Crypto World

Franklin Templeton Holds Over 118M XRP in Latest ETF Filing

TLDR

- Franklin Templeton’s XRP ETF holds 118 million XRP, valued at approximately $216.37 million by the end of December 2025.

- The ETF, launched on November 24, 2025, is entirely focused on XRP, with 100% of its assets allocated to the digital asset.

- As of February 17, 2026, the ETF’s net asset value (NAV) is $16.08, reflecting a year-to-date return of -18.54%.

- Since its launch, the ETF has seen a 23.20% decline in returns, primarily due to fluctuations in XRP’s price.

- Other major cryptocurrency ETFs, such as those from Bitwise and Grayscale, have contributed to the growing institutional exposure to XRP.

Franklin Templeton’s XRP exchange-traded fund (ETF), launched in late November 2025, has drawn attention for its growing holdings. The fund, trading under the ticker XRPZ, provides investors with exposure to XRP without directly purchasing the digital asset. As of December 31, 2025, the ETF’s holdings amounted to 118 million XRP, valued at $216.37 million.

118 Million XRP on the Books

According to Franklin Templeton’s latest SEC filing, the firm’s XRP ETF officially started on November 24, 2025. By the end of the year, the fund held 118,387,154 XRP, worth approximately $216.37 million. The report confirmed that 100% of the ETF’s net assets were invested in XRP.

The ETF’s primary structure focuses entirely on XRP, a pure-play approach without diversification into other assets. As of February 17, 2026, Franklin Templeton’s XRP ETF reached $243.6 million in total net assets. Despite the challenges in the crypto market, the fund has continued to attract institutional investment.

Franklin Templeton ETF Performance

Despite strong institutional interest, Franklin Templeton’s XRP ETF has faced challenges with market volatility. As of mid-February 2026, the fund’s net asset value (NAV) stood at $16.08, reflecting a year-to-date return of -18.54%. Since its inception, the ETF has experienced a decline of 23.20%, primarily due to the fluctuations in XRP’s price.

The cryptocurrency’s price saw a drop from $2.577 at launch to $1.11 by February 2026. At present, XRP price trades around $1.48, still significantly lower than its price at launch. These fluctuations have affected investor sentiment, as the firm cautions that past performance does not guarantee future results.

Franklin Templeton’s XRP ETF is part of a broader trend of institutional involvement in cryptocurrency investment products. Other major ETFs, including those from Bitwise, Canary Capital, and Grayscale, have also accumulated significant amounts of XRP. Combined with Franklin Templeton, these ETFs now control $1.06 billion in total assets focused on XRP.

Crypto World

Bitcoin Trades Narrow Range As Resistance Holds Near $71K

Bitcoin continued to trade in a small range on Wednesday as traders kept their eyes on a major resistance point near $71,400, and analysts indicate that any decisive move above the current price would mark the next significant direction for the cryptocurrency.

Bitcoin, the largest cryptocurrency, is currently trading around 70,335.18, down 2.13% over the last 24 hours, according to market data. The asset has experienced a mix of moves in recent sessions, though the trend has been short-term, reflecting a balance between buyers and sellers.

Charts Show Bitcoin Consolidating Near Key Levels

TradingView records indicate that Bitcoin is trading around $70,200 following a recovery after hitting new lows of about $66,700. The technical charts show that the cryptocurrency has been trading within a well-established channel, implying that the market has not adopted a strong direction of the bullish and bearish forces.

The indicators of momentum also indicate a neutral view. The Relative Strength Index (RSI) stands at approximately 55 which is generally referred to as a balanced market condition and not the strong upward or downward pressure.

In the meantime, the 50-day moving average of Bitcoin is located at around 71,400 and it is also an important resistance point. Analysts believe that a consistent move above the line would lead to a new wave of bullish activity, and failure to do so will most likely have the asset oscillating in its current range.

Analyst Highlights Bitcoin’s Current Consolidation Phase

Ali Martinez, a crypto market analyst, recently emphasized the Bitcoin consolidation stage in a post on the social platform X.

As of now, Bitcoin is in the range of 71,827 to 62,772. According to Martinez, it has been between this range in the past few weeks. The analyst observed that once the markets have been in a long period of consolidation, it seems to become more volatile; when price breaks above resistance or below support.

In the meantime, traders are watching resistance near $71,000–$71,400 and support around $66,000. A break above resistance could signal further gains, while a drop below support could trigger a more significant correction.

Unless these levels are decisively violated, analysts expect the market to remain range-bound as it awaits the next trigger point.

Crypto World

BTC trapped in tight range as growing open interest hints at defensive bets: Crypto Markets Today

Bitcoin traded recently around $70,100, down 0.1% since midnight UTC.

The largest cryptocurrency has been trapped in a tight trading range between $71,700 and $69,000 for the past 48 hours as volatility begins to wane despite continued conflict in the Middle East.

Oil rose back toward $100 per barrel on Thursday after a sixth ship was reportedly attacked by Iran on the Strait of Hormuz, adding to concerns about global energy supply.

The crypto market, however, remains relatively unperturbed; Hyperliquid’s HYPE token continued its ascent toward $40, adding 2.5% since midnight while MORPHO, ETHFI, and XMR all posted gains.

U.S. stock futures continued to show weakness with the Nasdaq 100 and S&P 500 index futures both losing around 0.6% overnight. The Dollar Index (DXY) moved back toward 100 after Wednesday’s CPI figures, putting a stop to any potential rate cuts.

Derivatives positioning

- Crypto futures open interest (OI) has increased by 2% to $102 billion in the past 24 hours.

- OI in bitcoin and ether rose by 2% and 4%, respectively, while annualized perpetual funding rates and cumulative volume delta (CVD) have remained flat to negative. This suggests that the recent build-up in open interest is being driven more by defensive, bearish positioning than by aggressive long-side bets.

- Decentralized exchange Hyperliquid’s HYPE token has gained 9% in 24 hours, extending the recent bull run. The rally, however, has yet to galvanize demand for leveraged bets, as evidenced by futures OI, which remains steady near multimonth lows of about 40 million HYPE.

- Activity in tether gold (XAUT) continues to cool, with futures OI slipping to 93.50 XAUT, the lowest since Feb. 28, and down notably from the March 2 high of 149.72K XAUT. This shows that gold-linked assets are slowly falling out of favor as the rally in spot gold stalls.

- Bitcoin and ether’s 30-day implied volatility indices, BVIV and EVIV, remain steady despite a renewed overnight rally in oil and a decline in U.S. stock futures.

- The steadfastness is a sign traders are not yet seeing a meaningful shift in forward-looking risk or cross‑asset contagion for major cryptocurrencies.

- On Deribit, bitcoin and ether put options, which offer protection against a market decline, continue to trade at a premium to call options. There is notable interest in the $20,000 put option, a bet that BTC’s spot price will plunge to below that level.

Token talk

- The altcoin market continues to show resilience despite a risk-off environment in global markets.

- Decentralized finance (DeFi) token SKY posted a 7.6% gain over the past 24 hours while AI-focused bittensor (TAO) is up by around 4.5%.

- One token that has failed to keep tabs with its peers has been midnight (NIGHT), the privacy token set up by Cardano founder Charles Hoskinson. NIGHT is currently trading at $0.046, having dropped 10% in the past 24 hours after Tuesday’s listing on Binance gave holders an off-ramp to sell.

- The altcoin-heavy CoinDesk 80 (CD80) Index was the best-performing benchmark over the past 24 hours, adding 2.5% while the bitcoin-heavy CoinDesk 5 (CD5) is up by only 0.9%.

- The altcoin market’s next move depends on whether bitcoin can break out of the current range with a move above $74,000, a breakout on convincing volume followed by a consolidation would lead to rotation into more speculative altcoins.

Crypto World

Eightco shares jump $125 million funding commitment from Btmine, ARK, Kraken parent Payward

Eightco Holdings’ (ORBS) shares rose as much as 25% in early trading after the firm said it secured $125 million in new institutional funding commitments and made $75 million in AI and crypto investments.

The commitments include $75 million from Bitmine Immersion Technologies (BMNR), an ether (ETH) treasury asset company that holds a near 7% stake in the firm, according to MarketScreener data. Bitmine Chairman Tom Lee will join the board.

ARK Invest, whose chief futurist, Brett Winton, becomes an adviser, and Payward, the parent company of crypto exchange Kraken, each committed to $25 million. Several other firms, including Coinfund, Pantera and FalconX, also agreed to support the company.

Alongside the funding, Eightco said it has already deployed capital into two high-profile investments. These include $50 million into OpenAI, the company behind ChatGPT, and $25 million into Beast Industries, the business arm of YouTube creator MrBeast.

The company, formerly known as Cryptyde and active in packaging and logistics, also maintains a large treasury position in , a cryptocurrency tied to the World identity network co-founded by OpenAI CEO Sam Altman.

The project uses biometric verification through specialized devices known as “Orbs” to create a digital identity that confirms a user is a real person rather than an automated bot.

That system aims to address a growing problem on the internet: distinguishing human activity from content produced by AI systems.

Eightco has accumulated roughly 277 million WLD tokens, close to 10% of the token’s circulating supply, along with 11,000 ether and $82 million in cash reserves, according to a company update.

Dan Ives, who chaired the company during its 2025 strategic shift, will step down.

Bitmine’s Lee said the strategy connects several major technology trends.

“To me, there is tremendous synergy between Proof of Human (Worldcoin), the OpenAI foundational models, and connectivity to the greatest content creator in the world, MrBeast,” he said in a statement.

Bitmine invested $200 million in Beast Industries in January.

WLD’s price rose more than 2% on the announcement to now trade at $0.362 per token. ORBS were recently trading at $1.00.

Crypto World

Nio (NIO) Stock Climbs on Robust Q4 Earnings and Wave of Positive Analyst Revisions

TLDR

- Nomura initiated a Buy rating on NIO with a $6.60 price objective, suggesting approximately 34% potential gains from current trading levels

- Macquarie increased its price objective to $6.50 while maintaining an Outperform stance following fourth-quarter 2025 earnings

- Fourth-quarter revenue climbed 76% annually and 59% sequentially to reach RMB34.7 billion

- Vehicle gross margin expanded to 18.1% during Q4, compared to 13.1% in the prior-year period

- NIO projected Q1 2026 vehicle deliveries between 80,000 and 83,000 units, with revenue expectations exceeding analyst estimates

The Chinese electric vehicle manufacturer Nio has experienced an eventful week. Following the release of impressive fourth-quarter 2025 financial results, the company secured multiple analyst upgrades and elevated price objectives from prominent Wall Street firms.

The standout metric proved difficult to overlook. Fourth-quarter total revenue reached RMB34.7 billion, representing a 76% increase compared to the same quarter last year and a 59% jump from the previous quarter. Such robust expansion typically captures market attention.

Nomura made the boldest move, elevating NIO from a Neutral stance to Buy. The investment bank established a $6.60 price objective, reduced from its earlier $8.40 forecast, yet still suggesting roughly 34% upside potential from the stock’s recent trading level around $4.94.

The brokerage highlighted two consecutive quarters of operational improvements, emphasizing increased vehicle deliveries and enhanced expense management as catalysts for stronger profitability. Nomura now anticipates NIO will achieve non-GAAP operating profit breakeven during 2026.

Despite reducing delivery projections for 2026 and 2027 — acknowledging intensified competition within the EV sector — Nomura still forecasts vehicle deliveries will expand at approximately 25% compounded annual growth between 2025 and 2028. Revenue expansion is anticipated at roughly 21% during the identical timeframe.

Gross margin projections for 2026 and 2027 received upward revisions, while operating margin estimates were boosted by over 3 percentage points for both fiscal years. This represents a substantial reassessment of the company’s cost efficiency.

Enhanced Profitability Fuels Positive Analyst Sentiment

Macquarie similarly elevated its price objective, advancing to $6.50 from $6.10, while preserving its Outperform recommendation. The firm identified vehicle margin expansion as the primary narrative.

Vehicle margin reached 18.1% during Q4 2025, climbing significantly from 13.1% during the comparable quarter one year prior. The recently launched ES8 model received credit for contributing substantially to that improvement. Additional sales margin widened to 11.9% from merely 1.1% in Q4 2024.

NIO also reduced R&D expenditures through workforce optimization and intends to maintain quarterly R&D costs within the RMB2.0 billion to RMB2.5 billion range. The manufacturer generated positive operating cash flow during the quarter, which Macquarie noted reduces future capital-raising requirements.

Macquarie did reduce its fiscal 2026 volume projection by 8%, acknowledging subdued near-term demand and escalating competition within the EV SUV category from rivals including Li Auto, XPeng, Xiaomi, and Seres. However, it narrowed its 2026 net loss forecast to RMB1.8 billion from RMB4.5 billion, reflecting decreased operating costs and an improved product portfolio.

Additional Financial Institutions Provide Analysis

BofA Securities increased its price objective to $6.70 while maintaining a Neutral recommendation, observing that Q4 performance largely aligned with projections. Morgan Stanley reaffirmed its Overweight rating with a $7.00 price target following optimistic delivery growth commentary from NIO’s founder.

For Q1 2026, NIO provided delivery guidance of 80,000 to 83,000 vehicles. The midpoint sits approximately 8% below Bloomberg consensus figures but 2% above Macquarie’s projection. Revenue guidance ranging from RMB24.5 billion to RMB25.2 billion exceeded both Macquarie’s estimate and broader consensus expectations.

NIO has three additional mid- to large-size SUV models under development, with two variants scheduled to debut during Q2 2026.

The stock had appreciated 17.77% during the preceding week through Wednesday’s trading session, with a market capitalization standing at $14.41 billion.

Crypto World

Marathon Petroleum (MPC) Stock Surges After Blowout Q4 Earnings and Strong Cash Returns

Key Highlights

- Marathon Petroleum reported Q4 2025 adjusted EPS of $4.07, surpassing analyst consensus of $3.01 by more than 35%

- Annual 2025 adjusted EBITDA reached approximately $12 billion

- Shareholders received $1.3 billion in Q4 distributions, contributing to $4.5 billion total for the year

- Marathon closed 2025 with $3.7 billion cash position and zero utilization of its $5 billion revolving credit line

- Wall Street analysts set price targets between $210 and $225, maintaining predominantly bullish ratings

Marathon Petroleum (MPC) delivered an exceptional fourth quarter in 2025, capturing Wall Street’s attention with results that significantly exceeded expectations. The refining giant reported adjusted earnings reaching $4.07 per diluted share, obliterating the consensus forecast of $3.01 by over 35%. Quarterly revenue totaled $33.4 billion, marginally topping analyst projections.

Marathon Petroleum Corporation, MPC

Quarterly net income reached $1.5 billion, translating to $5.12 per diluted share. This represented a dramatic improvement from the $371 million recorded in the year-ago quarter. Adjusted EBITDA for the period climbed to $3.5 billion versus $2.1 billion in Q4 2024.

The Refining & Marketing business unit emerged as the primary catalyst behind the earnings outperformance. This segment generated EBITDA of $1.997 billion while maintaining crude capacity utilization at 95%. The R&M margin expanded to $18.65 per barrel.

Operational refining costs increased to $5.70 per barrel, yet the margin growth easily absorbed this headwind. Capture rates exceeding 100% played a critical role in the quarter’s success.

The midstream operations added meaningful value, producing EBITDA of $1.7 billion. Enhanced throughput volumes and contributions from newly acquired assets drove this performance, though some asset sales provided a partial offset.

The Renewable Diesel business unit contributed $7 million in EBITDA. While not the primary growth driver, it remains a developing component of the portfolio.

Marathon concluded the year holding $3.7 billion in cash. The company maintained a pristine balance sheet with zero outstanding borrowings against its $5 billion revolving credit facility entering 2026.

Shareholder Returns Remain a Strategic Priority

The refiner distributed $1.3 billion to investors during Q4. Throughout 2025, total distributions reached $4.5 billion. Since 2017, Marathon has allocated over $45 billion toward share repurchases, meaningfully reducing outstanding shares and enhancing per-share financial metrics.

Operating cash flow for 2025 approached $8.3 billion. Management continues executing a balanced capital allocation strategy combining regular dividends with aggressive share buybacks, which forms a cornerstone of the investment thesis.

Analyst price objectives have moved upward recently. Wall Street firms have published targets of $210, $217, and $225 during February. The consensus 12-month price target across coverage sits slightly above $204, with most analysts maintaining Buy-equivalent ratings.

Shares have been changing hands near the high-$190s range, marking substantial year-to-date appreciation. The stock advanced approximately 3% on March 11 and continued extending gains throughout the week.

Favorable Market Conditions Supporting Performance

Escalating geopolitical instability across the Middle East has driven oil prices upward and improved investor sentiment toward domestic refiners. Market participants are anticipating tighter product supply-demand dynamics and more robust refining crack spreads.

Elevated crude prices present both challenges and opportunities for Marathon. While input costs increase, refining margins can expand when finished product pricing outpaces crude appreciation. Current market conditions suggest investors are betting on this favorable scenario.

Institutional ownership patterns show continued strong interest from large asset managers. Some major shareholders reduced holdings during late 2025, while others increased positions — representing normal portfolio rebalancing activity for a large-cap energy name.

For full-year 2025, Marathon recorded adjusted EBITDA approaching $12 billion, with the refining and marketing segment achieving $7.15 per barrel in Q4 compared to a $5.63 full-year average.

Crypto World

Polkadot (DOT) drops 2.3% as index trades lower

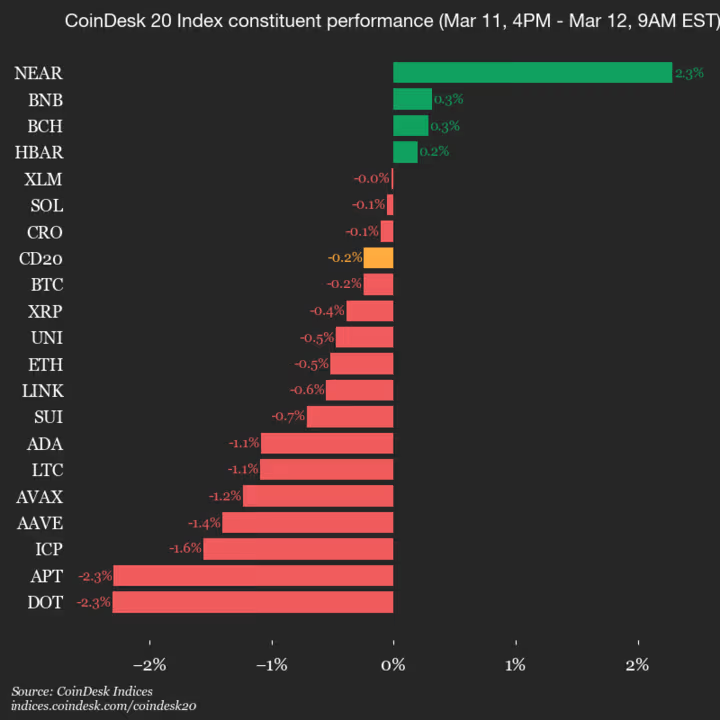

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2012.94, down 0.2% (-4.89) since 4 p.m. ET on Wednesday.

Four of 20 assets are trading higher.

Leaders: NEAR (+2.3%) and BNB (+0.3%).

Laggards: DOT (-2.3%) and APT (-2.3%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

US Jobs Data Keeps Bitcoin Price Stuck Around $70,000

Bitcoin (BTC) circled $70,000 into Thursday’s Wall Street open after US jobs data matched expectations.

Key points:

-

Bitcoin shrugs off more US macro data as jobless claims copy flat CPI numbers.

-

Oil stays volatile, while markets ignore almost any chance of a March interest-rate cut.

-

BTC price action stays indecisive around the $70,000 mark.

Bitcoin surfs new US jobless claims release

Data from TradingView showed ongoing BTC price compression on the day, with BTC/USD acting in an increasingly narrow range.

US initial jobless claims were 213,000 for the week through March 7, just 1,000 below the previous week’s print and 2,000 below market consensus.

The numbers furthered relief over the US economy after Wednesday’s Consumer Price Index (CPI) release also avoided major deviations from its expected values.

Volatility, however, remained in oil, which was up by more than 5% on the day at the time of writing after initially rising above $95. News of a coordinated release of 400 million barrels from reserves to counteract the Strait of Hormuz impasse thus failed to alter the price trend.

Analyzing the situation, trading resource The Kobeissi Letter suggested that a lack of clarity from US President Donald Trump over how long the Middle East conflict would last was fueling oil’s ongoing surge.

“The reason behind this rally was largely that President Trump was not signaling how long the Iran war would last,” it wrote on X.

“Since then, the ONLY factor that has changed is that President Trump has said the war will be over ‘pretty quickly.’ However, this also implies that military action will likely continue until at least the end of March.”

The latest inflation prints, meanwhile, did nothing to alter the market’s views of future Federal Reserve policy.

The latest data from CME Group’s FedWatch Tool showed the odds of an interest-rate cut at the Fed’s March 18 meeting — a key potential crypto tailwind — at less than 1%.

BTC price breakout can take “several more weeks”

Key Bitcoin price levels remained in place as traders waited for directional cues.

Related: Bitcoin braces for oil shock and death crosses: 5 things to know this week

Trader Daan Crypto Trades flagged $72,000 and $62,000 as lines in the sand around spot price, with the Point of Control (PoC) at around $68,000.

“Anything in between will just chop you up as we have been seeing already. Ranges like these can easily take several more weeks before resolving,” he told X followers on Wednesday.

As Cointelegraph reported, consensus stayed bearish on the mid-term outlook, favoring a drop to new macro lows to come.

Trader and analyst Rekt Capital noted that by historical standards, Bitcoin’s bear market should continue from here.

“Time-wise, Bitcoin will soon be halfway through its Bear Market,” he summarized in one of several recent X updates.

“Retracement-wise however, Bitcoin has already performed 75% of the downside in its Bear Market correction.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Tether aims to bring stablecoins and payments to Bitcoin with investment in Ark Labs

Tether, the crypto firm behind the most popular stablecoin USDT, said Thursday it has invested in Ark Labs to bring programmable payments to the Bitcoin network.

The backing formed part of a $5.2 million funding round for the startup. Ark Labs develops Arkade, a system that aims to allow faster transactions and application building on top of Bitcoin. With the new funding, the start-up said it has raised about $7.7 million in total.

The project focuses on making Bitcoin usable for payments and financial tools that often require faster settlement and automation. Arkade acts as an execution layer that developers can use to build services such as payment networks, lending tools and digital asset platforms.

“Bitcoin is the most liquid digital asset in the world, but it has lacked the programmable infrastructure that financial applications require,” said Marco Argentieri, CEO of Ark Labs. “Arkade aims to change that,” he added.

Tether said the funding will help expand infrastructure that could support stablecoins on Bitcoin. Stablecoins are digital tokens pegged to fiat currencies such as the U.S. dollar and often move across other blockchains like Ethereum or Tron.

“Stablecoins were born on Bitcoin, and expanding access on the Bitcoin network remains a priority for us,” Tether CEO Paolo Ardoino said in a statement.

The investment is part of Tether’s effort to expand beyond its stablecoin issuance roots and enhance the use of its $185 billion digital dollar token USDT. Last month, the firm invested in online marketplace Whop and cross-chain protocol LayerZero.

Crypto World

American Airlines (AAL) Stock Slides on Soaring Fuel Prices and Wall Street Downgrades

Key Takeaways

- AAL declined approximately 3% to $11.11 during pre-market hours on March 11, continuing a steep slide from mid-February highs

- Crude oil-linked jet fuel has jumped from $85–90 per barrel to a range of $150–200 per barrel amid escalating Middle East conflict

- Unlike competitors, American maintains zero fuel hedging exposure, leaving it vulnerable to a $50M annual cost increase per penny of fuel price rise

- Wall Street consensus has shifted toward caution, with TD Cowen and Rothschild slashing forecasts and lowering ratings

- Internal pressure mounts as the flight attendants’ union delivered an unprecedented no-confidence declaration targeting CEO Robert Isom

American Airlines (AAL) delivered an adjusted pre-tax profit of merely $352 million for 2025. Meanwhile, Delta achieved $5 billion and United reached $4.6 billion during the same period. This performance disparity has become increasingly critical.

American Airlines Group Inc., AAL

Brent crude currently hovers near $91 per barrel, with industry analysts projecting sustained levels above $95 through the next eight weeks should Middle Eastern supply chain disruptions persist. Jet fuel costs have rocketed from their previous $85–90 baseline to peaks approaching $200 per barrel, based on Air New Zealand’s reporting.

While most global carriers employ fuel hedging strategies to mitigate risk, American has chosen a different path. Without hedging contracts, the carrier faces complete vulnerability to volatile spot market pricing — and current conditions are proving particularly harsh.

AAL stock plummeted over 5% on March 5 following both a downgrade announcement and a crude price surge connected to intensifying geopolitical tensions surrounding the Strait of Hormuz. Shares recently traded near $11.04, representing a significant retreat from mid-February valuations.

During March 11 pre-market activity, AAL extended losses with another ~3% decline to $11.11. Delta experienced a 2.2% drop while United fell 3.6% in parallel trading, yet American’s unhedged position amplifies its vulnerability considerably.

Company disclosures reveal that each additional penny per gallon translates to approximately $50 million in added annual fuel expenses for American. By comparison, Delta faces $40 million per penny, while Southwest’s exposure stands at just $22 million.

Financial Outlook Faces Headwinds

Executive leadership has projected a Q1 2026 loss ranging from $0.10 to $0.50 per share, with full-year earnings estimated between $1.70 and $2.70 per share. These full-year projections rest on the assumption that fuel prices stabilize — an increasingly questionable premise.

The carrier’s most recent quarterly results disappointed expectations. Actual EPS registered approximately $0.16 against consensus estimates of $0.38. Operating margins compressed to roughly 0.2%.

On March 9, American took steps to strengthen its financial position, expanding revolving credit facilities from $3.0 billion to $3.11 billion while pushing maturity dates to March 2031.

The airline closed 2025 carrying $36.5 billion in total debt obligations, with management targeting a reduction below $35 billion before 2026 concludes. Sustained elevated fuel costs threaten this deleveraging objective.

Wall Street Sentiment Deteriorates

Investment firms have grown increasingly cautious. TD Cowen reduced its price objective from $17 to $13 while maintaining a Buy rating with diminished enthusiasm. Rothschild & Co downgraded AAL from Buy to Neutral while slashing its target from $17 to $12.50, pointing to “constrained financial maneuverability amid rising cost pressures.”

Among 17 analysts monitored by MarketBeat, current ratings show 9 Hold recommendations, 6 Buy ratings, and 2 Sell ratings. The consensus 12-month price target stands at $16.22 — suggesting potential upside exceeding 40% from present levels, though achieving this outcome faces mounting obstacles.

Compounding financial challenges, the flight attendants’ union delivered an unprecedented no-confidence resolution against CEO Robert Isom, highlighting operational shortcomings and competitive underperformance.

Industry observers are focused on American’s upcoming appearance at the J.P. Morgan Industrials Conference scheduled for March 17, where Isom is anticipated to detail the carrier’s strategy for managing escalating costs while pursuing debt reduction commitments.

Crypto World

Bitcoin climbs the wall of worry amid escalating Iran war and oil volatility

Bitcoin remains pinned around $70,000, showing impressive price stability even as market sentiment remains deeply pessimistic amid the Iran war and oil price volatility.

Crypto’s fear and greed index, a widely tracked sentiment indicator, has persistently signaled extreme fear in recent weeks, suggesting traders remain cautious despite the lack of a major price breakdown.

Market positioning also paints a dour picture. Annualized funding rates for bitcoin perpetual futures have been negative since early March, reflecting a growing bias for bearish short bets. The current stretch marks the longest period of negative funding since April 2025, when bitcoin ultimately formed a market bottom, around $76,000.

This is consistent with fear on Wall Street, where the VIX index jumped to 25 this week, its highest in over a year.

Yet bitcoin’s price action has been notably resilient. Since the escalation of the Middle East conflict on Feb. 28, the largest cryptocurrency has gained roughly 7%. That compares favorably with other major assets over the same period. The Nasdaq 100 has been largely steady while the S&P 500 has dropped about 1%, gold has slipped roughly 3% and silver has fallen nearly 9%.

This is in addition, to brent crude briefly pushing back above $100 per barrel earlier today amid ongoing tensions in the region.

The contrast was also visible during Wednesday’s U.S. trading session. BlackRock’s iShares Bitcoin Trust (IBIT) traded 1% higher. While major equity benchmarks were in the red, including the S&P 500 (SPX), the Nasdaq 100 (QQQ), the Russell 2000 (IWM) and the Dow Jones Industrial Average (DJI), highlighting bitcoin’s relative resilience during U.S. market hours.

The outperformance likely stems from big traders and institutions snapping up coins in privately negotiated transactions, keeping demand steady.

For now, bitcoin appears to be performing better than the market mood surrounding it, holding steady despite persistent fear across the broader financial landscape.

-

Business6 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

News Videos3 days ago

News Videos3 days ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Ann Taylor

-

Crypto World3 days ago

Crypto World3 days agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech1 day ago

Tech1 day agoA 1,300-Pound NASA Spacecraft To Re-Enter Earth’s Atmosphere

-

Sports7 days ago

Sports7 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

Politics6 days agoTop Mamdani aide takes progressive project to the UK

-

Business2 days ago

Business2 days agoExxonMobil seeks to move corporate registration from New Jersey to Texas

-

Tech2 days ago

Tech2 days agoChatGPT will now generate interactive visuals to help you with math and science concepts

-

Sports5 days ago

Sports5 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports4 days ago

Sports4 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

NewsBeat20 hours ago

NewsBeat20 hours agoResidents reaction as Shildon murder probe enters second day

-

NewsBeat7 days ago

NewsBeat7 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Entertainment5 days ago

Entertainment5 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Business4 days ago

Business4 days agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Business1 day ago

Business1 day agoSearch Enters Sixth Week With New Leads in Tucson Abduction Case

-

NewsBeat3 days ago

NewsBeat3 days agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech3 days ago

Tech3 days agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Business3 days ago

Business3 days agoSearch Enters 39th Day with FBI Tip Line Developments and No Major Breakthroughs

-

NewsBeat24 hours ago

NewsBeat24 hours agoI Entered The Manosphere. Nothing Could Prepare Me For What I Found.