Crypto World

Gold Price Falls to a 10-Day Low

As today’s XAU/USD chart shows, the price of gold has dropped below the lows of 12 February, marking its weakest level in ten days. According to media reports, several factors are weighing on bullion:

→ Easing geopolitical tensions. Safe-haven demand has diminished amid US–Iran and Russia–Ukraine negotiations.

→ Slowing US inflation. This may be prompting traders to reassess expectations for Federal Reserve policy in 2026.

→ The holiday effect. With Presidents’ Day in the US and Lunar New Year celebrations in Asia, trading volumes have declined. In such thin market conditions, prices can become more vulnerable to speculation and abrupt moves.

On 9 February, when analysing gold price movements, we:

→ confirmed the validity of the long-term ascending channel;

→ noted that following a spike in extreme volatility at the turn of the month, the market could begin seeking a new equilibrium;

→ suggested a scenario involving a contraction in price swings on the XAU/USD chart, with the potential formation of temporary balance between supply and demand around the psychological $5k mark.

Indeed, from 9 to 12 February the market formed a consolidation zone slightly above $5k — more precisely, between resistance R1 and local support S1.

Technical Analysis of the XAU/USD Chart

A false bullish breakout (indicated by the arrow) highlighted the bulls’ inability to sustain momentum and effectively became a trap for buyers.

This, in turn, allowed bears to attempt to seize the initiative, resulting in a successful break below the S1 level. Subsequently, the breached level acted as resistance (R2).

Today’s decline on the XAU/USD chart suggests that:

→ bears remain in control, as evidenced by the break of local support S2;

→ a key argument in favour of the bulls may come from the major support at the lower boundary of the long-term channel.

In February, the market has already twice returned within the boundaries of the long-term upward channel. It cannot be ruled out that the price will remain inside it. Notably, if a decisive break above the resistance line (shown in red) occurs, this could reasonably be interpreted as a breakout of a bullish flag pattern.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Is Crypto Next to Benefit?

The market is increasingly turning against the US dollar, with short positions at their highest level since January 2012, according to Bank of America’s foreign exchange and rates sentiment survey.

This shift in sentiment comes as the US Dollar Index, which tracks the value of the greenback against a weighted basket of six major currencies, has declined 1.3% year to date.

Sponsored

Record Bearish Positioning Reflects Deep Skepticism About the Dollar

The latest Bank of America survey finds dollar positioning in February reached its most negative level in more than 14 years. Moreover, overall dollar exposure has fallen below the lows of April 2025, signaling continued loss of confidence among fund managers.

Despite efforts to restore confidence in the Federal Reserve, skepticism remains. President Trump’s January 2026 nomination of Kevin Warsh as Fed Chair aimed to reassure investors in US monetary policy. Nevertheless, this move has not lifted dollar demand.

“Survey respondents see further signs of US labor market weakness as the main risk for a lower dollar,” WSJ reported.

Meanwhile, the bearish sentiment comes amid a substantial slide in the US Dollar Index. In 2025, the index fell 9.4%, with declines continuing this year.

On January 27, DXY fell to 95.5, its lowest level since February 2022. At the time of writing, DXY recovered to reach 97.08.

Sponsored

DXY at Crossroads as Traders Debate Breakdown Versus Bottom

Market analysts are increasingly pointing to technical signals that point to further downside for the US dollar. Trader Donny forecasted that the index could decline below the 96 level.

“I’m seeing another bearish leg forming on the DXY,” he wrote.

Other analysts are looking even further out. The Long Investor highlighted longer-term charts that, in his view, outline a much deeper structural decline. He suggested that bearish targets could extend into the 52–60 range over the 2030s.

Sponsored

However, some analysts see potential for a dollar rebound. The Macro Pulse stated recent behavior suggests the index may be entering a “potential bottoming process.”

“My base case is a recovery toward 103–104 by July 2026,” the post read.

Sponsored

Implications for Cryptocurrency Markets

A weaker US dollar typically creates more supportive conditions for risk assets, including cryptocurrencies. When the dollar declines, investors may rotate into alternative assets in search of higher returns or protection against the depreciation of fiat currencies.

Bitcoin, in particular, is frequently positioned as a hedge against monetary debasement. This can strengthen its appeal during periods of sustained dollar weakness.

Still, the connection between dollar weakness and crypto gains is not always straightforward. Broader macroeconomic conditions remain critical.

If a softer dollar reflects slowing US growth or rising recession risks, investors may adopt a defensive stance. In such an environment, capital could flow into traditional safe havens such as gold rather than into more volatile digital assets.

Recent positioning data supports that caution. Bullish bets on gold have increased, signaling that many investors remain optimistic about the metal’s prospects.

As the dollar slips and fund managers maintain historically bearish positions, the coming months will test whether crypto markets can capitalize on shifting currency dynamics, or whether persistent macro uncertainty will continue to temper upside momentum in digital assets.

Crypto World

Is Gold Betting Against America’s Comeback?

The Bitcoin vs. gold debate has heated up over the past few months as investors reassess inflation risks and the future direction of monetary policy.

Yet according to one market strategist, the divide now extends beyond portfolio hedging. In his view, it reflects something far larger: a wager on the trajectory of the American economy itself.

Sponsored

Sponsored

Bitcoin vs Gold: Two Assets, Two Visions of America’s Path

In a recent post, James E. Thorne, Chief Market Strategist at Wellington-Altus, framed the two assets as opposing bets on the trajectory of the US economy.

“For the record. Bitcoin Is a Bet on Trump’s Success. Gold Is a Bet on America’s Failure,” Thorne wrote.

The strategist explained that gold, in his view, has become what he described as a “verdict.” Rather than simply protecting against inflation or volatility, he argued that rising demand for gold reflects a growing lack of confidence in “Trump’s economic revolution” and the ability of policymakers to reform an economy burdened by excessive debt.

According to Thorne, investors piling into gold are effectively betting that the US will continue down a path of monetary expansion, debt accumulation, and currency debasement.

“It is the old guard’s confession that they see only one way out of excessive leverage: print, debase, and hope the music doesn’t stop,” he remarked. “Trump, Bessent, and Warsh argue there is another path: reform the Fed, end the subsidy to idle reserves, stop paying banks to sit on cash, and force capital out of sterile Treasury holdings and back into the productive economy where it belongs.”

By contrast, Thorne positioned Bitcoin as a “speculative flag of success.” He suggested that it is a digital bet that regulatory clarity for the crypto sector, including measures such as the proposed CLARITY Act, alongside broader policy shifts, would position the US as a global crypto hub.

Sponsored

Sponsored

In this “split-screen” vision of the future, gold signals doubt that America can grow its way out of mounting fiscal pressures, while Bitcoin reflects confidence that reform-driven growth can reduce the real burden of debt.

“If Trump’s program works, if growth, deregulation, and redirected capital start to shrink the real burden of debt instead of inflating it away, Wall Street will have to rediscover its purpose: generating credit for builders, not rent for bondholders. Then those who rushed into gold as a monument to decline will face a brutal reckoning: their ‘safe haven’ will stand as a shiny, inert tribute to one vast miscalculation — that America would fail just as its leaders chose to make it succeed,” Thorne mentioned.

Bitcoin’s Safe-Haven Narrative Faces Scrutiny

The remarks come at a time when gold has surged amid macroeconomic uncertainty despite volatility. On the other hand, Bitcoin has experienced notable drawdowns, reigniting debate over its store-of-value narrative.

Trader Ran Neuner recently raised concerns over Bitcoin’s response amid periods of genuine market stress and uncertainty.

“For the first time in 12 years, I’m questioning Bitcoin’s thesis,” he said. “We fought for ETF approval. We fought for institutional access. We wanted it inside the system. Now it is. There is nothing to fight for anymore.”

Neuner argued that episodes marked by tariff disputes, currency tensions, and fiscal instability presented a real-world test for Bitcoin’s safe-haven narrative. During those periods, however, investor flows appeared to favor gold over digital assets.

With exchange-traded funds approved and institutional channels widely available, access to Bitcoin is no longer a structural constraint. This removes a longstanding explanation for muted performance during stress events.

He also pointed to subdued retail engagement and weaker speculative momentum compared to prior cycles. While this does not imply a structural breakdown for Bitcoin, he suggested it raises questions about whether its investment thesis remains as clear-cut as it once appeared.

Crypto World

Binance stablecoin reserves drop $9B, signal fading risk appetite

Binance logs three straight months of heavy stablecoin outflows, erasing $9B in reserves and signaling a sustained liquidity squeeze across crypto markets.

Summary

- Binance has seen negative stablecoin netflows for three consecutive months, the longest stretch since the 2023 downturn.

- Net outflows climbed from about $1.8B in December to nearly $2.9B in January and around $3B halfway through February.

- Stablecoin reserves dropped from roughly $50.9B in November to $41.8B, shrinking the exchange’s capacity to absorb volatility.

Binance has recorded three consecutive months of negative stablecoin netflows, marking a sustained contraction in crypto market liquidity, according to data shared by CryptoQuant.

The outflows represent the longest comparable stretch since the 2023 bear market, the data showed.

Monthly figures indicate an acceleration in the trend. December saw approximately $1.8 billion in net stablecoin outflows, followed by nearly $2.9 billion in January, according to the data. February outflows have reached close to $3 billion despite the month being only halfway complete.

Binance’s stablecoin reserves have declined from approximately $50.9 billion in November to $41.8 billion, representing a contraction of nearly $9 billion, the data indicated.

Stablecoin outflows from major exchanges typically indicate capital leaving the exchange ecosystem rather than being redeployed into other crypto assets, according to market analysts. Stablecoins serve as readily deployable capital in cryptocurrency markets, and declining balances reduce the capacity to absorb price volatility.

The outflows occur amid elevated global uncertainty and geopolitical tensions, factors that market observers say may be influencing investor behavior toward more defensive positioning.

The trend has continued without signs of stabilization, according to the latest available data from CryptoQuant.

Crypto World

Bitcoin crash risk? Kevin O’Leary flags growing quantum fears

Bitcoin has plunged nearly 50% from its all-time highs, but investor and entrepreneur Kevin O’Leary says the real story goes far beyond price action.

Summary

- Kevin O’Leary remains long Bitcoin but says institutions are increasingly cautious, limiting allocations to around 3% amid concerns over quantum computing risks.

- Bitcoin’s latest 50% correction has reinforced institutional selectivity, with capital concentrating mainly in Bitcoin and Ethereum while smaller tokens continue to be sidelined.

- Technical indicators remain weak, with Bitcoin consolidating near $68,000 as selling pressure persists and key support at $65,000–$60,000 remains in focus.

In a recent post, O’Leary argued that while sharp drawdowns are nothing new for Bitcoin (BTC), institutional behavior is evolving and a new technological threat is entering the conversation: quantum computing.

“Bitcoin just took another brutal correction… but something bigger is happening underneath,” O’Leary wrote. He pointed to the October market meltdown, when Bitcoin tumbled and much of the broader crypto market collapsed 80–90%, with many tokens never recovering.

According to O’Leary, institutions have since become more selective.

“If you want 90% of the upside and volatility in crypto, you only need Bitcoin and Ethereum,” he said, dismissing smaller tokens as “worthless” in the eyes of large capital allocators.

O’Leary maintains he is still long Bitcoin. However, he says institutional investors are hesitating due to rising concerns that future quantum computers could theoretically break cryptographic security underpinning blockchain networks. While such a threat remains speculative and likely years away, he argues it is enough to cap institutional exposure at around 3% allocations until there is greater clarity.

“They’ll stay cautious, they’ll stay disciplined, and they’ll wait,” O’Leary noted, suggesting the next major leg higher may depend as much on technological reassurance as macro conditions.

Bitcoin price analysis: Weak momentum, key levels in focus

Meanwhile, the daily BTC/USDT chart shows Bitcoin trading around $68,100 after a sharp cascade from the mid-$90,000 region earlier this year.

A capitulation wick near the $60,000 zone marked a local bottom, followed by a modest relief bounce. However, price action has since stalled, moving sideways just below the $70,000 psychological level.

The Balance of Power indicator sits at -0.58, signaling sellers retain short-term control. Meanwhile, the Chaikin Money Flow (20) remains slightly negative at -0.06, indicating weak capital inflows and a lack of strong accumulation.

Immediate resistance lies near $70,000–$72,000, where recent candles have repeatedly rejected upside attempts. A break above that zone could open the door toward $75,000.

On the downside, $65,000 stands as initial support, with the $60,000 capitulation low acting as a critical structural floor. A loss of that level would likely intensify bearish pressure.

Crypto World

Can XRP Price Successfully Register a 33% Breakout Past $2?

XRP is attempting to regain upward momentum after weeks of consolidation. Recent price action suggests a potential breakout from a bullish triangle pattern.

Market conditions remain critical for confirmation. While volatility persists across the broader cryptocurrency market, XRP’s structure indicates building pressure.

Sponsored

Sponsored

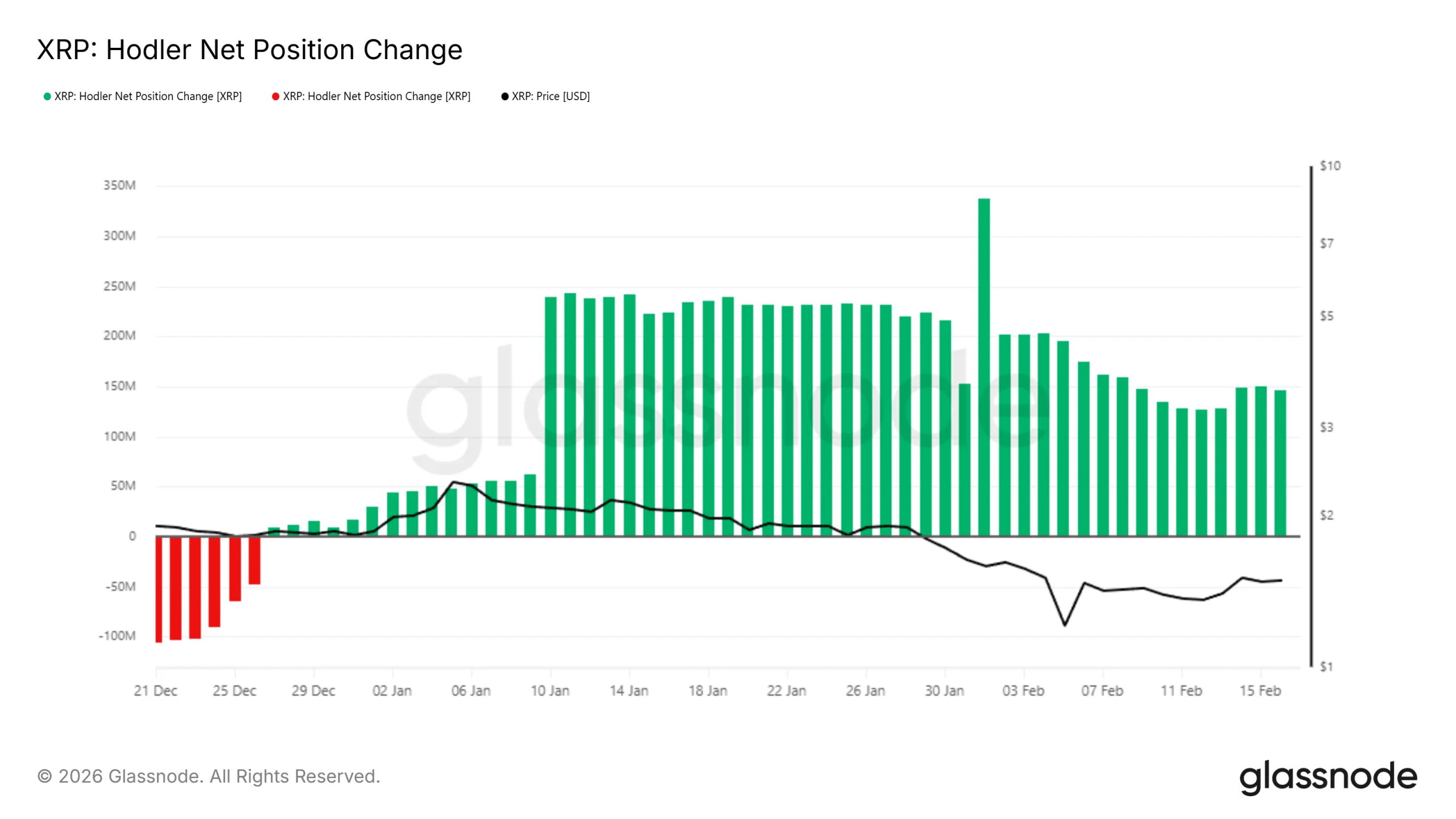

XRP Holders Support The Breakout

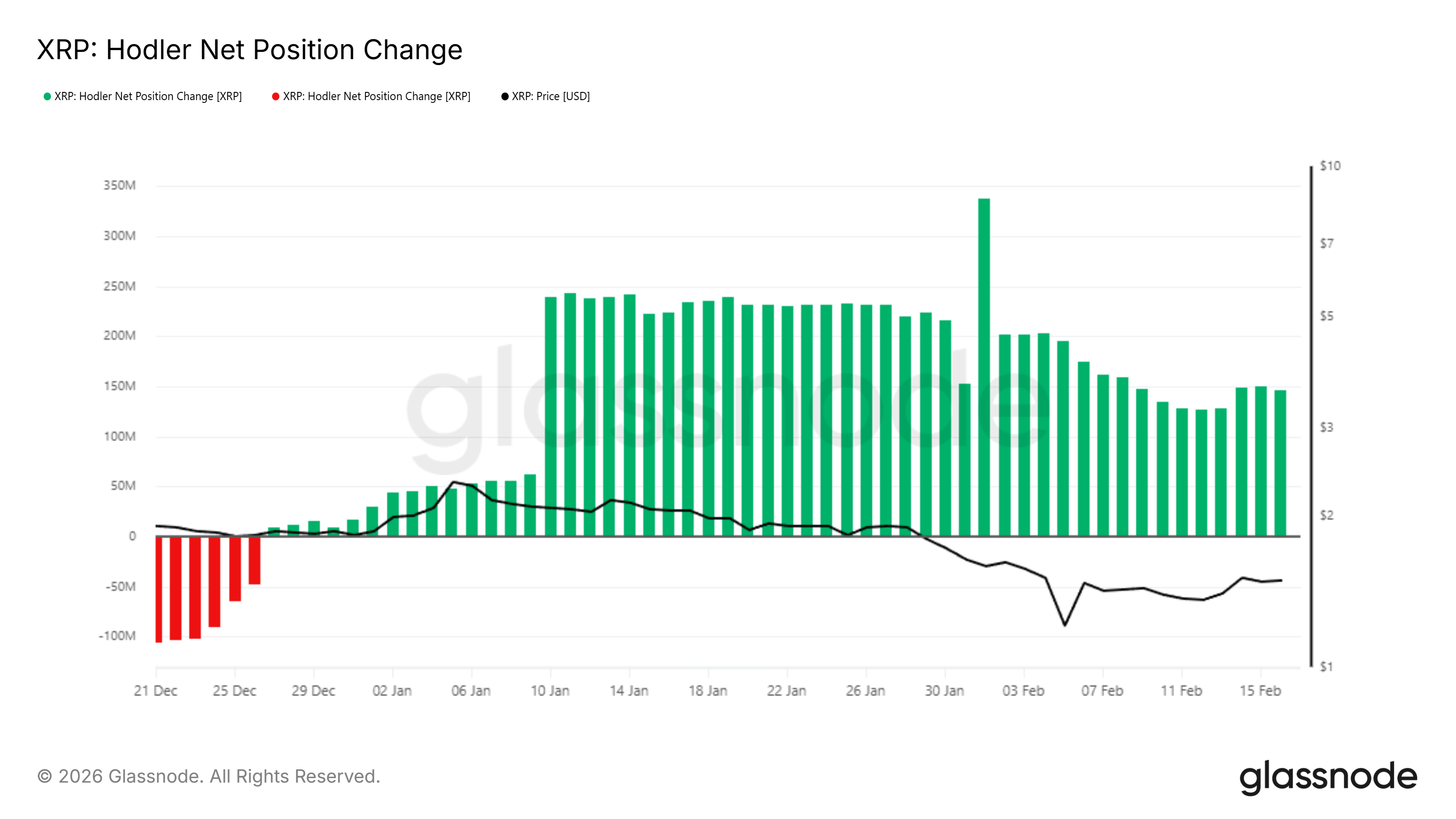

On-chain data shows steady support from long-term XRP holders. The HODLer Net Position Change metric currently reflects consistent accumulation. Green bars on the indicator signal capital inflows into long-term wallets.

This pattern suggests conviction among experienced investors. Long-term holders tend to accumulate during consolidation phases. Their support can stabilize the price during uncertainty. Sustained inflows strengthen the probability of a breakout by reducing available supply on exchanges.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

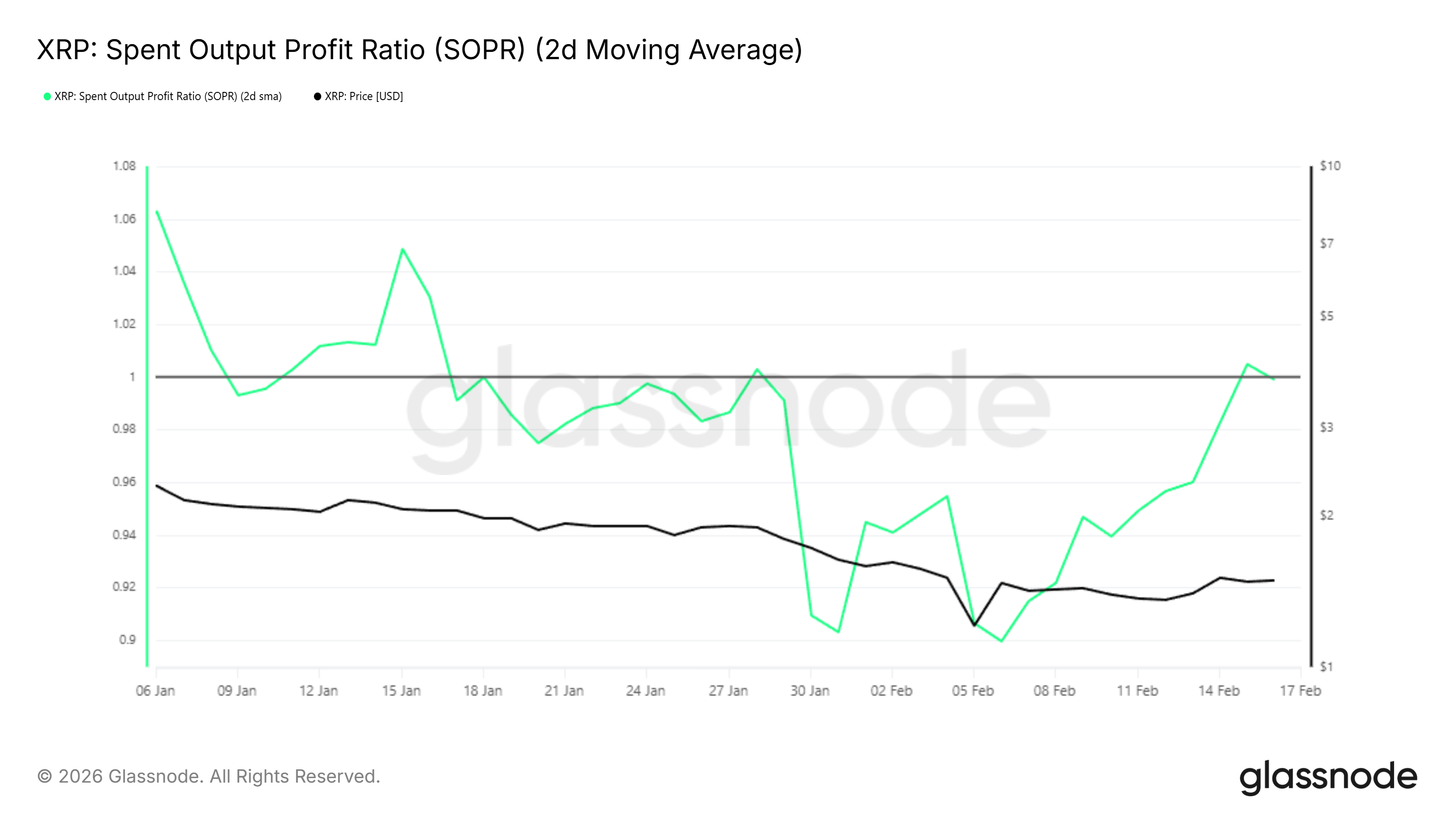

Another key indicator, the Spent Output Profit Ratio, or SOPR, provides further insight. SOPR measures whether investors are selling at a profit or a loss. A reading below 1.0 signals realized losses, while a reading above it reflects profitable selling.

XRP’s SOPR has climbed back above 1.0. This shift indicates investors are no longer capitulating at losses. Instead, they are transacting at profit levels. Improving profitability often restores confidence and encourages healthier capital rotation, which can support upward price movement.

Sponsored

Sponsored

XRP Price Levels To Watch

XRP is currently forming a symmetrical triangle pattern. Technical analysis projects a potential 33% breakout if resistance levels are breached. For now, confirmation requires a sustained move above $1.70. Without this breakout, the price remains within the consolidation boundaries.

A move past $1.58 would signal early breakout momentum. Strong investor support could then help XRP flip $1.70 into a new support level. If sustained buying pressure continues, the altcoin may advance beyond $1.80, reinforcing bullish technical structure.

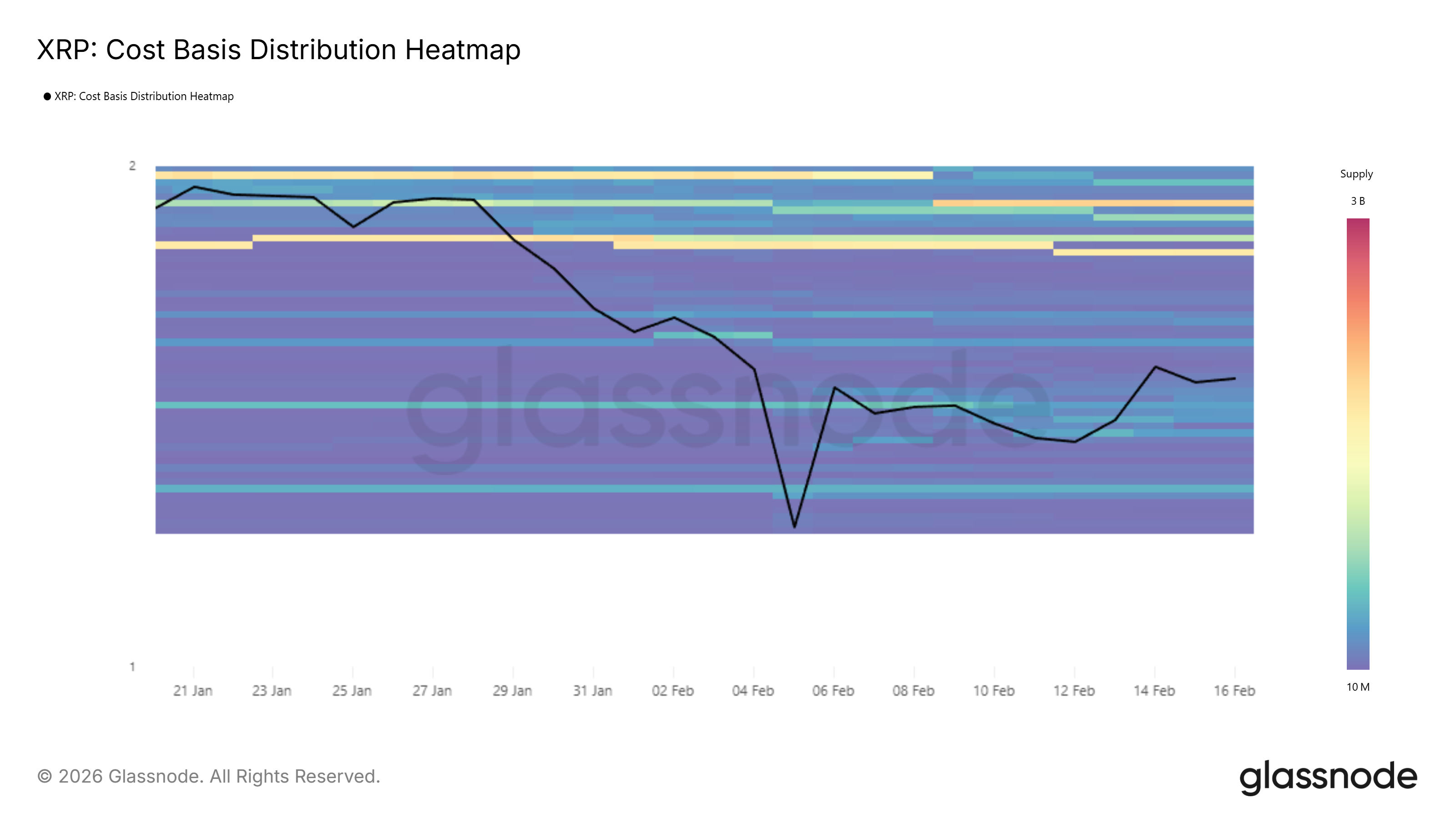

However, resistance remains a concern. The CBD Heatmap indicates notable supply concentration between $1.76 and $1.78. Many investors accumulated XRP in this range. As price revisits these levels, some may sell to offset losses, potentially limiting upward momentum.

If bullish momentum fails entirely, downside risk increases. A rejection could push XRP below the $1.47 support level. Such a move may lead to renewed consolidation above $1.37, similar to patterns observed in early February. This scenario would invalidate the near-term bullish thesis.

Crypto World

Bitcoin remains under pressure near $68,000 even as panic ebbs

Bitcoin is struggling to build any upward momentum, even as the key panic gauge pulls back from its early-month high and hints at renewed stability.

Bitcoin’s 30-day implied volatility, the fear or panic gauge, which reflects investors’ expectations for price swings over 4 weeks, has dropped to an annualised 52%, according to data source Volmex. The decline has reversed the early-month spike, which saw the index rise from roughly 48% to nearly 100% as bitcoin crashed to nearly $60,000.

The receding volatility suggests that panic has ebbed and that investors are no longer chasing options or hedging instruments as frantically as during the crash.

Options are derivative contracts offering insurance against price swings. A call option allows you to profit from upside price volatility in BTC, while a put option protects against price slides. Demand for options influences implied volatility.

“Implied volatility has dropped, and deleveraging is running out of steam, analysts at Bitfinex said in an email to CoinDesk, noting the newfound stability and ebbing of panic.

Still, bitcoin’s price remains under pressure, trading just under $68,000 at press time, a 1.2% drop over the past 24 hours, per CoinDesk data. The early-month sell-off fizzled near $60,000 on Feb. 6, sparking a recovery, but prices haven’t sustainably moved above $70,000 since.

That’s telling of weak demand.

“Funding rates have yet to show appetite for aggressive re-leveraging and derivatives markets support the view of a stabilization rather than renewed buying,” Bitfinex analysts explained.

Perpetual funding rates are periodic payments exchanged between long and short traders in crypto perpetual futures contracts to keep the contract price anchored to the spot price. A positive rate implies that longs (buyers betting on price rises) pay shorts (sellers betting on drops), signaling more bullish positioning in the market. A negative rate suggests a bias for short positions.

While the implied volatility has receded sharply, funding rates in BTC perpetuals remain just above zero, a sign of mild bullish leanings among traders, but nothing aggressive yet.

Institutional appetite hasn’t been great either. The U.S.-listed spot bitcoin exchange-traded funds have registered a net outflow of $677.98 million this month, extending a three-month streak of redemptions, according to data source SoSoValue.

Macro offers hope

Battered bulls can pin their hopes on the dwindling U.S. inflation and lower real yields, which could offer a tailwind to risk assets and non-yielding assets like bitcoin.

Data released last week showed the consumer price index (CPI) slowed to 2.4% year-on-year in January from 2.7% in December, strengthening hopes for at least two 25 basis-point rate cuts by the Fed this year.

The real or inflation-adjusted yield on the U.S. 10-year Treasury note fell to 1.8%, the lowest since Dec. 1. A decline in real yield typically prompts investors to increase exposure to assets like bitcoin.

“Lower real yields reduce the relative carry disadvantage of non-yielding assets such as Bitcoin, while a softer dollar supports global liquidity conditions,” Bitfinex analysts noted.

Crypto World

Veteran Analyst Says Bitcoin is Dead, But Long Live Crypto

Bitcoin’s long-held narrative as a safe haven and digital gold is under scrutiny, as veteran analyst Ran Neuner, among others, questions the pioneer crypto’s future.

Experts outline why Bitcoin may no longer serve the role it once claimed, and why the broader crypto ecosystem could be on the brink of a new era.

Sponsored

Bitcoin’s Store-of-Value Thesis Faces Crisis as Crypto Evolves

Despite a weakening US Dollar and mounting global uncertainty, Bitcoin underperformed expectations as a hedge against fiat debasement.

The US Dollar Index (DXY) fell roughly 9% in 2025, and another 2% year-to-date in 2026, yet Bitcoin declined 20–22% YTD, trading for $68,255 as of this writing. Gold, by contrast, surged, proving resilient in risk-off scenarios.

“When tariffs, currency tension, and fiscal instability hit, this was the moment Bitcoin was supposed to behave like a store of value. Instead, capital ran to gold,” wrote analyst Ran Neuner.

Analysts, including Willy Woo and Henrik Zeberg, reinforce this view, highlighting that Bitcoin behaves as a high-beta, risk-on asset rather than a safe haven.

Bitcoin’s ideological allure appears to be fading. Retail participation has reached multi-year lows, and early evangelists have largely exited the market.

Sponsored

“We fought for ETF approval. We fought for institutional access. We wanted it inside the system. Now it is. There is nothing to fight for anymore…If it’s not used as cash, and it didn’t meaningfully absorb the stress bid, then what exactly is the narrative?” Neuner said, describing the post-ETF era as a turning point.

Institutional Access Achieved, But at a Cost

With 11 spot Bitcoin ETFs approved, corporate treasuries holding large allocations, and pro-crypto regulatory frameworks in place, Bitcoin has fully integrated into TradFi systems.

Michael Burry warned that this shift exposes companies holding BTC to significant value erosion if markets continue to correct:

Sponsored

“BTC has failed as a safe haven like gold and behaves more like a volatile stock tied to the S&P 500,” SwanDesk reported, citing Burry.

Crypto’s Next Phase: AI and Machine-Native Finance Amid Narrative Shift

Neuner sees the future not in Bitcoin’s store-of-value thesis, but in the emerging economy powered by AI agents.

Trillions of autonomous microtransactions will require instant, programmable settlement rails, a need that blockchain networks are uniquely positioned to serve.

“AI agents won’t use banks. They won’t use credit cards. They’ll need instant, programmable settlement rails. That’s crypto,” he said.

Sponsored

While Bitcoin struggles to retain its original purpose, broader crypto infrastructure could become the foundation for the next digital economy.

Analysts suggest that even if Bitcoin bled to death, decentralized networks, altcoins, and blockchain-based solutions may capture real utility and revenue models in the AI-driven era.

Neuner’s assessment highlights a critical turning point for crypto. Bitcoin may no longer be the ideological engine it once was, but the industry’s potential extends far beyond a single token.

Crypto World

Ripple (XRP) Price Predictions for This Week

XRP holds above $1.40. Can it reclaim $1.60 next before another rally?

XRP went through some intense volatility during the weekend, spiking above $$1.65 before it was rejected and pushed south to $1.40. What levels should investors watch before the next move?

Ripple (XRP) Price Predictions: Analysis

Key support levels: $1.40, $1.00

Key resistance levels: $1.60

1. XRP Finds Support at $1.4

Buyers returned to XRP at the $1.40 support and managed to hold the price above this key level for more than a week. This opens up the possibility for this cryptocurrency to rally all the way to $1.60 before sellers return.

2. Momentum Remains Bearish

Even if XRP managed to find support, the overall momentum remains bearish. To turn this downtrend around, buyers will have to break above the $1.60 resistance as well. If they are successful there, then the $2.00 target becomes realistic.

3. Daily RSI Leaves Oversold Area

The daily RSI bounced out of the oversold area, but has still not managed to move above $0.50. As long as it remains under this level, sellers have the advantage. Nevertheless, XRP has a real chance here to continue higher if buyers don’t vanish this week.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

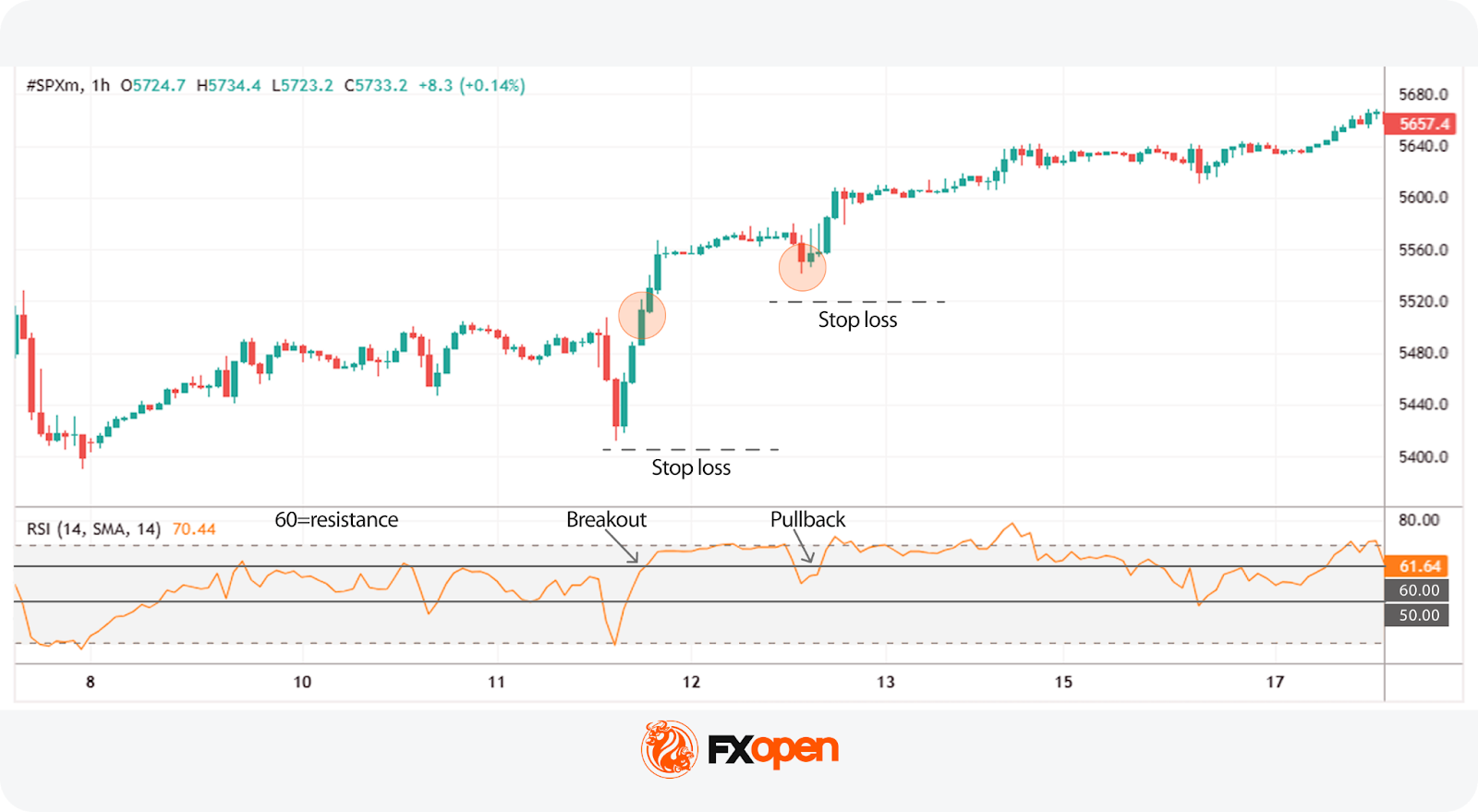

Relative Strength Index (RSI): Trading Strategies, Settings, and Market Applications

RSI is a popular momentum indicator in technical trading across forex, stock, and cryptocurrency* markets. The Relative Strength Index (RSI) is a momentum oscillator developed by J. Welles Wilder that measures the speed of price movements on a 0–100 scale. Traders use it to detect overbought/oversold conditions, trend strength, pullbacks, and exhaustion.

Although often viewed as a basic oscillator, the RSI plays a more nuanced role in professional trading strategies, particularly when combined with trend and volatility indicators. Understanding how the RSI behaves in different market environments may help traders refine entries, implement risk management strategies, and confirm trade setups.

In this article, we will consider how the RSI indicator works, how it is calculated, and how it can be applied in practical trading strategies across multiple asset classes.

Takeaways

- The Relative Strength Index (RSI) is a momentum indicator that measures the speed and magnitude of recent price movements to evaluate whether an asset is overbought or oversold.

- Developed by J. Welles Wilder, the RSI is plotted on a scale from 0 to 100 and is most commonly calculated over a 14-period timeframe.

- At its core, the RSI compares the average size of recent gains with the average size of recent losses over a defined period.

- Traditionally, RSI trading rules suggest that readings above 70 indicate overbought conditions, while readings below 30 signal oversold levels.

- Besides overbought and oversold signals, the indicator can provide divergence, trend strength, and failure swings signals.

What Is the Relative Strength Index?

The Relative Strength Index (RSI) is a momentum oscillator in modern technical analysis. Developed by J. Welles Wilder Jr. and introduced in 1978 in New Concepts in Technical Trading Systems, the indicator measures the speed and magnitude of recent price movements in order to evaluate underlying market momentum.

The RSI is plotted on a scale from 0 to 100 and is classified as an oscillator because it fluctuates within a fixed range rather than following price directly. This structure allows traders to evaluate whether buying or selling pressure is strengthening or weakening relative to recent market activity.

In practice the RSI functions less as a reversal indicator and more as a momentum persistence gauge. In directional markets the oscillator spends extended time in one half of its range, reflecting order-flow imbalance rather than exhaustion. Professional traders therefore interpret extreme readings as trend participation signals unless market structure begins to break.

Although the RSI is often introduced as a simple overbought-oversold tool, its practical application in professional trading is considerably broader. In leveraged markets such as forex and CFDs, traders use the indicator to identify pullbacks within trends, detect momentum divergence, and refine entry timing across multiple timeframes. The RSI therefore functions less as a standalone signal generator and more as a contextual momentum filter within broader trading systems.

The RSI belongs to the family of bounded momentum oscillators introduced by J. Welles Wilder in New Concepts in Technical Trading Systems (1978), alongside the average true range (ATR), the average directional movement index (ADX), and the parabolic stop and reverse (Parabolic SAR).

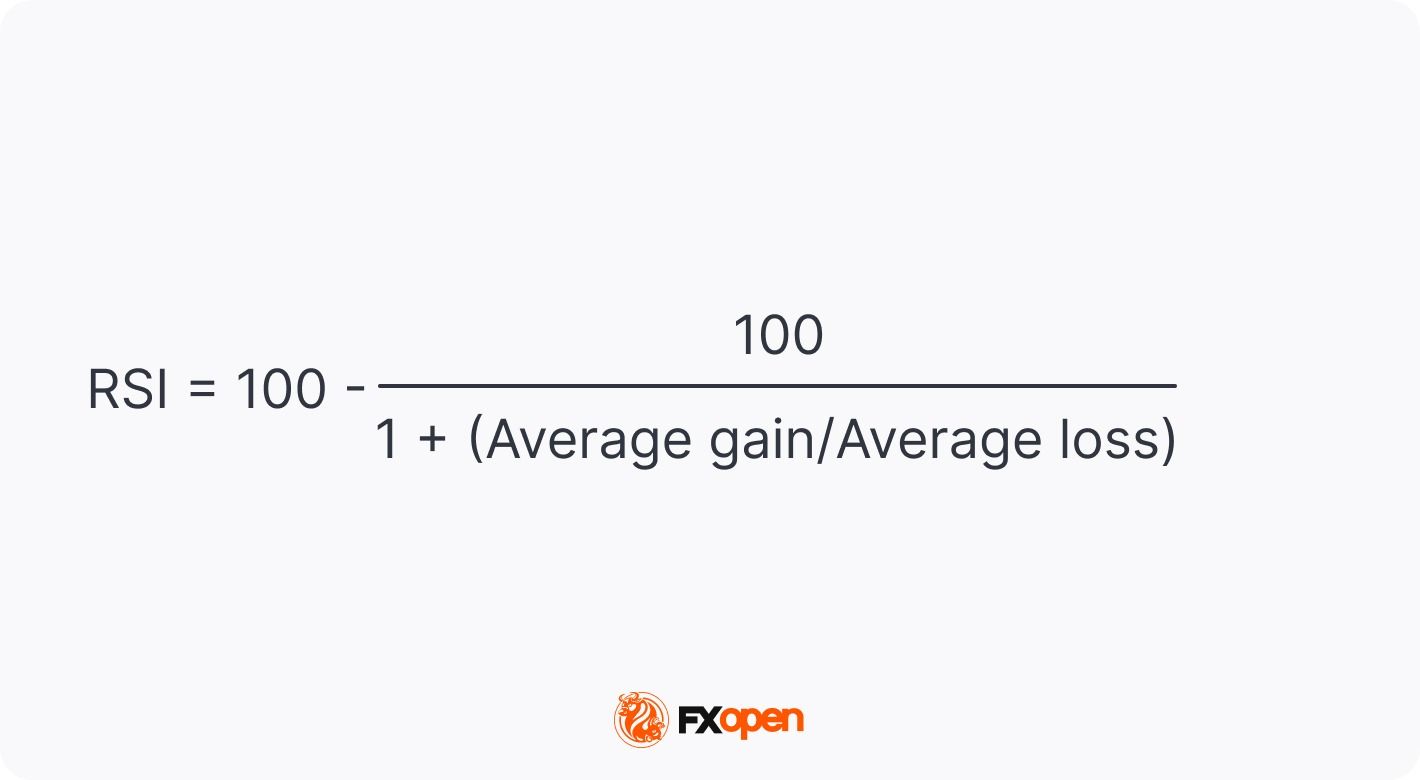

RSI Formula and Calculation

How is RSI calculated? It’s quite difficult to calculate the RSI. Fortunately, you don’t need to do it manually, as it’s one of the standard indicators implemented in most trading platforms. For instance, you can use TickTrader to examine the RSI without making complicated calculations.

However, it’s worth understanding how the indicator is measured to know which metrics can affect its performance.

The RSI Formula Explained

RSI formula

The calculation involves three main steps. First, the average gain and average loss over the selected period are determined. Second, these values are used to calculate relative strength, defined as the ratio of average gains to average losses. Finally, this ratio is transformed into an index value between 0 and 100 using the RSI formula.

The most popular RSI period is 14, meaning its values are based on closing prices for the latest 14 periods, regardless of the timeframe. We will use this period as an example of RSI calculations.

The standard RSI formula description:

Step 1: Average Gain and Average Loss

To calculate average gains and losses, you need to calculate the price change from the previous period.

Note: If the current price is higher than the previous one, add the gain to a total gain variable. If the price declined from the previous period, add the figure to a total loss variable.

After you calculate the change for all 14 periods, you need to add up the gains and divide them by 14 and sum up the losses and divide the total by 14.

Step 2: Calculate the Relative Strength (RS)

RS = Average Gain / Average Loss

To calculate the relative strength, divide the average gain by the average loss.

Step 3: Calculate the RSI

Now that you calculated the RS, you can proceed with the RSI value. For this, you need to add 1 to RS, divide 100 by the sum, and subtract the result from 100.

Relative Strength Index = 100 – 100 / (1 + RS)

Because the calculation uses smoothed averages of gains and losses, the RSI reacts to volatility contraction faster than to volatility expansion. This asymmetry explains why the indicator often gives early signals near market tops but delayed signals near lows.

What RSI Setting Do Traders Use?

The standard period is 14. Shorter lookback periods produce a more sensitive indicator that reacts quickly to price changes but generates more noise. Longer periods smooth out fluctuations but may lag behind rapid market shifts. This trade-off explains why RSI settings are often adjusted according to strategy type, whether scalping, day trading, or swing trading.

The following adjustments are common depending on strategy and timeframe:

Scalping strategies often use shorter RSI periods to capture rapid momentum shifts on lower timeframes. While this increases signal frequency, it also requires stricter risk management due to higher noise levels.

Want to learn how to read the RSI indicator signals?

How Is the RSI Indicator Used in Trading?

How to interpret the RSI indicator? There are four common ways to use the RSI indicator when trading: spot overbought and oversold conditions, find price divergences, implement failure swings for reversal signals, and determine market trends.

Relative Strength Index: Overbought/Oversold Indicator

The traditional interpretation of RSI levels focuses on the 70 and 30 thresholds. Readings above 70 are commonly described as overbought, while readings below 30 are considered oversold. However, in professional trading environments these thresholds are treated as reference zones rather than absolute signals.

The 70/30 framework works primarily in rotational markets. During macro-driven trends, price commonly continues moving after entering overbought or oversold territory because positioning flows dominate short-term mean reversion. In these conditions the RSI defines pullback zones rather than reversal zones.

During sustained uptrends, the RSI typically fluctuates between 40 and 80 (sometimes reaching 90 in very strong trends). Pullbacks often hold above 40, showing that bullish momentum remains intact. In sustained downtrends, the RSI usually ranges between 20 and 60, with rallies failing near 60, reflecting persistent selling pressure. These shifting RSI ranges may help traders assess trend strength rather than relying solely on the traditional 70/30 overbought–oversold levels.

Sustained RSI range shifts usually reflect systematic positioning rather than retail momentum. When the oscillator establishes a higher equilibrium range, dips towards the mid-zone often coincide with passive liquidity absorption rather than trend rejection.

On the daily chart of the GBP/USD pair, the RSI entered the oversold area on 22nd April, left it for a while on 4th May, but returned to it and continued moving upwards only on 15th May.

An example of the oversold RSI

Additionally, when using overbought/oversold signals, traders keep in mind that they can reflect an upcoming correction, not a trend reversal. The GBP/USD pair was trading in a strong downtrend, and the RSI provided a signal of a short-term correction only.

To distinguish between corrections and reversals, traders combine the RSI with other tools. A cross of a moving average can confirm a change in the trend.

Oversold RSI strategy

On the chart above, the RSI broke above the 30 level on 28th September. A trader could go long, using a trailing take profit. After the MA/EMA cross occurred (1), a trader could trail the take-profit target. Another option would be to place the take-profit order at the closest resistance level (2) and wait for the cross to confirm the reversal signal. After the confirmation, a trader could open another buy position and drive the uptrend.

RSI Divergence Strategy

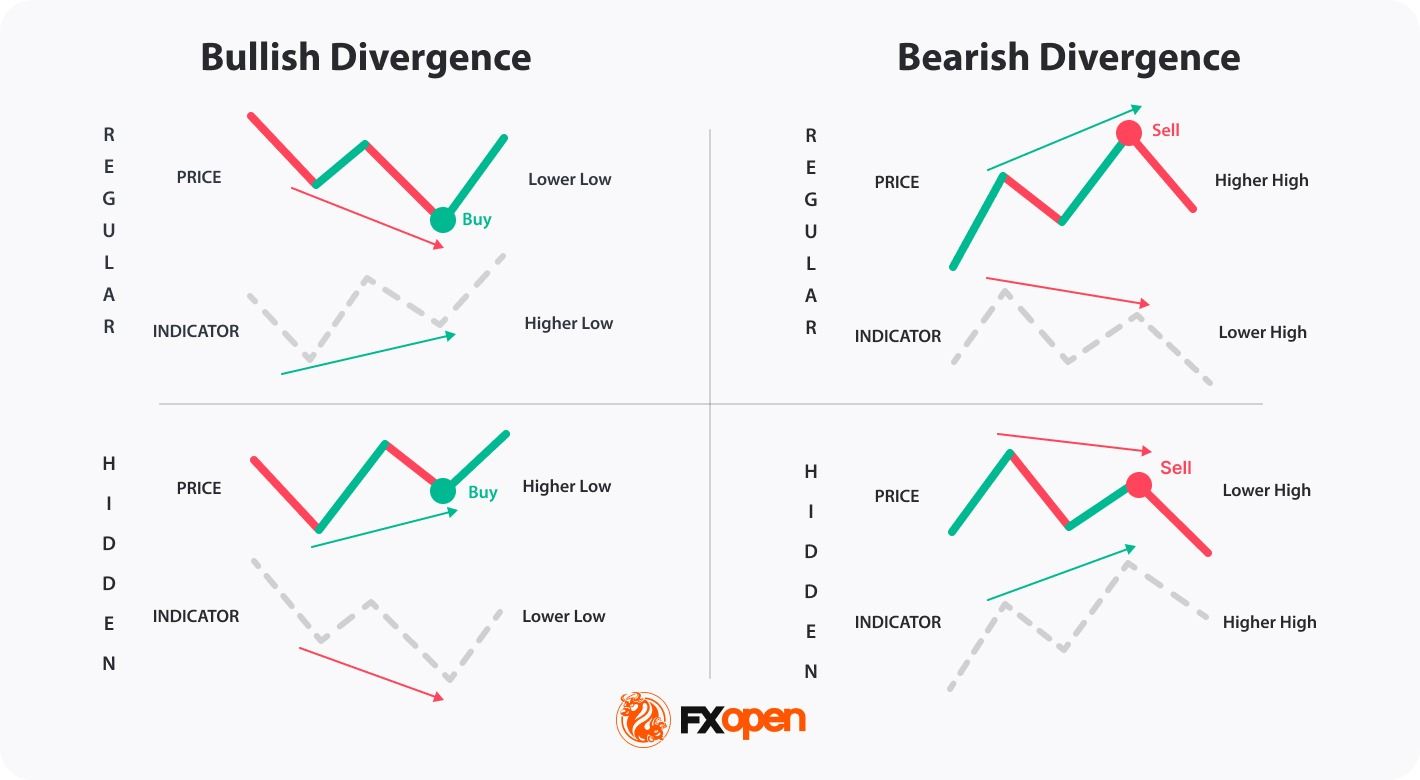

RSI is a divergence indicator. Another option for using the RSI is to look for divergences between the indicator and the price chart. Divergence occurs when price action and indicator momentum move in opposite directions, signalling a potential shift in underlying market dynamics.

A convention widely used in exchange educational materials is:

- An RSI bullish divergence forms when price records a lower low while the RSI prints a higher low. This pattern indicates that selling pressure is weakening even as price continues to decline.

- An RSI bearish divergence, by contrast, appears when price reaches a higher high but the RSI forms a lower high, suggesting diminishing upward momentum.

Divergence is more popular when it occurs near key support or resistance levels. However, because divergence can persist for extended periods before price reverses, it is rarely traded in isolation. Many traders confirm RSI divergence using tools such as the MACD or structural breaks in market structure.

Hidden divergence is another variation that signals trend continuation rather than reversal. In trending markets, this form of divergence may help traders identify pullbacks that are likely to resolve in the direction of the prevailing trend.

- A bullish divergence forms when the price rises with higher lows, but the relative strength index declines with lower lows, traders expect the price to move upwards.

- A bearish divergence forms when the price falls with lower highs, but the relative strength index moves upwards with higher highs, traders believe the price will decline.

Regular and hidden RSI divergence

Divergence frequently precedes momentum slowdown instead of immediate reversal. Markets often transition into consolidation before changing direction, which is why many traders wait for structure breaks rather than trading the first divergence signal. For example, in liquid index markets the first divergence often leads to range formation before trend change.

In the RSI example chart below, the indicator and the price formed a regular bearish divergence. As a result, the price fell (1). There was another divergence before the fall, but the price decline was short-lived (2). This highlights risks associated with the incorrect signals the RSI divergence may provide.

An example of the RSI divergence

RSI Failure Swings: A Reversal Signal

Another signal that traders can consider is failure swings of the RSI which occur before a strong trend reversal. Although it is less common than the others, traders can add it to their list of tools.

The theory suggests traders don’t consider price actions but look at the indicator alone.

- Bullish reversal. A trend may turn bullish when the RSI breaks below 30, leaves the oversold area, falls to 30 but doesn’t cross it and rebounds, continuing to rise.

- Bearish reversal. A trend may reverse down when the RSI enters the overbought area, crosses below 70, and returns to 70 but bounces and continues falling.

An example of RSI failure swings

Failure swings lose significance during volatility expansion events such as economic releases, when directional movement is driven by repricing rather than momentum decay.

In the chart above, the RSI trading indicator broke below 30, left the oversold area, and retested the 30 level (1). At the same time, the price formed the bottom, and the downtrend reversed upwards (2).

Failure swings are more common on short-term timeframes and do not always reflect a trend reversal. Therefore, traders combine the RSI with trend and volume indicators.

How Traders Identify Market Trends with RSI

The RSI can be used to identify a trend direction. Constance Brown, the author of multiple books about trading, noticed in her book Technical Analysis for the Trading Professional that the RSI indicator doesn’t fluctuate between 0 and 100. In a bullish trend, it moves in the 40-90 range. In a bearish trend, it fluctuates between 10 and 60.

To identify the trend, traders consider support and resistance levels. In an uptrend, the 40-50 zone serves as support. In a downtrend, the 50-60 range acts as resistance.

An example of trend determination using the RSI

In the chart above, the RSI stayed above 40 as the price was moving in a solid uptrend. Once it broke below the 40-50 support level (1), the trend changed (2).

However, there may be incorrect signals. In the chart below, the RSI broke below the support level twice, but the trend didn’t change.

An example of unsuccessful trend detection using RSI

Ranges may vary depending on the trend strength, price volatility, and the period of the RSI.

RSI and Simple Moving Average

Usually, the RSI indicator consists of a single line. However, there are variations of the indicator. It can be combined with the simple moving average. The moving average usually has the same period as the RSI.

The rule is that when the RSI breaks below the SMA, the price is supposed to fall (1). When the RSI rises above the SMA, the price is expected to increase (2).

RSI and Simple Moving Average

However, there are some aspects to consider. Firstly, traders avoid using RSI/SMA cross signals in the ranging market as the lines move close to each other and cross all the time, providing many fake signals. Secondly, a cross doesn’t determine the period of a rise or a fall. Traders use additional tools to identify where the price may turn around.

Note: The RSI is sensitive to volatility clustering. During news-driven sessions the indicator’s thresholds lose value because price movement is distribution-driven rather than momentum-driven.

RSI Trading Strategies Used by Professional Traders

Professional use of the RSI typically involves integrating the indicator into structured trading frameworks rather than relying on single signals. Several widely used approaches illustrate how momentum analysis can support decision-making.

What Is the 70-30 RSI Trading Strategy?

70-30 RSI Trading Strategy

The 70-30 RSI strategy simply uses the overbought and oversold RSI readings to identify potential turning points. However, instead of simply going short above 70 (overbought RSI) and long below 30 (oversold RSI), traders typically apply a few levels of refinement.

Entry:

- Traders determine if the trend is bullish or bearish.

- They apply a trend filter. The RSI can produce false signals in a strong trend, showing overbought for a long time in a bullish trend and vice versa. They often use the 70-30 strategy to look for shorts when the price rallies in a downtrend and longs when the price dips in an uptrend.

- They enter the market when the RSI crosses back into the normal range. For instance, they’ll open a short trade when the RSI falls back below 70, indicating that a potential bearish reversal may be underway.

Stop Loss:

- Stop losses are often set beyond a nearby swing point.

Take Profit:

- Profits might be taken at an area of support or resistance when the RSI hits the opposite extreme (e.g. 70 when long), or when other indicators signal a price reversal.

Mean-reversion RSI strategies statistically depend on market volatility compression. As volatility expands, breakout continuation tends to dominate over oscillator reversal signals.

50-60 and 40-50 Trading Strategies

50-60 RSI Trading Strategy

What is the 50-60 RSI trading strategy? The 50-60 RSI strategy works on the idea that the market shows bullish momentum above 50, with 60 acting as a resistance level. When the price breaks through 60, it can signal that bullishness is strong, offering a potential entry point.

Note:

- Despite the name, the same logic can be applied in a bearish trend, where 40 acts as a support level.

- This strategy is popular in markets with a strong trend. Indices, such as the S&P 500 and Nasdaq 100, or commodities like gold, that exhibit strong trends are often chosen by traders.

Entry:

- Traders may enter the market when the price crosses above 60 for the first time.

- Alternatively, they might wait for a pullback to 60 before going long.

Stop Loss:

- A stop loss may be set beyond the nearest major swing point or just beyond the entry candle on a pullback.

- Alternatively, some traders manually stop out if the price crosses below 50.

Take Profit:

- Profits might be taken when the price crosses below 50, giving room for the trade to run in a strong trend. However, this may limit potential returns when trading on short-term timeframes. Therefore, some traders prefer the closest resistance levels.

Typical RSI Strategy Comparison

RSI Meaning in Trading: Forex, Stocks, and Crypto* Markets

The RSI is applied across asset classes, but it behaves differently because persistence characteristics vary. Equity indices exhibit autocorrelation, currencies exhibit mean reversion around macro levels, and digital assets display momentum clustering. RSI interpretation should therefore be adjusted to the instrument’s structural behaviour rather than fixed thresholds.

In forex trading, where macroeconomic factors often drive sustained directional moves, the RSI is commonly used to identify pullbacks within trends rather than outright reversals. Currency pairs can remain overbought or oversold for extended periods when central bank policy or macro data supports a strong directional bias.

What is the RSI indicator in the stock market? In the stock markets, the indicator is frequently applied to mean-reversion strategies around key support and resistance levels. Stocks tend to exhibit more frequent range-bound behaviour than major currency pairs, making traditional overbought-oversold interpretations somewhat more applicable.

Cryptocurrency* markets, characterised by high volatility and rapid sentiment shifts, often produce extreme RSI readings. In this environment, divergence analysis becomes particularly valuable, as momentum frequently weakens before price reverses.

How to Use the Relative Strength Index with Other Indicators

In professional trading systems, the RSI is rarely used in isolation. Combining momentum analysis with trend, volatility, and volume tools may help traders filter signals and false entries.

RSI with MACD

RSI and MACD (moving average convergence divergence) are oscillators. However, they measure momentum differently, which allows one to confirm the signals of another. Usually, traders look for RSI overbought/oversold signals and MACD divergence. For instance, when the RSI is in the oversold zone but the MACD has a bullish divergence with the price chart, traders consider this a confirmation of a coming price rise. Read our article RSI vs. MACD.

RSI with Moving Averages

Early signals are one of the limitations of the RSI indicator. Therefore, traders often combine them with lagging technical analysis tools. An exponential moving average (EMA) is one of the options. Traders add two EMAs with different periods to the chart and wait for a cross to confirm the trend reversal signal the RSI provided.

RSI with Bollinger Bands

Bollinger bands are used similarly to the RSI, showing when the market is possibly overbought or oversold. Used together, these two indicators can provide confluence; for example, if the RSI indicates overbought and the price has closed through the upper band, then there may be an increased likelihood of a bearish reversal, and vice versa.

RSI with On-Balance Volume (OBV)

The on-balance volume (OBV) is a tool that tracks volume to confirm trends. Paired with the RSI, it has two uses. The first is that it can indicate trend strength. If the RSI is falling alongside the OBV, the bearish trend is likely genuine and vice versa. The second is confirming divergences. The OBV can diverge from the price like the RSI, so if both diverge, a reversal may be inbound.

Using RSI on Trading Platforms

Most trading platforms include the RSI as a standard built-in indicator. Platforms such as MetaTrader 4 and MetaTrader 5 allow traders to adjust periods, apply smoothing, and set custom alert levels. Also, you can implement the RSI indicator into your trading strategy on TradingView and TickTrader platforms, which also allow you to set up the indicator for your unique trading style.

Professional traders often integrate RSI signals into multi-timeframe analysis. For instance, a higher-timeframe RSI reading may define directional bias, while a lower-timeframe signal provides entry timing. This approach reduces the likelihood of trading against broader market momentum.

Pros and Cons of the RSI Indicator

Although the relative strength index is one of the most popular indicators, it has limitations. Let’s explore the two sides of the coin.

Benefits of the RSI in Trading

The relative strength index is a useful tool because of:

- Numerous signals. The RSI provides different signals so traders with different trading approaches can add it to their tool list.

- Numerous assets and timeframes. One of its advantages is that you can use the RSI on any timeframe of any asset. What does the RSI stand for in stocks? The same thing that it stands for in forex, commodity, and cryptocurrency* markets.

- Simplicity. Despite the wide range of signals, it’s easy to remember them. If you are familiar with other oscillators such as the stochastic oscillator, you will quickly learn how to use the RSI indicator.

- Standard settings. Although you can change the period of the RSI, its standard period of 14 is used in many trading strategies.

- Working signals. The RSI is one of the most popular trading tools. However, the reliability of its signals depends on trader skills and market conditions.

Limitations and False Signals of RSI

Although the RSI is a functional tool, there are some pitfalls traders should consider.

- Weak at trend reversals. The indicator may provide early signals when spotting trend reversal.

- False signals. The relative strength index isn’t a very popular tool in ranging markets.

- Lagging indicator. The RSI is based on past price data, meaning it may be relatively slow to react to sudden movements.

- Overbought/oversold conditions can persist. In strong trends, prices may remain above 70 or below 30 for long periods, leading to premature entries and exits.

Note: The RSI does not determine price direction; it measures the condition of the current move. Its primary value lies in distinguishing continuation conditions from exhaustion conditions.

Final Thoughts

The Relative Strength Index continues to play a central role in technical trading across forex, equities, and cryptocurrency* markets. Its value lies not in reflecting reversals in isolation but in providing insight into the strength and sustainability of price movements. When used alongside trend analysis, volatility measures, and volume indicators, the RSI becomes a powerful component of structured trading strategies.

For traders operating in leveraged CFD and forex markets, proper application involves combining the indicator with broader analytical tools, adapting settings to the trading timeframe, and maintaining disciplined risk management.

You can consider opening an FXOpen account today to build your own trading strategy in over 700 instruments with tight spreads from 0.0 pips and low commissions from $1.50 (additional fees may apply).

FAQ

What Does the RSI Stand For?

RSI stands for relative strength index. It’s a momentum-based indicator that measures the speed and magnitude of price movements.

What Is the RSI Setting?

The only setting of the Relative Strength Index is the period, which reflects the number of past candles used to calculate average gains and losses, affecting how sensitive the RSI is to price changes. The default period is 14, though shorter or longer settings may be applied depending on trading style and timeframe.

How Traders Use the RSI Indicator

The RSI moves between 0 and 100, with >70 meaning the asset is overbought and <30 meaning oversold. It can be used to spot potential market reversals and confirm trend strength.

Is RSI Used in Forex Trading?

Yes. The RSI is widely used in forex to identify pullbacks, confirm trends, and detect divergence signals.

How Do Traders Use RSI Divergence?

Divergence between price and RSI is often used to identify weakening momentum and potential reversals, particularly when confirmed by other indicators or price-structure analysis.

What Is the RSI in Stocks?

The RSI meaning in stocks refers to the same RSI indicator used in other asset classes. It’s used to gauge buying and selling pressure.

Is High RSI Bullish or Bearish?

A high RSI (above 70) signals bullish momentum, suggesting an overbought market and a potential soon downward reversal.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

SBI Holdings Eyes Majority Stake in Singapore-based Coinhako

SBI Holdings, the Tokyo-listed financial group, is intensifying its crypto play by pursuing a controlling stake in Singapore-based Coinhako. Through its wholly owned subsidiary SBI Ventures Asset, SBI signed a nonbinding letter of intent with Holdbuild, Coinhako’s parent company, to inject capital and acquire shares from existing investors. If the deal moves forward, SBI would secure a majority stake and Coinhako would become a consolidated subsidiary, subject to regulatory approvals. Financial terms were not disclosed, and the investment structure remains under discussion. The proposal signals SBI’s broader ambition to build international digital-asset infrastructure beyond a single trading platform, including ventures in tokenized securities and stablecoins.

Chairman and CEO Yoshitaka Kitao framed the development as part of a larger strategy rather than a mere acquisition. He underscored Coinhako as a building block in SBI’s plan to create cross-border rails for digital assets, aligning with efforts to expand tokenized securities, settlement networks, and regulated stablecoins across Asia-Pacific. The Singapore base would offer a licensed footprint in one of the region’s most regulated crypto hubs, potentially smoothing the path for SBI’s foreign-market expansion.

Coinhako, founded in Singapore, operates a regional digital-asset trading platform and related services through Hako Technology, which is licensed by the Monetary Authority of Singapore as a Major Payment Institution. The group also runs Alpha Hako, a virtual asset service provider registered with the British Virgin Islands Financial Services Commission. The exchange’s trajectory has included SBI’s involvement in 2021 via the SBI-Sygnum-Azimut Digital Asset Opportunity Fund, a vehicle that signaled SBI’s willingness to co-invest with established crypto and traditional-finance partners.

Yusho Liu, Coinhako’s co-founder and CEO, framed the alliance as a pathway to scale institutional-grade systems. He emphasized that the partnership would address rising demand for tokenized assets and stablecoins while reinforcing Singapore’s role as a linchpin of the world’s next-generation financial system. The collaboration is seen as a catalyst for deeper liquidity, more robust custody tools, and scalable settlement workflows that could attract regulated participants seeking compliant, cross-border rails.

For SBI, the potential consolidation of Coinhako dovetails with a long-running strategy to broaden its blockchain footprint. The group has pursued tokenization initiatives, payment networks, and other crypto-related businesses for several years. In December 2025, SBI partnered with Startale Group to develop a fully regulated Japanese yen-denominated stablecoin aimed at tokenized asset markets and cross-border settlement, with issuance and redemption handled by Shinsei Trust & Banking and circulation supported by SBI VC Trade, SBI’s own crypto exchange. Earlier in 2025, SBI Group joined forces with Chainlink to build digital-asset tools for financial institutions in Japan and across the Asia-Pacific region. Taken together, these moves illustrate SBI’s intent to connect traditional finance with crypto-native capabilities—spanning custody, liquidity, and programmable settlement rails.

The announcement comes at a time when Singapore’s regulatory framework continues to attract and shape institutional crypto activity. By seeking a licensed base in Singapore, SBI would align with a jurisdiction that has sought to balance innovation with consumer protections and market integrity. The nonbinding nature of the LOI means terms could evolve, and the ultimate path to a definitive agreement will hinge on regulatory scrutiny and the willingness of both sides to align on governance, integration, and capital deployment. The Coinhako deal, if consummated, would place a notable cross-border asset under SBI’s umbrella, potentially accelerating the bank’s ability to service institutional clients seeking regulated access to tokenized assets and stablecoins in Asia’s evolving ecosystem.

Industry observers will watch closely how the transaction might influence Coinhako’s roadmap. A successful consolidation could enable deeper institutional onboarding, more rigorous risk-management protocols, and a broader product set that leverages SBI’s capital, technology, and network—potentially including enhanced liquidity provisioning, custody enhancements, and more formalized cross-border settlement rails. Yet the deal also poses questions about regulatory approvals, competition in Singapore’s exchange landscape, and how a larger SBI-backed entity would interact with local incumbents and market entrants. As with many cross-border crypto ventures, execution risk centers on navigating a complex regulatory matrix and aligning strategic priorities across jurisdictions.

Beyond Coinhako, SBI’s broader blockchain push signals a continuing appetite among major financial groups to blend traditional finance with crypto-native capabilities. The yen-stablecoin initiative with Startale, the Chainlink collaboration, and other partnerships indicate a deliberate roadmap toward tokenized markets, regulated stablecoins, and interoperable networks that can support tokenized securities, digital cash equivalents, and cross-border settlement. If the Coinhako talks crystallize into a binding deal, SBI could gain a foothold in Singapore’s regulated crypto infrastructure, potentially serving as a gateway for further collaborations, licenses, and product launches across the region. The coming months are likely to reveal whether these strategic threads converge into a cohesive, long-term platform strategy or remain a portfolio of exploratory projects that complement SBI’s core banking and payments businesses.

Key takeaways

- SBI Holdings’ subsidiary SBI Ventures Asset signed a nonbinding letter of intent to inject capital into Coinhako and acquire shares from existing investors, potentially giving SBI a majority stake and making Coinhako a consolidated subsidiary pending approvals.

- The terms of the arrangement were not disclosed, and the deal structure remains under discussion, subject to regulatory clearance.

- Coinhako operates a MAS-licensed trading platform in Singapore, with additional services via Alpha Hako in the British Virgin Islands; the exchange has previously attracted SBI investment.

- CEO Yusho Liu described the partnership as a path to scale institutional-grade systems to meet demand for tokenized assets and stablecoins, reinforcing Singapore’s role in the future financial system.

- SBI’s broader blockchain initiatives—yen-stablecoin development with Startale and digital-asset tools with Chainlink—underscore the group’s aim to build cross-border, regulated rails for digital assets in Asia-Pacific.

Market context: The move reflects ongoing consolidation and institutionalization of crypto activities in regulated Asia markets, with Singapore acting as a focal point for cross-border infrastructure and compliant product suites. Regulatory approvals will shape the timeline and scope of any definitive agreement, while the broader market trend toward tokenized assets and stablecoins provides a backdrop for SBI’s expansion strategy.

Why it matters

The potential consolidation of Coinhako under SBI would extend SBI’s footprint beyond traditional financial services into a regulated, cross-border crypto platform. If completed, the transaction could accelerate Coinhako’s ability to scale institutional-grade operations, offering more robust custody, liquidity, and integration with SBI’s broader payments and tokenization programs. The arrangement also signals how large financial groups view regulated hubs like Singapore as launchpads for cross-border crypto activity, not just as regional trading venues but as gateways to tokenized markets across Asia-Pacific.

For Coinhako, the deal could bring additional capital, governance expertise, and access to a global network of financial partners, potentially speeding up product development and regulatory compliance improvements. For Singapore, the move reinforces the city-state’s standing as a regulated center for digital assets, encouraging more collaboration between traditional financial institutions and crypto-native platforms while maintaining stringent oversight to protect market integrity.

From a broader market perspective, SBI’s actions—coupled with its yen-stablecoin initiative and Chainlink collaboration—illustrate a trend among traditional financiers to build multi-faceted ecosystems that blend tokenized assets with regulated stablecoins and cross-border settlement workflows. This could influence how other regional players structure partnerships, custody solutions, and liquidity access as demand for regulated, scalable crypto infrastructure continues to rise.

What to watch next

- Definitive agreement: Sign-off on a binding agreement and disclosure of terms, subject to regulatory approvals.

- Regulatory review: MAS scrutiny and any conditions placed on a potential consolidation and cross-border activities.

- Structural details: Governance, board representation, and integration plans for Coinhako within SBI’s corporate umbrella.

- Product roadmap: Any announced additions to Coinhako’s platform, including tokenized assets or stablecoin-related services linked to SBI’s ecosystem.

- Follow-up disclosures: Additional statements from SBI, Holdbuild, or Coinhako regarding timelines, milestones, or financing rounds.

Sources & verification

- SBI Holdings announces a nonbinding LOI to acquire Coinhako via a press release (pdf): https://www.sbigroup.co.jp/english/news/pdf/2026/0213_a_en.pdf

- Coinhako’s previous SBI investment described in a Cointelegraph article: https://cointelegraph.com/news/sbi-holdings-invests-in-singapore-crypto-exchange-coinhako

- Startale and SBI yen-stablecoin collaboration mentioned in Cointelegraph: https://cointelegraph.com/news/japan-sbi-and-startale-plan-regulated-yen-stablecoin-in-2026-under-new-framework

- SBI Group’s Chainlink partnership to build digital asset tools for APAC: https://cointelegraph.com/news/sbi-group-partners-chainlink-crypto-asia-finance-market

- Background discussion on Asia-Middle East corridor and permissioned-scale approaches: https://cointelegraph.com/news/future-crypto-asia-middle-east-corridor-lies-in-permissioned-scale

SBI bid to anchor Coinhako: implications and next steps

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video18 hours ago

Video18 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech6 hours ago

Tech6 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal