Crypto World

Forward Industries Maintains $600M Solana Position Despite $1B Unrealized Loss

TLDR:

- Forward Industries holds nearly 7 million SOL tokens, more than its next three competitors combined.

- FWDI’s average SOL acquisition cost of $232 creates $1 billion unrealized loss at current $85 price.

- The company’s debt-free balance sheet enables offensive consolidation while rivals face selling pressure.

- Forward raised $1.65 billion in 2025 from Galaxy Digital, Jump Crypto, and Multicoin Capital backing.

Forward Industries controls nearly 7 million SOL tokens as the largest publicly traded Solana treasury company. The firm’s holdings face substantial unrealized losses amid current market conditions.

Unlevered Balance Sheet Provides Strategic Advantage

FWDI purchased its SOL holdings at an average price of $232 per token. Current valuations place SOL near $85, creating a paper loss approaching $1 billion. The company’s share price has declined from $40 to approximately $5.

Chief Investment Officer Ryan Navi maintains the firm can consolidate weaker competitors during this downturn. “Scale plus an unlevered balance sheet is a real advantage in this market,” Navi told CoinDesk. “We can play offense when others are playing defense,” he added.

Forward Industries operates without corporate debt or leverage on its balance sheet. “Forward Industries has strategically avoided leverage and debt by design,” Navi explained. This structure provides flexibility to deploy capital when market opportunities emerge.

The firm raised $1.65 billion through a private investment in public equity during 2025. Galaxy Digital, Jump Crypto and Multicoin Capital led the funding round. Forward Industries now holds more SOL than its next three public competitors combined.

Staking Strategy and Permanent Capital Model

Forward Industries stakes its SOL holdings to generate yields between 6% and 7%. The staking rate will decrease over time as Solana’s programmed issuance declines. This creates an increasingly disinflationary supply environment for the network.

The company partnered with Sanctum to launch fwdSOL, a liquid staking token. This instrument earns staking rewards while functioning as collateral in decentralized finance protocols. Forward can borrow against this collateral at rates below the staking yield on platforms like Kamino.

Navi positions Forward Industries as a permanent capital vehicle rather than a short-term trading operation. “We’re not running a trading book, we’re building a long-term Solana treasury,” Navi stated. The company plans to underwrite real-world assets and tokenized royalties that exceed its cost of capital.

Kyle Samani announced his departure as managing director of Multicoin Capital on Wednesday. He retains his position as chairman of Forward Industries. Samani is receiving his exit from the Multicoin Master Fund in FWDI shares and warrants instead of cash redemption.

“What differentiates Forward is discipline: no leverage, no debt,” Navi said. The firm maintains a long-term view on Solana as strategic infrastructure rather than a speculative bet. Management believes its debt-free structure positions it to lead sector consolidation during this challenging period.

Crypto World

Markets Rally as Trump Announces Iran Conflict Nearing Conclusion

TLDR

- Ethereum surged past the $2,000 threshold while Solana posted the strongest gains among major cryptocurrencies following Trump’s announcement that U.S. military goals in Iran were “pretty well complete”

- American equity futures posted gains Tuesday following a turbulent trading day; crude oil prices plummeted from peaks above $119 down to approximately $88 per barrel

- Digital asset investment vehicles attracted $619 million in capital over the week despite significant market volatility, with bitcoin-focused products capturing the majority

- Bitcoin’s three-month correlation coefficient with the S&P 500 reached 0.78, indicating alternative cryptocurrencies are amplifying broader market movements

- The upcoming Federal Reserve policy meeting scheduled for March 17–18 represents the next critical event, with any hawkish stance potentially pressuring higher-risk digital assets

Digital currency markets alongside U.S. equity futures experienced significant upward movement Tuesday following President Donald Trump’s declaration that hostilities with Iran were approaching conclusion, calming anxieties that had destabilized worldwide markets merely twenty-four hours prior.

Trump addressed journalists Monday evening, stating U.S. military goals were “pretty well complete” while expressing his belief that the conflict was progressing “very far” beyond its initially projected four-to-five week duration. He echoed these sentiments in statements to CBS News, indicating adversarial forces had essentially been stripped of their naval and aerial combat capabilities.

Oil markets responded immediately. West Texas Intermediate crude, which had momentarily surged beyond $119 per barrel during Sunday’s overnight session, declined to approximately $88. Brent crude retreated to roughly $92 per barrel.

Asian stock indices jumped 2% Tuesday after experiencing a 3.7% decline Monday. Technology equities within the MSCI Asia Pacific index soared 3.5%. Dow Jones futures increased 0.28%, while S&P 500 and Nasdaq 100 contracts similarly advanced.

Within cryptocurrency markets, ether appreciated 2.6% to reach $2,029, recapturing the $2,000 threshold it has struggled to maintain since February’s conclusion. Solana demonstrated the strongest performance with 2.9% gains, hitting $85.67. BNB increased 2.6% to $639. XRP climbed 1.7% to $1.37. Dogecoin managed just 1% growth and continues trading 1.4% lower for the week.

Market intelligence firm Nansen’s analysts observed that cryptocurrency markets had “already absorbed the negatives and priced them in,” indicating reactions were driven by news cycles rather than fundamental economic deterioration.

Institutional Capital Continues Flowing Into Digital Assets

Notwithstanding recent market turbulence, professional investors maintained their acquisition pace. CoinShares documented $619 million in cryptocurrency fund contributions for the week concluding Friday. Bitcoin investment vehicles captured $521 million of those inflows, elevating total assets under management to $108.3 billion.

These capital inflows occurred during a week witnessing the S&P 500 erasing $1 trillion in market capitalization during a single trading session while the U.S. economy eliminated 92,000 employment positions.

Ryan Kirkley, co-founder and CEO of Global Settlement, observed that spot bitcoin ETFs are “attracting capital even as price weakens,” highlighting how institutional participants view price declines as strategic accumulation opportunities.

Ethereum’s subsequent critical resistance sits at $2,500, where FxPro market strategists suggest a sustainable upward trajectory could be validated. Solana continues trading approximately 55% beneath its cycle peak and has lagged ether during every rally attempt since October.

XRP has maintained consolidation between $1.30 and $1.45 throughout most of March. Regulatory clarity stemming from Ripple’s previous legal resolution has proven insufficient to independently catalyze upward price action.

Federal Reserve Decision Emerges as Next Critical Catalyst

Kirkley highlighted that bitcoin’s 90-day correlation coefficient with the S&P 500 has climbed to 0.78, representing one of the strongest relationships since mid-2022. When bitcoin demonstrates tight coupling with traditional equities, alternative cryptocurrencies amplify directional movements in both upward and downward scenarios.

The Federal Reserve convenes March 17–18. Any hawkish communication or indication of potential interest rate increases would disproportionately impact higher-risk digital asset categories.

Regarding corporate developments, Oracle is scheduled to release quarterly results Tuesday, with Adobe reporting Thursday. February’s Consumer Price Index statistics arrive Wednesday, followed by January’s Personal Consumption Expenditures data Friday.

Remember: Preserve all tokens like [[EMBED_0]], [[IMG_0]], [[LINK_START_0]], [[LINK_END_0]], [[SCRIPT_0]], [[FIGURE_0]] etc. exactly as they appear. These are placeholders for embeds, images, and links that must not be changed.

Crypto World

Bitcoin (BTC) Surges Past $70K as Oil Prices Plunge and Trump Signals Iran Conflict Resolution

TLDR

- BTC climbed back above $70,000 following a weekend decline to approximately $65,000

- Crude oil retreating from ~$120 to ~$90 per barrel helped calm inflation concerns

- President Trump’s remarks regarding possible resolution to Iran conflict improved market optimism

- Spot Bitcoin ETFs in the United States recorded $568 million in net inflows last week; total cumulative inflows surpass $55 billion

- Polymarket probability of BTC reaching $75,000 in March surged from 34% to 56% within 24 hours

Bitcoin experienced a significant decline to approximately $65,000 during the weekend before staging a comeback above $70,000 by Tuesday morning during Asian market hours. The downturn was sparked by a spike in crude oil prices following supply disruptions at the Strait of Hormuz, which sent WTI and Brent crude beyond $100 per barrel for the first time in several years.

The turnaround commenced as petroleum prices pulled back and overall market confidence strengthened.

President Donald Trump indicated that the current conflict involving Iran might conclude in the near future. While noting it probably wouldn’t finish this week, he warned that the United States would strike back “20 times harder” should Iran attempt to close the Strait of Hormuz.

Crude oil retreated to approximately $90 per barrel on Tuesday following Monday’s peak near $120. This decline helped alleviate concerns about worldwide inflation acceleration that had disturbed financial markets.

Asian equity markets bounced back on Tuesday, recouping portions of Monday’s declines. U.S. markets also recorded gains during overnight trading, with Bitcoin following the positive shift in risk appetite.

Bitcoin ETF Capital Flows Stay Strong

Spot Bitcoin ETFs in the United States maintained consistent investor interest throughout the market turbulence. Net capital inflows totaled approximately $568 million last week, compared to $787 million the previous week, per SoSoValue data.

Total cumulative net inflows for all U.S. spot Bitcoin ETF offerings have now exceeded $55 billion. Preliminary figures indicated Monday’s inflows were approximately $57 million, although not all providers had released data at publication time.

Market maker Enflux observed that Bitcoin demonstrated greater resilience than equities and certain traditional safe-haven assets during the initial market downturn. The company noted that BTC briefly dropped below $66,000 before finding stability in the $66,000–$68,000 zone.

Market Expectations Pivot Rapidly

Decentralized prediction platform Polymarket revealed a dramatic change in trader forecasts. The likelihood of Bitcoin hitting $75,000 in March soared from approximately 34% to 56% within one day as BTC recovered the $70,000 threshold.

Researchers at Glassnode observed that momentum indicators, ETF demand patterns, and profitability measurements are showing enhancement. They noted, however, that capital flow dynamics remain subdued and speculative market participation continues to be constrained.

From a technical analysis perspective, Bitcoin encounters resistance around the $69,250 and $69,600 levels. Breaking decisively above $69,600 could pave the way toward $70,500 followed by $72,000.

Critical support zones are positioned at $68,000 and $67,500. The primary support floor remains established around $65,500.

Market participants are currently monitoring the upcoming U.S. January CPI data scheduled for Wednesday and the February PCE index release set for Thursday.

Crypto World

Bhutan Offloads $42M in Bitcoin (BTC) Holdings as National Reserve Shrinks by 58%

TLDR

- The Himalayan nation transferred 175 Bitcoin valued at $11.85 million from its sovereign reserves on Monday, per Arkham Intelligence blockchain tracking data.

- The kingdom’s Bitcoin treasury has declined 58% from approximately 13,000 BTC in late 2024 to about 5,400 BTC currently.

- Throughout 2026, Bhutan has liquidated roughly $42.5 million in Bitcoin and USDT, with several transfers directed to QCP Capital trading firm.

- The nation’s sovereign wealth fund, Druk Holding and Investments, oversees these assets accumulated via hydroelectric-powered mining operations with virtually no cost basis.

- Last December, the country committed up to 10,000 BTC toward financing the Gelephu Mindfulness City special economic zone development.

The small Himalayan kingdom of Bhutan has been systematically liquidating portions of its sovereign Bitcoin treasury during the early months of 2026, with on-chain analysis revealing a methodical reduction of the nation’s cryptocurrency reserves.

Druk Holding and Investments, the state-controlled investment vehicle, transferred 175 Bitcoin valued at $11.85 million on Monday to a wallet address that had previously received 184 Bitcoin during February.

The February receiving address subsequently forwarded its assets to yet another wallet, which has accumulated 1,910 Bitcoin since 2024.

Blockchain intelligence firm Arkham Intelligence, which monitors these transactions, reports that Bhutan has transferred approximately $42.5 million in Bitcoin and USDT from its sovereign holdings throughout 2026.

February witnessed four distinct transfers: the 184 Bitcoin transaction, two separate transfers to QCP Capital trading firm totaling approximately 200 Bitcoin valued at $15 million, and a $1.5 million USDT deposit to a Binance wallet.

Arkham observed that when Bhutan previously moved comparable Bitcoin volumes in February, the transaction was associated with a $7 million sale executed through QCP Capital.

The consistent pattern of transfers to identical counterparties in comparable amounts suggests a deliberate treasury management strategy rather than emergency liquidation.

How Bhutan Built Its Bitcoin Stack

The Buddhist kingdom launched government-backed Bitcoin mining operations in 2019, utilizing nearly exclusively surplus hydroelectric power generated from its mountainous river systems.

By the end of 2024, Bhutan had amassed approximately 13,000 Bitcoin, establishing itself among the world’s most significant sovereign Bitcoin holders.

After the April 2024 Bitcoin halving event reduced mining rewards to 3.125 Bitcoin per block, mining economics deteriorated and accumulation rates decreased.

Since Bhutan acquired its Bitcoin through mining operations powered by excess renewable energy, its acquisition cost is essentially negligible — resulting in pure profit from every sale, contrasting sharply with corporate entities that purchased at prevailing market rates.

What Bhutan Is Doing With the Money

Prime Minister Tshering Tobgay disclosed in a March 2025 Al Jazeera interview that revenue from Bitcoin liquidations has financed healthcare initiatives, environmental conservation programs, and government employee compensation.

In December 2025, Bhutan unveiled a national Bitcoin Development Pledge, allocating up to 10,000 BTC to capitalize Gelephu Mindfulness City, a proposed special economic zone designed to utilize digital assets as monetary reserves.

The Numbers Today

Bhutan’s current Bitcoin holdings stand at approximately 5,400 Bitcoin, ranking it seventh globally among sovereign holders.

The United States maintains the largest government-held Bitcoin position at 328,372 Bitcoin, valued at nearly $22 billion.

Bhutan’s treasury, which peaked above $1.5 billion when Bitcoin approached $119,000, now carries a valuation near $374 million with Bitcoin trading around $69,000.

Druk Holding and Investments has not issued a response to media inquiries.

Crypto World

Hyperliquid’s tokenized futures hit $1.2B as traders bet on oil, stocks

Decentralized exchange Hyperliquid’s permissionless platform, which lets anyone create perpetual futures tied to any asset, is more popular than ever.

Since its debut on Oct. 13, the so-called HIP-3 market has steadily gained traction, with open interest — the total value of all active contracts — hitting a record $1.2 billion on Sunday, according to data source ASXN. It has since remained at all time highs in a sign of growing adoption and activity on the platform.

The growth has been driven by booming activity in futures tied to equities and commodities, including oil, gold, and silver. It highlights how decentralized markets are increasingly being used to trade traditional assets, especially as a tool for price discovery over weekends when traditional exchanges are closed.

This story is worth discussing, Arca said in a weekly update, nothing the massive surge in activity on Hyperliquid.

“Interestingly, on Hyperliquid, just 7 of the top 30 markets are crypto pairs, while the vast majority are commodity and equity pairs on Trade.XYZ. This makes sense given the moves in silver, gold, and oil over the past few months, and it is a testament to Hyperliquid that we finally have a real platform where tokenized trading of RWAs is happening in meaningful size,” the firm said.

As of writing, the tokenized equity futures contract XYZ100-USDC led the pack, with open interest of $213 million, followed by the oil-focused CL-USDC at $169.8 million. Other top contracts included futures tied to Brent crude, the S&P 500, silver, and gold.

CL-USDC led in trading volume, seeing $1.62 billion in activity over 24 hours.

This follows the weekend surge in prices for select few crude oil grades, like the Murban crude, which traded at $103 per barrel, as conflict in the Middle East intensified, disrupting tanker flows through the Strait of Hormuz. Major oil benchmarks, such as Brent and WTI, surged above $110 per barrel on Monday, before crashing into two figures.

HIP-3, Hyperliquid’s builder-deployed perpetual futures, have shaken up how markets are made. Instead of limiting new contracts to a small set of validators, anyone can launch a market by staking 500,000 HYPE tokens — which serve as both a security deposit and a guard against spam.

This essentially puts the power to create markets in the hands of the community, opening the door to a far wider range of trading opportunities than traditional platforms allow.

Crypto World

TRON DAO becomes governing member of Agentic AI Foundation

The TRON network has joined the Agentic AI Foundation (AAIF), marking a new step in its push to integrate blockchain infrastructure with emerging artificial intelligence technologies.

Summary

- TRON joined the Agentic AI Foundation as a Gold Member and will serve on its governing board.

- The foundation, backed by the Linux Foundation, aims to develop open infrastructure for autonomous AI agents.

- TRON plans to explore how blockchain networks can support payments and economic activity between AI systems.

According to an announcement from TRON DAO, the blockchain ecosystem has joined the foundation as a Gold Member and will serve on its governing board, participating in the organization’s oversight and development initiatives.

The AAIF operates under the umbrella of the Linux Foundation and aims to build open, interoperable infrastructure for agentic AI systems—autonomous AI programs capable of executing tasks, interacting with digital tools and collaborating with other AI agents.

The foundation was created to support the development of standardized tools and protocols that allow AI agents to operate across platforms and interact with real-world systems more efficiently. Major technology companies and open-source contributors have backed the initiative as part of a broader effort to ensure transparency and interoperability in the emerging AI-agent ecosystem.

TRON said its participation will focus on exploring how blockchain infrastructure can support machine-to-machine economic activity, particularly payments and settlement layers for autonomous software agents. The network processes large volumes of stablecoin transactions and positions its infrastructure as suitable for high-frequency micro-transactions that AI agents could require.

“Excited to see @trondao join @AgenticAIFdn! TRON continues to support and build for this next phase of autonomous economic innovation,” wrote Tron founder Justin Sun.

Agentic AI, systems capable of planning actions and executing tasks independently, has become a growing area of interest across the technology sector as companies explore how autonomous software could perform business processes, financial transactions and digital services.

By joining the foundation, TRON aims to collaborate with other technology organizations and open-source developers working on standards for this emerging “agent economy,” where autonomous AI systems may interact directly with blockchain-based financial infrastructure.

The move highlights a broader trend of convergence between blockchain networks and artificial intelligence, as both sectors experiment with decentralized systems capable of supporting automated digital economies.

Meanwhile, the news did not have much impact on the native token of the Tron (TRX) blockchain. TRX was trading at $0.28 at press time, down 0.7% in the last 24 hours.

Crypto World

Enterprise AI Infrastructure India: Opportunities, Costs & Outlook

AI Summary

- In the evolving landscape of artificial intelligence, India is emerging as a key player in the global AI infrastructure race, with significant investments in computing power, data centers, and specialized chips.

- This blog post delves into the technical foundations, investment dynamics, and future outlook of India’s AI infrastructure ecosystem.

- With explosive data generation and massive global investments, India is witnessing a surge in GPU-powered data centers and AI infrastructure services.

- The rise of AI infrastructure as a service model allows enterprises to access compute resources and AI tools on demand, reducing barriers to AI adoption.

- Despite the capital-intensive nature of building AI infrastructure, strategic opportunities abound for enterprises across sectors.

Artificial Intelligence is no longer just an algorithmic breakthrough; it is an infrastructure race. Around the world, governments and technology companies are investing billions into computing power, data centers, and specialized chips. India is rapidly positioning itself as one of the most strategic locations in this new AI economy.

From hyperscale data centers and GPU clusters to sovereign cloud environments and enterprise-ready AI platforms, the country is building the digital backbone required to support large-scale AI deployments. But behind the headlines lies a deeper story: massive capital investments, infrastructure gaps, and an evolving ecosystem where enterprises increasingly rely on specialized AI infrastructure services to operationalize AI at scale. This article explores the technical foundations, investment dynamics, costs, and long-term outlook of India’s evolving AI infrastructure ecosystem.

The Infrastructure Layer Behind AI Innovation

Most conversations about artificial intelligence revolve around models like GPT, multimodal AI, or generative systems. However, these systems depend heavily on large-scale compute environments. Training a modern large language model requires thousands of GPUs operating simultaneously, high-bandwidth networking, and distributed storage systems capable of processing petabytes of data.

These components collectively form what is now referred to as enterprise AI infrastructure. This infrastructure stack typically includes:

- GPU clusters for training and inference

- High-speed networking such as InfiniBand

- Distributed data pipelines

- Model training frameworks

- Scalable orchestration systems

Companies deploying AI at scale rely on an AI infrastructure platform that integrates these components into a unified environment capable of handling model development, training, deployment, and monitoring. In many cases, enterprises no longer build this stack from scratch. Instead, they partner with an AI Development company that provides end-to-end AI development infrastructure tailored to enterprise workloads.

Why India is Emerging as a Global AI Infrastructure Hub

India’s emergence as an AI infrastructure destination is driven by several macroeconomic and technological factors.

1. Explosive Data Generation

India generates nearly 20% of the world’s data, yet it currently accounts for only about 3% of global data center capacity. This imbalance is rapidly driving infrastructure expansion across the country.

As AI adoption increases across industries like banking, healthcare, telecom, and logistics, demand for computing infrastructure is accelerating.

To meet future demand, experts estimate India will require 45–50 million square feet of additional data center space and roughly 40-45 terawatt hours of power by 2030. This scale of expansion signals a massive opportunity for companies delivering AI infrastructure services.

2. Massive Global Investments

Global technology companies are pouring capital into India’s AI ecosystem.

For example, Microsoft recently announced a $17.5 billion investment to expand cloud and AI infrastructure in India between 2026 and 2029, including hyperscale data centers and sovereign cloud capabilities.

The initiative includes:

- New hyperscale cloud regions

- AI compute clusters powered by GPUs

- Sovereign cloud architecture for regulated industries

- National AI skilling initiatives

This type of investment is transforming India into a strategic node in the global AI cloud infrastructure landscape.

3. Data Center Expansion and GPU Clusters

India’s AI boom is strongly tied to the rapid development of GPU-powered data centers.

Specialized AI facilities now deploy thousands of GPUs connected through high-bandwidth networking to support large-scale model training.

Recent industry deployments indicate:

- AI data centers hosting 8,000-10,000 cloud GPUs per facility

- High-speed networking reaching 3.2 Tbps interconnect speeds

- Rack densities exceeding 200 kW per rack for AI workloads

Such environments form the backbone of modern AI infrastructure platforms used by enterprises building generative AI and predictive models.

The Rise of AI Infrastructure as a Service (AIaaS)

While hyperscalers build massive infrastructure environments, enterprises increasingly prefer consuming these capabilities as managed services.

This shift has led to the rise of AI infrastructure as a service, a model where organizations access compute resources, GPU clusters, and AI development tools on demand. Instead of investing millions into physical infrastructure, companies can deploy AI workloads through scalable cloud environments. Typical AIaaS offerings include:

- GPU-based compute clusters

- Model training pipelines

- Automated ML infrastructure

- Data engineering frameworks

- AI model hosting and inference services

This model drastically reduces the barrier to entry for enterprises adopting artificial intelligence. Organizations can focus on building AI applications rather than managing the underlying AI development infrastructure.

The Cost of Building AI Infrastructure in India

Despite the rapid expansion, building AI infrastructure is an extremely capital-intensive process. A typical hyperscale AI data center includes several cost layers:

AI compute hardware is the most expensive component. Advanced GPUs used for AI workloads can cost between $25,000 and $40,000 per unit, depending on the architecture and memory configuration. Large training clusters often require thousands of GPUs operating in parallel.

AI data centers are highly energy intensive. High-performance compute environments require an enormous electricity supply for both compute and cooling. In many facilities, electricity consumption per rack can exceed 100-200 kW, far higher than traditional data centers. Power costs, therefore, become a critical factor when designing enterprise AI infrastructure.

Training large models requires an extremely fast networking infrastructure. Technologies such as RDMA networking and InfiniBand enable GPU clusters to communicate with minimal latency. At the same time, distributed storage systems must handle massive training datasets efficiently. These layers form the core of a scalable AI infrastructure platform.

- Talent and Operational Costs

Infrastructure alone does not guarantee AI success. Organizations must also invest in:

- ML engineers

- Data scientists

- Infrastructure specialists

- AI operations teams

This talent layer is often delivered through specialized AI infrastructure services offered by advanced AI Development companies.

Strategic Opportunities for Enterprises

India’s AI infrastructure expansion is creating a wide range of opportunities across sectors.

Banks, insurance companies, and healthcare providers are increasingly deploying AI to automate operations, detect fraud, and deliver predictive insights. Access to scalable AI cloud infrastructure enables these organizations to build enterprise AI capabilities without building data centers internally.

India’s startup ecosystem is rapidly embracing AI. Access to GPU clusters and AI infrastructure as a service allows startups to experiment with large models and generative AI applications that were previously accessible only to major technology companies.

- Sovereign AI and National AI Platforms

Governments and enterprises are also exploring sovereign AI strategies. These initiatives focus on building national AI models trained on local data and hosted on domestic infrastructure. This approach strengthens regulatory compliance, data privacy, and technological independence.

Challenges India Must Overcome

Despite strong momentum, India’s AI infrastructure journey faces several challenges.

AI workloads require massive GPU availability. However, global supply chains remain constrained, creating bottlenecks in infrastructure deployment.

AI data centers consume large amounts of electricity. Scaling AI infrastructure while maintaining sustainable energy usage will become a critical challenge.

While India produces a large number of engineers annually, the number of professionals with deep AI infrastructure expertise remains limited. Bridging this gap will require continued investment in AI education and skill development.

Now is the time to Build the Foundation for India’s AI Revolution

The Future Outlook: India’s AI Infrastructure in the Next Decade

India’s AI infrastructure expansion is still in its early stages. Over the next decade, several major trends will shape the ecosystem.

- Hyperscale AI Data Centers

Large-scale AI compute facilities capable of hosting tens of thousands of GPUs will become more common. These data centers will serve as regional AI hubs supporting enterprises, governments, and startups.

Businesses will increasingly rely on integrated AI infrastructure platforms that combine compute, data pipelines, model management, and deployment tools. These platforms will simplify AI adoption across industries.

- AI Infrastructure as a Strategic Industry

Infrastructure providers, cloud companies, and specialized AI Development companies will play a central role in enabling enterprise AI transformation. Companies that deliver scalable AI infrastructure services will become essential partners for enterprises navigating the AI economy.

The Road Ahead for AI Infrastructure

India is entering a decisive phase in the global AI economy where infrastructure capacity will determine how quickly innovation moves from research labs to real-world deployment. As enterprises adopt large language models, real-time analytics, and autonomous systems, the demand for scalable enterprise AI infrastructure will continue to accelerate. Organizations must therefore prioritize resilient compute environments, secure data pipelines, and high-performance deployment frameworks that support long-term AI initiatives. Building this capability often requires collaboration with a specialized AI Development company experienced in designing production-grade AI infrastructure platforms.

Antier enables enterprises to establish scalable AI development infrastructure, helping organizations deploy advanced AI systems with robust AI infrastructure services tailored for enterprise-scale innovation and operational efficiency.

Crypto World

Hyperliquid crypto price soars as Arthur Hayes predicts HYPE will hit $150

- Arthur Hayes predicts the Hyperliquid crypto price could reach $150.

- Hayes’ prediction is supported by strong trading activity, which fuels more buybacks.

- The immediate resistance levels to watch sit at $35.03, $39.87, and $43.82.

The price of Hyperliquid (HYPE) has climbed steadily as it responds to growing bullish sentiment around the fast-rising derivatives exchange.

At press time, the token was trading at around the $33 after a strong recovery from recent lows.

Why is the price of Hyperliquid crypto rising?

Much of today’s Hyperliquid crypto price surge can be attributed to the excitement around Arthur Hayes’ prediction that the HYPE token could surge to $150 this year.

My essay on why $HYPE is going to $150 by August 2026.

— Arthur Hayes (@CryptoHayes) March 9, 2026

This bold forecast has quickly become one of the most talked-about topics in the crypto derivatives market.

Hayes believes the rally could unfold over the next few months as the Hyperliquid exchange continues to expand its ecosystem and attract new trading activity.

He even described HYPE as his largest liquid altcoin bet, a statement that immediately caught the attention of traders looking for the next major breakout project.

Notably, Hayes’ prediction comes at a time when decentralised derivatives platforms are gaining ground in the broader crypto industry.

More traders are exploring alternatives to centralised exchanges, especially platforms that offer deep liquidity and fast execution, and Hyperliquid has managed to capture that demand by focusing on high-performance infrastructure and a streamlined trading experience.

As a result, Hyperliquid has rapidly built a reputation as one of the most active decentralised derivatives venues in the market.

Strong trading activity supports the bullish HYPE outlook

One of the key factors supporting the bullish narrative is the platform’s growing trading activity.

Higher trading volumes translate directly into revenue for the protocol, and a large portion of this revenue is used to buy back HYPE tokens from the market.

These buybacks tighten the supply of HYPE tokens available on exchanges and help strengthen price momentum during periods of rising demand.

Nevertheless, analysts believe that reaching Hayes’s ambitious $150 target would likely require a major expansion in exchange revenue.

That kind of growth would depend heavily on continued adoption of derivatives trading within the crypto sector.

The key technical levels to watch

Beyond the fundamental story, technical indicators are also providing clues about where the Hyperliquid (HYPE) price could move next.

Recent price movements show that $32.28 has emerged as a short-term support zone since it has repeatedly held during recent pullbacks.

If that support gives way, the next support level appears near $28.98, which has acted as a historical price floor.

On the upside, traders should closely watch the $35.03 resistance level.

The cryptocurrency has tested this zone several times in recent sessions.

A clear breakout above that level could open the door for a move toward $39.87, which analysts say represents the next major resistance area.

If momentum continues beyond that point, the third resistance level sits around $43.82.

Breaking through these resistance levels would likely confirm a stronger bullish trend in the months ahead, likely towards the Arthur Hayes-predicted price target.

Crypto World

RWAs Will Run on Two Blockchain Rails, Says Redstone Co-Founder

Institutional adoption of real-world assets (RWAs) is splitting between public and permissioned networks, exposing a divide between the liquidity advantages of blockchains like Ethereum and the privacy demands driving systems such as Canton Network.

The divergence is becoming more pronounced as tokenized assets gain traction among major asset managers.

Marcin Kaźmierczak, co-founder of blockchain oracle provider RedStone, said product development is likely to occur on public blockchains, while permissioned systems are better suited for institutional processes that require confidentiality.

“There are some operations between institutions that simply have to stay private, and this is the value proposition that Canton offers very effectively,” Kaźmierczak told Cointelegraph.

Digital Asset’s Canton Network lets banks and asset managers tokenize and settle RWAs while keeping transaction details visible only to involved parties. The network says it processed $6 trillion in RWA value in 2025.

Rather than converging on a single architecture, banks and asset managers are building parallel systems designed to serve different functions within the tokenized financial stack, according to Kaźmierczak.

Ethereum’s Merge was Wall Street’s tokenization moment

Tokenization has become one of the main narratives behind institutional blockchain adoption beyond spot crypto exposure and exchange-traded funds (ETFs).

In June 2024, McKinsey estimated that tokenized assets could reach around $2 trillion by 2030. More optimistic projections have much higher forecasts, including a $30.1-trillion target by 2034 set by Standard Chartered and Synpulse.

Regulatory clarity in the US has contributed to the shift. The GENIUS Act, passed in 2025, created a federal framework for stablecoins, which serve as the settlement layer for many tokenized assets.

Kaźmierczak said confidence in Ethereum began improving earlier, after the network transitioned to proof-of-stake in 2022.

“In 2022, when I was talking to institutions, the Merge was like a big question mark for those institutions,” Kaźmierczak said. “They saw it worked without any hiccups, so it gave them this confidence.”

Kaźmierczak claimed that RWA projects among institutions started in 2023 or 2024, but as institutions work with yearly budgets, developments and project launches don’t occur in weeks or months like they do in crypto. That led to a cluster of institutions announcing tokenization projects last December, he said.

“It’s not that they started in Q4 last year. No, they started a year before, and now we are seeing the fruits.”

Today, over $26.4 billion worth of RWA tokens use blockchains as distribution layers, and over $15 billion of those are on Ethereum. It also holds the deepest liquidity as the veteran in the smart contracts circle, with over $160 billion in stablecoins.

Related: Why institutions still prefer Ethereum despite faster blockchains

Banks are splitting activity across public and private chains

Institutions separate market-facing activity from internal operations. On one hand, public blockchains provide liquidity, composability and access to decentralized finance (DeFi) strategies such as lending and tokenized vaults. On the other hand, permissioned networks are preferred for settlement processes, bilateral transactions and internal asset management workflows that cannot be exposed on open networks.

Systems such as Canton allow financial firms to automate those processes while keeping transaction details restricted to counterparties. That structure is closer to existing traditional financial (TradFi) infrastructure.

That division suggests institutional blockchain adoption may not converge on a single network model. Instead, financial firms appear to be building parallel infrastructure, with public chains handling liquidity and permissioned systems supporting operational processes behind the scenes, according to Kaźmierczak.

“There are some operations between institutions that just have to stay private, and this is the value proposition that Canton offers very effectively. That’s the reason we want to be on both of those legs,” he said.

Several major financial institutions were involved in the Canton Network from its inception. Digital Asset and a consortium of firms, including Microsoft, Goldman Sachs and Deloitte, announced the network’s launch in May 2023. In September 2024, Digital Asset and the Depository Trust & Clearing Corporation completed a pilot of the US Treasury Collateral Network on Canton.

According to RWA.xyz, the Canton Network has over $313 billion in represented RWA tokens, referring to assets that use the blockchain as a recordkeeping layer.

Related: Privacy tools are rising behind institutional adoption, says ZKsync dev

ZK-proofs vs. permissioned privacy

One of the clearest distinctions between the two institutional tracks lies in how privacy is achieved. While many blockchain projects pursue confidentiality through cryptographic tools such as zero-knowledge (ZK) proofs, Canton relies on permissioned data sharing, where transactions are visible only to the parties involved.

Not everyone in the industry agrees that this is the strongest model. Matter Labs CEO Alex Gluchowski said in a social media exchange with Digital Asset’s Yuval Rooz that ZK systems strengthen blockchain security by requiring cryptographic proofs that every state transition follows the protocol’s rules. Even if operators or administrators are compromised, attackers cannot insert invalid transactions into the ledger without generating a valid proof of execution.

Rooz, in a blog post, claimed that fully opaque implementations of ZK systems could make it harder to audit activity in financial markets. If transaction data becomes entirely hidden, errors or fraud could remain undetected, potentially recreating the kind of “black box” conditions that once enabled corporate scandals such as Enron.

The disagreement highlights a broader architectural question for institutional blockchain adoption, as Kaźmierczak pointed out.

Financial firms are experimenting with multiple approaches to balancing privacy, verifiability and control. Public networks continue to host market-facing liquidity and DeFi activity, while permissioned systems replicate institutional processes that require confidentiality, forming parallel rails for the tokenized financial system.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

How United Nations Development Programme is using blockchains for public infrastructure

A new United Nations Development Programme report outlines how blockchain can support public systems.

Public institutions are under pressure to modernize faster than their systems were built to handle. In its recent report, New Tech, New Partners: Transforming development in the digital era, the United Nations Development Programme (UNDP) outlines a model for using blockchains as part of a broader effort to modernize public systems. The publication showcases over 40 pilot projects around the world that apply blockchain technology to improve transparency, speed and accountability of public systems. This ranges from payment infrastructure and social safety nets to climate finance and community-level funding mechanisms, enabled by fundraising platforms, wallets and digital certificates.

The UNDP uses a pipeline model, which creates purpose-built partnerships that bring governments, blockchain startups and local companies together to solve public sector problems. Institutions get an opportunity to test new tools through small, problem-led initiatives and specific use cases. These tools are implemented on a local level and designed to solve specific problems, such as inefficient payment rails for micro-entrepreneurs or regional ESG control.

In its framework, UNDP treats blockchains as a trusted ledger for coordination and verification. The ability of blockchains to support shared records, traceable transactions and rule-based processes across multiple actors makes them a useful tool for governmental systems. UNDP also makes clear that these benefits are conditional. Poor governance, weak privacy protections and flawed technical design can create serious risks, such as defects in smart contracts or Illicit use of payment systems. The report reaches a pragmatic conclusion: Blockchain can be useful, but only when institutional safeguards are built in from the start and the technology is adopted responsibly with robust oversight.

Central to UNDP’s approach is a commitment to platform-agnostic ways of working, which ensures that no single provider or protocol creates new dependencies, and that the digital infrastructure being built today remains open, interoperable, and genuinely in service of people and public purpose.

The report showcases how blockchains can be used to make public institutions more efficient and transparent, with examples from more than 40 countries across payments, financial access, identity systems and climate-related programs. Examples include projects such as crypto wallets for informal business payments, the use of eco-credit tokens and more. The cases also show how digital tools can help institutions extend services in developing nations, where trust is limited and infrastructure is fragmented.

Explore the full UNDP report to see the complete framework, lessons and portfolio of use cases.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. This article is for general information purposes and is not intended to be and should not be taken as, legal, tax, investment, financial, or other advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph. Cointelegraph does not endorse the content of this article nor any product mentioned herein. Readers should do their own research before taking any action related to any product or company mentioned and carry full responsibility for their decisions. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Vitalik Buterin Envisions One-Click Institutional Staking

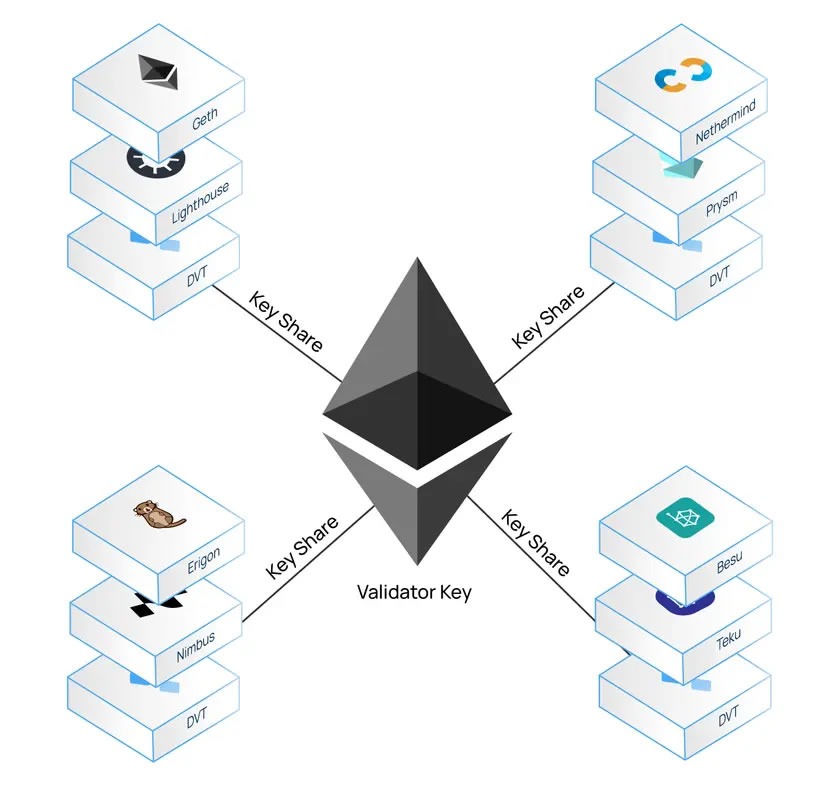

Ethereum co-founder Vitalik Buterin has revealed the Ethereum Foundation used a simplified distributed validator technology called DVT-lite to stake 72,000 Ether in February, tech he says could make staking for institutions much easier.

“My hope for this project is that in the process, we can make it maximally easy and one-click to do distributed staking for institutions,” said Buterin on X on Monday.

Buterin explained that with DVT-lite, users can “choose which computers run their nodes, make a config file where they all have the same key, and then from there everything gets set up automatically.”

DVT-lite is a simplified form of distributed validator technology tailored for easier deployment, especially in institutional or semi-professional Ethereum staking setups.

In regular solo staking, everything is run on one computer, which can result in “slashing” or penalties if it crashes, gets hacked, or loses internet. Full DVT splits the secret keys across many computers that constantly communicate, which is very secure, but complicated to set up.

DVT-lite uses the same validator key on several computers, so if one computer dies, another quickly takes over, resulting in almost no downtime and very low risk of penalties.

The Ethereum Foundation started its staking program using the technology in late February, and the assets are currently sitting in the validator entry queue waiting to be staked on March 19.

“One click” staking for institutions

Buterin said that the idea that running infrastructure is this “scary complicated thing” where each person participating must be a professional is “awful and anti-decentralization, and we must attack it directly.”

He added that there should be a “docker container” or “nix image” or similar, which has “one click” or command line per node that automates the process of staking.

Related: AI ‘vibe coding’ could put Ethereum roadmap ahead of schedule: Vitalik Buterin

Buterin said he plans to use DVT-lite soon and hopes more institutions holding ETH can stake in this way.

“We want the authority over staking nodes to be highly distributed, and the first step to doing this is to make it easy.”

In January, he suggested “native DVT” network integration, which would allow stakers to “stake without fully relying on one single node.”

Big demand for staking despite low prices

There is still a huge demand for Ether (ETH) staking despite its bear market price action.

There are currently 3.2 million ETH in the validator entry queue, with a 55-day wait, and just 29,000 in the exit queue with a 12-hour wait, according to ValidatorQueue.

There are currently 37.5 million ETH staked, worth around $76.5 billion at current prices (around the same as the market cap of DoorDash or Motorola), and representing 31% of the total supply.

Magazine: China’s ‘50x’ blockchain boost, Alibaba-linked AI mines Bitcoin: Asia Express

-

Business4 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Ann Taylor

-

News Videos21 hours ago

News Videos21 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World17 hours ago

Crypto World17 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports5 days ago

Sports5 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports3 days ago

Sports3 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat5 days ago

NewsBeat5 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business2 days ago

Business2 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

NewsBeat8 hours ago

NewsBeat8 hours agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech18 hours ago

Tech18 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death

-

Business13 hours ago

Business13 hours agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat5 days ago

NewsBeat5 days agoGood Morning Britain fans delighted as Welsh presenter returns to host ITV show