Crypto World

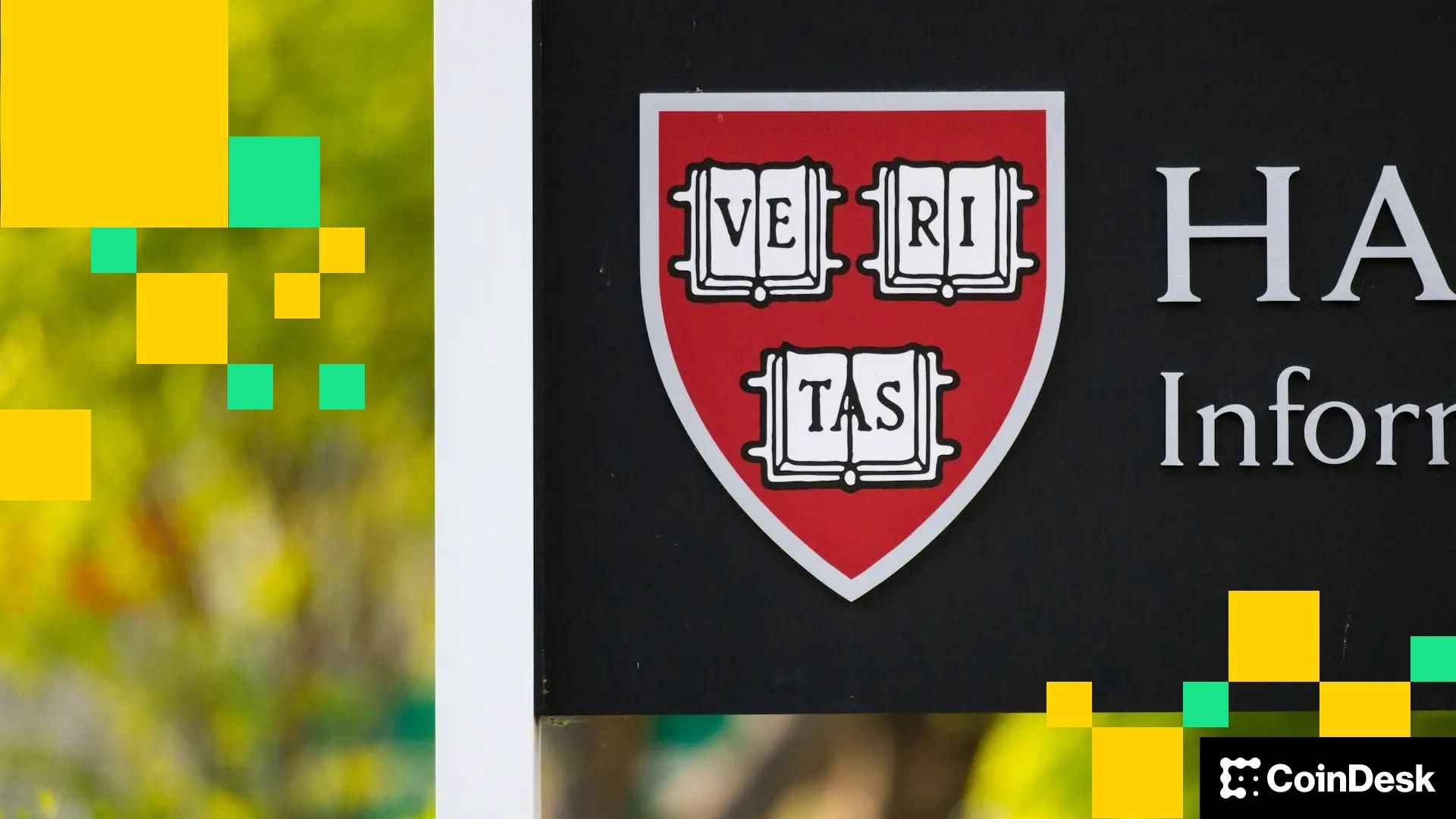

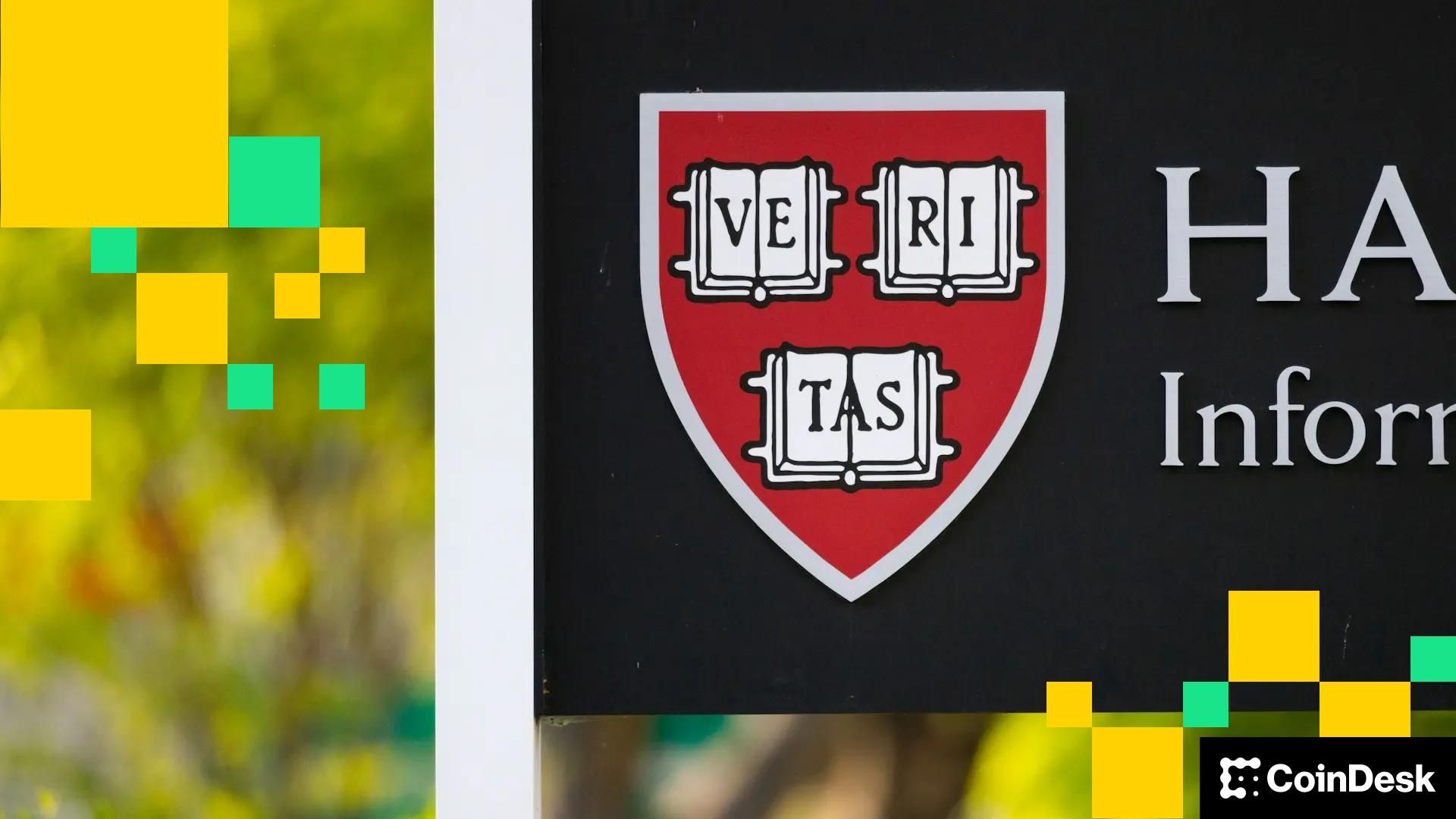

Harvard cuts bitcoin exposure by 20%, adds new ether position

Harvard University’s $56.9 billion endowment made its first foray into ether last quarter, even as it scaled back its exposure to bitcoin .

According to an SEC filing, the Harvard Management Company (HMC) bought almost 3.9 million shares of BlackRock’s iShares Ethereum Trust (ETHA), valued at around $86.8 million.

The company also reduced its stake in the iShares Bitcoin Trust (IBIT) by 21%, selling roughly 1.5 million shares. The bitcoin exchange-traded fund remains Harvard’s largest publicly disclosed holding at $265.8 million.

The shift comes after the price of bitcoin dropped from an all-time high of around $125,000 in October to close the quarter just below $90,000.

The move, however, may have less to do with sentiment and more to do with market dynamics, according to Andy Constan, founder and chief investment officer at Damped Spring Advisors.

The sale could reflect the unwinding of a trade that meant to capitalize on bitcoin treasury companies trading at premiums to the value of their BTC holdings, as measured by the multiple of net asset value, or mNAV, which compares enterprise value to bitcoin value.

When bitcoin’s price was booming, digital asset treasury (DAT) firms like Strategy (MSTR) traded at high premiums to the value of the bitcoin in their treasuries. MSTR, for example, at one point traded near 2.9 mNAV, meaning investors buying the shares were paying around $2.9 to own $1 of BTC.

That premium reflects not only the underlying cash-generating business, but also the company’s potential to keep accumulating bitcoin. Still, various investors bet on that mNAV gap narrowing. They held bitcoin indirectly through IBIT and shorted the shares of Strategy and similar digital asset treasury (DAT) companies.

Then the unwind took place, according to Constan. As the price of bitcoin plunged, so did that of DAT shares. Strategy, for example, now trades at 1.2 mNAV. These traders may also be rebalancing their portfolios, as bitcoin’s price nearly doubled last year despite the drawdown, suggesting it could be above the institution’s desired portfolio allocation, he wrote on X.

Data from 13F filings with the SEC gathered by Todd Schneider at 13.info backs these points. It shows that institutions reported owning 230 million IBIT shares in the fourth quarter, down from 417 million in the third.

Harvard also boosted investments in chipmakers Broadcom and TSMC, as well as in Google’s parent company Alphabet and railroad operator Union Pacific, while trimming stakes in Amazon, Microsoft and Nvidia.

Crypto World

Bitcoin Slumps in February, Yet HODLers and Miners Signal Support

Bitcoin slides in February, but strong miner and long-term holder accumulation hints at possible price support.

The opening weeks of February have delivered a stark diagnosis for Bitcoin’s health, with nearly 43% of its circulating supply in a state of loss and quarterly price performance standing at just under -26%, according to analyst GugaOnChain.

According to them, there is little prospect for recovery before April.

On-Chain Metrics Show Widespread Capitulation

In their latest assessment of the Bitcoin market, CryptoQuant contributor GugaOnChain painted a grim picture for holders of the OG cryptocurrency. Per the analyst, 42.85% of Bitcoin’s circulating supply is now underwater, while the Net Unrealized Profit/Loss (NUPL) indicator has slumped to 21.30%, which is firmly in fear territory.

GugaOnChain’s analysis was backed by experts at XWIN Research, who noted that the recent reading of 8 on the Fear and Greed Index was one that has rarely been seen, only appearing in previous stress events, including the 2018 bear market bottom, the March 2020 COVID crash, and the FTX collapse in November 2022.

The analysts pointed out that from a behavioral finance perspective, this reflects loss aversion and herd behavior, with investors reducing risk exposure after significant losses.

Looking at the quarterly price performance, it stands at -25.8%, with GugaOnChain seeing little prospect for recovery before Q2 2026. Additionally, spot Bitcoin ETF flows tell a similar story of institutional exhaustion. Since the start of the month, the products have seen net outflows of $2.17 billion, with the exodus accelerating as prices tumbled toward $60,000 on February 6.

Price Action Reflects Volatility

Other recent research provides context for the conditions described above. For instance, analytics firm Santiment reported that funding rates across exchanges had turned deeply negative, meaning traders were heavily positioned for price drops.

You may also like:

BTC’s price movement is reflecting the tension, with data from CoinGecko showing the asset had fallen about 3% in the last seven days, 10% over two weeks, and 28% across the past month, while trading roughly 46% below its October 2025 all-time high when it went past $126,000.

The growth contraction extends beyond Bitcoin itself, with GugaOnChain’s analysis showing the broader crypto economy shrinking, as mid-cap and small-cap altcoins contracted by 18.3% while the growth rate of the top 20 assets folded by -12.48%.

However, even with prices collapsing, demand from accumulator addresses has stayed strong at 380,104 BTC over the last 30 days. Furthermore, miners appear to be holding their BTC rather than selling, with their operations supported in part by AI revenue streams.

Taken all together, the conditions described in GugaOnChain’s assessment frame the current phase as one defined by fear, defensive positioning, and selective accumulation with little broad market confidence. According to them, “the turn toward recovery now depends on investor resilience.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

This Top Analyst Warns Bitcoin Price Could Fall to $10,000 as Bear Market Deepens

Bitcoin just got hit with one of its most extreme warnings yet. A well known strategist is calling this an imploding bubble, with a potential slide toward $10,000 price point.

That would mean roughly 85% downside from current levels. A scenario that sounds unthinkable to many, but impossible to ignore when it is coming from experienced market voices.

Is the Bubble Finally Bursting?

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, is not calling this a healthy pullback. He says the crypto story needs a reality check.

In his view, capital is rotating into the so called AI scare trade and away from digital assets.

McGlone describes it as a post inflation deflation cycle. When inflation fades, the most speculative assets usually feel it first.

He also points to Bitcoin’s tight link with tech stocks. That correlation used to help. Now it is a risk. If tech gets pressured by AI disruption fears, crypto can get dragged down with it.

Bitcoin Price “Possible” Path to $10,000

The numbers are not comforting. McGlone points to $64,000 as the key level right now.

If Bitcoin price closes below that level, he believes the door opens to a much deeper deflationary slide, potentially all the way toward $10,000.

Technical breakdowns can accelerate downside momentum, but projecting a drop from $64,000 to $10,000 implies a full macro reset comparable to 2018 or 2022. Those episodes were driven by forced deleveraging events and systemic liquidity shocks, conditions not currently evident in credit markets.

Roughly $678 million left Bitcoin ETFs in February, extending a multibillion dollar selloff that started in November. Still, ETF positioning must be viewed in context.

Total assets under management across major vehicles remain significantly higher than pre-approval levels. A multi-billion-dollar unwind would be more concerning if it erased the entirety of prior inflows — which has not occurred.

Some on chain models place a more moderate bear market floor near $55,000. But McGlone’s thesis assumes a harsher unwind.

He also highlights aggressive profit taking in gold and silver, arguing that liquidity is being pulled from risk assets broadly. In that kind of environment, Bitcoin would not be immune.

It is important to note that Mike McGlone is mostly bearish on Bitcoin. He has been accurate on some longer-term upside milestones in the distant past, but his Bitcoin-specific predictions have mostly not come true on schedule, or at all.

Mike Mcglone Can’t Say The Same About Bitcoin Hyper

Bitcoin still depends on macro liquidity, ETF flows, and correlation with tech. When those wobble, price grinds. Momentum fades. Traders wait.

Bitcoin Hyper ($HYPER) is built differently.

This Bitcoin-focused Layer-2, powered by Solana technology, adds speed, lower fees, and real on-chain utility without changing Bitcoin core security. It is designed for activity, not just holding through volatility.

And traction is already building. The Bitcoin Hyper presale has raised over $31 million so far, with $HYPER priced at $0.0136751 before the next increase. Staking rewards currently reach up to 37%.

If Bitcoin spends months debating whether $64K holds or collapses, Bitcoin Hyper is positioned to move regardless of that macro noise.

Visit the Official Bitcoin Hyper Website Here

The post This Top Analyst Warns Bitcoin Price Could Fall to $10,000 as Bear Market Deepens appeared first on Cryptonews.

Crypto World

DAO Development Guide: Building Investor-Ready Governance

In high-stakes Web3 funding rooms, conversations no longer start with token price or community size. They start with the governance structure. Institutional investors now scrutinize how decisions are made, how capital is protected, and how accountability is enforced long before they evaluate market traction. Governance has become the primary signal of whether a decentralized project is built for experimentation or for longevity. This is where strategic development defines competitive advantage.

This guide shows you how strategic DAO development transforms decentralized governance into an investor-ready operating model. You will learn how to design compliant frameworks, protect capital, strengthen transparency, and position your protocol for premium funding and sustainable growth.

The Institutional Shift: Why Governance Is Now a Funding Requirement

Institutional participation in Web3 has entered a new phase. Capital is no longer driven primarily by speculation, narratives, or short-term market cycles. It is increasingly guided by operational discipline, governance maturity, and long-term risk management. Recent industry research indicates that a majority of institutional investors planning digital asset exposure now prioritize infrastructure reliability, transparency, and governance readiness when evaluating blockchain projects. Governance quality has become a core signal of whether a protocol is built for experimentation or for sustainable growth.

Regulatory bodies and financial oversight organizations have also emphasized the importance of accountability structures, treasury controls, and transparency in decision-making in decentralized ecosystems. These frameworks are viewed as essential for market stability and institutional participation.

As a result, investor evaluation standards have evolved significantly:

- Governance structure is now a central component of institutional due diligence

- Treasury visibility and auditability are treated as baseline requirements

- Voting concentration and power distribution are closely reviewed

- Legal and compliance preparedness is increasingly assessed before funding

This evolution reflects a fundamental reality:

“Capital moves toward systems that demonstrate clarity, accountability, and operational resilience.”

Projects that lack formal governance architecture, documented processes, and transparent controls often struggle to meet modern investment standards. Even technically strong platforms face delays or rejection when governance maturity does not match investor expectations.

See how investor-ready governance works for you.

How Investors Evaluate DAO Maturity Today

Modern investors use a multi-layered governance assessment model:

1. Control Architecture

- Who controls treasury access?

- How are upgrades approved?

- Are emergency powers centralized?

2. Decision Transparency

- Are votes traceable?

- Is quorum enforced?

- Is participation healthy?

3. Risk Management

- Are attack vectors documented?

- Are fallback mechanisms in place?

- Is insurance integrated?

4. Legal Defensibility

- Is the DAO structure jurisdiction-aware?

- Are contributors protected?

- Is liability minimized?

A professional DAO development company designs these layers systematically instead of leaving them to community improvisation.

Why Informal Governance Repels Institutional Capital

Many early-stage DAOs continue to operate without structured oversight, often lacking professional DAO development services to formalize decision-making frameworks. Instead, they rely on chat-based voting, off-chain signaling, founder-controlled wallets, loosely defined proposal systems, and manually executed treasury operations. While this approach may function during early experimentation, it rarely withstands ecosystem growth, regulatory scrutiny, or institutional evaluation.

As scale increases, informal governance creates decision bottlenecks, risks of power concentration, exposure to treasury mismanagement, and internal friction within the community. Institutional investors view these weaknesses as operational instability rather than decentralization strength. In capital markets, perceived governance risk directly reduces confidence, delays funding decisions, and ultimately suppresses valuation potential.

Strategic DAO Architecture: The Investor-Grade Framework

Successful DAOs are built on structured governance frameworks that separate authority, execution, finance, and compliance into clearly defined layers. Supported by professional DAO development services, this modular approach improves accountability, reduces operational risk, and enables scalable decision-making.

Rather than relying on informal coordination, investor-ready DAOs formalize governance responsibilities across multiple interconnected systems through well-defined governance architecture and enterprise-grade implementation practices.

Layer 1: Constitutional Governance

Defines the foundational rules that govern participation, authority, and protocol evolution.

Defines:

- Voting rights and eligibility criteria

- Proposal submission requirements

- Quorum and approval thresholds

- Emergency intervention mechanisms

- Protocol amendment and upgrade rules

- Founder and core contributor limitations

This layer functions as the DAO’s legal and operational constitution, establishing predictable governance behavior and preventing arbitrary control.

Layer 2: Operational Governance

Controls how daily activities, programs, and ecosystem initiatives are executed and supervised.

Controls:

- Annual and quarterly budget approvals

- Grant allocation and performance tracking

- Working group formation and oversight

- Vendor onboarding and contract management

- Service provider evaluation

- Milestone-based fund releases

This layer ensures that community-approved initiatives are implemented efficiently and remain aligned with strategic objectives.

Review your DAO structure with specialists.

Layer 3: Financial Governance

Manages capital allocation, risk exposure, and long-term financial sustainability.

Manages:

- Treasury diversification across asset classes

- Yield generation and liquidity strategies

- Reserve management and contingency funds

- Spending limits and authorization hierarchies

- Periodic financial reporting

- Internal and external audit schedules

This layer protects investor capital by enforcing disciplined financial management and transparent fund utilization.

Layer 4: Compliance Governance

Ensures legal alignment, regulatory readiness, and contributor protection across jurisdictions.

Ensures:

- KYC and AML framework integration

- Jurisdiction-specific legal structuring

- Regulatory reporting and disclosures

- Contributor agreements and IP protections

- Data privacy compliance

- Risk and liability mitigation policies

This layer enables DAOs to operate confidently in regulated environments while preserving decentralization principles. Professional DAO platform development embeds these governance layers directly into programmable smart contracts, automated workflows, and monitoring systems. As a result, governance becomes a living system rather than a static framework, capable of adapting to growth, regulation, and institutional expectations.

How Strategic Governance Drives Long-Term Valuation

In institutional markets, valuation depends on predictability as much as performance. Strategic governance, often supported by an experienced DAO development company, builds this predictability by embedding discipline, transparency, and accountability into daily operations.

Strong governance delivers long-term advantages across four key areas.

- Capital Efficiency: Improves budget control, reduces waste, and strengthens capital allocation.

- Brand Credibility: Builds trust with partners, investors, and regulators through consistent governance practices.

- Community Stability: Encourages participation, reduces churn, and strengthens ecosystem alignment.

- Exit and Liquidity Readiness: Prepares projects for acquisitions, listings, and strategic partnerships.

Investors reward predictable, well-governed organizations with higher valuations.

Final Thoughts

Your protocol speaks through its governance. To investors, governance answers:

Can we trust you?

Can you scale?

Can you survive regulation?

Can you protect capital?

Strategic DAO development ensures the answer to each of these questions is yes. When governance is designed with institutional standards in mind, it becomes a foundation for confidence, resilience, and sustainable growth. This is where a specialized DAO development company plays a critical role in structuring governance for long-term scalability and compliance. If you are preparing for institutional capital, regulatory expansion, or ecosystem scale, your governance architecture must evolve accordingly.

This is where experienced partners like Antier help founders make a decisive leap from experimental governance to investor-ready infrastructure. By combining governance engineering and compliance-aligned. Ready to build investor-ready governance? If you are serious about attracting premium capital, strengthening compliance, and future-proofing your protocol, now is the time to act.

Partner with experts who understand both decentralization and institutional standards.

Crypto World

Shiba Inu (SHIB) Could Explode by 50% But Under This Vital Condition

Is SHIB gearing up for a move toward $0.0000099?

Shiba Inu (SHIB) has been on an evident downtrend in the past several months, reflecting a broader cooling of enthusiasm among traders and investors.

However, one popular analyst believes the meme coin has a chance to post a substantial price increase in the near future.

What Needs to Happen?

SHIB saw a strong rebound over the weekend, climbing to $0.0000072, the highest point since late January. Its rise coincided with a broader meme coin upswing triggered by news that X will soon allow users to trade stocks and cryptocurrencies directly from their timelines.

SHIB’s revival was short-lived, and it is currently worth around $0.000006596, representing a 3% decline over the past 24 hours. According to renowned analyst Ali Martinez, however, the asset may be poised for another jump.

He noted that SHIB has been pressing against the $0.0000067 resistance level. Should the token flip this area into support, Martinez believes it could open the door to a 50% rally to $0.0000099. Many X users who engaged with the post agreed with this potential scenario. Global Rashid, for instance, said:

“SHIB sitting right at decision time. Reclaim $0.0000067 as support and momentum shifts fast towards $0.0000099. Lose it, and this stays a range. Structure > hype.”

Some indicators point toward the possibility of a short-term rally. Shiba Inu’s burn rate has soared by 70% on a daily scale, resulting in more than three million tokens sent to a null address. While the USD equivalent of the destroyed stash is negligible, sustained efforts in that field can support price appreciation (especially if demand doesn’t decline).

SHIB’s exchange reserves are also worth observing. Recently, the number of coins stored on centralized platforms fell to a new five-year low, signaling that investors continue to shift toward self-custody, thereby reducing immediate selling pressure.

You may also like:

The Doom Scenario?

Ali Martinez has been quite vocal about SHIB lately and, last week, outlined a completely different prediction. At the time, the price of the meme coin dipped well below $0.00000667, and the analyst viewed this as a precursor to a severe 80% decline.

Another element suggesting that a sustainable rally for the meme coin is far-fetched is the fading interest from market participants. SHIB has generated trading volume of just $167 million over the past 24 hours, a figure that pales in comparison to activity seen in other popular altcoins, including Dogecoin (DOGE), Ripple (XRP), Solana (SOL), Cardano (ADA), and many more.

Shibarium’s stalled progress is another worrying factor. Shiba Inu’s layer-2 blockchain solution was launched in the summer of 2023 and is designed to foster ecosystem growth by reducing transaction fees, improving speed, and enhancing scalability. At one point, daily transactions on the protocol were in the millions, but data show that activity has dropped to zero over the last few weeks.

Shibarium’s downfall appears to have begun in September last year, when its security was breached. Several reports claimed that the attack was carried out using a flash loan to purchase 4.6 million BONE tokens. LUCIE (the pseudonymous marketing strategist for Shibarium) refused to characterize the incident as a hack and assured investors that their funds were safe.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Analyst Warns BTC Price May Fall to $10K as Crypto Bubble Implodes

Analyst warns Bitcoin could crash to $10K as macro stress and risk-asset unwinding signal a bursting crypto bubble if equities slide further.

Bloomberg Intelligence senior commodity strategist Mike McGlone has published a warning suggesting Bitcoin (BTC) could revert toward $10,000 as broader financial market turbulence spreads.

His remarks framed the current market slide as part of a broader risk-asset unwind tied to stocks, volatility cycles, and macro liquidity.

Macro Stress Signals Point to Rising Pressure

McGlone linked his outlook to several macro signals, including U.S. stock market capitalization relative to GDP at century highs, unusually low 180-day volatility in the S&P 500 and Nasdaq 100, and a rally in gold and silver that he said is occurring at speeds last seen about fifty years ago.

He characterizes the current environment as one where “the crypto bubble is imploding” and framed 2026 as potentially reminiscent of 2008 in terms of market turbulence.

The analyst shared a chart that compared Bitcoin divided by ten with the S&P 500, which showed both hovering below 7,000 on February 13. He added that if equities revert toward 5,600 on the S&P, BTC could mirror that move toward about $56,000, then potentially much lower if stocks peak.

“It seems unlikely that volatile and beta-dependent Bitcoin can stay above this threshold if beta doesn’t,” McGlone wrote, which serves as the centerpiece of his bearish outlook. “Initial normal reversion is toward 5,600 SPX ($56K Bitcoin), then what? Part of my base case for Bitcoin to revert toward $10,000 is a US stock market peak. 7,000 S&P 500, 50,000 Dow can’t be tops — or else.”

Recent performance data shows why such warnings are gaining traction. Bitcoin is down about 2% in 24 hours and nearly 28% over the past month, with six-month losses near 39%. Trading activity remains elevated, with roughly $44 billion in futures volume and open interest near the same level, suggesting heavy derivatives positioning during the decline.

Furthermore, a February 16 report from CryptoQuant found that about 43% of Bitcoin’s circulating supply is currently at a loss, while the Fear and Greed Index dropped to 8, a level seen during prior crisis periods such as the FTX collapse.

You may also like:

Long-Term Holders and Institutions Still Accumulating

Despite the bearish signals, not all indicators point down, especially considering that data from CryptoQuant shows so-called accumulator addresses are buying about 372,000 BTC per month, up from about 10,000 in September 2024.

These wallets meet strict criteria, such as no outflows and multi-year activity, which analysts say reduces distortion and suggests long-term positioning rather than short-term trading.

Institutional behavior also shows major players still have faith in BTC, with Binance confirming it completed converting its $1 billion SAFU insurance reserve entirely into Bitcoin and is now holding about 15,000 BTC. Days earlier, a filing showed Goldman Sachs still had exposure to 13,740 BTC through spot ETFs, even though the value of those holdings had fallen sharply with the price.

Meanwhile, some commentators, like economist Holger Zschaepitz, are watching cross-asset links to explain the prevailing market conditions. The analyst wrote on X that Bitcoin has recently moved alongside software stocks under pressure from AI disruption, suggesting tech investors, many of whom hold BTC, may be selling crypto to raise cash.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bittensor price forecast as TAO hits $200 resistance amid Upbit listing

- Bittensor price rose to highs of $207 amid Upbit’s listing announcement.

- However, buyers retreated and saw TAO touch lows of $179.

- The daily chart signals a potential bullish move, and $300 could be the next target.

Bittensor (TAO) has retested the $200 mark, reaching intraday highs of $207 in early trading on Monday as top cryptocurrencies look to hold key levels.

While the TAO price made gains in early trading, it has fluctuated heavily in the past hours, with the volatility coming amid a major exchange listing and broader market weakness.

Bittensor pares gains as Upbit lists TAO pairs

At the time of writing, TAO traded around $185, slightly off intraday highs and about 2% down in the past 24 hours.

The latest uptick and subsequent sharp decline align with the listing announcement from South Korea’s leading cryptocurrency exchange, Upbit.

신규 디지털 자산 비트텐서(TAO) 거래지원 안내

✅ 지원 마켓: KRW, BTC, USDT 마켓

📅 거래지원 개시 시점 : 2026-02-16 16:00 KST 예정🔗공지 바로가기:https://t.co/2Zre01hLuM#Upbit #TAO@opentensor pic.twitter.com/3LsILJZxU5

— Upbit Korea (@Official_Upbit) February 16, 2026

The exchange has added TAO pairs on its spot trading platform, a development that sparked immediate price action.

According to Upbit, traders can now access TAO/KRW, TAO/BTC, and TAO/USDT trading pairs as of Feb.16, which is a notable move set to bolster accessibility for TAO across one of Asia’s largest crypto markets.

Localized demand has often seen tokens listed on Korean exchanges post sharp gains, and that’s what TAO experienced.

However, amid profit taking, which has coincided with a 51% uptick in daily volume, prices have revisited support at $179.

Can Bittensor hold onto momentum?

Beyond the Upbit catalyst, Bittensor’s recent price rally from lows of $145 ties closely to a recent pivotal leadership shift.

This is because Jacob Steeves, known as “const,” announced he had stepped down as CEO of the OpenTensor Foundation, marking a key transition to a “headless” protocol free from centralized control.

Steeves’ announcement amplified decentralization sentiment among investors, positioning Bittensor as a resilient AI infrastructure play.

With dynamic TAO upgrades and subnet competition already live, the protocol now operates as a self-sustaining ecosystem.

Grayscale has also highlighted potential institutional interest in the token, particularly with its TAO ETP filing.

Bittensor price prediction: more pain or $300 next?

The cryptocurrency market’s struggles have led to most altcoins tracking losses over the past several months.

Bittensor price mirrors this outlook, and with Bitcoin constrained around $70,000, sentiment remains largely bearish.

Despite this, can TAO break towards the $300 mark?

The daily chart paints a slightly bullish picture, given the RSI and MACD indicators.

Bulls can solidify control near $180 and look to reclaim the critical $200 level.

Such a breakout from the descending channel could allow buyers to target the 50-day moving average and swing highs of $240.

From here, the next target of $300 would come into view.

However, failure to successfully reclaim $200 risks a retest of demand zones seen in recent months.

The area around $144 could mark a key short-term support level.

Crypto World

3 Meme Coins To Watch In The Third Week Of February 2026

Momentum is rotating aggressively within the meme coin sector, with select names breaking structure and attracting speculative inflows.

Several tokens are pressing into key technical inflection points, where confirmation could unlock continuation moves. BeInCrypto has analysed three such meme coins that the investors should watch in the third week of February.

Sponsored

Sponsored

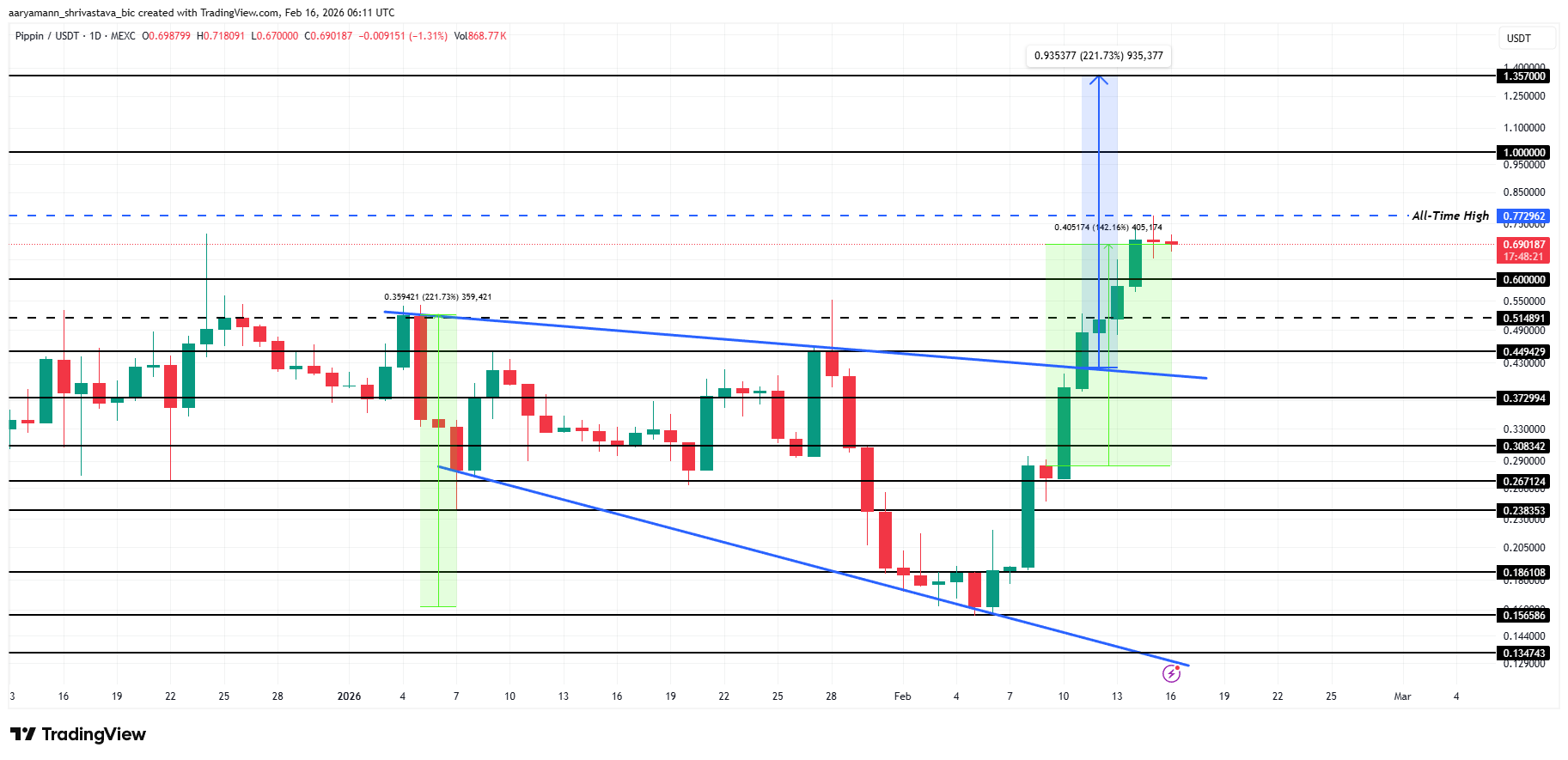

Pippin (PIPPIN)

PIPPIN has gone vertical, rallying by 142% in the last seven days and trading at $0.690 at the time of writing. It’s currently the best performer in the meme coin space this week. Structurally, price has broken out of the descending broadening wedge, a setup that typically precedes high-volatility expansion if confirmed.

The pattern projects a target rally of roughly 221%. The key trigger level sits at $0.772, the current ATH. A decisive reclaim and hold above that level — turning resistance into support — would confirm the breakout and open the door for continuation. Even a conservative follow-through could see momentum carry price toward $1.000, with the technical projection extending toward $1.357.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That said, risk management matters here. If the NVT ratio starts climbing while exchange inflows increase, it would suggest weakening on-chain activity relative to valuation — a classic early warning sign. In that scenario, a retrace toward $0.514 becomes likely, with $0.372 as deeper structural support. A breakdown to those levels would invalidate the bullish setup and flip short-term momentum bearish.

Sponsored

Sponsored

Mubarak (MUBARAK)

MUBARAK is changing hands at $0.0189, having reclaimed the $0.0174 (0.5 Fib) and is now pressing into $0.0189 (0.618 Fib) — a key decision level. Flipping this level into support suggests continuation toward higher retracement targets.

The MFI at 64.37 reflects strong buying pressure without flashing overbought conditions above 80.0. A strong daily close above $0.0189 would confirm bullish control and expose the meme coin $0.0210 (0.786 Fib) as the next upside objective, followed by $0.0237 (1.0 Fib).

On the downside, $0.0174 now acts as immediate support, with $0.0159 (0.382 Fib) and $0.0141 (0.236 Fib) below. A decisive daily close back under $0.0174 would weaken structure, while a breakdown through $0.0141 would invalidate the bullish setup.

BAN has emerged as one of the stronger-performing meme coins this week, climbing 30% to trade at $0.0987 at the time of writing. The rally pushed the price above the $0.0914 resistance level. This breakout reflects growing speculative interest and improved short-term trading momentum.

The altcoin is now eyeing a move above the $0.1000 psychological barrier. BAN’s correlation with Bitcoin stands at -0.27, indicating mild inverse movement. As Bitcoin trends lower, BAN may benefit from independent momentum. Sustained demand could drive the meme coin toward the $0.1094 resistance zone.

However, volatility remains elevated across the cryptocurrency market. If investors begin locking in profits, selling pressure could intensify quickly. A decline toward $0.0846 would signal weakening momentum. Losing that support may expose BAN to further downside near $0.0752, invalidating the current bullish outlook.

Crypto World

Polymarket renames Artemis II explosion bet after backlash

Polymarket has renamed its “Artemis II explodes?” market after outraged critics branded the company as “evil” and suggested that it could lead to the mission being intentionally sabotaged.

The prediction market first featured the controversial bet on January 20 as part of its series related to NASA’s Artemis II launch and it has so far pulled in over $81,000 in trading volume.

Users on X, however, voiced their distaste after Citations Needed podcast host Adam Johnson claimed that markets “wagering on people dying should not be legal!”

Aerospace engineering professor Dr Chris Combs said, “The fact that there could now be a financial incentive to sabotage a crewed space mission is pretty dystopian.”

Others noted the incentive and claimed that it could see “prediction markets turn into assassination markets.”

Read more: Polymarket faces backlash over ‘sick’ California wildfire markets

In response to Johnson’s first post, Polymarket said, “To clarify: this was a market about a potential booster-stage rupture — a defined hardware failure scenario — not about the Orion crew capsule or astronaut safety.”

It added, “This was not a market on crew injury or loss of life.”

However, this response wasn’t well received and some called Polymarket a “truly evil company.” Others, meanwhile, told the person behind the post to quit their job and stop working for an indefensible firm.

Some users took Polymarket’s logic to highlight how ridiculous it sounds. One user said, “I would like to bet on whether your social media team’s vehicles suffer brake failures — a defined hardware failure scenario. This would not be a market on team injury or loss of life.”

Eventually, Polymarket changed the name of the market to the more tasteful “Artemis II booster rupture?”

It noted, “This market’s language has been updated for clarity.”

Houston, we have a problem gambler

Others weren’t so upset by the market. Economics professor Chris Freiman argued that this market holds “important information that should motivate decision makers to cancel the launch.”

He said, “We shouldn’t lose life-saving information because some outside observers find it gross.” Another economics professor, Alex Tabarok, tried to equate banning the exploding market to banning life insurance.

Both professors were shot down by users on X. Some noted that authoritative figures in charge of the launch won’t be checking Polymarket to assess vessel safety, nor would anyone with that information working on the launch keep that information away from their superiors to gamble on Polymarket instead.

Others noted that, even if it could be compared to banning life insurance, this market would be closer to the Stranger-Originated Life Insurance and be “extremely” illegal.

Read more: Logan Paul fakes $1M Super Bowl bet on Polymarket

Polymarket is no stranger to controversial markets and has hosted many that involved people potentially dying.

Back in 2023, when it was still unknown what fate had befallen the crew of the failed Titan Submersible, Polymarket held a wager on when the vessel would be found.

It frequently holds markets on military conflicts across the world, and has even hosted bets on how far fires would spread during the 2025 La Wildfires.

More recently, arrests have been made and charges issued against Israelis over various bets made on Polymarket that allegedly utilised confidential military secrets.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

How Are Traders Playing It?

PIPPIN is now the 7th-largest meme coin.

While the broader cryptocurrency market has been struggling in the past weeks, the lesser-known meme coin pippin (PIPPIN) defied the bearish environment by posting an impressive rally.

Momentum around the asset has been building, with rising popularity fueling fresh price predictions and prompting traders to open interesting positions.

The Next Targets

Pippin exploded by 300% over the past two weeks, hitting a new all-time high of almost $0.76 on February 15. Currently, it trades at around $0.73 (per CoinGecko’s data), whereas its market capitalization stands at roughly $730 million. This makes it the 82nd-largest cryptocurrency and the 7th-biggest in the meme coin sector.

Its impressive performance has caused traders to open long positions in anticipation of further gains. X user Tryrex disclosed an entry at $0.695 with 7x leverage, a stop-loss placed at $0.6034, and aims to take profits if the valuation reaches $0.9755.

Shortly after, they made a slight amendment, moving the stop-loss to $0.6125 and “slightly increasing” the position. “That means I’m aiming for 3.4R. The target remains $0.97,” the trader added.

Crypto Tony said they are awaiting a test of the $0.78 level to see whether “the bulls can flip the high and continue, or if we then look for shorts.” For now, the analyst remains spot long on PIPPIN.

It is important to note that not all traders are so bullish. X user Nehal identified a potential short setup, describing the $0.75-$0.72 range as a good entry zone, with $0.63, $0.56, and $0.51 as the next targets, and placing a stop-loss at $0.81.

You may also like:

Tread Carefully

People considering whether to deal with PIPPIN should be extremely cautious for several reasons. First, it is part of the meme coin sector, widely regarded as one of the most volatile areas of the cryptocurrency market. Tokens from that niche can rise by double and triple digits in a short period of time, but they may also collapse just as quickly to literally zero.

Moreover, many argue that PIPPIN’s use cases are questionable (to say the least), while its pump is primarily driven by pure speculation. X user van00sa believes that insiders hold more than 80% of the meme coin’s supply, which could enable them to manipulate its price.

“Last cycle, this thing hit $330M and crashed 90% to $8M. Now it’s back up double with even less fundamentals than before. Generational short imo. Just make sure your risk tolerance is high,” she warned.

Shual is also among the critics. The X user thinks PIPPIN’s rise is driven entirely by supply control and manipulation, and that the success of such coins (albeit short-lived in many cases) could damage the reputation of the entire crypto industry.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How CryptoProcessing by CoinsPaid helps businesses like PropShopTrader scale globally

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

CryptoProcessing by CoinsPaid has published a case study detailing how Estonia-based proprietary trading firm PropShopTrader expanded globally by integrating crypto payments. The collaboration highlights how digital asset payments can reduce costs, lower chargeback risks, and improve conversion rates for online businesses.

Crypto payments are no longer a fringe experiment. For an increasing number of digital-first businesses, they are becoming a practical tool to reduce costs, improve conversion rates, and reach a global customer base that expects modern payment options. A recent case study from CryptoProcessing, the crypto payment gateway by CoinsPaid, shows how this shift works in practice through its collaboration with proprietary trading firm PropShopTrader.

Crypto payments are entering the mainstream

Merchant adoption of cryptocurrency payments has accelerated over the past few years. A joint survey conducted by PayPal and the National Cryptocurrency Association found that nearly 40% of merchants already accept crypto payments, while 84% expect crypto to become a common payment method within five years. Importantly, adoption is being driven by customers themselves: 88% of merchants reported that users have asked about paying with crypto.

This trend is reflected globally. Industry research estimates that tens of thousands of online merchants now support crypto payments, with stablecoins playing a central role thanks to their lower volatility and faster settlement times.

Against this backdrop, companies operating in fintech, trading, and digital services are increasingly reassessing their reliance on card-only payment models.

Why PropShopTrader looked beyond card payments

PropShopTrader is an Estonia-based proprietary trading firm that evaluates and funds traders from around the world. Before integrating crypto payments, the company relied exclusively on card transactions. While familiar and widely used, card payments brought several challenges: higher processing fees, exposure to chargebacks, and limited flexibility for a globally distributed, crypto-savvy audience.

“Integrating CryptoProcessing by CoinsPaid changed how we think about payments. We’ve reduced chargebacks, optimised fees, and expanded access to traders around the world. We especially value the ability to accept multiple cryptocurrencies while automatically converting everything to USDC. It gives us the flexibility of crypto with the stability we need to run our business confidently,” shared Ashley Kozak, Founder and Managing Partner at PropShopTrader.

Implementing CryptoProcessing

By integrating CryptoProcessing’s payment gateway, PropShopTrader has enabled users to pay with more than 20 cryptocurrencies, while the business itself can automatically convert incoming funds into USDC or fiat. This removes exposure to market volatility while preserving the benefits of blockchain-based payments.

Equally important is compliance. Operating within the EU regulatory framework, PropShopTrader required a solution with built-in AML monitoring, transaction screening, and transparent reporting. CryptoProcessing’s infrastructure provides these safeguards, allowing the company to expand its payment options without increasing regulatory or operational risk.

Measurable business results

The impact of crypto payments became visible shortly after launch. Around 7% of PropShopTrader’s clients began using cryptocurrency to fund their accounts, indicating clear demand from a segment that may have otherwise faced friction at checkout. At the same time, the company reported a reduction of approximately 3% in average transaction costs and an overall revenue increase of about 5%, driven by improved conversion and broader accessibility.

These figures highlight a key point often overlooked in discussions around crypto payments: adoption does not need to be universal to be meaningful. Even partial uptake can deliver measurable financial benefits.

Why CryptoProcessing resonates with businesses

CryptoProcessing’s appeal lies in its balance between innovation and practicality. Businesses gain access to a wide range of digital assets and blockchain rails, while still benefiting from instant settlements, treasury management tools, and regulatory safeguards. For companies serving international or digitally native audiences, this combination can translate directly into lower costs and higher customer satisfaction.

More broadly, crypto payments are increasingly seen as a strategic advantage rather than a speculative bet. As stablecoins become more integrated into mainstream payment flows — including support through platforms like Apple Pay, the gap between traditional and crypto payments continues to narrow.

A practical example of crypto in action

The PropShopTrader case illustrates how crypto payments can move beyond theory and hype. By working with CryptoProcessing, the company has addressed real operational pain points while opening the door to new customer segments. The result was not just a more modern checkout experience, but tangible improvements in cost efficiency and revenue.

As global commerce becomes increasingly digital and borderless, examples like this suggest that crypto payments are evolving into a core component of modern payment strategies — especially for businesses willing to meet their customers where they already are.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat23 hours ago

NewsBeat23 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show