CryptoCurrency

Ethereum price compresses into triangle structure, why breakout is approaching

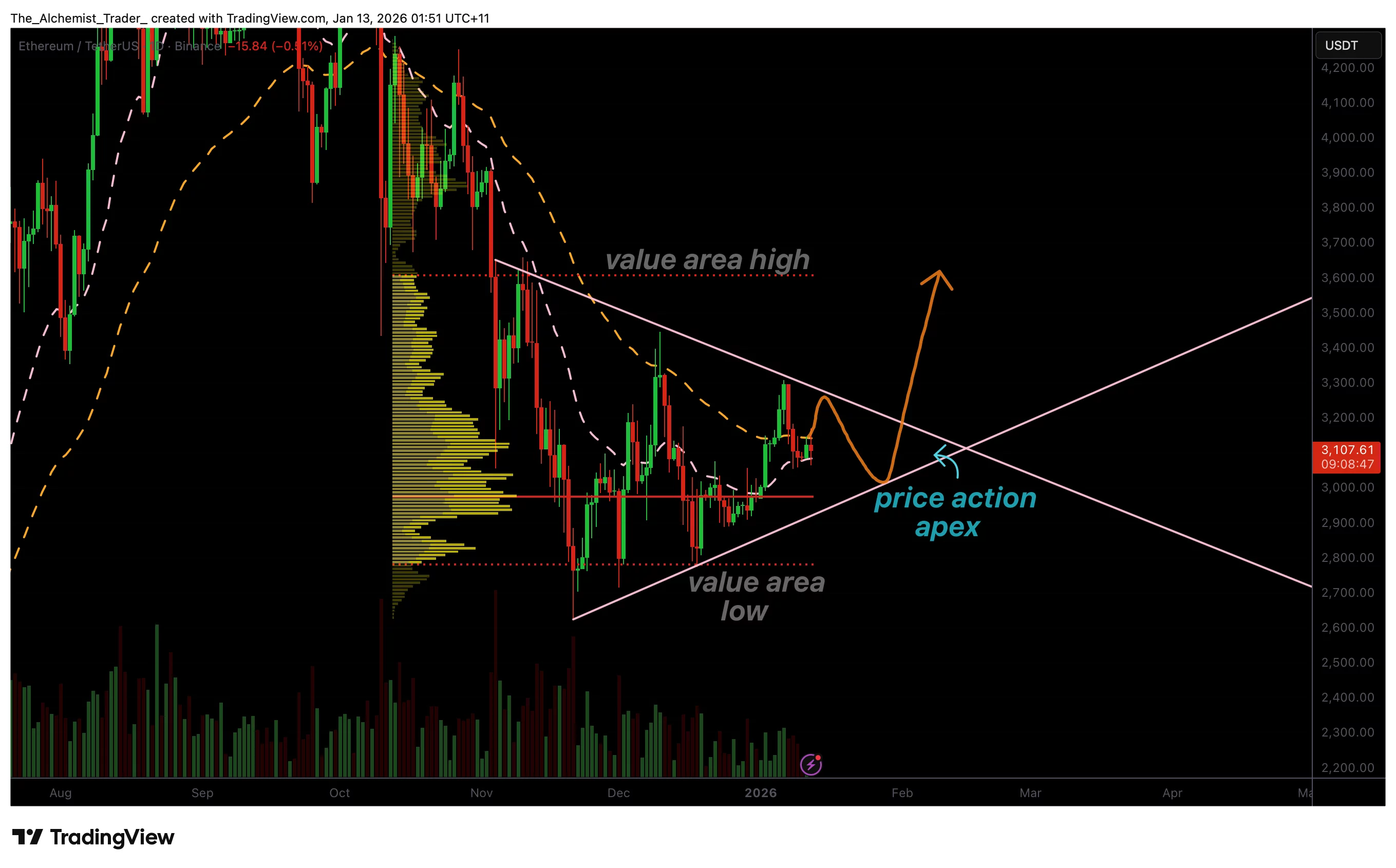

Ethereum’s price is compressing into a tightening triangle, with converging support and resistance levels signaling a decisive breakout as volatility continues to contract.

Summary

- ETH is trading into a triangle apex with converging support and resistance

- Price remains above the Point of Control, supporting bullish bias

- A volume-backed breakout is needed to confirm direction

Ethereum’s (ETH) current price action is entering a critical technical phase as the market continues to coil within a well-defined triangle pattern. This structure reflects a period of volatility compression, where price is being squeezed between rising support and descending resistance. Such formations often precede decisive directional moves, making this a key moment to monitor.

As Ethereum trades deeper into the apex of the triangle, the window for sideways movement continues to narrow. From a technical perspective, this compression suggests that a breakout is becoming increasingly likely, with the direction of that move dependent on volume confirmation and how price behaves around key structural levels.

Ethereum price key technical points

- Ethereum is trading within a triangle apex, with dynamic support and resistance converging

- Price is holding above the Point of Control, a constructive bullish signal

- A confirmed breakout requires strong volume expansion to validate direction

Triangle patterns form when markets enter a state of balance, with neither buyers nor sellers able to assert full control. Over time, this balance tightens as price action compresses, reducing volatility and limiting range expansion. Eventually, the market is forced to resolve this compression through a breakout.

In Ethereum’s case, dynamic support and resistance are converging rapidly, creating a narrowing apex zone. This zone represents a decision point at which the price can no longer trade sideways. The closer price moves toward the end of the triangle, the higher the probability of a sharp expansion in volatility.

Importantly, breakouts from triangle structures tend to be most effective when accompanied by strong volume. Without volume confirmation, moves beyond the pattern are more prone to failure and false breaks.

Volume as the confirmation signal

At present, Ethereum’s volume profile remains subdued, which is typical during consolidation phases. Declining volume during compression does not weaken the setup; rather, it reflects market participants waiting for confirmation before committing capital.

For a true breakout to occur, volume must expand meaningfully as price exits the apex. A surge in volume signals participation, conviction, and acceptance at higher or lower prices. This influx allows the market to sustain momentum beyond the initial breakout point.

Until such volume expansion is observed, Ethereum may continue to trade tightly within the triangle, even as the breakout draws closer.

Point of control and bullish bias

A notable technical detail in Ethereum’s current structure is that price remains above the Point of Control. From a market profile perspective, this is a constructive signal, as it suggests that the area of highest traded volume is acting as support rather than resistance.

Holding above the Point of Control within a compression structure often tilts probabilities slightly in favour of an upside resolution. As long as Ethereum maintains acceptance above this level while remaining within the apex, the likelihood of a bullish breakout increases.

If this scenario plays out, the next logical upside objective sits at the value area high, located around the $3,600 region. This level represents a major resistance zone where price previously encountered selling pressure and would act as the first significant test of bullish continuation.

Why apex zones matter

Apex zones are inherently unstable price regions. As support and resistance converge, the market’s ability to trade sideways diminishes. This creates pressure that must be resolved through directional movement.

Historically, assets that compress deeply into triangle apexes tend to produce stronger breakouts compared to those that break earlier in the structure. The longer the compression persists, the more energy is stored for the eventual move.

Ethereum’s price action currently reflects this dynamic. With each passing session, volatility contracts further, reinforcing the idea that a breakout is approaching rather than optional.

What to expect in the coming price action

In the immediate short term, Ethereum may continue consolidating within the triangle as volume remains muted. However, as the price moves closer to the apex, the likelihood of a decisive breakout increases.

From a technical, price-action, and market-structure perspective, Ethereum is approaching a pivotal moment. The compression phase is nearing completion, and a volatile breakout appears increasingly likely in the coming weeks as the triangle structure resolves.