Crypto World

How DeepSeek R1 is Redefining AI

The emergence of DeepSeek R1 has shaken the strategies of tech giants, sent shockwaves through financial markets, and ignited a new level of geopolitical competition between the United States and China. But beyond these immediate impacts, DeepSeek R1 represents a fundamental shift in how artificial intelligence (AI) is developed and deployed. Rather than following the traditional “bigger is better” approach, where massive models with trillions of parameters dominate, DeepSeek R1 champions a new paradigm: efficiency.

A Break from Tradition: The Efficiency Revolution

For years, the prevailing AI philosophy was simple: larger models, more GPUs, and higher energy consumption meant better performance. DeepSeek R1 challenges this notion. Trained at a fraction of the cost of its Western counterparts, just $5.6 million compared to the billions invested by OpenAI and Google, DeepSeek proves that scalability depends not solely on size but algorithmic intelligence.

The introduction of R1 raises critical questions about the future of Large Language Models (LLMs). Are these expansive models already on the verge of obsolescence? With rapid advancements in efficiency-driven AI, businesses and researchers must reconsider their dependence on resource-intensive models that leaner, more cost-effective alternatives may soon outpace.

The Geopolitical Battle Over AI

DeepSeek R1’s arrival is more than a technological breakthrough; it has geopolitical implications. The AI race is now a battleground for global influence, drawing comparisons to Huawei’s dominance in 5G technology. Just as the U.S. took extreme measures to curb Huawei’s expansion, it is now attempting to regulate AI development by restricting advanced GPUs and open-source AI.

However, DeepSeek R1 demonstrates that such restrictions cannot slow China’s AI progress. By optimising efficiency and reducing dependency on high-end chips, DeepSeek has circumvented U.S. sanctions and emerged as a formidable competitor. This has raised concerns in the West about the control of AI-generated information. If AI models developed in China become globally dominant, the risk of information control and censorship increases, influencing public discourse on key issues.

Open-Source AI vs. Proprietary Models, A Coexisting Future

One of the most striking aspects of DeepSeek R1 is its open-source nature. Historically, open-source software has challenged proprietary solutions by dramatically reducing costs and increasing accessibility. We have seen this pattern with Linux in enterprise computing, Android in mobile operating systems, and MySQL in database management. AI is now following the same trajectory.

Yet, major Western AI labs, OpenAI, Google, and Anthropic, continue to lead in multimodal AI, safety protocols, and model security. DeepSeek R1 may be efficient, but concerns over its robustness and potential vulnerabilities remain. Microsoft’s immediate integration of DeepSeek R1 into Azure suggests a growing appetite for open models, particularly for businesses looking to balance cost and flexibility. However, proprietary models will continue to play a crucial role in ensuring security and regulatory compliance, leading to a hybrid AI ecosystem where both approaches coexist.

The Economic Implications of AI Cost Reduction

One of the most debated aspects of DeepSeek R1 is its development cost. While $5.6 million is a fraction of what leading AI firms spend, the figure likely only accounts for training, excluding infrastructure, engineering, and deployment costs. Nevertheless, the real game-changer is inference cost, the cost associated with using AI models in real-world applications. Lower inference costs mean broader adoption, much like declining semiconductor prices fueled the mass adoption of consumer electronics.

This shift will have profound economic consequences. As AI becomes more affordable, startups and mid-sized enterprises can integrate advanced AI without requiring massive infrastructure investments. This democratisation of AI will disrupt industries traditionally dominated by a handful of tech giants.

The Role of Reinforcement Learning and AI Agents

DeepSeek R1 is not just another LLM but a shift toward reasoning-based AI. Historically, LLMs excelled at pattern recognition but struggled with logical reasoning and decision-making. DeepSeek R1 integrates reinforcement learning techniques, allowing it to solve complex problems methodically rather than simply predicting the next word in a sequence.

This evolution paves the way for autonomous AI agents capable of adapting to dynamic workflows. From customer service to administrative tasks and data analysis, AI is moving beyond predefined scripts to real-time decision-making. The business world must prepare for a future where AI-driven automation extends beyond simple chatbot interactions into comprehensive, intelligent task execution.

The Chip Shortage Driving Algorithmic Innovation

The U.S. imposed semiconductor export restrictions to limit China’s AI capabilities. However, these constraints have unintended consequences: they have pushed Chinese researchers to prioritise efficiency over brute computational power. As AI models become more optimised, the demand for high-end chips could decrease, fundamentally altering the AI hardware landscape.

While Western AI firms continue to invest heavily in GPU-driven research, China’s focus on efficiency could prove to be a more sustainable long-term strategy. The balance between computational power and algorithmic efficiency will likely define the next phase of AI innovation.

What Comes Next? A Shifting AI Landscape

DeepSeek R1 is not the final chapter in AI development; it is the beginning of a broader shift. Here are three key takeaways for businesses, regulators, and AI researchers:

- Efficiency is the new frontier: The AI race will no longer be won by sheer computing power. Algorithmic advancements will drive the next wave of breakthroughs.

- Regulation must balance security with innovation: Overregulating AI could slow down Western progress while allowing China to take the lead in global adoption.

- Application matters more than model size: AI accessibility is increasing, but success will depend on how effectively companies integrate AI into their operations.

Conclusion: AI’s Future Lies in Strategic Deployment

The rise of DeepSeek R1 signals a transformation in AI development. Rather than investing solely in more extensive and expensive models, the industry must focus on efficiency, usability, and strategic deployment. Businesses that adapt to this shift will gain a competitive edge, while regulators must navigate the complex landscape of security, innovation, and geopolitical competition.

AI is no longer just about who builds the biggest model, it’s about who uses it most effectively. The future belongs to those who can harness AI’s power efficiently and strategically. DeepSeek R1 is just the beginning.

Crypto World

Can PMI above 50 trigger Altcoin Season in 2026?

As macro conditions regain influence over digital assets, investors are increasingly asking whether a rebound in economic activity, particularly a Purchasing Managers Index (PMI) reading above 50, could ignite the next altcoin season.

Summary

- PMI above 50 would signal improving economic conditions and a potential return of risk appetite

- Nearly 40% of altcoins trading near all-time lows reflects extreme weakness but possible late-stage capitulation

- Bitcoin dominance remains elevated, suggesting rotation into altcoins has not yet begun

What PMI means for Altcoin Season

The Purchasing Managers’ Index (PMI) is a forward-looking economic indicator that measures manufacturing and services activity. A reading above 50 signals expansion, while below 50 indicates contraction.

Crypto markets, especially altcoins, are highly sensitive to liquidity and risk appetite. When PMI rises above 50 after a contraction phase, it typically signals improving growth expectations, stronger corporate activity, and loosening financial conditions.

Historically, periods of macro expansion have coincided with greater investor willingness to rotate into higher-beta assets, including mid- and small-cap cryptocurrencies.

Bitcoin often reacts first to improving macro conditions, benefiting from institutional flows. Altcoin season tends to follow when investors move further out the risk curve in search of higher returns. In prior cycles, altcoin rallies have emerged during early-to-mid expansion phases when liquidity conditions improved but speculative excess had not yet peaked.

Current conditions: Pressure before rotation?

However, the present backdrop remains fragile.

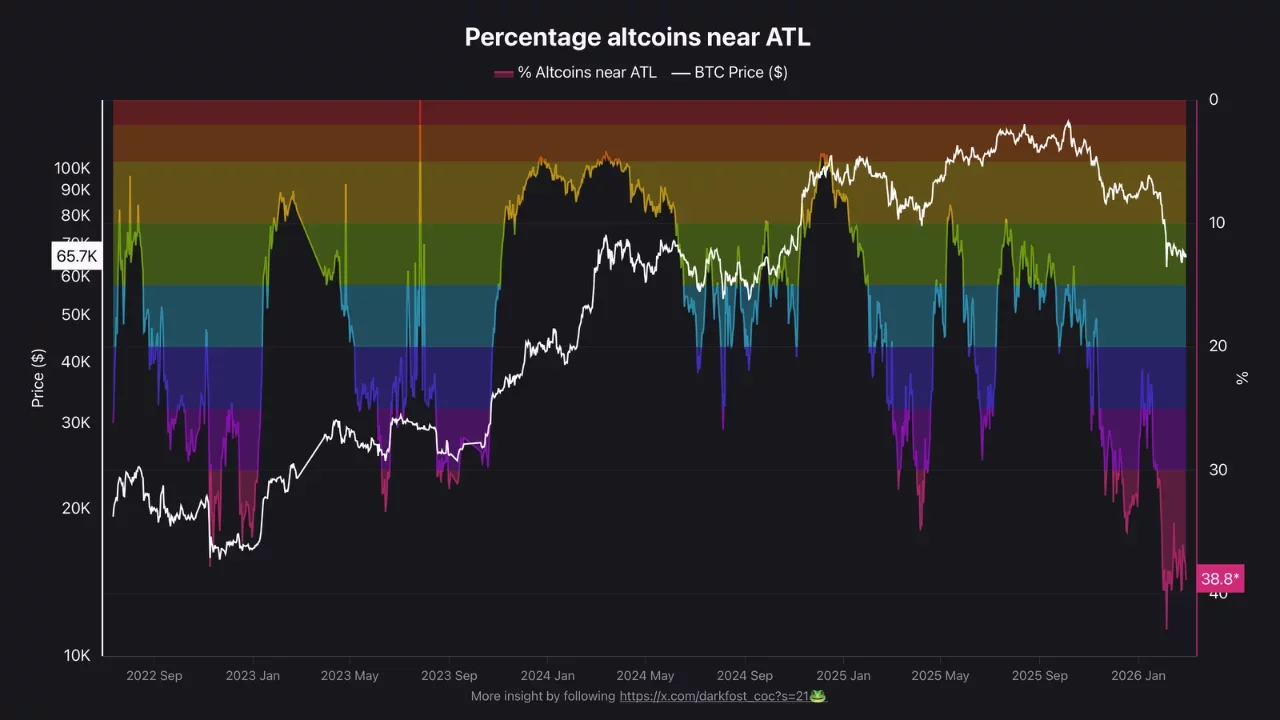

According to a CryptoQuant analyst, 38% of altcoins are trading near their all-time lows, a worse reading than both April 2025 (35%) and even the immediate aftermath of the FTX collapse (37.8%). This marks the deepest regression for altcoins in the current cycle, underscoring persistent risk aversion.

Moreover, the Bitcoin Dominance (BTC.D) chart reinforces this narrative. Dominance remains elevated near 58–59%, after peaking around 60% in February.

While BTC.D has pulled back slightly from local highs, it has not broken into a decisive downtrend, a necessary condition for sustained altcoin outperformance.

For a PMI-driven altcoin season to materialize, three things likely need to occur simultaneously: PMI moving sustainably above 50, Bitcoin consolidating rather than trending sharply higher, and BTC dominance breaking below key support to confirm capital rotation.

Until then, macro stabilization may first benefit Bitcoin before liquidity meaningfully spreads into the broader altcoin market.

In short, a PMI recovery could be the spark, but dominance trends suggest altcoin season has not yet begun.

Crypto World

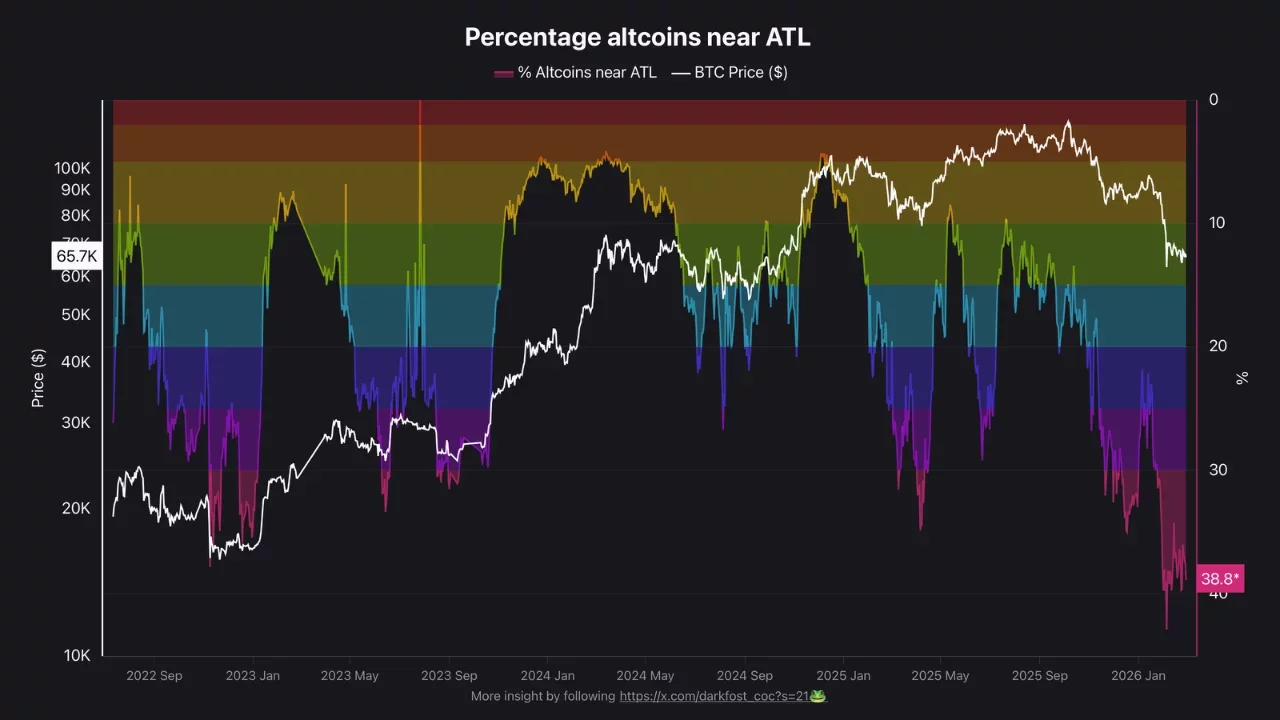

Riot Posts Record $647M Revenue in 2025 as Bitcoin Miners Struggle

Riot Platforms (NASDAQ: RIOT) closed 2025 with a record revenue footprint, anchored by a surge in Bitcoin (CRYPTO: BTC) mining and a strategic pivot toward AI-friendly data infrastructure. The miner reported $647.4 million in revenue for the year, up 72% from $376.7 million in 2024, with Bitcoin mining revenue accounting for the bulk of that rise — $576.3 million — as the company’s hashrate climbed and Bitcoin prices firmed. The year saw Riot mine 5,686 BTC, up from 4,828 BTC in 2024. The average cost to mine one Bitcoin, excluding depreciation, rose to $49,645 from $32,216 in 2024, reflecting a 47% increase in the global network hashrate and higher mining difficulty, though power credits grew 68% over the year, helping offset some costs. Engineering revenue also climbed to $64.7 million from $38.5 million in 2024.

Key takeaways

- Full-year revenue reached $647.4 million, a 72% year-over-year rise, driven largely by Bitcoin mining.

- Bitcoin mining revenue totaled $576.3 million in 2025, with Riot producing 5,686 BTC for the year.

- The average cost to mine one BTC rose to $49,645 due to a 47% jump in the global network hashrate and higher mining difficulty; power credits rose 68% to help compensate.

- Riot still posted a net loss of $663 million for 2025 due to accounting adjustments and the paper value of its Bitcoin holdings, though adjusted EBITDA reached $13 million.

- At year-end, Riot held 18,005 BTC on its balance sheet (3,977 BTC pledged as collateral), valued at about $1.6 billion at the period’s price; the company maintained $309.8 million in cash, including $76.3 million restricted.

- The year featured notable strategic moves, including an AMD data-center agreement and the sale of Bitcoin to fund a 200-acre land purchase in Rockdale, Texas, amid activist pressure to accelerate a pivot toward AI/HPC infrastructure.

Tickers mentioned: $BTC, $RIOT, $AMD

Sentiment: Neutral

Market context: The 2025 crypto cycle remained volatile, with miners navigating lower price environments and rising mining difficulty as global hashrates expanded. Riot’s results reflect both the resilience of Bitcoin mining revenue and the pressures of noncash accounting on reported profits, while the sector-wide shift toward data-center and AI infrastructure gained pace among peers.

Why it matters

Riot’s 2025 numbers underscore the enduring profitability potential of Bitcoin mining when operational scale and efficiency align with favorable Bitcoin price trends. The company’s ability to produce 5,686 BTC in a year demonstrates the continued relevance of large-scale, purpose-built mining operations even as macro conditions vary. Yet the sizable net loss for 2025 highlights the distinction between cash generation and reported earnings, driven by noncash accounting adjustments and the mark-to-market treatment of Bitcoin holdings. For investors, the key takeaway is whether Riot’s business model can convert its rising revenue into sustainable cash flow as it diversifies beyond mining into AI-focused data-center infrastructure.

Riot’s strategic pivot toward AI and HPC infrastructure is a central theme in the sector. The company’s leadership has signaled a broader trend among leading miners to repurpose existing power capacity for AI workloads, aligning with a market where demand for GPU-accelerated data centers and related services remains robust. This pivot aligns Riot with peers that have begun converting mining capacity into AI computing, a move that could unlock new monetization avenues beyond BTC production. The balance between mining economics and the potential upside from AI/HPC deployments will be critical to assess in the coming quarters, particularly as the company explores capital allocation decisions that could affect liquidity and leverage metrics.

The year’s narrative is also shaped by external pressures from activist investors. Starboard Value’s position suggested the AI/HPC pivot could unlock a valuation up to $21 billion, a view that intensifies scrutiny on how Riot deploys capital and scales its non-mining businesses. The broader mining ecosystem is undergoing a similar transformation, with other miners converting facilities and power capacity into data-center operations. In this environment, Riot’s execution on both mining efficiency and AI-centric expansion will be watched closely by holders and analysts alike.

Beyond Riot’s internal dynamics, the sector faced notable earnings results from peers during 2025. Core Scientific reported Q4 revenue of $79.8 million, down 16% year over year and short of estimates, while TeraWulf posted quarterly mining revenue of $35.8 million, below expectations. Marathon Digital Holdings (MARA) faced a steeper quarterly loss of $1.71 billion as revenue declined, underscoring the difficult backdrop for miners even as some players pursue diversification into AI infrastructure. The industry’s earnings narrative in 2025 highlighted both the fragility of pure mining profits and the potential for strategic pivots to sustain growth.

Riot’s year-end results also mirror a broader financial landscape in crypto by illustrating how the balance sheet interacts with price movements. The company finished the year with 18,005 BTC on hand, including nearly 4,000 BTC pledged as collateral, valued at approximately $1.6 billion using year-end Bitcoin prices. With $309.8 million in cash and $76.3 million restricted, Riot’s liquidity position provides a foundation for ongoing investments, including data-center expansions and potential acquisitions linked to its AI/HPC strategy. The role of Bitcoin as a treasury asset remains a focal point for investors evaluating the risk-reward profile of mining-centric businesses in a volatile market.

What to watch next

- Progress of the AMD data-center agreement and any related deployment milestones at Riot’s facilities.

- Updates on the Rockdale, Texas land development and whether additional capital is deployed toward AI/HPC infrastructure.

- Regulatory or market developments that could impact mining economics or Bitcoin’s treasury treatment in Riot’s financials.

- Future quarterly results for any signs of improved profitability from AI/data-center initiatives or changes in BTC holdings strategy.

- Ongoing discourse with activists and any governance actions tied to Riot’s strategic pivot and capital allocation plan.

Sources & verification

- Riot Platforms, Inc. announces full-year 2025 financial results and strategic highlights — official press release.

- Riot Platforms’ 2025 earnings report (PDF): Riot earnings report. Source: Riot.

- Details on the AMD data-center agreement and Rockdale land purchase: Riot Platforms Bitcoin AI HPC Texas land deal — original reporting.

- Activist investor Starboard Value commentary on Riot’s strategic pivot and potential valuation upside: Starboard Value discussion.

- Industry context on AI infrastructure and mining sector shifts: article on AI-focused data centers and high-yield bonds in BTC mining.

Riot Platforms’ 2025 results reflect a record top line and a pivot toward AI infrastructure

Riot Platforms (NASDAQ: RIOT) posted a year that underscored both the durability of large-scale Bitcoin mining and the strategic tension between traditional mining economics and the opportunity set created by AI-centric data centers. The revenue trajectory was unmistakable: a $647.4 million top line, a 72% ascent from the prior year, with BTC-driven mining revenue powering the majority of that growth. The company’s annual Bitcoin production reached 5,686 BTC, a solid step up from 4,828 BTC in 2024, illustrating how scale and efficiency can translate into tangible output even amid a volatile crypto environment. The mining segment’s strength is tempered by cost dynamics that have evolved in tandem with a rapidly expanding network hashrate — up 47% globally — and a corresponding rise in mining difficulty. Excluding depreciation, Riot’s estimated custo to mine a single Bitcoin rose to $49,645, a signal that margins can compress when the network grows quickly, though the resilience of power credits, which rose 68% in the year, helped cushion some of that pressure.

The company’s 2025 earnings narrative was not simple arithmetic. A net loss of $663 million dominated headlines, but much of that figure traces noncash accounting adjustments and changes in the paper value of Riot’s Bitcoin holdings. When noncash items are stripped away, adjusted EBITDA stood at $13 million for the year. Investors were reminded that cash-generating capacity can coexist with paper losses on the balance sheet, a dynamic that has become increasingly common among miners that carry substantial Bitcoin positions on their books. The disclosures around these noncash effects underscore the importance of parsing GAAP results from the underlying cash flow and operating performance when evaluating Riot’s long-term trajectory.

On the balance sheet, Riot ended 2025 with a sizable cache of Bitcoin — 18,005 BTC — worth roughly $1.6 billion using year-end prices, of which 3,977 BTC were pledged as collateral. The company also held $309.8 million in cash, with $76.3 million classified as restricted. These figures provide Riot with a degree of financial flexibility as it navigates capital allocations in a field that remains sensitive to Bitcoin’s price trajectory and mining economics. The year’s liquidity position supports ongoing initiatives tied to the AI/HPC pivot, including potential expansions of data-center capacity or related partnerships.

Strategically, Riot’s year highlighted deliberate steps toward redefining its role beyond pure mining. In January, Riot struck a data-center agreement with AMD (NASDAQ: AMD), signaling a potential shift toward AI accelerator workloads and high-performance computing. In tandem, the company disclosed plans to monetize Bitcoin to fund a 200-acre land purchase in Rockdale, Texas, a move that aligns with a broader push to increase on-site compute capacity while pursuing productive uses for capital. Activist investor Starboard Value pressed for a more accelerated pivot into AI infrastructure, arguing that the transformation could unlock substantial value. This tension between immediate mining returns and longer-term data-center profitability mirrors a wider industry debate about how miners should allocate capital as demand for AI infrastructure continues to grow.

Riot’s narrative sits within a broader ecosystem of miners pursuing similar diversification. Peers such as Hive, Hut 8, TeraWulf, and Iren have repurposed some of their power assets for data-center operations, while CoreWeave has moved toward fully AI infrastructure. The evolving earnings mix reflects an industry-wide recalibration: mining revenues remain a foundational contributor, but AI-focused data centers promise new avenues for revenue and margin expansion if executed with discipline and scale. The 2025 results thus offer a snapshot of a sector in transition — one where the fate of an individual miner hinges on execution across multiple fronts: efficiency, balance-sheet discipline, capital allocation, and the ability to monetize AI compute opportunities as demand for AI workloads climbs.

Looking ahead, Riot’s path will depend on how successfully it translates its AI/HPC ambitions into tangible earnings and how it navigates Bitcoin’s price volatility. The company’s forthcoming disclosures and quarterly updates will be critical for assessing whether the AI pivot can meaningfully augment free cash flow and provide a sustainable alternative to mining-driven revenue. As miners balance the traditional economics of BTC production with the strategic imperative to invest in AI infrastructure, Riot’s 2025 experience could serve as a bellwether for the broader market’s willingness to embrace diversification as a route to enduring profitability.

Crypto World

Riot Reports Record $647M Revenue in 2025, Holds $1.6B in Bitcoin

Riot Platforms posted record annual revenue of $647.4 million for 2025, up 72% from $376.7 million a year earlier.

In a Monday announcement, the company said the increase was driven by a $255.3 million jump in Bitcoin (BTC) mining revenue, which reached $576.3 million in 2025 amid a rise in operational hashrate and higher average Bitcoin prices. During the year, Riot produced 5,686 Bitcoin, up from 4,828 BTC in 2024.

The average cost to mine one Bitcoin, excluding depreciation, climbed to $49,645 from $32,216 in 2024. Riot attributed the higher cost largely to a 47% increase in the global network hashrate, which increased mining difficulty. That impact was partly offset by a 68% increase in power credits received during the year, the company said. Engineering revenue also rose, reaching $64.7 million compared with $38.5 million in 2024.

Despite the record performance, Riot reported a net loss of $663 million because of accounting adjustments and changes in the paper value of its Bitcoin holdings. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for the year was $13 million.

Related: High-yield bond surge signals rising risk, demand in BTC mining, AI infrastructure

Riot closes 2025 with 18,005 BTC worth $1.6 billion

Riot ended 2025 with 18,005 Bitcoin on its balance sheet, including 3,977 BTC pledged as collateral. Based on a year-end Bitcoin price of $87,498, those holdings were valued at roughly $1.6 billion. The company also held $309.8 million in cash, of which $76.3 million was restricted.

In January, Riot signed a data center agreement with chipmaker AMD and sold Bitcoin to buy 200 acres of land in Rockdale, Texas. The move came after activist investor Starboard Value said the company’s shift toward artificial intelligence and high-performance computing could carry a valuation of up to $21 billion, urging the Bitcoin miner to accelerate the pivot.

Riot’s shift toward AI and data centers comes amid similar moves by other major miners. Companies including Hive, Hut 8, TeraWulf and Iren are converting mining facilities and power capacity into data-center operations, and some players such as CoreWeave have already transitioned fully into AI infrastructure.

Related: Trump family-backed miner American Bitcoin posts $59M quarterly loss

Bitcoin miners struggle amid crypto slump

Several publicly traded Bitcoin miners faced pressure in 2025 as crypto prices weakened. Core Scientific reported fourth-quarter revenue of $79.8 million, down 16% year-on-year and below analyst forecasts, with mining revenue almost halved to $42.2 million.

TeraWulf also missed estimates, reporting quarterly revenue of $35.8 million, down from $50.6 million in the previous quarter and below expectations. MARA Holdings posted even steeper losses. The miner reported a fourth-quarter net loss of $1.71 billion, compared with net income of $528 million a year earlier, as revenue slipped 6% to $202.3 million.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

Crypto World

OKB token still under pressure even as OKX introduces AI toolkit for developers

- OKX’s AI toolkit launch has not lifted market sentiment.

- OKB token price remains range-bound with neutral momentum.

- The key OKB price levels are the support at $72 and the resistance at $82.

OKB token remains under pressure despite OKX crypto exchange unveiling an upgrade to its OnchainOS infrastructure that introduces an AI toolkit built for developers.

The new system is designed to help autonomous agents interact directly with blockchain networks.

This will allow developers to plug AI models into wallet functions, trading routes, and market data feeds without building everything from scratch.

While the move aims at making OKX the backend layer for AI-driven crypto execution, the excitement around the product has not translated into a clear recovery for its native token, OKB.

At press time, the OKB token was trading at around $75.88, after a modest 24-hour decline of 0.3%.

Even though the altcoin remains far above its early-cycle lows, it has fallen more than 60% over the past year and its all-time high of $255.50, reached in August 2025, still looms large above the current price.

Technical analysis shows OKB in consolidation

From a technical standpoint, OKB is trading in a narrow range, although it appears to closely mirror Bitcoin’s price movements, which means broader market sentiment remains a critical factor.

Recent OKB price movements show that the cryptocurrency is consolidating rather than trending.

The Relative Strength Index (RSI), though having bounced from an oversold condition, is still sitting close to the oversold region at 39.74 at press time.

In case of a bullish breakout, the immediate resistance sits near the 7-day simple moving average at $76.657.

On the downside, the 61.8% Fibonacci retracement level at $73.31 has served as key support, with a second support zone near $72.62 based on recent price action.

These two levels create a support band that traders should closely watch if the market breaks down from the current consolidation.

If that support band fails, historical data points to $68.05 as the next area where buyers previously stepped in.

OKB token price prediction

While the AI toolkit gives OKX a compelling long-term story, OKB’s price action suggests traders want proof of impact before bidding the token higher.

The near-term price outlook for OKB remains neutral unless a decisive breakout occurs.

A strong move above $76.77, supported by higher trading volume, would be the first signal of short-term strength.

If buyers push the price above the $82.47 resistance, momentum could expand.

Historically, sustained trading above $82.47 has paved the way for $93.50, according to CoinLore.

Beyond that level, the next resistance to monitor would be $104.84.

But if bears outweigh bulls, a drop below $73.31 and $72.62 would weaken the current structure.

Such a move would likely expose the token to a retest of $68.05.

Crypto World

Why March Could End Bitcoin’s Five-Month Losing Streak

Bitcoin stands at a sensitive stage after a prolonged decline. However, several macroeconomic and on-chain signals suggest a strong reversal is possible. Many analysts even expect a medium-term recovery that could last several months.

Below are three main reasons why many analysts believe in this recovery scenario.

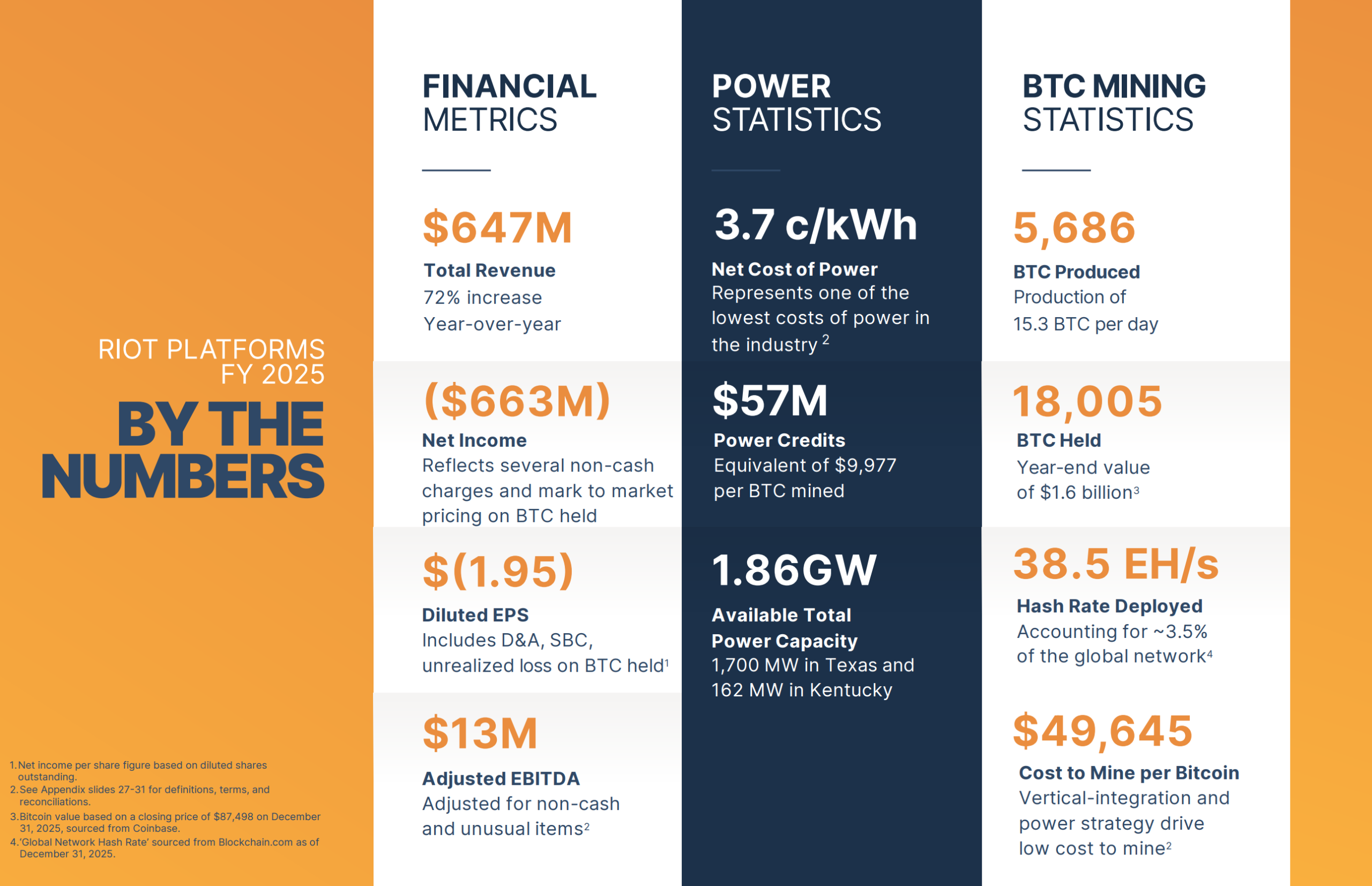

Correlation Between Bitcoin and the ISM Manufacturing PMI

First, the US ISM Manufacturing PMI recorded its second consecutive month of expansion. According to the latest report from the Institute for Supply Management (ISM), the February 2026 PMI reached 52.4%. Although the figure declined slightly from 52.6% in the previous month, it still exceeded market expectations of 51.8%.

This marks the second consecutive reading above 50. It ends a three-year contraction in the US manufacturing sector. The rise in this index suggests an environment in which investors expand their risk appetite. That condition creates room for capital to flow into Bitcoin.

Analyst Joe Consorti highlighted the correlation between this index and Bitcoin’s price in previous cycles. He suggested that the current setup signals a potential trend reversal.

“Historically, this has lined up with the early start of BTC bull markets (excluding 2022),” Joe Consorti commented.

Bitcoin’s Inter-Exchange Flow Pulse (IFP) Signals a Shift in Sentiment

Second, analyst CW believes a “golden cross” is about to appear on Bitcoin’s Inter-Exchange Flow Pulse (IFP) indicator.

CryptoQuant, an on-chain data and analytics platform, explains that IFP measures Bitcoin flows between spot and derivatives exchanges.

This flow data reflects market sentiment. When a large amount of Bitcoin moves to derivatives exchanges, the indicator signals a bullish phase. Traders transfer coins to open long positions in the derivatives market.

In contrast, when Bitcoin flows from derivatives exchanges to spot exchanges, the indicator signals the start of a bearish phase. This situation often occurs when traders close long positions, and large investors reduce their risk exposure.

In the past, this signal preceded strong recoveries from 2023 to 2025. Currently, after 1 year of correction, the golden cross is approaching. If the crossover receives confirmation, it would suggest the beginning of a new bullish cycle for Bitcoin.

“The golden cross is imminent in the BTC Inter-exchange Flow Pulse (IFP). After a year of correction, the price is ready to rise again. Everyone, buckle your seat belts,” analyst CW stated.

Five Consecutive Monthly Red Candles Signal Selling Exhaustion

Third, five consecutive monthly red candles are extremely rare. Bitcoin closed February 2026 with its fifth straight red monthly candle. This marks only the second time in history that such a streak has occurred.

The first instance took place during 2018–2019, when Bitcoin recorded six consecutive red candles. After that period, Bitcoin printed five successive green candles. The price surged more than 300%, rising from around $3,400 to $14,000.

Although the historical sample remains small, a longer red streak suggests that selling pressure is nearing exhaustion. A strong reversal can occur once buying demand returns.

“5 or 6 monthly RED candles doesn’t matter now, because the bulk of the drawdown is behind us and all the upside is still in front of us,” analyst Satoshi Flipper stated.

These signals have historically confirmed a multi-month upward trend. A recent report by BeInCrypto also reinforces the scenario that Bitcoin has entered a bottoming phase. However, analysts still see room for a deeper decline.

Analysts at BeInCrypto predict that March will likely depend on whether the $62,300 support level holds or the $79,000 resistance level breaks first.

Crypto World

Tether taps Deloitte for first USAT reserve report

Leading stablecoin issuer Tether has secured a sign-off from Deloitte for the first reserve report tied to its new U.S.-regulated stablecoin, after years struggling in its relationships with major accounting firms.

Deloitte reviewed a report prepared by Anchorage Digital Bank, which issued the company’s new USAT token. In a letter released Monday, the accounting firm said Anchorage reported $17.6 million in reserve assets backing 17.5 million USAT tokens in circulation. The token’s market cap has, since the report, risen to nearly $20 million as its growth accelerates.

The total market capitalization of the stablecoin sector has, in fact, been growing rapidly. It’s now past $315 billion, according to CoinMarketCap data, with Tether’s USDT making up $183 billion of that. Circle’s USDC comes in second place, at $76 billion.

The new USAT token follows the passage of the Genius Act last summer. The law limits the types of assets that can back stablecoins and requires larger issuers to move under federal oversight. USAT is structured to comply with those rules.

Third-party attestations such as this differ from full audits, however. They offer a snapshot of reserves at a specific point in time rather than a deep review of company finances.

Tether has been leveraging the revenue it generates from the assets backing its stablecoins to invest in a plethora of industries. These include a majority stake in Latin American agricultural firm Adecoagro (AGRO), a privacy-focused health app, a stake in video-sharing platform Rumble (RUM). More recently, it invested $200 million in digital marketplace Whop.

Crypto World

DOJ seeks forfeiture of $327K in USDT linked to romance scam

The United States Attorney’s Office for the District of Massachusetts filed a civil forfeiture action Monday seeking to recover 327,829.72 USDT, allegedly involved in a money laundering scheme connected to an online romance scam.

Summary

- DOJ is seeking to recover approximately $327,829 in USDT linked to a romance fraud and money-laundering scheme.

- Investigators say the stolen funds were routed through intermediary wallets and converted to stablecoin to conceal origin.

- The action underscores continued federal efforts to trace and reclaim crypto assets to return them to defrauded Americans.

Justice Department targets crypto laundering in online romance scam

The complaint, filed in federal court, names the cryptocurrency as defendant property and seeks its forfeiture under federal law as proceeds of fraud and laundering.

According to the complaint, the stolen funds originated from a Massachusetts resident who was targeted in late 2024 on a dating app. The fraudster, identified only by an alias, convinced the victim to send funds for purported cryptocurrency investments that never existed.

Rather than investing the money, the scammers diverted it through a series of cryptocurrency wallets and ultimately converted it to USDT, a common tactic to obfuscate the origin and movement of illicit proceeds.

Several of the wallets in question were seized by law enforcement in August 2025 after blockchain analysis traced connections to the scam.

Under U.S. civil forfeiture law, property traceable to illegal activity may be seized by the government and ultimately returned to victims if the court finds it to be proceeds of crime. The Justice Department’s action allows third parties with a legitimate interest in the property to file claims before any forfeiture is finalized.

Prosecutors said the forfeiture complaint is part of broader efforts to target online frauds, including romance scams, investment schemes, and cyber-enabled financial crime that increasingly leverage cryptocurrency to move and hide funds.

The case highlights both the growing sophistication of crypto-related fraud and law enforcement’s expanding use of blockchain analysis to trace and reclaim stolen digital assets for fraud victims.

Crypto World

Bank of Japan eyes tokenized central bank money in blockchain push

Bank of Japan Governor Ueda Kazuo said the rapid integration of blockchain and artificial intelligence is reshaping the financial system, positioning central banks to play a pivotal role in anchoring trust as crypto-linked infrastructure matures.

Summary

- The BoJ is exploring issuing or connecting central bank money to blockchain networks, including through Project Agorá and domestic sandbox testing.

- Japan’s retail CBDC program remains active, with technical experiments aimed at preparing digital cash as a future “anchor of trust.”

- Ueda warned that fragmented blockchain systems could create systemic risk unless central bank money bridges networks and ensures settlement finality.

Bank of Japan’s Ueda backs blockchain settlements, advances CBDC experiments

Speaking at FIN/SUM 2026 in Tokyo, Ueda described blockchain as moving firmly into its “implementation phase,” with decentralized finance (DeFi), smart contracts and tokenized assets increasingly influencing settlement, payments and cross-border finance.

He emphasized that blockchain’s programmability, particularly atomic transactions that bundle multiple actions into a single execution, could streamline complex processes such as delivery-versus-payment (DvP) and cross-border transfers.

For crypto markets, the speech revealed two key themes: interoperability and settlement in central bank money.

Ueda warned that a fragmented ecosystem of multiple blockchains and traditional payment rails could create conversion bottlenecks and systemic risks if interoperability is not ensured. He suggested central bank money, potentially in tokenized form, could function as a bridge across networks, preserving the “singleness of money” while enabling innovation.

The BOJ is advancing several initiatives with direct implications for digital assets. Its retail central bank digital currency (CBDC) pilot continues technical testing, while Project Agorá — a joint effort with other central banks and major financial institutions — is exploring tokenized central bank deposits on blockchain networks for cross-border payments.

A separate BOJ sandbox is testing how current account deposits at the central bank could be used to settle transactions conducted on distributed ledgers.

Ueda also highlighted AI’s growing role in analyzing blockchain transaction data for risk management and AML/CFT compliance, signaling closer scrutiny of crypto-linked activity even as innovation expands.

The message to markets was clear: blockchain-based finance is no longer experimental. But its long-term stability, Ueda said, will hinge on central banks embedding trust, liquidity and settlement finality into the next generation of digital infrastructure.

Crypto World

Will Solana price crash now that it has charted a bearish flag pattern?

Solana price tanked over 7% on Monday as fears of the impact of the ongoing U.S.-Iran war continued to drive investors away from risk assets. Current technical signals suggest the token could be set for a downturn.

Summary

- Solana price has remained in a downtrend as network revenue declined amidst a market-wide downturn.

- A bearish flag pattern has positioned the token for more downside.

According to data from crypto.news, Solana (SOL) price fell 7% from $88.05 on Sunday to an intraday low of $81.86 on Monday, March 2. Subsequently, it attempted a breach of the $90 resistance supported by a broader market recovery, but the rally lost steam just below that mark.

On the monthly timeframe, Solana has fallen over 30%, and is down over 44% from this year’s highs.

Solana price has remained in a downtrend as network revenues have fallen. Notably, the weekly revenue generated by the Solaba network has dropped over 30% from what was recorded during mid January, data from DeFiLlama show.

The total value locked in the network has also fallen from over $9 billion recorded on Jan. 17 to $6.64 billion at the time of writing.

With both network revenue and TVL going down, investors are concerned that Solana’s explosive growth phase is over, and the memecoin fever that fueled the network is finally breaking.

Demand for the token across the derivatives market has also contributed to the downturn. Data from CoinGlass show that SOL futures open interest has scaled back by nearly 45% to $4.93 billion from its January high of $8.88 billion as traders unwind positions awaiting signs of more calmness in the global geopolitical landscape.

Solana price is also affected by the market-wide downturn in response to the ongoing U.S.-Iran conflict, which has pushed investors away from risk assets to more traditional alternatives, as they expect more volatility over this week.

The most recent trigger came after the retaliatory attack from Iran on U.S. ships over the weekend, stationed around the Strait of Hormuz, sparking a jump in oil prices. Investors are concerned this could lead to higher inflation in the U.S., which could likely force the Fed to hike interest rates or hold them steady at restrictive levels for longer.

Risk-assets like Solana tend to benefit from interest rate cut expectations and struggle when the Fed sets a hawkish tone.

On the daily chart, Solana price has formed a bearish flag pattern since the token entered a downtrend from mid January this year, before moving into consolidation over the past few weeks. Bearish flags have typically been precursors to further downward breakouts.

Other technical indicators also favour the bears. The Supertrend has flashed red while the Aroon lines have pointed downwards, with the Aroon Down at 50%, indicating that sellers still maintain firm control of the market.

Hence, Solana price risks dropping to the Feb. 6 low of $70 if the current bearish momentum prevails, especially considering the broader downturn.

On the contrary, a rebound above $90, a resistance level that the token has struggled to break multiple times over the past few weeks, could offer the necessary optimism for a rally towards the $100 psychological resistance level.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Bitcoin Re-tests $70K as Loss Flows Drop to 2-Week Low

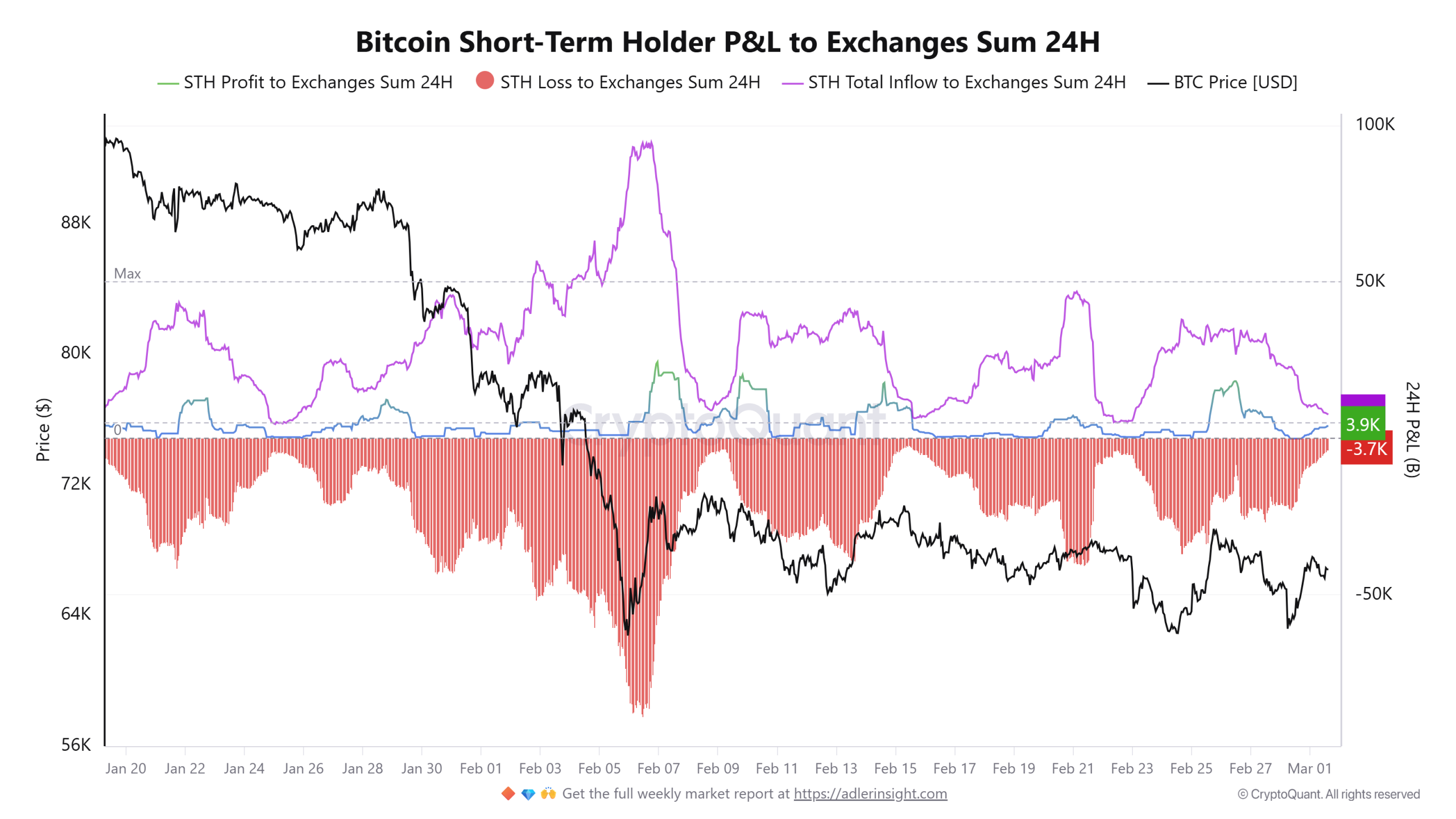

Bitcoin (BTC) rallied to $70,000 on Monday amid escalating tensions in the Middle East. CryptoQuant data shows short-term holder losses transferred to exchanges fell to a two-week low, contrasting with the heavier selling seen in early February.

Bitcoin short-term sellers step back

The short-term holder (STH) profit/loss (P&L) to exchanges metric tracks how much Bitcoin recent buyers send to exchanges at a profit or loss. These participants tend to amplify volatility during stress events.

On March 1, the realized losses fell to 3,700 BTC even as geopolitical tensions between the United States and Iran escalated in the Middle East. Bitcoin dipped to $63,000 during that window, but exchange inflows from this cohort did not expand in response.

For comparison, on Feb. 5–6, the STHs sent 89,000 BTC to exchanges at a realized loss within 24 hours. That marked a peak capitulation window. Since then, the loss-driven inflows have steadily compressed.

Crypto analyst MorenoDV noted that the most event-sensitive holders have not accelerated distribution and exhibited “zero panic.” The drop in loss transfers signals that the sell pressure from recent buyers has cooled.

A strong rally may depend on whether realized losses stay contained or reaccelerate toward prior capitulation levels during this period of geopolitical uncertainty.

Related: Michael Saylor’s Strategy buys $204M of Bitcoin in 101st purchase

BTC futures deleveraging meets external liquidity

BTC derivatives data indicate a significant risk reduction. Crypto analyst Darkfost highlighted that Binance open interest declined to 97,680 BTC from 130,800 BTC since the start of the year, a 25% contraction.

The estimated leverage ratio, which compares open interest to exchange BTC reserves, fell to a 0.146 weekly average. Levels below 0.15 have historically aligned with aggressive deleveraging phases during this cycle.

On the technical side, Bitcoin is attempting to reclaim its Monthly RVWAP (rolling volume-weighted average price), currently near the high-$68,000 region. The Monthly RVWAP is a volume-weighted average price anchored to the start of the month. BTC trading above it places the average monthly participant back in profit and often shifts the short-term positioning bias of traders.

The four-hour chart shows the price pushing through $70,000 and approaching the first external liquidity pocket from $70,000 to $71,500. Converting that range into support may trigger a price expansion to the $80,000 region, where prior supply capped upside in January. Crypto trader LP said,

“On the HTF, low-leverage liquidation clusters are stacking near and just above the range highs, sitting between 70–73K. These higher timeframe liquidity pools often act as magnets when they build in size.”

The BTC spot flow data adds further context. Binance spot printed roughly $7.79 million in positive delta during the breakout leg, Coinbase added about $1.16 million, and OKX contributed nearly $3.7 million.

The positive delta across venues signals aggressive spot bidding rather than isolated derivatives-driven activity. With leverage use reduced and loss-driven selling falling, the market’s attention shifts to how the price may react around the $71,500 liquidity band.

Related: Will Bitcoin crash if oil prices hit $100 per barrel?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business7 days ago

Business7 days agoTrue Citrus debuts functional drink mix collection

-

Politics2 hours ago

Politics2 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Sports3 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech7 days ago

Tech7 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat7 days ago

NewsBeat7 days agoPolice latest as search for missing woman enters day nine

-

Entertainment1 day ago

Entertainment1 day agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Crypto World7 days ago

Crypto World7 days agoEntering new markets without increasing payment costs

-

Politics2 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers