CryptoCurrency

How Stablecoin Development Will Shape the Banking Supercycle

A massive shift is underway in global finance, and institutions that move early will define the next era of banking. Settlement delays, fragmented cross border processes, and outdated infrastructure are giving way to real time, programmable, and globally accessible financial rails. At the center of this transformation is one catalyst driving unprecedented momentum across the industry: “Stablecoin Development.”

What started as a crypto experiment has now become the preferred settlement technology for banks, fintechs, enterprises, and even regulators. By 2025, institutions will no longer debate the relevance of stablecoins. They are discussing how quickly they must integrate them to stay competitive. Because the organizations that adopt stablecoin infrastructure today will own the speed, efficiency, and liquidity advantages that tomorrow’s financial leaders depend on. If your institution is exploring instant payments, automated compliance, or faster global liquidity movement, you are already standing at the edge of the stablecoin supercycle. This blog breaks down why the shift is happening now, how it will reshape banking, and the strategic moves institutions must prioritize to lead instead of follow in the new digital finance landscape.

The question is no longer should you adopt stablecoins; it’s how fast can you move?

Why Stablecoins Are Entering a Supercycle

Stablecoins are entering a supercycle because global finance is moving toward faster, cheaper, and more transparent settlement systems. Traditional rails can’t keep up with the demands of modern commerce, while stablecoins offer real-time transfers, on chain auditability, and seamless cross-border efficiency. As institutions push for speed and automation, stablecoins have become the most practical upgrade available, supported by rapid advancements in stablecoin development that make deployment safer and more scalable.

Banks, fintechs, and payment networks are already integrating stablecoins to streamline corporate payments, automate treasury workflows, and reduce operational friction. At the same time, regulators across the U.S., EU, Hong Kong, and Singapore have introduced clearer frameworks, removing long-standing compliance uncertainty and encouraging institutional scale adoption. With global enterprises seeking better liquidity movement and financial institutions modernizing their settlement layers, stablecoins are positioned for sustained, long term growth. The supercycle is being driven by real utility, not speculation.

What Is Pushing Institutions Toward Stablecoin Adoption

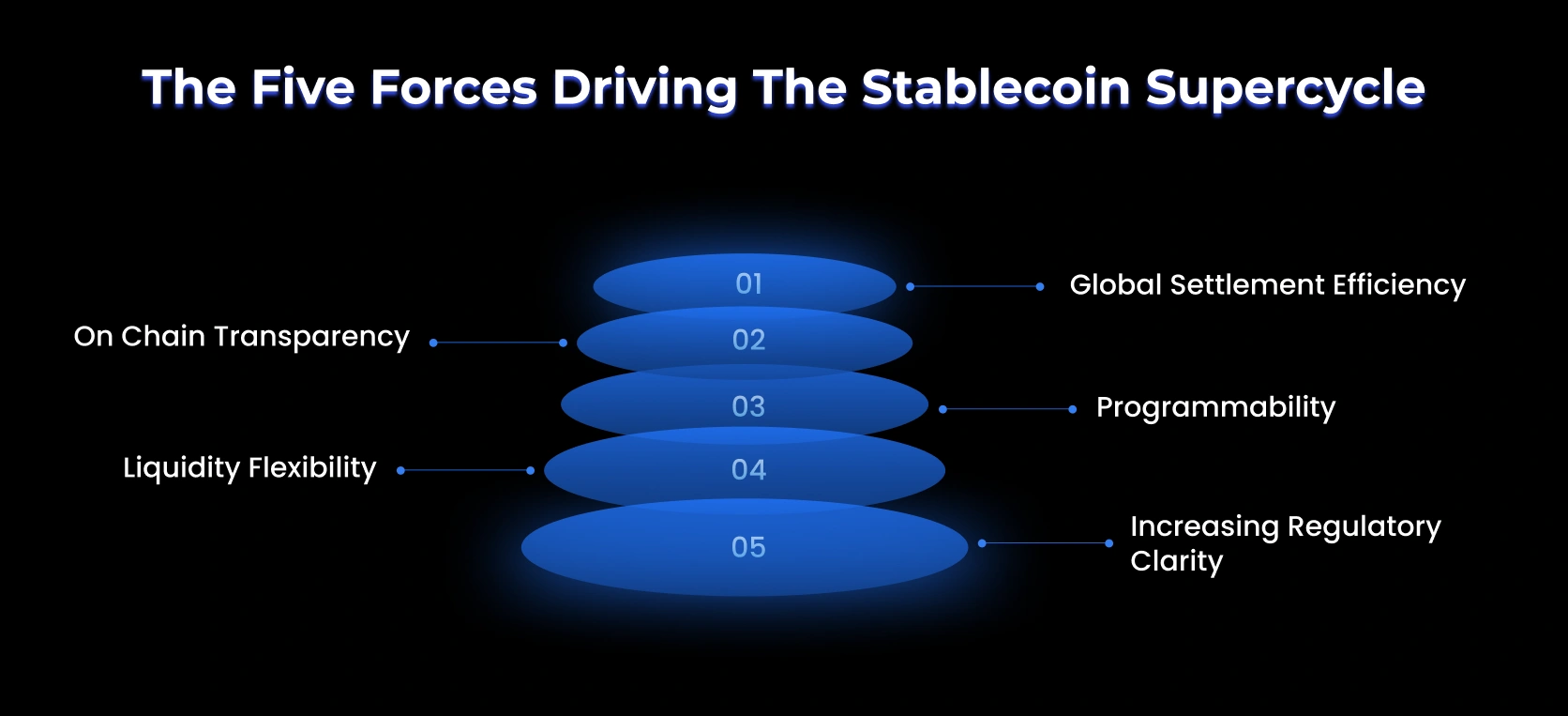

Institutions are not embracing stablecoins for ideological reasons. They are doing it because the financial advantages are too strong to ignore and because leaders across finance are evaluating how stablecoin development services can modernize settlement, liquidity, and compliance frameworks. Here are the drivers that are accelerating the supercycle.

- Global settlement efficiency: Cross-border settlements are excessively slow. Stablecoins reduce multi-day processes to minutes, which is a massive competitive advantage for treasury operations.

- On chain transparency: Every transaction can be verified in real time. This improves compliance workflows, audit trails, and fraud detection.

- Programmability: Banks can automate interest calculations, escrow releases, settlement workflows, and liquidity operations using smart contracts. This removes manual processes and reduces operational risks.

- Liquidity flexibility: Stablecoins can move across different chains, apps, and platforms without relying on old settlement windows. Businesses no longer need to keep capital locked in different corridors.

- Increasing regulatory clarity: More jurisdictions are formalizing frameworks around stablecoins, which makes institutional adoption safer. Clear rules are the biggest catalyst for traditional organizations.

These factors are not temporary. They reshape how money moves and how financial systems operate. Institutions looking to future-proof their offerings are actively evaluating stablecoin development to strengthen their infrastructure.

How the Banking Landscape Will Change

By late 2025, the banking sector will have entered a decisive transformation, moving from slow, batch-based settlement systems to real-time blockchain-powered financial infrastructure. Stablecoins are no longer experimental tools. They have become core to institutional settlement, with banks adopting them to modernize liquidity management, reduce operational costs, and meet rising enterprise demand for instant and transparent payments. As institutions invest in stablecoin development services, the shift toward programmable and automated settlement rails is becoming a defining competitive advantage.

- Key 2025 Data and Insights Shaping the Transition:

- 83% of global financial institutions are exploring or deploying blockchain based settlement rails.

- 90% of institutions are adopting or planning to adopt stablecoins for internal payment workflows.

- JPMorgan processes over $2 billion daily on its Kinexys network and has crossed $1.5 trillion in total blockchain settlement volume.

- 300+ banks and payment providers now use enterprise blockchain platforms like Fireblocks, which handles 15 percent of global stablecoin transfers (35 million transactions monthly).

- Regulation transformed in 2025:

- U.S. GENIUS Act

- EU MiCA is fully active

- Hong Kong Stablecoin Ordinance

- Singapore’s updated Payment Services Act

- Only 18% of European banks cite regulatory uncertainty as a barrier, a dramatic decline from past years.

- B2B stablecoin payments surged to $3 billion monthly, a 30x increase since 2023.

- Blockchain settlement reduces cross-border fees by up to 80% and cuts settlement time to under 10 minutes.

- Institutions leveraging blockchain save $27 billion annually, with compliance automation reducing operating costs by 45 percent.

- Tokenized real world assets surpassed $600 billion in processed value in 2025.

Explore Institutional Grade Stablecoin Architecture. Get a Technical Deep Dive.

This evolving landscape is redefining how banks compete. Institutions that integrate stablecoin infrastructure early are already delivering faster payments, programmable settlement logic, and improved liquidity operations. Meanwhile, regions like the U.S., EU, Hong Kong, and Singapore have set clear regulatory standards, giving banks confidence to roll out large-scale deployments. As fintechs adapt at an even faster pace, traditional banks face a narrowing window to upgrade outdated systems and remain relevant in a market shifting toward blockchain-enabled finance.

The direction is clear. The future banking model will be a hybrid system that blends regulated oversight with the speed, programmability, and transparency of blockchain. Stablecoins have moved from pilots to operational backbone technology, and the institutions embracing them now will shape the financial ecosystem for the next decade.

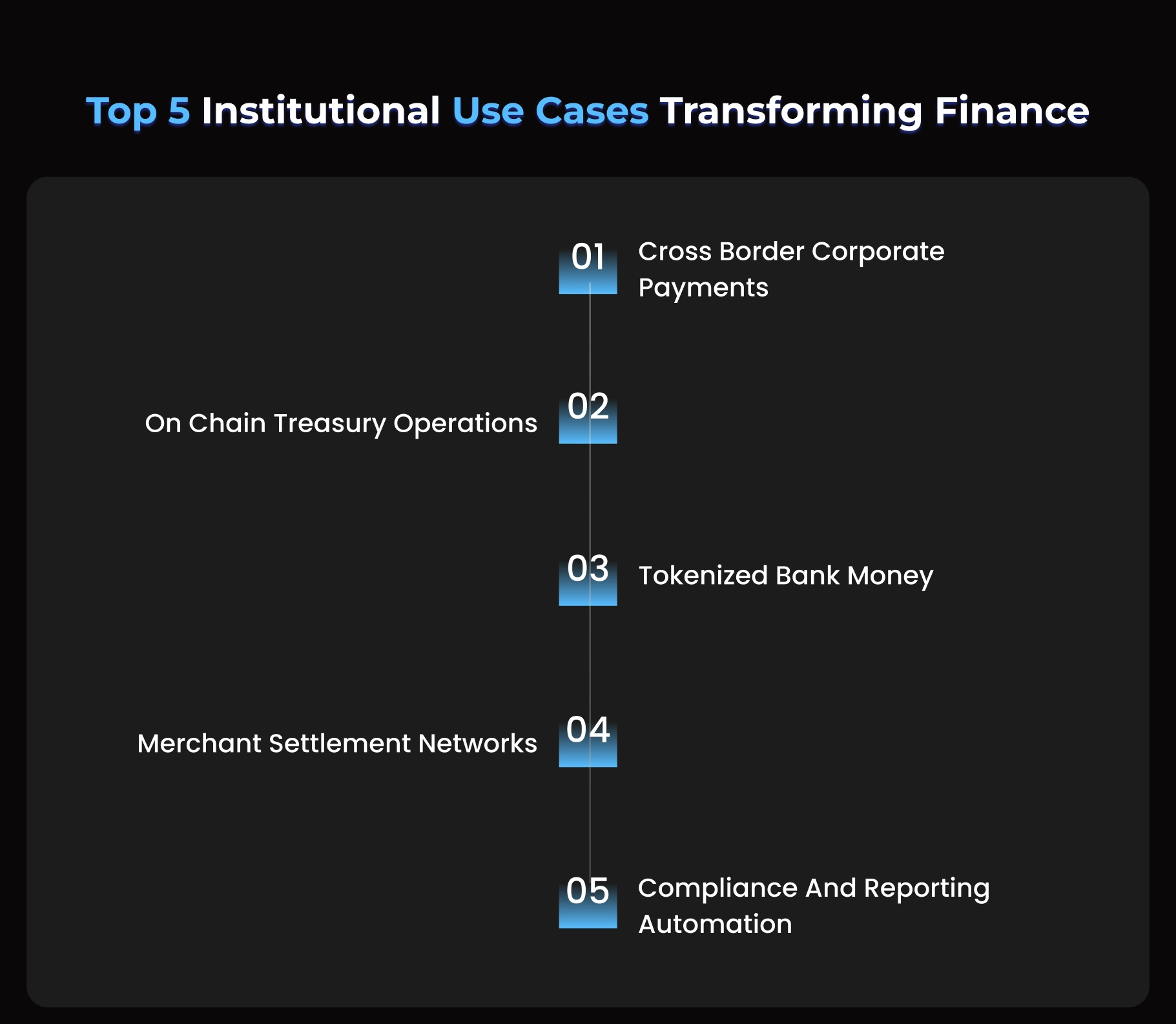

Institutional Use Cases That Are Growing Fast

The stablecoin supercycle is not a theoretical concept anymore. Real institutional use cases are scaling every month, and the organizations that understand these shifts early are the ones positioned to benefit the most. As banks, fintechs, and global enterprises explore stablecoin development services, they are discovering practical applications that enhance efficiency, reduce operational friction, and unlock entirely new financial models.

- Cross Border Corporate Payments

Global businesses face constant challenges with slow settlement cycles, intermediary fees, and corridor-specific delays. Stablecoins eliminate these pain points by enabling near-instant and cost-efficient transfers across borders. This is why exporters, logistics companies, and international B2B suppliers are rapidly shifting to stablecoin settlement for invoice payments and treasury mobility.

- On Chain Treasury Operations

Enterprises are increasingly parking capital in tokenized dollars to improve liquidity management. With stablecoins, treasury teams can move funds across exchanges, partners, and accounts instantly without relying on traditional clearing systems. This creates a more agile treasury environment that supports faster decision-making and reduces idle capital.

- Tokenized Bank Money

Many banks are now exploring or launching their own fiat backed institutional stablecoins. These assets allow financial institutions to maintain customer trust while introducing modern digital rails that offer faster settlements, programmable workflows, and improved transparency. It also positions banks to compete directly with fintech settlement networks.

- Merchant Settlement Networks

Payment processors and merchant acquirers are adopting stablecoins to settle transactions with merchants in real time. Faster settlement reduces chargeback exposure, improves merchant cash flow, and significantly increases operational efficiency. This is especially valuable for high volume e-commerce platforms and global marketplace operators.

- Compliance and Reporting Automation

Stablecoins offer built-in transparency that supports automated compliance workflows. Institutions can integrate on-chain analytics tools to perform AML checks, risk scoring, wallet behavior monitoring, and real time proof of reserves. This dramatically simplifies audits and supports stronger regulatory alignment.

The rapid growth of these use cases shows that we have already entered a sustained adoption cycle. Institutions that invest in the right infrastructure, guided by expert stablecoin development, will be best positioned to scale with confidence and lead the next era of financial innovation.

See Stablecoins in Action With a Live Demo. Reserve Your Slot Today.

What Institutions Must Do Right Now

The supercycle rewards early movers, and institutions that upgrade now will gain a long term competitive edge supported by expert stablecoin development services.

- Create a Roadmap: Define integration, compliance, and technical requirements. A structured plan prevents costly missteps and is often shaped with a stablecoin development company.

- Enable Settlement Rails: Begin with low risk corridors, launch pilots, and scale as real time liquidity and speed improvements become clear.

- Issue Institutional Stablecoins: A compliant, reserve backed asset unlocks new settlement networks and showcases leadership powered by modern development.

- Strengthen Compliance Tools: Adopt automated AML, KYC, and on chain analytics to safely manage faster, more complex stablecoin flows.

- Work With Specialists: Experienced teams accelerate deployment, reduce technical risk, and support smooth enterprise-scale rollout.

By acting now, institutions can future proof their financial infrastructure and lead the next wave of digital settlement innovation, and the right stablecoin development company will ensure that transition is seamless, secure, and built for scale.

Final Thoughts and a Clear Next Step

The stablecoin supercycle is no longer a future signal. It is happening now, reshaping global settlement infrastructure and redefining how money moves across institutions. Banks, fintechs, and enterprises that adopt early will command the next generation of financial rails, while those that delay will eventually be forced to adapt on someone else’s timeline. This is the moment when strategic decisions separate leaders from followers. If your institution wants to lead this shift, the next step is straightforward. Start evaluating the architecture, compliance models, and operational frameworks required to integrate stablecoin development into your core systems. With the support of the right stablecoin development company, you can replace slow, fragmented settlement processes with real time global money movement that aligns perfectly with regulatory expectations and enterprise scale demands.

Early movers will define the financial systems of tomorrow, and the institutions equipped with expert stablecoin development services will hold a decisive advantage. If you’re ready to build with precision, trust, and institutional grade execution, partner with Antier.

Frequently Asked Questions

01. What is driving the shift towards stablecoins in global finance?

The shift is driven by the need for faster, cheaper, and more transparent settlement systems, as traditional financial rails struggle to meet modern commerce demands. Stablecoins offer real-time transfers and seamless cross-border efficiency, making them a practical upgrade for institutions.

02. How are institutions integrating stablecoins into their operations?

Institutions such as banks and fintechs are integrating stablecoins to streamline corporate payments, automate treasury workflows, and reduce operational friction, enhancing their overall efficiency and competitiveness.

03. What is the significance of the regulatory environment for stablecoin adoption?

The introduction of clearer regulatory frameworks in regions like the U.S., EU, Hong Kong, and Singapore has removed compliance uncertainties, encouraging institutional adoption of stablecoins and supporting their sustained long-term growth.