Crypto World

Hong Kong (HKSAR) to continue support of local digital asset community, chief executive says

HONG KONG — Hong Kong is a growing locale for Web3 and crypto innovation, its chief executive said on Wednesday.

John KC Lee, the chief executive of the Hong Kong Special Administrative Region, opened CoinDesk’s Consensus Hong Kong conference with a brief speech about the city’s work to grow its crypto communities and businesses.

“The HKSAR Government is committed to establishing Hong Kong as a global hub for innovation in digital assets,” he said in taped remarks. “That’s why over the past few years, Hong Kong has been actively building the regulatory framework to promote the steady and sustainable development of our Web3 ecosystem.”

Hong Kong is positioned to take advantage of both growing crypto efforts and its existing position operating close to China and the broader financial markets, Lee said.

“Under the unique ‘one country, two systems’ principle, Hong Kong is the only city that converges both the China advantage and the global advantage,” he said. “… What’s more, Hong Kong’s financial regulatory system is robust, and our financial market stands out for its deep liquidity, innovative products and world-class investor protection.”

More specifically, he pointed to Hong Kong’s efforts in crypto, including last year’s policy statement on digital asset regulation and stablecoin work.

The Hong Kong Monetary Authority is close to issuing licenses for stablecoin issuers, he said, saying that the first licenses may come out in the next month.

Similarly, Hong Kong’s Securities and Futures Commission is working to grow the region’s virtual asset market liquidity to further “facilitate the development of this vibrant area of growth.”

“Hong Kong is in a strong position in promoting Web3 development,” he said. “Hong Kong will continue to go all out to stay at the forefront of this pivotal shift in finance and technology. We welcome companies and institutions from around the world to join hands with us, and build a brighter digital future together.”

Crypto World

XRP Traders Face $50B in Unrealized Losses as Price Slips Below $1.40

XRP price has taken a brutal hit.

The token is down about 63% from its multi-year high and has slipped below $1.40. That drop has left more than $50.8 billion in unrealized losses in XRP, with a large portion of holders now underwater.

With price hovering near $1.35, traders are facing a big question. Is this deep pullback finally forming a market bottom, or is more downside still ahead?

The answer likely comes down to a few key levels that could decide where XRP moves next.

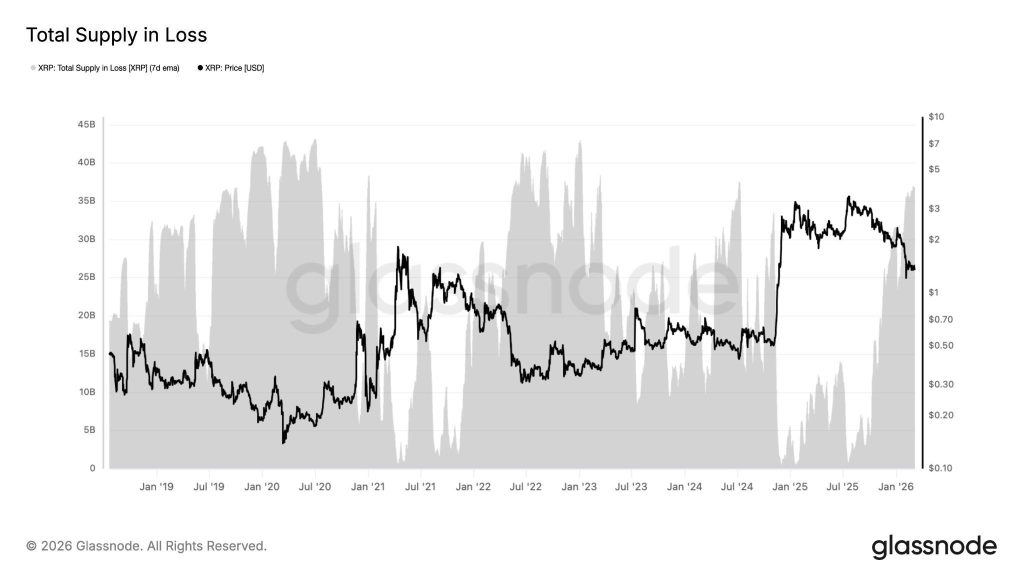

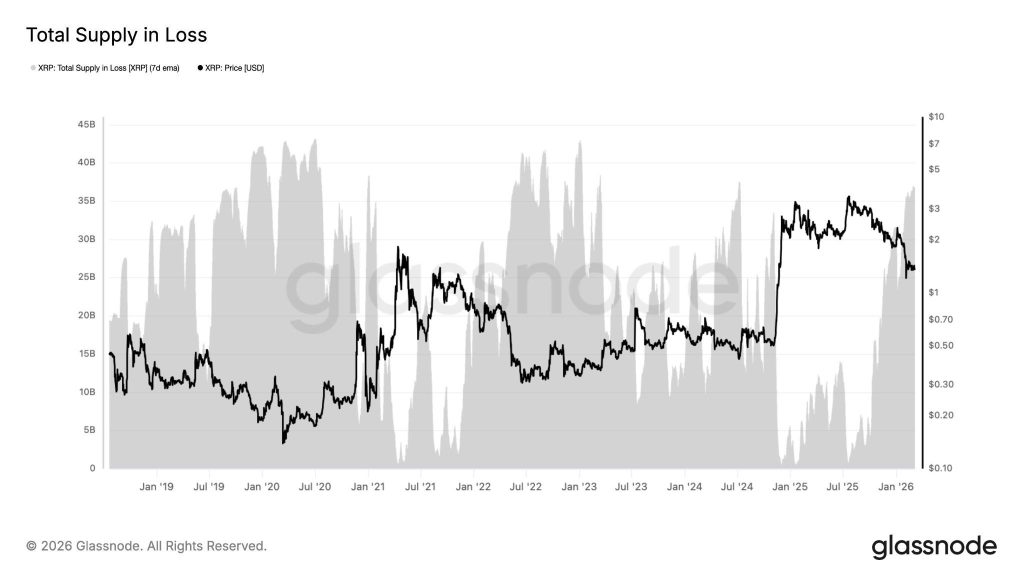

What the $50B Unrealized Loss Figure Actually Means for XRP Holders

On-chain data shows how heavy the pressure has become.

According to Glassnode, about 36.8 billion XRP are currently held at a loss. That puts the average holder cost around $1.44, meaning a large portion of investors are underwater while price trades below that level.

That creates an interesting dynamic. Traders sitting at a loss usually avoid selling unless support breaks and panic kicks in. But the moment price recovers near their entry, many rush to exit at break-even, turning that area into strong resistance.

At the same time, broader market pressure is not helping. XRP ETFs have seen steady outflows, including a $16.2 million redemption late last week.

With so many holders trapped and liquidity thinning, any sharp drop below current support could trigger a wave of forced selling.

Capitulation Risk: The Levels That Change Everything for XRP Price

Right now, everything revolves around a few key levels on the chart.

The biggest danger sits at $1.28. That is the monthly low XRP printed when momentum completely stalled earlier this year. If price breaks below that level, the next downside target appears near $1.11.

On the other hand, buyers have been defending the $1.31 to $1.34 zone. This area has repeatedly absorbed selling pressure and helped stabilize the market during recent dips.

For sentiment to improve, XRP needs to climb back above $1.48. That level roughly matches the average cost basis for many holders, meaning a recovery there could remove some of the heavy selling pressure.

In the short term, $1.43 is the first barrier to watch. A daily close above it would suggest the market is starting to recover.

The post XRP Traders Face $50B in Unrealized Losses as Price Slips Below $1.40 appeared first on Cryptonews.

Crypto World

Elon’s Grok AI Predicts the Price of XRP, Bitcoin and Ethereum by The End of 2026

When you feed Elon Musk’s Grok AI a carefully engineered prompt, it reveals explosive price predictions for XRP, Bitcoin, and Ethereum.

A surge in oil prices is adding fresh macro pressure to crypto markets, but Grok predicts the mid-to-long-term outlook for the three largest cryptocurrencies remains strong.

A mix of chart signals, regulatory developments, and ongoing industry momentum appears to support Grok’s analysis.

XRP ($XRP): Grok AI Predicts a Possible 9x Surge Within 10 Months

In a recent update, Ripple reiterated that XRP ($XRP) plays a central role in establishing the XRP Ledger (XRPL) as a scalable, enterprise-grade global payments network.

Thanks to rapid transaction settlement and extremely low fees, XRPL is can get an early lead in two of major blockchain use cases: stablecoins and tokenized real-world assets.

XRP is currently trading around $1.36, and Grok AI suggests the price could hit $14 during the year, delivering a tidy 10x for current HODLers.

Technical indicators reinforce the bullish outlook. XRP formed a bullish flag in recent months but has been held back by Bitcoin’s stagnation.

However, increased institutional participation following the US launch of XRP exchange-traded funds, Ripple’s expanding network of global partnerships, and possible regulatory clarity if the CLARITY Act passes Congress could all catalyze a price boom.

Bitcoin (BTC): Grok AI Says BTC Could Hit $250,000

Bitcoin ($BTC) reached a record high of $126,080 on October 6 before losing nearly half of its value during the following months.

Despite recent volatility, Grok AI says Bitcoin remains on a long-term upward trajectory, with the possibility of a price peak near $250,000 in 2026.

Often described as digital gold, Bitcoin continues attracting both investors who seek diversification and hedging against inflation and broader economic uncertainty.

At present, Bitcoin accounts for roughly $1.4 trillion of the $2.4 trillion cryptocurrency market. Its recent decline occurred after the US escalated rhetoric against Iran and Greenland, but it appears to have shaken off the effects of the US/Iran war.

Additionally, if Donald Trump follows through on proposals to establish a U.S. Strategic Bitcoin Reserve, Grok’s bull case becomes highly feasible.

Ethereum (ETH): Grok AI Sees an Eye-Watering $15,000 Price Target

Ethereum ($ETH) is the dominant smart contract platform, serving as the core infrastructure of decentralized finance.

With a market capitalization close to $244 billion and around $56 billion locked on chain, Ethereum is the primary settlement layer for on-chain financial applications.

Its strong security, leadership within the stablecoin sector, and early expansion into real-world asset tokenization position Ethereum well for broader institutional adoption.

However, growth depends on regulatory developments. Approval of the CLARITY Act in the United States could deliver the legal certainty many institutions need to deploy capital on Ethereum.

ETH is currently trading just above $2,000. Major resistance is expected around the $5,000 level, near its previous all-time high of $4,946.05 recorded last August.

If Ethereum decisively breaks $5,000, Grok’s model suggests a 6.5x run to $15,000.

Maxi Doge: Early-Stage Meme Coin Aiming for Major Gains

If XRP, Bitcoin, and Ethereum follow Grok’s calculations, then the ensuing meme season could top the halcyon days of 2021.

One meme coin is being hotly touted as next season’s BONK or WIF. Maxi Doge ($MAXI) has already raised $4.7 million ahead of launch as investors are drawn to its magnetic marketing and viral potential.

Maxi Doge is Dogecoin’s bigger, badder, degenerate gym bro cousin, channeling the comic culture that defined meme coin mania in 2021.

Built as an ERC-20 token on Ethereum’s proof-of-stake network, MAXI also has a significantly smaller environmental footprint compared with Dogecoin’s proof-of-work mining system.

Presale investors can currently stake MAXI tokens for yields of 67% APY, although rewards decline as more tokens enter the staking pool.

The token is $0.0002807 during the current presale phase, with automatic price increases scheduled as the project hits funding milestones.

Investors interested in purchasing MAXI can visit the Maxi Doge official website and connect a compatible wallet such as Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post Elon’s Grok AI Predicts the Price of XRP, Bitcoin and Ethereum by The End of 2026 appeared first on Cryptonews.

Crypto World

S&P 500 Index and VOO stock drops as Wall Street bank predicts more downside

The S&P 500 Index and VOO, its biggest exchange-traded fund, plunged for three consecutive days, reaching its lowest level since November last year.

Summary

- The S&P 500 Index continued its strong downward trend.

- JPMorgan analysts expect the index to continue falling this month.

- The index may still rebound later this year if Donald Trump capitulates on his war.

The blue-chip index, which tracks the biggest companies in the United States, dropped to $6,637, down by over 5.2% from its highest point this year.

This retreat happened as the crisis in the Middle East escalated, pushing crude oil prices to the highest point in years. Brent and the West Texas Intermediate rose to over $115 before paring back the gains.

The rising crude oil prices pushed US bond yields higher, with the 10-year rising to 4.17% and the 30-year hitting 4.766%. This surge is a sign that market participants expects the Federal Reserve to maintain a hawkish tone this year.

JPMorgan predicts a S&P 500 Index crash

Wall Street analysts are getting antsy about the market. In a research note, analysts at JPMorgan predicted that the index will move into a correction if the war continues.

Dropping into a correction, which is defined as a 10% drop from its peak, will push it to $6,300, its lowest level since August last year.

However, the analyst noted that signs of an off-ramp on the war in Iran will invalidate the bearish outlook. He noted:

“A definitive off-ramp to the conflict will end this tactical call as the underlying macro fundamentals remain supportive of risk-assets.”

Similarly, Yardeni, a top research company, boosted its odds of a market meltdown to 35% from the previous 20%.

Still, as we wrote earlier, there is a possibility that the S&P 500 and VOO stock will bounce back as President Donald Trump often pays close attention to the stock market and inflation. As such, there is a possibility that he will start to capitulate soon.

Looking ahead, the S&P 500 Index will react to the upcoming US consumer inflation report, which will come out on Wednesday.

Economists expect the report to show that the headline Consumer Price Index rose to 2.5% in February. A higher inflation than that, coupled with the rising oil prices, may also push Trump to capitulate on his war.

The index will also react to the upcoming Oracle earnings, which will come out on Tuesday. Oracle has become a major player in the artificial intelligence industry thanks to its huge backlog.

Crypto World

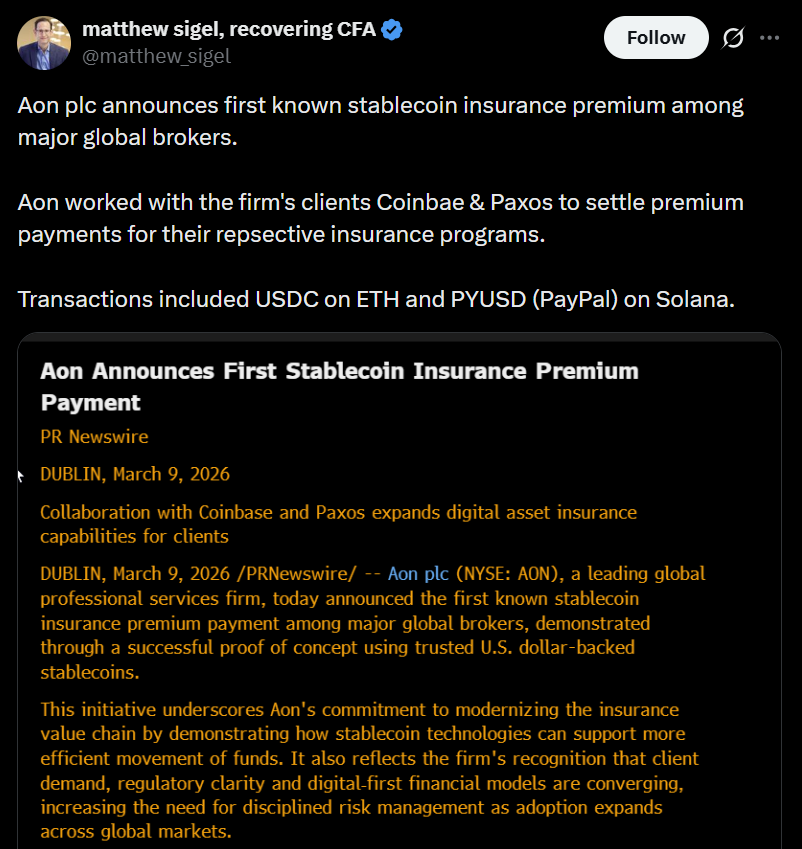

Aon Tests Stablecoin Payments for Insurance Premiums

Aon, one of the world’s largest insurance brokers, is testing the use of stablecoins to pay insurance premiums, highlighting the growing role of digital dollars in traditional financial infrastructure following the passage of the GENIUS bill last year.

In a Monday announcement, UK-based Aon said it completed a pilot that settled insurance premiums for clients, including Coinbase and Paxos, using USDC (USDC) on Ethereum and PayPal USD (PYUSD) on Solana.

Tim Fletcher, CEO of Aon’s financial services division, said the pilot reflects the company’s effort to explore stablecoins as a payment rail, predicting that tokenized assets will become more widely used in financial transactions.

Aon said in August that its analysis showed 120 re-insurers wrote nearly $2 trillion of gross written premium in 2024.

Instead of sending funds through traditional bank wires, the premiums were paid using stablecoins on blockchain networks. The pilot demonstrates how financial institutions are experimenting with blockchain settlement systems rather than relying solely on conventional payment infrastructure.

The approach could have implications for the insurance industry, where premium payments typically move through banks, clearing systems and international wire transfers — processes that can take several days, particularly for cross-border transactions. Stablecoin transfers can settle within minutes.

The pilot did not involve a new insurance product or an onchain policy. The underlying insurance coverage remained unchanged, with the only difference being the use of stablecoins to settle the premium payments.

Related: SoFi taps BitGo to provide infrastructure for bank-issued stablecoin

Stablecoins gain traction among financial institutions

Aon’s pilot also comes amid a more supportive regulatory backdrop for stablecoins following the passage of the GENIUS Act, which established a federal framework for issuing and supervising dollar-backed stablecoins in the United States.

The development reflects a broader shift as traditional financial institutions increasingly explore stablecoins for payments and settlement infrastructure. Several major banks, including Barclays, JPMorgan Chase, Bank of America and Citigroup, are either confirmed or reported to be in various stages of developing stablecoin or tokenized payment systems.

At the same time, crypto-native companies are expanding into the stablecoin payments stack. For example, Ripple has been building infrastructure aimed at supporting stablecoin custody, settlement and treasury management for institutions.

Related: US regulator mulls guidance for tokenized deposit insurance, stablecoins

Crypto World

Crypto-Backed PAC Spends $8.6M in Illinois Races ahead of US Midterms

Fairshake, the political action committee backed by crypto companies Ripple Labs and Coinbase, among others, has reported additional spending on Illinois congressional races with the US midterm elections less than eight months away.

In filings on Sunday with the Federal Election Commission, Fairshake reported a $16,000 media buy to oppose Illinois state representative La Shawn Ford in his run for the US Congress in 2026, adding to its roughly $1.8 million spent in 2026 on the race. The state is set to hold primary elections on March 17.

The filing followed others from Friday, showing that the PAC spent more than $5.5 million to oppose Illinois Lieutenant Governor Juliana Stratton, who is running as a Democrat for the US Senate in the midterm elections. Protect Progress, a Fairshake associated group supporting Democratic candidates, reported about $84,000 spent to support Nikki Budzinski for her 2026 House run representing Illinois, and $90,000 for Robin Kelly’s Illinois Senate race.

Altogether, according to The Daily Northwestern, the PAC and its associated groups have poured about $8.6 million in the Illinois races, a sixfold increase over what it spent in the 2024 elections for races in Midwestern US state. The committee has a larger war chest of funds from the cryptocurrency industry and others, reporting $193 million in its coffers as of January, and has publicly stated it will “oppose anti-crypto politicians and support pro-crypto leaders” in 2026.

Related: Crypto PACs secure massive war chests ahead of US midterms

Rather than support candidates directly through campaign donations, Fairshake and its associated groups typically fund ads to support or oppose politicians, often on issues completely unrelated to crypto policy. PACs are required to report spending and contributions to the Federal Election Commission.

Potentially influencing Texas primaries?

Fairshake has already made moves in 2026 for some of the early state primaries ahead of the midterm elections.

Last week, residents in North Carolina, Texas and Arkansas voted on some of the first candidates to be decided for the general election. Protect Progress reportedly spend $1.5 million opposing the reelection of Texas Representative Al Green, who has served in Congress since 2005.

While Democrat Christian Menefee, whom the advocacy organization Stand With Crypto rates as “strongly supports crypto,” did not win outright against Green, both candidates will head to a runoff in May.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

ETF Flows Signal Early Capital Rotation

Bitcoin ETF flows have shifted into positive territory over the last 30 days, even as gold ETF demand shows signs of fatigue after a prolonged rally. In the latest data pulse, bitcoin-focused funds logged a net inflow of $273 million on March 6 after a $1.9 billion outflow in February, while GLD—the largest US gold-backed ETF—saw a substantial one-day withdrawal that underscores a potential rotation in investor appetite. The backdrop is nuanced: gold prices have remained elevated, yet momentum appears to be cooling, while bitcoin demand shows resilience that could presage a broader reallocation within risk assets.

Key takeaways

- Bitcoin ETFs posted a 30-day net inflow of $273 million on March 6 after a $1.9 billion outflow in February, signaling renewed interest from what some observers call a risk-on cohort.

- Gold ETFs experienced a marked reversal, with GLD recording a $3 billion outflow on a single day—the largest in more than two years—after a longer streak of inflows totaling roughly $24 billion across January and February.

- Holdings shifted in native units: bitcoin ETF positions rose by about 4,021 BTC on March 6, while gold ETF holdings declined from 1.4 million ounces to roughly 621,100 ounces during the same window.

- Analysts point to a potential rotation from gold toward bitcoin as risk sentiment improves and the macro backdrop remains uncertain, though the timing of any sustained shift remains uncertain.

- Longer-term context from Fidelity suggests gold’s leadership cycle may be peaking, potentially opening room for bitcoin to take the lead in the coming quarters, in line with historical cross-asset dynamics between the two stores of value.

Tickers mentioned: $BTC, $GLD

Sentiment: Neutral

Price impact: Neutral. While flows point toward a possible rotation, there is no clear, immediate price move indicated by the data.

Market context: The flows sit within a broader pattern of ETF activity shaping crypto and precious metals markets as risk sentiment oscillates and liquidity conditions shift. The bitcoin-related inflows come as gold’s rally cools after a strong start to the year, illustrating how investors are reallocating capital across alternative stores of value in a fluctuating macro environment.

Why it matters

Across mainstream markets, exchange-traded funds provide a surprisingly transparent lens into the evolving sentiment of large participants—often illustrating where capital is seeking safety, exposure, or hedges against inflation and geopolitical risks. The latest divergence between bitcoin and gold ETF flows adds a new chapter to the long-running debate over which store of value may lead in a given cycle. The near-term implication is a potential shift in demand dynamics: as gold’s momentum wanes from its January–February surge, bitcoin could begin to attract fresh buyers seeking upside leverage to a risk-on environment.

On the holdings side, the shift is tangible. Bitcoin ETFs recorded a net increase of more than 4,000 coins in a single day, contrasting with a sharp decline in gold holdings over the same period. The data, drawn from native-asset balances rather than dollar-denominated valuations, give a clearer picture of actual accumulation versus distribution. These internal flows can be early signals that price action might follow as new entrants accumulate positions or exit as conditions change. The contrast between the two assets is notable, given their historically divergent performance during different macro regimes and risk cycles.

Market observers have tied the trend to a broader rotation from “safe-haven” assets toward instruments that offer growth exposure or diversification benefits in an improving risk environment. Joe Consorti, head of growth at Horizon, highlighted the possibility that gold’s leadership phase could be nearing its late-stage, with bitcoin poised to surge if the macro backdrop supports a continued risk-on tilt. He encapsulated the view succinctly: “Gold is stalling out while bitcoin is soaring. BTC is set to overtake gold’s % growth over the last month as the U.S. economy accelerates and risk sentiment improves. The anticipated risk-off → risk-on rotation could be underway.”

Further context comes from a 2026 outlook published by Fidelity Digital Assets. The firm noted gold’s 65% return in 2025—the fourth-largest annual gain since the end of the gold standard—arguing that gold could be near the late phase of its leadership cycle. The takeaway echoed by Fidelity is that the two assets have historically taken turns leading, suggesting that bitcoin could take the baton next if the cycle continues to evolve. This historical pattern adds a framework for investors assessing whether the current rotation is a temporary pause or the start of a more durable shift in cross-asset leadership.

What to watch next

- Next 30-day ETF flow data for bitcoin and gold to confirm whether the inflow streak for BTC persists and whether GLD continues to underperform relative to its peers.

- Price action around bitcoin and gold in the wake of any macro data releases that influence risk sentiment, including inflation and growth metrics.

- Monitoring holdings updates for major bitcoin and gold ETFs to verify ongoing accumulation or distribution in native units.

- Geopolitical developments and policy signals that could reintroduce risk-off dynamics or re-ignite appetite for safe havens.

- Industry commentary and analysis from market watchers and asset managers regarding the timing and durability of any rotation between gold and bitcoin.

Sources & verification

- Kobeissi Letter post detailing GLD’s $3 billion outflow and the context of gold’s price decline.

- bold.report flow data showing the 30-day net flow shift for bitcoin ETFs and the December–February momentum for gold ETFs.

- Joe Consorti, Horizon, discussion on bitcoin’s relative strength and potential rotation dynamics, as cited in social posts.

- Fidelity Digital Assets, 2026 Look Ahead report outlining gold’s prior rally, leadership-cycle considerations, and cross-asset dynamics with bitcoin.

- TradingView BTCXAU ratio analysis and related market commentary illustrating how the BTC-to-gold relationship has evolved in recent cycles.

ETF flows hint at Bitcoin-led rotation vs gold

Bitcoin ETF inflows and gold ETF outflows over the past month point to a nuanced shift in investment behavior that could have implications for both assets in the near term. On the one hand, bitcoin funds saw a notable positive swing, with a March 6 inflow of $273 million following a February outflow of $1.9 billion. On the other hand, GLD reversed a long period of inflows, registering a $3 billion one-day withdrawal that marked a stark departure from January’s and February’s robust cash-hauls. The divergence is telling: as gold’s price pullback and consolidation emerged, bitcoin buyers appeared to be re-entering the market, potentially signaling a rotation in the broader risk spectrum.

Holdings data reinforce the narrative. In native units, bitcoin ETF positions rose by about 4,021 BTC on March 6, a clear counterpoint to the gold side where holdings slid from 1.4 million ounces down to roughly 621,100 ounces in the same interval. By focusing on native asset balances rather than dollar valuations, analysts can better gauge genuine accumulation versus mere price-driven valuation changes. This distinction is essential for understanding whether flows translate into meaningful demand that could support higher prices over time.

Analysts have framed the shift within a larger macro tapestry. The idea of a rotation from gold into bitcoin is not new, but recent data adds a degree of plausibility to such a transition—especially if risk appetite improves alongside a cautiously optimistic macro backdrop. The commentary from Horizon’s Joe Consorti emphasizes that the pivot could be underway as market participants reassess the relative appeal of traditional safe-havens against digital stores of value with expected growth characteristics. Fidelity’s outlook provides complementary context, suggesting that the cycles between gold and bitcoin have historically oscillated, with each asset taking turns leading at different phases of monetary and geopolitical stress.

As the market continues to digest these cross-asset dynamics, investors will be watching for confirmatory signs—both in flows and in price action—that the rotation, if it is indeed forming, gains momentum. The 2025 performance of gold—an impressive 65% return—has already shaped expectations about when bitcoin might reassert leadership. The current data do not definitively settle the question, but they do underscore the importance of watching ETF flows as a real-time proxy for investor preferences in a landscape where macro uncertainty and liquidity conditions remain pivotal drivers of asset allocation.

Crypto World

Bitcoin May Follow Oil With A Rally To $79K

Key takeaways:

-

Oil price spikes often precede 20% spikes in Bitcoin value, though initial market reactions remain volatile and unpredictable.

-

Bitcoin currently mirrors tech stocks with an 81% Nasdaq 100 correlation, making it less sensitive to oil prices.

Oil prices surged to $101 per barrel on Sunday, marking a 55% increase in ten days—the largest move in history. The event caused the SPX to reach its lowest level in 10 weeks on Friday. Bitcoin (BTC) saw an initial positive reaction with prices jumping 16% between Feb. 28 and Wednesday, though it eventually erased the entire move by Sunday.

Traders now question whether Bitcoin price could suffer from the uncertainty brought by the US-Israel war with Iran. Persistently high oil prices could trigger inflation and hurt consumer spending while the US job market remains weak. Bitcoin price has benefited from sudden jumps in oil prices in the past, but the gains usually happen over a four-week period.

West Texas Intermediate (WTI) crude oil prices surged by 15% in a week starting on June 11, 2025, after global agencies assessed that Iran had enriched uranium nuclear warheads and Israel launched air strikes in the region two days later. Initially, Bitcoin price declined by 8% to $101,000 from $110,300, but it ended up reverting the move and posted 10% gains in four weeks.

On March 27, 2023, WTI prices jumped by 16% in eight days, fueled by a legal dispute leading to 450,000 barrels per day in exports from Kurdistan and a surprise production cut from OPEC. Bitcoin price gained 12% in two weeks but failed to sustain the bullish momentum, returning to the initial $28,000 level in less than a month.

A 29% weekly rally in WTI oil prices initiated on Feb. 28, 2022, following the full-scale military invasion of Ukraine by Russia, triggered global sanctions on Russian oil exports. Bitcoin prices jumped 17% over the initial two days, but those gains evaporated by the end of the week. Still, Bitcoin price eventually surged by 25% over the next three weeks as its price reached $48,000.

WTI gained 23% in nine days starting on Nov. 2, 2020, as traders anticipated the rollout of COVID-19 vaccines and US oil inventories showed unexpected drops. Bitcoin price followed the trend, gaining 16% during that nine-day window, eventually seeing 45% gains from the initial $13,500 price in under a month.

Related: Oil retreats from 25% surge as G7 weighs emergency reserve release

Bitcoin may reach $79,200 by the end of March if history repeats itself

On average, Bitcoin gained 20% over four weeks during the last four times WTI jumped by 15% or more within 10 days. These instances happened between November 2020 and June 2025, a period that includes the bear market of 2022 and most of 2023. Still, four events are not statistically significant enough to prove a solid correlation.

Bitcoin’s price has been much more closely tied to the tech sector lately, shown by its current 81% correlation with the Nasdaq 100 index. If Iran or the US de-escalate sooner than expected, the stock market may recover, and Bitcoin should benefit from that bullish momentum.

Ultimately, the duration of the war in Iran will decide if a Bitcoin rally to $79,200 is possible by the end of March. That target would match the historical 20% average gain from the $66,000 price seen since the oil rally picked up steam on Feb. 28.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Corastone and Zcash’s ZODL show blockchains growing up for real finance

Two new funding rounds for Corastone and Zcash Open Development Lab show blockchain infrastructure maturing for real‑world scale, private markets, and privacy‑first payments.

Summary

- Corastone raised backing from Fidelity, Hamilton Lane and others to run a private, permissioned blockchain as shared infrastructure for private‑market workflows.

- Zcash Open Development Lab secured over $25m from Paradigm, a16z crypto, Winklevoss Capital and others to scale Zcash’s privacy ecosystem.

- ZODL’s wallet, rebranded from Zashi, helped expand Zcash’s Orchard shielded pool while ZEC traded near $240.98 as investors assessed the new roadmap.

Two very different rounds announced this week point in the same direction: blockchain infrastructure is being rebuilt for scale, not hype. In New York, Corastone, a self‑described “hyperscaler for private‑market investing,” said Fidelity Investments, Future Standard and Hamilton Lane have joined Apollo, Franklin Templeton, KKR and Morgan Stanley as investors in its operating platform. The company runs a private, permissioned blockchain that acts as “the shared network infrastructure and data standard for private markets workflows,” replacing legacy file‑based processes with straight‑through processing for asset managers, distributors and administrators.

“As access to private markets continues to scale, firms need standardized, digital infrastructure that supports higher volumes and more complex structures without adding operational burden,” said Hamid Gayibov, co‑founder and president of Corastone. “Corastone was built to serve as a common operating layer for the ecosystem,” he added, arguing that the goal is to let “investors of all sizes access private market assets as efficiently and reliably as public markets.” Future Standard’s CTO Hari Moorthy framed the bet in similar terms, saying the firm “saw a need in the marketplace for an infrastructure technology that connects the various point‑to‑point systems used by investors and enables true straight‑through‑processing of transactions,” adding that its investment “reflects our confidence in the platform’s long‑term role.”

On the privacy side, Zcash Open Development Lab (ZODL) disclosed that it has raised more than $25 million in seed funding from Paradigm, a16z crypto, Winklevoss Capital, Coinbase Ventures and others to build out the Zcash ecosystem. Founded by former Electric Coin Company CEO Josh Swihart, ZODL now houses the technology behind the Zashi wallet, rebranded to Zodl, which helped grow Zcash’s Orchard shielded pool from around 1 million ZEC to roughly 4 million ZEC during 2025 by simplifying privacy UX. Cypherpunk Technologies, which also invested $5 million in the round, said the deal “gives its shareholders exposure to a private company building critical privacy infrastructure on the frontier” and aligns with its mission of “advancing technologies that guarantee privacy for all humans on the internet.”

At press time, Zcash traded near $240.98, up about 3.8% over the last 24 hours, with a 24‑hour volume of roughly $346.4 million, as investors digested the new funding and infrastructure roadmap. For more detailed price data, see the crypto.news price page for Zcash (ZCASH).

Crypto World

Blockchain.com Enters Ghana After Nigeria Trading Surge

TLDR

- Blockchain.com expanded into Ghana after recording a 700 percent rise in brokerage trading volume in Nigeria.

- The company reported that Bitcoin, Tether, and Tron ranked as the most traded assets in Nigeria.

- Blockchain.com said active users in Ghana increased by 140 percent over the past year.

- The company confirmed it is working with Ghanaian regulators to support a local regulatory framework.

- Blockchain.com plans to integrate mobile money services as it builds operations in Ghana.

Blockchain.com has expanded into Ghana after reporting a 700% surge in brokerage transaction volume in Nigeria. The company plans to launch its trading platform for Ghanaian users while building local infrastructure. It confirmed ongoing talks with regulators as it targets wider growth across Africa.

Blockchain.com Reports 700% Trading Surge in Nigeria

Blockchain.com launched retail brokerage operations in Nigeria last year and tracked rapid growth. The company recorded a 700% increase in brokerage transaction volume during the period. It said users actively traded major digital assets across its platform.

Bitcoin BTC $68,517 led trading activity on the platform in Nigeria. Tether USDT $1 and Tron TRX $0.29 followed as the most traded assets. The company attributed the growth to rising demand from retail users.

Chainalysis data ranked Nigeria among the top countries for grassroots crypto adoption. The data linked activity to remittances, currency volatility, and mobile usage. Nigeria received over $92 billion in onchain crypto value between July 2024 and June 2025.

Sub-Saharan Africa received more than $205 billion in onchain crypto value during the same period. Chainalysis reported a 52% year-over-year increase across the region. The report placed the region as the third-fastest-growing crypto market globally.

Ghana Market Entry and Rising Bitcoin Activity

Blockchain.com confirmed it will offer Ghanaian users access to its trading services. The company reported a 140% increase in active users in Ghana over the past year. It also recorded an 80% rise in transaction volumes ahead of launch.

A spokesperson said, “We are actively collaborating with Ghanaian officials and regulators to help build a regulatory framework.” The company has established local compliance representation in Ghana. It said it will focus on regulatory engagement as operations expand.

The spokesperson said mobile money integration remains a key priority in Ghana. “Given how widely used mobile money is in Ghana, integration with the mobile money ecosystem is a key focus,” the spokesperson said. The company is building local teams to manage partnerships and compliance.

South Africa, Ethiopia, Kenya, and Ghana rank among the next largest crypto markets in Africa. Analysts linked demand to cross-border payments and currency volatility. Stablecoins have gained traction for remittances and faster settlements.

Vera Songwe spoke at the World Economic Forum Annual Meeting in Davos in January. She said traditional transfers cost about $6 per $100 sent. She added that stablecoins reduce fees and settle transactions within minutes.

Africa Bitcoin Corporation executive chairman Stafford Masie addressed crypto adoption trends. He said on the Coin Stories podcast that some communities use Bitcoin for daily payments. Merchants in certain areas accept satoshis instead of fiat currencies.

Borderless.xyz reported that Africa recorded the highest median stablecoin-to-fiat conversion spreads in February. The payments infrastructure company published the data earlier this month. Blockchain.com operates in more than 70 jurisdictions worldwide.

Crypto World

South Korea Proposes 6-Month Partial Ban on Bithumb

TLDR

- South Korea’s Financial Intelligence Unit issued a preliminary notice proposing a six-month partial suspension of Bithumb.

- Regulators said Bithumb conducted transactions with unregistered overseas virtual asset businesses.

- Authorities also cited failures in enforcing certain Know Your Customer procedures.

- The proposed suspension would restrict virtual asset transfers for newly registered users only.

- Existing users would still deposit and withdraw funds and continue trading on the platform.

South Korean regulators have moved against Bithumb over alleged anti-money laundering failures. The Financial Intelligence Unit issued a preliminary notice that proposes a six-month partial business suspension. However, the measure would limit only certain services for newly registered users if authorities confirm it.

Bithumb Receives Preliminary Sanction Notice From FIU

The Financial Services Commission’s Financial Intelligence Unit sent the notice under the Act on Reporting and Using Specified Financial Transaction Information. The FIU oversees anti-money laundering compliance for cryptocurrency firms operating in South Korea. Regulators said Bithumb continued transactions with overseas virtual asset businesses that lacked local registration.

Authorities also said the exchange failed to enforce certain Know Your Customer procedures. As a result, the FIU proposed a six-month partial suspension and disciplinary action against the chief executive. However, officials stated that the decision remains subject to review before final confirmation.

The proposed restriction would apply only to virtual asset transfers by newly registered users. Therefore, existing customers would still deposit and withdraw Korean won and cryptocurrencies and continue trading. Local media reported that the FIU plans to hold a sanctions deliberation committee later this month.

Officials will determine the final penalty during that review session. The FIU may adjust the scope or duration of the sanction after discussions. Until then, Bithumb continues normal operations for current users.

Regulators Tighten Oversight After Prior Enforcement Actions

South Korean authorities have increased oversight of digital asset platforms over the past year. The FIU previously imposed a three-month partial suspension on Dunamu, which operates Upbit. Regulators also fined Dunamu 35.2 billion won, or about $23.65 million, for compliance failures.

In a separate case, regulators fined Korbit 2.73 billion won and issued an institutional warning. Officials cited similar shortcomings in anti-money laundering controls. These enforcement actions reflect a pattern of stricter supervision of registered exchanges.

Founded in 2014, Bithumb ranks among South Korea’s largest cryptocurrency exchanges. CoinGecko data places it second in domestic trading volume behind Upbit. Along with Coinone and Korbit, it accounts for most trading activity among locally registered exchanges.

The latest action follows an operational error reported last month. Bithumb mistakenly distributed billions of dollars worth of bitcoin to users during that incident. After that event, the country’s financial watchdog increased its oversight of cryptocurrency market operations.

-

Politics7 days ago

Politics7 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

News Videos14 hours ago

News Videos14 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Crypto World10 hours ago

Crypto World10 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Tech5 days ago

Tech5 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Politics4 days ago

Politics4 days agoTop Mamdani aide takes progressive project to the UK

-

Business1 day ago

Business1 day agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Sports7 days ago

Sports7 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

NewsBeat1 hour ago

NewsBeat1 hour agoPagazzi Lighting enters administration as 70 jobs lost and 11 stores close across Scotland

-

Tech11 hours ago

Tech11 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech5 days ago

Tech5 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death