Crypto World

Ethereum price prediction after Tom Lee’s Bitmine buys 20K ETH worth $41.98M

Tom Lee’s Bitmine has moved closer to its goal of acquiring 5% of the total supply with its latest 20K ETH purchase. But a bearish flag pattern confirmed on the weekly ETH/USDT chart suggests a potential price correction for Ethereum may be imminent.

Summary

- Tom Lee’s Bitmine has acquired 20,000 ETH for $41.98 million.

- Market demand generated from spot Ethereum ETFs remains weak.

- A bearish head and shoulders pattern was confirmed on the weekly chart.

Bitmine, the tech-focused infrastructure company run by renowned market strategist Tom Lee, had acquired another 20,000 ETH worth $41.98 million over the weekend. The move follows its acquisition of over 40,000 ETH in late January, valued at approximately $117 million at that time.

Following Bitmine’s latest purchase, the company’s total reserves now stand at nearly 4.29 million ETH, making it nearly 71% complete with its goal of owning at least 5% of the total circulating supply.

In contrast to the debt-fueled acquisition strategy popularized by Michael Saylor’s Strategy, Bitmine Immersion Technologies (BMNR) maintains a pristine, zero-debt balance sheet bolstered by over $586 million in cash and short-term liquidity.

The company’s most strategic pivot, however, is the transition to active Ethereum staking. By putting its massive ETH treasury to work, Bitmine is positioned to generate over $500 million in annual high-margin revenue, provided staking yields hold above the 2.5% threshold.

When large institutional players like Bitmine continue to gobble up supply, it typically tends to create a supply shock, which helps support price floors in the long run.

However, the overall outlook for Ethereum still remains precarious as a number of bearish catalysts may continue to overshadow any optimism generated by big buys.

First, the Ethereum (ETH) price has remained in a steady downtrend since mid January, dropping over 45% to nearly $1,800 last week. This decline came about as the broader market remained gripped by fear, as macroeconomic and geopolitical volatility combined with massive recurring liquidations continued to keep investor appetite at bay.

Second, spot Ethereum ETFs, which had previously served as a primary bullish driver, have been witnessing back-to-back outflow months since November of last year. These investment products have shed over $2.5 billion in that period alone, and any further outflows could erode retail confidence and often make traders reevaluate their positions.

Third, the total value locked on the Ethereum network has fallen to $57 billion, which is significantly lower than the $98 billion recorded in October of last year. Declining TVL means reduced on-chain utility and could likely sour the sentiment of traders and hence further dampen the recovery.

On the weekly chart, Ethereum price has confirmed a head and shoulders pattern as it fell below a key support level at $2,800 last month. The pattern is formed of three distinct peaks, where the middle peak is the highest, and the two outside peaks are relatively equal in height. It is widely considered one of the most popular bearish reversal patterns in technical analysis.

At press time, the Ethereum price was trading close to $2,000, which is another key psychological support level that could largely dictate market sentiment for weeks to come.

A sharp drop below this crucial floor could trigger a deeper slide toward $1,000, which represents the next major historical support. Prices could even fall as low as $800, a bearish target calculated by subtracting the total height of the head from the point at which the price broke below the neckline of the pattern.

Several technical indicators seem to support this grim prediction. Notably, the MACD lines remain stuck under the zero line and are currently pointing downward, indicating strong selling momentum, while the supertrend indicator has flashed a clear red signal.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Bitcoin price outlook: buy signals appear amid deep BTC correction

- Bitcoin (BTC) is showing early buy signals amid an ongoing correction near $69,500.

- The key support levels at $65,800 and $60,100 attract dip buyers.

- A break above $74,500 could trigger renewed bullish momentum.

Bitcoin has been in a volatile state over the past month, with prices hovering near $69,500.

The cryptocurrency has faced a 23.2% drop over the last month, signalling a deeper correction in progress.

Despite the decline, recent market activity suggests early buy signals are starting to emerge.

Bitcoin price trapped in a sideways phase

BTC is currently trading in a sideways range between $62,800 and $78,900 over the past seven days.

This range indicates indecision among traders, with neither bulls nor bears fully controlling the market.

Analyst Doctor Profit warn that this sideways phase could be a trap, potentially leading to a deeper drop toward $44,000–$50,000.

However, this view is balanced by macroeconomic developments that may provide temporary support for Bitcoin.

The recent rebound above $70,000 came after a short squeeze pushed BTC higher, liquidating over $245 million in positions.

This shows that buying pressure still exists, particularly from opportunistic traders looking to enter at perceived lows.

Liquidity remains relatively strong, with 24-hour trading volume exceeding $46 billion, suggesting continued investor participation.

Bitcoin technical outlook: the buy signals

From a technical standpoint, Bitcoin remains capped below key resistance at $69,000–$69,500.

Breaking above this level is essential for bulls to regain control of short-term momentum.

On the flip side, the support levels at $65,800 and $60,100 provide clear thresholds where buyers may step in.

Recent dip buying indicates that some traders are accumulating Bitcoin during the correction.

Notably, the reset of leveraged positions in derivatives markets points to reduced short-term selling pressure.

Meanwhile, macro factors such as strong US economic data and Federal Reserve liquidity injections provide additional tailwinds.

Political events like Japan’s election have also lifted global risk appetite, indirectly supporting BTC and other risk assets.

Historical trends show that Bitcoin often experiences deep corrections after major rallies, making the current slump consistent with past market cycles.

The all-time high of $126,080, reached in October 2025, remains distant, but the current consolidation may offer opportunities for medium-term accumulation.

Analysts emphasise that patience is critical, as further volatility is expected before a sustained uptrend emerges.

Bulls should watch these key technical zones carefully, knowing that a breakout above $74,500 could signal renewed upward momentum.

Conversely, a fall below $65,800 could intensify selling and extend the correction phase.

Overall, the market is balancing between lingering bearish pressure and emerging buying interest, creating a cautious but potentially rewarding environment.

Investors with a longer-term perspective may view current prices as an entry point amid market-wide corrections.

Short-term traders should remain alert to both upside breakouts and downside risks in the coming weeks.

Crypto World

Mining difficulty drops by most since 2021 as miners capitulate

Bitcoin’s mining difficulty dropped by around 11%, its largest decline since China’s 2021 crackdown on the industry, after a sharp decline in hashrate triggered by plunging prices and widespread winter storm-related outages in the U.S.

Mining difficulty, which determines how hard it is to find new Bitcoin blocks, adjusts roughly every two weeks to maintain a 10-minute block interval on the network.

The latest change brought the metric down from over 141.6 trillion to about 125.86 trillion, according to Blockchain.com data, signaling a steep drop in the number of active machines securing the network.

The decline follows a series of blows to miners. Bitcoin prices have fallen significantly from an all-time high of $126,000 in October to around $69,500.

That price drop forced many miners, especially those running outdated equipment and facing high energy costs, to shut down. Some also repurposed their hardware to focus on artificial intelligence (AI), as megacap firms offer stable contracts and often economically irresistible terms.

Bitfarms (BITF) notably saw its share price surge after saying it’s no longer a bitcoin company, and is instead focusing on data center development for high-performance computing and AI workloads.

Bitcoin mining revenue on a per terahash basis, measured via the hashprice, has plunged from nearly $70 at the time the cryptocurrency was trading at an all-time high, to now stand at little over $35.

Severe winter storms, particularly in Texas, compounded the situation. Grid operators issued curtailment requests to conserve electricity for residential users. Public mining firms scaled back production, with some seeing daily bitcoin output fall by more than 60%.

Although a drop in difficulty might appear alarming, it functions as a self-correcting mechanism. For miners who remain online, the reduced competition can increase profitability and help maintain the business model.

Historically, major difficulty drops have also signaled market capitulation, often preceding a stabilization or rebound in price as miners sell the BTC they mine to cover operational expenses.

Crypto World

Why Japan’s Election Is a Short-Term Drag but Long-Term Win for Bitcoin

Japan’s landslide election boosted equities but added near-term pressure to Bitcoin as capital rotated and liquidity tightened.

Japan’s ruling bloc secured a two-thirds majority in the Lower House on February 8, handing Prime Minister Sanae Takaichi a decisive victory that has already reshaped global market positioning.

The result has lifted Japanese equities while adding short-term pressure to Bitcoin (BTC), even as longer-term policy shifts in Tokyo may support institutional crypto adoption.

Takaichi’s Victory Reshapes Capital Flows

Market reaction to the election was swift, with Japanese stocks pushed to fresh record highs in the hours after the result, and the Nikkei extending gains as traders priced in aggressive fiscal stimulus and a more tolerant stance toward yen weakness.

Market watcher Ash Crypto wrote on X that Japan’s stock market had hit a new all-time high following Takaichi’s victory, reflecting optimism around domestic reflation.

Research firms and analysts were more cautious about global spillovers. XWIN Research described the outcome as bearish for Bitcoin in the near term, pointing to tighter global liquidity and shifting capital flows.

Meanwhile, GugaOnChain noted that the so-called “Takaichi Trade” is not a simple exit from U.S. assets but a portfolio rebalance. Japanese Government Bonds, sidelined for years by ultra-low yields, are attracting incremental capital as fiscal expansion raises reflation expectations.

That rotation has coincided with a pullback in U.S. equities. Over the past seven days, the Nasdaq Composite fell about 5.6%, the S&P 500 slipped by about 2.7%, and the Russell 2000 dropped close to 2.6%.

You may also like:

A stronger dollar, driven by yen weakness and persistent rate gaps between the U.S. and Japan, has tightened financial conditions further. In these risk-off phases, Bitcoin has tended to move alongside U.S. equities, allowing equity-led de-risking to spill into crypto markets.

“The Takaichi Trade strengthens Japan but puts pressure on the U.S. and Bitcoin,” wrote GugaOnChain. “The capital flight to JGBs and a robust dollar create an environment of inevitable adjustments, requiring investors to closely monitor the correlation between U.S. indexes and crypto assets.”

Weak Sentiment Now, Policy Tailwinds Later

At the time of writing, BTC was trading just below $71,000, up about 2% on the day but down more than 6% over the past week and nearly 22% in the last month.

Adding to the feeling of fragility in the market, the Bitcoin Fear and Greed Index fell to a 6-year low on February 7 after BTC slid from above $90,000 in late January to near $60,000 before rebounding.

CryptoQuant’s latest report shows Bitcoin trading below its 365-day moving average, with spot and institutional demand weak and liquidity tightening, all common features of a bear phase.

Still, Japan’s political backdrop looks different beyond the immediate risk-off trade. With a two-thirds majority, Takaichi’s administration has room to pursue legislative changes, and officials have previously framed Web3 as an industrial policy focus. As such, analysts expect discussions around crypto tax reform and stablecoin rules to resume.

As XWIN concluded,

“Near-term pressure on U.S. equities and Bitcoin is macro-driven, while Japan’s institutional reforms may support crypto markets longer term.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Xinbi Handled Nearly $18B in Crypto Transactions After Ban: TRM Labs

A Chinese-language crypto guarantee marketplace known as Xinbi processed nearly $18 billion in onchain transaction volume despite platform bans and United States enforcement actions aimed at dismantling similar services, according to a new report from TRM Labs.

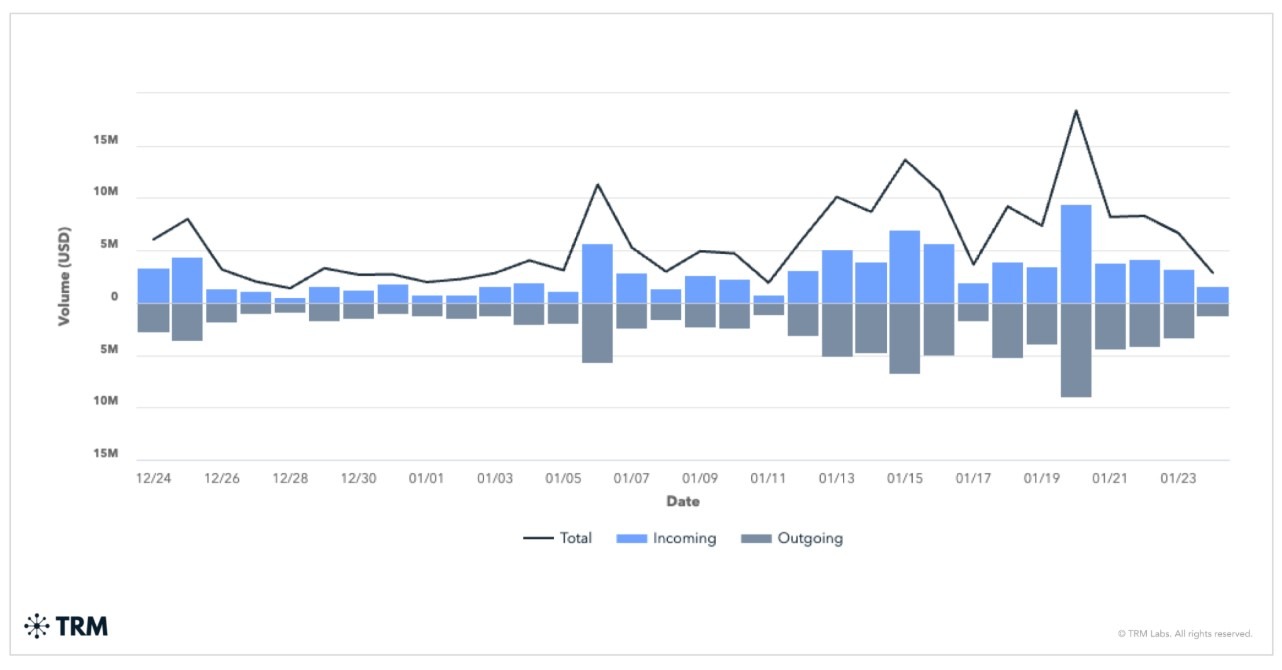

The report said recent crackdowns — reshaped but failed to dismantle — a key layer in crypto-enabled laundering infrastructure. TRM’s analysis showed that Xinbi sustained on-chain activity after Telegram banned clusters of Chinese-language guarantee services in 2025.

The report attributes Xinbi’s resilience to rapid migration to alternative messaging services and the launch of an affiliated wallet, XinbiPay. Onchain data showed wallet activity rebounded in January 2026 as users transitioned to the new setup.

The analytics firm said Xinbi has allegedly played a central role in allegedly laundering proceeds for scam operations and cybercrime syndicates, including pig-butchering fraud schemes.

The $17.9 billion figure reflects gross onchain transaction volume processed by wallets attributed to Xinbi by TRM. This includes inflows, outflows and internal transfers within the platform’s escrow and wallet system.

TRM said the figure does not represent the net proceeds or confirmed illicit gains, and may include internal recycling of funds, which is common to guarantee services.

Alleged illicit guarantee service Xinbi adapts to enforcement

In a statement sent to Cointelegraph, Ari Redbord, global head of policy at TRM Labs, said services like Xinbi are adapting.

“Guarantee services like Xinbi are learning to survive enforcement by fragmenting across platforms and building their own infrastructure,” Redbord said.

“These services sit at the center of the scam economy,” he said, adding that taking them out of the laundering chain exposes entire networks that depend on them.

TRM said Xinbi started promoting alternative channels for coordination as early as mid-2025, laying the groundwork for migration as enforcement pressure intensified.

The analytics firm said the transition accelerated in January, coinciding with additional actions against peer services and arrests tied to laundering networks.

Related: Crypto thieves, scammers plunder $370M in January: CertiK

Xinbi previously flagged over $8 billion in stablecoin flows

Xinbi has been under scrutiny since 2025. In May, blockchain analytics firm Elliptic reported that wallets linked to Xinbi Guarantee had received at least $8.4 billion in stablecoins, tied to money laundering and scam-related activity in Southeast Asia.

The earlier report linked Xinbi to a Chinese-language, Telegram-based marketplace selling money laundering services, stolen data, scam-enabling tools and other illicit offers.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

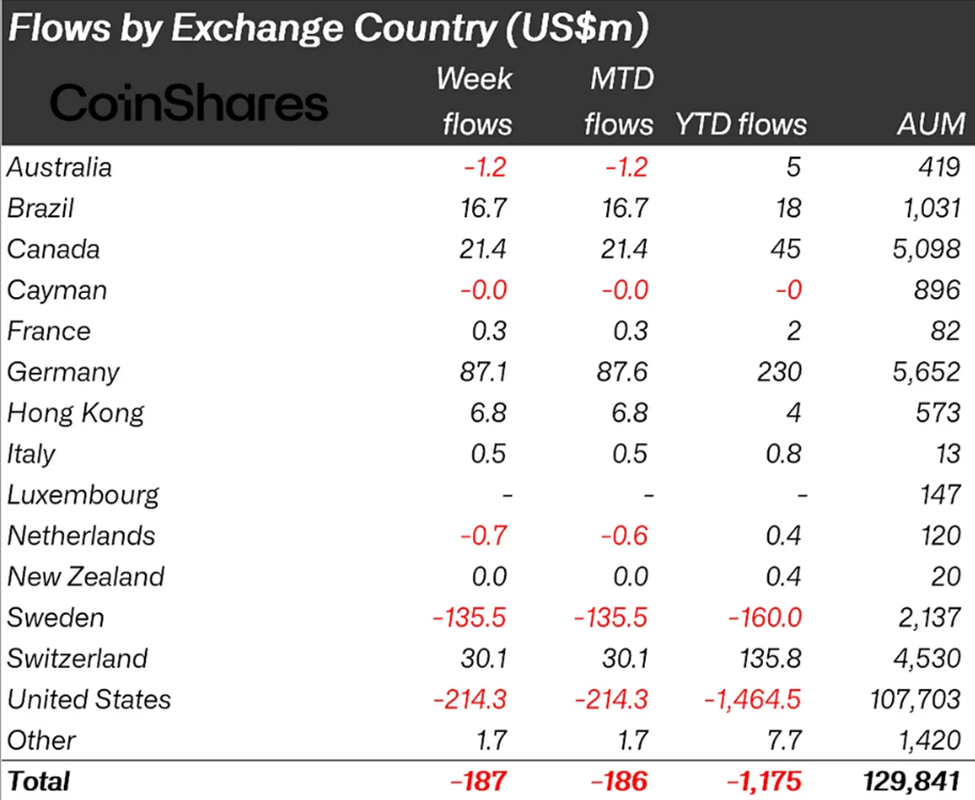

Crypto Fund Outflows Drop 89% to $187 Million

Crypto markets may be showing early signs of stabilization after weeks of intense selling, according to the latest CoinShares report on digital assets.

Investment products saw outflows collapse from over $1.7 billion recorded for two successive weeks to just $187 million last week.

Sponsored

Crypto Outflows Shrink to $187 Million, CoinShares Report Shows

CoinShares’ latest figures show that total assets under management fell to $129.8 billion, the lowest level since March 2025. This reflects the ongoing impact of the recent price slide.

Based on the chart below, regional trends hint at selective confidence, with institutional and region-specific strategies diverging even as global sentiment remains cautious.

Yet while investors were cautious, trading activity remained strong. Crypto exchange-traded products (ETPs) recorded a record $63.1 billion in weekly volume. With this, they surpassed the previous high of $56.4 billion set in October 2025.

Notably, high volumes amid slowing outflows indicate that investors are repositioning rather than abandoning the market, a subtle but important distinction.

Sponsored

Bitcoin experienced $264 million in outflows, highlighting a rotation away from the pioneer crypto toward alternative digital assets.

Among altcoins, XRP, Solana, and Ethereum led inflows, receiving $63.1 million, $8.2 million, and $5.3 million, respectively. XRP, in particular, has emerged as a favorite, attracting $109 million year-to-date.

Crypto Capitulation Shows Signs of Slowing, But Bottom Not Yet Confirmed

Despite continued price pressure, it is worth noting that the sharp drop in outflows is no mean feat, following $1.73 billion in negative flows and $1.7 billion the week before. This sharp contraction in crypto fund flows across successive weeks is being interpreted as a potential inflection point.

Sponsored

According to analysts, such a deceleration often precedes changes in market momentum, suggesting the selling frenzy could be approaching its limit.

“The deceleration in outflows suggests selling pressure is easing, and capital flight may be reaching exhaustion. Historically, this shift often precedes a change in market momentum. Early signs of stabilization are starting to emerge,” stated Andre.

Historically, crypto cycles rarely reverse immediately following peak sell-offs. Instead, the market often experiences a gradual easing of outflows before inflows return, a pattern that seems to be emerging in the current correction.

Therefore, last week’s slowing outflows may be a leading indicator, but should not be misconstrued as a guarantee of recovery.

Sponsored

The broader implication is that the market may be transitioning from panic-driven capitulation to consolidation and selective accumulation.

While Bitcoin continues to see outflows, the inflows into altcoins and regional markets suggest that investors are rotating risk rather than exiting crypto entirely.

Still, caution remains warranted because one week of slower crypto outflows does not signal a confirmed bottom.

Crypto World

Infini Hacker Returns After Exploit, Buys Ether Dip $13M

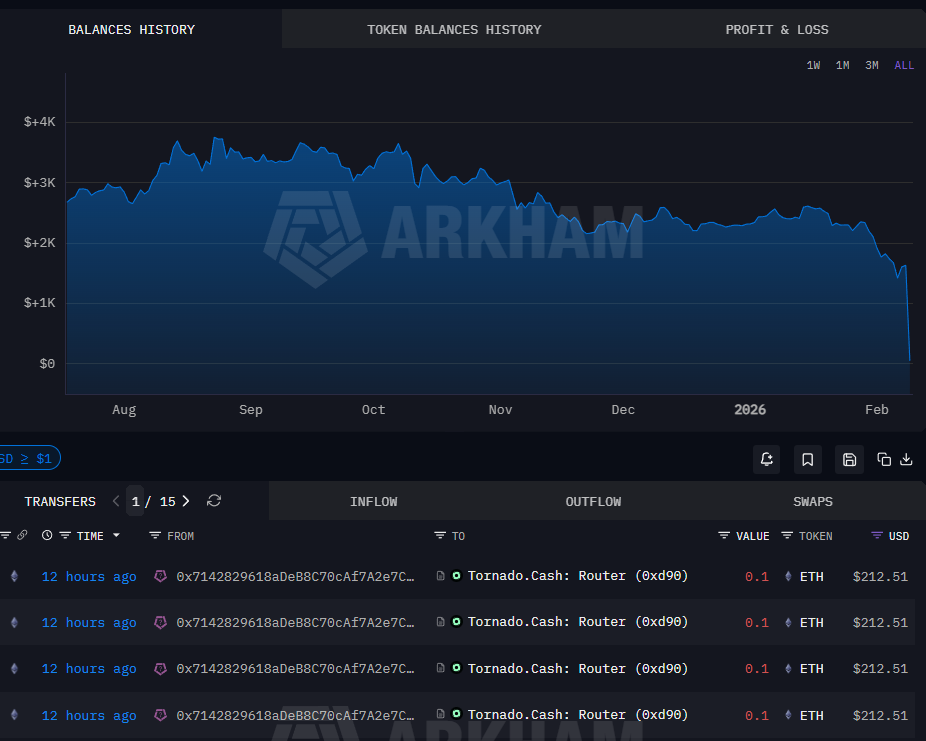

A wallet linked to the $50 million Infini exploit has become active again nearly a year after the breach, snapping up Ether during last week’s market downturn before routing the funds through a crypto mixing service.

The Infini exploiter-labelled wallet address bought $13.3 million worth of Ether (ETH) as the price dropped to $2,109 before sending the funds to crypto mixing protocol Tornado Cash, according to blockchain data platform Arkham.

“He seems very good at buying low and selling high,” blockchain tracking service Lookonchain said in a Monday X post.

The activity marked the wallet’s first known transactions since August 2025, when the same address sold about $7.4 million worth of Ether near $4,202, close to the asset’s yearly high at the time.

Infini exploiter buys ETH dip after massive liquidations

The renewed activity comes against the backdrop of a sharp market selloff. Crypto markets logged their 10th-largest liquidation event on record last week, with roughly $2.56 billion in leveraged positions wiped out, according to data from Coinglass.

Related: Wallet linked to alleged US seizure theft launches memecoin, crashes 97%

Ether’s price briefly sank to $1,811 on Thursday, marking a nine-month low last seen at the beginning of May 2025, TradingView data shows.

The acquisition comes a year after stablecoin payment company Infini lost $50 million in an exploit suspected to have been conducted by a rogue developer who retained administrative privileges after project delivery, Cointelegraph reported in February 2025.

The stolen USDC (USDC) was immediately swapped for Dai (DAI) stablecoins that have no freeze function. The latest transactions show that the attacker is still at large with the $50 million, using it to chase more profits through cryptocurrency trading.

The ETH purchase suggests the exploiter is still actively trading the proceeds of the attack, rather than exiting entirely into stablecoins.

Related: Bitcoin dips to $60K, TRM Labs becomes crypto unicorn: Finance Redefined

Infini launches Hong Kong lawsuit against developer

A month after the exploit, Inifini filed a Hong Kong lawsuit against a developer and several unidentified individuals suspected of involvement in the $50 million breach.

In a March 24 onchain message to the attacker, Infini named developer Chen Shanxuan and three unidentified persons with access to wallets involved in the exploit as defendants in the lawsuit.

The Hong Kong court also sent an injunction order via an onchain message to the attacker’s wallet, including a writ of summons for the defendants.

Infini previously offered 20% of the bounty to the hackers responsible for the attack, upon return of the stolen funds. The protocol claimed it had gathered IP and device information about the exploiters.

Cointelegraph reached out to Infini for comment on progress related to the legal dispute and the recovery of the stolen funds, but had not received a response by publication.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

Crypto World

January’s ‘great decoupling’ flips Bitcoin from buy-the-dip to sell-the-rip: Finestel

January’s “fake rally” ended with Bitcoin losing its $84k floor as smart money sold into ETF euphoria, rebuilt stablecoin war chests, and shifted to defensive accumulation, according to a new monthly report published by Finestel.

Summary

- Finestel says tourists chased “Trump QE” ETF flows as BTC spiked toward $98k, before Fed and Iran shocks sent Bitcoin crashing while gold hit new highs.

- BTC’s close near $77,195 trapped ~1.2m coins at a loss, while ETH broke $2,900 support, saw a 26% January drop, and on-chain realized losses topped $400m per day.

- Pro desks raised stablecoin allocations from ~5% to 28% and now favor a 55% BTC, 35% stables mix, treating $75k–$77k as support and $84k as the line to re-risk.

According to a new monthly report published by Finestel, January’s “great decoupling” was brutal, but it was not blind chaos. It was a month in which retail chased the “digital gold” myth while smart money quietly sold into them and raised cash at the top.

From Trump QE euphoria to Warsh shock

The year opened with what Finestel calls a “fake rally,” as roughly $1.42 billion rushed into U.S. spot Bitcoin ETFs on the back of “Trump QE” hopes and easy-money fantasies. “This was just tourists chasing a trend, not believers,” the report notes, as BTC ripped back toward $90,000 and briefly tested $98,000. Then came the double hit: Kevin Warsh emerging as Fed Chair favorite and rapidly escalating Iran tensions, which flipped the tape from risk-on to full risk-off almost overnight. Gold powered to fresh highs above $5,500 while Bitcoin “acted like a risky tech stock and crashed,” shattering the digital gold story for now.

Broken floors and forced sellers

Technically, the key event was the loss of the long‑defended $84,000 floor in Bitcoin. By month-end, BTC closed near $77,195, effectively trapping about 1.2 million coins at an unrealized loss and turning that supply into heavy overhead resistance. “We are no longer in a ‘buy the dip’ environment; until proven otherwise, we have entered a ‘sell the rip’ structure,” Finestel warns. Ethereum fared worse, ending January down 26% as the ETH/BTC ratio slid to multi‑year lows and the $2,900 support gave way, opening “the door to lower prices around $2,200” despite a $104 million ETH buy from Bitmine that the market simply faded. On‑chain, the reset was violent: short‑term holders were dumping at roughly $400 million in daily realized losses, while Jan. 31 alone saw $2.53 billion in liquidations, 88% from longs.

Smart money’s defensive rotation

Against this backdrop, Finestel’s asset‑manager data show professionals were not caught flat‑footed. “While the broader market chased the $95,000 breakout, professional desks on Finestel were already executing a quiet exit,” the report states. Stablecoin balances that had been run down to 5.2% in early January were methodically rebuilt, climbing to 18.5% as ETF inflows peaked and then to 28.4% by the time the late‑month liquidation cascade hit. “This wasn’t luck; it was a disciplined execution of ‘selling the rip,’” Finestel writes, arguing that January “transferred wealth from weak ETF hands to strong corporate balance sheets.”

Policy tailwinds beneath the pain

Ironically, January’s price carnage arrived as the regulatory backdrop turned more constructive. In Washington, the White House signaled support for a “Bitcoin Strategic Reserve,” indicating it plans to stop dumping seized BTC and instead hold it as a strategic asset. Japan moved to cut crypto investor taxes toward 20%, while South Korea lifted its ban on corporate crypto investing and layered in stronger consumer protections, steps Clifford Chance described as part of a broader “global crypto regulatory maturation” through January. Even privacy assets caught a bid, with softer rhetoric around privacy coins helping tokens like NIGHT “perform better than the rest of the market” despite the broader drawdown.

February: defensive accumulation, not hero trades

With leverage flushed and “tourists” blown out, Finestel’s playbook for February is deliberately dull: “Defensive Accumulation.” Top managers favor keeping roughly 55% in Bitcoin, 35% in cash‑like stablecoins, and a small residual for selective altcoin exposure, treating the $75,000–$77,000 band as the institutional line in the sand and $84,000 as the trigger to re‑risk. “The bottom is a process, not a single moment,” they argue, advising investors to “stay liquid, stay patient, and let the price come to you.”

Meanwhile, spot action reflects that bruised but functioning market. Bitcoin (BTC) trades near $70,746, with a 24‑hour range between roughly $60,256 and $71,604 and about $132.2B in volume. Ethereum (ETH) changes hands close to $2,062, with 24‑hour turnover over $64.1B and intraday prints between roughly $1,756 and $2,085. Solana (SOL) sits around $86, essentially flat on the day after a 35% monthly drawdown and a seven‑day range of roughly $75.76–$104.98 as derivatives activity and open interest grind lower.

Crypto World

BingX doubles down on AI with $300m bet on multi-asset trading edge

Crypto exchange BingX spends $300m on AI tools to turn macro, gold, and crypto volatility into personalized, multi-asset trading decisions.

Summary

In a year when crypto markets trade at macro speed, BingX is betting that the next edge will come from artificial intelligence woven into the plumbing of the exchange, not bolted on as an afterthought. The platform has committed $300 million to AI over the long term, positioning itself as what it calls an “all‑in AI” venue that treats automation as core infrastructure rather than marketing gloss.

BingX’s internal suite runs across multiple models, coordinated by specialized agents mapped to distinct points in the trading process.

Two flagship tools, BingX AI Bingo and BingX AI Master, are designed as decision‑support layers rather than execution engines, with AI Bingo acting as a conversational “trading idea generator” that scans more than 1,000 market pairs and surfaces scenarios, support and resistance levels, and probability forecasts.

“The outcome is an experience that feels less like software and more like a companion who understands you,” BingX product leadership has said of AI Master’s adaptive design, which learns risk tolerance and adjusts recommendations in real time.

This pivot is unfolding just as crypto venues pull in traditional instruments like precious metals and tokenized equity exposure, allowing traders to watch gold, oil, and Bitcoin from a single AI‑powered interface around a major macro release.

UBS has recently raised its gold price target to $6,200 per ounce for March, June and September 2026, while still expecting prices to ease slightly to $5,900 by year‑end, underscoring sustained institutional demand for precious metals even as tokenized versions migrate onto exchange rails. BingX argues that routing these assets through blockchain settlement improves traceability, while AI helps traders read macro‑driven moves across asset classes rather than in isolated order books.

The scale is already non‑trivial: BingX reports more than $2 billion in 24‑hour trading volume in its traditional‑market products alone and says its AI tools have attracted millions of users, with a broader ecosystem now claiming over 40 million accounts globally. As analysts frame AI‑supported, multi‑asset environments as a baseline expectation for 2026, the competitive battlefield is shifting away from raw speed toward interpretation, risk assessment, and personalization. In that contest, BingX’s wager is blunt: the exchanges that win the next decade will be those that turn correlated, cross‑asset noise into usable decisions—secure, simple, and responsive enough to keep pace with markets that no longer sleep.

Broader crypto market reactions

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $70,961, with 24‑hour turnover near $42.3B. Ethereum (ETH) changes hands close to $2,095, on roughly $20.9B in 24‑hour volume. Solana (SOL) trades around $87.6, with about $3.6B in day‑long activity. For BingX and its rivals, those flows are the proving ground for whether AI‑native exchanges can genuinely help traders keep up.coinmarketcap+3

Related coverage: BingX’s rollout of AI Master as a crypto trading “strategist,” a deep dive into the exchange’s AI Bingo and AI Master stack, and the latest UBS upgrade to its 2026 gold price targets as macro demand for safe‑haven assets accelerates.

Crypto World

Here’s how ‘invisible hands’ likely accelerated bitcoin’s crash to $60,000

Bitcoin plunged early this month to nearly $60,000, wiping out large chunks of value across the crypto market and vaporizing some trading funds.

Most observers pinned the slide on macro forces, including the capitulation of spot ETF holders (and potential rumors of funds blowing out their positions). Yet another, quieter force, one that typically keeps trading running smoothly, likely played a major role in crashing the spot price lower.

That force is the market makers, or dealers, who continuously post buy and sell orders in the order book when you trade, keeping liquidity strong so trades happen smoothly without significant delays or price jumps. They are always on the opposite end of investors’ trades and make money from the bid-ask spread, the small gap between the buy price (bid) and the sell price (ask) of an asset, without gambling on whether prices will rise or fall.

They hedge their exposure to price volatility by buying and selling actual assets (such as bitcoin) or related derivatives. And sometimes, these hedging activities end up accelerating the ongoing move.

That’s what happened between Feb. 4 and Feb. 7 as bitcoin fell from $77,000 to nearly $60,000, according to Markus Thielen, founder of 10x Research.

This episode shows bitcoin’s options market increasingly swaying its spot price, mirroring traditional markets where market makers quietly amplify volatility.

According to Thielen, options market makers were “short gamma” between $60,000 and $75,000, meaning they held bags of short (call or put) options at these levels without enough hedges or protective bets. This left them vulnerable to price volatility around these levels.

As bitcoin fell below $75,000, these market makers sold BTC in the spot or futures markets to rebalance their hedges and stay price-neutral, injecting extra selling pressure in the market.

“The presence of approximately $1.5 billion in negative options gamma between $75,000 and $60,000 played a critical role in accelerating Bitcoin’s decline and helps explain why the market rebounded sharply once the final large gamma cluster near $60,000 was triggered and absorbed,” Thielen said in a note to clients Friday.

“Negative gamma means that options dealers, who are typically the counterparties to investors buying options, are forced to hedge in the same direction as the underlying price move. In this case, as Bitcoin declined to the $60,000–$75,000 range, dealers became increasingly short gamma, which required them to sell bitcoin as prices fell to remain hedged,” he explained.

In other words, hedging by market makers established a self-feeding cycle of falling prices, forcing dealers to sell more, which further pushed prices lower.

Note that market makers’ hedging isn’t always bearish. In late 2023, they were similarly short options above $36,000. As Bitcoin’s spot price rose past that level, they bought BTC to rebalance, sparking a rapid rally above $40,000.

Crypto World

Over $278 Million Set to Hit the Market

TLDR

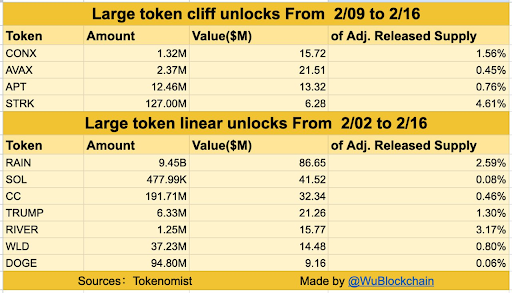

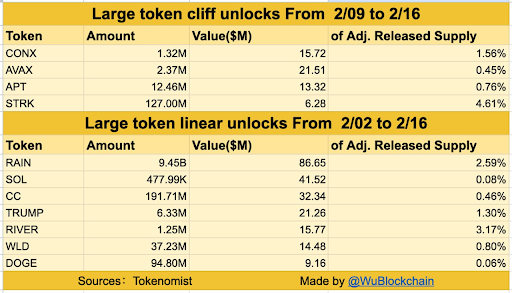

- Cliff token unlocks from CONX, AVAX, APT, and STRK will inject over $56 million into the market this week.

- STRK leads cliff unlock volume with 127 million tokens valued at $6.28 million.

- RAIN dominates linear unlocks, releasing $86.65 million in value, 2.59% of its total supply.

- SOL and CC follow with daily token unlocks valued at $41.52 million and $32.34 million, respectively.

- Combined cliff and linear token unlocks exceed $278 million, impacting short-term liquidity across multiple assets.

This week, the market will brace for token unlocks from February 9 to February 16 across Cliff and Linear token unlocks. These unlocks will introduce over $278 million worth of tokens into circulation, potentially impacting short-term market behavior.

Cliff Token Unlocks Set to Inject Over $56 Million

According to a summary prepared by Wu Blockchain, in the cliff token unlocks category, four major projects will release notable token volumes. CONX will unlock 1.32 million tokens worth $15.72 million, accounting for 1.56% of its adjusted released supply.

AVAX will release 2.37 million tokens, valued at $21.51 million, increasing its supply by 0.45%. APT is scheduled to unlock 12.46 million tokens worth $13.32 million, contributing 0.76% to circulation. STRK will release the largest amount by volume, unlocking 127 million tokens valued at $6.28 million, which equals 4.61% of its supply.

Linear Token Unlocks to Release Over $221 Million

On the other hand, linear token unlocks began today and will continue until February 16. RAIN will unlock 9.45 billion tokens worth $86.65 million, representing 2.59% of its supply. SOL will release 477,990 tokens, valued at $41.52 million, representing only 0.08% of its supply.

CC will unlock 191.71 million tokens valued at $32.34 million, adding 0.46% to circulation. TRUMP will release 6.33 million tokens worth $21.26 million, equal to 1.30% of the supply.

RIVER will inject 1.25 million tokens, worth $15.77 million, into the market, representing 3.17% of the adjusted supply. WLD will release 37.23 million tokens valued at $14.8 million, representing 0.80% of the total supply. DOGE rounds off the list with 94.8 million tokens worth $9.16 million, impacting only 0.06%.

These token unlocks signal an increase in liquid supply for multiple assets. Cliff token unlocks introduce abrupt liquidity events, while linear unlocks apply steady distribution pressure. RAIN, SOL, and AVAX dominate in terms of value, while STRK and RIVER lead in percentage impact.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics17 hours ago

Politics17 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat12 hours ago

NewsBeat12 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business17 hours ago

Business17 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports7 hours ago

Sports7 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics20 hours ago

Politics20 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat6 days ago

NewsBeat6 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know