CryptoCurrency

How Is a White-Label Crypto Wallet Architected for the Philippine Market?

The Philippines is at the crossroads of digital finance transformation, and a high-impact white-label crypto wallet is the most direct route to capture that momentum. This blog demonstrates to product leaders and fintech founders how to design a blockchain wallet app that converts active users into loyal customers while meeting the requirements of local regulators and enterprise partners. You will get a tactical blueprint that covers market fit, compliance mapping, architecture patterns, retention features, and launch acceleration strategies. I explain what makes a wallet genuinely impactful for Filipino users, how to build modular infrastructure that scales, and which integrations turn a wallet into a revenue engine. Read on to learn a practical, technically mature path to build a wallet product that wins trust, drives transactions, and becomes a cornerstone of Philippine digital payments.

Why the Philippines Is a High-Growth Market for White-Label Crypto Wallets?

The Philippines combines high mobile penetration, a large diaspora that sends steady remittances, and strong grassroots interest in crypto use cases. These forces produce a market where digital wallet solutions and crypto rails can flourish. Retail adoption is high relative to the population, and recent industry reports place the Philippines among the leading countries for crypto uptake, creating a sizable addressable user base for wallets. Remittances remain a cornerstone of the economy and push demand for faster, cheaper settlement rails, including stablecoins and crypto-enabled corridors. Regulators have not been idle. The Bangko Sentral ng Pilipinas has published VASP guidance and built supervisory tools for risk-based oversight, which means products must embed compliance from day one. In practice, success requires wallets to combine localized fiat on/off ramps, enterprise-grade custody models, and strong identity verification, all tuned to Filipino user behavior and local settlement partners.

BSP, VASPs, and Compliance: What a White-Label Wallet Must Support

A Philippines-ready customized cryptocurrency wallet development solution must be designed for regulatory expectations and operational transparency:

1. VASP registration readiness and audit-friendly transaction logs.

2. Strong KYC and AML workflows that integrate local identity checks.

3. Proof of reserve or equivalent transparency for custodial offerings.

4. HSM and multi-sig custody options and clear key management policies.

5. Reporting hooks for central bank supervisors and suptech platforms.

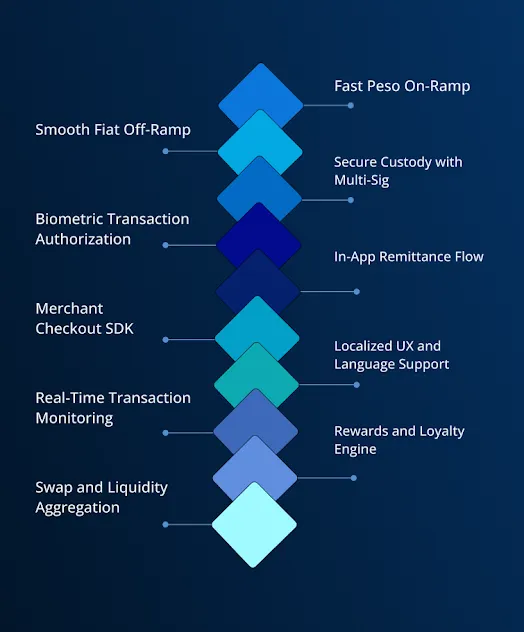

Feature Modules That Drive Retention in Philippine White Label Digital Wallet Apps

Who Should Launch a White-Label Crypto Wallet in the Philippines?

- Banks and licensed financial institutions are expanding digital services.

- Remittance operators focused on lowering fees and settlement times.

- Large e-commerce platforms and super apps are seeking embedded crypto rails.

- Fintech startups with existing user acquisition channels and fiat partners.

- Retail crypto exchanges and brokers want a branded mobile wallet.

- Gaming platforms and marketplaces that need frictionless payments and custody.

- Merchant networks and POS providers are aiming for alternative settlement rails.

White-Label vs. Custom Wallet Development: What Works Best for the Philippines?

Clear comparison table for quick executive decisions that are informed and researched:

| Aspect | White-Label Wallet | Custom Wallet |

| Time to MVP | Fast, configuration-driven | Longer, ground-up build |

| Upfront cost | Lower initial spend | Higher initial spend |

| Customization | Module-level customization | Full product control |

| Compliance readiness | Prebuilt connectors common | Built-to-spec compliance needed |

| Scalability | Enterprise-ready, vendor-tuned | Optimizable for unique scale needs |

| Ownership | Vendor dependency possible | Full code and data ownership |

| Best for | Rapid go-to-market and branded launches | Proprietary features and IP ownership |

Short guidance :

If your priority is speed, compliance-ready integrations, and tested infrastructure, white-label Web3 wallet development helps you win. If you need deep product differentiation, proprietary custody models, or full ownership of every layer, custom development is the better long-term play. Many enterprises use a hybrid plan: white-label for core rails and custom components where differentiation matters.

White-Label Crypto Wallet Architecture Explained

- Design the stack for compliance, resilience, and rapid ops. Core layers and responsibilities:

- User layer : native mobile apps and web, localized UX, and device biometric capture.

- API and orchestration : secure, rate-limited, multi-tenant APIs with RBAC.

- Identity and compliance : KYC engine, sanctions screening, risk scoring, and case management.

- Wallet core and custody : hot wallet cluster for day-to-day flows, cold storage in HSMs, and multi-sig workflows for transfers.

- Transaction signing : device HSM or secure enclave-backed signing; session tokens and biometric unlocks where available.

- On-ramp adapters : payment processors, peso rails, remittance development companies, and stablecoin liquidity sources.

- Monitoring and reporting : real-time analytics, anomaly detection, and reporting endpoints for auditors and regulators.

This modular approach lets you replace or upgrade individual components without a full rewrite, which is essential for the Philippine market’s agility.

How Long Does It Take to Launch a White-Label Crypto Wallet in the Philippines?

Rather than promise an exact calendar, focus on what shortens the path. If you partner with an experienced white-label crypto wallet service provider that already supports the Philippine compliance connectors and peso rails, your path to a marketable product compresses considerably. Key accelerators are pre-integrated KYC vendors, existing on/off ramp adapters, a tested custody layer, and a regulatory playbook. With these in place, engineering can focus on branding, UX localization, and merchant integrations instead of reinventing core plumbing, which reduces legal cycles and testing iterations.

Factors That Impact Wallet Launch Speed in the Philippine Market

Primary accelerants and blockers of the white label blockchain wallet development:

1. Regulatory approvals, VASP registration backlog, and reporting setup.

2. Onboarding local fiat and remittance partners.

3. Custody choice and HSM provisioning.

4. KYC vendor integration and local identity verification paths.

5. Supported chains and cross-chain bridging complexity.

6. Security and penetration testing cycles.

7. Readiness of vendor SDKs and developer documentation.

8. Business readiness for AML monitoring and suspicious transaction workflows.

Why Partnering With Experts Matters for Regulatory-Safe Crypto Wallet Launches?

Experienced cryptocurrency wallet development companies compress risk and timelines. They bring tested KYC and AML connectors, custody models, audit trails, and compliance playbooks. They know local payment rails and can help map proof of reserve and transparency measures for custodial offerings. Expert partners also have hardened processes for security testing and incident response, which lets enterprises maintain operational continuity as regulatory expectations evolve. In the Philippines, where supervision and reporting tools are maturing, operational maturity is a major competitive advantage.

Search The Definitive Partner for White-Label Crypto Wallets

Building a truly impactful white-label mobile crypto wallet in the Philippines requires far more than basic blockchain integration. It demands architectural depth, security-first thinking, and a clear understanding of how real users interact with decentralized finance. This is where Antier distinctly stands apart. We specialize exclusively in designing and engineering advanced Web3 wallet solutions that are secure, scalable, and future-ready.

Our strength lies in deep wallet architecture. From custodial and non-custodial models to multi-chain support and biometric-backed security layers, every wallet we build is engineered for precision and performance. What elevates our solutions further is intelligent AI integration. We embed AI-driven risk detection, behavior analytics, and smart automation directly into the wallet layer, enabling safer transactions, adaptive security, and higher user trust.

Antier’s Web3 cryptocurrency wallet development teams combine years of hands-on blockchain experience with rigorous compliance awareness, delivering platforms that outperform generic solutions. For businesses and investors seeking differentiation, longevity, and technical excellence in the Philippine market, we are the partner that builds wallets designed to lead, not follow.

Contact us today!

Frequently Asked Questions

01. What is the significance of a white-label crypto wallet in the Philippines?

A white-label crypto wallet is crucial in the Philippines as it leverages the country’s high mobile penetration, strong remittance flows, and growing interest in crypto, providing a tailored solution that meets local regulatory requirements and user needs.

02. What are the key features a crypto wallet must have to succeed in the Philippine market?

A successful crypto wallet in the Philippines must include localized fiat on/off ramps, robust KYC and AML workflows, compliance with VASP regulations, and strong identity verification, all tailored to Filipino user behavior.

03. How can fintech founders ensure their crypto wallet meets regulatory standards in the Philippines?

Fintech founders can ensure regulatory compliance by incorporating VASP registration readiness, maintaining audit-friendly transaction logs, implementing strong KYC and AML processes, and providing transparency through proof of reserves and secure custody options.