CryptoCurrency

European Currencies Decline Ahead of Inflation Data

The GBP/USD and EUR/USD pairs remain under pressure, showing moderate declines as markets await fresh macroeconomic data. After a brief upward correction, neither the euro nor the pound managed to hold above key resistance levels, prompting a renewed shift towards the US dollar. The current movement forms part of a broader downtrend that has persisted for three consecutive weeks, and the next phase will depend on the data released over the coming trading sessions.

Investors are focused on inflation figures from the eurozone and the United Kingdom, which will serve as crucial indicators for assessing the future monetary policy stance of the ECB and the Bank of England. Another factor contributing to uncertainty is the resumption of US macroeconomic data releases following the recent end of the longest government shutdown in US history. Markets are awaiting updated employment and inflation reports, which may influence expectations regarding the Federal Reserve’s December decision. Until these reports are published, the US dollar remains stable, adding further pressure on European currencies.

EUR/USD

After two weeks of recovery from support near 1.1470, the euro failed to secure a position above 1.1650. Technical analysis of EUR/USD suggests a possible renewed decline towards 1.1500–1.1540, as a “bearish tweezer” pattern has formed on the daily timeframe. A resumption of upward movement is possible only if the price convincingly holds above 1.1660.

Events that may influence EUR/USD in the coming trading sessions:

- 11:00 (GMT+3): ECB meeting on non-monetary policy matters

- 13:00 (GMT+3): Eurozone Consumer Price Index (CPI)

- 14:30 (GMT+3): Speech by the Vice-President of the German Bundesbank, Buch

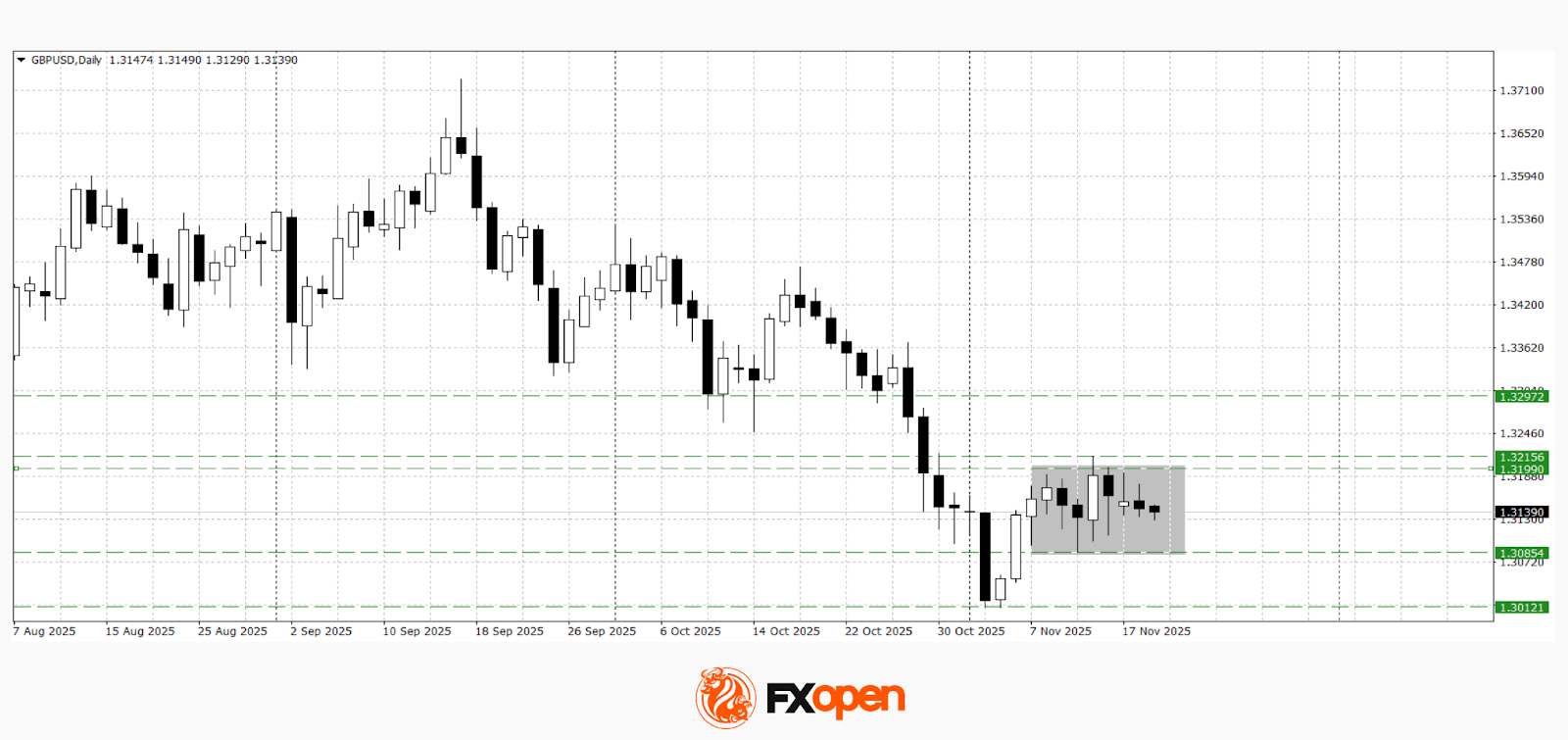

GBP/USD

The corrective upward movement in GBP/USD has slowed near the significant resistance range of 1.3190–1.3220. For several sessions, the pair has been trading within a sideways channel of 1.3090–1.3200, and a breakout from this range may offer clearer signals regarding the next trend direction. Weak macroeconomic reports from the UK may push the price below 1.3090, with the potential to retest the recent low at 1.3010. A breakout above 1.3200 could trigger a new bullish impulse towards 1.3260–1.3300.

Events that may influence GBP/USD in the coming trading sessions:

- 10:00 (GMT+3): UK Consumer Price Index (CPI)

- 12:30 (GMT+3): UK House Price Index

- 22:00 (GMT+3): Release of the FOMC minutes

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.