CryptoCurrency

Geofencing in White Label Crypto Exchange Software Development

The total number of crypto owners reached 730.53 million by the end of September. The appetite for global crypto expansion has never been greater. Enterprises and investors are eyeing international markets, yet the opportunity remains wrapped in a convoluted web of regional restrictions. Regulatory challenges have been escalating in many crypto-friendly jurisdictions, including the United States, the EU, Singapore, and the UAE.

In 2025, compliance costs for mid-sized crypto firms surged by 28%, averaging $620k per year. These were barely the entry prices into the regulated jurisdictions, driven mainly by AML, KYC, and sanctions enforcement.

Amid the constantly shifting regulatory landscape, a cryptocurrency exchange software can’t serve the world with a one-size-fits-all approach. Jurisdiction-specific compliance is a costly and complex solution.

Geoshield emerges as a comparatively easy and inexpensive mechanism for launching exchanges globally, with fewer legal headaches. With this integration, a crypto business can simply shut down its services in several regions without affecting its operations in other countries.

Market Overview

Blockchain is borderless, but regulations are associated with its use cases. The result is a fragmented landscape where compliance in one country can trigger violations in another. This table gives you a market overview while underscoring the importance of location-aware crypto exchange development.

| Region / Aspect | Key Statistic (2025) | Implication for Exchanges |

|---|---|---|

| Global Legality | Cryptocurrency is legal in 45/75 major markets, partially banned in 20, and fully banned in 10 |

Exchanges must actively restrict users from banned jurisdictions to avoid sanctions. |

| Adoption Leaders |

|

Rapid growth demands localized compliance systems and tailored onboarding flows. |

| Stablecoin Regulation |

|

White label crypto exchange platforms must dynamically enable/restrict region-specific stablecoins. |

| Risk Exposure |

IP geolocation is inaccurate in 70%+ of recent compliance audits |

Single-source checks can’t ensure compliance; multi-layer geofencing is now industry standard. |

What is Geoshield and How It Benefits Crypto Exchange Software Development?

Geoshield is an intelligent geofencing and compliance enforcement layer designed to restrict users in specific jurisdictions from accessing services. It uses multiple data points, including GPS, IP, Wi-Fi triangulation, and device metadata to determine a user’s true geographic location and automatically imposes access restrictions.

Benefits of Geoshield Integration For Cryptocurrency Exchange Development

At its core, GeoShield integration in cryptocurrency exchange development enables an exchange to:

- Restrict access from sanctioned jurisdictions such as North Korea, Iran, Syria, etc.

- Apply region-specific compliance logic, including KYC, leverage limits, and product restrictions

- Meet AML, FATF, and local data residency mandates through integrated data vaults

- Maintain verifiable audit trails for regulatory reporting and exchange licensing

- Enter high-adoption, regulation-friendly markets like the EU, UAE, or Singapore with confidence

- Run compliant airdrops (similar token distribution tactics were leveraged by Eigenlayer and MakerDAO), listings, and staking programs without any jurisdictional risk

- Attract institutional partners, liquidity providers, and investors through demonstrable compliance readiness

- Build credibility among retail traders who prefer platforms that are globally available yet regionally lawful.

But it does have downsides, ranging from high costs, complicated integration, and restricted market growth. While the other two may still be avoidable, the growth-limiting factor makes it degrading.

To which Jake Chervinsky, chief legal officer at Variant Fund, said:

“This is a drastic measure, but sometimes it’s unavoidable.”

GeoShield doesn’t stifle growth, but it redirects it toward compliant, high-opportunity jurisdictions where exchanges can operate freely and scale without fear of enforcement actions.

By automating location-based enforcements, exchanges cut compliance overheads and eliminate the risk of accidental regulatory breaches. This automation ensures real-time blocking of restricted regions, enabling FATF-aligned KYC without burdening users with redundant verifications.

More importantly, the same logic that filters out high-risk users also accelerates expansion in compliant markets. By leveraging geofencing-enabled white label cryptocurrency exchange software, businesses can go live in new regions instantly, without waiting for local code adaptations. These compliance-ready turnkey solutions reduce time-to-market by up to 60% compared to custom development cycles.

Operational efficiency is another clear advantage. Multi-source validation, drawing from GPS, IP, and device metadata, reduces false positives and trims manual review workloads by nearly half. When integrated into a white-label cryptocurrency exchange software, Geoshield acts as a compliance firewall between users and the exchange’s operational core, blocking unauthorized access while allowing compliant users to trade seamlessly. Enterprises integrating Geoshield-enabled white label exchange architecture typically report compliance cost savings exceeding $100,000 in their first year.

Access the 2025 Crypto Market Entry Zones PDF

What Is The Need For Geoshield-Enabled White Label Crypto Exchanges?

| Metric | Without Geofencing | With GeoShield-Enabled White Label |

|---|---|---|

| Compliance Risk | High |

Controlled and auditable |

| Setup Time |

6–9 months |

65-80% |

| Expansion Agility |

Low |

Dynamic by jurisdiction |

| Regulatory Readiness |

Manual |

Automated |

| Legal Exposure | Significant |

Contained |

Building a globally compliant cryptocurrency exchange software from the ground up is a slow, expensive, and redundant process. White label cryptocurrency exchanges eliminate the friction while retaining flexibility. Businesses can brand the turnkey solution to suit their branding needs, and at the same time can leverage a compliance-ready backend that allows:

- Plug-and-Play Compliance: Instant enforcement of jurisdictional rules without custom coding.

- Custom Policy Modules: Implementation of distinct access policies for each country or region.

- Regulatory Agility: Permission adjustments in real-time as laws evolve.

- Audit-Ready Reporting: Generation of jurisdiction-wise logs and compliance certificates.

- Cost Efficiency: Prebuilt modules minimize legal and technical overhead.

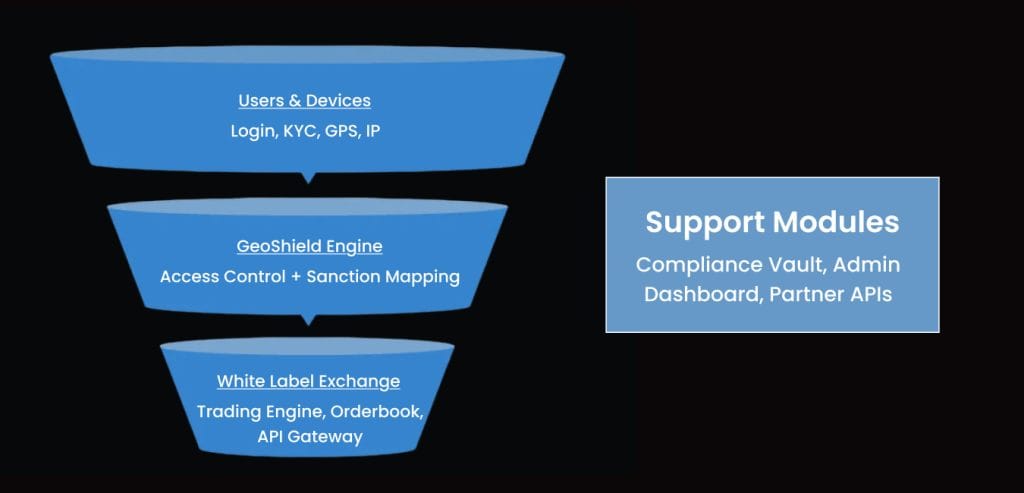

How GeoShield Integrates into a White Label Exchange Stack?

GeoShield can be embedded within the crypto exchange software architecture through API-level integration. A standard white label exchange software stack accommodates it in three layers:

1. Authentication Layer

- Intercepts login and signup requests.

- Runs a multi-source location check before a session token is issued.

- Flags VPN or proxy usage and prompts enhanced KYC if necessary.

2. Trading Layer

- Applies jurisdictional filters on trading pairs and order types.

- Enables or disables leverage, stablecoins, or derivatives per regional policy.

3. Withdrawal Layer

- Validates withdrawal destinations and user jurisdiction.

- Prevents cross-border transfers from restricted zones.

4. Admin Dashboard

- Provides a geofencing map visualization.

- Offers analytics for compliance reporting and audit readiness.

- Integrates with external providers such as GeoComply and MaxMind for layered verification.

This compliance module isn’t effective unless it is engineered into the trading flow. Antier’s premium white label crypto exchange software is designed with every layer equipped with a geofencing mechanism.

Real World Proof: Why Geoshield is Essential for Crypto Exchange Development?

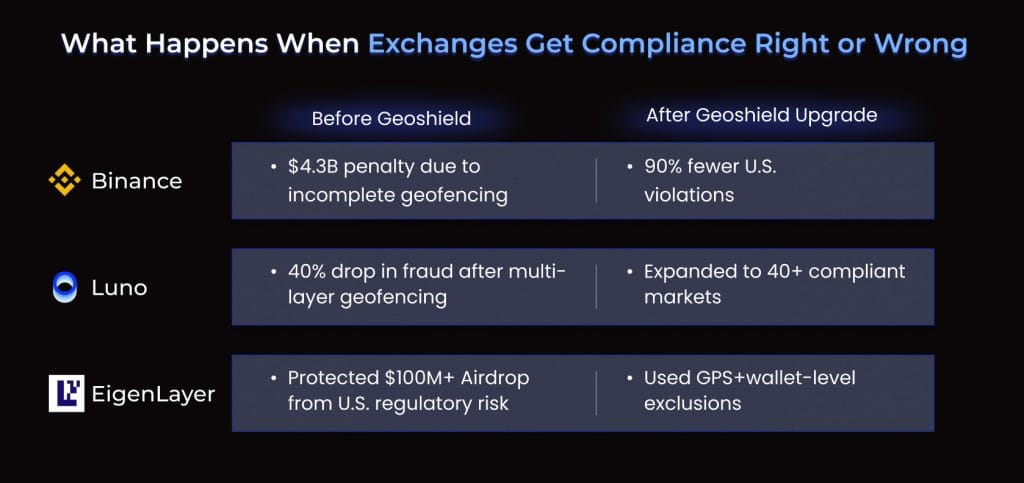

Despite initial geofencing claims, U.S. users accessed the platform via VPNs, resulting in a $4.3 billion settlement with FinCen and OFAC. After implementing advanced multi-source geofencing mechanisms, Binance reduced the unauthorized service exposure by 90%.

Luno, another leading crypto exchange software and wallet, integrated multi-layered geofencing across 40+ countries using GeoComply data, achieving a 40% drop in fraud and doubling user growth without legal challenges.

Both MakerDAO and EigenLayer geofenced U.S. and Chinese users during token distribution, dodging the SEC classification risks and preserving over $100M in value.

Launch Global. Stay Legal. With Geoshield-Enabled White Label Exchange Software

The global crypto market rewards speed but penalizes negligence. So, you can launch your crypto exchange software globally within 9 weeks, but still face fines, bans, and reputational damage if you’re not spending enough on compliance.

Geoshield-integrated white label crypto exchanges allow enterprises to operate globally, meet local laws automatically, and avoid the hefty engineering of custom compliance builds.

Antier helps enterprises launch with Geoshield-ready white label cryptocurrency exchanges built for global compliance, institutional trust, and rapid market entry. With modular geofencing, integrated KYC/AML, and audit-ready reporting, Antier’s white label exchange delivers a complete foundation for border-aware trading infrastructure.

Connect with the best white label crypto exchange development company today. Let’s Build Compliance-Ready Global Trading Venues Together.

Frequently Asked Questions

01. What is the current number of crypto owners globally as of September 2023?

The total number of crypto owners reached 730.53 million by the end of September 2023.

02. How have compliance costs for mid-sized crypto firms changed in 2025?

In 2025, compliance costs for mid-sized crypto firms surged by 28%, averaging $620,000 per year.

03. What is Geoshield and how does it assist crypto exchanges?

Geoshield is an intelligent geofencing and compliance enforcement layer that helps crypto exchanges restrict users from specific regions, simplifying compliance with local regulations.