Crypto World

Fed’s Kashkari says crypto is ‘utterly useless’

Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, offered a blunt take on digital assets, arguing that cryptocurrencies, including bitcoin and stablecoins, have yet to prove real utility.

Speaking at the 2026 Midwest Economic Outlook Summit in Fargo, North Dakota on Thursday, he contrasted the everyday utility of artificial intelligence (AI) tools with cryptocurrencies.

“Crypto has been around for more than a decade, and it’s utterly useless,” he said, while AI “has real long term potential for the U.S. economy.”

After asking the audience who had used AI tools like ChatGPT or Gemini in the past week, Kashkari posed a second question: “raise your hand if you’ve bought or sold something with bitcoin.”

When the discussion turned to payments and stablecoins, Kashkari said he’s unconvinced the technology improves on existing financial rails. “I hear these words and I like, it’s just, it’s like a buzzword salad,” he said. “What can I do with the stablecoin that I can’t do with Venmo today?”

Pressed on stablecoins being used for cheaper and faster cross-border payments, Kashkari argued that proponents quickly concede that those benefits aren’t aimed at U.S. consumers. While he admitted that adoption in emerging countries is rising, the said the tech still faces technical problems.

While stablecoin advocates promise instant transfers, he said, recipients still need to convert into local currency for everyday payments like buying groceries, which can be expensive.

Kashkari’s skepticism stands in stark contrast to the Trump administration, which has increasingly championed bitcoin and U.S. dollar-backed stablecoins as key strategic tools.

Treasury Secretary Scott Bessent argued that regulated stablecoins can extend the greenback’s dominance in global payments and reinforce its status as the world’s reserve currency, strengthening U.S. financial influence. President Trump also signed an executive order in March to create a strategic bitcoin reserve, which Bessent was an advocate for.

Crypto World

Kresus raises $13M from Hanwha to expand wallet and RWA infrastructure

- Hanwha invests KRW 18B ($13M) in Kresus to expand digital asset infrastructure.

- Funding supports enterprise wallets, RWA tokenization, and on-chain workflows.

- Deal follows MoU signed at Abu Dhabi Finance Week in December 2025.

Kresus Labs, a US-based digital wallet and blockchain infrastructure company, has raised about KRW 18 billion(roughly) in a strategic investment from Hanwha Investment & Securities.

The deal highlights how traditional finance is increasingly looking beyond crypto trading and toward the “plumbing” behind digital assets: secure wallets, enterprise systems, and tokenized products that can fit into existing financial services.

Strategic capital targets the infrastructure layer of digital assets

Kresus said the investment will support product development, enterprise deployments, and global partnerships, areas that typically require long implementation timelines and rigorous security standards.

The company builds digital asset tools for both consumers and institutions, and it operates enterprise-grade platforms for digital wallets and real-world asset (RWA) tokenization, along with on-chain financial workflows.

The investment follows a memorandum of understanding signed by Kresus and Hanwha Investment & Securities at Abu Dhabi Finance Week in December 2025, according to the companies.

That sequencing matters: MoUs are often used to formalize intent, outline collaboration areas, and set up technical and commercial work before funding or deeper integration plans are finalized.

Kresus also emphasized its security approach. It offers seedless wallet recovery technology, designed to reduce reliance on a single recovery phrase that can be lost or stolen.

It also uses MPC-based security systems which broadly refers to splitting sensitive signing or authorization steps across multiple components so there is less dependence on one device or one key.

In practice, these designs aim to make wallets harder to compromise and easier to recover, two pain points that have limited mainstream adoption.

“This investment validates both our technology and the direction Kresus has taken as a company,” Trevor Traina, founder of Kresus, said in a statement.

He added that Kresus has focused on infrastructure that works in real-world conditions, from consumer applications “used at scale” to enterprise solutions built for institutional requirements.

RWA tokenization becomes a practical focus for financial firms

For Hanwha Investment & Securities, the partnership is framed as a way to strengthen client-facing digital asset services and to pursue tokenization initiatives linked to existing financial products.

RWA tokenization generally means creating blockchain-based representations of real-world financial claims or instruments, with the goal of improving how assets are issued, tracked, or transferred inside digital systems.

“Kresus’s unique wallet security technology and RWA infrastructure will play a core role in advancing Hanwha Investment & Securities’ digital asset capabilities,” said Son Jong-min, chief strategy officer at Hanwha Investment & Securities.

He said the firm will continue collaborating with global technology companies as it seeks to evolve into a specialized digital asset securities firm.

The announcement fits a broader industry pattern: established financial institutions are showing more interest in controlled, enterprise-ready blockchain use cases than in retail speculation.

Wallet technology and tokenization platforms are increasingly treated as building blocks, tools that can be integrated into existing product lines, rather than standalone consumer brands.

Crypto World

Binance adds news features to Binance Junior to increase family crypto savings and learning

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Binance Junior introduces festive Red Packet gifting, Merchant Pay, and educational tools to foster financial literacy for kids and teens under parental supervision.

Summary

- Binance expands Binance Junior with gifting, payments, and in-app learning to boost family crypto literacy and savings habits.

- New Binance Junior updates let parents supervise crypto gifts, payments, and education for children aged 6–17 in a controlled setting.

- Interactive tools and parental controls position Binance Junior as a family-focused gateway to early digital asset education and use.

Binance has introduced new features to its Binance Junior platform, launched in December 2025. The news features focus on making saving and learning about crypto more accessible for families.

Binance Junior is a program designed for kids and teens aged 6 to 17 that offers a parent-controlled platform that encourages savings habits and financial literacy from an early age.

The newly added features include Red Packet gifting, Merchant Pay options, and seamless integration of the educational “ABCs of Crypto” eBook directly inside the Binance Junior app. These updates aim to create an interactive experience for families to delve into the digital assets world.

Parents can use the Binance Junior platform to guide their children through the world of digital assets while maintaining full control and the ability to enable or disable selected features. Parents can also monitor account activity through the platform’s interactive interface.

With parental approval, children now have permission to receive crypto gifts, make payments, and access education content that present crypto concepts in a fun and interesting way.

Parents can also now enable non-parental transfers from adult Binance accounts to Junior accounts, such as Red Packet gifting and regular peer-to-peer (P2P) transfers, allowing relatives and family friends to send crypto gifts to their children’s Binance Junior accounts.

Commenting on the matter, Yi He, Binance co-CEO, said that Binance Junior is designed to help children manage their allowance with savings and payment features. According to He, the company’s goal is to empower families build a solid foundation for their financial future by helping children develop good money management habits whilst they are still young.

Binance sees Binance Junior as a platform for users to grow in line with its broader goal of nurturing a new generation well-prepared for a financially digital future.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Eric Trump reitrates claim bitcoin (BTC) is just getting started on its road to $1 million

Eric Trump doubled down on his $1 million price prediction for bitcoin and said he has never been more bullish during the World Financial Forum that took place in Mar-a-Lago.

President Donald Trump’s younger son doubled down on his long-term optimism for bitcoin, calling it “one of the greatest performing asset classes” of the last decade in an interview with CNBC on Wednesday.

“I’m a huge proponent because I do think it hits $1 million dollars,” Trump said. “Go back two years. Bitcoin was at $16,000. Where is it at right now, $70,000?”

In August of 2025, Eric Trump, who described himself as a “bitcoin maxi, said bitcoin would reach $175,000 before the end of the year and, eventually climb to $1 million.

BTC closed 2025 at about $88,750, having fallen sharply from an all-time high of more than $126,000 in early October, according to CoinDesk data.

Trump also said that over the past 10 years, bitcoin has climbed roughly 70% annually on average, challenging viewers to “name an asset class that has performed better than Bitcoin.”

While acknowledging the asset’s volatility, Trump framed it as a trade-off for upside potential. “You’re going to have volatility with something that has tremendous upside,” he said. “But I’ve never been more bullish on bitcoin in my life. I’ve never been more bullish on cryptocurrency in my life.”

The post comes as bitcoin trades just below $67,000, after failing to reclaim the $70,000, a level it has not visited since Feb. 15.

The World Liberty Financial forum, held Wednesday at Mar-a-Lago, is tied to World Liberty Financial, a crypto-focused venture backed by the Trump family.

Crypto World

Four Sub-$60,000 BTC Price Levels Form Bitcoin Bottom ‘Roadmap’

Bitcoin (BTC) has four new key support levels to watch as a fresh wave of bearish BTC price action aims to push the market price below $50,000.

Key points:

-

Bitcoin’s realized prices remain important milestones as the market forms a long-term floor.

-

Binance users’ deposit cost basis is next up as a safety net, says analysis.

-

Realized losses reach levels unseen since the end of the 2022 bear market.

BTC price analysis puts focus on Binance traders

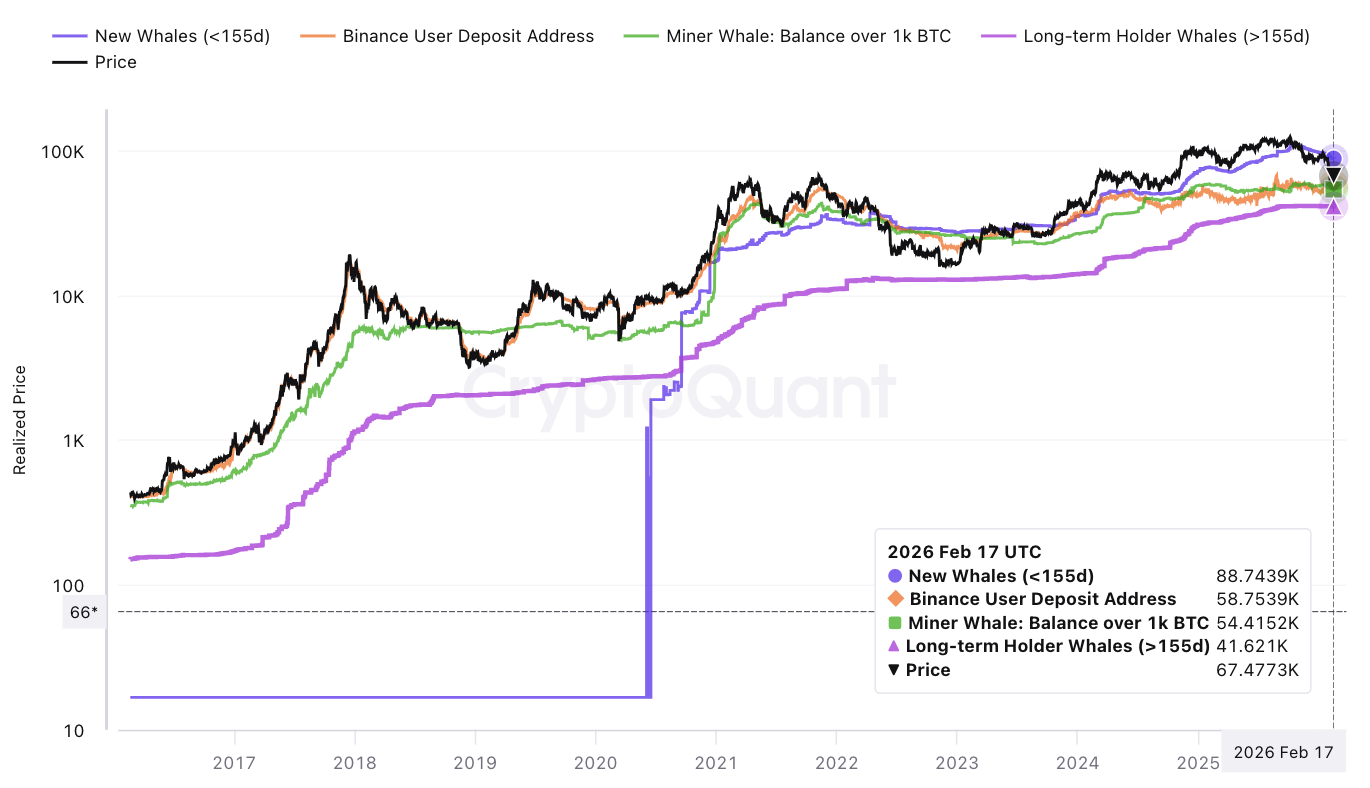

New analysis from Burak Kesmeci, a contributor to onchain analytics platform CryptoQuant, sees $58,700 as Bitcoin bulls’ next line in the sand.

“Which 4 levels am I watching in Bitcoin? 4 key realized price levels — essential for tracking the long-term trend in my view,” he wrote in one of CryptoQuant’s Quicktake blog posts on Wednesday, titled “Bitcoin’s Roadmap to the Bottom.”

Realized price refers to the aggregate cost basis of the BTC supply or a subset of it. When BTC moves onchain, its realized price becomes that at which it was last involved in a transaction.

Realized prices that involve larger groups of coins can often function as market support or resistance zones.

“Bitcoin has been dropping ever since it lost the New Whales’ cost basis — a classic bear cycle signal,” Kesmeci noted.

Newer Bitcoin whales’ aggregate buy-in price stands at $88,700, but with the price now far below, three others are on the radar. Older whales’ realized price is the lowest of the selection at $41,600, while Bitcoin’s overall cost basis now sits at $54,700.

Between the current spot price and those two levels, however, lies the realized price for deposit addresses (UDA RP) on major global crypto exchange Binance.

“From here, the 2 key supports I’ll be watching in order are Binance UDA RP and Bitcoin RP (58.7K and 54.7K),” Kesmeci added.

“The reason: once Bitcoin falls below New Whales’ cost basis, it historically tends to at least test the Realized Price. And the only support standing between here and there is 58.7K.”

Bitcoin losses echo 2022 bear market bottom

While panic selling from exchange users has cooled since BTC/USD rebounded from 15-month lows near $59,000 at the start of February, CryptoQuant data underscores the risk of further capitulation.

Related: Bitcoin 2024 buyers steady BTC price as trader sees $52K ‘next week or so’

The proportion of the BTC supply currently held at an unrealized loss has reached 46%, its highest reading since the end of Bitcoin’s 2022 bear market.

“It is worth noting that the correction has been so severe that the increase in supply held at a loss has occurred very rapidly,” CryptoQuant contributor Darkfost commented on X during the $60,000 swing lows.

Last week, meanwhile, Darkfost reported similarly conspicuous levels of realized losses from Bitcoin investors — coins moving at a lower price than in their previous transaction.

“At its peak, on February 5, realized losses exceeded 30,000 BTC,” he confirmed.

“This remains well below the extreme levels observed during the last bear market, when realized losses reached 92000 BTC and 80000 BTC on separate occasions. Nevertheless, it is still a clear sign that a capitulation phase has taken place.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

$58.7K Hint, Binance Cost Basis Critical

Bitcoin has moved into a phase where on-chain metrics and the behavior of larger holders are shaping short- to medium-term risk levels. A freshly published CryptoQuant analysis identifies four key realized-price levels that market participants watch for evidence of a long-term floor or renewed downside pressure, with the nearest line in the sand sitting around $58,700 and another around $54,700. The narrative suggests a fragile balance between momentum and capitulation risk as BTC hovers near critical support zones and as exchange-driven selling cooled after a recent dip near $59,000. In this context, market participants are closely watching how the realized price framework interacts with exchange-derived cost bases, especially on Binance, and how these factors could influence the next leg of the cycle.

Key takeaways

- Four key realized-price levels are identified as essential for tracking Bitcoin’s long-term trend, with liquidity pressure and potential support near the 58.7K and 54.7K marks.

- Realized price represents the aggregate cost basis of BTC that has moved on-chain, serving as a potential support or resistance zone depending on the direction of price action.

- Binance deposit cost basis (UDA RP) sits between the current price and other critical levels, functioning as a near-term safety net in the event of renewed selling pressure.

- The share of BTC supply held at an unrealized loss has climbed to the high 40s percentage range, approaching levels not seen since the end of the 2022 bear market, signaling a potential capitulation risk if prices weaken further.

- Older and newer whale cost bases provide a spectrum of pressure points: newer whales around $88,700 and older whales near $41,600, with the overall cost basis around $54,700.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The analysis points to risk of further downside as realized-price barriers are tested and unrealized losses rise among holders.

Trading idea (Not Financial Advice): Hold

Market context: The market remains sensitive to on-chain signals and macro liquidity trends, with a cautious tone prevailing as investors evaluate long-term cost-basis milestones against current spot prices.

Why it matters

At the core of the discussion is the concept of realized price—the average price at which BTC moved on-chain for a given cohort. This metric can act as a magnet for price actions, especially when the market experiences cascading moves. CryptoQuant’s analyst Burak Kesmeci emphasizes that four realized-price levels are essential for mapping Bitcoin’s trajectory over a prolonged downturn or potential bottom formation. The proximity of these levels to current prices matters not only for immediate liquidity but for the psychology of holders who evaluate whether this cycle is generating a fresh undercurrent of selling pressure or laying the groundwork for a durable base.

Indeed, the analysis points to the Binance UDA RP (the realized-price marker for deposit addresses on the exchange) as a near-term anchor that sits between prevailing prices and the deeper levels identified by longer-term holders. The logic is simple but consequential: once the price dips below a major realized-price threshold, there is historical tendency for price action to retest that marker, potentially triggering further selling that could push BTC toward the lower bound around 58.7K. The quote from the analyst underscores this dynamic: the only substantial support between the current level and the next test of realized price rests near 58.7K, creating a palpable risk of a test of the realized-price framework if price pressure intensifies.

Beyond the price action itself, the data reflect broader supply dynamics. The proportion of BTC supply currently at an unrealized loss has surged to levels not seen since the end of the 2022 bear market. Analysts have highlighted the speed with which this metric has climbed during the latest drawdown, pointing to rapid changes in holders’ on-chain costs as a key indicator of potential capitulation risk. Observers note that, while the extreme losses observed during the last bear cycle dwarfed today’s figures (with historic peaks well above 90,000 BTC in realized losses), the current level is still a meaningful signal that a phase of distribution may have intensified. The combination of elevated unrealized losses and a price break below key realized-price thresholds could increase the probability of a test of major anchors in the days ahead.

The story is nuanced by the behavior of different cohorts on-chain. Newer Bitcoin whales have a buy-in around $88,700, while older, longer-held addresses show a realized price near $41,600. The broad market’s cost basis sits around $54,700, providing a spectrum of pressure points that market participants monitor as price moves unfold. Between the current price and these thresholds lies the Binance UDA RP, creating a near-term focal point for traders who watch whether the market will hold above that line or slide toward the next substantial marker. A line from CryptoQuant summarizes the practical implication: once Bitcoin falls below the New Whales’ cost basis, it has historically tended to test the realized price, and the 58.7K level remains the pivotal buffer between here and that eventual test.

To illustrate the sense of risk, recent exchange-driven momentum has cooled after Bitcoin’s dip from multi-month highs near the $60,000+ zone. Yet the combination of rising unrealized losses and a price structure that now brackets several critical cost bases means the market remains vulnerable to renewed drawdown if buyers fail to reassert demand at or above these anchor points. The on-chain narrative, therefore, remains a crucial prism through which traders assess whether the market is carving out a sustainable floor or merely pausing before another leg lower.

The analysis is not isolated to one metric or one exchange narrative. It sits at the intersection of realized prices, exchange-specific cost bases, and the evolving behavior of large addresses that have shown significant exposure to price swings in recent months. As investors parse the implications of these data points, the broader market context—ranging from liquidity conditions to risk sentiment and macro developments—continues to shape which side of the range the market tests next. In short, the realized-price framework provides a structured lens for understanding where support might emerge and how far the market could fall before buyers re-enter with conviction.

What to watch next

- Bitcoin’s price reaction around 58.7K and 54.7K, and whether the market tests those thresholds again in the near term.

- Movement in Binance UDA RP: any shifts that indicate a critical mass of deposit-address cost-basis pressure is bearish or bullish for the next leg.

- Changes in the composition of unrealized losses across the BTC supply, especially in relation to newly active whales versus older holders.

- Updates to CryptoQuant’s Quicktake analyses or similar on-chain signals that might recalibrate the four-key-level framework.

- Macro or regulatory developments that could influence risk appetite and liquidity in the broader crypto space.

Sources & verification

- CryptoQuant Quicktake by Burak Kesmeci: Bitcoin’s Roadmap to the Bottom — 4 Levels to Watch (link to cryptoquant quicktake).

- Cointelegraph discussion on realized price and aggregate cost basis as a market metric (link to aggregate cost basis article).

- Cointelegraph coverage of New Whales’ cost basis and related on-chain signals (link to New Whales cost basis article).

- Cointelegraph reporting on Bitcoin price action during the February swing lows and peaks near $60,000 (link to Bitcoin rally and derivatives metrics article).

- Cointelegraph piece on early 2024 BTC buyers steadying price and the $52K level projection (link to 2024 buyers article).

Market reaction and key details

Bitcoin’s current setup centers on a four-fold realized-price framework that coinside with near-term support considerations, particularly the 58.7K and 54.7K markers. The Binance UDA RP line and the broader realized price for deposit addresses play a decisive role in shaping how the market traverses this zone. Realized losses have climbed, signaling that, even if price action stabilizes, the path toward a durable bottom may require a balance of renewed demand and patience from long-term holders. The pattern aligns with past cycles where downside pressure thins after a bear-market rally, but it also warns that a decisive break below the major anchors could accelerate a testing sequence toward lower support bands. As always, the on-chain narrative remains a critical counterpart to conventional price analysis, contributing to a more nuanced view of where Bitcoin could go next and what investors should monitor as events unfold. (CRYPTO: BTC)

Crypto World

CME Group to Launch 24/7 Crypto Futures Trading

CME Group is set to commence 24/7 cryptocurrency futures trading on its CME Globex platform.

CME Group, the world’s largest financial derivatives exchange, is set to launch 24/7 crypto futures trading on its CME Globex platform beginning on May 29, pending approval from U.S. regulators.

In a press release published today, the exchange said crypto futures and options will trade continuously on CME Globex “with at least a two-hour weekly maintenance period over the weekend.”

The exchange added that all holiday or weekend trading from Friday evening through Sunday evening will have a trade date of the following business day.

Tim McCourt, global head of equities, FX and alternative products at CME Group, said the exchange is expanding its crypto offerings as “client demand for risk management in the digital asset market is at an all-time high, driving a record $3 trillion in notional volume across our Cryptocurrency futures and options in 2025.”

CME Group also revealed cryptocurrency futures and options trading has continued to set new volume records in 2026.

So far this year, average daily volume has reached 407,200 contracts, a 46% increase from a year earlier, while average daily open interest stands at 335,400 contracts, up 7% year over year.

Futures contracts account for most of the activity, with average daily volume of 403,900 contracts, representing a 47% annual increase.

CME was one of the first regulated derivates marketplaces in the U.S. to offer cash-settled Bitcoin futures trading, back in 2017. The platform now offers futures and options for several large-cap crypto assets, including BTC, ETH, SOL, and XRP.

As The Defiant reported earlier this month, the exchange is considering launching its own token, possibly on a decentralized blockchain.

This article was generated with the assistance of AI workflows.

Crypto World

PayPal’s PYUSD Supply Crosses $4 Billion

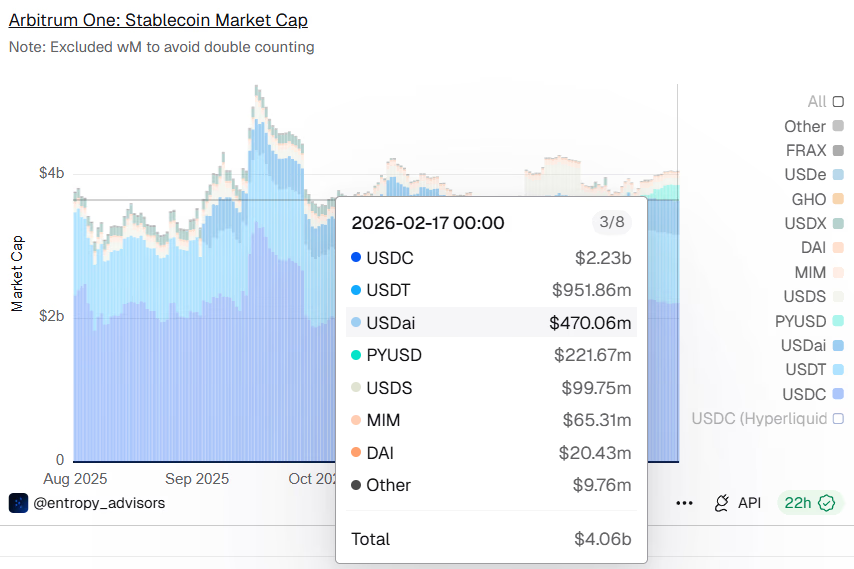

PYUSD has become the fourth-largest stablecoin on L2 Arbitrum after a partnership with USDai.

PayPal’s PYUSD stablecoin crossed $4 billion in total market capitalization this month, while its supply on Layer 2 Arbitrum One rose enough to rank it the network’s fourth-largest stablecoin.

According to data compiled by consulting firm Entropy Advisors, Arbitrum now has over $220 million worth of PYUSD circulating on the network, next only to USDAI, USDC and USDT. DefiLlama data records the PYUSD supply on Arbitrum at $256.6 million.

As analysts at Entropy Advisors explained in an X post on Feb. 16, PYUSD’s increase on Arbitrum appears to be tied to a partnership announced in mid-December between PayPal and Permian Labs, the core developer behind USDai (USDAI).

Under the agreement, PYUSD was added as a reserve asset backing USDAI and a settlement and liquidity asset for the protocol, which is primarily based on Arbitrum and is tied to financing for AI infrastructure, such as GPUs and data centers.

Per the announcement, up to $1 billion in PYUSD deposits on USDai will earn 4.5 % APY as part of a one-year incentive program.

“With this integration, USDAI’s loans can be issued in $PYUSD and settled directly into PayPal accounts. Borrowers can pay for GPUs, data center costs, rentals, and subscriptions using a single dollar based rail,” USDAI said in a December X post.

Following the integration, data from DefiLlama shows that nearly all of PYUSD’s supply on Arbitrum is deployed within USDai. PYUSD now accounts for more than 43% of all token deposits on the protocol, second only to WrappedM by M0 (WM), USDAI’s base asset, which makes up more than 56% of its TVL.

However, USDAI’s own documentation states that “incentives are used early to bootstrap liquidity, but they are not the end‑state yield source,” implying that stablecoins are deployed mainly to support settlement in the early phase, while the protocol is meant to transition toward GPU and AI-backed lending as its primary yield and collateral source.

Arbitrum One is currently the largest Ethereum L2 by total value secured, with $16.82 billion, according to data from L2Beat.

Crypto World

what happens beyond the yield

In today’s newsletter, Nassim Alexandre from RockawayX takes us through crypto vaults, what they are, how they work and risk evaluation.

Then Lucas Kozinski, from Renzo Protocol, answers questions about decentralized finance in Ask an Expert.

Understanding vaults: what happens beyond the yield

Capital flowing into crypto vaults surged past $6 billion last year, with projections indicating it could double by the end of 2026.

With that growth, a sharp split has emerged between vaults with robust engineering and controls and vaults that are essentially yield packaging.

A crypto vault is a managed fund structure deployed on-chain. An investor deposits capital, receives a token representing their share, and a curator allocates that capital in accordance with a defined mandate. The structure can be custodial or non-custodial, redemption terms depend on the liquidity of the underlying assets and portfolio rules are often encoded directly into smart contracts.

The central question around vaults is exposure: what am I exposed to, and can it be more than I am being told? If you can explain where the yield comes from, who holds the assets, who can change the parameters and what happens in a stress event, you understand the product. If you cannot, the headline return is irrelevant.

There are three risk layers worth understanding.

The first is smart contract risk: the risk that the underlying code fails. When was the last audit? Has the code changed since? Allocation controls sit here as well. Adding new collateral to a well-designed vault should require a timelock that allows depositors to see the change and exit before it takes effect. Strategy changes should require multi-signature approval.

The second is underlying asset risk: the credit quality, structure and liquidity of whatever the vault is actually holding.

The third underappreciated risk is redemption: under what conditions can you get your capital back, and how quickly? Understand who handles liquidations in a downturn, what discretion they have and whether the manager commits capital to backstop them. That distinction matters most in the exact moments you would want to leave.

The quality of a vault is largely dependent on the quality of its curation. A curator selects which assets are eligible, sets parameters around them and continuously monitors the portfolio.

For example, most real-world asset strategies on-chain today are single-issuer, single-rate products. A curated vault, by contrast, combines multiple, vetted issuers under active management, giving diversified exposure without managing single-name credit risk yourself.

Then there is ongoing monitoring. Default rates shift, regulations change and counterparty events happen. A curator who treats risk assessment as a one-time exercise is not managing risk.

What makes crypto vaults different from a traditional fund is transparency; investors don’t have to take the curator’s word for it. Every allocation, position and parameter change happens on-chain and is verifiable in real time. For advisors familiar with private credit, the underlying collateral may be recognisable. What requires attention is the on-chain structuring around it: whether you have genuine recourse, in which jurisdiction and against whom. That is where curator expertise matters. A curator is the risk manager behind a vault. They decide what assets are eligible, set the rules capital operates within, and actively manage the portfolio.

Curated vault strategies typically target 9-15% annually, depending on mandate and assets. That range reflects risk-adjusted return generation within defined constraints.

Vaults also allow a more efficient way to access assets you already allocate to, with capabilities that traditional structures do not offer. For family offices managing liquidity across multiple positions, this is a practical operational improvement.

The key one is composability. On-chain, a vault can allow you to borrow against a collateral position directly, without the documentation overhead of a traditional loan facility. For family offices managing liquidity across multiple positions, this is a practical operational improvement.

Permissioned vault structures are also noteworthy, as they allow multiple family offices or trustees to deposit funds into a single managed mandate without commingling, each retaining separate legal ownership while sharing the same risk-management infrastructure.

The vaults that survive this scrutiny will be the ones where the engineering, mandate, and curator’s judgment are built to hold under pressure.

– Nassim Alexandre, vaults partner, RockawayX

Ask an Expert

Q: With “yield-stacking” and many layers of decentralized finance (DeFi) protocols, what is needed to mitigate risk in vaults?

The first thing is minimizing complexity. Every additional protocol in the stack is another attack surface. So if you don’t need it, cut it. We won’t deposit into protocols that have discretionary control over funds — meaning they can move capital wherever they want without user consent. We want transparency about what other protocols are doing with our capital, but privacy around our strategies so others can’t see anything proprietary.

Beyond that, it comes down to transparency and time. Users should always be able to see exactly where their funds are and what they’re doing. And any parameter changes — fees, strategies, risk limits — should go through a timelock so people have a window to review and react before anything goes live. Smart contract audits matter too, but audits are a baseline, not a safety net. The architecture has to be sound before the auditor even shows up.

Q: At what point does institutional capital inflow compress DeFi yields to the level of traditional risk-free rates, and where will the next “alpha” be found?

It’ll happen eventually in the most liquid, simple strategies. But here’s what traditional finance (TradFi) can’t replicate: composability. The underlying instruments might be identical — take the USCC carry trade as an example — but in DeFi you can plug that same position into a lending market, use it as collateral, provide liquidity to a DEX pool and do all of that simultaneously. That’s not possible in TradFi without significant infrastructure cost.

The alpha won’t disappear. It’ll just move to whoever builds the most efficient capital pathways between strategies. The people who figure out how to stack yields across composable layers while managing risk properly will consistently outperform. And that gap between DeFi and TradFi infrastructure costs alone keeps the spread wide for a long time.

Q: How will the integration of Real World Assets (RWAs) into automated vaults change the correlation between crypto yields and global macro interest rate cycles?

Yes, crypto yields will become more correlated with macro as RWAs come in. That’s just the nature of bringing rate-sensitive assets on-chain. But I think people underweight the other side of that tradeoff.

Before RWAs, crypto holders had a binary choice: keep stables on-chain and earn crypto-native yields, or pull everything out and deposit into a brokerage. Now you can hold stables on-chain and access the same strategies you’d find in TradFi, without leaving the ecosystem. And crucially, you can layer on top of them — borrow against your RWA position, deploy that capital into a lending market, LP against pools that use these assets as collateral. The capital efficiency you get from that kind of setup is just not available in traditional finance. So yeah, more macro correlation — but also more optionality for where to deploy capital, which should push rates up over time as liquidity deepens.

– Lucas Kozinski, co-founder, Renzo Protocol

Keep Reading

Crypto World

Anchorage Digital Launches Regulated ‘Stablecoin Solutions’

Anchorage Digital has launched a new offering called Stablecoin Solutions, enabling banks to perform near-instant USD settlements.

Anchorage Digital has announced the launch of Stablecoin Solutions, a federally regulated service that enables banks to conduct near-instant USD settlements globally via blockchain technology. This move by Anchorage Digital, the first federally chartered crypto bank in the U.S., aims to modernize cross-border settlements while adhering to stringent regulatory standards.

The new offering consolidates minting, redemption, custody, fiat treasury, and settlement under Anchorage Digital Bank, N.A., operating under the oversight of the Office of the Comptroller of the Currency (OCC). This positions Anchorage to offer a seamless integration of stablecoin technology within traditional banking frameworks, eliminating the complexities of state-by-state licensing.

“Stablecoins are becoming core financial infrastructure,” said Nathan McCauley, co-founder and CEO of Anchorage Digital. “Stablecoin Solutions gives banks a federally regulated way to move dollars globally using blockchain rails, without compromising custody, compliance, or operational control. This is about modernizing settlement while preserving the standards the financial system depends on.”

Stablecoin Solutions aims to compress settlement timelines from days to minutes, reduce trapped liquidity, and mitigate counterparty and settlement risks by replacing traditional banking methods like correspondent banking and nostro/vostro pre-funded accounts. The offering supports various stablecoins, including Tether’s USA₮ and Ethena Labs’ USDtb, providing banks with flexible, stablecoin-agnostic rails.

Anchorage Digital’s foray into stablecoin solutions aligns with broader trends in the crypto industry, where major players like PayPal are also expanding their stablecoin activities.

This article was generated with the assistance of AI workflows.

Crypto World

Bitcoin price coils into a triangle formation, why a breakout is looming

Bitcoin price is compressing into a tightening triangle structure, signaling a major decision point as converging support and resistance suggest an imminent volatility expansion in the near term.

Summary

- Triangle compression signals imminent breakout, volatility expansion approaching

- Higher lows indicate growing demand, favoring bullish resolution

- $76,700 resistance becomes key target, if breakout confirms with volume

Bitcoin (BTC) price action has entered a constructive consolidation phase, forming a clear triangle pattern that reflects growing market equilibrium. After recent volatility, the price has entered a period of compression, with dynamic support and resistance continuing to narrow. This behavior often precedes significant directional movement, as markets rarely remain compressed for extended periods.

Triangle formations typically represent a balance between buyers and sellers before a decisive breakout occurs. In Bitcoin’s case, price remains inside the structure, meaning the breakout has not yet been confirmed. However, as the price approaches the apex of the triangle, the probability of a volatility expansion increases substantially.

The market is now nearing a macro decision point where momentum will likely return and determine Bitcoin’s next trend phase.

Bitcoin price key technical points

- Bitcoin trading inside a clear triangle formation, signaling compression

- Apex zone approaching, increasing breakout probability

- $76,700 high-timeframe resistance becomes upside target, if bullish break occurs

The current triangle formation is defined by converging dynamic support and resistance aligned closely with the value area low and value area high. Each rejection from resistance and defense of support has gradually tightened price action, reducing volatility and forming a classic apex structure.

Such formations indicate that neither buyers nor sellers currently dominate the market. Instead, liquidity builds on both sides as participants wait for confirmation of direction. As compression increases, even modest momentum can trigger a sharp expansion once price escapes the pattern.

Importantly, Bitcoin has not yet broken out. Until a confirmed move occurs, price remains in consolidation rather than trend continuation.

Higher Lows Suggest Constructive Momentum

One notable feature within the triangle is the development of higher lows forming near the value area low. These higher lows indicate that buyers are stepping in earlier on each pullback, gradually applying upward pressure on price.

While this does not guarantee a bullish breakout, it does suggest constructive underlying demand. Markets forming higher lows during consolidation often lean toward upside resolution, particularly when support continues to hold consistently.

This behavior reflects accumulation rather than distribution, strengthening the possibility of a bullish expansion once the triangle resolves.

Apex zone becomes the market decision point

The apex of the triangle represents the most critical area in the current structure. As the price reaches this narrowing zone, the market is forced into a decision. Breakouts from triangle patterns frequently occur near the apex because the price has little room left to consolidate.

However, direction alone is not enough. Volume confirmation will be essential. A breakout accompanied by increasing volume would validate participation returning to the market and significantly improve the probability of sustained follow-through.

Without volume expansion, breakouts risk becoming false moves that quickly reverse back into the range.

Upside scenario targets $76,700 resistance

If Bitcoin breaks to the upside with strong volume confirmation, attention shifts toward high-timeframe resistance near $76,700. This level represents a major technical objective and aligns with prior supply areas within the broader trading structure.

A successful breakout would signal the end of the consolidation phase and the beginning of a new expansion leg, potentially attracting momentum traders and renewed market participation.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Bitcoin is approaching a macro decision point. The triangle formation indicates compression, and compression almost always leads to expansion.

In the immediate short term, traders should expect increasing volatility as price interacts with the apex zone. A confirmed breakout supported by rising volume will likely dictate the next major move.

While higher lows favor a bullish resolution, confirmation remains essential. Until the breakout occurs, Bitcoin remains in consolidation, but the technical evidence suggests that a significant move is approaching rapidly.

The upcoming sessions are likely to define Bitcoin’s next directional trend as the market prepares for an imminent expansion of volatility.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment1 day ago

Entertainment1 day agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports14 hours ago

Sports14 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment20 hours ago

Entertainment20 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World23 hours ago

Crypto World23 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat5 days ago

NewsBeat5 days agoUK construction company enters administration, records show

-

Crypto World6 days ago

Crypto World6 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery