 67% from its 2025 high.

- The network’s ecosystem growth has stalled.

- Technical analysis suggests that the Hedera price has further downside in the near term.

Hedera (HBAR) remains well below last year’s high of $0.3025 and the November 2024 high of $0.4012.

The recent rebound followed Hedera’s addition of FedEx to its governance council. It joined other top companies like Tata Communications, Google, Mondelez, ServiceNow, and IBM. All these companies have historically pledged to use Hedera’s technology in their decentralized products.

The risk, however, is that third-party data indicate that Hedera’s ecosystem is much smaller than those of newer crypto projects such as Monad, Plasma, Hyperliquid, and Provenance.

Hedera’s decentralized finance ecosystem has a total value locked of just $58 million, with most projects showing no activity. This is despite Hedera being capable of handling over 1,000 transactions per second and having much lower fees than other chains.

Hedera also has a negligible market share in the stablecoin industry, with its total supply down to $68 million from last year’s peak of over $300 million. The stablecoin supply across all chains has jumped to over $300 billion.

Hedera has no market share in the booming Real-World Asset tokenization industry, which has accumulated over $24 billion in assets under management. Ethereum has the largest market share, with over $17 billion in assets, and is followed by other popular chains such as BNB, Solana, and XRP Ledger.

These metrics likely explain why the Canary HBAR ETF has struggled to attract assets. It has had no inflows since February 9, while its total assets have dropped to $51.3 million. Hedera’s futures open interest has also continued to fall over the past few months.

HBAR price technical analysis

The weekly timeframe chart shows that the HBAR price has been in a strong downward trend in the past few months, moving from a high of $0.3026 in July to the current $0.1.

The coin remains below all moving averages and is stuck at the Ultimate Support level of the Murrey Math Lines tool. It is also below the Supertrend and the Ichimoku cloud indicators.

Therefore, the most likely Hedera price forecast is bearish, with the next key target being the year-to-date low of $0.0725. A drop below that level will point to more downside, potentially to the all-time low of $0.036.

Crypto World

Berkshire Hathaway trims Apple stake, buys NYTimes stock in Buffett’s last moves as CEO

Warren Buffett speaks during the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska, on May 4, 2024.

CNBC

Warren Buffett’s Berkshire Hathaway trimmed more of its Apple stake and began a new position in The New York Times in the fourth quarter, according to a new securities filing.

The Omaha-based conglomerate disclosed that it pared its position in the iPhone maker by 4.3% to $61.96 billion, per data from InsiderScore. Even with the cut, Apple remains by far Berkshire’s largest equity holding.

Berkshire revealed that it trimmed its stake in Apple and started a stake in fellow “Magnificent Seven” name Alphabet in the third quarter. The conglomerate had also cut its equity holding of Apple in the second quarter of last year after slashing its stake by two-thirds in 2024.

While Apple posted its third consecutive winning year in 2025, rising around 9%, it still underperformed the S&P 500, which gained more than 16% last year. The stock has been lagging even more this year, falling about 3%. In fact, it experienced its worst day since April 2025 just last week.

Apple shares, year-to-date

It’s unclear whether the moves were done by Buffett or investment managers Todd Combs and Ted Weschler. Buffett has viewed Apple as more of a consumer products company rather than a pure technology play, and the moves may reflect Buffett making the portfolio more easily manageable for his successor.

In addition to the cut in its Apple holding, Berkshire disclosed a relatively small $351.7 million stake in The New York Times. The position is ranked 29th out of its 41 total positions.

Berkshire Hathaway’s Top 10 Holdings, as of the end of Q4

| TICKER | NAME | VALUE ($ BILLION) | CHANGE IN NO. OF SHARES (%) |

|---|---|---|---|

| AAPL | Apple | 61.96 | -4.3 |

| AXP | American Express | 56.09 | N/A |

| BAC | Bank of America | 28.45 | -8.9 |

| KO | Coca-Cola | 27.96 | N/A |

| CVX | Chevron | 19.84 | 6.6 |

| MCO | Moody’s | 12.6 | N/A |

| OXY | Occidental Petroleum | 10.89 | N/A |

| CB | Chubb | 10.69 | 9.3 |

| KHC | Kraft Heinz | 7.9 | N/A |

| GOOGL | Alphabet | 5.59 | N/A |

Source: InsiderScore

The fourth quarter marked the last quarterly period with Buffett at the helm of Berkshire, as Greg Abel – who had been serving as vice chairman of non-insurance operations at the company – took the reins as CEO at the start of the new year.

Prior to Buffett’s departure, structural changes were announced at the company, including one involving Combs. After resigning in December, the former Berkshire investment manager and Geico CEO joined JPMorgan Chase as head of its new Security and Resiliency Initiative in January.

Buffett first announced at Berkshire’s annual meeting last May that he was going to ask Berkshire’s board to have Abel replace him. Though Buffett is no longer the chief executive, he remains chairman of the board.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech20 hours ago

Tech20 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video15 hours ago

Video15 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World14 hours ago

Crypto World14 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports21 hours ago

Sports21 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery