Crypto World

Grayscale and Canary Capital Introduce SUI ETFs for Direct Token Exposure

TLDR

- Canary Capital launched the Canary Stake SUI ETF on Nasdaq, offering exposure to the SUI token and staking rewards.

- Grayscale converted its SUI trust into an ETF, providing investors with direct access to the SUI token through NYSE Arca.

- The new SUI ETFs allow both institutional and retail investors to participate in the growing SUI blockchain ecosystem.

- SUI is a Layer 1 blockchain developed by Mysten Labs, with its token used for transaction fees and smart contract execution.

- The SUI ETFs enable investors to earn rewards through SUI’s proof-of-stake mechanism while tracking the spot price of the token.

Two new exchange-traded funds (ETFs) linked to SUI token launched on Wednesday, offering investors direct exposure to SUI’s price. Canary Capital debuted the Canary Stake SUI ETF on Nasdaq, while Grayscale converted its SUI trust into an ETF on NYSE Arca. Both funds will track SUI’s price, with the added benefit of enabling investors to earn staking rewards.

Canary Capital’s SUI ETF: Canary Stake SUI ETF (SUIS)

Canary Capital launched its Canary Stake SUI ETF, trading under the ticker symbol SUIS on Nasdaq. This new fund tracks the spot price of SUI and allows investors to benefit from staking rewards. SUI operates on a proof-of-stake mechanism, which the ETF integrates into its structure, allowing investors to earn net staking rewards.

Steven McClurg, CEO of Canary Capital, emphasized the importance of this fund, saying, “The Canary Staked SUI spot ETF (SUIS) brings exposure to SUI in a registered, exchange-traded structure, while also enabling investors to benefit from net staking rewards generated through SUI’s proof-of-stake mechanism.” The ETF provides a regulated way for investors to engage with the SUI ecosystem and benefit from staking.

Grayscale Launches SUI Fund as an ETF

Grayscale followed suit, launching its own SUI fund on the same day. The company converted its SUI trust into an ETF, trading under the ticker GSUI on NYSE Arca. This ETF will provide investors with exposure to the SUI token, offering another way to participate in the growing blockchain ecosystem.

Grayscale’s decision to turn its SUI trust into an ETF aims to provide easier access for institutional and retail investors. By offering direct exposure to the SUI token, the fund offers an alternative to buying the token directly on cryptocurrency exchanges.

SUI’s Growing Ecosystem

SUI, developed by Mysten Labs, is a Layer 1 blockchain used to power decentralized applications and smart contracts. The SUI token plays a vital role in the blockchain, serving as a means to pay for transaction fees and support various other network functions. SUI is currently ranked 31st by market capitalization, valued at approximately $3.7 billion.

The launch of these SUI ETFs marks an important milestone for the blockchain’s adoption. It allows a broader range of investors to gain exposure to the SUI ecosystem in a regulated, traditional investment format. The ETFs make it easier for individuals to invest in the blockchain’s native token while also earning rewards through its proof-of-stake mechanism.

Crypto World

WLFI Jumps 30% as CEOs Sign Up for Mar-a-Lago Crypto Forum

The token’s surge highlights how headlines and political visibility continue to drive sentiment.

World Liberty Financial’s WLFI token surged as much as 30% over the past 24 hours as top Wall Street CEOs prepare to headline a crypto forum at President Donald Trump’s Mar-a-Lago resort.

The token climbed to a high of $0.128 this morning before retracing to around $0.123, still up 21% on the day. The move raised 24-hour trading volume to about $450 million and pushed the Trump-backed decentralized finance (DeFi) project’s market capitalization to $3.3 billion, according to CoinGecko.

WLFI’s surge highlights how investor sentiment around WLFI remains strongly driven by attention-grabbing headlines and high-profile events. It also underscores the rapidly growing convergence between politics and cryptocurrency.

The World Liberty Forum, organized by World Liberty Financial, aims to bring together leading financial leaders and policymakers to discuss cryptocurrency, finance, and technology.

Some scheduled speakers include the CEOs of Goldman Sachs, Franklin Templeton and Nasdaq, along with the president of the New York Stock Exchange (NYSE). The event is hosted by Donald Trump Jr. and Eric Trump, both co-founders of World Liberty Financial. However, President Trump is not expected to attend, Reuters reported.

The rally comes after the company faced scrutiny earlier this month when it was revealed that a member of the Abu Dhabi royal family acquired a 49% stake in the company shortly before Trump’s 2025 inauguration.

Despite the controversy, World Liberty Financial has become a major part of the Trump family’s business interests. Its USD1 stablecoin now has about $5.1 billion in circulation, up from $3 billion just weeks ago, making it the fifth-largest stablecoin by market capitalization, according to DeFiLlama.

President Trump’s other crypto ventures include the official TRUMP and MELANIA memecoins, which were trading around $3.45 and $0.12, respectively, over the past day, per CoinGecko. The tokens have market capitalizations of around $800 million for TRUMP and $115 million for MELANIA.

Crypto World

FTX-linked Effective Ventures sells UK manor at $14.5M loss

Recently published accounts from FTX-backed charity Effective Ventures confirm that the company sold a £17 million ($23 million) stately manor at a £10.7 million ($14.5 million) loss as it continues to wind down its UK operations.

Effective Ventures’ UK arm bought the manor in 2022 as part of a plan to host educational events for the effective altruism movement, a set of beliefs that involves wealthy donors directing funds to specific causes that they deem will do the most good most efficiently.

FTX donated over $26 million to the Effective Ventures Foundation, which was later paid back during the exchange’s bankruptcy proceedings. The charity told UK government regulators that it had received funds from FTX, and after an inquiry, was found to have acted “diligently” in response to FTX’s collapse.

In its accounts for the year up to June 2025, published last Friday, it confirmed that the manor was sold for £5.95 million ($8 million) and that it had incurred an impairment loss of £8.6 million ($11.6 million).

Read more: FTX funded this UK charity, now it’s under investigation

Local outlets reported that the manor’s price was initially set at £15 million ($20.3 million) before being slashed to £12 million ($16.3 million) a year later, and eventually to just under £6 million ($8 million).

The charity says property valuation experts recommended that it cut the asking price due to “reductions in market sentiment.”

Effective Ventures UK CEO says funds will be donated

Effective Ventures CEO Rob Gledhill had already revealed in the Effective Altruism forum that the manor was officially sold on November 11, 2025.

He reiterated that “market conditions for country estates” led to the drop in value and added that the proceeds from the sale, “will be allocated to high-impact charities, including EV’s operations.”

Within the accounts, the charity says that it’s made “significant progress” spinning out projects into new independent entities as it winds down the firm.

The charity said that it doesn’t expect to sponsor any new projects and that it should wind down in “2026 or beyond.”

Read more: FTX-funded charity Effective Ventures agrees to return donations

It also revealed that the charity made £12 million ($16.3 million) during the 2025 fiscal year, of which £11.2 million ($15.2 million) was made up of donations and grants.

It’s less than half of the £31.6 million ($42.8 million) it made in 2024.

Its expenditure has also gone up by over £2 million ($2.7 million) from 2024 to 2025, as the firm spent £37.5 million ($51 million) in the 2025 fiscal year.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

The Protocol: Zora moves to Solana

Network News

ZORA MOVES FROM BASE TO SOLANA: On-chain social platform and decentralized protocol Zora is making a decisive shift beyond its non-fungible tokens (NFT) and creator roots with the launch of “attention markets” on Solana, a product that allows users to trade tokens tied to internet trends, memes and cultural moments. The feature, unveiled Feb. 17, lets anyone create a new market for 1 SOL. Once live, users can buy and sell positions on whether a topic will gain or lose traction across social media. Instead of wagering on elections or macro data, traders speculate on buzz itself — such as hashtags, viral narratives, even broad themes like “AI girlfriend” or “bitcoin.” The design leans heavily into Solana’s strengths. Fast block times and low transaction costs make it easier to support rapid price updates and frequent trading, which are essential for markets built around fleeting online momentum. Initial activity was limited, however. The primary “attentionmarkets” token briefly touched roughly $70,000 in market capitalization, with around $200,000 in trading volume. Most other trend markets struggled to attract meaningful liquidity, with few crossing the $10,000 mark on their first day. Percentage swings were sharp, though largely driven by thin order books rather than sustained demand. Zora was among the breakout applications on Coinbase’s Layer 2 Base network in the past few years. It launched its ZORA token there in April and helped roll out Creator Coins tied to Base profiles in July, a push that briefly helped Base overtake Solana in daily token creation. Creator coins are tokens tied to an individual creator’s online profile, brand or community. Think of them as tradable “shares” in a person’s internet presence. On platforms like Zora and Base, a creator coin could be automatically generated from a user’s profile. Fans could buy the coin to signal support, gain social clout, or speculate that the creator’s popularity would grow. As more people bought in, the price could rise, and interest faded, it could fall. As such, some in the Base community saw the new “attention markets” product as a pivot away from that momentum. — Shaurya Malwa Read more.

EF EXECUTIVE-DIRECTOR TO LEAVE: Tomasz Stańczak, co-executive director of the Ethereum Foundation (EF), announced he will step down from his leadership role at the end of February 2026, marking a notable shift in the organization’s executive team. Stańczak, who has co-led the foundation alongside Hsiao-Wei Wang since early 2025, said in a blog post that he believes the foundation and the broader Ethereum ecosystem are “in a healthy state” as he prepares to hand over the reins to Bastian Aue, who will take the co-executive director role alongside Wang. Stańczak’s tenure began at a turbulent time for the EF. He was brought aboard following the transition of long-time executive director Aya Miyaguchi into a new leadership position amid mounting community criticism that the foundation wasn’t doing enough to aggressively push the Ethereum ecosystem forward. At the time, detractors pointed to a perceived disconnect between the EF and developers, including conflicts of interest, clashes over strategic direction and frustrations about ETH’s price performance. Such criticisms helped spur a broader leadership restructuring. While Stańczak stressed his confidence in the team’s ability to carry forward the EF’s mission, he also signaled his intention to remain involved in the ecosystem. — Margaux Nijkerk Read more.

XRP LEDGER RELEASES MEMBER-ONLY DEX: The XRP Ledger has activated a new “Permissioned DEX” amendment, a technical upgrade designed to let regulated institutions trade on XRPL without opening markets to everyone. The change, known as XLS-81, allows the creation of permissioned decentralized exchanges that work like XRPL’s existing built-in DEX, but with a key difference. A permissioned domain can restrict who can place offers and who can accept them, creating a gated trading venue where participation is tied to compliance requirements such as KYC and AML checks. Think of it as a ‘members only’ marketplace, while still keeping the trading mechanics native to the ledger. The feature is aimed at banks, brokers and other firms that may want onchain settlement and liquidity but cannot interact with fully open DeFi markets. For these players, the ability to control access is not optional; it is a minimum requirement. The activation also adds to a growing set of “institutional DeFi” primitives XRPL has been rolling out this month. Token Escrow, or XLS-85, went live last week, extending XRPL’s native escrow system beyond XRP to all trustline-based tokens and Multi-Purpose Tokens, including stablecoins such as RLUSD and tokenized real-world assets. — Shaurya Malwa Read more.

ETHEREUM MEMBERS REVIVE NEW VERSION OF THE DAO: In the summer of 2016, the Decentralized Autonomous Organization, known as the DAO, became the defining crisis of Ethereum’s early years. A smart contract exploit siphoned millions of dollars’ worth of ether (ETH) from that initial project, and the community’s response — a contentious hard fork to recover those funds, splintered the original chain from the current one, leaving the old chain behind, known as Ethereum Classic. The DAO was once the greatest crowdfunding effort in crypto’s history, but faded into a cautionary tale of governance, security, and the limits of “code is law.” Now, nearly a decade later, that story has taken an unexpected turn. What was lost, or rather, left untouched, is being repurposed as a ~$150 million (at today’s prices) security endowment for the Ethereum ecosystem. The endowment, now known as TheDAO Security Fund, will stake some of the 75,000 dormant ether (ETH) and deploy the yield through community-driven funding rounds to support Ethereum security research, tooling and rapid-response efforts, while keeping claims open for any remaining eligible token holders. At the center of this story is Griff Green, one of the original DAO curators and a veteran of Ethereum decentralized governance. “When the DAO hack happened [in 2016], obviously, I jumped into action and basically led everything but the hard fork,” Green said of assembling the white hat group that rescued funds on the original Ethereum chain. “We hacked all these hackers. It was straight up DAO wars”. That effort, alongside others, helped salvage funds that might otherwise have been lost forever. At the time, the hard fork restored roughly 97% of the DAO’s funds to token holders, but left a small fraction, roughly 3%, in limbo. These “edge case” funds came from quirks of the original smart contracts: people who paid more than expected, those who burned tokens to form sub-DAOs, and other anomalies that didn’t cleanly map back. Over time, that leftover balance, once only worth a few million, ballooned into something far more significant due to ether’s appreciation. “The value of the funds we control has grown dramatically… well over 75,000 ETH,” a blog post for the new DAO fund states. — Margaux Nijkerk Read more.

In Other News

- A recent poll of 1,000 American investors in digital assets found that over half are scared they’ll face an IRS tax penalty this year as new transparency rules governing crypto exchanges take effect. The data collected at the end of January by crypto tax platform Awaken Tax canvassed U.S. holders’ concerns about a radical shift from self-disclosure to automatic reporting of transactions. This has been enacted through the introduction of the “Digital Asset Proceeds From Broker Transactions,” or Form 1099-DA, which tens of millions of Americans will be made aware of over the next month or so. The new rules are designed to clamp down on crypto tax evasion and compel brokers, such as crypto exchange Coinbase (COIN), to report all sales and exchanges of digital assets that occurred in 2025 to the tax agency. The aim is to give tax authorities a clear view of investor gains and losses by opening up customer data inside exchanges for the first time, allowing the IRS to compare what crypto brokers report with what taxpayers file. While the goal is to remove any margin of error, the rules are a “blunt instrument,” created by legislators who know nothing about crypto, according to Awaken Tax founder Andrew Duca. “It means crypto is being treated like stocks, but it doesn’t behave in that way. Real crypto users will move assets between multiple wallets and interact with decentralized finance (DeFi) protocols, using pretty complex trading strategies,” Duca said. — Ian Allison Read more.

- Crypto venture firm Dragonfly Capital completed a $650 million fourth fund, marking one of the largest raises in the sector at a time when many blockchain-focused VCs are struggling, Managing Partner Haseeb Qureshi said. “It’s a weird time to celebrate,” Qureshi wrote on a social media post, describing low spirits and “the gloom of a bear market” for crypto. However, he noted that Dragonfly has historically raised capital during downturns, including the 2018 ICO crash and just before the 2022 Terra collapse, ‘vintages,’ he said, ultimately became the firm’s best performers. In September, the firm said it aimed to raise $500 million for its fourth fund, targeting early-stage projects. It has not yet identified any of them. In May 2023, Dragonfly Capital raised $650 million for its third crypto fund for later-stage companies. — Olivier Acuna Read more.

Regulatory and Policy

- Hyperliquid (HYPE), a blockchain-based exchange that processed more than $250 billion in perpetual futures trading last month, has launched a U.S. lobbying and research arm to shape how lawmakers regulate decentralized finance (DeFi). The Hyperliquid Policy Center, a Washington, D.C.-based nonprofit, will focus on regulatory frameworks for decentralized exchanges, perpetual futures and blockchain-based market infrastructure, according to a press release. Jake Chervinsky, a prominent crypto lawyer and former policy head at the Blockchain Association, will serve as founder and CEO. The launch comes as Congress and federal agencies debate how to oversee crypto trading platforms and derivatives markets. Perpetual futures, which allow traders to hold leveraged positions without an expiration date, are widely used on offshore venues but remain a gray area under U.S. law. The arrival of a new group also represents just the latest entrant into a Washington crypto-policy scene that’s jammed with similar organizations, including the DeFi Education Fund and Solana Policy Institute, in addition to the broader groups such as the Digital Chamber, Blockchain Association and Crypto Council for Innovation. And the new organization lands as negotiation is well underway on Senate legislation that may set U.S. DeFi policy. — Kristzian Sandor Read more.

- The legal challenges from state governments against certain aspects of prediction markets such as Polymarket and Kalshi received a sharp rebuke from U.S. Commodity Futures Trading Commission Chairman Mike Selig, who is arguing that his federal agency has jurisdiction, not the states. “To those who seek to challenge our authority in this space, let me be clear: we will see you in court,” Selig said in a video statement posted on social media site X. He said his agency filed a legal brief in court to back up the federal role as the leading regulator over this corner of the derivatives markets. “The CFTC has regulated these markets for over two decades,” he said. “They provide useful functions for society by allowing everyday Americans to hedge commercial risks like increases in temperature and energy price spikes; they also serve as an important check on our news media and our information streams.” — Jesse Hamilton Read more.

Calendar

- Feb. 18-21, 2026: EthDenver, Denver

- Feb. 23-24, 2026: NearCon, San Francisco

- Mar. 24-26, 2026: Digital Asset Summit, New York City

- Mar. 30-Apr. 2, 2026: EthCC, Cannes

- Apr.15-16, 2026: Paris Blockchain Week, Paris

- Apr. 29-30, 2026: Token2049, Dubai

- May 5-7, 2026: Consensus, Miami

- Sept. 29-Oct.1, 2026: Korea Blockchain Week, Seoul

- Oct. 7-8, 2026: Token2049, Singapore

- Nov. 3-6, 2026: Devcon, Mumbai

- Nov. 15-17, 2026: Solana Breakpoint, London

Crypto World

$50,000 Price Odds Remain As 2024 Hodlers Help Stabilize BTC

Two-year Bitcoin hodlers “absorbed” seller pressure in recent weeks, according to new research, but most analysts still expect new macro BTC price lows.

New analysis suggests that Bitcoin (BTC) is “relying” on early 2024 buyers as its price action stalls below $70,000.

Key points:

-

Bitcoin buyers from early 2024 are in focus as a giant potential safety net for BTC price.

-

Their cost basis extends down to $60,000, and a major capitulation has not yet happened.

-

New macro BTC price lows remain a popular near-term bet.

2024 Bitcoin hodlers have “absorbed” new sellers

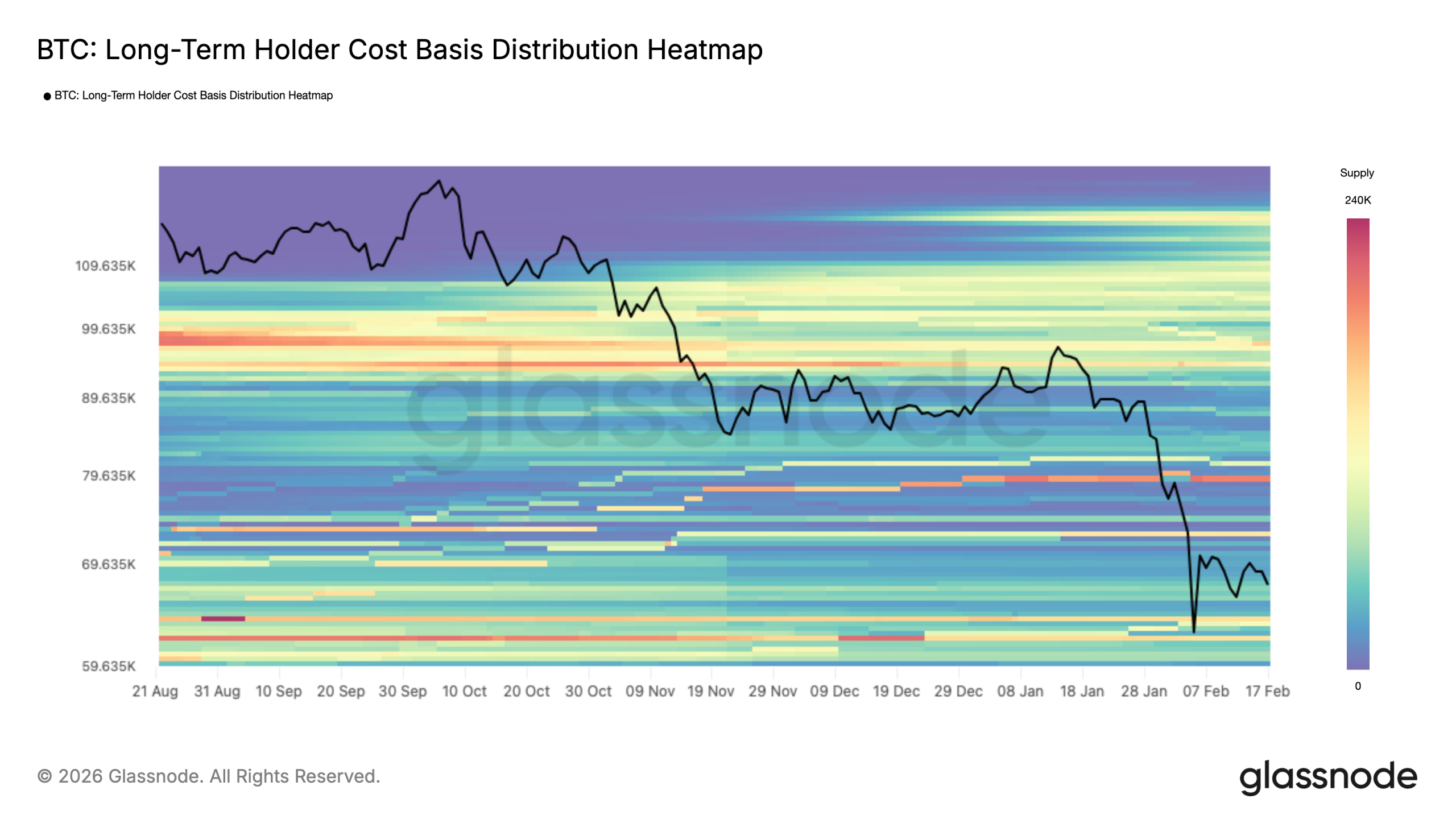

In the latest edition of its weekly newsletter, “The Week Onchain,” crypto analytics platform Glassnode said that BTC price was in a “dense demand zone.”

As BTC/USD treads water around 45% below its October 2025 all-time highs, buyers from long before that event are holding up the market.

Their importance has become much more noticeable since Bitcoin dropped below its true market mean price near $80,000.

“A closer inspection of price behavior since the breakdown below the True Market Mean indicates that downside pressure has largely been absorbed within a dense demand zone between $60k and $69k,” Glassnode summarized.

“This cluster was primarily established during the H1 2024 consolidation phase, where investors accumulated within a prolonged range and have since held their positions for over a year.”

Researchers referenced the seven-month consolidation structure that characterized much of 2024, and which itself placed old all-time highs of $69,000 from late 2021 in focus.

Now, those buyers face falling into unrealized loss, but are so far avoiding capitulation.

“The positioning of this cohort near breakeven levels appears to have moderated incremental sell pressure, contributing to the development of another sideways structure since late January 2026,” “The Week Onchain” continued.

“The defense of the $60k–$69k range suggests that medium-term holders remain resilient, allowing the market to transition from impulsive decline into range-bound absorption.”

New BTC price lows in “next week or so?”

The presence of hodler resilience comes at a crucial time as market participants still expect new macro lows to come next.

Related: Bitcoin price ignores $168M Strategy BTC purchase as Iran tensions escalate

As Cointelegraph reported, Bitcoin traders have little faith in the current range holding as support, with $50,000 now a popular target.

“Expected a quick bounce to reset indicators then straight back down. I still believe 52-53k is coming in the next week or so,” one such forecast from trader Roman stated this week.

An accompanying chart suggested that the indicator “reset” would affect the relative strength index (RSI) and moving average convergence/divergence (MACD) on four-hour time frames.

Earlier, Cointelegraph noted rare lows for weekly RSI, with analysis hinting that such levels were a once-per-cycle phenomenon.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Trust Wallet Launches Cash Deposits: Convert Cash to Crypto

Trust Wallet, the world’s leading self-custody web3 wallet with over 220 million users, today announced the launch of Cash Deposits in the United States, a new feature that allows users to load physical cash and convert it into digital assets directly inside their Trust Wallet – without a bank account, debit card, or custodial balance.

Powered by Coinme, a leading enterprise crypto infrastructure platform, Cash Deposits enables users to load cash into a digital wallet at over 15,000 retail locations nationwide and receive stablecoins and other digital assets (BTC, SOL etc) directly into their self-custodial wallet.

With this launch, Trust Wallet removes one of the biggest barriers to participating in the digital economy: access to traditional banking.

“Millions of people in the U.S. earn and live on cash, yet most digital financial tools still assume all have a bank account or card,” said Felix Fan, CEO of Trust Wallet.

“Cash Deposits is about meeting these users where they are. If you have cash, you now have a fast, direct way to turn it into digital assets that you fully control – no intermediaries holding your funds, and no reliance on traditional banks.”

Across the United States, millions of people are paid fully or partially in cash, such as gig workers, service workers, and individuals in cash-heavy local economies. For many, opening or maintaining a bank account can be difficult, cards may not be available, and existing cash services can be slow, expensive, or require giving up control of funds.

Cash Deposits removes those barriers. With Trust Wallet, users can now load cash and convert their money to digital assets, enabling them to receive directly into a self-custody wallet they control – unlocking faster payments, easier remittances, and broader access to decentralised and digital finance.

Unlike traditional cash services that rely on banks, cards, or custodial accounts, Cash Deposits enables a direct path from physical cash to a user’s self-custody wallet. Through Coinme’s nationwide retail network, cash is converted into digital assets and delivered straight to the user’s Trust Wallet – without intermediaries holding funds after the transaction is completed.

The supported retail locations are displayed in the Trust Wallet app before users begin, allowing them to view nearby deposit options available through Coinme’s retail network.

“At Coinme, our focus has always been building compliant, nationwide infrastructure that bridges physical cash with digital assets,” said Neil Bergquist, CEO and co-founder of Coinme.

“By powering Trust Wallet’s Cash Deposits feature, we’re enabling that infrastructure to operate seamlessly within a leading self-custody experience, making it simple for users to move from cash to crypto at scale.”

Funds typically arrive within minutes rather than days, giving users faster access to their money while maintaining full control over their assets. Available across 48 U.S. states*, the feature brings national scale to a cash-to-digital experience that has historically been fragmented or inaccessible.

By combining Coinme’s established cash onramp infrastructure with Trust Wallet’s self-custody wallet, the partnership delivers one of the first mainstream, nationwide cash-to-stablecoin experiences within a single app – making digital finance more practical and accessible for everyday users.

*The cash on-ramp is currently available in the U.S. and Puerto Rico, excluding New York and Vermont. Stablecoin purchases are available in supported states, excluding Texas.

About Trust Wallet

Trust Wallet is the secure, self-custody Web3 wallet and gateway for people who want to fully own, control, and leverage the power of their digital assets. From beginners to experienced users, Trust Wallet makes it easier, safer, and convenient for millions of people around the world to experience Web3, access dApps securely, store and manage their crypto and NFTs, as well as buy, sell, and stake crypto to earn rewards — all in one place and without limits.

About Coinme Crypto-as-a-Service

Founded in 2014, Coinme is a leading licensed and regulated provider of an enterprise stablecoin and crypto payments platform. Coinme enables a fully native and seamless stablecoin and crypto payment experience within partners’ web or mobile apps. By integrating with Coinme’s simple API suite, SDKs, and widget, partners can quickly deploy crypto and stablecoin products and services natively while leveraging Coinme’s robust exchange and compliance infrastructure. For more information, please visit https://coinme.com.

Crypto World

EUR CoinVertible Stablecoin Launches on XRP Ledger, Expanding Reach

TLDR

- Société Générale Forge has launched EUR CoinVertible on the XRP Ledger, expanding its stablecoin to a new Layer-1 network.

- The deployment follows previous integrations on Ethereum and Solana, strengthening the firm’s multi-chain strategy.

- Ripple supports the launch by providing institutional-grade custody and infrastructure services to ensure security.

- The integration on XRP Ledger enhances scalability, reduces transaction costs, and offers a secure decentralized architecture.

- SG-FORGE aims to increase the adoption of its euro-backed stablecoin for trading, payments, and collateral use cases.

Société Générale Forge has launched its euro-backed stablecoin, EUR CoinVertible, on the XRP Ledger. This move expands the stablecoin’s presence, following previous deployments on Ethereum and Solana. The integration into the XRP Ledger strengthens the firm’s multi-chain strategy and enhances the adoption of compliant digital assets across various blockchain networks.

EUR CoinVertible Expands to XRP Ledger

Société Générale Forge has successfully deployed EUR CoinVertible on the XRP Ledger. This launch adds another Layer-1 network to the stablecoin’s ecosystem, which already includes Ethereum and Solana. According to SG-FORGE, the decision to use the XRP Ledger stems from its high-performance capabilities, which can provide faster transactions, lower fees, and a secure decentralized architecture.

Ripple has supported the launch by providing its institutional-grade custody and infrastructure services. This partnership aims to ensure the stablecoin’s seamless integration while maintaining high security standards. Ripple’s technology enables SG-FORGE to enhance the operational and security standards for the stablecoin’s use cases.

SG-FORGE highlighted several key advantages of integrating EUR CoinVertible into the XRP Ledger. The platform’s scalability and low transaction costs are central to its appeal. XRP Ledger’s decentralized infrastructure also ensures a high level of security for institutional users of the stablecoin.

Jean-Marc Stenger, CEO of SG-FORGE, emphasized the firm’s focus on delivering transparent and secure digital assets. “The launch of EUR CoinVertible on XRP is a milestone in our effort to advance regulated digital assets that are compliant and scalable,” Stenger stated. The integration on XRP reinforces SG-FORGE’s commitment to expanding its offering of euro-backed stablecoins for trading, payments, and collateral use.

Ripple’s Role in Expanding EUR CoinVertible Use Cases

Ripple’s involvement in the launch is crucial, as it provides both infrastructure and custody services for EUR CoinVertible. The partnership with Ripple supports SG-FORGE’s strategy of driving the adoption of the stablecoin across various financial and crypto markets.

Cassie Craddock, Ripple’s Managing Director for UK and Europe, remarked that SG-FORGE is at the forefront of creating structured crypto-asset offerings in Europe. “Ripple’s infrastructure has been integral to supporting the launch and ongoing expansion of regulated stablecoins like EUR CoinVertible,” Craddock added. The move to integrate with XRP’s robust platform is expected to unlock new use cases for the stablecoin, such as trading collateral and further integration into Ripple’s product suite.

Crypto World

ETHZilla struggles to find footing as Peter Thiel’s Founders Fund exits

ETHZilla Corp (ETHZ) shares faced intense pressure in pre-market trading this Wednesday following news that billionaire investor Peter Thiel and his venture firm, Founders Fund, have completely liquidated their position.

Summary

- An SEC filing revealed that Peter Thiel and Founders Fund have completely liquidated their 7.5% stake in Ethzilla (ETHZ), triggering a 5.13% pre-market drop to $3.33.

- Originally a biotech firm (180 Life Sciences), Ethzilla’s high-leverage pivot to a “corporate Ethereum treasury” model has faltered, with the stock currently down 97% from its 2025 highs.

- Amidst heavy debt and market volatility, the company is attempting to stabilize by pivoting again, this time toward tokenizing jet engines and home loans, though investor confidence remains shaken.

The Thiel exodus: Founders Fund liquidates stake in ETHZilla

The stock, which has already plummeted over 97% from its 2025 highs, hit a pre-market low of $3.33, representing a 5.13% drop from its previous close.

The sell-off was triggered by a late Tuesday SEC filing revealing that Thiel’s entities now hold zero shares in the company. This marks a dramatic reversal from August 2025, when the fund disclosed a significant 7.5% stake.

At the time, Thiel’s entry was seen as a massive vote of confidence for ETHZilla’s pivot from biotechnology to a corporate Ethereum (ETH) treasury model.

The massive sell-off marks a dramatic fall from grace for the firm, which rebranded from 180 Life Sciences last year to become a high-leverage Ethereum treasury. While the initial pivot drew over $425 million in institutional backing, the recent liquidation of its ETH holdings has left investors questioning the sustainability of its ‘crypto-first’ balance sheet.

Crisis in the ETH treasury model

The full exit by Founders Fund underscores the growing skepticism surrounding companies that use high-leverage strategies to accumulate Ethereum. While similar “Bitcoin treasury” plays have remained popular, Ether-focused firms like ETHZilla have struggled under the weight of market volatility and debt obligations.

ETHZilla has recently attempted to diversify its business to stabilize its balance sheet. Recent moves include:

- Asset Tokenization: Launching “ETHZilla Aerospace” to tokenize leased jet engines.

- Debt Repayment: Liquidating over 24,000 ETH in late 2025 to settle convertible bond obligations.

- Real Estate: Acquiring modular home loan portfolios for on-chain yields.

Despite these efforts to pivot toward Real World Assets (RWA), the market appears focused on the loss of its most prominent institutional backer. For many investors, Thiel’s departure signals that the “Saylor-style” accumulation strategy for Ethereum may be facing a structural breakdown.

Crypto World

Arthur Hayes Predicts AI Banking Crisis And Bitcoin Surge

The divergence between Bitcoin and tech stocks is a warning sign of a potential artificial intelligence-driven credit crisis that could lead to more central bank money printing, says Arthur Hayes.

“Bitcoin is the global fiat liquidity fire alarm. It is the most responsive freely traded asset to the fiat credit supply,” said the crypto entrepreneur in his latest blog post on Wednesday.

Hayes went on to caution that the recent divergence between Bitcoin (BTC) and the tech-heavy Nasdaq 100 Index “sounds the alarm that a massive credit destruction event is nigh.”

When these two previously correlated asset classes diverge, “it warrants further investigation into any trigger that could cause a destruction of fiat” — mostly dollars and credit, which is also known as deflation, he said.

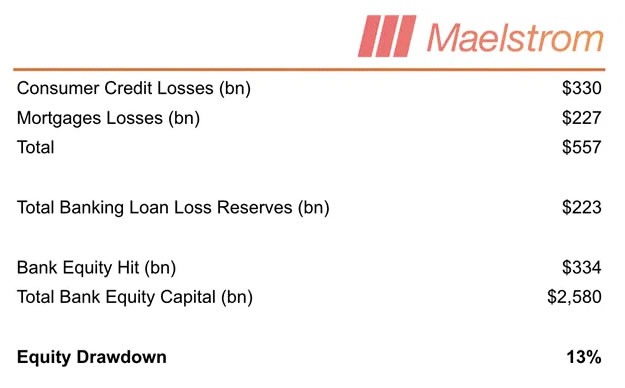

Hayes believes that job losses due to AI adoption will have a major impact on consumer credit and mortgage debt “because of the inability of white-collar knowledge worker debt donkeys to meet their monthly payments.”

“That’s a bold statement to call for a financial crisis because of job losses caused by AI adoption.”

AI job losses could trigger another banking crisis

In 2025, companies cited AI when announcing 55,000 job cuts, more than 12 times the number of layoffs attributed to AI just two years earlier, reported CBS News in early February.

“This AI financial crisis will restart the money printing machine for realz,” said Hayes.

His loose model suggests that a 20% reduction in the 72 million “knowledge workers” in the US could produce around $557 billion in consumer credit and mortgage losses, representing a 13% write-down of US commercial bank equity.

Hayes speculates that weaker regional banks would buckle first, depositors would flee, and credit markets would seize. The Federal Reserve would eventually panic and start printing money.

“While the Fed is fighting windmills, AI-related job losses will destroy the balance sheets of American banks,” he said.

“Finally, the monetary mandarins panic and press that Brrrr button harder than I shred pow the morning after a one-meter dump.”

Related: 1 in 4 CEOs expect to sack staff due to AI this year

Hayes predicted that this surge in fiat credit creation would “pump Bitcoin decisively off its lows,” and that the future expectation of increased fiat creation to save the banking system would “propel Bitcoin to a new all-time high.”

In addition to Bitcoin, Hayes said there are two altcoins that his company, Maelstrom, will “deploy excess stables into once the Fed blinks.” Those coins are Zcash (ZEC) and Hyperliquid (HYPE).

More money-printing theories abound

However, this is not the first radical money-printing thesis Hayes has proposed.

In January, he said that the Federal Reserve would print money to alleviate the Japanese bond crisis.

In December 2025, he predicted that BTC would surge to $200,000 by March due to money printing through a new Fed liquidity tool called Reserve Management Purchases, which resembles quantitative easing.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express

Crypto World

Trump Family-Backed WLFI Token Surges Ahead of Mar-a-Lago Crypto ‘Forum‘

Lawmakers, Wall Street executives, and cryptocurrency leaders will meet at US President Donald Trump’s private Mar-a-Lago club for a crypto “forum” organized by World Liberty Financial, the company backed by Trump and his sons.

Ahead of the event, the price of World Liberty’s WLFI token surged by more than 23%, to about $0.12 from $0.10. Trading volume in the past 24 hours topped $466 million.

On Wednesday, the president’s sons, Eric Trump and Donald Trump Jr. — also the co-founders of World Liberty Financial — along with Coinbase CEO Brian Armstrong, BitGo co-founder and CEO Mike Belshe, CFTC Chair Michael Selig and others will gather to discuss crypto-related policy issues at Trump’s Florida property.

The event, described as a crypto-aligned “forum” by World Liberty, comes as US lawmakers consider a comprehensive digital asset market structure bill amid concerns about how to address stablecoin yield. Selig is scheduled to speak with New York Stock Exchange President Lynn Martin on the bill.

Although aligned with crypto policy and including lawmakers like Ohio Senator Bernie Moreno and Florida Senator Ashley Moody, the President was not slated to appear at the event as of Wednesday morning.

Meanwhile, many Democratic senators are still pushing for the market structure bill to include provisions addressing conflicts of interest for US lawmakers and elected officials profiting from the crypto industry while in office.

Related: CFTC chair doubles down on defending prediction markets from state lawsuits

Media outlets have reported that Trump and his family have generated more than $1 billion from crypto projects since he took office in January 2025. In contrast to the president’s second term, Trump in 2019 said he was “not a fan” of Bitcoin (BTC) and other cryptocurrencies, while referring to the coin as a “scam” after leaving office in 2021.

US market structure bill is under scrutiny

Passed as the CLARITY Act in the US House of Representatives in July, the market structure bill under consideration in the Senate is expected to provide clarification on oversight of digital assets by the Commodity Futures Trading Commission and Securities and Exchange Commission, Washington’s two main financial markets regulators.

In January, the Senate Agriculture Committee, which has CFTC oversight, advanced its version of the bill along partisan lines, with no Democrats voting for the legislation. The Senate Banking Committee postponed its markup of the bill in January after the Coinbase CEO said he could not support the legislation as written, citing concerns about tokenized equities and decentralized finance.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

Telegram blocks 7.46m channels as Russia mulls April 1 ban

Telegram use in Russia faces rising blocks and slowdown as regulators tighten controls.

Summary

- Telegram blocked 238.8k channels on Feb 15 and 187.3k on Feb 16, taking total blocked groups and channels to over 7.463m since Jan 1.

- Russia fully blocked WhatsApp and removed its domains from DNS, steering users toward the state-backed Max messenger amid broader social-media restrictions.

- Despite throttling and potential April 1 blocking, Russian users increasingly rely on VPNs and alternative apps like imo to keep messaging access.

Telegram has begun blocking illegal content and has sufficient time to meet Russian regulatory requirements, according to a senior parliamentary committee member overseeing the matter.

Andrey Svintsov, deputy chairman of the Committee on Information Policy at the State Duma, told state news agency TASS that the messaging platform has started actively complying with Russian Federation requirements. “Over the past week, Telegram has blocked more than 230,000 channels and pieces of content that violated current legislation,” Svintsov stated. “This indicates that Durov’s company has begun to interact more actively.”

Russian authorities slowed traffic to the messenger earlier this month, citing non-compliance with national regulations. Media reports emerged this week suggesting the platform could be fully blocked on April 1, though Russian officials have neither confirmed nor denied the reports.

Svintsov said Telegram could fulfill Roskomnadzor’s requirements within one to two months and continue operating in Russia. “In my opinion, Telegram will not be blocked before April 1,” he stated, referring to messenger founder and CEO Pavel Durov.

Roskomnadzor, the Federal Service for Supervision of Communications, Information Technology and Mass Media, serves as Russia’s telecommunications regulator and media oversight body. According to Svintsov, the requirements include opening a legal entity, storing data on Russian territory, paying taxes and blocking prohibited content. “Opening a legal entity takes a week at most. Moving personal data processing takes another two or three weeks,” the deputy said.

Last summer, reports that Telegram was preparing to establish an office in Russia under the country’s “landing law” were denied by Durov, either directly or indirectly, according to previous media accounts.

Yulia Dolgova, president of the Russian Association of Bloggers and Agencies, told TASS that determining whether Telegram will be fully blocked remains difficult at this stage. She noted that unlike WhatsApp, Telegram is actively taking measures to maintain service functionality. Roskomnadzor completely removed Meta’s WhatsApp domain from its DNS servers last week, effectively blocking access from Russia. Dolgova also noted widespread VPN usage among Russian users to bypass such restrictions.

Telegram, the government and crypto

The Telegram channel Baza, citing government sources, reported that Roskomnadzor is preparing to “begin a total blocking of the messenger” on April 1. In response to media inquiries, Roskomnadzor said it had “nothing to add” to previous statements threatening “sequential restrictions.”

TASS reported this week that Telegram’s administration blocked 238,800 channels and groups on February 15 and 187,300 channels and groups worldwide on February 16, according to updated statistics on the messenger’s website. As of February 17, more than 7.463 million groups and channels have been blocked on Telegram since the beginning of the year, the agency reported.

Telegram ranks as the second most popular messaging application in Russia with 93.6 million users, trailing WhatsApp, which had 94.5 million monthly users before being blocked. As Russia implements restrictive measures against both platforms while promoting the state-backed Max messenger, Russian citizens have increasingly turned to imo, a U.S.-made messaging alternative, according to reports.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World1 day ago

Crypto World1 day agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Business18 hours ago

Business18 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video1 day ago

Video1 day agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment5 hours ago

Entertainment5 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Tech9 hours ago

Tech9 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business11 hours ago

Business11 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal