Crypto World

Harvard University Pulls Back From Bitcoin ETFs While Mutuum Finance Presale Sees Explosive $20.6M Inflows

Harvard University’s endowment exposure to Bitcoin exchange-traded funds (ETFs) has been reduced, according to recent crypto news. The move signals a more cautious stance amid continued market volatility. Meanwhile, in the DeFi crypto sector, Mutuum Finance (MUTM) has captured significant investor attention, raising over $20.60 million in its ongoing presale. The project leverages a framework that combines a dual-lending mechanism.

Harvard Reduces Bitcoin Exposure and Adds Ethereum

Harvard University has adjusted its cryptocurrency portfolio, cutting back on its Bitcoin ETF holdings while entering the Ethereum market for the first time. According to its latest 13F filing, Harvard Management Company, the subsidiary managing the university’s endowment, held 5.35 million shares of the iShares Bitcoin Trust ETF (IBIT) as of Dec. 31, a 21% decrease from the previous quarter, valued at roughly $265.8 million. Despite the reduction, IBIT remains the largest single position in Harvard’s portfolio, representing 12.78% of total assets.

At the same time, Harvard initiated a stake in the iShares Ethereum Trust ETF (ETHA), acquiring 3,870,900 shares worth approximately $86.8 million. This comes as Bitcoin retraces 26% over the last 30 days, falling from $97,000 to below $70,000. Recent crypto news shows the leading asset saw $223M in liquidations as it fell below $68,000, its 200-week EMA. As Bitcoin retraces, Mutuum Finance (MUTM) is exploding in momentum during presale. The project recently launched its V1 Protocol on Sepolia testnet, a significant move that has attracted investor attention.

Presale Participation and Platform Features

The MUTM presale has attracted broad interest, with over 19,020 participants contributing more than $20.60 million to date. Investors can join the DeFi crypto’s presale at just $0.04 today before its upcoming phases, where its prices are set to go higher, including $0.045 in phase 8 and $0.06 at launch.

In a recent update, Mutuum Finance now allows investors to participate in its presale using both cryptocurrency and traditional card payments, making it accessible to a wider audience. By supporting debit and credit card purchases alongside crypto options, the project removes the barrier of needing to first acquire digital assets, enabling newcomers to enter the ecosystem quickly and seamlessly.

The project further incentivizes participation through an ongoing $100,000 giveaway, where 10 lucky participants will each receive $10,000 worth of MUTM. To qualify, users need to join the presale with a minimum $50 purchase and complete a few simple tasks, such as following the project’s social media channels. In addition, the top buyer each day, based on the highest MUTM purchase, receives a $500 MUTM reward.

Strengthening Lending Security

Mutuum Finance employs a multi-layered oracle framework to enhance the safety of its lending ecosystem. The protocol uses Chainlink Price Feeds as the primary reference, supported by fallback oracles and an internal Time-Weighted Average Price (TWAP) mechanism. This approach ensures accurate asset valuations even during periods of high market volatility or disruptions in price feeds, helping reduce the risk of manipulation.

The system is also designed to protect borrowers from sudden market shocks. If a token’s price on a major exchange diverges sharply from the verified feed due to sudden crypto news or any other event, the platform temporarily suspends activity for that market to prevent unintended liquidations. For instance, a sudden anomalous Bitcoin price e.g; $10,000 on a single exchange, would be disregarded, with loan values calculated based on the verified average price, around $68,000 today. This safeguards users from both accidental errors and potential market manipulation.

Hands-On Learning via Testnet Access

The V1 Protocol is currently live on the Sepolia testnet, allowing users to experience the Mutuum Finance ecosystem firsthand. Participants can deposit test assets to receive mtTokens, while borrowers receive debt tokens that track obligations on-chain.

An automated liquidator bot monitors positions to maintain protocol stability and reduce default risk. The testnet currently supports USDT, ETH, LINK, and WBTC, with plans to integrate additional assets after full launch. This environment enables users to explore borrowing and lending mechanics, understand the protocol’s operational features, and familiarize themselves with the platform without risking real assets.

As Harvard trims its Bitcoin ETF holdings in the latest crypto news, institutional sentiment toward traditional crypto products remains mixed amid ongoing volatility. In contrast, Mutuum Finance (MUTM) is seeing explosive presale inflows, surpassing $20.60 million from over 19,020 participants at its Phase 7 price of $0.04. The DeFi crypto platform features a multi-layered oracle security, a live testnet, and a transparent lending framework, attracting strong interest. Phase 7 presale is progressing fast and will sell out soon. Join now before it’s too late.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

When Will Ripple’s (XRP) Bull Run Resume? We Asked 4 AIs (And Their Answers Surprised Us)

The AI solutions agreed that XRP is currently hunting for a bottom. Also, a few of them put massive price targets for the asset.

Ripple’s cross-border token has been highly volatile since the US presidential elections in late 2024. At the time, it traded at $0.60, exploded to its 2018 all-time high of $3.40 in January 2025, plunged in the following months, before it skyrocketed to a new record of $3.65 in July.

Since then, it has been mostly downhill, with the asset currently sitting below $1.40 – or a 62% decline since the July peaks. Most recently, it was rejected at $2.40 in early January, dumped to $1.11 a month later, but has found some support at the aforementioned level.

Being more than 60% down in just several months puts it in a bearish territory. Consequently, we decided to ask ChatGPT, Gemini, Grok, and Perplexity how long it would take for XRP to reignite its bull run and head for new records.

Find a Bottom First

Before even having a theoretical chance of reversing its trend, XRP would need to bottom out first. OpenAI’s platform noted that the token is currently searching for it, which could happen by April, but before it does, it could face even harsher declines if history is any indication:

“Historically, February has been weak for XRP, and 2026 is no exception. The asset has posted losses in most Februarys, averaging declines and severe drawdowns in prior cycles.”

Nevertheless, ChatGPT and Perplexity agreed that several factors have aligned to suggest that XRP’s bottom might be rather close – a 50% month decline from January 6 to February 6 was met with immediate buying pressure, funding rates reached deeply negative levels, a development that preceded rallies in the past, and panic selling appears to have subsided.

Recovery and Run Reignition

Gemini and Grok were somewhat optimistic that XRP could indeed locate a bottom by spring 2026, which would open the door for the next phase – “base building and recovery.” In this neutral-to-cautiously bullish stage, XRP could regain some traction by the beginning of the summer season.

Gemini was even more specific, indicating that the asset would need to reclaim the 50-day EMA, currently located at around $1.80, to signal the traditional exit from bearish territory.

You may also like:

ChatGPT agreed to an extent, but warned that most of the highly anticipated bullish catalysts from the past few years, such as the SEC lawsuit resolution and the approval of spot XRP ETFs, are already behind the token, so it might be in search of new ones. As such, it was rather conservative in predicting a target for the summer, putting a base case around the $2.40 range.

“If XRP reclaims $2, the market will likely consider the bear phase technically over,” said Grok.

All AIs noted that a full-on bull phase wouldn’t start by at least Q3 of this year, most likely in Q4. Once it begins, though, they added that XRP is positioned to benefit a lot, indicating some massive targets for the longer-run.

“$8 by year-end 2026 in aggressive institutional adoption scenarios,” said ChatGPT

“$8-13 long-term consolidation breakout targets,” – noted Perplexity.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

SBI Launches Security Token Bonds With XRP Rewards for Retail Investors

TLDR:

- SBI will issue Security Token bonds through blockchain instead of traditional depository systems used in Japanese capital markets.

- Retail investors can trade the bonds on a digital exchange platform starting in March 2026.

- Eligible bondholders will receive XRP benefits tied to their subscription and interest payment dates.

- The project supports Japan’s push to merge regulated finance with token-based settlement systems.

SBI Holdings has unveiled plans to issue its first Security Token bonds aimed at individual investors in Japan. The offering marks a shift from traditional bond management toward blockchain-based issuance and settlement.

Trading will begin on a digital marketplace designed for retail participation. The move signals a broader push to integrate tokenized assets into regulated capital markets.

Security Token bonds enter Japan’s retail market

SBI Holdings filed an amended shelf registration with the Kanto Local Finance Bureau to prepare the bond sale. The bonds will carry the nickname SBI START Bonds and operate under a digital transfer registration system.

Unlike conventional bonds recorded through Japan Securities Depository Center, the issuance will rely on blockchain infrastructure. SBI will use the ibet for Fin platform developed by BOOSTRY to manage the full lifecycle.

The digital system will handle issuance, administration, and redemption electronically. SBI said this approach removes paper-based processing and reduces reliance on legacy settlement workflows.

Retail trading will start on March 25, 2026, through the proprietary trading system START. The platform is operated by Osaka Digital Exchange and will allow individual investors to buy and sell the bonds in an open market.

XRP rewards and blockchain settlement model

Investors who purchase the Security Token bonds will receive XRP benefits linked to their subscription amounts. SBI confirmed that only domestic residents and corporations qualify for the incentive.

To receive the XRP, bondholders must open an account with SBI VC Trade and complete required procedures by the stated deadline. Distribution will occur on each interest payment date through 2029.

The company framed the reward structure as part of its broader digital asset strategy. SBI has expanded its blockchain operations through partnerships, investments, and proof-of-concept trials across Japan.

The group said tokenized bonds support its vision of an economy where transactions and settlements occur directly on blockchain networks. Officials also stated that growth in the Security Token bond market could help modernize Japan’s capital markets.

According to the company’s disclosure, the issuance will not materially affect consolidated financial results. SBI positioned the project as an infrastructure experiment rather than a revenue driver.

The bond launch follows a wider trend among Japanese financial firms to test tokenized securities under existing regulatory frameworks.

SBI described the initiative as a step toward linking traditional finance with on-chain settlement systems while keeping investor protections intact.

Crypto World

Bitcoin Price Metric Reveals $122K Average Return Over 10 Months

Bitcoin has drawn renewed attention from traders and analysts as data-driven signals suggest a potential upside path into 2027, even amid a recent stretch of muted sentiment. An informal metric developed by market economist Timothy Peterson points to an 88% probability that BTC/USD will be higher by early 2027, a claim grounded in monthly patterns dating back to 2011. If history repeats, the model implies a price near $122,000 per coin within ten months, positioning Bitcoin for what some view as an “average return” rather than a rapid meteoric rise. The narrative sits alongside a broader chorus of bullish commentary from major banks and market observers who continue to think Bitcoin can stage a substantial recovery in the coming year, even as risk-off currents persist across traditional markets.

Key takeaways

- An informal metric from Timothy Peterson suggests a roughly 88% chance BTC/USD will be higher by early 2027, based on historical frequency of positive months.

- Under this scenario, Bitcoin could reach about $122,000 per coin within ten months, which would equate to an “average return” given past performance since 2011.

- Despite a period of underperformance since late 2025, bullish forecasts remain active, with analysts highlighting inflection-point dynamics rather than precise price targets.

- Bernstein has surfaced a bulls-case target of around $150,000 for Bitcoin, underscoring continued institutional interest in a multiyear rally.

- Wells Fargo’s note flags potential capital inflows into Bitcoin and equities totaling about $150 billion by the end of March, suggesting further speculative appetite.

Tickers mentioned: $BTC

Sentiment: Bullish

Price impact: Positive. The convergence of upbeat forecasts and improving sentiment could support upside momentum for Bitcoin in the near term.

Trading idea (Not Financial Advice): Hold. While the setup leans toward upside, volatility and macro risk warrant a cautious stance until clearer directional signals emerge.

Market context: The market has been digesting a mix of technical signals and macro influences, with a notable divergence between short-term momentum and longer-horizon forecasts. The discussion around Bitcoin’s path centers on whether historical patterns can translate into a sustained rally despite periodic pullbacks and risk-on/risk-off cycles that characterize crypto liquidity and funding conditions.

Why it matters

The ongoing debate about Bitcoin’s trajectory sits at the intersection of on-chain behavior, macro liquidity, and evolving investor psychology. If Peterson’s 88% odds hypothesis holds, it would suggest that the crypto market has entered a phase where repeated positive monthly readings can precede a meaningful upside. The reference point of $122,000, anchored to a decade of price data, provides a tangible milestone that traders and risk managers can monitor against volatility spikes and pullbacks.

Institutional interest remains a persistent tailwind for the bull case. Bernstein’s recent analysis arguing for a $150,000 target signals that large-scale wealth and professional funds continue to view Bitcoin as a potential long-horizon hedge and return driver, not merely a speculative asset. At the same time, Wells Fargo’s note on potential inflows—citing a $150 billion expansion into Bitcoin and equities by the end of March—highlights the interplay between crypto markets and traditional asset streams. The combination of high-conviction targets and expected capital inflows underscores a continued re-pricing dynamic in which narrative and data-driven signals reinforce each other.

Nonetheless, the mood within the market remains fractured. Peterson’s own work cautions that the metric he discusses emphasizes inflection points rather than precise targets, and a survey cited in the report points to prevailing bearish sentiment in parts of the crypto ecosystem. The tension between a favorable long-term thesis and a wobbling near-term momentum is typical of a market navigating a transition from macro-tilted risk-off periods to periods of renewed speculative interest. In other words, the narrative is compelling, but the path to a sustained rally is likely to be choppy, with volatility continuing to reflect shifting risk appetites across both crypto and broader financial markets.

Beyond the headline forecasts, the story includes practical market dynamics that have featured in recent reporting. For example, even as some analysts flag upside potential, others point to recent price patterns and the episodic nature of Bitcoin’s momentum. There is also recognition that positive data points can coexist with caution about timing—investors are watching for concrete catalysts that could shift the trajectory from consolidation to a more pronounced up-leg. The crypto ecosystem has also seen episodes where large holders or “whales” participate in accumulation, offsetting sell pressure and contributing to sporadic surges in price. This pattern of selective accumulation has been noted in related coverage and remains a factor that traders monitor as they assess the probability of a sustained breakout. See for example commentary highlighting whale-driven V-shaped accumulation as a counterweight to sell-offs.

In this backdrop, the narrative remains nuanced: the macro backdrop is not uniformly bullish, but there is a persistent belief among a subset of market observers that Bitcoin’s longer-run risk-reward profile justifies continued interest. The expectation is that if the next few quarters deliver supportive price action and a stream of positive signals—on-chain activity, liquidity, and institutional participation—the market could sustain an upward drift that aligns with the optimism expressed by Bernstein and others. Meanwhile, the data points that have historically preceded rallies—such as a persistent sequence of higher months and improving on-chain metrics—will continue to be scrutinized as potential inflection signals rather than definitive price triggers.

Additional context comes from the broader conversation around crypto sentiment and risk appetite. The market’s mood can swing rapidly in response to macro news, regulatory developments, or shifts in funding conditions on major exchanges. The 2021–2022 era of rapid price appreciation followed by sharp corrections has conditioned market participants to weigh upside potential against the risk of retracements. In that sense, Peterson’s framework offers a lens to identify potential turning points, while Bernstein’s and Wells Fargo’s forecasts remind investors that price targets are only one piece of a complex puzzle. Investors facing this environment are likely to weigh multiple signals—price momentum, on-chain activity, institutional commentary, and macro indicators—before committing to meaningful exposure shifts.

Looking ahead, the interplay between these forecasts, market sentiment, and actual price action will be pivotal. The crypto market has shown resilience when liquidity returns and risk tolerance improves, yet the path to a durable rally requires sustained participation from both retail and institutional players. As analysts continue to publish scenarios that hinge on historical patterns repeating, traders should remain attentive to contingency setups, including potential catalysts that could accelerate or pause the rally. The balance of probabilities remains cautiously bullish, anchored by data-driven signals and the prospect of deeper institutional engagement, but never free of risk.

Sources and verifications discussed in this article include a pair of data-driven signals and commentary from market researchers and financial institutions, along with linked materials that capture the ongoing discourse around Bitcoin’s price path.

What to watch next

- Monitor BTC price action toward the $122,000 target within the next ten months and observe how monthly performance aligns with Peterson’s frequency-based metric.

- Track updates to Bernstein’s price scenario and Wells Fargo’s capital-flow expectations for Bitcoin and related equities, including any new investor communications or research notes.

- Watch for shifts in market sentiment as measured by surveys or social-media signals tied to crypto views, particularly around inflection-point indicators.

- Observe on-chain accumulation patterns, especially among large holders, as reported in relevant analyses and linked research notes.

Sources & verification

- Timothy Peterson’s X posts detailing the 88% odds via a trailing-month metric measuring frequency of positive months (data goes back to 2011).

- Bernstein’s analysis citing a $150,000 BTC target and framing Bitcoin’s decline as the “weakest bear case” in history.

- Wells Fargo’s note on potential $150 billion in inflows into Bitcoin and stocks by the end of March, highlighting growth in speculative participation.

- Reports and data on whale accumulation dynamics and related on-chain signals referenced in coverage surrounding V-shaped accumulation patterns.

- Historical discussion of Bitcoin price targets and market sentiment within the crypto narrative and linked market commentary.

Bitcoin momentum and the road ahead

Bitcoin (CRYPTO: BTC) has drawn renewed attention from traders and analysts as data-driven signals suggest a potential upside path into 2027, even amid a recent stretch of muted sentiment. An informal metric developed by market economist Timothy Peterson points to an 88% probability that BTC/USD will be higher by early 2027, a claim grounded in monthly patterns dating back to 2011. If history repeats, the model implies a price near $122,000 per coin within ten months, positioning Bitcoin for what some view as an “average return” rather than a rapid meteoric rise. The narrative sits alongside a broader chorus of bullish commentary from major banks and market observers who continue to think Bitcoin can stage a substantial recovery in the coming year, even as risk-off currents persist across traditional markets.

The analysis frames its outlook around a few core ideas. First, the notion that a substantial portion of monthly price action over the past two years has been positive—roughly half—creates a probabilistic backdrop for a potential upward swing. Peterson explains that his metric measures frequency, not magnitude, so it could still register a down-month even in a broader uptrend. Still, he notes the utility of the approach for identifying inflection points that might precede a new phase of price appreciation. In a post on X, he underscored that the method is informal but helpful for spotting transitions in momentum.

Second, a separate line of bullish thinking continues to gain attention from institutions. Bernstein’s research team has argued for a substantial upside with a $150,000 target, framing Bitcoin’s recent drawdown as a potential setup for a longer-term rebound. This view aligns with a segment of the market that sees Bitcoin as a multiyear hedging asset whose risk premium may be re-rated as liquidity conditions improve and macro narratives shift. Meanwhile, Wells Fargo’s note projects sizable inflows into Bitcoin and equities by the end of March, underscoring the belief that a broader wave of savings and speculative capital could re-enter risk assets in the near term. Analysts there highlighted the appeal of “YOLO” style trades in a climate of improved liquidity and improving sentiment among some investor cohorts.

Despite the sense of optimism, the market remains cautious. Peterson’s own work cautions that while the metric can help identify inflection points, it does not guarantee a particular price path. The broader sentiment picture includes pockets of bearishness, as evidenced by surveys and on-chain commentary, which means that buyers should be prepared for a choppy advance rather than a straight line higher. The fact that bullish scenarios coexist with continued caution is a reminder that Bitcoin’s price trajectory will be influenced by a blend of on-chain dynamics, macro trends, and evolving investor appetite.

As the calendar moves toward early 2027, the most pertinent questions revolve around whether the momentum signals can translate into sustained price gains and whether the demand side—institutional capital, wealth managers, and retail participants—will sustain a higher level of engagement. The references to the Bernstein and Wells Fargo analyses, coupled with Peterson’s frequency-based perspective, provide a framework for assessing how different catalysts—ranging from improved liquidity to renewed risk-appetite cycles—could align to support a longer-term uptrend. In a market where headlines oscillate between caution and confidence, the likely path forward is not a single, definitive move but a sequence of incremental advances punctuated by periods of consolidation. For traders and long-term holders alike, the question remains: where does the next decisive breakout come from, and how will risk controls shift as Bitcoin tests higher price levels?

For readers seeking a direct line of verification, the key pieces of evidence in this discourse include Peterson’s analysis shared on X, Bernstein’s bullish scenario, and Wells Fargo’s inflow projections, all of which sit alongside ongoing reporting on on-chain activity and macro risk signals that influence market direction.

Crypto World

Quantum Computing Threat: Zcash Co-Founder Warns It’s Coming for Bitcoin

TLDR:

- Crypto networks must formally recognize the quantum computing threat before technical mitigation efforts can move forward.

- Post-quantum cryptography already exists and can replace vulnerable signature schemes in major blockchain protocols.

- Expert-led teams will define standards and security levels for wallets and core crypto infrastructure.

- Implementation requires coordinated upgrades across protocols, wallets, and external blockchain services.

The quantum computing threat has moved back into focus after a warning from a leading cryptography figure in the crypto sector.

The message targets Bitcoin and other blockchains that still rely on traditional signature schemes. It outlines a structured path for how networks should prepare for a post-quantum future. The call stresses urgency but centers on coordination and technical readiness.

Quantum Computing Threat Prompts Call for Industry-wide Awareness

Eli Ben-Sasson, a co-founder of Zcash and chair of Starknet.io, shared a multi-step plan on social media to confront the quantum computing threat.

He said the first challenge lies in recognition. Networks must openly accept that large-scale quantum machines would weaken current cryptographic standards.

Education followed as the second priority. He urged developers and users to study both quantum progress and existing post-quantum cryptography options.

Ben-Sasson noted that secure alternatives already exist. He pointed to signature schemes and stronger hash requirements as areas ready for evaluation.

The post framed the issue as technical, not theoretical. It called on Bitcoin and other chains to treat quantum risk like any other core protocol vulnerability.

Post-quantum Cryptography Becomes a Development Priority

The third step focused on organizing expert teams. According to Ben-Sasson, blockchains must appoint specialists in post-quantum cryptography and fund their work.

He said collaboration should span multiple projects. Several parallel efforts would reduce reliance on a single standard or implementation.

Listening to technical feedback formed the fourth stage. Experts can define which cryptographic standards best fit blockchain systems and wallet infrastructure.

The final step centered on execution. Development teams should integrate new signature schemes into core protocols and external tools like wallets.

His comments highlighted infrastructure gaps. Wallet providers and node operators would need updates alongside consensus changes.

The message framed the quantum computing threat as a long-term engineering task. It did not suggest immediate disruption but warned against delay.

Social media reactions showed strong engagement from developers and security researchers. Many echoed the need for early testing and gradual deployment.

The discussion also reinforced a broader trend in crypto security. Networks increasingly prioritize resilience against future computing advances rather than current attack vectors.

Crypto World

This Bitcoin Miner Sold Its Entire BTC Stash as Profit Crashed

Singapore-based Bitcoin miner Bitdeer has liquidated its entire BTC treasury, abandoning the industry’s standard holding strategy.

This drastic move comes as plunging mining profitability forces the company to restructure its debt and accelerate its AI pivot.

Why did this Bitcoin Miner dump its Holdings?

On February 20, the crypto mining company disclosed it held zero Bitcoin, completely draining its reserves. Notably, this excludes its customer deposits.

The firm confirmed that it had sold its entire recent output of 189.8 Bitcoin, and posted a massive net reduction of 943.1 Bitcoin.

Indeed, this aggressive sell-off highlights a deepening crisis for operators caught in a severe margin squeeze.

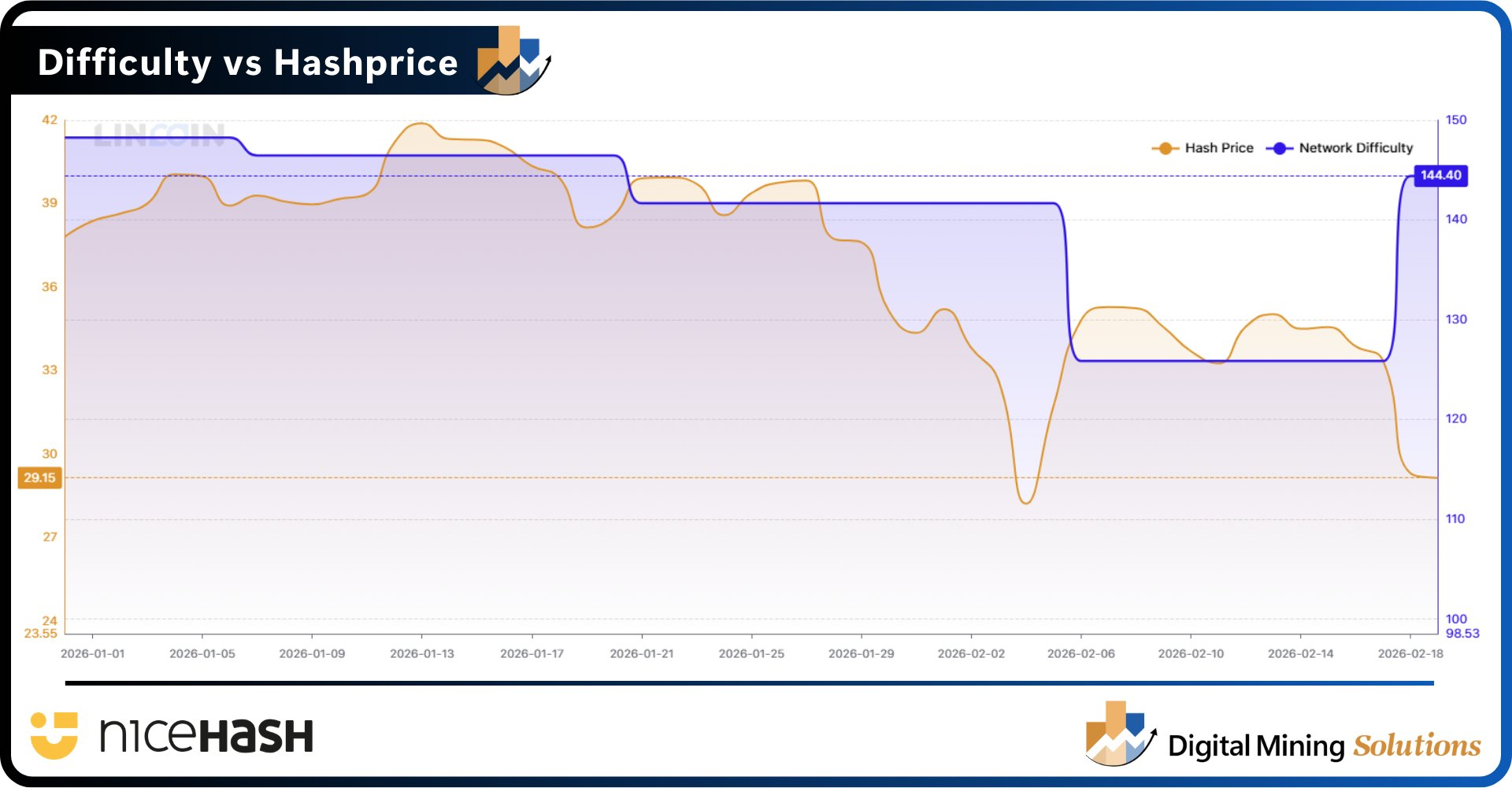

Following a temporary reprieve caused by US winter storms that knocked domestic mining fleets offline, the Bitcoin network experienced a rapid V-shaped recovery.

This week, network difficulty surged 14.7%. This is the largest upward adjustment since May 2021 and erases the operational relief miners experienced earlier in the year.

Consequently, mining profitability, measured by hashprice, plummeted to under $30 per petahash per day. The critical metric now sits inches above its all-time low, pushing production costs higher.

Bitdeer Seeks Funding for AI Pivot

To navigate the crunch, Bitdeer is turning heavily to Wall Street to fund its pivot into artificial intelligence.

On February 20, the company announced an upsized $325 million private sale of convertible senior notes.

The sale, expected to close on February 24, includes an option for the initial purchasers to purchase an additional $50 million in notes.

The financial maneuvering is highly defensive. Bitdeer will allocate $138.2 million to repurchase its existing 5.25% convertible senior notes due in 2029. This effectively extends the miner’s runway by restructuring its debt.

Another $29.2 million will fund capped call transactions, an insurance policy that protects existing shareholders from dilution if the stock price rises.

The remaining proceeds signal a clear strategic departure from pure-play crypto mining.

Bitdeer stated it will use the fresh capital to expand its high-performance computing and AI cloud businesses, develop proprietary ASIC mining rigs, and fund data center expansion.

Meanwhile, the treasury liquidation and strategic pivot occur alongside a paradoxical industry milestone: Bitdeer is now the largest publicly traded self-miner in the world.

Recent reports have revealed that Bitdeer’s self-managed hash rate reached 63.2 exahashes per second, surpassing competitor Marathon Digital’s 60.4 EH/s. This makes the Singapore-based firm the largest publicly traded company with the highest self-managed Bitcoin hashrate.

Crypto World

BTC Price Analysis All But Guarantees Bitcoin Higher by Early 2027

Bitcoin past performance gave 88% odds of higher prices by early 2027, the latest in a series of new bullish BTC price predictions.

Bitcoin (BTC) at $122,000 in ten months could be an “average return” if history repeats itself.

Key points:

-

An “informal” Bitcoin price metric gives 88% odds of BTC/USD trading higher by early 2027.

-

$122,000 per coin would mark an “average return” based on prior performance.

-

Bullish BTC price predictions remain in place despite the current low sentiment.

BTC price ended half of past 24 months higher

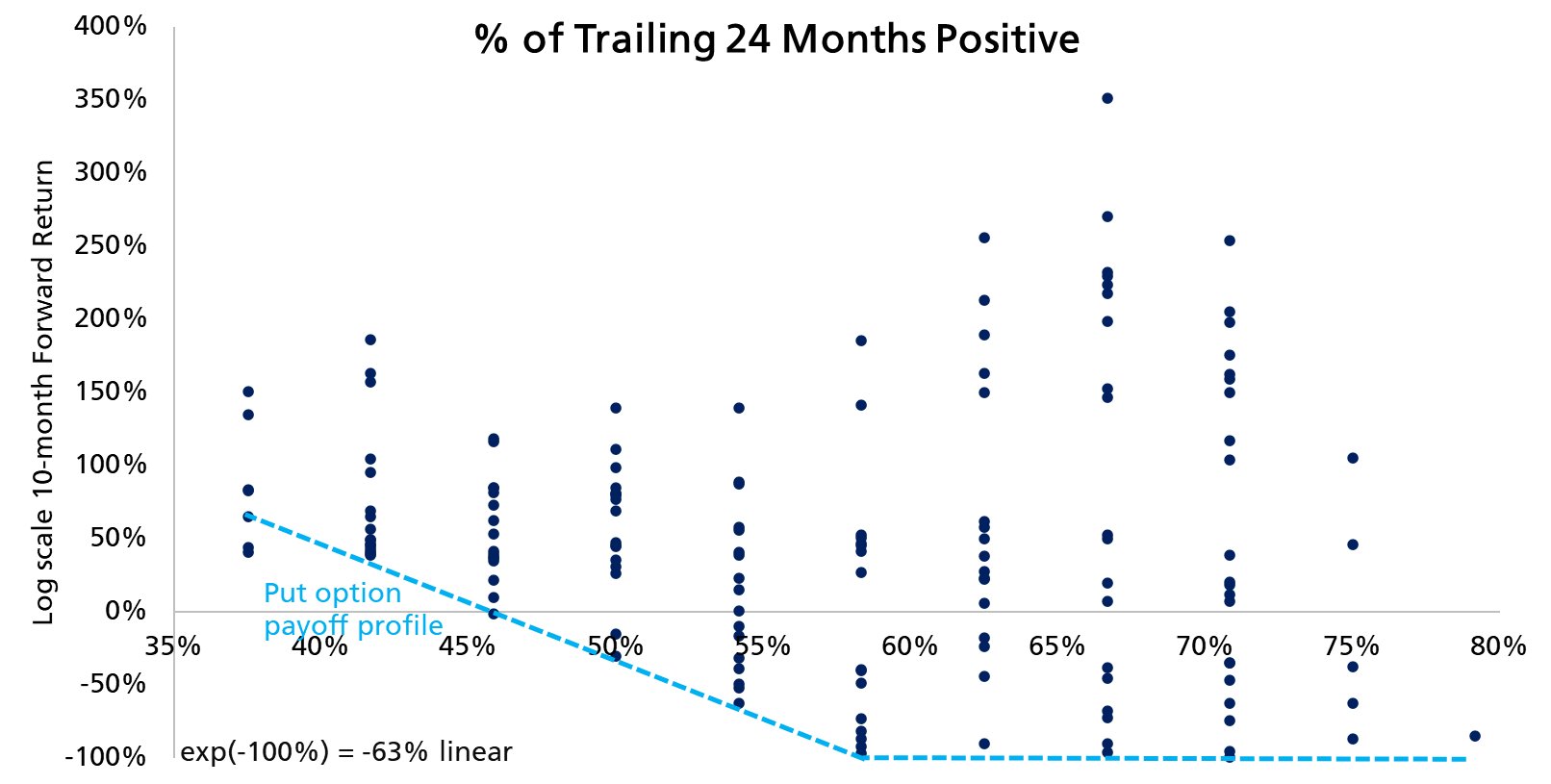

New analysis from network economist Timothy Peterson gives almost 90% odds of a BTC price being higher by early 2027.

Bitcoin’s underperformance since Q4 2025 has not removed every bullish BTC price prediction that leverages historical data.

For Peterson, monthly price action over the past two years points to a recovery through the rest of the year.

“50% of the past 24 months have been positive. This implies a 88% chance that Bitcoin will be higher 10 months from now,” he reported on X.

“The average return is exp(60%)-1 = 82% => $122,000. Data goes back to 2011.”

In a previous post, Peterson acknowledged that trailing price performance is more useful for identifying trend “inflection points” than price targets.

“This metric measures frequency, not magnitude. So Bitcoin could trend sideways for months and this metric could still go down. But it is still very useful for identifying inflection points,” he wrote, calling the tool “informal.”

A survey conducted by Peterson on Sunday, meanwhile, underscored existing bearish crypto market sentiment.

Bitcoin bulls double down

As Cointelegraph reported, other market sources continue to beat on a major BTC price recovery in 2026.

Related: Bitcoin whales participate in V-shaped accumulation, offsetting 230K BTC sell-off

Among them is an analysis from Bernstein, which this month offered a $150,000 target, calling Bitcoin’s comedown its “weakest bear case” in history.

US banking giant Wells Fargo additionally sees $150 billion in capital inflows into Bitcoin and stocks by the end of March.

“Speculation picks up with bigger savings…we expect YOLO to return,” analyst Ohsung Kwon wrote in a note last week.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

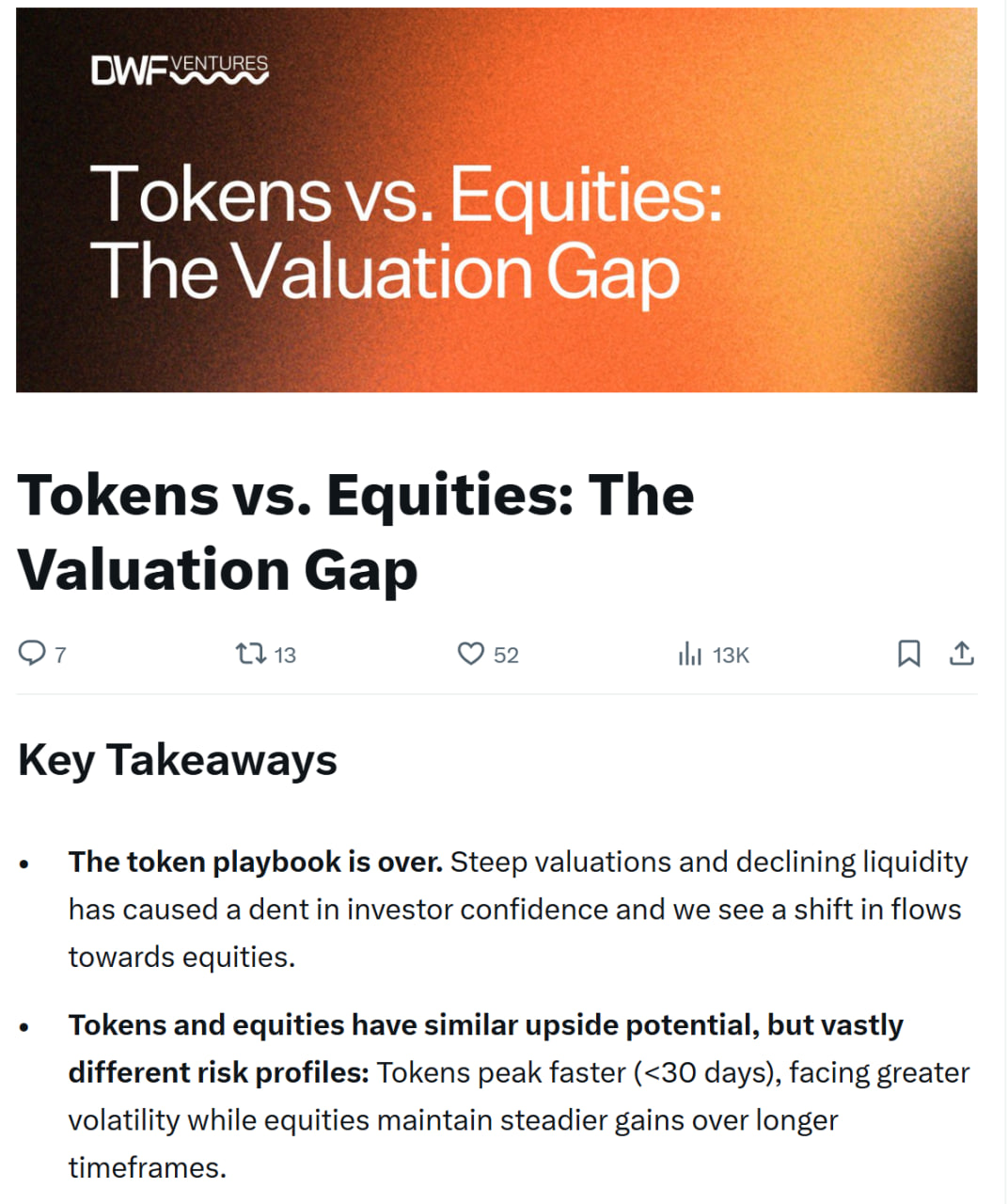

Crypto Capital Shifts From Tokens to Stocks as Launches Struggle: DWF

Investor capital increasingly flows from tokens into publicly listed crypto companies as new token launches struggle, according to research and commentary from market maker DWF Labs.

Drawing on Memento Research data covering hundreds of token launches across major centralized and decentralized exchanges, the firm said more than 80% of projects have fallen below their token generation event (TGE) price. Typical drawdowns range between 50% and 70% within roughly 90 days of listing, suggesting public buyers often face immediate losses after launch.

DWF Labs managing partner Andrei Grachev told Cointelegraph that the figures reflect a consistent post-listing pattern rather than short-term market volatility. He said most tokens reach a price peak within the first month and then trend downward as selling pressure builds.

“TGE price is the exchange-listed price set before launch,” Grachev said. “This is the price the token is set to open at on the exchange, so we can see how much the price actually changes due to volatility in the first few days,” he added.

The analysis focused on structured launches tied to projects with products or protocols, rather than memecoins. Airdrops and early investor unlocks were identified as major sources of selling pressure.

Related: Kraken-backed SPAC raises $345M in upsized Nasdaq IPO

Crypto IPOs, M&A surge as capital shifts from tokens

In contrast, capital formation has strengthened in traditional markets tied to the sector. Fundraising for crypto-related initial public offerings (IPOs) reached about $14.6 billion in 2025, up sharply from the prior year, while merger and acquisition (M&A) activity surpassed $42.5 billion, the highest level in five years.

Grachev said the shift should be understood as a rotation rather than a withdrawal of capital. If capital were simply leaving crypto, you wouldn’t see IPO raises jump 48x year-over-year to $14.6 billion, M&A hit a 5-year high of over $42.5 billion, and crypto equity performance outpacing token performance,” he said.

In its report, DWF compared listed companies such as Circle, Gemini, eToro, Bullish and Figure with tokenized projects using trailing 12-month price-to-sales ratios. Public equities traded at multiples between roughly 7 and 40 times sales, compared with 2 to 16 times for comparable tokens.

The firm argued that the valuation gap is driven by accessibility. Many institutional investors, including pension funds and endowments, are restricted to regulated securities markets. Public shares can also be included in indexes and exchange-traded funds, creating automatic buying from passive investment products.

Maksym Sakharov, co-founder and group CEO of WeFi, also confirmed to Cointelegraph that there has been a capital rotation from token launches. “When risk appetite tightens, investors don’t stop craving exposure, so they start demanding cleaner ownership, clearer disclosure, and a path to enforceable rights,” he said.

Sakharov added that the money is going toward businesses that look like infrastructure because of custody, payments, settlement, brokerage, compliance and plumbing. He noted that the “equity wrapper” is attractive because it aligns with real-world adoption, enabling licensing, audits, partnerships and distribution channels.

Related: CertiK keeps IPO on the table as valuation hits $2B, CEO says

Why investors favor crypto equities over tokens?

The market is increasingly treating tokens and businesses as separate things, Sakharov said, noting that a token alone cannot replace distribution or a working product. If a project fails to generate steady users, fees, transaction volume and retention, the token ends up priced on expectations rather than real activity, which is why many launches look successful at first but later disappoint.

Listed crypto equities are not necessarily safer, but they are clearer and easier for investors to evaluate, according to Sakharov. Public companies offer reporting standards, governance and legal claims, and they fit within institutional portfolio rules, whereas holding tokens often requires custody approvals and policy changes.

Grachev described this shift as structural rather than cyclical. While tokens will remain part of crypto networks for incentives and governance, he said institutional capital increasingly prefers equity rails.

“Tokens won’t disappear, but we’re seeing a permanent bifurcation: serious protocols with real revenue will thrive, while the long tail of speculative launches faces a much harder environment,” he concluded.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

SportFi could shift from fan engagement to on-chain markets tied to live sports outcomes

SportFi has spent most of its life in a familiar lane: tokens that reward fandom with voting rights, perks and a thin layer of speculative trading. The next version being mapped out by some of the sector’s biggest builders suggests a more ambitious destination — one where sports become a live data feed for smart contracts, and tokens behave less like collectibles and more like programmable markets.

The logic is simple: sports already produce constant, globally understood outcomes. Win, lose, qualify, get relegated — the “settlement layer” is the scoreboard. If token supply and incentives can be tied to those outcomes, SportFi starts to resemble a gamified asset class rather than a bolt-on engagement product.

One roadmap outlined by sports-focused blockchain firm Chiliz frames this shift as “gamified tokenomics”: match-day results would trigger mint-and-burn mechanics, for example, burning supply on wins or expanding it on losses, executed transparently through smart contracts.

“Our journey is about trying to become like a sentiment marketplace above these tokens and making them available everywhere so developers can create tools where we can indeed play with these tokens as a sentiment game,” Chiliz CEO Alexandre Dreyfus told CoinDesk in an interview.

Dreyfus pitched it less as gambling and more as a sentiment marketplace that mirrors sport’s competitive rhythm: seasonal, event-driven and reactive to real-world performance.

That matters because it changes who the product is for. Fan tokens have typically leaned on a sense of “ownership” in a team, such as voting on the colour of the club’s warm-up kit and what song plays in the stadium as the players walk out. Trading activity, however, has often been driven by headline moments — signings, managerial changes, tournament runs.

A rules-based, outcome-linked supply model is designed to formalize that behaviour into the token itself, making price formation and scarcity part of the match-day experience rather than an accidental byproduct.

Intersection with prediction markets

If that layer works, it opens the door to the next one: DeFi around sports-native assets. In practice, that means building the plumbing for tokens to be used as collateral, traded in deeper liquidity pools, or packaged into structured products, a step toward sports assets behaving like other crypto primitives.

It’s also where SportFi begins to intersect with prediction markets, without trying to become one. “We are investing in making our fan tokens more gamified. So, maybe I’m betting on Polymarket that Barcelona is going to beat Paris Saint-Germain, but then maybe I’m going to hedge that by buying the fan token of Barca,” Dreyfus said.

The idea is that fan tokens could become another instrument for match outcomes: a liquid, tradable expression of sentiment that can sit alongside event contracts rather than replace them.

The longer-term arc is even more conventional and potentially more transformative. Sports organizations are famously asset-rich and cash-poor, sitting on valuable media rights, brand IP and stadium economics while managing volatile costs. Tokenization could turn those future cash flows into on-chain instruments, giving clubs alternative liquidity routes beyond banks and specialized funds. Decentral, a Chilliz-based protocol, is tokenizing future receivables such as broadcasting rights, allowing teams to receive stablecoin liquidity.

None of this is guaranteed. Regulation will define how far SportFi can go, especially when tokens resemble gambling, as prediction markets have found out.

Nevertheless, SportFi’s journey shows signs of evolving from simply putting a badge on a blockchain into using smart contracts to translate sports’ real-world outcomes and, eventually, their real-world cash flows into programmable financial markets.

Crypto World

Ripple ETF Demand Is Gone as XRP Price Tumbles 11% Weekly

It has been over three months since the first XRP ETF launched, but the demand seems to have evaporated.

It has been another week of underwhelming XRP ETF performance, with the funds attracting little to no actual net inflows.

At the same time, the underlying asset has struggled to maintain the price resurgance from last week, and now trades over 10% lower.

Where Did the Ripple ETF Demand Go?

Canary Capital’s XRPC was met by investors with open arms, breaking the 2025 debut-day trading volume record on November 13. Four more products tracking the altcoin followed suit, and the total inflows quickly skyrocketed to over $1 billion. However, it has been mostly plateauing since then, and even some weeks deep in the red.

For example, investors pulled out $40.64 million during the week that ended on January 23, and another $52.26 million the following week. The next one was more positive, with $39.04 million in net inflows. The trend changed then: the interest and demand are nowhere to be found.

Two weeks ago – on February 11 – the ETFs had no reportable daily flows, with SoSoValue showing a clear “$0.00” for the first time since the products’ inception. This behavior worsened last week when there were two such days – February 17 and February 20. Even the other two showed little interest: $2.21 million in net outflows on February 18 and $4.05 million in net inflows on February 19.

Since Monday was a national holiday in the US and the markets were closed, this meant that half of the business days had no actual trading volume to report. As such, it’s no surprise that the cumulative net inflows have remained flat at $1.23 billion.

XRP Price Falls

Somewhat unexpectedly, Ripple’s native cross-border token jumped hard by double digits last weekend, going to a multi-week peak of over $1.65 despite the lack of ETF action. However, this sporadic price pump was short-lived, and the asset quickly lost traction. It returned to $1.40 mid-week and even dipped below that level on a couple of occasions.

You may also like:

It has managed to defend that support as of press time, but it’s still more than 10% down weekly. Aside from ETF investors who had displayed a serious lack of interest in the asset, data shared by popular analyst CW shows that short traders continue to dominate the XRP landscape.

Nevertheless, a recent report by Santiment suggested that XRP could be slightly undervalued at the moment, according to the 30-day MVRV ratio. Moreover, the skyrocketing amount of realized losses could lead to a significant price rebound for Ripple’s token, as it has happened in the past. In fact, it led to a 114% surge back in 2022 when such losses were last observed.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

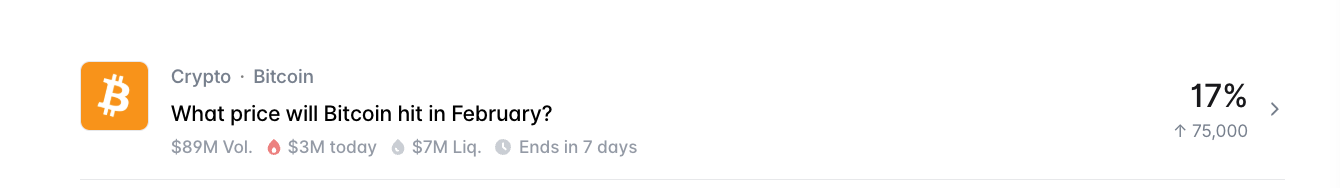

Polymarket Bitcoin Price Prediction Says $75K, But Charts Don’t

Bitcoin price has traded mostly flat over the past 24 hours near $68,000, reflecting continued indecision. The broader seven-day trend still shows a mild decline, highlighting the lack of strong bullish momentum. Yet one prediction market’s positioning is telling a far more optimistic story.

On Polymarket, the single largest February outcome, at 17%, expects Bitcoin to cross $75,000. This makes it the most popular directional bet as the month approaches its final week. However, market structure, on-chain activity, and whale positioning suggest reality may not align with this bullish expectation.

Prediction Markets Favor $75,000 — But Hidden Bearish Divergence Signals Trouble

Prediction market data shows ‘above $75,000’ remains the most favored February target despite weakening sentiment. Polymarket volumes, for this bet, exceed $88 million, with millions in active liquidity.

However, the probability of the $75,000 outcome has already declined by more than 50%, reflecting fading confidence.

At the same time, the next most likely outcome sits at ‘under $60,000’ with a 12% probability. This positioning reveals a growing split in expectations. While many traders still hope for upside, a large portion of the market is increasingly preparing for a deeper correction instead.

This growing caution aligns closely with Bitcoin’s technical structure.

On the daily chart, Bitcoin formed a lower high between November 15 and February 16. This means price failed to fully recover during its latest rally attempt.

Meanwhile, the Relative Strength Index (RSI), which measures momentum strength, formed a higher high during the same period.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Because Bitcoin was already in a downtrend, this creates a hidden bearish divergence. This pattern usually signals continuation of the existing downtrend rather than a bullish reversal. It shows that even though momentum improved briefly, the broader selling pressure remains intact.

Since this divergence appeared, Bitcoin has already corrected nearly 6%. As long as this signal remains active, the probability of reaching the prediction market’s $75,000 target remains limited.

Long-Term Holders Have Slowed Selling, But Have Not Started Buying

Long-term holder activity helps explain why prediction markets still retain some optimism, even as risks increase. These investors may have held Bitcoin for more than 1 year. Their buying and selling patterns often determine whether Bitcoin enters a sustained rally or correction.

On February 5, long-term holders reduced their holdings by 244,919 BTC (30-day rolling change), a sign of extremely heavy selling. By February 21, this number improved to 81,019 BTC. This marks a roughly 67% reduction in selling pressure.

This sharp slowdown in selling helps stabilize Bitcoin’s price and explains why some traders still expect upside.

However, long-term holders are still net sellers overall. They have not yet transitioned into accumulation. Their activity has improved, but they are not yet providing the strong buying support needed to push Bitcoin toward new highs.

This creates a neutral balance. Bitcoin may avoid immediate collapse, but it also lacks the strength needed for a major breakout to push it close to $75,000.

Whale Behavior Is Split

Whale positioning further reflects uncertainty.

The largest Bitcoin whales, holding between 100,000 and 1 million BTC, increased their holdings from 676,540 BTC to 690,000 BTC. This represents an accumulation of about 13,460 BTC, signaling cautious buying.

However, smaller whales holding between 10,000 and 100,000 BTC reduced their holdings from 2.27 million BTC to 2.26 million BTC. This means roughly 10,000 BTC were sold during the same period.

This opposing behavior shows a lack of unified conviction, even though the net balance slightly tilts towards accumulation. Some whales are preparing for a rebound, while others remain defensive.

At the same time, cost basis distribution data reveals a major resistance cluster between $72,600 and $73,200. Around 149,000 BTC were accumulated in this range. These levels also appear clearly on the price chart as a major resistance zone just below $75,000.

When Bitcoin approaches this area, many holders may sell to exit at breakeven. And the whale accumulation strength, as seen, isn’t strong enough to absorb the supply yet. This selling pressure creates a strong barrier that prediction markets may be underestimating.

Bitcoin Price Structure Shows BTC May Remain Trapped Between Key Levels

Bitcoin’s price structure closely aligns with these on-chain cost basis clusters.

To reach the $75,000 prediction target, Bitcoin must first break above $72,200. This level represents both technical resistance and is close to one of the largest cost basis clusters on the chart. Breaking this zone would require a rally of more than 6% from current levels.

However, failure to break this resistance increases the likelihood of continued range-bound movement. On the downside, strong support exists between $64,300 and $63,800, where approximately 150,000 BTC were accumulated.

On the Bitcoin price chart, the key support level resembling the zone is $63,300, breaking which would also mean the supply cluster break. Breaking under $63,300 can make the $60,000 zone, the 12% probability bet on Polymarket, come to fruition.

As a result, Bitcoin is currently trapped between two major cost basis zones. Resistance near $72,200 limits upside, while support near $63,300 prevents immediate collapse.

This range-bound structure suggests that prediction markets may be overestimating the probability of a breakout toward $75,000 while underestimating the growing risk of continued consolidation or a correction.

-

Video6 days ago

Video6 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Crypto World5 days ago

Crypto World5 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Video3 days ago

Video3 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Boden – Corporette.com

-

Sports5 days ago

Sports5 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Politics7 hours ago

Politics7 hours agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Tech5 days ago

Tech5 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 days ago

Business5 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment4 days ago

Entertainment4 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video5 days ago

Video5 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech4 days ago

Tech4 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports3 days ago

Sports3 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 hours ago

Business2 hours agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Entertainment4 days ago

Entertainment4 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business4 days ago

Business4 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat7 days ago

NewsBeat7 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Politics5 days ago

Politics5 days agoEurovision Announces UK Act For 2026 Song Contest

-

Crypto World4 days ago

Crypto World4 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat7 days ago

NewsBeat7 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market