Crypto World

Ethereum Foundation Outlines Main Priorities For 2026

The Ethereum Foundation has announced it is targeting faster transactions, smarter wallets, better cross-chain interoperability, and quantum-resistant security as its “protocol priorities” in 2026.

In a statement published on Wednesday, the Ethereum Foundation outlined several goals, including continuing to scale the gas limit — the maximum amount of computational work a block can handle — “toward and beyond” 100 million, a major topic of discussion among the Ethereum community in 2025.

Some members of the Ethereum community anticipate that the gas limit will increase significantly this year. In November, Ethereum educator Anthony Sassano said that the goal of significantly increasing Ethereum’s gas limit to 180 million in 2026 is a baseline, not a best-case scenario.

“Post-quantum readiness” is a focus for Ethereum

The foundation highlighted the Glamsterdam network upgrade, scheduled for the first half of 2026, as a major priority. It also emphasized “post-quantum readiness” as a priority in its trillion-dollar security initiative.

On Jan. 24, Ethereum researcher Justin Drake said in an X post that the foundation had “formed a new Post-Quantum (PQ) team.”

“Today marks an inflection in the Ethereum Foundation’s long-term quantum strategy,” Drake said.

The Ethereum Foundation said it will also focus on improving user experience in 2026, with an emphasis on enhancing smart wallets through native account abstraction and enabling smoother interactions between blockchains via interoperability.

“The goal remains seamless, trust-minimized cross-L2 interactions, and we’re getting closer day by day. Continued progress on faster L1 confirmations and shorter L2 settlement times directly supports this.”

The foundation said that 2025 was one of the “most productive years,” citing two major network upgrades, Pectra and Fusaka, and the community raising the gas limit from 30 million to 60 million between the upgrades, for the first time since 2021.

Buterin’s big plans for Ethereum and AI

Ethereum Foundation’s Mario Havel said in an X post on Wednesday that, “It took us a while to push out the announcement because we were preparing the biggest curriculum so far.”

Related: Ethereum reclaims 42% outflows from Solana — DeFi Report

It comes just days after Ethereum co-founder Vitalik Buterin shared his latest vision for Ethereum’s intersection with artificial intelligence on Feb. 10. Buterin explained that he sees the two working together to improve markets, financial safety and human agency.

Buterin said his broader vision for the future of AI is to empower humans rather than replace them, though he said the short term involves much more “ordinary” ideas.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

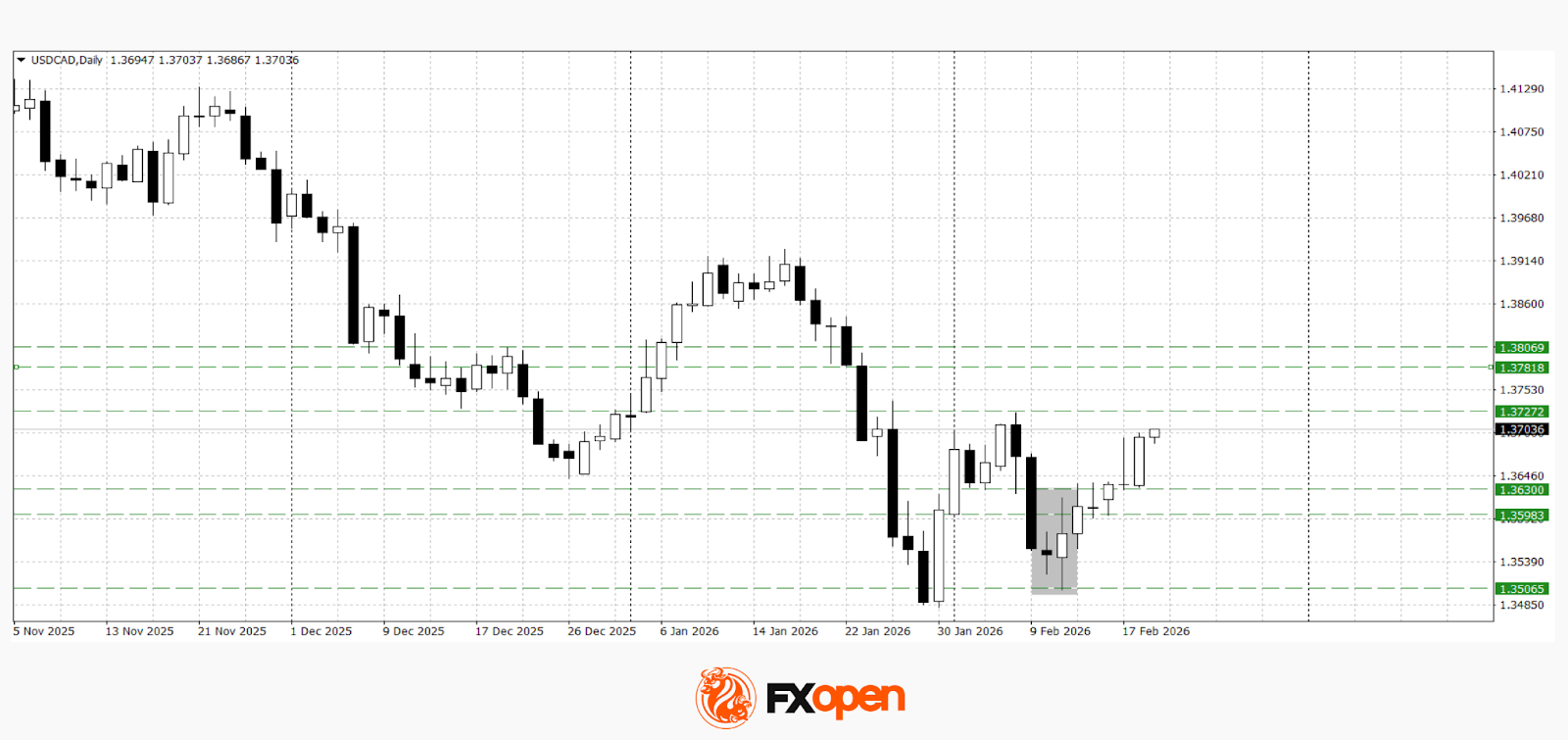

FOMC Minutes Support the Dollar: Yen and Canadian Dollar Retreat

The dollar strengthened following the release of the minutes from the Federal Open Market Committee, reflecting the regulator’s more hawkish tone. In the document, policymakers highlighted persistent inflationary risks and the need for a cautious approach to any potential policy easing. This reduced expectations of imminent rate cuts and supported demand for the US currency.

At the same time, the market remains focused on upcoming US macroeconomic releases due before the end of the week. Attention is centred on the Philadelphia Fed Manufacturing Index, initial jobless claims, trade data, and housing market statistics. These releases could either reinforce the impact of the minutes or partially offset it if the figures come in weaker than expected.

Overall, the dollar has rebounded from support levels after the publication of the minutes. However, the further development of the upward correction in USD/JPY and USD/CAD will depend on incoming data. Market sentiment remains neutral-analytical, as participants assess whether the data will confirm the resilience of the US economy or trigger a deeper dollar correction.

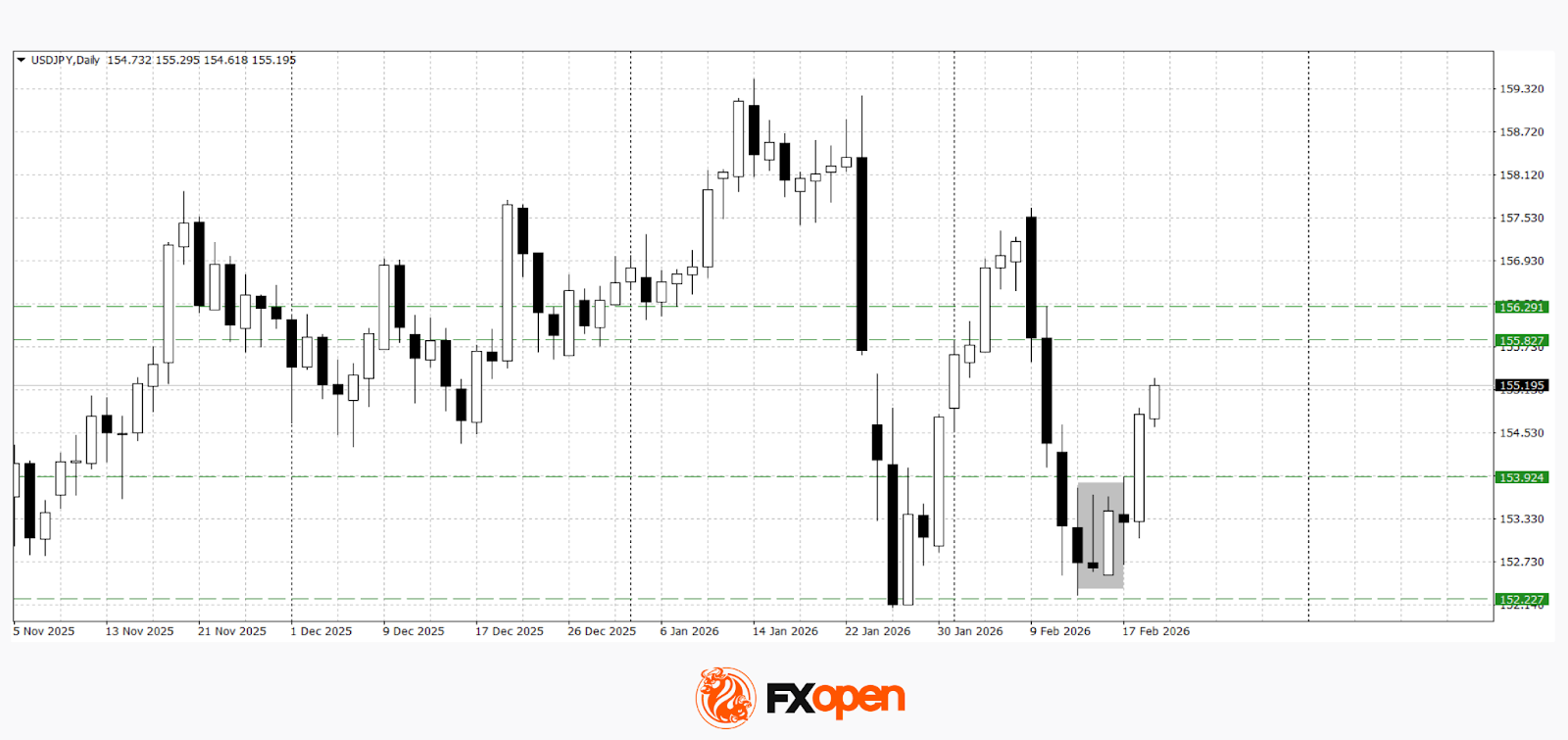

USD/JPY

After testing the support zone near the January lows, USD/JPY has moved into an upward corrective phase. Technical analysis points to the potential for gains towards 155.80–156.30, as a bullish engulfing pattern has formed on the daily timeframe. The upside scenario would be invalidated by a sustained move below 154.00.

Key events for USD/JPY:

- today at 15:20 (GMT+2): speech by FOMC member Bostic;

- today at 15:30 (GMT+2): Philadelphia Fed Manufacturing Index (US);

- today at 15:30 (GMT+2): US initial jobless claims.

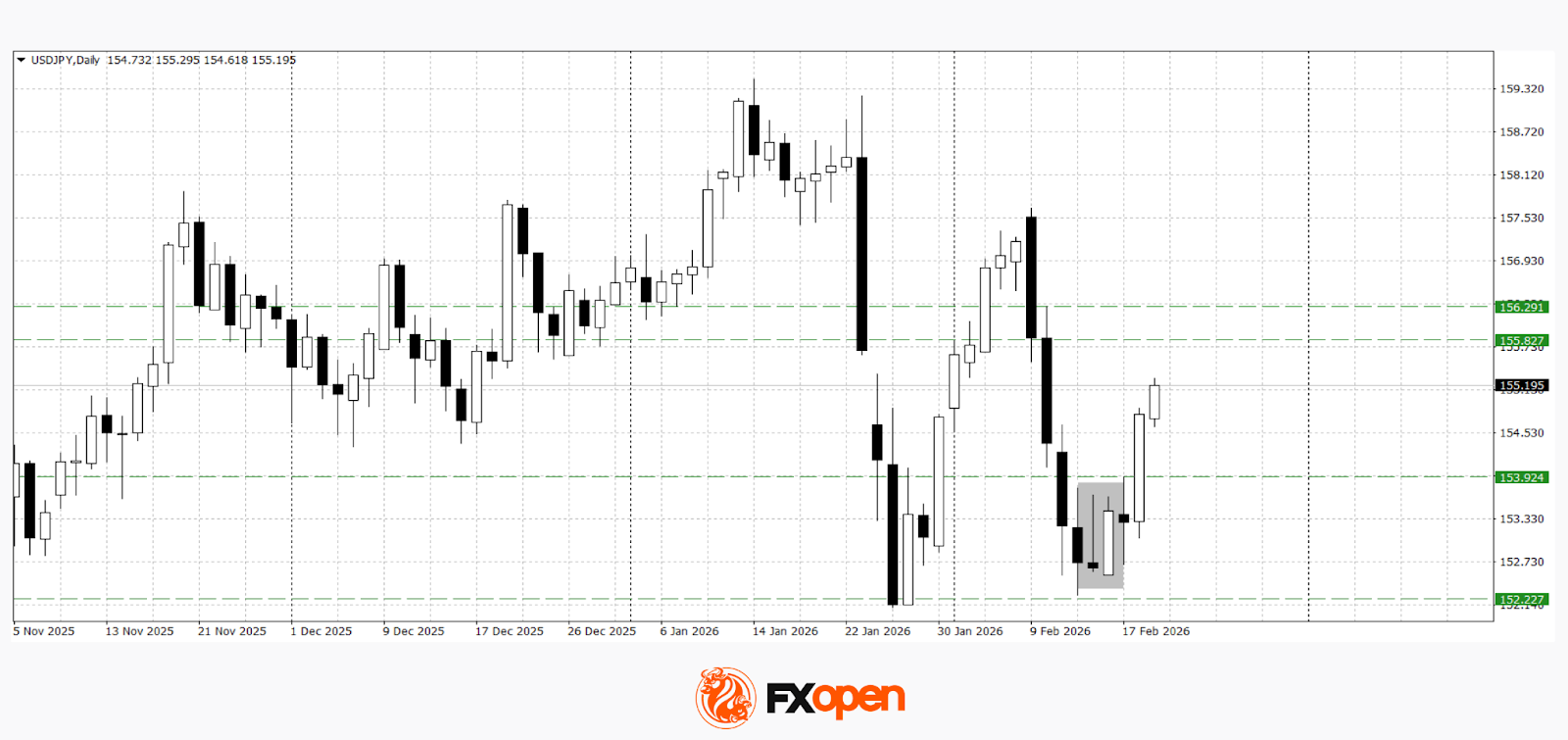

USD/CAD

USD/CAD has also rebounded from the January lows and formed a bullish reversal pattern. The pair is currently approaching the key resistance level at 1.3700. If buyers manage to secure a firm break above this level in the coming sessions, further gains towards 1.3730–1.3800 are possible. Conversely, a move below 1.3630–1.3590 could open the way for a retest of the 1.3500 area.

Key events for USD/CAD:

- today at 15:30 (GMT+2): Canada’s trade balance;

- today at 17:30 (GMT+2): Canadian export data;

- today at 19:00 (GMT+2): US crude oil inventories.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

ICON Amsterdam Reports Record 2025 Performance and Announces Planned U.S. Expansion for 2026

[PRESS RELEASE – Amsterdam, Netherlands, February 18th, 2026]

ICON Amsterdam today announced that it closed 2025 with its strongest financial performance to date, marking a milestone year following a period of internal restructuring and operational realignment. The company also confirmed that it is preparing to explore expansion into the United States in 2026.

According to the company, 2025 revenue reached record levels compared to prior years. Leadership attributes the performance to refined product focus, tighter inventory management, improved departmental accountability, and strengthened coordination between marketing, operations, and product teams.

The milestone follows a period earlier in the decade marked by rapid scaling, rising costs, and internal coordination challenges that affected cash flow and alignment. In response, the company initiated a structured operational review instead of continuing accelerated expansion.

As part of this process, ICON updated its performance tracking systems, clarified departmental responsibilities, and introduced standardized operating procedures to support more consistent execution. According to leadership, the company adjusted its growth strategy to prioritize operational stability and the development of repeatable processes over rapid expansion.

“Growth must be supported by structure,” said Samuel Onuha, Founder of ICON Amsterdam. “The focus over the past two years has been on strengthening the fundamentals of the business.”

In addition to reporting record performance for 2025, ICON confirmed it is evaluating phased entry into the U.S. market in 2026. The company indicated that any expansion would be incremental and aligned with existing operational capacity.

ICON is also preparing for the opening of its first physical retail presence in Amsterdam. While details remain under review, the initiative would represent a transition from a primarily direct-to-consumer model toward a blended retail approach.

Leadership emphasised that the company intends to maintain a measured growth strategy moving forward, prioritising operational discipline and financial sustainability.

Further updates regarding retail development and international expansion are expected to be shared in 2026.

About ICON Amsterdam

Founded in 2018, ICON Amsterdam is a Netherlands-based direct-to-consumer menswear company focused on modern tailoring and stretch-engineered apparel. The company operates primarily online and serves customers across Europe and international markets. ICON emphasises structured operations, product consistency, and disciplined growth strategy.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

CoinFello Debuts Onchain AI Agent at ETHDenver

[PRESS RELEASE – Denver, Colorado, February 18th, 2026]

CoinFello, an AI agent capable of interacting directly with smart contracts, will be introduced to ETHDenver attendees during the conference’s opening ceremonies. The debut provides attendees with early access to CoinFello through a special preview application called BuffiBot, created by the CoinFello team.

For ETHDenver, CoinFello developed BuffiBot as the event’s official AI assistant for conference information. Attendees can ask about schedules, speakers, workshops, expo vendors, and side events. The experience is accessible through the ETHDenver app and supports both text and real-time voice interactions.

BuffiBot synthesizes ETHDenver’s hundreds of sessions and activities into a single conversational interface. While the ETHDenver deployment highlights a live event use case, CoinFello’s broader functionality extends beyond conference support.

CoinFello is designed as an AI application for executing and automating interactions with smart contract protocols. Through a chat-based interface, the agent interprets context, executes user-defined intents, and manages both synchronous and asynchronous smart contract actions. The system is built to present smart contract functionality in plain language.

The platform analyzes a user’s wallet history to surface relevant tokens, protocols, and potential actions, reducing reliance on traditional browser-based decentralized applications. CoinFello is also launching as an EIP-8004 agent, enabling it to be called by other AI agents within Ethereum’s emerging agent ecosystem.

CoinFello was founded by JacobC.eth, previously Lead of Operations for MetaMask at ConsenSys. At MetaMask, he helped develop growth and monetization strategies for the Ethereum wallet.

“The previous model for crypto UX is saturated,” said jacobc.eth. “Agentic AI enables onchain execution and DeFi interactions to become accessible to billions of people through familiar and safer user experiences.”

“We’re pleased to collaborate with the CoinFello team as they bring agent-driven experiences to users through the MetaMask Smart Accounts Kit,” said Ryan McPeck, Product Lead at Consensys for the MetaMask Smart Accounts Kit. “We see a future where AI agents can safely act on behalf of users using granular, transitive permissions that allow individuals to define how activity is executed on-chain.”

ETHDenver attendees will receive exclusive access to CoinFello without joining the public waitlist. Access to CoinFello will continue following the conference, while the BuffiBot experience remains exclusive to ETHDenver.

“ETHDenver has always been where the edges of possibility converge — where builders come to test what the future feels like before the rest of the world catches up,” said John Paller, Founder of ETHDenver. “The fusion of decentralized infrastructure and agentic AI signals a new chapter for coordination itself. When humans and autonomous systems co-create in open networks, we expand who can participate and how value is generated. This is the frontier — and it’s unfolding in real time.”

About CoinFello

CoinFello is an AI agent designed to explain, execute, and automate interactions with smart contracts. Built for self-custody, the platform is currently available in private alpha for end users, with developer versions expected soon. CoinFello supports EVM-compatible networks, leverages EigenAI to enable a self-custodied AI environment, and integrates the MetaMask Smart Accounts Kit to provide users with control over their assets.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

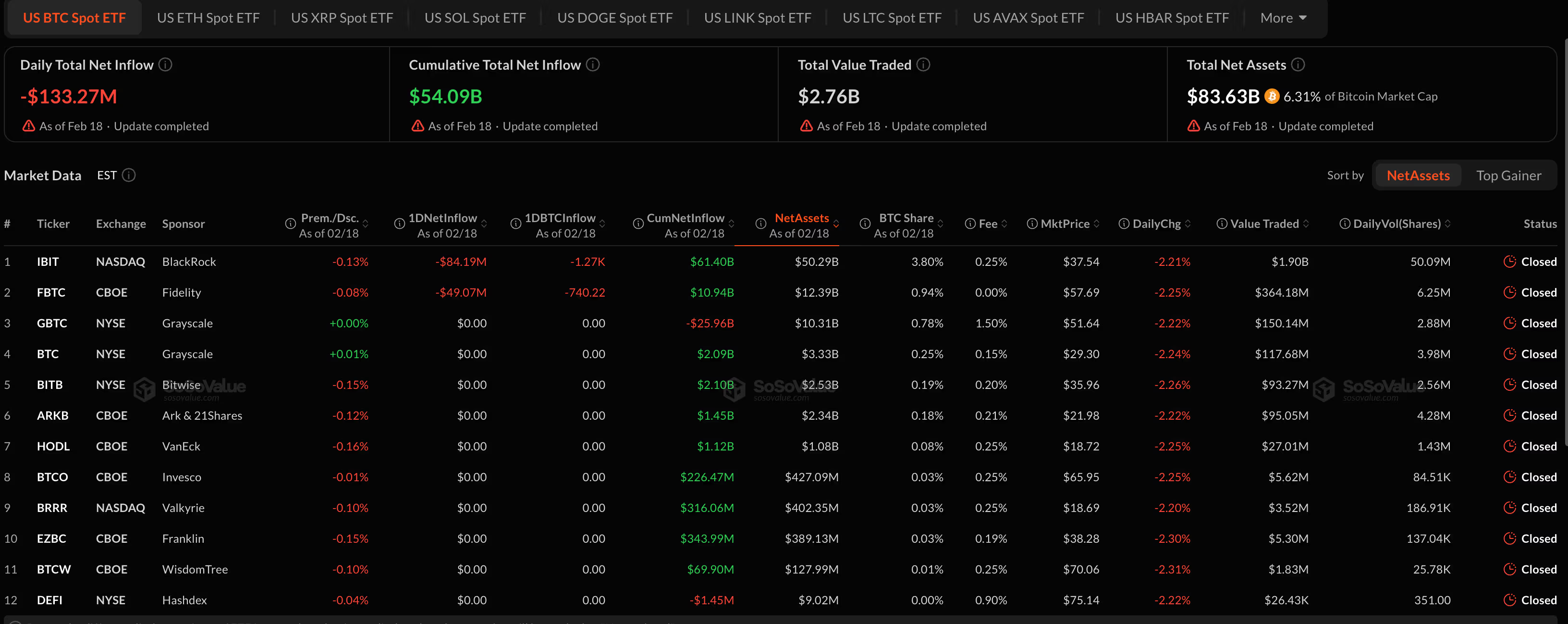

Bitcoin, ether, xrp ETFs bleed while Solana bucks outflow trend

U.S.-listed crypto ETFs are flashing red across the board, with one notable exception.

Bitcoin spot ETFs saw $133.3 million in daily net outflows as of Feb. 18, led by BlackRock’s IBIT, which shed $84.2 million, and Fidelity’s FBTC, which lost $49 million. Total net assets across bitcoin funds stand at $83.6 billion, roughly 6.3% of bitcoin’s market cap, but recent flows suggest institutions are trimming exposure rather than adding on dips.

Ethereum products followed a similar pattern. U.S. ETH spot ETFs recorded $41.8 million in net outflows on the day, with BlackRock’s ETHA losing nearly $30 million. Total net assets across ether funds sit at $11.1 billion, about 4.8% of ETH’s market cap.

The steady bleed comes as ether trades below $2,000 and struggles to build momentum despite broader expectations of rate cuts later this year.

XRP ETFs also slipped into negative territory, posting $2.2 million in daily outflows. Total net assets across XRP funds are just over $1 billion, or roughly 1.2% of XRP’s market cap. Price action in XRP has mirrored the cautious tone, with the token down over 4% on the day.

Solana, however, stood out.

U.S. SOL spot ETFs recorded $2.4 million in net inflows, pushing cumulative inflows to nearly $880 million. Bitwise’s BSOL led with $1.5 million in fresh capital. While modest in absolute terms, the inflow contrasts sharply with the broader risk-off positioning across bitcoin and ether products.

Elsewhere, smaller altcoin ETFs such as LINK saw marginal inflows, but the overall picture remains one of selective exposure rather than broad-based accumulation.

The divergence suggests investors are rotating within crypto rather than exiting entirely. With macroeconomic uncertainty lingering and the dollar firming, ETF flows offer a real-time read on where institutional conviction remains and where it is fading.

Crypto World

Warren Urges Fed And Treasury To Reject Crypto Bailout

Senate Banking Committee ranking member Elizabeth Warren has reportedly sent a letter to Treasury Secretary Scott Bessent and Federal Reserve chair Jerome Powell, urging them not to bail out “cryptocurrency billionaires” with taxpayer dollars.

Warren warned that any potential bailout “would be deeply unpopular to transfer wealth from American taxpayers to cryptocurrency billionaires,” adding that it could also “directly enrich President Trump and his family’s cryptocurrency company, World Liberty Financial, according to CNBC.

The letter comes as Bitcoin (BTC) prices have fallen more than 50% from their all-time high in October, hitting a local low of $60,000 on Feb. 6.

The letter also came on the same day that World Liberty Financial hosted its first “World Liberty Forum” for crypto executives and pro-industry policymakers at the President’s private Mar-a-Lago club in Palm Beach, Florida.

The US government is retaining seized Bitcoin

Senator Warren also referenced the Financial Stability Oversight Council’s Annual Report hearing on Feb. 4, during which Secretary Bessent was asked about his authority to bail out the crypto industry.

During the hearing, Congressman Brad Sherman asked Bessent if the Treasury Department “has the authority to bail out Bitcoin?” or instruct banks to buy Bitcoin or Trumpcoin (TRUMP).

A bemused Bessent asked for clarification on the question, stating that “within the context of asset diversification within banks, they could hold many assets.”

Related: Senators ask Bessent to probe $500M UAE stake in Trump-linked WLFI

Sherman also expressed concern that US tax dollars might be invested in crypto assets. “Why would a private bank be your tax dollars?” asked the Treasury secretary.

Bessent confirmed that “we are retaining seized Bitcoin,” which is not tax money, but an “asset of the US government.”

Senator Warren claims response was deflection

Warren saw the exchange differently, stating in her letter that Bessent “deflected.”

“It’s deeply unclear what, if any, plans the US government currently has to intervene in the current Bitcoin selloff,” she wrote.

“Ultimately, any government intervention to stabilize Bitcoin would disproportionately benefit crypto billionaires.”

“Your agencies must refrain from propping up Bitcoin and transferring wealth from taxpayers to crypto billionaires through direct purchases, guarantees, or liquidity facilities,” the letter reportedly stated.

Cointelegraph reached out to Warren and the Treasury for comment, but did not receive an immediate response. A Federal Reserve spokesman confirmed they had received the letter but declined to comment.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express

Crypto World

Is BTC About to Drop Below $60K?

Analysts are expecting a volatile near-term future for BTC, with some questioning whether new lows are on their way.

Bitcoin went through some intense trading sessions at the end of January and the beginning of February, plunging from over $90,000 to a 15-month low at $60,000 in under ten days. However, it has been rather sluggish since then, mostly trading below $70,000, with little sign of a breakout.

Founder and CIO of MN Fund, Michaël van de Poppe, outlined the recent stagnation, indicating that BTC’s volatility is “the lowest it has been since the crash.” Consequently, he determined that “there’s a big move on the horizon” and outlined his plan for buying or selling.

Sub-$60K or Above $80K?

The volatility on #Bitcoin is the lowest it has been since the crash.

That means; there’s a big move on the horizon.

If we dip, I’ll be a big buyer, for sure.

If we go back upwards, I’ll start taking some profits on a test at $80-85K to be trading the trend.

Volatility is… pic.twitter.com/7Irp4iTzT9

— Michaël van de Poppe (@CryptoMichNL) February 18, 2026

The popular analyst said he would be a “big buyer for sure” if bitcoin dips again. In contrast, he would “start taking some profits” if the cryptocurrency tests the $80,000-$85,000 range.

Merlijn The Trader also weighed in on BTC’s recent performance, highlighting the significance of the current $67,000 level. If lost, the analyst believes $60,000 will come into focus again. His worst-case scenario envisions a massive drop below $50,000 if the February 6 bottom gives in.

BITCOIN IS AT THE CRUX: $67K.

Reclaim $73K the trend repair begins.

Lose $60K liquidity vacuum opens below.Next real demand zone:

$48K–$49K (0.618 retrace)This isn’t volatility.

It’s the market choosing a direction. pic.twitter.com/FQfrBNYrTe— Merlijn The Trader (@MerlijnTrader) February 18, 2026

Glassnode was slightly less bearish, predicting that bitcoin could drop to as low as $55,000 if the landscape worsens again soon.

You may also like:

Year of the Metals

Doctor Profit, who has been among the few analysts to predict BTC’s crash below $100,000 at the end of 2025, said the cryptocurrency now trades around 50% lower than its October all-time high. He noted that “it’s bad to lose money, but it’s even worse to lose it in terms of USD.”

The analyst predicted that 2026 will be the year of precious metals, such as gold and silver. Both assets experienced intense volatility in 2026 as well. Gold, for example, skyrocketed to a new all-time high of $5,600/oz in late January before it crumbled to $4,400 days later. It has managed to rebound to $5,000 as of press time.

Silver, on the other hand, exploded to over $120, dumped to $64, and now sits close to $80. Both metals are slightly in the green on a year-to-date scale, while BTC is deep in the red.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP price prediction ahead of December PCE Inflation report

XRP price is trading in a tight range as investors await the December Personal Consumption Expenditures (PCE) inflation report, due Friday, Feb. 20. The token’s next move could hinge not just on crypto-specific catalysts, but on broader macroeconomic data that shapes Federal Reserve policy expectations.

Summary

- XRP is consolidating near $1.43 ahead of the December PCE inflation report, a key macro event that could influence Federal Reserve policy expectations.

- November’s PCE came in hot at 2.8%, but Truflation data shows cooling trends, with estimates at 1.54% headline and 1.94% core, raising hopes of a softer official print.

- Technically, XRP remains in a broader downtrend but is stabilizing between $1.35 and $1.50, with resistance at $1.47 and support at $1.35 and $1.20.

The PCE index is the Fed’s preferred inflation gauge, particularly core PCE, which excludes food and energy and tracks persistent price pressures. November’s PCE and core PCE both came in at 2.8%, surprising to the upside and reinforcing concerns that inflation progress had stalled.

However, fresh data from Truflation suggests cooling pressures.

Its real-time estimates currently place headline PCE at 1.54% and core PCE at 1.94%, well below the official November print. Traders are now watching to see whether the U.S. Bureau of Economic Analysis reflects that cooling trend.

As inflation data directly impacts rate expectations, it also influences risk-sensitive assets like XRP. A softer reading could revive hopes of future rate cuts and support crypto prices, while a hotter print may pressure the market through a stronger dollar and tighter financial conditions.

XRP price analysis: Consolidation after sharp drop

XRP is trading around $1.43 at press time, stabilizing after a steep decline from the early-January high near $2.40. The daily chart shows a clear downtrend marked by lower highs and lower lows.

The recent capitulation candle near $1.20 triggered a strong bounce, but the Ripple token (XRP) has since entered a tight consolidation range between roughly $1.35 and $1.50.

The 9-day moving average (~$1.43) is attempting to flatten, while the 21-day moving average (~$1.47) remains above price and continues sloping downward. This suggests short-term stabilization but a broader bearish structure remains intact.

The Balance of Power (BBP) indicator sits slightly negative at -0.09, indicating sellers still have a marginal edge, though bearish momentum has eased compared to early February’s sharp selloff.

Immediate resistance lies at $1.47, aligning with the 21-day MA. A break above that could open a move toward $1.60. On the downside, key support rests near $1.35, followed by stronger support around $1.20.

With XRP coiling ahead of the PCE release, Friday’s inflation data could act as the catalyst for the next decisive move.

Crypto World

Moonwell Proposes $2.68M Recovery Plan After cbETH Liquidation Incident Harms 181 Borrowers on Base

TLDR:

- Roughly 181 Moonwell borrowers on Base lost ~$2.68M due to oracle-driven cbETH liquidations from Feb 14–18, 2026.

- Moonwell will allocate ~$310,000 from its Apollo Treasury as an immediate pro-rata repayment to all affected borrowers.

- The remaining ~$2.37M will be repaid gradually through future protocol fees and OEV revenue via Sablier over 12 months.

- MFAM holders will convert their tokens into stkWELL at a 1:1.5 ratio, consolidating Apollo DAO into Moonwell’s primary governance.

Moonwell has released a recovery proposal addressing unfair liquidations of cbETH collateral between February 14 and 18, 2026.

The incident affected roughly 181 borrowers on Base, resulting in approximately $2.68M in net losses. Protocol behavior tied to MIP-X43, not user error, drove the liquidations.

The plan combines treasury funds with future revenue and includes a transition for MFAM holders into the WELL ecosystem.

cbETH Liquidation Recovery Targets 181 Affected Borrowers

The Moonwell team conducted a full onchain review of all liquidation activity during the incident window. Each borrower’s loss was calculated on a net basis, meaning only realized economic harm qualifies for remediation.

The methodology accounts for all cbETH collateral seized, minus the USD value of debt repaid at the time of liquidation.

The proposal was direct about what caused the harm. “These users trusted Moonwell with their assets and were harmed through no fault of their own,” the post stated.

Crucially, cbETH was repriced at $2,200 per token to correct erroneous oracle values that contributed to the problem. This adjustment ensures that repayments reflect actual market conditions rather than distorted price data.

To begin repayments promptly, approximately $310,000 will be drawn from the Moonwell Apollo Treasury. This amount will be distributed pro-rata to affected borrowers based on their individual calculated losses.

The proposal described this allocation as “an immediate good-faith remediation without jeopardizing protocol stability.”

The remaining balance of roughly $2.37M will be repaid over time through future protocol revenue. This includes net protocol fees and OEV revenue under the current fee split structure.

All repayments will be claimable through Sablier over a 12-month window, after which unclaimed rewards expire.

MFAM Wind-Down Consolidates Apollo DAO Into Moonwell’s Primary Governance

The proposal also addresses the full deprecation of Moonwell on Moonriver, which was completed on January 29, 2026. Chainlink’s decision to sunset oracle feeds on Moonriver forced a gradual reduction of collateral factors. With MIP-R38 passed, all Moonriver markets reached a 0% collateral factor, formally closing the deployment.

As Moonriver operations wind down, the Apollo DAO governed by MFAM will consolidate into the primary Moonwell DAO governed by WELL.

The proposal described the transition as “simplifying governance, aligning incentives, and closing out legacy infrastructure.” MFAM holders will convert their holdings into stkWELL at a 1:1.5 ratio, based on a snapshot taken at proposal submission.

The proposal noted that this conversion brings MFAM holders “direct exposure to Moonwell’s ongoing development on Base and future deployments, while eliminating fragmentation across governance tokens and treasuries.” The MFAM-to-stkWELL conversion will also be claimable for up to 12 months via Sablier.

By addressing both the cbETH incident and the MFAM wind-down together, the proposal aims to close out Moonriver “in a clean, accountable manner.”

The Moonwell DAO will vote separately on treasury allocation, the long-term repayment commitment, and execution authority.

Crypto World

US CLARITY Act To ‘Hopefully’ Pass By April: Bernie Moreno

The US CLARITY Act, a highly anticipated bill aimed at providing greater clarity for the US crypto industry, could make it through Congress in just over a month, according to crypto-friendly US Senator Bernie Moreno.

“Hopefully by April,” Moreno told CNBC during an interview at US President Donald Trump’s Mar-a-Lago property in Florida on Wednesday.

Coinbase CEO Brian Armstrong joined Moreno for the interview, explaining that they were with representatives from the crypto, banking and US Congress at the World Liberty Financial (WLF) crypto forum to reach a solution on market structure.

“A path forward” is in sight, says Moreno

“One of the big issues that did come up in the past was this idea of stablecoins on rewards,” Armstrong said. The banking industry previously raised concerns that offering stablecoin yields could undermine traditional banking and shift deposits and interest away from banks.

While Armstrong had issues with the draft bill and withdrew his support for the CLARITY Act in January, he said there is “now a path forward, where we can get a win-win-win outcome here.”

“A win for the crypto industry, a win for the banks, and a win for the American consumer to get President Trump’s crypto agenda through to the finish line, so we can make America the crypto capital of the world,” Armstrong said.

Armstrong said the crypto exchange previously couldn’t support the bill because it includes provisions that ban interest-bearing stablecoins and position the US Securities and Exchange Commission as the primary regulator of the crypto industry. The White House was reportedly disappointed by Coinbase’s decision to withdraw its support, describing the move as a “unilateral” action that blindsided administration officials.

Moreno admitted that the delay stems from “getting hung up” on the stablecoin rewards, which he said “shouldn’t be part of this equation.”

Crypto prediction platform Polymarket’s odds of the US CLARITY Act passing in 2026 briefly surged to 90% on Wednesday before falling to 72% at the time of publication.

Moreno shuts down idea of a Democrat-led midterm election

Meanwhile, Moreno dismissed the idea that a Democratic takeover of Congress could threaten the bill when asked. “The House isn’t going to go Democrat, and neither is the Senate,” Moreno said.

“The American people are sick and tired of open borders; that is why we got elected. They were sick and tired of high inflation, and they were sick and tired of an out-of-control government,” he added.

Related: ECB targets 2027 digital euro pilot as provider selection begins in Q1 2026

On Dec. 19, White House crypto and AI czar David Sacks voiced strong confidence that the bill would pass early this year.

“We are closer than ever to passing the landmark crypto market structure legislation that President Trump has called for. We look forward to finishing the job in January,” Sacks said at the time.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

Ledn raises $188m with first BTC backed bond sale in asset backed market

Ledn, a crypto lending company, has completed the first asset-backed securities (ABS) deal backed by bitcoin collateral, raising $188 million for crypto credit markets.

Asset-backed securities are bonds backed by pools of underlying loans, with investors receiving payments from the cash flows generated by those loans.

Bloomberg reported that the bonds are secured by a pool of more than 5,400 consumer loans issued by the firm, each backed by borrowers’ bitcoin holdings. The loans carry a weighted average interest rate of 11.8%.

The deal includes two tranches, with the investment-grade portion priced at 335 basis points over the benchmark rate. Jefferies served as sole structuring agent and bookrunner, according to Bloomberg.

Bitcoin’s volatility has been in focus, with the largest cryptocurrency by market capitalization falling as much as 50% over the past four months to as low as $60,000.

Crypto firm Ledn sells Bitcoin-backed bonds in ABS market first

>First ever deal of its kind in asset-backed debt

>Secured by pool of 5,400 Bitcoin-collateralized loans that consumers took from Ledn at weighted avg rate of 11.8%

>Investment grade tranche priced at +335bps pic.twitter.com/Rx3944uGys— matthew sigel, recovering CFA (@matthew_sigel) February 18, 2026

The structure employs automated collateral liquidation when thresholds are breached, a feature designed to protect investors during sharp market declines.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment19 hours ago

Entertainment19 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech24 hours ago

Tech24 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports5 hours ago

Sports5 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment11 hours ago

Entertainment11 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World14 hours ago

Crypto World14 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit