Crypto World

Ethereum Foundation Sets 2026 Protocol Priorities

The EF announced its 2026 Protocol priorities, emphasizing scalability, user experience, and security, as the network prepares for the Glamsterdam upgrade.

The Ethereum Foundation (EF) has outlined its Protocol priorities for 2026, focusing on scalability, improved user experience, and enhanced network security.

Over the coming year the EF looks to push its gas limit “toward and beyond” 100 million, lean into account abstraction and interoperability, and continue to “harden the L1” focusing on security, censorship resistance, and network resilience.

Today’s initiative release comes shortly after co-executive director Tomasz Stańczak announced his intent to step down at the end of the month. Stańczak indicated he will continue to spend his professional time in the Ethereum ecosystem, working closely with developers and founders. Bastian Aue is assuming interim co-executive director duties for the time being.

The Foundation established Protocol in June 2025 as an improved and more responsive path towards network development. This initiative potentially laid the groundwork towards Ethereum co-founder Vitalik Buterin’s new outlook on the Layer 2 ecosystem, and lays the foundation for future network upgrades like Glamsterdam and Hegota.

Glamsterdam, which is expected to ship in the first half of 2026, is comprised of up to 22 different Ethereum Improvement Proposals (EIPs) and focuses on Layer 1 scalability.

This article was generated with the assistance of AI workflows.

Crypto World

ETH Whales Are Quietly Buying the Dip: On-Chain Data Reveals What’s Really Happening

TLDR:

- ETH-accumulating whales increased their balance as the realized price dropped, confirming active buying at lower levels.

- The realized cap for accumulating whale addresses rose, ruling out any selling activity within this cohort.

- ETH is currently trading at $1,949, with a 1.80% price gain recorded over the past seven-day period.

- Trader Daan Crypto warns that a drop below $1,900 could push ETH toward its February lows fairly quickly.

ETH continues to draw attention from large investors even as its price shows signs of pressure. On-chain data reveals that accumulating whale addresses are not selling their holdings.

Instead, these whales are buying at lower price levels. The realized price metric for this cohort has bent downward, which may seem alarming at first glance.

However, a closer look at balance and realized cap data tells a more complete story about what these large holders are actually doing.

What the Realized Price Drop Really Means for ETH

The realized price of accumulating whale addresses has turned downward for the first time. This kind of movement can point to two separate scenarios in the market.

Either a whale with a higher cost basis sold their ETH, pulling the average down. Or new buying occurred at lower prices, which also pulls the realized price downward.

To determine which case applies, analysts cross-referenced balance data and realized cap figures. In the same period where the realized price dropped, the balance of accumulating whales went up. At the same time, their realized cap also rose, not fell.

These two data points together confirm that no selling took place among this cohort. On the contrary, whales added more ETH to their holdings at reduced price levels. This buying behavior is what caused the realized price to bend downward, not distribution.

CryptoMe, a well-followed Cryptoquant on-chain analytics analyst, stated that accumulating whales’ trust in ETH still looks strong based on this data set.

Price Levels and What Traders Are Watching Closely

Even with whale accumulation continuing, the broader price action remains uncertain. ETH is currently trading at $1,949.06, with a 24-hour volume of over $18.8 billion. The asset posted a 0.23% gain in the past 24 hours and a 1.80% rise over the past seven days.

Crypto trader Daan Crypto Trades pointed out that liquidity levels are clear in this range. According to Daan, a move above $2,150 would mark a new local high and likely push prices further up. However, a drop to $1,900 or below opens the door to revisiting February lows.

That caution is worth noting, especially since the accumulating whale data only covers one segment of the market. Other investor groups and broader macro conditions can still move the ETH price independently.

The on-chain data does not account for retail behavior, derivatives activity, or sentiment shifts.

Therefore, while whale accumulation is a constructive sign, it does not guarantee price direction in the short or medium term.

Traders and investors are advised to monitor multiple data sources before concluding where ETH heads next.

Crypto World

Community Banks Saw $78M Net Outflows to Coinbase, KlariVis Study Finds

New analysis from banking data company KlariVis found that 90% of community banks in its sample had customers transacting with Coinbase. Across 53 banks where transaction direction could be determined, $2.77 flowed to the crypto exchange for every $1.00 returning, resulting in a net $78.3 million deposit shift over 13 months.

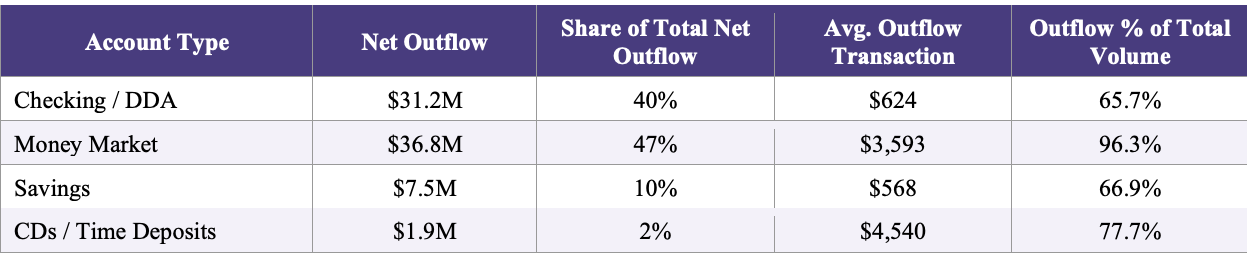

The study reviewed 225,577 Coinbase-related transactions across 92 community banks and found that transfers were heavily concentrated in money market accounts, where 96.3% of identifiable transaction volume represented funds leaving banks for the exchange.

“In general, community banks can be defined as those owned by organizations with less than $10 billion in assets,” the Federal Reserve says on its website.

KlariVis said that if the patterns observed in the sample hold nationally, more than 3,500 of the country’s roughly 3,950 community banks could have similar customer activity tied to Coinbase transfers.

The size of the 53 banks with directional data ranged from $185 million to $4.5 billion in deposits, with smaller institutions showing higher relative exposure. At banks with less than $1 billion in deposits, 82% to 84% of Coinbase-related transactions represented funds moving out, compared with about 66% to 67% at banks above $1 billion.

Across those banks, total outflows reached $122.4 million compared with $44.2 million in inflows. The average outbound transfer was $851, while inbound transfers averaged $2,999 but occurred far less frequently.

Money market accounts accounted for $36.8 million of the net outflow, with average transfers of $3,593, significantly higher than checking account movements.

Community banks hold about $4.9 trillion in deposits and fund about 60% of small business loans under $1 million and 80% of agricultural lending, according to the report, which argues sustained deposit migration could affect local credit availability.

Using academic estimates that small banks reduce lending by about $0.39 for every $1 decline in deposits, KlariVis said the $78.3 million net outflow could translate into about $30.5 million in reduced lending capacity.

Related: Coinbase’s Base transitions to its own architecture with eye on streamlining

CLARITY Act stalled by debate over stablecoin yield

The study comes as the US Congress, banks and crypto-native companies debate the CLARITY Act, which aims to define the regulatory framework for digital asset markets and determine whether crypto exchanges and stablecoin intermediaries can offer yield on customer holdings.

While the GENIUS Act, passed in July 2025, bars stablecoin issuers from paying interest, it does not prohibit third-party intermediaries such as Coinbase from offering yield on stablecoin balances, which has become a major point of contention between financial institutions and crypto companies.

In August, Banking groups, led by the Bank Policy Institute, urged lawmakers to address what they describe as a “loophole” in the law, warning that allowing exchanges to offer indirect yield could accelerate deposit outflows, disrupt credit flows and shift up to $6.6 trillion from the traditional banking system.

Last month, Bank of America CEO Brian Moynihan echoed that sentiment, saying interest-bearing stablecoins could draw up to $6 trillion from the US banking system, citing US Treasury-backed research suggesting deposits could migrate if issuers are allowed to pay yield.

Meanwhile, Coinbase CEO Brian Armstrong has pushed back against restrictions on stablecoin rewards. In January, he withdrew support for a version of the bill, writing on X: “We’d rather have no bill than a bad bill.” He raised several concerns about the draft, one of which was that it would eliminate stablecoin yield and protect banks from competition.

Despite ongoing tensions between banks and crypto companies, US Senator Bernie Moreno said on Wednesday he thinks the CLARITY Act could advance through Congress by April. Prediction marketplace Polymarket currently shows an 83% chance that the legislation will be signed into law this year.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

AI Agents Won’t Take Jobs if They’re Too Expensive

The high costs of deploying and running artificial intelligence agents in the workforce may prevent them from replacing humans who can do the same work at lower cost, say two multimillionaire tech investors.

Tech investor Jason Calacanis said on the All-In podcast on Saturday that he has been paying $300 per day for an Anthropic Claude AI agent to help run his businesses, despite the bot only operating at 10% to 20% of full capacity.

“When do tokens outpace the salary of the employee?” Calacanis questioned, referring to the usage allowance, called tokens, that users must purchase to use most AI models.

Social Capital CEO Chamath Palihapitiya said he had the same problem and that the cost of the models means they “need to be at least two times as productive as another employee.” He added he may need to set a budget on how much AI his business can use.

What Happens When AI Tokens Cost More Than Your Employees?@Jason:

“We, with our agents, hit $300/day per agent using the Claude API, like instantly. And that was doing, maybe, 10 or 20%. That’s $100k/year per agent.”@chamath:

“We’re getting to a place where we have to… pic.twitter.com/5N0rteNFts

— The All-In Podcast (@theallinpod) February 18, 2026

Tech investor Mark Cuban said on Thursday that the high cost of AI adoption in the workforce raised by Calacanis and Palihapitiya was the smartest counter-argument he’d seen to AI taking over jobs.

Cuban said that with the cost of tokens and maintenance, it could cost twice as much for eight Claude AI agents “to do what an employee does per day” for $1,200.

He questioned whether the AI bots were more than twice as productive as a human. or if there were “qualitative issues like morale, morality […] that can’t be quantified, that need to go into the decision.”

The threat of AI replacing large swathes of the workforce has caused uncertainty in recent years, as some companies have initiated layoffs, pointing to their use of AI making some jobs obsolete.

A research paper from Microsoft in July found that knowledge-based occupations, along with customer service and sales roles, were most at risk of being replaced by AI.

Related: China’s AI lead will shape crypto’s future

White House AI and crypto czar David Sacks is one of many who claim such fears are overhyped, saying in August that AI still needs to be prompted and verified to “drive business value.”

However, others, such as business consulting firm McKinsey & Co, have highlighted that the point of these AI agents is to automate tasks end-to-end, operating without constant human input.

Stablecoins could be agentic AI’s native currency

The use of AI agents has grown in popularity among crypto users, and stablecoin issuer Circle CEO Jeremy Allaire predicted last month that billions of AI agents will be transacting with stablecoins for everyday payments on behalf of users within five years.

Binance co-founder Changpeng Zhao said in January that crypto would end up being the native currency for AI agents due to blockchain being the “most native technology interface for AI agents.”

AI agents are already operating on several blockchains, such as Ethereum Layer 2 Base, where AIXBT, via the Virtuals Protocol, makes micropayments and facilitates trades on behalf of users, while ASI Alliance on Fetch.ai can manage assets and coordinate other economic tasks for users.

On Wednesday, OpenAI launched a new benchmark evaluating how well different AI models detect, patch, and even exploit security vulnerabilities found in smart contracts.

OpenAI said the research was useful as it is becoming more important to evaluate their performance in “economically meaningful environments.”

“Smart contracts secure billions of dollars in assets, and AI agents are likely to be transformative for both attackers and defenders,” it said.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Kraken xStocks Tops $25B in Volume, 80K+ On-Chain Holders

Kraken’s tokenized equities platform, xStocks, has surpassed $25 billion in total transaction volume in under eight months since its launch, signaling accelerating adoption of tokenized assets among mainstream investors. Kraken disclosed the milestone on Thursday, noting that the figure covers trades executed across both centralized and decentralized venues, as well as minting and redemption activity. The jump represents a 150% increase from the $10 billion milestone reached in November, the point at which xStocks first crossed that threshold. The tokens are issued by Backed Finance, a regulated asset provider delivering 1:1 backed tokenized representations of publicly traded equities and exchange-traded funds, with Kraken serving as a primary distribution and trading venue. Since its 2025 debut, xStocks has expanded to more than 60 tokenized equities, including notable exposures to major U.S. technology leaders such as Amazon, Meta Platforms, Nvidia and Tesla. The momentum in on-chain activity has been a central driver of growth, with on-chain trading volume totaling $3.5 billion and more than 80,000 unique on-chain holders. On-chain trading, conducted directly on public blockchains, offers transparency and self-custody of assets, a contrast to trading confined to centralized exchange order books. The rise in on-chain participation suggests users are not only trading tokenized equities but also integrating them into broader decentralized finance ecosystems. Eight of the 11 largest tokenized equities by unique holder count are now part of the xStocks ecosystem, underscoring its growing market share in this nascent segment.

Key takeaways

- xStocks reached $25 billion in total transaction volume within eight months of launch, incorporating centralized, decentralized, minting, and redemption activity, a 150% rise from the $10 billion mark seen in November.

- On-chain activity is a major growth driver, with $3.5 billion in on-chain trading volume and more than 80,000 unique on-chain holders to date.

- At launch, xStocks offered more than 60 tokenized equities; eight of the 11 largest tokenized equities by holder count are now within the xStocks ecosystem.

- Tokenized real-world assets (RWAs) continue to gain traction, with tokenized RWAs up 13.5% in the past 30 days and tokenized stocks reaching a $1.2 billion market capitalization in December.

- The structure involves Backed Finance issuing 1:1 backed tokenized representations of publicly traded securities, while Kraken remains a key distribution and trading channel.

Sentiment: Bullish

Market context: The ongoing expansion of tokenized equities fits into a broader trend toward real-world asset tokenization, where liquidity, transparency, and cross-venue settlement are increasingly appealing to investors seeking alternative exposure beyond traditional markets. While the broader crypto market has experienced volatility, demand for tokenized RWAs and on-chain settlement continues to grow, reflecting a diversification dynamic within digital asset ecosystems.

Why it matters

The milestone achieved by xStocks matters for several reasons. First, it demonstrates tangible monetizable traction for tokenized equities in a relatively short window, suggesting that institutions and individual investors are testing the feasibility of on-chain settlement and custody for traditional securities. By reaching $25 billion in total volume, xStocks signals that tokenization is moving beyond a niche experiment toward a scalable model that could reshape how investors access equity exposure. The fact that nine-figure volumes are now a routine attribute of a regulated tokenized product adds a layer of credibility to the broader tokenization narrative.

Second, the architecture underpinning xStocks—where Backed Finance issues 1:1 backed tokenized shares and Kraken provides distribution and liquidity—highlights a credible pathway for regulatory-aligned asset digitization. The 1:1 backing is a key feature designed to address concerns about the legal and financial solidity of tokenized assets, while Kraken’s established trading infrastructure offers a familiar on-ramp for traders who want to access tokenized equities without abandoning traditional market workflows. This combination could help bridge traditional exchanges and on-chain markets, potentially accelerating adoption among both retail and institutional participants.

Third, the on-chain growth underscores a broader DeFi-enabled use case for tokenized equities beyond mere trading. With $3.5 billion in on-chain volume and more than 80,000 unique holders engaging on public blockchains, participants are increasingly integrating tokenized stocks into cross-contract and cross-chain strategies. This points to a maturing ecosystem where tokenized assets intersect with liquidity protocols, lending and yield-generating strategies, and other DeFi innovations. If on-chain participation continues to rise, it could spur new product possibilities — such as on-chain custody solutions, collateralization for loans, or liquidity provisioning keyed to tokenized stock tokens — expanding the utility of tokenized equities beyond price discovery alone.

Lastly, the data showing eight of the 11 largest tokenized equities by holder count being part of xStocks signals meaningful market share gains. It suggests that a core subset of tokenized equities is achieving stronger network effects, attracting more funds and holders, and potentially driving more issuers and asset classes into the tokenization fold. While tokenized RWAs have demonstrated resilience and growth in a challenging market environment, tokenized stocks now appear to be carving out a distinct, investable niche within the broader crypto and digital asset landscape.

The outlook remains contingent on several external factors, including regulatory clarity across jurisdictions and the pace of mainstream adoption. As tokenized assets evolve, observers will be watching for new tokenized equities, expanded custodial and settlement mechanisms, and additional platforms embracing tokenized securities with similar architectures to Backed Finance. The trend toward real-world asset tokenization is not a fleeting one; it represents a structural development in how markets can be accessed and transacted on-chain, potentially altering liquidity dynamics and the composition of investment portfolios for years to come.

What to watch next

- Continued growth in on-chain trading volume and the number of unique on-chain holders for xStocks, with a focus on whether momentum persists beyond the current milestone.

- Expansion of tokenized equities beyond the initial lineup of more than 60 tokens, including new assets and potential broadened access to additional market segments.

- Regulatory developments affecting tokenized securities and standardized on-chain settlement, including any jurisdictional approvals or clarifications that could facilitate broader deployment.

- Integration opportunities with DeFi ecosystems, such as enhanced liquidity provision, collateralization options, and new yield-based use cases for tokenized equities.

Sources & verification

- Kraken’s public disclosure detailing the $25 billion total transaction volume milestone and the scope of trade types (centralized, decentralized, minting, redemption).

- Launch specifics: xStocks initially offered over 60 tokenized equities, including exposure to Amazon, Meta Platforms, Nvidia and Tesla, as cited in the disclosure.

- On-chain activity metrics: $3.5 billion in on-chain trading volume and 80,000+ unique on-chain holders as reported by Kraken.

- Tokenized RWAs performance: 13.5% growth in tokenized RWAs over 30 days and Token Terminal data indicating tokenized stocks reached a $1.2 billion market cap in December.

Momentum for tokenized equities grows as xStocks hits $25B in total volume

Kraken’s tokenized equities platform, xStocks, has demonstrated unaudited momentum by surpassing $25 billion in total transaction volume less than eight months after launch. The achievement spans a blend of centralised and decentralised trading activity, as well as the minting and redemption of tokenized assets. In a market environment where crypto prices have fluctuated, the acceleration in tokenized equity volumes showcases growing investor curiosity about on-chain settlement, transparent asset representation, and regulated issuance models. The milestone is framed by the fact that xStocks began life in 2025 with a catalogue of more than 60 tokenized equities, a roster that included shares tied to Amazon, Meta Platforms, Nvidia and Tesla, among others.

According to Kraken, the $25 billion figure captures trading that occurs across both traditional exchange venues and decentralized trading channels, reflecting a broader push to digitize publicly traded securities. The platform’s issuer, Backed Finance, provides 1:1 backed representations of the underlying stocks and ETFs, offering a structured path for investors to own tokenized shares with clearly defined backing. Kraken positions itself as a gateway for such instruments, handling distribution and trading while Backed Finance shoulders the task of token issuance and alignment with real-world assets. This arrangement aligns with a growing appetite for regulated tokenized products that can be traded with familiar market mechanics while benefiting from the transparency of blockchain settlement.

On-chain activity has emerged as a major growth lever. With $3.5 billion in on-chain volume and more than 80,000 unique holders interacting with tokenized equities on public blockchains, the ecosystem is differentiating itself from conventional off-chain trading. On-chain participation implies that investors are comfortable with self-custody and direct visibility into transactions, a dynamic that complements the more traditional off-chain trading seen on centralized exchanges. The increased on-chain activity is also indicative of broader market interest in DeFi-native use cases for tokenized assets, including potential liquidity access, programmable settlement, and cross-venue arbitrage opportunities that leverage the transparent, verifiable nature of blockchain records.

Competitive dynamics within tokenized equities become more meaningful as data show eight of the 11 largest tokenized equities by unique holder count now belong to the xStocks ecosystem. This concentration hints at a rising market share within the tokenized equities space, where a core group of assets is attracting a growing community of holders. The development cements xStocks’ role as a leading force in the early-stage tokenization wave, signaling to issuers and investors that there is tangible, scalable demand for tokenized representations of real-world assets.

Beyond the headline numbers, the broader context underscores a market increasingly comfortable with tokenized real-world assets (RWAs). Tokenized RWAs grew by 13.5% in value over the last 30 days, a period when the overall crypto market moved lower by roughly $1 trillion in market capitalization. Market observers have likened tokenized stocks to a potential “stablecoin moment” for asset tokenization—where rapid early adoption leads to widespread acceptance and predictable use cases. Supporting data from Token Terminal shows tokenized stocks reached a market capitalization of about $1.2 billion in December, marking a notable emergence from a period of minimal presence just half a year prior. This trajectory suggests a broadening base of participants and a more robust, diversified ecosystem for tokenized asset products.

https://platform.twitter.com/widgets.js

Crypto World

Goldman Sachs ceo backs strict us crypto rulebook

Solomon urges strict US crypto rules as CLARITY Act momentum builds.

Summary

- Solomon says crypto must operate under a clear us rule-based framework, rejecting a “no rules” approach and citing el salvador as outlier.

- Senator Moreno targets april for passing the clarity act, arguing Republicans keep congress and dismissing democrat takeover risks.

- Ripple’s Garlinghouse puts odds near 80% that the market structure bill is signed by end of april once stablecoin reward disputes ease.

Goldman Sachs CEO David Solomon called for the United States to establish a clearly defined, rules-based framework governing crypto market operations during remarks at the World Liberty Forum in Mar-a-Lago on Wednesday.

Speaking in an interview with CNBC, Solomon stated that lawmakers should take a long-term view when shaping crypto legislation. The banking executive said the US banking system must function alongside emerging technologies rather than be displaced by them.

Solomon rejected the notion that cryptocurrency can thrive without regulatory oversight. “If there are people who think we are going to operate in this environment without rules, they are probably wrong, and they should move to El Salvador,” Solomon said, according to CNBC.

The CEO indicated Goldman Sachs maintains active involvement in digital asset-related areas, including digitization and tokenization. However, he noted that digital assets represent a relatively small portion of the firm’s overall operations.

Solomon’s comments came amid ongoing debate in Washington over proposed crypto market structure legislation, commonly referred to as the CLARITY Act. Senator Bernie Moreno acknowledged earlier Wednesday that he retains concerns about the bill, but expressed optimism that Congress could pass the measure by April, according to reports.

Moreno dismissed concerns that potential Democratic gains in November’s midterm elections could jeopardize the legislation. The senator predicted Republicans would maintain control of both chambers of Congress.

Ripple CEO Brad Garlinghouse suggested on Tuesday that the CLARITY Act could advance quickly toward passage once disputes over stablecoin rewards between banking and crypto sectors are resolved. Garlinghouse estimated an 80% probability the market structure bill will be signed into law by the end of April, according to his public statements.

Crypto World

SEC Leadership Speaks on ‘Number go Down‘ Regulatory Concerns

Paul Atkins and Hester Peirce spoke at ETHDenver on Wednesday on the future of regulation at the SEC and its response to crypto market volatility.

Paul Atkins, chair of the US Securities and Exchange Commission (SEC), and the agency’s crypto task force head, Hester Peirce, said Wednesday they would support efforts to clarify how “tokenized securities interact with existing regulation,” better positioning industry developers.

Speaking to attendees at the ETHDenver conference on the future of regulation, Atkins and Peirce addressed concerns about volatility in many cryptocurrency prices and how the agency plans to move forward with digital asset regulation amid a potential market structure bill in Congress.

In response to “falling crypto prices of late,” likely referring to the price of Bitcoin (BTC) and Ether (ETH) falling by more than 28% and 40%, respectively, in the previous 30 days, Atkins said:

“As regulators, the best thing we can do is to ensure that the rules governing the asset classes we regulate enable people to have the information they need to express their market sentiments through decisions about whether to buy, sell, or hold the assets at issue.”

Neither commissioner directly spoke on efforts to pass market structure legislation in Congress, although Peirce said that the SEC had “provided technical assistance” on the matter. A bill moving through the US Senate, called the CLARITY Act when it passed the House of Representatives in July, could shift much of the SEC’s authority over digital assets to the Commodity Futures Trading Commission (CFTC).

Related: Democratic lawmakers slam SEC Chair Atkins over crypto enforcement

ETHDenver, happening this week in Colorado, is one of the largest cryptocurrency events in the United States, bringing together developers and industry leaders.

CFTC is still understaffed, despite Senate-confirmed chair

Michael Selig, confirmed as a commissioner and chair of the CFTC in December, remains the sole leader at an agency intended for five commission members. As the US Senate considers provisions within the market structure bill, some lawmakers have pushed for language requiring at least four commissioners to be confirmed before the law can take effect.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

Crypto price prediction as hawkish FOMC minutes sparks market sell-off

The latest Federal Open Market Committee minutes struck a hawkish tone, pressuring risk assets including cryptocurrencies.

Summary

- Policymakers warned inflation progress may be “slower and more uneven,” signaling rate cuts are not imminent and that hikes have not been fully ruled out.

- With Treasury yields rising and easing deemed potentially premature, high-beta assets like Bitcoin, Ethereum and XRP faced renewed selling pressure.

- BTC holds near $66.8K but remains below its 50-day SMA; ETH consolidates near $1,960 with weak inflows; XRP trades under key Bollinger resistance near $1.46.

Policymakers acknowledged that while inflation has cooled from its highs, progress toward the Fed’s 2% target “might be slower and more uneven than generally expected,” and warned that the risk of inflation remaining persistently above target “was meaningful.”

That language reinforced expectations that rate cuts are not imminent and that policymakers remain cautious about declaring victory over price pressures.

The minutes also revealed that several participants would have supported a “two-sided” description of risks, signaling that further rate hikes have not been fully ruled out if inflation reaccelerates. At the same time, officials indicated that additional policy easing “may not be warranted” until there is clear evidence that disinflation is firmly back on track.

While two members dissented in favor of an immediate cut, the broader message emphasized patience and vigilance, a stance that typically tightens financial conditions and weighs on high-beta assets such as crypto.

With Treasury yields climbing and expectations for near-term liquidity fading, digital assets faced renewed selling pressure. This sets the stage for a closer look at how Bitcoin (BTC), Ethereum (ETH) and XRP (XRP) are reacting on the charts.

Crypto price prediction: Bitcoin (BTC)

Bitcoin extended its pullback following the hawkish Fed minutes, briefly dipping toward $65,000 before stabilizing before staging a rebound. It is currently trading around $66,800, but remains well below the 50-day SMA near $82,600, which signals that the broader short-term trend is still bearish.

The RSI is hovering around 34, recovering from near-oversold territory but still below the neutral 50 level, suggesting weak momentum despite the bounce. Immediate support sits near $64,000, followed by the recent low around $60,000.

On the upside, resistance is seen near $70,000, with stronger structural resistance around $75,000–$76,000. Unless BTC reclaims those levels, rallies may continue to face selling pressure.

Ethereum (ETH)

Ethereum saw a sharp sell-off in early February, dropping toward the $1,900 zone before stabilizing. It is now trading around $1,960, consolidating in a tight range amid the Fed-driven volatility.

The Balance of Power indicator has turned slightly positive, hinting at mild buying pressure, but CMF remains marginally negative, suggesting capital inflows are still weak. Immediate support lies at $1,900, with a deeper floor around $1,800.

On the upside, ETH faces resistance near $2,050, followed by $2,200, where prior breakdown levels sit.

XRP

XRP remains under pressure compared to BTC and ETH. After sliding from above $2.00 earlier in the year, it recently bounced from the $1.20–$1.25 area and is currently trading near $1.41.

Price is sitting below the mid-Bollinger Band (around $1.46), while the upper band near $1.65 acts as dynamic resistance.

CMF remains slightly negative, indicating limited buying conviction. Immediate support rests at $1.35, followed by the recent swing low near $1.25. Resistance is seen at $1.46, with a stronger barrier at $1.60–$1.65.

Crypto World

Nexo’s Cumulative Credit Withdrawals Hit $863M All-Time High as Bitcoin Stabilizes

TLDR:

- Nexo’s cumulative credit withdrawals hit an all-time high of $863 million between 2025 and 2026.

- Weekly retail withdrawals on Nexo surged 107%, climbing from $6.73M to $13.92M in just one month.

- CryptoQuant’s Estimated Leverage Ratio reset to healthier levels, pointing to reduced systemic risk across crypto markets.

- Bitcoin’s stabilization near $67,000 is lowering collateral risks, making crypto-backed borrowing more practical for users.

Nexo’s cumulative credit withdrawals have reached an all-time high of $863 million between 2025 and 2026. This record arrives as Bitcoin stabilizes near $67,000 following a -48% correction between October and February.

The broader crypto market is now shifting from sharp repricing toward steady consolidation. Weekly retail borrowing on Nexo nearly doubled from December 2025 to January 2026. This renewed activity points to growing confidence among crypto-backed liquidity users.

Retail Credit Withdrawals Signal a Market Shift

Nexo’s retail credit withdrawals declined through most of 2025, reflecting a broad risk-off trend. Many clients moved to tighten their balance sheets as crypto prices fell sharply.

However, the pace slowed considerably in late 2025 and early 2026. This leveling off suggests that retail participants have mostly completed their balance sheet tightening.

Weekly retail withdrawals grew from $6.73 million to $13.92 million between December 2025 and January 2026. That jump represents approximately 107% growth in just one month.

The data shows borrowing demand returned quickly once market conditions began steadying. Clients are clearly more willing to access crypto-backed credit in the current environment.

CryptoQuant’s Estimated Leverage Ratio has also been resetting to healthier levels during this period. Declining leverage across the market often creates a foundation for more sustainable borrowing activity.

As excess leverage clears, participants tend to re-engage credit markets with renewed conviction. This broader trend aligns with the withdrawal data now emerging from Nexo.

Bitcoin’s stabilization near $67,000 plays a direct role in this borrowing recovery. A steadier price environment lowers the risk of rapid collateral liquidation for active borrowers.

When the leading cryptocurrency consolidates, crypto-backed lending becomes a more practical financial tool. Nexo users appear to be responding directly to this change in market conditions.

Cumulative Withdrawals and the Path to Renewed Confidence

Nexo’s $863 million in cumulative credit withdrawals reflects consistent demand across multiple market cycles. This figure covers borrowing activity through both bullish and bearish price periods.

It confirms that appetite for crypto-backed liquidity holds up even during extended corrections. The milestone speaks to the resilience of Nexo’s lending model over time.

Open interest across the broader crypto market has declined from prior highs. Funding rates are also normalizing, and liquidation volumes have been subsiding in recent weeks.

These conditions are typical of a market absorbing the final stages of a correction cycle. They create a more stable ground for platforms offering crypto-backed credit solutions.

Selling pressure around Bitcoin has also weakened noticeably in recent weeks. Reduced sell-side activity supports a more stable price for collateral-backed borrowers.

Borrowers on platforms like Nexo benefit directly when Bitcoin holds within a tighter price range. Credit activity tends to pick up naturally as volatility subsides.

Recent data from Nexo suggests the market may now be entering a new borrowing phase. Weekly withdrawal growth and cumulative figures together tell a coherent recovery story.

Borrowing demand is returning as the correction cycle winds down. The broader crypto credit market appears to be stabilizing after months of contraction.

Crypto World

Bitcoin Faces 5th Consecutive Red Month: Where Is The Bottom?

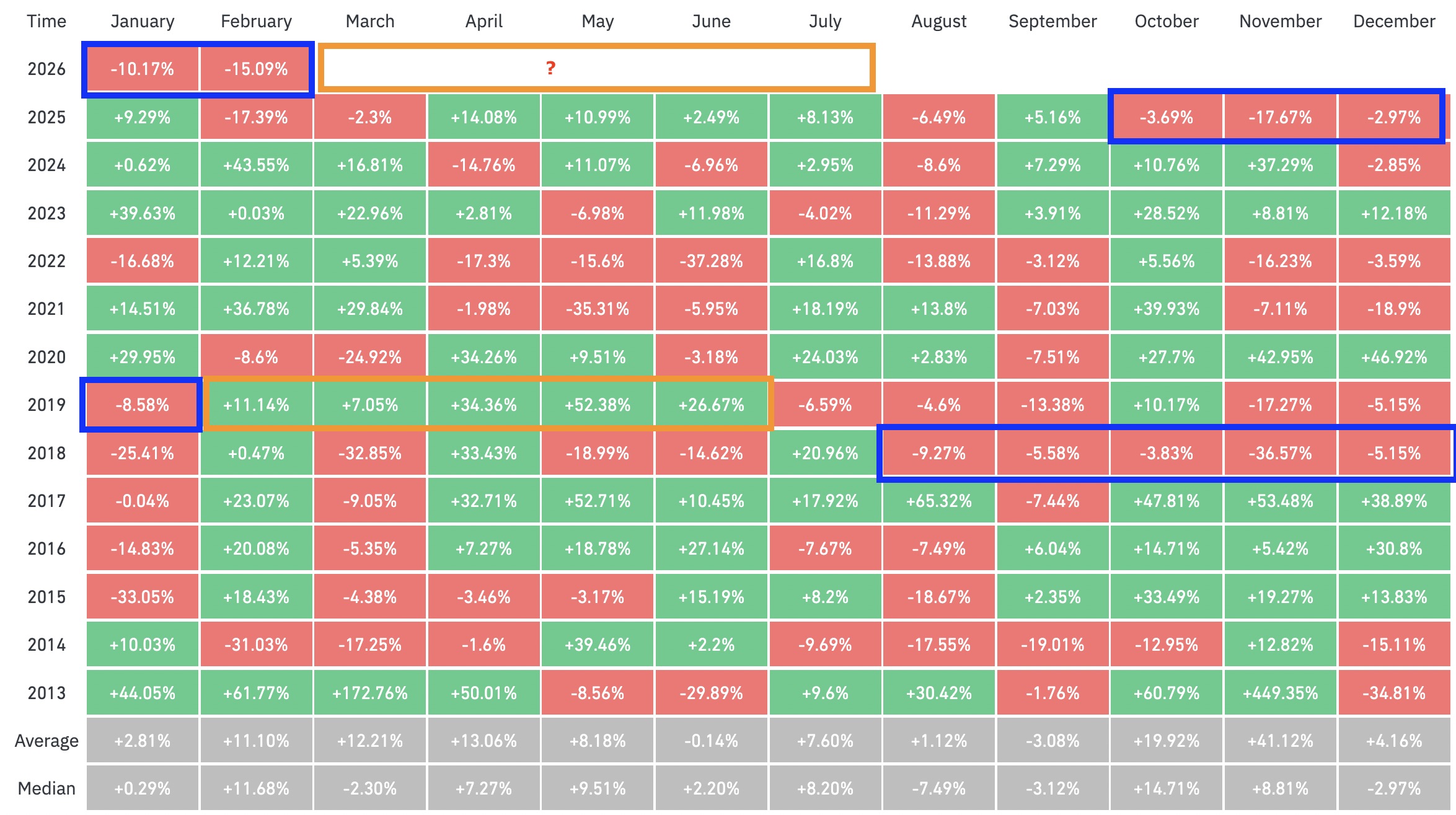

Bitcoin (BTC) is forming what may prove to be a fifth consecutive red monthly candle, which would be the longest losing streak since 2018. The silver lining is that data suggests that March may prove to be a profitable month for BTC.

Previous multimonth downtrends were followed by 300% price gains

Historical price data from CoinGlass confirms Bitcoin is now facing its fifth consecutive red month, down 15% this month after closing the previous four months in the red.

The last time this happened was in 2018, when it entered a bear market after reaching record highs in 2017.

“Last time this happened was in 2018/19 when we saw 6 red months,” analysts at macro investor outlet Milk Road said in an X post on Thursday.

This led to a reversal with over 316% returns over the following five months, the analysts said, adding:

“If history repeats, the reversal will begin on April 1st.”

Analyzing Bitcoin’s quarterly performance during the 2022 bear market provides a more cautious interpretation of BTC price history. The data shows Bitcoin recorded four consecutive red quarters during that year.

Losses stacked across the four quarters, bringing the total losses to 64% as the BTC/USD pair closed the year at $16,500 from an opening price of $46,230. This marked one of the harshest drawdowns in Bitcoin’s history.

As Cointelegraph reported, many analysts expect 2026 to be a bear market year, and a similar stretch of four losing quarters could extend the weakness below the 15-month low of $60,000.

Analyst Solana Sensei shared a chart that focused on Bitcoin’s weekly performance, with the price printing the fifth candlestick in a row.

This is the longest streak since 2022, making it the second-longest losing streak on record.

In 2022, BTC price saw nine red weeks, dropping to $20,500 from $46,800.

Therefore, while past monthly performance suggests an impending rebound, quarterly and weekly data from 2022 demonstrate that BTC price declines could last longer than expected.

Related: Bitcoin’s consolidation nears ‘turning point’ as $70K comes in focus: Analyst

The current market is “fundamentally different”

Veteran analyst Sykodelic argues that Bitcoin’s current bear phase is “fundamentally different” for several reasons, including the monthly relative strength index (RSI) having already reached the 2015 and 2018 bear market lows.

Sykodelic said that due to the lack of a true overbought expansion in the monthly RSI during the bull phase, market participants will be misguided to expect a symmetric contraction.

“This is yet again another situation in which we look a lot more like 2020 than any other period in time,” the analyst said in a post on X, adding:

“I am not seeing anything that tells me we are in the same style bear market as we have had previously, and everyone should be aware of these differences.”

This suggests the current bear cycle is not following historical patterns, and Bitcoin’s bottom and subsequent recovery could catch many traders off guard.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Trader Leaves Crypto Forever After Losing $10,000 in LIBRA

One year has passed since Argentine President Javier Milei backed a project that drove hundreds of thousands of people worldwide to invest in Libra, a meme coin that turned out to be a rug pull.

Alfonso Gamboa Silvestre, a 25-year-old from Chile, was among the many traders who suffered steep losses. The token’s launch and swift demise cost him $10,000. Since that moment, he has left the crypto industry for good.

A Presidential Endorsement That Drove a Buying Frenzy

On Valentine’s Day last year, Gamboa Silvestre was trading on his computer. The day seemed normal until a notification popped up on his phone from one of the many crypto groups he had on Telegram.

He opened the message, which read something along the lines of “Argentina’s president just launched a crypto token.” Gamboa Silvestre ran to X (formerly Twitter) to see whether it was true.

At first, he thought Milei’s account had been hacked. But after carefully reading the president’s verified tweet and the “Viva La Libertad Project” website he included, Gamboa Silvestre ruled out the possibility.

So he bought the token. In total, he invested $5,000.

“I made two purchases. First, a smaller one. When I was totally sure it was [Milei’s] tweet, I made a bigger one,” Gamboa Silvestre told BeInCrypto in an interview in Spanish.

After that, Gamboa Silvestre left the house to go out to dinner with his family, but he couldn’t keep his eyes off his phone. Libra’s price kept dropping, and he didn’t know what to do.

Choosing what looked best on the menu and averting his family’s worried gaze was hard enough, so he locked himself in the restaurant’s bathroom.

“At first I thought the token was going to go down, and then it was going to go back up to infinity,” Gamboa Silvestre said. “But that didn’t happen. I saw that it was going down and down, and my February 14th ended up being a nightmare.”

As investors began withdrawing their money en masse, so did Gamboa Silvestre. He ended up doubling his original investment in losses.

The event also marked his permanent exit from the crypto ecosystem.

From Active Trader To Complete Exit

Gamboa Silvestre first ventured into crypto in 2016, mostly out of curiosity. However, he began to take it seriously in 2022 and became an active trader.

The meme coin sector had treated him well at first.

Gamboa Silvestre was among the first investors in TRUMP and MELANIA, the two tokens launched by US President Donald Trump and First Lady Melania Trump less than 48 hours before Trump assumed the presidency.

He fared well for himself, and he believed that the story would be similar with Libra.

“I thought that, since Milei had been having different meetings with Donald Trump and Elon Musk, I said, well, this is going down the same path, they’re going to do things right, and I’m going to be able to make money with that,” Gamboa Silvestre recalled.

But things didn’t turn out that way. Besides the money he lost, Gamboa Silvestre surrendered something that was even more important to him: his love for crypto.

“After what happened with Libra, I completely stepped away from that world. I stopped doing something that I really liked that had generated me a lot of profitability during that period,” he said. “In the future, I saw myself only living from that. But I lost all confidence.”

Today, the only ties that Gamboa Silvestre has left to the industry are his participation in a class action brought against Milei.

Data Disputes Milei’s Claims

Gamboa Silvestre is one of 212 investors seeking reparation for their losses in a lawsuit pending in Argentina.

Even though Milei has repeatedly dialled down the impact that LIBRA had on investors, the facts tell a different story.

According to data from Ripio, just one centralized exchange operating in the country, 1,329 citizens lost money. These numbers directly contradicted Milei’s previous claims that only a handful of Argentine investors had been affected.

Argentines weren’t the only ones who had lost money. The impact was international, affecting investors anywhere from Bosnia to Lebanon to Australia.

In the United States, a separate class action lawsuit is moving forward against Hayden Davis, the American investor and CEO of Kelsier Ventures, who has been accused of being the mastermind behind the project.

Trust Erodes As Investigation Continues

Despite it being a year since Libra launched, Milei has yet to provide a coherent explanation of his level of involvement in the token project.

According to Agustín Rombolá, one of the lawyers representing the complainants in the class action, Milei’s answers have varied greatly over the past year.

“He first told us it was a casino, that you don’t cry in the casino. Then he told us that he had the right to sell his opinions. And then he told us that he was not working as the president at the moment of the tweet. [After that], he told us he was scammed,” Rombolá told BeInCrypto.

According to Congressman Maximiliano Ferraro, one of the most outspoken critics in the Libra scandal, Milei has yet to address a key issue regarding his role in the case.

“There are still many questions unanswered. Who approached the President, and how did they give him that [smart contract address] that had more than 40 characters and did not have a public status?” Ferraro said in an interview in Spanish.

As the investigation into what happened continues, the financial damage is still being tallied, as is the loss of trust.

For Gamboa Silvestre and thousands of others, Libra was not just a failed investment but a turning point that reshaped their relationship with crypto altogether.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports22 hours ago

Sports22 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World1 day ago

Crypto World1 day agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

Crypto World4 hours ago

Crypto World4 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show