Crypto World

How Long Can It Stay Above?

Bitcoin has bounced roughly 17% from Friday’s $60,150 trough, but the rebound has not erased the undercurrent of caution rippling through the derivatives market. Traders remain wary of chasing fresh upside exposure as the price hovers near the $70,000 level, with liquidity dynamics painting a mixed picture. In the past five sessions, leveraged bullish futures liquidations totaled about $1.8 billion, fueling speculation that major hedge funds or market makers may have faced sizable losses. The market’s struggle to sustain momentum after Thursday’s skid highlights how fragile appetite for risk remains, even as the price attempt to reclaim ground continues.

Key takeaways

-

Bitcoin’s derivatives signals point to elevated caution, with the options skew measuring roughly 20% on the week as traders weigh a potential second wave of fund liquidations.

-

While the price retraced some of Thursday’s losses, the rally is not translating into broad demand for new long exposure, especially when compared with gold and technology equities.

-

Aggregate futures liquidations indicate a recent wave of forced liquidations, but open interest on major venues remains steady, suggesting mixed conviction among bulls and sellers.

-

The futures market shows cooling demand for bullish leverage, with the BTC futures basis rate sinking to the lowest in over a year, underscoring a cautious stance despite a price move above key levels.

Tickers mentioned: $BTC

Sentiment: Bearish

Market context: The current dynamics unfold against a backdrop of tepid leverage appetite in crypto markets, with options and futures signals diverging from spot-price gains. Investors are reevaluating risk, liquidity, and potential catalysts that could reaccelerate a broader uptrend, while systemic concerns about market-makers and liquidity have kept participants cautious.

Why it matters

The present mood in the Bitcoin market illustrates a broader tension between price action and risk appetite embedded in derivatives markets. The rally from Friday’s low has been constrained by a thinning of upside demand, suggesting that buyers are selective and selective exposure remains the name of the game. For market participants, the key takeaway is not a lack of interest in Bitcoin per se, but a hesitation to deploy fresh leverage when volatility remains high and liquidity conditions are not uniformly supportive.

The liquidation backdrop underscores how fragile liquidations can ripple through the marketplace. When approximately $1.8 billion of leveraged bullish futures contracts liquidate over a five-day window, it can prompt a reassessment of risk by major players, potentially widening bid-ask spreads and triggering protective selling pressures that outlive the immediate move. This environment makes it harder for bulls to build sustained momentum, even as the price tests and briefly surpasses notable thresholds.

On the sentiment front, the skew in options markets provides a counterpoint to price recovery. A 20% two-month options skew signals persistent fear and a premium placed on downside protection. In calmer times, a higher demand for calls—indicative of optimism—would push the skew down toward neutral readings. Instead, the market appears more attuned to the risk of further losses than to a runaway rally. The lack of a clear catalyst for a renewed surge adds to the sense that any upside may be incremental and exposed to negative surprises if liquidity tightens or macro risk shifts.

Traders will be watching whether institutions that have been operating behind the scenes—market makers, hedge funds, or proprietary desks—adjust their risk models in the near term. The fear of an unseen balance-sheet event can weigh on market psychology, particularly when combined with ongoing questions about systemic leverage in the crypto space. While some bulls have been adding exposure as prices attempt to climb toward and beyond $70,000, the overall tone remains cautious, with the derivatives landscape signaling that risk-off tendencies could reassert themselves if new liquidity concerns or regulatory headlines surface.

The current narrative also invites a closer look at the relationship between price movements and hedging behavior. The apparent dissonance between a late-week price rally and dwindling leverage demand raises questions about what comes next for Bitcoin’s trajectory. If the price can sustain its gains without drawing in a broader wave of leverage, a potential scenario could involve a gradual reaccumulation of long positions. Conversely, any renewed shock—whether from leverage unwind, a regulatory development, or macro catalysts—could accelerate a fresh wave of selling pressure, given the fragile confidence that currently characterizes the market.

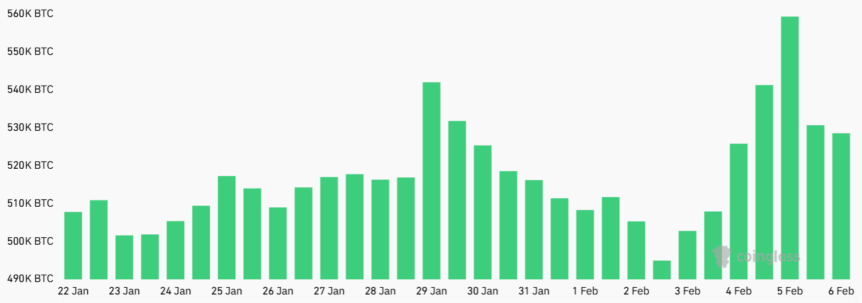

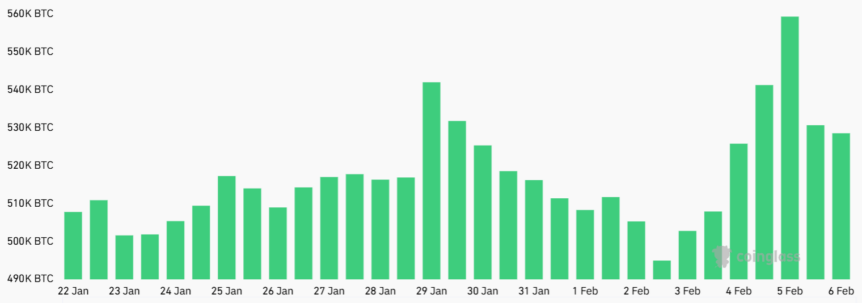

The data paints a picture of a market tentatively treading water near critical levels. The aggregated Bitcoin futures open interest across major exchanges stood at roughly 527,850 BTC on Friday, essentially flat versus the prior week, even as the notional value of those contracts declined from about $44.3 billion to $35.8 billion. The juxtaposition—steady open interest with a sharp drop in notional exposure—reflects a snapshot of risk being redistributed rather than a wholesale shift in bullish conviction. It implies that while some traders are choosing to run hedges or reduce exposure, others are still accumulating, albeit cautiously, with a renewed emphasis on margin discipline as prices move in and out of the $70,000 region.

To contextualize whether larger players are reconsidering risk, the BTC futures basis rate—an indicator of the premium paid for futures relative to spot over a set horizon—fell to about 2% on Friday, the lowest in more than a year. In neutral conditions, the annualized premium would typically sit in a 5%–10% range to compensate for the settlement lag. The decline signals a cooling appetite for bullish leverage, even as the price manages to breach the psychological threshold of $70,000. This divergence between price strength and leverage appetite helps explain why the market has yet to embark on a fresh, sustained ascent and why traders remain alert to potential pullbacks if liquidity tightens or risk sentiment worsens.

Options dynamics add another layer of caution. The BTC options market has shown a growing tendency to put protection against downside moves, a hallmark of risk-averse positioning. A prominent feature in the latest readings is the elevated put-call skew, which suggests traders were willing to pay a premium to insure against declines. The skew’s elevation aligns with periods of market stress in which fear and uncertainty dominate price action. While some participants might anticipate a sharper comeback if macro conditions stabilize, the absence of a compelling bullish catalyst leaves room for continued volatility and potential dissipations in sentiment as the market digests new information.

The current mood sits within a broader narrative where fear and uncertainty have grown even without a singular, obvious catalyst. A widely cited discussion—What’s really weighing on Bitcoin? Samson Mow breaks it down—highlights structural concerns in the market’s structure and liquidity dynamics. While there is no single event driving the downturn, the combination of forced liquidations, a fragile risk appetite, and a cautious options market reinforces a narrative of vulnerability that could persist in the near term.

Traders are likely to continue weighing the possibility that a large market maker or hedge fund could be facing distress, and this sentiment tends to erode conviction and raise the odds of downside moves. In such an environment, the probability of a durable bullish breakout remains tempered, even as Bitcoin shows signs of breaking beyond key price levels. As the market digests ongoing data and seeks stability, participants should prepare for continued volatility and carefully monitor leverage, funding dynamics, and macro headlines that could tilt sentiment anew.

Crypto World

Peraso (PRSO) Stock Soars Over 100% on Defense Contract Win

TLDR

- Defense contractor InTACT from Israel has chosen Peraso’s 60 GHz millimeter-wave technology to power a military-grade drone Identification Friend or Foe (IFF) system.

- The system enables military personnel on the ground to differentiate between friendly and hostile drones using mutual authentication protocols.

- Peraso’s beamforming transceiver chips provide directional, low-power communications that are difficult to intercept or jam.

- The collaboration between Peraso and InTACT has spanned more than two years, concentrating on tactical drone identification capabilities.

- PRSO shares skyrocketed by as much as 115% during Friday’s trading session and continued climbing over 33% in Monday’s pre-market hours.

Peraso Inc. (PRSO) experienced an extraordinary trading session on Friday. The semiconductor manufacturer based in California witnessed its share price soar by as much as 115% during intraday trading following news that its 60 GHz millimeter-wave technology will be integrated into a military drone identification platform.

The agreement centers around InTACT, a defense contractor headquartered in Israel. InTACT has selected Peraso’s semiconductor technology as the foundation for its Identification Friend or Foe (IFF) drone system — a critical tool that enables armed forces to rapidly determine whether an approaching drone poses a threat or belongs to allied forces.

The collaboration between these two entities has been ongoing for more than 24 months. This latest announcement signals a significant milestone in their relationship, as the technology transitions toward real-world military applications.

PRSO shares jumped over 96% during pre-market hours on Friday before the rally intensified to 115% intraday. The stock settled at a closing gain exceeding 86%. Monday’s pre-market session saw another surge of 33%.

How the Technology Works

Peraso’s 60 GHz beamforming transceiver chips serve as the core hardware for InTACT’s IFF platform. These semiconductors establish a short-distance, highly directional wireless communication link between unmanned aerial vehicles and troops on the ground.

The directional characteristics of the signal are crucial. This design makes the communications extremely difficult to detect or disrupt in contested electronic warfare scenarios — precisely the environments where such systems are needed most.

Through mutual authentication protocols, ground-based units can verify in real time whether an approaching drone is part of friendly operations. In modern combat zones saturated with drone activity, this identification capability provides significant tactical advantages.

CEO Ron Glibbery characterized the technology as “designed to provide a secure, directional communications channel ideally suited for these environments.”

Peraso’s Recent Business Performance

Peraso has shown signs of business momentum leading up to this defense contract announcement. During Q3 of fiscal year 2025 (concluded September 2025), the company reported revenue growth of 45% on a quarter-over-quarter basis, reaching $3.2 million.

This revenue increase was primarily fueled by record-breaking sales from millimeter wave products — the exact product category featured in this defense partnership.

Despite the sequential growth, total revenue for that quarter still declined 16% year-over-year, falling from $3.84 million in the comparable period.

For a micro-cap semiconductor firm, securing a design win in the defense industry can fundamentally alter investor perception of the company’s prospects. Commercial agreements typically don’t carry the same strategic weight as military deployment contracts.

InTACT has not revealed the financial parameters of this partnership. Neither contract value nor revenue forecasts have been made public.

The company has confirmed that its beamforming transceiver technology is ready for production and has been officially selected as the hardware platform for InTACT’s system. A specific timeline for military deployment has not been announced.

As of Monday’s pre-market trading, PRSO was up more than 33% following Friday’s impressive 86% closing gain.

Crypto World

Cardano Called the ‘Most Useless Network in Crypto’ as ADA Down 92% From ATH

The analyst who made that claim also laid out the most important support levels for ADA going forward.

Popular crypto market observer and commentator Ali Martinez took it to X to criticize the popular blockchain network, Cardano, for its failure to deliver on many of its promises.

Given the project’s popularity, many of the comments below the post lashed out at his harsh words, but there were some that agreed with his statements.

Most Useless Blockchain?

In a post titled “The Most Useless Network In The Crypto Market,” Martinez began by indicating that the Cardano DeFi ecosystem has never exceeded the coveted $1 billion mark. He added that it has “historically been only a fraction of what is locked on competing platforms like Ethereum.”

A quick double check on DeFiLlama confirms his words, as the Cardano TVL in DeFi peaked last year at roughly $700 million. However, the value has plummeted to $136 million as of press time. In comparison, the TVL on Ethereum is currently at a whopping $55 billion, down from almost $100 billion reached last year.

Solana’s TVL jumped to over $12 billion in September 2025, but it’s down to $6.6 billion as of now. Martinez also compared Cardano’s TVL with newer chains like SUI, which has already surpassed it with $568 million after peaking at $2.5 billion last year.

“Unlike Ethereum, which has built a dominant position in DeFi, or Solana, which has captured high-speed consumer applications, Cardano still lacks a clear use case that consistently attracts users, developers, and investors,” said Martinez.

He added that Cardano was officially launched nine years ago, but smart contracts were introduced in 2021, which allowed its competitors to “build stronger network effects with more developers, applications, and liquidity.”

He believes Cardano’s research-driven model, which prioritizes academic review and formal verification, slows down product rollouts compared to other blockchains.

You may also like:

As mentioned above, the community was split after his post, with some bringing out Cardano’s liquid staking capabilities, while others agreed to a large extent with his words.

ADA’s Survival

Martinez also explained that blockchains that reach scale early tend to attract more capital and talent as this is a market “driven by adoption and network activity.” This makes it “difficult for slower-growing networks to catch up once competitors establish a lead,” which could be the main reason behind ADA’s struggles.

The token peaked at over $3 in 2021, but it has fallen from grace since then, currently trading 91.7% away from those levels. Even the 2024/2025 bull rally managed to drive it to as high as $1.30, and it now sits at around $0.25.

Martinez weighed in on ADA’s performance as well, suggesting that if it breaks the $0.245 support, it could plunge to the next ones at $0.112 or $0.021, which would represent another 50% to 80% decline.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Oil Cools After Overnight Spike as G7 Eyes Reserve Release

Oil prices pulled back sharply early Monday after reports that Group of Seven (G7) finance ministers planned an emergency call to discuss a coordinated release of strategic crude reserves, giving markets a possible policy response to the war-driven supply shock.

The Financial Times reported that G7 finance ministers planned an emergency call to discuss a possible coordinated release of 300 million to 400 million barrels from strategic oil reserves to calm markets after the war-driven spike in crude prices. The G7 countries consist of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States, with the European Union as a non-enumerated member.

On Hyperliquid, crude oil futures rose nearly 25% to as high as about $117 overnight before falling by around 14.5% to roughly $100 after the G7 reports emerged. The reversal suggested traders were quickly repricing the risk of a coordinated reserve release even as the conflict continued to threaten supply.

Bitcoin rebounds after earlier drop

Bitcoin (BTC) also rebounded after an earlier drop during the oil spike. After falling to about $65,725, CoinGecko data shows BTC climbing as high as $67,992.88 at the time of writing, a gain of roughly 3.45% in a few hours.

CryptoQuant analyst Darkfost said in a market note that higher oil prices and Strait of Hormuz tensions could weigh on risk appetite and complicate the outlook for volatile assets such as Bitcoin.

“Historically, periods when oil prices regain strength often coincide with BTC end-of-cycle phases,” he wrote.

Hyperliquid HIP-3 hits record weekend volume on oil price surge

The episode also underscored how onchain venues can attract demand when traditional markets are closed.

Hyperliquid’s oil-linked contracts had already surged after the initial US-Israeli strike on Iran in late February, with traders turning to decentralized perpetuals for round-the-clock commodity exposure. Hyperliquid data shows that Tradexyz, a trading interface built on Hyperliquid, reached its highest weekend volume of over $610 million on Feb. 28.

Related: Iranian crypto outflows spike 700% after US-Israeli airstrikes

As the conflict escalates, oil prices have continued to rise, and Tradexyz has surpassed its previous weekend record with nearly $720 million in trading volume over the weekend, onchain analytics hub Pine Analytics said in an X post on Monday.

“These two waves of demand in the past month on Tradexyz show the platform is absorbing demand for traditional assets by people who don’t have TradFi access, or at points in time when these exchanges are offline,” Pine wrote.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

How Do SEC Regulations for Tokenized Assets Impact RWAs?

AI Summary

- The blog post discusses the regulatory challenges and implications of tokenized securities.

- It highlights the recent regulatory clarity provided by the U.S.

- Securities and Exchange Commission, signaling a turning point for the sector.

- The post emphasizes the importance of a robust compliance strategy and legal framework for real-world asset tokenization.

- It addresses legal challenges, regulatory compliance, custody solutions, and governance mechanisms essential for successful tokenized asset platforms.

For a number of years, the promise of tokenized securities has been hindered by one major obstacle: the issue of regulatory ambiguity. While blockchain technology has continued to develop and advance, the institutions and organizations in the sector have remained hesitant due to the unclear interpretation of securities laws in the context of on-chain transactions. For tokenization platforms, asset issuers, and investors alike, the complex nature of the regulations has hindered the sector, with many projects remaining in the idea phase.

The most recent announcement by the U.S. Securities and Exchange Commission has marked a turning point in the tokenization sector. In providing a level of clarity on the application of existing SEC regulations on tokenized assets, the SEC has started to set boundaries on the legality of blockchain-based securities. For those in the sector looking to leverage blockchain-based securities, this is a positive indication of a more structured and compliant environment in the future.

While the SEC has provided a level of clarity, this does not remove the complexity; it changes it. For businesses, a robust compliance strategy, legal model, and technological model will be required in line with the emerging regulations on real world asset tokenization.

Regulatory Boundaries Clearly Defined

The U.S. Securities and Exchange Commission’s most recent regulatory clarification establishes a critical new framework for understanding blockchain-based financial assets under U.S. securities law. For companies that have been developing tokenized securities for years, operating in such an environment has been filled with uncertainty. Although many believed that tokenized assets would be covered by the existing regulations surrounding how traditional financial instruments are regulated, there was and still is very little clarity around how traditional legal principles apply to the issuance, transfer and/or trading of securities on blockchain.

With the most recent guidance, regulators have confirmed a key concept: digitized securities are subject to the same legal and compliance requirements as traditional financial instruments, regardless of how they are represented — by paper certificates on a centralized ledger, or a distributed ledger. The underlying regulatory expectations continue to be the same.

This clarification helps reduce the previously existing degree of ambiguity related to the SEC regulations for tokenized assets. Companies creating tokenized investment vehicles in an increasing variety of real-world asset types (real estate, private equity, commodities, and debt) will need to re-evaluate their operating structures against the changing actual product-specific regulations regarding tokenized investments.

Key implications include:

- Tokenized securities remain subject to federal securities laws, regardless of whether they are issued on blockchain platforms.

- Platforms facilitating trading or transfers of tokenized securities may need to register as broker-dealers, alternative trading systems (ATS), or exchanges.

- Compliance obligations around investor protection, disclosure, and custody continue to apply to blockchain-based securities structures.

- Firms must design tokenized asset platforms with regulatory oversight integrated from the beginning.

Addressing RWA Tokenization Legal Challenges

Tokenization changes how we see ownership of things but also makes things legally complicated which traditional finance wasn’t built for as it didn’t expect to be dealing with digital assets. When real-world assets are moved onto the blockchain they are not only digital tokens, but they also involve many different systems intersecting, like Property law, Securities law, Smart Contracts and Digital Custody Frameworks.

These overlapping domains create several RWA tokenization legal challenges that businesses must address before launching compliant tokenized asset ecosystems. One major issue lies in ensuring that the legal rights embedded in traditional asset agreements are accurately reflected and enforceable within blockchain-based token structures.

For instance, if a token represents a fractional ownership in a piece of real estate or a private fund, the investor’s rights will still have to be enforceable as per the legal agreements regardless of whether any transactions take place on-chain or off-chain. The blockchain also needs to include provisions in the underlying technology to ensure compliance with laws relating to investor onboarding, asset transfers and the settlement process.

In order to address these legal complexities, it will be necessary for there to be close collaboration by the legal professionals, technology architects and compliance professionals.

Common challenges include:

- Ensuring that token holders possess enforceable legal ownership rights tied to the underlying asset.

- Managing cross-jurisdictional regulatory requirements when tokenized assets are traded internationally.

- Aligning smart contract logic with legal agreements governing asset ownership and investor rights.

- Maintaining compliance with securities registration, disclosure, and custody obligations.

Organizations entering the tokenization space increasingly rely on specialized advisory partners to navigate these complexities and build legally resilient infrastructure.

How This Impacts Institutional RWA Adoption

For many years, institutional investors have realized that there are advantages to using tokenization; these advantages include better liquidity (the ease with which something can be sold or bought), fractional ownership, and a faster time frame when it comes to settling transactions. However, regulatory uncertainty has limited large institutions’ (such as banks or asset managers) ability to adopt tokenization on a large scale.

With its latest guidance, the SEC is providing a more clear understanding of the regulations that govern tokenized assets, which gives institutions more confidence in exploring potential ways to apply tokenization. By providing specific examples of how SEC regulations for tokenized assets will apply to the blockchain ecosystem, the SEC has removed a lot of the ambiguity that has previously kept large institutions from participating.

Regulatory clarity will allow institutional stakeholders to have better structured risk management practices in place. Now that compliance teams can evaluate potential tokenized assets based on clearly defined regulatory guidelines instead of hypothetically interpreting them, many organizations can move past research-based pilot projects to implementing scale and enterprise-level platforms that utilize tokenized assets.

As institutions increasingly explore digital asset strategies, the development of a robust RWA legal framework for blockchain assets becomes essential to ensure operational and regulatory alignment.

Key impacts for institutional adoption include:

- Greater regulatory certainty supporting long-term investment strategies in tokenized markets.

- Increased confidence among institutional investors and financial service providers.

- Accelerated development of regulated tokenized securities platforms.

- Improved integration between traditional financial infrastructure and blockchain networks.

Looking to Launch Compliant tokenized assets in a rapidly evolving regulatory environment? Connect with the Experts!

Building a Compliant RWA Legal Framework for Blockchain Assets

Regulatory frameworks need to be established by the private sector for tokenization to fully grow in the regulatory constraints of financial services. The SEC’s recent guidance implies that compliance must be an integral part of the design of a tokenized platform’s architecture rather than an afterthought and embedded through the entire lifecycle of the token.

A comprehensive RWA legal framework for blockchain assets is the means by which technology can be used to create new financial products while still adhering to existing regulation while providing transparency and protection for investors. Such a framework must be able to create a bridge between traditional means of creating financial documentation and executing them using blockchain technology.

Identifying a comprehensive framework for RWAs built on blockchain technology will require all organizations involved in the development of such a framework to focus on multiple areas of foundational concern, including the structure and function of the asset, onboarding procedures for investors, custody of the asset, and regulatory reporting obligations. Additionally, all participants in the development of tokenized platforms must also establish governance mechanisms that define the roles and responsibilities of the issuers, custodians, exchanges, and service providers.

Structuring tokenized assets in accordance with securities laws and investor protection requirements

A tokenization initiative’s legal structuring can significantly impact whether or not it’s compliant with regulations. This means that when you get a token, it needs to show you have legally enforceable rights to the underlying asset. Examples of the underlying assets could be either equity, debt instruments, real estate, commodities, etc. Proper structuring means that you, as a token holder, would have the same rights, protections and access to disclosures as a traditional investor would have in a conventional securities offering.

In order for an issuer to comply with the SEC regulations for tokenized assets, they need to define how each token relates to ownership, dividends, voting rights and claims to the underlying assets. Legal documentation related to the tokens (such as offering memoranda, shareholder agreements, and asset contracts) need to be consistent with the structure of the tokens created and retained on the blockchain. This will allow for on-chain transactions to reflect the underlying legal rights and obligations of the asset.

Implementing robust compliance protocols for investor identity verification and regulatory reporting

Transaction monitoring and onboarding investors are both essential to remain in compliance with regulations when using tokenized financial ecosystems. In order for a blockchain-based platform to allow eligible users access to trade in tokenized securities markets that must comply with regulatory requirements, all platforms will need to incorporate robust procedures for verifying the identities of their users.

This includes implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, verifying accredited investor status when required, and maintaining ongoing compliance reporting systems. These mechanisms are essential to ensure that tokenized asset platforms operate within the boundaries of SEC regulations for tokenized assets and broader financial oversight requirements.

In addition to the initial verification process, platforms will also need to develop reporting capabilities that are transparent to both regulatory authorities and other interested stakeholders. This can be accomplished through developing automated compliance tools and/or building smart contract logic into the platforms’ tokenization processes to enforce transaction restrictions ensuring that the transfer of tokens follows regulatory limitations and the eligibility of each investor.

Ensuring secure custody solutions for digital asset representations of traditional securities

Custody is a key component of the operational aspects associated with a tokenized asset infrastructure. When a real-world asset is digitized into a token that operates on a blockchain, then the way the token will be stored and protected must comply with security and regulatory standards as applicable to that asset class.

A tokenized security typically will require a regulated custodian that can securely hold the representation of the digital asset while still retaining its legal relationship to the underlying asset. The custodian will also have strong safeguards to prevent the unauthorized transfer of digital assets and from cyber threats and operational risks that could result in the loss of investor’s assets.

Custody frameworks provide for the protection of tokenized assets when they are in trade across decentralized or distributed systems. Institutional investors rely heavily upon the custodial mechanism both to ensure secure custody of the asset and to operate within the broader RWA legal framework for blockchain assets.

Establishing transparent governance mechanisms to manage tokenized asset platforms

The way that governance is structured will dictate how decisions are made, distributed responsibilities are assigned, and how any disputes are settled in the ecosystem of tokenized assets. Without established governance frameworks, a tokenized platform is subject to operational disarray, regulatory uncertainty, and investor unpredictability.

Governance mechanisms will help establish the rights and roles of issuers, custodians, operators of the platform, and compliance officials; as well as define processes for managing upgrades of smart contracts, resolution of investor disputes, and response to regulatory inquiries.

Transparent governance not only strengthens investor trust but also ensures that tokenized platforms maintain accountability within regulated financial environments. As tokenized asset ecosystems expand, governance models must evolve to support scalable operations while maintaining compliance with emerging real world asset tokenization regulation standards.

Strategic Role of an RWA Compliance Consulting Firm

With the ongoing changes in the way regulations are being developed concerning tokenized assets, more companies are starting to realize that they need access to specialized expertise that bridges together innovations in blockchain with financial regulation. Legal teams traditionally have expertise and experience with securities law but often do not have much experience related to the infrastructure and platform involved in blockchain-based systems; on the flip side, technology developers typically use their time developing systems functionality without appropriately considering how those systems relate to regulatory implications.

Utilizing a qualified RWA legal consulting company can assist a business throughout every phase of developing a tokenized asset–starting from the initial legal structuring of the tokenized asset through a comprehensive compliance strategy, through engaging regulators in the regulatory approval process, and finally launching the tokenized asset on the developers’ blockchain platform.

Among the various advisory services that will typically be provided by a RWA Legal Consulting Company are:

- Conducting regulatory risk assessments for tokenized asset projects.

- Structuring tokenized securities offerings to comply with U.S. regulatory requirements.

- Creating governance and compliance frameworks for blockchain-based financial systems.

- Supporting regulatory filings and communicating with regulatory authorities.

By utilizing the services of an RWA legal consulting firm, companies are provided the ability to minimize their legal risks associated with developing and launching tokenized assets and can accelerate innovation in compliance with regulatory requirements for tokenized assets.

What This Means for the Future of On-Chain Assets

The SEC’s latest guidance signals a broader transition in how regulators view blockchain-based financial infrastructure. Rather than treating tokenization as an experimental or fringe concept, regulatory authorities are increasingly integrating it into established financial oversight frameworks.

This shift indicates that tokenization is moving from a niche innovation to a core component of the evolving digital financial system. As SEC regulations for tokenized assets become more defined, market participants will gain the confidence required to develop larger and more sophisticated tokenized asset ecosystems.

Clear regulatory expectations also encourage standardization across platforms, improving interoperability and strengthening investor protection. Over time, this regulatory clarity is expected to accelerate the development of global markets built around compliant real world asset tokenization regulation.

- Expansion of regulated tokenized securities markets.

- Increased institutional investment in tokenized real-world assets.

- Development of standardized legal and technological frameworks for tokenization.

- Stronger collaboration between regulators, financial institutions, and blockchain innovators.

In this evolving regulatory environment, partnering with an experienced RWA legal consulting company becomes critical for organizations seeking to navigate tokenization with confidence. We support enterprises with end-to-end blockchain advisory and compliance-driven strategies to help build secure, regulation-ready tokenized asset ecosystems.

Crypto World

Coinbase Futures Go Live in Europe: Regulated Crypto Derivatives Now Available in 26 Countries

TLDR:

-

- Coinbase has rolled out regulated futures trading across 26 European countries through Coinbase Advanced.

- Traders can access up to 10x leverage on BTC, ETH, and equity index futures contracts on Coinbase.

- Two contract types are available: perpetual-style futures with 5-year expiries and dated contracts.

- Coinbase offers fees as low as 0.02% per contract, making derivatives more accessible in Europe.

Coinbase futures are now available to European traders for the first time. The crypto exchange has rolled out regulated futures contracts across 26 countries in Europe.

Available through Coinbase Advanced, the offering covers Bitcoin, Solana, and equity index products. Germany, France, and the Netherlands are among the eligible markets.

The launch gives European traders access to a regulated alternative to the unregulated platforms many have historically relied on for crypto derivatives.

Two Contract Types With Flexible Leverage Options

Coinbase futures come in two primary forms: perpetual-style contracts and dated contracts. Perpetual-style futures carry five-year expiries and use an hourly funding mechanism.

They are cash-settled once per day to keep prices aligned with underlying assets. Dated contracts, by contrast, expire on specific monthly or quarterly dates.

Dated contracts are marked to market daily using official exchange settlement prices. If held until expiry, these contracts are also cash-settled.

Together, both contract types offer traders flexibility in managing their positions. This dual structure caters to both short-term and longer-term trading strategies.

Traders can access up to 10x leverage on select contracts, including BTC, ETH, and equity indices. Other products carry leverage ranging from 4x to 5x.

Coinbase noted it is “making derivatives trading more accessible with fees as low as 0.02% per contract.” These rates exclude NFA, exchange, and clearing fees.

The product range also covers equity index futures, including the Mag7 + Crypto Equity Index Futures. This moves Coinbase futures beyond crypto and into broader financial markets.

European traders now have access to multi-asset derivatives on a single regulated platform. The exchange has positioned itself as a one-stop shop for multiple asset classes.

How European Traders Can Access and Begin Trading

Eligible Coinbase users can find the new offering under the derivatives tab on Coinbase Advanced. This tab is available on both the web and mobile versions of the platform.

Traders must complete eligibility checks, including assessments of their trading experience. Know-your-customer verification is also required before trading can begin.

Accounts can be funded using EUR or USDC. Once set up, users gain access to the full range of Coinbase futures products.

The process is designed to be straightforward for existing Coinbase Advanced users. New users may need to complete additional onboarding steps before proceeding.

The rollout follows growing regulatory clarity across Europe for crypto derivatives. Coinbase offers these contracts through its MiFID-regulated entity.

In a statement, the company described the launch as “a major step in our push to build an exchange for everything.” It added that it is looking “to expand beyond crypto all within the trusted Coinbase app.”

Coinbase futures represent a step toward the exchange’s goal of becoming a full-service financial platform. The company stated it is “looking forward to continuing to introduce new and expanded services” as regulations mature globally.

European traders now have a regulated, multi-asset derivatives option available to them. Additional product launches are expected as the regulatory landscape continues to develop.

Crypto World

Can $1.35 hold amid massive 400M barrel oil dump?

The crypto markets witnessed a shift today as oil prices underwent one of their most significant intraday reversals in history. Following an initial surge of nearly 30% that saw Brent crude flirting with $120 per barrel due to the escalating conflict in the Middle East and the effective closure of the Strait of Hormuz, the market plunged back toward the $100 mark.

Summary

- Oil prices reversed sharply after reports that G7 nations may release up to 400 million barrels of crude from reserves, easing inflation concerns.

- XRP is consolidating between $1.34 and $1.40 after rejecting the $1.47 local high earlier this month.

- Technical indicators show neutral momentum and steady accumulation, suggesting selling pressure may be fading near the $1.30 support level.

This sudden correction followed an exclusive report from the Financial Times stating that G7 finance ministers, in coordination with the International Energy Agency (IEA), are weighing the largest-ever emergency intervention: a release of up to 400 million barrels of crude oil from strategic reserves.

For the cryptocurrency sector, and specifically for XRP, this cooling of energy-driven inflation fears has provided a much-needed window of stability.

XRP price analysis

The current price action on the XRP/USDT (XRP) 4-hour chart illustrates a period of high-tension consolidation following a significant rejection from the $1.47 local high.

After peaking on March 4th, the asset entered a steady downtrend characterized by a series of lower highs and lower lows. However, a vital defensive effort by bulls is now visible around the $1.34 to $1.35 range, where price has begun to trade sideways in a narrow cluster.

The most immediate support is firmly established at the $1.30 level, which served as a major floor during the late February sell-off.

Conversely, overhead resistance is concentrated at $1.40, a psychological barrier that has repeatedly stifled recovery attempts. If bulls can successfully leverage the current macro stabilization to push back above $1.40, the next significant resistance target lies at the recent swing high of $1.47.

Technical indicators suggest that while the immediate trend is cautious, the selling pressure may be nearing exhaustion. The Money Flow Index (MFI-14) is currently positioned at 44.58, indicating a neutral momentum that has recovered from an oversold dip below 20 seen on March 7th.

This suggests that capital is slowly re-entering the asset at these lower price points.

Additionally, the Accumulation/Distribution line remains relatively flat at 26.1 billion, showing that despite the price drop from $1.47, there hasn’t been a massive exodus of volume, pointing toward “strong hands” holding through the volatility.

For a definitive bullish reversal, traders are looking for a break out of the current tight range, specifically a close above the $1.36 level seen in the most recent candle.

Failure to defend the $1.34 immediate floor could lead to a retest of the $1.30 primary support, while a breakout could pave the way for a run back toward $1.50 if global energy fears continue to subside.

Crypto World

Oracle (ORCL) Stock: Three Critical Metrics for March 10 Earnings Report

Quick Summary

- Oracle’s Q3 FY26 financial results arrive March 10 following market close

- Analysts project earnings per share of $1.71 (+16.3% YoY) with revenue around $16.92 billion (+20% YoY)

- Cloud infrastructure revenue surged 68% in Q2 FY26, with full-year FY26 target of 77% expansion

- Remaining performance obligations reached $523 billion in Q2, representing 438% annual increase

- ORCL shares have declined over 20% this year; Deutsche Bank reduced target from $375 to $300

Oracle approaches Tuesday’s Q3 FY26 financial disclosure under considerable pressure. Shares have tumbled more than 20% since the year began, trading approximately 50% beneath the September 2024 high. As the company prepares to release results after trading hours on March 10, market participants are zeroing in on three critical data points.

The Street anticipates adjusted earnings per share of $1.71, marking a 16.3% year-over-year increase. Revenue projections hover near $16.92 billion, translating to approximately 20% growth. During the previous quarter, Oracle fell short of revenue expectations with $16.06 billion — a 14.2% annual gain that nonetheless missed analyst estimates.

Notably, Oracle leads the pack as the initial major data and analytics software provider reporting results this earnings cycle. Without peer comparisons available, investors are navigating this report in relative isolation.

Cloud Infrastructure Revenue: The Primary Growth Driver

OCI represents the powerhouse behind Oracle’s expansion narrative currently. Revenue acceleration has maintained momentum across multiple consecutive quarters — climbing from 49% in Q3 FY25 to 52% in Q4, then 55% in Q1 FY26, and most recently 68% in Q2 FY26.

Executives have set expectations for OCI to expand approximately 77% throughout the complete fiscal year, generating roughly $18 billion in revenue. Looking further ahead, Oracle has established ambitious targets of $144 billion in aggregate cloud revenue by fiscal year 2030.

This represents a substantial objective. It’s the primary rationale behind most analysts maintaining confidence in the stock despite this year’s downturn.

Oracle’s remaining performance obligations — effectively representing future contracted revenue — totaled $523 billion during Q2 FY26, marking a remarkable 438% year-over-year surge. This substantial backlog demonstrates robust appetite for cloud and artificial intelligence infrastructure agreements.

The Q3 RPO metric will draw intense scrutiny. Any deceleration in this figure could trigger investor concern.

Infrastructure Investment Sparks Questions

The flip side of Oracle’s expansion trajectory involves the financial commitment. Oracle anticipates deploying approximately $50 billion in capital expenditures throughout fiscal 2026.

Future operating lease obligations have also ballooned to roughly $248 billion as of last November — substantially exceeding cloud competitors Microsoft and Amazon. This represents considerable financial exposure for an enterprise still expanding its infrastructure foundation.

Consequently, Oracle’s trailing free cash flow has dipped into negative territory, despite operating cash flow remaining above $22 billion. Market participants will examine capex guidance meticulously for indications of either moderation — or further acceleration.

Deutsche Bank analyst Brad Zelnick lowered his price objective on ORCL from $375 to $300 this Monday, while maintaining his Buy rating. He expressed concerns regarding cash consumption tied to Oracle’s AI infrastructure expansion, but highlighted two encouraging developments: Oracle’s successful unsecured investment grade bond issuance in February, and OpenAI securing a $110 billion private funding round.

Aggregate Wall Street sentiment maintains a Strong Buy rating — with 25 Buy recommendations and 6 Hold ratings issued over the past three months. The consensus price target stands at $270.14, suggesting approximately 76.6% potential upside from present trading levels.

Oracle releases earnings following market close on March 10.

Crypto World

Crude Oil Skyrockets to $119 Per Barrel Amid Iran-Israel Conflict and Hormuz Blockade

TLDR

- Both Brent crude and WTI peaked at $119.50 per barrel during Monday trading before retreating from their highest prices since mid-2022.

- Israeli forces targeted Iranian oil infrastructure this weekend, while Tehran retaliated with strikes on Gulf state oil facilities.

- Tehran has implemented a blockade of the Strait of Hormuz, disrupting approximately 20% of global oil shipments.

- Finance ministers from G7 nations are convening Monday to evaluate a coordinated emergency oil reserve deployment.

- Gasoline futures in the United States jumped more than 10%, approaching four-year peak levels above $3.00 per gallon.

Crude oil markets experienced dramatic volatility Monday following unprecedented Israeli military action against Iranian petroleum infrastructure. The escalation, marking the first such strikes since hostilities commenced in early March, drove both Brent crude and West Texas Intermediate futures to an intraday peak of $119.50 per barrel—price levels unseen since mid-2022.

BREAKING: US oil prices are currently attempting one of their biggest reversals in history.

At 10:30 PM ET, US oil prices were up as much as +30% on the day.

Then, FT reported that G7 countries are considering releasing 400 million barrels of crude oil from reserves.

Less than… pic.twitter.com/G1uRHvkFxX

— The Kobeissi Letter (@KobeissiLetter) March 9, 2026

Market prices moderated by midday, with Brent settling at $106.80 per barrel and WTI trading at $102.79, retreating from overnight highs. The decline followed a Financial Times exclusive reporting that G7 finance ministers scheduled an emergency Monday session to evaluate releasing strategic petroleum reserves.

The planned discussions are anticipated to include coordination efforts with the International Energy Agency. At least three G7 member states, the United States among them, have publicly indicated willingness to participate in a collaborative reserve deployment.

Oil markets have experienced gains exceeding 25% since the Iran-Israel conflict erupted in early March. Weekend developments intensified the rally as trading resumed Sunday evening.

Israeli military operations targeted petroleum storage infrastructure in Tehran on Saturday. Tehran’s response included drone strikes against a Bahraini oil refinery, the Wall Street Journal confirmed.

Strait of Hormuz Now Effectively Blocked

Iranian forces have also initiated attacks on vessels transiting the Strait of Hormuz. This critical chokepoint, responsible for transporting roughly 20% of worldwide oil demand, now sees virtually no commercial traffic.

OCBC analysts noted that “tail risks from a sustained Hormuz stoppage remain in play,” drawing parallels to the magnitude of the 2022 Russia-Ukraine energy crisis.

Deutsche Bank’s Jim Reid acknowledged the G7 reserve release could provide relief, though he emphasized “the duration and intensity of the conflict will still be far and away the most important driver.”

Both Kuwait and the United Arab Emirates announced production cuts over the weekend, following similar moves by Iraq in recent days. Storage capacity limitations stemming from supply chain disruptions are compelling producers to reduce output.

In an unusual development, Saudi Arabia has begun offering crude on spot markets—a signal Riyadh is attempting to address supply shortfalls created by the regional conflict.

Trump Warns Prices Will Stay High Short-Term

President Donald Trump addressed the oil price spike Sunday evening. He indicated prices would likely maintain elevated levels temporarily but predicted they would “drop rapidly” following resolution of the Iranian conflict.

Trump has consistently minimized concerns about rising domestic fuel costs, stating to Reuters that the Iranian military campaign remains his administration’s top priority.

Gasoline futures in the United States surged over 10% Monday, breaching $3.00 per gallon and approaching their highest valuation since mid-2022.

Jefferies economist Mohit Kumar characterized the Iranian infrastructure bombing as evidence of “a shift in war strategy,” cautioning that targeting essential infrastructure elevates both humanitarian and economic consequences.

In OCBC’s moderately severe projection, assuming partial shipping resumes under naval protection, Brent crude could sustain pricing near $100 per barrel through the middle of the year.

Crypto World

Nigel Farage invests in UK BTC treasury firm Stack BTC

Nigel Farage, leader of the Reform UK party, invested 215,000 pounds ($286,000) in Stack BTC (STAK), a U.K.-listed bitcoin treasury company, in a fundraising round that also involved Blockchain.com.

In total, the company raised 260,000 by selling 5.2 million new shares at 5 pence each, it said on Monday. The new shares are expected to begin trading on the Aquis Growth Market on March 12.

Farage invested through his Thorn In The Side Ltd. company and will hold 6.31% of Stack following admission of the new shares. Farage said he has long supported bitcoin and believes the U.K. should position itself as a global hub for the crypto industry. Reform is leading in the polls, and has attempted to court the crypto vote by accepting donations in cryptocurrency.

“I have long been one of the UK’s few political advocates for Bitcoin,” he said in the statement, adding that London should continue to strengthen its role as a center for financial innovation.

Stack BTC is chaired by former Chancellor Kwasi Kwarteng, who said the investment aligns with the company’s goal of building a portfolio of cash-generative U.K. businesses while accumulating bitcoin as a treasury asset. It currently holds 21 BTC.

Blockchain.com will work with the company to develop its bitcoin treasury infrastructure and institutional-grade custody services.

Stack BTC shares rose 12% to 6.875 pence as of 9:30 a.m. in London.

Crypto World

BTC Exchange Reserves Hit 2019 Lows as ETFs and Corporate Treasuries Lock Up Supply

TLDR:

- BTC exchange reserves have fallen to roughly 2.7 million BTC, matching levels last recorded in 2019.

- The FTX collapse in November 2022 triggered a loss of over 325,000 BTC from exchanges in one month.

- Spot Bitcoin ETFs launched in January 2024 and have since accumulated around 1.3 million BTC total.

- Corporate treasury firms now collectively hold approximately 1.1 million BTC, near 5% of total supply.

BTC exchange reserves have fallen to their lowest point since 2019, now sitting at around 2.7 million BTC. This marks a sustained decline that started in 2022, following the collapse of FTX.

Two major forces have since accelerated this drawdown considerably. These include the arrival of spot Bitcoin ETFs in January 2024 and the rise of corporate treasury adoption.

Together, they are reshaping how Bitcoin is held and accessed across global markets.

Exchange Reserve Decline Traces Back to the FTX Collapse

In November 2022, over 325,000 BTC left centralized exchanges within a single month. The FTX collapse triggered widespread concern about the safety of exchange-held assets.

Many investors moved their holdings into private wallets as a direct response. This marked the beginning of a sustained decline in BTC exchange reserves.

Crypto analyst Darkfost shared the data on X, noting that reserves have returned to 2019 levels. According to the post, Binance holds roughly 20% of the 2.7 million BTC across retail-accessible exchanges.

Coinbase Advanced leads among platforms serving professional investors, holding around 800,000 BTC. However, that figure is already down approximately 200,000 BTC compared to July 2025.

The shift away from exchanges reflects a broader change in how market participants store Bitcoin. Self-custody became the preferred choice for many retail holders after 2022.

This move reduced the amount of BTC on trading platforms. As a result, exchange-side liquidity has continued to tighten.

The decline is not driven by reduced interest in Bitcoin. Rather, it points to a structural change in how BTC is being distributed across the market.

Investors began treating Bitcoin less as a trading asset and more as a long-term store of value. This behavioral shift played a direct role in pulling exchange reserves lower.

ETFs and Corporate Treasuries Are Locking Up Bitcoin Supply

Spot Bitcoin ETFs launched in January 2024, adding another layer to the ongoing reserve decline. At the time of their launch, exchange reserves still stood above 3.2 million BTC.

Since then, ETFs have accumulated around 1.3 million BTC. That figure represents roughly 6.7% of Bitcoin’s entire circulating supply.

Corporate treasury adoption has also contributed to tightening the available supply. Companies holding BTC as a reserve asset now collectively own approximately 1.1 million BTC.

That amount equals close to 5% of the total supply. Both ETFs and corporate treasuries consistently remove BTC from active exchange circulation.

These institutional and corporate holdings differ in nature from typical retail exchange balances. They tend to remain static and are rarely liquidated for short-term trading purposes. Over time, this removes a layer of sell-side pressure from the broader market.

Together, these forces — alongside the self-custody movement — explain the structural drop in BTC exchange reserves. The data shows that Bitcoin’s ownership model is evolving.

An increasing share of supply is now held within formal financial or corporate structures. This gradual transformation may shape Bitcoin’s market behavior well into the future.

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business5 days ago

Business5 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business17 hours ago

Business17 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World4 days ago

Crypto World4 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment4 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death