Crypto World

Gold Rises Back Above $5,100 as Sharp Retreat Attracts Buyers

Gold prices extended gains for a second day, climbing back above $5,100 as a historical pullback from record highs offered a buying opportunity for investors.

In early trading, New York futures rose 3.4% to $5,102.90 a troy ounce following a 6% jump in the previous session.

The recent correction doesn’t signal a change in gold’s underlying drivers, with the medium-term outlook supported by continued central-bank buying, firm ETF demand, and persistent geopolitical and economic uncertainty.

Crypto World

Why Institutions Still Prefer Ethereum Over Faster Blockchains

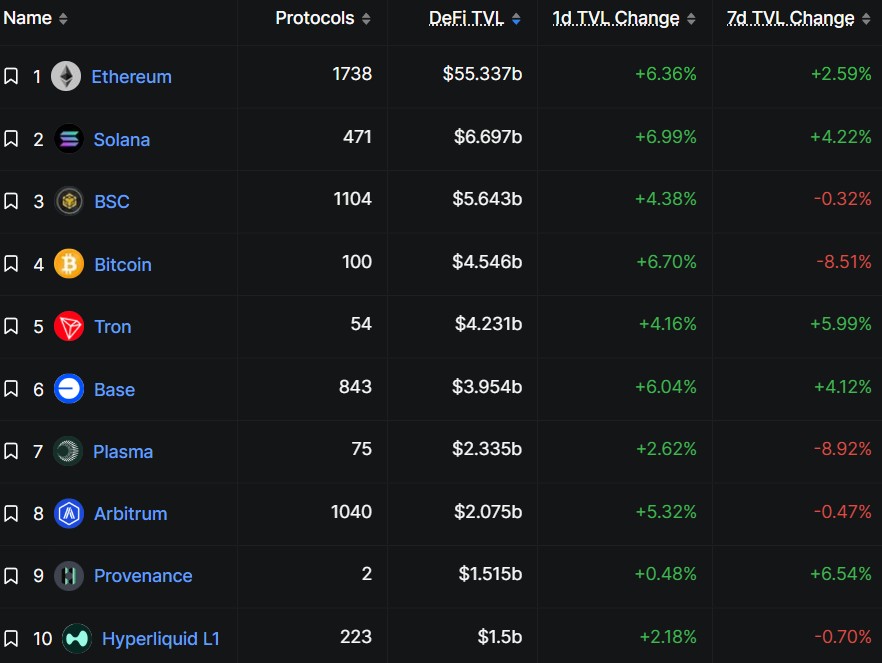

As institutional capital continues to enter the crypto ecosystem, the backbone of on-chain activity remains the same: liquidity depth and the concentration of stablecoins. The market has witnessed a recurring debate about whether newer networks can outpace the incumbent by sheer throughput, but veteran money tends to chase depth and resilience first. A former Morgan Stanley derivatives executive who has watched Asia’s markets highlights a core truth: institutions care about where liquidity already sits, not just how fast a chain can process transactions. That dynamic underpins a broader narrative about who really ships value in crypto—users, traders, and institutions alike—rather than just the pace of technology.

Key takeaways

- Ethereum (CRYPTO: ETH) remains the deepest liquidity hub for DeFi and stablecoins, attracting large-scale capital that anchors on-chain markets and stabilizes supply.

- Institutional participation—through assets like tokenized funds and RWAs—adds scale and stability to crypto ecosystems, extending beyond hype-driven retail activity.

- Layer-2 solutions helped relieve mainnet congestion, but liquidity fragmentation across L2s ultimately reinforced Ethereum’s central role by maintaining a single, deep liquidity pool for large trades.

- Upcoming scaling upgrades, notably the Glamsterdam fork planned for 2026, aim to push the mainnet toward higher throughput (potentially around 10,000 TPS over time) while preserving liquidity depth.

- While rivals such as Solana tout higher TPS, Ethereum’s liquidity depth continues to attract institutions that value tight spreads and the ability to absorb sizeable transactions without slippage.

Tickers mentioned: $ETH, $SOL, $BUIDL

Market context: The debate between throughput and liquidity sits against a backdrop of growing institutional interest in stablecoins and real-world assets (RWAs) on-chain, with major asset managers exploring scalable, liquid rails for large-scale tokenized products.

Why it matters

The essence of the current market structure is that deep liquidity creates stability. Ethereum (CRYPTO: ETH) has solidified its status as a distribution layer for stablecoins and DeFi capital, a position that matters for actors ranging from market makers to fund managers seeking large, predictable liquidity pools. In practice, this depth translates into tighter bid-ask spreads and lower slippage for sizable trades, attributes that matter for institutions seeking to deploy capital without disrupting market prices. The presence of stablecoins and institutional liquidity solidifies a chain’s ecosystem, enabling more robust on-chain activity beyond speculative retail cycles.

Institutional players are not simply chasing a single metric like throughput; they want a ecosystem with proven settlement reliability, regulatory compatibility, and the ability to deploy RWAs and other real-world assets. BlackRock’s USD Liquidity Fund (BUIDL), a tokenized Treasury fund that started on Ethereum and later expanded to multiple blockchains, exemplifies how large investors are bridging traditional finance with digital liquidity. Ethereum’s share of the BUIDL market underscores how much of the industry’s capital defaults to the largest, most battle-tested chain. The on-chain footprint of such products reinforces Ethereum’s role as a backbone for stability, rather than just a playground for speculative tokens.

On the technical side, the evolution of Layer-2 rollups has been a double-edged sword. They alleviated cost pressures on the mainnet and expanded execution capacity—but liquidity was splintered across several environments, complicating large trades that require cross-rollup coordination. Still, the net effect, according to practitioners, was a retention of liquidity within the Ethereum ecosystem rather than a shift to competing L1s. The liquidity concentration on Ethereum has meant that even as projects tout higher theoretical TPS, the marketplace converges on the venue with the deepest pools and the most robust market depth.

In conversations around who leads the charge, the supply of liquidity is often described using a downtown-versus-suburb analogy. Ethereum, in this framing, functions as the “downtown”—the place where the most active liquidity and the broadest set of financial instruments converge. “If you want the deepest liquidity, you go downtown, and that’s Ethereum,” one advocate summarized. The comparison captures why institutions—and the traders who serve them—prefer to locate capital where the largest pools exist, even if there are more nimble, cheaper chains elsewhere. The goal is to minimize price impact and preserve execution quality even for large, complex orders.

Amid these dynamics, Solana (CRYPTO: SOL) has been positioned by some as an “Ethereum killer” due to its throughput gains. The narrative around its higher TPS has been a magnet for retail activity, even as long-term sustainability and liquidity depth remain points of scrutiny. Solana’s rise, followed by a wave of “Solana killers” that promise even higher theoretical throughput, illustrates a broader industry race to scale. Yet industry observers caution that higher throughput alone does not guarantee meaningful capital flows; institutions still seek the deepest, most reliable pools of liquidity that can absorb sizable transactions without destabilizing prices. The ongoing discussion about liquidity depth versus raw speed remains central to how capital allocates across networks.

“I think of Ethereum as like downtown,” Lepsoe observed. “You could build a marketplace uptown somewhere in the suburbs, and you might find price efficiency there, but if you want the deepest liquidity, you go downtown.”

As the crypto landscape matures, institutional interest is increasingly oriented toward practical use cases—stablecoins, tokenized assets, and RWAs—over speculative price plays. The deployment of RWAs on Ethereum, together with stablecoin dominance, continues to define the path for institutional adoption. The narrative is not simply about which chain is fastest; it is about which chain provides the most reliable, scalable, and well-supported liquidity rails for large, real-world financial transactions.

Nevertheless, the industry remains optimistic about scaling on the mainnet. The Ethereum ecosystem has acknowledged that a portion of the early L2 momentum resulted in liquidity fragmentation, but this has been recast as a blessing in disguise by many observers. If liquidity remains accessible on Ethereum while L2s handle execution, the ecosystem can preserve a unified, deep pool that supports institutional activity. In a broader sense, the community is recalibrating expectations around what “scaling” means in a mature market: not just faster blocks, but more efficient execution and deeper markets that survive cycles of hype and drawdown.

On the horizon, scaling upgrades are expected to reshape the liquidity landscape further. The Glamsterdam fork, penciled in for 2026, aims to raise Ethereum’s block gas limit significantly, potentially lifting throughput and enabling more expansive on-chain activity without sacrificing liquidity depth. As these upgrades unfold, infrastructure providers are also pursuing innovations to improve execution efficiency. Projects like ETHGas, which aims to optimize block construction through off-chain coordination, and zero-knowledge-based bundling techniques, are examples of the kinds of fine-tuning that could complement the larger scaling narrative. In parallel, leading researchers emphasize the enduring value of battle-tested networks, suggesting that institutions will continue to favor chains that have withstood multiple market cycles and robust security assumptions before expanding into new ecosystems.

Industry participants also note that institutions are increasingly evaluating cross-chain strategies that let them maintain exposure to Ethereum’s liquidity while leveraging other networks for specific use cases or privacy requirements. The interplay between depth and customization—privacy, throughput, and settlement speed—will shape the next phase of institutional crypto infrastructure. While Solana and Canton offer competitive features—privacy assurances and rapid execution—they are unlikely to displace Ethereum’s liquidity advantage in the near term. The dominant thesis remains: for large allocators, liquidity depth remains the primary differentiator when choosing where to deploy capital.

In sum, Ethereum’s leadership in DeFi liquidity and stablecoins—coupled with growing RWAs and tokenized assets—continues to anchor institutional adoption. While faster networks entice speculative activity and offer marginal improvements in execution, the deepest markets and the most mature on-chain ecosystems remain on Ethereum. As 2026 approaches, the industry will be watching how Glamsterdam and related scaling initiatives interact with continued capital inflows, whether through BUIDL-like products or broader tokenized real-world assets, to shape the next cycle of growth in institutional crypto markets.

What to watch next

- Glamsterdam fork: Expected in 2026, with a potential increase in block gas limit from 60 million to 200 million and a long-term path toward higher TPS.

- Layer-2 development: Ongoing maturation of rollups and cross-L2 liquidity strategies to reduce fragmentation while preserving deep liquidity on the mainnet.

- RWAs and stablecoins adoption by institutions: Monitoring the evolution of tokenized assets on Ethereum and the appetite of major asset managers for real-world assets.

- Private and privacy-focused chains: Evaluation of Canton-like offerings and how they influence institutions’ multi-chain strategies while maintaining liquidity depth.

- Institutional products: Deployment and performance of tokenized funds such as BUIDL and related vehicles, including on- and cross-chain liquidity metrics.

Sources & verification

- Vitalik Buterin’s discussion on L2 scaling and mainnet priorities: https://x.com/VitalikButerin/status/2018711006394843585

- BlackRock’s USD Liquidity Fund (BUIDL) tokenized Treasury product on Ethereum: https://www.blackrock.com/corporate/literature/whitepaper/bii-global-outlook-2026.pdf

- RWA.xyz assets page for BUIDL: https://app.rwa.xyz/assets/BUIDL

- DefiLlama stablecoins data, illustrating Ethereum’s leadership by market capitalization: https://defillama.com/stablecoins

- Article on Ethereum scaling and the Tok/Market perspective, including discussions around Glamsterdam and L2 decentralization: https://cointelegraph.com/news/ethereum-foundation-quantum-gas-limit-priorities-protocol

What Ethereum’s liquidity leadership means for users and builders

Ethereum’s enduring liquidity edge matters for users who rely on predictable execution and for builders who develop on-chain financial primitives. The combination of a deep stablecoin market, broad DeFi activity, and tokenized real-world assets provides a persistent foundation on which new applications can scale without chasing liquidity across multiple disconnected chains. For developers, it signals that building with robust liquidity incentives, tight slippage controls, and cross-chain interoperability will likely yield the strongest, most resilient user experiences. For investors, liquidity depth translates into relatively safer entry points for large exposures and more stable pricing dynamics during volatile episodes.

Crypto World

Berkshire Hathaway (BRK.A) Q4 2025 earnings

Warren Buffett and Greg Abel walkthrough the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 3, 2025.

David A. Grogen | CNBC

Berkshire Hathaway reported a big decline in its operating earnings for the fourth quarter, due in large part to weakness in the conglomerate’s insurance business.

Earnings from operations totaled $10.2 billion in Q4. That’s down more than 29% from $14.56 billion in the year-earlier period.

This was the final quarter under Warren Buffett as CEO, who announced he was stepping down at the annual shareholders meeting last May. Greg Abel took the reins to start 2026 and vowed in Berkshire’s annual letter accompanying Saturday’s results to continue the culture Buffett built of financial strength and capital discipline. Buffett remains chairman.

Insurance underwriting profits dropped 54% to $1.56 billion from $3.41 billion a year prior. Insurance investment income slid nearly 25% from to $3.1 billion from $4.088 billion.

For the full-year 2025, operating earnings totaled $44.49 billion. That’s down from $47.44 billion in the year prior.

Profits from insurance underwriting came in at $7.26 billion, down from $9 billion in 2024. Insurance investment income for the year eased to $12.5 billion from $13.6 billion a year prior.

No buybacks, cash hoard dips slightly

Buffett again refrained from buying back Berkshire shares despite ending Q4 along the flatline.

Despite the lack of buybacks, the conglomerate’s cash hoard did slip to $373.3 billion from a record of $381.6 billion in the third quarter.

Berkshire Hathaway Class A shares rose 10% in 2025, lagging the S&P 500’s 16.4 advance.

This is breaking news. Please check back for updates.

Crypto World

Stablecoin Payments Hit $390B Annualized as Enterprise Adoption Surges

TLDR:

- Stablecoin payments total $390B annualized, led by B2B enterprise and supplier settlements.

- Card-linked spending is fastest growing by transaction count, rising +673% year-on-year.

- P2P transfers reach $77B with 0.37% market penetration, reshaping remittance corridors.

- B2C payouts total $11B, growing +86%, led by payroll and creator economy adoption.

Stablecoin payments are tracking $390 billion on an annualized basis, data shows. B2B activity dominates with $226 billion, fueled by enterprise settlements and supplier payments.

Card-linked spending is rising rapidly, with transaction volumes up 673 percent. Peer-to-peer transfers and early B2C payouts remain smaller but show significant growth momentum.

Enterprise and B2B Adoption Drives Market Growth

Enterprise and B2B transactions are the main contributors to stablecoin volume, accounting for over half of total payments. Corporate settlements and supplier payments have increased 733 percent compared with prior periods, indicating growing institutional reliance.

According to blockchain transaction data shared by expert Leon Waidmann, businesses are integrating stablecoins for faster, borderless liquidity and automated payments. Card-linked spending also continues to rise, positioning debit cards funded with stablecoins as the fastest-growing consumer-facing segment.

P2P transfers remain smaller at $77 billion but already reach a 0.37 percent market penetration rate. This suggests remittance corridors are being restructured as stablecoins replace traditional intermediaries.

The growth in enterprise adoption precedes broader consumer adoption, highlighting the strategic prioritization of infrastructure over retail. Payments data from public blockchain networks confirms that B2B and enterprise transactions remain the primary driver of total stablecoin activity.

Despite rapid growth, total market penetration across all segments is only 0.02 percent. The low overall adoption underscores how early the market remains for stablecoin payments.

Stablecoins are securing a foundation in enterprise liquidity before reaching mass consumer use. Analysts tracking network activity highlight the potential for future retail adoption once infrastructure is established.

Consumer Spending and Emerging B2C Applications

Consumer adoption of stablecoin payments is emerging primarily through cards and payroll applications. Card-linked transactions have surged, offering a practical entry point into retail spending.

Debut B2C use cases, including creator economy payouts and payroll, are still in early phases, totaling roughly $11 billion. Growth in these areas reached 86 percent, signaling accelerating adoption for emerging markets.

Payroll and creator-focused payments are just beginning to leverage stablecoins for recurring and cross-border payouts. Early integrations suggest that consumer adoption will expand as infrastructure matures.

The expansion of cards as a consumer touchpoint complements enterprise dominance, bridging users into the broader ecosystem. Data from transaction networks suggests that these consumer-facing applications will grow alongside enterprise settlement systems.

The broader stablecoin ecosystem is positioning for a multi-trillion-dollar market, with infrastructure leading adoption. Companies building B2B stacks are establishing early dominance before retail markets mature.

Card-linked and P2P transactions serve as entry points for consumer engagement. Continued adoption in enterprise, remittances, and emerging B2C applications underscores stablecoins’ expanding market footprint.

Crypto World

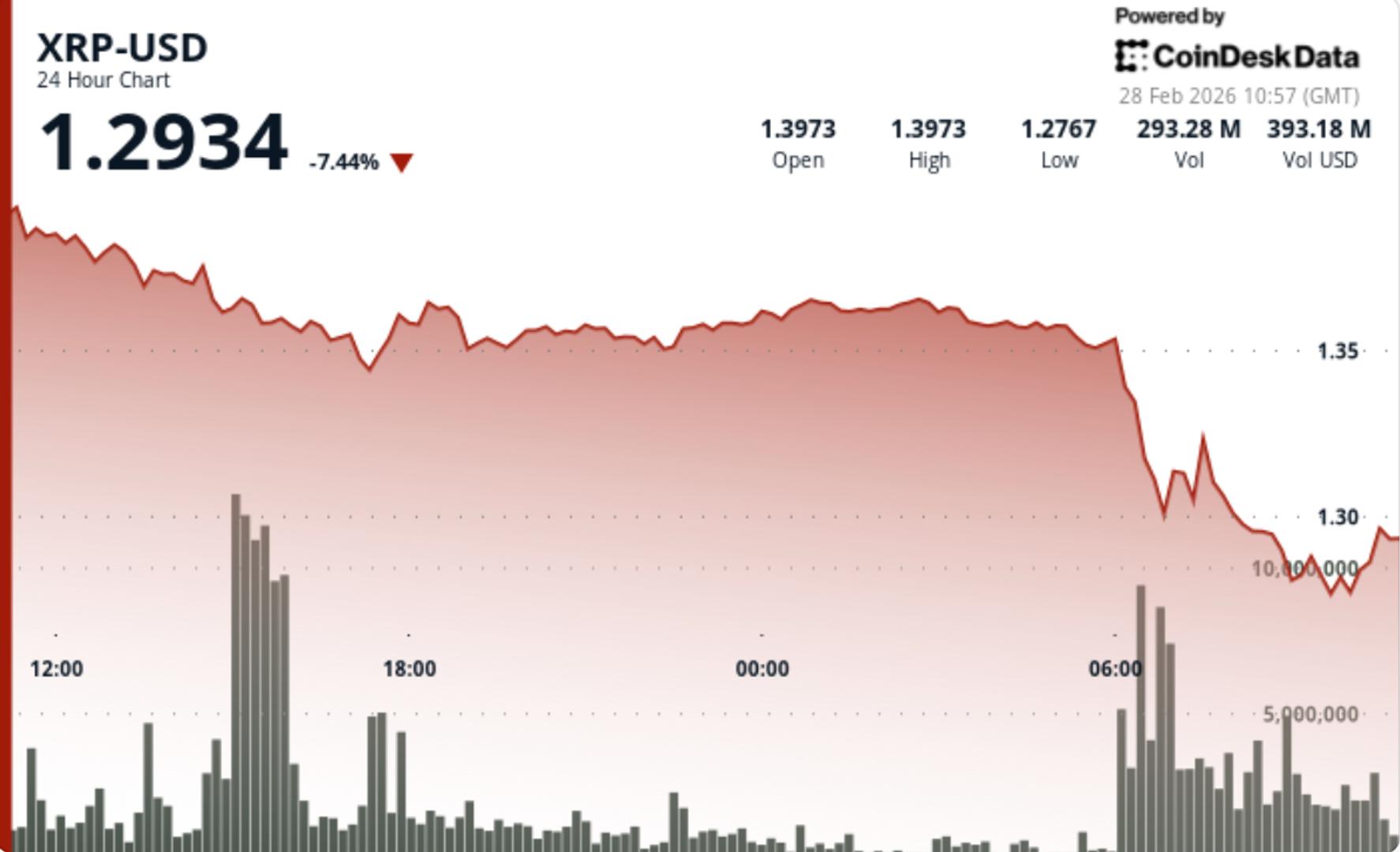

What next for Ripple-linked token as it nosedives 10%

XRP reversed sharply after failing to sustain its rebound, with a high-volume breakdown through $1.36 accelerating downside momentum.

News Background

- XRP fell alongside renewed weakness across the broader crypto market, but the decisive move was technical rather than headline-driven.

- The token had staged a brief relief rally earlier in the week, only to stall below key resistance and roll over as sellers defended higher levels.

- The breakdown extends XRP’s corrective pattern since its July 2025 peak, reinforcing a sequence of lower highs and failed recovery attempts.

Price Action Summary

- XRP dropped 9.1% from $1.42 to $1.30

- Selling intensified once $1.36 support failed

- Volume surged more than 170% above average during the main capitulation phase

- A brief rebound toward $1.33 was quickly rejected

Technical Analysis

- The critical event was the clean break below $1.36, which had served as near-term structural support.

- Once lost, downside momentum accelerated, driving price toward $1.30 on outsized volume — a sign of forced selling rather than gradual distribution.

- A short-covering bounce pushed XRP to $1.325, but the rally stalled immediately, forming a clear lower high and confirming the broader downtrend remains intact. Former support at $1.36–$1.37 now acts as resistance, while $1.32–$1.33 caps near-term recovery attempts.

- On higher timeframes, XRP remains below key retracement levels, with $1.47 representing the next meaningful structural hurdle should buyers regain control.

What traders say is next?

- Traders are focused on whether $1.30 can hold as a near-term floor.

- If $1.30 stabilizes, XRP may consolidate before attempting another push toward $1.32–$1.36. A reclaim of $1.36 would be the first sign that the breakdown was overextended.

- If $1.30 fails decisively, downside risk shifts toward the $1.20–$1.22 region, where longer-term demand is expected to emerge.

- For now, momentum favors sellers, and any bounce is viewed as corrective until resistance levels are reclaimed.

Crypto World

SolarEdge Tumbles 9.5% as Solar Industry Faces Widespread Decline

Key Takeaways

- SolarEdge (SEDG) closed down 9.5% at $36.57 on February 27, trading on approximately half its typical daily volume.

- Solar stocks experienced significant declines, with Sunrun plummeting 35%, Array Technologies falling 34%, and Shoals Technologies dropping 31% following quarterly reports.

- Industry-wide challenges include tariff-related margin compression and reduced federal incentives dampening residential solar adoption.

- While SolarEdge exceeded Q4 earnings expectations, the company continues operating at a loss with a net margin of -34.2%.

- Wall Street maintains a “Reduce” rating on SEDG, with the consensus price target of $27.28 indicating potential downside from current levels.

Shares of SolarEdge Technologies (SEDG) declined 9.5% during trading on February 27, finishing the session at $36.57 compared to the previous close of $40.40.

SolarEdge Technologies, Inc., SEDG

Trading activity was notably subdued, with approximately 1.57 million shares changing hands — roughly half the company’s 3.16 million share average daily volume.

The decline in SEDG wasn’t an isolated event. The entire solar industry experienced significant downward pressure throughout the week.

Sunrun plummeted 35% following its earnings announcement. Array Technologies saw shares drop 34%. Shoals Technologies declined 31%. First Solar fell 14%. The Invesco Solar ETF registered an 8% loss for the week — marking its steepest five-day decline since June.

This widespread selloff signals fundamental challenges facing the industry rather than temporary market volatility.

Tariff pressures are compressing profit margins at companies including First Solar, Array, and Shoals, with each citing these impacts during quarterly earnings discussions. Changes to federal energy policy have reduced financial incentives for consumers, while demand in the residential solar market shows signs of deterioration.

According to Wood Mackenzie forecasts, U.S. residential solar installations are projected to contract by 18% in 2026.

Sunrun’s quarterly results provided evidence of this declining trend. The company reported a 17% year-over-year decrease in new subscribers during Q4 2025 compared to Q4 2024, while the net value per new customer fell 30% in the period. The company’s 2026 outlook further dampened investor confidence — Jefferies analyst Julien Dumoulin-Smith downgraded the stock from Buy to Hold, pointing to expectations for “a more prolonged period of market contraction.”

First Solar’s Contract Backlog Signals Industry Headwinds

First Solar’s contract backlog declined to 50.1 gigawatts by year-end 2025, representing a significant drop from 68.5 gigawatts at the beginning of the year.

The company experienced more contract cancellations and terminations than new bookings during the quarter — marking the seventh straight quarter of declining backlog, according to Raymond James analyst Bobby Zolper.

Zolper observed that the company’s 2026 and 2027 projections fell approximately 15% short of earlier expectations across key metrics including shipment volumes, revenue, and EBITDA. He maintained a Market Perform rating, stating he would “wait out the near-term negatives.”

SolarEdge Posted Better-Than-Expected Results

Despite the share price decline, SolarEdge delivered fourth-quarter results that surpassed analyst forecasts. The company reported an adjusted EPS loss of $0.14, narrower than the anticipated loss of $0.19. Quarterly revenue reached $333.8 million, exceeding the $330.33 million consensus estimate and representing a 70.9% increase year over year.

However, profitability remains elusive. The company’s net margin stands at -34.2% with return on equity at -45.5%.

Wall Street’s view on SEDG leans bearish. The consensus recommendation is “Reduce,” comprising one Buy rating, 16 Hold ratings, and seven Sell ratings. The average analyst price target of $27.28 sits below the stock’s current trading range.

Recent analyst activity includes Deutsche Bank lowering its price target from $35 to $33 while maintaining a Hold rating on February 20, and Morgan Stanley increasing its target from $33 to $40 with an Equal Weight rating on February 19.

The stock’s 50-day moving average stands at $33.76, while the 200-day moving average is $34.19. SEDG maintains a market capitalization of approximately $2.06 billion with a beta coefficient of 1.66.

Institutional ownership accounts for 95.1% of outstanding shares.

Crypto World

Why Institutions Still Prefer Eth Despite Faster Blockchains

Ethereum continues to host the largest concentration of stablecoins and decentralized finance (DeFi) capital, even as successive waves of faster networks emerge.

Newer blockchains have promised higher throughput and lower costs, raising questions about whether institutional capital could eventually migrate away from Ethereum.

Kevin Lepsoe, founder of ETHGas and a former Morgan Stanley derivatives executive in Asia, said he expects Ethereum’s lead to endure, as institutions tend to prioritize capital depth over flashy performance.

“[Transactions per second] is the metric that gets engineers excited, but is that what drives capital to the blockchain?” Lepsoe asked in an interview with Cointelegraph.

“The capital is on Ethereum; the stablecoins are there. TradFi is looking at where the liquidity is,” he said.

Institutional capital brings scale and stability to a blockchain’s ecosystem. Large asset managers and tokenized fund issuers move capital in volumes that deepen liquidity and anchor stablecoin supply. Their presence can establish a network’s position beyond hype-driven retail activity that surges in bull markets and fades in downturns.

Liquidity keeps Ethereum ahead of faster rivals

If institutions prefer to operate where most of the money already sits, then simply making a faster blockchain will not pull capital away from Ethereum.

Over the past several cycles, performance has become a weapon to attract users. Solana has emerged as Ethereum’s high-speed alternative, dubbed an “Ethereum killer,” though that label is debated. It onboarded retail traders through the non-fungible token (NFT) boom and the memecoin frenzy, but the heightened activities weren’t sustained in the long run.

Related: Can Solana shed its memecoin image in 2026?

Solana now has its own generation of “Solana killers” that advertise higher theoretical transactions per second (TPS). But Ethereum’s liquidity grants tighter spreads, lower slippage for large trades and the capacity to absorb institutional-sized transactions without heavily distorting prices.

“I think of Ethereum as like downtown,” Lepsoe said.

“You could build a marketplace uptown somewhere in the suburbs and you could get far off market prices there, maybe it’s more convenient or maybe you like the vibe. But if you want the deepest liquidity, you go downtown, and that’s Ethereum.”

Though past crypto booms featured high-stakes retail speculation, the next phase is shaping up to include more institutional capital. As it stands, institutional players have expressed interest in practical use cases such as stablecoins and real-world assets (RWAs).

Even the world’s largest asset manager is leaning into RWA products. BlackRock’s USD Liquidity Fund (BUIDL) is its tokenized Treasury fund that started on Ethereum and branched out to several blockchains. Ethereum holds over a 30% BUIDL market capitalization.

Ethereum is the largest network for stablecoins as well, which BlackRock’s global head of market development, Samara Cohen, said are “becoming the bridge between traditional finance and digital liquidity.”

Ethereum leads the industry in stablecoin market cap, with $160.4 billion, according to DefiLlama.

Ethereum’s L2 liquidity is returning to L1

Though Lepsoe said liquidity depth shapes institutional preference, a network’s efficiency cannot be completely disregarded.

Ethereum has been adjusting its own technical profile. Transaction fees that once routinely spiked to virtually unusable prices have fallen significantly, as layer-2 rollups eased pressure on the main chain. These solutions brought in new problems of their own. Rollups fragmented liquidity across multiple environments.

Related: 2026 is the year Ethereum starts scaling exponentially with ZK tech

Lepsoe described the liquidity fragmentation as a blessing in disguise for Ethereum. He argued that if L2s didn’t take away liquidity from the main chain, capital would have flown out to competitors.

“I think it actually saved the liquidity from going to other L1s, where they eventually probably couldn’t have brought it back,” he said.

Recently, Ethereum has shifted its focus back to scaling the main chain. Co-founder Vitalik Buterin said that many layer 2s have failed to decentralize, while the main chain is now sufficiently scaling.

“Both of these facts, for their own separate reasons, mean that the original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path,” Buterin said in a recent X post.

Scaling upgrades strengthen Ethereum’s liquidity advantage

With transaction fees tamed, Ethereum is expected to execute the Glamsterdam fork in 2026, raising the block gas limit to 200 million from 60 million and putting its layer 1 on the road to 10,000 TPS over time.

For Ethereum, the timing coincides with institutions evaluating blockchain infrastructure for the next generation of financial services.

Alongside protocol upgrades, infrastructure providers are experimenting with ways to improve execution efficiency. Projects like Lepsoe’s ETHGas aim to optimize Ethereum’s block construction process through offchain execution and coordination, while Psy Protocol uses zero-knowledge technology to bundle multiple transactions into one.

Marcin Kaźmierczak, co-founder of blockchain oracle RedStone — which supplies data feeds for tokenized assets and institutional blockchain applications — said that Ethereum has the edge, as institutions prefer blockchains that have been battle-tested and around “for a very long time.” However, while institutions are “aggressively” expanding into Ethereum, they’re also shopping around.

“They look at Solana, which is getting good traction. Canton is extremely important for them because it gives them privacy, which they value very, very much,” Kaźmierczak told Cointelegraph.

Lepsoe said he sees “zero threat” from Solana or Canton, arguing that Ethereum still has the deepest liquidity pool, which is the primary draw for large allocators.

For institutional capital, performance improvements may expand Ethereum’s capacity, but liquidity remains its defining advantage. In blockchain markets, speed can attract users during booms, but capital tends to stay where the deepest markets already exist.

Magazine: 6 massive challenges Bitcoin faces on the road to quantum security

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Market analysts spar as bitcoin heads for worst five-month losing streak since 2018

With a few hours still to go, Bitcoin is on track to post its worst losing streak since 2018, with February about to mark a fifth consecutive monthly decline.

The run of losses would be the longest since that 2018–2019 bear market and follows what has already been bitcoin’s worst first 50-day start to a year on record, leaving BTC down more than 25% year to date and on course for its first-ever back-to-back January and February declines.

More? The bitcoin-to-gold ratio fell to 12.288 ounces in February, marking a 70% drawdown over the last 14 months.

Bitcoin is also about to close out its worst month since June 2022 as the collapse of Terra-Luna that year sent the price plunging by about one-third. With bitcoin currently at about $66,000, the decline this February stands at more than 16%.

But some analysts argue that comparing the current stretch to 2018 may be oversimplifying what’s unfolding.

Repricing within a structural regime shift

“What we’re seeing isn’t just weakness. It’s repricing inside a structural regime shift,” Mati Greenspan, senior eToro market analyst and founder of Quantum Economics, told CoinDesk.

He believes that while tariffs, ETF flows and macro fears may explain the timing of the selloff, they don’t explain the deeper move, which he sees as a broader recalibration in how markets value risk assets in an era of elevated uncertainty.

Bitcoin is also approaching a fifth straight weekly decline, a streak last seen between March and May 2022.

Geopolitical tensions have strengthened the U.S. dollar and crude oil prices, tightening financial conditions and weighing on risk assets.

Yet, this downturn stands out for another reason: bitcoin’s uneven relationship with equities. While U.S. stocks have remained relatively resilient, BTC has sharply underperformed, marking an unusual period of instability in its traditional risk-asset correlation.

Confronting arguments

“Bitcoin doesn’t have a narrative right now, and it’s getting squeezed from both sides,” Jonatan Randin, senior market analyst at PrimeXBT, said in an email to CoinDesk.

Randin pointed to mounting macro pressure, including $3.8 billion in ETF outflows over the past five weeks, escalating tariff tensions and a Federal Reserve that has yet to signal imminent rate cuts.

While gold has attracted safe-haven flows and equities have ridden AI momentum, bitcoin has lagged. “Gold is up roughly 48% since September while bitcoin has fallen about 41% over the same period,” Randin said, explaining that the divergence shows investors are still treating BTC as a liquidity-sensitive risk asset rather than digital gold.

The correlation picture has been volatile. “The 20-day BTC-Nasdaq correlation swung from -0.68 to +0.72 between early and mid-February. That’s not decorrelation, that’s instability,” Randin said. “When the risk-on trade is working, and one asset gets left behind, that’s usually weakness, not strength.”

The narrative “hasn’t changed since 2009. It is a global, neutral alternative to debt-based fiat systems,” according to Greenspan.

Decorrelations are not random

“When correlations break during regime shifts, it’s usually not random. It’s early repricing,” Greenspan said. “If equities are still being treated as cyclical growth exposure while bitcoin starts trading more like a sovereign hedge, that divergence is structurally bullish.”

Despite the scale of the drawdown, Randin cautioned against assuming the correction is over.

“Bitcoin’s now declined 52% from the October highs,” he said. “That sounds like a lot, but when you look at prior bear markets where we’ve seen drawdowns of 80% or more, we could realistically be only halfway through this correction.”

He added that while the weekly relative strength index (RSI) has fallen to its lowest reading in bitcoin’s history and accumulator addresses have absorbed roughly 372,000 BTC since late December, signals often associated with cycle bottoms, similar conditions in past downturns were followed by another 30% to 40% drop before a definitive low formed.

Greenspan, however, said sentiment may already reflect much of the pessimism. “When sentiment gets this uniformly negative while long-term fundamentals remain intact, reversals tend to be sharp,” he said.

Until bitcoin can reclaim the $68,000–$72,000 zone, Randin said, “I’d expect this streak to grind on rather than break cleanly.” He identified $60,000 as a key near-term support level, with the 200-week moving average near $58,500 just below it.

“The losing streak narrative focuses on five months,” Greenspan added. “The structural story spans decades.”

Crypto World

Should You Invest in Broadcom Stock Before This Week’s Earnings Report?

Quick Summary

- Broadcom’s Q1 FY2026 financial results scheduled for March 4, 2026

- Analyst consensus calls for $19.21 billion in revenue, marking a 29% annual increase

- Expected earnings per share of $2.02 represents 26% growth; the company has surpassed projections for nine consecutive quarters

- AI semiconductor division projected to generate $8.2 billion, representing a year-over-year doubling

- UBS maintains Buy recommendation with $475 target; analyst consensus shows Strong Buy rating averaging $452.32

Broadcom will unveil its Q1 FY2026 financial performance on March 4, 2026. The upcoming disclosure arrives with substantial anticipation from market observers and several critical factors demanding attention.

Financial analysts are forecasting quarterly revenue of $19.21 billion, representing a 29% increase from the comparable quarter in the previous fiscal year.

Regarding profitability metrics, Wall Street consensus points to earnings of $2.02 per share, reflecting 26% annual expansion. The semiconductor giant has exceeded analyst projections throughout the previous nine reporting periods, establishing elevated expectations for this announcement.

AVGO stock has surged 60% during the trailing twelve months, propelled predominantly by robust appetite for its specialized artificial intelligence processors. The shares have declined approximately 8% since the calendar year began.

Options traders are anticipating an 8.64% price swing surrounding the earnings announcement, illustrating considerable uncertainty regarding the forthcoming results.

Artificial Intelligence Semiconductor Division Takes Center Stage

Broadcom’s AI-focused chip revenues are forecast to approach $8.2 billion during this quarter, approximately doubling the figure from the year-ago period. This expansion stems from major tech corporations scaling their computational infrastructure.

On February 26, Broadcom announced expectations for exceptionally robust demand for an innovative AI processor utilizing sophisticated stacking architecture. According to Reuters reporting, deliveries may exceed one million units before 2027 concludes.

The semiconductor manufacturer has begun delivering its inaugural 2-nanometer custom compute system-on-chip, produced with its proprietary 3.5D eXtreme Dimension System in Package technology. Company executives emphasize the architecture enhances energy efficiency while reducing communication delays within AI computing clusters.

This represents a significant technological advancement. Reduced manufacturing node dimensions typically enable increased computational capabilities with decreased power consumption—a crucial consideration for enterprise-scale artificial intelligence deployments.

VMware Software Operations Draw Scrutiny

While semiconductor operations appear robust, market watchers are monitoring Broadcom’s infrastructure software business more closely, which expanded considerably following the VMware transaction.

UBS equity analyst Timothy Arcuri maintained his Buy recommendation before the quarterly disclosure, establishing a $475 valuation target. His analysis suggests recent share price softness correlates with compressed valuation multiples throughout the software sector rather than fundamental challenges within Broadcom’s semiconductor operations.

Arcuri identified several concerns within the software division, including possible customer attrition at VMware during contract renewal periods.

He additionally highlighted decelerating expansion following recent platform modernization cycles and the emergence of AI-powered development tools potentially accelerating cloud migration.

Wall Street sentiment toward the equity remains overwhelmingly constructive. Among 30 analyst assessments issued during the past three months, 28 recommend buying while two suggest holding, with zero sell ratings.

The consensus valuation target among these professionals stands at $452.32, suggesting approximately 41.5% appreciation potential from present trading levels.

Broadcom commences distribution of its 2-nanometer custom system-on-chip as the March 4 earnings announcement approaches.

Crypto World

UAE Diamonds Go On-Chain in $280M XRP Ledger Deal

TLDR:

- Ctrl Alt and Billiton Diamonds launch $280M UAE diamond tokenization on XRP Ledger.

- XRP Ledger enables secure, low-cost trading of previously illiquid luxury commodities.

- Ripple Custody provides bank-grade vaulting for $280M in physical diamond inventory.

- UAE regulatory alignment ensures global standards for on-chain real-world asset trading.

A $280 million diamond tokenization deal has launched in the UAE, bridging physical assets and blockchain. Ctrl Alt and Billiton Diamonds partnered to bring over a billion AED in diamonds on-chain.

The XRP Ledger will host the transaction, leveraging its speed and low costs for high-value real-world assets. The initiative highlights growing digital commoditization in the UAE’s regulated blockchain ecosystem.

XRP Ledger Supports High-Value Asset Tokenization

Ctrl Alt’s tokenization project relies on the XRP Ledger’s native features for secure and efficient trading. The platform allows diamonds, historically illiquid, to become tradable digital assets in real time.

Ripple Custody provides bank-grade vaulting for over $280 million in physical inventory. Integration with the UAE’s regulatory framework ensures compliance with DMCC and VARA standards.

Tokenized diamonds can be transferred or traded on-chain without moving the physical asset. The system uses smart ledger functionality to track ownership and provenance digitally.

Transaction costs remain low, which supports frequent trading of previously non-liquid assets. The platform demonstrates practical scalability for real-world luxury asset markets globally.

Regulatory and Market Implications of On-Chain Diamonds

The UAE’s regulatory alignment offers a blueprint for secure tokenization of high-value commodities. Ctrl Alt and Ripple operate within forward-thinking frameworks to reduce trust gaps for investors.

The project showcases how banks and custodians can engage with digital assets safely. Tokenization of luxury goods may expand to other commodities like gold, art, and collectibles.

Ripple’s involvement signals increasing institutional adoption of blockchain for asset-backed products. By addressing storage, verification, and transfer risks, the initiative strengthens investor confidence.

Digital ownership protocols reduce fraud risk while maintaining transparency in real-time audits. The project may accelerate broader adoption of the XRP Ledger for real-world asset markets.

Crypto World

Banking Giant Morgan Stanley Wants to Double Down on Crypto

Morgan Stanley has applied for a national trust bank charter to provide direct cryptocurrency custody for its institutional clients. This represents a major escalation in Wall Street’s push into the digital asset sector.

The $9 trillion banking giant filed the de novo application with the Office of the Comptroller of the Currency on February 18.

Morgan Stanley’s New OCC Bid to Rival BitGo and Anchorage

If approved, the charter would transform Morgan Stanley into a direct competitor to crypto-native custodians such as BitGo and Anchorage Digital, while testing the limits of traditional banking regulations.

The filing marks a significant shift in the competitive landscape. While the OCC has previously granted conditional trust charters to crypto-focused firms, a legacy wirehouse securing full approval would signal a major thaw in regulatory oversight.

Industry analysts attribute this renewed momentum to the Trump administration’s efforts to provide clearer federal guidelines for traditional financial institutions entering the digital asset space.

“People are going to be stunned this year — The world’s largest institutions and corporates are coming fully into crypto,” Hunter Horsley, Bitwise CEO, said.

Meanwhile, Morgan Stanley’s application outlines ambitious plans to offer custody, trading, and staking services under one roof.

So, the OCC filing is part of a bifurcated digital asset strategy that distinctly separates institutional wealth management from retail trading operations.

On the institutional side, the bank is actively investing in blockchain infrastructure. A recent job posting for a lead engineer revealed Morgan Stanley is building a platform for decentralized finance and real-world asset tokenization.

The role requires expertise in both public blockchains, such as Ethereum and Polygon, and private, permissioned networks like Hyperledger and Canton.

This highlights the bank’s intent to bridge walled-garden institutional assets with public network liquidity.

Simultaneously, Morgan Stanley is preparing a massive retail expansion.

The firm plans to launch direct cryptocurrency trading on its ETrade platform in the first half of 2026, offering Bitcoin, Ethereum, and Solana to everyday investors.

The ETrade integration represents a direct challenge to retail-focused exchanges like Coinbase and Robinhood.

Indeed, this dual approach underscores a broader trend among traditional financial titans.

Encouraged by a more accommodating regulatory environment in Washington, legacy banks are rapidly accelerating their crypto roadmaps. They are now hiring specialized Web3 talent and transitioning from passive exchange-traded fund facilitation to core infrastructure development.

-

Politics6 days ago

Politics6 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports5 days ago

Sports5 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Fashion19 hours ago

Fashion19 hours agoWeekend Open Thread: Iris Top

-

Business4 days ago

Business4 days agoTrue Citrus debuts functional drink mix collection

-

Politics5 days ago

Politics5 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Politics2 days ago

Politics2 days agoITV enters Gaza with IDF amid ongoing genocide

-

Crypto World4 days ago

Crypto World4 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

Sports9 hours ago

The Vikings Need a Duck

-

Business6 days ago

Business6 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Tech4 days ago

Tech4 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

Business6 days ago

Business6 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

NewsBeat3 days ago

NewsBeat3 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat5 days ago

NewsBeat5 days ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

Tech6 days ago

Tech6 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat6 days ago

NewsBeat6 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics6 days ago

Politics6 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Business2 days ago

Business2 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

NewsBeat4 days ago

NewsBeat4 days agoPolice latest as search for missing woman enters day nine

-

Sports5 days ago

2026 NFL mock draft: WRs fly off the board in first round entering combine week