Crypto World

Here’s How Much Bitcoin (BTC) Drake Lost Betting on the Super Bowl

The “Drake curse” is back again.

The Canadian musician Aubrey Drake Graham, better known as Drake, suffered a substantial crypto loss after betting on the outcome of the Super Bowl.

Over the years, he parted with millions of dollars worth of Bitcoin (BTC) on bets he publicly shared, as the teams he backed in football, basketball, and other sports often ended up losing.

Drake’s Latest Crypto Loss

The Super Bowl – one of the most-watched sporting events across the globe – was held on February 8 and offered a great show for the spectators. The arena of the match was Levi’s Stadium, while the two teams competing for the title were the Seattle Seahawks and the New England Patriots.

This particular match is usually the most heavily bet-on single sporting event in the United States. One popular person who tried his luck on it was the rapper Drake.

He revealed on his personal Instagram account that he wagered a whopping $1 million worth of Bitcoin (BTC) on the New England Patriots to win the game.

The odds were set at 2.95, meaning Drake would have made a profit of almost $2 million worth of the cryptocurrency had the team been victorious. Unfortunately for him, the Seattle Seahawks became champions after beating their opponents 29-13.

The Previous Bets

While the musician seems to be a huge fan of betting on various sports events, he rarely picks the right horse. In 2022, he wagered a little over $600,000 worth of BTC on the English football club Arsenal to beat Leeds United and on FC Barcelona to win “El Clásico” versus its biggest rival, Real Madrid. The team from Spain’s capital won the game, leaving Drake to taste defeat once again.

You may also like:

At the start of 2024, the Canadian tried his luck with UFC, betting $700,000 worth of BTC on Sean Strickland to beat Dricus du Plessis. The latter, though, won after a split decision from the judges.

Several months later, he tried a really risky bet. He wagered $300,000 in the primary cryptocurrency on Canada’s national football team to win against the reigning world champion Argentina. The odds for the North American country were almost 10, meaning Drake would have made a substantial profit. Somewhat expectedly, however, the team captained by Lionel Messi won by 2-0.

Those losses (and many more) over the years gave rise to the so-called “Drake curse.” It is a popular Internet meme that refers to the pattern where the rapper publicly supports or bets on a club or athlete, only for them to lose in the aftermath.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

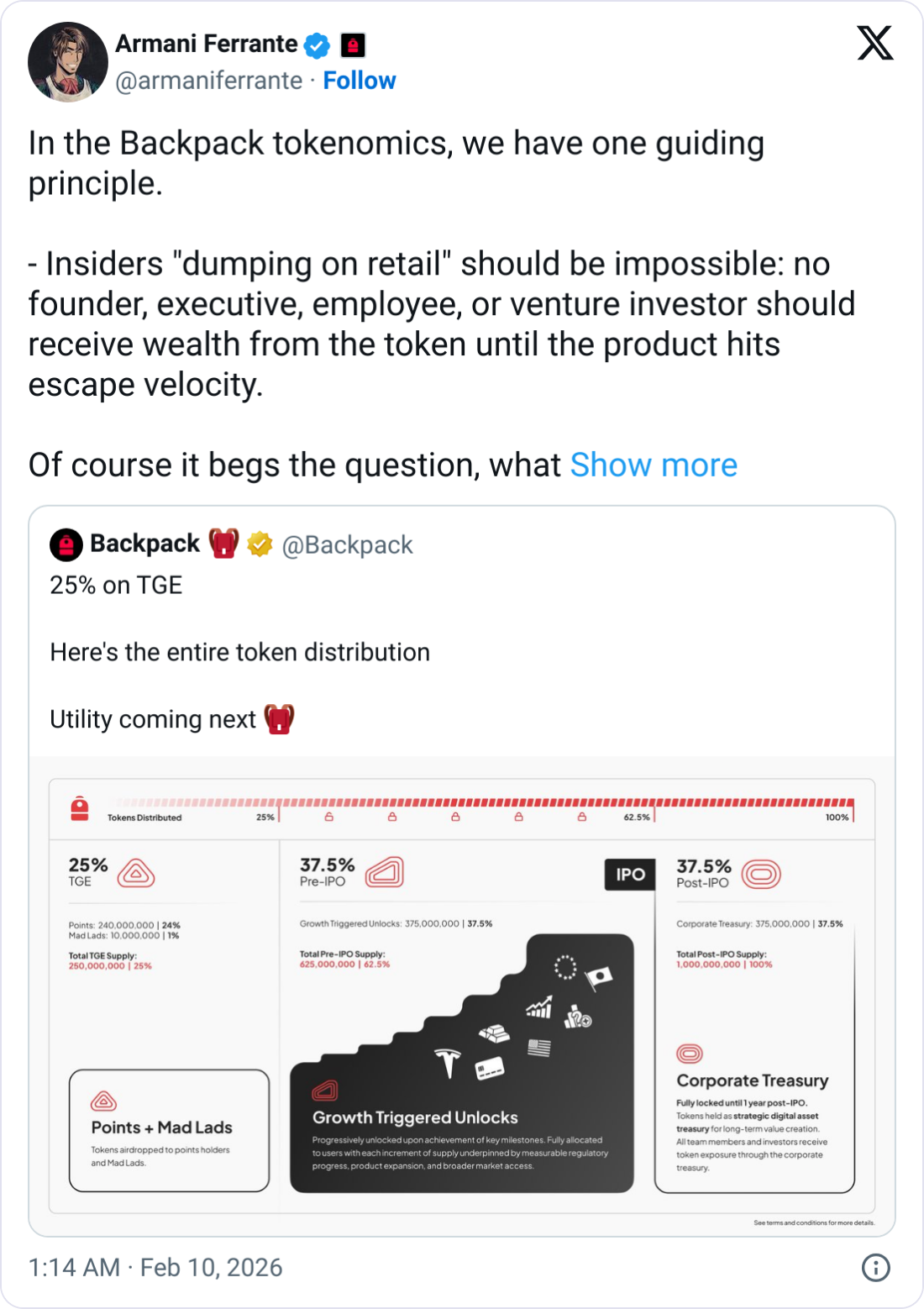

Backpack, a crypto exchange founded by former employees of FTX, says it will launch a 1-billion-supply token in the future, with its distribution schedule tied to its goal of going public in the US.

Backpack posted to X on Monday that its token launch will begin with 25% of the intended supply, or 250 million tokens, to become available on a yet-to-be-disclosed launch date.

Another 37.5% of the total supply, or 375 million pre-IPO tokens, will be made available “upon achievement of key milestones,” which Ferrante said would include opening in a new region or launching a new product.

The remaining 375 million post-IPO tokens would be locked until a year after the company goes public, with the tokens held strategically in a corporate treasury.

The IPO push comes as Axios reported on Monday that Backpack is in discussions to raise $50 million at a $1 billion pre-money valuation, potentially making it the crypto industry’s latest unicorn.

In a separate post, Backpack co-founder and CEO Armani Ferrante wrote on X on Monday that the “guiding principle” for its token unlocks was that “insiders ‘dumping on retail’ should be impossible.”

Ferrante, an early employee at the FTX-linked Alameda Research, added that none of the Backpack team or investors should gain wealth from the token “until the product hits escape velocity,” which he said would happen when the company launches an initial public offering.

“Going public might happen quickly, it might happen not so quickly, and in fact, it might not happen at all,” Ferrante said. “In any case, we’re going for it.”

Related: Backpack Exchange launches beta testing of prediction market platform

Ferrante said that “not a single founder, executive, team member, or venture investor has been given a direct token allocation,” and that the team instead owns equity in the company.

“It’s not until the company goes public (or has some other type of equity exit event), that the team can earn any wealth from the project,” he added.

“It’s not until the company has done all the hard work to earn access to those markets that the team can reap the rewards of the value created by the Backpack community from now until then.”

Backpack launched in 2022 and Ferrante co-founded the exchange alongside former FTX.US strategy lead Tristan Yver and former FTX general counsel Can Sun.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

YouTube star MrBeast buys youth-focused financial services app Step

Creator, Entrepreneur and Philanthropist Jimmy Donaldson, also known as MrBeast, speaks onstage during the 2025 New York Times Dealbook Summit at Jazz at Lincoln Center on December 03, 2025 in New York City.

Michael M. Santiago | Getty Images News | Getty Images

The world’s largest YouTuber by subscriber count, Jimmy Donaldson, better known as MrBeast, has acquired the financial services app Step, marking his company’s entry into fintech with a focus on serving younger users.

Step is advertised as an all-in-one money app for teens and young adults to manage money, build credit and access financial tools. The app will operate under the umbrella of Donalson’s company, Beast Industries.

“Nobody taught me about investing, building credit, or managing money when I was growing up. That’s exactly why we’re joining forces with Step,” MrBeast told his millions of fans on Monday. “I want to give millions of young people the financial foundation I never had. Lots to share soon.”

Beast Industries did not disclose how much it paid for Step. CNBC contacted the company for comment but did not receive a response by publication.

Beast Industries has been fundraising over the past year, including a recent $200 million investment from Bitmine Immersion Technologies, the largest corporate holder of the cryptocurrency Ether and chaired by Fundstrat’s Tom Lee.

Step is backed by fintech giant Stripe, as well as venture capital firms such as Coatue, Collaborative Fund, Crosslink Capital and General Catalyst.

The newly acquired Step was founded in 2018 by fintech veterans CJ MacDonald and Alexey Kalinichenko, with a mission of providing the next generation with tools for financial literacy.

While it is not a bank, Step partnered with Evolve Bank & Trust, a consumer banking company, for banking services in 2022. The platform also includes a Step Visa Card, an account for saving, spending, sending money and investing, with no monthly fees.

Beast Industries said in a press release Step’s over 7 million users, technology platform and in-house fintech team would complement its large digital audience and philanthropic initiatives.

“This acquisition positions us to meet our audiences where they are, with practical, technology-driven solutions that can transform their financial futures for the better,” Jeff Housenbold, CEO of Beast Industries, said in a statement.

Beast Industries’ other ventures include Feastables, a snack brand, Beast Philanthropy, its non-profit arm, and Beast Games, its reality competition series on Amazon Prime Video.

Those ventures leverage Donaldson’s YouTube brand, which had over 450 million subscribers and 5 billion monthly views across channels as of early 2026.

Crypto World

Bitcoin’s U.S. demand signal flickers back after crash

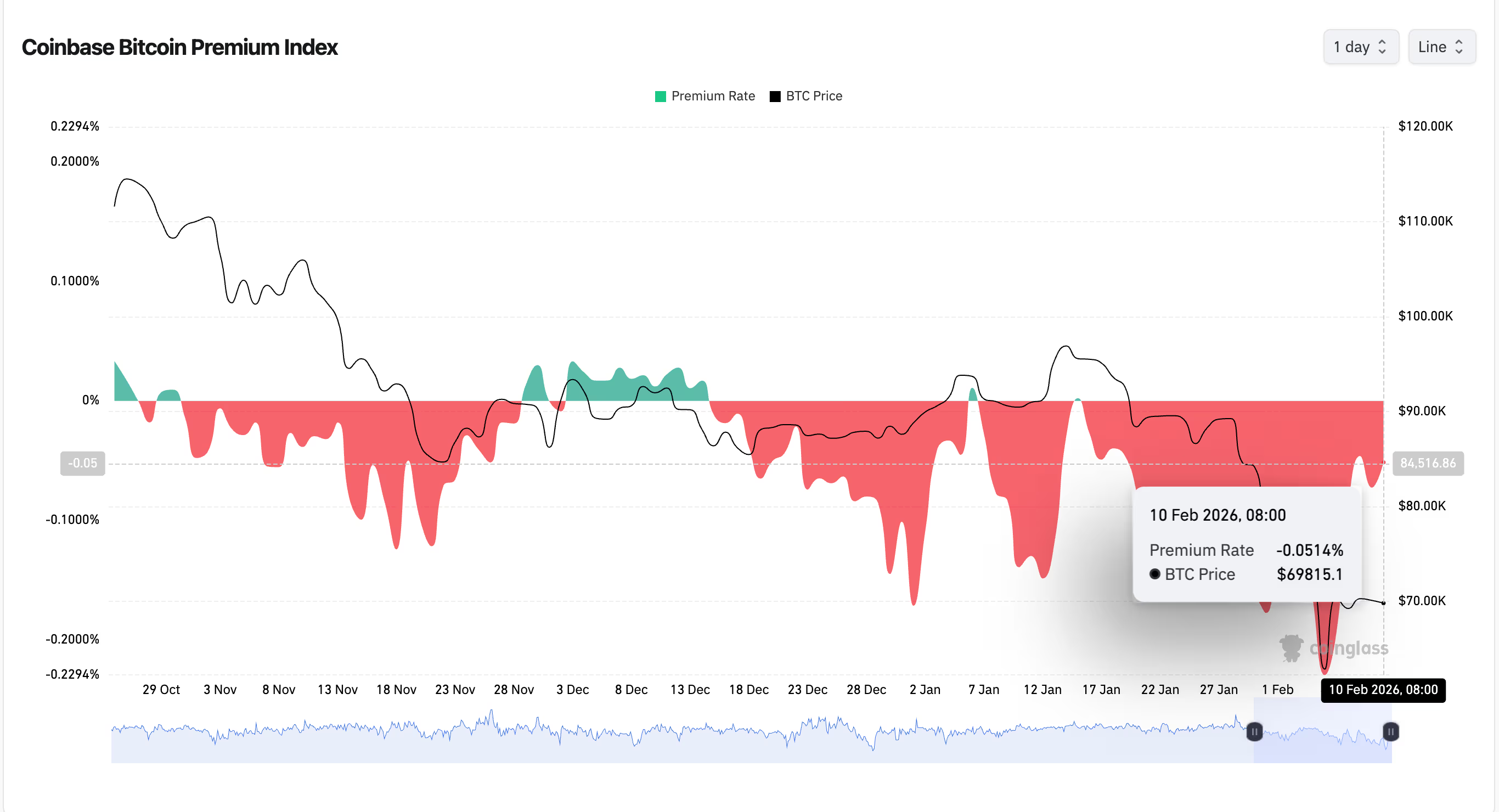

Bitcoin’s sharp rebound from last week’s plunge toward $60,000 has been accompanied by a subtle but important shift in one closely watched indicator of U.S. demand.

The Coinbase Bitcoin Premium Index — which tracks the price gap between bitcoin traded on Coinbase and the global market average — has climbed sharply from deeply negative territory, moving from around -0.22% at the height of the selloff to roughly -0.05% by Tuesday.

While the index remains below zero, the rebound suggests U.S.-based investors stepped in to buy the dip as forced selling pressure eased.

Coinbase is widely viewed as a proxy for institutional and dollar-based flows. A deeply negative premium typically signals U.S. investors are either selling aggressively or staying on the sidelines altogether. The move back toward neutral indicates that some buyers found value at lower levels, particularly as bitcoin stabilized after its fastest drawdown since the FTX collapse in 2022.

Still, the premium has not turned positive, a threshold that historically coincides with sustained accumulation and renewed risk appetite among U.S. funds. Instead, the current move points to selective buying rather than broader conviction.

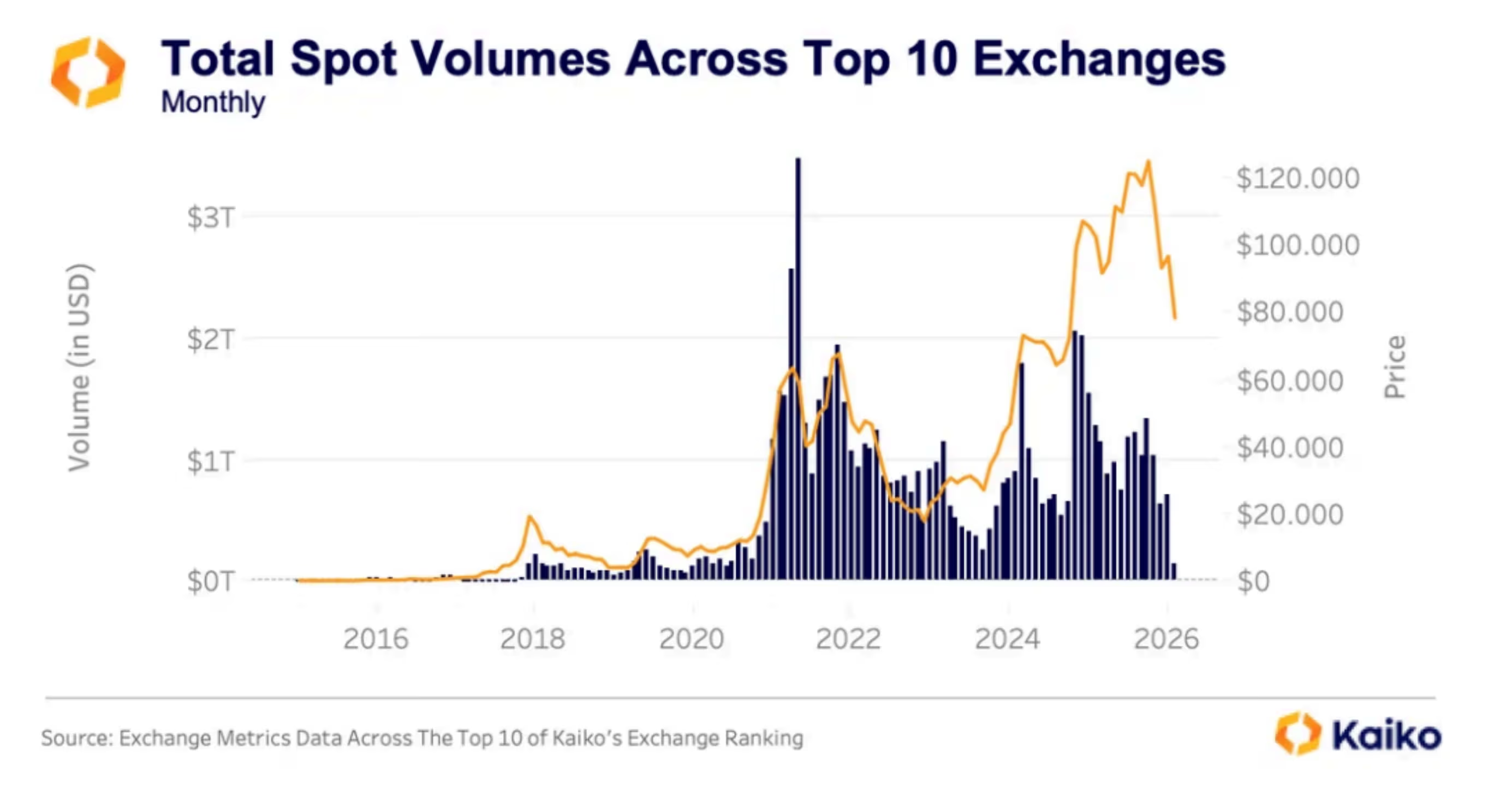

Market structure data supports that cautious interpretation. Aggregate trading volumes across major exchanges remain well below late-2025 highs, according to Kaiko, with spot activity showing signs of gradual attrition rather than a decisive surge in demand.

Thin liquidity means prices can bounce sharply once selling exhausts itself, but also leaves the market vulnerable to renewed downside if buyers fail to follow through.

Bitcoin is currently trading just under $70,000 after recovering more than 15% from its intraday low, though it remains down over 10% on the week.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

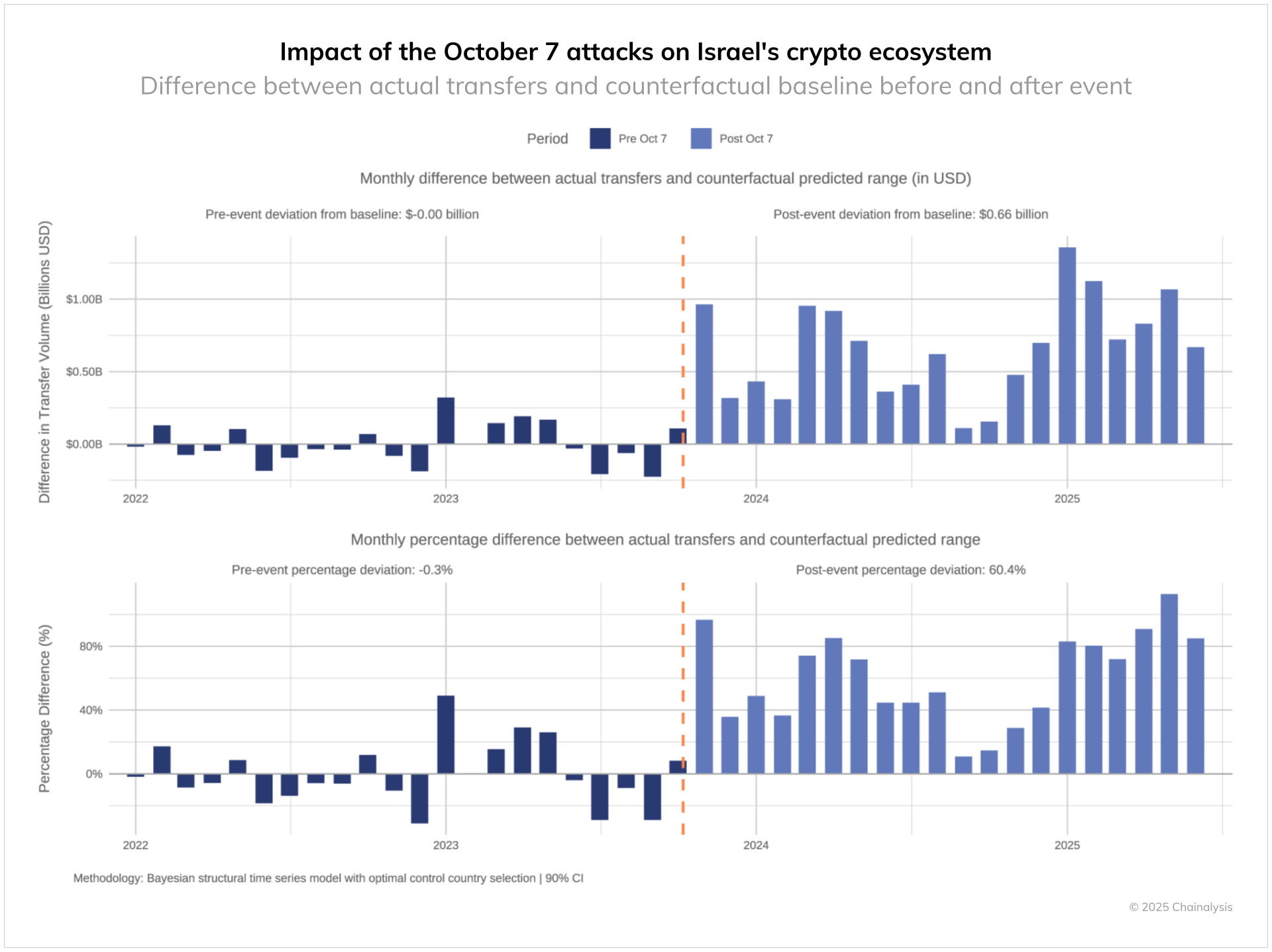

The Israeli Crypto Blockchain & Web 3.0 Companies Forum last week launched a lobbying effort to push regulatory reforms that research from KPMG says may add 120 billion shekels ($38.36 billion) to the country’s economy by 2035 and create 70,000 new jobs.

At a Feb. 3 event in Tel Aviv, Forum leader Nir Hirshman-Rub said there is broad public support for legislation that would relax rules on stablecoins and tokenization, along with simplifying tax compliance requirements.

In the wake of the US-brokered ceasefire of the Gaza war, 2026 is seen as a “defining year” for the local digital assets industry, Hirshman-Rub said.

“The Israeli public is already there and the politicians need to act,” Hirshman-Rub told Cointelegraph on the sidelines of the Tel Aviv event. “More than 25% of the public already has had crypto dealings in the last five years and more than 20% currently hold digital assets,” he said, citing the KPMG research.

Steady growth as digital asset landscape evolves

An October Chainalysis report showed that the G-20 country’s crypto economy has showed steady growth, with inflows topping $713 billion last year. Those levels reflect a sharp increase in crypto volumes in the aftermath of the October 2023 Hamas attacks, which were sustained by strong retail activity, the report said.

Israeli companies, such as Fireblocks and Starkware, have established leadership positions in the global digital assets landscape and are among the Forum’s sponsors. According to NGO Startup Nation Central, more than 160 locally founded companies have attracted more than 5% of the $30 billion invested worldwide in the sector, employing more than 2,500, primarily in the greater Tel Aviv area.

“The problem is that once a company here disclosed that it deals with digital assets, Israeli banks refuse to serve the company or require the company’s attorneys to make an impossible declaration that funds originating in a digital asset will not be deposited in an Israeli bank account,” said Hirshman-Rub. “It may not be outright refusal, but simply dragging their feet, adding demands in a never-ending due diligence process.”

Related: EU tokenization companies push for DLT pilot changes amid US momentum

Among other barriers that the group seeks to reform is an income tax ordinance that penalizes token distribution to employees as stock options. While traditional stock options provided to employees are taxed at a 25% rate, tokenized options will pay a 50% rate for similar value.

A national strategy

In July, the country’s National Crypto Strategy Committee presented an interim report to the Israeli Knesset for parliamentary review. The committee outlined a strategic framework underpinned by five pillars, including establishing a unified regulator, creating token issuance rules, and banking integration.

In August, the Israel Tax Authority published a new Voluntary Disclosure Procedure that would offer taxpayers a path to disclose previously unreported income and assets, including digital assets, and obtain immunity from criminal proceedings. It was the agency’s third attempt to implement a disclosure regime.

However, last month, the agency said taxpayer participation has so far fallen short of expectations, but committed to seeing the initiative through to the end of August 2026.

“The Israeli banking system is not willing to accept cryptocurrency, and it is also very difficult to bring in funds as a result of selling cryptocurrency,” Tax Authority director Shay Aharonovich said, according to local media reports. “There is no doubt that this also affects the willingness to make voluntary disclosure, because in the end people do not just want to pay the tax, but to use the money.”

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

American billionaire and hedge fund manager Ray Dalio has warned that central bank digital currencies (CBDCs) are coming, which will offer benefits but also potentially allow governments to exert more control over people’s finances.

“I think it will be done,” said Dalio on CBDCs in a wide-ranging interview on the Tucker Carlson Show on Monday, which also included topics on the US debt crisis, gold prices, and even a potential civil war.

Raymond Dalio is a billionaire hedge fund manager who has been co-chief investment officer of Bridgewater Associates since 1985, after founding the firm in 1975.

During the interview, Dalio said CBDCs could be appealing due to the ease of transactions, comparing them to money market funds in functionality, but he also cautioned about their downsides.

He said there will be a debate, but CBDCs “probably won’t” offer interest, so they will not be “an effective vehicle to hold because you’ll have the depreciation [of the dollar].”

Dalio also cautioned that all CBDC transactions will be known to the government, which is good for controlling illegal activity, but also provides a great deal of control in other areas.

“There will be no privacy, and it’s a very effective controlling mechanism by the government.”

Taxation, forex controls and political debanking

A programmable digital currency will enable the government to tax directly, “they can take your money,” and establish foreign exchange controls, he said.

That will be an “increasing issue,” particularly for international holders of that currency, as the government can seize funds from nationals of sanctioned countries.

Dalio also said that you could be “shut off” from a CBDC if you were “politically disfavored.”

Related: China-led CBDC project mBridge tops $55B in cross-border payments

An American CBDC is not likely to be deployed in the near future, however, as US President Donald Trump has been vocally opposed to them.

Soon after taking office in January 2025, Trump signed an executive order prohibiting “the establishment, issuance, circulation, and use” of a US CBDC.

Only three countries have launched a CBDC

According to the Atlantic Council’s CBDC tracker, only three countries have officially launched one: Nigeria, Jamaica, and The Bahamas.

49 countries are in the pilot testing phase, including China, Russia, India, and Brazil. 20 nations have a CBDC in development, and 36 are still researching central bank digital currencies.

India’s central bank reportedly proposed an initiative in January linking BRICS CBDCs to facilitate cross-border trade and tourism payments.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

Bitcoin & Ethereum News, Crypto Prices & Indexes

Coinbase’s Base App, pitched as a central piece of Coinbase’s “Everything App” strategy, is winding down its Creator Rewards program and its Farcaster-powered social feed. The move signals a shift away from social incentives toward a trading-first experience that prioritizes tradable assets. The Creator Rewards program, launched in July to foster a more social Base ecosystem, distributed roughly $450,000 to about 17,000 creators over seven months, according to an official Base App X update. That translates to an average payout of around $26 per creator. As the project evolves, the team underlined that the app’s core mission is changing, with trading taking center stage.

Base App’s creator-focused initiative will culminate with final payouts on February 18, and the program will wrap on the preceding Sunday. The decision comes alongside a broader reorientation of Base App’s social features. Founder Jesse Pollak framed the pivot by stressing simplicity and focus: “As we’ve rolled the app out, we’ve realized we need to do less, better. And by focusing on tradable assets, that’s exactly what we can do.” He added, “The app needs to have one primary focus, and that thing is trading.” The message reflects Coinbase’s intent to consolidate Base App as the trading hub for a suite of crypto primitives rather than a multi-faceted social platform.

With the Creator Rewards sunset, Base App’s social feed powered by Farcaster is unlikely to remain a central pillar of the user experience. Pollak acknowledged the talk feed’s misalignment with Base App’s core capabilities and said the team plans to continue supporting the decentralized social network and its developer ecosystem, even as the product emphasis shifts. “…candidly, I think the truth is that the base app was always an imperfect farcaster client,” he noted. “With this change, I expect those users to flow back to the farcaster app (myself included) and inject more energy into the economy there, with a best in class interface.”

Base App is at the center of Coinbase’s future

The refocus aligns with Coinbase’s broader ambition to become an Everything App spanning spot trading, derivatives, stablecoins, tokenization of real-world assets, prediction markets, and more. The company has signaled ongoing exploration of Base’s tokenization potential, though public commentary from CEO Brian Armstrong and Pollak on a Base token has been relatively quiet in recent months. The move also preserves Base App’s Creator Coins program, which enables users to mint ERC-20 tokens linked to their Base profile and the Zora ecosystem, even as the social feed portion is deprioritized. The platform’s December launch, following a longer beta period, established Base App as a self-custody wallet and all-in-one trading companion for a growing trading experience.

The broader strategy, including a renewed emphasis on tradable assets, occurs in a context where retail liquidity and investor appetite for accessible tokenized products remain central to crypto markets. The enterprise behind Base App continues to weave its product narrative around asset ownership, on-chain tokenization, and user-controlled liquidity, rather than social hooks alone. The project’s trajectory has also intersected with conversations about a Base token, a notion that has drawn attention even as the leadership has offered few recent public updates. Meanwhile, Base App’s Creator Coins program remains active, offering a way for users to deploy ERC-20 tokens tied to their Base activity and to participate in broader ecosystems such as Zora.

Beyond its internal pivots, the initiative sits within a wider industry discourse about how social tooling, creator monetization, and trading workflows intersect on-chain. In related coverage, the industry has noted the growing interest in open, interoperable tools for prediction markets and open-source data feeds, underscoring a trend toward more modular, developer-friendly ecosystems.

Base App’s evolution also points to a continued emphasis on practical utility for users who want to manage custody, trading, and tokenization in a single interface. The product’s December launch, together with the sunset of Creator Rewards, reflects a clear prioritization of liquidity and tradable assets over experimental social features, even as the company remains committed to supporting its broader developer network and ecosystem partners.

Related discussions around Base and its ecosystem continue to surface in strategy discussions about decentralized social networks, on-chain governance, and the role of creator-driven tokens in digital economies. The product’s remaining integration points, including its links to broader Coinbase services, will likely shape how users navigate the interface as it moves deeper into the trading-centric phase of its development.

Why it matters

The decision to sunset Creator Rewards and narrow the Base App’s focus to tradable assets marks a significant strategic refinement for Coinbase’s technology roadmap. By concentrating on a trading-first experience, Base App aims to streamline user flows, reduce feature complexity, and enhance liquidity within its ecosystem. The change also signals how Coinbase views social features as a potential risk to a clean, asset-centered user journey, especially in an environment where on-chain trading and asset tokenization are increasingly central to platform differentiation.

For developers and creators, the move redraws incentives. While Creator Rewards offered a tangible earnings stream, the shift reallocates attention and resources toward building robust trading experiences, improved interfaces, and more reliable asset integrations. The ongoing support for Farcaster suggests a recognition that decentralized social ecosystems remain valuable to certain user segments, even if they no longer sit at the core of Base App’s product strategy. In practice, users who valued social signals and creator-driven tokens may migrate toward stand-alone social clients or alternative on-chain ecosystems, while trading-centric features gain momentum on Base App.

From a market perspective, the development underscores how major crypto players balance social experimentation with the economics of liquidity and tradable assets. It also reinforces Coinbase’s narrative around the Everything App, positioning Base App as a strategic hub for on-chain activity, rather than a standalone social portal. The outcome will hinge on how effectively Base App can scale its trading features, attract liquidity, and maintain a coherent user experience as more functions are integrated into the ecosystem. In short, the Pivot foregrounds trading utility as the backbone of a user-centric on-chain toolset, while social experiments take a back seat until or unless they prove to materially enhance liquidity and engagement.

What to watch next

- Final Creator Rewards payouts on February 18 — confirm user receipts and overall distribution metrics.

- Any updates regarding Base Token discussions and public messaging from Coinbase/Base leadership.

- Progress on Farcaster integration strategy and how users engage with decentralized social features outside Base App.

- Updates to the Creator Coins program and its interaction with Zora and other on-chain ecosystems.

- Shifts in Base App’s feature set and new liquidity- or asset-focused updates as part of the Everything App roadmap.

Sources & verification

- Base App X post detailing roughly $450,000 distributed to about 17,000 creators over seven months.

- Announcement that Creator Rewards will end with final payouts on February 18.

- Jesse Pollak’s comments on focusing on trading and the imperfect fit of Farcaster for Base App.

- Base App’s December launch and its role as a self-custody wallet within the trading experience.

- Creator Coins program page and its ERC-20 token mechanics tied to Base App profiles and Zora.

Base App pivots toward trading-first design

Coinbase’s Base App is pruning its social-oriented features to emphasize tradable assets, a move underscored by public remarks from Base’s leadership and corroborated by the platform’s payout data. By winding down the Creator Rewards program and tightening feature focus, Base App aims to deliver a cleaner, more efficient trading experience that aligns with the broader mission of Coinbase’s Everything App. The decision to sunset social incentives comes alongside ongoing conversations about Base’s strategic direction and the potential paths for tokenization and open-access financial tooling within the Coinbase ecosystem.

Ethereum (CRYPTO: ETH) remains a reference point in these discussions, as Base App seeks to harness its layer-2 capabilities and on-chain liquidity to support a more robust trading flow. The emphasis on tradable assets is intended to create a more compelling value proposition for users who want direct asset ownership, faster settlement, and accessible DeFi-native workflows within a single interface. As Base App navigates these changes, observers will be watching not only for concrete product updates but also for how the ecosystem adapts to maintain creator engagement and developer participation without relying primarily on social reward mechanics.

In the evolving crypto landscape, open-source tooling, tokenized assets, and streamlined custody play increasingly central roles. The Base App pivot illustrates how major platforms are recalibrating to align product-market fit with liquidity pressures and regulatory expectations, while still preserving avenues for creator-led innovation through tokens and decentralized ecosystems. The ongoing dialogue around Base’s roadmap, tokenization ambitions, and the role of social features will shape how users engage with Coinbase’s broader platform — and how new entrants attempt to replicate or improve upon this integrated, trading-focused approach.

Crypto World

Capital Rotation vs Capital Exit in DeFi Markets

One of the most misunderstood dynamics in DeFi is the difference between capital rotation and capital exit. When prices stall or certain narratives cool off, the default reaction on Crypto Twitter is to declare that “liquidity is leaving.”

Most of the time, that’s just… wrong.

What’s usually happening is not an exodus — it’s a rotation.

Understanding this distinction is critical for builders, investors, and traders who want to survive beyond the hype cycle and actually position themselves where liquidity is going, not where it’s already been.

What Capital Exit Really Looks Like

Capital exit occurs when funds leave the DeFi ecosystem entirely. This typically shows up as:

-

Stablecoins moving off-chain to CEXs and then into fiat

-

Sustained drops in Total Value Locked (TVL) across multiple chains

-

Reduced on-chain activity, fewer transactions, and declining fee revenue

-

Liquidity providers fully unwinding positions instead of reallocating them

We saw clear capital exit during events like:

During true exits, nothing is spared. Blue chips bleed alongside long-tail protocols. Infrastructure starves. Innovation slows.

That is not what most “bearish” DeFi phases actually look like today.

Capital Rotation: The Default State of DeFi

Capital rotation happens when liquidity stays on-chain but moves between:

-

Sectors (DEXs → LSDs → Perps → RWAs → InfoFi)

-

Chains (Ethereum → Arbitrum → Base → Solana → back again)

-

Risk profiles (high-yield farming → stable yield → delta-neutral strategies)

In rotation phases:

-

TVL might look flat or even decline in specific protocols

-

But stablecoin supply stays elevated

-

Transaction volume remains healthy

-

New protocols capture liquidity quickly

This is DeFi behaving like a living market, not a dying one.

Real Examples of Capital Rotation in Action

1. DEX Liquidity → Liquid Staking

After the initial AMM boom, liquidity rotated from DEX LPs into liquid staking protocols as users sought yield with less impermanent loss.

Key projects:

-

Lido

-

Rocket Pool

-

Frax Ether (frxETH)

-

StakeWise

ETH never left the ecosystem — it just stopped farming Uniswap pools and started earning validator yield instead.

2. Yield Farming → Perpetuals & Derivatives

As passive yields compressed, capital rotated toward protocols offering leverage, speculation, and fee-based rewards.

Notable projects:

-

dYdX

-

GMX

-

Gains Network

-

Vertex

-

Aevo

Liquidity didn’t vanish — it moved from LP tokens into trading collateral.

3. Layer 1 to Layer 2 Rotation

Ethereum mainnet capital rotated heavily into rollups once users demanded lower fees and faster execution.

Examples:

-

Arbitrum

-

Optimism

-

Base

-

zkSync

-

Starknet

This rotation pulled liquidity away from some Ethereum-native DeFi apps — but it stayed within the Ethereum security umbrella.

4. DeFi → Real World Assets (RWA)

As yields normalized, capital rotated into protocols offering exposure to off-chain yield sources.

Key RWA players:

Instead of leaving crypto for TradFi, liquidity brought TradFi on-chain. That’s rotation, not exit.

5. Passive Yield → Strategy & Automation Protocols

Users increasingly prefer optimized strategies over manual farming.

Capital flowed into:

-

Yearn Finance

-

Enzyme

-

Sommelier

-

Pendle

-

Gearbox

Yield didn’t disappear — it got abstracted, packaged, and automated.

6. Narrative Rotation: Privacy, MEV, and InfoFi

Narratives themselves attract liquidity. As attention shifts, capital follows.

Examples:

-

Privacy & MEV protection: Flashbots, Eden, CoW Protocol

-

InfoFi & on-chain intelligence: Arkham, Dune, Nansen

-

Automation & execution layers: Gelato, Keep3r, Autonolas

Liquidity often moves before the narrative fully forms on social media.

Why Rotation Is Healthy (and Necessary)

Capital rotation is a sign of:

If capital never rotated, DeFi would stagnate. Rotation is how weak designs get drained, and stronger primitives get funded.

Exit kills ecosystems.

Rotation refines them.

How to Tell Rotation from Exit (On-Chain Signals)

Look beyond price charts:

-

Stablecoin supply on-chain

-

Bridge inflows/outflows

-

Fee generation across protocols

-

Gas usage and transaction counts

-

Where TVL is moving, not just shrinking

If money leaves one protocol and shows up in three others, that’s rotation.

If it leaves the chain entirely, that’s exit.

Final Thoughts

DeFi doesn’t die in dramatic explosions. It mutates.

Capital rotation is the market’s way of voting — quietly, continuously, and ruthlessly — on which ideas deserve liquidity next.

The mistake isn’t missing the top.

It’s assuming the money left when it simply changed seats.

If you’re watching carefully, rotation isn’t bearish.

It’s a roadmap.

REQUEST AN ARTICLE

Crypto World

BTC faces fresh resistance near $71,000

Bitcoin’s rebound from last week’s selloff is already running into a wall.

After briefly sliding into the low-$60,000s in a capitulation-style move last week, the largest cryptocurrency snapped back toward the $70,000 level over the weekend but momentum has since faded.

That stall has traders re-framing the bounce as a classic bear-market pattern a sharp relief rally that draws in dip buyers, only to meet a wave of supply from investors looking to exit at better prices.

“There is still a huge supply in the markets from those who want to exit the first cryptocurrency on the rebound,” FxPro chief market analyst Alex Kuptsikevich said in an email. “In such conditions, it is worth being prepared for a new test of the 200-week moving average soon.”

“We remain very sceptical about the near future, as the recovery momentum lost steam over the weekend, encountering a sell-off near the $2.4T level. Perhaps we have only seen a bounce on the way down, which is not yet complete,” he added.

Sentiment data paints a similarly fragile picture. The Crypto Fear and Greed Index sank to 6 over the weekend to reach the same levels as an FTX-led 2022 downturn, before recovering to 14 by late Monday.

Kuptsikevich said those readings remain “too low levels for confident purchases,” arguing the shift reflects more than temporary nerves.

Liquidity conditions are adding to the unease. With thinner order books, modest sell pressure can produce outsized moves, which then triggers additional stop-outs and liquidations a feedback loop that makes price action feel disorderly.

That dynamic, rather than a single headline, can explain why bitcoin can swing thousands of dollars in a session while still failing to break through key resistance.

A Kaiko note on Monday described the backdrop as a broader risk-off unwind. It said aggregate trading volumes across major centralized exchanges have declined by roughly 30% since October and November, with monthly spot volumes dropping from around $1 trillion to the $700 billion range.

The firm said that although last week saw a few sharp bursts of trading, the broader trend has been a steady drop in participation. That points to traders, particularly retail investors, gradually leaving the market rather than being forced out all at once.

When liquidity thins like this, prices can slide quickly on relatively modest selling pressure, without the kind of heavy, panic-driven volume that usually signals a clear capitulation and a durable bottom.

Kaiko also framed the move within the familiar four-year halving cycle logic. Bitcoin peaked around $126,000 in late 2025/early 2026 and has since retraced sharply, with the pullback into the $60,000-$70,000 zone representing a roughly 50%-plus drawdown from the highs.

Historically, those bottoms can take months to develop and often feature multiple failed rallies.

For now, bitcoin’s ability to hold the $60,000 area is the key tell. If buyers continue to defend it, the market may settle into a choppy consolidation. If not, the same thin-liquidity dynamics that fueled the washout could return quickly, especially if broader macro conditions stay risk-off.

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

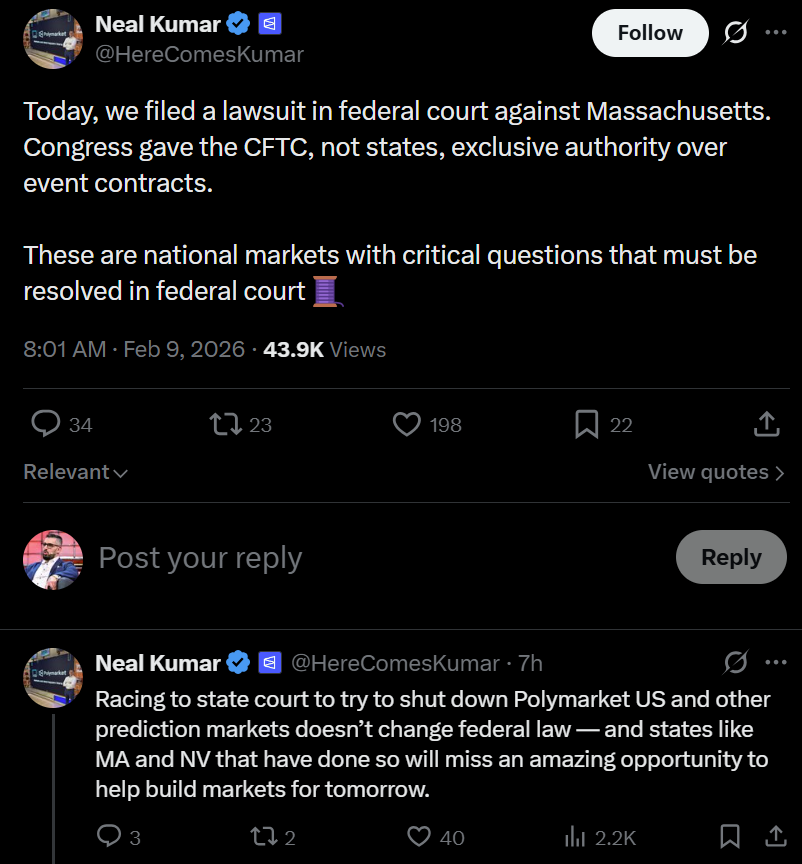

Polymarket has filed a federal lawsuit against the state of Massachusetts, arguing that Congress granted the Commodity Futures Trading Commission (CFTC) exclusive authority over event contracts, preventing states from independently shutting down federally regulated prediction markets.

Neal Kumar, Polymarket’s chief legal officer, confirmed the lawsuit on Monday, saying the dispute involves national markets and unresolved legal questions that must be addressed at the federal, not state, level.

“Racing to state court to try to shut down Polymarket US and other prediction markets doesn’t change federal law — and states like MA and NV that have done so will miss an amazing opportunity to help build markets for tomorrow,” Kumar said, referring to Massachusetts and Nevada.

As reported by Bloomberg Law, the lawsuit was filed preemptively to block potential enforcement action by Massachusetts Attorney General Andrea Campbell, which Polymarket argues would unlawfully interfere with federally regulated derivatives markets.

The legal challenge follows a recent state court ruling in Massachusetts that granted a preliminary injunction barring Kalshi, another prediction market, from offering contracts on sports-related events in the state.

The move also comes one week after a Nevada judge blocked Polymarket from offering sports contracts to users in the state, citing “irreparable” harm to Nevada’s ability to maintain the integrity of its sports betting regulatory framework, according to Cointelegraph.

Related: Jump Trading eyes Kalshi, Polymarket stakes as institutional interest grows: Report

Prediction markets face growing state scrutiny as volumes surge

As Cointelegraph has reported, Massachusetts and Nevada are not the only states pushing back against prediction markets. At least eight others, including New York, Illinois and Ohio, have taken steps to restrict or challenge sports-related prediction markets, according to Kalshi.

The regulatory pushback comes even as prediction markets have seen rapid growth in recent months. Data from Dune shows that prediction markets recorded $3.7 billion in trading volume during a single week in January, marking a new high.

Separate data from Messari indicates that Polymarket and Kalshi are currently neck and neck in trading volume, despite operating under different models, with Polymarket running on decentralized infrastructure.

Both companies have secured significant venture financing, with Polymarket valued at $9 billion and Kalshi at $11 billion following their most recent funding rounds.

Related: DraftKings eyes crypto offerings as it expands into prediction markets

Crypto World

Bitcoin, Ethereum, Crypto News & Price Indexes

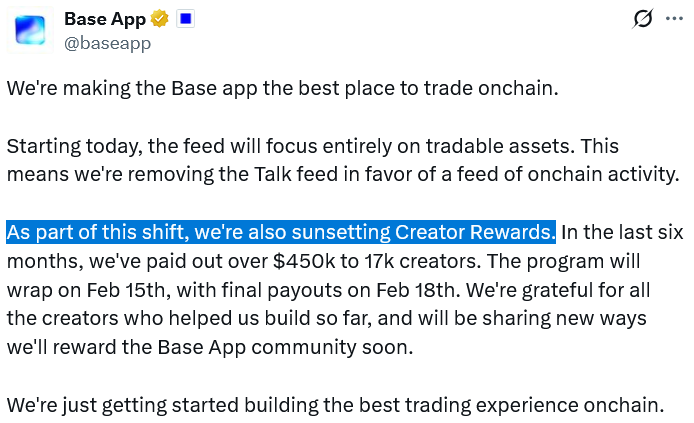

Coinbase’s “Everything App,” Base App, is sunsetting its Creator Rewards program and Farcaster-powered social feed as part of a strategic shift to focus entirely on tradable assets.

The Creator Rewards program was launched in July and was intended to make Ethereum layer 2 Base a more social ecosystem, where activity and engagement translated into earnings.

The Base App X account said on Monday that it handed out around $450,000 to 17,000 creators over seven months, with the data suggesting that creators earned an average of $26.

“As we’ve rolled the app out, we’ve realized we need to do less, better. And by focusing on tradable assets, that’s exactly what we can do,” Base creator Jesse Pollak said, adding:

“The app needs to have one primary focus, and that thing is trading.”

The Base App’s Creator Rewards program will wrap on Sunday, with final payouts on Feb. 18.

As for the Farcaster, Pollak said Base App wasn’t a perfect fit for its talk feed feature, though he plans to continue supporting the decentralized social network and its developer ecosystem.

“…candidly, I think the truth is that the base app was always an imperfect farcaster client,” said Pollak.

“With this change, I expect those users to flow back to the farcaster app (myself included) and inject more energy into the economy there, with a best in class interface.”

Base App is at the center of Coinbase’s future

The shift in focus to tradable assets aligns with Coinbase’s broader mission to become an “Everything App” across spot crypto and derivatives trading, stablecoins, real-world asset tokenization, prediction markets and more.

Base App, which officially launched in December after several months in beta, is the self-custody wallet and all-in-one app facilitating part of that trading experience.

Related: Prediction markets are the new open-source spycraft

Coinbase also previously touted the idea of launching a Base token. However, Coinbase CEO Brian Armstrong and Pollak have been relatively silent on that plan in recent months.

The sunset of Creator Rewards does not affect Base App’s Creator Coins program, which allows users to create ERC-20 tokens linked to their Base App profile and decentralized social media platform Zora.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat8 hours ago

NewsBeat8 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat1 day ago

NewsBeat1 day agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports24 hours ago

Sports24 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat19 hours ago

NewsBeat19 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports7 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report