Crypto World

Feed Every Gorilla (FEG) Marks Five Years of Decentralized Finance Infrastructure Development

[PRESS RELEASE – Dubai, UAE, February 20th, 2026]

Feed Every Gorilla (FEG), a decentralized finance infrastructure project established in 2021, marks its five-year anniversary, reflecting continued development of blockchain-based protocol infrastructure designed to support decentralized token ecosystems and on-chain financial systems.

Since its launch, FEG has focused on developing transparent and verifiable smart contract infrastructure intended to support decentralized finance participants. Over the past five years, the project has implemented multiple protocol improvements, strengthened its contract architecture, and completed independent security audits to support system integrity and operational reliability.

A central component of the ecosystem is the SmartDeFi Launchpad, a decentralized protocol framework designed to support token creation, deployment, and lifecycle management through transparent on-chain mechanisms. The infrastructure enables developers to deploy and manage tokens within a structured protocol environment designed to improve accessibility and consistency across decentralized ecosystems.

As part of its ongoing roadmap, SmartDeFi’s bonding curve infrastructure is currently in the final stages of testing. This protocol-level mechanism is designed to introduce structured liquidity functionality directly within token infrastructure. The SmartDeFi Launchpad is also preparing for expansion across additional EVM-compatible blockchain networks, supporting broader developer participation and ecosystem accessibility.

The five-year milestone represents continued protocol development and infrastructure expansion, as FEG focuses on supporting decentralized finance through transparent, blockchain-based systems.

About Feed Every Gorilla (FEG)

Feed Every Gorilla (FEG) is a decentralized finance infrastructure project focused on developing blockchain-based protocol frameworks and tools designed to support decentralized token ecosystems. Established in 2021, the project develops infrastructure for token deployment, on-chain trading systems, and decentralized ecosystem management.

Its core protocol, the SmartDeFi Launchpad, provides decentralized infrastructure for token creation and lifecycle management using transparent smart contract systems. FEG’s development efforts emphasize verifiable on-chain functionality, protocol transparency, and ongoing infrastructure advancement.

The project continues to expand its infrastructure and protocol capabilities to support decentralized finance participants, developers, and blockchain ecosystems globally.

Website: https://FEG.io

Launchpad: https://SmartDeFi.com

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Trump Signs New 10% Global Tariff Despite Supreme Court Defeat: Will BTC Crash Again?

So far, bitcoin has remained relatively stable after the new tariffs were announced, but history shows pain might be on its way.

On Friday, the US Supreme Court ruled against President Trump’s tariffs, indicating that he could not use a 1977 law – the International Emergency Economic Powers Act (IEEPA) – to levy taxes on imports from almost all countries.

Trump’s reaction was immediate, calling the ruling a disgrace and threatening to take even more actions. He did so hours later, announcing a new 10% temporary tariff on goods from all countries under a law that was never used before, known as Section 122.

It allows him to impose tariffs of up to 15% for 150 days before Congress steps in. However, experts have warned that Trump could once again work around the law, as Section 122 does not expressly prohibit him from allowing the tariffs to lapse after 150 days and then declaring a new emergency to bring them back.

It’s worth noting that the Friday court ruling applies only to tariffs that Trump had enacted under the IEEPA. This allows the President to regulate trade in response to an emergency. Additionally, tariffs imposed under Section 232 of the Trade Expansion Act of 1962 will remain, including those on steel, aluminium, lumber, and automotives.

In its 6-3 ruling on Friday, the Supreme Court failed to address or provide guidance on returning the money to the affected parties that paid the taxes, worth around $130 billion. Treasury Secretary Bessent said after the decision was announced that the refund issue could drag on for years.

For now, perhaps the most important question for crypto investors is whether these latest developments will lead to another crash in the market.

Recall that BTC and the alts plunged in February and April last year when Trump hit essentially every country with tariffs. More corrections took place a few months ago when he only threatened the EU with additional taxation during the Greenland saga.

You may also like:

So far, bitcoin has remained relatively stable, trading around $68,000. However, it appeared stable after the threats against the EU but plummeted once all financial markets opened on that Monday morning.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

MARA Bitcoin Miner Acquires Majority Stake in Exaion AI Data Center

In a strategic move that blends crypto mining with enterprise AI ambitions, MARA Holdings completed a majority stake acquisition in Exaion, the French computing infrastructure operator. The deal, initially agreed in August 2025 with EDF Pulse Ventures, hands MARA France a 64% stake in Exaion after the necessary regulatory clearances. EDF remains a minority shareholder and customer, while NJJ Capital—the investment vehicle of telecom entrepreneur Xavier Niel—will take a 10% stake in MARA France as part of the broader alliance. Governance is being reshaped to reflect the new ownership structure: MARA, EDF Pulse Ventures, and NJJ will each hold board seats alongside Exaion’s CEO and co-founder, with Niel and MARA’s chief executive Fred Thiel also expected to participate on the board. The arrangement crystallizes a multi-party partnership that could accelerate Exaion’s AI and cloud ambitions while reinforcing MARA’s diversification beyond traditional mining operations.

Key takeaways

- MARA Holdings secures a 64% stake in Exaion, a French computing infrastructure operator, after regulatory approvals).

- EDF Pulse Ventures remains a minority shareholder and customer, preserving existing commercial ties with Exaion.

- NJJ Capital will acquire a 10% stake in MARA France, creating a broader alliance with MARA.

- Board composition will reflect the new tri-party ownership, with 3 seats for MARA, 3 for EDF Pulse Ventures, and 1 for NJJ, plus Exaion’s leadership.

- The move aligns with a wider industry trend of Bitcoin miners repurposing facilities for AI data centers to diversify revenue amid hashprice pressure and rising mining costs.

Tickers mentioned: $BTC, MARA

Market context: The deal sits at the intersection of crypto mining, AI infrastructure demand, and large-scale energy deployment. The sector has faced tighter economics since the 2024 halving reduced block rewards and rising network difficulty squeezed margins. In response, several miners have pursued hybrid models—maintaining mining as a cash-flow anchor while building AI computing capacity to stabilize revenue streams. This broader trend is evident in public players adapting their asset bases, with companies like HIVE Digital Technologies reporting strength driven by AI expansion, and others such as CoreWeave moving from crypto mining toward substantial AI infrastructure operations. The industry context underpins MARA’s strategic push into Exaion, emphasizing resilience through diversified endpoints rather than a sole reliance on hash-rate economics.

Bitcoin mining economics have continued to evolve as the hash-rate environment shifts. In the latest cycle, Bitcoin mining difficulty rose about 15% to 144.4 trillion, reversing a prior decline and underscoring the ongoing challenge of maintaining profitability in a volatile cost environment. The rebound in difficulty highlights the need for miners to find steadier revenue streams that can weather fluctuations in price and energy costs. As miners explore data-center-scale AI and high-performance computing services, the balance between pure block rewards and ancillary computing offerings remains a focal point for investors and operators alike.

In the context of this transaction, the governance structure is designed to ensure broad-based representation from MARA, EDF Pulse Ventures, and NJJ while preserving Exaion’s leadership, a balance that could shape how the company evolves as an AI-focused infrastructure provider.

Why it matters

The MARA-Exaion deal signals a concrete step toward a more integrated model of value creation in the crypto ecosystem—one that marries mining with enterprise-scale AI infrastructure. By consolidating Exaion under a majority stake, MARA positions itself to leverage Exaion’s data-center capabilities to offer AI-ready compute at scale, potentially tapping into markets that demand GPU-accelerated processing, machine learning workloads, and cloud-style services tailored for research, development, and production environments. This aligns with a broader industry leitmotif: as hash price becomes an increasingly uncertain driver of earnings, diversified revenue streams anchored in computing infrastructure can provide a stabilizing layer for balance sheets, particularly in a sector prone to volatility in crypto cycles.

The governance implications are non-trivial. The board composition—a representation split among MARA, EDF Pulse Ventures, and NJJ, plus Exaion’s leadership—suggests a framework designed to maintain continuity while enabling cross-pollination of strategic priorities. Xavier Niel’s NJJ Capital involvement and MARA’s continued leadership signal a durable collaboration that could accelerate product development, client acquisition, and international deployment of Exaion’s AI-oriented infrastructure. For investors, the arrangement offers a clearer line of sight into how a crypto-focused mining group can pivot toward high-value computing services while maintaining exposure to digital-asset cycles. For builders in the space, the alliance may foreshadow more multi-party partnerships that blend energy, telecom, and cloud-oriented compute into cohesive platforms for AI workloads and data processing at scale.

From a market perspective, the development occurs amid ongoing demand for AI capacity and cloud infrastructure. Publicly traded miners have increasingly pursued hybrid business models; several have reported that AI-focused data-center initiatives are contributing to revenue growth or serving as a counterweight to mining volatility. The MAVA-Exaion collaboration exemplifies how crypto operators can leverage established energy and data-center assets to participate in AI infrastructure without fully stepping away from mining fundamentals. This approach may influence how other players structure alliances and funding rounds, especially as regulatory and policy considerations around AI compute, data sovereignty, and energy efficiency continue to evolve.

In the long run, the Exaion partnership could shape a more resilient blueprint for how crypto-native firms participate in data-center ecosystems. While the shift toward AI infrastructure is driven by macro-level demand for compute power, it also reflects a broader appetite among investors for differentiated, asset-light growth vectors that are less dependent on volatile crypto price cycles. If executed effectively, the MARA-Exaion alliance could deliver an AI-forward product suite that appeals to enterprises seeking scalable, secure, and energy-conscious computing solutions—an outcome that would diversify both top-line growth and risk exposure for a company historically driven by mining revenues.

What to watch next

- Board governance implementation and any subsequent changes to Exaion’s leadership structure.

- The timing and terms of NJJ Capital’s 10% stake in MARA France and how it influences cross-border collaboration.

- Product roadmaps and enterprise customer wins for Exaion’s AI data-center services, including capacity expansions and new partnerships.

- Regulatory developments affecting AI infrastructure and energy usage across France and Europe that could impact deployment scales.

Sources & verification

- Official MARA Holdings press release detailing the Exaion stake acquisition and ownership structure.

- EDF Pulse Ventures partnership announcements outlining minority participation and customer relationships.

- Public disclosures from NJJ Capital regarding its 10% MARA France stake and strategic intent.

- Exaion governance documents and leadership statements released in connection with the transaction.

Strategic convergence: AI, cloud computing and Bitcoin mining intersect

Bitcoin (CRYPTO: BTC) has emerged as a reference point for miners as they recalibrate portfolios toward AI-forward infrastructure. The combination of a 64% Exaion stake for MARA (NASDAQ: MARA) and a 10% stake for NJJ Capital in MARA France signals a deliberate move to anchor AI data-center capabilities within a crypto ecosystem historically defined by hash power. The arrangement envisages Exaion as a platform for AI and high-performance computing, powered by MARA’s energy assets and regulatory experience, while EDF Pulse Ventures preserves its role as a strategic partner and customer. This alignment not only diversifies revenue streams but also positions the group to bid for larger enterprise workloads that require GPU-accelerated compute at scale, a space where the demand is growing even as crypto prices swing.

Industry dynamics underpinning the transaction extend beyond this deal. A number of mining operators are repurposing facilities to host AI and data-center workloads, a trend underscored by notable moves across the sector. HIVE Digital Technologies has reported strong results strengthened by AI initiatives, while CoreWeave has shifted from crypto mining toward AI infrastructure provision as GPU demand cooled for mining. Other players—TeraWulf, Hut 8, IREN, and MARA among them—are similarly realigning assets to unlock steadier, non-volatile income streams. The logic is straightforward: AI compute centers can offer recurring revenue tied to enterprise demand, while mining remains a cash-flow anchor rather than a sole driver of profitability.

In parallel, the industry continues to monitor mining difficulty and hash-rate dynamics. A rebound in difficulty—rising roughly 15% to 144.4 trillion—reiterates the energy and efficiency challenges miners face, including weather-related outages that periodically disrupt grid reliability. Against that backdrop, the ability to monetize excess energy capacity and repurpose facilities into AI data-center hubs could prove essential for long-term resilience. The MARA-Exaion venture thus sits at a confluence of capital, energy strategy, and enterprise-grade compute services, highlighting how crypto businesses are evolving to weather market cycles while expanding their tech footprint into AI-enabled markets.

Crypto World

Bitcoin Price Calls Are ‘Drying Up’ Which Is Healthy: Santiment

The overall number of crypto market participants calling for Bitcoin to enter new all-time high territory has tapered off, which crypto sentiment platform Santiment points out is a positive signal.

“Calls for Bitcoin to hit $150k to $200k, and even $50k to $100k, are drying up,” Santiment said in a report on Friday.

“This reduction in FOMO and ‘Lambo’ memes is actually a healthy market indicator. It shows that retail optimism is fading,” Santiment added.

Bitcoin sentiment bumps up to ‘neutral’

While prominent Bitcoin (BTC) advocates such as BitMEX co-founder Arthur Hayes and BitMine chair Tom Lee were openly calling for Bitcoin to reach as high as $250,000 during 2025, the asset’s price ended up reaching $126,100 in October, before entering a downtrend that ultimately led to ending the year lower than where it started.

The downtrend continued into the new year, with Bitcoin dropping to near $60,000 on Feb. 6, but has since edged up to $67,847 at the time of publication, according to CoinMarketCap.

Santiment said that the sentiment around Bitcoin, measured by the ratio of bullish to bearish social media comments, has recovered from “extreme bearishness” to “neutral territory,” which may make it harder for market participants to make trading decisions.

“Better to avoid trading in these scenarios or at least discount the significance of sentiment metrics in your analysis,” Santiment said.

Meanwhile, other indicators suggest that crypto investors are still fearful.

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, stayed in “Extreme Fear” territory on Saturday, posting a score of 8, suggesting investors are extremely cautious.

Related: Bitcoin ignores US Supreme Court, Trump tariff strike amid talk of $150B refund

However, Santiment said the overall activity on the Bitcoin network is “flashing warning signs,” explaining that transaction volume, active addresses, and network growth are all “steadily declining.”

“These utility indicators suggest the network is being used less frequently. While not immediately bearish, this dormancy implies traders are sitting on their hands,” Santiment said, arguing that market expansion would show growing user participation.

Magazine: 6 massive challenges Bitcoin faces on the road to quantum security

Crypto World

Here Is Why Aptos’ Structural Fixes Failed to Spark a Price Rally

TLDR:

- Aptos slashed staking rewards from 5.19% to 2.6%, cutting sell pressure on APT nearly in half immediately.

- The Aptos Foundation locked 210 million APT, removing roughly 18% of the total circulating supply from the market.

- Programmatic buybacks and a 32 million APT annual burn were introduced to create consistent token demand.

- Despite strong tokenomics reforms, the APT price saw no reaction due to weak retail interest and no clear narrative.

APT, the native token of the Aptos blockchain, recently received a major tokenomics upgrade. The changes addressed long-standing structural concerns around inflation and supply pressure.

However, the price showed little reaction following the announcement. Analysts point to a deeper problem rooted in weakened market confidence.

The fixes may improve the foundation, but demand has not followed. The central question now is whether these reforms came too late to matter this cycle.

What the Aptos Tokenomics Upgrade Actually Changed

Aptos cut staking rewards nearly in half, dropping from 5.19% to 2.6%. This move directly reduces the selling pressure that had weighed on APT for months.

The Aptos Foundation also locked 210 million APT, removing roughly 18% of the circulating supply. A hard cap of 2.1 billion tokens was also clarified for the market.

Beyond supply controls, the project introduced programmatic buybacks and a projected annual burn of 32 million APT. Grant issuance was shifted to a performance-based model, tightening how new tokens enter circulation.

Together, these changes represent a meaningful pivot in how the project manages its token economy. On paper, the reforms are serious and directly responsive to earlier criticism.

Crypto analyst account @ourcryptotalk noted the changes address structural issues it raised two months prior. The account stated that emissions cut nearly in half immediately reduces selling pressure.

It also noted the foundation lock removes roughly 18% of the circulating supply permanently. Buybacks, it added, create systematic demand.

Still, the market responded with indifference. Retail investors have not rotated into APT following the announcement.

Institutions have not signaled a clear preference for the asset either. On-chain activity has not produced the kind of demand shock that typically moves prices.

Why Price Ignored the News and What Comes Next

Markets generally do not reward projects for correcting past mistakes. The lack of price reaction reflects this well-established pattern in crypto.

Trust, once broken by poor tokenomics design and unlock cycles, requires more than adjusted numbers to rebuild. It requires a visible surge in usage and ecosystem activity.

Aptos also lacks a dominant narrative in the current market cycle. Move language is a technical feature, not a category-defining story.

Competing chains have captured niches in areas like real-world assets, gaming, and institutional infrastructure. Aptos has not yet claimed ownership of any single space.

Ourcryptotalk framed the remaining challenge clearly. The project needs live dashboards for burn, emissions, and buybacks to build transparency.

It also needs to route ecosystem fees into stakers or burns to make APT feel like true ownership. Without a killer narrative, the token risks fading even with improved supply mechanics.

If ecosystem growth accelerates while emissions remain suppressed, a supply squeeze could quietly develop. Without that growth, the tokenomics upgrade alone is unlikely to drive a sustained rally.

Crypto World

Official Trump (TRUMP) Soared 10% After POTUS Teased Alien Disclosure: Details Here

At one point, TRUMP’s market capitalization approached the psychological mark of $1 billion.

Several Trump-related meme coins experienced a significant resurgence on Friday, following an intriguing announcement made by the President of the United States.

However, the asset lost almost all gains in the following hours, perhaps driven by a blow against Trump from the US Supreme Court.

The Trump Effect or Just a Coincidence?

Official Trump (TRUMP) – the biggest meme coin related to the POTUS – jumped to almost $3.80 on Friday, its highest point since the beginning of February. Its market capitalization neared $900 million, solidifying it as the sixth-largest meme coin.

Other Trump-themed tokens, including Pepe Trump (PTRUMP), Super Trump (STRUMP), and SUI TRUMP (SUITRUMP), also headed north, albeit charting more modest gains.

Their revival coincides with the president’s pledge to direct the Secretary of War and other relevant departments to begin identifying and releasing government files concerning alien and extraterrestrial life. The topic has always fascinated the public, but a recent podcast featuring the former US leader Barack Obama has further amplified attention.

Asked about the existence of aliens, he affirmed they are real but clarified that he has never personally seen any. Moreover, Obama said they are not being kept at the notorious Area 51 “unless there’s this enormous conspiracy and they hid it from the president of the United States.”

It is important to note that Trump’s pledge on that front may not be the only factor fueling a resurgence for the aforementioned meme coins. The broader cryptocurrency market, where Bitcoin (BTC) and many altcoins have seen minor increases over the last 24 hours, could also have played a role.

You may also like:

What’s Next?

Some commentators on X noted TRUMP’s recent pump, suggesting it might have more fuel left for additional gains. The analyst who goes by the moniker Don claimed the meme coin “looks good,” hinting that its price structure signals potential upside to $13.29.

Nonetheless, investors and traders should be extremely cautious when dealing with such assets due to their infamous volatility. TRUMP, which saw the light of day in January last year, initially exploded above $70 only to crash by double digits mere days later.

The asset’s Relative Strength Index (RSI) also indicates a possible correction ahead. The technical analysis tool measures the speed and magnitude of recent price changes and provides traders with an idea of potential reversal points. It ranges from 0 to 100, with ratios around and above 70 suggesting the token is overbought and due for a pullback. On the other hand, anything below 30 is considered a buying opportunity. Currently, the RSI stands just south of the bearish zone.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin Price Flashes Its Biggest Warning of 2026

Bitcoin price has rebounded more than 4% since February 19, helping it recover above $68,200. This bounce offered temporary relief after weeks of weakness. However, new technical and on-chain signals now show that Bitcoin may be approaching its most dangerous level of 2026.

A combination of bearish chart structure, heavy supply clusters below price, and rising leverage risk suggests a deeper correction could begin soon.

Bitcoin’s 8-hour chart currently shows a head-and-shoulders pattern. This is a bearish reversal structure that forms when price creates three peaks, with the middle peak higher than the others. It signals weakening buying strength and increasing selling pressure.

At the same time, Bitcoin has formed a hidden bearish divergence between February 6 and February 20. During this period, the Bitcoin price created a lower high, meaning the recovery failed to fully regain its previous peak.

However, the Relative Strength Index, or RSI, formed a higher high.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

RSI measures buying and selling momentum on a scale from 0 to 100. When RSI rises, but price fails to rise equally, it shows that buying strength is weakening. This pattern often appears before price declines or pullbacks.

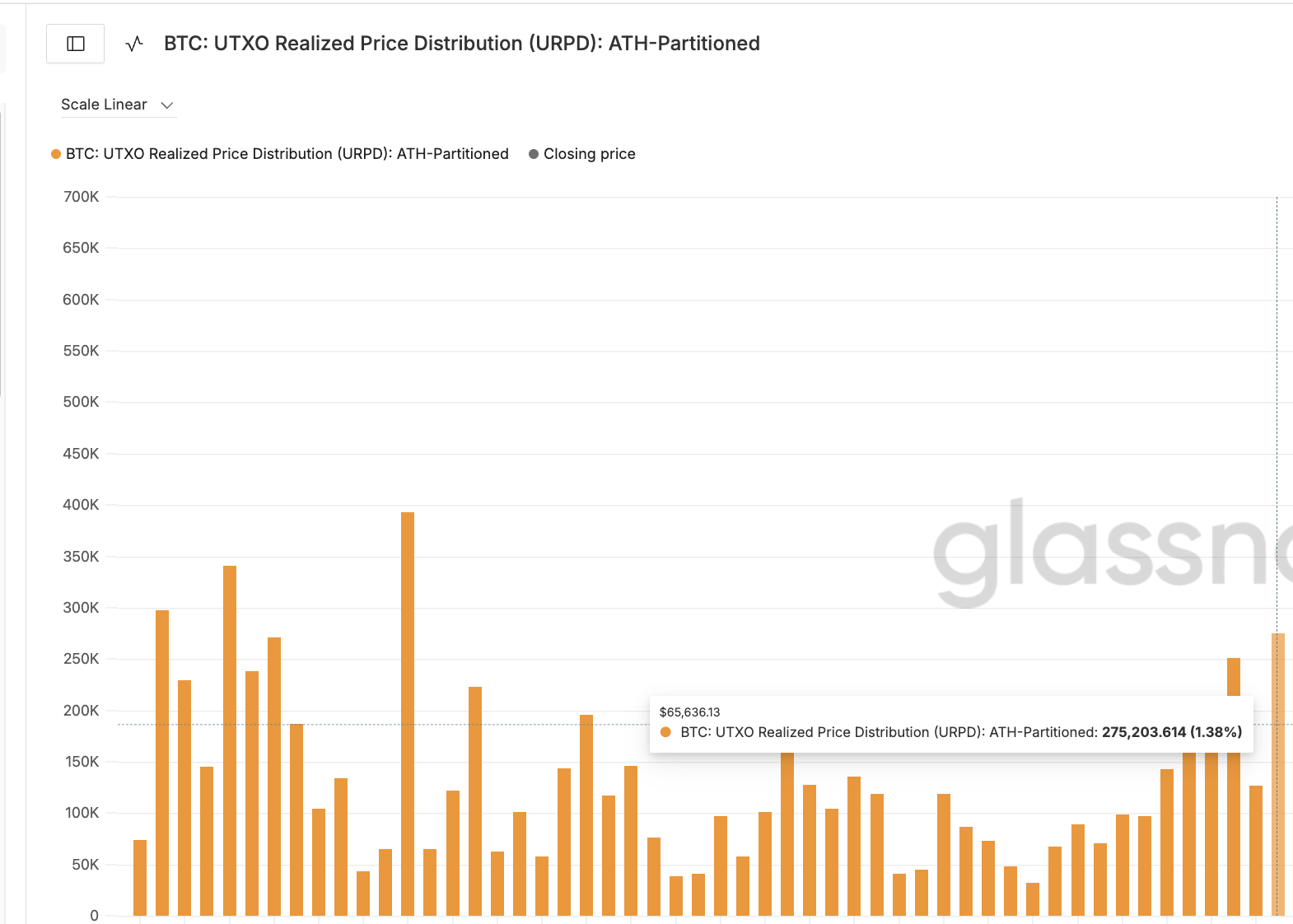

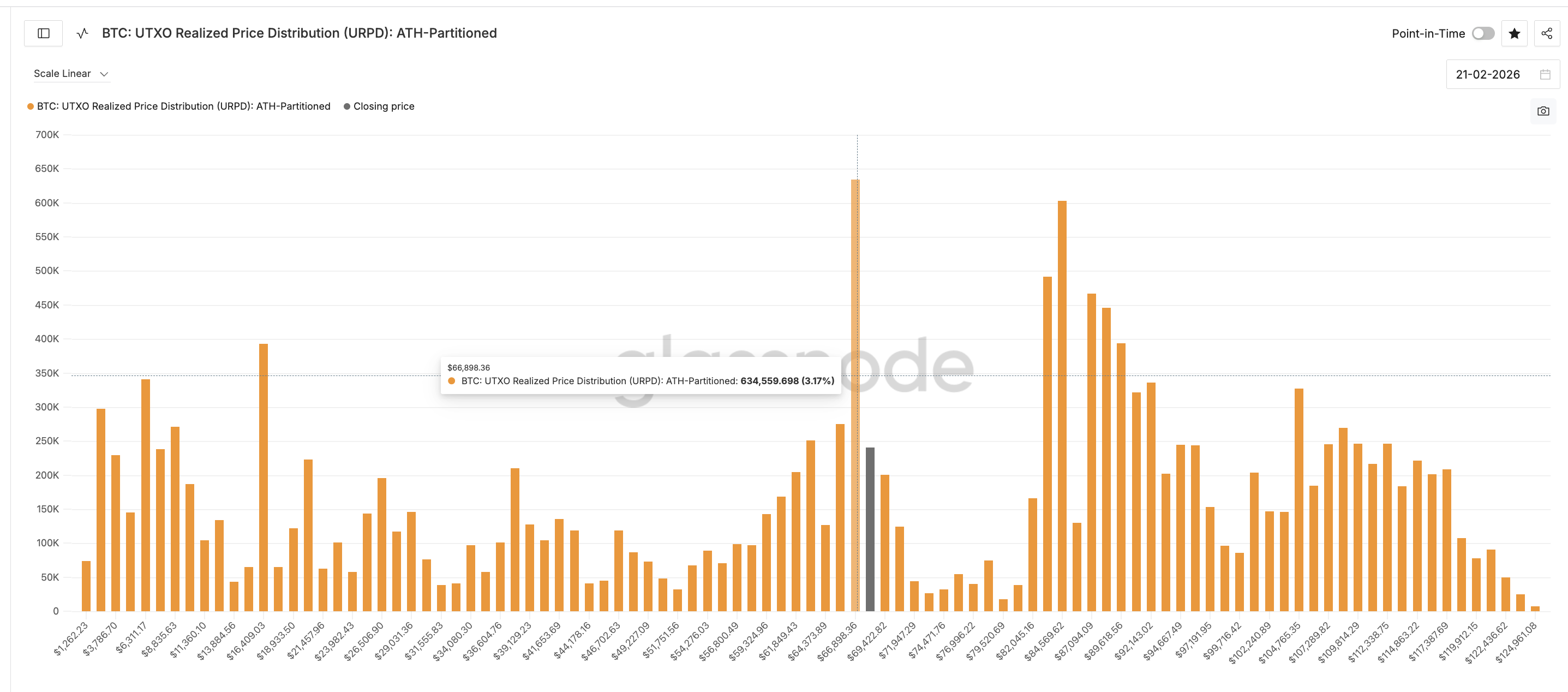

The biggest risk now comes from Bitcoin’s on-chain cost basis levels. Data from the UTXO Realized Price Distribution, or URPD, shows that the largest supply cluster sits at above $66,800. This level holds 3.17% of Bitcoin’s total circulating supply.

Another major cluster sits at $65,636, holding an additional 1.38% of supply.

These levels are important because they represent prices at which many investors bought Bitcoin. If Bitcoin falls below these levels, holders may begin selling to avoid losses. This can accelerate the price decline quickly.

Together, these clusters represent more than 4.5% of Bitcoin’s supply concentrated just below the current price. This creates a high-risk zone directly under Bitcoin’s support. That explains the biggest price warning

If Bitcoin closes below this region, the head-and-shoulders pattern realization could gain strength.

Rising Leverage and ETF Outflows Increase Liquidation Threat

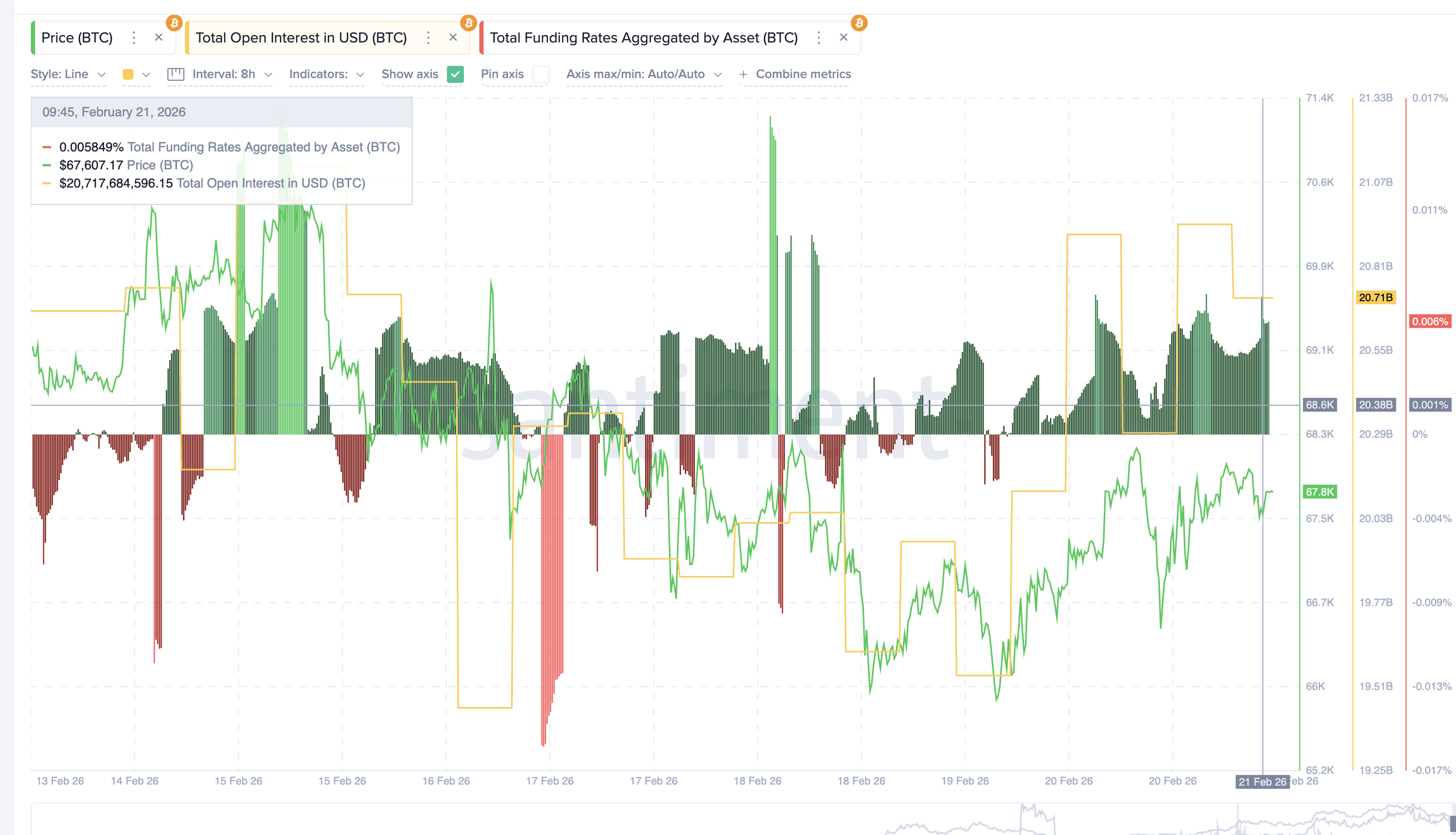

Derivatives data shows rising liquidation risk as Bitcoin rebounded. Open interest, which measures the total value of active futures positions, has increased from $19.54 billion on February 19 to about $20.71 billion now, during the bounce.

This means more traders have entered leveraged positions during the recovery.

At the same time, funding rates have turned positive. Funding rates are payments between long and short traders. Positive funding means more traders are betting on price increases. This creates a dangerous situation.

If the Bitcoin price starts falling, these leveraged long positions may be forced to close. This triggers a long squeeze, where bullish traders are pushed out of their positions. Such forced exits can create a liquidation cascade, adding extra selling pressure and accelerating the price drop.

Institutional sentiment also remains weak. Spot Bitcoin ETFs have now recorded five consecutive weeks of net outflows. This shows that institutional investors are still withdrawing capital rather than accumulating.

This reduces support during price declines.

Bitcoin Price Faces Critical Test Below Institutional Resistance

Bitcoin also remains below its monthly Volume Weighted Average Price, or VWAP, which sits near $70,000. VWAP represents the average price weighted by trading volume. Monthly VWAP is widely used as a proxy for institutional cost basis.

When Bitcoin trades below VWAP, it means the average institutional position is currently at a loss. This often causes institutions to reduce exposure or avoid new buying, explaining the ETF apathy.

A recovery above $70,000 would signal renewed institutional strength. But as long as Bitcoin stays below this level, recovery attempts may remain limited, and the broader structure remains bearish.

On the downside, Bitcoin’s first key support sits near $67,300. If this level breaks, the next support appears at $66,500, followed by $65,300. These levels align closely with the major supply clusters mentioned earlier. Failure to hold these levels could trigger the larger head-and-shoulders breakdown near the $60,800 neckline.

A breakdown can then trigger a price breakdown target of over 7.5%, hinting at a target price of $56,000, in the near-to-mid-term.

On the upside, Bitcoin must reclaim $68,200 to stabilize its short-term structure. However, a full recovery would require reclaiming the $70,000 VWAP level.

Crypto World

Bitcoin, Ether Hold Strong as Trump Announces Additional Universal 10% Tariff

Cryptocurrency markets showed resilience Friday after US President Donald Trump unveiled a new universal 10% tariff on imports, even as the policy followed a Supreme Court decision blocking his earlier use of emergency economic powers.

Key Takeaways:

- Crypto prices held steady despite Trump announcing a new 10% universal tariff.

- The Supreme Court blocked the use of emergency powers, but the administration shifted to other trade laws.

- Unlike past trade tensions, markets reacted cautiously with no major selloff in Bitcoin or Ether.

Bitcoin traded near $67,800 during the session, while Ether held around $1,960, according to data from CoinMarketCap.

Broader crypto conditions remained steady, with the total digital asset market capitalization hovering around $2.33 trillion and sentiment indicators continued to reflect caution rather than panic.

Trump Orders 10% Global Tariff Using New Legal Authority After Court Ruling

Trump sharply criticized the court’s ruling during a press conference, calling the decision “ridiculous,” and said his administration would proceed using alternative legal authorities.

“Effective immediately… I will sign an order to impose a 10% Global tariff under Section 122 over and above our normal tariffs already being charged,” he said, adding that national security tariffs under Sections 232 and 301 would remain in force.

The Supreme Court earlier ruled that the White House lacked authority to impose tariffs under the International Emergency Economic Powers Act (IEEPA) during peacetime.

In its opinion, the court emphasized that the Constitution grants Congress, not the executive branch, the power to levy duties and taxes, noting no previous administration had used the statute to enact tariffs of comparable scale.

Tariffs have historically unsettled risk assets, including equities and digital currencies, as trade disputes tend to tighten liquidity expectations and cloud economic forecasts.

Previous tariff announcements from Washington have often triggered rapid selloffs across global markets.

This time, however, crypto traders appeared to take a measured stance. Bitcoin showed only marginal intraday changes and Ethereum posted small gains over 24 hours, while major tokens such as XRP and BNB also moved modestly.

Trump had previously imposed tariffs of 25% on certain imports from Canada and Mexico and 10% on Chinese goods, citing national security and trade deficit concerns.

The court rejected those justifications under the emergency statute, but the administration’s new order relies on longstanding trade laws, including the Trade Expansion Act of 1962 and the Trade Act of 1974.

Bitcoin Loses 25,000 Millionaire Addresses Under Trump

As reported, Bitcoin has shed roughly 25,000 millionaire addresses in the year since Donald Trump returned to the White House, even as US policy shifted toward a more crypto-friendly stance.

Blockchain data shows the number of addresses holding at least $1 million in BTC fell about 16% year over year, suggesting regulatory optimism has not translated into sustained on-chain wealth growth.

The pullback was less severe among the largest holders. Addresses with more than $10 million in Bitcoin declined by about 12.5%, indicating that top-tier investors were better able to withstand price volatility, while wallets near the millionaire threshold were more exposed to market swings.

Much of the increase in Bitcoin millionaire addresses occurred before Trump took office, driven by a late-2024 rally fueled by election-related optimism and expectations of deregulation.

The post Bitcoin, Ether Hold Strong as Trump Announces Additional Universal 10% Tariff appeared first on Cryptonews.

Crypto World

MARA Takes Controlling Stake in French AI Data Center Operator Exaion

MARA Holdings has completed the purchase of a majority stake in French computing infrastructure operator Exaion, deepening its push into artificial intelligence (AI) and cloud services.

The deal, first agreed in August 2025 with EDF Pulse Ventures, gives MARA France a 64% stake in Exaion after required regulatory approvals were secured, the Bitcoin miner said in a Friday announcement. French energy giant EDF will remain a minority shareholder and continue as a customer of the business.

The investment also creates a broader alliance. NJJ Capital, the investment vehicle of telecom entrepreneur Xavier Niel, will acquire a 10% stake in MARA France as part of a partnership with MARA.

Governance of Exaion will reflect the new ownership structure. The company’s board will include three representatives from MARA, three from EDF Pulse Ventures and one from NJJ, alongside Exaion’s chief executive and co-founder. Niel and MARA CEO Fred Thiel will both hold seats on the board.

Related: Bitcoin miners chase 30 GW AI capacity to offset hashprice pressure

Bitcoin miners pivot to AI amid pressure

Bitcoin mining companies are increasingly turning to AI and data center computing as pressure on mining economics grows. After the 2024 halving cut block rewards and rising network difficulty squeezed margins, several publicly traded miners began adopting a hybrid model, keeping mining as a source of cash flow while building steadier revenue from AI cloud and high-performance computing services.

HIVE Digital Technologies is one example of the shift. The company reported strong results even during weaker Bitcoin prices, supported by expanding AI operations. CoreWeave has also moved from crypto mining to become a major AI infrastructure provider after GPU mining demand fell.

Other firms, including TeraWulf, Hut 8, IREN and MARA, are also repurposing mining facilities and energy capacity into AI data centers.

In November last year, CleanSpark announced plans to raise roughly $1.13 billion in net proceeds, up to $1.28 billion if additional notes are purchased, through a $1.15 billion senior convertible note offering to fund expansion of its Bitcoin mining and data center operations.

Related: Crypto miner Bitdeer tanks 17% after $300M debt offering

Bitcoin mining difficulty jumps 15%

Meanwhile, Bitcoin’s mining difficulty rose about 15% to 144.4 trillion on Friday, reversing an 11% drop earlier in the month, the steepest decline since China’s 2021 mining ban. The earlier fall followed severe winter storms across the United States that disrupted power grids and temporarily forced many miners offline, sharply reducing hash rate.

While the higher difficulty reinforces Bitcoin’s security, it also raises the computing effort needed to mine new blocks, adding further margin pressure on operators already dealing with rising costs.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

Bitcoin ETFs add $88M, ending three-day outflow streak

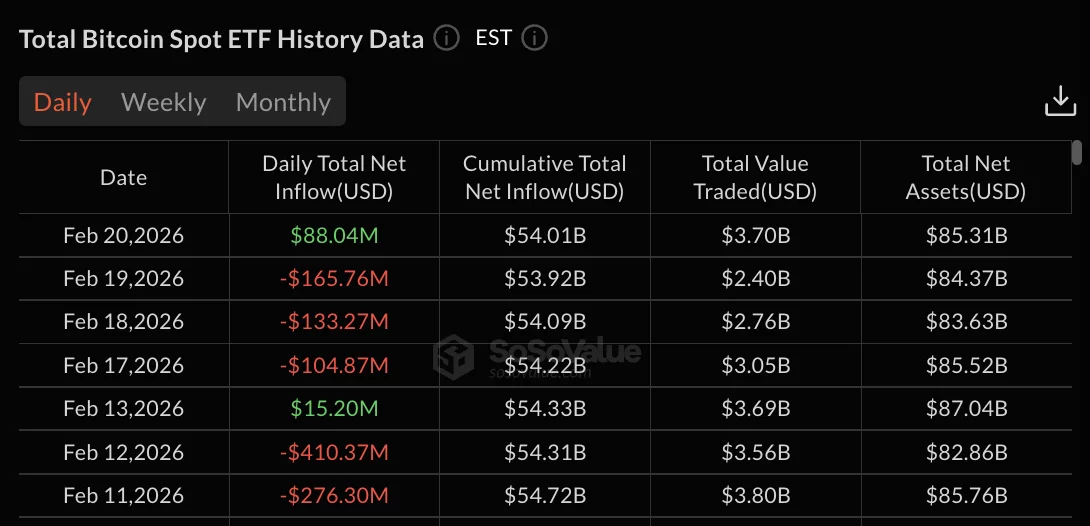

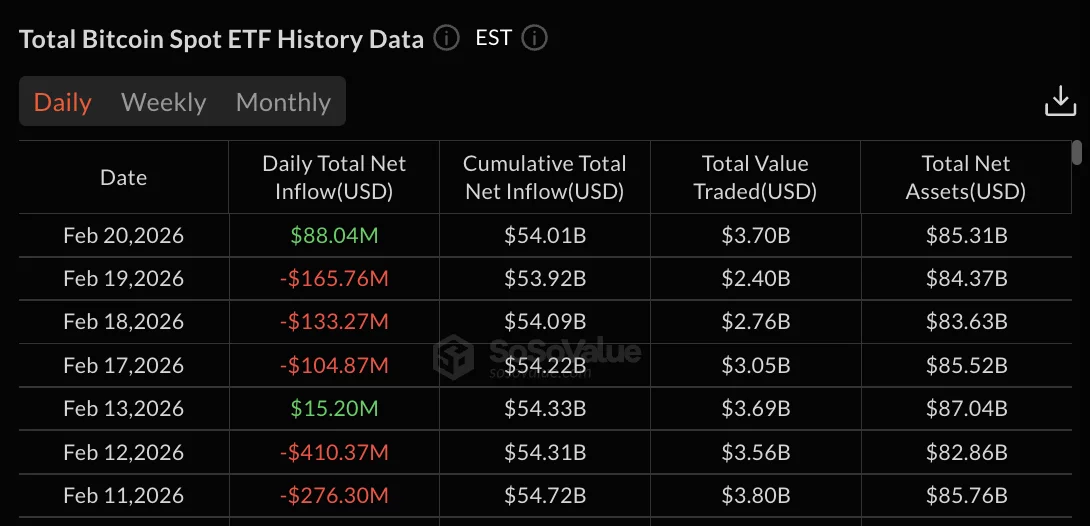

Bitcoin ETFs recorded $88.04 million in net inflows on February 20, breaking a three-day outflow streak that drained $403.90 million.

Summary

- Bitcoin ETFs post $88M inflows after three days of $403M outflows.

- IBIT and FBTC drive all flows as most funds remain inactive.

- Weekly redemptions continue with $315M leaving BTC products.

BlackRock’s IBIT led with $64.46 million while Fidelity’s FBTC attracted $23.59 million, with remaining funds posting zero flows.

Bitcoin (BTC) traded at $67,800 with minimal 24-hour movement after touching a low of $66,452 during the session.

Total net assets reached $85.31 billion while cumulative total net inflow stood at $54.01 billion.

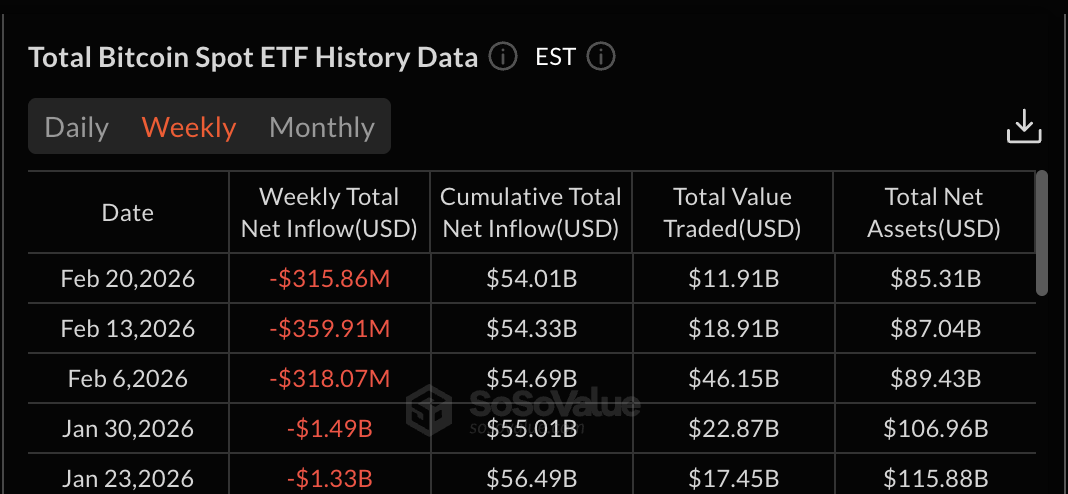

Three-day Bitcoin ETF outflow streak totaled $403 million

February 17-19 posted consecutive days of redemptions before February 20’s reversal. February 19 recorded the largest single-day withdrawal at $165.76 million.

This was followed by February 18’s $133.27 million and February 17’s $104.87 million in outflows.

The selling pressure dropped total net assets from $87.04 billion on February 13 to $85.31 billion on February 20.

February 13’s $15.20 million inflow briefly interrupted the pattern before three days of sustained withdrawals resumed.

Most Bitcoin ETF products recorded zero activity on February 20, with only IBIT and FBTC posting flows.

Grayscale’s GBTC and mini BTC trust, along with Bitwise’s BITB, Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all showed no movement.

BlackRock’s IBIT maintains $61.30 billion in cumulative net inflows. Fidelity’s FBTC holds $10.96 billion in total inflows.

Weekly outflows persist at $315 million

The week ending February 20 posted $315.86 million in net outflows and was the fourth consecutive weekly redemption period.

The week ending February 13 recorded $359.91 million in withdrawals, while the week ending February 6 saw $318.07 million in outflows.

Late January posted the heaviest weekly redemptions. The week ending January 30 drained $1.49 billion from Bitcoin ETFs, while the week ending January 23 recorded $1.33 billion in withdrawals.

The four-week outflow period from January 23 through February 20 totals approximately $2.48 billion.

Weekly trading volume reached $11.91 billion for the period ending February 20, down from $18.91 billion the previous week.

Crypto World

Uniswap Founder Slams Scam Crypto Ads After Victim ‘Lost Everything’

Hayden Adams, founder of the decentralized exchange Uniswap, has warned users about fraudulent ads impersonating the platform, highlighting a case in which a victim reportedly lost everything.

It comes after January saw the highest amount of money stolen in crypto scams in 11 months.

“Scam ads keep returning despite years of reporting,” Adams said in an X post on Friday. “There were scam Uniswap apps while we waited months for App Store approval,” he said.

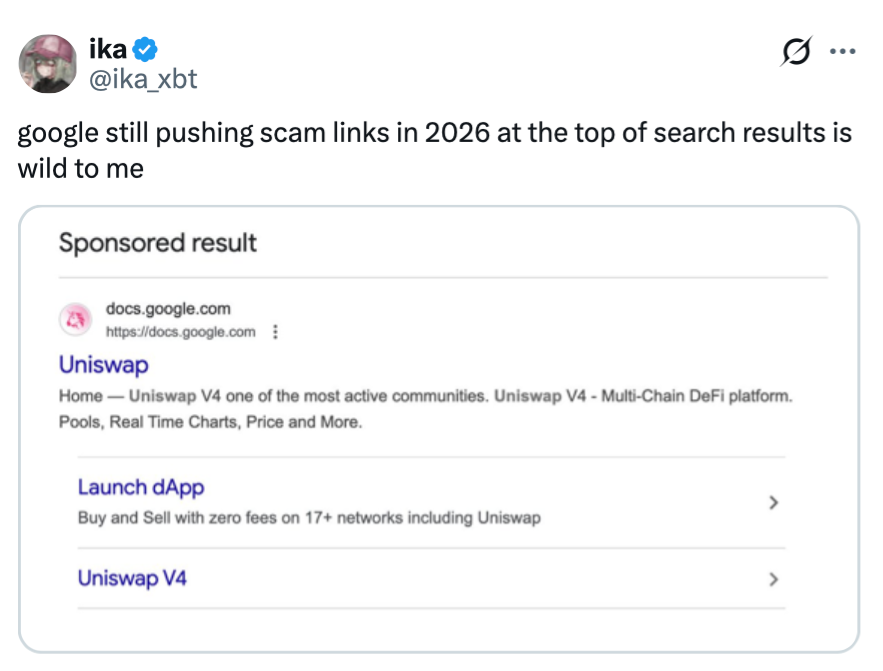

Scammers are increasingly buying ads on popular search engines targeting keywords like “Uniswap,” so when crypto users search for it, the top result looks official.

Unsuspecting users may then connect their wallets and approve a transaction, allowing scammers to drain their entire funds.

A consequence of a “long chain of bad decisions”

An X user named “Ika” said in an X article, titled “I lost everything, what’s next?” that his crypto wallet, valued in the mid-six-figure range, was drained despite his extreme care. “Disciplined for two years. Half-searching for a web3 job, half-hoping to make it fast enough not to need one,” he said.

“I believe that getting drained isn’t bad luck. It’s the final consequence of a long chain of bad decisions,” Ika said.

The lengthy post on X came shortly after he posted a screenshot of a top Google search result with an inauthentic Uniswap link.

It isn’t the first time that Uniswap has experienced this issue. In October 2024, Cointelegraph reported that scammers recognized the website’s lack of domain authority and created a version of the site that looks exactly like the real one, except that it featured a “connect” button where “get started” should have been and a “bridge” button where “read the docs” should have been.

Related: Dutch authorities call on Polymarket arm to cease activities

More recently, the value of cryptocurrency stolen through exploits and scams reached $370.3 million last month, the highest monthly figure in 11 months and a nearly fourfold rise from January 2025.

Crypto security company CertiK said that of the 40 exploit and scam incidents over January, the majority of the total value stolen came from one victim that lost around $284 million due to a social engineering scam.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

-

Video5 days ago

Video5 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World4 days ago

Crypto World4 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Fashion14 hours ago

Fashion14 hours agoWeekend Open Thread: Boden – Corporette.com

-

Video1 day ago

Video1 day agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment3 days ago

Entertainment3 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat6 days ago

NewsBeat6 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World3 days ago

Crypto World3 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest

-

NewsBeat6 days ago

NewsBeat6 days agoMan dies after entering floodwater during police pursuit

-

Crypto World1 day ago

Crypto World1 day ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat7 days ago

NewsBeat7 days agoUK construction company enters administration, records show

Gavin Newsom isn’t mincing words:

Gavin Newsom isn’t mincing words: