CryptoCurrency

How Do Dollar-to-Stablecoin Swaps Power the Future of White-Label Neo Banking?

The global financial landscape is entering a decisive shift as stablecoins rapidly evolve from niche digital assets into high-velocity instruments powering real-world transactions. With trillions in annual on-chain settlement and growing adoption from fintechs, payment processors, and multinational enterprises, dollar-backed stablecoins are reshaping how value moves across borders.

This momentum has placed dollar-to-stablecoin swaps at the core of modern banking infrastructure, especially for platforms aiming to deliver instant, low-friction, globally accessible financial services. For customized crypto neo bank service providers, enabling seamless conversion from fiat dollars to stablecoins is no longer a forward-looking capability; it is a fundamental requirement to stay relevant in an economy increasingly defined by speed, transparency, and programmability. As businesses seek stronger liquidity control and faster settlement cycles, the demand for integrated, compliant swap mechanisms has never been more urgent.

Current Market Hype

Stablecoins have shifted from niche crypto tooling to mainstream rails for real-world value transfer, and dollar-to-stablecoin swaps are at the center of that shift. Recent industry data shows stablecoin transaction volumes and on-chain transfers surging as corporations, payment providers, and fintechs adopt dollar-pegged tokens for faster settlements and cheaper remittances.

Regulatory clarity in major markets has accelerated enterprise experimentation while banks and card networks pilot tokenized dollar solutions. For emerging market customers, dollar stablecoins offer a hedge against local currency volatility and a low-cost channel for cross-border payroll, supplier settlements, and treasury management. Meanwhile, developer ecosystems are improving liquidity routing and automated market maker integrations so swaps can be executed with minimal slippage and predictable fees. As stablecoin infrastructure matures, white-label neo-banking platforms that embed reliable, compliant dollar-to-stablecoin swap flows unlock new revenue pockets, increase customer stickiness, and enable creative productization like instant payroll, merchant settlement, and programmable invoices.

Why Are Dollar-to-Stablecoin Swaps an Important Integration in White-Label Neobank Apps?

- Instant settlements and liquidity optimization- Shifting from legacy rails to stablecoins removes multi-day settlement delays. Neo-banks can offer clients near-instant settlement while improving treasury visibility and reducing float. This matters for B2B payments, payroll, and merchant payouts.

- Cost efficiency for cross-border flows- Stablecoin solutions reduce intermediary fees, FX friction, and reconciliation costs. For international remittances and merchant acceptance, dollar-pegged tokens can make global payments materially cheaper.

- Hedging and predictable dollar exposure- Customers in FX-volatile markets value being able to hold dollar-pegged assets without opening a foreign currency account. Dollar-to-stablecoin swaps provide an access point to dollar exposure while remaining on-chain.

- Programmability and new product models- Once the value is tokenized, you can automate payroll, supplier financing, escrow, and subscription billing using smart contracts. This turns a simple swap into an avenue for product innovation.

- Regulatory and compliance advantages when implemented properly- A white-label BaaS platform provider that integrates KYC, AML screening, and audit-ready settlement reporting enables enterprises to use stablecoins within compliant guardrails, making adoption for conservative clients more feasible.

- Customer acquisition and retention- Offering dollar-to-stablecoin swaps in your neo banking platform appeals to global SMBs, fintechs, and crypto-native users. It becomes a powerful acquisition hook and a reason for clients to consolidate more of their financial stack with your platform.

Benefits of Dollar-to-Stablecoin Swaps in White-Label Neo Banking

1. Faster cash-to-on-chain onramps that improve customer experience and shorten time to value.

2. Lower cost for cross-border payments and remittances compared to traditional correspondent banking.

3. Better working capital management through faster receivable settlements and programmable disbursements.

4. Enhanced revenue streams: swap fees, custody fees, FX spreads, and value-added services like payroll and merchant settlement.

5. Improved business continuity: when legacy rails fail or are slow, having a tokenized dollar path ensures uninterrupted value transfer.

6. Competitive differentiation that positions the neo-bank as a modern BaaS provider with on-chain rails.

Antier’s Capabilities: Dollar-to-Stablecoin Swap in White Label BaaS Platforms

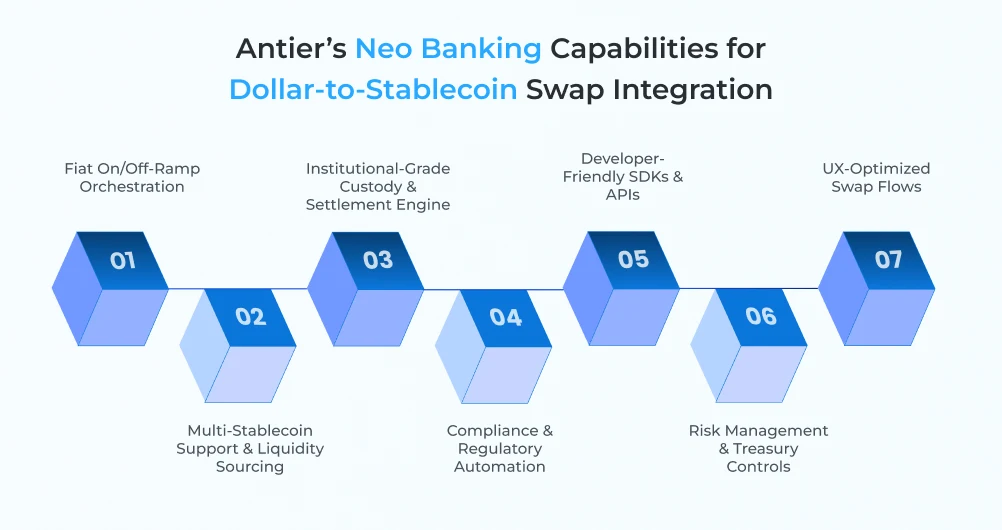

Antier is an experienced and a renowned crypto-friendly neo banking solution provider that designs and delivers full-stack Banking-as-a-service (BaaS) solutions that include core dollar-to-stablecoin swap capabilities as native platform features rather than bolt-on extras. Our approach focuses on the core capabilities.

- Fiat on/off-ramp orchestration- Seamless connections to fiat rails, payment gateways, and banking partners for USD deposits and withdrawals.

- Multi-stablecoin support and liquidity sourcing- Support for major dollar-pegged stablecoins and programmable routing to liquidity pools and OTC providers to minimize slippage.

- Custody and settlement engine- Institutional-grade custody with hot/cold segregation, multi-signature controls, and reconciled settlement ledgers for auditability.

- Compliance and regulatory tooling- Integrated KYC/AML, transaction monitoring, and compliance reporting workflows to ensure client transactions meet regulatory expectations.

- SDKs and APIs for seamless integration- Developer-friendly APIs and SDKs for wallet management, swap execution, webhooks for event-driven flows, and white-label front-end components.

- Risk management and treasury controls- Configurable limits, automated reserve management, and liquidity buffers to protect against market or operational shocks.

- UX-first client flows- White-label UI components for smooth swap experiences, fee transparency, and instant confirmations to reduce drop-offs.

These features are designed as platform primitives. They let businesses configure product flows, instant payroll, merchant settlement, treasury sweep, or cross-border payouts without re-architecting the stack.

Launch Your Own Banking App With Dollar-Stablecoin Swapping Feature With Confidence!

Real-World Implementations

- Instant payroll in stablecoins: Employers convert USD deposits into stablecoins and trigger on-chain payroll to global employees.

- Merchant settlement rails: Merchants receive stablecoins instantly and settle into local fiat only when needed.

- Programmable supplier payments: Escrow and timed releases via smart contracts after goods or milestones are confirmed.

- On-demand treasury sweeps: Automatically move idle balances between fiat and stablecoins to optimize yields or currency exposure.

- Stablecoin debit cards: Allow customers to spend stablecoins via customized crypto virtual card rails where backend swaps to fiat occur at settlement.

Future Potential of Neo Bank Platform With dollar-to-Stablecoin Swaps

The future of dollar-to-stablecoin swaps in crypto neo banking development solution is set to accelerate as global finance moves toward tokenized value and programmable banking. With regulatory clarity improving and major financial institutions exploring on-chain settlement, stablecoin rails are expected to become a standard component of commercial payments, corporate treasury operations, and cross-border settlement infrastructure. Enterprises and financial institutions will increasingly adopt hybrid models where tokenized dollars operate alongside fiat accounts, enabling faster clearing, transparent audits, and uninterrupted international value transfer. Advancements in liquidity routing, enterprise-grade custody, and automated compliance will reduce operational risk and support larger corporate flows.

As stablecoins integrate with POS systems, payroll automation, and supply chain finance, dollar-to-stablecoin swaps will evolve from a transactional feature into a strategic financial capability that reshapes how businesses move money, optimize liquidity, and build digital-first financial products.

The next wave of adoption will come from integration with mainstream financial infrastructure, clearer regulation, and enterprise tooling that lowers operational risk. Expect to see:

- Bank-backed stablecoin partnerships that give neobanks safer custody options and clearer clearing paths.

- Improved liquidity solutions that reduce swap friction for large corporate flows.

- Vertical-specific products such as supply chain finance, instant trade settlement, and cross-border payroll ecosystems.

- Tighter bank and card network integrations so stablecoins can be used seamlessly at point of sale.

- More regulatory-safe rails with audited reserves and on-chain transparency to build enterprise trust.

Don’t Risk Your Neo Banking Project Plans! Hire Antier

Dollar-to-stablecoin swaps are no longer an emerging trend; they are becoming a defining capability for the next generation of digital banking. As enterprises seek faster settlements, smoother cross-border operations, and dependable access to tokenized dollars, neo-banks that integrate these rails will naturally lead the competitive landscape. The shift toward programmable finance, real-time liquidity optimization, and transparent on-chain settlement is accelerating, and businesses that adopt these models early will secure a powerful edge in operational efficiency and global reach. With regulatory clarity improving and tokenized finance evolving at a rapid pace, stablecoin-centric architectures will soon become essential infrastructure, rather than optional innovation, for enterprise-grade financial products.

Antier strengthens this shift by providing future-ready architecture, enterprise-grade compliance, and modular systems that accelerate deployment without compromising security or performance. As a trusted white-label neo bank app development company, we ensure every swap-enabled neo-banking solution we build is scalable, compliant, and engineered for measurable adoption. Our proven frameworks, deep Web3 expertise, and focus on real-world usability empower enterprises to confidently launch products that stand out even in highly competitive markets. With us, you don’t just build a platform; you build a long-term strategic advantage, backed by a partner committed to your growth.

Frequently Asked Questions

01. What are dollar-to-stablecoin swaps and why are they important?

Dollar-to-stablecoin swaps are conversions between fiat dollars and dollar-backed stablecoins, which are crucial for modern banking as they enable instant, low-friction transactions, enhancing liquidity control and settlement speed for businesses.

02. How are stablecoins reshaping the financial landscape?

Stablecoins are transitioning from niche digital assets to mainstream tools for real-world value transfer, facilitating faster settlements and cheaper remittances, particularly for corporations, payment providers, and fintechs.

03. What benefits do dollar stablecoins offer to emerging market customers?

Dollar stablecoins provide a hedge against local currency volatility and serve as a low-cost solution for cross-border payroll, supplier settlements, and treasury management, making them valuable for customers in emerging markets.